Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - Trinseo Materials Operating S.C. A. | d683772dex322.htm |

| EX-31.2 - EX-31.2 - Trinseo Materials Operating S.C. A. | d683772dex312.htm |

| EX-10.35 - EX-10.35 - Trinseo Materials Operating S.C. A. | d683772dex1035.htm |

| EX-12.1 - EX-12.1 - Trinseo Materials Operating S.C. A. | d683772dex121.htm |

| EX-31.1 - EX-31.1 - Trinseo Materials Operating S.C. A. | d683772dex311.htm |

| EX-32.1 - EX-32.1 - Trinseo Materials Operating S.C. A. | d683772dex321.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2013

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 333-191460

| Trinseo Materials Operating S.C.A. | Trinseo Materials Finance, Inc. | |

| (Exact name of registrant as specified in its charter) | (Exact name of registrant as specified in its charter) |

| Luxembourg | Delaware | |

| (State or other jurisdiction of incorporation or organization) |

(State or other jurisdiction of incorporation or organization) |

| 98-0663708 | 46-2429861 | |

| (I.R.S. Employer Identification No.) |

(I.R.S. Employer Identification No.) |

1000 Chesterbrook Boulevard, Suite 300

Berwyn, Pennsylvania 19312

(610) 240-3200

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ¨ No x

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the Company is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

Indicate by check mark whether the Company is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

Trinseo Materials Operating S.C.A. is a Luxembourg partnership limited by shares. Its shares are not publicly traded and there is no established public trading market for its shares. Trinseo Materials Operating S.C.A.’s corporate capital was represented by 1,528 management shares (actions de commandite) and 2,370,642,128 ordinary shares (actions de commanditaire), all subscribed and fully paid-up. As of March 14, 2014, its shares were held by (i) Styron Holding S.à r.l., a Luxembourg société à responsabilité limitée (private limited liability company), which holds 1,528 ordinary shares, and (ii) Trinseo Materials S.à r.l. a Luxembourg société à responsabilité limitée (private limited liability company), which holds 2,370,640,600 ordinary shares and 1,528 management shares.

The issued and outstanding common stock of Trinseo Materials Finance, Inc. is not publicly traded and there is no established public trading market for its common stock. All of Trinseo Materials Finance, Inc.’s shares are held by Trinseo Materials Operating S.C.A. As of March 14, 2014, there were 1,000 shares of common stock of Trinseo Materials Finance, Inc. issued and outstanding.

Documents Incorporated by Reference

None.

Table of Contents

i

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K (“Annual Report”) contains forward-looking statements including, without limitation, statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements, which are not statements of historical facts. Forward looking statements may be identified by the use of words like “expect,” “anticipate,” “intend,” “forecast,” “outlook,” “will,” “may,” “might,” “potential,” “likely,” “target,” “plan,” “contemplate,” “seek,” “attempt,” “should,” “could,” “would” or expressions of similar meaning. Forward-looking statements reflect management’s evaluation of information currently available and are based on our current expectations and assumptions regarding our business, the economy and other future conditions. Because forward-looking statements relate to the future, they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. Specific factors that may impact performance or other predictions of future actions have, in many but not all cases, been identified in connection with specific forward-looking statements. Our actual results may differ materially from those contemplated by the forward-looking statements. They are neither statements of historical fact nor guarantees or assurances of future performance. We caution you therefore against relying on any of these forward-looking statements.

Important factors that could cause actual results to differ materially from those in the forward-looking statements include economic, business, competitive, market and regulatory conditions and the following:

| • | our continued reliance on our relationship with The Dow Chemical Company; |

| • | our substantial level of indebtedness; |

| • | the stability of our joint ventures; |

| • | lawsuits resulting from products or operations; |

| • | volatility in costs or disruption in the supply of the raw materials utilized for our products; |

| • | hazards associated with chemical manufacturing; |

| • | the competitive nature of our end markets; |

| • | our compliance with environmental, health and safety laws; |

| • | conditions in the global economy and capital markets; |

| • | any disruptions in production at our manufacturing facilities; |

| • | increases in the cost of energy; |

| • | our ability to maintain the necessary licenses and permits we need for our operations; |

| • | failure to maintain an effective system of internal controls; |

| • | current insurance not covering all potential exposures; |

| • | changes in laws and regulations applicable to our business; |

| • | our dependence upon key executive management and any inability to attract and retain other qualified management personnel; |

| • | fluctuations in currency exchange rates; |

| • | strategic acquisitions affecting current operations; |

| • | the loss of customers; |

| • | any inability to continue technological innovation and successful introduction of new products; |

| • | any inability to protect our trademarks, patents or other intellectual property rights; |

| • | data security breaches; |

| • | failure of our assumptions and projections to be accurate; |

| • | local business risks in different countries in which we operate; |

| • | seasonality of our business; and |

| • | other risks described in the “Risk Factors” section of this Annual Report. |

ii

Table of Contents

We derive many of our forward-looking statements from our operating budgets and forecasts, which are based upon many detailed assumptions. While we believe that our assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and, it is impossible for us to anticipate all factors that could affect our actual results. Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are disclosed under the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this Annual Report. All written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements as well as other cautionary statements that are made from time to time in our other public communications. You should evaluate all forward-looking statements made in this Annual Report in the context of these risks and uncertainties.

We caution you that the important factors referenced above may not contain all of the factors that are important to you. In addition, we cannot assure you that we will realize the results or developments we expect or anticipate or, even if substantially realized, that they will result in the consequences or affect us or our operations in the way we expect. The forward-looking statements included in this Annual Report are made only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

iii

Table of Contents

Trinseo Materials Operating S.C.A.

Trinseo Materials Finance, Inc.

Form 10-K Annual Report

For the Fiscal Year Ended December 31, 2013

Unless otherwise indicated or required by context, as used in this Annual Report, the term “Trinseo” refers to Trinseo S.A., a public limited liability company (société anonyme) existing under the laws of Luxembourg, and not its subsidiaries. The terms “Company,” “we,” “us” and “our” refer to Trinseo and its consolidated subsidiaries, taken as a combined entity and as required by context, may also include our business as owned by our predecessor The Dow Chemical Company for any dates prior to June 17, 2010. The terms “Trinseo Materials Operating S.C.A. and Trinseo Materials Finance, Inc.” refer to Trinseo’s indirect subsidiaries, Trinseo Materials Operating S.C.A., a Luxembourg partnership limited by shares incorporated under the laws of Luxembourg, and Trinseo Materials Finance, Inc., a Delaware corporation, and not their subsidiaries. All financial data provided in this Annual Report is the financial data of Trinseo and its consolidated subsidiaries unless otherwise indicated.

