Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HUDSON VALLEY HOLDING CORP | d719553d8k.htm |

Metro New York’s

Premier Business Bank

May 2014

Exhibit 99.1 |

| 2

Safe Harbor Statement

“Safe

Harbor”

Statement

under

the

Private

Securities

Litigation

Reform

Act

of

1995:

This presentation contains various forward-looking statements with respect to

earnings, credit quality and other financial and business matters within the

meaning of the Private Securities Litigation Reform Act of 1995. These forward-statements can be

identified by words such as “expects,”

“anticipates,”

“intends,”

“believes,”

“estimates,”

“predicts”

and words of similar import. The

Company cautions that these forward-looking statements are subject to numerous

assumptions, risks and uncertainties, and that statements

relating

to

future

periods

are

subject

to

uncertainty

because

of

the

increased

likelihood

of

changes

in

underlying

factors and assumptions. Actual results could differ materially from

forward-looking statements. Factors that may cause actual results to

differ materially from those contemplated by such forward-looking statements, include,

but are not limited to, statements regarding: (a) the OCC and other bank regulators

may require us to further modify or change our mix of assets, including our

concentration in certain types of loans, or require us to take further remedial actions; (b) our

inability to deploy our excess cash, reduce our expenses and improve our operating

leverage and efficiency; (c) our ability to pay quarterly cash

dividends to shareholders in light of our earnings, the current and future economic environment, Federal Reserve

Board guidance, our Bank’s capital plan and other regulatory requirements

applicable to Hudson Valley or Hudson Valley Bank; (d)

the

possibility

that

we

may

need

to

raise

additional

capital

in

the

future

and

our

ability

to

raise

such

capital

on

terms

that

are

favorable to us; (e) further increases in our non-performing loans and

allowance for loan losses; (f) ineffectiveness in managing our commercial

real estate portfolio; (g) lower than expected future performance of our investment portfolio; (h) inability to

effectively integrate and manage the new business and lending teams; (i) a lack of

opportunities for growth, plans for expansion (including opening new

branches) and increased or unexpected competition in attracting and retaining customers; (j) continued

poor economic conditions generally and in our market area in particular, which may

adversely affect the ability of borrowers to repay their loans and the value

of real property or other property held as collateral for such loans; (k) lower than expected

demand for our products and services; (l) possible additional impairment of our

goodwill and other intangible assets; (m) our inability to manage interest

rate risk; (n) increased expense and burdens resulting from the regulatory environment in which we

operate and our ability to comply with existing and future regulatory requirements;

(o) our inability to maintain regulatory capital above the minimum levels

Hudson Valley Bank has set as its minimum capital levels in its capital plan, or such higher capital

levels as may be required; (p) proposed legislative and regulatory action may

adversely affect us and the financial services industry; (q) legislative and

regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer

Protection Act and related regulations) may subject us to additional regulatory

oversight which may result in increased compliance costs and/or require us

to change our business model;(r) future increased Federal Deposit Insurance Corporation, or

FDIC,

special

assessments

or

changes

to

regular

assessments;

(s)

potential

liabilities

under

federal

and

state

environmental

laws; (t) legislative and regulatory changes to laws governing New York

State’s taxation of HVB’s REIT subsidiary. For a more detailed

discussion of these factors, see the Risk Factors discussion in the Company’s most recent Annual Report on

Form 10-K. The forward-looking statements included in this presentation are

made only as of the date hereof and the Company undertakes no obligation to

update or revise any of its forward-looking statements. Unless otherwise

noted, information presented is from Company sources. |

3

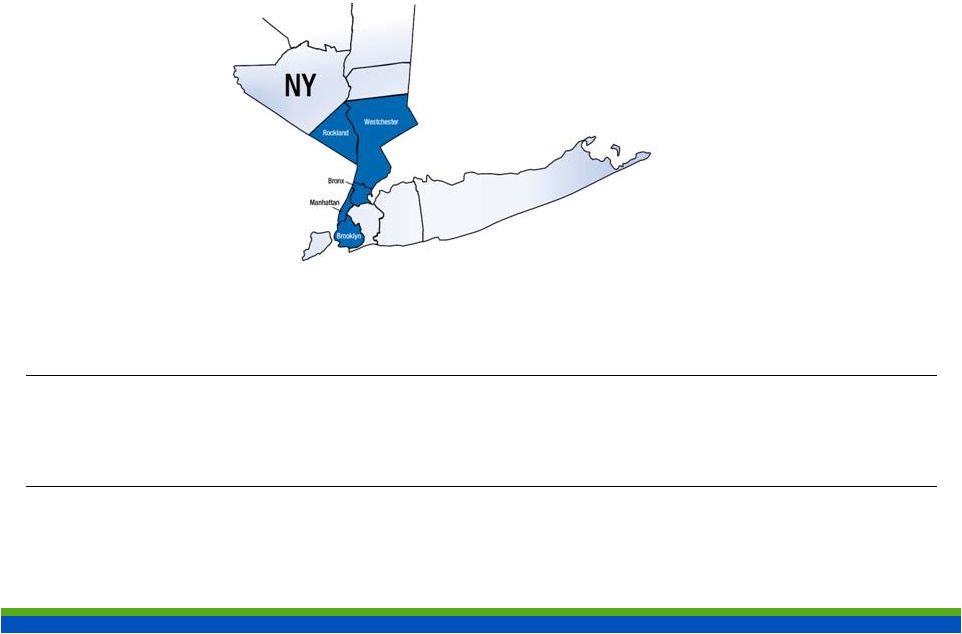

Hudson Valley: A Differentiated Business Model

•

$3 billion commercial bank focused on small and middle market businesses,

professional service firms and their principals –

they view us as their “private bankers”

•

Low-cost, core deposits = foundation of customer relationships

•

28 branches throughout Westchester, Rockland, the Bronx, Manhattan and Brooklyn in

New York

•

Historic growth achieved by taking deposit share from larger national bank

competitors Niche businesses

synergistically

complement each other to

form the core of HVB’s

business model

Focus on

Targeted

Niche

Segments

Attorneys

Not-For-

Profits

Property

Managers

Real

Estate

Developers

Municipal

-

ities

Trusts

General

Business |

4

How is HVB Different?

