Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BILL BARRETT CORP | d698808d8k.htm |

Exhibit 99.1

2013 ANNUAL REPORT

COMMODITY BALANCED PORTFOLIO

B Bill Barrett Corporation

FELLOW SHAREHOLDERS

R. Scot Woodall

Chief Executive Officer and President

2013 was an excellent year. We set forth a simplified, focused program intended to drive improved margins, reduce debt and realize enhanced value from our core oil programs. We delivered on our key objectives and realized a 51% increase in our price per share. Our achievements in 2013 are highlighted by:

30% growth in oil production

30% improvement in pre-hedge cash flow per barrel of oil equivalent (Boe) produced, reflecting improved profitability

88% growth in proved reserves at our three active oil programs

393% production replacement rate

$8.30 per Boe finding and development cost, demonstrating low cost proved reserve additions

$348 million increase in pre-tax PV10 of proved reserves

$189 million reduction in total debt

Safety record better than industry averages

Ending 2013 with a commodity balanced portfolio based on proved reserves and production, providing optionality in our long-term development programs.

Our 2013 operations program focused on our Denver Julesburg (DJ) Basin and Uinta Oil Program assets. In the DJ Basin, we delineated 70% of the recently acquired Northeast Wattenberg position, added 51 MMBoe in proved reserves and increased production by more than 100%. At year-end 2013, we had 1,697gross/844 net drilling locations and 76,000 net acres. The DJ Basin offers a sizable long-term asset base. Further, the program offers significant upside potential. Going forward we will expand our drilling program from the Northeast Wattenberg position to the Wattenberg core and into the Chalk Bluffs area. We plan to delineate the extent of multiple horizons, including the Niobrara B bench, Niobrara C bench and Codell, and test down-spacing to 40 acres. We also plan to test extended reach laterals, which have delivered superior returns for neighboring peer companies. Our progress in the DJ Basin was tremendous in 2013 and positioned us well for 2014 and beyond.

In the Uinta Basin, we had particular success in the East Bluebell acreage position where we drilled 20 wells, added 37 MMBoe proved reserves and increased production by more than 100%. Our 23,000 net acre position in East Bluebell offers economic returns competitive with the DJ Basin and sizable upside through further cost efficiencies associated with scale, down-spacing and a long-term inventory.

DJ BASIN

The Denver-Julesberg (DJ) Basin, located in Colorado and southern Wyoming: In 2013, production increased 112% and reserves increased more than 350% to 66 MMBoe. We delineated 70% of our net Northeast Wattenberg position, establishing a new scalable oil program. The DJ Program offers substantial upside across our 76,000 net acre position.

UINTA OIL PROGRAM

The Uinta Oil Program, located in the Uinta Basin, Utah: In 2013, production increased 38% and reseves increased 10% to 53 MMBoe. We completed two successful downspacing tests establishing 80-acre spacing in a portion of the Blacktail Ridge area and completed a 20 well program in the East Bluebell area where strong economics set the foundation for the 2014 program in the area.

2013 was an excellent year. We set forth a simplified, focused program intended to drive improved margins, reduce debt and realize enhanced value from our core oil programs.

In our effort to achieve commodity balance, focus the portfolio on key assets, and reduce debt, we sold the West Tavaputs dry natural gas assets in December 2013. Following the asset sale, we ended 2013 with a portfolio that is approximately 40% oil, 40% natural gas and 20% natural gas liquids.

Our 2014 operations program will be almost entirely focused on development of the DJ Basin and Uinta Oil Program along with participation in a number oil wells in the Powder River Basin to be operated by partners in this early stage program. We also continue to operate our Gibson Gulch program in the Piceance Basin where we do not plan to drill in 2014 but continue to generate cash flow from this established natural gas program. In 2014, we plan to spend $500 million – $550 million to drill approximately 120 wells in the DJ and Uinta programs as well as participate in approximately 80 wells in the DJ and Powder River Basins. Based on current commodity prices, we expect this year’s program to generate approximately 40% rates of return on drilling capital, and we expect to increase oil production by 30% again in 2014. We are well positioned to drive increased cash flow and increased profitability per barrel produced. In 2014 and forward, we will seek to generate profitable growth in production and cash flow as we continue to realize value from our core programs.