Prior to our formation, our business was wholly owned by The Dow Chemical Company. We refer to our predecessor business as “the Styron business.” On June 17, 2010, investment funds advised or managed by affiliates of Bain Capital Partners, LLC acquired the Styron business and Dow Europe Holding B.V., which we refer to as “Dow Europe,” or, together with other affiliates of The Dow Chemical Company, “Dow,” retained an ownership interest in the Styron business through an indirect ownership interest in us. We refer to our acquisition by Bain Capital as the “Acquisition.”

1

Table of Contents

| Item 1. | Business |

We are a leading global materials company engaged in the manufacture and marketing of emulsion polymers and plastics, including various specialty and technologically differentiated products. We have leading market positions in many of the markets in which we compete. We believe we have developed these strong market positions due to our technological differentiation, diverse global manufacturing base, long-standing customer relationships, commitment to sustainable solutions and competitive cost positions. We believe that growth in overall consumer spending and construction activity, increased demand in the automotive industry for higher fuel efficiency and lighter-weight materials, and improving living standards in emerging markets will result in growth in the global markets in which we compete. In addition, we believe our increasing business presence in developing regions such as China, Southeast Asia, Latin America and Eastern Europe further enhances our prospects.

We develop emulsion polymers and plastics products that are incorporated into a wide range of our customers’ products throughout the world, including tires and other products for automotive applications, carpet and artificial turf backing, coated paper and packaging board, food service packaging, appliances, medical devices, consumer electronics and construction applications, among others. We seek to regularly develop new and improved products and processes, supported by our strong patent portfolio, designed to enhance our customers’ product offerings. We have long-standing relationships with a diverse base of global customers, many of whom are leaders in their markets and rely on us for formulation, technological differentiation, and compounding expertise to find sustainable solutions for their businesses. Many of our products represent only a small portion of a finished product’s production costs, but provide critical functionality to the finished product and are often specifically developed to customer specifications. We believe these product traits result in substantial customer loyalty for our products.

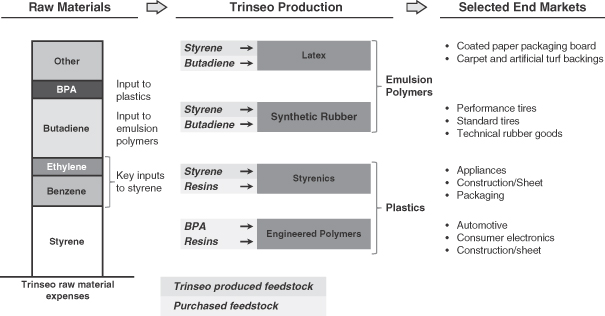

We operate our business in four reporting segments: Latex, Synthetic Rubber, Styrenics and Engineered Polymers. Our major products include: styrene-butadiene latex, or SB latex, and styrene-acrylate latex, or SA latex, in our Latex segment; solution styrene butadiene rubber, or SSBR, lithium polybutadiene rubber, or Li-PBR, emulsion styrene butadiene rubber, or ESBR, and nickel polybutadiene rubber, or Ni-PBR, in our Synthetic Rubber segment; polystyrene, acrylonitrile butadiene styrene, or ABS, and styrene acrylonitrile, or SAN, in our Styrenics segment; and polycarbonate, or PC, compounds and blends, and polypropylene compounds in our Engineered Polymers segment.

We have significant manufacturing and production operations around the world, which allows us to serve our global customer base. As of December 31, 2013, our production facilities included 35 manufacturing plants (which included a total of 83 production units) at 27 sites across 14 countries, including joint ventures and contract manufacturers. Our manufacturing locations include sites in high-growth emerging markets such as China, Indonesia and Brazil. Additionally, as of December 31, 2013 we operated 11 research and development (“R&D”) facilities globally, including mini plants, development centers and pilot coaters, which we believe are critical to our global presence and innovation capabilities.

2

Table of Contents

Prior to our formation in Luxembourg in 2010, the Styron business was wholly-owned by Dow. On June 17, 2010, we were acquired by investment funds advised or managed by Bain Capital Partners, LLC, and Dow Europe, which acquired an ownership interest in our parent company and sole shareholder, Bain Capital Everest Manager Holding SCA, which we refer to as our Parent. As of December 31, 2013, Dow Europe held an approximately 6.8% interest in our Parent. We continue to have a significant business relationship with Dow and rely on our agreements with Dow for certain operating and other services, for the supply of raw materials used in the production of our products and for certain intellectual property rights. See “—Our Relationship with Dow.”

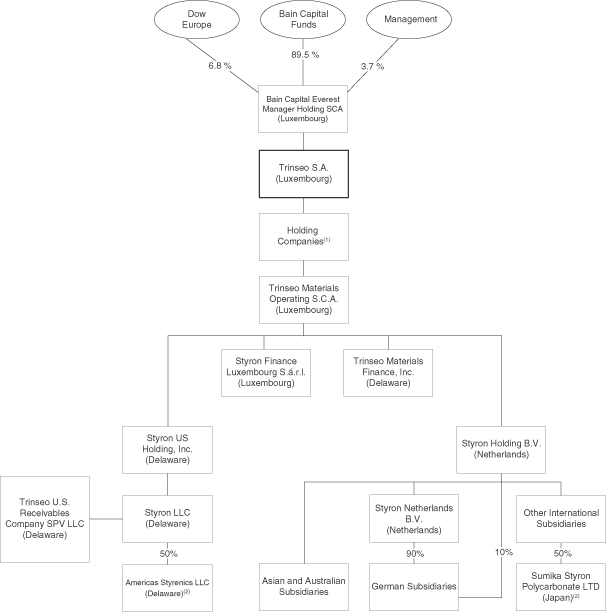

The following chart summarizes our corporate ownership structure as of December 31, 2013.

| (1) | These holding companies include the following entities: Styron Luxco S.à.r.l. (Luxembourg), Styron Holding S.à.r.l. (Luxembourg), Trinseo Materials S.à.r.l. (Luxembourg) and Styron Investment Holdings Ireland (Ireland). |

| (2) | Joint venture entity. |

3

Table of Contents

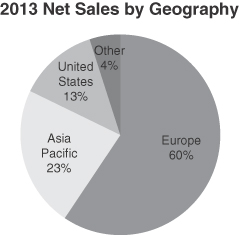

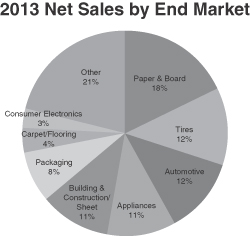

We are a global business with a diverse geographic revenue mix and significant operations around the world.

|

|

In 2013, we generated net sales of $5,307.4 million, adjusted EBITDA of $303.3 million, and a net loss of $22.2 million. Additional information regarding adjusted EBITDA, including a reconciliation of net income (loss) to adjusted EBITDA, is included in Item 7—Management’s Discussion and Analysis of Financial Conditions and Results of Operations.