There are more than 32,000 small

and middle market companies with

revenues of $1 million or more in

our market

MARKET SHARE

PLAY IN LARGE

MARKET

•

Ability to achieve meaningful growth with small market share gains

•

With 0.32% deposit market share, HVB ranks 22nd in its five-county, $813

billion deposit market

•

Gaining just 13 bps of share would give HVB over $1B in incremental deposits

SUPERIOR SERVICE

AND TECHNOLOGY

•

Investing in sophisticated technology and business solutions on par with the

largest banks, with longstanding superior client service

•

Customers enjoy easy access to decision makers, who live and operate in the local

market

EFFECTIVE AT

COMPETING IN A

DENSE MARKET

•

Niche market segmentation is unique

•

Will start small and work our way into lead bank position

•

Referral

driven

–

satisfied

customers,

Business

Development

Board

Members

&

centers of influence in key niche focus areas |

5

Summary Financial Highlights

(a)

Excluding effects of $1.9 million prepayment penalty on FHLB advances and $0.2 million

change related to NYS Corporate Tax Reform. Certain amounts in this column may

be considered non-GAAP financial measures. For a reconciliation to GAAP, please see the Company’s Form 8-K filed with the SEC

on April 28, 2014. Management believes these non-GAAP financial measures provide

information useful to investors in understanding the Company’s underlying

operating performance and trends, and facilitates comparisons with the performance of others banks.

(Dollars in thousands, except per share data)

