Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - ZOOSK, INC | d672159dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 17, 2014

Registration No. 333-195320

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ZOOSK, INC.

(Exact name of Registrant as specified in its charter)

| Delaware | 7370 | 39-2053601 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

989 Market Street, Fifth Floor

San Francisco, California 94103

(415) 728-9598

(Address, including zip code, and telephone number, including area code, of Registrant’s principal executive offices)

Shayan Zadeh, Chief Executive Officer

Alex Mehr, President

Zoosk, Inc.

989 Market Street, Fifth Floor

San Francisco, California 94103

(415) 728-9598

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Gordon K. Davidson, Esq. Cynthia C. Hess, Esq. Jeffrey R. Vetter, Esq. Fenwick & West LLP 801 California Street Mountain View, California 94041 (650) 988-8500 |

Eric R. Barnett, Esq. Yun Yun Huang, Esq. Zoosk, Inc. 989 Market Street, Fifth Floor San Francisco, California 94103 (415) 728-9598 |

Sarah K. Solum, Esq. Davis Polk & Wardwell LLP 1600 El Camino Real Menlo Park, California 94025 (650) 752-2000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer |

¨ | Accelerated filer | ¨ | Non-accelerated filer | x | Smaller reporting company | ¨ | |||||||

| (Do not check if a smaller reporting company) |

||||||||||||||

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated April 17, 2014

PROSPECTUS

Shares

Common Stock

This is Zoosk, Inc.’s initial public offering. We are selling shares of our common stock.

We expect the public offering price to be between $ and $ per share. Currently, no public market exists for the shares. After pricing of this offering, we expect that the shares will trade on the New York Stock Exchange under the symbol “ZSK.” We are an “emerging growth company” as defined under federal securities laws and, as such, will be subject to reduced public company reporting requirements.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 10 of this prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

The underwriters may also exercise their option to purchase up to an additional shares from us at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about , 2014.

| BofA Merrill Lynch | Citigroup | RBC Capital Markets | ||

| Oppenheimer & Co. | William Blair | |||

The date of this prospectus is , 2014

Table of Contents

Table of Contents

Table of Contents

| 1 | ||||

| 10 | ||||

| 34 | ||||

| 35 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 39 | ||||

| 42 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

44 | |||

| 63 | ||||

| 78 | ||||

| 87 | ||||

| 95 | ||||

| 97 | ||||

| 99 | ||||

| 104 | ||||

| Material U.S. Federal Income Tax Considerations for Non-U.S. Holders of Our Common Stock |

106 | |||

| 112 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| F-1 |

We and the underwriters have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We and the underwriters take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may provide you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of the time of delivery of this prospectus or of any sale of our common stock.

Through and including , 2014 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

We and the underwriters have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons who come into possession of this prospectus and any applicable free writing prospectus we have prepared in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus and any such free writing prospectus applicable to that jurisdiction.

Table of Contents

This summary highlights information contained in greater detail elsewhere in this prospectus. This summary is not complete and does not contain all of the information you should consider in making your investment decision. You should read the entire prospectus carefully before making an investment in our common stock. You should carefully consider, among other things, our consolidated financial statements and the related notes and the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus.

ZOOSK, INC.

Overview

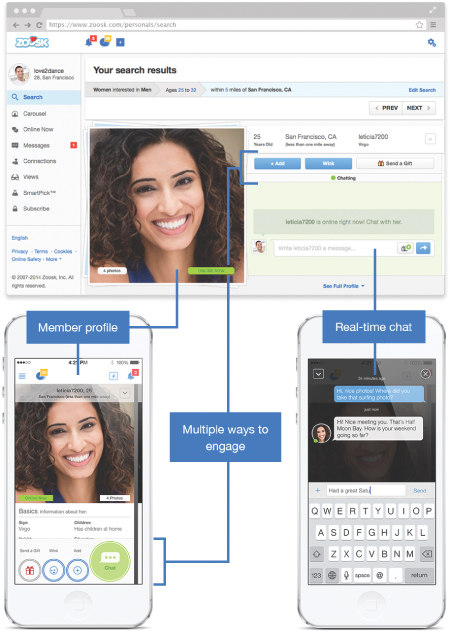

We are a leading global online dating platform with over 26 million members, including approximately 650,000 subscribers, across 80 countries as of December 31, 2013.* We help our members date smarter by leveraging data generated by their actions on our platform. Our proprietary Behavioral Matchmaking engine continuously learns from the clicks, messaging and other actions of our members in order to deliver connections that are predicted to result in mutual attraction. These connections occur on our unified global platform, allowing our members to discover and communicate with each other from their mobile phones, tablets or personal computers. We provide our members with highly personalized online dating experiences through easy-to-use features and adaptive technology. We were the #1 grossing dating app and a top 25 grossing app on the iPhone in the United States as of December 31, 2013. Our solution is offered to our members worldwide through our single brand and is localized in 25 languages.

We launched in 2007 with the belief that online dating would become so common that people would simply think of it as dating. Traditionally, it was difficult for singles to discover and connect with each other because they were limited by social circles, geography and time. Today, online dating has significantly reduced these limitations and improved the opportunity for singles to connect. While online dating has increased the number of accessible singles, we believe it has exacerbated the search problem of finding mutual attraction, which can be complex and time-consuming. According to the U.S. Census Bureau, there were over 100 million unmarried adults in the United States in 2012, and we estimate there to be over one billion unmarried adults worldwide.

Our Behavioral Matchmaking engine is self-learning and dynamically adapts based on member actions on our platform, such as sending a message, accepting a connection or expressing interest through certain premium features. Our technology processes these actions to present potential connections that are predicted to result in mutual attraction. As we collect more data, our algorithms are continuously refined to enhance the effectiveness of our solution for all our members.

