Attached files

| file | filename |

|---|---|

| 8-K - 8-K - STIFEL FINANCIAL CORP | d694854d8k.htm |

March 2014

Stifel Investor Presentation

Exhibit 99.1 |

Disclaimer

Forward-Looking Statements

This

presentation

may

contain

“forward-looking

statements”

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995

that

involve

significant

risks,

assumptions,

and

uncertainties,

including

statements

relating

to

the

market

opportunity

and

future

business

prospects

of

Stifel

Financial

Corp.,

as

well

as

Stifel,

Nicolaus

&

Company,

Incorporated

and

its

subsidiaries

(collectively,

“SF”

or

the

“Company”).

These

statements

can

be

identified

by

the

use

of

the

words

“may,”

“will,”

“should,”

“could,”

“would,”

“plan,”

“potential,”

“estimate,”

“project,”

“believe,”

“intend,”

“anticipate,”

“expect,”

and

similar

expressions.

In

particular,

these

statements

may

refer

to

our

goals,

intentions,

and

expectations,

our

business

plans

and

growth

strategies,

our

ability

to

integrate

and

manage

our

acquired

businesses,

estimates

of

our

risks

and

future

costs

and

benefits,

and

forecasted

demographic

and

economic

trends

relating

to our

industry.

You

should

not

place

undue

reliance

on

any

forward-looking

statements,

which

speak

only

as

of

the

date

they

were

made.

We

will

not

update

these

forward-looking

statements,

even

though

our

situation

may

change

in

the

future,

unless

we

are

obligated

to

do

so

under

federal securities laws.

Actual

results

may

differ

materially

and

reported

results

should

not

be

considered

as

an

indication

of

future

performance.

Factors

that

could

cause

actual

results

to

differ

are

included

in

the

Company’s

annual

and

quarterly

reports

and

from

time

to

time

in

other

reports

filed

by

the

Company

with

the

Securities

and

Exchange

Commission

and

include,

among

other

things,

changes

in

general

economic and

business conditions, actions of competitors, regulatory and legal actions,

changes in legislation, and technology changes. Use of Non-GAAP

Financial Measures The

Company

utilized

non-GAAP

calculations

of

presented

net

revenues,

compensation

and

benefits,

non-compensation

operating

expenses,

income

before

income

taxes,

provision

for

income

taxes,

net

income,

compensation

and

non-compensation

operating

expense

ratios,

pre-tax

margin

and

diluted

earnings

per

share

as

an

additional

measure

to

aid

in

understanding

and

analyzing

the

Company’s

financial

results

for

the

year

ended

December

31,

2013.

Specifically,

the

Company

believes

that

the

non-GAAP

measures

provide

useful

information

by

excluding

certain

items

that

may

not

be

indicative

of

the

Company’s

core

operating

results

and

business

outlook.

The

Company

believes

that

these

non-GAAP

measures

will

allow

for

a

better

evaluation

of

the

operating

performance

of

the

business

and

facilitate

a

meaningful

comparison

of

the

Company’s

results

in

the

current

period

to

those

in

prior

periods

and

future

periods.

Reference

to

these

non-GAAP

measures

should

not

be

considered

as

a

substitute

for

results

that

are

presented

in

a

manner

consistent

with

GAAP.

These

non-GAAP

measures

are

provided

to

enhance

investors'

overall

understanding

of

the

Company’s financial

performance. |

Market Overview |

Domestic Equity

Flows Equity Risk Premium

(1)

4

Market Overview

Source:

Investment

Company

Institute.

(

1)

Based

on

the

Daily

Treasury

Yield

Curve

Rates,

10

year. |

Stifel Overview |

6

Stifel Overview

Global Wealth Management

Institutional Group

Independent Research

Institutional Equity & Fixed Income

Brokerage

Equity & Fixed Income Capital Raising

M&A Advisory / Restructuring

Private Client

Stifel Bank & Trust

Customer Financing

Asset Management

(1)

As

of

3/10/14.

(2)

Insider

ownership

percentage

includes

all

fully

diluted

shares,

units

outstanding,

options

outstanding,

as

well

as

shares

owned

by

Stifel’s

former

Chairman

as

of

3/7/14.

Stifel Financial (NYSE: SF)

Financial

services

firm

demonstrating

growth,

scale

and

stability

$3.1

billion

market

capitalization

(1)

2013

Represented

Stifel’s

18

th

year

of

consecutive

record

net

revenues

Balanced business model

Top performing financial stock over the past ten years

34%

Insider

ownership

(2)

National presence with over 2,000

Financial Advisors

$166 billion in total client assets

Largest U.S. equity research platform

Broad product portfolio & industry

expertise |

7

Stifel’s Market Opportunity

Stifel’s Differentiated Value Proposition: Growth, Scale, and

Stability Bulge Bracket

Middle Market

Firm focus

Good research

Growth investor access

Issues

Lack of focus

Banker turnover

Lack of commitment

Research indifference

Lack of growth investors

Issues

Financial / firm stability

Trading support

Few with retail

Size / scale

Firm focus

Stability (financial &

personnel)

Large distribution

Growth investor access

Trading

Outstanding research

Retail

Size / scale

Large distribution

Trading

Retail |

Strategy:

Building

the

Premier

Investment

Bank

8

Unburdened by capital constraints

Low leverage business model and conservative risk management

Built the Company through 13 acquisitions since 2005; prudently evaluate

all opportunities Select growth of high-quality talent

Drive revenue synergies by leveraging the global wealth and institutional

businesses 18

th

Consecutive Year of Record Net Revenues

Positioned to Take Advantage of Opportunities

Net Revenues ($MM) |

(1)

Years 2012 and 2013 represents non-GAAP net income from continuing

operations. (2)

Client assets –

Includes FDIC-insured products as of 12/31/13 for years 2008-2013.

(3)

Includes Independent Contractors.

(4)

Book Value Per Share adjusted for April 2011 three-for-two stock

split (2006-2010). A Growth Story…

CAGR: 23%

CAGR: 24%

CAGR: 22%

CAGR: 16%

CAGR: 25%

9

Net Revenues ($MM)

Core Net Income ($MM)

(1)

Total Equity ($MM)

Total Client Assets ($BN)

(2)

Book Value Per Share

(4)

CAGR: 38%

Financial Advisors

(3)

CAGR reflects years 2006 to 2013. |

10

Building Scale…

Growth Focused

Investment Banking

Research, Sales and Trading

Achieved cost efficiencies

July 2010

Private Client

Revenue production has exceeded

expectations

October 2009

Significant enhancement to our

Capital Markets business

Achieved cost savings objectives

December 2005

Bank holding company

Financial holding company

Grown assets from ~ $100M to $5.0B

April 2007

Private Client

Public Finance

Seamless & efficient integration

December 2008

Fixed Income IB

Fixed Income Sales and Trading

Private Client

Seamless & efficient integration

October 2011

FIG Investment Banking

FIG Sales and Trading

FIG Research

February 2013

Private Client

Capital Markets

Achieved cost savings objectives

February 2007

Each merger has been accretive to Stifel

Retention remains high

Restructuring advisory

December 2012

Fixed Income Sales and

Trading –

U.S. & Europe

Fixed Income Research

July 2013

Asset Management

November 2013

Clean portfolio of 1-4 family

residential mortgages

October 2013 |

11

Recent Merger Update

Announced the acquisition of De La Rosa on January 30, 2014 and is

expected to close in the first quarter. Plan to integrate under

Stifel brand immediately. Investment bank and bond underwriter

with a 25-year operating history. Stifel will become #1

underwriter in California negotiated underwriting in par value

and number of issues.

Stifel

will

become

#1

underwriter

in

California

in

the

following

categories:

•

K-12

•

COP & Lease Revenue Bonds

•

Tax Increment

•

Economical Development

•

Water & Sewer.

Substantially all of the senior leadership has executed

continuation agreements with Stifel.

|

12

IFR Awards: 2013 US Mid-Market Equity House of the Year

IFR Recognizes Stifel’s Leadership Position As

The Premier Middle Market Investment Bank

“For its leadership among mid-market firms and

strong momentum in securing bookrunner roles,

Stifel is IFR’s US Mid-Market Equity House of the

Year”

“Stifel has been able to steer clear of the client conflicts

that have muddied perceptions of the bulge brackets

and in some cases act as a check on bulge bracket

execution”

“Winning mandates against bulge brackets with large

balance sheets at their disposal means a heavier

relative investment in research, seen in the firm’s

coverage of 1,300 stocks, up from 537 in 2005”

“Stifel is the largest US equity research provider bar

none, at a time when many bulge brackets have

downgraded their research capabilities amid

regulatory restrictions”

Source:

“US

Mid-market

Equity

House:

Stifel.”

International

Financing

Review’s

(IFR)

Americas

Review

of

the

Year

2013.

Web.

December

13,

2013. |

Stability Achieved Through A Balanced Business Model

13

Net Revenues

Balanced business model facilitates growth during volatile markets

Stable GWM business is augmented by profitable and growing Institutional

Group Proven ability to grow all businesses

Operating Contribution

2012

2013

2012

2013

Note:

Net

revenues

and

operating

contribution

excludes

the

Other

segment.

13 |

14

Leverage Ratio

Total Assets ($ in Billions)

Book

Value

Per

Share

(1)

Total Capitalization ($ in Billions)

(1)

Per

share

information

adjusted

for

April

2011

three-for-two

stock

split

Strong Balance Sheet Facilitates Growth

As December 31, 2013 |

15

Top Performing Stock

Cumulative Price Appreciation As of December 31, 2013

|

Attract and retain high-quality talent

Continue to expand our private client footprint in the U.S.

Continue to expand investment banking capabilities

Focus on quality asset generation within Stifel Bank

Expand traditional asset management capabilities

Approach acquisition opportunities with discipline

Opportunities Drive our Growth

16

Initiatives |

Global Wealth Management |

(1)

Includes Independent Contractors.

(2)

CAGR reflects years 2006 to 2013.

Global Wealth Management

Provides Securities Brokerage Services and Stifel Bank Products

CAGR: 29%

CAGR: 25%

18

Grown

from

600+

financial

advisors

in

2005

to

over

2,000

(1)

financial

advisors

currently

Proven organic growth and acquirer of private client business (56 UBS

branches, Butler Wick, Ryan Beck) Retail investors are generally

mid- to long-term buyers

Goal of providing price stability and support to the institutional order

book Strategy of recruiting experienced advisors with established

client relationships Expanding U.S. footprint

Net Revenues ($MM)

(2)

Overview

Operating

Contribution

($MM)

(2) |

(1)

Includes Independent Contractors. (2) Client assets include

FDIC-insured products as of 12/31/13 for years 2008-2013.

Global Wealth Management

19

Opportunity Through Growth

GWM Account Growth

GWM Broker Growth

(1)

GWM

Assets

Under

Management

Growth

($MM)

(2)

GWM Branch Growth |

Global Wealth Management –

Stifel Bank & Trust

Offers banking products (securities based loans and

mortgage loans) within the GWM client base,

including establishing trust services

Built-in source of business

High net worth clients

Highly efficient due to lack of “brick and mortar”

deposit focused facilities

Overview

Strength of Brokerage Position

20

Acquired FirstService Bank, a St. Louis-based,

Missouri-chartered commercial bank, in April 2007

Stifel Financial became a bank holding company and

financial services holding company

Balance sheet growth with low-risk assets

Funded by Stifel Nicolaus client deposits

Maintain high levels of liquidity

Interest

Earnings

Assets

(1)

Investment Portfolio

Loan Portfolio (Gross)

Total: $4.2 Billion

Total: $3.1 Billion

(2)

Total: $1.5 Billion

(3)

Data as of 12/31/13. (1) Average interest earning assets as of 12/31/13.

(2) MBS makes up less than 1% of Investment Portfolio. (3) Construction and Land & Commercial Real Estate make up less than 1% of the loan portfolio. |

Institutional Group |

(1) Based on 2013 U.S. trading volume per Bloomberg. (2)

Includes TWPG historical investment banking and brokerage revenues for years 2006 through September 30, 2010.

(3) 2012 includes realized and unrealized gains on the Company’s

investment in Knight Capital Group, Inc. of $39.0 million.

Institutional Group

22

Net

Revenues

($MM)

(2)(3)

Equity

Brokerage

+

Investment

Banking

(2)

(3)

Fixed Income Brokerage + Investment Banking

Overview

Provides securities brokerage, trading, research,

underwriting and corporate advisory services

Largest providers of U.S. Equity Research

2

nd

largest Equity trading platform in the U.S.

outside

of

the

Bulge

Bracket

(1)

Full Service Investment Bank

Comprehensive Fixed Income platform |

Largest provider of U.S. equity research

113 analyst across 12 sectors

Largest provider of Financial Services coverage

Ranked #2 in the FT/Starmine 2013 Survey

Stifel analysts ranked #1 & #2 in Earnings

Estimators among 4,000 analysts

Largest U.S. Equity Research Platform

U.S. Equity Research Coverage

(1)

Coverage Balanced Across All Market Caps

(2)

Institutional Group –

Research

Stifel Research Highlights

23

Companies Under Coverage

Rank

Firm

Overall

Small Cap

(2)

1

Stifel / Keefe, Bruyette & Woods

1,376

426

2

Bank of America Merrill Lynch

1,178

148

3

JPMorgan

1,105

140

4

Goldman Sachs

1,059

76

5

Wells Fargo Securities

1,020

152

6

Raymond James

989

285

7

Credit Suisse

976

146

8

Barclays

966

96

9

Citi

934

96

10

Deutsche Bank

906

118

11

Jefferies LLC

892

166

12

Morgan Stanley

867

84

13

RBC Capital Markets

856

104

14

UBS

766

60

15

Robert W Baird & Co

690

154

16

Sidoti & Company LLC

665

432

17

Morningstar, Inc.

658

N/A

18

Cowen & Co LLC

581

149

19

William Blair & Co LLC

572

150

20

BMO Capital Markets

555

91

21

Piper Jaffray & Co

538

176

22

Keybanc Capital Markets

535

114

23

Oppenheimer & Co Inc

532

108

24

Sterne, Agee & Leach

487

96

25

Macquarie Group

469

N/A

(1) Source: StarMine rankings as of 3/4/14. Does not include Closed End

Funds. (2) Small Cap includes market caps less than $1 billion; Mid

Cap includes market caps less than $5 billion.

Note: Bold font indicates middle–market firms. Research coverage

distribution as of 3/4/14. Small Cap

29%

Mid Cap 36%

Large Cap

35% |

Institutional Equity Sales

100 person sales force, commission based

Experts in small and mid cap growth and value

Team based sales model with 2-4 sales people per

account

Team leaders have an average of 15 years experience

Offices in all major institutional markets in North

America & Europe

Accounts range from large mutual funds to small

industry focused investors

Managed over 780 non-deal roadshow days in 2013

Extensive experience with traditional and overnight

corporate finance transactions

Equity Trading

53 sales traders located in

Baltimore, New York, Boston, Dallas, San

Francisco, and London

24 position traders covering each major industry

8 specialized traders focused on: Option Trading,

Convertible and ETF Trading

Profitable model with advantages of scale

Institutional Group –

Equity Sales and Trading

Powerful Platform Spanning North America and Europe

24

Extensive Distribution Network

Relationships with over 3,500 institutional accounts globally

Active daily market maker in over 3,700 stocks

Traded over 11.7 billion shares in 2013

Complete coverage of North America and Europe for North American

listed equities

Major liquidity provider to largest equity money management

complexes Multi-execution venues: high-touch, algorithms,

program trading, and direct market access Dedicated convertible

sales, trading, and research desk |

Overview

Strong Fixed Income Capital Markets Capabilities

Institutional Group –

Fixed Income

Client Distribution

(1)(2)

Platform & Products

(1)

Client

Distribution

is

for

1/1/12

–

10/31/13.

(2)

Other

category

includes:

Corporation,

Hedge

Fund,

Pension

Fund,

Trust

Company,

Foundation,

Endowment,

University

&

Non-Profit.

25

Comprehensive platform

90 traders with annual client trade volume

approaching $400 billion

28-person Fixed Income Research and Strategy

Group

9 person US Debt Capital Markets Group

Widespread distribution

Nearly 200 Institutional sales professionals

covering over 6,200 accounts

36 institutional fixed income offices nationwide

European offices in London and Zurich

Focus on long-only money

managers and income

funds versus hedge funds

Consistency of execution

Identification of relative

value through security

selection

Agency/Gov't Securities

Money Markets

Mortgages & MBS

Reverse MBS

Asset-Backed Securities

Investment Grade Credit

High Yield & Distressed

Aircraft Finance & Credit

Solutions

Whole Loans

Municipals

Emerging Markets

Structured Products

Stifel Capital Advisors

Hybrid Securities

Dedicated Loan Trading Group

Capable UK Sales & Trading

platform (former Knight team) |

Accomplished U.S. Equity Underwriting Franchise –

All Equity Transactions

Investment Banking

Bookrun Equity Deals Since 2010

All Managed Equity Deals Since 2010

26

($ in billions)

# of

$

Rank

Firm

Deals

Volume

1

Bank of America Merrill Lynch

893

$524.7

2

JPMorgan

883

$510.4

3

Citi

833

$505.4

4

Morgan Stanley

789

$487.1

5

Barclays

732

$423.8

6

Deutsche Bank

715

$424.1

6

Wells Fargo Securities

715

$373.2

8

Credit Suisse

710

$420.0

9

Stifel / Keefe, Bruyette & Woods

695

$246.4

10

RBC Capital Markets

642

$304.2

11

Goldman Sachs

631

$425.8

12

UBS

570

$320.3

13

Raymond James

469

$226.9

14

Piper Jaffray & Co

347

$158.0

15

Robert W Baird & Co

343

$92.5

16

Jefferies LLC

336

$70.6

17

Oppenheimer & Co Inc

310

$77.1

18

JMP Securities LLC

306

$57.5

19

William Blair & Co LLC

246

$67.5

19

Cowen & Co LLC

246

$54.8

($ in billions)

# of

$

Rank

Firm

Deals

Volume

1

Bank of America Merrill Lynch

813

$97.5

2

JPMorgan

777

$100.7

3

Citi

724

$93.0

4

Morgan Stanley

722

$110.5

5

Barclays

601

$85.4

6

Credit Suisse

568

$71.6

7

Goldman Sachs

563

$95.6

8

Deutsche Bank

556

$61.7

9

Wells Fargo Securities

500

$39.4

10

UBS

391

$39.3

11

Jefferies LLC

271

$15.9

12

RBC Capital Markets

245

$18.9

13

Stifel / Keefe, Bruyette & Woods

223

$10.6

14

Raymond James

138

$7.3

15

Piper Jaffray & Co

119

$5.3

16

Cowen & Co LLC

97

$3.1

17

Roth Capital Partners

86

$1.7

18

Robert W Baird & Co

79

$3.6

19

Leerink Partners LLC

75

$2.9

20

Lazard Capital Markets

62

$1.8

Source:

Dealogic.

Rank

eligible

SEC

registered

IPOs

and

Follow-On

offerings

since

2010.

Includes

demutualizations.

As

of

2/28/14.

Overlapping

deals

between

Stifel

and

its

acquired

firms

have

been

removed.

Note: $ Volume represents full credit to underwriter for All Managed

Equity Deals and apportioned credit to bookrunner for Bookrun Equity Deals. Bold font indicates middle-market firms. |

Financial Results |

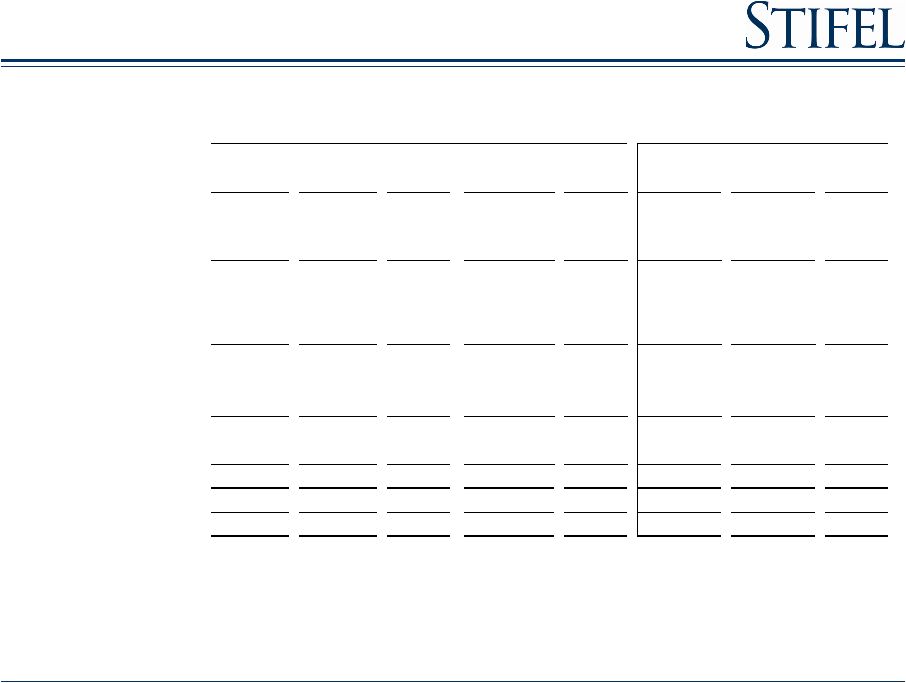

28

Stifel Financial Results

Three months ended December 31, 2013

($ in thousands, except per share amounts)

Non-GAAP

Non-Core

GAAP

12/31/12

% Change

9/30/13

% Change

Total revenues

576,236

$

(2,080)

$

574,156

$

419,885

$

37.2%

491,169

$

17.3%

Interest expense

11,555

75

11,630

8,602

34.3%

11,535

0.2%

Net revenues

564,681

(2,155)

562,526

411,283

37.3%

479,634

$

17.7%

Compensation and benefits

347,263

5,944

353,207

258,148

34.5%

297,374

16.8%

Non-comp operating expenses

126,990

4,340

131,330

92,784

36.9%

116,817

8.7%

Total non-interest expenses

474,253

10,284

484,537

350,932

35.1%

414,191

14.5%

Income from continuing operations before income taxes

90,428

(12,439)

77,989

60,351

49.8%

65,443

38.2%

Provision for income taxes

30,609

(4,746)

25,863

17,067

79.3%

25,795

18.7%

Net income from continuing operations

59,819

$

(7,693)

$

52,126

$

43,284

$

38.2%

39,648

$

50.9%

Discontinued operations:

Loss from discontinued operations, net

-

(3,857)

(3,857)

(3,330)

nm

-

-

Net income

59,819

$

(11,550)

$

48,269

$

39,954

$

49.7%

39,648

$

50.9%

Earnings per diluted common share:

Income from continuing operations

0.79

$

(0.10)

$

0.69

$

0.80

$

(1.3%)

0.53

$

49.1%

Loss from discontinued operations

-

(0.05)

(0.05)

$

(0.06)

-

Earnings per diluted common share

0.79

$

(0.15)

$

0.64

$

0.74

$

6.8%

0.53

$

49.1%

Weighted average number of shares outstanding:

Diluted

75,495

75,495

63,301

19.3%

75,191

0.4%

Ratios to net revenues:

Compensation and benefits

61.5%

62.8%

62.7%

62.0%

Non-comp operating expenses

22.5%

23.3%

22.6%

24.4%

Income from continuing operations before income taxes

16.0%

13.9%

14.7%

13.6%

Three Months Ended December 31, 2013

Three Months Ended

(1)

Non-core adjustments consist of merger-related revenues and

expenses associated with our acquisitions of KBW, the Knight Capital Fixed Income business, and Miller Buckfire and

discontinued operations of SN Canada.

(2)

Core (non-GAAP) results for the three months ended December 31, 2012

are the same as GAAP results. Results for the three months ended September 30, 2013 are Core (non-GAAP).

(1)

(2)

(2) |

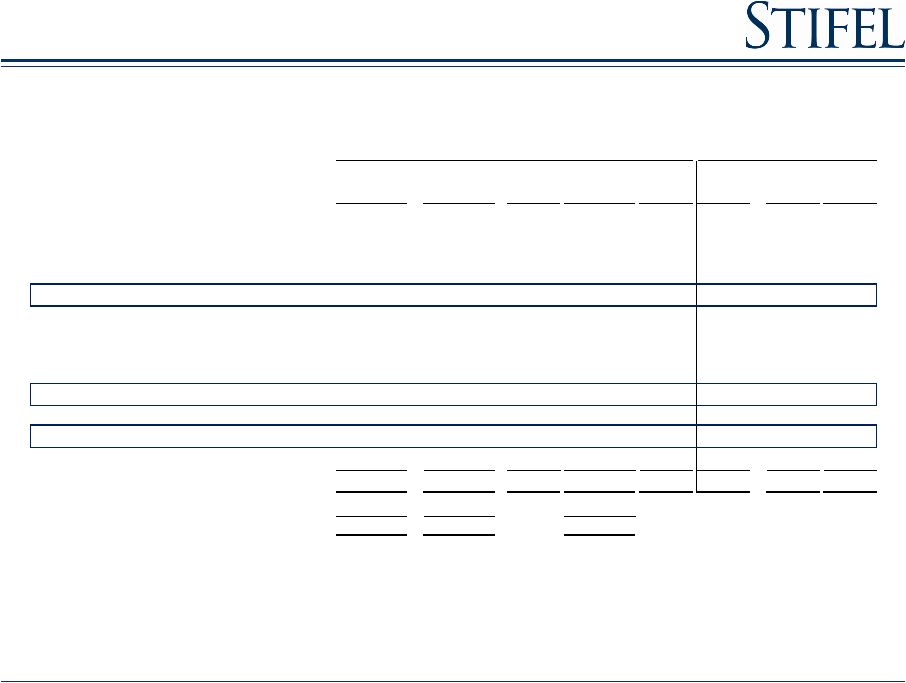

29

Stifel Financial Results

Year ended December 31, 2013

($ in thousands, except per share amounts)

Non-GAAP

Non-Core

GAAP

12/31/12

% Change

Total revenues

2,024,538

$

(4,724)

$

2,019,814

$

1,627,483

$

24.4%

Interest expense

46,198

170

46,368

33,370

38.4%

Net revenues

1,978,340

(4,894)

1,973,446

1,594,113

24.1%

Compensation and benefits

1,236,991

74,395

1,311,386

1,010,140

22.5%

Non-comp operating expenses

446,265

30,566

476,831

354,226

26.0%

Total non-interest expenses

1,683,256

104,961

1,788,217

1,364,366

23.4%

Income from continuing operations before income taxes

295,084

(109,855)

185,229

229,747

28.4%

Provision for income taxes

110,426

(98,104)

12,322

84,451

30.8%

Net income from continuing operations

184,658

$

(11,751)

$

172,907

$

145,296

$

27.1%

Discontinued operations:

Loss from discontinued operations, net

-

(10,894)

(10,894)

(6,723)

(100.0%)

Net income

184,658

$

(22,645)

$

162,013

$

138,573

$

33.3%

Earnings per diluted common share:

Income from continuing operations

2.51

$

(0.16)

$

2.35

$

2.31

$

8.7%

Loss from discontinued operations, net

-

(0.15)

(0.15)

(0.11)

(100.0%)

Earnings per diluted common share

2.51

$

(0.31)

$

2.20

$

2.20

$

14.1%

Weighted average number of shares outstanding:

Diluted

73,504

73,504

62,937

16.8%

Ratios to net revenues

:

Compensation and benefits

62.5%

66.5%

63.4%

Non-comp operating expenses

22.6%

24.1%

22.2%

Income from continuing operations before income taxes

14.9%

9.4%

14.4%

Year Ended December 31, 2013

Year Ended

(1)

Non-core

adjustments

consist

of

charges

related

to

expensing

stock

awards

issued

as

retention

in

connection

with

the

acquisitions

of

KBW

and

the

Knight

Capital

Fixed

Income

business

and

other

merger-related

revenues

and

expenses

associated

with

our

acquisitions

of

KBW,

the

Knight

Capital

Fixed

Income

business,

Miller

Buckfire

and

a

U.S.

tax

benefit

in

connection

with

discontinuing

operations of SN Canada.

(2)

Core (non-GAAP) results for the year ended December 31, 2012 are the

same as GAAP results. (1)

(2) |

30

Sources of Revenues

($ in thousands)

12/31/13

12/31/12

%

Change

9/30/13

%

Change

12/31/13

12/31/12

%

Change

Commissions

152,451

$

131,327

$

16.1%

145,837

$

4.5%

598,949

$

501,434

$

19.4%

Principal transactions

118,815

97,515

21.8%

122,583

(3.1%)

459,968

408,935

12.5%

Brokerage revenues

271,266

228,842

18.5%

268,420

1.1%

1,058,917

910,369

16.3%

Capital raising

71,379

46,320

54.1%

53,665

33.0%

246,631

185,761

32.8%

Advisory

87,481

26,618

228.7%

39,186

123.2%

201,429

95,519

110.9%

Investment banking

158,860

72,938

117.8%

92,851

71.1%

448,060

281,280

59.3%

Asset mgt and service fees

83,928

68,971

21.7%

76,710

9.4%

305,639

257,981

18.5%

Other

19,391

19,157

1.2%

13,063

48.4%

64,659

69,148

(6.5%)

Total operating revenues

533,445

389,908

36.8%

451,044

18.3%

1,877,275

1,518,778

23.6%

Interest revenue

40,711

29,977

35.8%

39,130

4.0%

142,539

108,705

31.1%

Total revenues

574,156

419,885

36.7%

490,174

17.1%

2,019,814

1,627,483

24.1%

Interest expense

11,630

8,602

35.2%

11,535

0.8%

46,368

33,370

39.0%

Net revenues

562,526

$

411,283

$

36.8%

478,639

$

17.5%

1,973,446

$

1,594,113

$

23.8%

Three Months Ended

Year Ended |

31

Core Non-Interest Expenses

Three months ended December 31, 2013

($ in thousands)

12/31/13

(1)

12/31/12

% Change

9/30/13

% Change

12/31/13

(1)

12/31/12

9/30/13

Net revenues

564,681

$

411,283

$

37.3%

479,634

$

17.7%

100.0%

100.0%

100.0%

Compensation and benefits

324,569

237,465

36.7%

275,503

17.8%

57.5%

57.7%

57.4%

Transitional pay

(2)

22,694

20,683

9.7%

21,871

3.8%

4.0%

5.0%

4.6%

Total compensation and benefits

347,263

258,148

34.5%

297,374

16.8%

61.5%

62.8%

62.0%

Occupancy and equipment rental

40,892

33,589

21.7%

39,856

2.6%

7.2%

8.2%

8.3%

Communication and office supplies

24,974

19,291

29.5%

25,105

(0.5%)

4.4%

4.7%

5.2%

Commissions and floor brokerage

8,213

7,271

13.0%

9,775

(16.0%)

1.5%

1.8%

2.0%

Other operating expenses

52,911

32,633

62.1%

42,080

25.7%

9.3%

7.9%

8.7%

Total non-comp operating expenses

126,990

92,784

36.9%

116,816

8.7%

22.4%

22.6%

24.4%

Total non-interest expense

474,253

350,932

35.1%

414,190

14.5%

84.0%

85.3%

86.4%

Income from continuing operations before income taxes

90,428

60,351

49.8%

65,444

38.2%

16.0%

14.7%

13.6%

Provision for income taxes

30,609

17,067

79.3%

25,795

18.7%

5.4%

4.0%

5.4%

Non-GAAP net income from continuing operations

59,819

$

43,284

$

38.2%

39,649

$

50.9%

10.6%

10.5%

8.3%

Non-core expenses (after-tax)

(7,693)

-

35,280

GAAP net income from continuing operations

52,126

$

43,284

$

74,929

$

Three Months Ended

% of Net revenues

(1)

Excludes non-core adjustments consisting of merger-related

revenues and expenses associated with our acquisitions of KBW, the Knight Capital Fixed Income business, and Miller Buckfire.

(2)

Transition pay includes amortization of retention awards, signing bonuses,

and upfront notes. |

32

Core Non-Interest Expenses

Year ended December 31, 2013

($ in thousands)

12/31/13

(1)

12/31/12

% Change

12/31/13

(1)

12/31/12

Net revenues

1,978,340

$

1,594,113

$

24.1%

100.0%

100.0%

Compensation and benefits

1,150,883

937,066

22.8%

58.2%

58.8%

Transitional pay

86,108

73,074

17.8%

4.4%

4.6%

Total compensation and benefits

1,236,991

1,010,140

22.5%

62.5%

63.4%

Occupancy and equipment rental

149,488

128,365

16.5%

7.6%

8.1%

Communication and office supplies

95,539

79,406

20.3%

4.8%

5.0%

Commissions and floor brokerage

35,812

29,610

20.9%

1.8%

1.9%

Other operating expenses

165,426

116,845

41.6%

8.4%

7.3%

Total non-comp operating expenses

446,265

354,226

26.0%

22.6%

22.2%

Total non-interest expense

1,683,256

1,364,366

23.4%

85.1%

85.6%

Income from continuing operations before income taxes

295,084

229,747

28.4%

14.9%

14.4%

Provision for income taxes

110,426

84,451

30.8%

5.6%

5.2%

Non-GAAP net income from continuing operations

184,658

$

145,296

$

27.1%

9.3%

9.1%

Non-core expenses (after-tax)

(11,751)

-

GAAP net income from continuing operations

172,907

$

145,296

$

Year Ended

% of Net revenues

(1)

Excludes non-core adjustments consisting of charges related to

expensing stock awards issued as retention in connection with the acquisitions of KBW and the Knight Capital Fixed Income business and other

merger-related

revenues

and

expenses

associated

with

our

acquisitions

of

KBW,

the

Knight

Capital

Fixed

Income

business,

Miller

Buckfire

and

a

U.S.

tax

benefit

in

connection

with

discontinuing

operations

of

SN

Canada. |

33

Segment Comparison -

Core

($ in thousands)

12/31/13

12/31/12

(1)

%

Change

9/30/13

%

Change

12/31/13

12/31/12

(1)

%

Change

Net revenues:

Global Wealth Management

292,836

$

253,775

$

15.4%

274,669

$

6.6%

1,117,179

$

991,597

$

12.7%

Institutional Group

267,282

160,693

66.3%

205,132

30.3%

861,158

604,654

42.4%

Other

4,563

(3,185)

(243.3%)

(167)

nm

3

(2,138)

(100.1%)

564,681

$

411,283

$

37.3%

479,634

$

17.7%

1,978,340

$

1,594,113

$

24.1%

Operating contribution:

Global Wealth Management

79,022

$

68,737

$

15.0%

72,128

$

9.6%

299,572

$

266,669

$

12.3%

Institutional Group

48,590

21,678

124.1%

34,986

38.9%

142,889

101,487

40.8%

Other

(37,184)

(30,064)

23.7%

(41,671)

(10.8%)

(147,377)

(138,409)

6.5%

90,428

$

60,351

$

49.8%

65,443

$

38.2%

295,084

$

229,747

$

28.4%

Operating contribution

(2)

Global Wealth Management

27.0

27.1

26.3

26.8

26.9

Institutional Group

18.2

13.5

17.1

16.6

16.8

Other

(6.6)

(7.3)

(8.7)

(7.4)

(8.7)

16.0

14.7

13.6

14.9

14.4

As a percentage of net revenues:

Three Months Ended

Year Ended

(1)

Core

(non-GAAP)

results

for

the

three

and

twelve

months

ended

December

31,

2012

are

the

same

as

GAAP

results.

