Attached files

| file | filename |

|---|---|

| EX-1.1 - EX-1.1 - Pattern Energy Group Inc. | d715360dex11.htm |

| EX-23.2 - EX-23.2 - Pattern Energy Group Inc. | d715360dex232.htm |

| EX-23.3 - EX-23.3 - Pattern Energy Group Inc. | d715360dex233.htm |

| EX-5.1 - EX-5.1 - Pattern Energy Group Inc. | d715360dex51.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 5, 2014

Registration No. 333-195488

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PATTERN ENERGY GROUP INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 4911 | 90-0893251 | ||

| (State or Other Jurisdiction of Incorporation or Organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Pier 1, Bay 3

San Francisco, CA 94111

(415) 283-4000

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

Daniel M. Elkort

General Counsel

Pattern Energy Group Inc.

Pier 1, Bay 3

San Francisco, CA 94111

(415) 283-4000

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

Copies to:

| Richard D. Truesdell, Jr. Davis Polk & Wardwell LLP 450 Lexington Avenue New York, NY 10017 (212) 450-4000 |

Jeffrey R. Lloyd Brendan D. Reay Blake, Cassels & Graydon LLP Suite 4000 199 Bay Street Toronto, ON M5L 1A9 (416) 863-2400 |

Shelley A. Barber Brenda K. Lenahan Vinson & Elkins L.L.P. 666 Fifth Avenue New York, NY 10103 (212) 237-0000 |

Philip D.A. Symmonds Rima Ramchandani Torys LLP Suite 3000 79 Wellington Street West Toronto, ON M5K 1N2 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE1

|

| ||||||||

| Title Of Each Class Of Securities To Be Registered |

Amount To Be Registered(1)(2) |

Proposed Maximum Offering Price Per Unit(1)(2)(3) |

Proposed Maximum Offering Price(1)(2)(3) |

Amount Of Registration Fee(3)(4) | ||||

| Class A common stock, $0.01 par value per share |

17,801,857 | $25.84 | $459,999,985 | $59,248 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated solely for the purpose of computing the amount of the registration fee pursuant to Rule 457(a) under the Securities Act of 1933. |

| (2) | Includes 2,321,981 additional shares of Class A common stock that may be purchased by the underwriters. |

| (3) | Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) promulgated under the Securities Act of 1933, as amended and is based upon the average of the high and low sales prices of the Class A common stock as reported on the NASDAQ Global Market on May 2, 2014. |

| (4) | Previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholder may sell these securities until this registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling shareholder are soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED MAY 5, 2014

PROSPECTUS

15,479,876 Shares

Pattern Energy Group Inc.

Class A Common Stock

Pattern Energy Group Inc. is offering 11,609,907 shares of its Class A common stock. Pattern Energy Group LP, the selling shareholder, is offering an additional 3,869,969 shares of Class A common stock. We will not receive any of the proceeds from the sale of the shares being sold by the selling shareholder.

Our Class A common stock is listed on the NASDAQ Global Market under the symbol “PEGI” and on the Toronto Stock Exchange under the symbol “PEG.” On May 2, 2014, the last reported sale price of our Class A common stock on the NASDAQ Global Market was $25.84 and on the Toronto Stock Exchange was C$28.23.

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 20 of this prospectus for a discussion of certain risks that you should consider before investing.

| Per Class A Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriters’ commissions |

$ | $ | ||||||

| Net proceeds to us, before expenses |

$ | $ | ||||||

| Net proceeds to the selling shareholder, before expenses |

$ | $ | ||||||

The underwriters may also purchase up to an additional 2,321,981 shares of our Class A common stock from the selling shareholder named herein at the public offering price, less the underwriters’ commissions, within 30 days from the closing date of this offering to cover overallotments, if any. We will not receive any proceeds from the exercise of the underwriters’ overallotment option.

The underwriters expect to deliver the shares of Class A common stock to purchasers on , 2014.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| BMO Capital Markets | Morgan Stanley | RBC Capital Markets | ||

| Scotiabank | BofA Merrill Lynch | Wells Fargo Securities | ||

| CIBC | KeyBanc Capital Markets | Raymond James | ||

The date of this prospectus is , 2014.

Table of Contents

| Page | ||||

| vi | ||||

| 1 | ||||

| 13 | ||||

| 16 | ||||

| 20 | ||||

| 30 | ||||

| 32 | ||||

| 33 | ||||

| 34 | ||||

| 35 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

37 | |||

| 64 | ||||

| 80 | ||||

| 105 | ||||

| 108 | ||||

| 110 | ||||

| 115 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Class A Common Shares |

117 | |||

| Material Canadian Federal Income Tax Considerations for Holders of Our Class A Common Shares |

120 | |||

| 125 | ||||

| 131 | ||||

| 131 | ||||

| 132 | ||||

Subscriptions will be received subject to rejection or allotment in whole or in part and the right is reserved to close the subscription books at any time without notice. We expect that delivery of our Class A shares will be made against payment therefor on or about the date specified on the cover page of this prospectus.

i

Table of Contents

NOTICE TO INVESTORS

We are a holding company with U.S. operating subsidiaries that are “public utilities” (as defined in the Federal Power Act, or “FPA”) and, therefore, subject to the jurisdiction of the U.S. Federal Energy Regulatory Commission, or “FERC,” under the FPA. As a result, the FPA places certain restrictions and requirements on the transfer of an amount of our voting securities sufficient to convey direct or indirect control over us. See “Risk Factors—Risks Related to this Offering and Ownership of our Class A Shares—As a result of the FPA and FERC’s regulations in respect of transfers of control, absent prior authorization by FERC, neither we nor Pattern Development can convey to an investor, nor will an investor in our company generally be permitted to obtain, a direct and/or indirect voting interest in 10% or more of our issued and outstanding voting securities, and a violation of this limitation could result in civil or criminal penalties under the FPA and possible further sanctions imposed by FERC under the FPA.”

MARKET AND INDUSTRY DATA

We obtained the industry, market and competitive position data used throughout this prospectus from our own internal estimates as well as from industry publications and research, surveys and studies conducted by third parties, including the Global Wind Energy Council, the World Meteorological Organization, North American Electric Reliability Corporation, National Energy Technology Laboratory, the U.S. Department of Energy, the U.S. Energy Information Administration, the Federal Energy Regulatory Commission, the Electric Reliability Council of Texas, the Public Utility Commission of Texas, the Centre for Energy, Natural Resources Canada, Ontario Power Generation, Ontario Power Authority, the Government of Manitoba, the Chilean Ministry of Energy and Puerto Rico Electric Power Authority. Industry publications, studies and surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe our internal company research is reliable and the market definitions are appropriate, neither such research nor these definitions have been verified by any independent source. Estimates of historical growth rates in the markets where we operate are not necessarily indicative of future growth rates in such markets.

TRADEMARKS

This prospectus includes trademarks, such as the Pattern name and the Pattern logo, which are protected under applicable intellectual property laws and are our property and/or the property of our subsidiaries. This prospectus also contains trademarks, service marks, copyrights and trade names of other companies, which are the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies. Solely for convenience, our trademarks and tradenames referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or the right of the applicable licensor to these trademarks and tradenames. We have entered into an agreement with Pattern Development under which Pattern Development licenses us the name “Pattern” and the Pattern logo and also grants us a right to acquire the name and logo, subject to our granting Pattern Development a license to use the name “Pattern” and the Pattern logo after we acquire it.

CURRENCY AND EXCHANGE RATE INFORMATION

In this prospectus, references to “C$” and “Canadian dollars” are to the lawful currency of Canada and references to “$”, “US$” and “U.S. dollars” are to the lawful currency of the United States. All dollar amounts herein are in U.S. dollars, unless otherwise stated.

ii

Table of Contents

Our historical consolidated financial statements that are included elsewhere or incorporated by reference in this prospectus are presented in U.S. dollars. The following chart sets forth for each of 2011, 2012 and 2013, and each completed month to date during 2014, the high, low, period average and period end noon buying rates of Canadian dollars expressed as Canadian dollars per US$1.00.

| Canadian Dollars per US$ 1.00 | ||||||||||||||||

| High | Low | Period Average(1) |

Period End | |||||||||||||

| Year |

||||||||||||||||

| 2011 |

C$ | 1.0605 | C$ | 0.9448 | C$ | 0.9887 | C$ | 1.0168 | ||||||||

| 2012 |

1.0417 | 0.9710 | 0.9995 | 0.9958 | ||||||||||||

| 2013 |

1.0697 | 0.9839 | 1.0300 | 1.0637 | ||||||||||||

| Month |

||||||||||||||||

| January 2014 |

1.1171 | 1.0612 | 1.0940 | 1.1116 | ||||||||||||

| February 2014 |

1.1137 | 1.0952 | 1.1054 | 1.1075 | ||||||||||||

| March 2014 |

1.1251 | 1.0965 | 1.1107 | 1.1053 | ||||||||||||

| April 2014 (through April 25) |

1.1041 | 1.0902 | 1.0993 | 1.1041 | ||||||||||||

| (1) | The average of the noon buying rates on the last business day of each month during the relevant one-year period and, in respect of monthly information, the average of the noon buying rates on each business day for the relevant one-month period. |

The noon buying rate in Canadian dollars on April 25, 2014 was US$1.00 = C$1.1041.