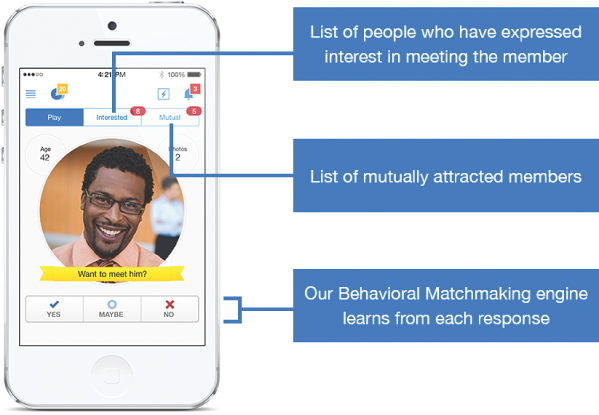

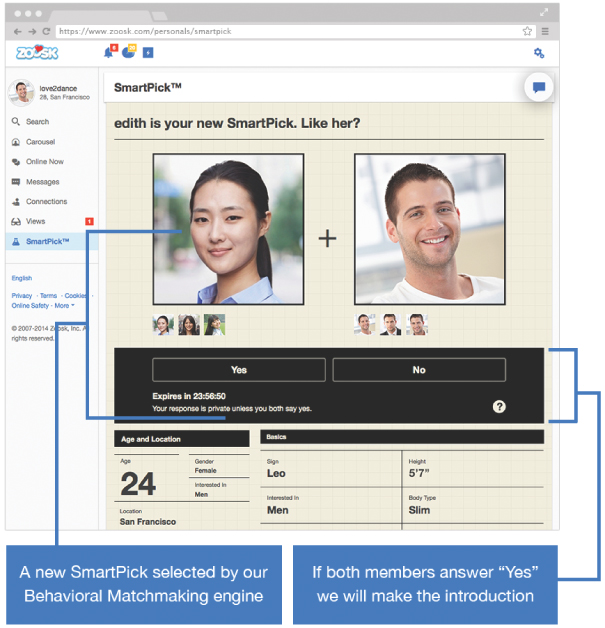

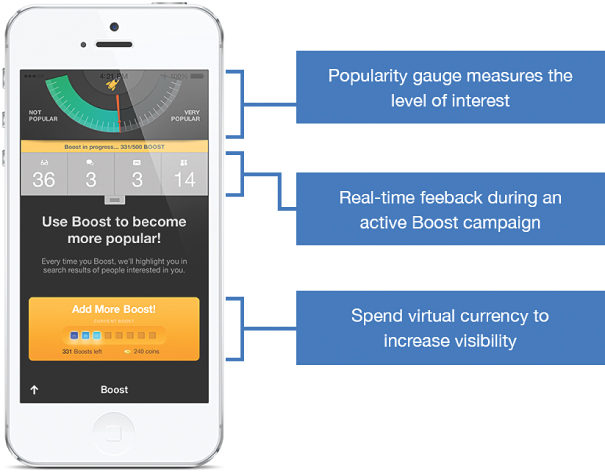

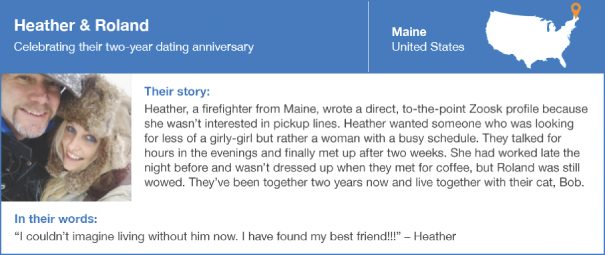

Our solution is easy to use and fun for our members. Once a member enters his or her email address and basic information, he or she can discover and connect with other members right away. Our Behavioral Matchmaking engine then starts to capture data, learn preferences and personalize the experience for that member. We offer our members multiple, distinct discovery tools such as Carousel, Search and SmartPick—all powered by our Behavioral Matchmaking engine. These tools and other features, such as Boost and chat, provide our members multiple ways to interact with each other.

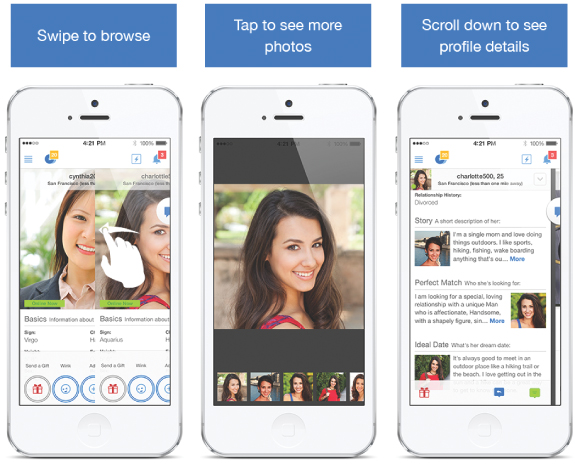

We believe our solution is well suited for mobile devices. Our intuitive mobile interface and “one-touch” features allow our members to engage with our platform throughout their day. The availability of our platform across mobile phones, tablets and personal computers enables our members to seamlessly move

| * | For a definition of members and subscribers, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Metrics.” |

1

Table of Contents

between devices, increasing the opportunities for member engagement and real-time interactions. During 2013, members using mobile devices had an average of 32% more sessions per day than members using personal computers. We were the #1 grossing dating app and a top 25 grossing app on the iPhone in the United States as of December 31, 2013 and our Android app has been downloaded over ten million times.

We generate revenues from subscriptions as well as virtual currency. Our member base has experienced rapid growth and we intend to continue to scale our investments in marketing and focus our efforts on the acquisition of new members and subscribers. Our number of members grew from over 18 million as of December 31, 2012 to over 26 million as of December 31, 2013. During the same period, our number of subscribers grew from approximately 483,000 to approximately 650,000. Our total revenues grew by 63% from $109.1 million to $178.2 million in 2012 and 2013, respectively. We had net losses of $20.7 million and $2.6 million in 2012 and 2013, respectively.

Industry Overview

Dating is typically episodic. A person may be single or in a relationship multiple times and for varying periods of time. Traditionally, the ability for singles to meet was limited by social circles, geography and time. Today, technology, mobile devices and the Internet have significantly reduced these limitations and improved the opportunity for singles to connect. At the same time, social acceptance of online dating has increased, resulting in more singles embracing online dating as a fun and effective way to meet other singles.

While online dating has increased the number of accessible singles, it has created a search problem that requires users to look through a large pool of potential candidates in hopes of finding mutual attraction. Some dating websites have tried to solve this search problem through user-generated search constraints to narrow the number of potential matches. Other dating websites have applied psychology-based methods to attempt to eliminate the need for search altogether by recommending potential matches based on lengthy compatibility-based questionnaires. These websites rely on time-consuming processes and potentially inaccurate self-assessments, producing static, predefined results. Others attempt to solve the search problem by limiting their members to particular religions, ages, careers, education levels or even food preferences.

Numerous online dating websites and apps have been created, resulting in a highly fragmented marketplace. However, few reach a critical mass of members. According to IBISWorld, the majority of dating services companies had less than 1% market share of the U.S. dating services market in 2013.

The U.S. online dating market is estimated to be $1.4 billion, according to IBISWorld. The global online dating market is significantly larger as this estimate does not take into account international markets. Also, we believe the proliferation of mobile devices in both U.S. and international markets will further drive the scale and growth of online dating.

Our Opportunity

We believe that there is a significant opportunity to help singles date smarter by leveraging behavioral data. Technology platforms such as Amazon, Netflix and Pandora have successfully used data generated by the actions of their customers to enhance their services and offer recommendations predicted to appeal to each individual customer.

We have applied this behavior-based approach to online dating. By leveraging behavioral data, we are able to address the complex and time-consuming search problem created by the increased number of accessible singles made possible by online dating. Our data-driven approach provides predictions of mutual attraction to help members discover and connect with other members.

