Attached files

| file | filename |

|---|---|

| EX-5.1 - EX-5.1 - PROSPECT GLOBAL RESOURCES INC. | a2219230zex-5_1.htm |

| EX-23.1 - EX-23.1 - PROSPECT GLOBAL RESOURCES INC. | a2219230zex-23_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS 2

FINANCIAL STATEMENTS Prospect Global Resources Inc. (An Exploration Stage Company) CONSOLIDATED FINANCIAL STATEMENTS March 31, 2013

As filed with the Securities and Exchange Commission on March 24, 2014

No. 333-194203

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

PROSPECT GLOBAL RESOURCES INC.

(Exact name of registrant as specified in its charter)

| Nevada (State or other jurisdiction of incorporation or organization) |

1520 (Primary Standard Industrial Classification Code Number) |

26-3024783 (I.R.S. Employer Identification Number) |

1401 17th Street, Suite 1550

Denver, Colorado 80202

(303) 990-8444

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Damon G. Barber

President and Chief Executive Officer

Prospect Global Resources Inc.

1401 17th Street, Suite 1550

Denver, Colorado 80202

Fax: (303) 990-8444

Email: dbarber@prospectgri.com

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

Jeffrey M. Knetsch

Brownstein Hyatt Farber Schreck, LLP

410 Seventeenth Street, Suite 2200

Denver, Colorado 80202

(303) 223-1100

Fax: (303) 223-1111

Email: jknetsch@bhfs.com

Approximate date of commencement of proposed sale to the public:

From time to time after the effectiveness of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of each class of securities to be registered |

Amount to be registered |

Proposed maximum offering price per share(1) |

Proposed maximum aggregate offering price(1) |

Amount of registration fee |

||||

|---|---|---|---|---|---|---|---|---|

Common Stock |

17,000,000 | $1.50 | $25,500,000 | $3,284.40(2) | ||||

|

||||||||

- (1)

- Pursuant to Rule 457(c) under the Securities Act, calculated based upon the price for the common stock as quoted on the Nasdaq Capital Market on February 24, 2014.

- (2)

- Previously paid.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or jurisdiction where the offer or sale is not permitted.

Subject to completion, dated March 24, 2014.

PROSPECTUS

PROSPECT GLOBAL RESOURCES INC.

17,000,000 Shares of Common Stock

We are offering 17,000,000 shares of our common stock to the public.

An investment in our securities involves serious risks, including the risk that we are unable to raise sufficient capital to continue funding our operations, service our debt and complete the exploration, development and build out of our Holbrook potash project and continue our listing on The Nasdaq Capital Market. You should read carefully the "Risk Factors" beginning on page 8 of this prospectus.

Our common stock is traded on The Nasdaq Capital Market under the symbol "PGRX." On [ ], 2014, the last reported sale price of our common stock was $[ ] per share.

|

||||

| |

Per Share |

Total |

||

|---|---|---|---|---|

Public offering price |

||||

Underwriting discount |

||||

Proceeds, before expenses, to us |

||||

|

||||

We have retained to act as our underwriter in connection with this offering. We have granted the underwriter an option, which expires on the 30th day following the date of this prospectus, to purchase from us, at a price equal to the public offering price, less the underwriting discount, up to an additional 2,550,000 shares of common stock to cover over-allotments, if any. See the section titled "Underwriting" on page [ ]of this prospectus. The underwriter expects that the shares will be ready for delivery in book-entry form through the facilities of the Depository Trust Company on or about [ ], 2014.

Our principal offices are located at 1401 17th Street, Suite 1550, Denver CO 80202 and our telephone number is 303-990-8444.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of the prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is [ ], 2014

We are responsible for the information contained in this prospectus. Neither we, nor any underwriter, have authorized anyone to provide information different from that contained in this prospectus.

This prospectus is not an offer to sell or solicitation of an offer to buy securities in any circumstances under which or jurisdiction in which the offer or solicitation is unlawful.

All common stock share amounts in this prospectus have been adjusted for the 50:1 reverse stock split that occurred on September 4, 2013 unless otherwise noted.

In this Prospectus, unless the context otherwise requires:

- (a)

- all

references to "Prospect" or "Prospect Global" refer to Prospect Global Resources Inc. f/k/a Triangle Castings, Inc., a Nevada corporation

incorporated on July 22, 2008.

- (b)

- all

references to "old Prospect Global" refer to our wholly owned subsidiary Prospect Global Resources Inc., a Delaware corporation.

- (c)

- all

references to "we," "us," "our" and "the Company" refer collectively to Prospect and its subsidiaries old Prospect Global, American West

Potash LLC or "AWP" and Apache County Land and Ranch, LLC or "Apache".

- (d)

- all

references to "Triangle" refer to Prospect Global prior to the merger, at which time its name was Triangle Castings, Inc.

- (e)

- all

references to "Karlsson" or "The Karlsson Group" refer to the independent third party that owned the 50% of AWP that we did not own prior to our

acquisition of The Karlsson Group's interest on August 1, 2012 and all references to "The Karlsson Group Acquisition" refer to the August 1, 2012 acquisition.

- (f)

- all references to "2013" mean the fiscal year ended March 31, 2013, "2012" to the fiscal year ended March 31, 2012 and "2011" to the fiscal year ended March 31, 2011.

This prospectus includes forward-looking statements. Forward-looking statements include statements concerning our plans, estimates, goals, strategies, intent, assumptions, beliefs or current expectations and can be identified by the use of terms and phrases such as "seek," "is expected," "budget," "believe," "plan," "intend," "anticipate," "target," "estimate," "expect," and the like, and/or future tense or conditional construction ("will," "may," "could," "should," etc.) and the negative forms of any of these words and other similar expressions.

The forward-looking statements are based on estimates and assumptions that we have made in light of our experience and perception of historical trends. In making the forward-looking statements in this prospectus, we have made many assumptions including, but not limited to, assumptions relating to: future demand for and supply of potash; our plan to capitalize on potash demand; our plan to convert our mineral resources into mineral reserves; the environmental and permitting process, preliminary mine design and anticipated completion of a definitive feasibility study; our plan of exploration; the economic and legal viability of a potash mine in the Holbrook Basin; future sales of state leases and permits; our ability to raise capital; servicing the debt we owe to The Karlsson Group and affiliates of Apollo Global Management, LLC; our ability to further implement our business plan and generate revenue; our ability to satisfy the requirements and successfully execute on the commercial arrangement set forth in the potash supply agreement we have entered into with Sichuan Chemical Industry Holding (Group) Co., Ltd.; our anticipation of investing considerable amounts of capital to establish production from our mining project in the Holbrook Basin in Arizona; our anticipation of our ability to identify

1

mineral reserves that are capable of providing an acceptable return for investors that is commensurate with the inherent risks of a mining project; anticipated capital and operating costs; impact of the adoption of new accounting standards and our financial and accounting systems and analysis programs; compliance with and impact of laws and regulations; impact of litigation and other legal proceedings; and effectiveness of our internal control over financial reporting.

