Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EMMIS COMMUNICATIONS CORP | d713183d8k.htm |

Exhibit 99.1

APRIL 2014

CONFIDENTIAL INFORMATION MEMORANDUM

$185,000,000 Senior Secured Term Loan

Table of contents

| 1. |

Executive summary | 1 | ||||

| Transaction summary | 1 | |||||

| Sources and uses and pro forma cap table | 2 | |||||

| Terms and conditions | 3 | |||||

| Company overview – Emmis Communications Corporation | 4 | |||||

| Target overview – WBLS and WLIB | 5 | |||||

| Strategic rationale | 6 | |||||

| Emmis historical financial summary | 7 | |||||

| WBLS & WLIB historical financial summary | 8 | |||||

| 2. |

Key investment considerations | 9 | ||||

| Geographically diversified portfolio with significant presence in top two markets | 9 | |||||

| Favorable position amongst its peers in the industry | 10 | |||||

| Well positioned in New York City as the largest radio market in the U.S. by population | 11 | |||||

| Marquee brands with dominant market positions | 12 | |||||

| Accretive acquisition will improve operating metrics and competitive position | 12 | |||||

| Proven commitment to deleveraging via strong cash flow generation and business rationalization | 14 | |||||

| Radio engages a broad spectrum of the population for an extended period of time on a daily basis | 15 | |||||

| Innovative culture and industry thought leader | 16 | |||||

| Dynamic management team | 17 | |||||

| 3. |

Summary of terms and conditions | 18 | ||||

| 4. |

Emmis overview | 19 | ||||

| Advertising sales | 19 | |||||

| Radio | 20 | |||||

| Publishing | 25 | |||||

| Industry involvement | 25 | |||||

| Community involvement | 25 | |||||

| Employees | 26 | |||||

| Local marketing agreement between Emmis subsidiary and ESPN / Disney | 26 | |||||

| Litigation | 26 | |||||

| 5. |

WBLS & WLIB overview | 28 | ||||

| WBLS and WLIB background | 28 | |||||

| WBLS operations | 29 | |||||

| WLIB operations | 30 | |||||

| 6. |

Executive management | 32 | ||||

| Appendix | ||||||

| A. |

Historical financial statements | 34 | ||||

| 1. | Executive summary |

Transaction summary

On February 11, 2014, Emmis Communications Corporation (“Emmis” or the “Company”), a domestic diversified media company, principally focused on radio broadcasting, reached an agreement with YMF Media New York LLC and YMF Media New York License LLC (collectively, “YMF”) to purchase urban adult contemporary WBLS 107.5 FM (“WBLS”), the second highest rated radio station in New York, and its sister station, WLIB 1190 AM (“WLIB”), NY’s first African-American targeted station offering an urban gospel format, for $131.0 million in cash. The purchase price will be paid in two installments. The first payment of approximately $55.0 million will occur promptly after the initial grant of the Federal Communications Commission’s (“FCC”) consent to assignment of the stations’ FCC licenses, expected to be in June 2014. The second payment of approximately $76.0 million will occur in February 2015 upon Emmis acquiring the remaining stake in WBLS and WLIB. Emmis will fund the acquisition, and refinance its existing senior secured credit facility, through the proposed $185.0 million Term Loan.

Emmis began operating the stations under a Local Marketing Agreement (“LMA”) on March 1, 2014. The monthly LMA fee is $1.275 million until the first purchase price payment. Thereafter, the monthly LMA fee will be reduced to $0.740 million and will continue to be paid until the second closing.

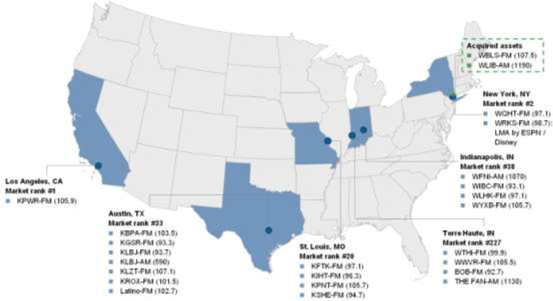

Emmis operates the 9th largest radio portfolio in the United States based on total listeners. Emmis owns 18 FM and 3 AM radio stations in New York, Los Angeles, St. Louis, Austin (Emmis has a 50.1% controlling interest in Emmis’ radio stations located there), Indianapolis and Terre Haute, IN. One of the Company’s FM radio stations in New York is operated pursuant to a LMA whereby a third party (Disney / ESPN) provides the programming for the station and sells all advertising within that programming.

Emmis has engaged J.P. Morgan Securities LLC (“J.P. Morgan”) as Sole Lead Arranger and Bookrunner to arrange and syndicate a new $185.0 million 7-year Senior Secured Term Loan (the “Term Loan”) for the Company. Proceeds from the Term Loan, along with a new $20.0 million 5-year Senior Secured Revolving Credit Facility, will be used to finance the purchase of WBLS and WLIB, refinance existing debt, pay related fees and expenses and to provide liquidity for working capital and general corporate purposes.

Pro forma for the full funding of the Term Loan, total leverage will be 4.58x based on pro forma expected EBITDA of $40.4 million for the fiscal year ending February 28, 2015.

1

Sources and uses and pro forma cap table

Illustrative sources and uses: June 2014

Exhibit 1.1

Sources and uses ($ millions)

Illustrative sources and uses: February 2015

Exhibit 1.2

Sources and uses ($ millions)

Existing and pro forma capitalization

Exhibit 1.3

Pro forma capitalization ($ millions)

| Emmis standalone | Phase 1 funding | Full term loan funding | ||||||||||||||||||||||||||||||||||

| ($ millions) |

2/28/14 | % of EV |

x LTM EBITDA |

PF 2/28/14 |

% of EV |

x PF EBITDA |

PF 2/28/15E |

% of EV |

x PF EBITDA |

|||||||||||||||||||||||||||

| Cash |

$ | 5.3 | $ | 5.3 | $ | 9.5 | ||||||||||||||||||||||||||||||

| Existing $20mm RC due 2017 |

$ | 0.0 | 0.0 | % | 0.00x | — | — | — | — | — | — | |||||||||||||||||||||||||

| Existing $80mm TLA due 2017 |

54.0 | 22.7 | % | 2.51x | — | — | — | — | — | — | ||||||||||||||||||||||||||

| New $20mm RC due 2019 |

— | — | — | $ | 4.2 | 1.4 | % | 0.14x | $ | 0.0 | 0.0 | % | 0.00x | |||||||||||||||||||||||

| New $185mm TLB due 2021 |

— | — | — | 109.0 | 36.7 | % | 3.66x | 185.0 | 50.7 | % | 4.58x | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Debt |

$ | 54.0 | 22.7 | % | 2.51x | $ | 113.2 | 38.1 | % | 3.80x | $ | 185.0 | 50.7 | % | 4.58x | |||||||||||||||||||||

| Market Cap.1 |

141.8 | 59.6 | % | 6.58x | 141.8 | 47.7 | % | 141.8 | 38.9 | % | ||||||||||||||||||||||||||

| Less cash |

(5.3 | ) | -2.2 | % | (5.3 | ) | -1.8 | % | (9.5 | ) | -2.6 | % | ||||||||||||||||||||||||

| Plus NCI |

47.6 | 20.0 | % | 47.6 | 16.0 | % | 47.6 | 13.0 | % | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total Enterprise Value |

$ | 238.1 | 100.0 | % | 11.05x | $ | 297.3 | 100.0 | % | 9.99x | $ | 364.9 | 100.0 | % | 9.04x | |||||||||||||||||||||

| LTM EBITDA |

$ | 21.5 | ||||||||||||||||||||||||||||||||||

| PF LTM EBITDA |

$ | 29.8 | ||||||||||||||||||||||||||||||||||

| PF 100% Consol. LTM EBITDA |

$ | 40.4 | ||||||||||||||||||||||||||||||||||

Source: Company financials

| 1 | Market capitalization as of April 14, 2014; Fully diluted share count sourced from FYE February 28, 2014 8-K and includes existing preferred shares on an as-converted basis to common shares |

2

Terms and conditions

Exhibit 1.4

Summary terms and conditions

| Borrower: | Emmis Operating Company (the “Borrower”) | |

| Guarantors: | All existing and future restricted, domestic subsidiaries of the Borrower | |

| Lead Arranger: | J.P. Morgan Securities LLC | |

| Administrative Agent: | JPMorgan Chase Bank, N.A. | |

| Facility: | $185.0 million1 Senior Secured Term Loan B | |

| Use of proceeds: | Finance the acquisition of YMF Media, LLC’s New York cluster of radio stations (the “Acquisition”), refinance certain indebtedness, pay fees and expenses associated with the Acquisition and fund working capital and general corporate purposes | |

| Security: | First priority lien on, and security interest in, substantially all tangible and intangible property of the Borrower and each Guarantor, including a pledge of 100% of the stock of the Borrower and each domestic restricted subsidiary, subject to FCC rules on licenses | |

| Tenor | 7 years | |

| Amortization: | 1% per annum commencing on March 31, 2015; bullet at maturity | |

| Incremental facility: | $40.0 million plus an unlimited amount subject to pro forma net senior secured leverage < 4.0x | |

| Call protection: | 101 soft call for 6 months | |

| Financial covenants: | No maintenance covenants with typical incurrence based covenants for acquisitions, additional debt, restricted payments, etc. | |

| Mandatory prepayments: | Mandatory prepayments required from proceeds of:

• 100% of net cash proceeds of non-ordinary course asset sales, as well as insurance and condemnation proceeds, with 12-month reinvestment rights

• 100% of debt issuance proceeds (other than permitted debt)

• 50% of ECF stepping down to 25% when net senior secured leverage < 3.75x and 0% when net senior secured leverage < 3.00x | |

| 1 | Approximately $76.0mm of the term loan will be funded into escrow at closing and used to pay the balance of the acquisition consideration in February 2015 |

3

Company overview – Emmis Communications Corporation

Headquartered in Indianapolis, IN, Emmis is a publicly traded radio broadcasting communications company (NASDAQ: EMMS) with an equity market capitalization of $141.8 million as of April 14, 2014. The Company was incorporated in 1979 and went public in 1994.