2

Table of Contents

Our Solution

We provide our members with highly personalized online dating experiences through easy-to-use features and adaptive technology. We believe our platform provides the following benefits to our members:

| • | Personalized. We create a personalized experience for each and every member. While other online dating websites often bucket their users into predefined, static groups, our Behavioral Matchmaking engine dynamically processes, learns and adapts to each member’s unique actions on our platform. |

| • | Easy. We make it easy for our members to get started quickly and focus on engaging with other members. After providing an email address and basic information, members can discover and connect with other members right away. |

| • | Mobile. The availability of our platform across mobile phones, tablets and personal computers enables our members to seamlessly move between devices, increasing the opportunities for member engagement and real-time interactions. |

| • | Flexible. Our platform can be used by members throughout their dating lives. We have members who range from 18 to over 90 years old. We seek to form long-term relationships with our members so they return to our platform each time they are looking for a new dating relationship. |

| • | Global. Our global platform serves members across 80 countries in 25 languages and accepts payments in 55 currencies. In 2013, 49% of our total revenues were international, and 62% of our members were international at the end of the year. |

| • | Authentic. We believe that the authenticity and quality of member profiles is important in creating an engaging and meaningful online dating experience for our members. Our member operations team is dedicated to managing the quality of member profiles by reviewing profile content for compliance with our terms and policies. |

Our Competitive Strengths

| • | Product focus. We aim to provide the most useful and powerful matching technology. Although our matching technology is complex, our interface provides a simple and intuitive way for members to find potential connections. |

| • | Proprietary technology. We typically process and analyze over 45 million member actions per day through our Behavioral Matchmaking engine to dynamically address each member’s preferences at scale. |

| • | Efficient global platform. We have a single platform that allows our members to access our product through their mobile phones, tablets and personal computers across 80 countries and in 25 languages. |

| • | Optimized for mobile. Our product is designed to be easy to use on small screens and enables members to sign up, engage and pay with their mobile devices. During 2013, 41% of our first-time subscriptions were purchased using mobile devices. |

| • | Large member base. Our platform served over 26 million members globally as of December 31, 2013. Our members have a large pool of singles with whom they can interact and be matched. As |

3

Table of Contents

| we collect more data from these actions, our algorithms are further refined to enhance the effectiveness of our solution for all our members. |

| • | Data-driven business operations. We perform extensive data analysis to make decisions and improve operations across multiple functions of our company, including marketing, product development, member operations, finance and human resources. |

Our Strategy

We intend to continue to strengthen our position as a leading global online dating platform. We have over 26 million members and intend to grow our member base with the following key strategies:

| • | Product innovation. We seek to continuously improve our products through enhancements to our Behavioral Matchmaking engine, user interface and features. |

| • | Mobile leadership. We intend to continue to develop and introduce mobile-optimized features that allow members to quickly view potential connections and express interest through a single touch. |

| • | Return-focused advertising. We seek to optimize for total return on advertising spend by frequently analyzing and adjusting this spend to focus on channels and markets that generate a high return. |

| • | Brand building. We plan to further increase our brand awareness and build trust with our members through increased public relations, social media and advertising. |

| • | Long-term member engagement. We will continue to make it easy for our members to return and receive an optimal experience each time they are looking for a new dating relationship. |

Risk Factors

Our business is subject to numerous risks and uncertainties, including those highlighted in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include the following:

| • | our limited operating history makes it difficult to evaluate our current business and future prospects; |

| • | we have a history of losses, anticipate increasing our operating expenses in the future, and may not achieve or sustain profitability in the future; |

| • | if we fail to retain existing members and subscribers or add new members and subscribers, or if our members and subscribers decrease their level of engagement with our platform, our business may be adversely affected; |

| • | we spend significant amounts on advertising campaigns to acquire new members and subscribers, which may not be successful or cost-effective; |

| • | the market in which we participate is fragmented and highly competitive and if we do not compete effectively, our prospects, operating results and financial condition could be adversely affected; |

| • | our number of members is significantly higher than our number of subscribers, and our business will be harmed if we are unable to attract new subscribers; |

| • | changes to the standard terms, conditions and policies of third-party platforms that distribute our apps, such as Apple, Facebook and Google, could adversely affect our business; |

4

Table of Contents

| • | if use of our platform on mobile devices does not continue to grow or we are unable to continue to successfully deliver and monetize our platform on mobile devices, our business could be harmed; |

| • | our quarterly operating results or other operating metrics may fluctuate significantly, which could cause the trading price of our common stock to decline; and |

| • | our directors, executive officers and principal stockholders will beneficially own, in the aggregate, approximately % of our shares of outstanding common stock after this offering and, if they acted together, could have control over the outcome of matters submitted to stockholders for approval or could delay or prevent a change in corporate control. |

Corporate Information

We were incorporated in the State of Delaware in April 2007. Unless expressly indicated or the context indicates otherwise, as used in this prospectus, the terms “Zoosk,” “we,” “us” and “our” refer to Zoosk, Inc., a Delaware corporation, and, where appropriate, its subsidiary taken as a whole. Our principal executive offices are located at 989 Market Street, Fifth Floor, San Francisco, California 94103 and our telephone number is (415) 728-9598. Our website address is www.zoosk.com. Information contained on, or that can be accessed through, our website is not incorporated by reference into this prospectus, and you should not consider information on our website to be part of this prospectus.

Zoosk, the Zoosk logo and other registered or common law trade names, trademarks or service marks of Zoosk appearing in this prospectus are the property of Zoosk. This prospectus contains additional trade names, trademarks and service marks of other companies that are the property of their respective owners. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies.

JOBS Act

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (“JOBS Act”). We will remain an emerging growth company until the earlier of the last day of the fiscal year following the fifth anniversary of the completion of this offering, the last day of the fiscal year in which we have total annual gross revenues of at least $1.0 billion, the date on which we are deemed to be a large accelerated filer (this means that we have been public for at least 12 months, have filed at least one annual report and the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year), or the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

In addition, the JOBS Act provides that an emerging growth company can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves of this exemption and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

5

Table of Contents

THE OFFERING

| Common stock offered by us |

shares |

| Underwriters’ option to purchase additional shares offered by us |

shares |

| Common stock to be outstanding immediately after this offering |

shares, or shares if the underwriters exercise their option to purchase additional shares in full. |

| Use of proceeds |

We estimate that our net proceeds from this offering will be approximately $ million, or approximately $ million if the underwriters exercise their option to purchase additional shares in full, based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, and after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

We intend to use the net proceeds for general corporate purposes, which may include marketing activities, working capital, product development, general and administrative matters and capital expenditures. See “Use of Proceeds.”

| Risk factors |

You should read the “Risk Factors” section of this prospectus for a discussion of factors to consider carefully before deciding to invest in shares of our common stock. |

| Proposed New York Stock Exchange symbol |

ZSK |

The number of shares of our common stock to be outstanding after this offering is based on 46,352,452 shares of our common stock outstanding as of December 31, 2013, and excludes:

| • | 7,133,825 shares of common stock issuable upon the exercise of options outstanding as of December 31, 2013, with a weighted-average exercise price of $2.72 per share; |

| • | 511,970 shares of common stock issuable upon the exercise of warrants outstanding as of December 31, 2013, with a weighted-average exercise price of $1.84 per share; |

| • | 4,801,250 shares of common stock issuable upon the exercise of options granted between December 31, 2013 and April 17, 2014, with a weighted-average exercise price of $5.94 per share; and |

| • | 12,265,724 shares of common stock reserved for future issuance under our equity compensation plans as of December 31, 2013, consisting of (a) 3,765,724 shares of common stock reserved for future issuance under our 2007 Stock Plan (which reserve: (i) includes the options to purchase shares of our common stock granted after December 31, 2013 and (ii) excludes an increase to the reserve of 2,000,000 shares of our common stock in February 2014), (b) 7,000,000 shares of common stock reserved for future issuance under our 2014 Equity Incentive Plan, which will |