Forward-looking statements are inherently subject to known and unknown business, economic and other risks and uncertainties that may cause actual results to be materially different from those expressed or implied by our forward-looking statements, including without limitation risks related to:

- •

- our history of operating losses and expectation of future losses;

- •

- our ability to develop a mine that is able to commercially produce potash;

- •

- our ability to obtain sufficient additional capital to satisfy our significant funding requirements;

- •

- our ability to pay the amounts due on our indebtedness to The Karlsson Group, Inc. and affiliates of Apollo Global

Management, LLC;

- •

- our ability to obtain all necessary permits and other approvals;

- •

- our ability to complete a definitive feasibility study and achieve our estimated timetables for production at the Holbrook

Basin;

- •

- the accuracy of our mineral resource estimates;

- •

- our ability to attract and retain key personnel;

- •

- competition in the mining industry;

- •

- acquiring additional properties;

- •

- our potash supply agreement with Sichuan Chemical;

- •

- the exploration, development and operation of a mine or mine property;

- •

- title defects on our mineral properties and our ability to obtain additional property rights;

- •

- our technical report, preliminary economic assessment and interim engineering study being prepared in accordance with

foreign standards that differ from the standards generally permitted in reports filed with the SEC;

- •

- governmental policies and regulation affecting the agricultural industry;

- •

- increased costs and restrictions on operations due to compliance with environmental legislation and other governmental

regulations;

- •

- the global supply of, and demand for, potash and potash products;

- •

- the cyclicality of the crop nutrient markets; and

- •

- global economic conditions.

This list is not exhaustive of the factors that may affect any of our forward-looking statements. Investors are urged to carefully review and consider the various risks and uncertainties and other factors referred to under the heading "Risk Factors" beginning on page 6 of this prospectus. If one or more of these risks or uncertainties materialize, or if the underlying assumptions prove incorrect, our actual results may vary materially from those expected or projected. In addition, although we have attempted to identify important risk factors that could cause actual achievements, events or conditions to differ materially from those identified in the forward looking statements, there may be other factors

2

we have not considered, or that we currently deem to be immaterial, that cause achievements, events or conditions not to be as anticipated, estimated or intended.

These forward-looking statements are based on the beliefs, expectation and opinions of management on the date the statements are made. We assume no obligation to update any forward-looking statements in order to reflect any event or circumstance that may arise after the date made, other than as may be required by applicable law or regulation. For the reasons set out above, investors should not place undue reliance on forward-looking statements.

CAUTIONARY NOTE TO INVESTORS REGARDING MINERAL DISCLOSURES

We commissioned a technical report in accordance with the Canadian Securities Administrator's National Instrument 43-101 "Standards of Disclosure for Mineral Projects," commonly known as NI 43-101, as well as a preliminary economic assessment, or PEA, an interim engineering study and a pre-feasibility study. The Canadian standards are different from the standards generally permitted in reports filed with the SEC. In accordance with NI 43-101, we historically have reported measured, indicated and inferred resources, measurements which are recognized terms under NI 43-101 but are not recognized by the SEC and are generally not permitted in filings made with the SEC. The term "resource" does not equate to the term "reserve." Under U.S. standards, mineralization may not be classified as a "reserve" unless the determination has been made that the mineralization could be economically and legally produced or extracted. Investors are cautioned not to assume that any part of our resources will ever be converted into economically mineable reserves. In addition, the estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. The SEC's disclosure standards normally do not permit the inclusion of information concerning "inferred resources" or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves" by U.S. standards in documents filed with the SEC subject to certain exceptions. The PEA, interim engineering study and pre-feasibility study contain estimates based on our measured, indicated and inferred resources. However, in accordance with both U.S. standards and NI 43-101, estimates of inferred mineral resources cannot form the basis of a feasibility study. We provided the disclosure of resources to provide a means of comparing our projects to those of other companies in the mining industry, many of which are Canadian and report pursuant to NI 43-101. Accordingly, our previously disclosed descriptions of our mineral deposits may not be comparable to similar information made public by other U.S. domestic companies subject to reporting and disclosure requirements under the U.S. federal securities laws and the rules and regulations thereunder. Further, investors should be aware that the issuer has no "reserves" as defined by SEC Industry Guide 7 and are cautioned not to assume that any part or all of the estimated mineral resources will ever be confirmed or converted into SEC Industry Guide 7 compliant "reserves."

Our Current Report on Form 8-K filed on October 18, 2012 refers to our interim engineering study as a "cost feasibility study." It is important to note that the interim engineering study is not a preliminary feasibility study or a final definitive or "bankable" feasibility study within the meaning of SEC Industry Guide 7 or NI 43-101. Among other things, the interim engineering study is a preliminary interim study that contains estimates based on inferred resources. As noted above, in accordance with both U.S. standards and NI 43-101, estimates of inferred resources cannot form the basis of a feasibility study. Investors are cautioned not to assume the interim engineering report constitutes a bankable feasibility study.

3

This summary contains basic information about us and this offering. This summary is not complete and does not contain all the information you should consider before investing in the securities offered hereby. You should read this summary in conjunction with, and the summary is qualified in its entirety by, the more detailed information contained elsewhere in this prospectus, including the information under "Risk Factors" beginning on page 6 of this prospectus and the financial statements and related notes included in this prospectus.

