Attached files

| file | filename |

|---|---|

| EX-32.2 - RedHawk Holdings Corp. | ex32-2.htm |

| EX-32.1 - RedHawk Holdings Corp. | ex32-1.htm |

| EX-31.2 - RedHawk Holdings Corp. | ex31-2.htm |

| EX-31.1 - RedHawk Holdings Corp. | ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

For the Fiscal Year Ended January 31, 2014

|

|

| o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

|

|

For the transition period from ______________ to ____________

|

Commission file number 000-54323

INDEPENDENCE ENERGY, CORP.

(Exact name of registrant as specified in its charter)

|

Nevada

|

20-3866475

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

3020 Old Ranch Parkway, Suite 300, Seal Beach, CA

|

90740

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number, including area code: (562) 799-5588

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Name of Each Exchange On Which Registered

|

|

|

N/A

|

N/A

|

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

|

Non-Accelerated Filer o

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

The aggregate market value of Common Stock held by non-affiliates of the Registrant on July 31, 2013 was $729,335 based on a $0.0085 average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date.

345,188,164 common shares as of April 29, 2014.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

11

|

|

Item 1B.

|

Unresolved Staff Comments

|

14

|

|

Item 2.

|

Properties

|

14

|

|

Item 3.

|

Legal Proceedings

|

17

|

|

Item 4.

|

Mine Safety Disclosures

|

17

|

|

Item 5.

|

Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

17

|

|

Item 6.

|

Selected Financial Data

|

18

|

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

18

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

22

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

23

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

36

|

|

Item 9A.

|

Controls and Procedures

|

36

|

|

Item 9B.

|

Other Information

|

37

|

|

Item 10.

|

Directors and Executive Officers

|

38

|

|

Item 11.

|

Executive Compensation

|

41

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

43

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

45

|

|

Item 14.

|

Principal Accounting Fees and Services

|

45

|

|

Item 15.

|

Exhibits

|

46

|

2

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms “we”, “us”, “our” and “our company” mean Independence Energy Corp., unless otherwise indicated.

Corporate Overview

We were incorporated in the State of Nevada on November 30, 2005 under the name “Oliver Creek Resources Inc.”. At inception, we were an exploration stage company engaged in the acquisition, exploration and development of natural resource properties.

Effective August 12, 2008, we effected a forward stock split of our issued and outstanding common stock on a 12 new for 1old basis such that, our authorized capital remains at 75,000,000 shares of common stock with a par value of $0.001 and our issued and outstanding shares increased from 2,000,000 shares of common stock to 24,000,000 shares of common stock. Also effective August 12, 2008, we have changed our name from “Oliver Creek Resources Inc.” to “Independence Energy Corp.”. The change of name was approved by our directors and a majority of our shareholders.

The name change, forward stock split and reduction of authorized capital became effective with the Over-the-Counter Bulletin Board at the opening for trading on August 12, 2008 under the new stock symbol “IDNG”.

Effective June 22, 2012, we effected a forward split of our authorized and issued and outstanding shares of common stock on a 5 new for 1 old basis such that, our authorized capital increased from 75,000,000 to 375,000,000 shares of common stock and correspondingly, our issued and outstanding shares of common stock increased from 24,360,831 to 121,804,155 shares of common stock, all with a par value of $0.001. Our CUSIP number is 45343Y 205.

3

Current Business

We are classified as a crude petroleum and natural gas company and, until recently, our business focused exclusively on oil and natural gas exploration and production in the United States. We continue to hold a 10% working interests in the Quinlan Wells, described below. We do not directly hold the leases underlying the wells and therefore are not responsible for the payment or evaluation of any obligations under the leases. The leaseholder of the property is responsible for paying and maintaining the leases. As a working interest holder, we are responsible for our pro-rata share of lease operating expenses. We may sell our working interest in the Quinlan Wells if we identify a favorable opportunity or otherwise determine that disposing of the asset would be in the best interest of the Company. As at the date of this report we have been invoiced for approximately $58,300 in lease operating expenses related to the Quinlan wells. This amount remains unpaid. Our failure to pay the outstanding amounts entitles the lease holder to foreclose on our working interest. We are actively seeking purchasers to assume our working interest and related liabilities.

Business History

On December 15, 2011, we closed the acquisition of a 2.5% working interest in the Quinlan Lease from Wise Oil and Gas LLC, with the option to increase that interest to 10%. On the closing of the acquisition on December 15, 2011, we began generating revenue from the operating well on the property even though the well is in the exploration and evaluation stage. On December 23, 2011, we closed an acquisition for an additional 2.5% working interest for a total of 5% working interest. The Quinlan Lease is located in Pottawatomie County, Oklahoma.

Effective March 1, 2012, our company, paid an additional $78,080 to Wise Oil and Gas for an additional 5% participation in the Quinlan 1, 2 and 3 wells located in Pottawatomie County, Oklahoma at a cost of $15,616 per 1%. Our company now holds a 10% interest in the Quinlan 1, 2 and 3 wells. As at the date of this report we have been invoiced for approximately $58,300 in lease operating expenses related to the Quinlan wells. This amount remains unpaid. Our failure to pay the outstanding amounts entitles the lease holder to foreclose on our working interest. We are actively seeking purchasers to assume our working interest and related liabilities.

Effective March 29, 2012, our company, acquired a 5% working interest, on a 70% net revenue interest, in a drilling program in Coleman County, Texas. The interest was acquired from MontCrest Energy, Inc. for total consideration of $115,000. On June 18, 2012, we amended and replaced the original agreement to acquire a 7% working interest, on a 75% net revenue interest in two well drilling programs, for additional consideration of $46,000.

On May 29, 2012, we entered into and closed a purchaser agreement and bill of sale to acquire a 2.5% working interest (on a 70% net revenue interest) in two oil and gas wells: the Taylor - MEI # 113 and Taylor - MEI # 115 from MontCrest. The wells are located on MontCrest's Taylor Lease in Coleman County, Texas. The 2.5% interest was acquired for total consideration of $82,500. The interest includes approximately 20 acres of land surrounding each well above the measured depth of four thousand feet. The wells are located within T. & N.O.R.R Survey No. 28, Abstract 1667 in Coleman County, Texas.

On June 8, 2012, we entered into and closed a joint development and operating agreement with MontCrest Energy Properties, Inc., MontCrest Energy, Inc. and Black Strata, LLC, to acquire a 12.5% working interest, with an option to acquire an additional 12.5% working interest in the areas in mutual interests from MontCrest Energy, Inc. The 12.5% interest was acquired for total consideration of $90,784.50. The areas in mutual interest, consists of approximately 2,421 acres, in Coleman County, Texas, located within T. & N.O.R.R Survey Block, Abstract 1640, Abstract 654, Abstract 851 and Abstract 865.