2014

2014

2013

Net Interest Income

$21,729

$21,729

$21,246

Non Interest Income

$2,479

$4,339

$4,517

Non Interest Expense

$21,790

$21,790

$19,611

Net Income

$1,602

$2,877

$3,651

Diluted Earnings Per Share

$0.08

$0.14

$0.18

Dividends Per Share

$0.06

$0.06

$0.06

Net Interest Margin

3.14%

3.14%

3.18%

Return on Average Equity

2.23%

4.01%

5.02%

Return on Average Assets

0.22%

0.39%

0.51%

Efficiency Ratio

82.60%

82.60%

74.97%

Tangible Common Equity Ratio

9.6%

9.6%

9.6%

Average Assets

$2,935,509

$2,935,509

$2,859,443

Average Net Loans

$1,615,848

$1,615,848

$1,422,132

Average Deposits

$2,589,978

$2,589,978

$2,493,021

Average Stockholders' Equity

$286,740

$286,740

$290,950

Three Months Ended March 31

(a) |

6

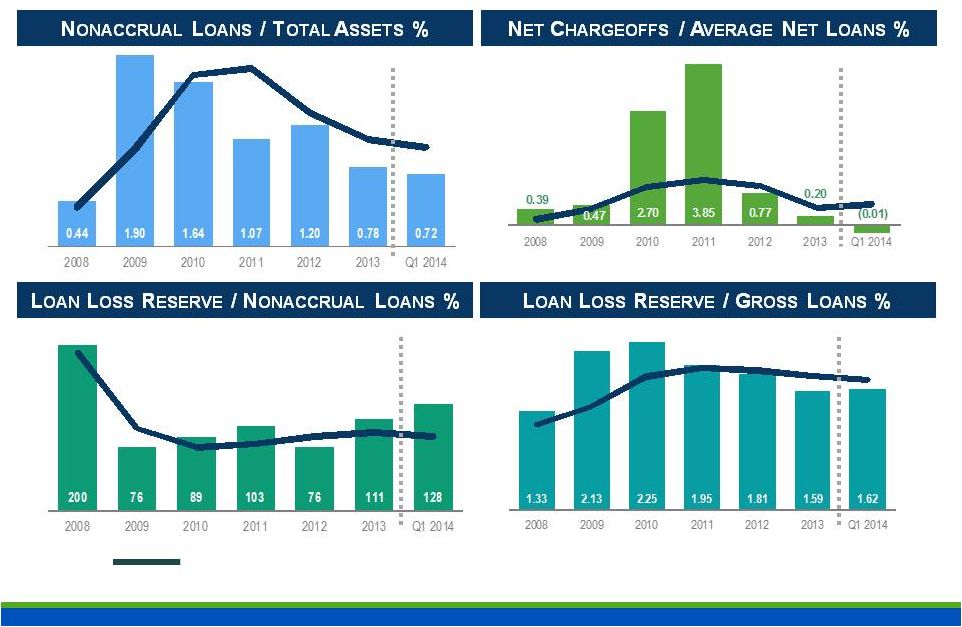

Asset Quality Remains Strong

Median of US-based, publicly traded commercial banks with assets between $1-$5

billion as of December 31, 2013. |

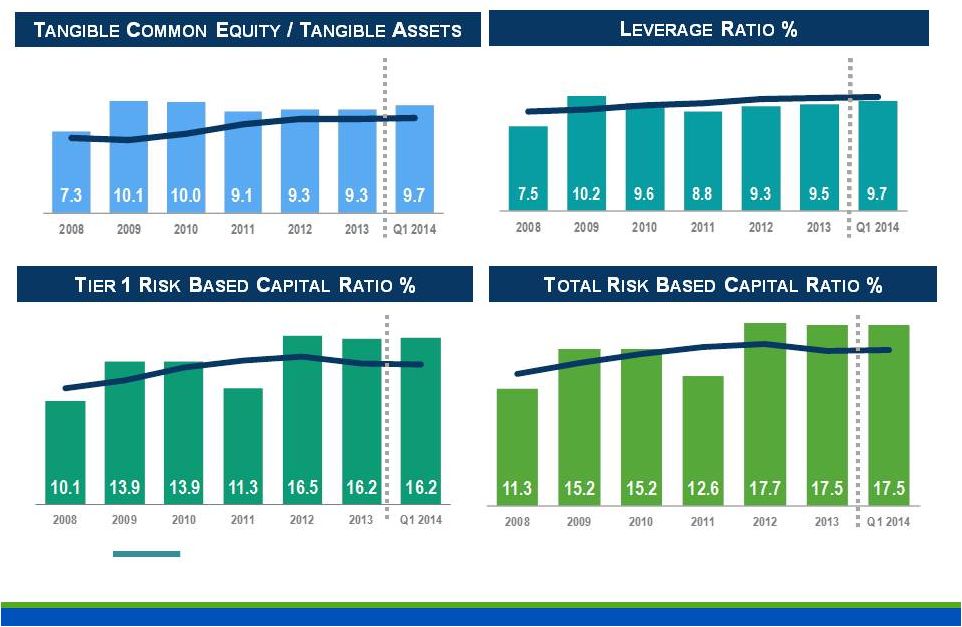

Capital Ready for Deployment

Median of US-based, publicly traded commercial banks with assets between $1-$5

billion as of December 31, 2013. 7 |

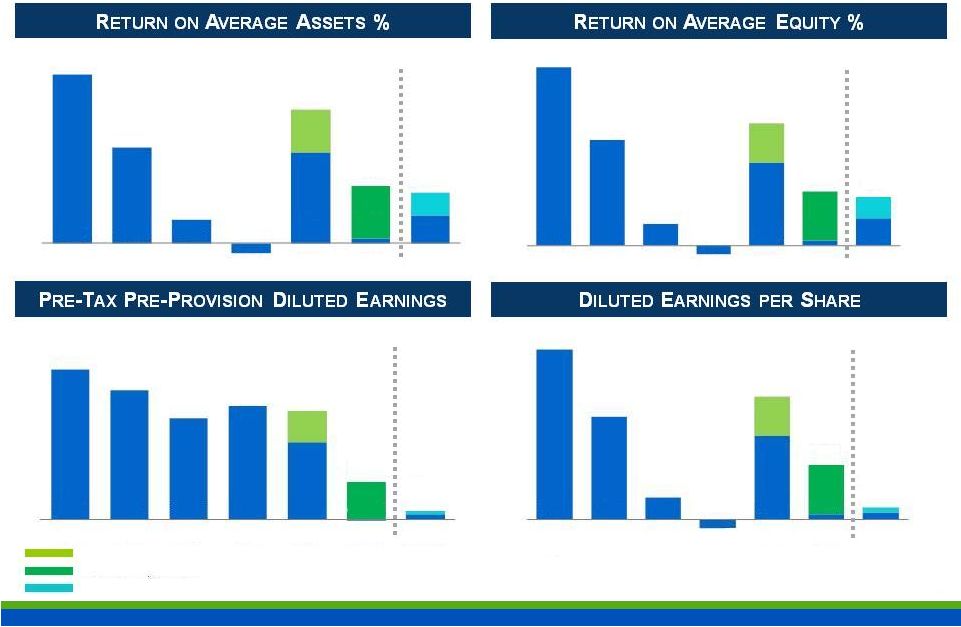

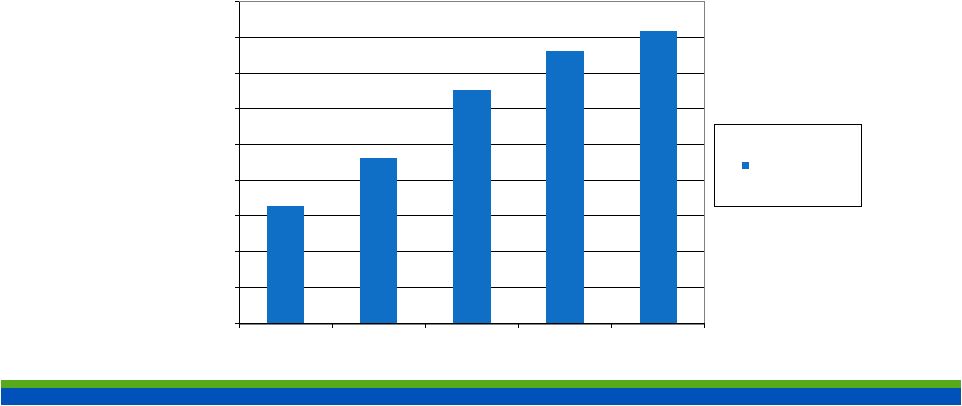

Working to Return to Historical Profitability

Goodwill impairment

$2.78

$1.49

-Pre-Tax Pre-Provision Diluted Earnings per Share is a Non-GAAP

measure. See Appendix slide for reconciliation 1.02

10.05

$2.78

$1.49

$0.90

$0.66

0.44

4.47

Income from loan sale

$0.22

$0.14

4.01

0.39

Prepayment penalty on FHLB advances and NYS Corporate Tax Reform

change

$3.84

$3.31

$2.58

$2.91

$1.97

($0.05)

$0.12

2008

2009

2010

2011

2012

2013

Q1 2014

14.76

8.74

1.75

(0.72)

6.82

0.39

2.23

2008

2009

2010

2011

2012

2013

Q1 2014

1.30

0.74

0.18

(0.08)

0.70

0.04

0.22

2008

2009

2010

2011

2012

2013

Q1 2014

$2.06

$1.24

$0.26

($0.11)

$1.01

$0.06

$0.08

2008

2009

2010

2011

2012

2013

Q1 2014

8 |

9

HVB: Becoming a Better Bank

LEGACY STRENGTHS

•

Exceptional metro NYC core deposit franchise

•

Unique niche-lending focus

•

Highly asset-sensitive balance sheet

•

Disciplined expense management

RECENT

ACCOMPLISHMENTS

•

Exceeded loan growth and liquidity deployment targets in 2013

•

New business or expansion of existing products: ABL, Equipment

Financing, Residential Mortgage

•

Meaningfully reduced operating expenses by 4.5% in 2013*

–

Despite investments in compliance, talent and growth

initiatives

•

Strengthened governance and leadership

•

Developed sophisticated cash management and mobile banking

tools on par with the largest banks

WHERE WE’RE GOING

•

Investing in the Company to be BETTER, not just to be different

•

Nimbly adapting to new environments, products, and competitors

while capitalizing on legacy strengths

•

More effectively serving our niche markets and new markets with a

more diverse array of profitable, customized products that meet their

needs

* Total non-interest expense of $100.1 million for 2013 included

non-recurring charges of $18.7 million pre-tax goodwill impairment and $1.3 million non-operating

expense related to branch consolidations. |

10

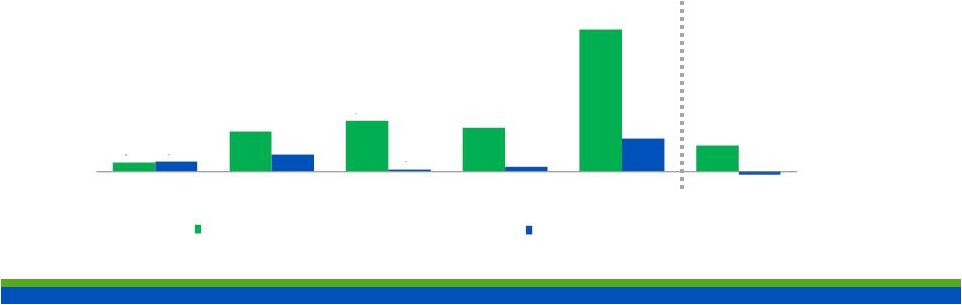

DISCIPLINED EXECUTION

•Unwavering focus on strategy for diversifying balance

sheet •

Launched ABL (Q4’13) and Equipment Financing businesses (Q1’14)