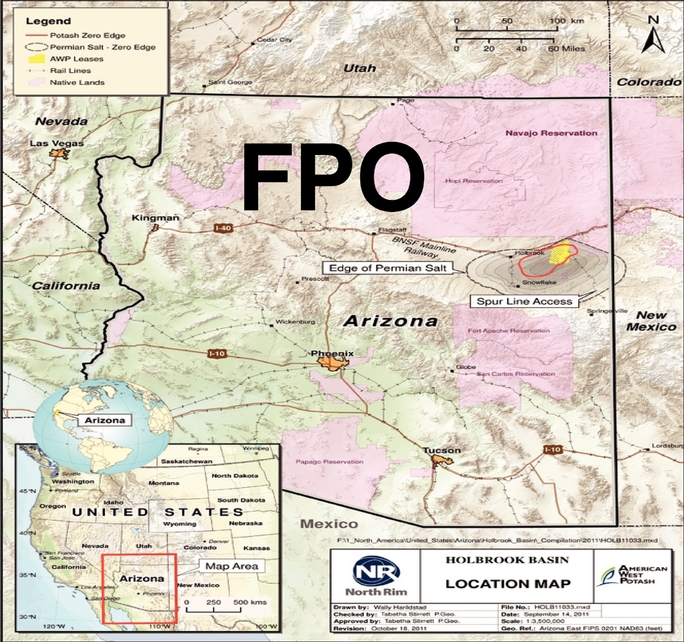

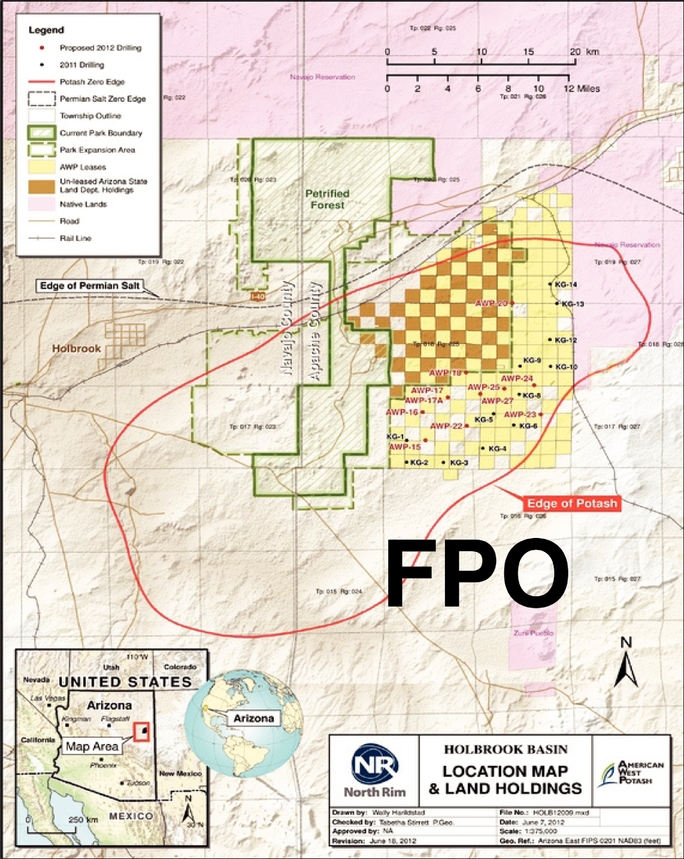

We are engaged in the exploration and development of a potash mine in the Holbrook Basin of eastern Arizona, which we refer to as the Holbrook Project. Potash is primarily used as an agricultural fertilizer due to its high potassium content. Potassium, nitrogen and phosphate are the three primary nutrients essential for plant growth. The Holbrook Project consists of permits and leases on 143 mineral estate sections spanning approximately 88,175 acres in the Holbrook Basin of eastern Arizona, along the southern edge of the Colorado Plateau.

We completed a pre-feasibility study, or PFS, for the Holbrook Project in July 2013. We are currently working toward a definitive feasibility study, or DFS, for the Holbrook Project. We commenced our phase 4 drilling program in August 2013 and completed the program in October 2013. We believe this drilling program completes the drilling necessary to complete a DFS.

Recent Financing

In February 2014 we raised $1.1 million of gross proceeds when we and each of the holders of 747,298 of our Series A Warrants issued in our June 26, 2013 public offering agreed that we would reduce the exercise price from $4.05 to $1.50 in exchange for these warrants being exercised immediately and the issuance of a new Series A Warrant for each warrant exercised with an exercise price of $1.50, exercisable for five years only upon stockholder approval of the exercise. Each of the participating warrant holders entered into a separate Series A Warrant exercise agreement. Pursuant to the full ratchet anti-dilution terms in the Series A Warrants, the exercise price of our remaining outstanding Series A Warrants was adjusted to $1.50 and we issued an additional 5,467,779 Series A Warrants with an exercise price of $1.50. As a result of the reduction of the exercise price of the Series A Warrants, the exercise price on the 1,787,171 warrants held by Buffalo Management was reduced from $4.05 to $3.50 and we issued Buffalo Management 280,841 additional warrants with an exercise price of $3.50.

Restructuring of Senior Secured Debt

On December 10, 2013, we entered into a debt restructuring and extension agreement, or Extension Agreement, with The Karlsson Group, which was amended on March 7 and 12, 2014, which restructured the senior first priority secured promissory note, as amended, that we originally issued to Karlsson on August 1, 2012 in connection with our purchase of Karlsson's 50% interest in our subsidiary American West Potash LLC. As of the date of the First Extension Agreement, the outstanding principal balance of the Karlsson Note was approximately $120 million and we were liable to Karlsson for accrued and unpaid interest and accrued tax gross-ups totaling approximately $28 million. Under the terms of the Extension Agreement, we have agreed to use our best efforts to raise a sufficient aggregate amount to prepay the entire Karlsson Note for an aggregate payment of

4

$25 million, which we refer to as the Discounted Payoff Amount, on or before April 10, 2014. In connection with the Extension Agreement:

- •

- upon payment of the Discounted Payoff Amount, the Karlsson Note will be deemed paid in full, and the Karlsson Group will

release its first priority lien over our assets;

- •

- The Karlsson Group will retain its 2% royalty interest in us following payment of the Discounted Payoff Amount;

- •

- our first tax gross up payment is due on April 10, 2014 and such payment will count towards the aggregate

$25 million Discounted Payoff Amount;

- •

- if we do not pay the Discounted Payoff Amount on or before April 10, 2014, we will be in default under the

pre-Extension Agreement Karlsson Note without the contractual right to cure such default, which would allow the Karlsson Group to foreclose on all of our assets;

- •

- the 172,117 warrants currently held by the Karlsson Group (of which 60,000 currently have an exercise price of $6.00 and

112,117 have an exercise price of $12.50 per share) will be repriced to the lowest price per share at which we sell common stock between December 10, 2013 and April 10, 2014 (these

options will not be repriced based on this offering);

- •

- upon payment of the Discounted Payment Amount the Karlsson Group is to receive 750,000 new warrants with an exercise price

equal to the lowest price per share at which we sell common stock between November 14, 2013 and April 10, 2014 (these options will not be repriced based on this offering). The new

warrants will have a term of five years from the issuance date, a cashless exercise option and basic anti-dilution protection;

- •

- we have agreed to pay Karlsson's legal fees in connection with the preparation and negotiation of the Extension Agreement

and a recent waiver, with $50,000 having been paid on December 13, 2013 and $100,000 on February 2, 2014 and with the balance, which we do not believe to be material, being payable no

later than April 10, 2014; amounts paid for legal fees do not count toward the $25 million Discounted Payoff Amount;

- •

- we agreed to amend the additional consideration agreement to cover all of our and our affiliates' current and future land

holdings pursuant to royalty agreements, and to record all royalty agreements in the real estate records in Arizona; and

- •

- we agreed to amend the supplemental payment agreement to provide that Karlsson is entitled to a one-time payment of 10% of the net proceeds in excess of $200 million received by us upon a sale of Prospect consummated on or before February 1, 2018. As of March 24, 2014, we are not contemplating a sale of Prospect.

If we are not able to raise the money to pay off the Karlsson Group debt on or before April 10, 2014 we may decide to file bankruptcy.

Restructuring of Senior Unsecured Debt

On January 10, 2014 we entered into an agreement with the holders of our Apollo debt pursuant to which we owe an aggregate amount of approximately $7.3 million in principal and interest. The agreement provides that upon repayment or extinguishment of our senior secured debt owing to The Karlsson Group, Inc. on or before March 10, 2014 (since extended to April 10, 2014) in accordance with the terms of the Extension Agreement and in any event for consideration with aggregate value less than or equal to 17% of the aggregate amount outstanding thereunder (including in respect of accrued interest and tax gross-up obligations) we may repay the notes by issuance of a number of shares of our common stock with an aggregate value of 17% of all amounts owing under the notes (including accrued

5

interest). If we are not able to raise the money to pay off the Karlsson Group debt on or before April 10, 2014 we may decide to file bankruptcy.

Restatement of Financial Statements

We recently restated our financial statements for the fiscal years ended March 31, 2013 and 2012 and the quarterly periods ending June 30, September 30 and December 31, 2012 and June 30 and September 30, 2013 to (i) reverse stock compensation related to unvested stock option awards for former employees and board members, (ii) expense certain costs that had been previously capitalized and (iii) remove references to us being a development stage company. The restated financial statements are included in this prospectus and have been filed in amendments to our annual report on Form 10-K for the year ended March 31, 2013 and quarterly reports on Form 10-Q for the quarters ended June 30, 2013, September 30, 2013 and December 31, 2013. This restatement does not change our reported cash or business plan.

