Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - PlayAGS, Inc. | a2013123110kex311.htm |

| EX-32 - EXHIBIT 32 - PlayAGS, Inc. | a2013123110kex32.htm |

| EX-31.2 - EXHIBIT 31.2 - PlayAGS, Inc. | a2013123110kex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) | |

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the fiscal year ended December 31, 2013

or

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

for the transition period from to .

Commission file number 000-55119

AP GAMING HOLDCO, INC.

(Exact name of registrant as specified in its charter)

Delaware | 46-3698600 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | |

6680 Amelia Earhart Court Las Vegas, NV 89119 |

(Address of principal executive offices) (Zip Code) |

(702) 722-6700 |

(Registrant’s telephone number, including area code) |

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.01 per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No o

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes o No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o | Non-accelerated filer x (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

Neither the registrant’s voting common stock nor its non-voting common stock are publicly traded, and accordingly have no market value as of June 28, 2013, the last business day of the registrant’s most recently completed second fiscal quarter. As of March 24, 2014, there were 10,000,000 shares of the Registrant’s common stock, $.01 par value per share, outstanding.

TABLE OF CONTENTS

ii

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains “forward-looking statements.” Forward-looking statements include any statements that address future results or occurrences. In some cases you can identify forward-looking statements by terminology such as “may,” “might,” “will,” “would,” “should,” “could” or the negatives thereof. Generally, the words “anticipate,” “believe,” “continue,” “expect,” “intend,” “estimate,” “project,” “plan” and similar expressions identify forward-looking statements. In particular, statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance contained in this Annual Report on Form 10-K in Item 1. “Business,” Item 1A. “Risk Factors” and Item 2. “Financial Information—Management’s Discussion and Analysis of Financial Condition and Results of Operations” are forward-looking statements. These forward-looking statements include statements that are not historical facts, including statements concerning our possible or assumed future actions and business strategies.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, many of which are outside of our control, which could cause our actual results, performance or achievements to differ materially from any results, performance or achievements expressed or implied by such forward-looking statements. These risks, uncertainties and other factors include, but are not limited to:

• | our ability to develop and manage frequent introductions of innovative products; |

• | changing economic conditions and other factors that adversely affect the casino and gaming industry, the play levels of our participation games, product sales and our ability to collect outstanding receivables from our customers; |

• | the effect of our substantial indebtedness on our ability to raise additional capital to fund our operations, react to changes in the economy or our industry and make debt service payments; |

• | changes in player and operator preferences in participation games, which may adversely affect demand for our products; |

• | increased competition in the gaming industry; |

• | changing regulations, new interpretations of existing laws, or delays in obtaining or maintaining required licenses or approvals, which may affect our ability to operate in existing markets or expand into new jurisdictions; |

• | changes in the regulatory scheme governing tribal gaming impacting our games and Native American customers, which could adversely affect revenues; |

• | legal and regulatory uncertainties of gaming markets, including, without limitation, the ability to enforce contractual rights on Native American land; |

• | legislation in states and other jurisdictions which may amend or repeal existing gaming legislation; |

• | decreases in our revenue share percentage in our participation agreements with customers; |

• | slow growth in the establishment of new gaming jurisdictions, declines in the rate of replacement of existing gaming machines and ownership changes and consolidation in the casino industry; |

• | our ability to realize satisfactory returns on money lent to new and existing customers to develop or expand gaming facilities or to acquire gaming positions in gaming facilities; |

• | adverse local economic, regulatory or licensing changes in Oklahoma, the state in which the majority of our revenue has been derived, or material decreases in our revenue with our largest customer, which comprised approximately 34% of our gaming revenue for the fiscal year ended December 31, 2013; |

• | inability to protect or enforce our intellectual property; |

• | future claims of litigation or intellectual property infringement or invalidity, and adverse outcomes of those claims; |

• | failure to attract, retain and motivate key employees; |

• | the security and integrity of our systems and products; |

• | losses due to technical problems or fraudulent activities related to our gaming machines and online operations; |

• | product defects which could damage our reputation and our results of operations; |

• | quarterly fluctuation of our business; |

• | certain restrictive open source licenses requiring us to make the source code of some of our products available to third parties and potentially granting third parties certain rights to the software; |

• | recently introduced or proposed smoking bans on smoking at our facilities that may adversely affect our operations; |

• | upon receipt of all required governmental approvals, AP Gaming VoteCo, LLC will be the sole holder of our voting common stock, par value $0.01 per share (“Common Stock”) and may have conflicts of interest with us in the future or interests that differ from the interests of holders of our non-voting common stock; |

• | failure of our suppliers to meet our performance and quality standards or requirements could result in additional costs or loss of customers; |

• | risks related to casino operations which are conducted at the discretion of our customers; |

• | risks related to operations in foreign countries and outside of traditional U.S. jurisdictions; and |

1

• | the other factors discussed under Item 1A. “Risk Factors.” |

Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. These forward-looking statements are made only as of the date of this Annual Report. We do not undertake and specifically decline any obligation to update any such statements or to publicly announce the results of any revisions to any such statements to reflect future events or developments unless required by federal securities law. New factors emerge from time to time, and it is not possible for us to predict all such factors.

2

PART I

ITEM 1. BUSINESS.

Unless the context indicates otherwise, or unless specifically stated otherwise, references to the “Company”, “AP Gaming”, “Successor”, “we,” “our” and “us” refer to AP Gaming Holdco Inc. and its consolidated subsidiaries, including AGS Capital, LLC (“AGS Capital”) and AGS, LLC.

Overview

We are a leading designer and manufacturer of Class II gaming machines for the Native American gaming market with an emerging presence in a broad range of commercial markets in the United States. As of December 31, 2013, we had 8,563 gaming machines in 184 gaming facilities in 19 U.S. states, with 154 gaming facilities under revenue sharing agreements and 30 facilities under daily fixed fee agreements. The majority of our systems are used by Native American gaming operators in both Class II and Class III environments, with a recent expansion into the Illinois video gaming terminal, or VGT, market. Our products include electronic gaming machines, server-based systems and back-office systems that are used by casinos and other gaming locations.

We currently derive substantially all of our gaming revenues from lease agreements whereby we place gaming machines and systems at a customer’s facility in return for either a share of the revenues that these games and systems generate or a daily fee, which we collectively refer to as “participation agreements” and as our “participation model.” For the year ended December 31, 2013, approximately 97% of our total revenue was recurring, generated from participation agreements and other licensing fees. We believe that our participation model provides our customers with distinct advantages. By leasing our gaming machines to customers, we enable our customers to introduce new games in their facilities with minimal cost and financial risk. Additionally, the participation model directly aligns our interests with our customers through a shared dependence on the games’ performance. We successfully grew our domestic installed base of participation gaming machines every year from 2003 to December 31, 2013, and we remain highly focused on continuing to expand our domestic installed base of participation gaming machines in both our current and new markets. We have also substantially increased the number of markets in which we have participation gaming machines, from four U.S. states in 2006 to 19 U.S. states as of December 31, 2013. We also have historically generated revenue from the sale of gaming machines and systems. We expect gaming machine sales and systems sales to continue to play a role in our business and complement our core participation model as we expand into new gaming markets.

