Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - Yongye International, Inc. | v373659_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Yongye International, Inc. | v373659_ex31-2.htm |

| EX-32 - EXHIBIT 32 - Yongye International, Inc. | v373659_ex32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________

FORM 10-K/A

Amendment No. 1

| x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2013 | |

| OR | |

| ¨ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from _____ to _____ |

| COMMISSION FILE NO. 001-34444 |

YONGYE INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| NEVADA | 20-8051010 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

6th Floor, Suite 608, Xue Yuan International Tower,

No. 1 Zhichun Road, Haidian District, Beijing, PRC

(Address of principal executive offices)

+86 10 8231 8866

(Issuer’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value US$0.001 per share | NASDAQ Global Select Market |

Securities Registered Pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act.

Yes ¨ No x

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No £

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. £

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer” and “large accelerated filer” in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer £ | Accelerated Filer x | Non-Accelerated Filer £ | Smaller Reporting Company £ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes £ No x

The aggregate market value of the 39,573,497 shares of common equity stock held by non-affiliates of the Registrant was approximately US$211,718,209 on the last business day of the Registrant’s most recently completed second fiscal quarter, based on the last sale price of the registrant’s common stock on the most recent date on which a trade in such stock took place prior thereto.

There were a total of 50,685,216 shares of the registrant’s Common Stock, par value US$0.001 per share, outstanding as of April 10, 2014.

EXPLANATORY NOTE

This Amendment No. 1 (“Amendment No. 1”) to the Annual Report on Form 10-K of Yongye International, Inc. (together with its subsidiaries, the “Company,” “Yongye,” “we,” “our” or “us”) for the fiscal year ended December 31, 2013 as originally filed with the Securities and Exchange Commission (“SEC”) on March 17, 2014 (the “2013 Annual Report”), is being filed to (i) amend certain disclosures contained in Item 1. Business regarding our cooperative joint venture in China, (ii) include additional disclosures regarding our proposed going private transaction and new planned manufacturing facilities in Item 1A Risk Factors and Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations and (iii) include in the 2013 Annual Report the information required by certain portions of Part III (Items 10, 11, 12 and 14) of Form 10-K.

This Amendment No. 1 does not affect any other portion of the 2013 Annual Report. Additionally, except as specifically referenced herein, this Amendment No. 1 does not reflect any event occurring after March 17, 2014, the filing date of the 2013 Annual Report.

TABLE OF CONTENTS

| PART I | |

| Item 1. Business | 3 |

| Item 1A. Risk Factors | 17 |

| PART II | |

| Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations | 37 |

| PART III | |

| Item 10. Directors, Executive Officers and Corporate Governance | 52 |

| Item 11. Executive Compensation | 57 |

| Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 61 |

| Item 14. Principal Accountant Fees and Services | 64 |

| PART IV | |

| Item 15. Exhibits and Financial Statement Schedules | 67 |

| Signatures | 70 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This 2013 Annual Report contains forward-looking statements and information relating to Yongye International, Inc., that is based on the beliefs of our management as well as assumptions made by and information currently available to us. When used in this 2013 Annual Report, the words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us or our management, are intended to identify forward-looking statements. These statements reflect our current view concerning future events and are subject to risks, uncertainties and assumptions, including among many others: a general economic downturn; a downturn in the securities markets; SEC regulations which affect trading in the securities of “penny stocks,” and other risks and uncertainties. Should any of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in this report as anticipated, estimated or expected. Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future. Important factors that may cause actual results to differ from those projected include the risk factors specified above. Notwithstanding the above, Section 27A of the Securities Act and Section 21E of the Securities Exchange Act expressly state that the safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time be considered as an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including statements regarding new and existing products and opportunities; statements regarding market and industry segment growth and demand and acceptance of new and existing products; any projections of sales, earnings, revenue, margins or other financial items; any statements of the plans, strategies and objectives of management for future operations; any statements regarding future economic conditions or performance; uncertainties related to conducting business in China; any statements of belief or intention; any of the factors mentioned in the “Risk Factors” section of this 2013 Annual Report; and any statements or assumptions underlying any of the foregoing. Also, forward-looking statements represent our estimates and assumptions only as of the date of this 2013 Annual Report. You should read this report or that we filed as exhibits hereto, completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in any forward-looking statements, even if new information becomes available in the future.

| 1 |

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by the context, references in this report to:

| · | “Yongye,” “we,” “us,” “YONG,” “the Company” or “our Company” are references to Yongye International, Inc.; |

| · | “YongyeNongfeng” is a reference to YongyeNongfeng Biotechnology Co., Ltd.; |

| · | “YongyeFumin” is a reference to Inner Mongolia YongyeFumin Biotechnology Co., Ltd.; |

| · | “Inner Mongolia Yongye” is a reference to Inner Mongolia Yongye Biotechnology Co., Ltd.; |

| · | “China” and “PRC” are references to the People’s Republic of China; |

| · | “Preferred Shares” are the Company’s Redeemable Series A convertible preferred shares, par value $.001; |

| · | “RMB” is a reference to Renminbi, the legal currency of China; |

| · | “U.S. dollar,” “$” and “US$” are references to the legal currency of the United States; |

| · | “Securities Act” is a reference to Securities Act of 1933, as amended; and |

| · | “Exchange Act” is a reference to the Securities Exchange Act of 1934, as amended. |

| 2 |

Part I

ITEM 1. Business

Business Overview

We are a leading crop nutrient company in China in term of total sales in 2013. We are primarily engaged in the research, development, manufacturing and sales of fulvic acid based crop and animal nutrient products for the agriculture and stock farming industry. We are headquartered in Beijing with production facilities in Hohhot, Inner Mongolia Autonomous Region of China (“Inner Mongolia”). Our products are sold nationwide in 30 provinces, autonomous regions and centrally-administered municipalities across China.

Currently, our principal product is our liquid crop nutrient products, from which we derived substantially all of our sales for the year ended December 31, 2013. We also produce powder animal nutrient product, which is mainly used for livestock. In 2012, we launched two new crop nutrient products, a crop seed nutrient product and a crop root nutrient product. The crop seed nutrient product helps crop seeds sprout and improves the growth of roots, and the crop root nutrient product improves crop roots’ ability to absorb water and fertilizers and enhance crop resistance against drought, freezing, diseases, and stalk leaning. We believe, by using our regular crop nutrient together with our new products at different stages of crop growth, the combined effectiveness of our products will further enhance crop yield. We market our regular crop and animal products under the trade name “Shengmingsu” (“生命素” in Chinese means “Life Essential”). Our new products for crop seeds and roots are named “Zhongbaosheng” and “Qianggenbao” respectively. We produce our liquid crop nutrient products, including the newly launched crop seed product and crop root product, based on our proprietary formulae utilizing fulvic acid as the primary compound base and combining with various micro nutrients such as zinc and boron, macro nutrients like nitrogen, phosphorous and potassium (“NPK”) and other nutrients that are essential for the crop health. Our crop nutrient’s core fulvic acid compound improves crop yield by enhancing the absorption of fertilizers and micro nutrients. In addition, the micro nutrients and NPK included in our crop nutrient formula serve as supplements during key growth stages of crops. We believe that our crop nutrient products are particularly well-suited for use in China, which generally has highly degraded farming soil as a result of over-farming, decades of over-use of chemical fertilizers and less advanced farming practices compared with more developed nations. Our regular crop nutrient product is most commonly applied by directly spraying onto leaves of crops after dilution with water, and is typically used at certain critical growth stages of crops in addition to normal fertilizer application. Our crop seed nutrient product is used by soaking the seeds in our product after water dilution. Soaking time and proportions of water to product vary among different crops and users should follow our product specifications. At the time that a seeding crop is transplanted, our crop root nutrient is used by applying the product onto the crop roots after water dilution and blending with soil. After the transplant, the water-diluted crop root product is used to irrigate the crops at the roots. Soaking time and water-product proportions during and after transplanting varies and users should follow our product specifications.

