Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Oro East Mining, Inc. | Financial_Report.xls |

| EX-31.1 - EX-31.1 - Oro East Mining, Inc. | ex31-1.htm |

| EX-31.2 - EX-31.2 - Oro East Mining, Inc. | ex31-2.htm |

| EX-10.5 - EX-10.5 - Oro East Mining, Inc. | ex10-5.htm |

| EX-32.1 - EX-32.1 - Oro East Mining, Inc. | ex32-1.htm |

| EX-32.2 - EX-32.2 - Oro East Mining, Inc. | ex32-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

x Annual Report Pursuant to Section 13 or 15(D) of the Securities Exchange Act of 1934

for the fiscal year ended December 31, 2013

¨ Transition Report Under Section 13 or 15(D) of the Securities Exchange Act of 1934

for the transition period from _______________ to _______________

Commission File Number: 000-53136

Oro East Mining, Inc.

(formerly known as Accelerated Acquisitions I, Inc.)

|

Delaware

|

26-2012582

|

|

|

(State or other jurisdiction of incorporation or

|

(IRS Employer Identification No.)

|

|

|

organization)

|

||

|

7817 Oakport Street, Suite 205,

|

||

|

Oakland, CA

|

94621

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Issuer's telephone number, including area code: (510) 638-5000

Former address if changed since last report:

1127 Webster Street, Suite 28

Oakland, CA 94607

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, par value $0.0001 per share

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

Non-Accelerated Filer o

(Do not check if a smaller reporting company)

|

Smaller Reporting Company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

State the number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 27,168,290 shares of common stock, par value $.0001 per share, outstanding as of March 31, 2014.

Reporting Currency, Financial, and Other Information

All amounts in this report are expressed in United States (U.S.) dollars, unless otherwise indicated.

Financial information is presented in accordance with accounting principles generally accepted in the United States ("U.S. GAAP").

References in this annual report to the “Company,” “we,” “our”, “us”, “Oro East” or “Oro East Mining, Inc.” refer to Oro East Mining, Inc. unless the context otherwise indicates.

A Note Regarding Forward-Looking Statements

This report contains forward-looking statements that relate to future events or our future financial performance. In some cases, forward-looking statements may be identified by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors,” that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Glossary of Exploration Terms

The following terms, when used herein, have the respective meanings specified below:

|

Andesite

|

An extrusive usually dark grayish rock consisting essentially of oligoclase or feldspar.

|

|

Dacite

|

A fine-grained light gray volcanic rock consisting primarily of quartz, plagioclase, and potassium feldspar, and also containing biotite, hornblende, or pyroxene.

|

|

Assay

|

A chemical test performed on a sample of ores or minerals to determine the amount of valuable metals contained.

|

|

Dendrite

|

A branching treelike figure produced on or in a mineral by a foreign mineral.

|

|

Dendritic

|

Resembling or having dendrites. Branching like a tree.

|

|

Deposit

|

When mineralized material has been systematically drilled and explored to the degree that a reasonable estimate of tonnage and economic grade can be made.

|

|

Development

|

Preparation of a mineral deposit for commercial production, including installation of plant and machinery and the construction of all related facilities. The development of a mineral deposit can only be made after a commercially viable mineral deposit, a reserve, has been appropriately evaluated as economically and legally feasible.

|

|

Diamond drill

|

A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock, which is recovered in long cylindrical sections an inch or more in diameter.

|

|

Diorite

|

A granular crystalline igneous rock commonly of acid plagioclase and hornblende, pyroxene, or biotite.

|

|

Exploration

|

The prospecting, trenching, mapping, sampling, geochemistry, geophysics, diamond drilling and other work involved in searching for mineral bodies’ a mining prospect which has not yet reached either the development or production stage.

|

|

Mafic

Mafic-ultramafic

|

Of, relating to, or being a group of usually dark-colored minerals rich in magnesium and iron.

Mafic and untramafic minerals together.

|

|

Mineral

|

A naturally occurring inorganic element or compound having an orderly internal structure and characteristic chemical composition, crystal form and physical properties.

|

|

Mineral Reserve

|

A mineral reserve is that part of a deposit which could be economically and legally extracted or produced at the time of the reserve determination.

|

|

Mineralization

|

Rock containing an undetermined amount of minerals or metals.

|

|

Miocene

|

Of, relating to, or being an epoch of the Tertiary between the Pliocene and the Oligocene or the corresponding series of rocks.

|

|

Paleogene

|

Of, relating to, or being the earlier part of the Tertiary including the Paleocene, Eocene, and Oligocene or the corresponding series of rocks.

|

|

Ultramafic

|

Minerals that are very low in silica and rich in iron and magnesium.

|

|

Trenching

|

The digging of long, narrow excavation through soil, or rock, to expose potential mineralization for geological examination or assays.

|

|

Waste

|

Material that is too low in grade to be mined and milled at a profit.

|

|

Waste Management Units (WMUs)

|

Heap leaches of mining waste and leached ore with residual tailings of gold values. The heap leaches referenced as WMUs herein are sealed by temporary geotextile covers. Through flotation, gold values can be extracted from the leached ore.

|

TABLE OF CONTENTS

|

PART I

|

||

|

Page

|

||

|

ITEM 1.

|

4

|

|

|

ITEM 1A.

|

8

|

|

|

ITEM 1B.

|

8

|

|

|

ITEM 2.

|

8

|

|

|

ITEM 3.

|

14

|

|

|

ITEM 4.

|

14

|

|

|

PART II

|

||

|

ITEM 5.

|

15

|

|

|

ITEM 6.

|

15

|

|

|

ITEM 7.

|

16

|

|

|

ITEM 7A.

|

19

|

|

|

ITEM 8.

|

19

|

|

|

ITEM 9.

|

31

|

|

|

ITEM 9A(T).

|

31

|

|

|

ITEM 9B.

|

31

|

|

|

PART III

|

||

|

ITEM 10.

|

32

|

|

|

ITEM 11.

|

33

|

|

|

ITEM 12.

|

34

|

|

|

ITEM 13.

|

35

|

|

|

ITEM 14

|

36

|

|

|

PART IV

|

||

|

ITEM 15.

|

37

|

|

|

39

|

||

PART I

Item 1. Description of Business.

ORGANIZATION WITHIN THE LAST THREE YEARS

Oro East Mining, Inc. (“Oro East”) was incorporated in Delaware as Accelerated Acquisitions I, Inc. on February 15, 2008.

On December 24, 2013, Oro East Mariposa, LLC, a California limited liability company and a wholly-owned subsidiary of the Company (“Subsidiary”) entered into an Asset Purchase and Option Agreement (the “Agreement”) with Sutton Enterprises, a general partnership. Under the terms of the Agreement, Subsidiary purchased certain mineralized material we believe are gold tailings, tangible property, and other entitlements commonly referred to by the parties as the WMUs (the “WMUs”) located on certain parcels of real property located in the County of Calaveras, State of California. The total purchase price for the WMUs is $6,000,000.00 and 30% net royalties contingent on the obtaining of all local, state, and other applicable agency approvals for the gold mineral concentrates production contemplated. Thereafter, the $6,000,000.00 shall be paid in certain installments, and the 30% net royalties will be held in escrow as secured collateral against the Agreement in favor of the Subsidiary. The Agreement further reserves an Option in favor of the Subsidiary for purchase of 39 parcels of real property as described in the Agreement and all claims rights, business assets, and additional property and assets as set forth in the Agreement for a purchase price of $32,000,000.00 less the $6,000,000.00 already paid on the WMUs. The Option period is for 180 days from the date of the contract.

