Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - COIL TUBING TECHNOLOGY, INC. | Financial_Report.xls |

| EX-31.2 - CERTIFICATION - COIL TUBING TECHNOLOGY, INC. | ctbg_10k-ex3102.htm |

| EX-31.1 - CERTIFICATION - COIL TUBING TECHNOLOGY, INC. | ctbg_10k-ex3101.htm |

| EX-21.1 - SUBSIDIARIES - COIL TUBING TECHNOLOGY, INC. | ctbg_10k-ex2101.htm |

| EX-32.1 - CERTIFICATION - COIL TUBING TECHNOLOGY, INC. | ctbg_10k-ex3201.htm |

| EX-32.2 - CERTIFICATION - COIL TUBING TECHNOLOGY, INC. | ctbg_10k-ex3202.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

| For the fiscal year ended December 31, 2013 |

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File No. 333-184443

COIL TUBING TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 76-0625217 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S Employer Identification No.) |

|

22305 Gosling Road Spring, Texas |

77389 |

| (Address of principal executive offices) | (Zip code) |

| Registrant's telephone number, including area code:(281) 651-0200 |

| Securities registered pursuant to Section 12(b) of the Exchange Act: |

| Title of each class | Name of each exchange on which registered |

None

Securities registered pursuant to Section 12(g) of the Exchange Act: None

| Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act | Yes ¨ | No x | ||

| Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act | Yes ¨ | No x |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shortened period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

| Non-accelerated filer | ¨ | Smaller reporting company | x |

The aggregate market value of the registrant's common stock held by non-affiliates of the registrant on June 30, 2013 was approximately $7,091,110 (based upon the closing price for shares of common stock as reported by the OTCQB market on that date).

The number of shares outstanding of the registrant's $0.001 par value common stock on March 31, 2014: 15,651,827 shares

Table of Contents

| Page | ||

| PART I | ||

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 10 |

| Item 1B. | Unresolved Staff Comments | 20 |

| Item 2. | Properties | 20 |

| Item 3. | Legal Proceedings | 20 |

| Item 4. | Mine Safety Disclosures | 20 |

| PART II | ||

| Item 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 21 |

| Item 6. | Selected Financial Data | 23 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 24 |

| Item 7A. | Quantitative and Qualitative Disclosure About Market Risk | 29 |

| Item 8. | Financial Statements and Supplementary Data | 30 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 31 |

| Item 9A | Controls and Procedures | 31 |

| Item 9B. | Other Information | 31 |

| PART III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 32 |

| Item 11. | Executive Compensation | 34 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 38 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 39 |

| Item 14. | Principal Accounting Fees and Services | 40 |

| PART IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 41 |

| 2 |

PART I

FORWARD-LOOKING STATEMENTS

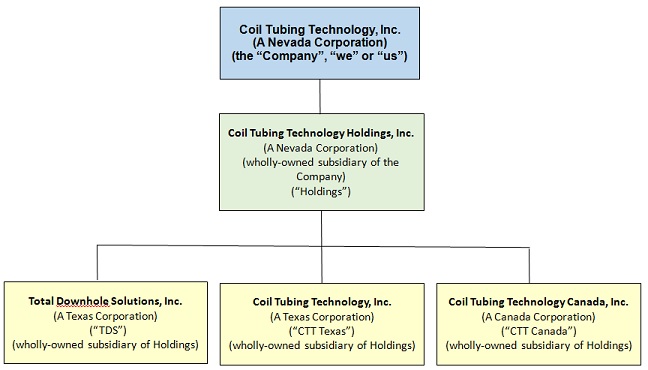

Except for the historical information and discussions contained herein, statements contained in this Annual Report on Form 10-K, may constitute forward-looking statements. These statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially, as discussed elsewhere in the Coil Tubing Technology, Inc. ("Company" or "CTT") filings with the U.S. Securities and Exchange Commission ("SEC"). The statements contained in this document that are not purely historical are forward-looking statements including without limitation statements regarding our expectations, beliefs, intentions or strategies regarding our business. This Annual Report on Form 10-K includes forward-looking statements about our business including, but not limited to, the level of our expenditures and savings for various expense items and our liquidity in future periods. We may identify these statements by the use of words such as "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "project," "should," "would" and other similar expressions. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements, except as may otherwise be required by law. Our actual results could differ materially from those anticipated in these forward-looking statements. References in this Form 10-K, unless another date is stated, are to December 31, 2013. As used herein, the “Company”, “CTT”, ”we”, “us”, “our” and words of similar meaning refer to Coil Tubing Technology, Inc. and its wholly-owned subsidiary, Coil Tubing Technology Holdings, Inc., which in turn has three wholly-owned subsidiaries, Total Downhole Solutions, Inc., Coil Tubing Technology, Inc. and Coil Tubing Technology Canada Inc.

ITEM 1. BUSINESS

History

Please refer to the Form S-1 Registration Statement filing (Amendment No. 3), Registration Number 333-184443, filed on January 18, 2013 and the final prospectus filed pursuant to Rule 424(b)(3) on January 30, 2013, for a more complete history of the Company. As a result of the effectiveness of the Form S-1 filing, the Company became a fully-reporting public company with the Securities and Exchange Commission effective January 28, 2013.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of our initial public offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and references herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

Business Operations

We specialize in the design and production of proprietary tools for the coil tubing industry. We concentrate on three categories of coil tubing applications: tubing fishing, tubing work over and coil tubing drilling, which categories of applications are described in greater detail below. We currently outsource 95% of our tools and components to be manufactured by outside manufacturers and purchase the remaining 5% of our products off the shelf.

We focus on the development, marketing, sales and rental of advanced tools and related technical solutions for use with coil tubing and jointed pipe in the bottom hole assembly for the exploration and production of hydrocarbons (“E&P”). Although various companies in the E&P services industry have realized the importance of coiled tubing, we have focused entirely on the development of dedicated, patented, proprietary downhole tools and related marketing strategies.

Our core products/tools are Jars, Rotating Tools, Jet Nozzles, Jet Hammers, Jet Motors, Accelerators and Oscillators. These tools are principally used in the drilling of oil and gas wells and the workover of existing wells. Even though we had a decline in 2013, overall we have continued to experience revenue growth in renting these tools over the last two years.

Our principal executive offices are located at 22305 Gosling Road, Spring, Texas 77389, and our telephone number is (281) 651-0200. Our website address is www.coiltubingtechnology.com. Information on our website and accessible through such website is not incorporated by reference into this report.

| 3 |

Coiled Tubing Operations

Coiled tubing refers to using a long, thin, continuous string of hollow pipe that is mounted on a truck to workover oil and gas wells. Crews lower this tubing into the well under the careful control of an operator and once in place this pipe allows the usage of specialized tools, and the pumping of fluids such as nitrogen into the well. The tool string at the bottom of the coil is often called the bottom hole assembly (“BHA”). The BHA can range from something as simple as a jetting nozzle, for jobs involving pumping chemicals or cement through the coil, to a larger string of logging tools, depending on the operations. Coiled tubing is used for a wide range of oil field services, including but not limited to drilling, logging, fracturing, cementing, fishing, completion and production.

Due to the natural characteristics of the hydrocarbon reservoir, a production reservoir needs maintenance to keep up production levels. Traditionally, workovers were performed using traditional rigs and jointed pipes. However, in the experience of our management, improvements in the material used to manufacture coiled tubing as well as the quality of the tools used in the bottom hole assembly have boosted demand for coiled tubing compared to traditional jointed drill pipes.