The above rates differ from the actual rates used in our consolidated historical financial statements and the calculation of cash available for distribution and dividends we declared and paid, if any, described elsewhere or incorporated by reference in this prospectus. Our inclusion of these exchange rates is not meant to suggest that the U.S. dollar amounts actually represent such Canadian dollar amounts or that such amounts could have been converted into Canadian dollars at any particular rate or at all.

For information on the impact of fluctuations in exchange rates on our operations, see “Risk Factors—Risks Related to Our Projects—Currency exchange rate fluctuations may have an impact on our financial results and condition” in our 2013 Form 10-K and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Quantitative and Qualitative Disclosure About Market Risk—Foreign Currency Risk.”

CAUTIONARY STATEMENT REGARDING THE USE OF NON-GAAP MEASURES

This prospectus, including documents incorporated by reference, contains references to Adjusted EBITDA, cash available for distribution before principal payments and cash available for distribution, which are not measures under generally accepted accounting principles in the United States, or “U.S. GAAP,” and, therefore, may differ from definitions of these measures used by other companies in our industry. We disclose Adjusted EBITDA, cash available for distribution before principal payments and cash available for distribution because we believe that these measures may assist investors in assessing our financial performance and the anticipated cash flow from our projects. None of these measures should be considered the sole measure of our performance and should not be considered in isolation from, or as a substitute for, the financial statements included elsewhere or incorporated by reference in this prospectus prepared in accordance with U.S. GAAP. For further discussion of the limitations of these non-U.S. GAAP measures and the reconciliations of net income to Adjusted EBITDA and net cash provided by (used in) operating activities to each of cash available for distribution before principal payments and cash available for distribution, see footnotes 1 and 2 to the table under the heading “Summary Historical Consolidated Financial Data” elsewhere in this prospectus.

iii

Table of Contents

MEANING OF CERTAIN REFERENCES

Unless the context requires otherwise, any reference in this prospectus to:

| • | “Class A shares” refers to shares of our Class A common stock, par value $0.01 per share; |

| • | “Class B shares” refers to shares of our Class B common stock, par value $0.01 per share; |

| • | our “construction projects” refers to the Grand, Panhandle 1, Panhandle 2 and El Arrayán projects, where we, or Pattern Development in the case of Panhandle 1 and Panhandle 2, have commenced construction; |

| • | the “Conversion Event” refers to the later of December 31, 2014 and the date on which our South Kent project has achieved commercial operations; |

| • | “El Arrayán” or the “El Arrayán project” refers to the wind power project assets held by Parque Eólico El Arrayán SpA, a share company formed under the laws of Chile, which upon commencement of commercial operations will have an owned capacity of 36 MW; |

| • | “FIT” refers to feed-in-tariff regime; |

| • | “Grand” or the “Grand project” refers to the wind power project assets held by a 45/45/10 joint venture between us, Samsung and the Six Nations which has an owned capacity of 67 MW; |

| • | “Gulf Wind” or the “Gulf Wind project” refers to the wind power project assets held by Pattern Gulf Wind LLC, a limited liability company formed under the laws of the State of Delaware, which has an owned capacity of 113 MW; |

| • | “Hatchet Ridge” or the “Hatchet Ridge project” refers to the wind power project assets held by Hatchet Ridge Wind, LLC, a limited liability company formed under the laws of the State of Delaware, which has an owned capacity of 101 MW; |

| • | “IPPs” refers to independent power producers; |

| • | “ISOs” refers to independent system organizations, which are organizations that administer wholesale electricity markets; |

| • | “ITCs” refers to investment tax credits; |

| • | “MW” refers to megawatts; |

| • | “MWh” refers to megawatt hours; |

| • | “OCC” refers to our operations control center; |

| • | “Ocotillo” or the “Ocotillo project” refers to the wind power project assets held by Ocotillo Express LLC, a limited liability company formed under the laws of the State of Delaware, which has an owned capacity of 265 MW; |

| • | our “operating projects” refers to the Gulf Wind, Hatchet Ridge, St. Joseph, Spring Valley, Santa Isabel, Ocotillo and South Kent projects, where we have commenced commercial operations; |

| • | “owned capacity” of any particular project refers to the maximum, or rated, electricity generating capacity of the project in MW multiplied by our percentage ownership interest in the distributable cash flow of the project; |

| • | our “predecessor” refers to our accounting predecessor, which consists of a combination of entities and assets contributed to us by Pattern Development concurrently with the IPO; |

| • | our “projects,” “portfolio” or “project portfolio” in each case refers to our operating projects together with our construction projects; |

iv

Table of Contents

| • | “Panhandle” or “the “Panhandle project” refers to the Panhandle 1 and Panhandle 2 projects collectively. |

| • | “Panhandle 1” or the “Panhandle 1 project” refers to the wind power project assets held by Pattern Panhandle Wind LLC, a limited liability company formed under the laws of the State of Delaware, and a 100% owned subsidiary of Pattern Development, which we have agreed to acquire from Pattern Development shortly after its commencement of commercial operations, which we expect to occur in June 2014, and will, upon the completion of our acquisition, have an owned capacity of 179 MW; |

| • | “Panhandle 2” or the “Panhandle 2 project” refers to the wind power project assets held by Pattern Panhandle Wind 2 LLC, a limited liability company formed under the laws of the State of Delaware, which we have agreed to acquire from Pattern Development and will, upon the completion of our acquisition, which we expect to occur in the fourth quarter of 2014, have an owned capacity of 147 MW; |

| • | “Pattern Development” refers to Pattern Energy Group LP and, where the context so requires, its subsidiaries (excluding us); |

| • | “Pattern Development-owned capacity” of any particular project refers to the maximum, or rated, electricity generating capacity of the project in MW multiplied by Pattern Development’s percentage ownership interest in the distributable cash flow of the project; |

| • | “power sale agreements” refers to PPAs and/or hedging arrangements, as applicable; |

| • | “PPAs” refers to power purchase agreements; |

| • | “PTCs” refers to production tax credits; |

| • | “rated capacity” refers to maximum electricity generating capacity in MW; |

| • | “RECs” refers to renewable energy credits; |

| • | “RFP” refers to a request for procurement; |

| • | “RPS” refers to Renewable Portfolio Standards; |

| • | “Santa Isabel” or the “Santa Isabel project” refers to the wind power project assets held by Pattern Santa Isabel LLC, a limited liability company formed under the laws of the State of Delaware, which has an owned capacity of 101 MW; |

| • | “shares,” “common shares” or “common stock” collectively refers to our Class A shares and Class B shares; |

| • | “South Kent” or the “South Kent project” refers to the wind power project assets held by South Kent Wind LP, a limited partnership formed under the laws of the Province of Ontario, which has an owned capacity of 135 MW; |

| • | “Spring Valley” or the “Spring Valley project” refers to the wind power project assets held by Spring Valley Wind LLC, a limited liability company formed under the laws of the State of Nevada, which has an owned capacity of 152 MW; and |

| • | “St. Joseph” or the “St. Joseph project” refers to the wind power project assets held by St. Joseph Windfarm Inc., a corporation formed under the laws of Canada, which has an owned capacity of 138 MW. |