(2)

Contribution margin for the other segment is divided by consolidated net

revenues. |

34

Global Wealth Management

($ in thousands)

12/31/13

12/31/12

% Change

9/30/13

% Change

12/31/13

12/31/12

% Change

Commissions

104,149

$

93,043

$

11.9%

99,427

$

4.7%

410,238

$

361,871

$

13.4%

Principal transactions

55,809

53,542

4.2%

58,658

(4.9%)

227,087

225,007

0.9%

Asset management & service fees

82,964

68,631

20.9%

76,667

8.2%

304,541

257,257

18.4%

Net interest

31,092

21,182

46.8%

27,665

12.4%

104,748

79,328

32.0%

Investment banking

9,568

10,818

(11.6%)

9,394

1.8%

45,400

44,919

1.1%

Other income

9,254

6,559

41.1%

2,858

223.9%

25,165

23,215

8.4%

Net revenues

292,836

253,775

15.4%

274,669

6.6%

1,117,179

991,597

12.7%

Compensation and benefits

167,980

146,311

14.8%

159,949

5.0%

648,681

576,744

12.5%

Non-comp operating expenses

45,834

38,727

18.4%

42,592

7.6%

168,926

148,184

14.0%

Total non-interest expenses

213,814

185,038

15.6%

202,541

5.6%

817,607

724,928

12.8%

Income before income taxes

79,022

$

68,737

$

15.0%

72,128

$

9.6%

299,572

$

266,669

$

12.3%

Compensation and benefits

57.4%

57.7%

58.2%

58.1%

58.2%

Non-comp operating expenses

15.6%

15.2%

15.5%

15.1%

14.9%

Income before income taxes

27.0%

27.1%

26.3%

26.8%

26.9%

Three Months Ended

Year Ended

Ratios to net revenues

: |

35

Stifel Bank & Trust (an operating unit of GWM)

As of

12/31/13

12/31/12

% Change

9/30/13

% Change

Assets

$

5,027,023

$

3,650,235

37.7

$

4,547,071

10.6

Investment securities

3,062,549

2,327,316

31.6

2,949,080

3.8

Retained loans, net

1,412,136

822,711

71.6

1,061,313

33.1

Loans held for sale

109,110

214,531

(49.1)

75,440

44.6

Deposits

4,663,323

3,346,133

39.4

4,228,405

10.3

Allowance for loan losses

12,668

$

8,145

$

55.5

13,233

$

(4.3)

Allowance as a percentage of loans

0.89

%

0.99

%

1.23

%

Non-performing loans

1,504

$

1,808

$

(16.8)

14,759

$

(89.8)

Other non-performing assets

131

373

(64.9)

-

100.0

Non-performing assets

1,635

$

2,181

$

(25.0)

14,759

$

(88.9)

Non-performing assets as a percentage of

total assets

0.03

%

0.06

%

0.32

%

As of |

36

Institutional Group

($ in thousands)

12/31/13

12/31/12

% Change

9/30/13

% Change

12/31/13

12/31/12

% Change

Net revenues

267,282

$

160,693

$

66.3%

205,132

$

30.3%

861,158

$

604,654

$

42.4%

Compensation and benefits

165,779

105,025

57.8%

119,874

38.3%

524,870

380,185

38.1%

Non-comp operating expenses

52,913

33,990

55.7%

50,272

5.3%

193,399

122,982

57.3%

Total non-interest expenses

218,692

139,015

57.3%

170,146

28.5%

718,269

503,167

42.7%

Income before income taxes

48,590

$

21,678

$

124.1%

34,986

$

38.9%

142,889

$

101,487

$

40.8%

Ratios to net revenues

:

Compensation and benefits

62.0%

65.4%

58.4%

60.9%

62.9%

Non-comp operating expenses

19.8%

21.1%

24.5%

22.5%

20.3%

Income before income taxes

18.2%

13.5%

17.1%

16.6%

16.8%

Three Months Ended

Year Ended |

37

Institutional Group Revenues

($ in thousands)

12/31/13

12/31/12

% Change

9/30/13

% Change

12/31/13

12/31/12

% Change

Institutional brokerage:

Equity

60,204

$

38,659

$

55.7%

58,677

$

2.6%

232,392

$

151,308

$

53.6%

Fixed income

51,103

43,598

17.2%

51,658

(1.1%)

189,200

172,183

9.9%

111,307

82,257

35.3%

110,335

0.9%

421,592

323,491

30.3%

Investment Banking:

Capital raising

Equity

46,634

16,947

175.2%

30,739

51.7%

142,636

81,818

74.3%

Fixed income

14,677

18,555

(20.9%)

13,531

8.5%

58,096

59,024

(1.6%)

61,311

35,502

72.7%

44,270

38.5%

200,732

140,842

42.5%

Advisory fees

87,981

26,618

230.5%

39,186

124.5%

201,928

95,519

111.4%

Investment banking

149,292

62,120

140.3%

83,456

78.9%

402,660

236,361

70.4%

Other

(1)

6,683

16,316

(59.0%)

11,341

(41.1%)

36,906

44,802

(17.6%)

Total net revenue

267,282

$

160,693

$

66.3%

205,132

$

30.3%

861,158

$

604,654

$

42.4%

Three Months Ended

Year Ended

(1)

Includes net interest and other income. |