Compared to a coiled tubing unit, a traditional rig using jointed tubes is complex, immobile and requires a large surface to operate. Moreover, coiled tubing allows for workovers leaving the production tubes in the well as the coiled tubing can be fed through the production tubes instead of having to pull these tubes out replacing them with jointed pipes. The consequential savings in time and related cost has proven to be significant.

Furthermore, drilling with coiled tubing allows the operator to virtually steer the BHA in any desired direction to optimize production of the reservoir with relative ease at limited cost, creating for example multi-lateral wells. If need be, the operator can maintain a continuous under-balanced condition throughout the whole drilling operation, whereas a conventional rig and jointed pipe may require re-establishment of under-balanced conditions every 30 feet drilled. Expanding an existing well to increase production levels using coiled tubing re-entry drilling, thereby extending the life of the existing facilities has created an enormous potential for the oil companies to reduce the cost per barrel produced.

Circulation - The most popular use for coiled tubing is circulation. A hydrostatic head (a column of fluid in the well bore) may be inhibiting flow of formation fluids due to its weight (the well is said to have been killed). The safest solution to this problem is to attempt to circulate out the fluid using a gas, frequently nitrogen. By running in coiled tubing to the bottom of the hole and pumping in the gas, the kill fluid can be forced out to production.

Pumping - Pumping through coiled tubing can also be used for disbursing fluids to a specific location in the well such as for cementing perforations or performing chemical washes of downhole components such as sandscreens. In the former case, coiled tubing is particularly advantageous compared to simply pumping the cement from surface, as allowing it to flow through the entire downhole pipe could potentially damage important components.

Drilling - A relatively modern drilling technique involves using coiled tubing instead of conventional drill pipe. This has the advantage of requiring less effort to get in and out of the well (the coil can simply be run in and pulled out while drill string must be assembled and dismantled joint by joint). Instead of rotating the drill bit by using a rotary table or top drive at the surface, it is turned by a downhole motor, powered by the motion of drilling fluid pumped from surface.

Logging and perforating - Well logging usually refers to downhole measurements made via instrumentation that is lowered into the well at the end of a wireline cable (the simplest way to lower equipment in and out of the well, usually just a long strand of very thin wire). These tasks are by default the realm of wireline because coiled tubing is rigid; it can be pushed into the well from the surface. This is an advantage over wireline, which is gravity dependent and depends on the weight of the toolstring to be lowered into the well. For highly deviated and horizontal wells, gravity may be insufficient.

Fishing - Fishing refers to the application of tools, equipment and techniques for the removal of junk, debris or fish (anything left in a wellbore) from a wellbore. By not having to connect individual pieces of pipe saves time and costs for the well owner, and coiled tubing crews greatly increase the speed of putting pipe into the well, whether dealing with circulation, pumping, drilling, logging and perforating and/or fishing operations.

Product Sales and Rentals

We believe that we have identified a market for an aggressive, innovative and independent, full line, tool company and have pursued that business strategy. We offer a turnkey tool package containing a full line of standard tools and proprietary downhole tools or a single item tool rental. Since the United States (“U.S.”) domestic market is currently by far the largest market for coiled tubing, we are focusing primarily on the domestic market, as well as expanding our presence in Canada. We are also working to expand our distribution markets to include Latin America and Middle Eastern markets.

We offer (1) product sales of our proprietary downhole tools, and (2) the ability for our customers to rent only a single item from our inventory. We cause to be manufactured (i.e., we do not purchase such products off the shelf, but instead have the following tools manufactured by third parties based on our engineering specifications and plans) several products used in drilling applications, including the following products described in greater detail below:

| 4 |

Coiled Tubing Drilling - Although coiled tubing drilling has always provided an alternative to traditional vertical drilling, more sophisticated applications like horizontal, underbalanced, and re-entry drilling have elevated the success of coiled tubing in drilling applications in recent years. Our coiled tubing drilling products include:

| · The “Jet Motor” |

The Jet Motor is a tool that produces rotation and horsepower by pumping fluid or gas through the components of the tool. The power generated by the tool is then used to drill subterranean objects in an oil well or to deepen an existing well.

|

| · The “Pulsator” |

The Pulsator is a tool much like an automobile shock absorber. The tool absorbs spike loads induced by the drilling application, which are often created by a Jet Motor or other similar tool.

|

| · The CTT “H/H” |

The CTT H/H jar enables energy to be stored like a spring placed in tension. When released the energy accelerates and is released to an internal hammer and anvil creating impact force to strike an object in a well.

|

| · The CTT “Amplidyne” |

The CTT Amplidyne is used to store the energy released by the CTT H/H through a fluid spring. Upon release of the energy, the Amplidyne allows acceleration of energy and magnifies the impact of the CTT H/H.

|

| · The CTT “Oscillator” | The CTT Oscillator distributes fluid and pressure through coil tubing, up to a volume required by a customer’s hydraulic specifications inducing vibration of the pipe. Recently, we completed testing of our newest product, Amplimax, which improves the flow and significantly lengthens the horizontal capabilities of the drilling operations. |

All of the products listed above are currently available for rent or sale by the Company. Additionally, the Company sometimes modifies its product at the request of a client and then sells such modified product to the client instead of renting it out.

Thru Tubing Well Maintenance - One of the biggest advantages of using coiled tubing technology is the ability to perform live-well workovers instead of killing the well first with fluids and deploying a conventional workover rig to the well. Our tools allow the well tubing to be cleared instead of replaced. We believe that the time and cost savings and ultimate effect on the cost per barrel produced using our technology is considerable. Our thru tubing well maintenance products include:

| · The “Jet Hammer” |

The Jet Hammer is a tool that creates rotational horsepower and axial impact energy to remove objects from a wellbore. The tool works under the same principal as a jackhammer cycling to 2000 impacts per minute. The tool is used for the removal of scale, sand cement, barium and paraffin from production tubing and the tool is also effective in shattering glass and ceramic discs placed in the well. The tool can be powered by water, light drilling fluids, air, nitrogen or other acid media. The tool is easy to operate and can withstand temperatures of up to 500 degrees Fahrenheit. Bits for the Jet Hammer are designed to maximize the penetration rate of the tool by taking advantage of the tool’s unique combination of rotational and percussive impact forces.

|

| · The “Jet Motor” |

The Jet Motor is a very compact (19 inch overall length) downhole motor. The tool has a unique jetting system to maximize torque. It has no rubber thereby allowing the use of acids, nitrogen or fluid at high operating temperatures. The tool is ideal for use in wells up to 500 degrees Fahrenheit.

|

| · The “Jet Nozzle” |

The Jet Nozzle incorporates a unique nozzle system developed for removal of downhole media deposits that impede efficient well productivity.

|

| · The 5 1/8 ”Rotorjet” |

The 5 1/8” RotorJet is a tool developed with Hammelmann Corporation and is used to clean production tubing of sediments deposited during the production of oil and gas.

|

All of the products listed above are currently available for rent or sale by the Company.