v

Table of Contents

DOCUMENTS INCORPORATED BY REFERENCE

Information has been incorporated by reference in this prospectus from documents filed with the Securities and Exchange Commission (“SEC”) or similar authorities in the provinces and territories of Canada. Copies of the documents incorporated in this prospectus by reference may be obtained on request without charge from the Corporate Secretary of Pattern Energy at Pier 1, Bay 3, San Francisco, CA, telephone 415-283-4000. In addition, copies of the documents incorporated by reference herein may be obtained from the SEC through EDGAR at www.sec.gov or similar authorities in Canada through SEDAR at www.sedar.com. The following documents, filed with the SEC or similar authorities in the provinces and territories of Canada, are specifically incorporated by reference into and form an integral part of this prospectus:

| • | Our Annual Report on Form 10-K for the fiscal year ended December 31, 2013 filed with the SEC on February 28, 2014 (“2013 Form 10-K”); |

| • | Amendment No. 1 to our 2013 Form 10-K filed with the SEC on May 5, 2014; |

| • | Our Quarterly Report on Form 10-Q filed with the SEC on May 2, 2014; |

| • | The information specifically incorporated by reference into the 2013 Form 10-K from our Definitive Proxy Statement on Schedule 14A filed with the SEC on April 23, 2014 (“2014 Proxy Statement”); |

| • | Our Current Report on Form 8-K filed with the SEC on May 5, 2014; |

| • | The description of our Class A common stock contained in our Registration Statement on Form 8-A, filed with the SEC on September 24, 2013; and |

| • | The description of our Class A common stock issued under our 2013 Equity Incentive Award Plan contained in our Registration Statement on Form S-8, filed with the SEC on October 9, 2013. |

Notwithstanding the foregoing, we are not incorporating by reference any documents, portions of documents, exhibits or other information that is deemed to have been furnished to, rather than filed with, the SEC.

vi

Table of Contents

This summary highlights information contained elsewhere in, or incorporated by reference into, this prospectus. It does not contain all the information you need to consider in making your investment decision. You should read this entire prospectus carefully and should consider, among other things, the matters set forth under “Risk Factors,” along with the financial data and related notes and the other documents that we incorporate by reference into this prospectus before making your investment decision. See “Documents Incorporated by Reference.” Unless the context provides otherwise, references herein to (i) “we,” “our,” “us,” “our company” and “Pattern Energy” refer to Pattern Energy Group Inc., a Delaware corporation, together with its consolidated subsidiaries and (ii) “Pattern Development” refers to Pattern Energy Group LP and, where the context so requires, its subsidiaries (excluding us). For an explanation of certain terms used in this prospectus see “Meaning of Certain References.” For recent and historical exchange rates between Canadian dollars and U.S. dollars, see “Currency and Exchange Rate Information.”

Our Business

We are an independent power company focused on owning and operating power projects with stable long-term cash flows in attractive markets with potential for continued growth of our business. Including the pending acquisitions of the Panhandle 1 and Panhandle 2 projects,1 which we have agreed to acquire from Pattern Development, we own interests in eleven wind power projects located in the United States, Canada and Chile that use proven, best-in-class technology and have a total owned capacity of 1,434 MW, consisting of seven operating projects and four construction projects. We expect our four construction projects will commence commercial operations prior to the end of 2014. Each of our projects has contracted to sell all or a majority of its output pursuant to a long-term, fixed-price power sale agreement with a creditworthy counterparty. Ninety-one percent of the electricity to be generated by our projects will be sold under these power sale agreements, which have a weighted average remaining contract life of approximately 17 years.

We have two classes of authorized common stock outstanding, Class A shares and Class B shares. The rights of the holders of our Class A and Class B shares are identical other than in respect of dividends and the conversion rights of our Class B shares. On December 31, 2014, which is the later of that date and the date on which our South Kent project achieved commercial operations (which occurred on March 28, 2014), and which we refer to as the “Conversion Event,” all of our outstanding Class B shares will automatically convert, on a one-for-one basis, into Class A shares. Our Class B shares, all of which are held by Pattern Development and members of management, have no rights to dividends. See “Description of Capital Stock.”

We intend to use a substantial portion of the cash available for distribution generated from our projects to pay regular quarterly dividends in U.S. dollars to holders of our Class A shares. On November 26, 2013, we announced the initiation of a quarterly common stock dividend and on each of January 30, 2014 and April 30, 2014, we paid a dividend to each of our Class A common shareholders of $0.3125 per Class A share, or $1.25 per Class A share on an annualized basis. We established our initial quarterly dividend level based on a target payout ratio of approximately 80% after considering our expected 2014 and subsequently sustainable cash available for distribution to be generated from our projects, together with the impact of the Class A shares to be issued upon the Conversion Event. We increased our quarterly dividend to $0.322 per Class A share, $1.288 per Class A

| 1 | We agreed in May 2014 to acquire Panhandle 1 from Pattern Development, subject to the satisfaction of customary closing conditions, shortly after its commencement of commercial operations, which we expect to occur in June 2014. We agreed in December 2013 to acquire Panhandle 2 from Pattern Development, subject to the satisfaction of customary closing conditions, following its commencement of commercial operations, which we expect to occur in the fourth quarter of 2014. See “Management’s Discussion & Analysis of Financial Condition and Results of Operations—Factors that Significantly Affect our Business—Recent Transactions—Project Acquisitions.” |

1

Table of Contents

share on an annualized basis, representing a 3% increase in our quarterly dividend, commencing with respect to dividends payable to shareholders of record on June 30, 2014. The declaration and amount of our future dividends, if any, will be subject to our actual earnings and capital requirements and the discretion of our Board of Directors, and will likely take into account any contribution to our expected sustainable cash available for distribution resulting from projects that we acquire from Pattern Development or third parties.

Pattern Development has granted us preferential rights to acquire projects that it owns and chooses to sell, including, among others, certain projects, or the “Initial ROFO Projects,” which are predominantly operational, in construction or construction ready and which we consider reasonably likely that we may have the opportunity to acquire at various times within the 18-month period following the completion of this offering. At the time of our initial public offering, or IPO, in October 2013, we identified six projects at Pattern Development with an aggregate owned capacity of 746 MW that comprised the Initial ROFO Projects, and we indicated we had initiated discussions with Pattern Development in connection with one of these originally identified Initial ROFO Projects, the Panhandle project, which we might acquire shortly after the closing of the IPO. Pattern Development subsequently increased the owned capacity of the Panhandle project by 78 MW, to a total of 326 MW, and split the project into the Panhandle 1 project, with a Pattern Development-owned capacity of 179 MW, and the Panhandle 2 project, with an owned capacity of 147 MW. Pattern Development also increased its estimated capacity of another of the originally identified Initial ROFO Projects, the Meikle project in British Columbia, by 10 MW, to 185 MW. In December 2013, we acquired one of the Initial ROFO Projects, the Grand project, with an owned capacity of 67 MW, and agreed to acquire the Panhandle 2 project, with such acquisition expected to be completed in the fourth quarter of 2014 at the time of that project’s commencement of commercial operations. In May 2014, we agreed to acquire the Panhandle 1 project from Pattern Development, with such acquisition to be completed shortly after its commencement of commercial operations, which we expect to occur in June 2014. After accounting for Pattern Development’s increase in the size of the Panhandle and Meikle projects, our acquisition of the Grand project and our agreements to acquire the Panhandle 1 and Panhandle 2 projects, the owned capacity of the remaining Initial ROFO Projects is 441 MW. See the table under “—Our Relationship with Pattern Development” for more information about the remaining Initial ROFO Projects.

Based on our anticipated cash available for distribution and our increased quarterly dividend level, we believe that we will generate excess cash flow that we can use, together with our cash on hand and the proceeds of any potential future debt or equity issuances, to invest in accretive project acquisition opportunities, including the remaining Initial ROFO Projects. Considering our preferential rights to acquire the Initial ROFO Projects, at the time of our IPO, we established a three-year targeted average annual growth rate in our cash available for distribution per Class A share of 8% to 10%. Taking into consideration our acquisition of the Grand project in December, our agreement to acquire the Panhandle 1 and Panhandle 2 projects later this year, Pattern Development’s increase in the size of the Panhandle and Meikle projects, and continued progress in the development of the remaining Initial ROFO Projects, we have increased our three-year targeted average annual growth rate in our cash available for distribution per Class A share to 10% to 12%.

Our Core Values and Financial Objectives

We intend to maximize long-term value for our shareholders in an environmentally responsible manner and with respect for the communities in which we operate. Our business is built around the core values of creating a safe, high-integrity and exciting work environment; applying rigorous analysis to all aspects of our business; and proactively working with our stakeholders to address environmental and community concerns.

