Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - OLIE INC | Financial_Report.xls |

| EX-99.1 - EXHIBIT 99.1 - OLIE INC | exhibit99-1.htm |

| EX-32.1 - EXHIBIT 32.1 - OLIE INC | exhibit32.htm |

| EX-99.3 - EXHIBIT 99.3 - OLIE INC | exhibit99-3.htm |

| EX-31.1 - EXHIBIT 31.1 - OLIE INC | exhibit31.htm |

| EX-99.2 - EXHIBIT 99.2 - OLIE INC | exhibit99-2.htm |

| EX-99.4 - EXHIBIT 99.4 - OLIE INC | exhibit99-4.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

Form 10-K/A

Amendment No. 1

(Mark One)

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: September 30, 2013

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________ to

________________

Commission file number: 333-178208

OLIE INC.

(Exact name of

Registrant as specified in its charter)

| Delaware | 33-1220056 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| 300 Jameson House | |

| 838 West Hastings Street | |

| Vancouver B.C. | V6C 0A6 |

| (Address of principal executive offices) | (Zip Code) |

+1 604 669 9000

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| N/A | N/A |

| Title of each class | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

Shares of Common Stock, $0.00001 par value

Title of Class

Indicate by check mark if the Registrant is a well-known

seasoned issuer, as defined in Rule 405 of the Securities Act.

[ ] Yes [X]

No

Indicate by check mark if the Registrant is not required to

file reports pursuant to Section 13 or Section 15(d) of the Act.

[ ] Yes [X]

No

Indicate by check mark whether the Registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

Registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

[X] Yes[ ] No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] Accelerated filer [ ] Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the Registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [X]

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant was approximately $188,000 based upon the price of our common stock as of December 2, 2013, of $0.0008. Shares of common stock held by each officer and director and by each person or group who owns 10% or more of than outstanding common stock amounting to 2,000,000,000 shares have been excluded in that such persons or groups may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of December 2, 2013, there were 2,264,500,000 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Exhibits incorporated by reference are referred to in Part IV.

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K/A (the “Amendment”) amends the Annual Report on Form 10-K of Olie Inc. (the “Company”) for the year ended September 30, 2013 (the “Original Filing”), that was originally filed with the U.S. Securities and Exchange Commission on January 14, 2014. The Amendment is being filed to submit Exhibit 99.1, 99.2, 99.3 and 99.4. The Amendment revises the exhibit index included in Part IV, Item 15 of the Original Filing. In addition, the Amendment revises certain disclosures related to the Company’s Audit Committee.

Except as described above, the Amendment does not modify or update the disclosures presented in, or exhibits to, the Original Filing in any way. Those sections of the Original Filing that are unaffected by the Amendment are not included herein. The Amendment continues to speak as of the date of the Original Filing. Furthermore, the Amendment does not reflect events occurring after the filing of the Original Filing. Accordingly, the Amendment should be read in conjunction with the Original Filing, as well as the Company’s other filings made with the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act subsequent to the filing of the Original Filing.

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These forward-looking statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks set out in the section hereof entitled “Risk Factors” and the risks set out below, any of which may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

These risks include, by way of example and not in limitation:

- risks related to our ability to continue as a going concern;

- the uncertainty of profitability based upon our history of losses;

- risks related to failure to obtain adequate financing on a timely basis and on acceptable terms for our planned development projects;

- risks related to our ability to continue to fund research and development costs;

- risks related to conducting business internationally due to our operations in Israel;

- risks related to our ability to successfully develop our technology into commercial products,

- risks related to our ability to successfully prosecute and protect our intellectual property;

- risks related to tax assessments; and

- other risks and uncertainties related to our prospects, properties, and business strategy.

The above list is not an exhaustive list of the factors that may affect any of our forward-looking statements. These and other risks described in this report should be considered carefully and readers should not place undue reliance on our forward-looking statements.

Forward-looking statements are made based on management’s beliefs, estimates and opinions on the date the forward-looking statements are made, and we undertake no obligation to update forward-looking statements should these beliefs, estimates, and opinions or other circumstances change. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these forward-looking statements to actual results.

Our financial statements are stated in United States dollars (“US$”) and are prepared in accordance with United States generally accepted accounting principles (“GAAP”).

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to "common stock" refer to the shares of our common stock.

As used in this Annual Report, the terms "we," "us," "our," "Olie Inc.," and “Issuer” mean Olie Inc., unless the context clearly requires otherwise.

3

PART I

ITEM 1. BUSINESS

Overview of the Company

We are a development stage company that was incorporated on December 10, 2010. We have commenced only limited operations focused on business acquisitions. We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings.

We have not generated any revenue to date and we do not expect to generate revenues prior to 2013. We do not currently have sufficient capital to operate our business, and, we will require additional funding in the future to sustain our operations. There is no assurance that we will have revenue in the future or that we will be able to secure the necessary funding to develop our business.

The Market Opportunity

The following market data regarding the US music production market is based on publicly available information. We have not conducted any independent market studies to verify this data.

History

The company has continued throughout the year to continue in a development stage. Its inception was as a music production company and whilst this was its original prime focus it has throughout the financial year explored development into other areas. It entertained a relationship with EnCansol that had developed Flat Plate RAM Cell battery technology. After the negotiations became too protracted the company terminated its relationship as disclosed in its 8K filed on May 10th 2013. Similarly it entertained a relationship with Whitehall 1V LLC that owned Mitch Stone Essentials, and by mutual consent that intent was terminated as disclosed in its 8K filed on May 28th 2013.

Subsequent to the year end the company announced its current corporate plan. It amended its Articles and Corporate Bylaws to create a series of anti-dilutive, convertible preferred shares. It announced its intention to transform to a Business Development Corporation; including providing corporate advisory services to other issuers, buy mature and secured debt from non-affiliates in other issuers, and with its convertible preferred securities purchase assets and business enterprises.

It is now implementing this plan and in particular, as reported in its 8K filed December 17th. 2013 the company acquired Settlement Management Series 1 LLC (SET1) that owns a $5,000,000 five year, 5% US Treasury Strip. This subsidiary then completed an assignment for $20,000,000 MTN USD credit linked to a Triple A US Treasury Strip (MTN), and also reported in the same 8K.

Marketing / Advertising

For a description of our marketing plans, please see the discussion in the Management Discussion and Analysis section below.

Patent, Trademark, License & Franchise Restrictions and Contractual Obligations & Concessions

We have not entered into any franchise agreements or other contracts that have given, or could give rise to, obligations or concessions. We intend to protect our private label for music production on the basis of applicable trademark and trade name laws. Beyond our common law right to our trade name, we do not hold any other intellectual property.

4

Research and Development Activities and Costs

We have not incurred any costs to date and have no plans to undertake research and development activities during the next year of operation.