Our focus has been in the Native American segment of the gaming market, particularly Class II gaming, with 5,789 Class II machines installed in over 97 facilities across eight states. We also believe that we have a strong market position within Class II games in Oklahoma. The Oklahoma Native American gaming market is the third largest gaming market in the United States, with gaming revenues of approximately $3.8 billion in 2012, according to the Oklahoma Indian Gaming Association. From 2004 to 2012, we nearly doubled our installed base of Class II machines and increased our Class II market share from 9.7% to 20.4%. Unlike Class III gaming, which requires a compact with the state, Native American tribes have the authority to operate an unlimited number of Class II games without executing a compact so long as the states permit bingo-style gaming. Class II games are an attractive option for Native American tribes because, among other things:

• | revenue from Class II gaming is not shared with the state; |

• | there are no limits on the number of Class II gaming machines that may be operated in any one facility; and |

• | a strong Class II offering improves a tribe’s position when negotiating a Class III compact and the related taxes it pays to the respective state, as it lessens the tribe’s reliance on Class III games. |

We have significant technical expertise in catering to local tastes within fragmented markets and are thus positioned to be a leading supplier of Class III machines to Illinois’ recently regulated route-based market. The Illinois route-based market is the result of the Illinois Video Gaming Act, which legalizes licensed liquor businesses to have up to five gaming terminals in locations such as bars, restaurants, truck stops, and fraternal and veterans’ organizations. The video gaming terminals in these establishments are operated by route operators who generally have games in multiple locations. We provide the games to the route operators through a lease. In order to maximize operator and location revenue, we developed a new multi-game terminal called Gambler’s Choice, which is offered with a portfolio of games that are well-suited to player preferences for the route operated segment. We are also working in conjunction with select route operators to acquire and consolidate undercapitalized routes across Illinois in exchange for long-term contractual rights to provide our gaming machines at a fixed daily fee. As of December 31, 2013, we had 1,174 terminals operating in Illinois.

3

Class III markets represent a large untapped opportunity for us. Over the last three years, we have aggressively secured licenses in key commercial markets. As a result of our investments, we have more than tripled our addressable markets to 776 casinos and 614,000 gaming machines. We recently placed Class III units in Nevada and Louisiana and expect to commence placement of Class III gaming machines in New Jersey and Mississippi in the near term. Our key initiatives for the Class III market include (i) building a proprietary platform to enable us to develop customized product solutions and (ii) developing unique game concepts (such as the It Pays to Know series of games, pachinko-based topper games such as Caribbean Pearls, and engaging games with strong player appeal such as Blackbeard’s Treasure). We intend to focus on niche placements of these and other premium games to drive growth. As of December 31, 2013, we have successfully placed our gaming machines in 23 casinos with an average of 57 games per location (excluding Oklahoma).

We have leveraged our leadership position in Class II content, our flexible technology platform that offers titles in both Class II and Class III formats, and our strong customer relationships to penetrate our core markets. Under our participation model, customers rely on us to select the mix of titles, maintain and service the equipment, and oversee promotional efforts for our titles. These dynamics foster strong long-term customer relationships, as demonstrated by the fact that our top ten participation model customers have been with us for an average of over eight years. In addition, our customer location retention rate as of December 31, 2013, was 96%.

Within Native American and other segments of the gaming industry, we focus on providing content for the local player. We believe that locals-oriented markets have greater consistency and visibility in performance than larger destination markets and have strong growth characteristics. Based on our internal research, we believe local players visit casinos with high frequency and demonstrate strong loyalty to gaming titles. Locals-oriented markets have proven to be more resilient during economic downturns, and we believe we are well-positioned to benefit from gaming expansion as states with recently passed legislation such as Florida, Illinois, Maryland, Massachusetts, Ohio and Pennsylvania continue to legalize various forms of gaming. We believe our understanding of these locals-oriented markets, early focus on new market opportunities and market-specific strategies and products distinguish us from many of our competitors.

We have built a strong management team and increased our product development capability in order to capitalize on our attractive market position and growth opportunities in our current and new markets. In addition, we have significantly increased our pipeline of new titles through continued investment in internal content development capabilities and increased efforts on leveraging third-party developers. We believe our expanded content library consisting of our core and new titles will allow us to drive incremental revenue from our domestic installed base of 8,563 gaming machines, gain additional placements in our current markets and penetrate new markets.

Business Strategy

We have invested and expect to continue to invest in new business strategies, products, services and technologies. We intend to pursue the following strategies as part of our overall business strategy:

• | Continue to expand our library of proprietary content. We will continue our focused efforts to develop games, both internally and through partnerships with third parties, tailored to our target markets. Investments in expanding our content have created a new title pipeline of 28 games that we released in 2013 (22 of which were developed internally), which equals the 28 titles we brought to market from 2002 to 2010 combined. Our proprietary game library grew from nine active titles in 2011 to 87 active titles at the end of 2013. |

• | Improve yield on existing customer installed base by managing title mix. We believe that more effective management of the title mix across our domestic installed base of 8,563 participation gaming machines in 169 gaming facilities represents an opportunity to generate incremental earnings growth without requiring growth in our domestic installed base of participation gaming machines. In addition, we expect improved game performance will likely drive incremental gaming machine placements within our customers’ facilities. |

• | Develop niche products for expansion into traditional gaming markets. With 979 casinos in 41 U.S. states as of December 31, 2013, and the replacement cycle on equipment at a cyclical low, we believe the market potential for new games is favorable. We will target the introduction of a small number of niche participation gaming machines to a large number of casinos. As of December 31, 2013, we are licensed to operate in 24 U.S. states, containing approximately 776 casinos in the aggregate. |

• | Execute on contracted Illinois VGT rollout. We have significant technical expertise in catering to the local tastes within fragmented markets and are positioned to be one of the leading suppliers to Illinois’ recently regulated route gaming market. To target this nascent route-based market, we have developed new products and features, including games, titles and bonus features specifically for the Illinois VGT market and a statewide player reward program. |

4

• | Continue expansion into Class III markets and increase penetration in Class II markets. We have a foothold of 1,600 Class III recurring revenue placements (excluding Illinois), and we plan to continue expanding in this market. Utilizing new, recently-issued gaming licenses, we expect to begin placing and selling Class III products in five new jurisdictions (Nevada, Mississippi, Louisiana, New Jersey and Connecticut). We also anticipate growing our presence in Class III markets where we currently operate, such as Oklahoma, Florida and California, by placing additional content from our expanding library of games in these states. In addition, we believe that our existing core Class II product offering is among the strongest in the industry today. We expect to continue gaining market share in existing Class II jurisdictions and are focused on penetrating newly licensed jurisdictions. |

Company History

The Acquisition

We are a Delaware corporation that was formed in August 2013 to acquire, through an indirect wholly owned subsidiary of the Company, 100% of the equity in AGS Capital, LLC (“AGS Capital”, “Predecessor”) from AGS Holdings, LLC (“AGS Holdings”).