•

Increase of $104 million in residential mortgage and home equity loans over the

last five quarters

•Instituted ERM platform suitable for $10-$15 billion-asset bank

PRUDENT LIQUIDITY DEPLOYMENT CONTINUES

10

(Dollars in millions)

Recent Successes

$25

$112

$143

$122

$402

$72

$28

$47

$6

$12

$93

-$10

Q1-2013

Q2-2013

Q3-2013

Q4-2013

2013 Total

Q1-2014

New Loan Originations and Purchases

Securities growth |

$1,250,000 $1,300,000

$1,350,000

$1,400,000

$1,450,000

$1,500,000

$1,550,000

$1,600,000

$1,650,000

$1,700,000

2013 Q1

2013 Q2

2013 Q3

2013 Q4

2014 Q1

Total Gross Loans

Liquidity Deployment

LENDING MOMENTUM

•

$402

million

in

loan

originations

and

purchases

in

2013

exceeded

$200

million

target

•

Growth

outpaced

runoff,

adding

$161

million

in

net

new

loans

for

2013

•

Strong Q1 2014 pace, with $27.9 million in net new loans.

11 |

| 12

Diversifying Offering: Liquidity Deployment

•

Methodically deploying excess liquidity from Q1’12 loan sales and

abundant cash generation

•

Building on core competency with CRE lending while launching new

or expanding products for niche commercial customers and their

owners, principals and managers:

1.

Jumbo residential mortgage and home equity products complementing

commercial offerings

2.

Recent launches of asset-based lending (ABL) and equipment financing

businesses will increase portfolio diversity

3.

Continue to pursue quality in-market CRE, moving up-market and building

on strong reputation in our marketplace |

13

Diversifying Offering: Residential Real Estate

•

Jumbo residential mortgage and home equity products support personal

financing needs for in-market borrowers

–

For existing commercial customer owners, principals and managers, a

broader array of competitive residential options than previously

offered

–

For prospective customers, a whole new line of products at our bankers’

disposal to develop new commercial relationships

LOAN BALANCES ($M)

March 31, 2014

INTEREST INCOME ($M)

March 31, 2014

Every ~$27 million in

additional residential

real estate balances

adds $1 million to

HVB’s annual interest

income*

* Assumes 1Q14 residential mortgage yield of 3.75%

Residential Mortgage & Home Equity

All Other |

| 14

14

Diversifying Offering: Asset Based Lending

•

HVB Capital Credit LLC launched in November 2013

•

Diversifies and improves risk profile of overall portfolio

•

Offering a growing array of products and services in demand by small-

and mid-sized commercial customers and prospects in metro NYC and

beyond

•

Flexible alternative financing solutions to companies with credit needs

between

$2.5

million

and

$25

million

–

a

range

typically

underserved

by

the country’s largest banks

•

Addition

of

veteran

ABL

team

builds

on

long

record

of

attracting

top

talent from national/multinational banks

•

Every

~$20

million

in

additional

ABL

balances

adds

$1

million

to

HVB’s

annual interest income*

* Assumes 1Q’14 ABL origination yield of 4.9% |

| 15

Diversifying Offering: Equipment Financing

•

HVB Equipment Capital LLC launched in March 2014

•

Nationwide lender to customers, wholesale partners and manufacturers, providing

equipment leasing and lending for a wide range of income-producing

equipment, including:

–

Manufacturing

–

Healthcare

–

Technology

–

Transportation

•

Focus on seizing opportunities to finance small and middle-market transactions

in the $100,000 to $5 million range

•

Offers new and existing customers a flexible alternative to traditional commercial

loans, enhancing cash flow and preserving working capital

|

| 16

16

Moving Upmarket with Technology

•

Over the past two years, implemented risk management systems and

capital management framework typical of a $10-$25 billion bank, with our

$3 billion balance sheet

•

An investment of $4 million, recognized over five years, for enhanced

technology solutions for business customers will be made, with the

solutions rolled out in 2014.

•

Applications for small and mid-sized companies, including mobile banking

applications and enhanced lockbox and other cash management tools

•

Designing sophisticated cash management resources for larger companies to

be competitive with the best cash management platforms offered in our

marketplace –

on par with the largest banks

–

Sophisticated

platforms

allow

us

to

meet

the

treasury

management

needs

of larger businesses

»

For example, in the past we have served law firms with 5-10

partners; now we can serve firms with 20-100 partners

|

17

Diversification Progress

LOAN COMPOSITION –

March 31, 2014

(1)

Total is gross of unearned income.

Loan Balances

March 31

$ in Millions

2014

REAL ESTATE

C&D - RESIDENTIAL

38

$

C&D - NON RESIDENTIAL

43

OWNER OCCUPIED CRE

162

NON-OWNER OCCUPIED CRE

426

MULTIFAMILY LOANS

250

1-4 FAMILY MORTGAGE

315

HOME EQUITY

114

COMMERCIAL & INDUSTRIAL

284

CONSUMER

10

LEASE FINANCING

14

OTHER

3

TOTAL (1)

