Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - STERLING CONSOLIDATED Corp | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - STERLING CONSOLIDATED Corp | v374664_ex32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - STERLING CONSOLIDATED Corp | v374664_ex31-2.htm |

| EX-32.2 - EXHIBIT 32.2 - STERLING CONSOLIDATED Corp | v374664_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - STERLING CONSOLIDATED Corp | v374664_ex31-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2013

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________ to ___________

Commission file number 333-183246

STERLING CONSOLIDATED CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 45-1840913 |

|

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) |

|

1105 Green Grove Road Neptune, New Jersey |

07753 |

| (Address of principal executive offices) | Zip Code) |

Registrant’s telephone number, including area code (732) 918-8004

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K.

x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |

|

Non-accelerated filer (Do not check if a smaller reporting company) |

¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter, June 30, 2013: N/A.

As of April 11, 2014, the registrant had 37,824,040 shares of its common stock, par value $0.001 per share, issued and outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

| Page | ||||

| PART I | ||||

| Item 1. | Business. | 3 | ||

| Item 1A. | Risk Factors. | 9 | ||

| Item 1B. | Unresolved Staff Comments | 9 | ||

| Item 2. | Properties. | 9 | ||

| Item 3. | Legal Proceedings. | 10 | ||

| Item 4. | Mine Safety Disclosures. | 10 | ||

| PART II | ||||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 10 | ||

| Item 6. | Selected Financial Data. | 10 | ||

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 11 | ||

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 17 | ||

| Item 8. | Financial Statements and Supplementary Data. | 17 | ||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure. | 17 | ||

| Item 9A. | Controls and Procedures. | 18 | ||

| PART III | ||||

| Item 10. | Directors, Executive Officers and Corporate Governance. | 19 | ||

| Item 11. | Executive Compensation. | 22 | ||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 23 | ||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 23 | ||

| Item 14. | Principal Accounting Fees and Services. | 24 | ||

| PART IV | ||||

| Item 15. | Exhibits, Financial Statement Schedules. | 25 | ||

| SIGNATURES | 26 | |||

| 2 |

PART I

Item 1. Business.

Overview

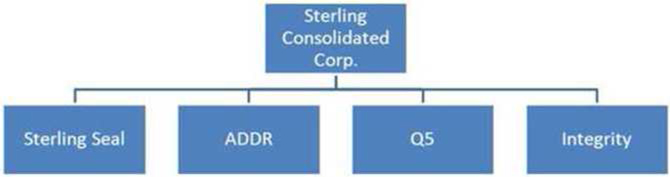

We were incorporated in the State of Nevada as Oceanview Acquisition Corp on January 31, 2011. On May 18, 2012, we amended our Articles of Incorporation to change our name to Sterling Consolidated Corp. We are a holding company, and all of our operations are conducted through our four subsidiaries: Sterling Seal & Supply, Inc. (“Sterling Seal”), ADDR Properties, LLC (“ADDR”), Q5 Ventures, LLC (“Q5”), and Integrity Cargo Freight Corporation (“Integrity”). In June 2012, these four entities became subsidiaries of the Company through an Equity Exchange Agreement by which the shareholders of Sterling Seal, ADDR, Q5, and Integrity became shareholders of the Company and in exchange the Company received all of the authorized and outstanding shares of Sterling Seal, ADDR, Q5, and Integrity.

Equity Exchange Agreement

On June 8, 2012, we executed an equity exchange agreement with Sterling Seal, ADDR, Q5 and Integrity. Under this exchange agreement, Sterling Consolidated Corp became the holding company and obtained 100% interest in each of the four consolidating entitles: Sterling Seal and Supply, Inc., ADDR Properties, LLC, Integrity Cargo Freight Corporation and Q5 Ventures, LLC. As consideration for the transfer of the equity interests of Sterling, ADDR, Q5 and Integrity, we agreed to issue a total of 33,817,040 shares of our common stock to the shareholders of Sterling, ADDR, Q5 and Integrity. Specifically, we issued shares as follows:

| (A) | 1,080,000 shares of common stock to the ADDR Members, of which: |

| i. | 540,000 shares of common stock were issued to Angelo DeRosa, |

| ii. | 270,000 shares of common stock were issued to Darleen DeRosa, and |

| iii. | 270,000 shares of common stock were issued to Darren DeRosa; |

| (B) | 1,500,000 SC Shares to the Integrity Shareholders, of which: |

| i. | 750,000 shares of common stock were issued to Angelo DeRosa, and |

| ii. | 750,000 shares of common stock were issued to Darren DeRosa; |

| (C) | 540,000 SC Shares to the Q5 Members, of which: |

| i. | 270,000 shares of common stock were issued to Kaveeta DeRosa, and |

| ii. | 270,000 shares of common stock were issued to Darren DeRosa; and |

| 3 |

| (D) | 30,697,040 SC Shares to the Sterling Seal Shareholders, of which: |

| i. | 15,000,000 shares of common stock were issued to Angelo DeRosa, |

| ii. | 15,000,000 shares of common stock were issued to Darren DeRosa, and |

| iii. | 697,040 shares of common stock were issued to the Private Placement Shareholders. |

After execution of the exchange agreement and coupled with shares sold in two private offerings and other issuances to consultants for services rendered, as of January 31, 2013, Sterling Consolidated Corp had a total of 37,074,040 shares outstanding, which consist of the following:

| - | 33,817,040 shares of common stock issued in the exchange agreement; |

| - | 2,880,000 shares of common stock retained by existing shareholder of Sterling Consolidated Corp.; 160,000 shares issued to Anslow & Jaclin, LLP and Delaney Equity Group for services rendered; |

| - | 100,333 shares of common stock sold in a June 2012 private placement; and 116,667 shares of common stock sold in a December 2012 private placement. |

Subsidiaries

Sterling Consolidated Corp. conducts its entire business through its four subsidiaries. Each subsidiary is responsible for a specific business function of the Company. For clarity, an organizational chart of the Company is provided below.

Sterling Seal & Supply, Inc.

Our largest subsidiary is Sterling Seal & Supply, Inc. (“Sterling Seal”), a New Jersey corporation which was incorporated in 1997. Its predecessor was Sterling Plastic & Rubber Products, Inc., which was incorporated in New Jersey and was founded in 1970. Sterling Seal engages primarily in the distribution and sale of O-rings, rubber seals, oil seals, custom molded rubber parts, custom Teflon parts, Teflon rods, O-ring cord, bonded seals, O-ring kits, and stuffing box sealant.

Sterling Seal is a distributor of O-rings. O-rings are one of the simplest, yet most engineered, precise, and useful seal designs. They are one of the most common and important elements of machine design. O-rings and the other products that Sterling Seal sells are used in a wide variety of industries, including automotive, pump, transmissions, oil and energy, machinery, and packaging. These products are utilized primarily as seals to prevent leakage of liquids or air. Most of the products carried by Sterling Seal are made of rubber, but some are coated and the rubber compound can change upon customer request.

| 4 |

Sterling Seal sells directly to smaller distributors and original equipment manufacturers in need of seals. It offers a catalogue of standard sizes, and will take orders for special sizes not available in the standard catalogue. In order to satisfy the needs of our customers and stay competitive, Sterling Seal always maintains a wide variety of products in substantial quantities at its main warehouse in Neptune, New Jersey, as well as its other facilities in the United States. The products that we hold in inventory at our warehouse are standard products that are most often ordered. If a customer orders a product that is not in our inventory, we order the product from one of our suppliers in China.

