Attached files

EXHIBIT 99.2

First Quarter 2014 Conference Call April 22, 2014 Built for success, positioned for growth

Built for success, positioned for growth This presentation contains forward-looking statements that involve risks, uncertainties and assumptions that could cause our results to differ materially from those expressed or implied by such forward-looking statements. All statements, other than statements of historical fact, are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, any statements regarding our strategy; any statements regarding future utilization; any projections of financial items; future operations expenditures; any statements regarding the plans, strategies and objectives of management for future operations; any statement concerning developments; any statements regarding future economic conditions or performance; any statements of expectation or belief; and any statements of assumptions underlying any of the foregoing. The forward-looking statements are subject to a number of known and unknown risks, uncertainties and other factors including but not limited to the performance of contracts by suppliers, customers and partners; actions by governmental and regulatory authorities; operating hazards and delays; our ultimate ability to realize current backlog; employee management issues; complexities of global political and economic developments; geologic risks; volatility of oil and gas prices and other risks described from time to time in our reports filed with the Securities and Exchange Commission ("SEC"), including the Company's most recently filed Annual Report on Form 10-K and in the Company’s other filings with the SEC, which are available free of charge on the SEC’s website at www.sec.gov. We assume no obligation and do not intend to update these forward-looking statements except as required by the securities laws. Social Media From time to time we provide information about Helix on Twitter (@Helix_ESG) and LinkedIn (www.linkedin.com/company/helix-energy-solutions-group). * Forward-Looking Statements

Built for success, positioned for growth Executive Summary (pg. 4) Operational Highlights by Segment (pg. 8) Key Balance Sheet Metrics (pg. 13) 2014 Outlook (pg. 16) Non-GAAP Reconciliations (pg. 21) Questions & Answers ROV onboard client’s vessel * Presentation Outline

Built for success, positioned for growth Executive Summary *

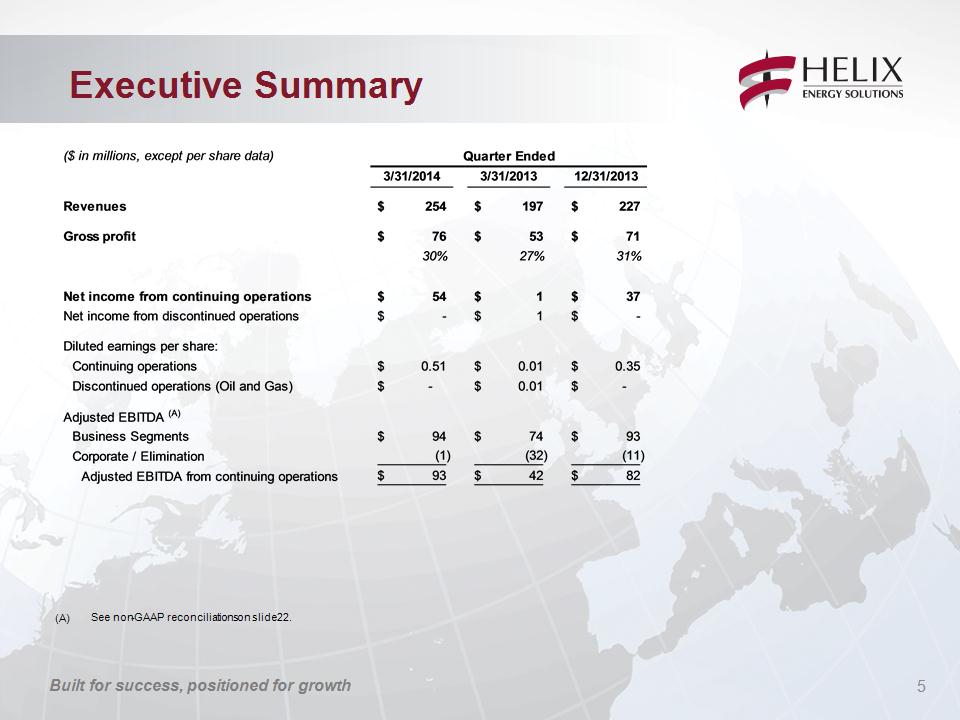

Built for success, positioned for growth See non-GAAP reconciliations on slide 22. * Executive Summary

Built for success, positioned for growth Q1 2014 earnings of $0.51 per diluted share compared to $0.35 per diluted share in Q4 2013 Q1 includes a $10.5 million gain on the sale of our former spoolbase facilities, and a $7.2 million insurance reimbursement settlement related to our former oil and gas business The two items contributed to $0.11 of after-tax diluted earnings per share Contracting Services and Production Facilities 91% utilization of Well Intervention vessels; strong outlook and backlog expected for 2014 and beyond Q4000 at 100% utilization for third consecutive quarter Skandi Constructor (chartered vessel) completed approximately 50 day well intervention campaign offshore West Africa in Q1; excellent operating performance and the recognition of deferred mobilization revenues was an important contribution to earnings Helix 534 commenced operations in the Gulf of Mexico in mid-February 2014; for Q1 the vessel was fully utilized for the 42 days from its “in-service” date Robotics chartered vessel fleet utilization of 80% in Q1; all four trenchers active during the quarter Helix Producer I experienced a power outage which suspended production from March 28 through April 13 * Executive Summary