I am proud of our team for our success in 2013 and look forward to continuing that success in 2014. As always, it is our priority to operate with environmental stewardship as we value our Rocky Mountain home and to maintain the highest level of health and safety standards for our employees.

Sincerely,

R. Scot Woodall

Chief Executive Officer and President

March 14, 2014

PICEANCE BASIN

The Gibson Gulch Program, located in the Piceance Basin, Colorado: The Gibson Gulch Program offers exposure to low-cost natural gas and NGLs.

POWDER DEEP OIL PROGRAM

The Powder Deep Oil Program, located in Wyoming: This exciting new area is in the early stages of development. We completed a five well program in 2013 targeting the Shannon formation. This stacked oil play offers targets to multiple horizons.

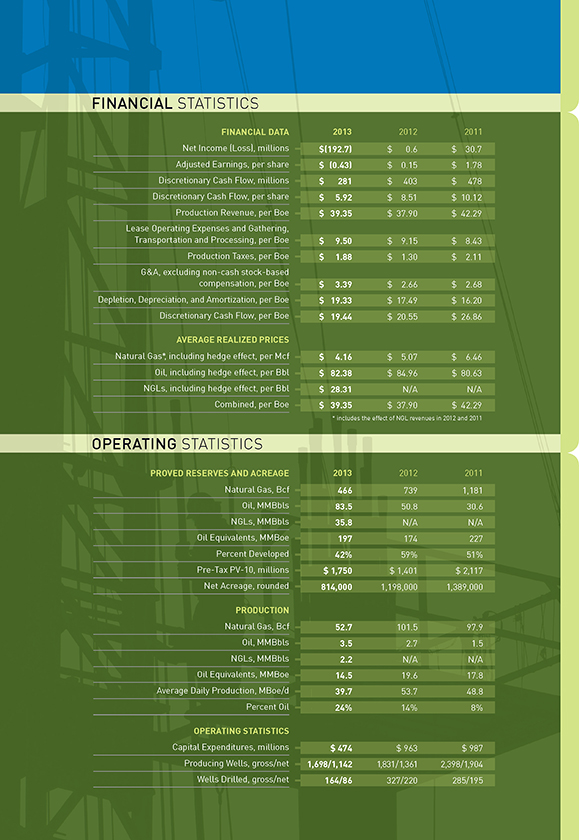

FINANCIAL STATISTICS

FINANCIAL DATA 2013 2012 2011

Net Income (Loss), millions $(192.7) $ 0.6 $ 30.7

Adjusted Earnings, per share $ (0.43) $ 0.15 $ 1.78

Discretionary Cash Flow, millions $ 281 $ 403 $ 478

Discretionary Cash Flow, per share $ 5.92 $ 8.51 $ 10.12

Production Revenue, per Boe $ 39.35 $ 37.90 $ 42.29

Lease Operating Expenses and Gathering,

Transportation and Processing, per Boe $ 9.50 $ 9.15 $ 8.43

Production Taxes, per Boe $ 1.88 $ 1.30 $ 2.11

G&A, excluding non-cash stock-based compensation, per Boe $ 3.39 $ 2.66 $ 2.68

Depletion, Depreciation, and Amortization, per Boe $ 19.33 $ 17.49 $ 16.20

Discretionary Cash Flow, per Boe $ 19.44 $ 20.55 $ 26.86

AVERAGE REALIZED PRICES

Natural Gas*, including hedge effect, per Mcf $ 4.16 $ 5.07 $ 6.46

Oil, including hedge effect, per Bbl $ 82.38 $ 84.96 $ 80.63

NGLs, including hedge effect, per Bbl $ 28.31 N/A N/A

Combined, per Boe $ 39.35 $ 37.90 $ 42.29

* includes the effect of NGL revenues in 2012 and 2011 OPERATING STATISTICS

PROVED RESERVES AND ACREAGE 2013 2012 2011

Natural Gas, Bcf 466 739 1,181

Oil, MMBbls 83.5 50.8 30.6

NGLs, MMBbls 35.8 N/A N/A

Oil Equivalents, MMBoe 197 174 227