We have approximately 3,300 customers that place orders with us for the delivery of O-ring or similar products. Our largest customer is a southeastern U.S. manufacturer/distributor of auotomotive/industrial products. Other automotive customers are Precision International, Fruedenberg and Sonnax Transmissions. We stock a variety of rubber seals to service pool filter and pump manufacturers. We also distribute our products to many resellers of replacement parts and pool stores. Bay State Pool and Horizon Pool and Spa are two of our larger accounts in the pool industry.

A large portion of our customer base services the plumbing and industrial industries. These accounts include, Fastenal, Kaman Industrial and Eastern Industrial. They are localized to service a wide range of products, but they purchase O-Rings and rubber seals from Sterling.

Sterling Seal receives requests for quotations electronically and by fax daily from its various customers. The sales force then reviews each request, and responds with a “quoted” price for delivery and price. If such a quote is accepted, the customer responds with a purchase order for a specific price and delivery.

After a purchase order is accepted and we do not have the ordered product in our inventory, we then contact one of our suppliers. All of our suppliers are located in China. In determining which suppliers to use, we look for suppliers that deliver quality products in a timely manner. We do not have any long term contracts with any of our suppliers. The following is the list of our 10 largest principal suppliers:

| - | Progum Elastomer Technology Co., Ltd. |

| - | Ivy Seals Group Corp. |

| - | Ge Mao Rubber Ind. Co. |

| - | Escort Seals |

| - | Rubber Best Industry Corp. |

| - | Wyatt Seal, Inc. |

| - | Best Ring Industrial |

| - | Supaseal Ltd. |

| - | Goodway Rubber Ind Co Ltd |

| - | AnySeals, Inc. |

O-ring and rubber seals are generally considered commodities, meaning that such goods are fungible and there is little if any distinction between the various producers and suppliers of the products. None of the products sold by Sterling Seal are under patent and there are no intellectual property or licensing issues. Sterling Seal sets itself apart from other similarly situated companies though the variety and quality of its inventory, the price point at which it sells its various products, and its ability to deliver products to customers on time. The time it takes us to deliver the ordered product to a customer will mainly depend on whether we have it in inventory or need to order it from a supplier in China. If we have it in inventory, we can package, ship and distribute the product within two (2) business days.

When orders arrive at Sterling Seal, we ship the products to our customer and invoice on a 45-day basis.

Asset Purchase

On September 16, 2013, Sterling Seal entered into and closed an asset purchase agreement (the “Asset Purchase Agreement”) with Superior Seals & Service, Inc., a North Carolina corporation (“Superior”) and its principal shareholders, Edward R. Tracy and Sue D. Tracy (collectively, the Principal Shareholders”), pursuant to which Sterling Seal agreed to purchase substantially all of Superior’s assets (the “Assets”).

| 5 |

Superior is a manufacturer and distributor of fluid sealing products.

Pursuant to the Asset Purchase Agreement, in consideration for the sale of Assets, Sterling Seal paid Superior Sixty-Two Thousand ($62,000) Dollars, Two Hundred Thousand (200,000) shares of the Company’s common stock, par value $0.001 per share (the “Stock Consideration”), and assumed certain liabilities associated with Superior.

As a condition to closing, Sterling Seal entered into an employment agreement (the “Employment Agreement”) with Edward R. Tracy (the “Employee”) to perform the duties of Vice President responsible for sales, servicing, purchasing and management and shall perform such other related duties and obligations as from time to time assigned to the Employee. The Employee shall be paid $48,000 per annum, payable in accordance with Sterling Seal’s ordinary payroll practices. Additionally, the Employee shall be eligible to receive performance bonuses as determined by Sterling Seal’s Board of Directors and receive a monthly automobile allowance. The Employment Agreement’s term commenced on September 15, 2013 and shall continue through September 15, 2018. The Employment Agreement contains a covenant not to compete which prohibits the Employee during his employment and five (5) years after termination from engaging in the business of manufacturing, marketing, selling or distributing fluid sealing products anywhere in the United States.

The Asset Purchase Agreement contains representations and warranties that each party thereto made to and solely for the benefit of each other as of specific dates. The assertions embodied in those representations and warranties were made solely for purposes of the contract between the parties to the Asset Purchase Agreement and may be subject to important qualifications and limitations agreed by the parties in connection with negotiating the terms of the contract or contained in confidential disclosure schedules. Those disclosure schedules contain information that modifies, qualifies or creates exceptions to the representations and warranties set forth in the Asset Purchase Agreement. Moreover, some of those representations and warranties (a) may not be accurate or complete as of any specified date and are modified, qualified and created in important part by the underlying disclosure schedules, (b) may be subject to a contractual standard of materiality different from that generally applicable to stockholders, or (c) may have been used for the purpose of allocating risk between the parties to the Asset Purchase Agreement rather than establishing matters as facts. For the foregoing reasons, the representations and warranties should not be relied upon as statements of factual information.

The foregoing description of the Asset Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to the Asset Purchase Agreement, a copy of which is filed herewith as Exhibit 10.3, and is incorporated herein by reference.

Integrity Cargo Freight Corporation

Our subsidiary, Integrity Cargo Freight Corporation (“Integrity”) is a freight forwarding business. They are primarily responsible for transporting products we order from our suppliers back to our warehouse in Neptune, NJ. After Sterling Seal confirms from its supplier that a product is ready to be picked up, Integrity Cargo is responsible for picking up the products and getting them to the dock and delivered to the Sterling Seal warehouse.

Integrity shares a facility with Sterling Seal and manages the importation of Sterling Seal’s products and its exports to various countries. Currently eighty percent (80%) of Sterling Seal’s imports come from Asia, and ten percent (10%) of the Company’s sales are exported to various countries. However, all payables are billed and collected in USD, so Sterling does not bear any foreign exchange risk on open payables.

We incorporated Integrity in order to vertically integrate our operations and not have to rely on third parties to deliver our products from the supplier. This has resulted in quicker delivery and more predictable delivery times.

This provides the Company with a competitive advantage over other importers of O-rings and seals as we can utilize our own freight company and consolidate our operations. As a result, the Company is able to provide lower prices to its customers. This also provides us with a much greater level of control over our shipping, which expedites lead times and deliveries to our customers.

| 6 |

Entering the freight forwarding market has provided the Company with a competitive advantage as compared with other importing distributors of rubber O-Rings. By having the ability to utilize our own freight company, we are able to consolidate shipments from various sources and ship as frequently as needed, which has resulted in improved efficiencies and delivery times.

Integrity also performs freight forwarding services for third party customers. Integrity currently has about twenty (20) customers for whom performs freight forwarding services. However, roughly fifty percent (50%) of its revenues derive from freight forwarding for Sterling Seal.

Integrity shares a facility and certain overhead costs such as information technology with Sterling Seal, so both entities have lower operational costs due to economies of scale.

ADDR Properties, LLC.

