Attached files

| file | filename |

|---|---|

| EX-10.39 - EX-10.39 - Gannett Co., Inc. | d694452dex1039.htm |

| EX-10.37 - EX-10.37 - Gannett Co., Inc. | d694452dex1037.htm |

| EX-21 - EX-21 - Gannett Co., Inc. | d694452dex21.htm |

| EX-32.2 - EX-32.2 - Gannett Co., Inc. | d694452dex322.htm |

| EX-32.1 - EX-32.1 - Gannett Co., Inc. | d694452dex321.htm |

| EX-31.1 - EX-31.1 - Gannett Co., Inc. | d694452dex311.htm |

| EX-31.2 - EX-31.2 - Gannett Co., Inc. | d694452dex312.htm |

| EX-10.38 - EX-10.38 - Gannett Co., Inc. | d694452dex1038.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 29, 2013

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-36097

New Media Investment Group Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

38-3910250 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1345 Avenue of the Americas, New York, New York |

10105 | |

| (Address of principal executive offices) | (Zip Code) | |

Telephone: (212) 479-3160

(Registrant’s telephone number, including area code)

Securities Registered Pursuant to Section 12(b) of the Act:

| Title of each class: |

Name of each exchange on which registered: | |

| Common stock, par value $0.01 per share | New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit and post such files). Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ |

Accelerated filer ¨ | Non-accelerated filer x | Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates on March 4, 2014 was $448,500,000. The Registrant was not a public company as of the last business day of its most recently completed second fiscal quarter and, therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date.

As of March 4, 2014, 30,000,000 shares of the registrant’s common stock were outstanding.

Table of Contents

NEW MEDIA INVESTMENT GROUP INC.

FORM 10-K

FOR THE YEAR ENDED DECEMBER 29, 2013

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD LOOKING INFORMATION

Certain statements in this report on Form 10-K may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 that reflect our current views regarding, among other things, our future growth, results of operations, performance and business prospects and opportunities, as well as other statements that are other than historical fact. Words such as “anticipate(s),” “expect(s)”, “intend(s)”, “plan(s)”, “target(s)”, “project(s)”, “believe(s)”, “will”, “aim”, “would”, “seek(s)”, “estimate(s)” and similar expressions are intended to identify such forward-looking statements.

Forward-looking statements are based on management’s current expectations and beliefs and are subject to a number of known and unknown risks, uncertainties and other factors that could lead to actual results materially different from those described in the forward-looking statements. We can give no assurance that our expectations will be attained. Our actual results, liquidity and financial condition may differ from the anticipated results, liquidity and financial condition indicated in these forward-looking statements. These forward looking statements are not a guarantee of future performance and involve risks and uncertainties, and there are certain important factors that could cause our actual results to differ, possibly materially from expectations or estimates reflected in such forward-looking statements, including, among others:

| • | general economic, market and political conditions; |

| • | the potential adverse effects of the Restructuring (as defined below); |

| • | the risk that we may not realize the anticipated benefits of the Local Media Acquisition (as defined below) or potential future acquisitions; |

| • | the availability and cost of capital for future investments; |

| • | our ability to pay dividends; |

| • | our ability to realize the benefits of the Management Agreement (as defined below); |

| • | the competitive environment in which we operate; |

| • | our ability to grow our digital business and digital audience and advertiser base; |

| • | our ability to recruit and retain key personnel. |

Additional risk factors that could cause actual results to differ materially from our expectations include, but are not limited to, the risks identified by us under the heading “Risk Factors” in Item 1A of this report. Such forward-looking statements speak only as of the date on which they are made. Except to the extent required by law, we expressly disclaim any obligation to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations with regard thereto or change in events, conditions or circumstances on which any statement is based.

ii

Table of Contents

| Item 1. | Business |

General Overview

New Media Investment Group Inc. (“New Media,” “Company,” “us,” or “we”), was formed as a Delaware corporation on June 18, 2013. Pursuant to the Restructuring (as defined below), Newcastle Investment Corp. (“Newcastle”) owned approximately 84.6% of New Media until February 13, 2014, upon which date Newcastle distributed the shares that it held in New Media to its shareholders on a prorata basis. New Media had no operations until November 26, 2013, when it assumed control of GateHouse Media, LLC (formerly known as GateHouse Media, Inc.) (“GateHouse” or “Predecessor”) and Local Media Group Holdings LLC (“Local Media Parent”). GateHouse was determined to be the predecessor to New Media, as the operations of GateHouse comprise substantially all of the business operations of the combined entities. Both New Media and Newcastle are externally managed and advised by an affiliate of Fortress Investment Group LLC (“Fortress”).

New Media is a newly listed company that owns, operates and invests in high quality local media assets. We have a particular focus on owning and acquiring strong local media assets in small to mid-size markets. With our collection of assets, we focus on two large business categories; consumers and small to medium size businesses (“SMBs”).

Our portfolio of media assets today spans across 352 markets and 24 states. Our products include 421 community print publications, 350 websites, 333 mobile sites and six yellow page directories. We reach over 12 million people per week and serve over 130,000 business customers.

We are focused on growing our consumer revenues primarily through our penetration into the local consumer market that values comprehensive local news and receives their news primarily from our products. We believe our rich local content, our strong media brands, and multiple platforms for delivering content will impact our reach into the local consumers leading to growth in subscription income. We also believe our local consumer penetration will lead to transaction revenues as we link consumers with local businesses. For our SMB business category, we focus on leveraging our strong local media brands, our in-market sales force and our high consumer penetration rates with a variety of products and services that we believe will help SMBs expand their marketing, advertising and other digital lead generation platforms.

Our business strategy is to be the preeminent provider of local news, information, advertising and digital services in the markets we operate in today. We aim to grow our business organically through what we believe are both our consumer and SMB strategies. We also plan to pursue strategic acquisitions of high quality local media assets at attractive valuation levels. Finally, we intend to periodically distribute a substantial portion of our free cash flow as a dividend to stockholders, subject to satisfactory financial performance, approval by our board of directors (the “Board of Directors”) and dividend restrictions in both the GateHouse Credit Facilities (as defined below) and Local Media Credit Facility (as defined below). The Board of Directors’ determinations regarding dividends will depend on a variety of factors, including the Company’s U.S. generally accepted accounting principles (“GAAP”) net income, free cash flow generated from operations or other sources, liquidity position and potential alternative uses of cash, such as acquisitions, as well as economic conditions and expected future financial results. The availability of free cash flow for the payment of dividends is also subject to restrictions in both the GateHouse and Local Media Credit Facilities.

We believe that our focus on owning and operating dominant local-content-oriented media properties in small to mid-size markets puts us in a position to better execute our strategy. We believe that being the dominant provider of local news and information in the markets in which we operate and distributing that content across multiple print and digital platforms, gives us an opportunity to grow our audiences and reach. Further, we believe our strong local media brands and our in-market sales presence gives us the opportunity to expand our advertising and lead generation products with local business customers.

1

Table of Contents

Central to our business strategy is our digital marketing services business called Propel Marketing (“Propel”). We launched the business in 2012 and have seen rapid growth since then. We believe Propel and its digital marketing service products will be a key component to our overall organic growth strategy.

We believe that Propel will allow us to capitalize on the following opportunities in the marketplace:

There are approximately 27 million SMBs in the U.S. according to the 2011 U.S. Census data. Of these, approximately 26.7 million have 20 employees or less.

Many of the owners and managers of these SMBs do not have the bandwidth, expertise or resources to navigate the fast evolving digital marketing sector, but are increasingly aware of the need to establish and maintain a digital presence in order to stay connected with current and future customers.

