Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Mastercard Inc | d720800d8k.htm |

| EX-99.1 - EX-99.1 - Mastercard Inc | d720800dex991.htm |

| Exhibit 99.2

|

MasterCard Incorporated First-Quarter 2014 Financial Results Conference Call

May 1, 2014

©2014 MasterCard. Proprietary

1

|

|

Thoughts for the Future

Operational Overview

Economic Update

Business Highlights

©2014 MasterCard.

Proprietary

Page 2

2

|

|

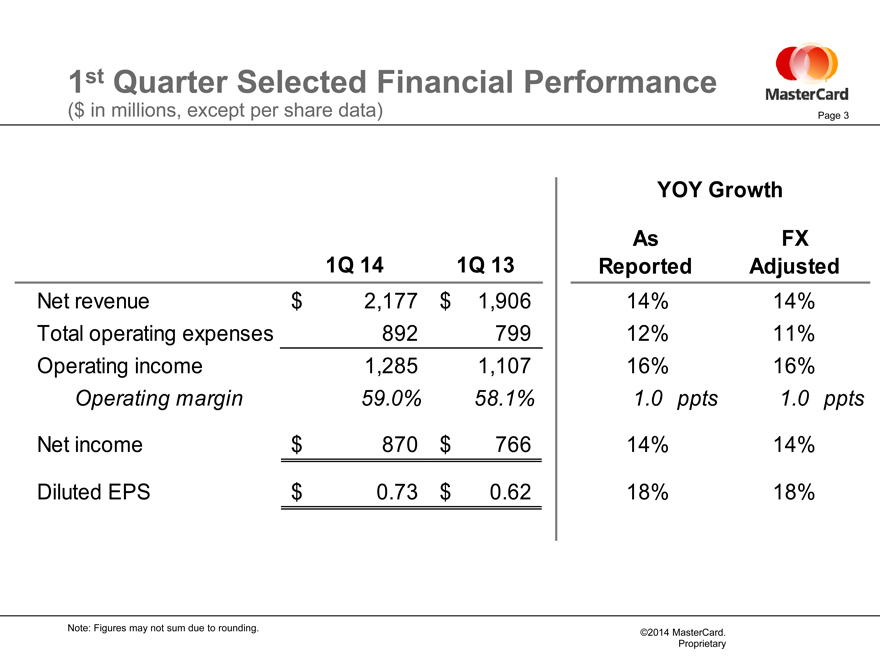

1st Quarter Selected Financial Performance

($ in millions, except per share data)

Page 3

YOY Growth

As FX

1Q 14 1Q 13 Reported Adjusted

Net revenue $ 2,177 $ 1,906 14% 14%

Total operating expenses 892 799 12% 11%

Operating income 1,285 1,107 16% 16%

Operating margin 59.0% 58.1% 1.0 ppts 1.0 ppts

Net income $ 870 $ 766 14% 14%

Diluted EPS $ 0.73 $ 0.62 18% 18%

Note: Figures may not sum due to rounding.

©2014 MasterCard.