Built for success, positioned for growth Balance sheet Cash and cash equivalents totaled $470 million at 03/31/2014 Liquidity* of $1.1 billion at 03/31/2014 Net debt of $91 million at 03/31/2014 See updated debt maturity profile on slide 14 We define liquidity as the total of cash and cash equivalents ($470 million) plus unused capacity under our revolving credit facility ($582 million). * Executive Summary

Built for success, positioned for growth Operational Highlights *

Built for success, positioned for growth ($ in millions) 91% utilization for the Well Intervention fleet Skandi Constructor completed West Africa well intervention campaign 80% chartered vessel utilization in Robotics 73% utilization of ROV, trencher and ROVDrill Robotics assets Well Enhancer * Business Segment Results

Built for success, positioned for growth GOM Q4000 100% utilized during Q1 IRS no. 2 on hire for 42 days during the quarter (12 days at standby rate) Helix 534 fully utilized during Q1 after being placed in service mid-February 2014 (17 days at repair rate due to IRS startup issues) Both vessels have full backlog for the remainder of 2014 North Sea Full utilization of Seawell and Skandi Constructor during Q1 on a variety of well intervention projects Well Enhancer fully utilized after leaving dry dock on schedule in late January Skandi Constructor returned to UK late March after a well intervention campaign offshore West Africa All vessels with high backlog in Q2 through Q3 2014, offshore UK and Canada; limited availability in Q4 2014 Q4000 * Well Intervention

Built for success, positioned for growth 80% chartered vessel fleet utilization in Q1 Includes 4 additional spot vessels utilized for a total of 62 days during the quarter 73% utilization for ROVs, trenchers and ROVDrill Deep Cygnus idle for 40 days during the quarter prior to commencement of cable installation and trenching project utilizing T750 in the North Sea Olympic Canyon continued operations in India at 100% utilization for the quarter REM Installer completed ROV support work in the Gulf of Mexico, then transited to the North Sea for accommodations project Grand Canyon commenced a 3 ½ month trenching project offshore Saudi Arabia utilizing i-Trencher and T1200 Olympic Triton Grand Canyon deploying the T1200 Jet Trencher * Robotics

Built for success, positioned for growth Olympic Canyon (1) Deep Cygnus (1) Olympic Triton (1) Grand Canyon (1) REM Installer (1) Seawell Well Enhancer Q4000 Skandi Constructor (1) H534 52 ROVs 2 ROVDrill Units 4 Trenchers (1) Chartered vessel * Utilization

Built for success, positioned for growth Key Balance Sheet Metrics *

Built for success, positioned for growth Total funded debt of $586 million at end of Q1 2014: $200 million Convertible Senior Notes – 3.25% (A) ($175 million net of unamortized debt discount) $289 million Term Loan – LIBOR + 2.50% (B) Annual amortization payments of 5% in years 1 and 2, 10% per annum in years 3 through 5 $97 million MARAD Debt – 4.93% Semi-annual amortization payments Convertible Notes Term Loan MARAD Debt Stated maturity 2032. First put / call date – March 2018. We have fixed the LIBOR interest rate on 50% of the Term Loan debt at 0.75%, utilizing interest rate swaps, through October 2016. * Debt Instrument Profile

Built for success, positioned for growth Liquidity of approximately $1.1 billion at 03/31/2014 ($ amounts in millions) Includes impact of unamortized debt discount under our convertible senior notes. We define liquidity as the total of cash and cash equivalents ($470 million) plus unused capacity under our revolving credit facility ($582 million). * Debt and Liquidity Profile

Built for success, positioned for growth 2014 Outlook *

Built for success, positioned for growth Earnings per share estimates based on a corporate tax rate ranging from 25% - 30%. * 2014 Outlook

Built for success, positioned for growth Total backlog as of March 31, 2014 was approximately $2.9 billion, of which approximately $2.7 billion associated with our Contracting Services businesses Utilization expected to remain strong for the well intervention fleet Q4000 backlog through 2015; negotiations ongoing to extend commitments into 2017 Helix 534 has full backlog through 2015, with visibility into 2017 Q5000 backlog currently a minimum of 270 days annually in first 5 years of operations Well Enhancer and Seawell have high levels of backlog in 2014 with contracts extending into 2015 Seawell re-fit dry dock expected to commence in December 2014 Skandi Constructor scheduled to commence first campaign in Canada Q2 / Q3 2014 Skandi Constructor scheduled for ~30 day dry dock in Q4 of 2014 * 2014 Outlook