The efficacy of fulvic acid for enhancing crop yield is well-documented by over 20 global research reports published by universities and institutions in the United States, China, Europe and other countries. The Inner Mongolia Autonomous Region Scientific and Technology Bureau (“IMARSTB”) conducted an official assessment of our liquid crop nutrient product in 2008 and concluded that our product increases agricultural output, improves the utilization rate of fertilizer, enhances crop resistance to diseases and droughts. In addition, the IMARSTB concluded that large scale experimentation in China has proven that our product can increase overall yields of staple crops, such as wheat and rice by 10-20%, and vegetables and fruits by 15-30%, while also improving product quality. Many other third parties also conducted tests on our product’s efficacy on different crops and geographical locations in China, and they have drawn similar conclusions as documented in the IMARSTB assessment.

Our powder animal nutrient product consists of our fulvic acid compound base, additional nutrients and Chinese herbs. Our animal products are currently targeted at and administered to dairy cows and other livestock through mixture with feeds.

Industry and Market Overview

China Agriculture Industry

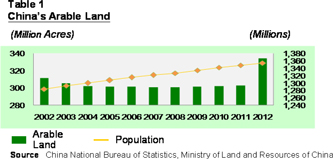

Limited Arable Land

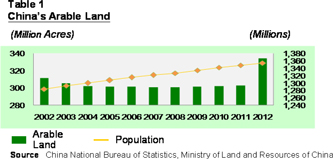

The long-term market growth of crop nutrient products in China is primarily driven by the need to improve crop yield to ensure sufficient food supply in view of limited per capita arable land in China. Currently, with only approximately 9% of the world’s arable land, China needs to feed 1.35 billion people, or approximately 19% of the world’s population. According to the National Population and Family Planning Commission of China, China’s population will reach 1.5 billion by 2030. Therefore, the country faces the challenge of producing additional food to feed the additional 200 million people within the next 20 years. This puts great pressure on China’s agricultural system to increase production output.

| 3 |

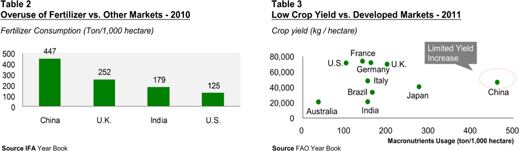

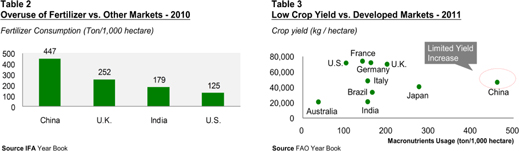

Over-farming, decades of overuse of chemical fertilizers and less advanced farming practices have led to degraded soil quality in China. Although, according to FAO (Food and Agriculture Organization), China leads the world in fertilizer consumption, applying more fertilizers than the world average on a per hectare basis, nevertheless, the crop yield lags behind most developed countries. This creates a huge demand for crop nutrient products that can help improve fertilizer utilization and increase crop yield. Fulvic acid based crop nutrients are particularly well suited for the market, as it can allow crops to more effectively absorb fertilizers and minerals from the degraded soils.

The market for our crop nutrient product is large and has attractive long-term growth prospects. China has 2.03 billion mu (each mu is equivalent to approximately 667 square meters) of arable land in total. Typically, each mu of arable land averagely requires more than 300 ml of our liquid crop nutrient product for one growing season. For the year of 2013, our crop nutrient product is estimated to have been used in approximately 6% of the arable land in China, assuming there is one and half growing season per annum on average for all the arable land across China.

Increasing Wealth is Expected to Increase Spending on Agricultural Products

As the economy grows and individual purchasing power expands in China, demand for more food products with higher quality is expected to increase. In China, huge reductions in poverty raised national average food consumption substantially, according to World Agriculture: towards 2015/2030, summary report by FAO of 2002. According to the Asian Development Bank, over 50% of China’s population is comprised of low income rural farmers. The government has pledged to narrow income gaps between urban and rural residents to tackle disparities in wealth levels. Farmers’ income achieved 10 consecutive years of fast growth since China’s reform and opening up, according to National Bureau of Statistics. The per-capita net income of rural residents reached RMB 8,896 (US$1,437) in 2013, up by 9.3% in real terms over the previous year. The figure is 1.6 percentage points higher than the GDP growth rate and 2.3 points higher than that of per capita disposable income of urban residents.

Government Support for the Agricultural Industry

According to the 12th Five-Year National Economic and Social Plan (2011-2015) of China, the Chinese government will continue to support the agriculture industry. Increasing agricultural production capacity and developing high-yield, high-quality and high-efficiency agriculture are the focus of the Chinese government. Given our product’s ability to improve fertilizer utilization, increase crop yield, improve product quality, and enhance drought-resistance, we expect that we will further benefit from the Chinese government’s agricultural policy.

In addition, agriculture continues to be a heavily invested sector in China. Brand name investors continue to invest into China’s agriculture industry because they have confidence in China’s long term outlook. The market volume for agricultural products is large, both for domestic sales and exports. This is driven by the growing domestic demand for higher quality food products and increased international reliance on food products from China. The No.1 central document of 2014 stated that, China should improve its national food security system, deepen rural land system reform and improve rural governance, while intensifying support and protection for agriculture and promoting financial support for rural areas.

| 4 |

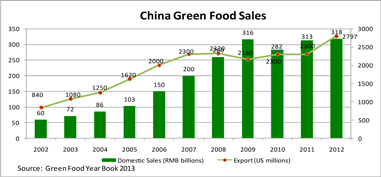

China Fertilizer Industry

Food safety is a top concern for Chinese shoppers, especially regarding such produce as vegetables, meat, seafood, grain, cooking oils and dairy goods, according to a report from IPSOS, an international research company. The rise of green food industry in China is also increasing the demand for environmental friendly fertilizers. According to the China Green Food Development Center, a governmental agency, China’s domestic sales of green food increased at a compound annual growth rate of 18.1% from RMB60 billion in 2002 to RMB318 billion in 2012, and China’s exports of green food increased at a compound annual growth rate of 12.8%, from US$840 million in 2002 to US$2.8 billion in 2012. In March 2011, our crop nutrient product obtained the certificate of production material for green food which was issued by the China Green Food Development Center. We believe China’s domestic market for green food will continue to expand as individual purchasing power grows in China and our business will benefit from this growth.

China’s Dairy Market

The growth of China’s economy has led to growth in consumer demand for dairy products and China’s government has attached great importance to the development of this industry, particularly after a food safety incident in China involving milk adulterated with melamine was widely reported in the international media during 2008 and 2010. In recent decades, China’s dairy market has matured rapidly. It was recorded by People’s Daily Online on January 31, 2013 that the number of dairy cattle in China was over 14 million as of 2012. However, China’s annual per capita dairy consumption is significantly lower than developed countries. According to Hongbin Gao, the Chairman of Dairy Association of China, China’s annual per capita dairy consumption is 32.4 kilograms, which accounts for less than one third of the average consumption globally.

Notwithstanding current consumption rates, the dairy market in China has great potential. According to China’s 12th Five-Year National Economic and Social Plan (2011-2015) of China, it is anticipated that the output of dairy raw material will be 50 million tons, and the output of dairy products will be 27 million tons by 2015. The Chinese government has increased efforts to regulate the industry and the industry has significantly increased barriers to entry.