On February 28, 2013, we entered into a compromise, settlement and property exchange agreement dated February 25, 2013 with MontCrest Energy, Inc. and Black Strata, LLC. Pursuant to the terms of the agreement, we transferred to MontCrest our 25% working interests in Wells 105, 106, 113 and 115 of the Coleman County South Leases located in Coleman County, Texas, in consideration of a 100% interest in approximately 1,400 acres of the Coleman County South Lease held by Black Strata, LLC. As at April 1, 2014, all oil & gas leases located on the Coleman County South Property were expired. Our management decided not to renew the Coleman Country South leases in light of our recent Asset Purchase Agreement with American Medical Distributors, LLC (described below) and its decision to focus our operations on the development of a medical device distribution business. We have no outstanding obligations in relation to the leases or the Compromise, Settlement, and Property Exchange Agreement dated February 25, 2013.

4

On April 5, 2013, we entered into a private placement subscription agreement with Europa Capital AG pursuant to which we issued to Europa a convertible debenture in the aggregate amount of $46,000. The convertible debenture carried interest at the rate of 6% per annum and could be converted into shares of our common stock at the rate of $0.01 per share Interest and principal were payable on the 3 year anniversary of the debenture, provided that any unconverted portions may be pre-paid at our discretion. As at January 31, 2014, we owed $2,284 of accrued interest in respect of the debenture. On January 31, 2014, the debenture holder forgave the convertible promissory note and all accrued interest, resulting in a gain on forgiveness of loan of $48,284.

Effective July 22, 2013, we entered into and closed a securities purchase agreement with Asher Enterprises, Inc. (“Asher”). Under the terms of the agreement, our company issued an 8% convertible promissory note, in the principal amount of $57,000, which matured on April 17, 2014 and could be converted into shares of our company's common stock at a rate of 58% of the market price on any conversion date, any time after 180 days from July 15, 2013, subject to adjustments as further set out in the note. Our company had the right to prepay the note together with all accrued interest within 180 days of July 15, 2013 subject to a prepayment penalty equal to 15% during the first 30 days of the prepayment period and increasing by 5% during each subsequent 30 day period. Following the maturity date of April 17, 2014, the note shall bore interest at the rate of 22%. Subsequent to January 31, 2014, all remaining principal and accrued interest in respect of the convertible promissory note was converted into shares of our common stock.

On September 23, 2013, we closed a securities purchase agreement dated September 17, 2013 with Asher. Under the terms of the agreement, our company issued an 8% convertible promissory note, in the principal amount of $32,500, which matured on June 19, 2014 and could be converted into shares of our company’s common stock at a rate of 58% of the market price on any conversion date, any time after 180 days from June 19, 2014, subject to adjustments as further set out in the note. Our company had the right to prepay the note together with all accrued interest within 180 days of September 17, 2013 subject to a prepayment penalty equal to 15% during the first 30 days of the prepayment period and increasing by 5% during each subsequent 30 day period. Following the maturity date of June 19, 2014, the note bore interest at the rate of 22%. Subsequent to January 31, 2014, all remaining principal and accrued interest in respect of the convertible promissory note was converted into shares of our common stock.

Medical Device Business

On March 31, 2014, we entered into and closed an asset purchase agreement with American Medical Distributors, LLC (“AMD”). Pursuant to the agreement we have acquired from AMD all right, title and interest of AMD in and to a certain distribution contract (the “HuBDIC Agreement”) dated November 27, 2013 with HuBDIC Co. Ltd., a Korea corporation, pursuant to which AMD has been granted the exclusive right to distribute in the Americas certain professional and consumer grade non-contact thermometers known as the Thermofinder FS-700 Pro and FS-700 (retail version), and any future versions. As additional consideration, we have also received $60,000 and any assets of AMD related to its distribution business, including, all sales leads and related materials (collectively, including the HuBDIC Agreement, the “AMD Assets”).

The material terms of the HuBDIC Agreement are as follows: (a) term of 5 years from November 7, 2013; (b) subject to FDA marketing clearance of the HuBDIC products, which is anticipated, we are required to purchase a minimum of 3,000 product units for re-sale during year 1 of the distribution period, 8,000 during year 2, and 15,000 during each subsequent year; (c) a $10,000 distribution fee paid to HuBDIC by AMD will be credited toward the first product order; and (d) the deposit is refundable to us at our election, and we may terminate the HuBDIC Agreement in the event FDA premarket clearance is not granted by April 26, 2014An application for premarket clearance was submitted by HuBDIC on January 20, 2014, however premarket clearance has not be obtained as at the date of this report. We have not elected to terminate the agreement and continue to anticipate receipt of premarket clearance.

5

In consideration of the AMD Assets, we have agreed to issue to four designees of AMD an aggregate of 152,172,287 shares of our common stock.

About Thermofinder FS-700 and FS-700 Pro

The Thermofinder is medical grade non-contact thermometer that is currently approved and distributed in Asia and Europe. It is available in two version, the FS-700 (retail model) and FS-700 Pro (professional model). The device`s features include the following:

|

·

|

Two measuring modes including body temperature and surface/ambience modes which allows the reading of air temperature and fluid temperature (bath water, baby’s bottles);

|

|

·

|

Non-invasive design—Operated by pointing and pressing within 3-5 centimeters of the patient’s forehead or other target;

|

|

·

|

Easy to read LCD backlit display with multi-color screen and alert function. A green light is shown for normal reading, and an orange light for high readings.

|

|

·

|

Less than 2 second reading response time.

|

|

·

|

Reading accuracy within 0.3 degrees celcius for body temperature and 2 degrees celcius for object temperature.

|

|

·

|

International Organization for Standardization (ISO) 13485 and American Society for Testing and Materials (ASTM) Compliant.

|

|

·

|

More hygienic than conventional oral and ear reading thermometers—Eliminating the need for probe covers and reducing sterilization requirements.

|

|

·

|

The PRO model is equipped with a medical grade protection cover, logo lanyard, anti-microbial option, and rechargeable battery and station.

|

HuBDIC Co. Ltd. submitted an application to the FDA on January 29, 2014 seeking premarket clearance for the Thermofinder. Premarket clearance is required before any marketing, sales or distribution of the product may be conducted in the U.S. Our management believes that clearance for the Thermofinder is forthcoming based on HuBDIC`s past successful clearance of thermometers which, in the opinion of our management, are substantially equivalent to the Thermofinder as a predicate device. Notwithstanding our management`s assessment, there is no guarantee that premarket clearance will be obtained in a timely manner, if at all.

Markets and Marketing Plan

The Thermofinder is intended to provide economic thermometry to a broad base of users and is ideal for home and institutional use. The market for the device includes:

|

·

|

Retail Pharmacies

|

|

·

|

Hospitals

|

|

·

|

Physicians Offices

|

|

·

|

Private and Public Healthcare Clinics

|

|

·

|

Corrections Facilities

|

|

·

|

Schools

|

|

·

|

Veterinary Clinics

|

|

·

|

Emergency Services

|

|

·

|

Long Term Care Facilities

|

6

Subject to receipt of FDA premarket clearance, we intend to focus our initial marketing on the professional market. This strategy will reduce initial marketing costs, while establishing product awareness in the health community.