ADDR Properties, LLC (“ADDR”) is one of our two subsidiaries that owns real property. ADDR owns a 28,000 square foot facility in Neptune, NJ. Roughly ninety percent (90%) of this property is used by Sterling Seal as its principal executive office and primary warehouse. The remaining 3,000 square feet of this facility is rented out to the Children’s Center of Monmouth. The current lease agreement with the Children’s Center of Monmouth is for three (3) years at $2,000 per month and expires in August 2014.

On April 29, 2013, ADDR sold a parcel of land (the “Land”) with the buildings, improvements, and structure thereon (“Improvements,” together with the Land, the “Premises”) to Old Bridge Realty Partner, LLC, or its nominee or assignee (the “Purchaser”) for a purchase price of Six Hundred and Fifty Thousand Dollars ($650,000) plus closing costs upon satisfaction of certain conditions (the “Transaction”). The Premises are located in the Township of Old Bridge, Middlesex County, New Jersey, commonly known as 160 Route 35 North, Cliffwood Beach, New Jersey 08857, and identified on the tax assessment map of said township as Lots 4 & 5 in Block 215.

The Purchaser is not affiliated with the Company or its advisors, and no material relationship exists between the Company and the Purchaser, except in connection with the Transaction.

On May 23, 2013, the Company issued a press release announcing the sale of the Premises. A copy of the press release is filed as Exhibit 99.1 to this Annual Report on Form 10-K and is incorporated herein by reference. Within certain terms of the contract, however the Purchaser was unable to obtain the appropriate approvals and canceled the Transaction. ADDR is continuing to rent out the property.

Q5 Ventures, LLC

Q5 Ventures, LLC owns a 5,000 square foot facility in Apopka, Florida, which is used by Sterling Seal for its Florida operations. This facility was specifically built for Sterling Seal’s operations. The lease is effective through January 1, 2013 and Sterling Seal pays Q5 rent in the amount of $5,000 per month.

Private Placements

In January of 2012, Sterling Seal and Supply, Inc. conducted a private placement under Rule 506 of Regulation D. In the offering, Sterling Seal and Supply, Inc. sold a total of 697,040 shares of common stock at $0.30 per share to 36 investors prior to the June 8, 2012 share exchange agreement for total proceeds of $209,112.

In June 2012, Sterling Consolidated Corp. conducted a private placement selling an additional 100,333 shares to two (2) investors for a total investment of $30,100.

In December of 2012, Sterling Consolidated Corp. obtained an equity investment of $35,000 in exchange for 116,667 shares from one investor.

| 7 |

Competition and Our Competitive Strengths

Rubber is the raw material that we are dependent on in our business. In order to compete in the US, a supplier must import from China. This is due to the fact that manufacturing rubber is a labor intensive project and labor costs are significantly cheaper in China than they are in the United States.

There is a lot of competition in the US for seals and products that we distribute. In order to establish competitive prices, we purchase large quantities of product at a time. It would be too costly for smaller companies or our customers to circumvent us by buying directly from the supplier because the prices are much higher for smaller orders. Importation costs are also high and add to the overall cost of the product.

This is a competitive advantage for us because we are a larger company that has the cash and other resources that enables us to hold inventory at our warehouse. This helps us maintain a competitive advantage because not only do we have the ability of reducing our costs, we can also decrease the amount of time it takes to deliver orders to our customers, provided that we have the product in our warehouse. Stockpiling an inventory also requires capital. Currently, we have over two million dollars in inventory to service our current customers’ demands.

For some of our customers, there is a cost incurred as a result of switching from Sterling Seal as a supplier. Because Sterling Seal is an approved supplier for many of our industrial and commercial customers, while other suppliers may not be approved, our customers could face increased costs as a result of switching to another supplier's product. For certain customers, in order to switch from an approved supplier, the product must be tested and approved. In the automotive industry the factories have to be audited and approved in addition to the distributor and their products. Because of the potential for increasing costs, our current customers are unlikely to abandon us.

In addition, many of our customers place small orders throughout the year. It takes a long time to build the business to cover overhead costs. For this reason, it is difficult for a supplier to enter into our industry. Most of Sterling Seal’s accounts are repeat customers with consistent demands for O-rings and custom-molded rubber.

Once we have the product in our warehouse, either if it is already in inventory or if we just received the shipment of the product from China, the Company is able to cost-effectively distribute products to local markets across the United States within two (2) business days because we have established multiple distribution factories over the course of our years of operating. This helps to expedite deliveries and reduce costs. This also gives us an advantage over our competitors. In addition, the vertical integration of our freight forwarding business, Integrity, with our primary operations through Sterling Seal helps us deliver products more cost-effectively.

We currently have relationships with domestic and international distributors. The Company intends to increase sales through acquisitions and investing in complementary corporations.

Seasonality and Cyclical Nature of Business

We do not experience much seasonality or cyclical nature to our business. Our sales are consistent from month to month. However, we do experience a slight increase in volume at the beginning of the year because most of our customers have a budget and cash available to purchase products for the entire year. Also, during the summer months our sales are a little slower due to factory shutdowns and increased vacations by purchasing agents.

Patents, Trademarks, and Licenses

We have no current plans for any registrations such as patents, trademarks, copyrights, franchises, concessions, royalty agreements or labor contracts. We will assess the need for any copyright, trademark or patent applications on an ongoing basis.

Research and Development Activities and Costs

We are a supplier and distributor of products and, therefore, do not incur any research and development and have no plans to undertake any research and development activities during the next year of operations.

| 8 |

Government Regulation

We are not aware of the need for any governmental approvals of our products. Since we utilize contract manufacturers, regulations will be the responsibility of the contract manufacturers. Before entering into any manufacturing contract we determine that the manufacturer has met all government requirements.

Environmental Laws (federal, state and local)

We do not believe that we will be subject to any environmental laws either state or federal. Any laws concerning manufacturing and shipping will be the responsibility of the contract manufacturer.

Marketing

We currently have relationships with several companies located in the United States and overseas. The Company markets its products primarily through word of mouth and referrals from its customers. We attend several trade shows during the course of the year specifically to market our products. We routinely attend the SEMA show in Las Vegas, NV which is one of the largest supplier shows of its kind for the automotive market. In addition, we supply distributors and end users with the product necessary for steering wheels and transmissions kits. Our largest customer is Freudenberg who sells replacements kits to John Deer and Harley Davidson, amongst many other companies. Other automotive customers are Precision International and Sonnax Transmissions.

Another trade show is the Atlantic City Pool and Spa show. We stock a variety of rubber seals to service the pool filter and pump manufacturers. We also distribute our products to many resellers of replacement parts and pool stores. Bay State Pool and Horizon Pool and Spa are two of our larger accounts in the pool industry.

A large portion of our customer base services the plumbing and industrial industries. These accounts include, Fastenal, Kaman Industrial and Eastern Industrial. They are localized to service a wide range of products, but they purchase O-Rings and rubber seals from Sterling Seal.

The marketing for ADDR and Q5, specifically the location of tenants, is through real estate agents. The current agent of record for both companies is Sheldon Gross Realty, 80 Main Street, West Orange, New Jersey.

Integrity Cargo markets through direct sales and referrals only.