Propel is designed to offer a complete set of turn-key digital marketing services to SMBs that provides transparent results to the business owners. Propel provides four broad categories of services: building businesses a presence, helping businesses to be located by consumers online, engaging with consumers, and growing their customer base.

We believe our local media properties are uniquely positioned to sell these digital marketing services to local business owners. Our strong and trusted local brands, combined with our in-market sales presence give us a distinct advantage to sell these services, which are new and can be complicated to local business owners.

Our core products include:

| • | 85 daily newspapers with total paid circulation of approximately 736,000; |

| • | 240 weekly newspapers (published up to three times per week) with total paid circulation of approximately 300,000 and total free circulation of approximately 680,000; |

| • | 96 “shoppers” (generally advertising-only publications) with total circulation of approximately 1.9 million; |

| • | 350 locally focused websites and 333 mobile sites, which extend our businesses onto the internet and mobile devices with approximately 100 million page views per month; |

| • | six yellow page directories, with a distribution of approximately 432,000, that cover a population of approximately 1.1 million people; and |

| • | Propel digital marketing services. |

Our print and online products focus on the local community from a content, advertising, and digital marketing perspective. As a result of our focus on small and midsize markets, we are usually the primary, and sometimes, the sole provider of comprehensive and in-depth local market news and information in the communities we serve. Our content is primarily devoted to topics that we believe are highly relevant and of interest to our audience such as local news and politics, community and regional events, youth sports, opinion and editorial pages, local schools, obituaries, weddings and police reports.

More than 84% of our daily newspapers have been published for more than 100 years and 100% have been published for more than 50 years. We believe that the longevity of our publications demonstrates the value and relevance of the local information that we provide and has created a strong foundation of reader loyalty and a highly recognized media brand name in each community we serve. As a result of these factors, we believe that our publications have high local audience penetration rates in our markets, thereby providing advertisers with strong local market reach.

We believe the large number of publications we have, our focus on smaller markets, and our geographic diversity also provide the following benefits to our strategy:

| • | Diversified revenue streams, both in terms of customers and markets; |

2

Table of Contents

| • | Operational efficiencies realized from clustering of business assets; |

| • | Operational efficiencies realized from centralization of back office functions; |

| • | Ability to provide consistent management practices and ensure best practices; and |

| • | Less competition and high barriers to entry. |

The newspaper industry has experienced declining revenue and profitability dating back to 2007 due to, among other things, advertisers’ shift from print to digital media and general market conditions. Our Predecessor was affected by this trend and has experienced a history of net operating losses. For the fiscal year ended December 30, 2012, our Predecessor experienced a net loss of $29.8 million.

Our revenues derived from our SMB category come from a variety of print and digital advertising products, digital service products we offer through our Propel business, and commercial printing services. Our consumer category revenue comes primarily from subscription income as consumers pay for our deep, rich local contents, both in print and online, however primarily print today.

Our operating costs consist primarily of labor, newsprint, and delivery costs. Our selling, general and administrative expenses consist primarily of labor costs. Compensation represents just over 50% of our operating expenses. Over the last few years, we have worked to drive efficiencies through centralization of back office functions, outsourcing and leveraging our scale to purchase more effectively. Additionally, we have taken steps to cluster our operations, thereby increasing the usage of facilities and equipment while increasing the productivity of our labor force. We expect to continue to employ these steps as part of our business and clustering strategy.

Local Media Acquisition

Newcastle acquired Local Media Group Inc. (formerly known as Dow Jones Local Media Group, Inc.) (“Local Media”) on September 3, 2013 from News Corp. Inc. and contributed to New Media 100% of the stock of Local Media Parent (which owns all of Local Media’s stock) on GateHouse’s emergence from bankruptcy on November 26, 2013 (the “Effective Date”) of the Plan (as defined below). Local Media is the publisher of locally-based print and online media. Local Media publishes eight daily community newspapers and seventeen weekly papers in seven states in the New England, Mid-Atlantic and Pacific Coast regions of the United States. Local Media also publishes associated internet sites, magazines and other news and advertising niche publications and offers commercial print and household distribution services. During the period ended December 29, 2013, the Local Media portfolio of products had a combined average circulation of 195,000 daily, as well as 180,734 average daily unique visitors to its local websites. Local Media has five print production facilities which are located in Hyannis, Massachusetts; Middletown, New York; Medford, Oregon; Portsmouth, New Hampshire; and Stockton, California.

In exchange for the contribution of Local Media, Newcastle received shares of common stock, par value $0.01 per share, of New Media (“New Media Common Stock” or our “Common Stock”), equal in value to the cost of the acquisition of Local Media by Newcastle (“Local Media Acquisition”). Local Media Parent is now a wholly owned subsidiary of New Media.

GateHouse manages the assets of Local Media pursuant to a management and advisory agreement. The agreement has a two-year term, with automatic renewal for successive two-year periods unless terminated. While the agreement is in effect, GateHouse will receive an annual management fee of $1.1 million, subject to adjustments (up to a maximum annual management fee of $1.2 million), and an annual incentive compensation fee based on exceeding EBITDA targets of Local Media.

On the Effective Date, New Media entered into a management agreement with FIG LLC (the “Manager”) (the “Management Agreement”) pursuant to which the Manager will manage the operations of New Media. The annual management fee will be 1.50% of New Media’s gross equity as set forth in the Management Agreement and the Manager is eligible to receive incentive compensation.

3

Table of Contents

Restructuring and Spin-off from Newcastle Investment Corp.

We acquired our operations as part of the restructuring (the “Restructuring”) of our Predecessor, GateHouse. On September 27, 2013 (the “Petition Date”), GateHouse commenced the Restructuring in which it sought confirmation of its bankruptcy plan sponsored by Newcastle, as the holder of the majority of the Outstanding Debt (as defined as follows). The Plan relates to the Restructuring of our Predecessor’s obligations under the amended and restated credit agreement by and among certain affiliates of GateHouse, the lenders from time to time thereto and Cortland Products Group, as administrative agent, dated February 27, 2007 (as amended, the “2007 Credit Facility”) and certain interest rate swaps (collectively, the “Outstanding Debt”). The Bankruptcy Court confirmed the reorganization plan (the “Plan”) on November 6, 2013 and GateHouse consequently emerged from Chapter 11 protection on November 26, 2013.

Pursuant to the Restructuring, Newcastle offered to purchase the Outstanding Debt in cash and at 40% of (i) $1,167 million of principal claims under the 2007 Credit Facility, plus (ii) accrued and unpaid interest at the applicable contract non-default rate with respect thereto, plus (iii) all amounts, excluding any default interest, arising from transactions in connection with interest rate swaps secured under the 2007 Credit Facility (the “Cash-Out Offer”) on the Effective Date. The holders of the Outstanding Debt had the option of receiving, in satisfaction of their Outstanding Debt, their pro rata share of the (i) Cash-Out Offer and/or (ii) New Media Common Stock and net proceeds, if any, of the GateHouse Credit Facilities. All pensions, trade and all other unsecured claims will be paid in the ordinary course.

On the Effective Date (i) GateHouse became our wholly-owned subsidiary as a result of (a) the cancellation and discharge of the currently outstanding equity interests in GateHouse (the holders of which received warrants issued by New Media) and (b) the issuance of equity interests in the reorganized GateHouse to New Media; (2) Local Media Parent, which was a wholly-owned subsidiary of Newcastle, following the Local Media Acquisition became a wholly-owned subsidiary of New Media as a result of Newcastle’s transfer of Local Media Parent to New Media; (3) New Media entered into the Management Agreement with our Manager, (4) New Media entered into the GateHouse Management and Advisory Agreement (the “GateHouse Management Agreement”) with GateHouse; and (5) all of GateHouse’s Outstanding Debt was cancelled and discharged and the holders of the Outstanding Debt received, at their option, their pro rata share of the (i) Cash-Out Offer and/or (ii) New Media Common Stock and the net proceeds of the GateHouse Credit Facilities. Pursuant to the Cash-Out Offer, Newcastle offered to buy the claims of the holders of the Outstanding Debt. As a result of these transactions, Newcastle owned 84.6% of New Media as of the Effective Date.