Competitive Advantages

We believe that our competitive advantages include the following:

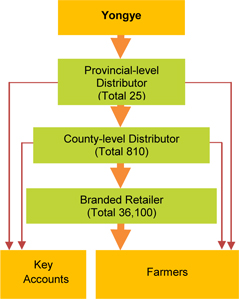

Unique and scalable distribution model. We employ a multi-tiered distribution model whereby we primarily sell our products to provincial-level distributors who sell to our end-customers either directly or indirectly through county-level and village-level distributors. We currently have 25 provincial-level distributors. For the most part, each distributor covers a single province, while the rest of them cover either multiple provinces or a portion of one province (in the case of Hebei, Inner Mongolia and Xinjiang). We select our provincial-level distributors based on criteria including experience, reputation, network coverage and financial strength, and we usually enter into multi-year distribution contracts with them. All of our contracts with provincial-level distributors include mutual exclusivity provisions whereby the provincial-level distributors are not allowed to distribute competing products, and we grant the distributor exclusive sales rights in the designated territory. We are careful to ensure that the sales territories of our provincial-level distributors do not overlap.

Our provincial-level distributors sell our products directly to county-level distributors, to key accounts, such as large farms, and farmers through promotional events. County-level distributors sell our products to independently owned Branded Retailers, which serve as village-level retailers of our products (“Branded Retailers”), large farms, and farmers through promotional events. Branded Retailers distribute our products directly to farmers in rural villages and towns. Most of them are privately owned individual agriculture stores while some have common ownership or belong to store chains. None of these Branded Retailers is owned or controlled by us. They are typically small in size and distribute a variety of agriculture-related products, including fertilizer, seeds and pesticides to farmers in the surrounding areas.

| 5 |

As of December 31, 2013, we sold our products primarily through 25 provincial-level distributors. There are 810 county-level distributors and 36,100 independently owned Branded Retailers across almost all provinces of China.

We believe that our unique distribution model has the following benefits:

| · | We leverage our distributors’ local knowledge and resources to enable quicker entry into new markets, to more efficiently reach potential Branded Retailers and to better communicate with farmers. |

| · | We have a highly scalable and replicable distribution model that can be replicated in new markets. We are thus uniquely situated amongst our competitors to take advantage of China’s growing market for agriculture nutrients. The significant expansion of our distribution network since 2008 has paralleled our robust growth in sales during the same period. |

| · | Our “Branded Retailer” concept creates a highly synergistic partnership among Yongye, our distributors and our Branded Retailers. We believe Branded Retailer owners embrace the Branded Retailer concept because they typically experience higher customer traffic and generate more sales as their stores become more prominent from the promotional displays and technical support we provide to them. We believe that our advertising campaign also effectively develops sales for distributors by attracting store owners to join our Branded Retailer network. With satisfied distributors and Branded Retailers, we are able to quickly scale up our distribution network and provide better service to our end-customers. |

Brand name recognition supported by integrated marketing campaign. Both of our regular crop and animal nutrient products are marketed under the name “Shengmingsu” and we believe that our integrated marketing campaign has led to widespread recognition of our brand name by our end-customers.

Our strategy is to build the Yongye brand by getting closer to farmers through both media channels as well as indoor and outdoor displays. We work with our distributors to coordinate advertisements on local television channels and in local newspapers. From 2009, we began running promotional campaign on CCTV-7, which is the national agriculture channel in China. Our Branded Retailers are decorated with our signature color and banners, and prominently display our products alongside promotional display materials that we provide. Working together with our distributors, we create posters with village-specific case studies that demonstrate a farmer’s incremental revenue, original investment and harvesting time saved from using our products. We believe these case studies have been a highly effective manner of marketing as they translate our product efficacy directly into dollar terms and are communicated through real stories which are connected with our end-customers.

In addition, we support our distributors and farmers by providing product training courses, conferences and seminars, product demonstrations, and educational pamphlets, magazines and infomercials.

Patented formulae and proprietary manufacturing processes for high-quality fulvic acid based nutrients backed by strong research and development platform. Our products are based on patented formulae that combine a fulvic acid base with other macro and micro nutrients. Our crop nutrient formula was designed to enhance crop yield by increasing absorption of fertilizer and micro nutrients and providing key micro nutrients and NPK in key growth stages of crops. In addition, our engineers designed our manufacturing process to overcome technical barriers associated with the extraction of fulvic acid and the blending of our products on an industrial scale so that micro and macro nutrients in our products are water soluble and can be easily absorbed by crops after being sprayed on the leaves. We have been granted nine 20-year invention patents by the State Intellectual Property Office in the PRC since 2005, which cover formulae for our various liquid crop nutrient products and powder animal nutrient product, as well as the manufacturing process for extraction and blending of our products. In addition to seeking patent protection, we maintain proprietary know-how related to extraction and blending processes as trade secrets. Both of our crop and animal nutrient products are protected by invention patents in China. They also won the top award for consecutive years at China Yangling Agricultural Hi-Tech Fair, one of the most prestigious agriculture trade fairs in China.

In addition to our internal research and development team with extensive experience in the agricultural research fields, we have established project partnerships with certain prestigious national and local agricultural universities and research institutes, including Chinese Academy of Agricultural Sciences, Beijing University of Agriculture, Inner Mongolia Agricultural University, and Inner Mongolia Academy of Agricultural Sciences.

| 6 |

Compelling value proposition of return on investment for farmers. Our patented crop product and animal product formulae are the results of large scale experimentation. Our internal experimentation on our products demonstrates increased production yields, shorter harvest times, extended life cycles, and enhanced crop taste, nutrition and appearance. As mentioned earlier, the IMARSTB concluded that our product can increase overall yields of staple crops, such as wheat and rice, and vegetables by 10 - 20% and 15 - 30%, respectively, while improving product quality.

Strength and experience of management team. We believe that our management team collectively has a great deal of experience in our relatively new market for agricultural nutrient products in China. Our chief executive officer, Mr. Zishen Wu, in particular, is considered a very successful entrepreneur in our industry. Additionally, our senior management team has many years of experience and strong education background in the Chinese agricultural industry, marketing and distribution, finance and general management.

Growth Strategies

Our strategic growth plan for 2014 consists of the following key elements.

Geographic expansion and higher penetration of our distribution and Branded Retailer network. We believe that there is significant market potential for our products across China and we plan to continue to enhance our coverage and penetration of the Chinese market in order to increase our market share and commercial opportunities. We believe this will further expand our immediate and long term revenue base. We believe that we can benefit from the growing market demand resulting from the increased need to boost agricultural productivity. In addition to driving further penetration in our existing markets, we plan to expand our distribution network in new geographic markets. We will also work to ensure continued successful replication of our Branded Retailer model in new markets by continuing to provide our distributors with value-added technical product and sales leadership training, and our integrated marketing campaigns support.

Enhance brand recognition on national and local levels. We will invest more resources on marketing efforts to enhance our brand image and increase our exposure in target markets, such as advertisement on national and local media and providing training and technical support to various levels of distributors, Branded Retailers and farmers.

Diversify product offering. We expect to offer new products in our distribution network, leveraging the strength of our channel and brand. In 2014, we are introducing a new water soluble humic acid product to diversify our product mix.

Share Exchange

We were incorporated in the State of Nevada on December 12, 2006 under the corporate name “Golden Tan, Inc.” At that time, we were engaged in the business of offering sunless tanning services and selling tanning lotions. In 2008, we began to pursue an acquisition strategy, whereby we sought to acquire an undervalued business with a history of operating revenues in markets that provide room for growth.