Employees

As of April 11, 2014, we have 23 full time employees. Our employees consist of: (i) salespersons; (ii) management and administrative; and (iii) warehouse and shipping operators.

Item 1A. Risk Factors.

Not applicable because we are a smaller reporting company.

Item 1B. Unresolved Staff Comments.

Not applicable because we are a smaller reporting company.

Item 2. Properties.

Our principal executive office is located at 1105 Green Grove Road, Neptune, New Jersey 07753, and our telephone number is (732) 918-8004. This facility is owned by our subsidiary, ADDR, and also serves as the principal executive office for each of our other subsidiaries.

In addition, we have a sales office located at 48 High Street, Norwell, Massachusetts 02061. This is a home office owned by 3 of our employees. We do not have a lease agreement or pay rent for them to use this as a home office.

| 9 |

ADDR also owns a property in Cliffwood Beach, NJ but it is not currently occupied or used by us. We rent it out to 4 tenants. A copy of the lease agreements are attached hereto.

Item 3. Legal Proceedings.

From time to time, we may become involved in various lawsuits and legal proceedings, which arise, in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that we believe will have a material adverse effect on our business, financial condition or operating results.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market Information

Our common stock trades on the OTCQB and OTCBB under the symbol “STCC”. The OTCQB and OTCBB is a quotation service that displays real-time quotes, last-sale prices, and volume information in over-the-counter (“OTC”) equity securities. An OTCQB and OTCBB equity security generally is any equity that is not listed or traded on a national securities exchange.

No established public trading market exists for the Company’s common stock. There are no plans, proposals, arrangements or understandings with any person with regard to the development of a trading market in any of the Company’s common stock.

Approximate Number of Equity Security Holders

As of April 11, 2014, there were approximately 65 stockholders of record. Because shares of our common stock are held by depositaries, brokers and other nominees, the number of beneficial holders of our shares is substantially larger than the number of stockholders of record.

Dividends

Holders of our common stock are entitled to receive dividends if, as and when declared by the Board of Directors out of funds legally available therefore. We have never declared or paid any dividends on our common stock. We intend to retain any future earnings for use in the operation and expansion of our business. Consequently, we do not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future.

Securities Authorized for Issuance under Equity Compensation Plans

We do not have in effect any compensation plans under which our equity securities are authorized for issuance.

Item 6. Selected Financial Data.

Not applicable because we are a smaller reporting company.

| 10 |

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The information and financial data discussed below is derived from the audited financial statements of the Company for its fiscal year ended December 31, 2013. The audited financial statements were prepared and presented in accordance with generally accepted accounting principles in the United States. The information and financial data discussed below is only a summary and should be read in conjunction with the historical financial statements and related notes contained elsewhere in this 10-K. The financial statements contained elsewhere in this 10-K fully represent the Company’s financial condition and operations; however, they are not indicative of the Company’s future performance. Although management believes that the assumptions made and expectations reflected in the forward-looking statements are reasonable, there is no assurance that the underlying assumptions will, in fact, prove to be correct or that actual results will not be different from expectations expressed in this 10-K.

Overview

We were incorporated in the State of Nevada as Oceanview Acquisition Corp. on January 31, 2011. On May 18, 2012, we amended our Articles of Incorporation to change our name to Sterling Consolidated Corp.

Our largest subsidiary is Sterling Seal & Supply, Inc. (“Sterling Seal”), a New Jersey corporation which was incorporated in 1997. Its predecessor was Sterling Plastic & Rubber Products, Inc., incorporated in New Jersey and was founded in 1970. Sterling Seal engages primarily in the distribution and sale of O-rings, rubber seals, oil seals, custom molded rubber parts, custom Teflon parts, Teflon rods, O-ring cord, bonded seals, O-ring kits, and stuffing box sealant.

We also own real property through our subsidiaries ADDR Properties, LLC (“ADDR”) and Q5 Ventures, LLC (“Q5”). ADDR owns a 28,000 square foot facility in Neptune, New Jersey, that is primarily used by Sterling Seal for its operations. ADDR also owns another property in Cliffwood Beach, New Jersey, that was previously occupied by Sterling Seal and is now rented out to tenants. Q5 owns a 5,000 square foot facility that is used by Sterling Seal in Florida.

In addition, our subsidiary Integrity Cargo Freight Corporation (“Integrity”) is a freight forwarding business. Integrity shares a facility with Sterling Seal and manages the importation of Sterling Seal’s products and exports products on behalf of Sterling Seal to various countries.

Recent Financings

Private Placements

In January of 2012, Sterling Seal and Supply, Inc. conducted a private placement under Rule 506 of Regulation D. In the offering, Sterling Seal and Supply, Inc. sold a total of 697,040 shares of common stock at $0.30 per share to 36 investors prior to the June 8, 2012 share exchange agreement for total proceeds of $209,112.

In June 2012, Sterling Consolidated Corp. conducted a private placement selling an additional 100,333 shares to 2 investors for a total investment of $30,100.

In December of 2012, Sterling Consolidated Corp. obtained an equity investment of $35,000 in exchange for 116,667 shares from one investor.

Results of Operations

Comparison of the year ended December 31, 2013 and 2012

Revenues

For the years ended December 31, 2013 and 2012 we generated revenues of $6,185,148 and $5,851,201, respectively. This represents an increase by approximately $333,947 or approximately 5.7%.

The increase in revenue was primarily attributed to improved sales and marketing efforts and the Company’s incremental sales from the acquisition made during the 3rd quarter of 2013.

| 11 |

Total Cost of Sales

For the years ended December 31, 2013 and 2012 our overall cost of sales was $4,042,333 and $3,943,348, respectively. This represents an increase of $98,985 or 2.5%.

The increase in cost of sales can be explained by the corresponding sales increases, offset by decreasing prices in rubber products throughout the industry.

Gross profit

For the years ended December 31, 2013 and 2012 our gross profit was $2,142,815 and $1,907,853, respectively. This represents an increase of $234,962, or 12.3%.

This increase can be explained by a corresponding increase in revenue and a lesser increase in cost of sales. Additionally, a decrease in overall prices for rubber products has contributed to this increase.

Operating Expenses

For the years ended December 31, 2013 and 2012 operating expenses were $2,177,706 and $1,846,976, respectively. This represents an increase of $330,730 or 17.9%.

This increase can be explained by increased salary and benefits attributed to higher headcount, one-time write-offs of bad debts, and professional fees related to being a public company.

Other Income and Expense

Other Income and Expense decreased $25,486 from a gain of $18,531 for the year ended December 31, 2012 to a loss of $7,135 for the year ended December 31, 2013 primarily due to decreased rental revenues in anticipation of selling the Cliffwood Beach property in 2013.

Net Loss

As a result of the above factors, our overall net loss was $97,794 for the year ended December 31, 2013, as compared to a net loss of $15,366 for the year ended December 31, 2012.

This increase can be explained by increased costs of being a public company and increased general and administrative expenses as described above.

Liquidity and Capital Resources

Cash requirements for, but not limited to, working capital, capital expenditures, and debt repayments have been funded from cash balances on hand, revolver borrowings, loans from officers, notes payable and cash generated from operations.