Our Competitive Strengths

Leading Positions in Consolidating Markets

We have leading positions in several of the markets in which we compete, including the #1 position in SSBR in Europe and the #1 position in SB latex globally, and we are a leading global producer of plastics products, including polystyrene and PC. We attribute our strong market positions to our technologically differentiated products, the scale of our global manufacturing base, our long-standing customer relationships and our competitive cost positions.

The markets in which we compete are also highly consolidated and have continued to experience further consolidation over the last several years through the business combinations of BASF Group and Ciba Specialty Chemicals, Yule Catto & Co. plc and PolymerLatex GmbH (currently known as Synthomer plc), Omnova Solutions Inc. and Eliokem International SAS and the formation of Styrolution Group GmbH. As a result, from 2005 to 2011, over 400 kMT of production capacity was eliminated in the SB latex markets in North America and Europe, which represented approximately a 20% reduction in production capacity since 2005. In 1990, the top three producers, measured by production capacity, in North America and Europe represented 68% and 49% of estimated regional capacity, respectively. As a result of the capacity rationalizations and consolidations, including those described above, the top three producers in each of North America and Europe represented over 80% of estimated regional production capacity in 2013.

Production capacity has also been reduced in several core markets including Styrenics. For example, from 2006 to 2011, the polystyrene industry experienced substantial capacity rationalization with over 1,000 kMT of annual U.S. and Western Europe polystyrene capacity being eliminated during this time period, representing a reduction of approximately 20% of the 2005 total capacity in those regions.

Technological Advantage and Product Innovation

Most of our products are critical inputs that significantly impact the functionality, production costs and quality of our customers’ products. Many of our products are also differentiated by their performance, reliability,

4

Table of Contents

customization and value, which are critical factors in our customers’ selection and retention of materials suppliers. For example, our advanced SSBR technology is designed to reduce a tire’s rolling resistance, resulting in better mileage and fuel efficiency and lower carbon dioxide emissions while at the same time improving the tire’s wet-grip, a measure of braking effectiveness and traction. We believe these are key performance attributes sought by the end user and have become more easily identifiable through the growing adoption of tire labeling requirements by regulatory agencies, including formal adoption by the European Union in late 2012. These attributes also help in meeting European carbon dioxide emissions legislation requirements. Other jurisdictions have adopted or are considering similar legislation, including tire labeling requirements.

Our lightweight plastics materials also allow automotive companies to reduce weight in vehicles by substituting heavier structural parts with our products and thereby improving fuel efficiency for cars. Higher end automotive interior applications have also benefitted from utilizing our technology which has high aesthetic appeal and excellent scratch resistant characteristics. Energy use is also substantially reduced by using our plastic in lighting and other consumer applications.

Through our performance latex portfolio, we offer a variety of products designed to meet the needs of multiple applications, including adhesives, building and construction and composites, road, athletic, and automotive surfaces, technical fabrics and technical papers and boards. Our performance latex products are designed to enhance and improve an application’s mechanical properties, including water, chemical, stain, abrasion or oil resistance, cohesive and adhesive strength, or dimensional stability, flexibility, water impermeability and efflorescence resistance. Using our technological expertise, we typically launch one to two new technologies in our latex segment each year.

The technology supporting our product innovation includes more than 250 patents and 200 pending patent applications that we own world-wide covering processes and technologies such as material formulations, material process technologies and various end-use industrial applications for our materials.

Diverse Global Reach with Strong Presence in Emerging Markets

As of December 31, 2013, our production facilities included 35 manufacturing plants (which included a total of 83 production units) at 27 sites in 14 countries, inclusive of joint ventures and contract manufacturers. We believe our diverse locations provide us with a competitive advantage in meeting and anticipating the needs of our global and local customers in both well-established and growing markets. We have a strong presence in Asia and Latin America, where we supply custom formulated latex products both for established and new paper mills, as well as a variety of engineered polymers, synthetic rubber and other products that are used in a variety of end-markets.

Long-Standing, Collaborative Customer Relationships

We and the Styron business have long-standing relationships with many of our customers, helping them to develop and commercialize multiple generations of their products. We believe we have developed strong relationships through our highly collaborative process, whereby we work with our customers, particularly in high-value segments such as SSBR, specialized plastics and performance latex, to develop products that meet their specific needs. As part of this process, we test our products at customer sites and work with customers to optimize and customize our product offerings. As a result of our close collaboration, we have historically achieved a high success rate of retaining customers. As of December 31, 2013, we served approximately 1,300 customers in over 75 countries with no single customer accounting for more than 7.0% of our net sales in 2013.

5

Table of Contents

Attractive Segments and End-Markets Experiencing Cyclical Recovery

Our strategy is to focus on what we believe are the most attractive segments for our customers’ products, or end-markets, where demand is underpinned by global trends supporting long-term volume growth, improving living standards in emerging markets, fuel efficiency and the increasing use of light-weight materials. We serve customers in a diversified mix of end-markets that we believe generally grow when global gross domestic product, or GDP, increases and we believe that the core end-markets that we serve, including automotive, construction, household and appliance will grow at rates exceeding the rate of global GDP growth. For example, we serve the global automotive market, which is projected to grow by more than 5% per year through 2018. The global household appliances market is also expected to grow by more than 5% per year through 2017 and the global construction market is expected to grow by more than 5% per year through 2018. In addition, certain key regional markets where we have a strong presence, such as China coated paper and board, are expected to outperform global growth rates.

Over half of our net sales in 2013 were to customers serving European end-markets, and we expect the continued cyclical recovery in Europe to result in increased demand for many of our products while also increasing utilization rates at our facilities from the depressed levels that we have experienced over the last few years. For example, we expect our Synthetic Rubber segment to benefit from the anticipated recovery in the European tire market, which in 2013 recorded its lowest level of sales since 2009. We also expect the cyclical recovery in North America and Europe to improve demand prospects for paper and carpet, which are key end-markets for our SB latex products.