The Company operates the 9th largest radio portfolio in the United States based on total listeners. Emmis owns 18 FM and 3 AM radio stations in New York, Los Angeles, St. Louis, Austin (Emmis has a 50.1% controlling interest in Emmis’ radio stations located there), Indianapolis and Terre Haute, IN. One of the Company’s FM radio stations in New York is operated pursuant to a LMA whereby a third party (Disney / ESPN) provides the programming for the station and sells all advertising within that programming. Emmis divested its remaining international radio assets in Slovakia and Bulgaria in January and February of 2013 to focus on its core domestic markets. The Company’s radio portfolio includes the 2 largest hip-hop stations in the world based in New York City (WQHT-FM Hot 97) and Los Angeles (KPWR-FM Power 106).

In addition to the Company’s radio properties, Emmis publishes several city and regional magazines. Emmis entered the publishing market in 1988, with the purchase of hometown Indianapolis monthly. Emmis’ publishing operations have grown to consist of Texas Monthly, Los Angeles, Atlanta, Indianapolis Monthly, Cincinnati, and Orange Coast. The Company believes that it is the country’s leading publisher of city and regional magazines.

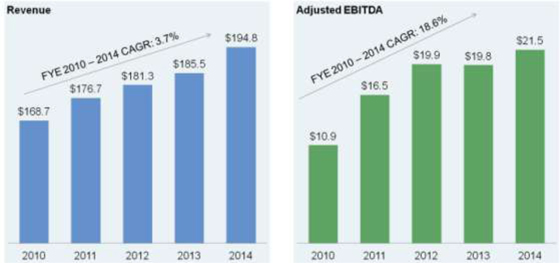

Excluding the Disney / ESPN 98.7FM LMA in New York, Emmis generated standalone revenue and station operating income for the fiscal year ended February 28, 2014 of $194.8 million and $39.0 million, respectively:

| • | Radio – 69.3% of revenues / 96.3% of station operating income; |

| • | Publishing – 30.7% of revenues / 3.7% of station operating income; |

For the fiscal year ended February 28, 2014 Emmis generated adjusted EBITDA of $21.5 million.

Exhibit 1.5

Emmis historical financial trends ($ millions)

Source: Company financials, pro forma for all stations owned and operated as of 2/28/2014, but excluding the Disney / ESPN 98.7FM LMA in New York

Note: Adjusted EBITDA net of Austin minority interest; 2012 EBITDA adjusted for Merlin sale completion bonus of $1.7 million and advisory and legal fees tied to March 2011 financing of $2.7 million

4

Target overview – WBLS and WLIB

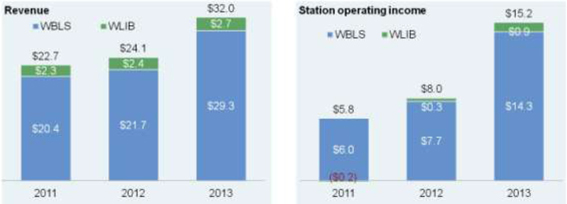

YMF Media-owned New York radio stations WBLS-FM (107.5Mhz, Urban AC) and WLIB (1190Khz, Black Gospel) operate urban and gospel formats, respectively, focused on the African American demographic. WBLS is the top-ranked Urban radio station in the U.S. and WLIB is New York City’s only 24-hour Gospel station. WBLS and WLIB reach an audience of approximately 2.5 million; 86% of which are African American.

In October 2012, YMF Media purchased WBLS and WLIB from Inner City Media Corporation in a sale under federal bankruptcy code. YMF Media is owned by Yucaipa Companies, Fortress Investment Group LLC and Earvin “Magic” Johnson. YMF Media initiated a competitive auction for the WBLS and WLIB radio assets in 2013, with Emmis acquiring the right to purchase the stations in February 2014.

WBLS and WLIB are difficult to replicate radio assets:

| • | WBLS ($29.3 million and $14.3 million of FYE 12/31/13 revenues and station operating income, respectively) – The only source for African American adult R&B fans in the New York City metro market; |

| • | WLIB ($2.7 million and $0.9 million of FYE 12/31/13 revenues and station operating income, respectively) – Frequently boasts the #1 time spent listening (engagement) in the market; |

WBLS, in format since 1974, operates one of the longest track records of any radio format in New York City. The station is well positioned as the go to provider for adult R&B in New York City and has a loyal audience base. The station actively engages its audience through market leading social and digital platforms as well as community based lifestyle events. The station has also demonstrated an ability to successfully develop programming, launching The Steve Harvey Morning Show in 2005. The Steve Harvey program has grown to be syndicated in over 60 markets, has approximately seven million weekly listeners and is the number one syndicated morning show in the top 25 metro markets.

WLIB is New York City’s only 24-hour praise and inspiration station catering to the 35+ African-American Christian Audience. The gospel format has been in place for seven years and features Grammy nominated Gospel artists, pastors and other active figures in the local community.

For the year ended December 31, 2013 WBLS & WLIB generated revenue and station operating income of $32.0 million and $15.2 million respectively.

Exhibit 1.6

WBLS & WLIB historical financial trends ($ millions)

Source: Audited and Management prepared financials

5

Strategic rationale

Expands operating metrics and scale

| • | Significantly improves station operating income and free cash flow allowing for substantial de-levering by 2017 |

| • | Increases net revenues by 16.4% and adjusted EBITDA by 95.3% on a pro forma basis |

Improves competitive position in growing New York market

| • | Better positions Emmis to compete in the New York radio market in targeted demographics |

| • | Substandard results in 2010-2012 when two adult urban competitors existed will likely preclude new entrant |

| • | New York radio market enjoyed robust 5% growth in 2013 |

Clear operating efficiencies

| • | $3 million in cost synergies already initiated |

| • | No additional corporate overhead required |

| • | WBLS’ Steve Harvey Morning Show is a key ratings driver; during 2013 a new 5-year agreement was executed |

| • | All key talent and station leadership (General Manager, Director of Sales, Programming Director) under contract |

Additional revenue growth opportunities

| • | Emmis has delivered stronger sales results from concerts, events, sponsorship, and digital sales on its existing station in the market, WQHT |

| • | Significant opportunities exist for Emmis to cross sell between the WQHT and WBLS brands |

The following table depicts Emmis’ pro forma operating profile:

Exhibit 1.7

Pro forma operating profile

| Metric |

Emmis | WBLS/WLIB1 | Pro Forma | |||||||||

| FYE 2014 net revenues |

$ | 194.8 million | $ | 32.0 million | $ | 226.8 million | ||||||

| FYE 2014 station operating income (“SOI”) |

$ | 39.0 million | $ | 15.2 million | $ | 54.2 million | ||||||

| EBITDA2 |

$ | 19.0 million | $ | 15.2 million | $ | 37.2 million | 3 | |||||

| EBITDA % |

9.8 | % | 47.5 | % | 16.4 | % | ||||||

| FYE 2014 free cash flow |

$ | 4.3 million | 4 | $ | 8.2 million | 5 | $ | 22.7 million | 6 | |||

| Radio SOI concentration by market7 |

|

• Los Angeles: 42%

• New York: 15%

• Austin: 16%

• Indianapolis: 14%

• St. Louis: 13% |

|

• New York: 100% |

|

• Los Angeles: 29%

• New York: 41%

• Austin: 11%

• Indianapolis: 10%

• St. Louis: 9% |

| |||||

Source: Audited financial statements

| 1 | WBLS / WLIB results are for the calendar year end 12/31/13; |

| 2 | Net of Austin minority interest of $5.6 million; |

| 3 | Includes $3 million of cost synergies already initiated; |

| 4 | Includes $8 million of mandatory debt amortization under current credit agreement; |

| 5 | Assumes 5% interest on acquisition purchase price of $131 million and $0.5 million of capital expenditures; |

| 6 | Interest on $185 million at 5%, $3.5 million of capital expenditures and 1% mandatory debt amortization; |

| 7 | Net of Austin minority interest |

6

Emmis historical financial summary

Exhibit 1.8

Historical Emmis financial results ($ millions)

| Fiscal year ended February 28 (29), | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| Income Statement |