Our financial objectives, which we believe will maximize long-term value for our shareholders, are to:

| • | produce stable and sustainable cash available for distribution; |

| • | selectively grow our project portfolio and our dividend; and |

2

Table of Contents

| • | maintain a strong balance sheet and flexible capital structure. |

Our Management Team

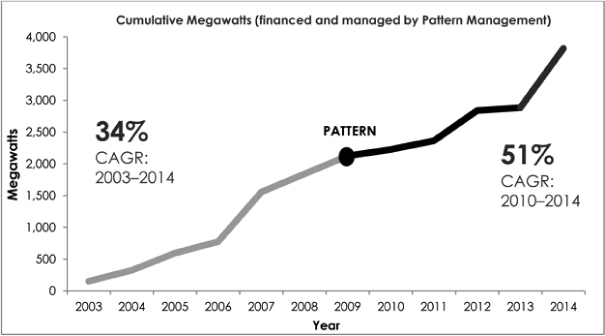

The executive officers who make up our management team have on average over 20 years of experience in all aspects of the independent power industry, including development, commercial contracting, finance, construction, operations and management, and are dedicated to protecting the long-term value of our projects. Almost all of the members of our and Pattern Development’s management teams have worked together since 2002 and have a proven track record of successfully identifying new opportunities, investing, constructing projects and operating energy assets during periods of both favorable and challenging economic conditions. While working together at Pattern Development and prior to its formation, members of our management team were responsible for, and successfully financed and managed, over $12 billion of infrastructure assets, including over 3,000 MW of wind power projects (representing a wind business compound annual growth rate, or “CAGR,” of 34% from 2003 to 2014, measured by cumulative wind MW installed), several independent transmission projects and other conventional power assets. Since the formation of Pattern Development in 2009, the Pattern Development management team has acquired and developed the operational and in-construction wind power projects that, including the Panhandle 1 and Panhandle 2 projects, comprise our owned capacity of 1,434 MW, representing a CAGR of 51%, and a more than 3,000 MW portfolio of development assets. We believe our management team, along with our talented staff, as well as the management team and staff at Pattern Development, provide our company with the depth of experience and breadth of skills to meet our financial objectives and successfully grow our business both domestically and internationally. In addition, we believe we are among the leaders in our industry in areas such as environmental mitigation, financing and commercial management, and we have built a team of highly skilled professionals dedicated to delivering high-quality, well-structured operating power projects.

3

Table of Contents

Our Projects

Including the pending acquisitions of the Panhandle 1 and Panhandle 2 projects, which we have agreed to acquire from Pattern Development, and which we expect to acquire at different times prior to the end of 2014, we own interests in eleven wind power projects, consisting of seven operating projects and four construction projects. The following table provides an overview of our projects:

| Location and Start-up | Capacity (MW) |

Power Sale Agreements | ||||||||||||||||||||||||||||||

| Projects |

Location | Construction Start(1) |

Commercial Operations (2) |

Rated (3) |

Owned (4) |

Type | Contracted Volume(5) |

Counterparty | Counter- party Credit Rating(6) |

Expiration | ||||||||||||||||||||||

| Operating Projects |

|

|||||||||||||||||||||||||||||||

| Gulf Wind |

Texas | Q1 2008 | Q3 2009 | 283 | 113 | Hedge(7) | ~58% | Credit Suisse Energy LLC |

A/A1 | 2019 | ||||||||||||||||||||||

| Hatchet Ridge |

California | Q4 2009 | Q4 2010 | 101 | 101 | PPA | 100% | Pacific Gas & Electric |

BBB/A3 | 2025 | ||||||||||||||||||||||

| St. Joseph |

Manitoba | Q1 2010 | Q2 2011 | 138 | 138 | PPA | 100% | Manitoba Hydro | AA/Aa1(8) | 2039 | ||||||||||||||||||||||

| Spring Valley |

Nevada | Q3 2011 | Q3 2012 | 152 | 152 | PPA | 100% | NV Energy | BBB+/Baa2 | 2032 | ||||||||||||||||||||||

| Santa Isabel |

Puerto Rico | Q4 2011 | Q4 2012 | 101 | 101 | PPA | 100% | Puerto Rico Electric Power Authority |

BBB/Ba2 | 2037 | ||||||||||||||||||||||

| Ocotillo(9) |

California | Q3 2012 | Q4 2012 | 223 | 223 | PPA | 100% | San Diego Gas & Electric |

A/A1 | 2033 | ||||||||||||||||||||||

| Q2 2013 | 42 | 42 | PPA | 100% | San Diego Gas & Electric |

A/A1 | 2033 | |||||||||||||||||||||||||

| South Kent |

Ontario | Q1 2013 | Q1 2014 | 270 | 135 | PPA | 100% | Ontario Power Authority |

AA-/Aa2(10) | 2034 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

| 1,310 | 1,005 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

| Construction Projects |

||||||||||||||||||||||||||||||||

| El Arrayán |

Chile | Q3 2012 | Q2 2014 | 115 | 36 | Hedge(11) | ~75% | Minera Los Pelambres |

NA | 2034 | ||||||||||||||||||||||

| Grand |

Ontario | Q3 2013 | Q4 2014 | 149 | 67 | PPA | 100% | Ontario Power Authority |

AA-/Aa2(10) | 2035 | ||||||||||||||||||||||

| Panhandle 1(12) |

Texas | Q4 2013 | Q2 2014 | 218 | 179 | Hedge(13) | ~77% | Citigroup Energy | A-/Baa2 | 2027 | ||||||||||||||||||||||

| Panhandle 2(12) |

Texas | Q4 2013 | Q4 2014 | 182 | 147 | Hedge(14) | ~80% | Morgan Stanley | A-/Baa2 | 2027 | ||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

| 664 | 429 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

| 1,974 | 1,434 | |||||||||||||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||||

| (1) | Represents date of commencement of construction. |

| (2) | Represents date of actual or anticipated commencement of commercial operations. |

| (3) | Rated capacity represents the maximum electricity generating capacity of a project in MW. As a result of wind and other conditions, a project or a turbine will not operate at its rated capacity at all times and the amount of electricity generated will be less than its rated capacity. The amount of electricity generated may vary based on a variety of factors discussed elsewhere or incorporated by reference in this prospectus See “Risk Factors” in our 2013 Form 10-K. |

| (4) | Owned capacity represents the maximum, or rated, electricity generating capacity of the project in MW multiplied by our percentage ownership interest in the distributable cash flow of the project. |

| (5) | Represents the percentage of a project’s total estimated average annual MWh of electricity generation contracted under power sale agreements. |

| (6) | Reflects the counterparty’s corporate credit ratings issued by S&P/Moody’s as of April 23, 2014. |

| (7) | Represents a 10-year fixed-for-floating power price swap. See “Business—Operating Projects—Gulf Wind.” |

| (8) | Reflects the corporate credit ratings of the Province of Manitoba, which owns 100% of Manitoba Hydro-Electric. |

| (9) | We initially commenced commercial operations on 223 MW of electricity generating capacity in the fourth quarter of 2012 and commenced commercial operations on the remaining 42 MW of electricity generating capacity from Ocotillo’s additional 18 turbines in July 2013. |

| (10) | Reflects the corporate credit ratings of the Province of Ontario, which owns 100% of the Ontario Power Authority. |

| (11) | Represents a 20-year fixed-for-floating swap. See “Business—Construction Projects—El Arrayán.” |

| (12) | The Panhandle project was separated into a separate Panhandle 1 project, with a Pattern Development-owned capacity of 179 MW, and the Panhandle 2 project, with an owned capacity of 147 MW; acquisition of the Panhandle 1 and Panhandle 2 projects is pending, and scheduled to close at different times prior to the end of 2014. |

| (13) | Represents a 13-year fixed-for-floating swap. See “Business—Construction Projects—Panhandle 1 and Panhandle 2.” |

| (14) | Represents a 12.25-year fixed-for-floating swap. See “Business—Construction Projects—Panhandle 1 and Panhandle 2.” |

Each of our projects has gone through a rigorous vetting process in order to meet our investment and our lenders’ financing criteria. The development of each project was managed and overseen by our and Pattern Development’s management teams over a period of several years and each project was designed to meet or exceed industry,

4

Table of Contents

environmental, community and safety standards applicable for industrial-scale power projects. As a result, our projects generally have the following characteristics: multi-year on-site wind data analysis; long-term contracts for our power sale, interconnection and real estate rights; fixed-price construction contracts with guaranteed completion dates; all necessary construction and operating permits; a comprehensive operations and maintenance service program; and safety, environmental and community programs.