Proprietary

3

|

|

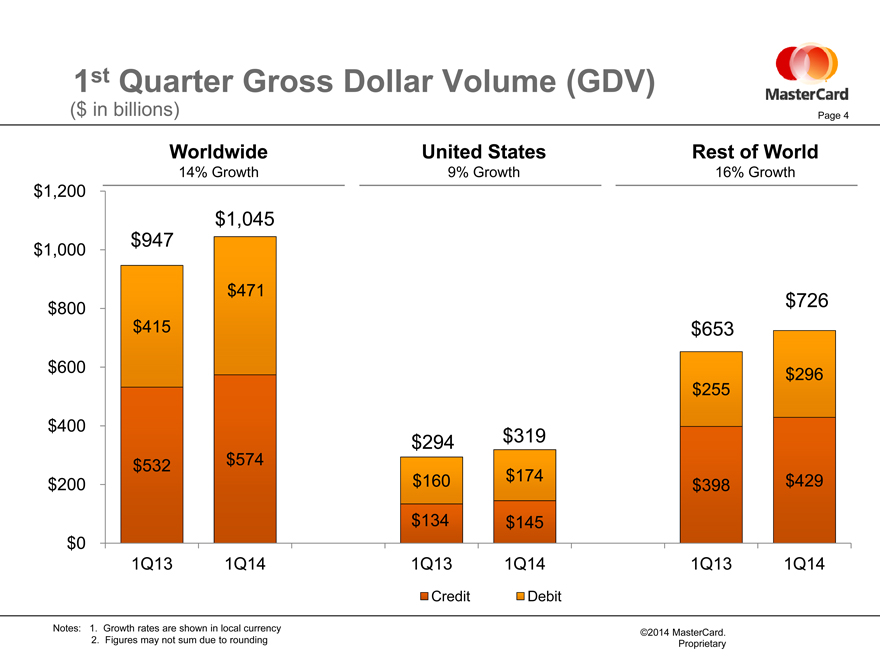

1st Quarter Gross Dollar Volume (GDV)

($ in billions)

Worldwide United States Rest of World

14% Growth 9% Growth 16% Growth $1,200

$1,045 $947

$1,000

$471 $800 $726 $415 $653 $600 $296 $255

$400

$294 $319

$532 $574 $160 $174 $429 $200 $398 $134 $145 $0 1Q13 1Q14 1Q13 1Q14 1Q13 1Q14

Credit Debit

Notes: 1. Growth rates are shown in local currency

2. Figures may not sum due to rounding

©2014 MasterCard.

Proprietary

Page 4

4

|

|

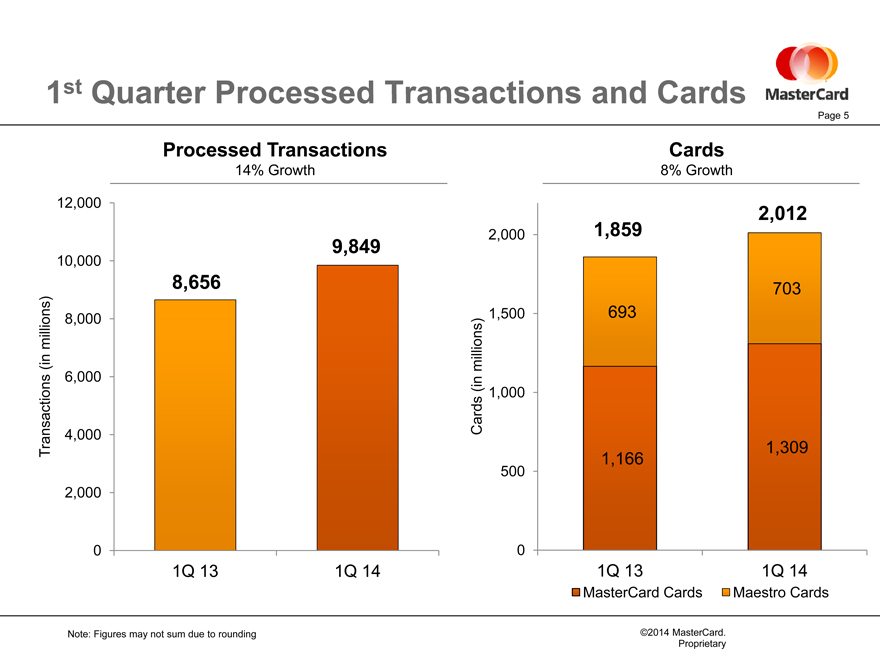

1st Quarter Processed Transactions and Cards

Page 5

Processed Transactions Cards

14% Growth 8% Growth

12,000

2,012

2,000 1,859 10,000 9,849

8,656 703

millions) 8,000 1,500 693 (in millions)

6,000 (in 1,000 4,000 Cards

Transactions 1,309 1,166

500 2,000

0 0

1Q 13 1Q 14 1Q 13 1Q 14

MasterCard Cards Maestro Cards

Note: Figures may not sum due to rounding

©2014 MasterCard.