On September 16, 2013, AGS Holdings, LLC, AGS Capital and AP Gaming Acquisition, LLC (“AP Gaming Acquisition”), an indirect wholly owned subsidiary of the Company and an affiliate of Apollo Global Management, LLC (“Apollo”), entered into an Equity Purchase Agreement (as subsequently amended and restated on December 3, 2013, the “Acquisition Agreement”). The Acquisition Agreement provided for the purchase of 100% of the equity of AGS Capital from AGS Holdings (the “Acquisition”) by AP Gaming Acquisition for an aggregate purchase price of approximately $220.5 million. The Acquisition was consummated on December 20, 2013 (the “Closing Date”).

The Acquisition was financed in part by the Senior Secured Credit Facilities (as defined herein), which are comprised of the $155 million Term Facility and the $25 million Revolving Facility (each, as defined herein). AP Gaming I, LLC, an indirect wholly owned subsidiary of AP Gaming, is the borrower of the Senior Secured Credit Facilities, which are guaranteed by AP Gaming Holdings, LLC (“AP Gaming Holdings”), AP Gaming I, LLC’s direct parent company, and each of AP Gaming I, LLC’s direct and indirect material wholly owned domestic subsidiaries including AGS Capital.

Predecessor History

In September 2005, AGS, LLC (“AGS”), a direct wholly owned subsidiary of AGS Capital, LLC, acquired Clapper Enterprises, Inc. and Worldwide Game Technology Corp., collectively referred to as CEI. Prior to 2002, CEI focused on the Class II market, utilizing new game and system software provided through its partnership with Bluberi. CEI’s primary market was Oklahoma, which was a non-compacted, Class II-only Native American market at this time. From 2002 to 2004, CEI grew their installed base of participation gaming machines from several hundred to approximately 3,000, of which approximately 89% were located in Oklahoma, with the remaining machines located in New York, Wyoming and Texas. See Item 7. “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Acquisitions and Divestitures.”

Our historical growth primarily has been accomplished by expanding our installed base of participation gaming machines through increased penetration of existing markets and the expansion into new markets. As of December 31, 2013, we had 8,563 gaming machines in 19 U.S. states. AGS Capital added the game sale model in 2008 to complement its participation strategy. In 2010, AGS Capital recruited a new CEO and several highly accomplished executives to its management team. In July 2010, AGS Capital reorganized its business by reducing staff and consolidating its field service operations to its Oklahoma facility which led to the closure of its Canoga Park, California facility and the closure of its Simpsonville, South Carolina facility. In January 2012, AGS Capital agreed to terminate its existing distribution agreement with Bluberi, which provided gaming content and software systems in exchange for certain royalties, and to acquire certain rights to gaming content and software systems covered thereunder.

5

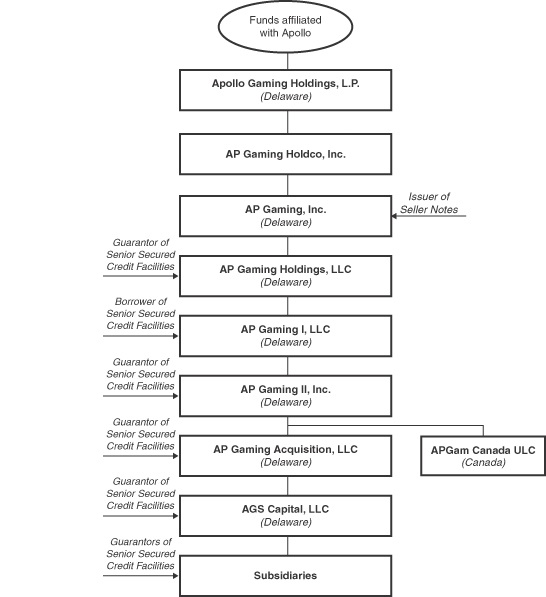

Corporate Structure

The following chart summarizes our current corporate structure:

6

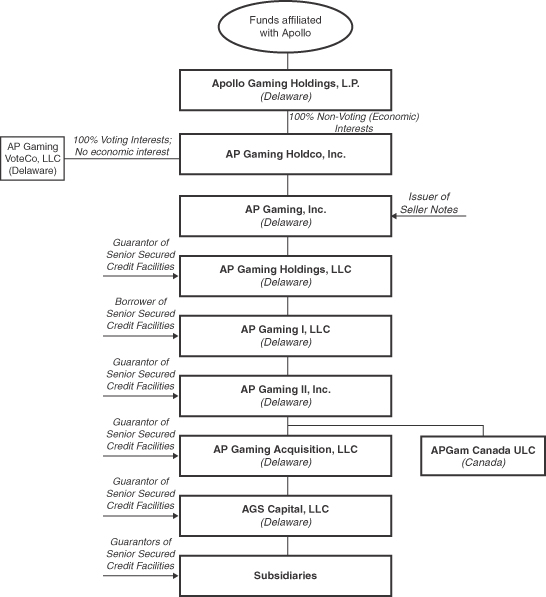

The following chart summarizes our corporate structure upon receipt of all required governmental regulatory approvals:

Apollo Overview

Founded in 1990, Apollo is a leading global alternative investment manager with offices in New York, Los Angeles, Houston, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of December 31, 2013 and 2012, Apollo had assets under management of $161 billion and $113 billion, respectively, invested in its private equity, capital markets and real estate businesses.

Apollo has a long history of successfully investing in leisure and site-based entertainment. Investments include resorts, cruise lines, gaming, spas, golf and restaurants. Apollo has a deep understanding and significant experience in the development / construction, marketing and cross-selling activities for these assets, as well as a broad network of industry professionals.

Apollo is currently invested in Caesars Entertainment Corporation, the world’s largest and most diversified casino-entertainment provider and the most geographically diverse U.S. casino-entertainment company with 61,900 slot machines, Gala Coral Group, one of Europe’s pre-eminent betting and gaming businesses with 7,082 slot machines and three cruise line companies, Norwegian Cruise Line, Oceania Cruises and Regent Seven Seas Cruises, with approximately 2,950 slot machines in the aggregate.

7

Our Operations

Under our participation agreements, we provide customers with gaming machines, systems software, computer hardware, signage and other equipment for operation within their gaming facilities. In return we receive a share of the revenue generated by these gaming machines and systems or a daily fee. The determination of whether our agreement results in a revenue share or daily fee arrangement is generally governed by local gaming jurisdictions. For our revenue share arrangements, we have historically shared between 15 – 20% of the revenues generated by the gaming machines. Under our participation agreements, we participate in selecting the mix of titles, maintain and service the equipment, and oversee certain promotional efforts. In support of our business and operations, we employ a professional staff including field service technicians, production, sales, account management, marketing, technology and game development, licensing and compliance, finance and administration.

Our field service technicians are responsible for installing, maintaining and servicing our player terminals and systems. Our field service operation including our call center, which operates 24 hours a day, seven days a week, is managed out of our Oklahoma facility. We can also access most of our gaming machines and systems remotely from approved remote locations to provide software updates and routine maintenance. In addition, our gaming machine and system production facility is also located in and managed out of Oklahoma.

Sales, account management and marketing are managed through our Oklahoma, Las Vegas and Illinois locations. Sales and account management oversees the customer relationship both at the individual location and corporate level and are responsible for developing new customer relationships. Account management is in charge of running on-site promotions and corporate sponsorship programs. In addition, our marketing team is in charge of general corporate marketing, including advertisements and participation at industry trade shows.