For additional information regarding each of our projects, see “Business—Our Projects.” Our ability to begin commercial operation of our construction projects and to achieve anticipated power output at our operating projects is subject to numerous risks and uncertainties as described under “Risk Factors” in our 2013 Form 10-K.

Our Strategy

We intend to make profitable investments in environmentally responsible power projects, while embracing a long-term commitment to the communities in which we operate. To achieve our financial objectives while adhering to our core values, we intend to execute the following business strategies:

| • | maintaining and increasing the value of our projects, by focusing on value-oriented project availability (by ensuring our projects are operational when the wind is strong and PPA prices are at their highest) and by regularly scheduled and preventative maintenance and by investing in our key personnel; |

| • | completing our construction projects on schedule and within budget, by having our highly experienced construction team closely overseeing construction-contractor and turbine-vendor activities, which are subject to fixed-price contracts with guaranteed completion dates; |

| • | maintaining a prudent capital structure and financial flexibility, by seeking to match our long-term assets with long-term liabilities, limiting exposure to commodity and interest rate risk and ensuring a prudent level of leverage in our business; |

| • | working closely with our stakeholders, including suppliers, power sale agreement counterparties and the local communities where we are located to best support our projects; and |

| • | selectively growing our business, by leveraging our management team’s extensive relationships, experience and highly disciplined approach to evaluating and facilitating new business opportunities, including through collaboration with Pattern Development and other developers to advance their development pipelines, and by focusing on projects and regions where we believe we can add value. |

For more information about our business strategy, see “Business—Our Strategy.”

Our Competitive Strengths

We believe our key competitive strengths include:

| • | our high-quality projects, which we believe provide the foundation for the stable long-term cash flows required to operate our business, service our debt and achieve our financial objectives; |

| • | our strong reputation in the industry, which we believe is derived from our integrity, expertise, solutions-oriented approach and record of success, which attracts talented people and opportunities; |

| • | our approach to project selection, which aims to deliver superior financial results and minimize long-term operating risks, by employing a highly disciplined, timely and comprehensive analysis of projects using our in-house experts; |

| • | our relationship with Pattern Development, which enhances our ability to operate our projects and provides us with access to a pipeline of acquisition opportunities, including the remaining Initial ROFO Projects (see “—Our Relationship with Pattern Development”); and |

5

Table of Contents

| • | our proven management team, which has extensive experience in all aspects of the independent power business, a demonstrated track record of successfully developing, constructing and operating wind power projects and a history of prudent financial and technological innovation in the power industry. |

For more information about our competitive strengths, see “Business—Competitive Strengths.”

Market Opportunity

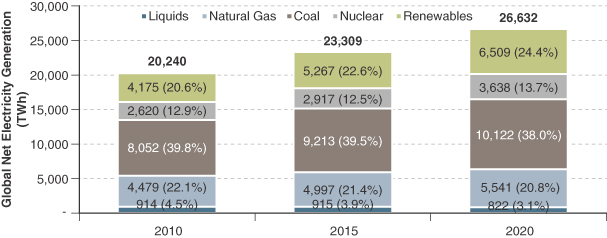

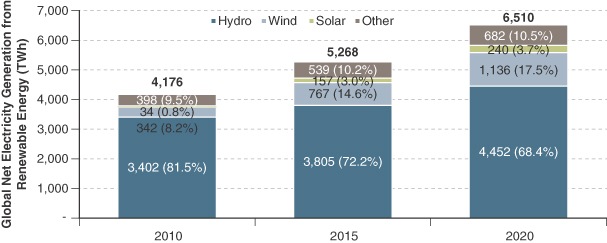

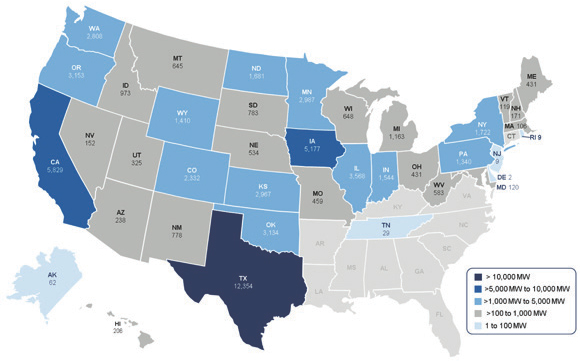

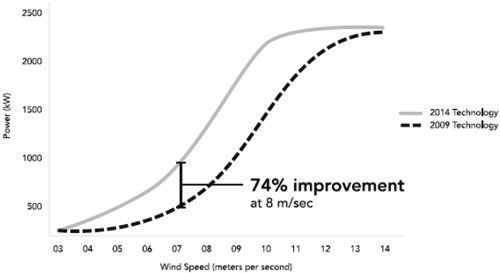

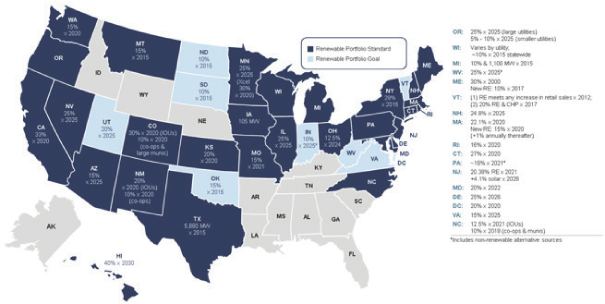

Wind power has been one of the fastest growing sources of electricity generation in North America and globally over the past decade. According to the Global Wind Energy Council, or “GWEC,” from 2003 through 2013, total net electricity generation from wind power in the United States and Canada grew at a CAGR of 25% and 38%, respectively. The growth in the industry is largely attributable to renewable energy’s increasing cost competitiveness with other power generation technologies, the advantages of wind power over other renewable energy sources and growing public support for renewable energy driven by concerns regarding security of energy supply and the environment. As global demand for electricity generation from wind power has increased, technology enhancements—supported by U.S. government incentives – have reduced the cost of wind power by more than 90% over the last twenty years, according to the American Wind Energy Association, or “AWEA.”

The United States is the second largest market for wind power in the world by electricity generating capacity. According to the U.S. Department of Energy, or “DoE,” wind power was the second largest source of new electricity generating capacity in the United States after natural gas for six of the seven years between 2005 and 2011. According to AWEA, wind power became a leading source of new electricity generating capacity in the United States for the first time in 2012. The success of wind power in the United States is evidenced by over $90 billion in investments over the last five years, according to AWEA.

The Canadian wind power industry has also experienced dramatic growth in recent years. In 2013, Canada experienced approximately 1,600 MW of new installed wind power generating capacity, resulting in wind power generating capacity in Canada reaching approximately 7,800 MW as of January 2014. Ontario, one of our markets, is the national leader in installed capacity, with approximately 2.5 gigawatts, or “GW,” of wind power generating capacity, although recent changes to the Ontario government FIT regime may make future projects less attractive and PPAs more difficult to obtain. The EIA forecasts total wind power generating capacity in Canada to exceed 13 GW by 2020.

Chile, also one of our markets, has an abundant wind resource, which GWEC estimates could provide the potential for more than 40 GW of generating capacity. As of the end of 2013, Chile had approximately 355 MW of installed wind power generating capacity, representing approximately 2% of total electricity generating capacity and, according to GWEC, approximately 6,445 MW of wind projects under various stages of development, of which 450 MW of wind power projects were expected to come online in 2014 and a further 1,400 MW during 2015 to 2018.

Given supply diversity requirements, falling equipment costs, the inherent stability of the cost of wind power as an energy resource and an active market for the purchase and sale of power projects, we believe that our markets present a substantial opportunity for growth. We require a relatively small share of a very large market to meet our growth objectives and we believe we will achieve growth through the acquisition of operational and construction-ready projects from Pattern Development and other third parties.

While we currently operate solely in wind power markets, we expect to continue to evaluate other types of independent power projects for possible acquisition, including renewable energy projects other than wind power projects, non-renewable energy projects and transmission projects.