Proprietary

5

|

|

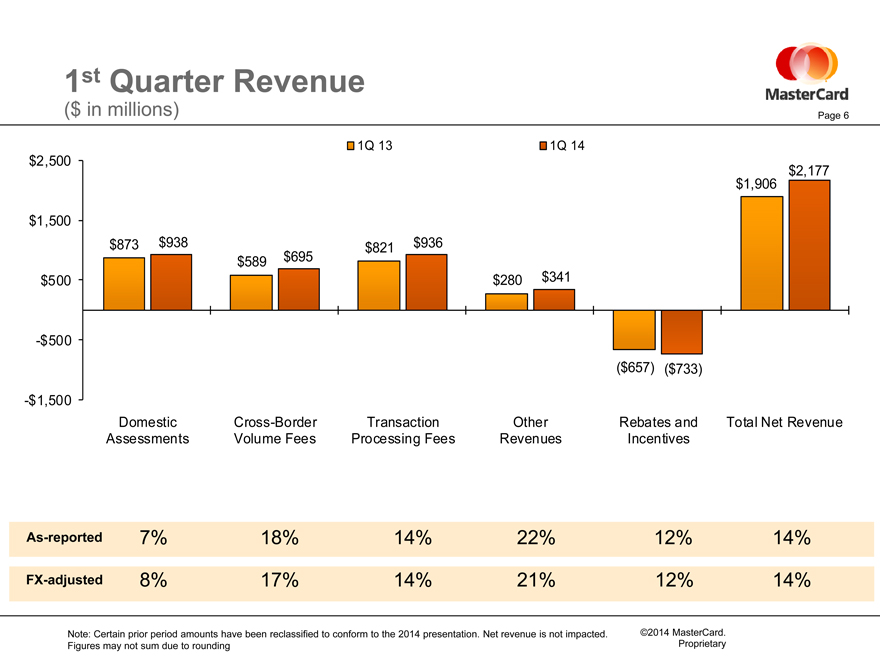

1st Quarter Revenue

($ in millions)

Page 6

1Q 13 1Q 14 $2,500 $2,177 $1,906 $1,500

$873 $938 $821 $936

$589 $695

$500 $280 $341 -$ 500 ($657) ($733)

-$ 1,500

Domestic Cross-Border Transaction Other Rebates and Total Net Revenue Assessments Volume Fees Processing Fees Revenues Incentives

As-reported

7%

18%

14%

22%

12%

14%

FX-adjusted

8%

17%

14%

21%

12%

14%

Note: Certain prior period amounts have been reclassified to conform to the 2014 presentation. Net revenue is not impacted. Figures may not sum due to rounding

©2014 MasterCard.

Proprietary

6

|

|

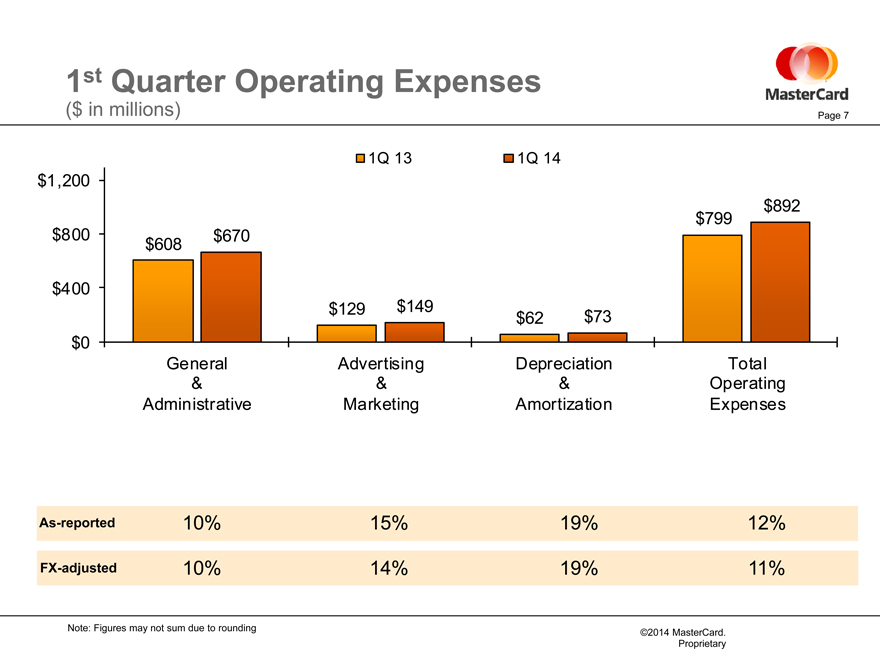

1st Quarter Operating Expenses

($ in millions)

1Q 13 1Q 14 $1,200 $892 $799 $800 $670 $608

$400 $129 $149

$62 $73 $0

General Advertising Depreciation Total

& & & Operating Administrative Marketing Amortization Expenses

Page 7

As-reported 10% 15% 19% 12%

FX-adjusted 10% 14% 19% 11%

Note: Figures may not sum due to rounding

©2014 MasterCard.