$1,659

C&D -

RESIDENTIAL

2%

C&D

-

NON

RESIDENTIAL

2%

OWNER

OCCUPIED

CRE

10%

NON-OWNER

OCCUPIED

CRE

26%

MULTIFAMILY

LOANS

15%

1-4 FAMILY

MORTGAGE

19%

HOME

EQUITY

7%

COMMERCIAL

&

INDUSTRIAL

16%

CONSUMER

1%

LEASE

FINANCING

1% |

18

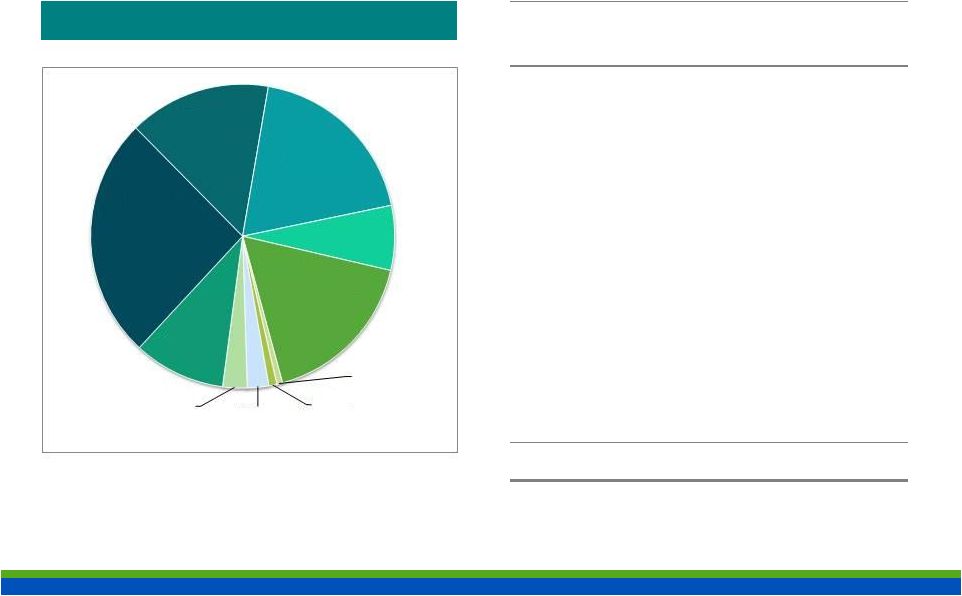

Legacy Strength: Core Deposit Franchise

DEPOSIT

COMPOSITION

–

Mar.

31,

2014

CORE FUNDING

-Core Deposits defined as total deposits less time deposits

>$100,000. 91%

64%

87%

97%

50%

60%

70%

80%

90%

100%

2008

2009

2010

2011

2012

2013

Q1 2014

Loans/Deposits

Core Deposits/Total Deposits

Money

Market

36%

Demand

38%

Savings 5%

Time > $100m

3%

Time < $100m

1%

Checking with

Interest 17%

TOTAL DEPOSITS -

$2,562

Million |

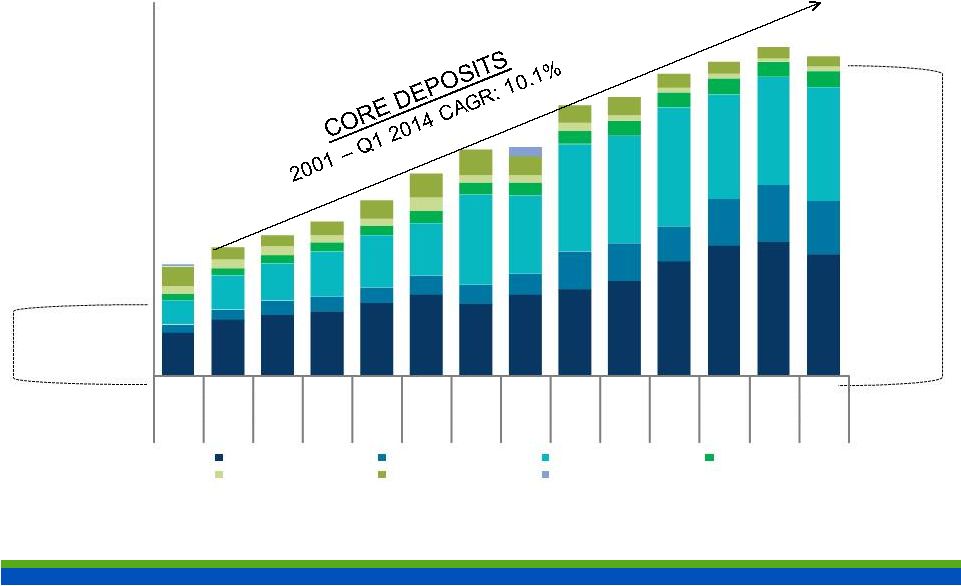

19

Continued Deposit Growth Drives Profitability

67.2%

CORE

DEPOSITS

(1)

96.7% CORE

DEPOSITS

(1)

VS.

89.5% FOR

PEERS

(2)

(1)

Core deposits defined as total deposits less time deposits > $100,000 and

brokered deposits. December 2006 Includes approximately $127 million of deposits as part of New

York National Bank acquisition

(2)

Peers = Median of US-based, publicly traded commercial banks with assets

between $1-$5 billion as of December 31, 2013. $0

$250

$500

$750

$1,000

$1,250

$1,500

$1,750

$2,000

$2,250

$2,500

$2,750

$3,000

$888

$1,027

$1,125

$1,235

$1,408

$1,626

$1,813

$1,839

$2,173

$2,234

$2,425

$2,520

$2,634

$2,562

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Mar

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Demand Deposits

Checking with Interest

Money Market Accounts

Savings Accounts

Time Deposits < $100m

Time Deposits > $100m

Brokered Deposits |

20

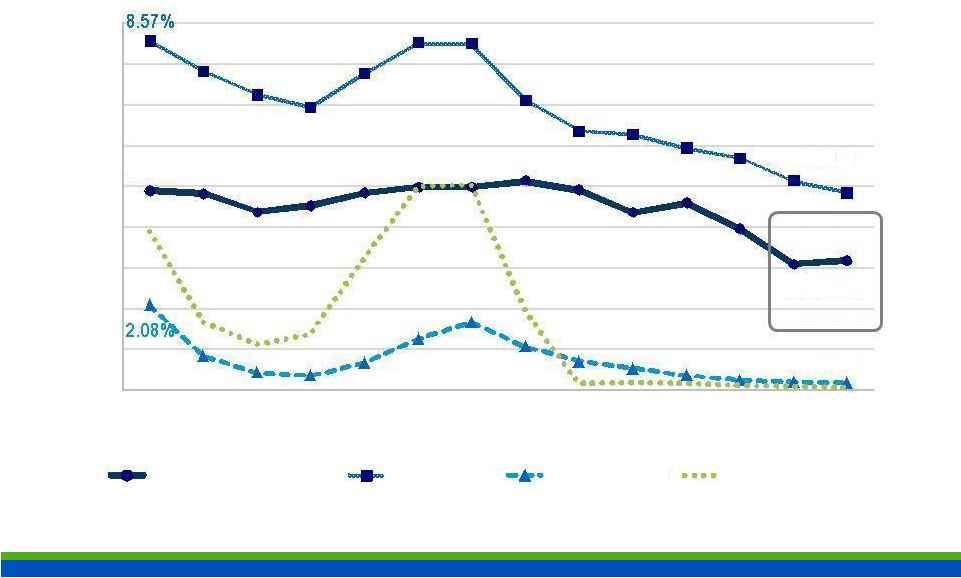

Net Interest Margin

(1)

Fully tax equivalent basis.