We also believe that the relatively modest level of capacity additions that have been announced in the marketplace will contribute to increased demand for our production capacity and products.

Cost Competitive Assets and Raw Material Sourcing

We believe that our asset and raw material utilization provides us with a competitive cost position for our products. Our products are produced on a global scale with well maintained, productive and cost efficient assets, at facilities which are positioned globally near some of our key customers or markets, or near major integrated petrochemical centers or are co-located at large Dow facilities, where we benefit from receiving certain raw materials supplied to our facilities by pipeline. We also benefit from existing long-term supply contracts for raw materials including ethylene, butadiene, and benzene, which are important in securing our supply of raw materials in markets where availability may fluctuate with demand.

The presence of some of our facilities on Dow manufacturing sites allows us to benefit from Dow’s existing manufacturing infrastructure in an efficient manner, without the need for us to construct our own infrastructure or provide our own related site services. Dow pipelines directly supply raw materials to our facilities in Terneuzen, The Netherlands and in Boehlen, Schkopau, and Stade, Germany. We share manufacturing infrastructure with Dow at these locations as well as in Midland, Michigan. At certain of our other facilities, we are able to limit the amount of our outbound freight costs as a result of the proximity of several of our facilities, including Tsing Yi, Hong Kong, Dalton, Georgia and Hamina, Finland, to key local customers.

We also seek to leverage our experience with our key raw materials, styrene monomer, to achieve economies of scale. We purchase styrene pursuant to cost-based contracts. We also produce styrene in Terneuzen, The Netherlands and Boehlen, Germany using assets that have operated in 2013 in the 1st or 2nd quartile for energy and raw material efficiency as compared to other European ethylbenzene styrene monomer producers.

Experienced Management Team

Our executive leadership team averages over 25 years of industry experience, including leadership positions within our business units, and significant public company leadership experience at other chemical companies.

6

Table of Contents

Our Growth Strategy

We believe that there are significant opportunities to grow our business globally and enhance our position as a leading global materials company engaged in the manufacture and marketing of standard, specialty and technologically differentiated emulsion polymers and plastics by executing on the following strategies:

Continue Product Innovation and Technological Differentiation

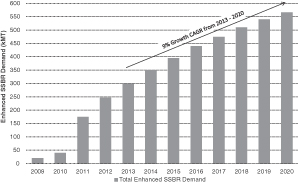

We intend to continue to address our customers’ critical materials needs by utilizing our technological expertise and development capabilities to create specialty grades, new and sustainable products and technologically differentiated formulations. We believe our technological differentiation positions us to participate in attractive, high growth areas of the markets in which we compete. One such area where we believe we have a technological advantage is enhanced SSBR, which is expected to grow at 9% annually through 2020. Enhanced SSBR technology, which includes later generations of SSBR and functionalized SSBR, is used in the latest generation of performance tires. The global market for enhanced SSBR is expected to constitute approximately 40% of the total SSBR market by 2017. We continue to devote significant R&D resources to improving and furthering our SSBR technology and our polybutadiene rubber technologies (such as neodymium butadiene rubber and lithium butadiene rubber) in order to remain a leader in these markets. Our development efforts are currently focused in large part on continuing to improve the fuel efficiency and performance characteristics of automotive tires.

We are also working with our industry partners, particularly in the automotive, medical devices and consumer electronics sectors, to develop new advanced plastics with the goal of gaining market share in higher value-added areas of the markets served by our Engineered Polymers business.

As a global leader in latex, we also continue to evaluate opportunities to expand our performance latex business by targeting particular end-markets and chemistries where we believe we have a competitive advantage, such as SB performance latex and styrene acrylics. We believe that performance latex accounts for a substantial portion of the total synthetic latex market, but only accounted for 10% of our Latex segment’s net sales in 2013, and we believe that we are well positioned to capture a larger share of this performance latex market.

Strategically Invest in Attractive Segments of the Market

We plan to make strategic capital investments to extend our leadership in select market segments and meet expected growing demand for our products. Our new SSBR production line in Schkopau, Germany began production on October 1, 2012, adding 50 kMT of new capacity. In addition, we entered into an agreement in February 2014 to repurchase 25 kMT of SSBR production capacity rights at our Schkopau facility from JSR Corporation Tokyo, Wallisellen Branch, effective April 1, 2014, at a significant discount to the estimated cost to build equivalent new capacity. With these two capacity additions, we have approximately doubled our SSBR production capacity.

Expand and Deepen Our Presence in Emerging Markets

We expect to capitalize on growing demand for our products in emerging markets such as China, Southeast Asia, Latin America and Eastern Europe and increase our local market share by expanding our customer base and local capabilities in these geographies. We believe that improving living standards and growth in GDP across emerging markets are creating increased demand for our products. We are also adding an additional 25 kMT of SB latex capacity at our facility in Zhangjiagang, China, which we expect to become operational in the second quarter of 2015. We expect to leverage our existing technology and platforms to make additional investments in emerging markets to address expected increases in demand for our SSBR, performance latex and plastics products in those geographies. We also expect this growth to occur in the end markets that use our products. For example, light-weight vehicle auto production is expected to grow from 2013 through 2018 at an annual rate of approximately 9% in China, approximately 6% in Asia and approximately 5% in South America. In addition,

7

Table of Contents

output for coated paper and paperboard in China has grown in recent years with related increases in the demand for paper coating chemicals. Consumption of SB latex for paper coatings in China is expected to grow by approximately 7% per year through 2016 and consumption of SB latex in China for use in carpet backing is expected to grow by approximately 6% per year through 2016.

We expect to capitalize on growing demand for our products in emerging markets and increase our local market share by expanding our customer base and local capabilities in these geographies. For example, we recently announced a 25 kMT expansion of our SB latex capacity at our facility in Zhangjiagang, China, which we expect to become operational in the second quarter of 2015 and will represent a 33% increase in our SB latex capacity in China.

We also expect to leverage our existing technology and platforms to make additional investments in emerging markets to address expected increases in demand for our SSBR, performance latex and plastics products in those geographies.

Opportunistically Pursue Strategic Acquisitions to Extend Leadership Positions

We intend to pursue acquisitions and joint ventures that have attractive risk-adjusted returns to extend our leadership positions in what we believe are the more attractive market segments (such as synthetic rubber and performance latex) and geographies for us, including emerging markets. We believe that a long-term trend toward consolidation in our industry will continue, which we expect to create opportunities for us given our scale, broad customer base, and geographic reach.