Coiled Tubing Fishing - Fishing in the oilfield is generally known as the process of removing debris from a well. The process is used when a well production is affected and the debris must be removed. Our coiled tubing fishing products include:

| · The “Rotating Tool” |

The Rotating Tool has been designed and developed specifically for use in our coiled tubing operations. Its purpose is to mechanically provide rotation to assist in connecting to a fish. The Rotating Tool can be also be used with CTT H/Hs in combination with an Amplidyne to remove a fish that remains stuck.

|

| · The CTT “H/H ” |

The CTT H/H as described in the drilling application above can also be used in the fishing operations.

|

| · The CTT “Amplidyne” | The CTT Amplidyne, also discussed above, can also be used for fishing operations. |

All of the products listed above are currently available for rent or sale by the Company.

| 5 |

Coiled Tubing Industry

The coiled tubing industry is made up of three operational markets:

| — | Oil Companies; | |

| — | Coiled Tubing Operators; and | |

| — | Service Companies. |

Oil companies typically outsource most of their coil tubing work to the E&P service industry in general and the coiled tubing industry in particular. The oil companies’ engineers rely on coiled tubing operators and downhole service companies to provide operational recommendations and applications to accomplish a specific task on their well. They are constantly seeking new tools for their operations, which often allow proprietary tool companies, such as us, an advantage on their wells. The trend to outsource services is expected to continue, as the oil companies are not interested in owning and paying for the upkeep of high cost coil tubing equipment and tools. As a result, service companies are responsible for the operation of the majority of drilling and fishing procedures using coil tubing technology. The service companies use mostly proprietary tools and large service companies, with whom we compete, including National Oilwell Varco, Thru Tubing Solutions, Baker-Hughes, Weatherford, and Smith International, all of whom are increasing their focus on drilling. These companies are attempting to create a one-stop-shop concept with turnkey solutions for oil companies, especially abroad, as the U.S. domestic market is regarded as highly competitive in this respect.

Market for Coiled Tubing

We believe that the U.S. domestic market and Canada, which we are actively trying to expand our presence in is by far the largest and the most competitive market for coil tubing technology, due to the older age of wells and the difficulty in keeping them profitable. Moreover, the U.S. is considered to be the breeding ground for new technology with a consequential large build-up of coiled tubing units and related companies keeping the rates competitive and therefore coiled tubing workovers more viable. We are currently focusing our efforts primarily in the U.S and Canada; however we are also working to expand our distribution markets to include Mexico and Middle Eastern markets.

Business Strategy

We have based our business strategy on the sales and rental of our product lines to oil companies; coiled tubing operators and well servicing companies.

There are four components to our strategic vision:

| — | Build profitable year over year sales of existing proprietary products; | |

| — | Accelerate development of new proprietary products for the oil and gas industry; | |

| — | Accelerate growth of new distribution stockpoints worldwide; and | |

| — | Expand into other areas of drilling, such as conventional drilling tools. |

We believe increasing our proprietary product lines availability to our customers is critical to our profitability. Therefore, we will focus on initiatives to drive sales growth for our existing products, funding permitting, emphasizing:

| — | Enhanced customer focus through a concerted sales and marketing effort in the future; | |

| — | Increased investment in product lines; and | |

| — | Accelerated growth of new product lines. |

Material Agreements

Hammelmann Distributor Contracts - On or about January 1, 2007, Coil Tubing Technology, Inc. (“CTT Texas”), the wholly-owned subsidiary of Holdings, entered into two Statement of Understandings with Hammelmann Corp. (“Hammelmann” and the “Statement of Understandings”). The Statement of Understandings provide for Hammelmann to provide CTT Texas the coil tubing nozzles known as the 5 1/8” RotorJet and “TurboJet” and the surface cleaner known as the “Coil Tubing Cleaner” and for CTT Texas to market, field test and to report the performance to Hammelmann, with any revenues generated on such products to be split 50/50 between CTT Texas and Hammelmann. The Statement of Understandings remain in effect until terminated with sixty (60) days prior written notice to the non-terminating party. For the years ended December 31, 2013 and 2012, there have been no revenues generated under this agreement.

Distribution Agreement - The Company has a Distribution Agreement in place with Supreme Oilfield Services (“Supreme”) pursuant to which Supreme has agreed to distribute the Company’s products in the area south and west of Corpus Christi, Texas. The agreement was effective May 5, 2010, and renewable for successive one year terms thereafter until terminated by any party for any reason with ninety (90) days prior written notice. The Distribution Agreement, similar to other distribution agreements the Company has entered into in the past and which the Company may enter into in the future provides for the Company to train the employees of the distributor, provide product literature, expense reimbursements, and engineering and field support and that the parties will work together to jointly promote the products subject to such Distribution Agreement. Total rentals for products under this agreement are $2,055,714 and $2,288,244 for the years ended December 31, 2013 and 2012, respectively.

| 6 |

Billing Process

We bill rental fees based on the use of rented tools by our customers. If a tool is on a jobsite but not being used for a downhole application we receive a standby fee for and if any tool is used downhole on any particular day we receive a much larger day rate for the use of these tools. We also bill our customers for the full cost of any tools which are lost and/or damaged in use and recognize the full cost of the tool as revenue after subtracting the net carrying cost of such tool.

Corporate Organization

We currently have one wholly-owned subsidiary, Coil Tubing Technology Holdings, Inc., a Nevada corporation, which in turn has three wholly-owned subsidiaries, Total Downhole Solutions, Inc. (“TDS”) and Coil Tubing Technology, Inc. (“CTT Texas”) both of which are Texas corporations, and Coil Tubing Technology Canada Inc., an Alberta, Canada corporation (“CTT Canada”). The majority of our tool rental operations are run through CTT Texas. TDS owns certain manufacturing equipment formerly used to produce tools used in the workover segment of the Company’s rental business, which generally require smaller tools than other coil tubing operations. TDS also stocks coil tubing tool parts which it sells directly to other service companies, making TDS a supply and sales arm for non-proprietary tools and equipment of the Company. CTT Canada opened a sales and service center in Alberta, Canada, and became operational in January 2012. In 2013 we experienced a decrease in coil tubing activity in Canada; however, we still believe this is one of the largest markets for coil tubing products and technology and, accordingly we have invested and plan to continue to invest in facilities, equipment and tools in Canada.

Major Suppliers

We obtain materials which we use to produce our coil tubing technology from the following suppliers, however we do not have any agreements in place with such suppliers:

| — | Industrial Bearing Services (IBS); | |

| — | H.E. Halford Welding; | |

| — | South Texas Inspection; and | |

| — | Triple J Coil Tubing Products, LLC. |

Precision Machining Specialties is our principal contract manufacturer of our patented products/tools. This manufacturer is located in Spring, Texas.

Major Customers

The Company had total revenue of $6,143,093 and $7,764,984 during the years ended December 31, 2013 and 2012, respectively. The Company had two customers representing approximately 17% and 18% of gross sales and 15% and 37% of total accounts receivable for the year ended December 31, 2013. The Company had two customers representing approximately 16% and 18% of gross sales and 32% and 20% of total accounts receivable for the year ended December 31, 2012.

| 7 |

The majority of our revenues have historically been due to a small number of repeat customers. However, our repeat customers are using our products in multiple geographic locations such as the Eagle Ford shale in South Texas, the Haynesville shale in Northwest Louisiana, the Marcellus shale in Pennsylvania and the Bakkan shale in Alberta, Canada. Each location is unique in its customer relations and purchasing and rental process. Generally, we maintain an inventory of our products/tools at the customer location. We do not currently have any material agreements in place with any of our customers (except as set forth above under “Material Agreements”, above). We bill our customers based on purchase orders (“POs”) which contain standard provisions, and allow our customers thirty (30) days from the PO date to pay for their tool rentals.