The business related to the Agreement is now the primary business of the Company and the Company has discontinued most of its exploration activities related to its former exploration activity in the Philippines. To date, the Company is in the process of compiling all information related to test results on assays it has conducted on the gold tailings its has purchased under the Agreement. There is the likelihood of the mineralized material we believe are gold tailings purchased pursuant to the Agreement containing little or no economic mineralization or of gold content or other minerals.

On June 23, 2010, Mutual Gain Hong Kong Group Limited (“Purchaser”) agreed to acquire 23,850,000 shares of the Company’s common stock par value $0.0001 (the “Shares”) for a price of $0.0001 per share. At the same time, Accelerated Venture Partners, LLC agreed to tender 3,500,000 of its 5,000,000 shares of the Company’s common stock par value $0.0001 for cancellation. Following these transactions, Mutual Gain Hong Kong, Limited owned 94.1% of the Company’s 25,350,000, issued and outstanding shares of common stock par value $0.0001 and the interest of Accelerated Venture Partners, LLC was reduced to approximately 5.9% of the total issued and outstanding shares. Simultaneously with the share purchase, Timothy Neher resigned from the Company’s Board of Directors effective immediately and Tian Qing Chen was simultaneously appointed to the Company’s Board of Directors. Such action represented a change of control of the Company. The Purchaser used its working capital to acquire the Shares. The Purchaser did not borrow any funds to acquire the Shares.

Prior to the purchase of the Shares, the Purchaser was not affiliated with the Company. However, the Purchaser is now deemed an affiliate of the Company as a result of its stock ownership interest in the Company. The purchase of the shares by the Purchaser was completed pursuant to a written Subscription Agreement with the Company. The purchase was not subject to any other terms and conditions other than the sale of the Shares in exchange for the cash payment.

On June 24, 2010, the Company entered into a Consulting Services Agreement with Accelerated Venture Partners LLC (“AVP”), a company controlled by Timothy J. Neher. As AVP did not achieve any of the milestones set forth in the agreement before the expiration date, the Company redeemed from AVP 1,500,000 shares it purchased from the exercise of the option granted under this agreement.

On July 2, 2010, the Company changed its business plan to become an exploration and refining company for the mining of gold, copper, and other precious or industrial mineral deposits through the acquisition of certain rights in the Republic of the Philippines. On that date, the Company obtained rights to its principal mining claim, MPSA 320-2010-XI, by way of entering into an Assignment of Rights Agreement (“Rights Agreement”) with Oro East Mining Company Ltd., a Philippines corporation indirectly controlled by Tian Qing Chen, our Chief Executive Officer. Pursuant to the terms of the Rights Agreement, Assignor assigned to the Company certain rights and obligations with respect to permitted mining claims of approximately $1.6 billion. Pursuant to the Rights Agreement, The Company assumed the rights and obligations of Assignor to explore, extract, refine and produce precious metals and other industrial deposits on the claims and earn fees with respect to such services. By entering into the Rights Agreement, the Company commenced business as an exploration, mining, refinery and production company. Assignor assigned to the Company two (2) mineral claims with the Mines and Geosciences Bureau for the Republic of the Philippines: MPSA 184-XI and APSA 167-XI “Portfolio of Mineral Claims”, and assigned all mineral rights related to Assignor’s claims to the Company. After the execution of the Rights Agreement, the numbering of claim “MPSA 184-XI” changed to MPSA 320-2010-XI. The assignment includes control of the surface, the subsurface and the air above any and all real property or claims owned by Assignor. The Company may freely sell, lease, gift or bequest these rights individually or entirely to others, within the scope and terms of the Rights Agreement and applicable laws of the Republic of Philippines. The Rights Agreement also grants to the Company all rights to production, which shall include but not be limited to right to mineral extraction on all mineral claims and tenements owned or controlled by Assignor, the right to control production in all aspects, right to enter the property and remove the minerals or resources at its election. The Company intends to focus on extracting gold, silver, copper, iron ore and other industrial minerals.

Under the Mineral Rights Agreement the Republic of the Philippines has granted the Company the rights to the exploration, development and commercialization of gold, copper, silver, zinc and “other associated mineral deposits” for a 25-year term, expiring February 10, 2035. Company must to commence exploration activities no later than three months after the effective date of the agreement, which the Company has already done, and continue such exploration activities for a term of no longer than six years for nonmetallic metals and eight years for metallic metals. In the first year, the Company must spend not less than 8,242,000 PhP (approximately $193,000) on its exploration work program. In the second year, the Company must spend not less than 4,420,000 PhP (approximately $103,500) on its exploration work program. The Company must complete the development of the mine, including the construction of production facilities, within 36 months from the submission and approval of its Declaration of Mining Project Feasibility under the agreement.

On September 10, 2010, the Company entered into a Limited Agency and Services Agreement with Sichuan Dujiangyan Weida Company, Limited, dba Weida Co., Ltd. (the “Agent”).

On September 20, 2010, the Company filed a Certificate of Amendment of its Certificate of Incorporation with the Secretary of State of the State of Delaware pursuant to which the Company changed its name from Accelerated Acquisitions I, Inc. to Oro East Mining, Inc.

On November 18, 2010, Oro East Mining, Inc. invested about $50,000 to establish Oro East Greentech Philippines Inc. (“Greentech”). Greentech is wholly owned by Oro East and will be in charge of the mining business in Philippines. The financial statements presented are consolidated for Oro East Mining, Inc. and Oro East Greentech Philippines Inc.

On December 15, 2010, the Company entered into a Consulting Agreement with Hobson Consultant International, Ltd. (“Hobson”). The Company believes that Hobson is potentially important to the Company to help the Company find potential investors. The Company fair valued the 225,000 shares issued at $2 per share and recognized share-based compensation expense of $450,000 for services rendered during 2012 and 2011.

On March 1, 2011, the Company hired Ma International and agreed to issue 24,440 shares for the consulting services to be received over the period of two years. The Company fair valued the 24,440 shares issued at $2 per share and recognized share-based compensation expense of $48,888 for the services rendered during 2013, 2012 and 2011.

In October of 2011, we filed a registration statement on the Form S-1 for the public offering of 6,866,440 shares of common stock (“Offering”), and on July 25, 2012 the SEC approved and declared the effectiveness of the registration statement. On March 1, 2013, the Company filed a Post-Effective Amendment to the Form S-1 to deregister 4,290,150 shares of the Company’s common stock in the offering of 5,000,000 shares of common stock by the Company that remain unsold. The Company issued a total of 709,850 shares for cash of $2,090,550.

In September 2012, the Company established its foreign wholly owned subsidiary, Oro East Mining LLC, for the purpose of conducting mining business in Mexico. There have been no activities for the subsidiary since its establishment.

On May 8, 2013, the Board of Directors of the Company approved and adopted the terms and provisions of a 2013 Stock Incentive Plan (the “Plan”) for the Company. An aggregate of 5,000,000 shares of the Company’s common stock are initially reserved for issuance under the Plan. As of December 31, 2013, 4,959,000 shares were available for grant under the Plan.

On May 13, 2013 the Company redeemed from AVP 1,500,000 shares of common stock of the Company for an aggregate redemption price of $150.00, pursuant to a Stock Redemption Agreement. AVP is still a holder of 1,500,000 shares of common stock of the Company following the redemption. The Company returned the 1,500,000 shares redeemed from AVP to the authorized stock of the Company.