At December 31, 2013, we had cash and cash equivalents of approximately $543,945 as compared to approximately $115,489 as of December 31, 2012, representing an increase of $428,456. This increase can be explained by increased debt financing in 2013, whereby the Company obtained additional commercial credit. At December 31, 2013 and 2012, our working capital was approximately $1,369,134 and $978,141, respectively.

The cash flows from operating activities decreased from net cash provided of $116,503for the year ended December 31, 2012 to net cash used of $45,751 for the year ended December 31, 2013. This decrease is primarily attributed to increased operating costs of being a public company and additional headcount related to the Company’s acquisition in the third quarter of 2013.

The cash flow from investing activities reflects an increase of capital spending from net cash used of $63,635 for the year ended December 31, 2012 to net cash used of $80,109 for the year ended December 31, 2013. This increase can be explained by the cash used for the acquisition made in the third quarter of 2013.

| 12 |

The cash flow from financing activities increased from net cash provided of $32,945 for the year ended December 31, 2012 to net cash provided of $554,316 for the year ended December 31, 2013. This increase is primarily attributed to increased commercial financing.

The Company intends to supplement its cash position with institutional financing via an equity credit facility in the second quarter of 2014.

In 2012, the Company made capital expenditures of $63,635 for a Company vehicle and an upgrade to the phone system and the security and fire system for the warehouse and headquarters. $46,115 of this was financed with a 5-year note payable and the remainder was purchased with cash or other assets.

The Company intends to use the equity markets via an equity credit facility, to obtain financing in the current fiscal year. Any world events or other economic occurrences that adversely affect the equity markets, may hinder our ability to raise the additional capital desired.

Bank Loans

The Company refinanced its debt in 2013 with a New York commercial bank and there are currently a $1.25 million line of credit and a $1,200,000 mortgage outstanding. The line of credit calls for a variable interest rate of the Wall St. Journal published prime rate plus 1% and requires an annual review. The mortgage has a variable rate of LIBOR plus 4.25% and is for a 5 year term expiring in October of 2018.

Critical Accounting Policies

Use of Estimates

The preparation of consolidated financial statements in accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. A change in management’s estimates or assumptions could have a material impact on the Company’s financial condition and results of operations during the period in which such changes occurred. Significant estimates include the estimated depreciable lives of fixed assets, inventory reserves and allowance for doubtful accounts.

Actual results could differ from those estimates. The Company’s consolidated financial statements reflect all adjustments that management believes are necessary for the fair presentation of their financial condition and results of operations for the periods presented.

Cash and Cash Equivalents

For purposes of the statement of cash flows, the Company considers all highly liquid debt instruments purchased with a maturity of three months or less to be cash equivalents. At times, balances in a single bank account may exceed federally insured limits.

Accounts Receivable

Accounts receivable, if any, are carried at the expected net realizable value. The allowance for doubtful accounts, when determined, will be based on management's assessment of the collectability of specific customer accounts and the aging of the accounts receivables. If there were a deterioration of a major customer's creditworthiness, or actual defaults were higher than historical experience, our estimates of the recoverability of the amounts due to us could be overstated, which could have a negative impact on operations. The Company is subject to the following concentration risk: one (1) customer accounted for 11% and 10.8% of accounts receivable in 2013, and 2012 respectively. This same customer accounted for 10.4% and 7.8% of sales for the periods ended December 31, 2013 and 2012, respectively.

| 13 |

The Company’s accounts receivable net of allowances were $801,861 and $802,151on December 31, 2013 and 2012, respectively. The Company’s allowance is approximately 2% of the sales per year plus amounts that are deemed uncollectible.

Property, Plant and Equipment

Property and equipment are carried at cost. Expenditures for maintenance and repairs are charged against operations. Renewals and betterments that materially extend the life of the assets are capitalized. When assets are retired or otherwise disposed of, the cost and related accumulated depreciation are removed from the accounts, and any resulting gain or loss is reflected in income for the period. The Company allocates 50% of its depreciation and amortization expenses to Cost of Sales.

Depreciation is computed for financial statement purposes on a straight-line basis over estimated useful lives of the related assets. The estimated useful lives of depreciable assets are:

| Estimated | ||

| Useful Lives | ||

| Building & Leasehold Improvements | 10-40 years | |

| Machinery and Equipment | 5-10 years | |

| Furniture and Fixtures | 5-10 years | |

| Vehicles | 10 years | |

| Software | 3 years |

For federal income tax purposes, depreciation is computed under the modified accelerated cost recovery system. For financial statements purposes, depreciation is computed under the straight-line method or double declining balance method.

| 2013 | 2012 | |||||||

| Land, building & leasehold improvements | $ | 2,342,747 | $ | 2,275,322 | ||||

| Machinery and equipment | 785,367 | 820,143 | ||||||

| Vehicles | 197,943 | 197,943 | ||||||

| Less: accumulated depreciation | 731,060 | 609,109 | ||||||

| Property and equipment, net | $ | 2,594,997 | $ | 2,684,299 | ||||

Depreciation expense included as a charge to income was $119,531 and $111,192 for the year ended December 31, 2013 and 2012, respectively.

Inventories

Inventories, which are comprised of finished goods, are stated at the lower of cost (based on the first in, first out method) or market. Cost does not include shipping and handling fees, which are charged directly to income. The Company provides for estimated losses from obsolete or slow-moving inventories, which is approximately 4% of the total inventory, and writes down the cost of inventory at the time such determinations are made. Reserves are estimated based upon inventory on hand, historical sales activity, industry trends, the business environment, and the expected net realizable value. The net realizable value is determined based upon current awareness of market prices. The Company recorded an inventory reserve of $125,000 and $123,000 as of December 31 2013 and 2012, respectively.

| 14 |

Revenue Recognition

The Company recognizes revenue based on Account Standards Codification (“ASC”) 605 “Revenue Recognition” which contains Securities and Exchange Commission Staff Accounting Bulletin No. 101, “Revenue Recognition in Financial Statements’ and No. 104, “Revenue Recognition”. In the case of Sterling, revenue is recognized only when the price is fixed or determinable, persuasive evidence of an arrangement exists, shipment of the product has occurred, price is fixed or determinable and collectability of the resulting receivable is reasonably assured. For provision of third-party freight services provided by Integrity, revenue is recognized on a gross basis in accordance with ASC 605-45 " Revenue Recognition: Principal Agent Considerations " since Integrity is the primary obligor in its shipping arrangements. Revenue is generally recognized when the contracted goods arrive at their destination point. When revenues and expenses straddle a period end due to the time between shipment and delivery, Integrity allocates revenue between reporting periods based on relative transit time in each period with expenses recognized as incurred. Cost of goods is comprised of sale of O-rings and related rubber products. Freight services is comprised of freight forwarding and related services earned by Integrity and Rental services is comprised of revenue from rental of commercial space to third parties.

The Company had total sales of $6,185,148 and $5,786,286 for the year ended December 31, 2013 and 2012, respectively. No one customer comprised more than 10% of sales for the years ended December 31, 2013 and 2012, respectively.

Expenses

Cost of goods includes inventory costs, warehousing costs, direct labor and a depreciation allocation. Cost of inbound freight of $388,204 and $248,348, for the years ended December 31, 2013 and December 31, 2012, respectively, is included in cost of goods on the Statements of Operations.