On September 27, 2013, Newcastle announced that its board of directors unanimously approved a plan to spin-off our Company. Newcastle’s board of directors made the determination to spin-off our assets because it believed that our value can be increased over time through a strategy aimed at acquiring local media assets and organically growing our digital marketing business. In order to effect the separation and spin-off of our Company, we filed a registration statement on Form S-1, as amended, which was declared effective by the Securities and Exchange Commission (the “SEC”) on January 30, 2014.

Each share of Newcastle common stock outstanding as of 5:00 PM, Eastern Time, on February 6, 2014, the Record Date, entitled the holder thereof to receive 0.07219481485 shares of our Common Stock (the “Distribution” or the “spin-off”). The spin-off was completed on February 13, 2014, the Distribution Date. Immediately thereafter, we became publicly traded company independent from Newcastle trading on the New York Stock Exchange under the ticker symbol “NEWM.”

4

Table of Contents

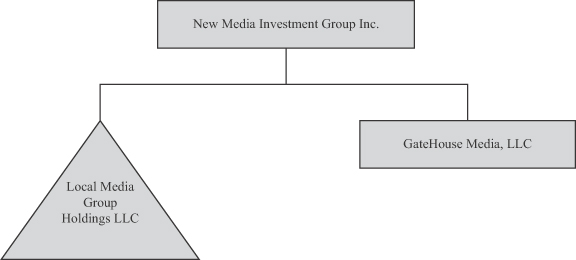

Corporate Entity Structure

The chart below sets forth our entity structure and that of our direct and indirect subsidiaries. This chart does not include all of our affiliates and subsidiaries and, in some cases, we have combined separate entities for presentation purposes.

Industry Overview

We operate in what is sometimes referred to as the “hyper-local” or community news market and market within the media industry. Media companies that serve this segment provide highly focused local content and advertising that is generally unique to each market they serve and is not readily obtainable from other sources. Local publications include community newspapers, websites, shoppers, traders, real estate guides, special interest magazines and directories. Due to the unique local nature of their content and audience, community publications compete for advertising customers with other forms of traditional media, including direct mail, directories, radio, television, and outdoor advertising. They also compete with new local and national digital and social media businesses for advertising, digital services and customers. We believe that local print and online publications in smaller markets are the most effective medium for local retail advertising, which emphasizes the price of goods in an effort to move inventory on a regular basis, in contrast to radio, broadcast and cable, television, and the internet, which are generally used for image or branding advertising. In addition, we believe local print and online publications generally have the highest local audience penetration rates, which allows local advertisers to get their message to a large portion of the local audience. Finally, national digital competitors tend to have no local in-market sales presence which we believe gives the local community publications an advantage when selling these types of products and services.

Locally focused media in small and midsize communities is distinct from national and urban media delivered through outlets such as television, radio, metropolitan and national newspapers and the internet. Larger media outlets tend to offer broad based information to a geographically scattered audience, which tends to be more of a commodity. In contrast, locally focused media delivers a highly focused product that is often the only source of local news and information in the market it serves. Our segment of the media industry is also characterized by high barriers to entry, both economic and social. Small and midsize communities can generally only sustain one newspaper. Moreover, the brand value associated with long-term reader and advertiser loyalty, and the high start-up costs associated with developing and distributing content and selling advertisements, help to limit competition.

We also believe there is a growing need among small to mid-size businesses to be able to generate leads and interact with consumers across all the digital platforms, which takes many forms including websites, mobile sites,

5

Table of Contents

tablets and social media. These local business owners and managers lack the time, expertise and resources to capitalize on the potential of these new consumer-reaching channels. National competitors in this category do not generally have a local in-market presence. We believe this represents a substantial opportunity for our local media business.

Advertising Market

The primary sources of advertising revenue for local publications are small businesses, corporations, government agencies and individuals who reside in the market that a publication serves. By combining paid circulation publications with total market coverage publications such as shoppers and other specialty publications (tailored to the specific attributes of a local community), local publications are able to reach nearly 100% of the households in a distribution area. As macroeconomic conditions in advertising change due to increasing internet and mobile usage and the wide array of available information sources, we have seen advertisers shift their focus to incorporate a digital advertising and services component into their overall local marketing strategy. To that end, in addition to printed products, the majority of our local publications have an online presence that further leverages the local brand, ensures higher penetration into the market, and provides a digital alternative for local advertisers to reach consumers. We also have a strong digital marketing services business, Propel.

Digital Media

The time spent online and on mobile devices each day by media consumers continues to grow and newspaper web and mobile sites offer a wide variety of content providing comprehensive, in-depth and up to the minute coverage of news and current events. The ability to generate, publish and archive more news and information than most other sources has allowed newspapers to produce some of the most visited sites on the internet. Newspaper websites have proven to be some of the most visited websites by online media news consumers.

We believe that our local publications are well positioned to capitalize on their existing market presence and grow their total audience base by publishing proprietary local content digitally: via the internet, mobile websites and mobile applications. Local digital media include traditional classifieds, directories of business information, local advertising, databases, audience-contributed content and mobile applications. We believe this additional community-specific content will further extend and expand both the reach and the brand of our publications with readers and advertisers. We believe that building a strong local digital business extends the core audience of a local publication.

The opportunity created by the digital extension of the core audience makes local digital advertising an attractive complement for existing print advertisers, while opening up opportunities to attract new local advertisers that have not previously advertised with local publications. In addition, we believe that national advertisers have an interest in reaching buyers on a hyper-local level and, although they historically have not been significant advertisers in community publications, we believe the digital media offers them a powerful medium to reach local audiences. This opportunity is further enhanced by our behavioral targeting products, which allow advertisers to reach specific demographics of our audience and follow that audience across multiple websites, delivering advertisements across the platforms. Further, digital marketing services businesses are poised to benefit from the rise in internet marketing spend, with newspaper digital marketing services revenue growing 11% between 2011 and 2012, and 208% between 2005 and June 30, 2013, according to the 2013 IAB Internet Advertising Revenue Report.

We believe that a strong digital business will enhance our revenues. In addition, we believe that we have the expertise and sales resource to help other businesses maximize their digital opportunities. Accordingly, we have launched our digital marketing services business, Propel, designed to help SMBs utilize the digital space to generate leads, interact with consumers and grow their businesses. New Media’s digital revenue derived from

6

Table of Contents

advertising circulation and other revenue have grown since the launch of Propel in 2012. New Media’s digital revenue was $48.6 million for the year ended December 29, 2013, a 22.4% growth as compared with the same period in 2012, which had digital revenue of $39.7 million. Of this, $6.4 million, or 13.2% of digital revenue for the year ended December 29, 2013 was attributable to Propel. See “Risk Factors—Risks Related to Our Business—We have invested in growing our digital business, but such investments may not be successful, which could adversely affect our results of operations.”

We anticipate that the digital marketing services sector will continue to grow as SMBs move from print to digital marketing in connection with consumers spending more time online. According to the 2011 U.S. Census data, there are approximately 27 million SMBs in the US, 26.7 million of the SMBs have 20 employees or less, and these businesses are expected to spend $24 billion on digital marketing by 2015 (according to the 2011 U.S. SMB Spending Forecast by BIA/Kelsey). Owners of these businesses often lack the bandwidth to navigate the digital marketing sector. Recent studies done by Google Places For Businesses in 2012 and the Small Business Sentiment Survey by Yodle in 2013 indicate that although 89% of consumers expect all businesses to have a website and 97% of consumers search for local businesses online, 52% of SMBs do not have a website and 90% do not have a mobile website. Further, 60% of SMBs with websites were found to not have a phone number on their website according to the 2012 BIA Kelsey. Propel offers SMBs digital services, including website design, search engine optimization, mobile websites, social media, retargeting and other advertising services. Our Predecessor believed, and we too believe, that Propel is well positioned to assist SMBs in the digital space and expects Propel to contribute meaningfully to future revenue growth. Propel is also able to leverage the more than 1,000 New Media sales representatives within the local markets served.

Circulation

Overall daily newspaper print circulation, including national and urban newspapers, has been declining slowly over the past several years. Small and midsize local market newspapers have generally had smaller declines and more stability in their paid print circulation volumes due to the relevant and unique hyper-local news they produce. In addition, this unique and valuable hyper-local content along with multiple delivery platforms now available will allow smaller market newspapers to continue to raise prices, leading to stable circulation revenues. Data and technology now available to newspapers allow them to target pricing more at the household level rather than purely by market. This will lead to more effective pricing strategies and enhance stability for circulation revenues. According to the Newspaper Association of America, pay meters and pricing helped the newspaper industry grow circulation revenue by 5% from 2011 to 2012.

Our Strengths

High Quality Assets with Leading Local Businesses. Our publications benefit from a long history in the communities we serve as one of the leading, and often sole, providers of comprehensive and in-depth local content. This has resulted in brand recognition for our publications, reader loyalty and high local audience penetration rates, which are highly valued by local advertisers. We continue to build on long-standing relationships with local advertisers and our in-depth knowledge of the consumers in our local markets.

Large Locally Focused Sales Force. We have large and well known “in-market” local sales forces in the markets we serve, consisting of over 1,000 sales representatives, including 35 dedicated to Propel and 14 third party sales affiliations. Our sales forces are generally among the largest locally oriented media sales forces in their respective communities. We have long-standing relationships with many local businesses and have the ability to be face to face with most local businesses due to these unique characteristics we enjoy. We believe our strong brands combined with our “in-market” presence give us a distinct advantage in selling and growing in the digital services sector given the complex nature of these products. We also believe that these qualities provide leverage for our sales force to grow additional future revenue streams in our markets.

Ability to Acquire and Integrate New Assets. We have created a national platform for consolidating local media businesses and have demonstrated an ability to successfully identify, acquire and integrate local media

7

Table of Contents

asset acquisitions. We have acquired over $1.7 billion of assets since 2006. We have acquired both traditional newspaper and directory businesses. We have a very scalable infrastructure and platform to leverage for future acquisitions.

Scale Yields Operating Profit Margins and Allows Us to Realize Operating Synergies. We believe we can generate higher operating profit margins than our publications could achieve on a stand-alone basis by leveraging our operations and implementing revenue initiatives, especially digital initiatives, across a broader local footprint in a geographic cluster and by centralizing certain back office production, accounting, administrative and corporate operations. We also benefit from economies of scale in the purchase of insurance, newsprint and other large strategic supplies and equipment. Finally, we have the ability to further leverage our centralized services and buying power to reduce operating costs when making future strategic accretive acquisitions.

Local Business Profile Generates Significant Cash Flow. Our local business profile will allow us to generate significant recurring cash flow due to our diversified revenue base, high operating profit margins and our low capital expenditure and working capital requirements. As a result of the Restructuring, which extinguished GateHouse’s Outstanding Debt, our interest and debt servicing expenses are significantly lower than GateHouse’s interest and debt servicing expenses. As of the Effective Date, our debt structure consists of the GateHouse Credit Facilities and the Local Media Credit Facility. We currently estimate that we will have significant available cash flow totaling $50 to $70 million in 2014 which we believe will create stockholder value through our investments in organic growth, investments in accretive acquisitions and the return of cash to stockholders in the form of dividends, subject to approval by our Board of Directors. We further believe the strong cash flows generated and available to be invested will lead to consistent future dividend growth.

Experienced Management Team. Our senior management team is made up of executives who have an average of over 20 years of experience in the media industry, including strong traditional and digital media expertise. Our executive officers have broad industry experience with regard to both growing new digital business lines and identifying and integrating strategic acquisitions. Our management team also has key strengths in managing wide geographically disbursed teams, including the sales force, and identifying and centralizing duplicate functions across businesses leading to reduced core infrastructure costs.

Our Strategy

We intend to create stockholder value through a variety of factors including organic growth driven by our consumer and SMB strategies, pursuing attractive strategic acquisitions of high quality local media assets, and through the distribution of a substantial portion of our free cash flow as a dividend. However, there is no guarantee that we will be able to accomplish any of these strategic initiatives.

Our strategy will be to acquire and operate traditional local media businesses and transform them from print-centric operations to dynamic multi-media operations through our existing online advertising and digital marketing services businesses. We will also leverage our existing platform to operate these businesses more efficiently. We believe all of these initiatives will lead to revenue and cash flow growth for New Media and will enable us to pay dividends to our stockholders. We expect to distribute a substantial portion of our free cash flow as a dividend to stockholders, subject to satisfactory financial performance and approval by our Board of Directors. The Board of Directors’ determinations regarding dividends will depend on a variety of factors, including the Company’s GAAP net income, free cash flow generated from operations or other sources, liquidity position and potential alternative uses of cash, such as acquisitions, as well as economic conditions and expected future financial results. The availability of free cash flow for the payment of dividends is also subject to restrictions in both the GateHouse Credit Facilities and Local Media Credit Facility. The key elements of our strategy include:

Maintain Our Leading Position in the Delivery of Proprietary Content in Our Communities. We seek to maintain our position as a leading provider of local content in the markets we serve and to leverage this position to strengthen our relationships with both readers and local businesses, thereby increasing penetration rates and

8

Table of Contents

market share. A critical aspect of this approach is to continue to provide local content that is not readily obtainable elsewhere and to be able to deliver that content to our customers across multiple print and digital platforms.

Grow Our New Digital Marketing Services Business. We plan to scale and expand our new recently created digital marketing services businesses, Propel. We believe Propel will allow us to sell digital marketing services to SMBs both in and outside existing New Media markets. The SMB demand for digital service solutions is great and represents a rapidly expanding opportunity. According to 2011 U.S. census data, there are approximately 27 million SMBs in the U.S. and, according to a 2011 U.S. SMB Spending forecast by BUIA/Kelsey, these businesses are expected to spend $24 billion on digital marketing by 2015. Owners of these businesses often lack the bandwidth to navigate the digital marketing sector, with 52% of SMBs not having a website and 90% not having mobile-friendly websites according to a Yodle Small Business Sentiment Survey in 2013.

Pursue Strategic Accretive Acquisitions. We intend to capitalize on the highly fragmented and distressed newspaper and directory industries which have greatly reduced valuation levels. We initially expect to focus our investments in the local newspaper and yellow page directory sectors, in small to mid-size markets. We believe we have a strong operational platform as well as a scalable digital marketing services business, Propel. This platform, along with deep industry specific knowledge and experience that our management team has can be leveraged to reduce costs, stabilize the core business and grow digital revenues at acquired properties. The size and fragmentation of the addressable newspaper and yellow page directory market place in the United States, the greatly reduced valuation levels that exist in these industries, and our deep experience make this an attractive place for our initial consolidation focus and capital allocation. Over the longer term we also believe there may be opportunity to diversify and acquire these types of assets internationally, as well as other traditional local media assets such as broadcast TV, out of home advertising (billboards) and radio, in the United States and internationally.