||||||||||||||||||||

| Net revenues |

$ | 168.7 | $ | 176.7 | $ | 181.3 | $ | 185.5 | $ | 194.8 | ||||||||||

| % growth |

-23.6 | % | 4.8 | % | 2.6 | % | 2.3 | % | 5.1 | % | ||||||||||

| Station operating income (“SOI”) |

$ | 28.3 | $ | 36.0 | $ | 38.5 | $ | 36.7 | $ | 39.0 | ||||||||||

| % margin |

16.8 | % | 20.4 | % | 21.2 | % | 19.8 | % | 20.0 | % | ||||||||||

| Consolidated EBITDA, after MI |

$ | 11.0 | $ | 16.4 | $ | 15.5 | $ | 16.0 | $ | 19.1 | ||||||||||

| % margin |

6.5 | % | 9.3 | % | 8.6 | % | 8.6 | % | 9.8 | % | ||||||||||

| Adjusted EBITDA1 |

$ | 10.9 | $ | 16.5 | $ | 19.9 | $ | 19.8 | $ | 21.5 | ||||||||||

| % margin |

6.5 | % | 9.3 | % | 11.0 | % | 10.7 | % | 11.1 | % | ||||||||||

| Net income2 |

($ | 118.5 | ) | ($ | 11.5 | ) | $ | 30.7 | $ | 48.3 | $ | 48.7 | ||||||||

| Cash Flow Statement |

||||||||||||||||||||

| Stock-based compensation |

$ | 2.4 | $ | 1.8 | $ | 1.2 | $ | 2.9 | $ | 4.9 | ||||||||||

| Capital expenditures |

4.6 | 3.4 | 5.1 | 3.4 | 3.1 | |||||||||||||||

| Depreciation and amortization |

11.2 | 6.9 | 5.5 | 5.7 | 5.7 | |||||||||||||||

| Cash paid for acquisitions |

4.9 | 0.0 | 0.0 | 0.0 | 0.0 | |||||||||||||||

| Balance Sheet |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 6.8 | $ | 6.1 | $ | 5.6 | $ | 8.7 | $ | 5.3 | ||||||||||

| Accounts receivable |

36.8 | 38.9 | 28.8 | 28.1 | 31.0 | |||||||||||||||

| Other current assets |

30.9 | 18.0 | 20.2 | 13.8 | 17.7 | |||||||||||||||

| PP&E, net |

50.2 | 44.8 | 34.0 | 32.6 | 32.2 | |||||||||||||||

| Total assets |

498.2 | 472.5 | 340.8 | 261.6 | 265.3 | |||||||||||||||

| Total debt3 |

341.2 | 331.0 | 237.7 | 67.0 | 54.0 | |||||||||||||||

| Shareholders’ equity |

(179.0 | ) | (189.7 | ) | (101.2 | ) | (10.0 | ) | 35.8 | |||||||||||

| Non-controlling interests |

49.4 | 47.8 | 47.8 | 47.1 | 47.6 | |||||||||||||||

| Total book capitalization4 |

$ | 211.6 | $ | 189.0 | $ | 184.3 | $ | 104.1 | $ | 137.4 | ||||||||||

Source: Company filings, pro forma for all stations owned and operated as of 2/28/2014

| 1 | Compliance EBITDA; |

| 2 | Consolidated net income as reported in Company 10-K filings, FYE 2/28/2014 per Company 8-K filing; |

| 3 | Excludes non-recourse ESPN / Disney LMA debt; |

| 4 | Calculated as total debt plus shareholders’ equity plus non-controlling interests |

Exhibit 1.9

Summary Emmis historical credit statistics ($ millions)

| Fiscal year ended February 28 (29), | ||||||||||||||||||||

| 2010 | 2011 | 2012 | 2013 | 2014 | ||||||||||||||||

| Adjusted EBITDA1 |

$ | 10.9 | $ | 16.5 | $ | 19.9 | $ | 19.8 | $ | 21.5 | ||||||||||

| Interest expense2 |

24.8 | 16.5 | 19.9 | 18.2 | 3.7 | |||||||||||||||

| Total debt2 |

$ | 341.2 | $ | 331.0 | $ | 237.7 | $ | 67.0 | $ | 54.0 | ||||||||||

| Total debt / EBITDA |

31.30x | 20.06x | 11.94x | 3.38x | 2.51x | |||||||||||||||

| Total debt / capitalization |

161.2 | % | 175.1 | % | 129.0 | % | 64.4 | % | 39.3 | % | ||||||||||

| EBITDA / interest |

0.44x | 1.00x | 1.00x | 1.09x | 5.90x | |||||||||||||||

| EBITDA – capex / interest |

0.25x | 0.75x | 0.71x | 0.90x | 5.06x | |||||||||||||||

Source: Company filings, pro forma for all stations owned and operated as of 2/28/2014

| 1 | Compliance EBITDA; |

| 2 | Excludes non-recourse ESPN / Disney LMA debt and interest expense |

7

WBLS & WLIB historical financial summary

YMF Media New York LLC’s audited financials for the year ended December 31, 2013 will be posted separately to IntraLinks.

Exhibit 1.10

Historical target financial results ($ millions)

| Year ended December 31, | ||||||||||||

| 2011 | 2012 | 2013 | ||||||||||

| Income Statement |

||||||||||||

| Net revenues |

$ | 22.7 | $ | 24.1 | $ | 32.0 | ||||||

| % growth |

— | 6.3 | % | 32.7 | % | |||||||

| Station operating income (“SOI”) |

$ | 5.8 | $ | 8.0 | $ | 15.2 | ||||||

| % margin |

25.5 | % | 33.0 | % | 47.5 | % | ||||||

| Consolidated EBITDA |

$ | 5.8 | $ | 8.0 | $ | 15.2 | ||||||

| % margin |

25.5 | % | 33.0 | % | 47.5 | % | ||||||

| Net income |

$ | 5.5 | $ | 7.7 | $ | 4.2 | ||||||

Source: The Company

8

| 2. | Key investment considerations |

Geographically diversified portfolio with significant presence in top two markets

Emmis currently owns and operates two FM radio stations in the nation’s top two markets (97.1 WQHT-FM in New York and 105.9 KPWR-FM in Los Angeles). Additionally, the Company owns another FM radio station in New York that is operated pursuant to an LMA agreement with ESPN / Disney. Pro forma for the transaction, Emmis will increase its presence in the New York area by adding two radio stations that are complementary with its existing station in the market.

Additionally, Emmis has 15 FM and 3 AM radio stations in other attractive markets including St. Louis, Austin, Indianapolis and Terre Haute.

Exhibit 2.1

Emmis’ national footprint

Source: Company filings; Company website

Note: Market rankings by revenue

9

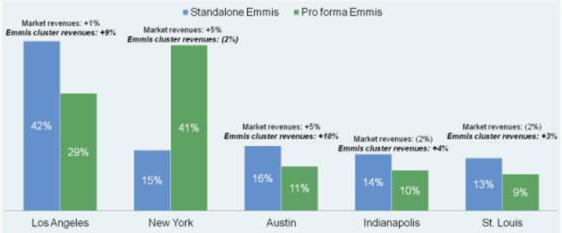

During the fiscal year ended February 28, 2014, 4 out of 5 of the Company’s radio clusters outperformed their markets. The Company’s acquisition of WBLS and WLIB repositions its portfolio to better compete in the growing New York City market. The chart below captures Emmis’ station operating income concentration by market as well as revenue growth performance versus the market as a whole.

Exhibit 2.2

Radio cluster operating performance (fiscal year ended February 28, 2014)

Source: Company filings and Miller Kaplan

Note: Net of minority interest for Austin and excludes NY SPV

Favorable position amongst its peers in the industry

Pro forma for the acquisition of WBLS and WLIB, Emmis will continue to be favorably positioned amongst its peers in the radio broadcasting industry. Although the Company operates on a smaller scale, it generates significant cash flow from a strong presence in the top two radio markets (New York and Los Angeles). The Company’s strategy is to counteract scale with speed and skill of execution. Emmis focuses on outperforming the market in local spot advertising and emphasizing growth in the digital, events and social marketing (Incite) categories.

| • | Local Spot Advertising (65% of radio net revenues): Emmis realized a CAGR from 2011 to 2013 of 3.7% in local spot advertising revenues versus market growth in the Los Angeles, New York, Indianapolis, St. Louis and Austin radio markets of 0.6%. The Company believes that its emphasis on sales, hiring, training and local programming provide an advantage over larger competitors in the stable local advertising arena |

| • | Digital (7% of total net revenues): Digital sales grew 25% in the fiscal year ended 2014 as the Company has built a robust business developing web, mobile and video content and selling these impressions to advertisers |

| • | Events (10% of total net revenues): The Company’s focus on events has led to a 14% CAGR from 2011 – 2013 with events like Summer Jam in New York and Powerhouse in Los Angeles |

| • | Incite (10% of total net revenues): Focused on social marketing programs for not-for-profit, government agency and corporate clients, Emmis’ Incite sales grew 25% during fiscal year ended 2014 |

Emmis seeks to continually stay ahead of industry trends and has diversified its revenues away from the national and network sources that are less stable and dominated by larger competitors.

The Company has also demonstrated strong discipline when compared to its peer group in terms of leverage, debt coverage, and prudent use of its free cash flow.