(2)

Peers = Median of US-based, publicly traded commercial banks with assets

between $1-$5 billion as of December 31, 2013. VS. 3.63%

PEERS

(1,2)

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

Q1 2014

N

ET

NTEREST

M

ARGIN

(FTE)

IELD

ON

OANS

C

OST

OF

EPOSITS

F

EDERAL

F

UNDS

ATE

I

Y

L

D

R

4.89%

3.19%

4.84%

0.17% |

21

Core Deposits Differentiate HVB from Peers

(1)

Core Deposits defined as total deposits less time deposits >$100,000 and

brokered deposits. (2)

Peers = Median of US-based, publicly traded commercial banks with assets

between $1-$5 billion as of December 31, 2013. (3)

Represents Net Loans to Deposits

3/31/13

3/31/14

HVB

HVB

Peers

(2)

Non Interest Bearing/Total Deposits

40%

38%

22%

Core Deposits / Total Deposits

(1)

96%

97%

90%

Deposits / Total Funding

98%

99%

91%

Loans / Deposits Ratio

(3)

56%

64%

80%

Net Interest Margin (FTE)

3.24%

3.19%

3.63%

Cost of Total Deposits

20 bp

17 bp

38 bp

Deposit Metrics |

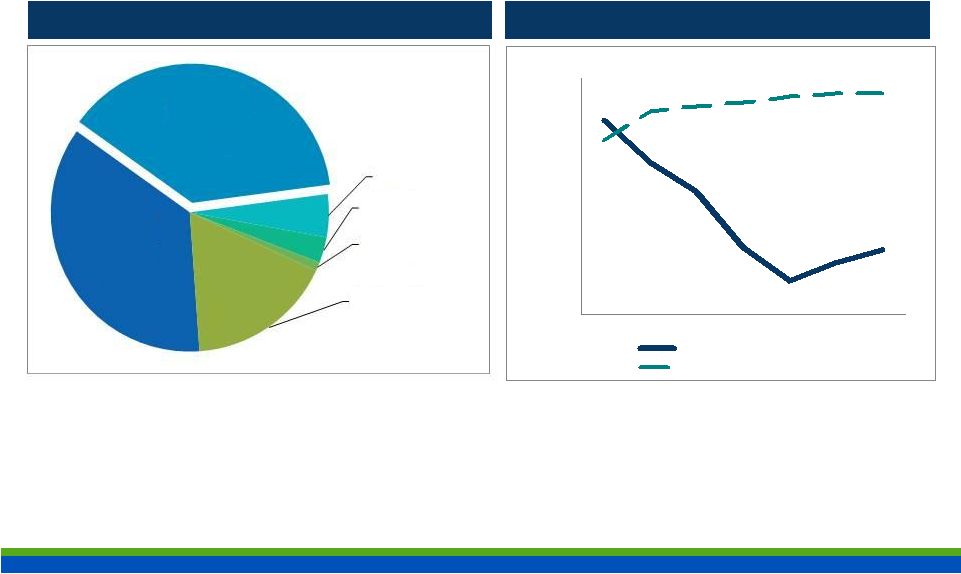

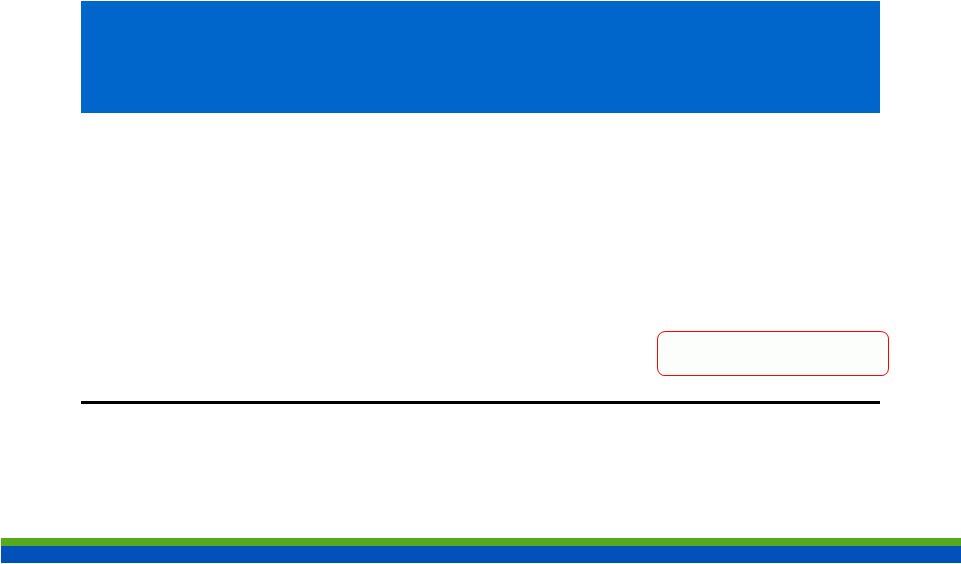

Deposit Franchise Provides Funding Advantage

COST OF

DEPOSITS

YIELD ON

LOANS

HVB’s deposit costs

are relatively stable and

lower than peers over

interest rate cycles

HVB’s average loan

yields are in line with

peer banks

22

Source: SNL Financial. Data for SNL $1-$5B Banks reflects the median of

US-based, publicly traded commercial banks with assets between $1-$5 billion as of December 31, 2013. |