Percent Developed 42% 59% 51%

Pre-Tax PV-10, millions $ 1,750 $ 1,401 $ 2,117

Net Acreage, rounded 814,000 1,198,000 1,389,000

PRODUCTION Natural Gas, Bcf 52.7 101.5 97.9

Oil, MMBbls 3.5 2.7 1.5

NGLs, MMBbls 2.2 N/A N/A

Oil Equivalents, MMBoe 14.5 19.6 17.8

Average Daily Production, MBoe/d 39.7 53.7 48.8

Percent Oil 24% 14% 8%

OPERATING STATISTICS

Capital Expenditures, millions $ 474 $ 963 $ 987

Producing Wells, gross/net 1,698/1,142 1,831/1,361 2,398/1,904

Wells Drilled, gross/net 164/86 327/220 285/195

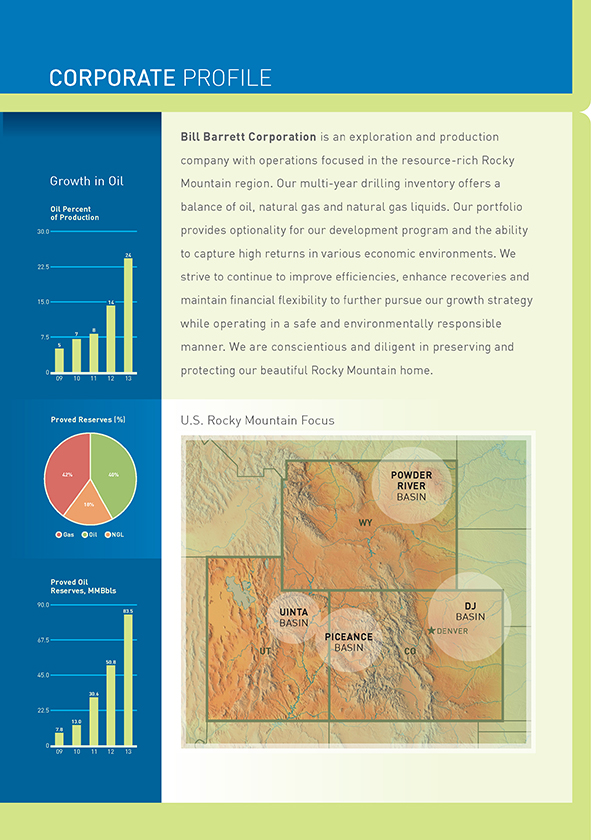

CORPORATE PROFILE

Growth in Oil

Oil Percent of Production

30.0

22.5

15.0

7.5

24

14

7 8

5

0

09

10

11

12

13

Proved Reserves (%)

42%

40%

18%

Gas

Oil

NGL

Proved Oil Reserves, MMBbls

90.0

67.5

45.0

22.5

83.5

50.8

30.6

13.0

7.8

0

09

10

11

12

13

Bill Barrett Corporation is an exploration and production company with operations focused in the resource-rich Rocky Mountain region. Our multi-year drilling inventory offers a balance of oil, natural gas and natural gas liquids. Our portfolio provides optionality for our development program and the ability to capture high returns in various economic environments. We strive to continue to improve efficiencies, enhance recoveries and maintain financial flexibility to further pursue our growth strategy while operating in a safe and environmentally responsible manner. We are conscientious and diligent in preserving and protecting our beautiful Rocky Mountain home.

U.S. Rocky Mountain Focus

POWDER RIVER BASIN

WY

UINTA BASIN

PICEANCE BASIN

DJ BASIN

DENVER

UT

CO

Board of Directors

Jim W. Mogg, Chairman of the Board, Past Chairman of DCP Midstream Partners

Carin M. Barth, President of LB Capital, Inc.

Kevin O. Meyers, Past Senior Vice President, Exploration and Production,

Americas of ConocoPhillips and President of ConocoPhillips Canada

William F. Owens, Former Governor of Colorado

Edmund P. Segner, Past President and Chief of Staff of EOG Resources, Inc.