Built for success, positioned for growth Robust 2014 trenching market in the North Sea, Norwegian Continental Shelf and Middle East Newbuild 1,500hp jet trencher (T1500) expected to enter fleet in mid Q2 2014 with healthy backlog “Walk-to-work” accommodations project in the North Sea utilizing the REM Installer commenced March 2014; expected duration of approximately six months Grand Canyon, T1200 and i-Trencher scheduled to commence cable burial offshore Qatar mid Q4 2014 through the end of 2015 Grand Canyon II vessel now expected to enter Robotics long-term chartered fleet early 2015 * 2014 Outlook

Built for success, positioned for growth Total capital expenditures budgeted at approximately $400 million for 2014; $70 million (including capitalized interest) incurred in Q1, including: Approximately $20 million to acquire the minority interest in the Helix Producer I in February 2014 Approximately $17 million for the Helix 534 prior to the vessel being placed in service in mid February Approximately $12 million for ROVs and T1500 jet trencher Approximately $10 million incurred on well intervention newbuilds, including intervention riser systems Approximately $11 million of maintenance capex, including the Well Enhancer dry docking and Seawell life extension Growth capital of approximately $320 million Maintenance capital of approximately $55 million Other capital includes $5 million in IT and leasehold improvements; and the aforementioned $20 million to acquire the minority interest in the Helix Producer I * 2014 Outlook – Capex

Built for success, positioned for growth Non-GAAP Reconciliations *

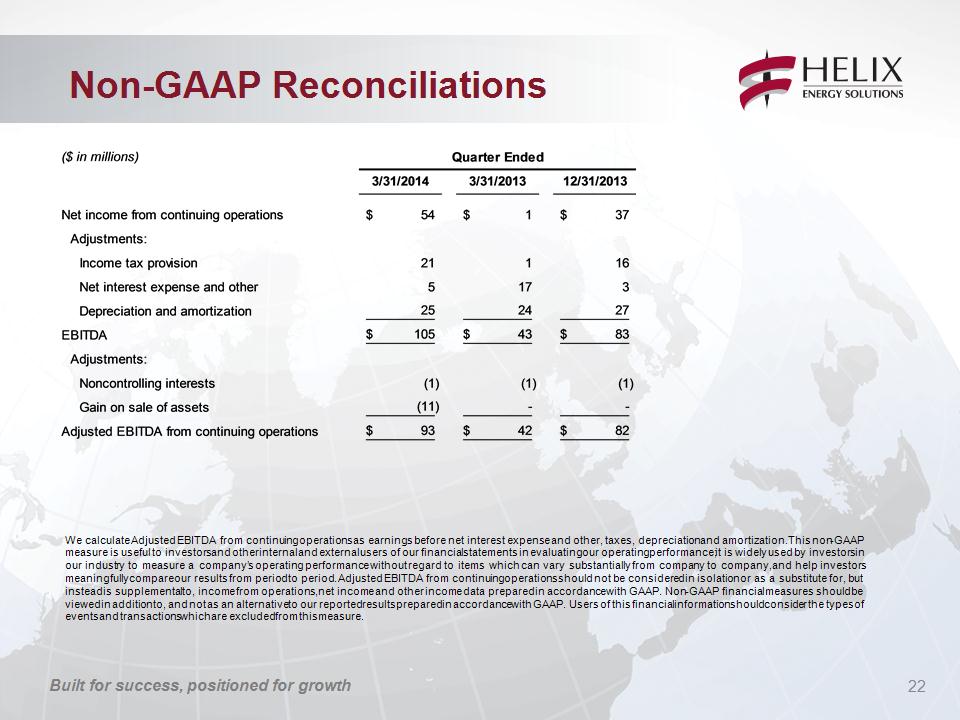

Built for success, positioned for growth We calculate Adjusted EBITDA from continuing operations as earnings before net interest expense and other, taxes, depreciation and amortization. This non-GAAP measure is useful to investors and other internal and external users of our financial statements in evaluating our operating performance; it is widely used by investors in our industry to measure a company’s operating performance without regard to items which can vary substantially from company to company, and help investors meaningfully compare our results from period to period. Adjusted EBITDA from continuing operations should not be considered in isolation or as a substitute for, but instead is supplemental to, income from operations, net income and other income data prepared in accordance with GAAP. Non-GAAP financial measures should be viewed in addition to, and not as an alternative to our reported results prepared in accordance with GAAP. Users of this financial information should consider the types of events and transactions which are excluded from this measure. * Non-GAAP Reconciliations

Built for success, positioned for growth Follow Helix on Twitter: @Helix_ESG Join the discussion on LinkedIn: www.linkedin.com/company/helix