Our technology and game development division operates primarily out of our Toronto location and secondarily out of our Las Vegas location. We employ game developers, software and system programmers, project managers and other development and administrative staff that oversee our internal game development efforts and manage third party relationships.

Our legal, licensing and compliance division operates out of our Las Vegas and Oklahoma locations. Our licensing and compliance division oversees the application and renewal of our corporate gaming licenses, findings of suitability for key officers and directors and certification of our gaming equipment and systems for specific jurisdictions, as well as coordinating gaming equipment and software shipping and onsite and remote service of our equipment with gaming authorities.

Our finance and administration division is located in our corporate headquarters in Las Vegas. Finance and administration oversees financial reporting, cash management, human resources and other administrative and corporate functions.

Products

We provide our customers with gaming machines, systems software, computer hardware, signage and other equipment for operation within their gaming facilities.

Roadrunner Platform

We received regulatory approval for the Roadrunner platform in 2012. The Roadrunner platform represents a substantial advancement from our legacy Encore platform, both in terms of user interface and platform architecture. We designed Roadrunner to be a leading Class II gaming platform with the capability to port Class III outcomes within a Class II construct with limited degradation in game play. Since Roadrunner is able to run in both Class II and Class III formats, we are able to develop both Class II and Class III titles for the platform, and can also easily retrofit it to certain of our existing products.

Utilizing both in-house and third party providers, we have created a portfolio of new titles for the Roadrunner platform. The Roadrunner platform was designed with our revenue share model in mind, and title conversions can be executed by loading software off of a USB drive. Roadrunner is also compatible with downloadable conversions, however regulatory standards in most jurisdictions do not currently permit this technology.

Gaming Titles

Prior to 2010, we relied solely on external content providers, and currently approximately 85% of our installed base runs on externally developed platforms. We have strategically shifted our focus to create new internal content, however, and our research and development program has been the largest contributor to our new titles over the past two years. As a result, we expect internally generated content to be a larger source of our installed base going forward.

8

We have four categories of gaming titles: Standard, Premium, Bluberi and Colossal. Our Standard and Premium products utilize internally produced content, while our Bluberi and Colossal products utilize externally produced content. We acquired rights to the Bluberi products and titles in 2012 and also signed an exclusive distribution agreement with Colossal Gaming in 2012 for the California, Oklahoma, Washington, Florida, New York and Texas markets.

Core Titles

We partnered with Bluberi beginning in 2002 to develop our initial set of Class II games for release in the Oklahoma market. Under this agreement, we paid Bluberi a licensing fee equal to a percentage of revenues earned on titles placed in casinos that operated on Bluberi’s proprietary platform. This collaboration resulted in the development of successful core titles, such as Royal Reels, Cool Catz and Liberty 7’s, which are among the top ten Class II games in the market today. These titles have historically been the highest gross earners in our product portfolio and as of December 31, 2013, represented 52% of our installed base and 61% of our total revenue. In May 2012, we negotiated a purchase agreement with Bluberi for the licensing and royalty rights to Royal Reels, Cool Catz and Liberty 7’s, among others. We believe that there is significant value in these brands, and we plan to leverage them through developing title extensions on the Roadrunner platform.

Roadrunner Titles

We continue to launch our Premium titles in three primary formats: mechanical wheel top box, mechanical pachinko top box and 42” vertical slant top. These self-merchandising cabinet formats are Premium in nature and atheistically appealing to the casino customer. The variety of formats allows for an appropriate level of experimentation of unique selling propositions within our product.

We have entered into licensing agreements with a number of top brands and are developing a series of trivia-based games which will be marketed as the It Pays to Know series. The brands include Ripley’s Believe it or Not!, Are You Smarter Than a 5th Grader? and Family Feud. For each brand, we intend to take to market at least two different products to maximize the potential of creating a hit franchise. In December 2012, we launched Blackbeard’s Treasure, a culmination of the unique bonus schemes, play mechanisms and game features developed for the Roadrunner platform. It represents the first game on the Roadrunner platform which will be featured in a Premium format.

Specialty Game Concepts

Our Diamond Lotto game has quickly become one of the leading grossing games in the state of Florida since its launch in 2009. To build on Diamond Lotto’s success and increase its presence in the Florida market, in the future we will be launching the Lottomania Multi-Game, featuring line extensions that include Shamrock Lotto, Great West Lotto, Ruby Lotto and Jewel Lotto. We plan to replicate the success of Diamond Lotto in other Class III gaming markets where we have a smaller footprint.

We introduced our Gambler’s Choice multi-game unit, designed specifically for the Illinois VGT market, in September 2012. This unit runs on our Roadrunner platform and enables us to offer up to 24 titles per terminal, including traditional reel games, classic card games and specialty poker products in order to maximize operator and location revenue. We researched the market intensively to carefully create a portfolio of games that are well suited to player preferences for a route operated market. The resulting mix is a collection that includes several of our highest grossing titles as well as external content that was specifically licensed for use in the Illinois market. Among the offerings is Cherry Master, a game that we in-licensed and recreated for the Illinois VGT market.

Third Party Content

Our product strategy also involves title development utilizing independent design studios to create content on the new Roadrunner platform. In November 2011, we entered into an exclusive rights agreement to license five titles, with an option to expand, from Gametech International’s video lottery terminal library for use in the Illinois market. We are also implementing the first of three titles that we acquired from Design Works Gaming, an independent studio based in Phoenix. The first of these titles is Armadillo Artie, which was launched in the third quarter of 2013.

In September 2012, we entered into an exclusive distribution agreement with Colossal Gaming to distribute Colossal’s Class II and Class III games in California, Florida, New York, Oklahoma, Texas and Washington. As part of the distribution agreement, we will provide sales and service for Colossal designed games. Colossal’s products offer a unique selling proposition with creatively designed oversized games. For example, the Big Red cabinet is over eight feet wide and we believe is one of the top games in both California and Oklahoma. More recently, we expanded our development agreement with Colossal to include three Colossal titles that will be developed on our GT5000 cabinet for sale or deployment in all jurisdictions where we are licensed.

9

Product Strategy

Our product strategy is to develop unique Premium product offerings and create our own product categories and subcategories featuring these Premium offerings. We will also test various unique game play methods on our Standard series of games which will also be used to manage yield in the existing installed base. Our growing library of new Standard titles provides us with a broader selection to actively manage our title mix and keep our installed base fresh with new popular content.

For Premium games, we intend to become the market leader in sub-categories wherever possible. For example, our It Pays to Know series of games will feature well-known brands such as Ripley’s Believe it or Not!, Are You Smarter Than a Fifth Grader? and Family Feud. All games in the It Pays to Know series will also include a trivia bonus feature, which is unique to our games. We believe this strategy will allow us to maintain our market leadership within our Class II base in existing markets and to expand into Class III casinos in other key jurisdictions.