Patents, Trademarks and Licenses

Below is a summary of the Company’s trademark and patents, pending patents and related rights as of December 31, 2013, which Patents were acquired from Jerry Swinford, the Company’s Executive Vice President and Chairman pursuant to the November 2010 IP Purchase Agreement and January 2012 IP Assignment Agreement (both described in greater detail below under “Certain Relationships and Related Transactions”), provided that Mr. Swinford has a first priority security interest over the Patents until such time as the $1,175,000 promissory notes he was provided in connection with the IP Purchase Agreement are satisfied in full (the first note, in the amount of $475,000 was paid in full in January 2011):

| Type of Intellectual Property | Registered Number (or Provisional Number) | Expiration Date |

| Trademark - Registered Mark | Serial No. 3,355,177 | The Trademark will continue as long as it is used in the marketplace |

| Patent - Letters Patent Issued Subterranean Rotating Device & Method | Serial No. 5,584,342 | Expires June 6, 2015 |

| Patent - Jet Motor For Providing Rotation In a Downhole Tool |

US - No. 7,686,102

Singapore – No. 146369

Canada-Application No. 2,646,326

Canada-Application No. 2,797,565 |

March 30, 2027

March 29, 2015*

March 30, 2015*

March 29, 2014* |

| Patent– Rotation Tool |

US - No. 7,946,348

Canada-Application No. 2,734,285

Indonesia-Application No. W00201001371 |

May 24, 2029

July 16, 2014*

Under examination |

| Patent Application Filed – Drilling Jar |

US - No. 8,151,910

Canada-Application No. 2,723,420

Indonesia- IDP 0029982 |

May 7, 2029

May 7, 2014*

January 16, 2015* |

|

Patent Application Filed – Jet Hammer |

US - No. 12/480,680 | Awaiting decision of appeal |

|

Patent Application Filed – Method and Apparatus for Washing Downhole Tubulars and Equipment

|

US - No. 13/046,662

Norway Application No. 20120910 |

Under examination

March 31, 2015* |

| Provisional Patent Application Filed-Downhole Oscillator |

US - 13/434,812

Canada – 2,837,938 |

Non provisional filed on March 29, 2012 (registration has not been finalized as of the date of this filing – waiting for examination)

March 30, 2015* |

| Patent Cooperation Treaty (“PCT”) – Patent Application Filed |

UK Application No. 1216072.7 |

Under examination annuity due March 31, 2015 |

| Patent – Jet Motor For Providing Rotation In a Downhole Tool | US - No. 8,151,908 |

December 4, 2029 |

*All annual patent permits have been paid and accordingly all patents are in force as of December 31, 2013.

| 8 |

The issued patents and the PCT, provisional and non-provisional patent applications, which are described above (collectively the “Patents”) make up the core of our business and we believe provide us with a competitive advantage over other coil tubing companies. The vast majority of our revenues are derived from the Patents, through the manufacture and rental of our proprietary tools based on the Patents. There are risks associated with our loss of the use of the Patents, which are described in greater detail above under “If We Are Unable To Adequately Protect Our Intellectual Property Rights Our Business Is Likely To Be Adversely Affected ” and “Jerry Swinford, Our Executive Vice President And Chairman Has A First Priority Security Interest Over Our Patents”.

Research and Development

Over the past two years we have incurred research and development costs to advance the technology of our coil tubing technologies and workover product lines. We will continue to incur these research and development costs in 2014.

Seasonality

Our revenues are generated by drilling and well services activities, and therefore, cold weather and holidays and employee vacations during our first and fourth quarters exert downward pressure on revenues for those quarters, which is usually partially offset by the year-end efforts on the part of many customers to spend any remaining funds budgeted for services and capital expenditures during the year. Our customers’ annual budget process is normally completed in the first quarter of each calendar year, which can slow our services at the beginning of the year. Principally, due to these factors, our first and fourth quarters are typically less robust than our second and third quarters.

Employees

As of March 31, 2014, we had 25 full-time employees and no part-time employees. We also utilize independent contractors and consultants to assist us with key functions. Our agreements with these independent contractors and consultants are usually short-term. We believe that our relations with our employees, independent contractors and consultants are good. None of our employees are represented by a union or covered by a collective bargaining agreement.

Available Information

We file periodic and other reports with the United States Securities and Exchange Commission, or SEC. Additionally, we may provide shareholders proxy and information statements and other information in the future. Copies of the reports and other information may be examined without charge at the Public Reference Room of the SEC, 100 F Street, N.E., Room 1580, Washington, D.C. 20549, or on the Internet at http://www.sec.gov.

Information about Coil Tubing Technology, Inc. is available on our website (www.coiltubingtechnology.com). Information on or accessible through our website is not incorporated by reference into this report.

Government Regulations

Our assets and operations are subject to regulation by federal, state and local authorities, including regulation by the Federal Energy Regulatory Commission (“FERC”) and regulation by various authorities under federal, state and local environmental laws. In addition, because we operate in multiple states and Canada, we are subject to various taxing authorities. Regulation affects almost every aspect of our business. Changes in such regulations may affect our capacity to conduct our business effectively and/or to operate profitably.

| 9 |

JOBS Act

In April 2012, the JOBS Act was enacted. Section 107 of the JOBS Act provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended (the “Securities Act”) for complying with new or revised accounting standards. Specifically, Section 102(b)(1) of the JOBS Act exempts “emerging growth companies” from being required to comply with new or revised financial accounting standards until private companies (that is, those that have not had a Securities Act, registration statement declared effective or do not have a class of securities registered under the Exchange Act) are required to comply with the new or revised financial accounting standard. The JOBS Act provides that a company can elect to opt out of the extended transition period and comply with the requirements that apply to non-emerging growth companies but any such election to opt out is irrevocable. The Company has elected not to opt out of the transition period.

ITEM 1A. RISK FACTORS.

Set forth below and elsewhere in this Report and in other documents that we file with the SEC are risks and uncertainties that could cause actual results to differ materially from the results contemplated by the forward-looking statements contained in this Report. You should be aware that the occurrence of any of the events described in these risk factors and elsewhere in this Report could have a material adverse effect on our business, financial condition and results of operations and that upon the occurrence of any of these events, the trading price of our common stock could decline. The below risk factors include a discussion of all material risks which we believe are applicable to the Company, its operations and its securities.

We May Require Additional Financing To Implement Our Business Plan And Continue Developing And Marketing Our Products. The revenues we have generated since our incorporation have not been sufficient to support our operations, which have principally been funded through sales of common stock to date. We currently believe that we will be able to continue our business operations for approximately the next twelve months with our current cash on hand and from our expected revenues. Historically we have received funds from our largest shareholder and former director, Herbert C. Pohlmann, through private placements of our common stock, which we have used to fund our operations. We anticipate the need for additional funding to support the planned expansion of our operations over the next approximately twelve months. Additional available capital may not be available on favorable terms, if at all. We may choose to raise additional funds in the future through sales of debt and/or equity securities to support our ongoing operations and for expansion.

Even if we are successful in raising capital in the future, we will likely need to raise additional capital to continue and/or expand our operations and repay our outstanding liabilities. If we do not raise the additional capital, it is likely that we may need to scale back or curtail implementing our business plan.