On June 3, 2013, the Company established the California subsidiary Oro East Mariposa, LLC for the purpose of conducting mining or minerals exploration business in the State of California, in the United States. On June 24, 2013, the Company, through its subsidiary, entered into an exclusive Mining Lease and Royalties Agreement for the Red Bank Gold Mine (“Red Bank”). Red Bank is located in the Mother Lode vein system just east of San Francisco and within the western Sierra Nevada Ranges

In October 2013, Oro East Mariposa issued an additional 158,000 units to a foreign corporation owned by a shareholder. The Company now owns 95% equity interest of Oro East Mariposa. Through Oro East Mariposa, the Company sought out prospective minerals investment opportunities throughout California.

On November 8, 2013, Typhoon Haiyan devastated the Davao region of the Philippines where the Company’s MPSA 320-2010-XI claim is located. The typhoon swept away and destroyed roads, developed lands, and buildings. On the grounds of force majeure, the Company’s mining operations ceased and are presently ceased indefinitely as the region focuses on rebuilding itself. As a result of Typhoon Haiyan, there have been no further activities by the company in the Philippines.

That same month the Company directors convened to discuss the trajectory of its business and decided unanimously to focus business in the United States, in particular gold and other precious mineral acquisitions in California. The Company voted to cease exploration in the Philippines and invest fully in developing its business acquisitions in the mineral industry within the United States.

Through its subsidiary Oro East Mariposa, negotiations commenced with third and fourth generation gold mine proprietors Sutton Enterprises, run by the Sutton Brothers, Brad and Mark Sutton, in the western region of the United States to acquire control over exploration and prospective gold refinery operations in the region. Oro East Mariposa then commenced research, due diligence, and a pilot plant testing phase at various site locations to determine viability of full refinery operations.

On December 5, 2013, we entered into a Convertible Note Purchase Agreement (the “Note Agreement”) with one investor. Under the terms of the Note Agreement, the Company offered and sold a Convertible Promissory Note (the “Note”) for aggregate proceeds of $360,000. Closing for the Note sale took place on December 6, 2013. The Note bears interest at 12% annually, which interest compounds annually, and all principal and interest is due no later than June 5, 2014. All principal and interest due under the Note is convertible, at the election of the holder of the Note, into shares of common stock of the Company at a rate of $3.00 per share. The Company offered and sold the Note in reliance on the exemption from registration afforded by Rule 903(b)(3) of Regulation S, promulgated pursuant to the Securities Act of 1933, as amended, where the Company offered and sold the Note offshore of the US, to a non-US person, there were no directed selling efforts in the US and offering restrictions were implemented.

Memorializing the earlier October negotiations, on December 24, 2013, Oro East Mariposa entered into an Asset Purchase and Option Agreement (the “Purchase Agreement”) with Sutton Enterprises, a general partnership. Under the terms of the Purchase Agreement, Oro East Mariposa is purchasing certain gold tailings, tangible property, and other entitlements commonly referred to by the parties as the WMUs (the “WMUs”) located on certain parcels of real property located in the County of Calaveras, State of California. The total purchase price for the WMUs is $6,000,000.00 and 30% net profit royalties contingent on the obtaining of all local, state, and other applicable agency approvals for the gold mineral concentrates production contemplated. Thereafter, the $6,000,000.00 shall be paid in certain installments, and the 30% net profit royalties will be held in escrow as secured collateral against the Purchase Agreement in favor of the Subsidiary. The Purchase Agreement further reserves an Option in favor of Oro East Mariposa for purchase of 39 parcels of real property as described in the Purchase Agreement and all claims rights, business assets, and additional property and assets as set forth in the Purchase Agreement for a purchase price of $32,000,000.00 less the $6,000,000.00 already paid on the WMUs. The Option period is for 180 days from the date of the contract. However, currently there are no known mineral reserves and no refinery operations on any property the Company is examining.

Oro East Mariposa has commenced processing the WMU stockpiles into gold concentrates and the first shipment of sale of gold concentrates was transacted shortly thereafter in December 2013. The Company by way of its subsidiary is now continuing its processing of the stockpiles into gold concentrates for sale.

Presently through Oro East Mariposa, LLC, the Company is processing the tailings in the WMUs for gold concentrates.

IN GENERAL

Oro East Mining, Inc. (“Oro East”), a Delaware corporation, has discontinued exploration activities, and is focusing on producing gold concentrates.

At present, the Company is building a flotation plant for processing mining waste from the WMUs purchased from Sutton Enterprises with the intent of selling the gold concentrates produced from flotation.

PROPERTY HISTORY

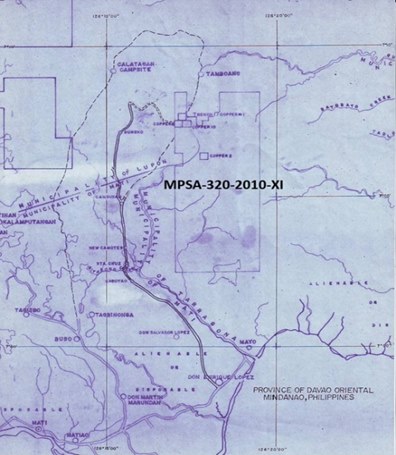

In the Philippines, the Company controls a certain tenement claim, MPSA 320-2010-XI (7,855 hectares, 19,401 acres), which is situated on the outskirts of Davao City in the Philippines. The parcel was applied-registered with the Mines and Geosciences Bureay Region XI, “MGB Region XI” on May 16, 1997.

DESCRIPTION OF CLAIMS

Refer to Item 2 for detailed description of the claims.

COMPETITIVE CONDITIONS

Prior to Typhoon Haiyan, the mineral exploration business had been an extremely competitive industry. We were competing with many other exploration companies looking for minerals.

GOVERNMENT APPROVALS AND RECOMMENDATIONS

COSTS AND EFFECTS OF COMPLIANCE WITH APPLICABLE ENVIRONMENTAL LAWS

In the United States, the Company has come into possession of 3 WMUs, or three substantial piles of leached ore at an aggregate mine in Carson Hill, California. The Carson Hill site owned by Sutton Enterprises is located on the south side of Highway 49 in the central Sierra foothills of Calaveras County. The Company has obtained a right of entry and access to the 3 WMUs, which are personal property now owned by the Company through an Assets Purchase and Option Agreement signed between the Company’s subsidiary, Oro East Mariposa, LLC and Sutton Enterprises on December 24, 2013.

In June 2001 the Central Valley Regional Water Quality Control Board (“Regional Water Board”) issued Waste Discharge Requirements (Order No. 5-01-150) that covers the use and management of the leached ore in the WMUs, this order required that:

|

·

|

Active mining and ore processing other than quarrying and processing of inert materials are prohibited.

|

|

·

|

The discharge of wastes containing soluble pollutants, which could cause water quality degradation to ground water or surface water, is prohibited.

|

|

·

|

No materials shall be removed from below the standing water level in the bowls of WMU-1, WMU-2, or WMU-3.

|

|

·

|

Rock products from the WMUs or overburden piles determined to have leachable concentrations of antimony, mercury, or molybdenum exceeding 0.006 milligrams per liter (mg/l), 0.00005 mg/l, or 0.010 mg/l, respectively shall only be used offsite when placed beneath paved areas or other low permeable material.

|

|

·

|

Continued Group “C” mining waste classification5 of overburden and leached ore shall be contingent on confirmation that the discharge is in compliance with applicable water quality control plan, other than for turbidity.

|

In a letter dated May 3, 2005, the Regional Water Board reclassified the WMUs as Group “B” mining waste per 27 CCR § 22480(b)(2)(B) (Water Board, 2007; Finding 50). The reclassification was performed because the Regional Water Board determined that Site data suggested discharges from these units were causing impacts to water quality.