Continue to Implement Cost Saving Measures and Focus on Cash Flow Generation

We have a proven track record of offsetting fixed cost inflation with cost saving actions, and we continue to seek to identify incremental cost saving opportunities. In recent years, we have launched several company-wide initiatives intended to further reduce our costs and increase our competitiveness. We have reduced our fixed cost base by approximately $70 million since 2011 through a number of cost-saving initiatives such as streamlining production and administrative processes and optimizing logistics. We believe that our current cost structure positions us favorably to compete and grow in the current market environment, and we have ongoing corporate cost saving initiatives intended to realize annual cost savings at or above the rate of fixed cost inflation.

In addition, we continue to focus on cash flow generation through disciplined working capital and capital expenditure management. Following the completion of the SSBR capacity expansion at our Schkopau, Germany facility in 2012, capital expenditures have been reduced from approximately $112 million in 2012 to approximately $55 million in 2013, net of a $6 million and a $19 million government subsidy for SSBR expansion, respectively. We believe that our maintenance capital expenditures on our current fixed asset base will be in the range of $30 million to $40 million per year over the next several years, which represents less than 1% of our net sales.

8

Table of Contents

Business Model

The chart below illustrates our primary business operations in each of our business units, from the raw materials used in our products to our end-markets.

9

Table of Contents

Segment Overview

We operate in four reporting segments under two business units. Our Emulsion Polymers business unit includes our Latex reporting segment and our Synthetic Rubber reporting segment. Our Plastics business unit includes our Styrenics reporting segment and our Engineered Polymers reporting segment. The table below includes our net sales, operating income (loss) and adjusted EBITDA in each of our reporting segments for the year ended December 31, 2013, as well as a description of our major products and end-markets by segment.

| Emulsion Polymers | Plastics | |||||||||||||||

| Latex | Synthetic Rubber | Styrenics | Engineered Polymers | |||||||||||||

|

|

Year Ended December 31, 2013 (dollars in millions) |

| ||||||||||||||

| Net sales |

$1,341.4 | $622.1 | $2,305.4 | $1,038.5 | ||||||||||||

| Operating Income (loss) |

67.7 | 84.4 | 135.7 | (16.9) | ||||||||||||

| Adjusted EBITDA1 |

106.2 | 113.5 | 148.0 | 1.9 | ||||||||||||

| Adjusted EBITDA Margin1 |

7.9% | 18.2% | 6.4% | 0.2% | ||||||||||||

| Major Products |

|

• Styrene-butadiene latex (“SB latex”)

• Styrene-acrylate

• Performance |

|

|

• Solution styrene- butadiene rubber (“SSBR”)

• Lithium

• Emulsion styrene-

• Nickel |

|

|

• Polystyrene

• Acrylonitrile-

• Styrene-

• Ignition resistant

|

|

|

• Polycarbonate resins (“PC”)

• Compounds

• Polypropylene |

| ||||

| Major End-Markets |

|

• Coated paper and packaging board

• Carpet and

• Tape saturation

• Cement

• Building products |

|

|

• Performance tires

• Standard tires

• Polymer

• Technical rubber |

|

|

• Appliances

• Building and

• Packaging

• Automotive

• Consumer

• Consumer |

|

|

• Automotive

• Consumer

• Building and

• Others (including |

| ||||

| 1 | Excludes unallocated corporate expenses of $66.3 million. For a reconciliation of net income (loss) to adjusted EBITDA, refer to Item 7—Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

See Note S to our consolidated financial statements included in this Annual Report for detailed financial data by segment and by geography.

Latex Segment

Overview

We are a global leader in SB latex, holding a strong market position across the geographies and applications in which we compete, including the #1 position in SB latex in Europe and the #2 position in North America. We produce SB latex primarily for coated paper used in advertising and magazines, packaging board coatings, carpet and artificial turf backings, as well as a number of performance latex applications. In 2013, approximately half of our Latex segment’s net sales were generated in Europe, approximately 25% were generated in the United States and the remainder was generated in Asia and other geographies.

We believe that our leading scale and differentiated capabilities in this segment are a competitive advantage that allows us to invest in new formulation capabilities and polymer science. Using our two pilot coating

10

Table of Contents

facilities in the United States and Switzerland, we work alongside our customers to develop new products and customer branding. We believe that this capability allows us to capture new business, strengthen our existing customer relationships and broaden our technological expertise.

We believe our development and formulation capabilities contribute to our strong position. Further, we believe our growth prospects in latex are enhanced by our expanding capacity in China. We believe that emerging markets, and in particular China, will contribute a substantial portion of the global growth of the paper and packaging board market segment over the next decade. We believe our growth prospects could also be enhanced if the recent trend of industry capacity reduction and consolidation continues. This consolidation trend includes the business combinations of BASF Group and Ciba Specialty Chemicals, Omnova Solutions Inc. and Eliokem International SAS, and Yule Catto & Co plc and PolymerLatex GmbH (currently known as Synthomer plc). We also believe we are well positioned to capture additional share in the performance latex market, which has accounted for a substantial portion of the total synthetic latex market, but only accounted for 10% of our Latex segment’s net sales in 2013.

Products and End Uses

We are a global leader in the production and marketing of SB latex for coated paper with the #1 position in SB latex in Europe and the #2 position in North America. For coated paper, we primarily manufacture SB latex, a high-volume product that is widely used as a binder for mineral pigments as it allows high coating speeds, improved smoothness, higher gloss level, opacity and water resistance. Typically, SB latex formulations are engineered in close collaboration with customers, and are tailored specifically to optimize finished product properties and production efficiency, and to minimize mill down time. Since SB latex accounts for, on average, approximately 8% of the total production cost for coated paper but is a critical element of the manufacturing process and provides performance characteristics key to the product’s end-use, we believe customers view it as a crucial component of their manufacturing process and typically seek high-quality, reliable producers.

We are also a leading supplier of latex polymers to the carpet and artificial turf industries and offer a diverse range of products for use in residential and commercial broadloom, needlefelt, and woven carpet backings. We produce high solids SB latex, SA latex, vinylidene chloride, and butadiene-methacrylate latex products for the commercial and niche carpet markets. We incorporate vinyl acrylic latex in our formulations for its ignition resistant properties, with the sourcing of vinyl acrylic latex readily available from a number of industry suppliers. SB latex is also used in flooring as an adhesive for carpet and artificial turf fibers.