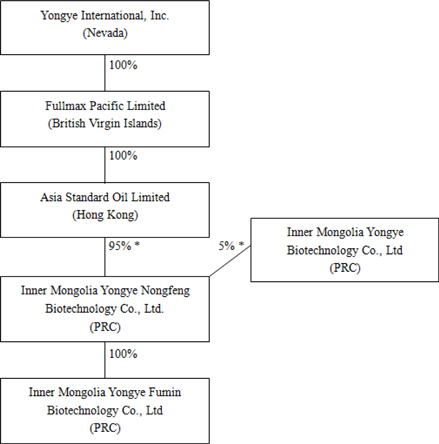

On April 17, 2008, we entered into a share exchange agreement with Fullmax Pacific Limited, a company organized under the laws of the British Virgin Islands (“Fullmax”), the shareholders of Fullmax, who together owned 100% of the equity of Fullmax, and our principal shareholder. Pursuant to the share exchange agreement, the Fullmax shareholders transferred to us 100% of Fullmax’s equity in exchange for 11,444,755 shares of our common stock (the “Share Exchange”). As a result of the Share Exchange, Fullmax became our wholly owned subsidiary.

Restructuring

At the time we acquired Fullmax, it had acquired certain assets that form the basis of our trading business from Inner Mongolia Yongye Biotechnology Co., Ltd., a company organized under the laws of the PRC (“Inner Mongolia Yongye”), and owned and controlled by Zishen Wu, our chairman, chief executive officer and president. The first step in this process occurred in November 2007, when Fullmax’s wholly-owned subsidiary, Asia Standard Oil Limited, a Hong Kong company (“Asia Standard”) entered into a Sino-foreign cooperative joint venture agreement with Inner Mongolia Yongye (the “2007 CJV Agreement”). The CJV which was formed was Yongye Nongfeng Biotechnology Co., Ltd (“Yongye Nongfeng”).

In connection with a September 2008 private placement of our common stock, we agreed with the investors participating in the transaction to complete the remaining steps necessary for acquiring the assets that form the basis of our operations from Inner Mongolia Yongye. We completed these remaining steps, which we refer to as the “Restructuring” in the Annual Report on Form 10-K, in October 2009. Prior to the Restructuring, Inner Mongolia Yongye owned and operated the principle assets of our business and had been in the business of researching, producing and selling its own fulvic acid based crop and animal products since 2003. Until Yongye Nongfeng obtained the required license to produce our products in May 2009, Inner Mongolia Yongye manufactured such products exclusively for us.

| 7 |

As part of the Restructuring and pursuant to the 2007 CJV Agreement, Inner Mongolia Yongye transferred to Yongye Nongfeng its management and other personnel, and the land, buildings and equipment comprising its manufacturing facility. In addition, Inner Mongolia Yongye assisted with obtaining the necessary governmental approvals required for these transfers, as well as with the issuance in May 2009 by the PRC Ministry of Agriculture of a fertilizer license, the patented technology under which was formerly held in the name of Inner Mongolia Yongye, to Yongye Nongfeng.

All of our operations are conducted through Yongye Nongfeng, and its 100% owned subsidiary Yongye Fumin. Pursuant to the 2007 CJV Agreement, among other things, (i) Asia Standard Oil was entitled to 90% of the profits distribution of Yongye Nongfeng and Inner Mongolia Yongye was entitled to 10%; (ii) upon the liquidation of Yongye Nongfeng and after its liquidation committee pays up all of its outstanding debts, the remaining properties were to belong to Inner Mongolia Yongye; and (iii) the board of Yongye Nongfeng shall consist of three directors, one of whom was to be appointed by Asia Standard Oil and two of whom were to be appointed by Inner Mongolia Yongye.

On December 1, 2007, Asia Standard Oil entered into a letter agreement (the“2007 Letter Agreement”) with Inner Mongolia Yongye, pursuant to which Inner Mongolia Yongye unconditionally and irrevocably granted Asia Standard Oil the right to nominate one of the two directors of Yongye Nongfeng that Inner Mongolia Yongye was entitled to appoint under the 2007 CJV Agreement and agreed to appoint such director at Asia Standard Oil’s nomination and request. Asia Standard Oil and Inner Mongolia Yongye have complied with the terms of the 2007 Letter Agreement, which still remains effective.

On June 5, 2009, Asia Standard Oil and Inner Mongolia Yongye entered into an amended cooperative joint venture contract to revise the profit-sharing percentage such that Asia Standard Oil and Inner Mongolia Yongye were entitled to 99.5% and 0.5% of Yongye Nongfeng’s profits distribution respectively.

On October 10, 2009, Asia Standard Oil and Inner Mongolia Yongye entered into the restated cooperative joint venture contract dated October 10, 2009 (the “2009 CJV Agreement”). Pursuant to the terms of the 2009 CJV Agreement, we are entitled to 95% of the profits of Yongye Nongfeng and Inner Mongolia Yongye is entitled to 5%. The 2009 CJV Agreement also provides that upon the liquidation of Yongye Nongfeng and after its liquidation committee pays up all of its outstanding debts, the remaining properties shall be distributed to its shareholders according to their respective profit distribution proportions of Yongye Nongfeng (thus, under the 2009 CJV Agreement, Asia Standard Oil would receive 95% of the assets).

Zishen Wu, our chairman, president and chief executive officer, owns 95.0% of the outstanding equity interests of Inner Mongolia Yongye and, therefore, is entitled to a portion of the profits of Yongye Nongfeng that are attributed to Inner Mongolia Yongye. Mr. Wu is the chairman of Inner Mongolia Yongye.

The following chart reflects our current organizational structure as of the date hereof. The ownership percentages of Yongye Nongfeng are approximations.

| * | Pursuant to the terms of the 2009 CJV Agreement we are entitled to 95% of the profits distribution of Yongye Nongfeng and Inner Mongolia Yongye is entitled to 5%. In preparing the consolidated financial statements, Inner Mongolia Yongye was noncontrolling interest holder as of December 31, 2011, 2012 and 2013. |

The Articles of Association of Yongye Nongfeng provide that the termination and dissolution of Yongye Nongfeng shall be unanimously approved by its board of directors. In addition, subject to PRC law, each shareholder has the right to terminate Yongye Nongfeng in certain circumstances, such as the inability of Yongye Nongfeng to continue operations due to the failure of the other shareholder’s failure to fulfill its obligations under the 2009 CJV Agreement and the Articles of Association of Yongye Nongfeng.

On July 20, 2010, Yongye Nongfeng set up a wholly-owned subsidiary, Inner Mongolia Yongye Fumin Biotechnology Co., Ltd. (“Yongye Fumin”), with the paid in capital of US$14,731,880 (equivalent to RMB100 million). Yongye Fumin is engaged in the manufacturing and sales of fulvic acid based liquid and powder nutrient compounds. Yongye Fumin expands our production capacity for fulvic acid based liquid and powder nutrient compounds. Yongye Fumin became fully operational since the first quarter of 2011.

| 8 |

Recent Developments

On September 23, 2013, the Company entered into an agreement and plan of merger (the “Merger Agreement”) with Full Alliance International Limited, a British Virgin Islands company (“Holdco”), Yongye International Limited, an exempted company with limited liability incorporated under the laws of the Cayman Islands and a wholly-owned subsidiary of Holdco (“Parent”), and Yongye International Merger Sub Limited, a Nevada corporation and a wholly owned subsidiary of Parent (“Merger Sub”, together with the Company, Holdco and Parent, the “Parties” and any one of them a “Party”). Pursuant to the Merger Agreement, upon the terms and subject to the conditions thereof, at the effective time of the merger, Merger Sub will be merged with and into the Company, the Company will become a wholly-owned subsidiary of Parent and each of the Company’s shares of common stock issued and outstanding immediately prior to the effective time of the merger will be converted into the right to receive US$6.69 in cash without interest, except for (i) shares owned by Holdco, Parent and Merger Sub, including shares of common stock and Preferred Shares to be contributed to Parent by Holdco, Mr. Zishen Wu, Prosper Sino Development Limited and MSPEA, immediately prior to the effective time of the merger pursuant to a contribution agreement, dated as of September 23, 2013, among Parent, Holdco, Mr. Zishen Wu, Prosper Sino Development Limited and MSPEA (except that, with respect to Prosper Sino, only such shares designated as “Prosper Sino rollover shares” in the preliminary proxy statement in connection with the special meeting of stockholders will be contributed), and (ii) shares of common stock held by the Company or any subsidiary of the Company ((i) and (ii) collectively, the “Excluded Shares”), which will be cancelled for no consideration and cease to exist as of the effective time of the merger. Currently, Holdco, Mr. Zishen Wu, Prosper Sino Development Limited and MSPEA, collectively beneficially own approximately 33.1% of the Company’s outstanding shares of common stock, on an as converted basis.