However, the leached ore in the WMUs still contain gold values and concentrates. The Company purchased personal property title rights to the WMUs and in 2013, the Company and Sutton Enterprises collaboratively submitted a proposal to the Regional Water Board to reclassify the WMUs as Group “C” mining waste per Title 27.

The objectives of the Company’s environmental reclassification project are as follows:

|

·

|

Modify existing plants on Sutton Enterprises’ site with froth flotation units to process the leached ore from the WMUs, collect representative samples, and test the said samples

|

|

·

|

Produce a geochemical report of the test results that will allow the Regional Water Board to determine whether the processed tailings meet the Title 27 criteria for reclassification to Group “C” mining waste

|

COSTS AND EFFECTS OF COMPLIANCE WITH PHILIPPINE ENVIRONMENTAL LAWS

Philippine Environmental Laws

In the past ten years, laws and policies for environmental protection in the Philippines have moved towards stricter compliance and stronger enforcement, therefore the exact costs of compliance is unknown but is estimated to $250,000 per year. The basic laws in the Philippines governing environmental protection in the mineral industry sector of the economy are the Environmental Protection Law, the Environment Impact Assessment Law and the Mineral Resources Law. The State Administration of Environmental Protection and its provincial counterparts are responsible for the supervision, implementation and enforcement of environment protection laws and regulations. Provincial governments also have the power to issue implementing rules and policies in relation to environmental protection in their respective jurisdictions. Applicants for exploration rights must submit environmental impact “assessments” and those projects that fail to meet environmental protection standards will not be granted licenses.

In addition, after exploration the licensee must perform water and soil maintenance and take steps towards environmental protection. After the exploration rights have expired or the concessionaire stops mining during the permit period and the mineral resources have not been fully developed, the concessionaire must perform water and soil maintenance, land recovery and environmental protection in compliance with the original development scheme, or must pay the costs of land recovery and environmental protection. After closing, the mining enterprises shall perform water and soil maintenance, land recovery and environmental protection in compliance with mine closure approval reports, or must pay the costs of land recovery and environmental protection.

Penalties for breaching the Environmental Protection Law include a warning, payment of a penalty calculated on the damage incurred, or payment of a fine. When an entity fails to adopt preventative measures or control facilities that meet the requirements of the enacted environmental protection standards, it is subject to suspension of production or operations and for payment of a fine. Material violations of environmental laws and regulations causing property damage or casualties may result in criminal liabilities.

COMPLIANCE WITH ENVIRONMENTAL CONSIDERATIONS AND PERMITTING COULD HAVE A MATERIAL ADVERSE EFFECT ON THE COSTS OR THE VIABILITY OF OUR PROJECTS. THE HISTORICAL TREND TOWARD STRICTER ENVIRONMENTAL REGULATION MAY CONTINUE, AND, AS SUCH, REPRESENTS AN UNKNOWN FACTOR IN OUR PLANNING PROCESSES.

All mining is regulated by the government agencies at the Federal and Provincial levels of government in the Philippines. Compliance with such regulation has a material effect on the economics of our operations and the timing of project development. Our primary regulatory costs have been related to obtaining licenses and permits from government agencies before the commencement of mining activities. An environmental impact study that must be obtained on each property in order to obtain governmental approval to mine on the properties is also a part of the overall operating costs of a mining company.

The possibility of more stringent regulations exists in the areas of worker health and safety, the dispositions of wastes, the decommissioning and reclamation of mining and milling sites and other environmental matters, each of which could have an adverse material effect on the costs or the viability of a particular project. Compliance with environmental considerations and permitting could have a material adverse effect on the costs or the viability of our projects.

MINING AND EXPLORATION ACTIVITIES ARE SUBJECT TO EXTENSIVE REGULATION BY FEDERAL AND PROVINCIAL GOVERNMENTS. FUTURE CHANGES IN GOVERNMENTS, REGULATIONS AND POLICIES, COULD ADVERSELY AFFECT OUR RESULTS OF OPERATIONS FOR A PARTICULAR PERIOD AND OUR LONG-TERM BUSINESS PROSPECTS.

Mining and exploration activities are subject to extensive regulation by government. Such regulation relates to production, development, exploration, exports, taxes and royalties, labor standards, occupational health, waste disposal, protection and remediation of the environment, mine and mill reclamation, mine and mill safety, toxic substances and other matters. Compliance with such laws and regulations has increased the costs of exploring, drilling, developing, constructing and operating mines and other facilities. Furthermore, future changes in governments, regulations and policies could adversely affect our results of operations in a particular period and our long-term business prospects.

The development of mines and related facilities is contingent upon governmental approvals, which are complex and time consuming to obtain and which, depending upon the location of the project, involve various governmental agencies. The duration and success of such approvals are subject to many variables outside our control.

EMPLOYEES

We have used the services of subcontractors for manual labor. We have also engaged a North American educated geoscientist as outside consultant to evaluate and conform to American standards and to render independent recommendations. The Company currently has five full and part-time employees and will hire engineers and other subcontractors on an as needed basis.

See also “Significant Employees” under Part III, Item 10(b) below.

Item 1A. Risk Factors.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Description of Properties.

OFFICE FACILITIES

The Company was incorporated in the State of Delaware on February 15, 2008, and established an end of December fiscal year end. Its corporate headquarters was initially located at 1127 Webster Street, Suite 28, Oakland, CA 94607. On or about May 1, 2013 the Company moved to its present headquarters located at 7817 Oakport Street, Suite 205, Oakland, CA 94621, which the Company is leasing, with telephone number (510) 638-5000.

The Company had also leased an office space at Harbourview Horizon All-Suite Hotel Suite I-2005, 12 Hung Lok Road, Hunghom Bay, Kowloon, Hong Kong. However, the lease was not renewed after its expiration on January 29, 2013.

EXPLORATION PROPERTY

On or about 2010, the Company commenced exploration activities on its tenement claim in the Philippines, MPSA 320-2010-XI, which was obtained through an assignment agreement with Oro East Mining Company Ltd. However, after Typhoon Haiyan in November, 2013, the Company has ceased all business activities and exploration at its Philippine mine property.

At present, the Company is not engaged in any exploration activities on its mine properties. The Company ceased exploration at MPSA 320-2010-XI due to the natural disasters that ravaged the region and turned its focused its business activities back to the United States. It entered into a lease with Red Bank with the initial intent to explore, but due to a business management decision, the Company put the Red Bank exploration on hold and has instead, focused its efforts on Carson Hill.

The Company does not presently own any property or claims at Carson Hill and instead, has obtained a right of entry through the Assets Purchase and Option Agreement with Sutton Enterprises. Oro East Mariposa owns the personal property of mining waste (the 3 WMUs) at Carson Hill and is presently investing its resources in setting up a flotation refinery to extract gold concentrates from the mining waste.

PROPERTY HISTORY

In the Philippines, the Company’s claim, MPSA 320-2010-XI (7,855 hectares, 19,401 acres) is a tenement claim situated on the outskirts of Davao City in the Philippines. The parcel was applied-registered with the MINES AND GEOSCIENCES BUREAU REGION XI “MGB Region XI” on May 16, 1997.

DESCRIPTION OF CLAIMS

As to its asset, MPSA 320-2010-XI in the Philippines, the Company acquired all exploration, extraction and production rights from Oro East Mining Company Ltd., a privately-held corporation organized under the laws of the Republic of the Philippines licensed for mine acquisition, exploration, and development.

Prior to the Company’s acquisition of its claims, Oro East Mining Company Ltd. did manual test-pitting, artisanal tunneling and trenching activities which indicated a weighted-average Copper (CU) grades of 2.763% Cu based on length (from 18 laboratory assays on rock samples collected). Based on the 18 samples analysis, the Au (gold) weighted-average analysis content was from 1.528 grams/ton based on length.