6

Table of Contents

| become effective in connection with the completion of this offering (which reserve includes the options to purchase shares of our common stock granted to our non-employee directors on the date of this prospectus), and (c) 1,500,000 shares of common stock reserved for future issuance under our 2014 Employee Stock Purchase Plan, which will become effective in connection with the completion of this offering. In connection with the completion of this offering, any remaining shares available for issuance under our 2007 Stock Plan will be added to the shares reserved under our 2014 Equity Incentive Plan, and we will cease granting awards under our 2007 Stock Plan. Our 2014 Equity Incentive Plan and 2014 Employee Stock Purchase Plan also provide for automatic annual increases in the number of shares reserved under the plans each year, as more fully described in “Executive Compensation—Employee Benefit and Stock Plans.” |

Except as otherwise indicated, all information in this prospectus assumes:

| • | the filing of our amended and restated certificate of incorporation and the effectiveness of our amended and restated bylaws in connection with the completion of this offering; |

| • | the automatic conversion of all outstanding shares of our convertible preferred stock as of December 31, 2013 into an aggregate of 31,822,227 shares of common stock in connection with the completion of this offering; |

| • | the automatic conversion of outstanding warrants exercisable for shares of our convertible preferred stock as of December 31, 2013 into warrants exercisable for 455,830 shares of common stock in connection with the completion of this offering; |

| • | no exercise of outstanding stock options or warrants subsequent to December 31, 2013, except for the exercise of an outstanding warrant for an aggregate of 31,852 shares of our common stock on or prior to the completion of this offering; and |

| • | no exercise of the underwriters’ option to purchase additional shares. |

7

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL AND OTHER DATA

The following summary consolidated financial data should be read with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus. The summary consolidated financial data in this section are not intended to replace the consolidated financial statements and are qualified in their entirety by the consolidated financial statements and related notes included elsewhere in this prospectus. The summary consolidated statements of operations data presented below for 2011, 2012 and 2013 and the consolidated balance sheet data presented below as of December 31, 2013 are derived from our audited consolidated financial statements included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in any future period.

| Year Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | ||||||||||||||||||||||

| (in thousands, except per share data) | ||||||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||

| Subscription |

$ | 94,487 | $ | 103,751 | $ | 153,882 | ||||||||||||||||||

| Virtual currency |

2,748 | 5,376 | 24,350 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total revenues |

97,235 | 109,127 | 178,232 | |||||||||||||||||||||

| Cost of revenues(1) |

13,945 | 18,600 | 25,347 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Gross profit |

83,290 | 90,527 | 152,885 | |||||||||||||||||||||

| Operating expenses(1): |

||||||||||||||||||||||||

| Marketing |

81,137 | 92,708 | 128,686 | |||||||||||||||||||||

| Research and development |

6,147 | 10,276 | 14,849 | |||||||||||||||||||||

| General and administrative |

5,778 | 6,340 | 9,556 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total operating expenses |

93,062 | 109,324 | 153,091 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Loss from operations |

(9,772 | ) | (18,797 | ) | (206 | ) | ||||||||||||||||||

| Other expense, net: |

||||||||||||||||||||||||

| Interest expense |

(1,979 | ) | (1,322 | ) | (906 | ) | ||||||||||||||||||

| Other expense, net |

(476 | ) | (540 | ) | (1,512 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Net loss |

$ | (12,227 | ) | $ | (20,659 | ) | $ | (2,624 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Net loss per common share—basic and diluted(2) |

$ | (0.86 | ) | $ | (1.44 | ) | $ | (0.18 | ) | |||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Weighted-average common shares used to compute net loss per common share—basic and diluted(2) |

14,259 | 14,374 | 14,457 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Pro forma net loss per common share—basic and diluted(2) (unaudited) |

$ | (0.06 | ) | |||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

| Pro forma weighted-average shares used to compute pro forma net loss per common share—basic and diluted(2) (unaudited) |

46,279 | |||||||||||||||||||||||

|

|

|

|||||||||||||||||||||||

8

Table of Contents

| (1) | Includes stock-based compensation expense as follows: |

| Year Ended December 31, | ||||||||||||||||||||||||

| 2011 | 2012 | 2013 | ||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||

| Cost of revenues |

$ | 48 | $ | 87 | $ | 118 | ||||||||||||||||||

| Marketing |

159 | 105 | 179 | |||||||||||||||||||||

| Research and development |

356 | 587 | 777 | |||||||||||||||||||||

| General and administrative |

391 | 541 | 858 | |||||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| Total |

$ | 954 | $ | 1,320 | $ | 1,932 | ||||||||||||||||||

|

|

|

|

|

|

|

|||||||||||||||||||

| (2) | See Note 2 of the notes to our consolidated financial statements for a description of the method used to compute net loss per common share—basic and diluted, and pro forma net loss per common share—basic and diluted. |

| As of December 31, 2013 | ||||||||||||||||||||||

| Actual | Pro Forma(1) |

Pro Forma As Adjusted(2) | ||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||||||||||||

| Cash and cash equivalents |

$ | 20,530 | $ | 20,530 | $ | |||||||||||||||||

| Working capital (deficit) |

(28,554 | ) | (28,554 | ) | ||||||||||||||||||

| Total assets |

38,601 | 38,601 | ||||||||||||||||||||

| Deferred revenue |

21,992 | 21,992 | ||||||||||||||||||||

| Notes payable, current and non current portion, net of discount |

7,940 | 7,940 | ||||||||||||||||||||

| Capital lease obligation, current and non current portion |

4,554 | 4,554 | ||||||||||||||||||||

| Other long-term liabilities |

4,518 | 1,890 | ||||||||||||||||||||

| Convertible preferred stock |

61,122 | — | ||||||||||||||||||||

| Total stockholders’ (deficit) equity |

(28,809 | ) | (26,181 | ) | ||||||||||||||||||

| (1) | The pro forma column reflects (i) the automatic conversion of all outstanding shares of convertible preferred stock into 31,822,227 shares of common stock and (ii) the resulting reclassification of the preferred stock warrant liability from other long-term liabilities to additional paid-in capital, each to be effective in connection with the completion of this offering. |

| (2) | The pro forma as adjusted column reflects all adjustments included in the pro forma column and gives effect to (i) the exercise of an outstanding warrant for an aggregate of 31,852 shares of our common stock on or prior to the completion of this offering and (ii) the sale of shares of common stock by us in this offering, based on an assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the midpoint of the price range set forth on the cover page of this prospectus, would increase (decrease) our cash and cash equivalents, working capital (deficit), total assets and total stockholders’ (deficit) equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions. The pro forma as adjusted information is illustrative only and will change based on the actual initial public offering price and other terms of this offering determined at pricing. |

| As of December 31, | ||||||||||||

| 2011 | 2012 | 2013 | ||||||||||

| (in thousands) | ||||||||||||

| Other Data: |

||||||||||||

| Members(1) |

11,606 | 18,150 | 26,390 | |||||||||

| Subscribers(1) |

316 | 483 | 650 | |||||||||

| (1) | For a definition of members and subscribers, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Metrics.” For a discussion of certain limitations on our member and subscriber metrics, see “Industry Data and Company Metrics.” |

9

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including our consolidated financial statements and related notes, before investing in our common stock. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that affect us. If any of the following risks occur, our business, financial condition, operating results and prospects could be materially harmed. In that event, the price of our common stock could decline, and you could lose part or all of your investment.

Risks Related to Our Business and Our Industry

Our limited operating history makes it difficult to evaluate our current business and future prospects.

We were founded in 2007 and have a limited history operating our business at its current scale, which makes it difficult to evaluate our current business and future prospects, including our ability to plan for and model future growth. Although we have experienced significant revenue growth rates in recent periods, you should not rely on our historical growth rates as an indication of future growth rates. We have encountered and will continue to encounter risks and difficulties as our company and our industry evolve. If we do not address these risks successfully, our business and operating results will be adversely affected, and our stock price could decline. Further, we operate in a rapidly evolving market. As such, any predictions about our future revenues and expenses may not be as accurate as they would be if we had a longer operating history or operated in a more predictable market.

We have a history of losses, anticipate increasing our operating expenses in the future, and may not achieve or sustain profitability in the future.

We have incurred net losses in all fiscal years since our inception, including net losses of $12.2 million, $20.7 million and $2.6 million in 2011, 2012 and 2013, respectively. As of December 31, 2013, we had an accumulated deficit of $95.6 million. We anticipate that our operating expenses will increase substantially in the foreseeable future as we continue to increase our marketing expenditures to broaden our member and subscriber base and brand awareness, enhance our platform and its features and functionality, expand our operations, hire additional employees and continue to develop our technology. These efforts may prove more expensive than we currently anticipate, and we may not succeed in increasing our revenues sufficiently, or at all, to offset these higher expenses. Growth of our revenues may slow or revenues may decline for a number of possible reasons, including slowing demand for our platform, decreasing return on our advertising spend, increasing competition or decreasing growth of our overall market. If we are unable to meet these risks and challenges as we encounter them, our business may suffer. If we do achieve profitability, we may not be able to sustain or increase such profitability.

If we fail to retain existing members and subscribers or add new members and subscribers, or if our members and subscribers decrease their level of engagement with our platform, our business may be adversely affected.

The scale and engagement of our member and subscriber base are critical to our success. Our financial performance has been and will continue to be significantly determined by our success in adding, retaining and engaging members and subscribers. If people do not perceive our platform to be useful, reliable and trustworthy, we may not be able to attract or retain members or subscribers or maintain or increase the frequency and duration of their engagement. We may experience an erosion of our member and subscriber base or engagement levels. Our member and subscriber behavior has changed over time and can be difficult to predict, particularly as we introduce new, and modify existing, features and functionality. Any number of factors could negatively affect the size and engagement of our member and subscriber base, including if:

| • | we are unable to maintain a sufficient member base in certain regions and among certain demographics, making our platform less useful to existing and prospective members in those regions and demographics; |

10

Table of Contents

| • | our Behavioral Matchmaking engine does not recommend relevant connections for our members and subscribers or if we are unable to continue to refine or improve our technology to ensure members and subscribers are presented with potential connections that are relevant to them or there are changes in member and subscriber sentiment about the quality or usefulness of our platform; |

| • | technical or other problems prevent us from delivering our platform and its features in a rapid and reliable manner or otherwise negatively affect the member and subscriber experience; |

| • | we are unable to continue to develop products for mobile devices that members and subscribers find engaging or that work with a variety of mobile operating systems and networks; |

| • | members increasingly engage with our competitors’ products or services or other products or services; |

| • | our pricing policies or the pricing policies of our competitors change; |

| • | there are changes in member and subscriber or the general public’s concerns related to privacy and sharing, safety, security or other factors; |

| • | we fail to provide adequate customer service to members and subscribers; |

| • | we or other companies in our industry are the subject of adverse media reports or other negative publicity; or |

| • | there are adverse changes in our services that are mandated by legislation, regulatory authorities or litigation. |

Any decrease in the size or engagement of our member or subscriber base could render our platform less attractive to current and potential members and subscribers, which may have a materially adverse impact on our business, financial condition and operating results.

If our current members disengage with our platform, if current subscribers do not renew their subscriptions, or if our former members and subscribers do not return to our platform, our business will be harmed.

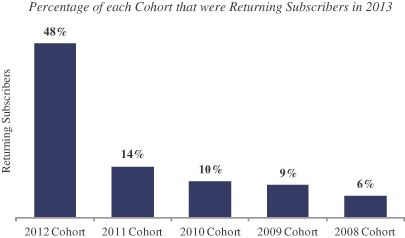

We must continually add new members and subscribers to replace members or non-renewing subscribers and to grow our member and subscriber base. Subscribers may choose not to renew their subscriptions for many reasons, including changes in a subscriber’s relationship status, a desire to use a service offered by one of our competitors or dissatisfaction with our platform. Dating is, by nature, episodic, and our members and subscribers periodically stop engaging with our platform when they enter into a relationship and may reengage or return to our platform after the relationship ends. If the rate at which our members reengage or our subscribers renew their subscriptions decreases, or if our former members and subscribers do not return to our platform when they are looking for a new dating relationship, our business, financial condition and operating results may be adversely affected.

If we fail to recommend connections to our members and subscribers that result in mutual attraction, we may fail to retain existing members and attract new and former members.

We are continually refining our proprietary Behavioral Matchmaking engine to improve our suggested connections and the usefulness of our platform to our members and subscribers. We may experience difficulty in refining and improving our Behavioral Matchmaking engine, whether due to unforeseen delays or difficulties in the development process or otherwise.

11

Table of Contents

If our Behavioral Matchmaking engine does not recommend connections for our members and subscribers that result in mutual attraction or if we are unable to continue to refine or improve our technology, our platform may fail to meet the expectations of our members and subscribers or otherwise be useful to them. Any resulting decrease in member and subscriber satisfaction could lessen our ability to retain existing members and subscribers and attract new and former members and subscribers, which could have a material adverse effect on our business.

If members’ profiles are outdated, inaccurate or contain only basic information, our members may not be able to realize the full potential of our platform, which could adversely affect the growth of our business.

The value of our platform to our members may decrease if a significant number of our members’ profiles are outdated, inaccurate or contain only basic information. Outdated or inaccurate profiles or profiles that contain only basic information could diminish the ability of our members to find relevant potential connections, such as by impairing the ability of our Behavioral Matchmaking engine to suggest relevant connections. If a significant number of our members do not update their information or provide accurate information when they join our platform, or if a significant number of profiles contain only basic information, other members may become dissatisfied with our platform, our brand may be negatively affected and our member engagement and member and subscriber base could decline.

We spend significant amounts on advertising campaigns to acquire new members and subscribers, which may not be successful or cost-effective.

We acquire many of our members through paid marketing channels. In 2012 and 2013, marketing expenses were $92.7 million and $128.7 million, respectively, representing 85% and 72% of our total revenues, respectively. We expect to continue to spend significant amounts to acquire additional members and subscribers. In order to maintain our current revenues and grow our business, we need to continually optimize advertising campaigns aimed at acquiring new members and subscribers. Our success in these efforts depends, in part, upon our continued ability to promote our platform on third-party websites, such as Facebook and Google, to whom we pay fees to advertise our platform. If one of our advertisers to which we direct considerable online advertising expenditures, such as Facebook or Google, were to increase their fees, change their interface or experience disruptions in service, we may incur additional advertising expenses to acquire members and subscribers. If our advertising spend increases, the return on our advertising campaigns may be lower than we anticipate regardless of the revenues generated by new subscriptions, and our growth rate and operating results may be adversely affected.

If any significant third-party websites or platforms on which we advertise lose their market position or otherwise fall out of favor with consumers or other factors cause their user bases to stop growing or shrink, we may need to identify alternative channels for advertising and promoting our platform, which would consume substantial resources and may not be effective, or available at all.

While we seek to structure our advertising campaigns in the manner that we believe is most likely to encourage individuals to join our platform and purchase subscriptions, we may fail to identify advertising opportunities that satisfy our anticipated return on advertising spend as we scale our investments in marketing, accurately predict member acquisition or fully understand or estimate the conditions and behaviors that drive member behavior. If for any reason any of our advertising campaigns prove less successful than anticipated in attracting members and subscribers, we may not be able to recover our advertising spend, and our rate of member and subscriber acquisition may fail to meet market expectations, either of which could have an adverse effect on our business.

In addition to paid advertising channels, we rely on Internet search engines, such as Google, Bing and Yahoo, to direct traffic to our website, including our mobile website. If search engine companies change their search methodologies or if our competitors’ search engine optimization efforts are more successful than ours, the growth of our member and subscriber base could be adversely affected.

12

Table of Contents

The market in which we participate is fragmented and highly competitive. If we do not compete effectively, our prospects, operating results and financial condition could be adversely affected.

The online dating industry is intensely competitive and has few barriers to entry. We primarily compete with large online dating websites and apps in the United States and internationally, such as Match.com, eHarmony.com and Meetic.com. We also face competition from numerous smaller companies in the online dating market, including a large number of free websites and apps. Our competitors may enjoy competitive advantages, such as greater name and brand recognition, longer operating histories, substantially greater market share, large existing user bases, better competitive positions in certain geographic regions or user demographics, and substantially greater financial, technical and other resources. These factors may allow our competitors to offer products and services similar to ours at a lower price, develop different products and services to compete with us and respond more quickly and effectively than we do to new or changing opportunities, technologies, market conditions and user preferences. These competitors may also engage in more extensive research and development efforts, undertake more far-reaching advertising campaigns and adopt more aggressive pricing policies that may allow them to build larger user bases. Our competitors may develop products or services that are equal or superior to ours or that achieve greater market acceptance than ours. In addition, new and different types of social discovery may also increase in popularity at the expense of online dating. These activities could attract members and subscribers away from our platform, reduce our market share and have a material adverse effect on our business, operating results and financial condition.

New competitors, business models and products and services are likely to emerge. If we are not able to compete effectively against our current or future competitors, the size and level of engagement of our member and subscriber base may decrease, which could materially and adversely affect our business, operating results and financial condition.

Our quarterly operating results or other operating metrics may fluctuate significantly, which could cause the trading price of our common stock to decline.

Our quarterly operating results and other operating metrics have historically fluctuated and may continue to fluctuate from quarter to quarter. We expect that this trend will continue as a result of a number of factors, many of which are outside of our control and may be difficult to predict, including:

| • | the timing, size and effectiveness of our advertising campaigns to acquire new members and subscribers; |

| • | our ability to maintain or increase the size and engagement of our member and subscriber base, including our ability to maintain or increase the rate at which we attract new subscribers, the duration of subscriptions they purchase and the number and frequency of repeat subscribers; |

| • | levels of virtual currency purchases; |

| • | increases or decreases in our revenues and expenses caused by fluctuations in foreign currency exchange rates; |

| • | increases in and timing of marketing and other operating expenses that we may incur to grow and expand our operations and to remain competitive; |

| • | the rate of growth in mobile usage and our ability to monetize through our mobile apps; |

| • | the development and introduction of new products and services by us or our competitors; |

| • | pricing pressure as a result of competition or otherwise; |

13

Table of Contents

| • | interruptions or outages in our data centers and other technical infrastructure; |

| • | failures or breaches of security or privacy, and the costs associated with remediating any such failures or breaches; |

| • | adverse litigation judgments, settlements or other litigation-related costs; |

| • | changes in the legislative or regulatory environment, such as with respect to privacy; |

| • | costs related to the acquisition of businesses, talent, technologies or intellectual property, including potentially significant amortization costs and possible write-downs; and |

| • | general economic conditions in either domestic or international markets. |

Any one of the factors above or the cumulative effect of some of the factors referred to above may result in significant fluctuations in our operating results. As a result, comparing our quarterly operating results may not be meaningful.

In addition, in future periods, seasonal variations in member and subscriber behavior may cause fluctuations in our financial results. We may experience seasonal variation in member and subscriber acquisition and engagement during certain vacation and holiday periods. We may also incur higher marketing expenditures during the fourth quarter of each calendar year due to the higher cost of advertising during the holiday season. While seasonal trends may affect our quarterly operating results, our recent growth may have overshadowed these effects.

The variability and unpredictability of our quarterly operating results or other operating metrics could result in our failure to meet our expectations or those of any analysts that cover our company or investors with respect to revenues or other operating results for a particular period. If we fail to meet or exceed such expectations for these or any other reasons, the market price of our common stock could fall substantially, and we could face costly lawsuits, including securities class action suits.

Our number of members is significantly higher than our number of subscribers. If we are unable to attract new subscribers, if former subscribers do not return to our platform or if existing subscribers do not renew their subscriptions, our business may be adversely affected.

Our business model depends in part on attracting and maintaining a large member and subscriber base. It also depends on former subscribers returning to our platform when they are looking for a new dating relationship and existing subscribers renewing their subscriptions. We generate revenues primarily through subscription sales to our subscribers, who constitute a relatively small portion of our overall member base, as well as through sales of virtual currency to our members and subscribers. Subscription fees accounted for 95% and 86% of our total revenues in 2012 and 2013, respectively. If we are unable to attract new subscribers, if former subscribers do not return to our platform when they are looking for a new dating relationship or if existing subscribers do not renew their subscriptions, our business may be adversely affected.

Changes to the standard terms, conditions and policies of third-party platform providers that distribute our apps, such as Apple, Facebook and Google, could adversely affect our business.

We depend on third-party platform providers to allow members to locate and download our apps that enable access to our platform, facilitate payments through our mobile apps and streamline member registration. A substantial number of our members and subscribers choose to engage with our platform through mobile apps downloaded from third-party app stores, such as the Apple App Store and Google Play. Apple also provides

14

Table of Contents

payment processor services for members who purchase subscriptions or virtual currency through our iOS mobile apps. We are subject to the standard terms, conditions and practices of these platform providers for app developers, which govern the promotion, distribution, operation and use of our apps downloaded from their respective platforms. Platform providers have broad discretion to change their standard terms and conditions and have the right to prohibit a developer from distributing apps on their platform if the developer violates the standard terms and conditions. In addition, platform providers can change their policies or interpretations of their standard terms and conditions. Our business could suffer materially if platform providers change their standard terms and conditions, interpretations or other policies and practices in a way that is detrimental to us or if platform providers determine that we are in violation of their standard terms and conditions and prohibit us from distributing our apps on their platforms. For instance, currently Apple charges a commission on purchases and subscriptions made through its App Store. If other third-party platform providers begin imposing a fee for sales through their platform, our marketing costs could increase, which could have an adverse impact on our operating results. Moreover, if we are unable to maintain a good relationship with these platform providers, our business and operating results could be adversely affected. For example, our business would be harmed if these platform providers:

| • | discontinue, limit or restrict access to their platforms by us or our apps; |

| • | modify their terms of service or other policies, including restrictions on app developers; |

| • | increase or impose commissions on subscription or virtual currency sales through their platforms; |

| • | establish more favorable relationships with one or more of our competitors; |

| • | develop their own competitive offerings; or |

| • | impose fees associated with access to and use of their platforms. |

When a new member registers for our platform using a third-party social network, such as Facebook, our platform may collect information from the social network to enable the member to quickly and easily create a profile. We also use notification systems provided by or through third-party platforms and social networks to provide certain communications to our members, such as mobile app notifications. Our business could be harmed if these social networks or platforms change their terms and conditions relating to how information of their users may be shared with us on or through their platforms, change their notification features or capabilities, or restrict how their users can share information with friends on these platforms or across other platforms, which could impact member acquisition, the quality of member profiles and member engagement.

Our email and text message campaigns are an important means to drive member and subscriber engagement. Disruptions in, restrictions on or any increase in the costs associated with the sending or receipt of emails or text messages or a decrease in member and subscriber willingness to receive emails and text messages could adversely affect our revenues and business.

Our email and text message campaigns are an important means to drive member and subscriber engagement. We send a large volume of emails and text messages to members and subscribers notifying them of a variety of activities on our platform, such as new connections. We also rely on the use of email and text messages as a part of our registration and validation processes. Because of the importance of email and text messages to our business, if we are unable to successfully deliver emails or text messages to our members and subscribers or if members and subscribers consistently decline to open our emails or text messages, our business could be adversely affected.

We also face a risk that service providers or email applications may block bulk message transmissions or otherwise experience technical difficulties that result in our inability to successfully deliver emails or text

15

Table of Contents

messages to our members and subscribers. Third parties may also block our emails as spam, impose restrictions on our emails or text messages, or start to charge for the delivery of emails through their email systems. In addition, changes in how webmail applications organize and prioritize email may reduce the number of members and subscribers opening our emails. For example, Google’s Gmail service recently introduced a new feature that organizes incoming emails into categories (for example, primary, social and promotions). Such categorization or similar inbox organizational features may result in our emails being delivered in a less prominent location in a member’s or subscriber’s inbox or viewed as “spam” by our members and subscribers and may reduce the likelihood of that member or subscriber opening our emails.

Email communications and advertising may subject us to potential risks, such as liabilities or claims resulting from unsolicited email or spamming, lost or misdirected messages, security breaches, illegal or fraudulent use of email or personal information or interruptions or delays in email service. For example, in the United States, the Controlling the Assault of Non-Solicited Pornography and Marketing Act of 2003 (the “CAN-SPAM Act”) establishes certain requirements for the distribution of “commercial” email messages and provides for penalties for transmission of commercial email messages that are intended to deceive the recipient as to source or content. In addition, some states have passed laws regulating commercial email practices that are, in some cases, significantly more punitive and difficult to comply with than the CAN-SPAM Act. For instance, we are currently involved in a class action lawsuit asserting claims under California’s anti-spam statute relating to an email advertising campaign that was carried out by a third-party. Such legal claims, if successful, might result in substantial costs and the diversion of resources or limit or prohibit our ability to send emails.

Text messages may subject us to potential risks, including liabilities or claims relating to consumer protection laws. For example, the Telephone Consumer Protection Act of 1991 (the “TCPA”) restricts telemarketing and the use of automatic SMS text messages without proper consent. The Federal Trade Commission (“FTC”) has guidelines that impose responsibilities on companies with respect to communications with consumers, such as text messages, and impose fines and liability for failure to comply with rules with respect to advertising or marketing practices it may deem misleading or deceptive. Furthermore, a number of states and countries have enacted statutes that address telemarketing through SMS text messages. Restrictions on marketing through text messages are enforced in the United States by the FTC, the Federal Communications Commission (“FCC”), state agencies and through the availability of statutory damages and class action lawsuits for violations of the TCPA or similar laws. The scope and interpretation of the laws that are or may be applicable to our use of text messages are continuously evolving and developing. If we do not comply with these laws or regulations or if we become liable under these laws or regulations, we could be harmed, and we may be forced to implement new marketing methods, which may be costly or ineffective.

Without the ability to deliver emails and text messages to members and subscribers, we may have limited means of maintaining contact with our members and subscribers and inducing them to use our platform. Due to the importance of email and text messages to our business, any disruptions or restrictions on the distribution or receipt of emails or text messages or increase in the associated costs could have a material adverse effect on our business and operating results.

If use of our platform on mobile devices does not continue to grow or we are unable to continue to successfully deliver and monetize our platform on mobile devices, our business could be harmed.

Our future success depends in part on the continued growth in the use of our platform on mobile devices by our members and subscribers and our continued ability to deliver and monetize our platform on mobile devices. The use of mobile technology may not continue to grow at historical rates, and singles may not continue to use mobile technology for online dating. Further, mobile technology may not be accepted as a viable long-term platform for a number of reasons, including actual or perceived lack of security of information and possible disruptions of service or connectivity. In addition, traffic on our mobile apps may not continue to grow if we do not continue to innovate and introduce enhanced products on mobile platforms or if members believe that our competitors offer superior mobile products. If use of our platform on mobile devices does not continue to grow, or declines, our business and operating results could be harmed.

16

Table of Contents

If we are unable to expand our apps to new devices and third-party platforms, our business could be adversely affected.

The number of people who access online services through mobile phones and tablets offered by various third parties has increased dramatically in the past few years. As new devices and new third-party platforms are continually being released, it is difficult to predict the challenges we may encounter in developing new versions of our apps for use on these alternative devices and third-party platforms, and we may need to devote significant resources to the creation, support and maintenance of our apps on such devices and third-party platforms. If we are unable to successfully expand the devices and third-party platforms on which our services are available or if the apps that we create for alternative devices and third-party platforms are not compelling to our members or subscribers, our business will suffer.

Our future performance depends in part on the continued functionality and support of third-party operating systems, platforms and browsers, which affect how members interact with our platform.