The Merger Agreement contained representations and warranties of the Parties that are, in general, customary for a transaction of this type. The assertions embodied in those representations and warranties were made solely for purposes of the contract among the Parties and may be subject to important qualifications and limitations agreed to by the Parties in connection with the negotiated terms. Moreover, some of those representations and warranties may not be accurate or complete as of any specified date, may be subject to a contractual standard of materiality different from those generally applicable to investors or may have been used for purposes of allocating risk among the Parties rather than establishing matters as facts.

The Parties have also agreed to certain covenants, including covenants requiring the Company to conduct its business in the ordinary course of business consistent with past practice in all material respects and use commercially reasonable efforts to preserve substantially intact its business organization and relationships with governmental authorities, customers, suppliers and other persons with which it has material business relations and keep available the services of its current officers and key employees through the effective time of the merger, except as expressly provided in the Merger Agreement.

The Merger Agreement also included customary termination provisions for both the Company and Parent. In specified circumstances, if the Merger Agreement is terminated, the Company shall pay Parent a termination fee in the amount of $4,000,000 or $2,000,000, as applicable, or receive from Parent a termination fee in the amount of $10,000,000. The Merger Agreement also provides that if the required stockholder approvals shall not have been obtained at the stockholders’ meeting, Parent shall reimburse the Company’s expenses up to $2,000,000.

The Company’s Board of Directors, acting upon the unanimous recommendation of a special committee of the Board of Directors comprised solely of independent and disinterested directors (the “Special Committee”), approved and adopted the Merger Agreement and recommended that the Company’s shareholders vote to approve the Merger Agreement. The Special Committee negotiated the terms of the Merger Agreement with the assistance of legal and financial advisors to the Special Committee.

The merger is subject to closing conditions including, but not limited to: (a) adoption of the Merger Agreement by the (i) affirmative vote of the holders of at least a majority of the issued and outstanding shares of common stock and preferred shares of the Company, voting together as a single class, with the number of votes the holders of preferred shares were entitled to vote equal to the number of shares of common stock into which such preferred shares were convertible, as determined in accordance with the articles of incorporation of the Company, (ii) affirmative vote or consent of the holders of at least a majority of the issued and outstanding preferred shares of the Company and (iii) affirmative vote of the holders of at least a majority of the issued and outstanding shares (other than the Excluded Shares); (b) the absence of any order, injunction or decree preventing or making illegal the consummation of the merger; (c) the truth and correctness of each Party’s representations and warranties at closing (subject to materiality qualifiers); (d) the compliance of each Party with its covenants in all material respects, and (e) the absence of any material adverse effect on the Company.

On January 3, 2014, the Company issued a press release announcing that it has established the close of business on January 10, 2014 as the record date for its special meeting of stockholders entitled to receive notice of and to vote at its upcoming special meeting of stockholders.

In connection with the special meeting of stockholders to approve the Merger Agreement, the Company filed a definitive proxy statement with the Securities and Exchange Commission (the "SEC") on January 9, 2014, and mailed the definitive proxy statement to its stockholders.

The Company’s special meeting of stockholders was held on February 19, 2014, and the stockholders approved the adjournment of the special meeting and the special meeting was adjourned until 2:00 p.m. China time, on March 5, 2014 at Jinshan Economic Development Zone, Hohhot City, Inner Mongolia, the People’s Republic of China. The special meeting was adjourned to provide the Company with additional time to solicit proxies from its stockholders in favor of the proposal to approve the Merger Agreement.

Subsequently, the adjourned special meeting of stockholders was held on March 5, 2014, and the proposal to approve the Merger Agreement did not receive approval from holders of at least a majority of the issued and outstanding shares of the Company (other than the Excluded Shares). The Merger Agreement was therefore not approved by the Company’s stockholders.

On April 9, 2014, the Parties entered into an amendment (the “Amendment”) to the Merger Agreement (the Merger Agreement as so amended, the “Amended Merger Agreement”).

The Amendment provides for an increase in the per share merger consideration to be paid to holders of shares of common stock of the Company under the Amended Merger Agreement, other than the Excluded Shares, from $6.69 per Share to $7.10 per Share.

The Amendment revises the requirement that the Merger Agreement be approved by the affirmative vote of the holders of at least a majority of the issued and outstanding shares of common stock of the Company (other than the Excluded Shares) to instead require that the Amended Merger Agreement be approved by the affirmative vote of the holders of at least a majority of the issued and outstanding shares of common stock of the Company (other than the Excluded Shares) that are present in person or by proxy and voting for or against approval of the Amended Merger Agreement at the stockholders’ meeting.

The Amendment also provides for an increase in the maximum amount of the Company’s expenses in connection with the transactions contemplated by the Merger Agreement reimbursable by Holdco and Parent under certain circumstances in which the Amended Merger Agreement is terminated from US$2,000,000 to US$3,000,000 and extends the termination date from June 23, 2014 to September 22, 2014 such that, subject to certain conditions, the Amended Merger Agreement may be terminated and the merger may be abandoned by either the Company (upon the approval of the special committee of the Company’s Board of Directors) or Parent if the proposed merger is not consummated on or before September 22, 2014.

Other than as expressly modified by the Amendment, the Merger Agreement remains in full force and effect as originally executed on September 23, 2013.

Our Principal Products and Services

The base of our products is our own fulvic acid base compound, which is extracted from humic acid. Fulvic acid binds itself to and strengthens the cell walls of crop and cell membranes of animals, thereby increasing the ability of cells to retain vitamins and minerals and to fight sickness and disease. Fulvic acid also acts as a transport agent by delivering nutrients that stimulate cell growth, increasing oxygen intake into cells, and binding with and removing toxins such as heavy metals and other pollutants. These help with better nutrient uptake in crop and digestion in animals.

Liquid Crop Nutrient Product

Our liquid crop nutrient product consists of our fulvic acid compound base and nutrients that crops need to grow, and can be applied to various types of crops by spraying the liquid product directly on the crops after dilution with water, typically in conjunction with fertilizers and pesticides. We primarily sell our crop product by 100 milliliter bottle and 10 liter container. In 2012, we launched two new crop nutrient products, a crop seed nutrient product and a crop root nutrient product. The crop seed nutrient product helps crop seeds sprout and improves the growth of roots, and the crop root nutrient product improves crop roots’ ability to absorb water and fertilizers and enhance crop resistance against drought, freezing, diseases, and stalk leaning. Our new products for crop seeds and roots are named “Zhongbaosheng” and “Qianggenbao” respectively. We are also examining market opportunities for introducing diversified crop nutrient products targeted at corn, peppers, wheat, rice, cucumbers, tomatoes, cotton, potatoes, sunflowers, grapes, tropical fruits and flowers. We believe that when used correctly, our product can help farmers more efficiently use fertilizers and pesticides, which may reduce the farmers’ overall input costs and environmental damage to the farmers’ land.

Powder Animal Product

Our animal nutrient product is a powder which consists of our fulvic acid compound base and additional nutrients and Chinese herbs that reduce inflammation. Our animal products are currently targeted at and administered to dairy cows through mixture with feeds. We sell our animal product, which are mainly packaged in bags, with each bag containing twenty, 300 gram packets.