Manufacturing

We have a manufacturing agreement with Cole Kepro International, LLC (“Cole”) to build our gaming cabinets. We believe we have limited concentration risk with Cole, since we own the rights to our cabinet designs and thus have the ability to change manufacturers in the event of a dispute. Cole is based in Las Vegas, Nevada and is owned by Kepro International, a large international manufacturing company with multiple manufacturing facilities. We believe our gaming cabinets can easily be designed at another of Kepro’s plants in the event of an unforeseen interruption at Cole’s Las Vegas plant.

Our gaming machine and system production facility is also located in and managed out of Oklahoma. Production at this facility includes assembling and refurbishing gaming machines (excluding gaming cabinets) and servers, parts support and purchasing. Field service technicians are located in various jurisdictions throughout the U.S. and are dispatched from a central call center located in our Oklahoma facility. They are responsible for installing, maintaining and servicing the player terminals and systems.

Manufacturing commitments are generally based on projected quarterly orders from customers. Due to uneven order flow from customers, component parts common to all gaming machines are purchased and assembled into a partial product that are inventoried to be able to quickly fill final customer orders.

We generally warrant our new gaming machines sold in the United States for a period of 365 days, while we warrant our gaming machines sold internationally for a period of 180 days to one year. Our warranty costs have not been significant.

Customers

We believe the quality and breadth of our customer base is a strong testament to the effectiveness and quality of our product offerings, technological innovation and customer service. At the core of our relationship with our customers is our participation model, which aligns our financial incentives with those of our customers through a shared dependence on the games’ performance. The combination of our customer-aligned participation model, quality customer service and strong game performance has allowed us to develop long-term relationships with our tribal and commercial casino customers. We have a strong customer location renewal rate, which averaged 96% as of December 31, 2013. Our top ten participation customers have been with us for an average of over eight years, and we believe that we maintain long-term relationships with key customer decision-makers. The combination of our customer-aligned participation model, attentive customer service and superior game performance has allowed us to develop long-term relationships with our tribal and commercial casino customers. As of December 31, 2013, we had 8,563 gaming machines in 19 U.S. states.

Oklahoma is our largest market and our participation gaming machines in the state accounted for approximately 78% of our total revenue for the fiscal year ended December 31, 2013. Our largest customer is the Chickasaw Nation, a Native American gaming operator in Oklahoma, which accounted for approximately 34% of our gaming revenue for the fiscal year ended December 31, 2013. The revenues we earn from the Chickasaw Nation are derived from numerous agreements. One such agreement, which covers our leasing of 200 units for the Winstar project, is scheduled to expire May 11, 2014, while the other agreements are scheduled to expire between 2015 and 2018. We have historically offered select existing and prospective customers financing for casino development and expansion projects in exchange for exclusive rights to a percentage of their floor space. In addition to our long-term relationships and contractual arrangements, the consistent demand for our titles from the loyal, repeat players of our titles further ensures our strong presence on our customers’ casino floors.

Within the Native American market, we provide both Class II and Class III games. We also serve customers in commercial, video lottery terminal, charity bingo and route-based markets.

10

Customer Contracts

We derive the majority of our gaming revenues from participation agreements whereby we place gaming machines and systems, along with our proprietary and other licensed game content, at a customer’s facility in return for a share of the revenues that these gaming machines and systems generate or a daily fee. We measure the performance of our domestic installed base of participation gaming machines on the net win per day per machine, often referred to as the win per day, or WPD. Under our participation agreements, we earn a percentage of the WPD of our domestic installed base of participation gaming machines. For the fiscal year ended December 31, 2013, our average revenue share was 18.9% and the average WPD of our domestic installed base of participation gaming machines increased 3.6% compared to the prior year.

Our standard participation contracts run one to three years in duration and may contain auto-renewal provisions for an additional term. Our contracts generally specify the number of gaming machines and other equipment to be provided, revenue share, daily fee or other pricing, provisions regarding installation, training, service and removal of the machines, and other terms and conditions standard in the industry. In some circumstances, we enter into trial agreements with customer that provide a free or fee-based trial period during which the customer may use our gaming machines. Each trial agreement lays out the terms of payment should the customer decide to continue using our machines.

Our development or similar agreements in the Native American and other markets may involve both a loan or advance of funds and a gaming equipment lease agreement. These agreements are typically longer term contracts, ranging from four to ten years depending on the amount of financing provided, market and other factors. These contracts specify the amount and timing of the advances that we will provide, the uses of those funds, and target timing for the construction or remodeling of the gaming facility, if applicable. In addition, the contracts specify the repayment terms of the loans which vary by customer and agreement. Typical terms contained in these agreements include the percentage of the floor, minimum number of gaming machines, or percentage of the route operation allocated to us, the associated term or period of exclusivity for that allocation or number of gaming machines, minimum game performance thresholds, cure periods and resulting obligations, if any, and other general terms and conditions. Certain of these development agreements also contain a buyout option, which provides that upon written notice and payment of a buyout fee, the customer can terminate our floor space privileges. The IGRA states that a Native American tribe must have the “sole proprietary interest” in its gaming (25 U.S.C. § 2710(b)(2)(A)). To the extent that any of our agreements with Native American tribes are deemed by the NIGC to create an impermissible proprietary interest, such agreements would need to be amended in order to be valid. To our knowledge, none of our current agreements with Native American tribes create an impermissible proprietary interest in Indian gaming. As of the consummation of the Acquisition, approximately $11.0 million of the notes receivable remain with the Seller.

We generally make efforts to obtain waivers of sovereign immunity in our contracts with Native American customers. However, we do not always obtain these provisions and where we do they can be limited in scope. There is no guarantee that we will continue or improve our ability to get this term in future contracts. While we have not had any experience with contract enforceability vis-à-vis our Native American customers, we are cognizant of recent cases involving other parties dealing with waivers of sovereign immunity. Those cases put into question how sovereign immunity may be viewed by courts in the future. In the event that we enter into contracts with Native American customers in the future that do not contain a waiver of sovereign immunity, such contracts may be practically unenforceable.

Our game sale contracts are typical of those in the industry. They specify the general terms and conditions of the sale, equipment and services to be provided, as well as pricing and payment terms. In some cases, we provide the central server that is used to operate the purchased equipment on a lease and charge a fee per day based on the number of gaming machines connected to the server.

Research and Development

We conduct research and development through an internal team to develop new gaming systems and gaming content. Research and development costs consist primarily of salaries and benefits, travel and expenses and other professional services. We employ approximately 60 game developers, software and system programmers, project managers and other development and administrative staff that oversee internal game development efforts and manage third party relationships. The technology and game development division operates primarily out of our Toronto location as well as in Las Vegas.

Competition

We encounter intense competition from other designers, manufacturers and operators of electronic gaming machines and systems. Our competitors range from small, localized companies to large, multi-national corporations, several of which have substantial resources and market share.

11

Our competitors include, but are not limited to, International Game Technologies, or IGT, WMS Industries Inc., Bally Technologies, Inc., or Bally, Aristocrat Technologies Inc., or Aristocrat, Video Gaming Technologies, Inc., or VGT, Multimedia Games, Inc., or MGAM, Konami Co. Ltd., or Konami, and Cadillac Jack. Many of our competitors are large, well-established companies with substantially larger operating staffs and greater capital resources and have been engaged in the design, manufacture and operation of electronic gaming equipment business for many years. Some of these companies contain significant intellectual property including patents in gaming technology and hardware design, systems and game play and trademarks. In addition, the larger competitors contain significantly larger content portfolios and content development capability and resources, are licensed in markets throughout the United States, and have international distribution. Bally, IGT, Konami, and Aristocrat all have a presence in the back-office accounting and player tracking business which expands their relationship with casino customers. VGT, Cadillac Jack and MGAM are our primary competitors in the Class II market.