We are dependent on the interoperability of our platform with popular mobile operating systems that we do not control, such as Google’s Android and Apple’s iOS. Any changes in such systems that degrade the functionality of our platform or give preferential treatment to competitive products and services could adversely affect our business. We also rely on the continued functioning of the app stores of these platform providers because a portion of our revenues is derived from subscription and virtual currency sales through these platforms. Members who purchase subscriptions or virtual currency from some of these platforms are required to use these platforms to enable or disable automatic renewals of their subscriptions, change the payment method they use for their purchases, cancel their subscriptions and set certain other preferences. In the event that these platforms are unavailable or if in-app purchasing or preference setting functionality from these platforms is non-operational for a prolonged period of time, our members and subscribers could become dissatisfied with our platform, which could negatively affect our brand and have a material adverse effect on our revenues and operating results.

We also depend on various Internet web browsers, such as Internet Explorer, Chrome, Firefox and Safari, to allow our members to access our platform. If Internet web browsers’ features or specifications are modified in such a way that make them incompatible with our platform or harder for our members and subscribers to use our platform, overall growth in our member and subscriber base could slow, member and subscriber engagement could decrease, and we could lose existing members and subscribers, which would negatively impact our business.

Our business depends on a strong brand. If events occur that damage our reputation and brand, we may be unable to maintain and grow the size and engagement of our member and subscriber base, and our business and financial results may be harmed.

We believe that maintaining, protecting and enhancing our reputation and brand is critical to expanding our member and subscriber base and engagement with our platform. Maintaining, protecting and enhancing our brand will depend largely on our ability to continue to provide high-quality, useful and innovative services, features and functionality. If members do not perceive our platform to be of high quality, the value of our brand could diminish, thereby decreasing the attractiveness of our platform to members and prospective members. We also believe that our reputation and brand may be harmed if we fail to maintain a consistently high level of customer service.

Our reputation and brand could also be negatively affected by the actions of members that are hostile, inappropriate or illegal, whether on or off our platform, or by members with inaccurate profile information. In addition, members and subscribers may become dissatisfied with our billing policies, our handling of personal data or other aspects of our platform. If we fail to adequately address these or other member complaints, negative publicity about us or our platform could diminish confidence in and the use of our platform. Maintaining, protecting and enhancing our reputation and brand may require us to make substantial investments, and these

17

Table of Contents

investments may not be successful. Our reputation and brand are also important to attracting and maintaining high-performing employees. If we fail to successfully promote and maintain our reputation and brand or if we incur significant expenses in this effort, our business and financial results may be adversely affected.

Misuse of our platform or actions off our platform could damage our reputation and our brand, which in turn could adversely affect our business or financial condition.

Our platform could be used to facilitate illegal or dishonest activities and behavior. Illegal or dishonest activities and behavior by our members could injure our other members and may jeopardize our reputation and the integrity of our brand. Members could also post fraudulent profiles or create false or unauthorized profiles on behalf of other, non-consenting parties. This behavior could subject us to liability or lead to negative publicity that could damage our reputation and the reputation of the online dating industry.

The nature of online dating is such that we cannot control the actions of our members in their communications or physical actions. It is possible that one or more of our members could be physically, financially, emotionally or otherwise harmed following interaction with other members. If one or more of our members suffers or alleges to have suffered physical, financial, emotional or other harm following contact initiated on our platform or an online dating website of one of our competitors, any resulting negative publicity or legal action could harm our reputation and business and may have an adverse effect on us and the reputation of the online dating industry in general, potentially leading to, among other things, increased government scrutiny and regulation and an adverse effect on our business, financial condition and operating results.

We are subject to a number of risks related to payment methods, primarily related to accepting credit card and debit card payments.

We accept payments from our members primarily through credit and debit card transactions and certain online payment service providers. If we are unable to maintain our chargeback or refund rates at levels that credit card and debit card issuers and payment processors deem acceptable, these entities may increase fees for chargeback transactions or for many or all categories of transactions, or they may terminate their relationship with us. Any increases in fees could adversely affect our operating results, particularly if we elect not to raise the prices for our platform to offset the increase. The termination of our ability to process payments on any major credit or debit card or through certain online payment service providers or payment processors could significantly impair our ability to operate our business.

We may also incur losses from erroneous transactions on our platform, from members who claim they did not authorize transactions on our platform. In addition to the direct costs of such losses, if they are related to credit card transactions and become excessive, they could potentially result in the loss of our right to accept credit cards for payment. If we fail to adequately prevent fraudulent credit card transactions, we may face civil liability, diminished public perception of our security measures and significantly higher credit card-related costs, each of which could adversely affect our business, financial condition and operating results.

We pay interchange and other fees for credit card, debit card and certain online payment transactions, and these fees may increase over time. We may not be able to offset any such increases to our operating expenses by increasing the prices we charge for usage of our platform without causing us to lose subscribers and revenues, which would adversely affect our operating results. As we offer new payment options to our members, we may be subject to additional regulations, compliance requirements and fraud.

We are subject to rules and regulations of payment card associations. Our failure to adhere to such rules and regulations could subject us to damages and liability and could eventually prevent us from processing or accepting credit card payments.

We are subject to payment card association operating rules, certification requirements and rules governing electronic funds transfers, including the Payment Card Industry Data Security Standard (the “PCI

18

Table of Contents

DSS”), a security standard with which companies that collect, store or transmit certain data regarding credit and debit cards, credit and debit card holders and credit and debit card transactions are required to comply. Our failure to comply fully with the PCI DSS may violate payment card association operating rules, U.S. federal and state laws and regulations and the terms of our contracts with payment processors and merchant banks. Such failure to comply fully also may subject us to fines, penalties, damages and civil liability and may result in the loss of our ability to accept credit and debit card payments. In addition, there is no guarantee that PCI DSS compliance will prevent illegal or improper use of our payment systems or the theft, loss or misuse of data pertaining to credit and debit cards, credit and debit card holders and credit and debit card transactions.

We are exposed to fluctuations in currency exchange rates, which could negatively affect our financial condition and operating results.

Revenues from members and subscribers outside the United States accounted for 51% and 49% of our total revenues in 2012 and 2013, respectively, while only a relatively small portion of our costs were incurred in foreign currencies. Our international revenues are denominated in foreign currencies, and therefore, our revenues are subject to foreign currency risk. We have not engaged in currency hedging activities to limit the risk of exchange fluctuations and, as a result, our financial condition and operating results could be adversely affected by such fluctuations. Even if we were to implement hedging strategies to mitigate foreign currency risk, these strategies might not eliminate our exposure to foreign exchange rate fluctuations and would involve costs and risks of their own, such as ongoing management time and expertise, external costs to implement the strategies and potential accounting implications.

Our future growth plan depends in part on continuing to deepen our market penetration outside of the United States, and we are therefore subject to a number of risks associated with international operations.

We intend to continue to offer our platform globally and to use third-party service providers located outside of the United States. International operations are subject to a number of risks, including the following:

| • | fluctuations in exchange rates between the U.S. dollar and foreign currencies in markets where we do business; |