6

Table of Contents

Our Relationship with Pattern Development

We were incorporated as a Delaware corporation by Pattern Development in October 2012 with the intent that we would own, operate and construct power projects and that Pattern Development would focus on its extensive development pipeline. Since it was formed, Pattern Development has been very active in developing project opportunities. We and Pattern Development have agreed that we will transfer Pattern Development’s employees to our company, at no cost, once we reach $2.5 billion in total market capitalization, which we believe is a sufficient size to undertake development of future projects.

Key members of our management team, together with certain other executives at Pattern Development and investment funds managed by Riverstone Holdings LLC, or “Riverstone,” formed Pattern Development in June 2009. Upon its formation, Pattern Development acquired a portfolio of development projects, but did not own any operating or construction projects. In late 2009, Pattern Development closed financing for its first construction project, Hatchet Ridge. In 2010, Pattern Development acquired the Gulf Wind project, completed construction of the Hatchet Ridge project, commenced construction of the St. Joseph project and formed a joint venture with a subsidiary of Samsung C&T Corporation, or “Samsung,” to develop at least 1,000 MW of wind power projects located in Ontario. Since 2010, Pattern Development also successfully completed construction and commenced operation of the St. Joseph, Spring Valley, Santa Isabel, Ocotillo and South Kent projects and commenced construction of the El Arrayán, Panhandle 1 and Panhandle 2, Grand and K2 projects. Certain members of Pattern Development’s management team who are not part of our management team, including John Calaway, Pattern Development’s Senior Vice President—Wind Development, and George Hardie and Colin Edwards, each a Vice President—Development, intend to continue in their current roles at Pattern Development. These individuals have been key contributors to Pattern Development’s success and to the more than 3,000 MW portfolio of development assets that includes the remaining Initial ROFO Projects.

Upon completion of this offering, Pattern Development will hold approximately 27.46% of our outstanding Class A shares and 99.1% of our outstanding Class B shares (or 22.55% and 99.1%, respectively, if the underwriters exercise their overallotment option in full), representing in the aggregate an approximate 45.17% voting interest in our company (or 41.48% if the underwriters exercise their overallotment option in full). The remaining 0.9% of our outstanding Class B shares are held by members of our management. Until the Conversion Event, neither Pattern Development nor the management holders of our Class B shares will be entitled to receive any dividends on their Class B shares.

We own, acquire and operate projects for which the development risks have been substantially reduced in order to generate stable long-term cash flows, and we expect that Pattern Development will invest in and deploy its staff to engage in higher-risk project development activities. Pattern Development holds a retained interest of approximately 27% in Gulf Wind, representing approximately 76 MW of Pattern Development-owned capacity, which we refer to as the “Pattern Development retained Gulf Wind interest” and interests in development projects with an expected total rated capacity of more than 3,000 MW, including wind power and solar power projects, as well as certain transmission development projects. Three of these development projects, together with the Pattern Development retained Gulf Wind interest, constitute the remaining Initial ROFO Projects, and are predominantly operational or construction ready.

| Remaining Initial ROFO Projects |

Capacity (MW) | |||||||||||||||||||||

| Status | Location | Construction Start(1) |

Commercial Operations(2) |

Contract Type |

Rated(3) | Pattern Development- Owned(4) |

||||||||||||||||

| Gulf Wind |

Operational | Texas | 2008 | 2009 | Hedge | 283 | 76 | |||||||||||||||

| K2 |

In Construction | Ontario | 2014 | 2015 | PPA | 270 | 90 | |||||||||||||||

| Armow |

Ready for Financing | Ontario | 2014 | 2015 | PPA | 180 | 90 | |||||||||||||||

| Meikle |

Pre-Construction | British Columbia | 2015 | 2016 | PPA | 185 | 185 | |||||||||||||||

|

|

|

|

|

|||||||||||||||||||

| 918 | 441 | |||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||||

7

Table of Contents

| (1) | Represents date of actual or anticipated commencement of construction. |

| (2) | Represents date of actual or anticipated commencement of commercial operations. |

| (3) | Rated capacity represents the maximum electricity generating capacity of a project in MW. As a result of wind and other conditions, a project or a turbine will not operate at its rated capacity at all times and the amount of electricity generated will be less than its rated capacity. The amount of electricity generated may vary based on a variety of factors. |

| (4) | Pattern Development-owned capacity represents the maximum, or rated, electricity generating capacity of the project multiplied by Pattern Development’s percentage ownership interest in the distributable cash flow of the project. |

Our Purchase Rights

To promote our growth strategy, concurrent with the completion of our IPO, we entered into a purchase rights agreement with Pattern Development and its equity owners that provides us with three distinct avenues to grow our business through acquisitions:

| • | the right to acquire the Pattern Development retained Gulf Wind interest at any time between the first and second anniversary of the completion our IPO on October 2, 2013 at its then current fair market value, which we refer to as our “Gulf Wind Call Right;” |

| • | a right of first offer with respect to any power project that Pattern Development decides to sell, including the Initial ROFO Projects, which we refer to as our “Project Purchase Right;” and |

| • | a right of first offer with respect to Pattern Development itself, or substantially all of its assets, if the equity owners of Pattern Development decide to sell any material portion of the equity interests in Pattern Development or substantially all of its assets, which we refer to as our “Pattern Development Purchase Right.” |

We refer to these rights as our “Purchase Rights.” Our Gulf Wind Call Right will commence on the first anniversary of the completion of the IPO, or October 2, 2014, and will terminate on the second anniversary of the completion our IPO, or October 2, 2015. Our Project Purchase Right and Pattern Development Purchase Right will terminate together upon the fifth anniversary of the completion our IPO, or October 2, 2018, but are subject to automatic five-year renewals unless either party dissents at the time of renewal. In addition, Pattern Development will have the right to terminate our Project Purchase Right and Pattern Development Purchase Right together upon the third occasion (within any five-year initial or renewal term) on which we have elected not to exercise our Project Purchase Right with respect to an operational or construction-ready project and following which Pattern Development has sold the project to an unrelated third party.

We have made a commitment to acquire the Panhandle 1 project from Pattern Development shortly after the commencement of that project’s commercial operations, which we expect to occur in June 2014, and the Panhandle 2 project from Pattern Development following the commencement of that project’s commercial operations, which we expect to occur in the fourth quarter of this year. In addition, although we have no commitments to make any such acquisitions, we consider it reasonably likely that we may have the opportunity to acquire some or all of the remaining Initial ROFO Projects under our Purchase Rights at various times within the 18-month period following the completion of this offering. See “Use of Proceeds” and “Certain Relationships and Related Party Transactions—Our Relationship with Pattern Development—Our Purchase Rights” in our 2014 Proxy Statement.

Shareholder Approval Rights Agreement

We entered into a shareholder approval rights agreement, or the “Shareholder Agreement,” with Pattern Development concurrently with the completion of our IPO. Pursuant to the Shareholder Agreement, for so long

8

Table of Contents

as Pattern Development beneficially owns at least 33 1/3% of our shares, Pattern Development’s consent will be necessary for us to take certain material corporate actions, including: (i) our consolidation with or merger into an unaffiliated entity; (ii) certain acquisitions of stock or assets of a third-party; (iii) our adoption of a plan of liquidation, dissolution or winding up; (iv) certain dispositions of our or our subsidiaries’ assets; (v) the incurrence of indebtedness in excess of a specified amount; (vi) a change in the size of our board of directors (subject to certain exceptions); and (vii) issuing equity securities with preferential rights to our Class A shares. See “Certain Relationships and Related Party Transactions—Shareholder Agreement” in our 2014 Proxy Statement.

Non-Competition Agreement

We entered into a non-competition agreement, or the “Non-Competition Agreement,” with Pattern Development concurrently with the completion of our IPO. Pursuant to the Non-Competition Agreement, Pattern Development agreed that, for so long as any of our Purchase Rights are exercisable, it will not compete with us for acquisitions of power generation or transmission projects from third parties. Pattern Development will notify us of opportunities to acquire power generation or transmission projects that it wishes to pursue and, should we be interested in acquiring all or a portion of such projects, we may direct Pattern Development to forego such opportunities. We may also elect to collaborate with Pattern Development to jointly pursue acquisition opportunities from time to time. Riverstone is not subject to the Non-Competition Agreement.