We also offer a broad range of performance latex products, including SB latex, SA latex, and vinylidene chloride latex primarily for the adhesive, building and construction as well as the technical textile paper market, and have begun to implement the use of starch and associated new chemistries in paper coatings and carpet backing.

Customers

We believe our Latex segment is able to differentiate itself by offering customers value-added formulation and product development expertise. Our R&D team and Technical Services and Development, which we refer to as TS&D, team are able to use our two pilot coating facilities in Switzerland and the United States, four paper fabrication and testing labs in Brazil, China, Switzerland and the United States, three carpet technology centers located near carpet producers in China, the United States and Switzerland, and two product development and process research centers, one each in Germany and the United States, to assist customers in designing new products and enhancing the manufacturing process. Additionally, our global manufacturing capabilities are key in serving customers cost-effectively, as latex is costly to ship over long distances due to its high water content. We believe that our global network of service and manufacturing facilities is highly valued by our customers.

Many of our major customers rely on our dedicated R&D and TS&D teams to complement their limited in-house resources for formulation and reformulation tests and trials. We seek to capture the value of these services

11

Table of Contents

through our pricing strategy. In addition, as paper mills become larger and increasingly sophisticated with higher fixed costs, we believe there is greater demand for custom-formulated latexes. Historically, we have focused on capturing a majority share of new SB latex formulations for startups and major overhauls of existing paper coaters. In carpet applications, our product development expertise also allows us to provide differentiated products to our customers.

Competition

Our principal competitors in our Latex segment include BASF Group, Omnova Solutions Inc., Synthomer plc and Lin Cham Ltd. In our Latex segment, we compete primarily based on our ability to offer differentiated products, the reliability of our products, the quality of our customer service and the length and depth of our relationships.

Industry Outlook

Certain changes in industry structure have had a beneficial effect for latex producers, driven by industry capacity reduction and consolidation. From 2006 to 2011 industry capacity in North America and Europe contracted by approximately 20% due to shut downs and consolidations. Key industry events include the business combinations of BASF Group and Ciba Specialty Chemicals and resulting significant capacity reduction, a capacity rationalization by Dow / Dow Reichhold, Omnova Solutions Inc.’s rationalization at its Mogadore facility, the exit of The Lubrizol Corporation from the latex business, Omnova Solutions Inc.’s acquisition of Eliokem International SAS, and Yule Catto & Co. plc’s acquisition of PolymerLatex GmbH (currently known as Synthomer plc).

We also expect recent declines in the demand for coated paper to slow in the developed markets, particularly in Europe, and such declines to be more than offset by growth in emerging markets such as China as improving living standards generate increased demand for coated paper end products. Chinese consumption of styrene-butadiene latexes is expected to grow over 6% annually through 2016.

In addition, several historical developments that appeared to have an unfavorable impact at first, including the emergence of substitutes for SB latex in carpet backing applications in North America, have had less of an impact than initially anticipated due to superior SB latex performance, as many customers that we believe have switched to substitute products have switched back to SB latex due to its superior quality. This trend has been bolstered by increased butadiene availability and decreased butadiene cost in recent years. We also anticipate the housing recovery in the U.S. market will benefit our SB latex business through increased demand for carpet backing applications. We believe that if the recent trends of industry capacity reduction and consolidation and increasing demand in emerging markets continue, this will lead to a favorable production environment.

Synthetic Rubber Segment

Overview

We are a significant producer of styrene-butadiene and polybutadiene-based rubber products and we have a leading European market position in SSBR. While 100% of our sales were generated in Europe in 2013, approximately 15% of these net sales were exported to Asia, 8% to Latin America and 5% to North America.

We have a broad synthetic rubber technology and product portfolio, focusing on specialty products, such as SSBR and Li-PBR, while also producing core products, such as ESBR and Ni-PBR. Our synthetic rubber products are extensively used in tires, with an estimated 86% of our net sales from this segment in 2013 attributable to the tire market. We estimate that three quarters of these sales relate to replacement tires. We have strong relationships with many of the top global tire manufacturers and believe we have remained a supplier of choice as a result of our broad rubber portfolio and ability to offer technologically differentiated product and product customization capabilities. Other applications for our synthetic rubber products include polymer modification and technical rubber goods.

12

Table of Contents

Our most advanced rubber technology, SSBR, is a critical material for tires with low rolling resistance, which increases fuel efficiency and improves wet-grip and also leads to better traction and safety characteristics. We believe our growth prospects are enhanced by increasing demand for high performance tires, which are now more commonly used by automakers as OEM specified tires in their vehicles as a result of regulatory reforms in the EU, Japan and Korea that are aimed at improving fuel efficiency and reducing carbon dioxide emissions. As a result of these and other factors, demand for SSBR is expected to grow substantially faster than global GDP over the next 5 years.

Products and End Uses

Our Synthetic Rubber segment produces synthetic rubber products used in high-performance tires, impact modifiers and technical rubber products, such as conveyor belts, hoses, seals and gaskets. We participate significantly in the European synthetic rubber industry, where tire producers focus on high-performance and ultra high-performance tires and rely heavily on rubber suppliers to provide their supply of rubber, in contrast to North America where tire manufacturers produce most of their required rubber.

SSBR. We sell SSBR products for high-performance and ultra high-performance tire applications. We produce both clear and oil extended SSBR through batch polymerization in our three SSBR production lines. We believe these processes provide leading and technologically differentiated solutions to tire manufacturers.

We believe we are well-positioned to capture additional market share in high-growth high-performance tire applications and have expanded capacity to meet this anticipated demand. Our new SSBR production line in Schkopau, Germany began production on October 1, 2012, and expanded our SSBR production capacity by 50 kMT. In addition, we entered into an agreement in February 2014 to repurchase 25 kMT of SSBR production capacity rights at our Schkopau facility from JSR Corporation Tokyo, Wallisellen Branch, effective April 1, 2014, at a significant discount to the estimated cost to build equivalent new capacity. With these two capacity additions, we have approximately doubled our SSBR production capacity.

Our synthetic rubber portfolio is anchored by our SSBR technology and further strengthened by our new functionalized SSBR (SSBR engineered to perform specific functions) product offering. Our new product platform is used in the manufacture of high-performance and ultra high-performance tires. We expect demand growth for European performance tires, which are designed to improve passenger safety, tire longevity and vehicle fuel efficiency, to accelerate due to European legislation that became effective late in 2012.