Costs and Effects of Compliance with Environmental Laws and Regulations

We are not in a business that involves the use of materials in a manufacturing process where such materials are likely to result in the violation of any existing environmental rules and/or regulations. Further, we do not own any real property that could lead to liability as a landowner. Therefore, we do not anticipate that there will be any material costs associated with compliance with environmental laws and regulations.

Employees

We have commenced only limited operations; therefore, we have no employees and do not anticipate having any employees during the first twelve months of operations. Our officers and Directors provide service to us on an as-needed basis, and we will be relying heavily on our Secretary and Director, Mr. Gardner. When we commence full operations, we will need to hire full-time management and administrative support staff. For a detailed description, see "Plan of Operation".

ITEM 2. PROPERTIES

Our Principal Executive Offices

We do not own any real property. We currently maintain our mailing address at 300 Jameson House, 838 West Hastings Street, Vancouver, British Columbia. The mailing address is a private address and is provided at no cost to the Company. We do not have any present plans for obtaining new office space the current space is sufficient for our operations.

ITEM 3. LEGAL PROCEEDINGS

We know of no material, active or pending legal proceedings against our Company, nor of any proceedings that a governmental authority is contemplating against us.

We know of no material proceedings to which any of our Directors, officers, affiliates, owner of record or beneficially of more than 5 percent of our voting securities or security holders is an adverse party or has a material interest adverse to our interest.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

5

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Our common stock is quoted under the symbol “OLIE” on the OTCBB operated by the Financial Industry Regulatory Authority, Inc. (“FINRA”) and the OTCQB operated by OTC Markets Group, Inc. Few market makers continue to participate in the OTCBB system because of high fees charged by FINRA. Consequently, market makers that once quoted our shares on the OTCBB system may no longer be posting a quotation for our shares. As of the date of this report, however, our shares are quoted by several market makers on the OTCQB. The criteria for listing on either the OTCBB or OTCQB are similar and include that we remain current in our SEC reporting. Our reporting is presently current and, since inception, we have filed our SEC reports on time.

A trading market for our securities did not begin to develop until after the fiscal year ended September 30, 2013.

The following tables set forth the range of high and low prices for our common stock for the each of the periods indicated as reported by the OTCQB. These quotations reflect inter-dealer prices, without retail mark-up, mark-down or commission and may not necessarily represent actual transactions.

| Fiscal Year Ending September 30, 2013 | ||||||

| Quarter Ended | High $ | Low $ | ||||

| September 30, 2013 | $ | 0.06 | $ | 0.0104 | ||

| March 31, 2013 | $ | 1.55 | $ | 0.75 | ||

| June 30, 2013 | $ | 1.50 | $ | 0.128 | ||

| December 30, 2012 | $ | 1.60 | $ | 1.60 |

| Fiscal Year Ending September 30, 2012 | ||||||

| Quarter Ended | High $ | Low $ | ||||

| September 30, 2012 | NA | NA | ||||

| March 31, 2012 | NA | NA | ||||

| June 30, 2012 | NA | NA | ||||

| December 30, 2011 | NA | NA |

Market for our common stock

There is currently no market for our shares. We cannot give you any assurance that the shares will ever have a market or that if a market for our shares ever develops, that you will be able to sell your shares. In addition, even if a public market for our shares develops, there is no assurance that a secondary public market will be sustained.

The shares are quoted on the OTC Bulletin Board under the symbol OTC BB “OLIE”, but no active trading market has developed and we cannot assure you that an active trading market will ever develop.

6

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Record Holders

As of December 2, 2013, we had outstanding 2,264,500,000 shares of common stock, which were held by 40 non affiliated stockholders of record and 1 affiliated stockholders of records.

Dividends

Since our inception, we have not declared nor paid any cash dividends on our capital stock and we do not anticipate paying any cash dividends in the foreseeable future. Our current policy is to retain any earnings in order to finance our operations. Our Board of Directors will determine future declarations and payments of dividends, if any, in light of the then-current conditions it deems relevant and in accordance with applicable corporate law.

Securities Authorized for Issuance under Equity Compensation Plans

The Board of Directors filed a Registration Statement prepared in accordance with the requirements of Form S-8 under the Securities Act of 1933, as amended, registering 350,000,000 shares of common stock, par value $0.00001, issuable pursuant to the 2013 Employee and Consultant Stock Incentive Plan.

7

Recent Sales of Unregistered Securities; Use of Proceeds from Sale of Registered Securities

We have not sold any equity securities not registered under the Securities Act.

Purchases of Equity Securities by the Issuer and Affiliated Purchases

During each month within the fourth quarter of the fiscal year ended September 30, 2013, neither we nor any “affiliated purchaser,” as that term is defined in Rule 10b-18(a)(3) under the Exchange Act, repurchased any of our common stock or other securities.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements.” These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements.

Overview

We are a development stage company with limited operations and no revenues from our business operations. We do not anticipate that we will generate significant revenues until we are able to continue making advances in obtaining additional assets and additional revenue generating opportunities. Accordingly, we must raise cash from sources other than our operations in order to implement our marketing plan.

We have raised approximately $40,000 from our shareholders. We believe that we will need to raise an additional approximate $60,000 in order to allow us to begin our market development and sales activities and to remain in business for twelve months including the costs related with being a public company. There is no reasonable expectation as to when revenues may be generated. If we raise the necessary funds, but are unable to generate revenues within twelve months of the effectiveness of this Registration Statement for any reason, or if we are unable to make a reasonable profit within twelve months of the effectiveness of this Registration Statement, we may have to suspend or cease operations. At the present time, we have not made any arrangements to raise additional cash to finance our operations. We may seek to obtain additional funds through a second public offering, a private placement of securities, or loans. Other than as described in this paragraph, we have no financing plans at this time.

8

Plan of Operation

We have not shown any revenues or profits since our inception date. Over the next twelve months we intend to commence an advertising and promotional strategy as we continue to transform into a business acquisition corporation and generate revenue.

Results of Operations

During the period from December 10, 2010 (date of inception) through September 30, 2011, we incurred a net loss of $1,917. During the year ended September 30, 2012, we incurred a net loss of $46,981. During the year ended September 30, 2013, we incurred a net loss of $756,563. These losses consisted of general and administrative expenses, primarily comprising professional fees.

Purchase or Sale of Equipment

We do not expect to purchase or sell any property or significant equipment

Revenues

We had no revenues for the period from December 10, 2010 (date of inception) through September 30, 2013.

Liquidity and Capital Resources

Our balance sheet as of September 30, 2013, reflects assets of $83 comprised entirely of cash, and current liabilities of $295,743. Cash from inception to date have been insufficient to provide the working capital necessary to operate. During the year ended September 30, 2013, virtually all expenses were paid with issuances of stock. As of September 30, 2013, loans payable amounted to $171,133 and represented accrued compensation payable. The loans are unsecured, non-interest bearing, and due on demand. Since inception, we have issued 2,264,500,000 shares of common stock to our Directors, consultants and investors.