Management Services Agreement and Shared Management

We intend to grow our assets until we have sufficient size and cash flow to undertake development activities. Until such time, we have contracted for certain services pursuant to the terms of a bilateral services agreement with Pattern Development, or the “Management Services Agreement,” that we entered into upon the completion of our IPO. However, under the terms of the Management Services Agreement, upon the completion of the first 20 consecutive trading day period during which our total market capitalization is no less than $2.5 billion, such event, the “reintegration event,” the employees of Pattern Development will become our employees, which we refer to as the “employee reintegration.”

Our project operations and maintenance personnel and executive officers are solely compensated by us and their employment with Pattern Development terminated concurrently with the completion of our IPO. These executives lead our business functions and rely on support from Pattern Development employees for certain administrative functions. Pattern Development retained only those employees whose primary responsibilities relate to project development or legal, financial or other administrative functions. The Management Services Agreement provides for us and Pattern Development to benefit, primarily on a cost-reimbursement basis, from the parties’ respective management and other professional, technical and administrative personnel, all of whom report to and are managed by our executive officers. In the event that Pattern Development is, or substantially all of its assets are, acquired by an unrelated third party, we have the unilateral right to terminate the Management Services Agreement.

Pursuant to the Management Services Agreement, certain of our executive officers, including our Chief Executive Officer, also serve as executive officers of Pattern Development and devote their time to both our company and Pattern Development as is prudent in carrying out their executive responsibilities and fiduciary duties. We refer to our employees who serve as executive officers of both our company and Pattern Development as the “shared PEG executives.” The shared PEG executives have responsibilities to both us and Pattern Development and, as a result, these individuals do not devote all of their time to our business. Under the terms of the Management Services Agreement, Pattern Development is required to reimburse us for an allocation of the compensation paid to such shared PEG executives reflecting the percentage of time spent providing services to Pattern Development.

9

Table of Contents

Upon employee reintegration, we expect that our principal focus will continue to be owning operational and under construction power projects. However, reintegration is expected to enhance our long-term ability to independently develop projects and grow our business. Following the employee reintegration, we will continue to provide management services to Pattern Development (including services from the reintegrated departments of Pattern Development) to the extent required by Pattern Development’s remaining development activities and the consideration for such services would continue to be paid primarily on a cost reimbursement basis. See “Certain Relationships and Related Party Transactions—Management Services Agreement and Shared Management” in our 2014 Proxy Statement for a further discussion of the Management Services Agreement and the employee reintegration.

Initial Public Offering and Contribution Transactions

Concurrent with the completion of our IPO, pursuant to the terms of a contribution agreement between us and Pattern Development, which we refer to as the “Contribution Agreement,” we entered into a series of transactions with Pattern Development, or the “Contribution Transactions.” In connection with the Contribution Transactions, Pattern Development contributed to us all of our initial projects, including the related properties and other assets to be used in our business, together with liabilities and obligations to which such projects are subject.

On October 2, 2013, we issued 16,000,000 shares of Class A common stock in an IPO generating net proceeds of approximately $317.0 million. Concurrent with our IPO, we issued 19,445,000 shares of Class A common stock and 15,555,000 shares of Class B common stock to Pattern Development and utilized approximately $232.6 million of the net proceeds of the IPO as a portion of the consideration to Pattern Development for the entities and assets contributed to us in the Contribution Transactions, consisting of interests in eight wind power projects, including six projects in operation (Gulf Wind, Hatchet Ridge, St. Joseph, Spring Valley, Santa Isabel and Ocotillo), and two projects under construction (El Arrayán and South Kent). In accordance with ASC 805-50-30-5, Transactions between Entities under Common Control, we recognized the assets and liabilities contributed by Pattern Development at their historical carrying amounts at the date of the Contribution Transactions. On October 8, 2013, our underwriters exercised in full their overallotment option to purchase 2,400,000 shares of Class A common stock from Pattern Development, the selling shareholder, pursuant to the overallotment option granted by Pattern Development.

In connection with the Contribution Transactions, we also assumed certain indemnities previously granted by Pattern Development for the benefit of the Spring Valley, Santa Isabel and Ocotillo project finance lenders. These indemnity obligations consist principally of indemnities that protect the project finance lenders from the potential effect of any recapture by the U.S. Department of the Treasury, or “U.S. Treasury,” of any amount of the ITC cash grants previously received by the projects. The indemnity obligations that we assumed are in amounts that are up to the greater of the respective cash grant loans or the amounts of any cash grant subsequently recaptured. Such maximum indemnity amounts are approximately $116 million, $80 million and $58 million for the Ocotillo, Spring Valley and Santa Isabel projects, respectively. In addition, we also assumed an indemnity that was granted by Pattern Development to our Ocotillo project finance lenders in connection with certain legal matters, which is limited to the amount of certain related costs and expenses. See “Risk Factors—We are subject to various indemnity obligations,” in our 2013 Form 10-K, “Business—Legal Proceedings” and “Management’s Discussion & Analysis of Financial Condition and Results of Operations—Description of Credit Agreements—Santa Isabel Senior Financing Agreement and —Ocotillo Senior Financing Agreement” in our 2013 Form 10-K.

10

Table of Contents

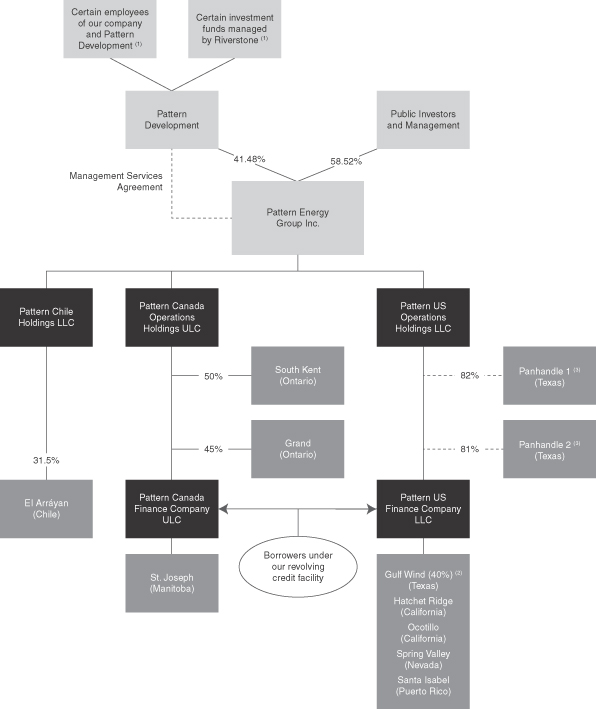

Our Ownership Structure

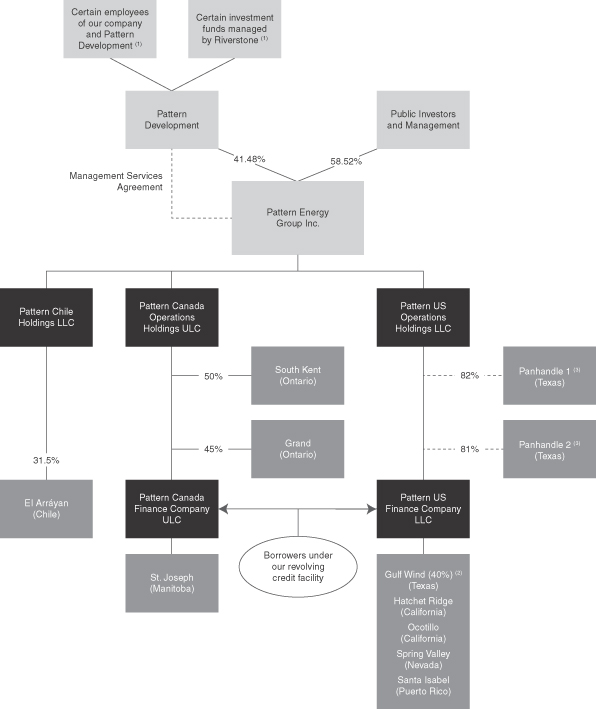

The following diagram summarizes our ownership structure upon completion of this offering (assuming that the underwriters’ option to purchase up to an additional 2,321,981 shares is exercised).