Proprietary

7

|

|

Thoughts for the Future

Page 8

Business update through April 28

Long-Term Performance Objectives

Thoughts for 2014

Impact from Acquisitions

Revenue

Operating Expenses

Tax Rate

FX Impact

MasterCard Incorporated

©2014 MasterCard.

Proprietary

8

|

|

MasterCard

9

|

|

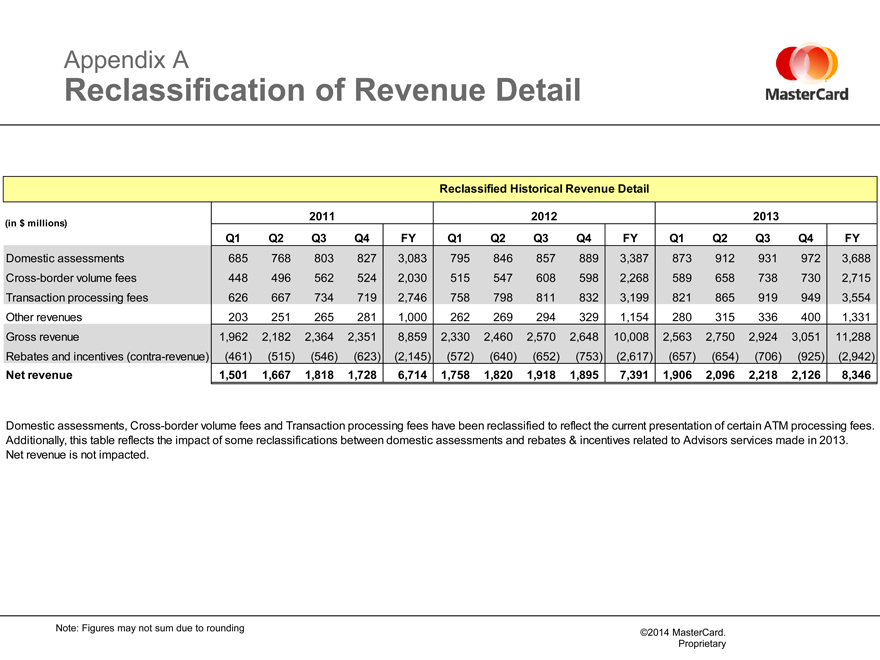

Appendix A

Reclassification of Revenue Detail

Reclassified Historical Revenue Detail

(in $ millions) 2011 2012 2013

Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY Q1 Q2 Q3 Q4 FY

Domestic assessments 685 768 803 827 3,083 795 846 857 889 3,387 873 912 931 972 3,688

Cross-border volume fees 448 496 562 524 2,030 515 547 608 598 2,268 589 658 738 730 2,715

Transaction processing fees 626 667 734 719 2,746 758 798 811 832 3,199 821 865 919 949 3,554

Other revenues 203 251 265 281 1,000 262 269 294 329 1,154 280 315 336 400 1,331

Gross revenue 1,962 2,182 2,364 2,351 8,859 2,330 2,460 2,570 2,648 10,008 2,563 2,750 2,924 3,051 11,288

Rebates and incentives (contra-revenue)(461)(515)(546)(623)(2,145)(572)(640)(652)(753)(2,617)(657)(654)(706)(925)(2,942)

Net revenue 1501, 1,667 1818, 1728, 6714, 1758, 1820, 1918, 1,895 7391, 1906, 2096, 2,218 2126, 8,346

Domestic assessments, Cross-border volume fees and Transaction processing fees have been reclassified to reflect the current presentation of certain ATM processing fees. Additionally, this table reflects the impact of some reclassifications between domestic assessments and rebates & incentives related to Advisors services made in 2013. Net revenue is not impacted.

Note: Figures may not sum due to rounding

©2014 MasterCard.

Proprietary

10