Stabilize Our Core Business Operations. We have four primary drivers in our strategic plans to stabilize our core business operations, including: (i) identifying permanent structural expense reductions in our traditional business cost infrastructure and re-deploying a portion of those costs toward future growth opportunities, primarily on the digital side of our business; (ii) accelerating the growth of both our digital audiences and revenues through improvements to current products, new product development, training, opportunistic changes in hiring to create an employee base with a more diversified skill set and sharing of best practices; (iii) accelerating our consumer revenue growth through subscription pricing increases, pay meters for digital content and growth in our overall subscriber base; and (iv) stabilizing our core print advertising revenues through improvements to pricing, packaging of products for customers that will produce the best results for them, and more technology and training for sales management and sales representatives.

The newspaper industry has experienced declining revenue and profitability over the past several years due to, among other things, advertisers’ shift from print to digital media following the consumer shift, and general market conditions. GateHouse, our Predecessor, was affected by this trend and experienced net losses of $160.8 million during the nine month period ended September 29, 2013 and $29.8 million during the fiscal year ended December 30, 2012. Total revenue decreased by 1.9% to $356.2 million for the nine months ended September 29, 2013 and 5.1% to $488.6 million for the year ended December 30, 2012. The Restructuring significantly reduced New Media’s interest expense. In addition, New Media intends to focus its business strategy on building its digital marketing business and growing its online advertising business, which we believe will offset many of the challenges experienced by GateHouse. With its new capital structure and digital focus, we believe that New Media will be able to create stockholder value given its strengths and strategy. However, there can be no assurance that we will be profitable. See “Risk Factors” under Item 1A of this Annual Report on Form 10-K.

9

Table of Contents

Challenges

We will likely face challenges commonly encountered by recently reorganized entities, including the risks that even under our new capital structure, we may not be profitable.

As a publisher of locally based print and online media, we face a number of additional challenges, including the risks that:

| • | the growing shift within the publishing industry from traditional print media to digital forms of publication may compromise our ability to generate sufficient advertising revenues; |

| • | investments in growing our digital business may not be successful, which could adversely affect our results of operations; and |

| • | our advertising and circulation revenues may decline if we are unable to compete effectively with other companies in the local media industry. |

For more information about New Media’s risks and challenges, see “Risk Factors” under Item 1A of this Annual Report on Form 10-K.

Products

Our product mix consists of four publication types: (i) daily newspapers, (ii) weekly newspapers, (iii) shoppers and (iv) niche publications. Most of these publications have a digital presence as discussed in the following table. Some of the key characteristics of each of these types of publications are also summarized in the table below.

| Daily Newspapers |

Weekly Newspapers |

Shoppers |

Niche Publications | |||||

| Cost: |

Paid | Paid and free | Paid and free | Paid and free | ||||

| Distribution: |

Distributed four to seven days per week | Distributed one to three days per week | Distributed weekly | Distributed weekly, monthly or on annual basis | ||||

| Format: |

Printed on newsprint, folded | Printed on newsprint, folded | Printed on newsprint, folded or booklet | Printed on newsprint or glossy, folded, booklet, magazine or book | ||||

| Content: |

50% editorial (local news and coverage of community events, some national headlines) and 50% ads (including classifieds) | 50% editorial (local news and coverage of community events, some national headlines for smaller markets which cannot support a daily newspaper) and 50% ads (including classifieds) | Almost 100% ads, primarily classifieds, display and inserts | Niche content and targeted ads (e.g., Chamber of Commerce city guides, tourism guides and special interest publications such as, seniors, golf, real estate, calendars and directories) | ||||

| Income: |

Revenue from advertisers, subscribers, rack/box sales | Paid: Revenue from advertising, subscribers, rack/box sales | Paid: Revenue from advertising, rack/box sales | Paid: Revenue from advertising, rack/box sales | ||||

| Free: Advertising revenue only, provide 100% market coverage. | Free: Advertising revenue only, provide 100% market coverage | Free: Advertising revenue only | ||||||

| Internet Availability: | Maintain locally oriented websites, mobile sites and mobile apps, for select locations | Major publications maintain locally oriented websites and mobile sites for select locations | Major publications maintain locally oriented websites | Selectively available online | ||||

10

Table of Contents

Overview of Operations

We operate in four publication groups: Small Community Newspapers, Metros, Large Daily Newspapers and Local Media. We also operate over 350 related websites and 333 mobile sites.

The following table sets forth information regarding our publications.

| Number of Publications | Circulation (1) | |||||||||||||||||||||||

| Operating Group |

Dailies | Weeklies | Shoppers | Paid | Free | Total Circulation |

||||||||||||||||||

| Small Community Newspapers |

58 | 103 | 69 | 290,514 | 1,150,795 | 1,441,309 | ||||||||||||||||||

| Metro Newspapers |

7 | 117 | 7 | 253,279 | 483,391 | 736,670 | ||||||||||||||||||

| Large Daily Newspapers |

12 | 3 | 12 | 255,299 | 550,491 | 805,790 | ||||||||||||||||||

| Local Media |

8 | 17 | 8 | 237,970 | 428,883 | 666,853 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total |

85 | 240 | 96 | 1,037,062 | 2,613,560 | 3,650,622 | ||||||||||||||||||

| (1) | Circulation statistics are estimated by our management as of December 29, 2013. |

Small Community Newspaper Group. Our Small Community Newspaper group encompasses publications typically located in communities that have a population less than 35,000 people, in the states of Illinois, Missouri, Kansas, Michigan, California, Minnesota, Arkansas, New York, Louisiana, Pennsylvania, West Virginia, Colorado, Nebraska, Oklahoma, North Dakota, Tennessee, and Iowa. There are a total of 58 daily newspapers, 103 weekly newspapers and 69 shoppers. In addition to a good geographic mix, we benefit from a diverse economic and employment base across this group.

From the western shore of Lake Michigan to the eastern shore of the Mississippi River and running over 400 miles north to south, Illinois is a picture of manufacturing, agricultural and recreational diversity. Coupled with major daily newspapers from our Large Daily Newspaper Group in Rockford, Peoria, and the state capital of Springfield, we are the largest publishing company in Illinois. Twenty paid daily newspapers, 30 paid weekly newspapers, and 20 shoppers provide coverage across the state which, is supported by four print production facilities.

La Junta in the southeastern part of the state represents the Colorado properties. Along with La Junta we also serve Bent County and Fowler and produce the weekly agricultural newspaper, The Ag Journal.

We are represented in California by two daily newspapers in Ridgecrest and Yreka, five paid weekly papers in Dunsmuir, Mt. Shasta, Weed, Gridley and Taft, and three shoppers in Gridley, Mt. Shasta, Ridgecrest and Yreka. These publications reach from northern California through the southern desert and China Lake naval base in Ridgecrest.

The greatest concentration of circulation and market presence in Missouri is in the northern part of the state where we operate seven daily newspapers, four weekly newspapers and five shoppers. We serve the 22,000 square mile area from Hannibal, on the state’s eastern border, to the western border and from Columbia in the south to the Iowa border in the north. Local employers include the University of Missouri and other colleges, local and federal governments, State Farm Insurance and 3M.

Our southern Missouri operations are clustered around Lake of the Ozarks and Joplin. Located midway between Kansas City and St. Louis and approximately 90 miles from Springfield, Missouri, our three daily newspapers, seven weekly newspapers and three shoppers that serve the Lake of the Ozarks area reach approximately 165,000 people.

Located in southwest Missouri and southeast Kansas is our Joplin cluster with three daily and four weekly newspapers and four shoppers, serving a population of approximately 170,000. There are several colleges and universities in the area, a National Guard Fort, several large medical centers and a diverse mix of retail businesses, including the 120-store Northpark Mall.

11

Table of Contents

This group also includes our Kansas City cluster with six publications (two daily and two weekly newspapers and two shoppers) located in the eastern Kansas cities of Leavenworth and Lansing and on the Missouri side, Independence and Blue Springs. The Leavenworth Times was one of our original daily newspapers and the balance of the cluster was acquired afterward. In addition, we secured the military publication, The Fort Leavenworth Lamp, in Fort Leavenworth. The Kansas City cluster is home to several prominent companies, including Hallmark, H&R Block, Interstate Bakeries, and the University of Kansas.

The Wichita cluster consists of three dailies, six weeklies and three shoppers in the towns of Andover, Augusta, El Dorado, Pratt, Wellington, Newton and McPherson near Wichita, Kansas. The clustering of the small dailies in this area allows the group to sell advertisers a package providing access to multiple communities. Major aircraft manufacturers Boeing, Bombardier, Cessna and Raytheon have facilities nearby and McConnell Air Force Base is a major component of the local economy.

We also have clusters in and around Grand Forks, North Dakota (home to the Grand Forks Air Force Base and the University of North Dakota) and near Mason City, Iowa, where Cargill, ConAgra, Kraft, Winnebago and Fort Dodge Animal Health, a division of Wyeth, each maintain significant operations.

We are represented in southwestern Minnesota through seven paid weekly newspapers and four shoppers. St. James, Redwood Falls, Sleepy Eye, Granite Falls, Cottonwood, Wabasso, and Montevideo are all communities with populations of 10,000 and under. These papers represent the primary local news and information source for these communities.

In Louisiana, we have an operating cluster in the southwestern part of the state, located between Lake Charles and Alexandria. This cluster consists of five publications located in the cities of Leesville, Sulpher, DeRidder and Vinton. Local employers include major manufacturers such as Alcoa, Firestone, International Paper and Proctor & Gamble.

Our Baton Rouge cluster consists of four weeklies and three shoppers in the southeastern Louisiana cities of Donaldsville, Gonzales, and Plaquemine. Numerous petrochemical companies such as BASF, Exxon Mobil and Dow Chemical, plus universities including Louisiana State, support the local economies.

In southwestern New York, our operations are centered around five publications based in Steuben County. In Corning, The Leader, a 6,624 circulation daily newspaper, dominates the eastern half of the county and shares its hometown namesake with Corning Incorporated. The Hornell Evening Tribune circulates daily throughout the western half of the county. Situated directly between these two dailies in the county seat of Bath is the 10,850 circulation Steuben Courier, a free-distribution weekly. The Pennysaver Plus, a standalone shopper, solidifies this flagship group.

We also have a strong presence in the print advertising markets in three other New York counties that surround Steuben. In Allegany County to the west, the Wellsville Daily Reporter and its shopper, the Pennysaver Plus, cover most households. In Livingston County to the north, the Pennysaver Plus and the Genesee Country Express complement one another with combined circulation of 32,412. In Yates County to the north and east, The Chronicle-Express and Chronicle Ad-Visor shopper distribute weekly to nearly 14,000 households centered around the county seat of Penn Yan.

In nearby Chemung County, the 17,771 circulation Horseheads Shopper anchors our presence in this area. The majority of the southwestern New York cluster parallels Interstate 86 across the central southern tier of New York State, which is benefiting from continued improvement and expansion under an omnibus federal highway appropriations bill. Moreover, the cluster has several colleges and universities nearby, including Cornell University, Ithaca College, Elmira College and Houghton College.

Our Honesdale cluster, approximately 30 miles from Scranton, Pennsylvania, consists of seven publications in the cities of Carbondale, Honesdale and Hawley, Pennsylvania, along with Liberty, New York, located just

12

Table of Contents

across the Delaware River to the east. The cluster was created from our daily and shopper operations in Honesdale and later supplemented by our acquisition of weeklies and shoppers in Carbondale and Liberty. Local employers include General Dynamics, Blue Cross/Blue Shield, Commonwealth Telephone and various colleges and universities, medical centers and governmental agencies.

Our Pennsylvania/West Virginia cluster includes dailies in Waynesboro, Pennsylvania, Keyser and Ripley, West Virginia. We also have two weeklies throughout the group and a commercial printing operation in Ravenswood, West Virginia.

We have a strong presence in southern Michigan where five of our dailies, Adrian, Coldwater, Holland, Hillsdale and Sturgis, along with two weeklies and seven shoppers blanket the southern tier of the state and into Indiana. The 12,301 circulation Holland Sentinel is the flagship publication of the group. This area has several large employers, including Delphi, ConAgra, Tecumseh Products, Kellogg, JCI, Herman Miller, Hayworth, Gentex, Jackson State Prison, and a number of colleges and universities.

The communities we serve in the Small Community Newspaper group are largely rural but also support educational institutions, government agencies (including prisons and military bases), tourism, veterinary medicine and ethanol and agricultural chemical manufacturing. The area also includes automotive (including recreational vehicles), boat, home construction products and furniture manufacturing businesses.

The following table sets forth information regarding the number of publications and production facilities in the Small Community Newspaper Group:

| Publications | Production Facilities |

|||||||||||||||

| State of Operations |

Dailies | Weeklies | Shoppers | |||||||||||||

| Illinois |

15 | 30 | 13 | 2 | ||||||||||||

| Missouri |

12 | 15 | 12 | 5 | ||||||||||||

| Kansas |

5 | 8 | 7 | 1 | ||||||||||||

| Michigan |

8 | 2 | 10 | 4 | ||||||||||||

| California |

2 | 5 | 3 | 1 | ||||||||||||

| Minnesota |

1 | 8 | 6 | 0 | ||||||||||||

| Arkansas |

3 | 11 | 0 | 2 | ||||||||||||

| New York |

3 | 4 | 7 | 0 | ||||||||||||

| Louisiana |

1 | 8 | 4 | 1 | ||||||||||||

| Pennsylvania |

2 | 4 | 2 | 2 | ||||||||||||

| West Virginia |

1 | 2 | 2 | 2 | ||||||||||||

| Colorado |

1 | 3 | 0 | 1 | ||||||||||||

| Nebraska |

0 | 2 | 1 | 0 | ||||||||||||

| Oklahoma |

2 | 0 | 1 | 2 | ||||||||||||

| North Dakota |

1 | 0 | 1 | 1 | ||||||||||||

| Tennessee |

1 | 0 | 0 | 0 | ||||||||||||

| Iowa |

0 | 1 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

58 | 103 | 69 | 24 | ||||||||||||

Metro Newspaper Group. Our Metro Newspaper Group includes publications that are typically within 50 miles of a metropolitan area with total population greater than 1.0 million people in the states of Massachusetts, New York, and Delaware. We are one of the largest community newspaper publishers in Massachusetts by number of daily publications and also publish a large concentration of weekly newspapers, serving 113 communities in markets across eastern Massachusetts. The three largest daily newspapers in this region are: The Patriot Ledger (founded in 1837 with circulation of 28,770), the Enterprise (founded in 1880 with circulation of 17,890) and the MetroWest Daily News (founded in 1897 with circulation of 14,127). We also have over 160 web sites, with more than 4.8 million average combined monthly unique visitors in Massachusetts.

13

Table of Contents

Many of the towns within our Massachusetts footprint were founded in the 1600s and our daily and weekly newspapers in the region have long been institutions within these communities. In fact, our Massachusetts publications have 30 daily and weekly newspapers that are over 100 years old. The Boston designated market areas (“DMA”) is the eighth largest market in the United States with 2.5 million households and 6.5 million people, and ranks first nationally in concentration of colleges and universities. Massachusetts has more than 1.0 million households in the region earning greater than $75,000, and a substantial homeownership rate. We reach 1.4 million readers in the eastern Massachusetts market. Eastern Massachusetts is also an employment center for technology, biotechnology, healthcare and higher education.

In New York we operate and own a combination of 16 publications in Suburban Rochester that span four counties and have a combined circulation of 123,180. This market has a tourism industry and is known for boutique wineries and recreational activities. The flagship of Messenger Post Media is the 7,665 circulation Daily Messenger in Canandaigua.

The Delaware cluster publishes six weekly newspapers, one shopper, and various specialty papers that cover most of the state of Delaware, and range from suburban Wilmington in the north to Georgetown, Delaware at the southern end of the state. The weekly Express shopper serves nearly all of lower Delaware and a good portion of the Eastern Shore of Maryland. Circulation for the cluster is primarily free, and totals approximately 95,161 weekly.

The following table sets forth information regarding the number of publications and production facilities in the Metro Newspaper Group:

| Publications | Production Facilities |

|||||||||||||||

| State of Operations |

Dailies | Weeklies | Shoppers | |||||||||||||

| Massachusetts |

6 | 100 | 2 | 2 | ||||||||||||

| New York |

1 | 11 | 4 | 1 | ||||||||||||

| Delaware |

0 | 6 | 1 | 1 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

7 | 117 | 7 | 4 | ||||||||||||

Large Daily Newspaper Group. Our Large Daily Newspaper Group includes publication clusters in communities that typically have more than 35,000 people and are greater than 50 miles from a major metropolitan area. These publications are in Illinois, New York, Ohio, and Connecticut with a total of 12 daily newspapers, 3 weekly newspapers and 12 shoppers. In addition to a good geographic mix, we benefit from a diverse economic and employment base across this group.

Approximately 85 miles to the west of Chicago, Illinois is the Rockford Register Star supported by its 37,158 daily paid circulation base and its total market coverage (“TMC”) product The Weekly, with six zoned editions. The Rockford Register Star operates successful web sites that have more than 909,000 average monthly unique visitors.

The Journal (Freeport, IL) Standard is published Tuesdays through Sundays. The newspaper’s coverage area includes Caroll, Jo Daviess, Ogle and Stephenson counties. The newspaper has a daily circulation of 6,441 and a Sunday circulation of 8,109. The Journal Standard also publishes a website journalstandard.com and receives a monthly average of 918,000 page views and monthly unique visitors over 193,000.

The Peoria Journal Star with its daily paid circulation of 58,218 is the dominant newspaper in Peoria, Tazewell and Woodford Counties and is also distributed in an additional 17 surrounding counties. There are two shoppers—JS Shopper and Pekin Extra—which have a combined weekly circulation of 95,896. The Peoria facility provides print services to our neighboring New Media publications and commercial printing for Lee Enterprises’ The Pantagraph. The market includes manufacturing facilities for Caterpillar and Komatsu, and higher education at Bradley University, Illinois Central College and Midstate College. Peoria has a large medical

14

Table of Contents

community including OSF Healthcare, Methodist Medical Center, Proctor Hospital, University Of Illinois College Of Medicine and St. Jude Children’s Hospital Midwest Affiliate. It has agricultural facilities Archer Daniels Midland, LG Seeds and the USDA Ag Lab. The Journal Star has pjstar.com and pjstar.mobi with combined monthly average of page views of over 1.1 million per month. The combined average monthly unique visitors are over 1.0 million.

The Springfield State Journal-Register with a daily paid circulation of 31,563 and a Sunday paid circulation of 52,911 covers the state capital of Illinois. The daily paid circulation includes a branded edition of 2,901 of the Lincoln Courier. The State Journal-Register also has successful web sites with monthly unique visitors of more than 1.4 million.

The Ohio cluster is anchored in Canton, Ohio and covers Stark and Tuscarawas Counties. It is comprised of three daily newspapers, one weekly publication and two shoppers. The Repository is a 52,473 daily newspaper that covers the entire area of Stark County. The Dover New Philadelphia Times Reporter is a 16,535 daily publication located 40 miles south of Canton in Tuscarawas County. The Massillon Independent is an 8,397 circulation daily that circulates in western Stark County. The Suburbanite is a 32,600 weekly publication that circulates in the affluent northern Stark County area. The Ohio facility also provides commercial print services to the Akron Beacon Journal. The Ohio cluster has very successful web sites with more than 1.4 million combined monthly unique visitors. Together the newspapers and web sites dominate their local markets.

The Central New York cluster is anchored by the Observer-Dispatch in Utica, New York which has circulation of 25,505 Daily and 34,877 Sunday subscribers. The Utica operations include one daily and two shoppers and one weekly newspaper in Hamilton. Utica also has web sites with combined monthly unique visitors of more than 619,000. Other dailies in this group are located in Herkimer and Little Falls. The Utica and Herkimer County operations take advantage of numerous synergies in printing, circulation, and advertising.

Our Norwich, Connecticut publication diversifies the Large Daily Newspapers as the eastern Connecticut economy differs from the nation and New England markedly. Primary economic drivers include casinos, military submarine manufacture and pharmaceutical research. Major industrial employers in the region include General Dynamics, Pfizer, Dow Chemical, Dominion Resources and the United States Navy.

The following table sets forth information regarding the number of publications and production facilities in the Large Daily Newspaper Group:

| Publications | Production Facilities |

|||||||||||||||

| State of Operations |

Dailies | Weeklies | Shoppers | |||||||||||||

| Illinois |

5 | 0 | 7 | 2 | ||||||||||||

| New York |

3 | 2 | 2 | 0 | ||||||||||||

| Ohio |

3 | 1 | 2 | 2 | ||||||||||||

| Connecticut |

1 | 0 | 1 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

12 | 3 | 12 | 4 | ||||||||||||

Local Media Group. Local Media operates in five publication group clusters: the (1) New York/Pennsylvania Media Group, (2) Southeastern Massachusetts Media Group, (3) Seacoast Media Group (Coastal New Hampshire and Maine cluster), (4) San Joaquin Media Group (Stockton, California cluster) and (5) Southern Oregon Media Group.

New York/Pennsylvania Media Group. This cluster includes the Hudson Valley Media Group and the Pocono Mountains Media Group.

The Hudson Valley Media Group publishes one paid daily, two free weekly newspapers, and one shopper. The flagship publication of the Hudson Valley Media Group is the Times Herald-Record. The Times Herald-Record, with a daily circulation of 55,896, is the premier daily and Sunday local paper in Orange County, NY.

15

Table of Contents

The Pocono Mountains Media Group publishes one paid daily, one free weekly newspaper, and one shopper. The flagship publication of the Pocono Mountains Media Group is the Pocono Record. The Pocono Record, with a daily circulation of 15,572, is the premier daily and Sunday local paper in the Pocono Mountains area.

Southeastern Massachusetts Media Group. This cluster includes the Cape Cod Media Group, the Southcoast Media Group and the Nantucket Island Media Group.

The Cape Cod Media Group publishes one paid daily, one paid weekly newspaper and one shopper. The flagship publication of the Cape Cod Media Group is the Cape Cod Times. The Cape Cod Times, with a daily circulation of 36,323 is the premier daily and Sunday local paper on Cape Cod. The Barnstable Patriot, the paid weekly newspaper, has a weekly circulation of 2,294.