Costs of services include direct costs for Freight services and Rental activities. The direct costs include agent fees, trucking, air and ocean freight and customs fees for the Freight services and repairs and maintenance and property taxes for the rental activities. Additionally, Cost of services includes direct labor for Freight services.

Sales and marketing includes direct labor and direct sales and marketing expenses.

General and administrative expenses include administrative and executive personnel, depreciation and other overhead expenses.

Advertising

Advertising expenses are recorded as sales and marketing expenses when they are incurred. The Company did not incur such expenses during the years ended December 31, 2013 and 2012.

Income Tax

Sterling and Integrity's S-Corporation election terminated effective January 1, 2012 in connection with the expectation of the initial public offering of the Company’s common stock in 2012. From Sterling and Integrity's inception in 1997 and 2008, respectively, it neither was not subject to federal and state income taxes since they were operating under an S-Corporation election. As of January 1, 2012, both Sterling and Integrity became subject to corporate federal and state income taxes. The consolidated financial statements presented herein, are presented as if all consolidating entities were subject to C-corporation taxes for the periods being reported on.

Under the asset and liability method prescribed under ASC 740, Income Taxes, the Company uses the liability method of accounting for income taxes. The liability method measures deferred income taxes by applying enacted statutory rates in effect at the balance sheet date to the differences between the tax basis of assets and liabilities and their reported amounts on the financial statements. The resulting deferred tax assets or liabilities have been adjusted to reflect changes in tax laws as they occur. A valuation allowance is provided when it is more likely than not that a deferred tax asset will not be realized.

| 15 |

The Company recognizes the financial statement benefit of an uncertain tax position only after considering the probability that a tax authority would sustain the position in an examination. For tax positions meeting a "more-likely-than-not" threshold, the amount to be recognized in the financial statements will be the benefit expected to be realized upon settlement with the tax authority. For tax positions not meeting the threshold, no financial statement benefit is recognized. As of December 31, 2011, the Company had no uncertain tax positions. The Company recognizes interest and penalties, if any, related to uncertain tax positions as general and administrative expenses. The Company currently has no federal or state tax examinations nor has it had any federal or state examinations since its inception. Tax years 2010, 2011, 2012, and 2013 are subject to federal and state tax examination under the current statutes.

Fair Value Measurements

In January 2010, the FASB ASC Topic 825, Financial Instruments, requires disclosures about fair value of financial instruments in quarterly reports as well as in annual reports. For the Company, this statement applies to certain investments and long-term debt. Also, the FASB ASC Topic 820, Fair Value Measurements and Disclosures, clarifies the definition of fair value for financial reporting, establishes a framework for measuring fair value and requires additional disclosures about the use of fair value measurements.

Various inputs are considered when determining the value of the Company’s investments and long-term debt. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in these securities. These inputs are summarized in the three broad levels listed below.

| · | Level 1 – observable market inputs that are unadjusted quoted prices for identical assets or liabilities in active markets. |

| · | Level 2 – other significant observable inputs (including quoted prices for similar securities, interest rates, credit risk, etc…). |

| · | Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments). |

The Company’s adoption of FASB ASC Topic 825, effectively at the beginning of the second quarter in FY 2010, did not have a material impact on the company’s financial statements.

The carrying value of financial assets and liabilities recorded at fair value is measured on a recurring or nonrecurring basis. Financial assets and liabilities measured on a non-recurring basis are those that are adjusted to fair value when a significant event occurs. The Company had no financial assets or liabilities carried and measured on a nonrecurring basis during the reporting periods. Financial assets and liabilities measured on a recurring basis are those that are adjusted to fair value each time a financial statement is prepared.

Recent Accounting Pronouncements

In April 2011, the FASB issued ASU 2011-02, “Receivables (Topic 310) A Creditor’s Determination of Whether a Restructuring Is a Troubled Debt Restructuring”. The update clarifies the guidance on a creditor’s evaluation of whether it has granted a concession as well as clarifying the guidance when a creditor’s evaluation of whether a debtor is experiencing financial difficulties. The guidance clarifies when a Company should record impairment due to concessions or the financial difficulties of the debtor. The new standard is effective for fiscal years and interim periods ending after June 15, 2011. The guidance should be applied retrospectively to restructurings occurring on or after the beginning of the fiscal year of adoption. The adoption did not have a material effect on the Company’s consolidated financial position or results of operations.

| 16 |

In April 2011, the FASB issued ASU 2011-03, “Transfers and Servicing (Topic 860) Reconsideration of Effective Control for Repurchase Agreements”. ASU 2011-03 applies to transactions where the seller transfers financial assets that both entitle and obligate the transferor to repurchase or redeem the financial assets before their maturity. The amendments in this guidance remove from the assessment of effective control the criteria requiring the transferor to have the ability to repurchase or redeem the financial assets on substantially the agreed terms even in the event of default by the transferee and the collateral maintenance guidance related to that criterion. The new standard is effective for fiscal years and interim periods ending after December 15, 2011 and should be applied on a prospective basis. The adoption does not have a material effect on the Company’s consolidated financial position or results of operations.

In May 2011, the FASB issued ASU 2011-04, “Fair Value Measurement (Topic 820), Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS”. The amendment results in a consistent definition of fair value and ensures the fair value measurement and disclosure requirements are similar between GAAP and International Financial Reporting Standards (“IFRS”). This amendment changes certain fair value measurement principles and enhances the disclosure requirements particularly for Level 3 fair value measurements. This amendment will be effective for the Company on January 1, 2012. Based on current operations, the adoption is not expected to have a material effect on the Company’s consolidated financial position or results of operations.

In June 2011, the Financial Accounting Standards Board (“FASB”) issued ASU 2011-05, “Comprehensive Income (Topic 220), and Presentation of Comprehensive Income”. ASU 2011-05 amends the presentation of other comprehensive income and the Statement of Consolidated Operations. Under this amendment, entities will be required to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. Regardless of which reporting option is selected, the Company is required to present on the face of the financial statements, reclassification adjustments for items that are reclassified from other comprehensive income to net income in the statements where the components of net income and the components of other comprehensive income are presented. The current option to report other comprehensive income and its components in the statement of changes in equity has been eliminated. This amendment will be effective for the Company on January 1, 2012 and full retrospective application is required. The Company does not anticipate that this amendment will have a material impact on its financial statements.

Off-Balance Sheet Arrangements

We do not have any off balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, sales or expenses, results of operations, liquidity or capital expenditures, or capital resources that are material to an investment in our securities.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk.

Not applicable because we are a smaller reporting company.

Item 8. Financial Statements and Supplementary Data.

Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure.

As previously disclosed in Amendment Number 1 to Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on August 20, 2013 (the “8-K/A”), the Company accepted the resignation of Sam Kan & Company (“Sam Kan”) as Independent Registered Public Accountants on August 6, 2013. Sam Kan advised the Audit Committee that their firm will no longer be servicing public clients. On August 6, 2013, the Board of Directors of the Company accepted such resignation.