MPSA 320-2010-XI (7,855 hectares, 19,401 acres) is a tenement claim situated on the outskirts of Davao City in the Philippines. The parcel was applied-registered with the MGB Region XI on May 16, 1997. It is located in the municipalities of Lupon and Tarragona in the Davao Oriental Province, Island Region of Mindanao, Philippines. The project sites at Mt. Tagopo and Mt. Mayo are bounded by coordinates 7 degrees 01’00” to 7 degrees 05’ 00” latitude and 128 degrees 08’ 00” to 126 degrees 11’30” longitude and 7 degrees 02’30” to 7 degrees 08’30” latitude and 126 degrees 17’00” to 126 degrees 19’20” longitude. Oro-East has undergone exploration for copper and gold-bearing veins or structures in this area. These exploration targets are shallow, for vein-type copper and gold-bearing deposits. Copper, gold, and silver are the primary mineral targets in this claim, with lead and zinc as secondary targets.

These mineral claims are located beneath the Philippine Fault and the Pacific Rim tectonic belt, also known as the “Pacific Ring of Fire,” The Company has obtained full permitting under the Mineral Right Sharing Agreement (MRSA) with the Philippine Government which allows the Company to commence full scale exploration and production as of May 15, 2010 on MPSA 320-2010-XI.

Detailed Description of the Claims.

|

I.

|

INTRODUCTION

|

Semi-detailed geological mapping using compass and tape method backed by Global Positioning System (GPS) was conducted by Agetro Davao Mapping Team from June 29, 2008 to August 27, 2008 at the 4,939 hectares of Oro East Mining Claim dominated as MPSA 320-2010-XI -184-XI Parcel II. The geological mapping was undertaken to confirm actual location of the copper ore bodies, gold vein system, alteration zones, lithology and other pertinent geological features. Location of creeks, gulleys, major tributaries, trails, old and current access roads was also facilitated. Prior to the end of the mapping program, location of the initial proposed trenches was also conducted within the areas where copper and gold veins were located. The geological evaluation was undertaken to come up with an initial geological data and recommendation that is deemed necessary for the succeeding exploration and mine operation activities.

|

II.

|

LOCATION AND ACCESSIBILITY

|

The project area referred to as Parcel II under MPSA 320-2010-XI with a total area of 4,939 hectares is more or less bounded by latitude 7 02'30” to 7 08'30” and longitude 126 17'00” to 126 19'30”. It is located within Sitio Mabalante, Barangay Calapagan, Municipality of Lupon and Sitio Manlandog, Bait, Antipolo, New Cebu, Botog, Nasa, Barangay Limot, Municipality of Taragona, all in the Province of Davao Oriental. From Davao City, the prospect can be reached on a three (3) to four (4) hours travel via commercial buses plying the Davao-Mati route. From the City of Mati, Mabalante area which is located at the northern part of the claim can be reached in a three (3) to four (4) hours travel on a 4x4 vehicle via the Mati-Tagbinunga-Calatagan Daticor old logging road towards Quinonoan headwaters Skynix camp area. Manlandog area on the other hand is accessible via Mati-Don Salvador-Cangusan access road in a 1-1/2 travel on a 4x4 vehicle or motorcycle. From Sitio Cangusan, another two (2) hours hike on a foot trail to Manlandog exploration fly camp east of Mayo River. The southern part of the claim is accessible via Mati-Limot-Botog access road, all within the Municipality of Taragona, Davo Oriental. The prospect areas which include New Cebu, Bait, Antipolo, Onlo, Botog, and Aponing area, all of which are interconnected by either old logging road or by foot trails.

|

III.

|

TOPOGRAPHIC SETTING

|

The area under consideration is characterized by rugged to extremely rugged topography with elliptical shape of top ridges, with elevations ranging from 500 to 1,751 meters above sea level. Mountain ranges exhibiting triangular facets are common in the area. The apparent physiographic conformity of deep valley seems to indicate an earlier mature erosion of land surface. The erosion surface has subsequently been dissected by youthful streams.

|

IV.

|

DRAINAGE, VEGETATION, CLIMATE

|

Drainage is generally dendritic as exemplified by the Quinonoan and Mayo River as the major drainage system, with system of modified rectangular drainage pattern and network of tributaries and subtributaries. In the gently sloping area, vegetation abounds in the form of tropical cogon grass, ferns, coffee, abaca, vegetable, corn, variety of outcrop in the rugged and steep parts of the area, are overgrown with second growth forest with some large trees and thick undergrowth. The average weather variation of the region falls under Type 2 of the Climate Map of the Philippines where there is no definite dry season and a very pronounced maximum rainfall from November to January.

|

V.

|

GEOLOGIC SETTING

|

A) REGIONAL GEOLOGY AND TECTONIC SETTING

Regionally, the prospect is located strategically at the southern segment of the Philippine fault. It can also be considered as part of the Diwata range which appears to be a paleogene subduction zone with upthrusted mafic-ultramafic rocks, metamorphic rocks and clastics, comprising the northern part and some igneous rocks at the western flank on the south. The northern part is overlain by Miocene clastics and limestone intruded by middle miocene diorite, andesite and dacite. The north-south trending Diwata range extending from Surigao to Davao forms the backbone of eastern Mindanao. The range is rugged and has several peaks with elevation from 900 to 2,500 meters. The highest which is Mt. Kampali is in the southern part of the range.

The Diwata range which is also known as the Cordilleras of the South is a mineral district of Southeastern Mindanao where porphyry and vein type copper, gold, molybdenum, tactite iron deposits containing sulfides are known to exist. At the western flank of the prospect is a north-south trending batholith 4-8 kilometers wide by more than 20 kilometers long. This batholith is often called by Geologists as diorite intrusive complex, since it consists of different facies mainly diorite, quartz diorite and hornblende diorite porphyry. This batholith is exposed and serves as hostrock in most if not all copper and gold deposits within Taguibo, Calapagan, Marayag, to the western flank of San Mariano up to the Mountain Ranges of Mt. Kinayan in the Municipality of New Bataan.

At the northeastern part of the prospect is an exposure of a columnar basaltic rock formation which is believed to be the oldest rock formation exposed in the district. Probable age of this rock formation is cretaceous to Paleocene (geologic epoch that lasted from about 65.5 to 56 million years ago). At the eastern flank is a thick formation of limestone formation of Oligocene age (23-34 million years ago) capped by the Eocene age volcanic clastics rock from Quinonoan to Mt. Tagbac area.

Dominating the geology of the region, the Eastern Mindanao ridge is a complex NNW-SSE trending volcanic island structure that developed during the upper cretaceous to quarternary as a result of convergent and transcurrent tectonics The area is inferred as being associated with relic east dipping subduction zone that collided with the west Mindanao ridge sometime in the late Miocene.

B) WITHIN PROSPECTS

1. MABALANTE AREA

The Mabalante-upper Quinonoan copper gold prospect is underlain essentially by three (3) rock units composed of diorite, intercalated sequences of metamorphosed volcanics and sedimentary rocks. Common rock exposure however at Mabalante area is volcanic clastics overlain by light to dark gray colored limestone formation. Porphyritic andesite dikes intruded the volcanic clastic rocks. These dikes are trending northwest and sub-parallel major faults in the area. In close proximity with these dikes are thin fractures filled with quartz anhydrite and calc silicate materials.

