Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Embarr Downs, Inc. | Financial_Report.xls |

| EX-32.2 - CERTIFICATION - Embarr Downs, Inc. | embr_ex322.htm |

| EX-31.1 - CERTIFICATION - Embarr Downs, Inc. | embr_ex311.htm |

| EX-32.1 - CERTIFICATION - Embarr Downs, Inc. | embr_ex321.htm |

| EX-31.2 - CERTIFICATION - Embarr Downs, Inc. | embr_ex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended FEBRUARY 28, 2014

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from__________________ to __________________.

Commission File Number: 000-55044

Embarr Downs, Inc.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

46-3403755

|

|

(State of Incorporation)

|

|

(I.R.S. Employer Identification No.)

|

|

205 Ave. Del Mar. #984, San Clemente, California

|

|

92674

|

| (Address of principal executive offices) | (Zip Code) |

(949) 461-1471

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Non-accelerated filer

|

o |

|

Accelerated filer

|

o

|

Smaller reporting company

|

x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

Title of Each Class

|

Outstanding as of

March 10, 2014,

|

|||

|

Common stock, par value $0.0001 per share

|

45,078,284 | |||

|

Class A Preferred Stock, par value $0.001 per share

|

4,000,000 | |||

|

Class B Preferred Stock, par value $0.001 per share

|

1,565,696 | |||

EMBARR DOWNS, INC.

FORM 10-Q

February 28, 2014

TABLE OF CONTENTS

| PART I -- FINANCIAL INFORMATION | |||||

|

Item 1.

|

Financial Statements

|

3 | |||

|

Item 2.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

8 | |||

|

Item 3.

|

Quantitative and Qualitative Disclosures About Market Risk

|

11 | |||

|

Item 4.

|

Control and Procedures

|

12 | |||

| PART II -- OTHER INFORMATION | |||||

|

Item 1.

|

Legal Proceedings

|

14 | |||

|

Item 1A.

|

Risk Factors

|

14 | |||

|

Item 2.

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

14 | |||

|

Item 3.

|

Defaults Upon Senior Securities

|

15 | |||

|

Item 4.

|

Mine Safety Disclosures

|

15 | |||

|

Item 5.

|

Other Information

|

15 | |||

|

Item 6.

|

Exhibits

|

15 |

2

PART I -- FINANCIAL INFORMATION

ITEM 1 – FINANCIAL STATEMENTS

|

Embarr Downs, Inc.

|

||||||

|

(A Development Stage Company)

|

||||||

|

Balance Sheet

(Unaudited)

|

|

February 28,

2014

|

August 31,

2013

|

|||||||

|

ASSETS:

|

||||||||

|

Current assets:

|

||||||||

|

Cash or cash equivalents

|

$ | 6,009 | $ | 2,902 | ||||

|

Thoroughbreds

|

52,263 | 55,000 | ||||||

|

Total assets

|

$ | 58,272 | $ | 57,902 | ||||

|

LIABILITIES AND SHAREHOLDERS’ EQUITY

|

||||||||

|

|

||||||||

|

Accounts payable

|

$ | 23,620 | $ | - | ||||

|

Notes payable- related party

|

31,375 | 13,000 | ||||||

|

Notes payable

|

210,000 | - | ||||||

|

Accrued interest

|

1,243 | - | ||||||

|

Accrued Dividends

|

11,270 | - | ||||||

|

Total liabilities

|

277,508 | 13,000 | ||||||

|

Shareholders’ equity:

|

||||||||

|

Preferred Stock Series A, Par Value $.001, 5,000,000 shares authorized, 4,000,000 and 4,000,000 Issued and Outstanding Issued and Outstanding, respectively.

|

4,000 | 4,000 | ||||||

|

Preferred Stock Series B, Par Value $.001, 2,000,000 shares authorized, 1,565,696 and 0 Issued and Outstanding Issued and Outstanding, respectively.

|

1,566 | - | ||||||

|

Common Stock, Par Value $.0001, 500,000,000 shares authorized, 45,075,284 and 78,284 Issued and Outstanding, respectively.

|

4,508 | 8 | ||||||

|

Additional Paid In Capital

|

1,000,051 | 61,117 | ||||||

|

Dividends

|

(13,002 | ) | - | |||||

|

Deficit accumulated in the development stage

|

(1,216,359 | ) | (20,223 | ) | ||||

|

Total shareholders' equity (deficit)

|

(219,236 | ) | 44,902 | |||||

|

Total liabilities and shareholders' equity (deficit)

|

$ | 58,272 | $ | 57,902 | ||||

The accompanying notes are an integral part of these unaudited financial statements.