We anticipate generating losses and, therefore, may be unable to continue operations in the future. Except for private placement financing from July 2011 through September 2011 and an investment by our Directors in 2010, we have not attempted to raise any additional capital. We estimate that we need approximately $100,000 to fund our activities over the next 12 months. We will need to raise approximately an additional $60,000 to fund the ongoing costs of being public. Currently, with cash assets of approximately $83, based on our projected operations over the next year, we cannot operate if no further funds are raised. Our cash assets are being kept in the United States.

To date, except for our selling stockholders we have not attempted to raise additional capital from any third party sources. Since we require additional capital, we may have to issue debt or equity or enter into a strategic arrangement with a third party.

We have not entered into any agreements with our Directors for interim financing, but we may nevertheless request that our current Directors provide us with such interim financing. There can be no assurance that additional capital will be available to us. We currently have no agreements, arrangements or understandings with any person to obtain funds through bank loans, lines of credit, or any other sources.

9

Going Concern Consideration

Our independent auditors included an explanatory paragraph in their report on the financial statements attached to our Annual Report on Form 10-K regarding concerns about our ability to continue as a going concern. Our financial statements for the fiscal period ended September 30, 2013 contain additional note disclosures describing the circumstances that lead to this disclosure by our independent auditors.

Off-Balance Sheet Arrangements

We have no off-balance sheet arrangements.

CRITICAL ACCOUNTING POLICIES

Our financial statements have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make certain estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses, and the related disclosures of contingent assets and liabilities as of the date of the financial statements and during the applicable periods. We base these estimates on historical experience and on other factors that we believe are reasonable under the circumstances. Actual results may differ materially from these estimates under different assumptions or conditions and could have a material impact on our financial statements.

Refer to Note 1 to the Financial Statements entitled “Summary of Significant Accounting Policies” included in this Annual Report for a discussion of accounting policies utilized by the Company.

There are no recent accounting pronouncements that are expected to have an effect on the financial statements.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Not applicable.

10

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

OLIE INC.

(A DEVELOPMENT STAGE COMPANY)

INDEX TO FINANCIAL STATEMENTS

SEPTEMBER 30, 2013

CONTENTS

11

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of:

Olie, Inc.

(a development stage company)

Vancouver, Canada

We have audited the accompanying consolidated balance sheet of Olie, Inc. and is subsidiary (a development stage company) (collectively, the “Company”), as of September 30, 2013 and the related consolidated statements of expenses, stockholders’ deficit and cash flows for the year then ended and for the period from December 10, 2010 (date of inception) through September 30, 2013. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits The financial statements of Olie, Inc. for the period December 10, 2010 (date of inception) through September 30, 2012 includes a net loss of $48,897. Our opinion on the statements of expenses, shareholders' deficit and cash flows for the period December 10, 2010 (inception) through September 30, 2013, insofar as it relates to amounts for prior periods through September 30, 2012, is based solely on the report of other auditors.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Olie, Inc. and its subsidiary as of September 30, 2013, and the results of their operations and their cash flows for the year then ended, and for the period from December 10, 2010 (date of inception) to September 30, 2013, in conformity with accounting principles generally accepted in the United States of America.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the financial statements, the Company had a net loss, negative cash flow from operating activities, and is still in the development stage. These conditions raise substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

As discussed in Note 8 to the financial statements, errors resulting in an understatement of revenue and an overstatement of deferred revenue were discovered by management. Accordingly, adjustments have been made to correct the error.

MaloneBailey, LLP

www.malonebailey.com

Houston, Texas

March 24, 2014

F-1

F-2

OLIE Inc.

(A Development Stage Company)

Consolidated Balance Sheets

| September 30, | September 30, | |||||

| 2013 | 2012 | |||||

| (Restated) | ||||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | 83 | $ | 127 | ||

| Total Current Assets | 83 | 127 | ||||

| TOTAL ASSETS | $ | 83 | $ | 127 | ||

| LIABILITIES AND STOCKHOLDERS' DEFICIT | ||||||

| Current Liabilities | ||||||

| Accounts payable and accrued expenses | $ | 172,610 | $ | 2,389 | ||

| Due to related parties | 41,188 | 465 | ||||

| Note payable | 129,945 | 5,970 | ||||

| Total Current Liabilities | 343,743 | 8,824 | ||||

| Stockholders' Deficit | ||||||

| Preferred stock: 45,000,004 authorized; $0.0001 par

value 104,955 and 0 shares issued and outstanding |

10 | - | ||||

| Common stock: 3,000,000,000 authorized;

$0.00001 par

value 2,264,500,000 and 96,000,000 shares issued and outstanding |

22,350 | 960 | ||||

| Additional paid in capital | 439,440 | 39,240 | ||||

| Deficit accumulated during development stage | (805,460 | ) | (48,897 | ) | ||

| Total Stockholders' Deficit | (343,660 | ) | (8,697 | ) | ||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 83 | $ | 127 |

See accompanying notes to the consolidated financial statements.

F-3

OLIE Inc.

(A Development Stage Company)

Consolidated Statements of Expenses

| December 10, | |||||||||

| 2010 | |||||||||

| For the Year Ended | (inception) to | ||||||||

| September 30, | September 30, | ||||||||

| 2013 | 2012 | 2013 | |||||||

| (Restated) | (Restated) | ||||||||

| Revenues | $ | - | $ | - | $ | - | |||

| Operating expenses | 752,060 | 46,981 | 800,957 | ||||||

| Net loss from operations | (752,060 | ) | (46,981 | ) | (800,957 | ) | |||

| Other income (expense) | |||||||||

| Interest expense | (4,503 | ) | - | (4,503 | ) | ||||

| Net loss | $ | (756,563 | ) | $ | (46,981 | ) | $ | (805,460 | ) |

| Basic and dilutive loss per share | $ | (0.00 | ) | $ | (0.00 | ) | |||

| Weighted average number of shares outstanding | 1,165,500,000 | 96,000,000 | |||||||

See accompanying notes to the consolidated financial statements.

F-4

OLIE Inc.