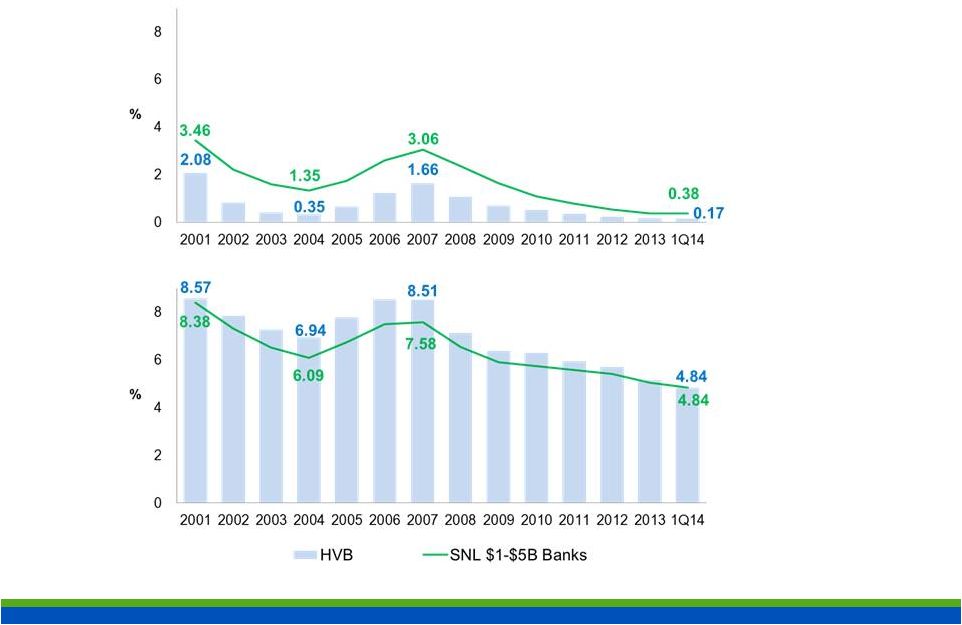

Positioned for Rising Rates

INTEREST RATE SENSITIVITY

Percent Change in Net Interest Income from

Gradual 12-month Change in Rates

As of March 31, 2014

Median impact

among banks with

similar interest rate

sensitivity method*

+0.93%

*Source: SNL Financial. Median of 49 banks reporting interest rate sensitivity

using a percent change to net interest income method for a gradual 12-

month increase of 200 basis points, as of December 31, 2013.

23 |

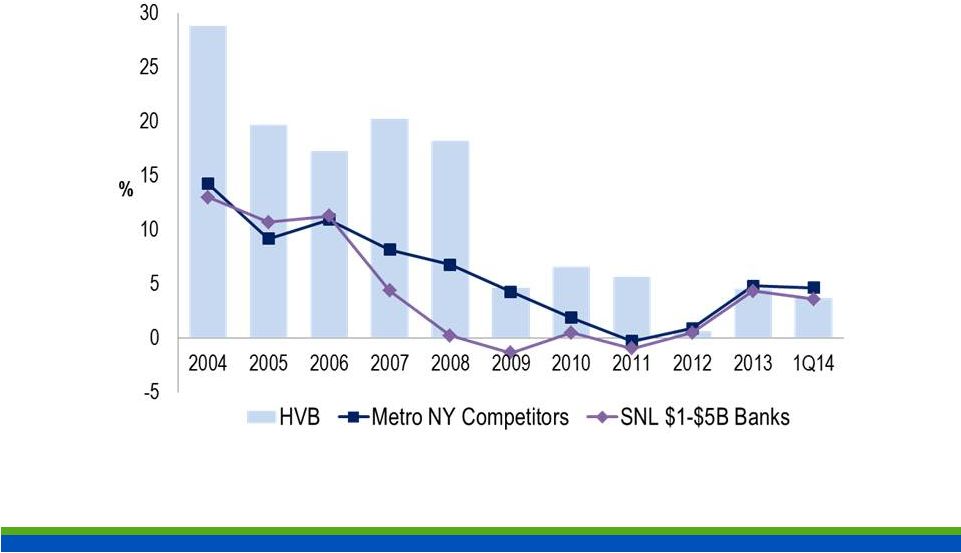

24

Deposit Premium

DEPOSIT PREMIUM

AT PERIOD END

Deposit premium defined as market value less common equity as a percentage of total

deposits Data for Metro NY Competitors and SNL $1-$5B Banks reflects the

median of each group. See Appendix for Metro NY competitors. WORKING TO

RESTORE SUPERIOR VALUATION OF PREMIER DEPOSIT FRANCHISE |

25

HVB: Becoming a Better Bank

LEGACY STRENGTHS

•

Exceptional metro NYC core deposit franchise

•

Unique niche-lending focus

•

Highly asset-sensitive balance sheet

•

Disciplined expense management

RECENT

ACCOMPLISHMENTS

•

Exceeded loan growth and liquidity deployment targets in 2013

•

New business or expansion of existing products: ABL, Equipment

Financing, Residential Mortgage

•

Meaningfully reduced operating expenses by 4.5% in 2013*

–

Despite investments in compliance, talent and growth

initiatives

•

Strengthened governance and leadership

•

Developed sophisticated cash management and mobile banking

tools on par with the largest banks

WHERE WE’RE GOING

•

Investing in the Company to be BETTER, not just to be different

•

Nimbly adapting to new environments, products, and competitors

while capitalizing on legacy strengths

•

More effectively serving our niche markets and new markets with a

more diverse array of profitable, customized products that meet their

needs

* Total non-interest expense of $100.1 million for 2013 included

non-recurring charges of $18.7 million pre-tax goodwill impairment and $1.3 million non-operating

expense related to branch consolidations. |

26

THANK YOU

FOR YOUR INTEREST IN

HUDSON VALLEY HOLDING CORP. |

27

APPENDIX

FINANCIAL DETAIL AND

NON-GAAP RECONCILIATION |

| 28

Metro New York Competitors

Astoria Financial Corporation

Northfield Bancorp, Inc.

BCB Bancorp, Inc.

Oritani Financial Corp.

Center Bancorp, Inc.

Peapack-Gladstone Financial Corporation

ConnectOne Bancorp, Inc.

People's United Financial, Inc.

Dime Community Bancshares, Inc.

Provident Financial Services, Inc.

First of Long Island Corporation

Signature Bank

Flushing Financial Corporation

Sterling Bancorp

Intervest Bancshares Corporation

Tompkins Financial Corporation

Investors Bancorp, Inc. (MHC)

Unity Bancorp, Inc.

Kearny Financial Corp. (MHC)

Valley National Bancorp

Lakeland Bancorp, Inc.