3

|

Embarr Downs, Inc.

|

|||||

|

(A Development Stage Company)

|

|||||

|

Statement of Operations

|

|||||

|

(Unaudited)

|

|

Three months

|

Three months

|

Six months

|

Six months

|

From inception February 23,

2012

|

||||||||||||||||

|

Ended

|

Ended

|

Ended

|

Ended

|

through

|

||||||||||||||||

|

February 28,

|

February 28,

|

February 28,

|

February 28,

|

February 28,

|

||||||||||||||||

|

2014

|

2013

|

2014

|

2013

|

2014

|

||||||||||||||||

|

Ordinary Income

|

$ | 25,838 | $ | - | $ | 25,838 | $ | - | $ | 25,838 | ||||||||||

|

Cost of Goods Sold

|

19,027 | 19,027 | - | 19,027 | ||||||||||||||||

|

Net Income

|

6,811 | - | 6,811 | - | 6,811 | |||||||||||||||

|

Operating Expenses

|

||||||||||||||||||||

|

Thoroughbred research

|

684 | 1,639 | 713 | 2,098 | 7,862 | |||||||||||||||

|

Thoroughbred expenses

|

28,946 | - | 37,285 | - | 37,285 | |||||||||||||||

|

Depreciation

|

8,654 | - | 11,710 | - | 11,710 | |||||||||||||||

|

General and administrative expense

|

197,627 | 2,250 | 1,153,239 | 3,750 | 1,166,313 | |||||||||||||||

|

Total Operating Expenses

|

235,911 | 3,889 | 1,202,947 | 5,848 | 1,223,170 | |||||||||||||||

|

Operating Income

|

(229,100 | ) | (3,889 | ) | (1,196,136 | ) | (5,848 | ) | (1,216,359 | ) | ||||||||||

|

Provisions for Income Tax

|

- | - | - | - | - | |||||||||||||||

|

Net Loss

|

$ | (229,100 | ) | $ | (3,889 | ) | $ | (1,196,136 | ) | $ | (5,848 | ) | $ | (1,216,359 | ) | |||||

|

|

||||||||||||||||||||

|

Earnings Per Share, Basic and Diluted

|

$ | (0.01 | ) | $ | (0.10 | ) | $ | (0.05 | ) | $ | (0.15 | ) | ||||||||

|

Weighted Average Number of Shares Outstanding

|

45,078,284 | 38,400 | 24,940,162 | 38,400 | ||||||||||||||||

The accompanying notes are an integral part of these unaudited financial statements.

4

|

Embarr Downs, Inc

|

|

(A Development Stage Company)

|

|

Statement of Cash Flows

(Unaudited)

|

|

From Inception

|

||||||||||||

|

Six Months ending

|

Six Months

ending

|

February 23, 2012 through

|

||||||||||

|

February 28,

2014

|

February 28,

2013

|

February 28,

2014

|

||||||||||

|

Cash flows from operating activities

|

||||||||||||

|

Net Loss

|

$ | (1,196,136 | ) | $ | (5,848 | ) | $ | (1,216,359 | ) | |||

|

Deprecation

|

11,710 | - | 11,710 | |||||||||

|

Stock Based Compensation

|

945,000 | - | 945,000 | |||||||||

|

Changes in assets and liabilities:

|

||||||||||||

|

Thoroughbred

|

(8,973 | ) | - | (8,973 | ) | |||||||

|

Accounts payable

|

23,620 | - | 23,620 | |||||||||

|

Accrued Interest

|

1,243 | - | 1,243 | |||||||||

|

Net cash provided by (used in) operating activities

|

(223,536 | ) | (5,848 | ) | (243,759 | ) | ||||||

|

Cash flows from financing activities

|

||||||||||||

|

Proceeds from sale of common stock

|

- | - | 3,125 | |||||||||

|

Contributed capital

|

- | 6,000 | 13,000 | |||||||||

|

Proceeds from note issued

|

37,500 | - | 37,500 | |||||||||

|

Proceeds from line of credit

|

172,500 | - | 172,500 | |||||||||

|

Payments on notes to related party

|

(32,327 | ) | - | (32,327 | ) | |||||||

|

Dividend payment

|

(1,732 | ) | - | (1,732 | ) | |||||||

|

Proceeds from note issued to related party

|

50,702 | - | 57,702 | |||||||||

|

Net cash provided by financing activities

|

226,643 | 6,000 | 249,768 | |||||||||

|

Net increase in cash

|

3,107 | 152 | 6,009 | |||||||||

|

Cash balance, beginning of periods

|

2,902 | 1,575 | - | |||||||||

|

|

||||||||||||

|

Cash balance, end of periods

|

$ | 6,009 | $ | 1,727 | $ | 6,009 | ||||||

|

|

||||||||||||

|

Cash paid for:

|

||||||||||||

|

Interest

|

$ | - | $ | - | $ | - | ||||||

|

Income taxes

|

$ | - | $ | - | $ | - | ||||||

|

Noncash financing and investing activities:

|

||||||||||||

|

Stock and note payable issued to purchase thoroughbreds by related party

|

$ | - | $ | - | $ | 55,000 | ||||||

|

Stock issued for Reverse Merger

|

$ | - | $ | - | $ | 3 | ||||||

|

Series B Preferred Share dividends issued to Common Stock Shareholder

|

$ | 1,566 | $ | - | $ | 1,566 | ||||||

|

Dividends Accrued

|

$ | 11,270 | $ | - | $ | 11,270 | ||||||

The accompanying notes are an integral part of these unaudited financial statements.

5

EMBARR DOWNS, INC.

(A Development Stage Company)

CONDENSED NOTES TO UNAUDITED FINANCIAL STATEMENTS

Note 1 – Basis of Presentation and significant accounting policies

The accompanying unaudited financial statements of Embarr Downs, Inc. (the “Company”) have been prepared in accordance with accounting principles generally accepted in the United States of America and the rules of the Securities and Exchange Commission ("SEC"), and should be read in conjunction with the audited financial statements and notes thereto contained in the Company's registration statement filed with the SEC on Form 10. In the opinion of management, all adjustments, consisting of normal recurring adjustments, necessary for a fair presentation of financial position and the results of operations for the interim periods presented have been reflected herein. The results of operations for interim periods are not necessarily indicative of the results to be expected for the full year. Notes to the financial statements which would substantially duplicate the disclosure contained in the audited financial statements for the most recent fiscal year 2013 as reported in Form 10, have been omitted.

Stock-based Compensation

Accounting Standards Codification (“ASC”) 718, “Accounting for Stock-Based Compensation" established financial accounting and reporting standards for stock-based compensation plans. It defines a fair value based method of accounting for an employee stock option or similar equity instrument. The Company accounts for compensation cost for stock option plans and for share based payments to non-employees in accordance with ASC 718. Accordingly, employee share-based payment compensation is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. Additionally, share-based awards to non-employees are expensed over the period in which the related services are rendered at their fair value. The Company accounts for share based payments to non-employees in accordance with ASC 505-50 “Accounting for Equity Instruments Issued to Non-Employees for Acquiring, or in Conjunction with Selling, Goods or Services”.

Note 2 – Going Concern

The Company's financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern, which contemplates the realization of assets and liquidation of liabilities in the normal course of business. However, the Company has negative working capital, recurring losses, and does not have an established source of revenues sufficient to cover its operating costs. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plan described in the preceding paragraph and eventually attain profitable operations. The accompanying financial statements do not include any adjustments that may be necessary if the Company is unable to continue as a going concern.

In the coming year, the Company’s foreseeable cash requirements will relate to continual development of the operations of its business, maintaining its good standing and making the requisite filings with the Securities and Exchange Commission, and the payment of expenses associated with operations and business developments. The Company may experience a cash shortfall and be required to raise additional capital.

Historically, it has mostly relied upon internally generated funds such as shareholder loans and advances to finance its operations and growth. Management may raise additional capital by retaining net earnings or through future public or private offerings of the Company’s stock or through loans from private investors, although there can be no assurance that it will be able to obtain such financing. The Company’s failure to do so could have a material and adverse effect upon it and its shareholders.