(A Development Stage Company)

Consolidated Statement of Stockholders' Deficit

| Additional Paid | ||||||||||||||||||||||||

| Preferred Stock | Common Stock | in | Subscription | Accumulated | ||||||||||||||||||||

| Shares | Amount | Shares | Amount | Capital | Receivable | Deficit | Total | |||||||||||||||||

| Balance, December 10, 2010 (inception) | - | $ | - | - | $ | - | $ | - | $ | - | $ | - | $ | - | ||||||||||

| Stock issued to related partied | - | - | 80,000,000 | 800 | (600 | ) | (200 | ) | - | - | ||||||||||||||

| Stock issued for cash and subscriptions | - | - | 16,000,000 | 160 | 39,840 | (480 | ) | - | 39,520 | |||||||||||||||

| Net loss | - | - | - | - | - | - | (1,916 | ) | (1,916 | ) | ||||||||||||||

| Balance, September 30, 2011 | - | - | 96,000,000 | 960 | 39,240 | (680 | ) | (1,916 | ) | 37,604 | ||||||||||||||

| Stock subscription received | - | - | - | - | - | 680 | - | 680 | ||||||||||||||||

| Net loss | - | - | - | - | - | - | (46,981 | ) | (46,981 | ) | ||||||||||||||

| Balance, September 30, 2012 | - | - | 96,000,000 | 960 | 39,240 | - | (48,897 | ) | (8,697 | ) | ||||||||||||||

| Stock issued for services | - | - | 139,000,000 | 1,390 | 141,818 | - | - | 143,208 | ||||||||||||||||

| Conversion of debt to equity | 104,955 | 10 | 2,000,000,000 | 20,000 | 258,382 | - | - | 278,392 | ||||||||||||||||

| Net loss | - | - | - | - | - | - | (756,563 | ) | (756,563 | ) | ||||||||||||||

| Balance, September 30, 2013 (Restated) | 104,955 | $ | 10 | 2,264,500,000 | $ | 22,350 | $ | 439,440 | $ | - | $ | (805,460 | ) | $ | (343,660 | ) | ||||||||

See accompanying notes to the consolidated financial statements.

F-5

OLIE Inc.

(A Development Stage Company)

Consolidated Statements of Cash Flows

| December 10, | |||||||||

| 2010 | |||||||||

| (inception) | |||||||||

| Year Ended | through | ||||||||

| September 30, | September 30, | ||||||||

| 2013 | 2012 | 2013 | |||||||

| (Restated) | (Restated) | ||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | |||||||||

| Net loss | $ | (756,563 | ) | $ | (46,981 | ) | $ | (805,460 | ) |

| Adjustment to reconcile net loss to net cash used in operations: | |||||||||

| Stock-based compensation | 143,208 | - | 143,208 | ||||||

| Increase (decrease) in operating liabilities: | |||||||||

| Accounts payable and accrued expenses | 613,311 | 2,389 | 615,700 | ||||||

| Net Cash Used in Operating Activities | (44 | ) | (44,592 | ) | (46,552 | ) | |||

| CASH FLOWS FROM FINANCING ACTIVITIES: | |||||||||

| Shareholder loans, net | - | 5,971 | 6,435 | ||||||

| Sale of common stock | - | 680 | 40,200 | ||||||

| Net Cash Provided by Financing Activities | - | 6,651 | 46,635 | ||||||

| Net increase (decrease) in cash and cash equivalents | (44 | ) | (37,941 | ) | 83 | ||||

| Cash and cash equivalents, beginning of period | 127 | 38,068 | - | ||||||

| Cash and cash equivalents, end of period | $ | 83 | $ | 127 | $ | 83 | |||

| Supplemental cash flow information | |||||||||

| Cash paid for interest | $ | - | $ | - | $ | - | |||

| Cash paid for taxes | $ | - | $ | - | $ | - | |||

| Non-cash transactions: | |||||||||

| Reclassify accounts payable to debt | $ | 164,698 | $ | 164,698 | |||||

| Debt converted to stock | $ | 278,392 | $ | - | $ | - | |||

See accompanying notes to the consolidated financial statements.

F-6

OLIE INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1. NATURE OF OPERATIONS AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

ORGANIZATION

Olie, Inc. (the “Company”), was incorporated in Delaware on December 10, 2010. The Company intends to continue to transform into a business acquisition corporation. The Company's financial statements are presented as those of a development stage enterprise. Activities during the development stage primarily include equity based financing and implementation of the business plan.

PRINCIPLES OF CONSOLIDATION

The consolidated financial statements comprise Olie, Inc. and its wholly owned subsidiary. All significant inter-company transactions and balances have been eliminated.

RISKS AND UNCERTAINTIES

The Company's operations may be subject to significant risk and uncertainties including financial, operational, technological, regulatory and other risks associated with a development stage company, including the potential risk of business failure.

USE OF ESTIMATES

The preparation of financial statements in conformity with U.S. generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Making estimates requires management to exercise significant judgment. It is at least reasonably possible that the estimate of the effect of a condition, situation or set of circumstances that existed at the date of the financial statements, which management considered in formulating its estimate could change in the near term due to one or more future confirming events. Accordingly, the actual results could differ significantly from estimates.

RESTATEMENT

Restatements of $17,138,272 were made. See note 8 for details.

F-7

OLIE INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid instruments purchased with a maturity of three months or less and money market accounts to be cash equivalents.

SHARE BASED PAYMENTS

Generally, all forms of share-based payments, including stock option grants, warrants, restricted stock grants and stock appreciation rights, are measured at their fair value on the awards’ grant date, and based on the estimated number of awards that are ultimately expected to vest. Share-based payment awards issued to non-employees for services rendered are recorded at either the fair value of the services rendered or the fair value of the share-based payment, whichever is more readily determinable. The expense resulting from share-based payments are recorded as a component of operating expense.

EARNINGS PER SHARE

Basic loss per share is computed by dividing net loss by weighted average number of shares of common stock outstanding during each period. Diluted loss per share is computed by dividing net loss by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during the period. The Company has no common stock equivalents.

Since the Company reflected a net loss in the reported period, the effect of considering any common stock equivalents, if outstanding, would have been anti-dilutive. A separate computation of diluted loss per share is not presented.

INCOME TAXES

Provisions for federal and state income taxes are calculated based on reported pre-tax earnings and current tax law.

Significant judgment is required in determining income tax provisions and evaluating tax positions. The Company periodically assesses its liabilities and contingencies for all periods that are currently open to examination or have not been effectively settled based on the most current available information. When it is not more likely than not that a tax position will be sustained, the Company records its best estimate of the resulting tax liability and any applicable interest and penalties in the financial statements.

Deferred tax assets and liabilities are recorded for temporary differences between the tax basis of assets and liabilities and their reported amounts in the financial statements using statutory rates in effect for the year in which the differences are expected to reverse. The Company presents the tax effects of these deferred tax assets and liabilities separately for each major tax jurisdiction.

F-8

OLIE INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

The effect on deferred tax assets and liabilities of a change in tax rates is recognized in the results of operations in the period that the changes are enacted. The Company records a valuation allowance to reduce deferred tax assets when it is more likely than not that some portion of the asset may not be realized. The Company evaluates its deferred tax assets and liabilities on a periodic basis.