10

Exhibit 2.3

Peer analysis ($mm)

| Emmis | Entercom | Salem | Radio One | Hubbard | ||||||||||||||||

| Presence in top 2 markets |

Yes | No | Yes | No | No | |||||||||||||||

| Corp. debt ratings |

[B2 / B | ] | B2 / B+ | B2 / B | B3 / B- | B1 / B+ | ||||||||||||||

| Enterprise value |

$ | 365 | 1 | $ | 891 | $ | 521 | $ | 1,176 | n/a | ||||||||||

| Revenue |

$ | 227 | $ | 378 | $ | 237 | $ | 449 | $ | 219 | 2 | |||||||||

| Adj. EBITDA3 |

$ | 40 | 1 | $ | 101 | $ | 53 | $ | 126 | ~$ | 83-88 | |||||||||

| EV / Adj. EBITDA |

9.0x | 1 | 8.9x | 9.8x | 9.3x | n/a | ||||||||||||||

| Interest expense |

$ | 9 | 1 | $ | 44 | $ | 17 | $ | 89 | n/a | ||||||||||

| Capital expenditures |

$ | 3 | $ | 4 | $ | 11 | $ | 9 | n/a | |||||||||||

| Total debt / Adj. EBITDA |

4.6x | 1 | 5.1x | 5.5x | 6.5x | 4.9x | 2 | |||||||||||||

| Adj. EBITDA / Int. expense |

4.4x | 1 | 2.3x | 3.1x | 1.4x | n/a | ||||||||||||||

Source: Company public filings; Emmis data pro forma as of February 28, 2014 for the Acquisition and excludes ESPN / Disney LMA and related debt; Salem Communications data as of September 30, 2013; Entercom and Radio One data as of December 31, 2013; Hubbard Radio data sourced from Rating Agency reports dated August 2013

| 1 | Emmis enterprise value, adjusted EBITDA and interest expense are pro forma for completion of the Acquisition |

| 2 | Revenue and leverage pro forma June 30, 2013 |

| 3 | Adjusted EBITDA defined as operating income before impairment and non-recurring gains and losses + depreciation and amortization (stock-based compensation is not added back) |

On a standalone basis, Emmis has outperformed the markets it operates in consistently over the past four years (New York, Los Angeles, St. Louis, Austin, Indianapolis and Terre Haute). The Company’s superior strategy and execution have lead to consistently better results than other radio operations.

Exhibit 2.4

Emmis versus the market

| Year ended 2/28 |

Emmis revenue growth |

Market revenue growth |

Emmis result | |||

| 2014 |

+4.9% | +2.7% | Emmis wins! By 2% | |||

| 2013 |

+3.3% | -1.2% | Emmis wins! By 4% | |||

| 20121 |

+4.0% | +0.6% | Emmis wins! By 3% | |||

| 20111 |

+6.7% | +4.5% | Emmis wins! By 2% |

Source: Miller Kaplan

| 1 | Excludes WRKS now operated under LMA with ESPN as WEPN-FM |

Well positioned in New York City as the largest radio market in the U.S. by population

Emmis currently generates 15% of its station operating income from the New York City market. The acquisition of WBLS and WLIB creates the opportunity for Emmis to further penetrate an industry leading market that has a scarcity of high quality signals available for sale. The New York City market is the #1 ranked radio market by Metro 12+ population and by African American 12+ population and #2 ranked by market revenues (after Los Angeles, where the Company operates KPWR-FM). Additionally, the New York market has demonstrated impressive growth compared to the industry, having grown 5% in both 2012 and 2013. Pro forma for the transaction Emmis will generate approximately 41% of its station operating income from the New York City market.

11

Exhibit 2.5

Market Rankings

| Rank |

Market |

Metro 12+ Pop. |

Rank | Market | African American 12+ Pop.1 |

Rank | Market | Rev. per station |

||||||||||||||

| 1 |

New York | 16,033,100 | 1 | New York | 2,724,700 | 1 | Los Angeles | 10,446 | ||||||||||||||

| 2 |

Los Angeles | 11,179,600 | 2 | Atlanta | 1,469,100 | 2 | New York | 7,293 | ||||||||||||||

| 3 |

Chicago | 7,910,200 | 3 | Chicago | 1,357,900 | 3 | Chicago | 6,064 | ||||||||||||||

| 4 |

San Francisco | 6,377,900 | 4 | Wash. DC | 1,262,600 | 4 | Philadelphia | 5,513 | ||||||||||||||

| 5 |

Dallas | 5,559,300 | 5 | Philadelphia | 923,300 | 5 | Houston | 5,266 | ||||||||||||||

| 6 |

Houston. | 5,253,500 | 6 | Houston | 888,000 | 6 | Miami | 5,038 | ||||||||||||||

| 7 |

Wash. DC | 4,720,300 | 7 | Dallas | 844,000 | 7 | Wash. DC | 4,834 | ||||||||||||||

| 8 |

Philadelphia | 4,547,300 | 8 | Detroit | 839,400 | 8 | Dallas | 4,522 | ||||||||||||||

| 9 |

Atlanta | 4,487,600 | 9 | Los Angeles | 798,100 | 9 | Detroit | 4,225 | ||||||||||||||

| 10 |

Boston | 4,145,900 | 10 | Miami | 776,000 | 10 | Baltimore | 3,971 | ||||||||||||||

Source: BIA, Nielsen, Miller Kaplan

| 1 | For a Metro to qualify for African American DST, the Metro’s African American P12+ population must be at least 9.5% African American or at least 4.5% African American with an estimated African American 12+ population of at least 75,000 |

Marquee brands with dominant market positions

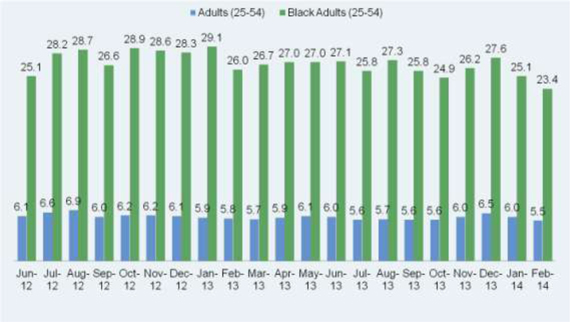

Emmis operates some of the most popular radio stations in top-rated markets. More specifically, Emmis’ key stations include Power 106 KPWR in Los Angeles and Hot 97 WQHT in New York City. Los Angeles based KPWR is ranked #1 within its primary target demographic (age 18-34). The station grew net revenue by 9% in the fiscal year ended February 28, 2014, compared to Los Angeles market growth of 1%. Market share for KPWR in Los Angeles also grew from 5.1% to 5.5% during the fiscal year ended 2014. WQHT ranked #3 in New York City with 6.9% market share in its target demographic (age 18-34) during February 2014. The station ranked #4 with African American listeners aged 25-54 (8.0% market share) during the same time period. WBLS serves as a strong addition to the Company’s New York City product offerings, ranked #1 with African American listeners aged 25-54, generating a commanding 23.4% market share. WQHT, WBLS and KPWR reach an estimated 6.3 million people in the New York and Los Angeles markets, approximately 32% of which are African American and 42% are Hispanic (source: Nielsen).

Accretive acquisition will improve operating metrics and competitive position

The acquisition of WBLS and WLIB will significantly enhance Emmis’ financial profile by greatly improving the Company’s station operating income and free cash flow. This creates a clear path for substantial de-leveraging by 2017. On a pro forma basis, the acquisition increases Emmis’ net revenues by 16.4% and EBITDA by 95.3%.

WBLS and WLIB provide Emmis with the scale to compete more effectively in the New York City market. During the fiscal year ended 2014, New York City was the only market that Emmis underperformed in. While the market as a whole grew 5%, sales at WQHT-FM decreased 2%.

12

The table below displays how the combination of the WQHT and WBLS product offerings will reposition Emmis in the New York City market.

Exhibit 2.6

New York Nielsen audio ratings – February 2014 (M-Su 6A-12A)

| Age 12+ | Age 18-34 | Age 18-49 | Age 25-54 | |||||||||||||||||||||||||||

| Station | Owner | Share | Station | Owner | Share | Station | Owner | Share | Station | Owner | Share | |||||||||||||||||||

| WBLS + WQHT |

8.5 | WBLS + WQHT |

11.4 | WBLS + WQHT |

10.3 | WBLS + WQHT |

9.3 | |||||||||||||||||||||||

| WLTW | CC | 6.8 | WHTZ | CC | 8.7 | WLTW | CC | 7.1 | WLTW | CC | 7.2 | |||||||||||||||||||

| WCBS | CBS | 5.7 | WSKQ | SBS | 7.3 | WHTZ | CC | 7.1 | WSKQ | SBS | 6.3 | |||||||||||||||||||

| WBLS | YMF | 5.6 | WQHT | Emmis | 6.9 | WSKQ | SBS | 6.5 | WHTZ | CC | 6.3 | |||||||||||||||||||

| WCBS-A | CBLS | 5.5 | WLTW | CC | 6.7 | WKTU | CC | 5.6 | WBLS | YMF | 5.5 | |||||||||||||||||||

| WHTZ | CC | 5.1 | WWPR | CC | 6.5 | WBLS | YMF | 5.2 | WKTU | CC | 5.0 | |||||||||||||||||||

| WINS-A | CBS | 4.6 | WKTU | CC | 6.0 | WQHT | Emmis | 5.1 | WCBS | CBS | 5.0 | |||||||||||||||||||

| WSKQ | SBS | 4.4 | WXNY | Univ. | 4.7 | WWPR | CC | 4.9 | WAXQ | CC | 4.6 | |||||||||||||||||||

| WKTU | CC | 4.1 | WBLS | YMF | 4.5 | WCBS | CBS | 4.5 | WWFS | CBS | 4.4 | |||||||||||||||||||

| WAXQ | CC | 3.9 | WWFS | CBS | 3.9 | WWFS | CBS | 4.4 | WWPR | CC | 4.0 | |||||||||||||||||||

| WXNY | Univ. | 3.5 | WCBS | CBS | 3.8 | WXNY | Univ. | 4.0 | WINS-A | CBS | 4.0 | |||||||||||||||||||

| WWFS | CBS | 3.4 | WNOW | CBS | 3.6 | WAXQ | CC | 4.0 | WXNY | Univ. | 3.9 | |||||||||||||||||||

| WFAN | CBS | 3.4 | WAXQ | CC | 3.2 | WINS-A | CBS | 3.5 | WQHT | Emmis | 3.8 | |||||||||||||||||||

| WWPR | CC | 3.1 | WPAT | Univ. | 2.3 | WFAN | CBS | 3.3 | WFAN | CBS | 3.6 | |||||||||||||||||||

| WQHT | Emmis | 2.9 | WINS-A | CBS | 2.3 | WNOW | CBS | 3.0 | WPLJ | CMLS | 3.3 | |||||||||||||||||||

Source: Nielsen

13

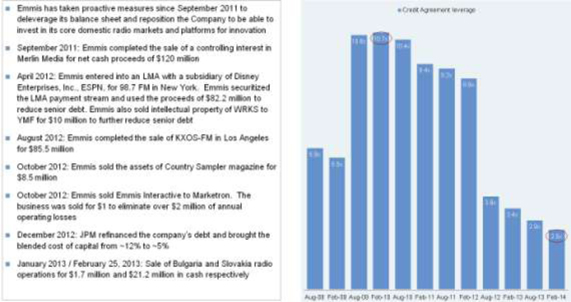

Proven commitment to deleveraging via strong cash flow generation and business rationalization

Emmis has taken proactive measures since 2011 to deleverage its balance sheet and reposition the Company to focus on its core domestic radio stations and new growth initiatives. Over the past three years, Emmis has reduced debt by over $125.0 million through strong operating results and strategic divestitures. Emmis has also undertaken a series of aggressive restructuring initiatives and cost rationalization measures in order to increase profitability and reduce balance sheet leverage. As part of these efforts, Emmis has monetized certain non-strategic or under performing assets to center its focus on providing local and compelling content to its core radio markets.