During the fiscal years ended December 31, 2011 and 2012 and through Sam Kan’s resignation on August 6, 2013, there were (1) no disagreements with Sam Kan on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedures, which disagreements, if not resolved to the satisfaction of Sam Kan, would have caused Sam Kan to make reference to the subject matter of the disagreements in connection with its reports, and (2) no events of the type listed in paragraphs (A) through (D) of Item 304(a)(1)(v) of Regulation S-K. The report of Sam Kan on the Company's financial statements for the years ended December 31, 2011 and 2012 did not contain any adverse opinion or disclaimer of opinion and was not qualified or modified as to uncertainty, audit scope or accounting principles.

| 17 |

On August 19, 2013, we furnished Sam Kan with a copy of the disclosure in the 8-K/A, providing Sam Kan with the opportunity to furnish the Company with a letter addressed to the SEC stating whether it agrees with the statements made by us in the 8-K/A in response to Item 304(a) of Regulation S-K and, if not, stating the respect in which it does not agree. A copy of Sam Kan’s letter to the SEC is filed as Exhibit 16.1 to this Annual Report on Form 10-K and is hereby incorporated by reference.

Engagement of New Independent Registered Public Accounting Firm

Concurrent with the acceptance of Sam Kan’s Resignation as our independent registered public accounting firm, the Board of Directors of the Company appointed Sadler, Gibb & Associates, LLC (“Sadler”) as our independent registered public accounting firm.

During the years ended December 31, 2012 and 2011 and through the date hereof, neither the Company nor anyone acting on its behalf consulted Sadler with respect to (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided to the Company or oral advice was provided that Salder concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issues; or (ii) any matter that was the subject of a disagreement or reportable events set forth in Item 304(a)(1)(iv) and (v), respectively, of Regulation S-K.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

Pursuant to Rule 13a-15(b) under the Securities Exchange Act of 1934 (“Exchange Act”), the Company carried out an evaluation, with the participation of the Company’s management, including the Company’s Chief Executive Officer (“CEO”) and Chief Financial Officer (“CFO”) (the Company’s principal financial and accounting officer), of the effectiveness of the Company’s disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period covered by this report. Based upon that evaluation, the Company’s CEO and CFO concluded that the Company’s disclosure controls and procedures are not effective to ensure that information required to be disclosed by the Company in the reports that the Company files or submits under the Exchange Act, is recorded, processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information is accumulated and communicated to the Company’s management, including the Company’s CEO and CFO, as appropriate, to allow timely decisions regarding required disclosure.

Management's Annual Report on Internal Control Over Financial Reporting.

The management of the Company is responsible for establishing and maintaining adequate internal control over financial reporting for the Company. Our internal control system was designed to, in general, provide reasonable assurance to the Company’s management and board regarding the preparation and fair presentation of published financial statements, but because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management assessed the effectiveness of the Company’s internal control over financial reporting as of December 31, 2013. The framework used by management in making that assessment was the criteria set forth in the document entitled “ Internal Control – Integrated Framework” issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that assessment, our CEO and CFO have determined and concluded that, as of December 31, 2013, the Company’s internal control over financial reporting was not effective.

| 18 |

As defined by Auditing Standard No. 5, “An Audit of Internal Control Over Financial Reporting that is Integrated with an Audit of Financial Statements and Related Independence Rule and Conforming Amendments,” established by the Public Company Accounting Oversight Board ("PCAOB"), a material weakness is a deficiency or combination of deficiencies that result in a more than a remote likelihood that a material misstatement of annual or interim financial statements will not be prevented or detected. In connection with the assessment described above, management identified the following control deficiencies that represent material weaknesses as of December 31, 2012:

| (1) | Lack of an independent audit committee or audit committee financial expert. Although our board of directors serves as the audit committee it has no independent directors These factors are counter to corporate governance practices as defined by the various stock exchanges and may lead to less supervision over management. |

| (2) | We do not have sufficient experience from our accounting personnel with the requisite U.S. GAAP public company reporting experience that is necessary for adequate controls and procedures. |

| (3) | Need for greater integration, oversight, communication and financial reporting of the books and records of our satellite offices. |

Our management determined that these deficiencies constituted material weaknesses.

Due to our small size, we were not able to immediately take any action to remediate these material weaknesses. In the second quarter of 2014, we have invested in a sophisticated cloud based inventory management and general ledger software that should improve our internal controls. The implementation is scheduled for the third quarter of 2014. We plan to address the control deficiencies in the near future. Notwithstanding the assessment that our Internal Controls over Financial Reporting was not effective and that there were material weaknesses identified herein, we believe that our consolidated financial statements contained in this Annual Report fairly present our financial position, results of operations and cash flows for the years covered thereby in all material respects.

This annual report does not include an attestation report of the Company’s registered public accounting firm regarding internal control over financial reporting. Management's report was not subject to attestation by the Company's registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit the Company to provide only management's report in this annual report.

Changes in Internal Control over Financial Reporting

No change in our system of internal control over financial reporting occurred during the period covered by this report, fourth quarter of the fiscal year ended December 31, 2013 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

PART III

Item 10. Directors, Executive Officers and Corporate Governance.

The following table sets forth the name and age of officers and director as of April 12, 2013. Our Executive officers are elected annually by our Board of Directors. Our executive officers hold their offices until they resign, are removed by the Board, or his successor is elected and qualified.

| Name | Age | Position | ||

| Angelo DeRosa | 71 | Chairman of the Board | ||

| Darren DeRosa | 40 | Chief Executive Officer | ||

| Scott Chichester | 43 | Chief Financial Officer |

Set forth below is a brief description of the background and business experience of our executive officer and director for the past five years.

| 19 |

Angelo DeRosa, Chairman of the Board

Angelo DeRosa founded the Company’s predecessor entity, Sterling Plastic & Rubber Products, Inc. in 1970. Angelo currently serves as Chairman of the Board of the Directors of the Company and is responsible for the financing and overall management of the entire organization. He also maintains key relationships with customers, banking institutions and industrial affiliations. Angelo studied Business Administration while attending Fairleigh Dickinson University. He is currently involved in multiple charitable organizations, including serving as treasurer of the Holmdel First Aid.

Darren DeRosa, Chief Executive Officer

Darren DeRosa has served as the chief executive officer of the Company since 2000. Darren runs the day-to-day operations of the Company, including managing business development projects in information technology, logistics and human resources, and seeking out potential acquisition targets. Darren earned a B.A. in Economics from Dickinson University and an M.B.A. from Monmouth University.

Scott Chichester, Chief Financial Officer

Scott R. Chichester CPA is the proprietor of Scott R. Chichester CPA, a New York City based accounting, tax and consulting firm. Mr. Chichester is experienced in taxation, capital formation and the financial services industry. He focuses his practice in the following areas: (i) corporate taxation; (ii) financial statement preparation and (iii) consulting. His most recent consulting engagement has been for the City of New York.

Prior to establishing the firm in 2001, Mr. Chichester worked in the financial services division as an auditor for Ernst & Young in New York City until 1994 when he passed the CPA exam. Mr. Chichester then spent 5 years as an accountant in the Equities Controllers Division at Goldman Sachs Group LP.

Within the last 5 years, Mr. Chichester CPA (Since 2001); Founder DirectPay USA LLC (Since 2006) (payroll company); CFO of Ong Corporation (2002-2008) (technology company) Founder Madison Park Advisors LLC (since 2010) (advisory services). None of these companies are a parent, subsidiary or other affiliate of the registrant.