To compete effectively, we must, among other things, continue to develop high performing games for the Class II market, provide excellent service and support to our existing customers, effectively manage our installed base of participation gaming machines, expand our library of proprietary content, develop niche products with strong appeal to local players, be first to market in new non-traditional markets, implement effective marketing and sales functions, and offer competitive pricing and terms on our participation and sale agreements.

Intellectual Property

We have a combination of internally developed and third-party intellectual property, all of which we believe maintain and enhance our competitive position and protect our products. Such intellectual property includes owned or licensed patents, patent applications, trademarks and trademark applications in the United States and Canada. In addition, pursuant to our license agreements with third-party game developers, we license and distribute gaming software.

Seasonality

Seasonality

Historically, our operating results have been highest during the first quarter and lowest in our third and fourth quarters, primarily due to the seasonality of player demand. Our quarterly operating results may vary based on the timing of the opening of new gaming jurisdictions, the opening or closing of casinos, the expansion or contraction of existing casinos, approval or denial of our products and corporate licenses under gaming regulations, the introduction of new products, the seasonality of customer capital budgets, the mix of domestic versus international sales and the mix of lease and royalty revenue versus sales and service revenue.

Inflation

Our operations have not been, nor are they expected to be in the future, materially affected by inflation. However, our operational expansion is affected by the cost of hardware components, which are not considered to be inflation sensitive, but rather, sensitive to changes in technology and competition in the hardware markets. In addition, we expect to continue to incur increased legal and other similar costs associated with regulatory compliance requirements and the uncertainties present in the operating environment in which we conduct our business.

Employees

We employ a professional staff, including field service technicians, production, sales, account management, marketing, technology and game development, licensing and compliance, finance and administration, to support our business and operations. As of December 31, 2013, we had 214 full-time employees in 11 different U.S. states and Toronto, Canada and no part-time employees. We are not a party to any collective bargaining agreements and have not experienced any strikes or work stoppages in the past.

12

Regulation and Licensing

We operate in numerous gaming jurisdictions, and our operations are subject to applicable federal, state, tribal and foreign governmental regulations as applicable in each of the gaming jurisdictions in which we operate. A significant portion of our operations take place at facilities conducting gaming activities on the tribal lands of Native American tribes resulting in our operations being subject to tribal and/or federal and sometimes state regulations depending on the classification of gaming being conducted in each such case as defined in the Indian Gaming Regulatory Act, or IGRA. In states where commercial gaming has been legalized, our operations are conducted subject to the applicable law of each such state and applicable federal laws.

While the specific regulatory requirements of each state and tribal jurisdiction vary, gaming regulatory authorities typically require licenses, permits, findings of integrity and financial ability, and other forms of approval to conduct operations as a gaming equipment manufacturer and/or provider of gaming related services. It is common for regulators to require reporting and disclosure concerning our activities in other gaming jurisdictions, resulting in the possibility that business activities or disciplinary action against us in one jurisdiction could result in disciplinary action in other jurisdictions. In addition, our officers, key employees, directors, major stockholders and, in some cases, equity holders and lenders are also each subject to licensure and/or suitability findings in connection with our operations. If regulators in any jurisdiction in which we conduct business determine that any officer, key employee, director, major stockholder (or other person or entity affiliated with us and subject to regulatory scrutiny under the regulations of such jurisdiction) is unsuitable to participate in the gaming industry in such jurisdiction, then we could be required to terminate our relationship with such person. In addition, many jurisdictions require our products to be tested for compliance with the jurisdiction’s regulations prior to our being permitted to distribute our products.

Our officers, key employees and operational entities have obtained or applied for all required government licenses, permits, registrations, findings of suitability, and approvals necessary to manufacture and distribute gaming products in all jurisdictions where we currently do business. In most jurisdictions, even once licensed or approved, we remain under the on-going obligation to keep the applicable gaming regulators informed of any material changes in the information provided to regulators as part of the licensing and approval process, and all licenses and approvals must be periodically renewed, in some cases as often as annually. In connection with any initial application or renewal of a gaming license or approval, we (and any individual required to submit to background review or licensure in connection with our application or renewal) are typically required to make broad and comprehensive disclosures concerning our business, including our finances, ownership and corporate structure, operations, compliance controls and business relationships. We must regularly report changes in our officers, key employees and other licensed positions to applicable gaming regulators. Gaming regulators typically have the right to disapprove any change in position by one of our officers, directors, or key employees, or require us to suspend or dismiss officers, directors, or other key employees and cause us to sever relationships with other persons or entities who refuse to file appropriate applications, or whom are found to be unsuitable.

Certain gaming jurisdictions in which we are licensed may prohibit us from making a public offering of our securities without their prior approval. Similarly, changes in control of a licensee through merger, consolidation, acquisition of assets or stock, management or any form of takeover typically cannot occur without the prior approval of applicable gaming regulators. Such regulators may also require controlling stockholders, officers, directors, and other persons or entities having a material relationship or involvement with the entity proposing to acquire control, to be investigated, and licensed as part of the approval process relating to the transaction.

Gaming regulators often have the power to investigate the holders of our debt or equity securities. If any holder of our debt or equity securities is found unsuitable by any gaming regulator in a jurisdiction in which we conduct business, our licensure or approval to conduct business in such jurisdiction could be subject to non-renewal, suspension or forfeiture.

Most gaming jurisdictions impose fees and taxes that are payable by us in connection with our application, maintenance and renewal of our licensure or our approval to conduct business.

Federal Registration

The Gambling Devices Act of 1962 makes it unlawful for a person to manufacture, transport, or receive gaming devices, or components across interstate lines unless that person has first registered with the Attorney General of the U.S. Department of Justice. This act also imposes gambling device identification and record keeping requirements. Violation of this act may result in seizure and forfeiture of the equipment, as well as other penalties. As an entity involved in the manufacture and transportation of gaming devices, we are required to register annually.

13

Native American Gaming

The rules for Native American gaming were established in 1988 under the IGRA. Under the IGRA, gaming activities conducted by federally recognized Native American tribes are segmented into three classes of gaming activities:

Class I. Class I gaming represents traditional forms of Native American gaming as part of, or in connection with, tribal ceremonies or celebrations (e.g., contests and games of skill) and social gaming for minimal prizes. Class I gaming is regulated only by individual Native American tribes. We do not participate in any Class I gaming activities.

Class II. Class II gaming involves the game of chance commonly known as bingo (whether or not electronic, computer, or other technological aids are used in connection therewith to facilitate play) and if played in the same location as the bingo, pull tabs, punch board, tip jars, instant bingo, and other games similar to bingo. Class II gaming also includes non-banked card games, that is, games that are played exclusively against other players rather than against the house or a player acting as a bank. However, the definition of Class II gaming specifically excludes slot machines or electronic facsimiles of Class III games. Class II gaming is regulated by the National Indian Gaming Commission (the “NIGC”) and the laws of the Native American tribe conducting such gaming. Subject to the detailed requirements of the IGRA, federally recognized Native American tribes are typically permitted to conduct Class II gaming on Indian lands pursuant to tribal ordinances approved by the NIGC.