Randy I. Stein, Tax, Accounting and Business Consultant, Former Principal of

PricewaterhouseCoopers LLP

Michael E. Wiley, Past Chairman and Chief Executive Officer of Baker Hughes Incorporated

Officers

R. Scot Woodall, Chief Executive Officer and President

Robert W. Howard, Chief Financial Officer and Treasurer

Terry R. Barrett, Senior Vice President – Geosciences

David R. Macosko, Senior Vice President – Accounting

Larry A. Parnell, Senior Vice President – Engineering, Planning and Business Development

Stephen W. Rawlings, Senior Vice President – Operations

Kenneth A. Wonstolen, Senior Vice President – General Counsel

Duane J. Zavadil, Senior Vice President – EH&S, Regulatory and Government Affairs

William M. Crawford, Vice President – Finance and Marketing

Jennifer C. Martin, Vice President – Investor Relations

Mitchell J. Reneau, Vice President – Land

Troy L. Schindler, Vice President – Drilling

Monty D. Shed, Vice President – Production

Michelle Vion, Vice President – Human Resources

Corporate Information

Corporate Office

1099 Eighteenth Street, Suite 2300

Denver, Colorado 80202

Telephone: 303-293-9100

Fax: 303-291-0420

www.billbarrettcorp.com

Investor Relations

Jennifer C. Martin

Vice President – Investor Relations

investor_relations@billbarrettcorp.com

Annual Shareholders’ Meeting

Our Annual Shareholder’s Meeting will be held

at 8:00 a.m. (MDT) on Tuesday, May 6, 2014

Bill Barrett Corporation, Corporate Headquarters

1099 18th St, Suite 2300

Denver, CO 80202

Transfer Agent

Computershare

211 Quality Circle, Suite 210

College Station, TX 77845

www.computershare.com/investor

Independent Auditors

Deloitte & Touche LLP

Denver, Colorado

Independent Reservoir Engineers

Netherland, Sewell & Associates, Inc.

Dallas, Texas

DISCLOSURE STATEMENTS

Please reference our filings with the Securities and Exchange Commission (“SEC”) for further information related to the following disclosures. Reference the accompanying Annual Report on Form 10-K for the year ended December 31, 2013, as well as Current Reports on Form 8-K and Quarterly Reports on Form 10-Q, specifically including the Form 8-K filed with the SEC on February 21, 2014, regarding our Fourth Quarter and Full-Year 2013 Results. SEC filings are posted to the Company’s website at www.billbarrettcorp.com. You may also obtain SEC filings by calling 1-800-SEC-0330 or at www.sec.gov.

Forward-Looking Statements

This report contains forward-looking statements regarding the Company’s future plans and expected performance based on assumptions the Company believes to be reasonable. A number of potential risks and uncertainties could cause actual results to differ materially from these statements. Please reference “Risks Related to the Oil and Natural Gas Industry and Our Business” in the accompanying Form 10-K for descriptions of such risks and uncertainties. The Company encourages readers to consider these factors and assumes no obligation to publicly revise or update any forward-looking statements.

New York Stock Exchange Certification

New York Stock Exchange Rule 303A. 12(a) requires the chief executive officers of listed companies to certify that they are not aware of any violations by their companies of the Exchange’s corporate governance listing standards. This annual certification by the chief executive officer of Bill Barrett Corporation has been filed with the New York Stock Exchange. In addition, Bill Barrett Corporation has filed Exhibits to the accompanying Form 10-K for the SEC certifications required for the chief executive officer and chief financial officer under Section 302 of the Sarbanes-Oxley Act.

Non-GAAP Measures

Non-GAAP Measures in this report include Discretionary Cash Flow, Adjusted Net Income, Pre-tax PV10 and G&A, excluding non-cash stock-based compensation

This report contains these non-GAAP measures because management believes that they are useful to investors evaluating the Company’s operating performance. These measures are widely used in the oil and natural gas industry, including by research analysts, in the valuation, comparison and recommendation of investments. Of note, the calculation of these measures may vary substantially from company to company depending upon accounting methods, internal decisions, and capital structure, and there are significant limitations in using these measures. The Company encourages readers to consider these non-GAAP measures along with the Company’s reported financial statements under GAAP. The computations and reconciliations of Discretionary Cash Flow and Adjusted Net Income may be found in the Company’s Current Report on Form 8-K filed February 21, 2014. Pre-tax PV10 is the discounted future cash flows of the Company as presented in the accompanying Form 10-K, without considering the effect of income taxes. G&A, excluding non-cash stock-based compensation is discussed in the accompanying Form 10-K.

Reserve Disclosure

Although the SEC permits oil and gas companies to disclose probable and possible reserves in their filings with the SEC, the Company did not include those estimates in its filings with the SEC.

FSC

www.fsc.org

MIX

Paper from responsible sources

FSC C101537