Plan of Operation

Our plan of operations for the next 12 months is to prepare our marketing and distribution strategy and our sales and distribution force in anticipation of FDA marketing clearance for the Thermofinder. Although our management believes that FDA marketing clearance of the Thermofinder is forthcoming, there is no guarantee that approval will be obtained or that it will be obtained in a timely manner. We will also require additional capital to carry out our current business plan. We currently do not have sufficient financing to fully execute our business plan and there is no assurance that we will be able to obtain the necessary financing to do so.

We may not be able to fund our cash requirements through our current operations. Historically, we have been able to raise a limited amount of capital through private placements of our equity stock, but we are uncertain about our continued ability to raise funds privately. Further, we believe that our company may have difficulties raising capital until FDA approval is granted. If we are unable to secure adequate capital to continue our acquisition efforts, our shareholders may lose some or all of their investment and our business may fail.

We estimate that our expenses over the next 12 months (beginning February 2014) will be approximately $1,000,000 as described in the table below. These estimates may change significantly depending on the performance of our products in the marketplace and our ability to raise capital from shareholders or other sources.

|

Description

|

Estimated

Completion

Date

|

Estimated

Expenses

($)

|

||||

|

Legal and accounting fees

|

12 months

|

100,000 | ||||

|

Marketing and advertising

|

12 months

|

500,000 | ||||

|

Employees and Consultant Compensation

|

12 months

|

250,000 | ||||

|

General and Administrative

|

12 months

|

150,000 | ||||

|

Total

|

1,000,000 | |||||

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements and, subject to timely receipt of FDA marketing clearance, through product sales. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any private placement financings on terms that will be acceptable to us. We may not raise sufficient funds to fully carry out our business plan, in which case we intend to scale back our expenditures in order to accommodate the budget available to us.

Insurance

We do not maintain any insurance but will be required to maintain insurance in the future prior to launching our medical device distribution operations. Because we do not currently have any insurance, if we are made a party to a liability action, we may not have sufficient funds to defend the litigation. If that occurs a judgment could be rendered against us that could cause us to cease operations.

Competition

The medical device distribution industry is highly competitive. We are a development stage company without established operations in our industry and have a weak competitive position. We aim to compete with junior and senior medical device manufacturers or distributors who are actively seeking to develop or acquire and sell devices competitive with our own. Competition for the medical device assets is intense and we may lack the technological information, human resources, infrastructure, expertise, and financial resources available to our competitors.

7

Many of the companies with which we aim to compete for financing and for the acquisition of medical device assets have greater financial and technical resources than those available to us. Accordingly, these competitors may be able to spend greater amounts on assets of merit or on developing and distributing their own technologies. Such competition could adversely impact our ability to attain the financing necessary for us to develop our current assets or obtain and develop future assets.

General competitive conditions may be substantially affected by various forms of regulation introduced from time to time by the governments of the United States and other countries, as well as factors beyond our control, including overall levels of supply and demand for the product types which we seek to distribute.

In the face of competition, we may not be successful in acquiring or successfully exploiting any distribution rights which we have acquired or may acquire in the future. Despite this, we hope to compete successfully in the medical device industry by:

|

·

|

keeping our costs low;

|

|

·

|

relying on the strength of our management’s and future sales team’s contacts;

|

|

·

|

utilizing our team's previous product and sales and support experience in the specific device area; and

|

|

·

|

using our size and experience to our advantage by adapting quickly to changing market conditions or responding swiftly to potential opportunities.

|

Research and Development Expenditures

We have not incurred any research expenditures over the past two fiscal years.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark. We have established a website and maintain the domain www.independenceenergycorp.com. We have also purchased the domain independencehealthcorp.com.

Employees; Identification of Certain Significant Employees

Currently, we do not have any employees. Additionally, we have not entered into any consulting or employment agreements with our president, chief executive officer, chief financial officer, treasurer and secretary other than previously filed. Our directors, executive officers and certain contracted individuals play an important role in the running of our company. We do not expect any material changes in the number of employees over the next 12 month period. We do and will continue to outsource contract employment as needed. In that regard we intend to engage contractors from time to time to consult with us on specific corporate affairs or to perform specific tasks in connection with our anticipated sales and marketing programs.

Government Regulation

Regulation of Medical Device Distribution Operations

Government authorities in the United States, Canada, and other countries in the Americas regulate the research, development, testing, manufacturing, labeling, promotion, advertising, distribution, marketing and export and import of medical devices at the federal, state and local levels. The process of obtaining regulatory approvals and the subsequent substantial compliance with appropriate federal, state, local and foreign statutes and regulations requires the expenditure of substantial time and financial resources.

In the United States, thermometers for human clinical use are classified as medical devices and require (i) an establishment license and (ii) depending on the class of device sought to be marketed, premarket approval (PMA) or the less rigorous premarket clearance.

8

Establishment License

Owners or operators of places of business (also called establishments or facilities) that are involved in the production and distribution of medical devices intended for use in the United States (U.S.) are required to register annually with the FDA. This process is known as establishment registration. Most establishments that are required to register with the FDA are also required to list the devices that are made there and the activities that are performed on those devices. As domestic distributors of medical devices in the United States, we will not be required to obtain an establishment license, although owner/operators of the products we distribute will be so required. Certain countries do not require establishment license.

Depending on the class designation of the device sought to be marketed, the owner/operator of the product must also obtain premarket approval (PMA) or premarket notification clearance before marketing in the U.S.

U.S. Medical Device Class Designations:

Class I includes products of which several examples are already approved and marketed in Canada or USA. As long as the basic science remains the same, the application for approval of a new product is straight forward. One product in this category would be a pregnancy test or regular needle/syringes.

Class II products are those which do not need to be injected (the device itself) or inserted into the patient (non-invasive). Often these products are approved and sold throughout the world. The products which we are currently focusing on distributing all belong to Class II. In order to secure the necessary license for these products, we are required to submit all the documentation which lead to the approval of the products in other countries. In our case, our products are already approved in Europe and Korea. As far as for FDA compliance is concerned, we are required to submit to the all the scientific data, results, approval process and certificates of good quality management, ISO 13485. Usually, products which have the ISO accreditation will satisfy FDA requirements.

Class III and IV include medical device which use invasive techniques. If the medical device has been approved in another region, it is considered Class III. If it is brand new, it is considered Class IV. Invasive tests such as colonoscopy, endoscopy, body lesion removal etc., are all considered Class III or IV. None of our products fall within Class III or IV.

Premarket Clearance

We intend to focus our medical device distribution business on Class I or II devices. Electronic Clinical Thermometers such as the Thermofinder are classified as Class II devices by the FDA are not subject to Premarket Approval (PMA).