At Mabalante area, the deposit is hosted to a large extent by andesite porphyry (Andesite is a type of igneous rock that is found in most volcanic regions of the world, especially around volcanoes that line the Pacific Basin), porphyritic-volcanic (a variety of igneous rock consisting of large-grained crystals) , volcanic clastics and partly by the uncomformity rock formation of sandy and basalt limestone, calcarenite, sandstone sequences that developed from spotty to hornfelsic texture. Silicification, chloritization, epidotization and kaolinization are common alteration in the prospect area. Copper mineralization consists predominantly of chalcopyrite, bornite and subordinates of sphalerite and galena, occurring usually as fracture filling and other interlacing minute fractures which serves as passageways or loci for sulfide mineralization. Malachite, azurite and chalcocite are dominant oxidation products.

Three (3) distinct vein systems were mapped and sampled at Mabalante area, namely: Mabalante Copper-molybdenum vein complex which is the focus of the past mining activities; the Southeastern Mabalante vein complex and the Eastern Mabalante vein complex.

1a. MABALANTE COPPER-MOLYBDENUM VEIN COMPLEX

The Mabalante copper-molybdenum vein complex also known as the main Mabalante vein system is a northeast-southwest trending copper vein system with multiple cymoidal and lacer structures along its strike. The main copper structure which was drifted prior to its collapse is composed of 2.0 meter massive copper vein, consisting of chalcopyrite, chalcocite, bornite and cubical specks of pyrite and botroidal marcasite. Fine bandings of white-grayish quartz, sericite and adularia were also noted. General trend of the main copper vein is North 48 -50 East dipping 45 southwest. Coatings of malachite and azurite are dominant especially near the portal. Two (2) minor faults at the footwall of the structure may have displaced the vein with a possible slight southeastern oblique movement.

At upper elevation of the main portal are two (2) abandoned adits with exposure of 0.30 to 1.30 meters copper vein composed of chalcopyrite, bornite, chalcocite, with bonded quartz-calcite specked with fine pyrite. The vein based on its strike and dip is correlative to the structure disclosed at the main portal, located at lower elevation. 30-50 meters north of the main copper structure are two (2) 0.50 meters vein (sample no. M-OTC-09) which may have converged with the main structure at lower elevation where the 0.50-0.70 meters molybdenum vein was exposed. Chipping the hanging wall disclosed a massive copper complex which may have converged forming one (1) major structure at lower elevation. As of this writing, the total strike of the Mabalante main vein complex is 150 meters. Three (3) proposed trenches at 50 meters interval were delineated at the southwestern side of the vein and another three (3) trenches at the northeast side.

Map of Claim Location MPSA 320-2010-XI Mandanao Island, Davao Oriental.

To identify the mineral resources on MPSA 320-2010-XI, the Assignor conducted a semi-detailed geological mapping using compass and tape method backed by Global Positioning System (GPS) and manual test-pitting, artisanal tunneling and trenching activities which indicated a weighted-average Copper (CU) grades of 2.763% Cu based on length (from 18 laboratory assays on rock samples collected). Based on the 18 samples analysis, the Au (gold) weighted-average analysis content was from 1.528 grams/ton based on length. This was conducted by Agetro Davao Mapping Team from June 29, 2008 to August 27, 2008 on 4,939 hectares of Oro East Mining Claim dominated as MPSA 320-2010-XI Parcel II (approximately two thirds of the fully permitted claim MPSA 320-2010-XI).

The Company’s exploration and productions recommendations come from the Assignors Semi-detailed Geological Mapping Report of ORO EAST MINING CLAIM MPSA 320-2010-XI PARCEL II, conducted by Agetro Commodities in September of 2008.

Agetro Commodities is a Philippine company located in Davao City that specializes in geological reports, topographic assay studies, and general geology consulting. Paul S. Ortega is the lead Consulting Geologist & Contractor who works closely with the Company. Francisco C. Rebillon and Noel Z. Franco are Consulting Geologists who, from time to time assist Mr. Ortega. Mr. Ortega formally served as the Senior Geologist at Apex Mining Corp., a public company in the Philippines. He is geologist licensed by the Philippine Board of Examination of the Professional Regulation Commission. He has over 30 years of experience in the mining industry.

Agetro Commodities in not an affiliate of Oro-East Mining Company LTD., Oro East Mining, Inc. or any of their respective affiliates. Fees paid by Oro-East Mining Company LTD. pursuant to its engagement of Agetro with respect to its report are $7,500, and the only fees paid by Oro-East Mining Company LTD. or Oro East Mining, Inc. to Agetro during the past three fiscal years is such $7,500.

1. The initial exposure at the main Mabalante copper-gold complex is very impressive. The potential of the prospect can possibly be substantially big for commercial operations. The geological investigation which includes semi-detailed geological mapping is aimed at actually proving its copper gold potentiality and accomplishing the same by undertaking the following:

1a) Further prospecting at the general area of potential mineralized zone;

1b) Fast track implementation of trench dozing at the proposed trenches to prove persistence of the lateral extent of the vein/structure; Prioritize excavation of trenches programmed at the southwestern part of the mining claims. Initially three (3) trenches were programmed at the southwestern part at 50 meter interval. Three (3) more trenches were also programmed and marked on the ground at the northeastern part of the vein/structure, also at 50- meter interval.

The results and exposure at the trenches will be the basis in the exploration, development and diamond drilling programs to come up with positive ore reserve which will then be the basis of the mining program. The same program should be facilitated at the Mabalante south vein complex and Mabalante east vein complex, respectively.

1c) Knowing the details of the ore which is very important. This is actually advance information not only for the Geologists but for the mining and metallurgical technical staff who will be conducting studies in the near future.

In view:

a. Collect vein samples and submit to the Mines & Geo-sciences Bureau for polish sectioning and mineralogical analysis;

b. A 50-kilo bag ore should also be collected and submitted to any reliable laboratory for metallurgical testing, subject to the approval of the metallurgical engineers.

2. New portal is hereby recommended to be installed or put up at lower elevation. For safety reasons, portal should be located at stable ground; off vein and aimed to intercept the main structure after a 5-10 meters advance, then facilitate drifting south at Mabalante main vein.

3. With the plan to resume tunneling/drifting, grade control and mine geology team should be organized to regularly monitor daily advance of the underground working(s) and at the same time implement effective grade control procedures.

4. Access road to be used, repaired and constructed should be considered. The Cangusan-Bongco road is one good shorter route to the mine site.

5. As observed, the impressive copper ore bodies and ore veins are located at the northern part of the claim particularly at Mabalante and its proximity. High sulphidation copper and gold ore system is very common in Mabalante. The Ore system shows permeability control governed by lithology, structure, changes in wall rock alteration and ore mineralogy. Based on studies, this system has been developed from the reaction with host rock or hot acidic magmatic fluids to produce alteration and later sulphide, gold, copper and silver deposition.

On the other hand, veins delineated at the southern part of the claim can be generally classified as clean ore. Low sulphidation within these areas are well pronounced as exhibited by the veins located thereat. These type of deposits based on studies have been developed from dilute near neutral ph fluids and display mineralogies derived dominantly from magmatic source rocks and others with mineralogies dominated from circulating geothermal fluid sources.

6. Several quartz vein systems were delineated within Manlandog, Karamatyan, Pamatian and the Onlo-Botog areas, respectively. Majority of these veins delineated during the mapping are clean ore material which is very ideal when fed to carbon-in-pulp (CIP) carbon-in-leach (CIL) milling process. The material is composed of quartz calcite with lesser sulphides and other poly metallic materials. To prove persistence of the aforesaid veins, the following are hereby recommended:

6a) Prioritize trench dozing at the abovementioned areas. The location of the proposed trenches are already marked at the ground. The results of the trench dozing will also be the basis in the preparation of diamond drilling program to prove persistence of the vein at depth.