The chart below outlines a summary of Emmis’s recent deleveraging events and historical leverage trends:

Exhibit 2.7

Summary of leverage trends

Note: Historical leverage gives full credit for EBITDA of divested assets

14

As a result of the strategic measures taken by management, the “new” Emmis has a significantly improved balance sheet and cash flow profile, driven by its increasing earnings and modest working capital and capital expenditure requirements. While management expects to continue to reinvest cash into high-ROI investments, it primarily plans to utilize its cash flow to de-lever.

Exhibit 2.8

Emmis’ transformation

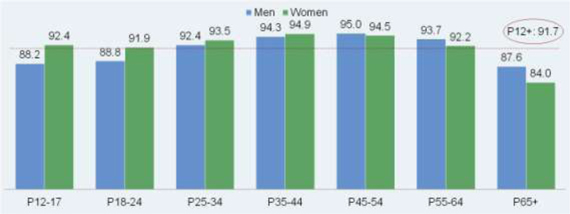

Radio engages a broad spectrum of the population for an extended period of time on a daily basis

Radio interacts with nearly 92% of the population that is aged 12 or older on a weekly basis. The reach of radio extends almost uniformly across all ethnicities and demographics and makes up 23% of media consumption.

The chart below shows the percentage of various demographics utilizing radio on a weekly basis:

Exhibit 2.9

Weekly Cume Rating

Source: RADAR 119, December 2013

Note: Radio Usage for five minutes or more Monday-Sunday between 6AM-12AM

242 million Americans, accounting for nearly 92% of the population over the age of 12, listen to radio each week. The reach of radio is second only to TV in time spent with media and usage is nearly identical across all major demographic groups, ethnicities and geographies.

15

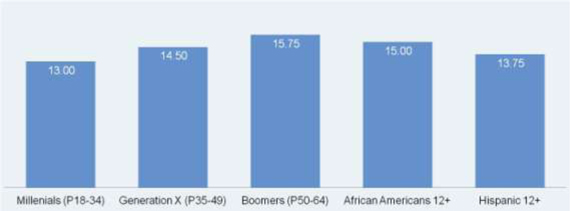

The majority of radio usage is driven by an employed audience that consumes radio away from their own home. According to Nielsen’s “State of the Media: Audio Today 2014”, radio usage peaks during the work-day with an average of 13.3% of the U.S. population tuning into radio in an average 15 minute period between 10:00am and 3:00pm. Employed Millenials (P18-34), Generation X (P35-49), Boomers (P50-64), Hispanics (P12+) and African Americans (P12+) all spend greater than 13 hours a week listening to radio.

Exhibit 2.10

Weekly time spent listening (employed audience)

Source: RADAR 119, December 2013; Monday-Sunday 6am-12am

Note: Hours per week

Innovative culture and industry thought leader

Emmis continually seeks innovative ways to combine or enhance its scalable, low cost FM radio distribution system with digital systems like HD Radio® and wireless broadband to enhance radio’s future through Emmis-created advances like TagStation® and NextRadio®.

Emmis, the National Association of Broadcasters, and the entire radio industry have been working to increase the number of cell phones activated with FM radio receivers.

Emmis has developed NextRadio – an FM smartphone app – and TagStation cloud services. NextRadio combines the efficiency and scalability of broadcast audio with the phone’s data channel to deliver an interactive artist and ad experience. TagStation empowers the radio industry with a platform to manage album art, meta data and enhanced advertising that are sent to the phone in sync with the broadcast. With other features like listener feedback, song tagging capabilities, and social integration, NextRadio stands out as an innovative mobile experience.

NextRadio provides advertisers the ability to deliver fully synchronized hybrid radio ads, increasing the value of the ads and the opportunity for higher listener engagement. The chart below displays the touch points through which advertisers can engage with listeners on the NextRadio smartphone application.

16

Exhibit 2.11

NextRadio’s interactive mobile platform

The NextRadio platform opens the door for more personalized interaction between consumers and broadcasters while consuming one third the battery life of streaming and benefitting carriers and consumers through decreased data traffic.

| • | Consumers receive free, unlimited audio entertainment from familiar, local radio stations with increased levels of interaction |

| • | Carriers benefit from decreased data congestion and a revenue opportunity through broadcaster partnerships |

| • | Currently Sprint, Boost and Virgin Mobile smartphones enable the NextRadio application to work with the embedded FM chip, and the Company believes additional carriers will adopt NextRadio in the future |

| • | Broadcasters expand their distribution of FM beyond the car, reach a mass market with one-to-one smartphone interaction, open the opportunity for a more meaningful portion of digital ad spend, and lower content costs compared to streaming distribution |

The Company expects to continue to invest in expanding the NextRadio / TagStation network of radio stations, mobile carriers and automobile manufacturers and will benefit along with the rest of the radio industry through additional listening and mobile advertising.

Dynamic management team

Emmis is managed by an exceptional management team with an industry leader at the helm. Jeff Smulyan founded the Company in 1980 and has since earned numerous industry accolades for his leadership in the radio broadcasting sector. He currently serves as the Chairman of the Board, President and CEO. The financial team is led by Patrick Walsh, the Company’s Chief Financial Officer and Chief Operating Officer. Pat came to Emmis in 2006 from iBiquity Digital Corporation, the developer and licenser of HD Radio technology, where he served as CFO and Senior Vice President. Pat has also held senior positions at two of the world’s most prestigious consultancies, Deloitte and McKinsey, as well as management positions at General Motors. Both Jeff and Pat have played an instrumental role in deleveraging and realigning the business since 2011. Jeff and Pat are supported by a seasoned executive management team with over 113 years of combined tenure at Emmis.

17

| 3. | Summary of terms and conditions |

Posted separately to IntraLinks

18

| 4. | Emmis overview |

Emmis is a diversified media company, principally focused on radio broadcasting. The Company operates the 9th largest radio portfolio in the United States based on total listeners. Emmis owns 18 FM and 3 AM radio stations in New York, Los Angeles, St. Louis, Austin (Emmis has a 50.1% controlling interest in Emmis’ radio stations located there), Indianapolis and Terre Haute, IN. One of the Company’s FM radio stations in New York is operated pursuant to a Local Marketing Agreement (“LMA”) whereby a third party (Disney/ESPN) provides the programming for the station and sells all advertising within that programming.

In addition to Emmis’ radio properties, the Company publishes several city and regional magazines. Emmis’ publishing operations consist of Texas Monthly, Los Angeles, Atlanta, Indianapolis Monthly, Cincinnati, and Orange Coast.

Advertising sales

Emmis’ revenues are mostly affected by the advertising rates its entities charge and the percentage of available advertising inventory they sell, as advertising sales represent more than 70% of the Company’s consolidated revenues. Advertising demand is based in large part on the Company’s ability to attract audiences/subscribers in demographic groups targeted by advertisers. Emmis’ stations and magazines derive their advertising revenue from local and regional advertising in the marketplaces in which they operate, as well as from the sale of national advertising. Local and most regional sales are made by a station’s or magazine’s sales staff. National sales are made by firms specializing in such sales, which are compensated on a commission-only basis. The Company believes that the volume of national advertising revenue tends to adjust to shifts in a station’s audience share position more rapidly than does the volume of local and regional advertising revenue.

During the year ended February 28, 2014, approximately 23% of Emmis’ total advertising revenues were derived from national sales, and 77% were derived from local and regional sales. For the year ended February 28, 2014, the Company’s radio stations derived a higher percentage of their advertising revenues from local and regional sales (81%) than its publishing entities (66%). Emmis’ strategy is based on disciplined hiring, training, innovation and local on-air, print and digital content. This differs from its competitors, which are more focused on scale and national platforms.

The Company’s Radio operations generate 69.3% of Emmis’ net revenue and greater than 95% of its station operating income. On a compounded basis, during the two fiscal years ended February 28, 2014, local advertising revenues grew less than 1% in the Company’s markets, while Emmis grew its local advertising revenues by almost 4%.

19

Exhibit 4.1

Diversification of revenue

Source: Company filings

Note: Revenue by segment excludes ESPN / Disney LMA revenues

Radio

Emmis’ radio operations consist of six domestic markets. The Company has recently divested its remaining international radio assets to focus solely on its core domestic portfolio. The Company’s radio brands include the two largest hip-hop stations in the world, one based in New York City (WQHT-FM Hot 97) and the other in Los Angeles (KPWR-FM Power 106).