Each person who wants to market in the U.S., a Class I, II, and III device intended for human use, for which a Premarket Approval (PMA) is not required, must submit a 510(k) to FDA unless the device is exempt from 510(k) requirements of the Federal Food, Drug, and Cosmetic Act (the Act) and does not exceed the limitations of exemptions in .9 of the device classification regulation chapters (e.g., 21 CFR 862.9, 21 CFR 864.9). There is no 510(k) form, however, 21 CFR 807 Subpart E describes requirements for a 510(k) submission. Before marketing a device, each submitter must receive an order, in the form of a letter, from FDA which finds the device to be substantially equivalent (“SE”) and states that the device can be marketed in the U.S. This order "clears" the device for commercial distribution.

A 510(k) is a premarket submission made to FDA to demonstrate that the device to be marketed is at least as safe and effective, that is, substantially equivalent, to a legally marketed device (21 CFR 807.92(a)(3)) that is not subject to PMA. Submitters must compare their device to one or more similar legally marketed devices and make and support their substantial equivalency claims. A legally marketed device, as described in 21 CFR 807.92(a)(3), is a device that was legally marketed prior to May 28, 1976, for which a PMA is not required, or a device which has been reclassified from Class III to Class II or I, or a device which

9

has been found SE through the 510(k) process. The legally marketed device(s) to which equivalence is drawn is commonly known as the "predicate." Although devices recently cleared under 510(k) are often selected as the predicate to which equivalence is claimed, any legally marketed device may be used as a predicate. Legally marketed also means that the predicate cannot be one that is in violation of the Act.

Until the submitter receives an order declaring a device SE, the submitter may not proceed to market the device. Once the device is determined to be SE, it can then be marketed in the U.S. The SE determination is usually made within 90 days and is made based on the information submitted by the submitter.

Substantial Equivalence

A 510(k) requires demonstration of substantial equivalence to another legally U.S. marketed device. Substantial equivalence means that the new device is at least as safe and effective as the predicate.

A device is substantially equivalent if, in comparison to a predicate it:

|

·

|

has the same intended use as the predicate; and

|

|

·

|

has the same technological characteristics as the predicate;

|

|

|

or

|

|

·

|

has the same intended use as the predicate; and

|

|

·

|

has different technological characteristics and the information submitted to FDA;

|

|

·

|

does not raise new questions of safety and effectiveness; and

|

|

·

|

demonstrates that the device is at least as safe and effective as the legally marketed device.

|

A claim of substantial equivalence does not mean the new and predicate devices must be identical. Substantial equivalence is established with respect to intended use, design, energy used or delivered, materials, chemical composition, manufacturing process, performance, safety, effectiveness, labeling, biocompatibility, standards, and other characteristics, as applicable.

A device may not be marketed in the U.S. until the submitter receives a letter declaring the device substantially equivalent. If FDA determines that a device is not substantially equivalent, the applicant may:

|

·

|

resubmit another 510(k) with new data,

|

|

·

|

request a Class I or II designation through the de novo process

|

|

·

|

file a reclassification petition, or

|

|

·

|

submit a premarket approval application (PMA).

|

Status of Thermofinder Premarket Clearance

HuBDIC Co. Ltd. has made a 510(k) submission to the FDA on January 29, 2014 to obtain premarket clearance for the Thermofinder FS-700 and FS-700 Pro. Our management believes that premarket clearance for the Thermofinder is forthcoming based on HuBDIC`s past successful clearance of thermometers which, in the opinion of our management, are substantially equivalent to the Thermofinder. Notwithstanding our management`s assessment, there is no guarantee that premarketing approval will be obtained in a timely manner, if at all.

10

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

Item 1A. Risk Factors

Risks Related to Our Overall Business Operations

We have a limited operating history with significant losses and expect losses to continue for the foreseeable future.

We have yet to establish any history of profitable operations. We have incurred net losses of $543,622 and $111,124 for the fiscal years ended January 31, 2014 and 2013, respectively. As a result, at January 31, 2014, we had an accumulated deficit of $813,192. We have not generated any revenues since our inception and do not anticipate that we will generate revenues sufficient to sustain our operations for the foreseeable future. Our profitability will require the successful commercialization of our medical device technology or future products for which we may acquire a distribution license. We may not be able to successfully exploit any distribution rights which we acquire and may never become profitable.

There is doubt about our ability to continue as a going concern due to recurring losses from operations, accumulated deficit and insufficient cash resources to meet our business objectives, all of which means that we may not be able to continue operations.

Our independent auditors have added an explanatory paragraph to their audit opinion issued in connection with the financial statements for the years ended January 31, 2014 and 2013, respectively, with respect to their doubt about our ability to continue as a going concern. As discussed in Note 1 to our financial statements for the year ended January 31, 2014, we have generated operating losses since inception, and our cash resources are insufficient to meet our planned business objectives. We expect to continue to incur development costs and operating costs, losses and negative cash flows until our products gain market acceptance sufficient to generate a commercially viable and sustainable level of sales, and/or additional products are developed and commercially released and sales of such products made so that we are operating in a profitable manner. Our history of losses and no revenues raise substantial doubt about our ability to continue as a going concern.

We have had negative cash flows from operations since inception. We will require significant additional financing, the availability of which cannot be assured, and if our company is unable to obtain such financing, our business may fail.

To date, we have had negative cash flows from operations and have depended on sales of our equity securities and debt financing to meet our cash requirements. We may continue to have negative cash flows. We have estimated that we will require approximately $1,000,000 to carry out our business plan for the next twelve months. There is no assurance that actual cash requirements will not exceed our estimates. We will require additional financing to finance working capital and pay for operating expenses and capital requirements until we achieve a positive cash flow.

Our ability to market and sell our medical devices will be dependent upon our ability to raise significant additional financing. If we are unable to obtain such financing, we will not be able to fully develop our business. Specifically, we will need to raise additional funds to:

11

|

·

|

support our planned growth and carry out our business plan;

|

|

·

|

hire top quality personnel for all areas of our business; and

|

|

·

|

address competing technological and market developments.

|

We may not be able to obtain additional equity or debt financing on acceptable terms as required. Even if financing is available, it may not be available on terms that are favorable to us or in sufficient amounts to satisfy our requirements. Any additional equity financing may involve substantial dilution to our then existing shareholders. If we require, but are unable to obtain, additional financing in the future, we may be unable to implement our business plan and our growth strategies, respond to changing business or economic conditions, withstand adverse operating results and compete effectively. More importantly, if we are unable to raise further financing when required, we may be forced to scale down our operations and our ability to generate revenues may be negatively affected.

If we fail to effectively manage the growth of our company and the commercialization of our medical devices, our future business results could be harmed and our managerial and operational resources may be strained.