Other directorships held during the last 5 years: Global X Funds (2008-present) (ETF fund complex); 58 funds. None of the funds in the fund complex are a parent, subsidiary or other affiliate of the registrant; Bayview Acquisition Corp (2010-August 13, 2012).

Identification of Certain Significant Employees

Fred Zink, President of Sterling Seal and Supply, Inc.,

Fred Zink, 65, has served as President of Sterling Seal and Supply, Inc. since 2008. All of the divisional Vice Presidents report directly to Mr. Zink. He is also responsible for all activities related to human resources, accounting and productivity. Mr. Zink also manages the sales and support staff for Sterling Seal for the southeast region. Mr. Zink graduated from Mount Wachusett Community College in 1969 with an associate’s degree in Business Administration.

Mr. Zink has worked for Sterling Seal and no other employers for the past five. Additionally, he has never held any other directorships.

Family Relationship

The Company’s Chairman, Angelo DeRosa, is the father of the Company’s Chief Executive Officer, Darren DeRosa.

Involvement in Certain Legal Proceedings

To the best of our knowledge, none of our directors or executive officers has, during the past ten years:

| 20 |

| · | been convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other minor offenses); |

| · | had any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or within two years prior to that time; |

| · | been subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities, or to be associated with persons engaged in any such activity; |

| · | been found by a court of competent jurisdiction in a civil action or by the Securities and Exchange Commission or the Commodity Futures Trading Commission to have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated; |

| · | been the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or |

| · | been the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory organization (as defined in Section 3(a)(26) of the Exchange Act), any registered entity (as defined in Section 1(a)(29) of the Commodity Exchange Act), or any equivalent exchange, association, entity or organization that has disciplinary authority over its members or persons associated with a member. |

Except as set forth in our discussion below in “Certain Relationships and Related Transactions,” none of our directors or executive officers has been involved in any transactions with us or any of our directors, executive officers, affiliates or associates which are required to be disclosed pursuant to the rules and regulations of the Commission.

Term of Office

Our directors are appointed for a one-year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Code of Ethics

We do not have a code of ethics that applies to our officers, employees and directors.

Corporate Governance

The business and affairs of the company are managed under the direction of our board. Each of our directors has attended all meetings either in person or via telephone conference. In addition to the contact information in this annual report, each stockholder will be given specific information on how he/she can direct communications to the officers and directors of the corporation at our annual stockholders meetings. All communications from stockholders are relayed to the members of the board of directors.

Role in Risk Oversight

Our board of directors is primarily responsible for overseeing our risk management processes. The board of directors receives and reviews periodic reports from management, auditors, legal counsel, and others, as considered appropriate regarding our company’s assessment of risks. The board of directors focuses on the most significant risks facing our company and our company’s general risk management strategy, and also ensures that risks undertaken by our company are consistent with the board’s appetite for risk. While the board oversees our company’s risk management, management is responsible for day-to-day risk management processes. We believe this division of responsibilities is the most effective approach for addressing the risks facing our company and that our board leadership structure supports this approach.

| 21 |

Section 16(a) Beneficial Ownership Reporting Compliance

The Company does not have a class of securities registered under the Exchange Act and therefore its directors, executive officers, and any persons holding more than ten percent of the Company’s common stock are not required to comply with Section 16 of the Exchange Act.

Item 11. Executive Compensation.

The following executives of the Company received compensation in the amounts set forth in the chart below for the fiscal years ended December 31, 2012 and 2011. No other item of compensation was paid to any officer or director of the Company other than reimbursement of expenses.

Summary Compensation Table

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Stock Awards ($) | Option Awards ($) | Non-Equity Incentive Plan Compensation ($) | Non-Qualified Deferred Compensation Earnings ($) | All Other Compensation ($) | Totals ($) | |||||||||||||||||||||||

| Darren DeRosa, Chief Executive Officer | 2013 | $ | 141,774 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 141,774 | |||||||||||||||||||||

| 2012 | $ | 106,000 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 106,000.00 | ||||||||||||||||||||||

| Scott Chichester, Chief Financial Officer | 2013 | $ | 0 | 0 | 0 | 0 | 0 | 0 | 0 | $ | 0 | |||||||||||||||||||||

| 2012 | $ | 0 | 0 | 0 | 0 | 0 | 0 | 7,865 | (1) | $ | 7,865 | |||||||||||||||||||||

| (1) | Compensation for tax preparation services in connection with Company’s tax filings. |

Outstanding Equity Awards at Fiscal Year-End Table

There were no outstanding equity awards for the years ended December 31, 2013 and 2012.

Compensation of Directors

The following table provides information for 2013 regarding all compensation awarded to, earned by or paid to each person who served as a non-employee director for some portion or all of 2013. Other than as set forth in the table, to date we have not paid any fees to or, except for reasonable expenses for attending Board and committee meetings, reimbursed any expenses of our directors, made any equity or non-equity awards to directors, or paid any other compensation to directors.

| Name and Principal Position | Year | Fees Earned ($) | Stock Awards ($) | All Other Compensation ($) | Totals ($) | |||||||||||||

| Angelo DeRosa, Chairman of the Board | 2013 | $ | 0 | 0 | 0 | $ | 0 | |||||||||||

| 2012 | $ | 10,000 | $ | 10,000 | ||||||||||||||

Employment Agreements

Currently, we do not have any employment agreement in place with any of our officers and directors.

| 22 |

Item 12. Security Ownership of Certain Beneficial Owners and Management.

The following table provides the names and addresses of each person known to us to own more than 5% of our outstanding shares of common stock as of April 11, 2014, and by the officers and directors, individually and as a group. Except as otherwise indicated, all shares are owned directly and the shareholders listed possesses sole voting and investment power with respect to the shares shown.

| Name | Number of Shares Beneficially Owned |

Percent of Class (1) | ||||||

| Angelo DeRosa (2) 1105 Green Grove Road Neptune, New Jersey 07753 |

16,560,000 | (5) | 43.78 | % | ||||

| Darren DeRosa (3) 1105 Green Grove Road Neptune, New Jersey 07753 |

16,560,000 | (6) | 43.78 | % | ||||

| Scott R. Chichester (4) 676a 9th Ave. Ste 239 New York, NY 10036 |

1,027,000 | 2.72 | % | |||||

| All Executive Officers and Directors as a group (3 persons) | 34,290,000 | 90.66 | % | |||||

| (1) | Based on 37,824,040 shares of common stock outstanding as of April 11, 2014. |

| (2) | Angelo DeRosa is the Chairman of the Board of the Company. |

| (3) | Darren DeRosa is the Chief Executive Officer of the Company. |

| (4) | Scott Chichester is the Chief Financial Officer of the Company. |

| (5) | Includes 16,290,000 shares issued to Angelo DeRosa and 270,000 shares issued to Darleen DeRosa who is his wife. |

| (6) | Includes 16,290,000 shares issued to Darren DeRosa and 270,000 shares issued to Kaveeta DeRosa who is his wife. |

Item 13. Certain Relationships and Related Transactions, and Director Independence.

The following are the related party transactions in which we have engaged since January 1, 2010: