Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Sunshine Biopharma, Inc | Financial_Report.xls |

| EX-32 - CERTIFICATION - Sunshine Biopharma, Inc | sbfm_ex32.htm |

| EX-31.1 - CERTIFICATION - Sunshine Biopharma, Inc | sbfm_ex311.htm |

| EX-31.2 - CERTIFICATION - Sunshine Biopharma, Inc | sbfm_ex312.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

__________________

FORM 10-K

__________________

(Mark one)

| þ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2013

|

| o |

TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF

1934 for the transition period from ________________ to________________________.

|

Commission File Number 000-52898

SUNSHINE BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

|

Colorado

|

20-5566275

|

|

|

(State or other jurisdiction of

Incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

469 Jean-Talon West

3rd Floor

Montreal, Quebec, Canada H3N 1R4

(Address of principal executive offices)

(514) 764-9698

(Issuer’s Telephone Number)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Act. Yes o No þ

Indicate by check mark whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o |

| Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No þ

The aggregate market value of the shares of voting stock held by non-affiliates of the Registrant as of March 18, 2014 was $5,242.110.

As of March 18, 2014, the Registrant had 62,175,728 shares of Common Stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE - None

TABLE OF CONTENTS

|

Facing Page

|

Page No.

|

|

|

Index

|

||

|

PART I

|

||

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

7

|

|

Item 1B.

|

Unresolved Staff Comments

|

18

|

|

Item 2

|

Properties

|

18

|

|

Item 3.

|

Legal Proceedings

|

18

|

|

Item 4.

|

Mine Safety Disclosures

|

18

|

|

PART II

|

||

|

Item 5.

|

Market for the Registrant’s Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

19

|

|

Item 6.

|

Selected Financial Data

|

21

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

20

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

24

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

25

|

|

Item 9.

|

Changes in and Disagreements on Accounting and Financial Disclosure

|

26

|

|

Item 9A.

|

Controls and Procedures

|

26

|

|

Item 9B.

|

Other Information

|

27

|

| 27 | ||

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

28

|

|

Item 11.

|

Executive Compensation

|

29

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

29

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

30

|

|

Item 14.

|

Principal Accounting Fees and Services

|

30

|

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

31

|

|

Signatures

|

32

|

2

FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Act of 1934. The statements regarding Sunshine Biopharma Inc. contained in this Report that are not historical in nature, particularly those that utilize terminology such as “may,” “will,” “should,” “likely,” “expects,” “anticipates,” “estimates,” “believes” or “plans,” or comparable terminology, are forward-looking statements based on current expectations and assumptions, and entail various risks and uncertainties that could cause actual results to differ materially from those expressed in such forward-looking statements.

Important factors known to us that could cause such material differences are identified in this Report and in our “Risk Factors” in Item 1A. We undertake no obligation to correct or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised, however, to consult any future disclosures we make on related subjects in future reports to the SEC.

PART I

ITEM 1.BUSINESS

History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” Until October 2009 our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies.

Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation, in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction we changed our name to “Sunshine Biopharma, Inc.” On December 21, 2011, Advanomics Corporation, a privately held Canadian company (“Advanomics”), and our licensor, exercised its right to convert the 850,000 shares of Series “A” Preferred Stock it held in our Company into 17,000,000 shares of Common Stock.

Description of Current Business

We are currently a pharmaceutical company focused on the research, development and commercialization of drugs for the treatment of various forms of cancer. The preclinical studies for our lead compound, Adva-27a, a multi-purpose antitumor compound, were successfully completed in late 2011. We are now continuing our clinical development of Adva-27a by conducting the next sequence of steps comprised of Good Manufacturing Practice (“GMP”) manufacturing, Investigational New Drug (“IND”)-enabling studies, regulatory filing and Phase I clinical trials. We plan to conduct our Phase I clinical trials for Adva-27a at the Jewish General Hospital, Montreal, Canada, one of McGill University’s Hospital Centers. The planned indication will be multidrug resistant breast cancer and in parallel pancreatic cancer as a second indication. In addition to other cancer types, Adva-27a has shown a positive effect on these two types of cancer for which there is currently little or no treatment options available. See “Clinical Trials” below.

We have licensed our technology on an exclusive basis from Advanomics, and we are planning to initiate our own research and development program as soon as practicable once financing is in place. There are no assurances that we will obtain the financing necessary to allow us to implement this aspect of our business plan, or to enter clinical trials.

3

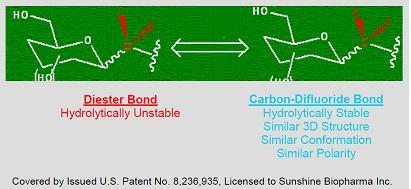

Carbon-Difluoride Platform Technology

Many therapeutically important compounds contain diester bonds that link different parts of the molecule together. Diester bonds are naturally unstable often leading to suboptimal performance when the molecule is administered to patients. Diester bonds have specific three-dimensional, as well as electrostatic properties that cannot be easily mimicked by other bonds. Bonds that do not mimic the diester bond correctly invariably render the compound inactive. In collaboration with Institut National des Sciences Appliquées de Rouen in France (“INSA”), Advanomics has developed a way to replace the diester bond with a Carbon-Difluoride bond which acts as a diester isostere. An isostere is a different chemical structure that mimics the properties of the original. In the body, Carbon-Difluoride compounds are resistant to metabolic degradation but recognized similarly to the diester compounds (see Figure 1).

Figure 1

While no assurances can be provided, we are planning to expand our product line through acquisitions and/or in-licensing as well as in-house research and development.

Our Lead Compound (Adva-27a)

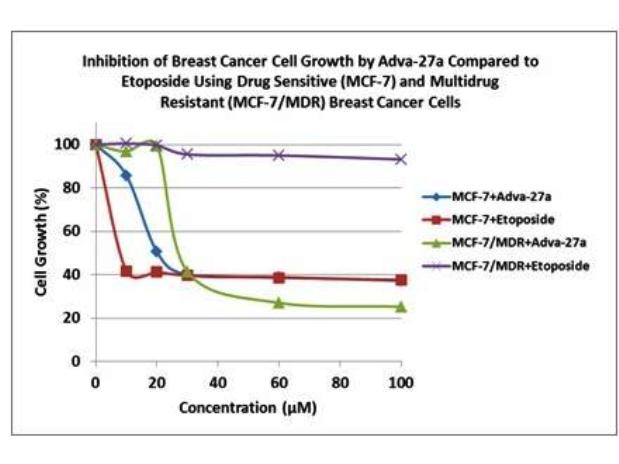

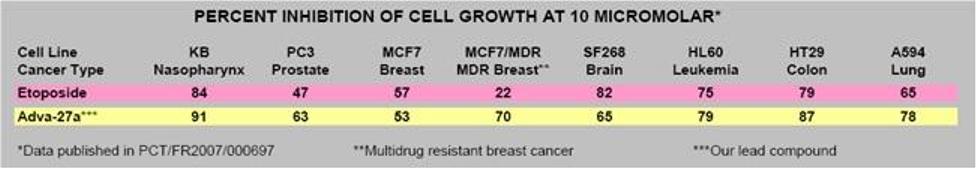

Our initial drug candidate is Adva-27a, a GEM-difluorinated C-glycoside derivative of Podophyllotoxin, targeted for various forms of cancer. If we are successful in our current financing efforts, Adva-27a is expected to enter Phase I clinical trials for multidrug resistant breast cancer and pancreatic cancer in mid to late 2015 (see “Clinical Development Path” and “Clinical Trials” below). Etoposide, which is also a derivative of Podophyllotoxin, is currently on the market and is used to treat various types of cancer including leukemia, lymphoma, testicular cancer, lung cancer, brain cancer, prostate cancer, bladder cancer, colon cancer, ovarian cancer, liver cancer and several other forms of cancer. Like Etoposide, Adva-27a is a Topoisomerase II inhibitor; however, unlike Etoposide and other anti-tumor drugs currently in use, Adva-27a is able to destroy multidrug resistant cancer cells. Adva-27a is a new chemical entity and has been shown to have distinct and more desirable biological properties compared to Etoposide. Most notably, Adva-27a is very effective against multidrug resistant breast cancer cells while Etoposide has no activity against this aggressive form of cancer (see Figure 2). In other side-by-side studies against Etoposide as a reference, Adva-27a showed markedly improved cell killing activity in various other cancer types, particularly prostate, uterine, pancreatic, colon and lung cancer (see Table 1). Our preclinical studies to date have shown that:

|

●

|

Adva-27a is effective at killing different types of multidrug resistant cancer cells, including:

|

|

-

|

Breast Cancer Cells (MCF-7/MDR)

|

|

-

|

Small-Cell Lung Cancer Cells (H69AR)

|

|

-

|

Uterine Cancer Cells (MES-SA/Dx5)

|

|

-

|

Pancreatic Cancer Cells (Panc-1)

|

4

|

●

|

Adva-27a is unaffected by P-Glycoprotein, the major enzyme responsible for making cancer cells resistant to anti-tumor drugs.

|

|

●

|

Adva-27a has excellent clearance time (half-life = 54 minutes) as indicated by human microsomes stability studies and pharmacokinetics data in rats.

|

|

●

|

Adva-27a clearance is independent of Cytochrome P450, a mechanism that is less likely to produce toxic intermediates.

|

|

●

|

Adva-27a is an excellent inhibitor of Topoisomerase II with an IC50 of only 13.7 micromolar.

|

|

●

|

Adva-27a has shown excellent pharmacokinetics profile as indicated by studies done in rats.

|

|

●

|

Adva-27a does not inhibit tubulin assembly.

|

These and other preclinical data have recently been published in ANTICANCER RESEARCH, a peer-reviewed International Journal of Cancer Research and Treatment. The manuscript entitled “Adva-27a, a Novel Podophyllotoxin Derivative Found to Be Effective Against Multidrug Resistant Human Cancer Cells” appeared in print in the October 2012 issue of the journal [ANTICANCER RESEARCH 32: 4423-4432 (2012)]. A copy of the full manuscript as it appeared in the journal is available on our website at www.sunshinebiopharma.com.

Figure 2

Table 1

5

Clinical Development Path

The early stage preclinical studies for our lead compound, Adva-27a, were successfully completed in late 2011 and the results have recently been published [ANTICANCER RESEARCH 32: 4423-4432 (2012)]. We are now continuing our clinical development program of Adva-27a by conducting the next sequence of steps comprised of the following:

|

●

|

GMP Manufacturing (for use in IND-Enabling Studies and Phase I Clinical Trials)

|

|

●

|

IND-Enabling Studies

|

|

●

|

Regulatory Filing (Fast-Track Status Anticipated)

|

|

●

|

Phase I Clinical Trials (Multidrug Resistant Breast Cancer and Pancreatic Cancer as a second indication)

|

Clinical Trials

Adva-27a’s initial indication will be multidrug resistant breast cancer for which there are little or no treatment options. In June 2011 we concluded an agreement with McGill University’s Jewish General Hospital in Montreal, Canada to conduct Phase I clinical trials for this and other indications. In January 2014, we announced that we will be conducting clinical trials for pancreatic cancer as a second indication in parallel. All aspects of the planned clinical trials in Canada will employ U.S. Food and Drug Administration (“FDA”) standards at all levels. We anticipate that the clinical trials will be completed by late 2016, at which time we expect to file for limited marketing approval for “compassionate-use” with the regulatory authorities in Canada and the FDA in the U.S. See “Marketing,” below.

Marketing

According to the American Cancer Society, nearly 1.5 million new cases of cancer are diagnosed in the U.S. each year. Given the terminal and limited treatment options available for the multidrug resistant breast cancer indication we are planning to study, we anticipate being granted limited marketing approval (“compassionate-use”) for our Adva-27a following receipt of funding and a successful Phase I clinical trial. There are no assurances that either will occur. Such limited approval will allow us to make the drug available to various hospitals and health care centers for experimental therapy and/or “compassionate-use”, thereby generating revenues in the near-term.

We believe that upon successful completion of Phase I Clinical Trials we may receive one or more offers from large pharmaceutical companies to buyout or license our drug. However, there are no assurances that our Phase I Trials will be successful, or if successful, that any pharmaceutical companies will make an acceptable offer to us. In the event we do not consummate such a transaction, we will require significant capital in order to manufacture and market our new drug.

Intellectual Property

We are the exclusive licensee for the U.S. of Advanomics’ Adva-27a which is covered by international patent applications filed on April 27, 2007 (PCT/FR2007/000697). These patent applications, which are now issued in Europe and the United States (US 8,236,935) and which are still pending elsewhere around the world, were originally owned by Institut National des Sciences Appliquées de Rouen (France) and have recently been purchased by Advanomics. On January 14, 2013, Advanomics filed a new patent application covering Adva-27a manufacturing processes as well as new Adva-27a derivatives and compositions.

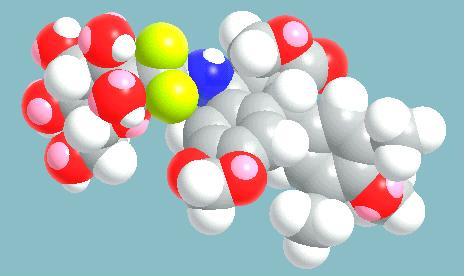

Space-Filling Model of Our Lead Anti-Cancer Compound, Adva-27a

6

Government Regulations

Our existing and proposed business operations are subject to extensive and frequently changing federal, state, provincial and local laws and regulations. We will be subject to significant regulations in the U.S. in order to obtain the approval of the FDA to offer our product on the market. The approximate procedure for obtaining FDA approval involves an initial filing of an IND application following which the FDA would give the go ahead with Phase I clinical (human) trials. Following completion of Phase I, the results are filed with the FDA and a request is made to proceed to Phase II. Similarly, following completion of Phase II the data are filed with the FDA and a request is made to proceed to Phase III. Following completion of Phase III, a request is made for marketing approval. Depending on various issues and considerations, the FDA could provide limited marketing approval on a humanitarian basis if the drug treats terminally ill patients with limited treatment options available. As of the date of this Report we have not made any filings with the FDA or other regulatory bodies in other jurisdictions. We have however had extensive discussions with clinicians at the McGill University’s Jewish General Hospital in Montreal where we plan to undertake our Phase I study for multidrug resistant breast cancer. They believe that Health Canada is likely to grant us a so-called fast-track process on the basis of the terminal nature of the cancer which we will be treating. There are no assurances this will occur.

Employees

As of the date of this Report we have three (3) employees, our management. We anticipate that if we receive financing we will hire additional employees in the areas of accounting, regulatory affairs, marketing and laboratory personnel.

Competition

We will be competing with publicly and privately held companies engaged in developing cancer therapies. There are numerous other entities engaged in this business that have greater resources, both financial and otherwise, than the resources presently available to us. Nearly all major pharmaceutical companies including Amgen, Roche, Pfizer, Bristol-Myers Squibb and Novartis, to name just a few, have on-going anti-cancer drug development programs and some of the drug they may develop could be in direct competition with our drug. Also, a number of small companies are also working in the area of cancer and could develop drugs that may be in competition with ours. However, none of these competitor companies can use molecules similar to ours as they would be infringing our patents.

Trademarks - Tradenames

We are the exclusive licensee for the U.S. of Advanomics’ Adva-27a which is covered by international patent applications filed on April 27, 2007 (PCT/FR2007/000697). These patent applications, which are now issued in Europe and the United States (US 8,236,935) and which are still pending elsewhere around the world, were originally owned by Institut National des Sciences Appliquées de Rouen (France) and have recently been purchased by Advanomics.

ITEM 1A. RISK FACTORS

An investment in our Common Stock is a risky investment. Prospective investors should carefully consider the following risk factors before purchasing shares of our Common Stock. We believe that we have included all material risks.

We may not be able to continue as a going concern or fund our existing capital needs.

Our independent registered public accounting firm included an explanatory paragraph in their report included herein on our financial statements related to the uncertainty in our ability to continue as a going concern. The paragraph stated that we do not have sufficient cash on-hand or other funding available to meet our obligations and sustain our operations, which raises substantial doubt about our ability to continue as a going concern. Our cash and cash equivalents were sufficient to fund our existing development commitments, indebtedness and general operating expenses through December 31, 2014; however, we will not be generating any product-based revenues or realizing cash flows from operations in the near term, if at all, and may not have sufficient cash or other funding available to complete our anticipated business activities during 2014.

7

We have incurred losses in the past and expect to incur greater losses until we implement our business plan.

We are a development stage company and we have not yet begun generating revenues and we do not expect to begin generating revenues until the clinical trials for our sole product candidate is completed and is successful. In particular, our multi-purpose anti-tumor compound, Adva-27a, expects to be entering Phase I clinical trials for multidrug resistant breast cancer indication during 2014, provided that we are successful in obtaining the funding necessary to conduct these trials. We expected that we would begin these clinical trials during 2012, but were unable to secure sufficient funding to undertake this activity. There can be no assurances that we will be successful in raising the funds necessary to conduct these trials. Further, there can be no assurance that the results obtained from laboratory or research studies will be replicated in human studies or that such human studies will not identify undesirable side effects. There can be no assurance that any of our therapeutic products will meet applicable health regulatory standards, obtain required regulatory approvals or clearances, be produced in commercial quantities at reasonable costs, be successfully marketed or be profitable enough that we will recoup the investment made in such product candidates.

We are a development stage company and may never attain product sales.

We have not received approval for any of our product candidates from the FDA. Any compounds that we discover or in-license will require extensive and costly development, preclinical testing and/or clinical trials prior to seeking regulatory approval for commercial sales. Our most advanced product candidate, Adva-27a, and any other compounds we discover, develop or in-license, may never be approved for commercial sale. The time required to attain product sales and profitability is lengthy and highly uncertain, and we cannot assure you that we will be able to achieve or maintain product sales.

We expect our net operating losses to continue for at least several years, and we are unable to predict the extent of future losses or when we will become profitable, if ever. We have incurred significant net losses since our formation in 2009. We have incurred an accumulated deficit of $5,494,149 as of December 31, 2013. Our operating losses are due in large part to the significant research and development costs required to identify, validate and license potential product candidates, conduct preclinical studies and conduct clinical trials of our more advanced product candidates. To date, we have not generated any revenues and we do not anticipate generating any revenues in the near term, if ever. We expect to increase our operating expenses over the next several years as we plan to:

● Prepare and carry out for the development of Adva-27a;

● Expand our research and development activities;

● Increase our required corporate infrastructure and overhead.

As a result, we expect to continue to incur significant and increasing operating losses for the foreseeable future. Because of the numerous risks and uncertainties associated with our research and product development efforts, we are unable to predict the extent of any future losses or when we will become profitable, if ever. Even if we do achieve profitability, we may not be able to sustain or increase profitability on an ongoing basis.

We have not conducted any significant business operations yet and have been unprofitable to date.

There is no prior operating history by which to evaluate the likelihood of our success or our contribution to our overall profitability. We may never complete clinical trials of our product and commence significant operations or, if we do complete these clinical trials there are no assurances that the results will be positive.

8

We will require additional funding to satisfy our future capital needs, and future financing strategies may adversely affect holders of our Common Stock.

Our operations will require significant additional funding in large part due to our research and development expenses, future preclinical and clinical testing costs, and the absence of any meaningful revenues in the near future. We do not know whether additional financing will be available to us on favorable terms or at all. If we cannot raise additional funds, we may be required to reduce our capital expenditures, scale back product development programs, reduce our workforce and license to others products or technologies that we may otherwise be able to commercialize.

To the extent we raise additional capital by issuing equity securities our stockholders could experience substantial dilution. Any additional equity securities we issue or issuances of debt we may enter into or undertake may have rights, preferences or privileges senior to those of existing holders of stock. To the extent that we raise additional funds through collaboration and licensing arrangements, we may be required to relinquish some rights to our technologies or product candidates, or grant licenses on terms that are not favorable to us.

We have not recorded any revenues from the sale of therapeutic products, have accumulated significant losses since inception and expect to continue to incur losses in the future.

There can be no assurance that we will ever be able to achieve or sustain sufficient sales or other revenue growth in order to achieve profitability or positive cash flow. To become profitable we, either alone or with one or more partners, must develop, manufacture and successfully market therapeutic product candidates. There can be no assurance that we will be successful in achieving the sales levels required to achieve profitability. In addition, lower than anticipated revenues may negatively impact our cash flows, which could accelerate the need for additional capital.

The FDA may change its approval policies or requirements, or apply interpretations to its policies or requirements, in a manner that could delay or prevent commercialization of Adva-27a.

Regulatory requirements may change in a manner that requires us to conduct additional clinical trials, which may delay or prevent commercialization of Adva-27a. We cannot provide any assurance that the FDA will not require us to repeat existing studies or conduct new or unforeseen experiments in order to demonstrate the safety and efficacy of Adva-27a before considering the approval of Adva-27a for the treatment of lung cancer or breast cancer indication. Further, FDA Advisory Panel meetings discussing such drug approvals may result in the heightened scrutiny of Adva-27a for the treatment of lung cancer or breast cancer.

Our business would be materially harmed if we fail to obtain FDA approval of a New Drug Application (“NDA”) for Adva-27a.

We anticipate that our ability to generate any significant product revenues in the near future will depend solely on the successful development and commercialization of Adva-27a. The FDA may not approve in a timely manner, or at all, the NDA that we submit. If we are unable to submit an NDA for other product candidates, or if the NDA we submitted is not approved by the FDA, we will be unable to commercialize those product in the United States and our business will be materially harmed. The FDA can and does reject NDAs, and often requires additional clinical trials, even when product candidates performed well or achieved favorable results in large-scale Phase III clinical trials. The FDA imposes substantial requirements on the introduction of pharmaceutical products through lengthy and detailed laboratory and clinical testing procedures, sampling activities and other costly and time-consuming procedures. Satisfaction of these requirements typically takes several years and may vary substantially based upon the type and complexity of the pharmaceutical product. Our product candidates are novel compounds or new chemical entities, which may further increase the period of time required for satisfactory testing procedures.

9

Data obtained from preclinical and clinical activities are susceptible to varying interpretations, which could delay, limit or prevent regulatory approval. In addition, delays or rejections may be encountered based on changes in, or additions to, regulatory policies for drug approval during the period of product development and regulatory review. The effect of government regulation may be to delay or prevent the commencement of clinical trials or marketing of our product candidates for a considerable period of time, to impose costly procedures upon our activities and to provide an advantage to our competitors that have greater financial resources or are more experienced in regulatory affairs. The FDA may not approve our product candidates for clinical trials or marketing on a timely basis or at all. Delays in obtaining or failure to obtain such approvals would adversely affect the marketing of our product candidates and our liquidity and capital resources.

Drug products and their manufacturers are subject to continual regulatory review after the product receives FDA approval. Later discovery of previously unknown problems with a product or manufacturer may result in additional clinical testing requirements or restrictions on such product or manufacturer, including withdrawal of the product from the market. Failure to comply with applicable regulatory requirements can, among other things, result in fines, injunctions and civil penalties, suspensions or withdrawals of regulatory approvals, product recalls, operating restrictions or shutdown and criminal prosecution. We may lack sufficient resources and expertise to address these and other regulatory issues as they arise.

We may be sued or become a party to litigation, which could require significant management time and attention and result in significant legal expenses and may result in an unfavorable outcome which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

While we have no knowledge of any threatened litigation matters, we may be subject to lawsuits from time to time arising in the ordinary course of our business. We may be forced to incur costs and expenses in connection with defending ourselves with respect to such litigation and the payment of any settlement or judgment in connection therewith if there is an unfavorable outcome. The expense of defending litigation may be significant. The amount of time to resolve lawsuits is unpredictable and defending ourselves may divert management’s attention from the day-to-day operations of our business, which could adversely affect our business, results of operations and cash flows. In addition, an unfavorable outcome in any such litigation could have a material adverse effect on our business, results of operations and cash flows.

Holders of our Common Stock may suffer significant dilution in the future.

In order to fully implement our business plan we will require additional capital, either debt or equity, or both. As a result, we expect to raise additional equity capital by selling shares of our Common Stock or other securities in the future to raise the funds necessary to allow us to implement our business plan. If we do so, investors will suffer significant dilution.

Our management and principal shareholders have the ability to significantly influence or control matters requiring a shareholder vote and other shareholders may not have the ability to influence corporate transactions.

Currently, Dr. Steve N. Slilaty owns, either directly or indirectly, approximately 51.1% of our outstanding voting securities. As a result, he has the ability to determine the outcome on all matters requiring approval of our shareholders, including the election of directors and approval of significant corporate transactions.

If we are unable to attract and retain qualified scientific, technical and key management personnel, or if our key executive, Dr. Steve N. Slilaty, discontinues his employment with us, it may delay our research and development efforts.

We rely on the services of Dr. Slilaty for strategic and operational management, as well as for scientific and/or medical expertise in the development of our products. The loss of Dr. Slilaty would result in a significant negative impact on our ability to implement our business plan. We have not entered into an employment agreement with any member of our management, including Dr. Slilaty. In addition, we do not maintain “key person” life insurance covering Dr. Slilaty or any other executive officer. The loss of Dr. Slilaty will also significantly delay or prevent the achievement of our business objectives.

10

Our business will expose us to potential product liability risks and there can be no assurance that we will be able to acquire and maintain sufficient insurance to provide adequate coverage against potential liabilities.

Our business will expose us to potential product liability risks that are inherent in the testing, manufacturing and marketing of pharmaceutical products. The use of our product candidates in clinical trials also exposes us to the possibility of product liability claims and possible adverse publicity. These risks will increase to the extent our product candidates receive regulatory approval and are commercialized. We do not currently have any product liability insurance, although we plan to obtain product liability insurance in connection with future clinical trials of our product candidates. There can be no assurance that we will be able to obtain or maintain any such insurance on acceptable terms. Moreover, our product liability insurance may not provide adequate coverage against potential liabilities. On occasion, juries have awarded large judgments in class action lawsuits based on drugs that had unanticipated side effects. A successful product liability claim or series of claims brought against us would decrease our cash reserves and could cause our stock price to fall significantly.

We face regulation and risks related to hazardous materials and environmental laws, violations of which may subject us to claims for damages or fines that could materially affect our business, cash flows, financial condition and results of operations.

Our research and development activities involve the use of controlled and/or hazardous materials and chemicals. The risk of accidental contamination or injury from these materials cannot be completely eliminated. In the event of an accident, we could be held liable for any damages or fines that result, and the liability could have a material adverse effect on our business, financial condition and results of operations. We are also subject to federal, state and local laws and regulations governing the use, manufacture, storage, handling and disposal of hazardous materials and waste products. If we fail to comply with these laws and regulations or with the conditions attached to our operating licenses, the licenses could be revoked, and we could be subjected to criminal sanctions and substantial liability or be required to suspend or modify our operations. In addition, we may have to incur significant costs to comply with future environmental laws and regulations. We do not currently have a pollution and remediation insurance policy.

We do not have any agreements with any collaborators or third party manufacturers to manufacture our products. If and when we do reach an agreement with these parties, they may not be able to manufacture our product candidates, which would prevent us from commercializing our product candidates.

If any of our product candidates is approved by the FDA or other regulatory agencies for commercial sale, we will need third parties to manufacture the product in larger quantities. If we are able to reach an agreement with any collaborator or third party manufacturer in the future, of which there can be no assurance, due to factors beyond our control these collaborators and/or third party manufacturers may not be able to increase their manufacturing capacity for any of our product candidates in a timely or economic manner, or at all. Significant scale-up of manufacturing may require additional validation studies, which the FDA must review and approve. If we are unable to increase the manufacturing capacity for a product candidate successfully, the regulatory approval or commercial launch of that product candidate may be delayed or there may be a shortage in the supply of the product candidate. Our product candidates require precise, high-quality manufacturing. The failure of collaborators or third party manufacturers to achieve and maintain these high manufacturing standards, including the incidence of manufacturing errors, could result in patient injury or death, product recalls or withdrawals, delays or failures in product testing or delivery, cost overruns or other problems that could seriously harm our business.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to sell and market any products we may develop, we may be unable to generate revenues.

We do not currently have product sales and marketing capabilities. If we receive regulatory approval to commence commercial sales of any of our product candidates, we will have to establish a sales and marketing organization with appropriate technical expertise and distribution capabilities or make arrangements with third parties to perform these services in other jurisdictions. If we receive approval to commercialize Adva-27a for the treatment of breast cancer indication, we intend to engage additional pharmaceutical or health care companies with existing distribution systems and direct sales organizations to assist us in North America and abroad. We may not be able to negotiate favorable distribution partnering arrangements, if at all. To the extent we enter into co-promotion or other licensing arrangements, any revenues we receive will depend on the efforts of third parties and will not be under our control. If we are unable to establish adequate sales, marketing and distribution capabilities, whether independently or with third parties, our ability to generate product revenues, and become profitable, would be severely limited.

11

Our ability to generate any significant revenues in the near-term is dependent entirely on the successful commercialization and market acceptance of Adva-27a. Factors that may inhibit our efforts to commercialize Adva-27a or other product candidates without strategic partners or licensees include:

| ● | difficulty recruiting and retaining adequate numbers of effective sales and marketing personnel; | |

| ● | the inability of sales personnel to obtain access to, or persuade adequate numbers of, physicians to prescribe our products; | |

| ● | the lack of complementary products to be offered by sales personnel, which may put us at a competitive disadvantage against companies with broader product lines; and | |

| ● | unforeseen costs associated with creating an independent sales and marketing organization. |

Even if we successfully develop and obtain approval for Adva-27a, our business will not be profitable if this product does not achieve and maintain market acceptance.

Even if our product candidate, Adva-27a, is approved for commercial sale by the FDA or other regulatory authorities, the degree of market acceptance of our approved product candidate by physicians, healthcare professionals, patients and third-party payors, and our resulting profitability and growth, will depend on a number of factors, including:

| ● | our ability to provide acceptable evidence of safety and efficacy; | |

| ● | relative convenience and ease of administration; | |

| ● | the prevalence and severity of any adverse side effects; | |

| ● | the availability of alternative treatments; | |

| ● | the details of FDA labeling requirements, including the scope of approved indications and any safety warnings; | |

| ● | pricing and cost effectiveness; | |

| ● | the effectiveness of our or our collaborators' sales and marketing strategy; | |

| ● | our ability to obtain sufficient third-party insurance coverage or reimbursement; and | |

| ● | our ability to have the product listed on insurance company formularies. |

If our product candidate achieves market acceptance, we may not be able to maintain that market acceptance over time if new products or technologies are introduced that are received more favorably or are more cost effective. Complications may also arise, such as development of new know-how or new medical or therapeutic capabilities by other parties that render our product obsolete.

Because the results of preclinical studies for our preclinical product candidates are not necessarily predictive of future results, our product candidates may not have favorable results in later clinical trials or ultimately receive regulatory approval.

Our product candidate has not been tested in clinical trials. Positive results from preclinical studies are no assurance that later clinical trials will succeed. Preclinical trials are not designed to establish the clinical efficacy of our preclinical product candidate. We will be required to demonstrate through clinical trials that our product candidate is safe and effective for use before we can seek regulatory approvals for commercial sale. There is typically an extremely high rate of failure as product candidates proceed through clinical trials. If our product candidate fails to demonstrate sufficient safety and efficacy in any clinical trial, we would experience potentially significant delays in, or be required to abandon, development of that product candidate. This would adversely affect our ability to generate revenues and may damage our reputation in the industry and in the investment community.

12

The future clinical testing of our product candidates could be delayed, resulting in increased costs to us and a delay in our ability to generate revenues.

Our product candidate will require preclinical testing and extensive clinical trials prior to submitting a regulatory application for commercial sales. We do not know whether clinical trials will begin on time, if at all. Delays in the commencement of clinical testing could significantly increase our product development costs and delay product commercialization. In addition, many of the factors that may cause, or lead to, a delay in the commencement of clinical trials may also ultimately lead to denial of regulatory approval of a product candidate. Each of these results would adversely affect our ability to generate revenues.

The commencement of clinical trials can be delayed for a variety of reasons, including delays in:

| ● | demonstrating sufficient safety to obtain regulatory approval to commence a clinical trial; | |

| ● | reaching agreement on acceptable terms with prospective research organizations and trial sites; | |

| ● | manufacturing sufficient quantities of a product candidate; | |

| ● | obtaining institutional review board approvals to conduct clinical trials at prospective sites; and | |

| ● | procuring adequate financing to fund the work. |

In addition, the commencement of clinical trials may be delayed due to insufficient patient enrollment, which is a function of many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites, the availability of effective treatments for the relevant disease, and the eligibility criteria for the clinical trial. If we are unable to enroll a sufficient number of evaluable patients, the clinical trials for our product candidates could be delayed until sufficient numbers are achieved.

We will face significant competition from other biotechnology and pharmaceutical companies, and our operating results will suffer if we fail to compete effectively.

We are a development stage company with three employees. Most of our competitors, such as Bristol-Myers Squibb, Pfizer, TEVA, Amgen, and others, are large pharmaceutical companies with substantially greater financial, technical and human resources than we have. The biotechnology and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change. The drug that we are attempting to develop will compete with existing therapies if we receive marketing approval. Because of their significant resources, our competitors may be able to use discovery technologies and techniques, or partnerships with collaborators, in order to develop competing products that are more effective or less costly than the product candidate we are developing. This may render our technology or product candidate obsolete and noncompetitive. Academic institutions, government agencies, and other public and private research organizations may seek patent protection with respect to potentially competitive products or technologies and may establish exclusive collaborative or licensing relationships with our competitors.

As a company, we do not have any experience in conducting clinical trials for our Adva-27a development program. Our competitors may succeed in obtaining FDA or other regulatory approvals for product candidates more rapidly than us. Companies that complete clinical trials, obtain required regulatory agency approvals and commence commercial sale of their drugs before we do may achieve a significant competitive advantage, including certain FDA marketing exclusivity rights that would delay or prevent our ability to market certain products. Any approved drugs resulting from our research and development efforts, or from our joint efforts with our existing or future collaborative partners, might not be able to compete successfully with our competitors' existing or future products.

Because our product candidate and our development and collaboration efforts depend on our intellectual property rights, adverse events affecting our intellectual property rights will harm our ability to commercialize products.

Our success will depend to a large degree on our own and our licensors' ability to obtain and defend patents for each party's respective technologies and the compounds and other products, if any, resulting from the application of such technologies. The patent positions of pharmaceutical and biotechnology companies can be highly uncertain and involve complex legal and technical questions. No consistent policy regarding the breadth of claims allowed in biotechnology patents has emerged to date. Accordingly, we cannot predict the breadth of claims that will be allowed or maintained, after challenge, in our or other companies' patents.

13

The degree of future protection for our proprietary rights is uncertain, and we cannot ensure that:

| ● | we were the first to make the inventions covered by each of our pending patent applications; | |

| ● | we were the first to file patent applications for these inventions; | |

| ● | others will not independently develop similar or alternative technologies or duplicate any of our technologies; | |

| ● | our pending patent applications will result in issued patents; | |

| ● | any patents issued to us or our collaborators will provide a basis for commercially viable products, will provide us with any competitive advantages or will not be challenged by third parties; | |

| ● | we will develop additional proprietary technologies that are patentable; or | |

| ● | the patents of others will not have a negative effect on our ability to do business. |

If we cannot maintain the confidentiality of our technology and other confidential information in connection with our collaborations, then our ability to receive patent protection or protect our proprietary information will be impaired. In addition, some of the technology we have licensed relies on patented inventions developed using U.S. and other governments’ resources. Under applicable law, the U.S. government has the right to require us to grant a nonexclusive, partially exclusive or exclusive license for such technology to a responsible applicant or applicants, upon terms that are reasonable under the circumstances, if the government determines that such action is necessary.

Confidentiality agreements with employees and others may not adequately prevent disclosure of trade secrets and other proprietary information and may not adequately protect our intellectual property.

We rely on trade secrets to protect our technology, particularly when we do not believe patent protection is appropriate or obtainable. However, trade secrets are difficult to protect. In order to protect our proprietary technology and processes, we rely in part on confidentiality and intellectual property assignment agreements with our employees, consultants, outside scientific collaborators and sponsored researchers and other advisors. These agreements may not effectively prevent disclosure of confidential information nor result in the effective assignment to us of intellectual property, and may not provide an adequate remedy in the event of unauthorized disclosure of confidential information or other breaches of the agreements. In addition, others may independently discover our trade secrets and proprietary information, and in such case we could not assert any trade secret rights against such party. Enforcing a claim that a party illegally obtained and is using our trade secrets is difficult, expensive and time consuming, and the outcome is unpredictable. In addition, courts outside the United States may be less willing to protect trade secrets. Costly and time-consuming litigation could be necessary to seek to enforce and determine the scope of our proprietary rights, and failure to obtain or maintain trade secret protection could adversely affect our competitive business position.

The implementation of our business plan will result in a period of rapid growth that will impose a significant burden on our current administrative and operational resources.

Our ability to effectively manage our growth will require us to substantially expand the capabilities of our administrative and operational resources by attracting, training, managing and retaining additional qualified personnel, including additional members of management, technicians and others. To successfully develop our products we will need to manage operating, producing, marketing and selling our products. There can be no assurances that we will be able to do so. Our failure to successfully manage our growth will have a negative impact on our anticipated results of operations.

Provisions of our Articles of Incorporation and Bylaws may delay or prevent a take-over that may not be in the best interests of our stockholders.

Provisions of our Articles of Incorporation and Bylaws may be deemed to have anti-takeover effects, which include when and by whom special meetings of our stockholders may be called, and may delay, defer or prevent a takeover attempt. In addition, certain provisions of the Colorado Business Corporations Act also may be deemed to have certain anti-takeover effects which include that control of shares acquired in excess of certain specified thresholds will not possess any voting rights unless these voting rights are approved by a majority of a corporation’s disinterested stockholders.

In addition, our Articles of Incorporation authorizes the issuance of up to 5,000,000 shares of Preferred Stock with such rights and preferences determined from time to time by our Board of Directors. Our Board of Directors may, without stockholder approval, issue Preferred Stock with dividends, liquidation, conversion, voting or other rights that could adversely affect the voting power or other rights of the holders of our Common Stock.

14

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Sarbanes-Oxley Act, the Dodd-Frank Act, and other applicable securities rules and regulations. Compliance with these rules and regulations increases our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources, particularly after we are no longer an “emerging growth company,” as defined in the Jumpstart our Business Startups Act, or the JOBS Act. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and operating results. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet this standard, significant resources and management oversight may be required. As a result, management’s attention may be diverted from other business concerns which could adversely affect our business and operating results. We may need to hire more employees in the future or engage outside consultants which will increase our costs and expenses.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure are creating uncertainty for public companies, increasing legal and financial compliance costs and making some activities more time consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from revenue-generating activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to their application and practice, regulatory authorities may initiate legal proceedings against us and our business may be adversely affected.

However, for as long as we remain an “emerging growth company,” we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We may take advantage of these reporting exemptions until we are no longer an “emerging growth company.”

We would cease to be an “emerging growth company” upon the earliest of: (i) the first fiscal year following the fifth anniversary of our becoming a reporting company, (ii) the first fiscal year after our annual gross revenues are $1.0 billion or more, (iii) the date on which we have, during the previous three-year period, issued more than $1.0 billion in non-convertible debt securities or (iv) as of the end of any fiscal year in which the market value of our Common Stock held by non-affiliates exceeded $700 million as of the end of the second quarter of that fiscal year.

We also expect that being a public company and these new rules and regulations will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

As a result of disclosure of information in this report and in future filings required of a public company, our business and financial condition will become more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be adversely affected, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business and operating results.

15

We are an “emerging growth company” and we cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make our Common Stock less attractive to investors.

We are an “emerging growth company,” as defined in the JOBS Act, and we may take advantage of certain exemptions from various reporting requirements that are applicable to public companies that are not “emerging growth companies” including, but not limited to, not being required to comply with the auditor attestation requirements of Section 404, reduced disclosure obligations regarding executive compensation in our periodic reports and proxy statements, and exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and shareholder approval of any golden parachute payments not previously approved. We cannot predict if investors will find our Common Stock less attractive because we may rely on these exemptions. If some investors find our Common Stock less attractive as a result, there may be a less active trading market for our Common Stock and our stock price may be more volatile.

In addition, Section 107 of the JOBS Act also provides that an “emerging growth company” can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an “emerging growth company” can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

Risks Related to our Common Stock

There is a limited trading market for our securities and there can be no assurance that such a market will develop in the future.

There is no assurance that a market will develop in the future or, if developed, that it will continue. In the absence of a public trading market, an investor may be unable to liquidate his investment in our Company.

We do not have significant financial reporting experience, which may lead to delays in filing required reports with the Securities and Exchange Commission and suspension of quotation of our securities on the OTCBB or a national exchange, which will make it more difficult for you to sell your securities.

The OTCBB and other national stock exchanges each limits quotations to securities of issuers that are current in their reports filed with the Securities and Exchange Commission. Because we do not have significant financial reporting experience, we may experience delays in filing required reports with the Securities and Exchange Commission (the “SEC”). Because issuers whose securities are qualified for quotation on the OTCBB or any other national exchange are required to file these reports with the SEC in a timely manner, the failure to do so may result in a suspension of trading or delisting.

There are no automated systems for negotiating trades on the OTCBB and it is possible for the price of a stock to go up or down significantly during a lapse of time between placing a market order and its execution, which may affect your trades in our securities.

Because there are no automated systems for negotiating trades on the OTCBB, they are conducted via telephone. In times of heavy market volume, the limitations of this process may result in a significant increase in the time it takes to execute investor orders. Therefore, when investors place market orders, an order to buy or sell a specific number of shares at the current market price, it is possible for the price of a stock to go up or down significantly during the lapse of time between placing a market order and its execution.

16

Our stock will be considered a “penny stock” so long as it trades below $5.00 per share. This can adversely affect its liquidity.

Our Common Stock is currently considered a “penny stock” and will continue to be considered a penny stock so long as it trades below $5.00 per share and as such, trading in our Common Stock will be subject to the requirements of Rule 15g-9 under the Securities Exchange Act of 1934. Under this rule, broker/dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements. The broker/dealer must make an individualized written suitability determination for the purchaser and receive the purchaser’s written consent prior to the transaction.

SEC regulations also require additional disclosure in connection with any trades involving a “penny stock,” including the delivery, prior to any penny stock transaction, of a disclosure schedule explaining the penny stock market and its associated risks. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from recommending transactions in our securities, which could severely limit the liquidity of our securities and consequently adversely affect the market price for our securities. In addition, few broker or dealers are likely to undertake these compliance activities. Other risks associated with trading in penny stocks could also be price fluctuations and the lack of a liquid market.

We do not anticipate payment of dividends, and investors will be wholly dependent upon the market for the Common Stock to realize economic benefit from their investment.

As holders of our Common Stock, you will only be entitled to receive those dividends that are declared by our Board of Directors out of retained earnings. We do not expect to have retained earnings available for declaration of dividends in the foreseeable future. There is no assurance that such retained earnings will ever materialize to permit payment of dividends to you. Our Board of Directors will determine future dividend policy based upon our results of operations, financial condition, capital requirements, reserve needs and other circumstances.

Any adverse effect on the market price of our Common Stock could make it difficult for us to raise additional capital through sales of equity securities at a time and at a price that we deem appropriate.

Sales of substantial amounts of our Common Stock, or in anticipation that such sales could occur, may materially and adversely affect prevailing market prices for our Common Stock.

The market price of our Common Stock may fluctuate significantly in the future.

The market price of our Common Stock may fluctuate in response to one or more of the following factors, many of which are beyond our control:

|

●

|

ccompetitive pricing pressures;

|

|

●

|

oour ability to produce and sell our products on a cost-effective and timely basis;

|

|

●

|

our inability to obtain working capital financing;

|

|

●

|

the introduction and announcement of one or more new alternatives to our products by our competitors;

|

|

●

|

cchanging conditions in the market;

|

|

●

|

cchanges in market valuations of similar companies;

|

|

●

|

sstock market price and volume fluctuations generally;

|

|

●

|

regulatory developments;

|

|

●

|

fluctuations in our quarterly or annual operating results;

|

|

●

|

additions or departures of key personnel; and

|

|

●

|

future sales of our Common Stock or other securities.

|

17

The price at which you purchase shares of our Common Stock may not be indicative of the price that will prevail in the trading market. You may be unable to sell your shares of Common Stock at or above your purchase price, which may result in substantial losses to you and which may include the complete loss of your investment. In the past, securities class action litigation has often been brought against a company following periods of stock price volatility. We may be the target of similar litigation in the future. Securities litigation could result in substantial costs and divert management’s attention and our resources away from our business. Any of the risks described above could adversely affect our sales and profitability and also the price of our Common Stock.

We cannot predict whether we will successfully effectuate our current business plan.

Each prospective purchaser is encouraged to carefully analyze the risks and merits of an investment in our Common Stock and should take into consideration when making such analysis, among others, the Risk Factors discussed above.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

ITEM 2. PROPERTIES

Our principal place of business is located at 469 Jean-Talon West, 3rd Floor, Montreal, Quebec, Canada, H3N 1R4, where we relocated in June, 2012. This is also the location of our licensor, Advanomics Corporation, who is providing this space to us on a rent free basis as of the date of this Report. If and when we are able to secure financing we expect that we will lease our own office and laboratory space. Our current space consists of approximately 1,000 square feet of executive office space. We anticipate that this will be sufficient for our needs until financing is in place, of which there is no assurance.

ITEM 3. LEGAL PROCEEDINGS

To the best of our management’s knowledge and belief, there are no material claims that have been brought against us nor have there been any claims threatened.

ITEM 4. MINE SAFETY DISCLOSURES

Not Applicable.

18

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Market Information

Trading of our Common Stock commenced on the OTCBB in September 2007 under the symbol “MWBN.” Effective November 30, 2009, the trading symbol for our Common Stock was changed to “SBFM” as a result of our name change discussed above.

The table below sets forth the reported high and low bid prices for the periods indicated. The bid prices shown reflect quotations between dealers, without adjustment for markups, markdowns or commissions, and may not represent actual transactions in our Common Stock.

|

Quarter Ended

|

High

|

Low

|

||||||

|

March 31, 2013

|

$ | 0.44 | $ | 0.24 | ||||

|

June 30, 2013

|

$ | 0.28 | $ | 0.19 | ||||

|

September 31, 2013

|

$ | 0.23 | $ | 0.16 | ||||

|

December 31, 2013

|

$ | 0.21 | $ | 0.13 | ||||

|

March 31, 2012

|

$ | 0.25 | $ | 0.13 | ||||

|

June 30, 2012

|

$ | 0.28 | $ | 0.19 | ||||

|

September 31, 2012

|

$ | 0.60 | $ | 0.18 | ||||

|

December 31, 2012

|

$ | 0.42 | $ | 0.19 |

As of March 18, 2014, the closing bid price of our Common Stock was $0.175.

Trading volume in our Common Stock is very limited. As a result, the trading price of our Common Stock is subject to significant fluctuations. See "PART I, Item 1A, Risk Factors."

The Securities Enforcement and Penny Stock Reform Act of 1990

The Securities and Exchange Commission has also adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges or quoted on the Nasdaq system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system).

As of the date of this Report, our Common Stock is defined as a “penny stock” under the Securities and Exchange Act. It is anticipated that our Common Stock will remain a penny stock for the foreseeable future. The classification of penny stock makes it more difficult for a broker-dealer to sell the stock into a secondary market, which makes it more difficult for a purchaser to liquidate his/her investment. Any broker-dealer engaged by the purchaser for the purpose of selling his or her shares in us will be subject to Rules 15g-1 through 15g-10 of the Securities and Exchange Act. Rather than creating a need to comply with those rules, some broker-dealers will refuse to attempt to sell penny stock.

19

The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from those rules, to deliver a standardized risk disclosure document prepared by the Commission, which:

|

●

|

contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading;

|

|

|

●

|

contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation to such duties or other requirements of the Securities Act of 1934, as amended;

|

|

|

●

|

contains a brief, clear, narrative description of a dealer market, including "bid" and "ask" prices for penny stocks and the significance of the spread between the bid and ask price;

|

|

|

●

|

contains a toll-free telephone number for inquiries on disciplinary actions;

|

|

|

●

|

defines significant terms in the disclosure document or in the conduct of trading penny stocks; and

|

|

|

●

|

contains such other information and is in such form (including language, type, size and format) as the Securities and Exchange Commission shall require by rule or regulation;

|

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, to the customer:

|

●

|

the bid and offer quotations for the penny stock;

|

|

|

●

|

the compensation of the broker-dealer and its salesperson in the transaction;

|

|

|

●

|

the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and

|

|

|

●

|

monthly account statements showing the market value of each penny stock held in the customer's account.

|

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules; the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement to transactions involving penny stocks, and a signed and dated copy of a written suitability statement. These disclosure requirements will have the effect of reducing the trading activity in the secondary market for our stock because it will be subject to these penny stock rules. Therefore, stockholders may have difficulty selling their securities.

Holders

We had 144 holders of record of our Common Stock as of the date of this Report, not including those persons who hold their shares in “street name.”

Stock Transfer Agent

The stock transfer agent for our securities is Corporate Stock Transfer, Inc., of Denver, Colorado. Their address is 3200 Cherry Creek South Drive, Suite 430, Denver, Colorado, 80209. Their phone number is (303) 282-4800.

Dividends

We have not paid any dividends since our incorporation and do not anticipate the payment of dividends in the foreseeable future. At present, our policy is to retain earnings, if any, to develop and market our products. The payment of dividends in the future will depend upon, among other factors, our earnings, capital requirements, and operating financial conditions.

Reports

We are subject to certain reporting requirements and furnish annual financial reports to our stockholders, certified by our independent accountants, and furnish unaudited quarterly financial reports in our quarterly reports filed electronically with the SEC. All reports and information filed by us can be found at the SEC website, www.sec.gov.

ITEM 6. SELECTED FINANCIAL DATA.

Not applicable.

20

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with our audited financial statements and notes thereto included herein. In connection with, and because we desire to take advantage of, the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, we caution readers regarding certain forward looking statements in the following discussion and elsewhere in this Report and in any other statement made by, or on our behalf, whether or not in future filings with the Securities and Exchange Commission. Forward looking statements are statements not based on historical information and which relate to future operations, strategies, financial results or other developments. Forward looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward looking statements made by, or on our behalf. We disclaim any obligation to update forward looking statements.

Overview and History

We were incorporated in the State of Colorado on August 31, 2006 under the name “Mountain West Business Solutions, Inc.” During our fiscal year ended July 31, 2009 our business was to provide management consulting with regard to accounting, computer and general business issues for small and home-office based companies. Effective October 15, 2009, we executed an agreement to acquire Sunshine Biopharma, Inc., a Colorado corporation (“SBI”), in exchange for the issuance of 21,962,000 shares of our Common Stock and 850,000 shares of Convertible Preferred Stock, each convertible into twenty (20) shares of our Common Stock (the “Agreement”). As a result of this transaction our officers and directors resigned their positions with us and were replaced by our current management. See PART III, Item 10, below. As a result of this transaction we have changed our name to “Sunshine Biopharma, Inc.”

Our principal place of business is located at 469 Jean-Talon West, 3rd Floor, Montreal, Quebec, Canada H3N 1R4. Our phone number is (514) 764-9698 and our website address is www.sunshinebiopharma.com.

We have not been subject to any bankruptcy, receivership or similar proceeding.

Results Of Operations

Comparison of Results of Operations for the fiscal years ended December 31, 2013 and 2012