Geographic footprint

Emmis has a portfolio of exceptional radio brands in the industry’s most attractive markets. The Company owns three FM radio stations in the nation’s top two markets (New York and Los Angeles); one of the FM radio stations in New York is operated pursuant to a LMA with ESPN / Disney. Additionally, Emmis has 15 FM and 3 AM radio stations in other attractive markets including St. Louis, Austin and Indianapolis. Each geographic market generated positive station operating income in the fiscal year ended February 28, 2014.

Portfolio of brands

The majority of Emmis’ established local media brands have achieved and sustained a leading position in their respective market segments over many years. Knowledge of local markets and consistently producing unique and compelling content that meets the needs of the Company’s target audiences are critical to its success. As such, Emmis makes substantial investments in areas such as market research, data analysis and creative talent to ensure that content remains relevant, has a meaningful impact on the communities they serve and reinforces the core brand image of each respective property. An overview of Emmis’ radio portfolio by geographic market is summarized in the figure on the following page.

20

Exhibit 4.2

Emmis’ markets and radio stations

| Markets |

Station / key facts |

Description / demographics | ||

| Los Angeles, CA

|

• Power 106 KPWR

• Market rank: #1

• Market revenue: $632.3mm

• Station net revenue: $30.6mm

• Total SOI: $14.8mm

• Ranking in primary demographic target: #1 |

• #1 Hip-hop station in Southern California with most diverse listeners

• Energetic, upbeat flavor along with best hip-hop and R&B providers

• Known for successful promotions and concerts (Powerhouse, Valentine’s Crush, Cali Christmas) | ||

| New York, NY

|

• Hot 97 WQHT

• Market rank: #2

• Market revenue: $587.3mm

• Station net revenue: $25.3mm

• Total SOI: $5.1mm

• Ranking in primary demographic target: #3 |

• Premier Hip-hop station, epicenter for the New York Hip-hop and R&B culture

• Targeted audience is adults age 18-34

• Well-known personalities like Funkmaster Flex and Angie Martinez

• Major annual promotion: Summer Jam, ~50,000 attend world’s largest Hip-Hop festival | ||

| Austin, TX

|

• Six station cluster with a translator operating as a seventh station

• Market rank: #33

• Market revenue: $84.9mm

• Station net revenue: $29.7mm

• Total SOI: $11.1mm

• Emmis owns 50% of partnership that holds these assets and consolidates the results of these stations in its financial statements |

• 103.5 BOB-FM KBPA – specializes in playing wide variety of hits

• 93.3 KGSR – Album Adult Alternative format, eclectic adult targeted music featuring national and local artists

• News Radio 590 KLBJ AM – local news on the hour and half hour seven days a week

• 93.7 KLBJ FM – 35 years as Austin’s rock leader targeting adults age 25-54

• 101X KROX – Independent, local, alternative concept targeting adults age 18-34, with an emphasis on 25-34

• 107.1 La Zeta KLZT – Regional Mexican Format featuring a combination of Norteno, Ranchera, and Mariachi music

• Latino 102.7 – Diverse mix of rhythmic, dance and spanish pop | ||

| Indianapolis, IN

|

• Four station cluster plus a statewide news network

• Market rank: #38

• Market revenue: $76.8mm

• Station net revenue: $21.3mm

• Total SOI: $4.8mm |

• 1070 The Fan WFNI – ESPN affiliate, Indy’s Sportscenter and leading Sports Talk radio in Indianapolis, IN

• 97.1 Hank FM WLHK – Country music format, playing the best country music for the past decade

• 93.1 WIBC – Indiana’s broadcast leader with 62-year heritage of award-winning news coverage and talk programming

• B105.7 WYXB – Soft adult contemporary rock station catering to women ages 35-50

• Network Indiana – Statewide news network providing news, sports and business programming to affiliated radio stations | ||

| St. Louis, MO

|

• Four station cluster

• Market rank: #20

• Market revenue: $111.1mm

• Station net revenue: $20.3mm

• Total SOI: $4.6mm |

• 97.1 KFTK – St. Louis’ FM NewsTalk station

• KHITS 96 KIHT – Adult hits radio station that specializes in hits of the 70’s and 80’s

• 105.7 The Point KPNT – St. Louis’ station for Everything Alternative; ranked consistently #1 with men18-34 and top 3 with persons 18-49

• 94.7 KSHE – The longest running rock station in the world | ||

Source: The Company

Note: Markets exclude Terre Haute, IN stations; Revenue and station operating income as of FYE 2/28/2014

21

Competition

Radio broadcasting stations compete with the other broadcasting stations in their respective market areas, as well as with other advertising media such as newspapers, cable, magazines, outdoor advertising, transit advertising, the Internet and direct marketing. Competition within the broadcasting industry occurs primarily in individual market areas, so that a station in one market (e.g., New York) does not generally compete with stations in other markets (e.g., Los Angeles). In each of Emmis’ markets, its stations face competition from other stations with substantial financial resources, including stations targeting the same demographic groups. In addition to management experience, factors that are material to competitive position include the station’s rank in its market in terms of the number of listeners or viewers, authorized power, assigned frequency, audience characteristics, local program acceptance and the number and characteristics of other stations in the market area. The Company attempts to improve its competitive position with programming and promotional campaigns aimed at the demographic groups targeted by Emmis’ stations. The Company also seeks to improve its position through sales efforts designed to attract advertisers that have done little or no radio advertising by emphasizing the effectiveness of radio advertising in increasing the advertisers’ revenues.

Although the broadcasting industry is highly competitive, barriers to entry exist. The operation of a broadcasting station in the United States requires a license from the FCC. Also, the number of stations that can operate in a given market is limited by the availability of the frequencies that the FCC will license in that market, as well as by the FCC’s multiple ownership rules regulating the number of stations that may be owned and controlled by a single entity and cross ownership rules which limit the types of media properties in any given market that can be owned by the same person or company.

22

License renewal

Radio stations operate pursuant to broadcast licenses that are ordinarily granted by the FCC for maximum terms of eight years and are subject to renewal upon approval by the FCC. The following table sets forth Emmis’ FCC license expiration dates in addition to the call letters, license classification, antenna elevation above average terrain (for FM stations only), power and frequency of all owned stations as of February 28, 2014.

Exhibit 4.3

Summary of broadcast licenses

| Radio market |

Stations |

City of license |

Frequency | Expiration date1 |

FCC |

Height above average terrain |

Power (kilowatts) |

|||||||||||||||

| Los Angeles, CA |

KPWR-FM | Los Angeles, CA | 105.9 | 12/2021 | B | 3035 | 25 | |||||||||||||||

| New York, NY |

WQHT-FM | New York, NY | 97.1 | 06/2014 | 2 | B | 1339 | 6.7 | ||||||||||||||

| WEPN-FM | New York, NY | 98.7 | 06/2014 | 2 | B | 1362 | 6 | |||||||||||||||

| St. Louis, MO |

KFTK-FM | Florissant, MO | 97.1 | 02/2021 | C1 | 561 | 100 | |||||||||||||||

| KIHT-FM | St. Louis, MO | 96.3 | 02/2021 | C1 | 1027 | 80 | ||||||||||||||||

| KPNT-FM | Collinsville, IL | 105.7 | 12/2004 | 2,3 | C1 | 715 | 54 | |||||||||||||||

| KSHE-FM | Crestwood, MO | 94.7 | 02/2021 | C0 | 1027 | 100 | ||||||||||||||||

| Austin, TX |

KBPA-FM | San Marcos, TX | 103.5 | 08/2013 | 2,3 | C0 | 1257 | 100 | ||||||||||||||

| KGSR-FM | Cedar Park, TX | 93.3 | 08/2021 | C | 1926 | 100 | ||||||||||||||||

| KLZT-FM | Bastrop, TX | 107.1 | 08/2013 | C2 | 499 | 49 | ||||||||||||||||

| KLBJ-AM | Austin, TX | 590 | 08/2013 | 2,3 | B | n/a | 5D / 1N | |||||||||||||||

| KLBJ-FM | Austin, TX | 93.7 | 08/2013 | 2,3 | C | 1050 | 97 | |||||||||||||||

| KROX-FM | Buda, TX | 101.5 | 08/2013 | C2 | 847 | 12.5 | ||||||||||||||||

| Indianapolis, IN |

WFNI-AM | Indianapolis, IN | 1070 | 08/2020 | B | n/a | 50D / 10N | |||||||||||||||

| WLHK-FM | Shelbyville, IN | 97.1 | 08/2020 | B | 732 | 23 | ||||||||||||||||

| WIBC-FM | Indianapolis, IN | 93.1 | 08/2004 | 2,3 | B | 991 | 13.5 | |||||||||||||||

| WYXB-FM | Indianapolis, IN | 105.7 | 08/2020 | B | 492 | 50 | ||||||||||||||||

| Terre Haute, IN |

WTHI-FM | Terre Haute, IN | 99.9 | 08/2020 | B | 489 | 50 | |||||||||||||||

| WWVR-FM | West Terre Haute, IN | 105.5 | 08/2020 | A | 295 | 3.3 | ||||||||||||||||

| WFNB-FM | Brazil, IN | 92.7 | 08/2020 | A | 299 | 6 | ||||||||||||||||

| WFNF-AM | Brazil, IN | 1130 | 08/2020 | D | n/a | 0.5D / 0.02N | ||||||||||||||||

Source: Company filings

| 1 | Under the Communications Act, a license expiration date is extended automatically pending action on the renewal application |

| 2 | Renewal application is pending |

| 3 | The station is authorized to continue operating with its existing facilities until the new facilities are constructed |

23

Properties

The types of properties required to support each of the Company’s radio stations include offices, studios and transmitter/antenna sites. Emmis typically leases its studio and office space, although the Company does own some of its facilities. Most of the studio and office space leases contain lease terms with expiration dates of five to fifteen years. A station’s studios are generally housed with its offices in downtown or business districts. Emmis generally considers its facilities to be suitable and of adequate size for current and intended purposes.