Proposed Warrant Exchange for Common Stock

We have filed with the SEC a preliminary proxy statement for a special meeting of stockholders. One of the proposals to be voted on at the meeting is an exchange of all 9,404,456 of our outstanding Series A Warrants and 2,068,012 warrants held by Buffalo Management, LLC for shares of common stock where no additional consideration will be paid by the warrant holders. We are asking our stockholders to approve this exchange because we believe, upon the advice of the potential underwriters of our previously announced proposed public offering of up to $25 million of common stock, that the warrant exchange will enhance the likelihood of a successful public offering by eliminating the "market overhang" of such a large number of full ratchet anti-dilution warrants. The issuance of these shares will nearly triple our outstanding number of shares of common stock and will have a significant dilutive effect on our 4,970,578 shares of common stock currently outstanding. Buffalo Management is majority owned and controlled by Chad Brownstein, our executive vice chairman. Barry Munitz, our non-executive board chairman, owns a non-voting minority interest in Buffalo Management.

6

The following is a brief summary of certain terms of this offering and is not intended to be complete. It does not contain all of the information that will be important to a holder of shares of our common stock.

Shares Offered by us |

17,000,000 |

|

Issue Price |

$[ ] per share |

|

Total Common Stock Outstanding at March [ ], 2014 |

4,970,578 shares |

|

Total Common Stock Outstanding After Warrant Exchange |

[ ] shares |

|

Total Common Stock Outstanding After This Offering |

[ ] shares |

|

Use of Proceeds |

The net proceeds to us from the sale of the common stock offered hereby are expected to be approximately $[ ] million ($[ ] million if the Underwriters exercise their over-allotment option to purchase additional shares of common stock in full) based on an assumed public offering price of $[ ] per share, which was the last reported sale price of our common stock on the Nasdaq Capital Market on [ ], 2014 and after deducting the underwriting discount and our estimated offering expenses. We intend to use the $[ ] of the net proceeds from this offering to extinguish our senior secured debt to The Karlsson Group, $[ ] for funding the development of the Holbrook Project and $[ ] to fund general corporate purposes. |

|

Nasdaq Trading Symbol |

PGRX |

|

Risk Factors |

Investing in our common stock involves a high degree of risk. As an investor you should be able to bear a complete loss of your investment. You should carefully consider the information set forth under "Risk Factors." |

7

Investing in our securities involves significant risks, including the potential loss of all or part of your investment. These risks could materially affect our business, financial condition and results of operations and cause a decline in the market price of our shares. You should carefully consider all of the risks described in this prospectus, in addition to the other information contained in this prospectus, before you make an investment in our shares. Unless otherwise indicated, references to us, Prospect or Prospect Global include our operating subsidiaries old Prospect Global, AWP and Apache.

Risks Related to Our Financial Condition and Business

We have significant short-term and immediate capital needs as well as significant capital needs over the next few years. Our substantial indebtedness could adversely affect our financial condition and ability to raise additional capital. Failure to secure this capital when needed or on terms that are acceptable to us has raised substantial doubt about the Company's ability to continue as a going concern. We have a $25.0 million payment to extinguish our senior secured indebtedness that is due on or before April 10, 2014 that we are unable to pay and will result in an immediate default and allow the Karlsson Group to foreclose on all of our assets, if we are unable to extend this payment due date.

As of March 24, 2014, we had approximately $0.1 million available for general corporate purposes. We have a $25.0 million payment due to The Karlsson Group on or before April 10, 2014. If we are not able to raise the money to make this payment by April 10, 2014 we may decide to file bankruptcy.

On December 10, 2013, we entered into the Extension Agreement with the Karlsson Group, as amended on March 7 and 12, 2014 under which we can retire all amounts owing under the Karlsson Note for $25 million provided we pay this amount on or before April 10, 2014. If we are unable to pay the $25 million on or before April 10, 2014 we will be in default of The Karlsson Group debt and the Karlsson Group could foreclose on all of our assets. A default on The Karlsson Group debt would cause the entire undiscounted amount then owing (approximately $152.1 million as of March 24, 2014) to become immediately due and payable and also cause a cross-default of our Apollo debt, which totaled approximately $7.4 million as of March 24, 2014. If we are unable to raise sufficient funds to pay the Karlsson Group debt and the Apollo debt on or before April 10, 2014, we anticipate that we would voluntarily file for bankruptcy protection rather than permit The Karlsson Group to initiate foreclosure proceedings.

If we are able to avoid defaulting on our debt, we will continue our capital raising and debt restructuring efforts. Future work on our Holbrook Project will require significant capital and will require the issuance of additional debt and/or equity securities. These requirements and the potential lack of available funding raise substantial doubt as to the Company's ability to continue as a going concern and our auditors EKS&H LLLP have issued a going concern opinion on our financial statements for the year ended March 31, 2013. Our consolidated financial statements reflect Prospect as a going concern. Our current cash situation has slowed the development of our Holbrook Project. We need significant amounts of cash to further develop the Holbrook Project.

There can be no assurance that we will be able to obtain needed funds on terms acceptable to us, or at all. In addition, there can be no assurance that our cash needs will not increase significantly in connection with the additional engineering studies required to complete a definitive feasibility study. Failure to raise the capital required for further development of the Holbrook Project will result in the delay or indefinite postponement of further development work and the potential loss of our interests in the Holbrook Project.

8

Although we have negotiated waivers and extensions under our debt agreements allowing us to avoid defaults, we may not be able to secure future waivers or extensions.

We have successfully negotiated multiple extensions, amendments and waiver with The Karlsson Group and Apollo since March 2013 in order to avoid a default and bankruptcy. We can provide no assurance that we will be able to negotiate extensions, amendments or waivers in the future that will allow us to avoid defaults.

Most of our outstanding warrants contain full ratchet anti-dilution protection and have an exercise price close to the recent trading price of our common stock as of March 24, 2014, which makes it highly likely that issuances of our common stock, at least in the short term, will trigger these highly dilutive provisions.

We have issued warrants to purchase an aggregate of approximately 11.9 million shares of our common stock, of which approximately 9.4 million are Series A Warrants containing full-ratchet anti-dilution protection for issuances below $1.50 per share. Under the Series A Warrants, any issuances of common stock (or securities exercisable or convertible into common stock) at a price below the exercise price of the warrants results in a reduction in the exercise price of the warrants to the new issuance price and a corresponding increase in the number of warrants issued. For example, if an investor held 300 warrants with an exercise price of $4.00 and we issued new shares of common stock at $3.00 per share, the strike price on the warrants would be reduced to $3.00 and the investor would receive an additional 100 warrants with a $3.00 exercise price. The sale of common stock by existing holders and the exercise of the Series A Warrants at $1.50 per share will not trigger the full ratchet anti-dilution protection.

The current exercise price of the Series A Warrants is $1.50, which is near the recent trading price of our common stock as of March 24, 2014. We require significant additional capital to continue development of the Holbrook facility which, based on the trading price of our common stock as of March 24, 2014, will most likely trigger these anti-dilution provisions.

Approval by our stockholders of a proposed warrant exchange will have a significantly dilutive effect on our outstanding common stock.

We have filed with the SEC a preliminary proxy statement for a special meeting of stockholders. Two of the proposals to be voted on at the meeting would approve exchanges of 11,472,468 of our outstanding warrants for shares of common stock where no additional consideration will be paid by the warrant holders. See "Prospectus Summary—Recent Events—Proposed Warrant Exchange for Common Stock." The issuance of these shares will nearly triple our outstanding number of shares of common stock and will have a significant dilutive effect on our 4,970,578 shares of common stock currently outstanding.

A claim for rescission of a $10.0 million investment in our November 2012 public offering could require that we raise additional capital.

We have received correspondence from a stockholder who purchased $10.0 million of shares in our November 2012 public offering asserting a right to rescind the purchase based on violation of securities laws in connection with that offering. While we believe the claim is without merit and no litigation has been commenced, the costs of defending the claim and paying any judgment resulting from the litigation could require that we raise additional capital. There can be no assurance that other investors will not bring claims against us based on federal or state securities laws alleging that our prior offerings or our filings under the Exchange Act contain defective disclosure or that our insurance carrier will provide coverage for any claims if alleged. Further, even if coverage is available, we would be liable for our retention under our policy and it is possible that any liability we ultimately incur could exceed our coverage limits. Even if we are successful in defending any such claims, securities litigation is distracting

9

to our management, may cause harm to our reputation and could adversely affect our stock price and our ability to raise capital in the future.

Our September 2013 warrant exercise transaction may have been conducted in violation of Section 5 of the Securities Act.

We may have inadvertently violated the federal and state securities laws in connection with our September 2013 warrant exercise transactions described under "Prospectus Summary—Recent Developments—Recent Financings." We conducted the transaction as a private placement under the exemption from registration under the Securities Act provided by Section 4(2) thereof. In its review of the registration statement of which this prospectus is a part the staff of the SEC indicated its concern that the exemption may not have been available from the registration requirements of Section 5 for the issuance of the securities upon exercise of our Series B-1 Warrants. The staff believes that because the initial issuance of our Series B Warrants was pursuant to a registered public offering that the subsequent exchange for Series B-1 Warrants and their exercise should have been conducted pursuant to a post-amendment to the original registration statement. Under the staff's position, participants in the September 2013 warrant transaction may be entitled to bring suit against us for recission of the transaction, which means that we would repurchase the securities issued upon exercise of the Series B-1 Warrants for the exercise price paid. If it is determined that every former holder of Series B-1 Warrants was entitled to recission rights, we could be obligated to repay up to an aggregate of approximately $3.0 million plus statutory interest. Also, the SEC and relevant state regulators could impose monetary fines or other sanctions on us as provided under relevant federal and state securities laws. Payment of significant recission obligations or fines would have a material, adverse effect on our cash flow, financial condition or prospects. If we are unable to raise funds necessary to satisfy these claims we may decide to file bankruptcy. As of March 24, 2014, we are not aware of any pending or threatened claims that the warrant exercise violated any federal or state securities laws. Based upon facts known to us at this time, we do not believe that assertion of such claims by any of our former Series B-1 Warrants is likely; however, there can be no assurance that any such claim will not be asserted in the future or that the claimant in any such action will not prevail. The possibility that such claims may be asserted in the future will continue until the expiration of the applicable federal and state statutes of limitations, which generally vary from one to three years from the date of sale. Claims under the anti-fraud provisions of the federal securities laws, if relevant, would generally have to be brought within two years of discovery, but not more than five years after occurrence. Even if we are successful in defending any such claims, securities litigation is distracting to our management, may cause harm to our reputation and could adversely affect our stock price and our ability to raise capital in the future.

We have no current revenue source and a history of operating losses, and we expect to generate operating losses for the foreseeable future. We may not achieve profitability for some time, if at all.

We have incurred losses each year since our inception. We expect to continue incurring operating losses until several months after production occurs, if ever. As of December 31, 2013, our accumulated losses were $198.2 million, which included derivative losses of $54.5 million that relate to the change in the fair value of the compound embedded derivatives of our convertible notes and warrants (see "Management's Discussion and Analysis" included elsewhere in this prospectus). The process of exploring, developing and bringing into production a producing mine is time-consuming and requires significant up-front and ongoing capital. We have not defined or delineated any proven or probable reserves at any of our properties. The development of the Holbrook Project into a producing mine will require further studies that demonstrate the economic viability of the project, necessary permits obtained, production decisions to be made and the arrangement of financing for construction and development. Our engineering work to date has been based on estimates of mineral resources, which are not mineral reserves and do not have demonstrated economic viability. There can be no assurance that a DFS will be completed on schedule or at all or that if completed the economic feasibility of the

10

Holbrook Project will be confirmed by a DFS. Few properties that are explored are ultimately developed into producing mines. We expect that we will continue to incur operating losses for the foreseeable future.

We have no history of commercially producing potash and there can be no assurance that we will ever make it to the production stage or profitably produce potash.

We have no history of commercially producing potash and no ongoing mining operations or revenue from mining operations. Many early stage mining companies never make it to the production stage. As a result, we are subject to all of the risks associated with establishing new mining operations and business enterprises, including:

- •

- the timing and cost, which can be considerable, of the construction of mining and processing facilities and related

infrastructure;

- •

- the availability and cost of skilled labor and mining equipment;

- •

- the need to obtain necessary environmental and other governmental approvals and permits, and the timing of those approvals

and permits;

- •

- the availability of funds to finance construction and development activities;

- •

- potential opposition from non-governmental organizations, environmental groups or local groups which may delay or prevent

development activities; and

- •

- potential increases in construction and operating costs due to changes in the cost of fuel, power, labor, materials and supplies and foreign exchange rates.

We currently are working toward the completion of a DFS; however, there is no guarantee that such a study will be completed on schedule, or at all, or that a completed study will confirm the economic feasibility of the Holbrook Project. Cost estimates may increase significantly as more detailed engineering work and studies are completed on a project. It is common in new mining operations to experience unexpected costs, problems and delays during development, construction and mine start-up. Accordingly, there are no assurances that our activities will result in profitable mining operations or that we will successfully establish mining operations or enter into commercial production. Our failure to enter successfully into commercial production would materially and adversely affect our business, prospects, financial condition and results of operations. In addition, there can be no assurance that our activities will produce natural resources in commercially viable quantities. There can be no assurance that sales of our natural resources production will ever generate sufficient revenues or that we will be able to sustain profitability in any future period.

Our potash supply agreement with Sichuan Chemical is subject to risks that may prevent us from realizing the benefit of the agreement or that may have a material adverse effect on our business, results of operations and financial condition.

Our agreement with Sichuan Chemical for its purchase of potash over a 10-year period may be terminated if the Holbrook Project has not achieved production by December 31, 2015. We will not achieve production by that date, and there can be no assurance that Sichuan Chemical will extend the December 31, 2015 deadline or that we will be able to commence production at all. In the event that Sichuan Chemical terminates its agreement with us, there is no guarantee that we will be able to enter into a similar agreement with another entity to purchase our potash and such an event could have a material adverse effect on our results of operations and financial condition.

In addition, the selling price of our potash to Sichuan Chemical is subject to factors beyond our control including the market price for potash in the People's Republic of China. There can be no

11

assurance that this selling price will be profitable to us and could have a material adverse effect on our results of operations and financial condition.

Furthermore, our agreement with Sichuan Chemical limits our ability to sell potash in the People's Republic of China. This may make it more difficult for us to enter into supply agreements with other parties in the future, which could have a material adverse effect on our business, financial condition and results of operations.

Our ability to attract and retain qualified contractors and staff is critical to our success. The departure of key personnel or loss of key contractors could adversely affect our business and financial condition.

We are dependent on the services of key executives including Damon Barber, our president and chief executive officer, and several key contractors. The construction and operation of a mine and mill of the size we have planned for the Holbrook Project is expected to require hundreds of workers during the construction phase and once the mine is in production. We will require many of the same skill sets sought by other natural resource companies and we will be competing with these other natural resource companies in finding qualified contractors, consultants and staffing. Since many of these skills sets are highly specialized, the market for and availability of individuals possessing these skills will be impacted by the overall health of the natural resource sector. Due to our relatively small size, the loss of these persons or the inability to attract and retain additional highly skilled employees required for the development of our activities may have a material adverse effect on our business or future operations.

Title and other rights to our mineral properties cannot be guaranteed, and we may be at risk of loss of ownership of one or more of our properties.

We cannot guarantee that legal title to our properties or mineral interests will not be challenged and, if challenged, that we would be the prevailing party with respect to such challenge. Certain of the private leases and permits we have obtained are subject to uncertain title, or title which may, in the past, have not been assigned properly. We may not have, or may not be able to obtain, all necessary property rights to develop a property. Certain of our mineral properties are, or may be, subject to prior agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We have not conducted surveys of all of the claims in which we hold a direct or indirect interest. Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained secure claims to individual leases or permits may be constrained. A successful challenge to the precise area and location of these claims could result in us being unable to explore on our properties as permitted or being unable to enforce our rights with respect to our properties. This may result in us not being compensated for our prior expenditure relating to the property or may impact our ability to develop the Holbrook Project.

We do not currently have the right to mine our properties. We are pursuing permits for the right to mine our properties but we may ultimately be unable to secure these rights. Failure to secure these rights would have a material adverse effect on our business, financial condition or results of operation.

We commissioned a technical report and an updated report in accordance with NI 43-101, which differs from the standards generally permitted in reports filed with the SEC.

We have prepared a technical report and an updated report in accordance with NI 43-101, which differs from the standards generally permitted in reports filed with the SEC. Under the first resource estimate completed in 2011, we reported indicated and inferred resources and under the updated resource estimate completed in 2012, we reported measured, indicated and inferred resources, measurements which are generally not permitted in filings made with the SEC. The estimation of measured or indicated resources involves greater uncertainty as to their existence and economic

12

feasibility than the estimation of proven and probable reserves. Investors should be aware that we have no "reserves" as defined by SEC Industry Guide 7 and much or all of the potential target mineral resources may never be confirmed or converted into SEC Industry Guide 7 compliant "reserves." The PEA, Interim Report and PFS contain estimates based on our inferred resources. However, in accordance with both Canadian statutes and NI 43-101, estimates of inferred mineral resources cannot form the basis of a feasibility study. See "Cautionary Note to Investors Regarding Mineral Disclosures" elsewhere in this prospectus.

We recently restated our financial statements and have concluded that our disclosure controls and procedures were not effective as of March 31, 2013.

We recently restated our financial statements for the fiscal years ended March 31, 2013 and 2012 and the quarterly periods ending June 30, September 30 and December 31, 2012 and June 30 and September 30, 2013 to (i) reverse stock compensation related to unvested stock option awards for former employees and board members, (ii) expense certain costs that had been previously capitalized and (iii) remove references to us being a development stage company. As a result of this restatement, our management has re-evaluated and amended its conclusions regarding the effectiveness of disclosure controls and procedures and internal control over financial reporting and concluded that our disclosure controls and procedures and internal control over financial reporting was not effective as of March 31, 2013.

There is no guarantee this offering will be successful.

There is no guarantee that we will be successful in selling securities in this offering, and we may raise little or no funds from this offering.

We are currently exploring and will continue to explore additional equity financing alternatives which could result in significant future dilution.

We need to raise additional capital to fund our operations and develop the Holbrook Project, and we are currently exploring alternatives that could involve issuing additional equity on terms that could be less favorable to us than the terms of this offering. To such extent, you will experience dilution.

The offering price determined for this offering is not an indication of our value.

The offering price of $[ ] per share (which represents approximately a [ ]% discount to the Nasdaq Capital Market closing price per share of our common stock on February 20, 2014, the last trading day before the announcement of this offering) may not necessarily bear any relationship to the book value of our assets, past operations, cash flows, losses, financial condition or any other established criteria for value. You should not consider the offering price as an indication of the value of our common stock. After the date of this prospectus, our common stock may trade at prices above or below the offering price.

Risks Related to the Mining Industry

Potash is a commodity whose selling price is highly dependent on and fluctuates with the business and economic conditions and governmental policies affecting the agricultural industry. These factors are outside of our control and may significantly affect our profitability.

Our future revenues, operating results, profitability and rate of growth will depend primarily upon business and economic conditions and governmental policies affecting the agricultural industry, which

13

we cannot control. The agricultural products business can be affected by a number of factors. The most important of these factors, for U.S. markets, are:

- •

- weather patterns and field conditions (particularly during periods of traditionally high crop nutrients consumption);

- •

- quantities of crop nutrients imported to and exported from North America;

- •

- current and projected grain inventories and prices, both of which are heavily influenced by U.S. exports and world-wide

grain markets; and

- •

- U.S. governmental policies, including farm and bio-fuel policies and subsidies, which may directly or indirectly influence the number of acres planted, the level of grain inventories, the mix of crops planted or crop prices.

International market conditions, which are also outside of our control, may also significantly influence our future operating results. The international market for crop nutrients is influenced by such factors as the relative value of the U.S. dollar and its impact upon the cost of importing crop nutrients, foreign agricultural policies, the existence of, or changes in, import barriers, or foreign currency fluctuations in certain foreign markets, changes in the hard currency demands of certain countries and other regulatory policies of foreign governments, as well as the laws and policies of the United States affecting foreign trade and investment.

In addition, as noted above, our agreement with Sichuan Chemical for the sale of potash is valued based on factors beyond our control including the then market price for potash in the People's Republic of China. If that market price would be materially lower than current prices, it could have a material adverse effect on our results and operations and financial condition. Also, Sichuan may terminate the agreement if we have not produced and sold an aggregate of 100,000 tonnes of potash from the Holbrook Basin in a 45 consecutive day period by December 31, 2015. We will not meet this condition by December 31, 2015.

Government regulation may adversely affect our business and results of operations.

Our operations and exploration and development activities are subject to extensive federal, state and local government laws and regulations, which may be changed from time to time. These laws and regulations primarily govern matters relating to:

- •

- protection of human health and the environment;

- •

- handling, storage, transportation and disposal of natural resources, including potash, or its by-products and other

substances and materials produced or used in connection with mining operations;

- •

- handling, processing, storage, transportation and disposal of hazardous materials;

- •

- management of tailings and other waste generated by our operations;

- •

- price controls;

- •

- taxation and mining royalties;

- •

- labor standards and occupational health and safety, including mine safety; and

- •

- historic and cultural preservation.

We may incur substantial additional costs to comply with environmental, health and safety law requirements related to these activities. Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining, curtailing or closing operations or requiring corrective

14

measures, the installation of additional equipment or remedial actions, any of which could result in us incurring significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws or regulations. It is also possible that future laws and regulations, or a more stringent enforcement of current laws and regulations by governmental authorities, could cause additional expense, capital expenditures, restrictions on or suspensions of our operations and delays in the exploration or development of our properties.

Our activities are subject to environmental laws and regulations that may increase our costs of doing business and restrict our operations.

All of our exploration and potential development and production activities are subject to regulation by governmental agencies under various environmental laws. Under the Comprehensive Environmental Response, Compensation, and Liability Act of 1980, or CERCLA, we could be held jointly and severally responsible for the removal or remediation of any hazardous substance contamination at future facilities, at neighboring properties to which such contamination may have migrated and at third-party waste disposal sites to which we have sent waste. We could also be held liable for natural resource damages. Liabilities under these and other environmental health and safety laws involve inherent uncertainties. Violations of environmental, health and safety laws are subject to civil, and, in some cases, criminal sanctions. As a result of liabilities under and violations of environmental, health and safety laws and related uncertainties, we may incur unexpected interruptions to operations, fines, penalties or other reductions in income, third-party claims for property damage or personal injury or remedial or other costs that may negatively impact our financial condition and operating results. Finally, we may discover currently unknown environmental problems or conditions that have been caused by previous owners or operators or that may have occurred naturally. The discovery of currently unknown environmental problems may subject us to material capital expenditures or liabilities in the future.

Environmental legislation in the United States is evolving and the trend has been toward stricter standards of enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and increasing responsibly for companies and their officers, directors and employees. There can be no assurance that future changes in environmental laws and regulations will not adversely affect our business.

Continued government and public emphasis on environmental issues can be expected to result in increased future investments in environmental controls at ongoing operations, which may lead to increased expenses. Permit renewals and compliance with present and future environmental laws and regulations applicable to our operations may require substantial capital expenditures and may have a material adverse effect on our business, financial condition and operating results.

Our current and anticipated future operations are dependent on receiving the required permits and approvals from governmental authorities. Denial or delay by a government agency in issuing any of our permits and approvals, imposition of restrictive conditions on us with respect to these permits and approvals or a failure to comply with the terms of any such permits that we have obtained may have a material effect on our business and operations.

We must obtain numerous environmental, mining and other permits and approvals from various United States federal, state and local government authorities authorizing our future operations, including further exploration and development activities and commencement of production on our properties. There can be no assurance that all permits that we require for the construction of mining facilities and to conduct mining operations will be obtainable on reasonable terms, or at all. A decision by a government agency to delay or deny a permit or approval, or a failure to comply with the terms of any such permits or approval that we have obtained, may delay the completion of a DFS on the Holbrook Project or may interfere with our planned development of this property and have a material adverse effect on our business, financial condition or results of operations.

15

Our properties may not yield resources in commercially viable quantities or revenues that are sufficient to cover our cost of operations.

Resource figures presented in our filings with the SEC, press releases and other public statements that may be made from time to time are based upon estimates made by independent technical experts. These estimates are imprecise and depend upon geologic interpretation and statistical inferences drawn from drilling and sampling analysis, which may prove to be unreliable. Even the use of geological data and other technologies and the study of producing mines in the same area will not enable us to know conclusively prior to mining whether resources will be present or, if present, whether in the quantities and grades expected. There can be no assurance that our estimates will be accurate or that any of our properties will yield resources in sufficient grades or quantities to recover our mining and development costs.

Resource estimates for our properties may require adjustments or downward revisions based upon further exploration or development work or actual production experience. There can be no assurance that recovery of minerals in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

The resource estimates contained in our public filings have been determined and valued based on assumed future prices, cut-off grades, recovery rates, extraction rates and operating costs that may prove to be inaccurate. Extended declines in market prices for potash may render portions of our mineralization and resource estimates uneconomic and result in reduced reported mineralization or adversely affect the commercial viability of one or more of our properties. Any material reductions in estimates of mineralization, or of our ability to extract this mineralization, could have a material adverse effect on our results of operations or financial condition.

We are subject to the risks of doing business internationally as we attempt to enter into contracts with international companies.

Our business operations are primarily conducted in the United States. However, we plan to do business with companies outside of the United States. The laws, regulations and policies in these countries may be different from those typically found in the United States. For example, our current potash supply agreement with Sichuan Chemical is governed by the laws of Hong Kong. Our international business relationships are subject to the financial and operating risks of conducting business internationally, including, but not limited to: unexpected changes in or impositions of legislative or regulatory requirements; potential hostilities and changes in diplomatic and trade relationships; local economic and political conditions; and political instability. The risks inherent in doing business internationally may have a material adverse effect on our business, operating results, and financial condition.

We face competition from larger companies having access to substantially more resources than we possess.

Our competitors include other mining companies and fertilizer producers in the United States and globally, including state-owned and government-subsidized entities. Many of these competitors are large, well-established companies having substantially larger operating staffs and greater capital resources than we do. We may not be able to conduct our operations successfully, evaluate and select suitable properties and consummate transactions in this highly competitive environment. Specifically, these larger competitors may be able to pay more for exploratory prospects and productive mineral properties and may be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. We may also encounter increasing competition from other mining companies in our efforts to hire the experienced mining professionals necessary to conduct our operations and advance our properties. In addition, such companies may be able to expend greater resources on the existing and changing technologies that we believe are and will

16

be increasingly important to attaining success in the industry. Our inability to compete with other companies for these resources would have a material adverse effect on our results of operations, financial condition and cash flows.

Our business is inherently dangerous and involves many operating risks that are beyond our control, which may have a material adverse effect on our business.

Our operations are subject to hazards and risks associated with the exploration, development and mining of natural resources and related fertilizer materials and products, such as:

- •

- fires;

- •

- flooding;

- •

- power outages;

- •

- explosions;

- •

- inclement weather and natural disasters;

- •

- mechanical failures;

- •

- rock failures and mine roof collapses;

- •

- unscheduled downtime;

- •

- industrial accidents;

- •

- environmental hazards such as chemical spills, discharges or release of toxic or hazardous substances, storage tank leaks;

and

- •

- availability of needed equipment at acceptable prices.

Any of these risks can cause substantial losses resulting from:

- •

- injury or loss of life;

- •

- damage to and destruction of property, natural resources and equipment;

- •

- pollution and other environmental damage;

- •

- regulatory investigations and penalties;

- •

- revocation or denial of our permits;

- •

- suspension of our operations; and

- •

- repair and remediation costs.

We do not currently maintain insurance against all of the risks described above. In the future we may not be able to obtain insurance at premium levels that justify its purchase, if at all. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to us or other companies within the mining industry. We may also experience losses in amounts in excess of the insurance coverage carried. We may suffer a material adverse impact on our business if we incur losses in excess of our insurance coverage carried or losses related to any significant events that are not covered by our insurance policies.

17

The mining industry is capital intensive and the ability of a mining company to raise the necessary capital can be impacted by factors beyond its control.

The upfront cost incurred for the acquisition, exploration and development of a mining project can be substantial, and the ability of a mining company to raise that capital can be influenced by a number of factors beyond the company's control including but not limited to general economic conditions, political turmoil, market demand, commodity prices and expectations for commodity prices, debt and equity market conditions and government policies and regulations.

Once in production, mining companies require annual maintenance capital in order to sustain their operations. This sustaining capital can also be substantial and may have to be secured from external sources to the extent cash flows from operations are insufficient.

Future cash flow from operations is subject to a number of variables, including:

- •

- the quality of the resource base and the grade of those resources;

- •

- the quantity of materials mined:

- •

- the cost to mine the materials; and

- •

- the prices at which the mined materials can be sold.

Any one of these variables can materially affect a mining company's ability to fund its sustaining capital needs.

If our future revenues are adversely affected as a result of lower potash prices, including those related to sales pursuant to our agreement with Sichuan Chemical, operating difficulties, declines in reserves or for any other reason, we may have limited ability to obtain the capital necessary to undertake or complete future mining projects. We may, from time to time, seek additional financing, either in the form of bank borrowings, sales of debt or equity securities or other forms of financing or consider selling non-core assets to raise operating capital. However, we may not be able to obtain additional financing or make sales of non-core assets upon terms acceptable to us.

New sources of supply can create structural market imbalances, which could negatively affect our operating results and financial performance.

Potash supply and demand has been volatile. If production increases to the point where the market is over supplied, the price at which we are able to sell and the volumes we are able to sell could be impacted, which may materially and adversely affect our projected business, operating results and financial condition.

Variations in crop nutrient application rates may exacerbate the nature of the prices and demand for our products.

Farmers are able to maximize their economic return by applying optimum amounts of crop nutrients. Farmers' decisions about the application rate for each crop nutrient, or to forego application of a crop nutrient, particularly phosphate and potash, vary from year to year depending on a number of factors, including among others, crop prices, crop nutrient and other crop input costs or the level of the crop nutrient remaining in the soil following the previous harvest. Farmers are more likely to increase application rates when crop prices are relatively high, crop nutrient and other crop input costs are relatively low and the level of the crop nutrient remaining in the soil is relatively low. Conversely, farmers are likely to reduce or forego application when farm economics are weak or declining or the level of the crop nutrients remaining in the soil is relatively high. This variability in application rates can materially aggravate the cyclicality of prices for our future products and our sales volumes.

18

Risks Relating to our Common Stock

We have been notified by NASDAQ that we have failed to satisfy a continuing listing rule and are subject to delisting from The NASDAQ Stock Market following an appeal hearing.

On April 25, 2013, we received written notification from The NASDAQ Stock Market that we are no longer in compliance with NASDAQ Listing Rule 5550(b)(2) because the market value of our listed securities has fallen below the $35 million minimum requirement for continued listing on the NASDAQ Capital Market for a period of at least 30 consecutive business days. Under NASDAQ Listing Rule 5810(c)(3)(C), we had 180 calendar days to regain compliance. Compliance can be achieved by meeting the $35 million minimum requirement for market value of listed securities for a minimum of 10 consecutive business days during the 180-day compliance period.

On October 23, 2013 we received written notification from The NASDAQ Stock Market that we have not regained compliance during that period and that our common stock would be delisted at the open of business on November 1, 2013. The NASDAQ rules permitted us to appeal the delisting determination to a NASDAQ Hearing Panel, and on December 11, 2013 our appeal was heard by NASDAQ. The Panel extended the time for us to regain compliance with the market value of listed securities rule to February 28, 2014, which has at our request been extended by the Panel to March 31, 2014. We will not regain compliance by March 31, 2014 and intend to request an additional extension. Under the NASDAQ rules we must regain compliance by April 21, 2014 or we will be delisted.

The market price and trading volume of our common stock has been volatile, and you may lose all or part of your investment.

Our common stock began trading on The NASDAQ Capital Market under the symbol "PGRX" on July 2, 2012. On September 4, 2013 we effected a 1-for-50 reverse stock split. The high and low sale prices of our common stock on The NASDAQ Capital Market since trading commenced, adjusted for the stock split, has been $230.00 and $1.45, respectively.

The price of our common stock has fluctuated and may fluctuate in the future in response to many factors, including:

- •

- the perceived prospects for natural resources in general;

- •

- differences between our actual financial and operating results and those expected by investors;

- •

- changes in the share price of public companies with which we compete;

- •

- news about our industry and our competitors;

- •

- changes in general economic or market conditions including broad market fluctuations;

- •

- the public's reaction to press releases and other public announcements and filings with the SEC;

- •

- arrival or departure of key personnel;

- •

- acquisitions, strategic alliances or joint ventures involving us or our competitors;

- •

- adverse regulatory actions; and

- •

- other events or factors, many of which are beyond our control.

Our shares may trade at prices significantly below current levels, in which case holders of the shares may experience difficulty in reselling, or an inability to sell, the shares. In addition, when the market price of a company's common equity drops significantly, stockholders often institute securities class action lawsuits against the company. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources away from the day-to-day operations of our business.

19

Our articles of incorporation permit us to issue debt securities with voting rights which would dilute the voting power of the holders of our common stock.

Our articles of incorporation permit us to issue debt securities with voting rights as permitted by Nevada corporate law. We do not have any debt securities with voting rights outstanding as of March 24, 2014. Holders of voting debt securities may have different interests than stockholders and may vote in accordance with those interests. Issuances of debt securities with voting rights could also have an anti-takeover effect, in that it could make a change in control or takeover of us more difficult. For example, we could grant voting rights to debt holders so as to dilute the voting rights of persons seeking to obtain control of us. Similarly, voting rights could be granted to debt holders allied with our management and could have the effect of making it more difficult to remove our current management by diluting the voting rights of persons seeking to cause such removal.

Future sales or issuances of shares of common stock or the exercise of our outstanding warrants may decrease the value of our existing common stock, dilute existing shareholders and depress the market price of our common stock. The substantial majority of our outstanding warrants contain full ratchet anti-dilution protection which can be highly dilutive to stockholders. We may also issue additional shares of our common stock or securities convertible into our common stock in the future.

We have issued warrants to purchase an aggregate of approximately 11.9 million shares of our common stock, of which approximately 9.4 million have full-ratchet anti-dilution protection. See "Risk Factors—Risks Related to our Financial Condition and Business. All of these warrants having anti-dilution protection have an exercise price near the recent trading price of our common stock as of March 24, 2014, which makes it highly likely that issuances of our securities, at least in the short term, will trigger these highly dilutive provisions.

As described under "Prospectus Summary—Restructuring of Senior Unsecured Debt" we have recently agreed with the holders of our $7.3 million (principal and accrued interest) of senior unsecured notes to issue them shares of common stock with an aggregate value equal to 17% of the amounts owed under their notes as full extinguishment of such debt, provided we are able to retire our Karlsson Group senior secured debt on or prior to April 10, 2014. If we are not be able to raise the money to pay off the Karlsson Group debt on or before April 10, 2014 we may decide to file bankruptcy.