6b) Conduct extensive prospecting particularly within the proximity of the quartz vein outcrops. Lithological surface cappings like the limestone have extensively blanketed the areas where the lateral extension of the veins are supposed to have been found.

7. Several factors have to be considered, should viable, mineable deposit will be blocked at the southern part of the claims.

7a) The access to the main highway is much more accessible.

7b) Three (3) phase source of electricity which is very vital when constructing and operating a mill plant is available at and near Barangay Limot, a few kilometers from the ore source.

7c) Several areas at the Sitio Botog-Nasa are ideal for mine, mill and other mining facilities. Several areas are also ideal for building a tailings dam. There is abundant source of potable and industrial water which can be tapped.

8. Lastly, the Oro East Parcel II claim is within the southern portion of the southern cordillera ranges. This mountain range which appears to be the backbone of the Southeastern Mindanao area is known to have hosted multiple impressive mineable deposits. Some of these deposits are already being exploited both by big scale and small scale mining method. During the course of the semi-detailed geological mapping conducted by the Agetro Davao Team, not only that the team was able to locate the now famous Mabalante copper-gold-molybdenum complex but also found several traces of multiple vein systems along and within the other part of the claims particularly towards south. The possibility of finding and proving other impressive, commercial and mineable vein systems is not remote.

MINING EQUIPMENT AND TRUCKS

We purchased and set up a gold refinery processing line and a lab at the Carson Hill property site for the WMUs under a right-of-entry and use clause in the Assets Purchase Agreement with Sutton Enterprises.

Item 3. Legal Proceedings.

Tax Penalties

In July and August 2013, the Internal Revenue Service (“IRS”) issued penalties against the Company under Section 6038 and 6038A of the Internal Revenue Code for failure to file Form 5471 and 5472. The total penalty assessment was $60,000 plus interest charges. As of December 31, 2013, total penalty assessment including interest charges was about $60,323. In response, the Company filed a Reasonable Cause Statement to appeal for full abatement of the penalty, citing reasonable cause and requesting an administrative waiver or offer-in-compromise. Subsequently, the Company retained Louie and Wong LLP, tax professionals to assist in handling the matter with the IRS. The final result of the proceeding is still pending as of this filing.

Aside from the foregoing tax matter, there are no other pending legal proceedings to which the Company is a party or in which any director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s mineral claim is not the subject of any pending legal proceedings.

.

Item 4. Mine Safety Disclosures.

Not applicable.

PART II

Item 5. Market for Common Equity, Related Stockholder Matters and Small Business Issuer Purchases of Equity Securities.

Common Stock

Our Certificate of Incorporation authorizes the issuance of up to 100,000,000 shares of common stock, par value of $.0001 per share (the “Common Stock”). The Common Stock is not listed on a publicly-traded market. The number of shares outstanding of each of the issuer’s classes of common equity, as of the latest practicable date: 27,168,290 shares of common stock, par value $.0001 per share, outstanding as of March 31, 2014.

The Company also issued 42,000 and 13,000 common shares for consulting services during 2013 and 2012. The Company recognized a total of $51,324 and $249,444 share-based payment expenses during 2013 and 2012, respectively.

The Company sold 427,300 and 269,550 shares of common stock to other investors for cash of $1,281,900 and $808,650 during 2013 and 2012, respectively.

The Company redeemed from Accelerated Venture Partners, LLP 1,500,000 shares of common stock for an aggregate redemption price of $150 pursuant to a Stock Redemption Agreement dated May 13, 2013. The Company then canceled and returned the 1,500,000 shares to the authorized stock of the Company.

Dividend Policy

We have not declared or paid dividends on our common stock since our formation, and we do not anticipate paying dividends in the foreseeable future. Declaration or payment of dividends, if any, in the future, will be at the discretion of our Board of Directors and will depend on our then current financial condition, results of operations, capital requirements and other factors deemed relevant by the Board of Directors. There are no contractual restrictions on our ability to declare or pay dividends.

Securities Authorized for Issuance under Equity Compensation Plans

We adopted the 2013 Stock Incentive Plan (the “Plan”) in May, 2013, which provides up to 5,000,000 shares of the Company’s common stock for issuance. Please refer to Item 13 of this annual report for further information of the Plan.

Recent Sales of Unregistered Securities

The Company did not sell any equity securities that were not registered under the Securities Act during the year ended December 31, 2013.

Issuer Purchases of Equity Securities

The Company redeemed 1,500,000 shares of common stock of the Company in May, 2013 for an aggregate redemption price of $150.00, pursuant to a Stock Redemption Agreement with AVP. The Company returned the 1,500,000 shares redeemed from AVP to the authorized stock of the Company.

Item 6. Selected Financial Data.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation.

The following discussion provides information that the Company’s management believes is relevant to an assessment and understanding of our results of operations and financial condition. The discussion should be read along with the Company’s consolidated financial statements and notes thereto. This section includes a number of forward-looking statements that reflect our current views with respect to future events and financial performance. Forward-looking statements are often identified by words like believe, expect, estimate, anticipate, intend, project and similar expressions, or words which, by their nature, refer to future events. Undue certainty should not be placed on these forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our predictions.

Business Overview

In 2013 the Company ceased mining exploration at its Philippine site due to force majeure conditions. Instead, it set its sights within the United States. On December 24, 2013, the Company’s subsidiary, Oro East Mariposa, LLC entered into an Assets Purchase and Option Agreement with Sutton Enterprises, the holder of the Carson Hill site.

Of particular note are three Waste Management Units (WMUs) that contain gold tailings at the Carson Hill site. Previously, the site’s owner, Sutton Enterprises was operating a rock aggregate business from the WMUs. However, the Company had a fortuitous meeting with the partners of Sutton Enterprises and discovered significant gold tailings in the WMUs that can be refined in a specialized process. Oro East Mariposa then purchased the WMUs from Sutton Enterprises, along with granting 30% Net Royalties from income generated by the gold in the WMU tailings. The Purchase Price was $6,000,000.00 payable in set installments. At present, no payments have been made on the Purchase Price, as the contract conditions payment on approval of the Regional Water Board’s approval of the WMUs Mining Waste Reclassification proposal and the City Council’s approval of the business activities. Oro East Mariposa, LLC and Sutton Enterprises are now working closely with the city and state to optimize a refining process for the gold reserves.

The current business activity of the Company does not include any mining exploration. Rather, after the purchase of the WMUs at Carson Hill, the Company is focused on producing gold concentrates from the mining waste and leached ore.

Our plan of operation for the period through December 31, 2014 is as follows:

|

·

|

Continue the aggressive production of gold concentrates through the flotation refinery from the mining waste and leached ore of the WMUs at Carson Hill, and commence active sales of the gold concentrates.

|

|

·

|

The Company entered into a purchase agreement with a foreign purchaser for the gold concentrates yielded from the Carson Hill WMUs. A $1,000,000.00 advance on the purchase price was credited to the Company to fund the processing and setup for the WMUs. The Company will be transacting primarily with said foreign purchaser for sales of the gold concentrates.

|

|

·

|

Work with the Regional Water Board at Carson Hill to reclassify the waste at the WMUs as Group “C” Mining Waste. There is an estimate of 3.5 million tons of spent ore in the WMUs and upon reclassification, the Company through its subsidiary will mine and process the material for gold. At the same time, the reclassification project will eliminate the need for long-term maintenance of the permanent waste storage units and mitigate negative environmental impacts to the area, in particular, mitigating potential sources of impact to groundwater quality.

|

|

·

|

Complete the pilot scale froth flotation system that the Company has set up at the Carson Hill site along with a Sand Plant. The leached ore from the WMUs are being crushed and transported to the Sand Plant to produce, bag, and ship gold concentrates.

|

|

·

|

Complete the due diligence investigations on the Carson Hill site presently owned by Sutton Enterprises, which the Company could purchase by Option reserved in the Asset Purchase and Option Agreement.

|

|

·

|

Advance aggressive sales of the gold concentrates from the WMUs.

|

|

·

|

Work collaboratively with the local government and community in the Philippines to assess feasibility of reopening the Philippine mining exploration activities.

|

|

·

|

Seek additional mineral exploration opportunities in the State of California.

|

Liquidity and Capital Resources

As of December 31, 2013 and 2012, the Company had a total of $647,489 and $690,440 in assets, respectively. The Company also had $959,796 and $939,281 current liabilities as of December 31, 2013 and 2012, respectively.