The Company leases most of its main transmitter/antenna sites with lease terms that generally range from five to twenty years and owns the remainder of its transmitter/antenna sites. The transmitter/antenna site for each station is generally located so as to provide maximum market coverage, consistent with the station’s FCC license. In general, Emmis does not anticipate difficulties in renewing facility or transmitter/antenna site leases or in leasing additional space or sites if required. Emmis has approximately $58.5 million in aggregate annual minimum rental commitments under real estate and other operating leases. Many of these leases contain escalation clauses such as defined contractual increases or cost-of-living adjustments.

The Company’s principal executive offices are located at 40 Monument Circle, Suite 700, Indianapolis, Indiana 46204, in approximately 91,500 square feet of owned office space which is shared by the Company’s Indianapolis radio stations and Indianapolis Monthly magazine. This property will be subject to a mortgage under the new credit facility.

Emmis owns substantially all of its other equipment, consisting principally of transmitting antennae, transmitters, studio equipment and general office equipment. The towers, antennae and other transmission equipment used by the Company’s stations are generally in good condition, although opportunities to upgrade facilities are periodically reviewed.

24

Publishing

Emmis entered the world of publishing in 1988, with the purchase of hometown Indianapolis Monthly. The company is widely recognized as the country’s leading publisher of city and regional magazines. Emmis Publishing’s marquee titles including Atlanta, Cincinnati, Indianapolis Monthly, Los Angeles, Orange Coast, and Texas Monthly magazines.

The monthly city and regional magazines target an upscale demographic with local interest stories, dining reviews and “best of” lists, among other topics. Emmis Publishing is known for editorial excellence, annually winning the most City and Regional Magazine Association Awards, and being awarded thirteen National Magazine Awards against much larger publishers.

Emmis is focused on diversifying its publishing revenues and strategically managing costs to maintain positive cash flow contribution from the Publishing segment. Emmis has expanded the number of custom publishing projects (alumni magazines, travel guides, etc.) it manages and has focused on events that leverage the Company’s brands and editorial product (Texas Monthly BBQ Festival). The publishing operations contributed revenue and station operating income of $59.8 million and $1.4 million, respectively, in the fiscal year ended February 28, 2014.

Exhibit 4.4

Summary of publishing division revenue performance ($ millions)

Source: The Company

Industry involvement

Emmis has an active leadership role in a wide range of industry organizations. The Company’s senior managers have served in various capacities with industry associations, including as directors of the National Association of Broadcasters, the Radio Advertising Bureau, the Radio Futures Committee, the Arbitron Advisory Council, the Media Financial Management Association and as founding members of the Radio Operators Caucus and Magazine Publishers of America. Emmis’ chief executive officer, Jeff Smulyan has been honored with the National Association of Broadcasters’ “National Radio Award” and as Radio Ink’s “Radio Executive of the Year.” The Company’s management and on-air personalities have won numerous industry awards.

Community involvement

Emmis believes that to be successful, the Company must be integrally involved in the communities it serves. The Company sees itself as community partners. To that end, each of the Company’s radio stations and magazines participates in many community programs, fundraisers and activities that benefit a wide variety of organizations. Charitable organizations that have been the beneficiaries of Emmis’ contributions, marathons, walkathons, dance-a-thons, concerts,

fairs and festivals include, among others, Big Brothers/Big Sisters, Coalition for the Homeless, Indiana Black Expo, the Children’s Wish Fund, the National Multiple Sclerosis Foundation and Special Olympics. The National Association of Broadcasters Education Foundation (“NABEF”) has honored Emmis with the Hubbard Award, honoring a broadcaster “for extraordinary involvement in serving the community.” Emmis was the second broadcaster to receive this prestigious honor, after the Hubbard family, for which the award is named. The NABEF also recently recognized Emmis’ WQHT-FM in New York for its outreach after Hurricane Sandy, both for the news coverage it provided and the relief efforts it organized in the weeks after the storm.

25

Employees

As of February 28, 2014, Emmis had approximately 720 full-time employees and approximately 280 part-time employees. Approximately 20 employees are represented by unions at the Company’s various radio stations. The Company considers relations with its employees to be good.

Local marketing agreement between Emmis subsidiary and ESPN / Disney

On April 26, 2012, a subsidiary of Emmis entered into a LMA with an affiliate of ESPN (New York AM Radio, LLC) pursuant to which it began purchasing from Emmis the right to provide programming on radio station WRKS-FM (now WEPN-FM), 98.7FM, New York, NY. Emmis’ subsidiary will retain ownership of the 98.7FM FCC license during the term of the LMA. The Company’s subsidiary received an annual fee of $8.4 million for the first year of the LMA, and the fee increases by 3.5% each year thereafter until the LMA’s termination.

| • | Disney Enterprises, Inc., the parent company of New York AM Radio, LLC, has guaranteed the obligations under the LMA |

| • | The term of the agreement runs until August 31, 2024 |

In connection with the transaction the Emmis subsidiary issued $82.2mm of non-recourse notes payable to Teachers Insurance and Annuity Association of America. The Company leveraged the guarantee by Disney Enterprises to achieve an interest rate of 4.1% on the notes. Proceeds from the debt issuance paid down all revolver borrowings and a portion of the Company’s term loan outstanding at that time. The notes are non-recourse to Emmis.

Litigation

The Company is a party to various legal proceedings arising in the ordinary course of business. In the opinion of management of the Company, there are no legal proceedings pending against the Company likely to have a material adverse effect on the Company.

Hungarian litigation

On October 28, 2009, the Hungarian National Radio and Television Board (ORTT) announced that it was awarding to another bidder the national radio license then held by our majority-owned subsidiary, Slager. Slager ceased broadcasting effective November 19, 2009. The Company believes that the awarding of the license to the other bidder was unlawful. In October 2011, Emmis filed for arbitration with the International Centre for Settlement of Investment Disputes (“ICSID”) seeking resolution of its claim. A hearing on jurisdiction was held in December 2013, with a ruling expected in the first half of calendar 2014. If the Company prevails at the jurisdictional hearing, a hearing on the merits of the case is expected to be held six to twelve months thereafter. During the years ended February 2012, 2013 and 2014, the Company incurred Hungary license litigation expenses of approximately $0.9 million, $1.4 million and $2.1 million, respectively.

26

Preferred stock litigation

Emmis and certain of its officers and directors were named as defendants in a lawsuit filed April 16, 2012 by certain holders of Preferred Stock (the “Lock-Up Group”) in the United States District Court for the Southern District of Indiana entitled Corre Opportunities Fund, LP, et al. v. Emmis Communications Corporation, et al. The plaintiffs alleged, among other things, that Emmis and the other defendants violated various provisions of the federal securities laws and breached fiduciary duties in connection with Emmis’ entry into total return swap agreements and voting agreements with certain holders of Emmis Preferred Stock, as well as by issuing shares of Preferred Stock to Emmis’ 2012 Retention Plan and Trust (the “Trust”) and entering into a voting agreement with the trustee of the Trust. The plaintiffs also alleged that Emmis violated certain provisions of Indiana corporate law by directing the voting of the shares of Preferred Stock subject to the total return swap agreements (the “Swap Shares”) and the shares of Preferred Stock held by the Trust (the “Trust Shares”) in favor of certain amendments to Emmis’ Articles of Incorporation.

Emmis filed an answer denying the material allegations of the complaint, and filed a counterclaim seeking a declaratory judgment that Emmis may legally direct the voting of the Swap Shares and the Trust Shares in favor of the proposed amendments.

On August 31, 2012, the U.S. District Court denied the plaintiffs’ request for a preliminary injunction. Plaintiffs subsequently filed an amended complaint seeking monetary damages and dismissing all claims against the individual officer and director defendants. On February 28, 2014, the U.S. District Court issued a ruling in favor of Emmis on all counts. In March 2014, the Plaintiffs filed with the U.S. Court of Appeals for the Seventh Circuit an appeal of the U.S. District Court’s decision. Emmis is defending this lawsuit vigorously.

Other

Certain individuals and groups have challenged applications for renewal of the FCC licenses of certain of the Company’s stations. The challenges to the license renewal applications are currently pending before the FCC. Emmis does not expect the challenges to result in the denial of any license renewals.

27

| 5. | WBLS & WLIB overview |

YMF Media LLC (“YMF Media”) owned radio stations WBLS-FM (107.5Mhz, Urban AC) and WLIB (1190Khz, Black Gospel) operate attractive formats with limited competition in the New York City market. WBLS is the top-ranked Urban radio station in the U.S. and WLIB is New York City’s only 24-hour Gospel station. Together WBLS and WLIB reach an audience of approximately 2.5 million people.

In October 2012 YMF Media purchased the WBLS and WLIB radio stations from Inner City Media Corporation in a sale under federal bankruptcy code. YMF Media is owned by Yucaipa Companies, Fortress Investment Group LLC and Earvin “Magic” Johnson. YMF Media initiated a competitive auction for the WBLS and WLIB radio assets in 2013, with Emmis acquiring the right to purchase the stations in February 2015.