During the last five years, we have been working closely with major tire producers around the world to develop multiple new SSBR grades, addressing key marketplace needs for improved tire fuel economy, grip, and abrasion characteristics, which we believe will lead to significant demand growth for our rubber products in Europe and around the world. We expect our synthetic rubber product mix to shift to new more advanced SSBR grades (from a relatively small portion of total SSBR volume in 2010 to more than 25% in 2015) to meet the expected demand growth.

ESBR. Our ESBR products are used in standard tires, technical goods, and footwear. Our ESBR product portfolio offers tire producers a comprehensive suite of synthetic rubber capabilities. For example, ESBR provides enhanced wet grip to tire treads and strength to the inner liner of tires, allowing the tires to be more easily processed.

Li-PBR. Our Li-PBR is used primarily for our own internal polymer modification applications. Polymer modification is the use of synthetic rubber to improve the impact resistance quality of plastic products. In 2013, approximately 80% of our Li-PBR products were consumed within our Plastics business unit for high impact polystyrene, or HIPS, and ABS production. We make two grades of Li-PBR exclusively for our polymer modification uses. In addition to impact resistance, Li-PBR provides visual surface gloss.

13

Table of Contents

Ni-PBR. We are currently the only European producer of Ni-PBR, with 30 kMT of capacity. We sell Ni-PBR products for use in standard tires, performance tires, technical goods and footwear. We believe Ni-PBR is valued by the tire industry because of its ability to form compounds that are easier to process, its ability to add wear resistance to the wet grip capabilities of SSBR and ESBR and its flexibility in tire sidewalls.

Customers

We maintain deep and long-standing relationships with a large number of multinational customers, including many of the top global tire manufacturers, as well as fast growing Asian tire manufacturers. Our relationships with our top customers, including with our predecessor business operated by Dow prior to the Acquisition, exceed 10 years on average.

Tire producers are the primary customers for our Synthetic Rubber segment. We believe we have remained a supplier of choice given our broad rubber portfolio, including technologically differentiated grades, and our product customization capabilities. The majority of our Synthetic Rubber segment net sales are based on contracts that generally include terms for at least three different rubber product families in addition to raw material pass-through clauses. Our R&D and TS&D teams use our broad rubber portfolio to develop differentiated specialty products for customers. Once implemented with a customer, these newly-developed specialty products cannot be easily replaced with a competitor’s product. As a result, we believe customers are likely to buy from us throughout the life cycle of specific tire models to avoid high switching costs and prevent repetition of the expensive development process.

Competition

Our principal competitors in our Synthetic Rubber segment include Asahi Kasei Corporation, JSR Corporation, Lanxess AG, Zeon Corporation, Versalis S.p.A and Synthos S.A. In our Synthetic Rubber segment, we compete primarily based on our ability to offer differentiated products, the reliability of our products, the quality of our customer service and the length and depth of our relationships.

Industry Outlook

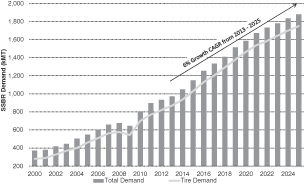

| Total Projected SSBR Demand |

Total Projected Enhanced SSBR Demand | |

|

|

Our Synthetic Rubber segment participates mainly in the European synthetic rubber industry, where tire producers rely on rubber suppliers, in contrast to North America where tire manufacturers produce most of their required rubber. Rubber suppliers typically manufacture more than one grade of rubber as customers typically require different grades of rubber from a single supplier. Performance tires represent an especially attractive market to rubber producers because they provide substantial value to end customers and the market for performance tires is

14

Table of Contents

expected to grow at twice the rate of the rest of the tire market. Tire manufacturers are expected to continually seek improvements in advanced rubber, which optimizes the combination of fuel economy and wet grip in order to meet EU regulations which set minimum requirements and are being phased in through 2020. Other jurisdictions have adopted or are considering similar legislation and are also beginning to adopt the tire labeling requirements that have become mandatory in Europe since late 2012. Enhanced SSBR, which includes later generations of SSBR and functionalized SSBR and is used in the new generation of performance tires, is expected to reach approximately 40% of the total SSBR market by 2017. We believe our leadership in the fast growing SSBR segment will position us to perform well relative to the broader industry and anticipate future strong demand from the broader adoption of legislation similar to the EU legislation and the relative performance advantages of our SSBR products. Combined with relatively modest incremental capacity announcements by our competitors, particularly in enhanced SSBR, we expect industry utilization rates to remain high and increase in the near-term.

Styrenics Segment

Overview

Our Styrenics segment includes polystyrene, ABS and SAN products, as well as our internal production and sourcing of styrene monomer, a raw material common in SB latex, synthetic rubber and styrenics products. We are a leading producer of polystyrene and mass ABS, or mABS, where we focus our efforts on differentiated applications such as the liners and encasements of appliances and consumer electronics including smartphones and tablets. Within these applications, we have worked collaboratively with customers to develop more advanced grades of plastics such as our HIPS and mABS products. For example, we work with appliance manufacturers around the world to develop improved environmental stress crack resistant products and with our construction sheet customers on smooth ABS. These products offer superior properties, such as rigidity, insulation and colorability, and, in some cases, an improved environmental footprint compared to general purpose polystyrene or emulsion ABS. Our Styrenics segment also serves the packaging and construction end-markets, where we have launched a new general purpose polystyrene product for improved performance in foam insulation applications.

We believe our growth prospects in our Styrenics segment are enhanced by periodic trends of industry capacity reduction and consolidation in Europe and North America, such as the completed formation of the Styrolution Group GmbH joint venture combining certain INEOS and BASF Group assets and the prior acquisition of INEOS Nova by INEOS, as well as INEOS’ most recent asset rationalizations in styrene monomer and polystyrene and Styrolution’s recent announcement to close a polystyrene plant in the United States. We also have a 50% interest in Americas Styrenics LLC, our joint venture with Chevron Phillips Chemical Company, which operates in the North American and Latin American markets and has benefitted from recent positive trends in those markets. We expect further consolidation in certain regions of Asia with numerous producers and low asset utilization, which we believe will create opportunities for us, given our scale and geographic reach. We believe our growth prospects are further enhanced by our established manufacturing footprint in the high economic growth regions of Asia and our focus on attractive end-markets where improving living standards drive demand for growing appliances and consumer electronics markets. In 2013, approximately 60% of sales from our Styrene segment were generated in Europe and an additional 33% of sales were generated in Asia.