As we proceed with the commercialization of our medical devices and the expansion of our marketing and commercialization efforts, we expect to experience significant growth in the scope and complexity of our business. We will need to add staff to market our services, manage operations, handle sales and marketing efforts and perform finance and accounting functions. We anticipate that we will be required to hire a broad range of additional personnel in order to successfully advance our operations. This growth is likely to place a strain on our management and operational resources. The failure to develop and implement effective systems, or to hire and retain sufficient personnel for the performance of all of the functions necessary to effectively service and manage our potential business, or the failure to manage growth effectively, could have a material adverse effect on our business and financial condition.

If premarket clearance for our sole medical device asset is not obtained in a timely manner our business may fail.

We are unable to market and sell the Thermofinder FS-700 and FS-700 PRO until premarket clearance is granted by the FDA. HuBDIC Co. Ltd., the owner of the Thermofinder technology, has made a 510(k) submission to the FDA to seek premarket clearance for the Thermofinder. Although our management believes that premarket clearance for the Thermofinder is forthcoming based on HuBDIC`s past successful clearance of similar thermometers, there is no guarantee that premarketing clearance will be obtained in a timely manner, if at all. If premarket clearance is not obtained in a timely manner, we may not have sufficient opportunity to take advantage of our acquired distribution rights, which expire on November 7, 2018. Furthermore, there is no guarantee that we will successful in renewing our license or acquiring distribution rights for any other products. Accordingly, if premarket clearance is not obtained in a timely manner our ability to generate sales and revenues, to solicit financing, and to otherwise sustain our business will be materially impaired, which may cause our business to fail.

Risks Related to the Market for Our Stock

The market price of our common stock can become volatile, leading to the possibility of its value being depressed at a time when you may want to sell your holdings.

The market price of our common stock can become volatile. Numerous factors, many of which are beyond our control, may cause the market price of our common stock to fluctuate significantly. These factors include: our earnings releases, actual or anticipated changes in our earnings, fluctuations in our operating results or our failure to meet the expectations of financial market analysts and investors; changes in financial estimates by us or by any securities analysts who might cover our stock; speculation about our business in the press or the investment community; significant developments relating to our relationships with our customers or suppliers; stock market price and volume fluctuations of other publicly traded companies and, in particular, those that are in our industry; customer demand for our products; investor perceptions of our industry in general and our Company in particular; the operating and stock performance of comparable

12

companies; general economic conditions and trends; announcements by us or our competitors of new products, significant acquisitions, strategic partnerships or divestitures; changes in accounting standards, policies, guidance, interpretation or principles; loss of external funding sources; sales of our common stock, including sales by our directors, officers or significant stockholders; and additions or departures of key personnel. Securities class action litigation is often instituted against companies following periods of volatility in their stock price. Should this type of litigation be instituted against us, it could result in substantial costs to us and divert our management’s attention and resources.

Moreover, securities markets may from time to time experience significant price and volume fluctuations for reasons unrelated to the operating performance of particular companies. These market fluctuations may adversely affect the price of our common stock and other interests in our Company at a time when you want to sell your interest in us. We do not intend to pay dividends on shares of our common stock for the foreseeable future.

We have never declared or paid any cash dividends on shares of our common stock.

We intend to retain any future earnings to fund the operation and expansion of our business and, therefore, we do not anticipate paying cash dividends on shares of our common stock in the foreseeable future.

We are subject to penny stock regulations and restrictions and you may have difficulty selling shares of our common stock.

The SEC has adopted regulations which generally define so-called “penny stocks” to be an equity security that has a market price less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exemptions. Our common stock is therefore subject to Rule 15g-9 under the Exchange Act, or the Penny Stock Rule. This rule imposes additional sales practice requirements on broker-dealers that sell such securities to persons other than established customers and “accredited investors” (generally, individuals with a net worth in excess of $1,000,000 or annual incomes exceeding $200,000, or $300,000 together with their spouses). For transactions covered by the Penny Stock Rule, a broker-dealer must make a special suitability determination for the purchaser and have received the purchaser’s written consent to the transaction prior to sale. As a result, this rule may affect the ability of broker-dealers to sell our securities and may affect the ability of purchasers to sell any of our securities in the secondary market.

For any transaction involving a penny stock, unless exempt, the rules require delivery, prior to any transaction in a penny stock, of a disclosure schedule prepared by the SEC relating to the penny stock market. Disclosure is also required to be made about sales commissions payable to both the broker-dealer and the registered representative and current quotations for the securities. Finally, monthly statements are required to be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stock.

There can be no assurance that our common stock will qualify for exemption from the Penny Stock Rule. In any event, even if our common stock were exempt from the Penny Stock Rule, we would remain subject to Section 15(b)(6) of the Exchange Act, which gives the SEC the authority to restrict any person from participating in a distribution of penny stock, if the SEC finds that such a restriction would be in the public interest.

We are not likely to pay cash dividends in the foreseeable future.

We intend to retain any future earnings for use in the operation and expansion of our business. We do not expect to pay any cash dividends in the foreseeable future but will review this policy as circumstances dictate. Should we decide in the future to do so, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. In addition, our operating subsidiaries, from time to time, may be subject to restrictions on their ability to make distributions to us, including restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions.

13

Our common stock is illiquid and subject to price volatility unrelated to our operations.

If a market for our common stock does develop, its market price could fluctuate substantially due to a variety of factors, including market perception of our ability to achieve our planned growth, quarterly operating results of other companies in the same industry, trading volume in our common stock, changes in general conditions in the economy and the financial markets or other developments affecting us or our competitors. In addition, the stock market itself is subject to extreme price and volume fluctuations. This volatility has had a significant effect on the market price of securities issued by many companies for reasons unrelated to their operating performance and could have the same effect on our common stock.

A large number of shares may be eligible for future sale and may depress our stock price.

We may be required, under terms of future financing arrangements, to offer a large number of common shares to the public, or to register for sale by future private investors a large number of shares sold in private sales to them.

Sales of substantial amounts of common stock, or a perception that such sales could occur, and the existence of options or warrants to purchase shares of common stock at prices that may be below the then-current market price of our common stock, could adversely affect the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities, either of which would decrease the value of any earlier investment in our common stock.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company”, we are not required to provide the information required by this Item.

Item 2. Properties

Our offices are currently located at 3020 Old Ranch Parkway, Suite 300, Seal Beach, CA 90740 and our telephone number is (562) 799-5588. We currently have a month to month lease for this space at the rate $175 per month. As of the date of this filing, we have not sought to move or change our office site as our space is adequate to meet our needs. We intend to secure additional office space for our planned medical device business. We do not own any real property.