The Southcoast Media Group publishes one paid daily newspaper, four paid weekly newspapers, two shoppers and one free weekly newspaper. The flagship publication of the Southcoast Media Group is the Standard-Times. The Standard-Times, with a daily circulation of 21,807, is the premier daily and Sunday local paper in the New Bedford, MA area. The other paid weeklies, the Spectator, the Chronicle, the Middleboro Gazette and the Advocate, have weekly circulations of 3,522, 1,950, 3,443 and 706, respectively.

The Nantucket Island Media Group publishes The Inquirer and Mirror. With a weekly circulation of 7,039, it has the largest circulation of any island newspaper.

Seacoast Media Group. The Seacoast Media Group publishes one paid daily, one paid Sunday paper, two newspapers which are published three times a week and two paid weekly newspapers. The flagship publication of the Seacoast Media Group is the Portsmouth Herald. The Portsmouth Herald, with a daily circulation of 10,006, is the premier daily and Sunday local paper in coastal New Hampshire. Seacoast Sunday, the Sunday paper, has a Sunday circulation of 14,919. The Hampton Union and the Exeter News-Letter, the two newspapers published three times a week, have weekly circulations of 2,102 and 2,568, respectively. The two paid weekly newspapers, the York County Coast Star and the York Weekly, have weekly circulations of 2,415 and 1,577, respectively.

San Joaquin Media Group. The San Joaquin Media Group publishes one paid daily, one free weekly paper, and one shopper. The flagship publication of the San Joaquin Media Group is the Record. The Record, with a daily circulation of 32,846, is the premier daily and Sunday local paper in the Stockton, CA area.

Southern Oregon Media Group. The Southern Oregon Media Group publishes two paid daily papers and two shoppers. The flagship publication of the Southern Oregon Media Group is the Medford Mail Tribune. The Medford Mail Tribune, with a daily circulation of 21,778, is the premier daily and Sunday local paper in southern Oregon. The other paid daily paper, the Ashland Daily Tidings, has a daily circulation of 1,431.

The following table sets forth information regarding the number of publications and production facilities in the Local Media Group:

| Publications | Production Facilities |

|||||||||||||||

| State of Operations |

Dailies | Weeklies | Shoppers | |||||||||||||

| Massachusetts |

2 | 7 | 3 | 1 | ||||||||||||

| New Hampshire |

1 | 4 | 0 | 1 | ||||||||||||

| New York |

1 | 2 | 1 | 1 | ||||||||||||

| Oregon |

2 | 0 | 2 | 1 | ||||||||||||

| California |

1 | 1 | 1 | 1 | ||||||||||||

| Pennsylvania |

1 | 1 | 1 | 0 | ||||||||||||

| Maine |

0 | 2 | 0 | 0 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total |

8 | 17 | 8 | 5 | ||||||||||||

16

Table of Contents

Directories

The core of our directory portfolio is comprised of the three yellow page directories, which are located in and around the Sacramento, California area, primarily in Roseville, California. The three directories have an aggregate circulation of approximately 360,000 and service Roseville, Auburn/Grass Valley/Nevada City and Folsom/El Dorado/Placerville, reaching four counties within the Sacramento region.

Our SureWest Directories portfolio is highlighted by the Roseville directory. The Roseville directory is the incumbent (with a circulation of approximately 200,000) and has served the local Roseville community for over 100 years and has achieved more than 50% market share.

We also own three additional directories including two Michigan and Indiana phone guides servicing St. Joseph County, Michigan and LaGrange County, Indiana, and Branch County, Michigan and Steuben County, Indiana, respectively, and one yellow page directory based in Mt. Shasta, California.

Propel Marketing

Propel is our digital marketing services division with digital products designed for SMBs. We believe the digital services industry represents a large and expanding opportunity. Propel is a business we created to attack that opportunity.

There are approximately 27 million SMBs in the United States today and about 26.7 million have less than 20 employees. Although these businesses are increasingly beginning to recognize the need to establish and maintain a strategy for the digital space, most do not have the time, expertise or resources to handle this themselves.

Propel is a company that can become the outsourced digital marketing service department for those SMBs. Propel’s products help an SMB build a presence across digital platforms, help them get found by consumers, help them engage with and grow their customer base. We pull these products together for the SMB with a proprietary customer dashboard which integrates activity and results for all Propel products.

We also believe Propel gives us an opportunity to expand beyond our current geographic boundaries, as its product set could be of value to SMBs around the country.

Revenue

Our operations generate three primary types of revenue: (i) advertising, (ii) circulation (including home delivery subscriptions, single copy sales and digital subscriptions) and (iii) other (primarily commercial printing and digital marketing services). In 2013, these revenue streams accounted for approximately 63%, 29% and 8%, respectively, of our total revenue. The contribution of advertising, circulation and other revenue to our total revenue for New Media, known as the Successor Company for the two months ended December 29, 2013 and the Predecessor Company for the ten months ended November 6, 2013 and years ended December 30, 2012 and January 1, 2012 was as follows:

| Successor Company | Predecessor Company | |||||||||||||||||

| Two Months Ended December 29, 2013 |

Ten Months Ended November 6, 2013 |

Year Ended December 30, 2012 |

Year Ended January 1, 2012 |

|||||||||||||||

| (in thousands) | ||||||||||||||||||

| Revenue: |

||||||||||||||||||

| Advertising |

$ | 63,340 | $ | 265,078 | $ | 330,881 | $ | 357,134 | ||||||||||

| Circulation |

29,525 | 118,810 | 131,576 | 131,879 | ||||||||||||||

| Commercial printing and other |

10,366 | 29,402 | 26,097 | 25,657 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

$ | 103,231 | $ | 413,290 | $ | 488,554 | $ | 514,670 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

17

Table of Contents

Advertising

Advertising revenue, which includes revenue generated from online and mobile products, is the largest component of our revenue, accounting for approximately 63%, 68% and 69% of our total revenue in 2013, 2012 and 2011, respectively. We categorize advertising as follows:

| • | Local Retail—local retailers, local stores for national retailers, grocers, drug stores, department and furniture stores, local financial institutions, niche shops, restaurants and other consumer related businesses. |

| • | Local Classified—local legal, obituaries, employment, automotive, real estate and other advertising. |

| • | Online—banner, display, classified, behavioral targeting, audience extension, search and other advertising on websites or mobile devices. |

| • | National—national and major accounts such as wireless communications companies, airlines and hotels, generally placed with us through agencies. |

We believe that our advertising revenue tends to be less volatile than the advertising revenue of large metropolitan and national print media because we rely primarily on local, rather than national advertising and our classified revenue, tends to be more local market oriented (job listing for example). We generally derive 95% or more of our advertising revenue from local advertising (local retail, local classified and online) and less than 5% from national advertising. We believe that local advertising tends to be less sensitive to economic cycles than national advertising because local businesses generally have fewer effective advertising channels through which they may reach their customers.

Our advertising rate structures vary among our publications and are a function of various factors, including local market conditions, competition, circulation, readership and demographics. Management works with local newspaper management to set advertising rates and a portion of our publishers’ incentive compensation is based upon growing advertising revenue. Our sales compensation program emphasizes digital and new business growth. We share advertising concepts throughout our network of publishers and advertising directors including periodic special section programs, enabling them to utilize advertising products and sales strategies that are successful in other markets we serve.

Substantially all of our advertising revenue is derived from a diverse group of local retailers and local classified advertisers, resulting in very limited customer concentration. No single advertiser accounted for more than 1% of our total revenue in 2013, 2012 or 2011 and our 20 largest advertisers account for less than 10% of total revenue.