WBLS and WLIB currently share office space with Emmis creating a clear path to cost saving synergies that have already been implemented. Emmis expects synergy actions already taken to generate $3 million in cost savings annually.

For the fiscal year end December 31, 2013 WBLS and WLIB generated net revenue and station operating income of $32.0 million and $15.2 million, respectively.

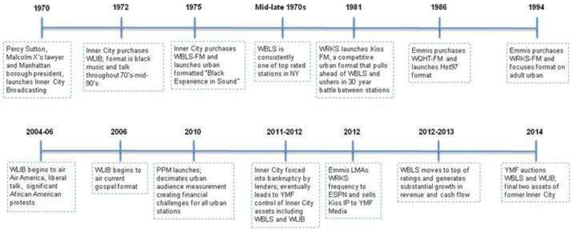

WBLS and WLIB background

WBLS and WLIB have a long, storied history in the New York African American community. The figure below contains a timeline of major events since the stations’ founding.

Exhibit 5.1

Timeline of key events

Source: The Company

28

WBLS operations

WBLS is the leading adult urban FM radio station in New York City with a music format centered on R&B. The station has one of the longest track records of any format in New York City.

WBLS has realized significant audience share gains since acquiring KISS FM’s intellectual property in April 2012. As part of the transaction, Emmis vacated the adult urban format in New York City, and ESPN commenced an LMA of KISS FM’s former frequency (98.7FM). The transaction merged the leading stations serving the New York City African American community into a single offering that has driven ratings higher and produced significant revenue and station operating income growth for WBLS.

WBLS seeks to drive listener growth through actively participating in the community with social events for the adult R&B audience. WBLS has an active event calendar including concerts, planned nights out, discounted tickets to broadway shows and business diversity summits. WBLS also has an active social and digital media platform generating approximately two million fan interactions on Facebook and over 2,000 brand posts, significantly higher than its competition. WBLS’ community involvement and digital marketing creates a loyal audience that spends more than four hours a week with the station.

Exhibit 5.2

Adults (25-54) weekly exposure

Source: Nielsen

Note: Data average for 5 month period from October 2013 to February 2014

The dominant market position and community involvement has resulted in WBLS’ #1 ranking among a variety of attractive audience demographics in the New York market including African American adults 25-54 and African American women 18-49. No other station delivers more African American adults and women than WBLS.

29

Exhibit 5.3

Listeners prefer WBLS – Average audience share (%)

Source: Nielsen

WLIB operations

WLIB is a unique radio station with a loyal customer base that frequently boasts market leading monthly audience engagement (measured as weekly hours spent listening). As New York City’s only 24-hour Gospel station catering to the 35+ African American Christian audience, WLIB is a difficult to replicate radio asset.

WLIB has been in the Gospel format for seven years. The station features Grammy-nominated Gospel artists, pastors and other active figures in the community. WLIB’s weekly programming includes back to back shows filling the popular 1:00 – 3:00 pm and 3:00 – 7:00 pm timeslot by influential community figures the Reverend Al Sharpton and Bishop Hezekiah Walker. WLIB’s weekly engagement with its target audience is displayed in the graph below:

Exhibit 5.4

African American Adults (25-54) weekly exposure

Source: Nielsen

30

The station generated approximately $2.7 million and $0.9 million of net revenue and station operating income, respectively, for the calendar year ended December 31, 2013.

31

| 6. | Executive management |

Executive management team

| Name |

Title |

Age | Joined Emmis | |||||||

| Jeff Smulyan |

Chairman of the Board, President and CEO | 67 | 1980 | |||||||

| Patrick Walsh |

Executive Vice President, Chief Financial Officer and Chief Operating Officer | 46 | 2006 | |||||||

| Rick Cummings |

President of Radio Programming | 62 | 1981 | |||||||

| Scott Enright |

Executive Vice President, General Counsel | 51 | 1998 | |||||||

| Greg Loewen |

President, Publishing Division | 42 | 2007 | |||||||

| Paul Brenner |

Senior Vice President, Chief Technology Officer | 45 | 1998 | |||||||

Jeff Smulyan – Chairman, President and CEO

Widely recognized as one of the most visionary leaders in the radio industry, Jeffrey H. Smulyan, 66, serves as Founder and Chairman of the Board of Emmis Communications Corporation.

A former director of the National Association of Broadcasters and former Chairman of the Radio Advertising Bureau, Smulyan served as past chair of the Central Indiana Corporate Partnership, a consortium of CEOs from central Indiana’s largest corporations, and sits on the Board of Trustees of his alma mater, the University of Southern California. He is a member of numerous civic boards and committees. As principal shareholder, he led a group that purchased the Seattle Mariners baseball team in 1989, selling the club three years later. During that time, Smulyan served on the Major League Baseball owner’s Ownership and Television committees.

Smulyan’s leadership has been recognized by the American Women in Radio and Television’s Silver Satellite Award, the National Association of Broadcasters’ National Radio Award, Radio Ink’s “Radio Executive of the Year,” the American Women in Radio and Television’s Star Award, the Sagamore of the Wabash, and the Entrepreneur of the Year Award from Ernst & Young. The radio industry newspaper, R & R, voted Smulyan one of the 10 most influential radio executives of the past two decades.

A cum laude graduate of the University of Southern California with a B.A. in History and Telecommunications, Smulyan earned a Juris Doctor degree from USC School of Law, where he served as note and comment editor of the USC Law Review.

Patrick Walsh – Executive Vice President, Chief Financial Officer and Chief Operating Officer

Patrick Walsh joined Emmis as EVP/Chief Financial Officer in September 2006 and was given the additional responsibilities of Chief Operating Officer, with oversight of the Emmis’ Radio Division, in December 2008.

Walsh came to Emmis from iBiquity Digital Corporation, the developer and licenser of HD Radio technology, where he served as CFO and Senior Vice President.

Prior to joining iBiquity, Walsh was a management consultant for McKinsey & Company, one of the world’s top management consulting firms. His previous management experience includes positions at General Motors Acceptance Corporation and Deloitte & Touche LLP. He earned a Bachelor of Business Administration degree in accounting and finance from the University of Michigan and an MBA from Harvard Business School.

Rick Cummings – President of Radio Programming

Rick graduated Magna Cum Laude from Butler University in 1973 where he majored in Radio/Television and minored in Journalism. In 1981, he joined Emmis Broadcasting as its first Program Director at flagship station WENS-FM, 97.1 Indianapolis (now Hank FM). In 1984 he became the National Program Director for Emmis.

32

He launched KPWR, Power 106, Los Angeles in 1986, as well as Hot 97 (WQHT, New York) and the country’s first all-sports station, WFAN, New York in 1987. In 2002, Rick became President of the Radio Division of Emmis Communications. On December 15, 2008, he became President of Programming for the domestic radio group.

He is a past member of the National Association of Broadcasters and Radio Advertising Bureau boards and is a member of the Board of Trustees at Butler University.

Scott Enright – Executive Vice President, General Counsel

Scott Enright is Executive Vice President, General Counsel and Secretary of Emmis Communications Corporation and its subsidiaries. Prior to joining Emmis as Associate General Counsel in 1998, Enright was a partner in the Indianapolis law firm of Bose McKinney & Evans, LLP and worked in the Office of Indiana Lt. Governor John M. Mutz.

Enright is a graduate of St. Olaf College in Northfield, Minnesota with a Bachelor of Arts degree in history and political science (1985) and Indiana University – Bloomington’s Kelley School of Business and Maurer School of Law, with a Juris Doctorate/Masters in Business Administration (1990).

Greg Loewen – President of Publishing Division

Greg Loewen serves as the President of Emmis’ Publishing Division. Prior to joining Emmis he worked at The Toronto Star, Canada’s largest newspaper, where he served the dual role of Vice President of Digital Media & Strategy and Publisher, thestar.com (2004 - 2007). In these roles, he was responsible for the Star’s digital business lines as well as strategic planning, consumer and trade marketing, market research, business development and external partnerships/acquisitions.

Prior to joining the Star, Loewen was a Global Account Manager in the Toronto office of Monitor Group (1993-2004), a leading global strategy consultancy. He was the gold medallist in his class at Queen’s University in Ontario (Bachelor of Commerce) and graduated as a Baker Scholar from the Harvard Business School (Masters in Business Administration).

Paul Brenner – Senior Vice President, Chief Technology Officer

As SVP/Chief Technology Officer, Mr. Brenner’s work focuses on technology business development, industry partnerships, broadcast engineering strategy and the development of new broadcasting and Internet content distribution systems

Brenner works both within the industry and with pure-play IT development companies. His perspective gained from interaction with automakers, Internet software companies and portable device makers leads him to product developments such as BTC and TagStation™ for radio broadcasters.

Paul is the originator of the data distribution consortium business model and currently serves as president of the Broadcaster Traffic Consortium, LLC (BTC), a partnership of more than 16 radio companies, throughout the United States and Canada, formed to distribute data via FM-RDS and HD Radio® technology. Paul is also SVP/Chief Technology Officer for Emmis Communications, one of the founding members of the BTC.

Paul joined Emmis from an IT consulting firm, DataShare Corporation, in 1998. He holds a Masters degree in Information Systems as well as degrees in E-Business and Electronic Engineering Technologies. He currently serves on the FCC Communication, Security, Reliability and Interoperability Council (CSRIC) working group for EAS CAP and is an active member of the NAB’s Digital Radio Committee. HD chip developer SiPort also utilizes Paul’s industry expertise as a member of their Board of Advisors.

33

| A. | Historical financial statements |

Historical financials statements for EMMIS, WBLS and WLIB posted separately to IntraLinks

34