Quinlan Lease

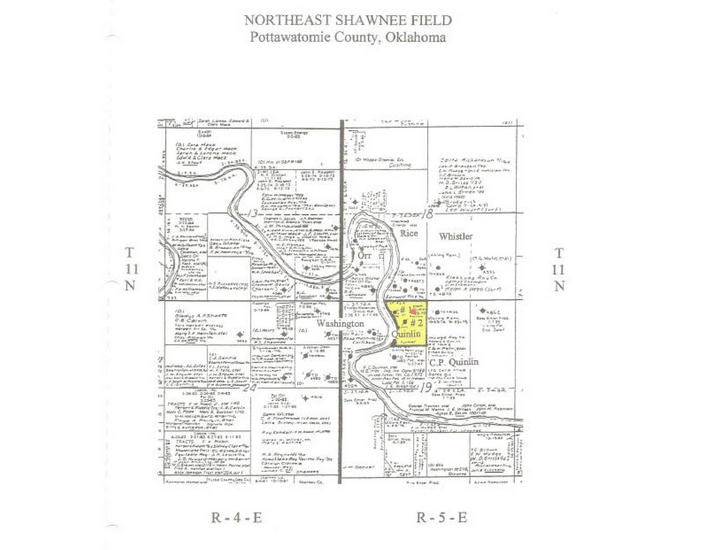

On December 15, 2011, we closed the acquisition of a 2.5% interest in the Quinlan Lease from Wise Oil and Gas LLC, with the option to increase that interest to 10%. On December 23, 2011 we closed an additional 2.5% for a total of 5%. The cost of 1% of interest in the Quinlan Lease is $15,616. The Quinlan Lease is located in Pottawatomie County, Oklahoma, within the NE Shawnee Field Township 11 North, Range 4 East. The Quinlan 1, 2, 3 and 4 wells are all located within Section 19. The four wells lie between the Nemaha ridge to the west and then on to the west flank of the Seminloe-Cushing ridge (Hunton Uplift) to the east and north of Pauls Valley. On December 23, 2011 we closed an additional 2.5% for a total of 5%.

Effective March 1, 2012, our company, paid an additional $78,080 to Wise Oil and Gas for an additional 5% participation in the Quinlan 1, 2 and 3 wells located in Pottawatomie County, Oklahoma at a cost of $15,616 per 1%.Our company, now holds a 10% interest in the Quinlan 1, 2 and 3 wells.

14

The Quinlan Lease lies within the NE Shawnee Field in Sections 13 and 24, Township 11 North, Range 4 East and Sections 18 and 19, Township 11 North, Range 5 East, Pottawatomie County, Oklahoma, and is approximately 11 miles north and east of Shawnee near the junction of State Highway 9A and Interstate I40 East. The Quinlan’s #1, #2, #3, and #4 (the salt water well) all lie in Section 19 of the above township and range and are in the southern most portion of the Central Oklahoma Platform. The Central Oklahoma Platform is located between two large sedimentary basins, the Anadarko Basin to the west and the Arkoma Basin to the east and southeast. The field with the four wells lie between the Nemaha Ridge to the west and then on to west flank of the Seminole-Cushing Ridge (Hunton Uplift) to the east and north of the Pauls Valley Uplift. The forces responsible for creating regional structures in the Ordovician appear to have begun in the middle Devonian epeirogeny. At this time, uplift occurred from the northeast, creating a regional dip to the southwest in the Hunton Limestone and older formations; therefore, with associated faulting with these uplifts allowed these ancient structures to accumulate oil reserves. The Wilzetta Fault occurred during this major uplift period and is a major fault system trending Northeast-Southwest and extending many miles both to the north and south of the NE Shawnee Field and is considered to be the west boundary fault to the field. Specifically, the field appears to be trapping oil in several faulted anticlinal features with production being reflected in the Hunton Limestone, Viola Limestone, and the first Wilcox Sand.

15

The Quinlan #1 was originally open hole completed in the first Wilcox Sandstone from 4,778' to 4,782'. The Simpson Dolomite from 4,742' to 4,750' and the Viola Limestone from 4,726' to 4,732' were tested several years later. Later production from the Quinlan #1 was documented producing an oil cut from 8 - 15%, (i.e. 100 barrels of total volume = 8 to 15 barrels are oil) on a daily basis from the first Wilcox Sandstone (primary objective), Viola Limestone and Simpson Dolomite (second objective). Finally, the Hunton Limestone formation was perforated and produced on a forty acre spacing pattern and was also perforated in the Quinlan #2. Since November 2009 when the well was purchased by Nitro Petroleum Inc., the Quinlan #1 has produced 13,946 barrels of oil from the Hunton Limestone.

The Quinlan #2 was originally drilled to the base of the Simpson Dolomite formation and completed in the Hunton Limestone. The Hunton Limestone was perforated from 4,594' to 4,604'. In 1976, the well was deepened to the first Wilcox and perforated in the Viola Limestone from 4,720' to 4,733' and the Simpson Dolomite from 4,756' to 4,762'. In February of 2011, the well was installed with a 70HP down-hole test submersible pump which was recently removed after a 90 day interval resulting in an average daily production rate of 13 barrels of oil with 1000 barrels of saltwater. The test pump was removed from the wellbore on May 17, 2011 and re-equipped the following day with a permanent 120HP down-hole submersible pump . Quinlan #2 has been totally re-equipped during 2012, and is currently producing 17 to 21 bbls per day.

The Quinlan #3 was tested in the Hunton Limestone and proved to be uneconomical due to a very low oil production rate with heavy water production. Quinlan #3 has been totally re-equipped during 2012, and is currently producing 13 to17 bbls per day.

The Quinlan #4 was the last well to be drilled in the field with the goal of finding the Hunton Limestone productive. Unfortunately, the down dip Hunton Limestone had incurred a facies change becoming heavily dolomitized with very low crystalline porosity. The first Wilcox Sandstone was tested after logs indicated a productive interval with a contradicting sample evaluation. Eventual testing results indicated fresh water had been injected into the zone from adjacent well without being reported to the proper authorities thus creating anonymous log inferences. The well was completed as a salt water field disposal well in the first Wilcox Sandstone which subsequently improved the overall field economics.

Summary of Estimated Oil and Gas Reserves as of Fiscal-Year End

We do not have any audited or independently verified figures for production or reserve reporting for the Quinlan property. We currently own a 10% interest in the Quinlan Leases.

Current Status of Working Interest

We currently own a 10% interest in the Quinlan Leases. As at the date of this report we have been invoiced for approximately $58,300 in lease operating expenses related to the Quinlan wells. This amount remains unpaid. Our failure to pay the outstanding amounts entitles the lease holder to foreclose on our working interest. We are actively seeking purchasers to assume our working interest and related liabilities.

Operator

Wise Oil and Gas is the operator of the Quinlan Lease. Wise Oil and Gas has been a fully licensed oil and gas operator since 1989 in the State of Oklahoma. Wise Oil and Gas have owned and operated wells throughout the State of Oklahoma, and continue to do so, since 1989. Wise Oil and Gas is the operator of our company’s working interest in the Quinlan project. Larry Wise has extensive oil and gas operating experience. Mr. Wise worked as a junior field engineer with Phillips 66 Petroleum Company 1977-1979. From 1979-1982 he worked for Jerry Scott Company as completion superintendent overseeing 14 drilling rigs and over 300 producing properties; 1982-1988 with JOMC Oil Co; 1988-1993 with Texas United Petroleum and 1993-1999 with Pottawatomie County Energy serving as president, fund raiser and chief operating officer for all three companies. From 1999 through to 2006 he operated Wise Oil and Gas Company, LLC and served as an independent engineering consultant responsible for all operations of Morris E. Stewart Oil Company, OKC, OK., Kirrie Oil Company, OKC, OK., HoCo, Inc. Oil Company, Wichita Falls, TX., and Buccaneer Energy Corporation, Tampa Bay, FL.