We May Have Difficulty Obtaining Future Funding Sources, If Needed, And We May Have To Accept Terms That Would Adversely Affect Shareholders. We will need to raise funds from additional financing. We have no commitments for any financing and any financing commitments may result in dilution to our existing stockholders. We may have difficulty obtaining additional funding, and we may have to accept terms that would adversely affect our stockholders. For example, the terms of any future financings may impose restrictions on our right to declare dividends or on the manner in which we conduct our business. Additionally, we may raise funding by issuing convertible notes, which if converted into shares of our common stock would dilute our then shareholders’ interests. Lending institutions or private investors may impose restrictions on a future decision by us to make capital expenditures, acquisitions or significant asset sales. If we are unable to raise additional funds, we may be forced to curtail or even abandon our business plan.

Our Ability To Grow And Compete In The Future Will Be Adversely Affected If Adequate Capital Is Not Available. The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. Our cash flow from operations may not be sufficient or we may not be able to obtain equity or debt financing on acceptable terms or at all to implement our growth strategy. As a result, adequate capital may not be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

Shareholders Who Hold Unregistered Shares Of Our Common Stock Will Be Subject To Resale Restrictions Pursuant To Rule 144, Due To The Fact That We Are Deemed To Be A Former “Shell Company”. Pursuant to Rule 144 of the Securities Act of 1933, as amended (“Rule 144”), a “shell company” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other assets. While we do not believe that we are currently a “shell company”, we were previously a “shell company” and as such are deemed to be a former “shell company” pursuant to Rule 144, and as such, sales of our securities pursuant to Rule 144 may not be able to be made until we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “Form 10 information” has been filed with the Commission reflecting the Company’s status as a non-“shell company”. Although to date we have complied with the requirement of Rule 144 as related to “shell companies”, our status as a former “shell company” could prevent us from raising additional funds, engaging consultants, and using our securities to pay for any acquisitions in the future (although none are currently planned).

| 10 |

We Lack A Significant Operating History Focusing On Our Current Business Strategy Which You Can Use To Evaluate Us, Making Share Ownership In Our Company Risky. Our Company lacks a long standing operating history focusing on our current business strategy which investors can use to evaluate our Company’s previous earnings. Therefore, ownership in our Company is risky because we have no significant business history and it is hard to predict what the outcome of our business operations will be in the future.

We Have Established Preferred Stock Which Can Be Designated By The Company's Board Of Directors Without Shareholder Approval And The Board Established Series A Preferred Stock, Which Gives The Holders Majority Voting Power Over The Company. The Company has 5,000,000 shares of preferred stock authorized. The shares of preferred stock of the Company may be issued from time to time in one or more series, each of which shall have a distinctive designation or title as shall be determined by the Board of Directors of the Company ("Board of Directors") prior to the issuance of any shares thereof. The preferred stock shall have such voting powers, full or limited, or no voting powers, and such preferences and relative, participating, optional or other special rights and such qualifications, limitations or restrictions thereof as adopted by the Board of Directors. In May 2007, we designated 1,000,000 shares of Series A Preferred Stock, $0.001 par value per share (the "Series A Preferred Stock"). The Series A Preferred Stock have no dividend rights, no liquidation preference, no redemption rights and no conversion rights. Shortly after being designated, we granted all 1,000,000 shares of such Series A Preferred Stock to our Executive Vice President and Chairman, Jerry Swinford, who held such shares until his entry into the Executive Employment Agreement in November 2010, described below under “Executive Employment Agreements” pursuant to which such Series A Preferred Stock were cancelled. The Series A Preferred Stock have the right, voting in aggregate, to vote on all shareholder matters equal to fifty-one percent (51%) of the total vote (the “Super Majority Voting Rights”). In June 2007, we designated 1,000,000 shares of Series B Preferred Stock and subsequently issued such Series B Preferred Stock to Grifco International, Inc. (“Grifco”). The Series B Preferred Stock have no voting rights, no dividend rights, and no conversion rights (provided that such shares were previously convertible into 66,667 shares of our common stock (0.0667 of one share for each share of Series B Preferred Stock outstanding), prior to November 30, 2012, only if Grifco exercised its option to acquire the Series A Preferred Stock of the Company for aggregate consideration of $100, which option and which conversion rights have since expired). We believe that Grifco is no longer an operating entity.

Because the Board of Directors is able to designate the powers and preferences of the preferred stock without the vote of a majority of the Company's shareholders, shareholders of the Company will have no control over what designations and preferences the Company's preferred stock will have.

Herbert C. Pohlmann, Our Majority Shareholder and Former Director, Can Vote A Majority Of Our Common Stock And Can Exercise Control Over Corporate Decisions. Herbert C. Pohlmann, our majority shareholder and former director beneficially owns 14,240,648 shares of our common stock as of the date of this filing, representing 81.6% of our outstanding common stock giving him the right to exercise control in determining the outcome of all corporate transactions or other matters, including the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. The interests of Mr. Pohlmann may differ from the interests of the other stockholders and thus result in corporate decisions that are adverse to other shareholders. Additionally, as described below under “Certain Relationships and Related Transactions” Mr. Pohlmann has made an approximate $3.75 million provision for our Executive Vice President and Chairman, Jerry Swinford in the event Mr. Pohlmann dies, which could cause conflicts of interest between Mr. Pohlmann, Mr. Swinford as our Executive Vice President and Chairman, and our minority shareholders. Mr. Pohlmann has also entered into a voting agreement with Mr. Swinford, described in greater detail below under the risk factor entitled “Jerry Swinford, Our Executive Vice President, And Director Is Party To A Voting Agreement With Our Majority Shareholder”.

Jerry Swinford, Our Executive Vice President, And Director Is Party To A Voting Agreement With Our Majority Shareholder. In January 2011, the Company’s majority shareholder and former director, Herbert C. Pohlmann, and the Company’s Executive Vice President, Chief Executive Officer and director, Jerry Swinford, entered into a Voting Agreement, pursuant to which Mr. Pohlmann agreed to vote the shares of the Company which he owns as directed by Mr. Swinford from time to time, to appoint at least 40% of the Company’s Board of Directors, rounded up to the nearest whole number of directors. As such, Mr. Swinford has the right to direct Mr. Pohlmann to appoint two (2) out of every five (5) directors of the Company, as determined by Mr. Swinford in his sole discretion, pursuant to the Voting Agreement, which remains in effect until December 31, 2015. Accordingly, Mr. Swinford will exercise significant control in determining the appointment of directors and subsequently, the outcome of corporate transactions or other matters concerning the Company, including the appointment of officers. The interests of Mr. Swinford may differ from the interests of the Company and the Company’s other stockholders. The voting rights provided to Mr. Swinford pursuant to the Voting Agreement may be viewed negatively by investors and the marketplace and may cause the value of our shares to decline in value and/or be worth less than similarly situated companies which do not have similar voting arrangements in place.

| 11 |

We Rely On Our Executive Vice President And Chairman, Jerry Swinford, And If He Were To Leave Our Company Our Business Plan Could Be Adversely Effected. We rely on Jerry Swinford, our Executive Vice President and Chairman, for the success of our Company. Mr. Swinford has an employment agreement with us, currently effective until November 2015, which employment agreement is described in greater detail below under “Executive Compensation”, “Executive Employment Agreements”. Mr. Swinford’s experience and input creates the foundation for our business and he is responsible for the direction and control over the Company’s development activities. Moving forward, should he be lost for any reason, the Company will incur costs associated with recruiting a replacement and any potential delays in operations which this may cause. If we are unable to replace Mr. Swinford with another individual suitably trained in coil tubing technology we may be forced to scale back or curtail our business plan.

Our Officers Receive Discretionary Bonuses From Time To Time In the Sole Discretion of The Board of Directors, And Have The Ability To Approve Their Own Bonuses. The Employment Agreements of our officers, Jerry Swinford and his son, Jason Swinford, provide for them to receive discretionary bonuses from time to time in the sole discretion of the Board of Directors. Jerry Swinford received discretionary bonuses of $71,255 for 2013 and $108,000 for the 2012 and 2011 fiscal years, respectively, and Jason Swinford received discretionary bonuses of $71,255 and $200,000, for the 2013 and 2012 fiscal years, respectively, which have been paid in full. The 2013 bonuses were granted based on the gross profit generated during the 2013 calendar year while the 2012 bonuses were not granted based on any certain revenue or EBITDA targets, but were instead granted at the discretion of the Board of Directors based on new technology developed for the Company by Jerry Swinford and on new sales generated by Jason Swinford during the 2012 calendar year. As Jerry and Jason Swinford represent all of the members of the Board of Directors, they have the power, in their sole discretion, to approve discretionary bonuses to themselves from time to time and to further determine the amount of such discretionary bonuses. The approval and payment of discretionary bonuses to Jerry and Jason Swinford at the discretion of the Board of Directors (of which Jerry and Jason Swinford are the only members) may ultimately not be in the best interests of the Company or its shareholders. Furthermore, the perception from the investing community that such discretionary bonuses are not fair to the shareholders or the Company, may be perceived negatively. The payment of discretionary bonuses may create actual or perceived conflicts of interest between such officers, the Company and the Company’s shareholders. Our results of operations may be adversely affected by discretionary bonuses declared and paid to Jerry and Jason Swinford and the value of our common stock may be adversely affected by such discretionary bonuses and/or negative perceptions from the investing community regarding such bonuses. See also the risk factor below entitled “We Face Corporate Governance Risks And Negative Perceptions Of Investors Associated With The Fact That We Currently Have Only Two Directors, None of Whom Are Independent” and the description of the Employment Agreements below under “Executive Compensation”, “Executive Employment Agreements”.

Our Chief Executive Officer and Executive Vice President Have The Right To Receive Substantial Bonuses From The Company Pursuant To Their Employment Agreements. The Employment Agreements of our Chief Executive Officer, Jason Swinford, and his father, Jerry Swinford, our Executive Vice President, provide them the right to receive discretionary bonuses (as described in the risk factor above), bonuses based on our yearly EBITDA (for each year other than fiscal 2013), bonuses based on our gross profit (for fiscal 2013) and in Jason Swinford’s case, a bonus based on the occurrence of certain fundamental transactions which effect the Company, including changes in control.

Each of the executives is due a bonus at the end of each calendar year during the term of the agreements (other than 2013) in the event the Company has positive earnings before interest, taxes, depreciation and amortization (minus extraordinary items including stock buybacks, acquisitions and other extraordinary items as determined at the reasonable discretion of the Board of Directors of the Company, and legal fees associated with such items) (“EBITDA”) for the prior calendar year ended December 31 (the “Prior Year”). The bonus is based on a percentage of the officer’s annual base salary for the Prior Year (the “Prior Year’s Salary”) pursuant to a set schedule from between 100% of the Prior Year’s Salary if EBITDA exceeds $7 million to no bonus if EBITDA is less than $2 million.

The officers were also provided the right to earn a profit sharing bonus equal to 2.5% of the Company’s Gross Profit (the “Profit Bonus”) monthly in arrears for each month from January 2013 through December 2013 (each a “Profit Sharing Month”), which Profit Bonus is paid to the officers by the Company based on the applicable Profit Sharing Month’s Gross Profit. “Gross Profit” is defined as the Company’s gross profit (in the event the Company has a gross loss for any period, there shall be no Gross Profit for the applicable period) for each applicable period, calculated by taking the Company’s revenue for the applicable period and subtracting cost of revenues.

In addition to the bonuses described above, Jason Swinford’s Employment Agreement provides for him to receive a bonus (the “Transaction Bonus”) in the event that a (a) Change of Control (as defined in the Employment Agreement) of the Company, Holdings, or CTT Texas; or (b) the sale by the Company of substantially all of the assets of the Company (or controlling interests in the Company’s subsidiaries), each in one or more related transactions (each a “Bonus Transaction”); occurs while Mr. Swinford is employed under the terms of the Employment Agreement or within six (6) months of the termination of such agreement by the Company for any reason other than cause, or by Mr. Swinford for good reason. The Amount of the Transaction Bonus varies based on a set schedule and provides for Mr. Swinford to receive 2% of the total consideration received by the Company in connection with the Bonus Transaction, if the total consideration exceeds $20 million, but is less than $25,000,000.01; 3% of the total consideration received by the Company in connection with the Bonus Transaction, if the total consideration exceeds $25,000,000.01, but less than $35,000,000.01, and 3.5% of the total consideration received by the Company in connection with the Bonus Transaction, if the total consideration received is greater than $35,000,000.01.

| 12 |

The Employment Agreements and the bonuses are described in greater detail below under “Executive Compensation”, “Executive Employment Agreements”. Due to the structure of the bonuses, the officers have an incentive to increase our EBITDA and Gross Profit in the periods covered by the bonuses and Jason Swinford has an incentive to facilitate a Bonus Transaction. Such bonuses may cause actual or perceived conflicts of interest between such officers, the Company and the Company’s shareholders. The payment of the bonuses will likely have a material adverse effect on our results of operations, cash flow and funds available for business operations. The payment of the bonuses may force us to curtail or abandon planned expansion activities. The requirement for the Company to pay the bonuses could prevent a change of control of the Company. Consequently, the bonuses could cause the value of our common stock to decline in value and/or be valued at less than a similarly sized company which does not have a similar bonus structure.

We Will Owe Substantial Consideration To Our Chief Executive Officer and Executive Vice President In The Event They Are Able to Terminate Their Employment Agreements With Us For “Good Reason”, Including Their Death Or Disability. We entered into five year Executive Employment Agreements with Jerry Swinford to serve as our Chief Executive Officer and Jason Swinford to serve as our Chief Operating Officer in November 2010. In December 2011, the agreements were amended, Jerry Swinford resigned as Chief Executive Officer of the Company (provided that he still serves as the Treasurer, and Secretary of the Company) and was appointed as Executive Vice President of the Company and Jason Swinford was appointed as the Chief Executive Officer of the Company. The agreements were subsequently amended several times between August 2012 and July 2013 and such amendments are reflected in the discussion below. Both agreements are renewable for additional one-year terms as provided in the agreements. Pursuant to Jerry Swinford’s amended employment agreement, he is currently due $120,000 per year for services to the Company. Pursuant to Jason Swinford’s amended employment agreement, he is currently due $200,000 per year for services to the Company. Additionally, each is due Options and Bonuses (as described below under “Executive Compensation”, “Executive Employment Agreements”) pursuant to the agreements. If either individual’s employment is terminated by the Company for “cause” as defined in their agreements, the Company is required to pay such individual the compensation earned by him through the date of termination, including any Bonus which is due (which is calculated pro rata through the end of the last full calendar quarter as applicable), within 10 days of such termination date. In the event the Company terminates either individual’s employment for no reason or such individual terminates the agreement for “good reason” as provided for in the agreements, including his death, the Company materially diminishing his responsibilities, his disablement, the Company breaching any term of the employment agreement, or a constructive termination (including such individual being demoted, having his salary decreased or being forced to relocate), the Company is required pay such individual his salary for the remaining amount of the term of the agreement (at such times as the consideration would be due as if he was still employed by the Company), along with an additional $100,000 lump sum payment, due within 10 days of the termination date of the agreement. As such, in the event that either Jerry or Jason Swinford’s employment agreements are terminated by them for “good reason”, including, but not limited to their death or disablement, we will be forced to continue to pay their salaries, honor their Options and pay them (or their estate) the bonuses they would have been due as if they were still employed by the Company, as well as paying them a $100,000 lump sum payment. The requirement for the Company to continue to pay the salaries and other compensation to Jerry and Jason Swinford after they are no longer employed by the Company could prevent us from having sufficient available cash to engage new officers or directors, materially adversely affect our ability to pay our expenses as they become due, negatively affect our results of operations, and/or prevent a change of control of the Company.

We Face Corporate Governance Risks And Negative Perceptions Of Investors Associated With The Fact That We Currently Have Only Two Directors, None of Whom Are Independent. Currently, our officers and directors include Jerry Swinford and Jason Swinford, his son. As such, Jerry and Jason Swinford have significant control over our business direction. As such, Jerry and Jason Swinford have control of the Board of Directors and can, among other things, declare themselves discretionary bonuses, take actions to maximize the consideration they are due under their Employment Agreements, and determine their own compensation levels. Jason Swinford and Jerry Swinford are also our Chief Executive Officer and Executive Vice President, respectively. As such, Jason and Jerry Swinford have significant control over our business direction. Additionally, there are no independent members of the Board of Directors available to second and/or approve related party transactions involving Jerry or Jason Swinford or Mr. Pohlmann, including the compensation paid to Jerry or Jason Swinford and the employment agreements we enter into with such individuals. Therefore, investors may perceive that because no other directors are approving related party transactions involving Jerry or Jason Swinford or Mr. Pohlmann, that such transactions are not fair to the Company. The price of our common stock may be adversely affected and/or devalued compared to similarly sized companies with multiple unrelated and independent officers and directors due to the investing public’s perception of limitations facing our Company due to the above.

We Have Arrangements In Place With Various Manufacturers To Build And Produce Our Products, And If The Demand For Those Manufacturers’ Skills Increases, The Cost Of Producing Our Products May Increase, Causing Our Profits (If Any) To Decrease. We currently have a number of arrangements with various manufacturing shops which manufacture our Coil Tubing Technology tools and equipment. In the event that the demand for those manufacturers’ time and unique skills increase, we may be forced to pay more money to have our products manufactured. If this were to happen, we may be forced to charge more for our products, which may cause the demand for our products and consequently our sales to decrease, which would likely cause any securities which you hold to decrease as well. Additionally, if the materials which our products are made from, including steel, increase in cost, it could similarly cause increases in the cost of manufacturing our products, which could force us to increase the prices we charge for our products, which could cause the demand for such products to decline.

| 13 |

Our Future Success And Profitability May Be Adversely Affected If We Fail To Develop And Introduce New And Innovative Products That Appeal To Our Customers. The oil and gas drilling industry is characterized by continual technological developments that have resulted in, and likely will continue to result in, substantial improvements in the scope and quality of oilfield chemicals, drilling and artificial lift products and services and product function and performance. As a result, our future success depends, in part, upon our continued ability to develop and introduce new and innovative products in order to address the increasingly sophisticated needs of our customers and anticipate and respond to technological and industry advances in the oil and gas drilling industry in a timely manner. If we fail to successfully develop and introduce new and innovative products and services that appeal to our customers, or if new companies or our competitors offer such products, our revenue and profitability may suffer.

If We Are Unable To Adequately Protect Our Intellectual Property Rights Our Business Is Likely To Be Adversely Affected. We rely on a combination of patents, trademarks, non-disclosure agreements and other security measures to establish and protect our proprietary rights. The measures we have taken or may take in the future may not prevent misappropriation of our proprietary information or prevent others from independently developing similar products or services, designing around our proprietary or patented technology or duplicating our products or services. Furthermore, some of our intellectual property rights are only protected by patent applications and we may choose to not move forward with those patent applications in the future. Finally, our patent applications may not be granted in the future. In the event that we do not move forward with the patent applications and/or do not obtain registration of those patents, we will have a diminished ability to protect our proprietary technology, which could cause us to spend substantial funds in connection with litigation and/or may force us to curtail or abandon our business activities.

Jerry Swinford, Our Executive Vice President And Chairman, Has A First Priority Security Interest Over Our Patents. The Patents (defined above under “Item 1. Business”, “Patents, Trademarks and Licenses”) which we acquired from Jerry Swinford, our Executive Vice President and Chairman, are significant to our operations and are required for us to operate our business and protect our intellectual property rights. Mr. Swinford currently holds a first priority security interest over the Patents in order to secure the repayment of a note in the original amount of $700,000 which is due September 15, 2015, and is payable in monthly installments of the lesser of $12,963 or the amount outstanding under such note per month, which note was provided to Mr. Swinford by the Company in connection with the IP Purchase Agreement and IP Assignment Agreement described in greater detail below under “Management's Discussion And Analysis Of Financial Condition And Results Of Operations”, “Liquidity and Capital Resources”. In the event we default in the repayment of such note and Mr. Swinford enforces his security interest over the Patents we may be forced to curtail or abandon our business operations. The total amount outstanding under the note as of December 31, 2013 was $246,295.

A Significant Amount Of Our Revenues Are Due To Only A Small Number Of Customers, And If We Were To Lose Any Of Those Customers, Our Results Of Operations Would Be Adversely Affected. The Company had total revenue of $6,143,093 and $7,764,984 during the years ended December 31, 2013 and 2012, respectively. The Company had two customers representing approximately 17% and 18% of gross sales for the year ended December 31, 2013. The Company had two customers representing approximately 16% and 18% of gross sales for the year ended December 31, 2012.

As a result, the majority of our revenues are due to only a small number of customers, and we anticipate this trend continuing moving forward. Additionally, we do not have any contracts in place with the majority of our customers (except as described above under “Item 1. Business”, “Material Agreements”) and instead operate purchase order to purchase order with such customers. As a result, a termination in relationship or a reduction in orders from these customers could have a materially adverse effect on our results of operations and could force us to curtail or abandon our current business operations.

A Significant Amount Of Our Revenues Come From Entities Which Are Also Our Competitors, And If We Were To Lose Any Of Those Customers, Or They Were To Create Products To Directly Compete With Ours, Our Results Of Operations Would Be Adversely Affected. For the years ended December 31, 2013 and 2012, a significant portion of our revenues came from customers who are also our competitors. While these companies do not currently compete directly for our products, they offer similar products. If these entities, or any other entity which is a future customer of ours, creates products in the future which directly compete with ours, such entities will likely cease using our services and our revenues could be adversely affected. Similarly, we could lose additional customers to such directly competing competitors, which would further cause a decrease in our results of operations.