Our animal product’s ability to reduce inflammation makes it attractive to Chinese farmers because of the prevalence of mastitis among dairy cows, an inflammation of the teats that slows down milk production, which is common in the global dairy industry. The Chinese Journal of Veterinary Medicine has reported that, in China, 50-80% of the cows have some form of mastitis, which is typically treated with antibiotics according to the “Handbook of Organic Food Safety and Quality” (International Standard Book Number 0849391547). Although antibiotics can clear up bacterial infections when used correctly, overuse of antibiotics can lead to drug-resistant strains of bacteria and antibiotics kill healthy gut bacteria which is vital to a healthy immune system. Our animal product can help Chinese farmers reduce costs and problems associated with the use of antibiotics to treat mastitis.

| 9 |

Our internal studies show that administration of our animal product to cows’ increases milk production and milk quality, improves cows’ immunity, reduces mastitis, decreases the need for antibiotics, and improves cows’ digestion and growth rate.

We are evaluating the prospects for introducing animal products designed for other livestock.

Production

Raw Materials

Our product’s core compound, fulvic acid, is extracted from humic acid. Humic acid is formed by the biodegradation of dead organic matter which is buried and compressed under soil, and humic acid is mostly contained in peat, lignite coal, leonardite coal, etc. Our production process primarily involves the extraction of fulvic acid and then the blending of fulvic acid with macro and micro nutrients based on our patented formulae. The molecular structure of fulvic acid is smaller than humic acid, which enables fulvic acid to be more easily absorbed by crop leaves.

Currently, our key raw materials for fulvic acid are lignite coal and humic acid purchased from third party suppliers, and the prices of lignite coal and humic acid are affected by factors such as market demand, quality and transportation cost. We also outsource fulvic acid extraction work to third party factories that use our raw materials and follow our manufacturing procedures. The humic acid we use comes from top grade lignite coal which is mined in Inner Mongolia and is typically sold on a per ton basis. We currently procure lignite coal from independent third party suppliers in Inner Mongolia for our manufacturing needs. Prior to 2011, the key raw material for our products was humic acid which was procured from third party suppliers. Upon the completion of our Wuchuan Facility at the end of 2010, we have been able to produce our products by extracting fulvic acid in-house from lignite coal and no longer completely rely on humic acid from intermediaries. Other raw materials used in our products include chemicals used in our extraction and blending processes as well as macro and micro nutrients.

Fluctuations in raw material costs will affect our cost of sales and gross profit margin, and we may not be able to pass such increased costs on to our distributors and then to our end customers.

Intellectual Property

Our products are based on patented formulae that combine a fulvic acid base with other macro and micro nutrients. Our crop nutrient product formula was designed to enhance crop yield by increasing absorption of fertilizer and micro nutrients and providing key micro nutrients and NPK in key growth stages of crops. In addition, our engineers designed our manufacturing process to overcome technical barriers associated with the extraction of fulvic acid and the blending of our products on an industrial scale so that micro and macro nutrients in our products are water soluble and can be easily absorbed by crops after being sprayed on the leaves. We have been granted nine 20-year invention patents by the State Intellectual Property Office in the PRC since 2005, which cover formulae for our various liquid crop nutrient products and powder animal nutrient product, as well as the manufacturing process for extraction and blending of our products. In addition to seeking patent protection, we maintain proprietary know-how related to extraction and blending processes as trade secrets.

Packaging and Shipment

Our liquid crop product is primarily packaged in 100 milliliter bottles and 10 liter containers. Our powder animal product is mainly packaged in bags, with each bag containing twenty 300 gram packets. Each type of packaging material, along with packaging labels, are purchased from several separate manufacturers as these packaging materials are readily available in the market.

After packaging our products at our manufacturing facility, we engage third parties to ship them to our distributors and we bear the risk of loss until our products are received by our distributors.

Quality Control

We have implemented and maintain strict quality control procedures. In July 2007, Inner Mongolia Yongye received ISO 9001:2000 accreditation after a third party audit of its quality control procedures at its manufacturing facility. In the Restructuring, Inner Mongolia Yongye transferred its manufacturing facility and personnel to Yongye Nongfeng. Yongye Nongfeng and Yongye Fumin both received ISO 9001:2000 accreditation following a similar third party audit.

| 10 |

Production Facility

Our product’s core compound fulvic acid is extracted from humic acid, which is in turn derived from lignite coal. Our production process primarily involves the extraction of fulvic acid and then blending it with macro and micro nutrients based on our patented formula. The molecular structure of fulvic acid is smaller than humic acid, which enables fulvic acid to be more easily absorbed by crop leaves.

We have two production facilities in Hohhot City, Inner Mongolia, with one located in Jinshan Industrial Park (the “Jinshan Facility”) and one in Wuchuan County (the “Wuchuan Facility”). Prior to the fourth quarter of 2010, the Jinshan Facility was our sole manufacturing facility and the Jinshan Facility uses purchased humic acid as the key raw material to produce our products. Our Wuchuan Facility was completed in the fourth quarter of 2010 and directly utilizes lignite coal as the key raw material to produce fulvic acid and bypasses intermediaries from whom we used to purchase humic acid. Our Wuchuan Facility also use fulvic acid from third party factories to which we outsourced extraction work. Those third party factories perform extraction work by using our raw materials and following our manufacturing instructions.

Currently, we procure lignite coal from independent third party suppliers in Inner Mongolia. In March 2010, in order to secure a long-term supply of humic acid, we entered into an agreement to acquire a mineral resource project in Wuchuan County, Inner Mongolia. In August 2011, Yongye Fumin, our wholly-owned subsidiary, obtained a Mineral Resource Exploration Permit for this project site in Wuchuan County, Inner Mongolia, which was issued by the Inner Mongolia Ministry of Land and Resources. Such approval granted us exclusive exploration rights for this project site for an initial period of three years beginning August 2, 2011. We are in the process of applying for the governmental approval for the Mineral Right and are preparing for the relevant reports, including but not limited to a Geological Report and a Geological Exploration Report. In June 2012, we commenced a detailed exploration process to obtain a Geological Exploration Report. The detailed exploration process has not been completed. If we cannot receive the report before the exploration right expires, we would apply for an extension from the local authority. We believe the costs to be incurred in completing the remaining administrative procedures and obtaining government approvals are not significant. Upon the granting of the Mineral Right, we will be able to further vertically integrate our operations.

In the third quarter of 2012, our Wuchuan Facility increased its manufacturing capacity. After the capacity expansion, we now have a total of approximately 70,000 tons of combined annual design production capacity at our Wuchuan and Jinshan Facilities.

Because of the proprietary nature of our products and manufacturing processes, we customized the core production components of our manufacturing facilities to enable capacity flexibility. Our design capacity is calculated by us based on key assumptions, including 300 days of operation in a year and normal manufacturing conditions. Under actual manufacturing conditions and based on the seasonality in our business, our production facilities have the flexibility to adjust actual production to levels higher than our stated theoretical design capacities. For instance, during the past several years, our production output during the peak second and third quarters have consistently exceeded the design capacity.

For the year ended December 31, 2013, our actual production output for liquid crop nutrient product was 53,789 tons and the actual output for powder animal nutrient was 1,479 tons. We expect to continue to expand our production capacity as required to respond to increasing demand for our products in the future, including the planned construction of new manufacturing facilities.

Marketing and Branding

Our end-customers make their purchase decisions primarily based on actual demonstrations of the efficacy of our product, typically over an entire growing season. Accordingly, our sales and marketing strategies primarily focus on local demonstration sites at which locally-grown crops are planted side-by-side with and without our liquid crop nutrient applied. In executing our marketing strategy, Branded Retailers play a key role in setting up these demonstration sites, marketing our products and providing technical support to farmers. Branded Retailers are typically trained by our distributors who receive regular and ongoing guidance from our sales and marketing and research and development teams. In addition, we hold large-scale training programs in various locations annually where we invite Branded Retailers from around China to directly receive product, sales and marketing training.