RECLASSIFICATIONS

Certain reclassifications have been made to prior year financial statements in order for them to be in conformity with the current year presentation. The reclassifications had no impact on change in net assets.

RECENT ACCOUNTING PRONOUNCEMENTS

There are no recent accounting pronouncements that are expected to have an effect on the Company’s financial statements.

NOTE 2. GOING CONCERN

The Company’s financial statements are prepared using accounting principles generally accepted in the United States of America applicable to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business. As of September 30, 2013, the Company has not yet established an ongoing source of revenues sufficient to cover its operating cost and allow it to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced to cease operations.

In order to continue as a going concern, the Company will need, among other things, additional capital resources. Management’s plan to obtain such resources for the Company include, obtaining capital from management and significant stockholders sufficient to meet its minimal operating expenses. However, management cannot provide any assurance that the Company will be successful in accomplishing any of its plans.

NOTE 3. INCOME TAXES

The Company has net operating loss carryforwards totaling approximately $662,000 at September 30, 2013, expiring through 2033. Utilization of these net operating losses may be limited due to potential ownership changes under the Internal Revenue Code.

Significant deferred tax assets at September 30, 2013 and 2012 are approximately as follows:

| September 30, | September 30, | |||||

| 2013 | 2012 | |||||

| Gross deferred tax assets: | ||||||

| Net operating loss carryforward | $ | 230,000 | $ | 17,000 | ||

| Less: Valuation allowance | (230,000 | ) | (17,000 | ) | ||

| Net deferred tax assets recorded | $ | - | $ | - |

F-9

OLIE INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 4. NOTE PAYABLE

In July 2012, the Company received $5,970. The loan is non-interest bearing and unsecured.

During the year ended September 30, 2013, various non related parties paid certain expenses for the Company totaling $164,698. The loans are non-interest bearing, unsecured and due on demand.

NOTE 5. DUE TO RELATED PARTIES

In February 2011, the Company’s Secretary loaned $465. The loan is non-interest bearing, unsecured, and due on demand.

As of September 30, 2013, the Company owed Robert Gardner, CEO $40,723 for certain expenses paid for on behalf of the Company. The loan bears no interest, is unsecured and due on demand. During the year additional advances, in the amount of $278,392, including $200,000 paid for the acquisition of EnCanSol Capital Corporation (agreement subsequently terminated and costs were written off as an impairment) were received and exchanged for preferred and common shares, as described in Note 7. Accrued interest, in the amount of $4,503 was due as of September 30, 2013.

NOTE 6. COMMON AND PREFERRED STOCK

STOCK TRANSACTIONS

On November 29, 2012, the Company enacted a 40 to 1 forward stock split. The common shares and per share information included in the financial statements have been retroactively restated for the forty to one (40:1) forward split approved on December 19, 2012.

On December 10, 2010 (date of inception) the Company issued 80,000,000 common shares to founders for $200 ($0.0000025/share).

On September 1, 2011, the Company issued 16,000,000 shares to individuals for $40,000 cash at $0.025 per share.

On April 29, 2013, the Company issued 500,000 shares of common stock for services rendered. These shares were valued at $325,000.

On June 18, 2013, the Company changed its common stock par value from $.0001 to $.00001.

On June 25, 2013, the Company issued 2 billion shares to its CEO in exchange for $20,000 of debt owed, which approximated its fair value.

On August 9, 2013, the Company issued 139,000,000 shares to various consultants for services rendered. These shares were valued at the fair market trading value of $143,208 at the date of grant.

F-11

OLIE INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

CONVERTIBLE PREFERRED STOCK

There are 4 shares of Series A convertible preferred stock authorized and zero issued and outstanding. These shares have a par value of $.0001 per share.

The holders of Series B, C and D convertible preferred stock are entitled to receive dividends when, and if declared by the Board of Directors, in their sole discretion. Upon liquidation, dissolution or winding up of the corporation, whether voluntarily or involuntarily, before any distribution or payment shall be made to the holders of any stock ranking junior to the Series B preferred stock, the holders of the Series B preferred stock are entitled to be paid out of the assets of the corporation an amount equal to $1.00 per share or in the event of an aggregate subscription by a single subscriber for each such Series preferred stock in excess of $100,000, $0.997 per share (as adjusted for any stock dividends, combinations, splits and recapitalization), plus all declared but unpaid dividends, for each share of Series B, C or D preferred stock held. After the payment of the full applicable preference value of each share of the Series B, C or D preferred stock, the remaining assets of the corporation legally available for distribution, if any, will be distributed ratably to the holders of the corporation’s common stock. There are 10,000,000, 25,000,000 and 10,000,000 shares authorized, respectively, and zero issued and outstanding. These shares have a par value of $.0001 per share.

Preferred Share Conversion Rights:

Preferred shares that have been issued and outstanding are held by controlling members and executive management. Management has waived rights of conversion, to the extent of available authorized shares, until such time that an adequate number of shares are available through amendments increasing the authorized shares or other events.

Series Preferred A: If at least one share of Series A Preferred Stock is issued and outstanding, then the total aggregate issued shares of Series A Preferred Stock at any given time, regardless of their number, shall be convertible into the number of shares of Common Stock which equals four times the sum of: i) the total number of shares of Common Stock which are issued and outstanding at the time of conversion, plus ii) the total number of shares of Series B, C and D Preferred Stock which are issued and outstanding at the time of conversion.

Series Preferred B, C and D: Each share of Series B, C and D Preferred Stock shall be convertible at par value $0.00001 per share into the number of shares of the Corporation's common stock, par value $0.00001 per share (the "Common Stock") equal to the price of the Series B Preferred Stock as stated in the Bylaws, divided by the par value of the Series B Preferred, subject to adjustment as may be determined by the Board of Directors from time to time (the "Conversion Rate").

On June 25, 2013, the Company issued 104,955 Series B Preferred shares to the CEO in exchange for debt. These shares were valued at $262,389, the amount of debt exchanged which is management’s estimate of the fair value of these shares.

NOTE 7. RELATED PARTY TRANSACTIONS

The balance due to the related party at September 30, 2013 and September 30, 2012 was $41,188 and $465, respectively. These amounts are payable on demand and bear no interest.

F-13

OLIE INC.