Note 3 – Related Party Transaction

As of August 31, 2013, a noted payable of $13,000 was due to the Company CEO Joseph Wade. During the six months ended February 28, 2014, the Company CEO contributed additional $50,702 as a note payable and repaid $32,327 for a total remaining amount owed of $31,375. These notes is unsecured, non-interest bearing and matures on December 31, 2014.

Note 4 – Equity

Shares issued for services

During the six months ended February 28, 2014, the Company issued 45,000,000 shares of common stock to employees and third party consultants ascompensation. The fair value of the shares was determined to be $945,000.

6

Reverse stock split

On September 20, 2013, the Company executed a Fifty Thousand to One (50,000:1) reverse stock split of issued and outstanding shares of its Common Stock. As part of the reverse, the total authorized shares of Common Stock were reduced to 500,000,000 shares. The Company accounted for the reverse stock split retrospectively and is presented accordingly in the Company’s consolidated financial statements.

Series B Preferred Stock

On September 20, 2012, the Company approved of the issuance of Series B Preferred Stock to its Common Stock shareholders. Each common stock shareholders, prior to the reverse stock split, received one share of Series B Preferred Stock for each 2,500 common stock shares owned. As a result 1,565,696 of Series B Preferred Stocks were issued for a total fair value of $1,566. The stock dividend is considered an equity transaction due to all shareholders participating in the issuance.

The Series B Preferred Stock consists of 2,000,000 authorized and 1,565,696 are issued and outstanding as of the date of this filing. The Series B Preferred has the following terms and rights:

Dividend: No dividend rights

Ranks: All shares of Preferred Stock shall rank superior with all of the Corporation's Common Stock, $.0001 par value (the "Common Stock"), now or hereafter issued, as to distributions of assets upon liquidation, dissolution or winding up of the Corporation, whether voluntary or involuntary, including the payment of dividends.

Conversion Provisions.

|

(a)

|

The company may convert, at any time by an affirmative vote of the Board of Directors, the shares of the Series B Preferred Stock into Common Stock equal to a rate equal to $1.00 divided by the closing price of the Company’s Common Stock as listed by OTC Markets (“Market Value”) for the date the conversion was approved by the Board of Directors. If no closing price is available, then the Market Value shall be assumed to be $1.00 per common share. Any fractional share shall be rounded up to the nearest share.

|

|

(b)

|

Each share of the Series B Preferred Stock, unless previously converted, will automatically convert on August 31, 2018 (the “mandatory conversion date”), into a number of shares of common stock equal to a rate equal to $1.00 divided by the closing price of the Company’s Common Stock as listed by OTC Markets (“Market Value”) for the date the conversion was approved by the Board of Directors. If no closing price is available, then the Market Value shall be assumed to be $1.00 per common share. Any fractional share shall be rounded up to the nearest share.

|

Voting Rights. The holders of the mandatory convertible preferred stock do not have voting rights other than those specifically required by Nevada law.

Dividends

One February 22, 2014, the Company declared dividends of $0.00025 for the common shareholder on February 28, 2014. The company has accrued $11,270 as of February 28, 2014 for dividends.

Note 5 – Notes Payable

On January 9, 2014, the Company entered into a line of credit agreement for $200,000. The material terms of the line of credit are as follows:

|

(1)

|

The Company to borrow up to $200,000.

|

|

(2)

|

The amount that the Company borrows will carry an interest equal to nine percent (9%) per annum.

|

|

(3)

|

The Company will pay the accrued interest on any outstanding principal balance on the 15th of each month.

|

|

(4)

|

The maturity date is August 31, 2016.

|

|

(5)

|

The Debt from the Line of Credit may not be converted into common shares of the company.

|

As of February 28, 2014, the Company borrowed $172,500 from this line of credit.

On December 30, 2013, the Company entered into an unsecured convertible promissory note with a principal amount of $37,500 with Asher Enterprises. The Company received net proceeds of $37,500 from the Transaction, which will be used as general working capital and to acquire thoroughbreds. Interest on the Note accrues at a rate of 8% annually and is to be paid with principal in full on the maturity date. The principal amount of the Note together with interest may be converted into shares of the Company's common stock, par value $0.0001 (“Common Stock”), at the option of the note holder at a conversion price equal to fifty-five percent (55%) of the average of the lowest three closing bid prices for the Common Stock during the ten trading days prior to the conversion. At any time up to 120 days from the date of the note, the company has the option to repay the principal amount plus any accrued interest at a rate equal to 140% of the principal amount and accrued interest. The company intends to repay this loan from the proceeds of the $200,000 line of credit.

Note 6 – Subsequent Events

|

1.

|

On March 25, 2014, the Company’s Board of Directors approved a dividend of $.0001 per share to shareholders of record on April 4, 2014.

|

|

2.

|

On March 24, 2014, the Company filed to form a wholly owned subsidiary Embarr Farms, Inc. in Nevada.

|

On March 24, 2014, the Company filed to form a wholly owned subsidiary Hemp Fish Water, Inc. in Nevada.

7

ITEM 2 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain matters discussed herein are forward-looking statements. Such forward-looking statements contained herein involve risks and uncertainties, including statements as to:

|

|

·

|

our future operating results;

|

|

|

·

|

our business prospects;

|

|

|

·

|

our contractual arrangements and relationships with third parties;

|

|

|

·

|

the dependence of our future success on the general economy;

|

|

|

·

|

our possible financings; and

|

|

|

·

|

the adequacy of our cash resources and working capital.

|

These forward-looking statements can generally be identified as such because the context of the statement will include words such as we “believe,” “anticipate,” “expect,” “estimate” or words of similar meaning. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties which are described in close proximity to such statements and which could cause actual results to differ materially from those anticipated as of the date of this report. Shareholders, potential investors and other readers are urged to consider these factors in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements included herein are only made as of the date of this report, and we undertake no obligation to publicly update such forward-looking statements to reflect subsequent events or circumstances.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read the following discussion of our financial condition and results of operations in conjunction with the financial statements and the notes thereto, included elsewhere in this report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward-looking statements. Factors that could cause or contribute to those differences include those discussed below and elsewhere in this report, particularly in the “Risk Factors” section.

History

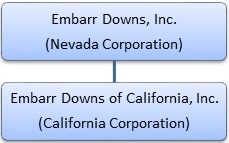

Embarr Downs, Inc. (“we”, “us”, “our”, the "Company" or the "Registrant") was originally incorporated in the State of Florida on June 27, 1997 under the name of July Project III Corp. and changed our name to Globalgroup Investment Holdings, Inc. on October 18, 2000 and subsequently changed our name to Embarr Downs, Inc. on August 20, 2013. The Company was reincorporated in Nevada on March 12, 2012. The Company is domiciled in the state of Nevada, and its corporate headquarters are located in the Los Angeles area of California. On August 20, 2013, the Company entered into an Agreement whereby the Company acquired 100% of Embarr Downs of California, Inc., incorporated in the State of California on February 23, 2013, and all operations of Embarr Downs, Inc., along with all the prior assets and liabilities were spun off through Sovereign Oil, Inc. On August 20, 2013, the acquisition closed and under the terms of the Agreement the Embarr Downs was the surviving entity. The Company selected August 31 as its fiscal year end.

This is the current corporate organization:

8

Embarr Downs, Inc. trades on the OTC Market Pink Sheets under the symbol EMBR.

Business of Registrant

The Company's business is the buying, selling and racing of thoroughbreds that can race in the allowance and stakes levels of thoroughbred racing; however, the Company will initially begin in the claiming level of thoroughbred racing. The Company intends to acquire 4-6 horses in its claiming division before acquiring horses for its allowance/stakes division. These 4-6 horses will provide the Company with revenue and a foundation to build out a stakes level stable. The Company’s main focus will be acquiring horses that will be capable of racing in stake races throughout the Country.

Allowance races are a race other than claiming for which the racing secretary drafts certain conditions (see below for more details). Stakes races are the top level races. The purse money is significantly higher in allowance and stakes level races. Claiming refers to the process by which a licensed person may purchase a horse entered in a race designated as a “claiming race” for a predetermined price. When a horse has been claimed, its new owner assumes title after the starting gate opens although the former owner is entitled to all purse money earned in that race. Claiming races are lowest level in thoroughbred racing. Stakes and allowance races are races in which the horses are not for sale. The Company also engages in the business of thoroughbred research.

The Company is a developmental stage company. Additionally, the Company's management has expressed substantial doubt about our ability to continue as a going concern. The Company needs to raise additional capital to continue operations and to implement its plan of operations. The Company has insufficient capital to continue operations for the next 12 months. The Company requires up to $40,000 to continue its current operations for the next 12 months. The officer, director and principal shareholder has verbally agreed to provide additional capital, up to $40,000, to the Company to funds it current operations until the Company can raise additional capital; however, there is no guarantee that our officers and directors will provide the loan to the Company. The company needs to raise capital in the amount of $1,600,000 to fully execute on its business plan on claiming at least 12-15 thoroughbreds over the next 18 months. The Company initially needs to raise $200,000 to begin implementing its business plan and acquiring thoroughbreds to race in claiming races. The Company needs the additional $1,400,000 to acquire a total of 8 thoroughbreds for its claiming division and 3-5 for its allowance/stakes division. The Company has not secured the financing necessary to execute timetables and/or acquisitions stated above. Furthermore, there is no guarantee that the Company will be able to raise the funds discussed in this paragraph.

Company’s Thoroughbreds

|

(1)

|

Rock Off was acquired by Joseph Wade, our CEO, on behalf of the Company. All rights to Rock Off have been transferred to our subsidiary, Embarr Downs of California.

|

|

(2)

|

Street Car was claimed on January 11, 2014 for $8,000.

|

Photos of the Thoroughbreds

|

|

||

| Rock Off (December 1, 2013) | Street Car (January 12, 2014) |

Racing Statistics

|

Year

|

Starts

|

Win

|

Place

|

Show

|

Earnings

|

Avg/Start

|

|

2014

|

3

|

0

|

1

|

0

|

$4,800

|

$1,600

|

|

2013

|

1

|

1

|

0

|

0

|

$10,800

|

$10,800

|

|

Total

|

4

|

1

|

1

|

0

|

$17,200

|

$4,300

|

9

Going Concern

Our financial statements have been prepared on a going concern basis, which implies the Company will continue to realize its assets and discharge its liabilities in the normal course of business. The Company has generated modest revenues since inception and has never paid any dividends and is unlikely to pay dividends. The continuation of the Company as a going concern is dependent upon the continued financial support from its shareholders, the ability of the Company to obtain necessary equity financing to continue operations and to determine the existence, discovery and successful exploration of economically recoverable reserves in its resource properties, confirmation of the Company’s interests in the underlying properties, and the attainment of profitable operations. The Company has had very little operating history to date. These financial statements do not include any adjustments to the recoverability and classification of recorded asset amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

Overview

During the Six Months ending February 28, 2014, we generated revenue of $25,838 and incurred a net loss of $1,196,136. We have received $25,838 in revenue, and have historically relied on equity and debt financings to finance our ongoing operations. Our operations generated a net loss since inception of $1,216,359.

Results of Operations

For the six months ending February 28, 2014 and 2013 respectively, the Company generated the following revenue:

|

Six Months ending

February 28, 2014 |

Six Months ending

February 28, 2013 |

|||||||

|

Revenue

|

$ | 25,838 | - | |||||

For the six months ending February 28, 2014 and 2013 respectively, the Company generated the following cost of goods:

|

Six Months ending

February 28, 2014 |

Six Months ending

February 28, 2013 |

|||||||

|

Cost of goods sold

|

$ | 19,027 | - | |||||

For the six months ending February 28, 2014 and 2013respectively, the Company generated the following expenses:

|

Six Months ending

February 28, 2014 |

Six Months ending

February 28, 2013 |

|||||||

|

Operating Expenses

|

||||||||

|

Thoroughbred research

|

713 | 2,098 | ||||||

|

Thoroughbred expenses

|

37,285 | - | ||||||

|

Depreciation

|

11,710 | - | ||||||

|

General and administrative expenses

|

1,153,239 | 3,750 | ||||||

|

Total Operating Expenses

|

1,202,947 | 5,848 | ||||||

10

Liquidity and Capital Resources

The following is a summary of our balance sheet as of February 28, 2014 and 2013respectively:

|

February 28,

2014

|

August 31,

2013

|

|||||||

|

ASSETS:

|

||||||||

|

Current assets:

|

||||||||

|

Cash or cash equivalents

|

$ | 6,009 | $ | 2,902 | ||||

|

Thoroughbreds

|

52,263 | 55,000 | ||||||

|

Total assets

|

$ | 58,272 | $ | 57,902 | ||||

In the opinion of management, available funds will not satisfy our growth requirements for the next twelve months. We believe our currently available capital resources will allows us to begin operations within our natural resource division and maintain its operation over the course of the next 12 months; however, our other expansion plans would be put on hold until we could raise sufficient capital.

Going Concern

We have not attained profitable operations and are dependent upon obtaining financing to pursue any extensive exploration activities. For these reasons our auditors stated in their report that they have substantial doubt we will be able to continue as a going concern.

Accounting and Audit Plan

In the next twelve months, we anticipate spending approximately $20,000 - $30,000 to pay for our accounting and audit requirements.

Off-balance sheet arrangements

We have no significant off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to stockholders.

Critical Accounting Policies

Our financial statements are impacted by the accounting policies used and the estimates and assumptions made by management during their preparation. A complete summary of these policies is included in Note 2 of the notes to our historical financial statements. We have identified below the accounting policies that are of particular importance in the presentation of our financial position, results of operations and cash flows and which require the application of significant judgment by management.

ITEM 3 – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The Company, as a smaller reporting company, as defined by Rule 229.10(f)(1), is not required to provide the information required by this Item.

11

ITEM 4 – CONTROLS AND PROCEDURES

(a) Evaluation of Disclosure Controls and Procedures

Our principal executive and principal financial officers have evaluated the effectiveness of our disclosure controls and procedures, as defined in Rules 13a – 15(e) and 15d – 15(e) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are designed to ensure that information required to be disclosed in our reports under the Exchange Act, is recorded, processed, summarized and reported within the time periods required under the SEC’s rules and forms and that the information is gathered and communicated to our management, including our principal executive officer and principal financial officer, as appropriate, to allow for timely decisions regarding required disclosure.

Our principal executive officer and principal financial officer evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rule 13a-15(e)) as of the end of the period covered by this report. Based on this evaluation, our principal executive officer and principal financial officer concluded that our disclosure controls and procedures were not effective as of the end of the period covered by this report.

The reason we believe our disclosure controls and procedures are not effective is because:

|

1.

|

No independent directors;

|

|

|

2.

|

No segregation of duties;

|

|

|

3.

|

No audit committee; and

|

|

|

4.

|

Ineffective controls over financial reporting.

|

As of February 28, 2014, the Company has not taken any remediation actions to address these weaknesses in our controls even though they were identified in 2011. The Company’s management expects, once it is in the financial position to do so, to hire additional staff in its accounting department to be able to segregate the duties. The Company expects that the expense will be approximately $60,000 per year which would allow the Company to hire 2 new staff members.

This 10-Q does not include an attestation report of the Company’s independent registered public accounting firm regarding internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to Rule 308(b) of Regulation S-K.

Management’s Report on Internal Control Over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act. Our internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. Our internal control over financial reporting includes those policies and procedures that:

|

|

1.

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets;

|

|

|

2.

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with U.S. GAAP, and that our receipts and expenditures are being made only in accordance with the authorization of our management and directors; and

|

|

|

3.

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

|

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

12

Management assessed the effectiveness of our internal control over financial reporting as of August 30, 2013. Based on this assessment, management concluded that the Company did not maintain effective internal controls over financial reporting as a result of the identified material weakness in our internal control over financial reporting described below. In making this assessment, management used the framework set forth in the report entitled Internal Control—Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission, or COSO. The COSO framework summarizes each of the components of a company's internal control system, including (i) the control environment, (ii) risk assessment, (iii) control activities, (iv) information and communication, and (v) monitoring.

Identified Material Weakness

A material weakness in our internal control over financial reporting is a control deficiency, or combination of control deficiencies, that results in more than a remote likelihood that a material misstatement of the financial statements will not be prevented or detected.

Management identified the following material weakness during its assessment of internal controls over financial reporting as of November 28, 2013:

Independent Directors: The Company intends to obtain at least 2 independent directors at its 2014 annual shareholder meeting. The cost associated to the addition in minimal and not deemed material.

No Segregation of Duties: Ineffective controls over financial reporting: The company intends to hire additional staff members, either as employees or consultants, prior to December 31, 2014. These additional staff members will be responsible for making sure that information required to be disclosed in our reports filed and submitted under the Exchange Act is recorded, processed, summarized and reported as and when required and will the staff members will have segregated responsibilities with regard to these responsibilities. The costs associated with the hiring the additional staff members will increase the Company's Sales, General and Administration (SG&A) Expense. It is anticipated the cost of the new staff members will be approximately $40,000 per year.

No audit committee: After the election of the independent directors at the 2014 annual shareholder meeting, the Company expects that an Audit Committee will be established. The cost associated to the addition an audit committee are minimal and not deemed material.

Resources: As of February 28, 2014, we have no full-time employees with the requisite expertise in the key functional areas of finance and accounting. As a result, there is a lack of proper segregation of duties necessary to insure that all transactions are accounted for accurately and in a timely manner.

Written Policies & Procedures: We need to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity transactions, and prepare, review and submit SEC filings in a timely manner.

Management’s Remediation Initiatives

As our resources allow, we will add financial personnel to our management team. We plan to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity transactions. We will also create an audit committee made up of our independent directors.

As of February 28, 2014, the Company has not taken any remediation actions to address these weaknesses in our controls even though they were identified during the year ending August 30, 2013. The Company’s management expects, once it is in the financial position to do so, to hire additional staff in its accounting department to be able to segregate the duties. The Company expects that the expense will be approximately $60,000 per year which would allow the Company to hire 2 new staff members.

(b) Changes In Internal Control Over Financial Reporting

We need to prepare written policies and procedures for accounting and financial reporting to establish a formal process to close our books monthly on an accrual basis and account for all transactions, including equity transactions, and prepare, review and submit SEC filings in a timely manner

13

PART II -- OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS

None.

ITEM 1A. RISK FACTORS

We are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required under this item.

The above statement notwithstanding, shareholders and prospective investors should be aware that certain risks exist with respect to the Company and its business, including those risk factors contained in our most recent Registration Statements on Form S-1 and Form 10, as amended. These risks include, among others: limited assets, lack of significant revenues and only losses since inception, industry risks, dependence on third party manufacturers/suppliers and the need for additional capital. The Company’s management is aware of these risks and has established the minimum controls and procedures to insure adequate risk assessment and execution to reduce loss exposure.

ITEM 2. UNREGISTERED SALE OF EQUITY SECURITIES AND USE OF PROCEEDS

On September 20, 2013 the Company and its shareholders approved a reverse stock split of the outstanding common shares of the Company by a ratio of One for Fifty Thousand (1:50,000) (the “Split”) with a record date of October 10, 2013 to be effective on October 16, 2013.

On November 21, 2013, the Company issued 40,000,000shares of Common Stock to our CEO. These shares were issued pursuant to the Personal Services Agreement executed on November 21, 2013. These shares are subjected to a lock up agreement whereby the shares shall be restricted from resale for 10-years from the date of issuance. Our CEO gifted 6,000,000 of these shares to family and friends. The gift shares are also subjected to the lock up agreement. The Company booked an $840,000 (or $0.021 per share) expense related to this issuance.

14

ITEM 3. DEFAULTS UPON SENIOR SECURITIES

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

ITEM 5. OTHER INFORMATION

There was no other information during the quarter ended February 28, 2014 that was not previously disclosed in our filings during that period.

ITEM 6. EXHIBITS

|

31.1

|

Certifications pursuant to Section 302 of Sarbanes Oxley Act of 2002

|

|

|

31.2

|

Certifications pursuant to Section 302 of Sarbanes Oxley Act of 2002

|

|

|

32.1

|

Certifications pursuant to Section 906 of Sarbanes Oxley Act of 2002

|

|

|

32.2

|

Certifications pursuant to Section 906 of Sarbanes Oxley Act of 2002

|

|

|

101.INS

|

XBRL Instance Document

|

|

|

101.SCH

|

XBRL Taxonomy Extension Schema

|

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase

|

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase

|

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase

|

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase

|

15

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, there unto duly authorized.

| EMBARR DOWNS, INC. | |||

|

Date: March 31, 2014

|

By:

|

/s/ Joseph Wade | |

| Joseph Wade | |||

| Chief Executive and Financial Officer | |||

16