The following is a summary of the Company's cash flows provided by (used in) operating, investing, and financing activities for the years ended December 31, 2013 and 2012:

|

2013

|

2012

|

|||||||

|

Net Cash Used In Operating Activities

|

$

|

(1,743,210

|

)

|

$

|

(425,179

|

)

|

||

|

Net Cash Used In Investing Activities

|

(159,441

|

)

|

(14,551

|

)

|

||||

|

Net Cash Provided By Financing Activities

|

1,611,433

|

735,529

|

||||||

|

Effect of exchange rate on cash

|

(25,558

|

)

|

(4,684

|

)

|

||||

|

Net Increase (Decrease) In Cash

|

$

|

(316,776

|

)

|

$

|

291,115

|

|||

Total cash decreased by about $317,000 was mainly due to about $1,740,000, $250,000, $160,000 and $130,000 of cash used in funding the operations, repayment of notes, acquisition of computer and office equipment, and repayment of shareholder advances, respectively, despite about $1,990,000 of cash provided by the stock and short-term notes issuances during the year ended December 31, 2013.

Results of Operations

The following is a summary of the Company’s operation results for the years ended December 31, 2013 and 2012:

|

2013

|

2012

|

|||||||

|

Total revenues

|

$

|

127,234

|

$

|

-

|

||||

|

Total cost of revenues

|

(73,390

|

)

|

-

|

|||||

|

Gross profit

|

53,844

|

-

|

||||||

|

Total operating expenses

|

(1,629,086

|

)

|

(1,213,506

|

)

|

||||

|

Total other income (expense)

|

(25,482

|

)

|

(10,572

|

)

|

||||

|

Net loss

|

$

|

(1,600,724

|

)

|

$

|

(1,224,078

|

)

|

||

As explained in Part I Item 1 and the Business Overview section above, the Company is no longer in the exploration stage upon changing of the Company’s business plan.

Net loss increased by about $380,000 from 2012 to 2013 due to the increase of about $30,000 and $380,000 in exploration costs and general and administrative expenses, respectively, despite about $54,000 gross profit generated from the gold concentrate sales.

Due to heavy flooding in the Philippines during the first quarter of 2012 and the pending of SEC’s approval of Form S-1 for funding from additional stock issuance, there were no exploration activities until the last quarter of 2012 when smaller scale exploration activities started. As explained in the Business Overview section, we did not have any exploration activities in Philippines starting October 2013. The exploration of the Red Bank was only for about three months due to the commencement of the Carson Hill project. Overall, exploration costs were increased by about $30,000. We started and completed the pilot testing of the Carson Hill project for the refinery operations in October 2013 and shipped the first batch of processed gold concentrates in December 2013.

Increase of $380,000 in general and administrative expenses was mainly due to the increase of $66,000 in donations to Philippines government agencies for flooding victims and other government activities, $320,000 in payroll expenses, $38,000 in legal and professional fees, $62,000 in tax penalties due to late filings, $117,000 in other general and administrative of Oro East Mariposa subsequent to its incorporation in June 2013, and the decrease of $198,000 and $25,000 in share-based compensation and travel expenses, respectively.

Off-Balance Sheet Arrangements

The Company does not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on the Company’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Seasonality

Our operating results are not affected by seasonality.

Inflation

Our business and operating results are not affected in any material way by inflation.

Critical Accounting Policies

The consolidated financial statements are presented in accordance with Accounting Standards Codification (“ASC”) 915 and SEC Industry Guide 7 for its characterization to be in the exploration stage.

Emerging Growth Company

We are an “emerging growth company,” as defined in the Jumpstart our Business Startups Act of 2012, and we may take advantage of certain exemptions from various reporting requirements that are applicable to other public companies, including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved.

Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Use of Estimates

The preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the balance sheet and reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Revenue

Revenue from gold concentrate sales is recognized when the title and risk of loss pass to the buyer and when collectability is reasonably assured. The title and risk of loss is passed to the buyer based on the terms of the sales contract entered into with the buyer when the gold concentrates are shipped at the loading port.

Revenue is recorded and buyer is invoiced based on a provisional sales price as determined in accordance with the terms as specified in the sales contract at the time of shipment. Upon final settlement with the buyer (generally one to two months from the shipment date), the provisional sales price is adjusted based on the contract terms. Between shipment and final settlement, changes in gold futures settlement price on the Commodity Exchange Inc. (“COMEX”) result in adjustment to the revenue. The gold concentrate sales contain an embedded derivative that is required to be bifurcated from the host contract, which is the sale of the metal gold contained in the concentrates at the COMEX gold future settlement prices as specified in the contract. The embedded derivative does not qualify for hedge accounting and is adjusted to fair value through earnings each reporting period, using the COMEX gold future settlement prices at period-end, until final settlement.

Exploration Costs

Mineral property exploration costs are expensed as incurred until such time as economic reserves are quantified.

Share-based Compensation

The Company recognizes the services received in a share-based payment transaction as the services are received. The services received are measured at the fair value of the equity instruments issued.

Concentrations

Major Customers

During 2013, all of the Company’s revenues were from one customer.

Credit Risk

Financial instruments that potentially subject the Company to concentration of credit risk consist primarily of cash and trade receivables. The Company’s cash are held at various recognized financial institutions, and we do not believe significant concentration of credit risk exists. The Company performed credit evaluation of its customer’s financial condition, and the receivables were secured by the letter of credit issued per contract terms. Therefore, we do not believe a significant risk of loss exists from a concentration of credit.

Foreign Currency Translation

The consolidated financial statements are presented in United States dollars. In accordance with ASC 830, foreign denominated monetary assets and liabilities are translated into their United States dollar equivalents using foreign exchange rates which prevailed at the balance sheet date. Revenue and expenses are translated at average rates of exchange during the year. Gains or losses resulting from foreign currency transactions are included in results of operations.

Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which assumes the Company will realize its assets and discharge its liabilities in the normal course of business. As reflected in the accompanying consolidated financial statements, the Company has an accumulated deficit of $4,723,329 and a negative working capital of $709,525 at December 31, 2013. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profit from operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from the normal business operations when they come due. Management’s plan includes obtaining additional funds by equity and debt financing and/or related party advances, but there is no assurance of additional funding being available. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments that might arise as a result of this uncertainty.

Contractual Obligations

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 7A. Quantitative and Qualitative Disclosures about Market Risk.

As a “smaller reporting company” as defined by Item 10 of Regulation S-K, the Company is not required to provide this information.

Item 8. Financial Statements and Supplementary Data.

Audited Consolidated financial statements begin on the following page of this report.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders

Oro East Mining, Inc.

Oakland, California