(A Development Stage Company)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 8. RESTATEMENT

Subsequent to the filing of the first amended Form 10-K/A on January 28, 2014, management discovered substantial errors in the valuation of common and preferred stock issued for services and for conversion of related party debt to equity. The original valuations of stock issued mostly to the CEO and sole board member were valued at market trading value. Corrected valuations were issued using the stock enterprise valuation since 99.7% of the fully-diluted shares outstanding as of September 30, 2013 were issued during the current year. To date, the Company has had no non-cash assets and no operations beyond development-stage preparations. A summary of the reduction in non-cash expenses is summarized below:

| As Originally | As | ||||||||

| Filed | Restatement | Amended | |||||||

|

Balance sheet, as of September 30, 2013 |

|||||||||

| Total Assets | $ | 83 | $ | 83 | |||||

| Total Liabilities | $ | 343,743 | $ | 48,000 | $ | 295,743 | |||

| Total Stockholders’ Equity | |||||||||

| Preferred

stock: 45,000,004 authorized; $0.0001 par

value 104,955 and 0 shares issued and outstanding |

10 | 10 | |||||||

| Common

stock: 3,000,000,000 authorized; $0.00001 par

value, 2,235,000,000 shares issued and outstanding |

22,645 | 295 | 22,350 | ||||||

| Additional paid in capital | 17,625,417 | (17,185,977 | ) | 439,440 | |||||

| Deficit accumulated during development stage | (17,943,732 | ) | (17,138,272 | ) | (805,460 | ) | |||

| Total Stockholders' Deficit | (295,660 | ) | (48,000 | ) | (345,660 | ) | |||

| Total Liabilities and Stockholders Deficit | $ | 83 | $ | 83 | |||||

| Income statement | |||||||||

| Net Loss | $ | 17,894,835 | $ | 17,138,272 | $ | 756,563 |

NOTE 9. SUBSEQUENT EVENTS

In accordance with ASC 855-10, management has evaluated subsequent events through the date the financial statements were issued. On November 3, 2013, the Company created a series of anti-dilutive convertible preferred shares.

During the quarter ended December 31, 2013, the Company issued 191,000,000 common shares for compensation valued at $1,475,700, 106,190 Series B convertible preferred shares in exchange for debt with a fair value of $265,475, and another 60,000 Series B convertible preferred shares to purchase 60,000 Series B convertible preferred shares of another company, Hi Score Corporation as an investment fair valued at $150,000. The Company also received 100,000 Series B convertible preferred shares of Laredo Resources Corp. for a 6-month consulting contract.

F-14

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

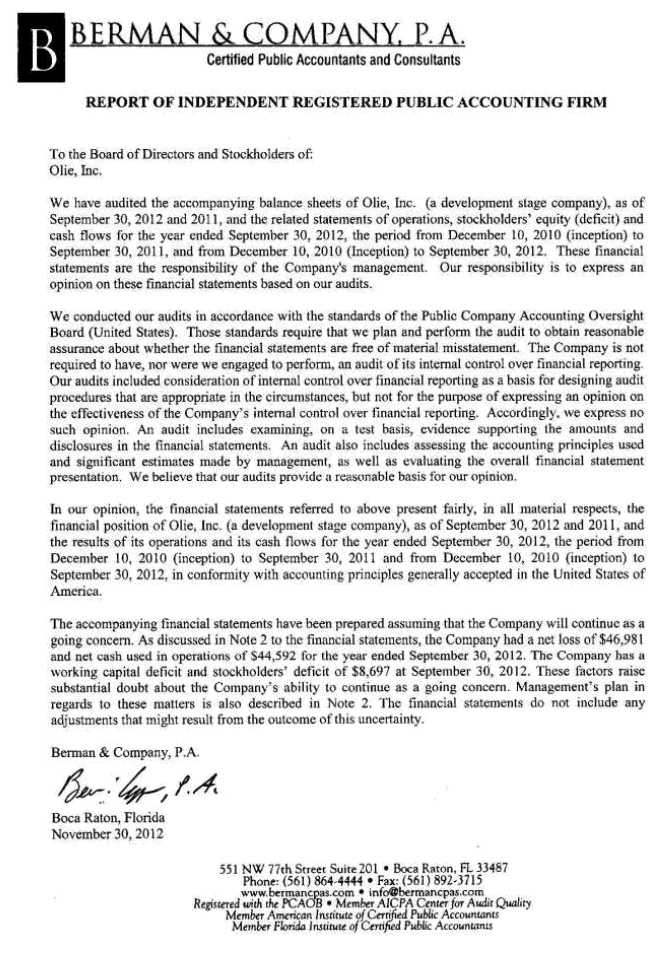

On February 8, 2013 the company informed its registered independent public accountant, Berman & Company PA. (“B&Co”), of Boca Raton Florida of their dismissal. The Board of Directors approved the decision to change independent accountants and there have been no disagreements with B&CO on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements if not resolved to the satisfaction of B&CO would have caused them to make reference thereto in their report on the financial statements.

On February 8, 2013, the Company engaged Drake, Klein, Messineo, CPAs PA (“DKM”) of Clearwater, Florida, as its new registered independent public accountant. On May 10, 2013 the Company dismissed DKM and engaged Messineo & Co., CPAs, LLC (“M&Co”). DKM did not audit any periods and issued no reports. There were no disagreements with DKM on any matter of accounting principles or practices, financial statement disclosures or audit scope or procedure, which disagreements, if not resolved to the satisfaction of DKM would have caused them to make reference thereto to filings or their report on the financial statements.

In January 2014, Messineo & Co., CPAs, LLC resigned as the Company's independent accountant as they were not CPAB registered. There were no disagreements with M&Co on any matter of accounting principles or practices, financial statement disclosures or audit scope or procedure, which disagreements, if not resolved to the satisfaction of M&Co would have caused them to make reference thereto to filings or their report on the financial statements.

On February 1, 2014, the Company engaged MaloneBailey LLP as its new independent public accountant.

ITEM 9A. CONTROLS AND PROCEDURES

(a) Disclosure Controls and Procedures

Disclosure controls and procedures are the controls and other procedures that are designed to provide reasonable assurance that information required to be disclosed by the issuer in the reports that it files or submits under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed by an issuer in the reports that it files or submits under the Exchange Act is accumulated and communicated to the issuer’s management, including the principal executive and principal financial officer, or persons performing similar functions, as appropriate, to allow timely decisions regarding required disclosure. Any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives.

We have carried out an evaluation, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, of the effectiveness of our disclosure controls and procedures, as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act as of the end of the fiscal year covered by this Annual Report.

Based on that evaluation, our Chief Executive Officer and Chief Financial Officer have concluded that the Company’s disclosure controls and procedures were not effective due to (i) limited personnel leading to improper segregation of duties and (ii) lack of formal review process which led to numerous audit adjustments.

(b) Management’s Annual Report on Internal Control over Financial Reporting

Management is responsible for establishing and maintaining adequate internal control over financial reporting, as defined in Securities Exchange Act Rule 13a-15(f). Internal control over financial reporting is designed to provide reasonable assurance regarding the reliability of financial reporting and preparation of financial statements for external purposes in accordance with U.S. GAAP. This annual report does not include a report of management's assessment regarding internal control over financial reporting due to a transition period established by rules of the Securities and Exchange Commission for newly public companies.

(c) Change in Internal Control over Financial Reporting

There were no significant changes to our internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act) during the period covered by this report, that could materially affect, or are reasonably likely to materially affect, our internal control over financial reporting.

ITEM 9B. OTHER INFORMATION

None.

12

PART III

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Our Directors hold office until the next annual general meeting of the stockholders or until their successors are elected and qualified. Our officers are appointed by our Board of Directors and hold office until the earlier of their death, retirement, resignation, or removal.

Our officers and Directors and their ages and positions are as follows:

| Name | Age | Position | ||

| Robert Clive Gardner | 73 | President, Chief Executive Officer, Chief Financial Officer and Director |

Mr. Robert Gardner

Set forth below is a brief description of the background and business experience of each of our current executive officers and directors.

Robert Gardner was appointed President, Chief Executive Officer, Chief Financial Officer, Secretary, Treasurer, and Director on September 10, 2012. He is the Proprietor and Principal of Gardner & Associates in Vancouver. He is a Barrister and Solicitor in the Province of British Columbia where he was called and admitted in 1966. He is currently President of Q-Gold Resources Ltd., a position he has held since approximately July of 2010. Formerly, he was Chairman of Viridis Energy, Inc. from approximately December 2009 until April 2011. He also served as President, CFO and Secretary of First Star Resources, Inc. from November 2010 through approximately December 2011. He was a member of the Board and Chairman of Stealth Energy from approximately 2006 until his resignation in approximately July 2011. He was Chairman and a member of the Board of Genco Resources (now Silvermex Resources, Inc.) from approximately February 2003 until his resignation in May 2010. During his time at Genco Resources, he also served as acting CEO from January 2009 to February 2010. He was a Director for Kootenay Gold, Inc. from June 2003 until his resignation in March 2009. He served as Chairman of Andover Resources from December 2006 until his resignation in September 2008. He was on the Board of Chief Consolidated Mining as an U.S.-associated company to Andover from March 2008 until his resignation in 2010. He was a Director for Atlas Technology Group from August 2005 until his resignation in February 2009. He served as Chairman of Bolero Resources Corp. from February 2006 until his resignation in February 2008. He was on the Board of Directors of Getty Copper from approximately 2003 until his resignation in November 2004. He was a director of Triple Dragon Resources, Inc. from February 23, 2006 to June 4, 2007.

Mr. Gardner was called to the Bar of England and Wales in 1964 and called and admitted in British Columbia in 1966. He is a member of the Honourable Society of the Inner Temple (London). He graduated from Cambridge University in 1961 with a BA, in 1962 with an LLB, in 1965 with an MA, and in 1995 with an LLM. He was made a Queens Counsel in 1989.

Term of Office

Our Directors are appointed for a one year term to hold office until the next annual general meeting of our shareholders or until removed from office in accordance with our bylaws. Our officers are appointed by our board of directors and hold office until removed by the board.

Family Relationships

There are no family relationships between or among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

13

Committees of the Board of Directors

We do not presently have a separately constituted audit committee, compensation committee, nominating committee, executive committee or any other committees of our Board of Directors. As such, our entire Board of Directors acts as our audit committee.

Audit Committee Financial Expert

Our Board of Directors does not currently have any member who qualifies as an audit committee financial expert. We believe that the cost related to retaining such a financial expert at this time is prohibitive. Further, because we are in the start-up stage of our business operations, we believe the services of an audit committee financial expert are not warranted at this time.

Involvement in Legal Proceedings

None of our Directors, nominee for Directors, or officers has appeared as a party during the past ten years in any legal proceedings that may bear on his ability or integrity to serve as a Director or officer of the Company.

Board Leadership Structure

The Company has chosen to combine the principal executive officer and Board chairman positions. The Company believes that this Board leadership structure is the most appropriate for the Company for the following reasons. First, the Company is a development stage company and at this early stage it is more efficient to have the leadership of the Board in the same hands as the principal executive officer of the Company. The challenges faced by the Company at this stage – obtaining financing and performing research and development activities – are most efficiently dealt with by having one person intimately familiar with both the operational aspects as well as the strategic aspects of the Company’s business. Second, Mr. Gardner is uniquely suited to fulfill both positions of responsibility because he possesses management experience, technical experience, and experience with start-up companies.

Potential Conflict of Interest

Since we do not have an audit or compensation committee comprised of independent Directors, the functions that would have been performed by such committees are performed by our Board of Directors. Thus, there is a potential conflict of interest in that our Directors have the authority to determine issues concerning management compensation, in essence their own, and audit issues that may affect management decisions. We are not aware of any other conflicts of interest with any of our executives or Directors.

Board’s Role in Risk Oversight

The Board assesses on an ongoing basis the risks faced by the Company. These risks include financial, technological, competitive, and operational risks. The Board dedicates time at each of its meetings to review and consider the relevant risks faced by the Company at that time. In addition, since the Company does not have an Audit Committee, the Board is also responsible for the assessment and oversight of the Company’s financial risk exposures.

14

ITEM 11. EXECUTIVE COMPENSATION

Option/SAR Grants

We do not currently have a stock option plan. No individual grants of stock options, whether or not in tandem with stock appreciation rights known as SARs or freestanding SARs have been made to any executive officer or any Director since our inception; accordingly, no stock options have been granted or exercised by any of the officers or Directors since we were founded.

Long-Term Incentive Plans and Awards

We do not have any long-term incentive plans that provide compensation intended to serve as incentive for performance. No individual grants or agreements regarding future payouts under non-stock price-based plans have been made to any executive officer or any Director or any employee or consultant since our inception; accordingly, no future payouts under non-stock price-based plans or agreements have been granted or entered into or exercised by any of the officers or Directors or employees or consultants since we were founded.

Compensation of Directors

There are no current arrangements pursuant to which Directors are or will be compensated in the future for any services provided as a Director.

Employment Contracts, Termination of Employment, Change-in-Control Arrangements

In January 2013, the Company has a management agreement with the CEO, Robert Gardner in the amount of $10,000 per month There are no compensation plans or arrangements, including payments to be made by us, with respect to our officers, Directors or consultants that would result from the resignation, retirement or any other termination of such Directors, officers or consultants from us. There are no arrangements for Directors, officers, employees or consultants that would result from a change-in-control.

ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Beneficial Ownership of Holdings

The following table sets forth, as of November 30, 2012, certain information with respect to the beneficial ownership of our common stock by each stockholder known by us to be the beneficial owner of more than 5% of our common stock and by each of our current Directors and executive officers. Each person has sole voting and investment power with respect to the shares of common stock, except as otherwise indicated. Information relating to beneficial ownership of common stock by our principal stockholders and management is based upon information furnished by each person using "beneficial ownership" concepts under the rules of the Securities and Exchange Commission. Under these rules, a person is deemed to be a beneficial owner of a security if that person has or shares voting power, which includes the power to vote or direct the voting of the security, or investment power, which includes the power to vote or direct the disposition of the shares. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial ownership within 60 days. Under the Securities and Exchange Commission rules, more than one person may be deemed to be a beneficial owner of the same securities, and a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary beneficial interest.