Webster Financial Corporation

New York Community Bancorp, Inc. |

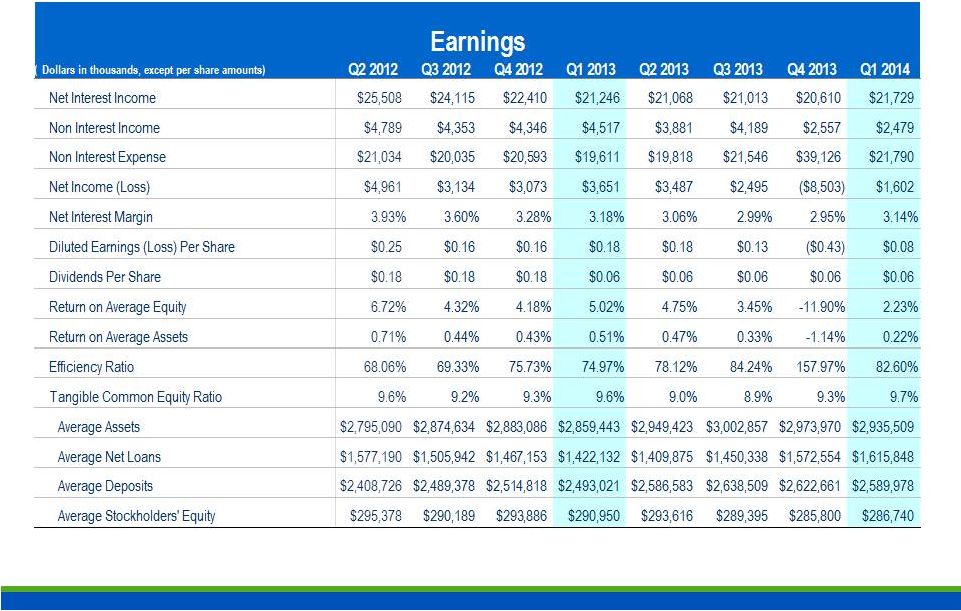

Quarterly Summary Financial Highlights

29 |

30

Quarterly Loan Balances

(1)

Total is gross of unearned income.

(Dollars in Millions)

Q2 2012

Q3 2012

Q4 2012

Q1 2013

Q2 2013

Q3 2013

Q4 2013

Q1 2014

REAL ESTATE

C&D - RESIDENTIAL

53

$

48

$

34

$

27

$

35

$

41

$

41

$

38

$

C&D - NON RESIDENTIAL

43

43

41

43

37

42

47

43

OWNER OCCUPIED CRE

229

195

181

177

186

191

168

162

NON-OWNER OCCUPIED CRE

405

389

369

399

408

408

425

426

MULTIFAMILY LOANS

213

209

196

195

196

215

227

250

1-4 FAMILY MORTGAGE

237

214

216

189

222

289

321

315

HOME EQUITY

109

109

109

106

107

107

111

114

COMMERCIAL & INDUSTRIAL

231

266

288

250

261

255

259

284

CONSUMER

19

20

19

17

16

15

15

10

LEASE FINANCING

14

14

14

11

10

12

14

14

OTHER

3

3

3

1

2

2

3

3

TOTAL (1)

1,557

$

1,510

$

1,470

$

1,415

$

1,480

$

1,577

$

1,631

$

1,659

$

Period Ending |

31

Non-GAAP Reconciliation

(a) Excluding the loan sale in the first quarter of 2012 resulting in a

gross gain of $15.9 million. (b) Excluding the

$18.7 million pre-tax goodwill impairment and $1.3 million non-operating expense related to branch

consolidations. (c) Excluding effects of

$1.9 million prepayment penalty on FHLB advances and $0.2 million change related to NYS Corporate Tax Reform.

(Dollars in thousands except share and per

share data)

2008

2009

2010

2011

2012(a)

2012

2013(b)

2013

Q1 2014(c )

Q1 2014

Net Income as reported

30,877

$

19,012

$

5,113

$

(2,137)

$

19,824

$

29,181

$

12,962

$

1,130

$

2,877

$

1,602

$

Income attributable to participating

shares as reported

-

-

-

-

(78)

(115)

(153)

(13)

(39)

(22)

Net Income attributable to common

shares as reported

30,877

$

19,012

$

5,113

$

(2,137)

$

19,745

$

29,065

$

12,809

$

1,116

$

2,838

$

1,580

$

Net Income as reported

30,877

$

19,012

$

5,113

$

(2,137)

$

19,824

$

29,181

$

12,962

$

1,130

$

2,877

$

1,602

$

Exclude:

Income Tax (1)

15,646

7,310

(1,406)

(5,413)

10,367

16,945

3,500

(4,625)

1,509

739

Provision for Loan Loss (2)

11,025

24,306

46,527

64,154

8,507

8,507

2,476

2,476

78

78

Income attributable to participating

shares (3)

-

-

-

-

(153)

(216)

12

12

(61)

(33)

Pre-tax, Pre-provision Earnings

57,548

$

50,628

$

50,234

$

56,605

$

38,545

$

54,417

$

18,949

$

(1,008)

$

4,403

$

2,385

$

Weighted Average Diluted common

shares

14,973,866

15,307,674

19,455,971

19,462,055

19,545,037

19,545,037

19,718,995

19,718,995

19,718,995

19,718,995

Diluted Earnings per Share as reported

2.06

$

1.24

$

0.26

$

(0.11)

$

1.01

$

1.49

$

0.65

$

0.06

$

0.14

$

0.08

$

Effects of (1) and (2) above

1.79

2.07

2.32

3.02

0.96

1.30

0.31

(0.11)

0.08

0.04

Pre-Tax, Pre-Provision Diluted Earnings

per Common Share

3.84

$

3.31

$

2.58

$

2.91

$

1.97

$

2.78

$

0.96

$

(0.05)

$

0.22

$

0.12

$

Tangible Equity Ratio:

Total Stockholders' Equity:

As reported

207,500

$

293,678

$

289,917

$

277,562

$

290,971

$

290,971

$

284,309

$

284,309

$

287,553

$

287,553

$

Less: Goodwill and other intangible

assets

25,040

27,118

26,296

25,493

24,745

24,745

5,855

5,855

5,807

5,807

Tangible stockholders' equity

182,460

$

266,560

$

263,621

$

252,069

$

266,226

$

266,226

$

278,454

$

278,454

$

281,746

$

281,746

$

Total Assets:

As reported

2,540,890

$

2,665,556

$

2,669,033

$

2,797,670

$

2,891,246

$

2,891,246

$

2,999,199

$

2,999,199

$

2,906,201

$

2,906,201

$

Less: Goodwill and other intangible

assets

25,040

27,118

26,296

25,493

24,745

24,745

5,855

5,855

5,807

5,807

Tangible assets

2,515,850

$

2,638,438

$

2,642,737

$

2,772,177

$

2,866,501

$

2,866,501

$

2,993,344

$

2,993,344

$

2,900,394

$

2,900,394

$

Tangible equity ratio

7.3%

10.1%

10.0%

9.1%

9.3%

9.3%

9.3%

9.3%

9.7%

9.7% |

32

THANK YOU FOR YOUR INTEREST IN

HUDSON VALLEY HOLDING CORP.

www.hudsonvalleybank.com

May 2014 |