In addition, our internal sales team frequently organizes presentations and seminars targeted at provincial-level and county-level distributors in order to convey our sales strategy effectively to them. We also designed a series of incentive programs to motivate our distributors to drive performance and enhance their loyalty to our Company, including sending selected distributors to a Yongye-sponsored executive training program at Tsinghua University, one of China’s most prestigious academic institutions.

At the national level, we have been conducting a variety of marketing and branding campaigns to enhance our brand recognition among not only our end-customers but also our existing and potential distributors and Branded Retailers. We are amongst the very few companies in our industry that actively sponsor CCTV (China national TV channel) agricultural programs. We also use local TV stations, agricultural publications and newspapers to carry our advertisements. In addition, we are currently working with a national celebrity, Wang Baoqiang, as our spokesperson, to enhance our product image.

| 11 |

Distribution & Sales Network

We employ a multi-tiered distribution model whereby we primarily sell our products to provincial-level distributors who in turn sell to our end-customers either directly or indirectly through county-level distributors and independently owned Yongye branded stores (village-level distributors) (“Branded Retailers”). We currently have 25 provincial-level distributors, most of which cover a single province, with the remaining distributors covering either multiple provinces or a portion of one province (in the case of Hebei, Inner Mongolia and Xinjiang). We select our provincial-level distributors based on criteria including experience, reputation, network coverage and financial strength, and we usually enter into multi-year distribution contracts with them. All of our contracts with provincial-level distributors include mutual exclusivity provisions whereby the provincial-level distributors are not allowed to distribute competing products, and we grant the distributor exclusive sales rights in the designated territory. We are careful to ensure that the sales territories of our provincial-level distributors do not overlap.

Our provincial-level distributors sell our products directly to county-level distributors, to key accounts, such as large farms, and farmers through promotional events. County-level distributors sell our products to independently owned Branded Retailers, large farms, and farmers through promotional events. Branded Retailers distribute our products directly to farmers in rural villages and towns. Most of the Branded Retailers are privately owned individual agriculture stores while some have common ownership or belong to store chains. None of these Branded Retailers are owned or controlled by us. They are typically small in size and distribute a variety of agriculture-related products, including fertilizer, seeds and pesticides to farmers in the surrounding areas.

The following chart illustrates our multi-tiered distribution model:

To ensure consistent pricing and channel margins nationwide, Branded Retailers are typically granted exclusive sales rights for our products in their authorized territory at the village or town level. We also provide the Branded Retailers with our distinct signage with the “Yongye Shengmingsu” logo which typically comprises the entire exterior storefront of Branded Retailers. Branded Retailers normally display our products in prominent shelf spaces and they are responsible for providing technical support to farmers and setting up demonstration sites for our products.

As of December 31, 2013, our products were sold in 30 provinces, autonomous regions and centrally-administered municipalities across China. We sell our products to 25 provincial-level distributors, who then sell our products to 810 county-level distributors and 36,100 Branded Retailers. Our multi-tiered distribution model allows us to penetrate the vast and highly fragmented rural area of China by utilizing our internal sales team to manage and leverage thousands of sales personnel at our provincial-level distributors, county-level distributors and Branded Retailers. Our internal sales team actively manages our multi-tier distribution network by participating in major distributor sales activities and providing training presentations and seminars.

Below is a table setting forth the expansion of our Branded Retailer network.

| 12 |

| Branded Retailer by Region | Year End 2013 | Year End 2012 | Year End 2011 | |||||||||

| Hebei/Beijing/Tianjin | 4,660 | 4,578 | 3,935 | |||||||||

| Inner Mongolia | 1,255 | 1,136 | 765 | |||||||||

| Shandong | 3,455 | 3,434 | 3,358 | |||||||||

| Guangdong/Hainan | 1,414 | 1,306 | 941 | |||||||||

| Henan | 2,991 | 2,889 | 2,456 | |||||||||

| Heilongjiang/Jilin/Liaoning | 2,599 | 2,533 | 2,180 | |||||||||

| Xinjiang | 2,556 | 2,437 | 2,097 | |||||||||

| Hubei/Hunan | 3,240 | 3,240 | 2,978 | |||||||||

| Gansu/Qinghai | 869 | 865 | 920 | |||||||||

| Jiangsu | 2,492 | 2,447 | 1,936 | |||||||||

| Shanxi | 1,803 | 1,745 | 1,310 | |||||||||

| Anhui | 1,508 | 1,494 | 1,420 | |||||||||

| Shaanxi | 1,766 | 1,691 | 1,491 | |||||||||

| Sichuan/Chongqing | 1,125 | 1,105 | 1,044 | |||||||||

| Jiangxi/Fujian | 1,417 | 1,346 | 1,006 | |||||||||

| Yunnan/Guizhou | 1,535 | 1,418 | 1,076 | |||||||||

| Zhejiang | 519 | 510 | 252 | |||||||||

| Guangxi | 520 | 508 | 472 | |||||||||

| Ningxia | 368 | 368 | 441 | |||||||||

| Shanghai | 8 | 8 | 8 | |||||||||

| Total | 36,100 | 35,058 | 30,086 | |||||||||

Customers

Since our inception, we have worked to build and maintain our sales and distribution networks. We have established good relationships with capable agricultural products distributors.

We usually sign three year contracts with distributors that we identify and choose based upon their overall business strength, credit worthiness and proven ability to develop their local markets. We generally renew those contracts with distributors before expiration.

Competition

While we compete with both nationwide and local manufacturers of humic or fulvic acid crop nutrients, we believe that we are a clear market leader. The Chinese agriculture industry and the retail market for agricultural goods are highly fragmented. As at the end of January 2014, there were more than 5,600 fertilizer products registered in the PRC Ministry of Agriculture’s registry. We mainly compete directly with producers of humic or fulvic acid based products, of which there were around 1,200 registered as at the end of January 2014.

In addition to humic or fulvic acid based crop nutrient products, our nutrient products also compete with other liquid fertilizers applied on crop leaves, such as amino acid-based nutrients and other liquid fertilizers containing NPK or minerals as many farmers view such liquid fertilizers as a single product category.

We believe that with our proven product efficacy, premium brand and nation-wide distribution network, we are well positioned to maintain our leadership position in this market.

Research and Development

Our research and development process begins with an internal evaluation of market demand for new types of products. After we initially identify market opportunities for new products, we will, either alone or in cooperation with our research partners, conduct research activities and develop new products. Once our research and development activities are complete, we make a final judgment regarding whether and when to bring the new product to market based upon a second evaluation of market demand, an estimate of the time and expense that will be required to obtain any necessary governmental approvals, the desirability for obtaining patents or feasibility of protecting our intellectual property by other means, and the results of market testing. The entire process normally takes anywhere from one to five years, depending on the product.

| 13 |

We are currently researching and market testing various customized products for crop and animals and our research and development expenses mainly consisted of field test expenses for new products, tests on different crops and tests in various geographic markets. We have already officially introduced two new products to the market in the first quarter of 2012. One new product is to help crop seeds to sprout and grow, and the other is to improve crop roots’ ability to absorb water and fertilizers and to enhance crop resistance against drought, freezing, diseases, and stalk leaning. We are market testing a new water soluble humic acid product to help improve crop yield. We are also examining market opportunities for introducing liquid crop nutrient products specifically targeted at corn, peppers, wheat, rice, cucumbers, tomatoes, cotton, potatoes, sunflowers, grapes, tropical fruits and flowers, though no assurance can be given that we will ultimately bring to market the products that we are currently researching or market testing. As to animal products, we are market testing the products used for livestock such as pig, chickens and sheep.