16

Acreage

The following table shows our gross and net acreage position on the Quinlan Lease as of January 31, 2014. Please note that we hold a total of 10% turnkey working interest in the property.

|

Property

|

Gross Acreage

(developed)

|

Net Acreage

(developed)

|

Gross Acreage

(undeveloped)

|

Net Acreage

(undeveloped)

|

||||||||||||

|

Quinlan Lease

|

120

|

12

|

80

|

8

|

||||||||||||

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which our director, officer or any affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for the Company’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

On October 12, 2006, our common stock was listed for quotation on the Over-the-Counter Bulletin Board under the symbol OVCR. Our stock did not begin trading until February 23, 2012. On August 12, 2008, we changed our name from “Oliver Creek Resources Inc.” to “Independence Energy Corp.”. The name change became effective with the Over-the-Counter Bulletin Board at the opening for trading on August 12, 2008 under the new stock symbol “IDNG”.

The following table sets forth the high and low bid information for our common stock obtained from Stockwatch and reflects inter-dealer prices, without retail mark-up, markdown or commission, and may not necessarily represent actual transactions.

The high and low bid prices of our common stock for the periods indicated below are as follows:

|

OTC Bulletin Board(1)

|

||||||||

|

Quarter Ended

|

High

|

Low

|

||||||

|

January 31, 2014

|

$ | 0.0099 | $ | 0.0025 | ||||

|

October 31, 2013

|

$ | 0.008 | $ | 0.0034 | ||||

|

July 31, 2013

|

$ | 0.0125 | $ | 0.0045 | ||||

|

April 30, 2013

|

$ | 0.04 | $ | 0.0027 | ||||

|

January 31, 2013

|

$ | 0.012 | $ | 0.003 | ||||

|

October 31, 2012

|

$ | 0.042 | $ | 0.0051 | ||||

|

July 31, 2012

|

$ | 4.83 | $ | 0.0275 | ||||

|

April 30, 2012

|

$ | 1.86 | Nil | |||||

|

January 31, 2012(1)

|

Nil | Nil | ||||||

|

·

|

Our stock was first quoted for trading on the OTC Bulletin Board on October 12, 2006, the first trade did not occur until February 23, 2012.

|

Record Holders

As of April 28, 2014, an aggregate of 345,188,164 shares of our common stock were issued and outstanding and there were approximately 40 shareholders of record of our common stock.

17

Our common shares are issued in registered form. Holladay Stock Transfer, 2939 N 67th Pl # C, Scottsdale, AZ 85251-6015 (telephone number (480) 481-3940) is the registrar and transfer agent for our common shares.

Recent Sales of Unregistered Securities

On March 4, 2014, we issued 10,714,286 common shares to Asher Enterprises, Inc. for the conversion of $15,000 of a convertible debenture.

On March 20, 2014, we issued 12,153,846 common shares to Asher Enterprises, Inc. for the conversion of $15,800 of a convertible debenture.

On March 24, 2014, we issued 4,346,154 common shares to Asher Enterprises, Inc. for the conversion of $5,650 of a convertible debenture.

On March 25, 2014, we issued 8,330,769 common shares to Asher Enterprises, Inc. for the conversion of $10,830 of a convertible debenture and accrued interest.

On April 3, 2014, we issued 15,625,000 common shares to Asher Enterprises, Inc. for the conversion of $18,750 of convertible debenture, as noted in Note 4.

On April 8, 2014, we issued 12,541,667 common shares to Asher Enterprises for the conversion of $15,050 of a convertible debenture and accrued interest.

Each of the above described issuances to Asher Enterprises Inc. was made in reliance on Rule 506 of Regulation D of the Securities Act of 1933.

On March 31, 2014, we entered into an asset purchase agreement with American Medical Distributors, LLC pursuant to which we issued an aggregate of 152,172,287 common shares to 4 investors. These securities were issued to 3 U.S. persons in reliance on Rule 506 of Regulation D of the Securities Act of 1933 and 1 non-U.S. person in reliance on Regulation S the Securities Act of 1933.

Except as noted above, we did not sell any equity securities which were not registered under the Securities Act during the year ended January 31, 2014 that were not otherwise disclosed in our registration statement on Form SB-2, Quarterly Reports on Form 10-Q or our Current Reports on Form 8-K filed during the year ended January 31, 2014.

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Equity Compensation Plan Information

We do not have in effect any compensation plans under which our equity securities are authorized for issuance and we do not have any outstanding stock options.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fourth quarter of our fiscal year ended January 31, 2014.

Item 6. Selected Financial Data

As a “smaller reporting company” we are not required to provide the information required by this Item.

Item 7. Management's Discussion and Analysis or Plan of Operation

The following discussion should be read in conjunction with our audited financial statements and the related notes for the years ended January 31, 2014 and 2013 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 14 of this annual report.

18

Our audited financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Working Capital

|

January 31,

2014

$

|

January 31,

2013

$

|

|||||||

|

Current Assets

|

11,656 | 48,835 | ||||||

|

Current Liabilities

|

362,725 | 216,830 | ||||||

|

Working Capital (Deficit)

|

(351,069 | ) | (167,995 | ) | ||||

Cash Flows

|

|

Year ended

January 31,

2014

$

|

Year ended

January 31,

2013

$

|

||||||

|

Cash Flows from (used in) Operating Activities

|

(161,943 | ) | (73,540 | ) | ||||

|

Cash Flows from (used in) Investing Activities

|

- | (485,015 | ) | |||||

|

Cash Flows from (used in) Financing Activities

|

133,000 | 580,000 | ||||||

|

Net Increase (decrease) in Cash During Period

|

(28,943 | ) | 21,445 | |||||

Operating Revenues

For the period from November 30, 2005 (date of inception) to January 31, 2014, our company did not earn any operating revenues.

Operating Expenses and Net Loss

Operating expenses for the year ended January 31, 2014 was $175,266 compared with $135,719 for the year ended January 31, 2013. The increase of $39,547 was due to an increase in general and administrative costs relating to an increase in management fees during the year of $40,000, and consulting fees of $20,000 offset by a decrease in investor relations of $22,770 as our company did not warrant the need for investor relations cost during the year, and a decrease in professional fees of $5,651 as our company had lower accounting and legal fees as compared to prior years.