15

The percentages below are calculated based on 2,264,500,000 shares of our common stock issued and outstanding as of December 2, 2013. We do not have any outstanding options, warrants or other securities exercisable for or convertible into shares of our common stock.

| Amount and | |||||||||

| Nature | |||||||||

| Name and Address of | of Beneficial | Percentage of | |||||||

| Title of Class | Beneficial Owner(2) | Ownership | Class(1) | ||||||

| Common Stock | Mr. Robert Gardner | 2,000,000, 000 | 88% | ||||||

| All officers as a Group | 88% |

| (1) |

Based on 2,264,500,000shares of our common stock issued. |

| (2) |

The address for Mr. Gardner is 300 Jameson House, 838 West Hastings Street, Vancouver, British Columbia V6C 0A6 |

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change in control of our Company.

Changes in Control

We are unaware of any contract or other arrangement the operation of which may at a subsequent date result in a change of control of our Company.

Equity Compensation Plan Information

| Number of | |||||||||

| securities | |||||||||

| remaining | |||||||||

| Number of | available for | ||||||||

| securities to be | future issuance | ||||||||

| issued upon | under equity | ||||||||

| exercise of | compensation | ||||||||

| outstanding | Weighted-average | plans (excluding | |||||||

| options, | exercise price of | securities | |||||||

| warrants and | outstanding options, | reflected in | |||||||

| rights | warrants and rights | column (a)) | |||||||

| Plan category | (a) | (b) | (c) | ||||||

| Equity compensation plans approved by security holders | 0 | 0 | 0 | ||||||

| Equity compensation plans not approved by security | |||||||||

| holders | 0 | 0 | 0 | ||||||

| Total | 0 | 0 | 0 |

16

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE.

Except as disclosed below, since the beginning of the fiscal year preceding the last fiscal year none of the following persons has had any direct or indirect material interest in any transaction to which our Company was or is a party, or in any proposed transaction to which our Company proposes to be a party:

- any Director or officer of our Company;

- any proposed Director of officer of our Company;

- any person who beneficially owns, directly or indirectly, shares carrying more than 5 percent of the voting rights attached to our common stock; or

- any member of the immediate family of any of the foregoing persons (including a spouse, parents, children, siblings, and in-laws).

Our officers and Directors may be considered promoters of the Registrant due to their participation in and management of the business since its incorporation.

Director Independence

We are not subject to listing requirements of any national securities exchange or national securities association and, as a result, we are not at this time required to have our board comprised of a majority of “independent Directors.” We do not believe that either of our directors currently meets the definition of “independent” as promulgated by the rules and regulations of NASDAQ.

ITEM 14. PRINCIPAL ACCOUNTING FEES AND SERVICES

Audit Fees

The aggregate fees billed since incorporation for professional services rendered by the principal accountant for the audit of our financial statements and review of financial statements included in our quarterly Reports on Form 10-Q and services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for these fiscal periods were as follows:

| Period ended | Year ended | |||||

| September 30, | September 30, | |||||

| 2012(1) | 2013(2) | |||||

| Audit Fees | $ | 7,000 | $ | 15,000 | ||

| Audit Related Fees | - | - | ||||

| Tax Fees | - | - | ||||

| All Other Fees | - | - |

Notes :

| (1) |

For the year ended September 30, 2012, principal accountants of the Company were Berman & Co, P.A. |

| (2) |

For the year ended September 30, 2013, principal accountants of the Company were Messineo & Co., CPAs , LLC and MaloneBailey, LLP |

17

Since incorporation and as of the fiscal year ended December 31, 2011, there were no fees billed for assurance and related services by the principal accountant that are reasonably related to the performance of the audit or review of our financial statements and are not reported under Item 9(e)(1) of Schedule 14A, for professional services rendered by the principal account for tax compliance, tax advice, and tax planning, for products and services provided by the principal accountant, other than the services reported in Item 9(e)(1) through 9(d)(3) of Schedule 14A.

Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditors

Given the small size of our Board as well as the limited activities of our Company, our Board of Directors acts as our Audit Committee. Our Board pre-approves all audit and permissible non-audit services. These services may include audit services, audit-related services, tax services, and other services. Our Board approves these services on a case-by-case basis.

18

PART IV

ITEM 15. EXHIBITS, FINANCIAL STATEMENT SCHEDULES

|

|

(a) |

Financial Statements and financial statement schedules |

|

|

|

|

|

(1) and (2) The financial statements and financial statement schedules required to be filed as part of this report are set forth in Item 8 of Part II of this report. | ||

|

|

|

|

|

|

(3) Exhibits. See Item 15(b) below. | |

|

|

|

|

|

|

(b) |

Exhibits required by Item 601 of Regulation S-K |

| Exhibit | |

| No. | Description |

| 3.1 |

Certificate of Incorporation (incorporated by reference from our Registration Statement on Form S-1 filed on November 29, 2011). |

| 3.2 |

Bylaws (incorporated by reference from our Registration Statement on Form S-1 filed on November 29, 2011). |

| 31 |

Section 302 Certification of the Sarbanes-Oxley Act of 2002 of Robert Gardner |

| 32 |

Section 906 Certification of the Sarbanes-Oxley Act of 2002 of Robert Gardner |

| 99.1 | |

| 99.2 | |

| 99.3 | |

| 99.4 | |

| 101.INS ** |

XBRL Instance Document |

| 101.SCH ** |

XBRL Taxonomy Extension Schema Document |

| 101.CAL ** |

XBRL Taxonomy Extension Calculation Linkbase Document |

| 101.DEF ** |

XBRL Taxonomy Extension Definition Linkbase Document |

| 101.LAB ** |

XBRL Taxonomy Extension Label Linkbase Document |

| 101.PRE ** |

XBRL Taxonomy Extension Presentation Linkbase Document |

** XBRL (Extensible Business Reporting Language) information is furnished and not filed or a part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, is deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise is not subject to liability under these sections.

19

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| OLIE INC. | ||

| (Registrant) | ||

| Dated: March 24, 2014 | By: | /s/ Robert Gardner |

| Name: Robert Gardner | ||

| Title: President, Chief Executive and | ||

| Financial Officer | ||

| (Principal Executive and Financial | ||

| Officer), and Director | ||

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| Dated: March 24, 2014 | By: | /s/ Robert Gardner |

| Name: Robert Gardner | ||

| Title: President, Chief Executive and | ||

| Treasurer (Principal Executive and | ||

| Financial Officer), and Director |

20