Intellectual Property

Our products are based on patented formulae that combine a fulvic acid base with other macro and micro nutrients. Our formulations were designed to enhance crop yield by increasing absorption of fertilizer and micro nutrients and providing key micro nutrients and NPK in key growth stages of crops. In addition, our engineers designed our manufacturing process to overcome technical barriers associated with the extraction of fulvic acid and the blending of our products on an industrial scale so that micro and macro nutrients in our products are water soluble and can be easily absorbed by crops after being sprayed on the leaves. We have been granted nine 20-year invention patents by the State Intellectual Property Office in the PRC since 2005, which cover formulae for our liquid crop nutrient product and powder animal nutrient product, as well as the manufacturing processes for extraction and blending of our products. In addition to seeking patent protection, we maintain proprietary know-how related to extraction and blending processes as trade secrets.

We have obtained a registered trademark for “Yongye”,“Shengmingsu”, “Zhongbaosheng” and “Qianggenbao” from the Trademark Bureau of the State Administration of Industry and Commerce of the PRC, which is valid till October 2017, April 2020, July 2023, and July 2023, respectively.

In addition to trademark and patent protection law in China, we rely on contractual confidentiality and non-competition provisions to protect our intellectual property rights and brand. We also take further steps to limit the number of people involved in the production process and refer to each ingredient by number rather than name when collecting and preparing them for mixture.

Employees

The table below presents the number of our employees as of the end of the periods indicated.

| Category | 2013 | 2012 | 2011 | |||||||||

| Administration | 85 | 91 | 86 | |||||||||

| Manufacturing | 326 | 325 | 302 | |||||||||

| Research & Development | 36 | 38 | 43 | |||||||||

| Sales & Supporting | 105 | 117 | 140 | |||||||||

| Total | 552 | 571 | 571 | |||||||||

Compared with 2012, the number of administration and sales & supporting staff decreased by 6 and 12 respectively at the year end of 2013, as we optimized administration structure during 2013 and kept less temporary sales staff during the non-peak season at year end 2013.

Governmental Regulation

Our products and services are subject to regulation by central and provincial governmental agencies in the PRC, which require us to obtain licenses and certifications. We are required to renew, pass an examination or make a filing in connection with these licenses and certifications on a regular basis.

Business License

Yongye Nongfeng’s business license enables it to research, develop, process, manufacture, market and sell fulvic acid based crop and animal nutrient products. The business license is valid till January 4, 2018 and is subject to annual examination. In September 2011, Yongye Nongfeng increased its registered capital to US$123,200,000. Yongye Fumin’s business license enables it to research, develop, process, manufacture, market and sell fulvic acid based crop and animal nutrient products, and soil conditioner. The business license is valid till July 19, 2020.

| 14 |

Fertilizer Registration

All fertilizers produced in the PRC must be registered with the PRC Ministry of Agriculture or its local branches at a provincial level. No fertilizer can be manufactured without such registration. As part of the Restructuring process, Yongye Nongfeng applied for its initial fertilizer registration certificate in May 2009 and received it on June 1, 2009. On November 4, 2009, the long-term certificate with a five-year term was issued to Yongye Nongfeng which is expected to be renewed in 2014. Fumin obtained temporary certificate which is expected to be renewed in September 2014.

Additive Pre-mixed Feed Certificate

With respect to manufacturing of our animal nutrient products in the PRC, Yongye Nongfeng is required to obtain an Additive Pre-mixed Feed Certificate. Yongye Nongfeng was granted this certificate in April 2010 by the Ministry of Agriculture, which is valid for a period of five years.

Environmental, Health and Safety Laws

We are in compliance in all material respects with the various laws, regulations, rules, specifications and permits, approvals and registrations relating to human health and safety and the environment, except where noncompliance would not have a material adverse effect on our business, financial condition and results of operations.

Legal Proceedings

On May 26, 2011 and June 3, 2011, we and three of our officers and directors were named in putative class action lawsuits filed in the US Federal District Court for the Southern District of New York alleging, among other things, that we and such officers and directors issued false and misleading information to investors about our financial and business condition. These securities class action complaints generally allege that Yongye’s business was not growing at the rate represented by the defendants and that Yongye’s financial results as reported to the Securities and Exchange Commission were inconsistent with its production capabilities. On December 12, 2011, the securities class actions were consolidated and a consolidated class action complaint was filed alleging we and our officers and directors issued false and misleading information to investors about our financial and business conditions. On March 5, 2012, the plaintiffs voluntarily dismissed this action with prejudice as to themselves as named plaintiffs.

On July 19, 2011 we and certain of our officers and directors were named in a derivative suit filed in the First Judicial District Court of the State of Nevada and for Carson City alleging, among other things, that such directors and officers breached their fiduciary duties to us, misrepresented our earnings, wasted corporate assets and unjustly enriched themselves at the expense of us. After we filed a motion to dismiss the complaint, the plaintiffs voluntarily dismissed the action without prejudice on September 6, 2012. The Court signed the stipulation of dismissal and closed the case on September 7, 2012.

On or about October 18, 2012 and October 22, 2012, five shareholder class action complaints were filed against the Company and certain officers and directors thereof in connection with the preliminary, non-binding proposal letter dated October 15, 2012, from Mr. Zishen Wu, MSPEA and Abax Global Capital (Hong Kong) Limited, to acquire all outstanding shares of common stock of the Company not already owned by those parties, in a going private transaction for $6.60 per share of common stock in cash, subject to certain conditions (the “ Wu Proposal ”). The five complaints are captioned, respectively, Doherty v. Yongye International, Inc., et al., A-12-670343-C; Kirby v. Zishen Wu, et al. , A-12-670468-C; Calisti v. Zishen Wu, et al., Case No. A-12-670758-B; Kong, et al. v. Zishen Wu, et. al., Case No. A-12-670874-B; and Harris v. Yongye International, Inc., et al. , Case No. A-12-670817-B. Each of the complaints was filed in Nevada state court in the District Court, Clark County, and each challenged the Wu Proposal, alleging among other things, that the consideration to be paid in such proposal was inadequate, as was the process by which the proposal was being evaluated. The complaints sought, among other relief, to enjoin defendants from consummating the Wu Proposal and to direct defendants to exercise their fiduciary duties to obtain a transaction that is in the best interests of all of the Company’s shareholders. On or about March 5, 2013, the plaintiff in the Doherty case filed a notice of voluntary dismissal. By stipulation and order, filed on April 23, 2013, the remaining cases were consolidated for all purposes under the caption In re Yongye International, Inc. Shareholders’ Litigation, Case No. A-12-670468-B (the “Consolidation Order”). Under the Consolidation Order, the plaintiffs were directed to file a consolidated complaint within 20 days of the announcement of a definitive merger agreement entered into in connection with any proposed going private transaction. On October 18, 2013 the parties stipulated, and the Court ordered, that the plaintiffs would file the consolidated complaint within 14 days of the filing of the preliminary proxy statement (the “Consolidation Stipulation”). The preliminary proxy statement was filed on October 28, 2013, and the consolidated complaint was filed on November 7, 2013. The consolidated complaint alleges, among other things, that consideration to be paid under the merger agreement is inadequate, that the process leading to the merger agreement was flawed, and that the defendants failed to include all material information in the proxy statement.

By stipulation and order filed on December 13, 2013, the defendants’ time to answer or otherwise respond to the consolidated complaint was adjourned until if and after the transaction contemplated in the merger agreement were to close. On December 23, 2013, the plaintiffs filed a motion to preliminarily enjoin the stockholder vote. The motion was heard on January 27, 2014, and on February 19, 2014 the court issued an order denying the plaintiffs’ motion.

| 15 |

We have reviewed the allegations contained in the complaints and believe they are without merit. We intend to defend the litigations vigorously. As such, based on the information known to us to date, we do not believe that it is probable that a material judgment against us will result.

Property