11

Table of Contents

| (1) | These funds and these employees hold indirect interests in Pattern Development. |

| (2) | Pattern Development holds an interest of approximately 27% in Gulf Wind, representing Pattern Development-owned capacity of 76 MW. |

| (3) | We have agreed to acquire the Panhandle 1 and Panhandle 2 projects from Pattern Development and expect to complete the acquisitions at different times prior to the end of 2014, subject to the satisfaction of customary closing conditions. |

Riverstone

Pattern Development was formed in June 2009 by the executive management team of Pattern Development and investment funds managed by Riverstone. Riverstone is an energy and power-focused private equity firm founded in 2000 with approximately $27.0 billion of equity capital raised across seven investment funds and related coinvestments, including the world’s largest renewable energy fund. Riverstone conducts buyout and growth capital investments in the midstream, exploration & production, oilfield services, power and renewable sectors of the energy industry. With offices in New York, London and Houston, the firm has committed approximately $25.8 billion to 107 investments in North America, Latin America, Europe, Africa and Asia.

Corporate Information

Our principal executive offices are located at Pier 1, Bay 3, San Francisco, California 94111, and our telephone number is (415) 283-4000. Our website is www.patternenergy.com. We make our periodic reports and other information filed or furnished to the SEC or Canadian Securities Administrators available, free of charge, through our website, as soon as reasonably practicable after those reports and other information are electronically filed with or furnished to the SEC or Canadian Securities Administrators. Except as specifically noted, information on our website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus.

12

Table of Contents

| Common stock offered by us |

11,609,907 Class A shares. |

| Common stock offered by the selling shareholder |

3,869,969 Class A shares |

| Class A common stock to be outstanding after this offering(x) |

47,312,722 Class A shares. |

| Total common stock to be outstanding after this offering(x) |

62,867,722 Total Class A and Class B shares. |

| Class B common stock to be outstanding after this offering |

15,555,000 Class B shares. The rights of the holders of our Class A and Class B shares are identical other than in respect of dividends and the conversion rights of the Class B shares. While each Class A and Class B share have one vote on all matters submitted to a vote of our shareholders, our Class B shares have no rights to dividends or distributions (other than upon liquidation). Upon the Conversion Event, on December 31, 2014, all of our outstanding Class B shares will automatically convert, on a one-for-one basis, into Class A shares. See “Description of Capital Stock.” |

| Conversion Event |

Our amended and restated certificate of incorporation provides that all of our Class B shares will automatically convert into Class A shares on a one-for-one basis upon the later of December 31, 2014 and the date on which our South Kent project achieves “Commercial Operations,” which occurred on March 28, 2014. |

| Overallotment option |

Pattern Development, or the “selling shareholder,” has granted the underwriters an option, exercisable within 30 days following the closing date of this offering, to purchase up to an additional 2,321,981 Class A shares at the public offering price to cover overallotments, if any. We will not receive any proceeds from the exercise of the underwriters’ overallotment option. See “Use of Proceeds.” |

| Use of proceeds |

We estimate we will receive net proceeds of approximately $287.3 million from this offering, based on an assumed public offering price of $25.84 per Class A share, which is the last reported sale price of our Class A common stock on the NASDAQ on the cover page of this prospectus, and after deducting underwriting commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering for working capital and general corporate purposes, including the acquisition of the Panhandle 1 wind project and potentially including certain other wind projects. See “Use of Proceeds” and “Certain Relationships and Related Party Transactions” in the 2014 Proxy Statement for additional information. |

| We will not receive any proceeds from the sale of the shares being sold by the selling shareholder. |

13

Table of Contents

| Pattern Development retained interest |

Upon completion of this offering, Pattern Development will hold approximately 27.46% of our outstanding Class A shares and 99.1% of our outstanding Class B shares (or 22.55% and 99.1%, respectively, if the underwriters exercise their overallotment option in full), representing in the aggregate an approximate 45.17% voting interest in our company (or 41.48% if the underwriters exercise their overallotment option in full). The remaining 0.9% of our outstanding Class B shares is held by members of our management. Until the Conversion Event, neither Pattern Development nor the management holders of our Class B shares will be entitled to receive any dividends on their Class B shares. |

| Dividends |

On November 26, 2013, we announced the initiation of a quarterly common stock dividend and on each of January 30, 2014 and April 30, 2014, we paid dividends to each of our Class A common shareholders of $0.3125 per Class A share, or $1.25 per Class A share on an annualized basis. We increased our quarterly dividend to $0.322 per Class A share, or $1.288 per Class A share on an annualized basis, commencing with respect to dividends payable to shareholders of record as of June 30, 2014. |

| Exchange listing |

Our Class A shares are listed on the NASDAQ Global Market, or “NASDAQ,” under the symbol “PEGI”, and the Toronto Stock Exchange, or “TSX,” under the symbol “PEG.” |

| U.S. Taxation of Dividends to Non-U.S. Holders |

The distributions that we will make to our shareholders will be treated as dividends under U.S. tax law only to the extent that they will be paid out of our current or accumulated earnings and profits computed under U.S. tax principles, which we refer to herein as “earnings and profits.” Our earnings and profits, as calculated under U.S. tax principles, may be negative at times due to various deductions, for example, depreciation. If the cash dividends paid to our shareholders exceed our current and accumulated earnings and profits for a taxable year, the excess cash dividends would not be taxable as a dividend but rather would be treated as a return of capital for U.S. federal income tax purposes, which would result in a reduction in the adjusted tax basis of our shares to the extent thereof, and any balance in excess of adjusted basis would be treated as a gain for U.S. federal income tax purposes. For non-U.S. Holders (as defined under “Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Class A Common Shares”), cash dividends that are treated as dividends would normally be subject to U.S. federal withholding tax at the rate of 30% (or at a reduced rate under an applicable income tax treaty). Although distributions on our Class A common shares in any year likely will exceed our earnings and profits and thus some or all of such distributions will not constitute dividends for U.S. federal income tax purposes, the facts necessary to make a determination of the extent to which a distribution on our Class A common shares is treated as a dividend for such purpose may not be known at the time of the distribution, and therefore a non- U.S. holder should expect that |

14

Table of Contents

| a withholding agent will treat the entire amount of a distribution on our Class A common shares as a dividend for purposes of determining the amount required to be withheld on such distribution. If it is later determined that all or a portion of such distribution did not in fact constitute a dividend for U.S. federal income tax purposes, a non-U.S. holder may be entitled to a refund of any excess tax withheld, provided that the required information is timely furnished to the IRS. |

| For more information, see “Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Class A Common Shares.” |

| Canadian Taxation of Dividends to Canadian Resident Shareholders and Non-Canadian Resident Shareholders |

Shareholders resident in Canada will generally be required to include in their income any dividends, including any amounts deducted for U.S. withholding tax, if any, received on the shares whether or not treated as dividends under U.S. tax law. Such shareholders may be eligible for a foreign tax credit or deduction in respect of any U.S. withholding tax in computing their Canadian tax liability. |

| Dividends paid in respect of our shares to shareholders not resident in Canada will not be subject to Canadian withholding tax or, generally, other Canadian income tax. |

| For more information, see “Material Canadian Federal Income Tax Considerations for Holders of Our Class A Common Shares.” |

| FERC-Related Purchase Restrictions |

As a result of the FPA and FERC’s regulations in respect of transfers of control, consistent with the requirements for blanket authorizations granted under or exemptions from FERC’s regulations, absent prior authorization by FERC, no purchaser in this offering will be permitted to purchase an amount of our Class A shares that would cause such purchaser and its affiliate and associate companies in aggregate to hold 10% or more of our common shares outstanding after this offering. See “Risk Factors—Risks Related to this Offering and Ownership of our Class A Shares—As a result of the FPA and FERC’s regulations in respect of transfers of control, absent prior authorization by FERC, neither we nor Pattern Development can convey to an investor, nor will an investor in our company generally be permitted to obtain, a direct and/or indirect voting interest in 10% or more of our issued and outstanding voting securities, and a violation of this limitation could result in civil or criminal penalties under the FPA and possible further sanctions imposed by FERC under the FPA.” |

| (x) | Includes (a) 11,609,907 Class A shares offered by us to the public hereby and (b) 35,702,815 Class A shares outstanding prior to this offering, and excludes 2,295,270 Class A shares available for future issuance under our 2013 Equity Incentive Award Plan. |

15

Table of Contents

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table presents summary historical consolidated financial data as of the dates and for the periods indicated. The summary historical consolidated financial data as of December 31, 2011, 2012 and 2013 and for the years ended December 31, 2011, 2012 and 2013 have been derived from the audited historical consolidated financial statements incorporated by reference in this prospectus. The summary historical consolidated financial data as of March 31, 2014 and for the three months ended March 31, 2013 and 2014 have been derived from our unaudited interim historical financial statements incorporated by reference in this prospectus.