Class III. Class III gaming includes all other forms of gaming that are neither Class I nor Class II and includes a broad range of traditional casino games such as slot machines, blackjack, craps and roulette, as well as wagering games and electronic facsimiles of any game of chance. The IGRA generally permits Native American tribes to conduct Class III gaming activities on reservation lands subject to the detailed requirements of the IGRA, including NIGC approval of the Native American tribe’s gaming ordinance and the entering into of a compact between the Native American tribe and the state in which the Native American tribe intends to conduct Class III gaming activities on its trust lands.

The IGRA is administered by the NIGC and the Secretary of the U.S. Department of the Interior. The NIGC has authority to issue regulations related to tribal gaming activities, approve tribal ordinances for regulating gaming, approve management agreements for gaming facilities, conduct investigations and monitor tribal gaming generally. The IGRA is subject to interpretation by the NIGC and may be subject to judicial and legislative clarification or amendment. The gaming ordinance of each Native American tribe conducting gaming under the IGRA and the terms of any applicable tribal/state compact establish the regulatory requirements under which we must conduct business on Native American tribal lands.

Under the IGRA, the NIGC’s authority to approve gaming related contracts is limited to management contracts and collateral agreements related to management contracts. A “management contract” includes any agreement between a Native American tribe and a contractor if such contract or agreement provides for the management of all or part of a gaming operation. To the extent that any of our agreements with Native American tribes are deemed to be management contracts, such agreements would require the approval of the NIGC in order to be valid. To our knowledge, none of our current agreements with Native American tribes qualify as management contracts under the IGRA.

In addition, as discussed above under “—Customers—Customer Contracts,” to the extent that any of our agreements with Native American tribes are deemed by the NIGC to create an impermissible proprietary interest, such agreements would need to be amended in order to be valid. To our knowledge, none of our current agreements with Native American tribes create an impermissible proprietary interest in Indian gaming.

International Regulation

Certain foreign countries permit the importation, sale, and operation of gaming equipment in casino and non-casino environments. Some countries prohibit or restrict the payout feature of the traditional slot machine or limit the operation and the number of slot machines to a controlled number of casinos or casino-like locations. Each gaming machine must comply with the individual country’s regulations. Certain jurisdictions do not require the licensing of gaming machine operators and manufacturers.

ITEM 1A. RISK FACTORS.

The following risk factors should be considered carefully in addition to the other information contained in this Annual Report on Form 10-K. This Annual Report on Form 10-K contains forward-looking statements that involve risks and uncertainties. Our actual results could differ materially from those contained in the forward-looking statements. Factors that may cause such differences include, but are not limited to, those discussed below as well as those discussed elsewhere in this Annual Report on Form 10-K. If any of the following risks actually occur, our business, financial condition and results of operations could be materially and adversely affected.

14

Our success in the competitive gaming industry depends in large part on our ability to develop and manage frequent introductions of innovative products. If we are unable to successfully and frequently introduce innovative products, we may be at a competitive disadvantage to our competitors, which could negatively impact our business.

The gaming industry is characterized by dynamic customer demand and technological advances. As a result, we must continually introduce and successfully market new themes and technologies in order to remain competitive and effectively stimulate customer demand.

There is no assurance that our investments in research and development will lead to successful new technologies or timely new products. We invest heavily in product development in various disciplines from hardware, software and firmware engineering to game design, video, multimedia, graphics and sound. Because our newer products are generally more technologically sophisticated than those we have produced in the past, we must continually refine our production capabilities to meet the needs of our product innovation. If we cannot efficiently adapt our manufacturing infrastructure to meet the needs of our product innovations, or if we are unable to make upgrades in our production capacity in a timely manner, our business could be negatively impacted.

Our customers will generally accept a new product if it is likely to increase operator profits. The amount of operator profits primarily depends on consumer play levels, which are influenced by player demand for our products. There is no assurance that our new products will attain this market acceptance or that our competitors will not more effectively anticipate or respond to changing customer preferences. In addition, any delays by us in introducing new products on schedule could negatively impact our operating results by providing an opportunity for our competitors to introduce new products and gain market share ahead of us.

Our business is vulnerable to changing economic conditions and to other factors that adversely affect the casino industry, which have negatively impacted and could continue to negatively impact the play levels of our participation games, our product sales and our ability to collect outstanding receivables from our customers.

Demand for our products and services depends largely upon favorable conditions in the casino industry, which is highly sensitive to casino patrons’ disposable incomes and gaming activities. Discretionary spending on entertainment activities could further decline for reasons beyond our control, such as continued negative economic conditions, natural disasters, acts of war or terrorism or transportation disruptions, including as a result of adverse weather conditions. Any prolonged or significant decrease in consumer spending on entertainment activities could result in reduced play levels on our participation games, causing our cash flows and revenues from a large share of our recurring revenue products to decline. Unfavorable economic conditions have also resulted in a tightening in the credit markets, decreased liquidity in many financial markets, and significant volatility in the credit and equity markets.

Furthermore, the extended economic downturn has impacted and could continue to impact the ability of our customers to purchase new gaming equipment or make timely payments to us. We have incurred, and may continue to incur, additional provisions for bad debt related to credit concerns on certain receivables.

Our substantial indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry and prevent us from making debt service payments.

We have a significant amount of outstanding indebtedness. As of December 31, 2013, after giving effect to the Acquisition, we had approximately $160.5 million of outstanding indebtedness.

Our substantial indebtedness could have significant effects on our business. For example, it could:

• | make it more difficult for us to satisfy our financial obligations, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the agreements governing our indebtedness; |

• | increase our vulnerability to general adverse economic, industry and competitive conditions; |

• | reduce the availability of our cash flow to fund working capital and capital expenditures, because we will be required to dedicate a substantial portion of our cash flow from operations to the payment of principal and interest on our indebtedness; |

• | limit our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; |

• | place us at a competitive disadvantage compared to our competitors that are less highly leveraged and that, therefore, may be able to take advantage of opportunities that our leverage prevents us from exploiting; and |

15

• | limit, along with the financial and other restrictive covenants in the agreements governing our indebtedness, among other things, our ability to borrow additional funds or dispose of assets. |

Demand for our products and the level of play of our products could be adversely affected by changes in player and operator preferences.

As a supplier of gaming machines, we must offer themes and products that appeal to gaming operators and players. Our revenues are dependent on the earning power and life span of our games. We therefore face continuous pressure to design and deploy new and successful game themes and technologically innovative products to maintain our revenue and remain competitive. If we are unable to anticipate or react timely to any significant changes in player preferences, the demand for our gaming products and the level of play of our gaming products could decline. Further, our products could suffer a loss of floor space to table games or other more technologically advanced games, we could fail to meet certain minimum performance levels, or operators may reduce revenue sharing arrangements with us, each of which could negatively impact our sales and financial results. In addition, general changes in consumer behavior, such as reduced travel activity or redirection of entertainment dollars to other venues, could result in reduced demand and reduced play levels for our gaming products.