Our Revenues Are Subject To Seasonal Rules And Regulations, Such As The Frost Laws Enacted By Several States And Canada, Which Could Cause Our Operations To Be Subject To Wide Seasonal Variations. Certain states which experience below freezing temperatures during the winter months, and Canada have enacted Frost Laws, which put maximum weight limits on certain public roads during the coldest months of the years, to help prevent damage to the roads caused by frost heaves. As a result, our revenues may be limited in such cold weather states (and Canada) by such Frost Laws and our results of operations for those winter months may be substantially less than our results of operations during the summer months. We are currently focusing our efforts primarily in the U.S., Canada and Latin America; however we are also working to expand our distribution markets to include the North Sea and Middle Eastern markets. As a result, our results of operations for one quarterly period may not give an accurate projection of our results of operations for the entire fiscal year and/or may vary significantly from one quarter to the other.

| 14 |

Our Revenues Are Subject to Seasonal Variations. Our revenues are generated by drilling and well services activities, and therefore, cold weather and holidays and employee vacations during our first and fourth quarters exert downward pressure on revenues for those quarters, which is usually partially offset by the year-end efforts on the part of many customers to spend any remaining funds budgeted for services and capital expenditures during the year. Our customers’ annual budget process is normally completed in the first quarter of each calendar year, which can slow our services at the beginning of the year. Principally, due to these factors, our first and fourth quarters are typically less robust than our second and third quarters. As a result, our results of operations for one quarterly period may not give an accurate projection of our results of operations for the entire fiscal year and/or may vary significantly from one quarter to the other.

We May Not Be Able To Successfully Manage Our Growth, Which Could Lead To Our Inability To Implement Our Business Plan. Our growth is expected to place a significant strain on our managerial, operational and financial resources, especially considering that we currently only have three executive officers and two directors. Further, as we enter into additional contracts, we will be required to manage multiple relationships with various consultants, businesses and other third parties. These requirements will be exacerbated in the event of our further growth. Our systems, procedures and/or controls may not be adequate to support our operations or our management may not be able to achieve the rapid execution necessary to successfully implement our business plan. If we are unable to manage our growth effectively, our business, results of operations and financial condition will be adversely affected, which could lead to us being forced to abandon or curtail our business plan and operations.

If We Make Any Acquisitions, They May Disrupt Or Have A Negative Impact On Our Business. If we make acquisitions in the future, funding permitting, of which there can be no assurance, we could have difficulty integrating the acquired company's personnel and operations with our own. We do not anticipate that any acquisitions or mergers we may enter into in the future would result in a change of control of the Company. In addition, the key personnel of the acquired business may not be willing to work for us. We cannot predict the effect expansion may have on our core business. Regardless of whether we are successful in making an acquisition, the negotiations could disrupt our ongoing business, distract our management and employees and increase our expenses. In addition to the risks described above, acquisitions are accompanied by a number of inherent risks, including, without limitation, the following:

| — | the difficulty of integrating acquired products, services or operations; | |

| — | the potential disruption of the ongoing businesses and distraction of our management and the management of acquired companies; | |

| — | difficulties in maintaining uniform standards, controls, procedures and policies; | |

| — | the potential impairment of relationships with employees and customers as a result of any integration of new management personnel; | |

| — | the potential inability or failure to achieve additional sales and enhance our customer base through cross-marketing of the products to new and existing customers; | |

| — | the effect of any government regulations which relate to the business acquired; | |

| — | potential unknown liabilities associated with acquired businesses or product lines, or the need to spend significant amounts to retool, reposition or modify the marketing and sales of acquired products or the defense of any litigation, whether or not successful, resulting from actions of the acquired company prior to our acquisition; | |

| — | difficulties in disposing of the excess or idle facilities of an acquired company or business and expenses in maintaining such facilities; and | |

| — | potential expenses under the labor, environmental and other laws of various jurisdictions. |

Our business could be severely impaired if and to the extent that we are unable to succeed in addressing any of these risks or other problems encountered in connection with an acquisition, many of which cannot be presently identified. These risks and problems could disrupt our ongoing business, distract our management and employees, increase our expenses and adversely affect our results of operations. Further, the commencement of business in other countries may be subject to significant risks in areas which we are not able to prepare for in advance.

RISKS RELATED TO OUR INDUSTRY

Volatility Or Decline In Oil And Natural Gas Prices May Result In Reduced Demand For Our Products And Services Which May Adversely Affect Our Business, Financial Condition And Results Of Operation. The markets for oil and natural gas have historically been extremely volatile. We anticipate that these markets will continue to be volatile in the future. Although oil and gas prices have increased significantly in recent years, there can be no guarantees that these prices will remain at current levels. Such volatility in oil and gas prices, or the perception by our customers of unpredictability in oil and natural gas prices, affects the spending patterns in our industry. The demand for our products and services is, in large part, driven by current and anticipated oil and gas prices and the related general levels of production spending and drilling activity. In particular, volatility or a decline in oil and gas prices may cause a decline in exploration and drilling activities. This, in turn, could result in lower demand for our products and services and may cause lower prices for our products and services. As a result, volatility or a prolonged decline in oil or natural gas prices may adversely affect our business, financial condition and results of operations.

| 15 |

Competition From New And Existing Competitors Within Our Industry Could Have An Adverse Effect On Our Results Of Operations. The oil and gas industry is highly competitive and fragmented. Our principal competitors include numerous small coil tubing companies capable of competing effectively in our markets on a local basis as well as a number of large coil tubing companies that possess substantially greater financial and other resources than we do. Furthermore, we face competition from companies working to develop advanced oil and gas technology which would compete with us and other coil tubing companies. Additionally, our larger competitors may be able to devote greater resources to developing, promoting and selling or renting their products and services. We may also face increased competition due to the entry of new competitors including current suppliers that decide to sell or rent their coil tubing products and services directly. As a result of this competition, we may experience lower sales if our prices are undercut or advanced technology is brought to market which accomplishes greater results on average than our technology, which would likely have an adverse effect on our results of operations and force us to curtail or abandon our current business plan.

A Reduction In Spending Due To The Economic Downturn Could Result In A Decrease In Demand For Our Products. If spending on capital expenditures for oil and gas related products such as our coil tubing technology decreases, the demand for products like those provided by us would likely decline. This decrease could reduce our opportunity for growth, increase our marketing and sales costs, and reduce the prices we can charge for products, which could reduce our revenue and operating results.

Our Results Of Operations May Be Negatively Affected By Sustained Downturns Or Sluggishness In The Economy, Including Reductions In Demand Or Low Levels In The Market Prices Of Commodities, All Of Which Are Beyond Our Control. Sustained downturns in the economy generally affect the markets in which we operate and negatively influence our operations. Declines in demand for oil and gas as a result of economic downturns may reduce our cash flows, especially if our customers reduce exploration and production activities and, therefore, use of our products.

Lower demand for oil and gas and lower prices for oil and gas result from multiple factors that affect the markets which consume our products and services:

| — | supply of and demand for energy commodities, including any decreases in the production of oil and gas which could negatively affect the demand for oil and gas in general, and as a result the need for our coil tubing technology; | |

| — | general economic conditions, including downturns in the U.S., Canada or other economies which affect energy consumption particularly in which sales to industrial or large commercial customers which could negatively affect the demand for oil and gas in general, and as a result the need for our coil tubing technology; and | |

| — | federal, state and foreign energy and environmental regulations and legislation, which could make oil and gas exploration more costly, which could in turn drive down demand for oil and gas, and which could in turn reduce the demand for our technology and cause our revenues to decrease. |