19

For the year ended January 31, 2014, our company incurred a net loss of $543,622 or $nil per share compared with $135,719 or $nil per share for the year ended January 31, 2013. In addition to operating expenses, our company incurred accretion and interest expense of $19,934 relating to the $45,000 of convertible note debentures which are unsecured, bears interest at 8% per annum, and due on April 17, 2014 and the $32,500 convertible note debenture, which is unsecured, bears interest at 8% per annum, and due on June 19, 2014. The $45,000 note is convertible into shares of common stock 180 days after the date of issuance (January 11, 2014) at a conversion rate of 58% of the average of the three lowest closing bid prices of our company’s common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to our company. The $32,500 note is convertible into shares of common stock 180 days after the date of issuance (March 16, 2014) at a conversion rate of 58% of the average of the three lowest closing bid prices of our company’s common stock for the ten trading days ending one trading day prior to the date the conversion notice is sent by the holder to our company. Subsequent to January 31, 2014, the remaining principal and accrued interest on all convertible note debentures were converted into common shares of our company. Furthermore, our company recorded a gain on the forgiveness of a loan for $48,284, and impairment loss of $335,284 relating to our company’s decision to not renew the Coleman County leases, and a gain on the change in fair value of the derivative liability of $54,438 based on the mark-to-market of the fair value of the floating rate conversion feature in the convertible debentures.

As at January 31, 2014, our company had cash of $7,292 compared with $36,235 at January 31, 2013. The decrease in cash was attributed to the fact that our company obtained additional financing from the issuance of convertible debentures during the year and used the proceeds for operating expenditures

Our company had total assets at January 31, 2014 of $220,334 compared with $587,260 at January 31, 2013. Overall, cash decreased by $28,943 and oil and gas properties decreased by $329,747 due to the impairment of the Coleman County properties for $335,284.

At January 31, 2014, our company had total liabilities of $362,725 compared with $216,830 at January 31, 2013. The increase in total liabilities was attributed to an increase in accounts payable and accrued liabilities of $12,824, and $35,834 for the liability relating to the convertible debentures, net of unamortized discount of $41,666, and derivative liability of $97,237 for the fair value of the beneficial conversion feature of the convertible debentures.

Cashflow from Operating Activities

During the year ended January 31, 2014, our company used cash of $161,943 for operating activities compared with $73,540 during the year ended January 31, 2013. The increase in cash used for operating activities was attributed to proceeds received from the issuance of convertible debentures which were used to repay outstanding obligations incurred in day-to-day operations of our company.

Cashflow from Investing Activities

During the year ended January 31, 2014, our company did not have any investing activities compared with the use of $485,015 during the year ended January 31, 2013 for the acquisition of oil and gas properties.

Cashflow from Financing Activities

During the year ended January 31, 2014, our company received $133,000 in financing from the issuance of convertible debentures. Our company received proceeds from convertible debentures for $46,000 which is unsecured, bears interest at 6% per annum, and due on April 5, 2016, $57,000 from the issuance of a convertible debenture which is unsecured, bears interest at 8% per annum, and due on April 17, 2014, and $32,500 from the issuance of a convertible debenture which is unsecured, bears interest at 8% per annum, and due on June 19, 2014, less financing fees which were deducted from the proceeds before being disbursed to our company. Our company received $580,000 during the period ended October 31, 2013 from the issuance of common shares.

20

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive acquisitions and activities. For these reasons, our auditors stated in their report on our audited financial statements that they have substantial doubt that we will be able to continue as a going concern without further financing.

Off-Balance Sheet Arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that are material to stockholders.

Future Financings

We will continue to rely on equity sales of our common shares in order to continue to fund our business operations. Issuances of additional shares will result in dilution to existing stockholders. There is no assurance that we will achieve any additional sales of the equity securities or arrange for debt or other financing to fund our operations and other activities.

Critical Accounting Policies

Our financial statements and accompanying notes have been prepared in accordance with United States generally accepted accounting principles applied on a consistent basis. The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting periods.

We regularly evaluate the accounting policies and estimates that we use to prepare our financial statements. A complete summary of these policies is included in the notes to our financial statements. In general, management's estimates are based on historical experience, on information from third party professionals, and on various other assumptions that are believed to be reasonable under the facts and circumstances. Actual results could differ from those estimates made by management.

Oil and Gas Properties

Our company utilizes the full-cost method of accounting for petroleum and natural gas properties. Under this method, our company capitalizes all costs associated with acquisition, exploration, and development of oil and natural gas reserves, including leasehold acquisition costs, geological and geophysical expenditures, lease rentals on undeveloped properties and costs of drilling of productive and non-productive wells into the full cost pool on a country-by-country basis. When our company obtains proven oil and gas reserves, capitalized costs, including estimated future costs to develop the reserves proved and estimated abandonment costs, net of salvage, will be depleted on the units-of-production method using estimates of proved reserves. The costs of unproved properties are not amortized until it is determined whether or not proved reserves can be assigned to the properties. Until such determination is made, our company assesses annually whether impairment has occurred, and includes in the amortization base drilling exploratory dry holes associated with unproved properties.

21

Our company applies a ceiling test to the capitalized cost in the full cost pool. The ceiling test limits such cost to the estimated present value, using a ten percent discount rate, of the future net revenue from proved reserves based on current economic and operating conditions. Specifically, our company computes the ceiling test so that capitalized cost, less accumulated depletion and related deferred income tax, do not exceed an amount (the ceiling) equal to the sum of: The present value of estimated future net revenue computed by applying current prices of oil and gas reserves (with consideration of price changes only to the extent provided by contractual arrangements) to estimated future production of proved oil and gas reserves as of the date of the latest balance sheet presented, less estimated future expenditures (based on current cost) to be incurred in developing and producing the proved reserves computed using a discount factor of ten percent and assuming continuation of existing economic conditions; plus the cost of property not being amortized; plus the lower of cost or estimated fair value of unproven properties included in the costs being amortized; less income tax effects related to differences between the book and tax basis of the property. For unproven properties, our company excludes from capitalized costs subject to depletion, all costs directly associated with the acquisition and evaluation of the unproved property until it is determined whether or not proved reserves can be assigned to the property. Until such a determination is made, our company assesses the property at least annually to ascertain whether impairment has occurred. In assessing impairment our company considers factors such as historical experience and other data such as primary lease terms of the property, average holding periods of unproved property, and geographic and geologic data. Our company adds the amount of impairment assessed to the cost to be amortized subject to the ceiling test.

Recently Issued Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect. These pronouncements did not have any material impact on the financial statements unless otherwise disclosed, and our company does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on its financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company” we are not required to provide the information required by this Item.

22

Item 8. Financial Statements and Supplementary Data

Independence Energy Corp.

(An Exploration Stage Company)

January 31, 2014

| Index |

|

|

Report of Independent Registered Public Accounting Firm

|

24

|

|

Condensed Balance Sheets

|

25

|

|

Condensed Statements of Operations

|

26

|

|

Condensed Statements of Cash Flows

|