The gaming industry is intensely competitive. If we are unable to compete effectively, our business could be negatively impacted.

Competition among manufacturers of electronic gaming equipment and systems is intense. Competition in our industry is primarily based on the amount of profit our products generate for our customers, together with cost savings, convenience and other benefits. We compete through the appeal of game content and features to the end player, the features and functionality of our hardware and software products, and the service and support we provide. Our competitors range from small, localized companies to large, multi-national corporations. Many of our competitors are large, well-established companies with substantially larger operating staffs and greater capital resources and have been engaged in the design, manufacture and operation of electronic gaming equipment business for many years. Some of these companies own significant intellectual property, including patents in gaming technology and hardware design, systems and game play and trademarks. In addition, our larger competitors may have significantly larger content portfolios and content development capability and resources, are licensed in markets throughout the United States, and have international distribution.

Obtaining space and favorable placement on casino gaming floors is also a competitive factor in our industry. In addition, the level of competition among equipment providers has increased significantly due to, among other factors, cutbacks in capital spending by casino operators resulting from the economic downturn and decreased player spend. In select instances, we may pay for the right to place gaming machines on a casino’s floor and increased fee requirements from such casino operators may greatly reduce our profitability.

In addition, we face competition from other segments of the gaming industry, including internet gambling, which is currently illegal in the United States, and state lotteries. There can be no assurance that new technologies or markets, such as legalized internet gambling, will not emerge that will increase these competitive pressures.

Our ability to operate in our existing markets or expand into new jurisdictions could be adversely affected by changing regulations, new interpretations of existing laws, and difficulties or delays in obtaining or maintaining required licenses or approvals.

We operate only in jurisdictions where gaming is legal. The gaming industry is subject to extensive governmental regulation by U.S. federal, state and local governments, as well as Native American tribal governments, and foreign governments. While the regulatory requirements vary by jurisdiction, most require:

• | licenses and/or permits; |

• | documentation of qualifications, including evidence of financial stability; |

• | other required approvals for companies who design, assemble, supply or distribute gaming equipment and services; and |

• | individual suitability of officers, directors, major stockholders, key employees and business partners. |

Any license, permit, approval or finding of suitability may be revoked, suspended or conditioned at any time. We may not be able to obtain or maintain all necessary registrations, licenses, permits or approvals, or could experience delays related to the licensing process which could adversely affect our operations and our ability to retain key employees.

To expand into new jurisdictions, in most cases we will need to be licensed, obtain approvals of our products and/or seek licensure of our officers, directors, major equity holders, key employees or business partners and potentially lenders. If we fail to obtain a license required in a particular jurisdiction for our games and gaming machines, hardware or software or have such

16

license revoked, we will not be able to expand into, or continue doing business in, such jurisdiction. Any delays in obtaining or difficulty in maintaining regulatory approvals needed for expansion within existing markets or into new jurisdictions can negatively affect our opportunities for growth. In addition, the failure of our officers, directors, key employees or business partners or lenders to obtain or receive licenses in one or more jurisdictions may require us to modify or terminate our relationship with such officers, directors, key employees or business partners or forego doing business in such jurisdiction.

Although we plan to maintain our compliance with applicable laws as they evolve, there can be no assurance that we will do so and that law enforcement or gaming regulatory authorities will not seek to restrict our business in their jurisdictions or institute enforcement proceedings if we are not compliant. Moreover, in addition to the risk of enforcement action, we are also at risk of loss of business reputation in the event of any potential legal or regulatory investigation whether or not we are ultimately accused of or found to have committed any violation. A negative regulatory finding or ruling in one jurisdiction could have adverse consequences in other jurisdictions, including with gaming regulators. Furthermore, the failure to become licensed, or the loss or conditioning of a license, in one market may have the adverse effect of preventing licensing in other markets or the revocation of licenses we already maintain.

Further, changes in existing gaming regulations or new interpretations of existing gaming laws may hinder or prevent us from continuing to operate in those jurisdictions where we currently do business, which would harm our operating results. In particular, the enactment of unfavorable legislation or government efforts affecting or directed at manufacturers or gaming operators, such as referendums to increase gaming taxes or requirements to use local distributors, would likely have a negative impact on our operations.

Many jurisdictions also require extensive personal and financial disclosure and background checks from persons and entities beneficially owning a specified percentage (typically 5% or more) of our equity securities and may require the same from our lenders. The failure of these beneficial owners or lenders to submit to such background checks and provide required disclosure could jeopardize our ability to obtain or maintain licensure in such jurisdictions.

Our revenues are vulnerable to the impact of changes to the Class II regulatory scheme.

Our Native American tribal customers that operate Class II games under the IGRA are subject to regulation by the NIGC. The NIGC is currently conducting consultations with industry participants regarding Native American gaming activities, including the clarification of regulations regarding Class II gaming machines. It is possible that any such changes in regulations, when finally enacted, could cause us to modify our Class II games to comply with the new regulations, which may result in our products becoming less competitive. Any required conversion of games pursuant to changing regulatory schemes could cause a disruption to our business. In addition, we could lose market share to competitors who offer games that do not appear to comply with published regulatory restrictions on Class II games and therefore offer features not available in our products.

Our ability to effectively compete in Native American gaming markets is vulnerable to legal and regulatory uncertainties, including the ability to enforce contractual rights on Native American land.

For the fiscal year ended December 31, 2013, we derived approximately 99.6% of our revenue from participation agreements with Native American gaming operators. Because federally recognized Native American tribes are independent governments with sovereign powers, subject to the IGRA, Native American tribes can enact their own laws and regulate gaming operations and contracts. Native American tribes maintain their own governmental systems and often their own judicial systems and have the right to tax persons and enterprises conducting business on Native American lands. Native American tribes also often have the right to require licenses and to impose other forms of regulation and regulatory fees on persons and businesses operating on their lands. In the absence of a specific grant of authority by Congress, U.S. states may regulate activities taking place on Native American lands only if the Native American tribe has a specific agreement or compact with the state. Our contracts with Native American tribal customers normally provide that only certain provisions, if any, will be subject to the governing law of the state in which a Native American tribe is located. However, these choice-of-law clauses may not always be enforceable.

Further, Native American tribes generally enjoy sovereign immunity from lawsuits similar to that of the individual U.S. states and the United States. Before we can sue or enforce contract rights with a Native American tribe, or an agency or instrumentality of a Native American tribe (for example, to collect revenue pursuant to our participation agreements or foreclose on financed gaming machines), the Native American tribe must effectively waive its sovereign immunity with respect to the matter in dispute, which we are not always able to obtain. Without a limited waiver of sovereign immunity, or if such waiver is held to be ineffective, we could be precluded from judicially enforcing any rights or remedies against a Native American tribe, including the right to enter Native American lands to retrieve our property in the event of a breach of contract by the tribe that is party to the disputed contract. Even if the waiver of sovereign immunity by a Native American tribe is deemed effective, there could be an issue as to the forum in which a lawsuit can be brought against the Native American tribe.

17