Products and End Uses

Polystyrene. We are a leading producer of polystyrene and focus on sales to injection molding and thermoforming customers. Our product offerings include a variety of GPPS and HIPS, which is polystyrene that has been modified with polybutadiene rubber to increase its impact resistant properties. These products provide customers with performance and aesthetics at a low cost across applications, including appliances, packaging, including food packaging and food service disposables, consumer electronics and building and construction materials.

We believe our STYRON™ brand is one of the longest established brands in the industry and is widely recognized in the global marketplace. We believe our R&D efforts have resulted in valuable, differentiated

15

Table of Contents

solutions for our customers. For instance, during the early 2000s, we developed an innovative STYRON A-TECH™ family of resins that is an advanced polystyrene product allowing customers to balance key properties such as toughness, gloss, stiffness, flow and cost, and provide combinations of properties that were previously not available with standard HIPS. We believe that over the past decade, this product family has become the industry standard for this application.

Acrylonitrile-Butadiene-Styrene (ABS). We believe we are a leading producer of ABS in Europe and are one of the few producers with a presence in North America. We produce mABS, a variation of ABS that has lower conversion and capital costs compared to the more common emulsion ABS, or eABS, process, marketed under the MAGNUM™ brand. mABS has similar properties to eABS but has greater colorability, thermal stability and lower gloss. mABS products can be manufactured to stricter specifications because it is produced in a continuous process as opposed to the batch process used in eABS. mABS also has environmental benefits such as waste reduction and higher yields. In addition to our own mABS production capacity, we also license our proprietary mABS technology to other producers.

Primary end uses for our ABS products include automotive and construction sheet. In 2013, we maintained a significant share of ABS sales into these markets, which we believe is driven by the differentiating attributes of our mABS products, our reputation as a knowledgeable supplier, our broad product mix and our customer collaboration and design capabilities.

Automotive manufacturers have developed innovative solutions in order to meet increasing fuel standards, such as the lightweighting of vehicles. Consequentially, manufacturers have been replacing heavier materials with durable yet lighter materials, such as mABS and polypropylene compounds. We expect this trend to continue, and we believe that our technological capabilities in our Styrenics segment together with our compounding and blending expertise will help generate future growth opportunities.

Styrene-Acrylonitrile. SAN is composed of styrene and acrylonitrile, which together provide clarity, stiffness, enhanced ability to be processed, mechanical strength, barrier properties, chemical resistance and heat resistance.

SAN is used mainly in appliances, consumer goods and construction sheets, due to its low-cost, clarity and chemical resistance properties. Within our Styrenics segment, we manufacture SAN under the TYRIL™ brand name for use in housewares, appliances, automotive, construction sheets, battery cases and lighting applications. In addition, TYRIL™ is suitable for self-coloring which adds value in many of these uses.

Technology licensing. From time to time, we may seek to opportunistically license our technology to third parties pursuant to licensing arrangements that may be exclusive to a particular geography or product.

Customers

Our customer centric model focuses on understanding customers’ needs and developing tailored solutions that create value for both parties. For durable applications, we focus our TS&D, R&D and marketing teams on product design engineering initiatives for developing and specifying plastics in the next generation of construction applications, appliances, automotive, and consumer electronics. In non-durable applications, we focus on innovative products that provide clear cost advantages to our customers, serving customers with our cost-advantaged technology and operating excellence. We have leveraged industry-leading product development and technology capabilities to develop long-standing customer relationships with many of our customers, including a number who have purchased from us, including our predecessor business operated by Dow prior to the Acquisition, for more than 20 years. We believe that our global presence is an advantage, allowing us to provide customers with consistent product grades and positioning us to strategically serve growth economies.

16

Table of Contents

Competition

Our principal competitors in our Styrenics segment are Styrolution Group GmbH, Versalis S.p.A. and Total S.p.A. In our Styrenics segment, we compete primarily based on our ability to offer differentiated products, the reliability of our products, the quality of our customer service and the length and depth of our relationships.

Industry Outlook

From 2006 to 2011, the polystyrene industry experienced substantial capacity rationalizations by major producers such as BASF Group, INEOS Nova, and others. Over 1,000 kMT of annual U.S. and Western Europe polystyrene capacity were eliminated during this time period, representing a reduction of approximately 20% of the 2005 total capacity in those regions. Consistent with the broader industry, we participated in these rationalizations by electing to shut down some of our less cost effective European assets and concentrating production at our most competitive facilities. This trend has continued since 2011 with the completed formation of the Styrolution joint venture combining certain INEOS and BASF Group assets and the prior acquisition of INEOS Nova by INEOS, as well as INEOS’ most recent asset rationalizations in styrene monomer and polystyrene and Styrolution’s recent announcement to close a polystyrene plant in the United States.

In addition to improving profitability through cost rationalizations, the polystyrene industry has also benefited from a number of consolidating activities. A number of our larger competitors have enhanced their platforms via acquisitions and joint ventures, such as the completed formation of the Styrolution joint venture combining certain INEOS and BASF Group assets and the prior acquisition of INEOS Nova by INEOS. Utilization rates are expected to improve in Europe by 2018 and steadily increase in North America and Asia from 2014 through 2018 as the reduced production capacity serves growing demand in end-markets.

The ABS and styrenics markets have also experienced a number of capacity rationalizations since 2006. These rationalizations, combined with improved end-market demand, have resulted in a substantial improvement in operating rates since the beginning of the global economic downturn. Global styrene utilization rates of approximately 84% in 2013 are expected to increase to 91% by 2018.

Engineered Polymers Segment

Overview

We are a leading producer of engineered polymers. Our products are predominantly used in the automotive, consumer electronics, construction, and medical device markets. We are focused on differentiated products which we produce in our polymer and compounds and blends manufacturing facilities located across Europe, Asia, North America and Latin America. We believe that the strategic locations of these facilities combined with close customer collaboration offers us a strategic advantage in serving our customers. Many of our PC products and more than half of our compounds and blends products are differentiated, based on their physical properties, performance and aesthetic advantages. Our history of innovation has contributed to long-standing relationships with customers who are recognized leaders in their respective end-markets. We have established a strong market presence in the global automotive and electronics sector, targeting both component suppliers and final product manufacturers. Our Engineered Polymers segment also compounds and blends our PC and mABS plastics into differentiated products for customers within these sectors, as well as into compounds of polypropylene. We have also developed compounds containing post-consumer recycle polymers to respond to what we believe is a growing need for some customers to include recycled content in their products. We are currently focused on reducing costs in order to improve our competitiveness in polycarbonate.

We believe growth in this segment is driven by a number of factors, including consumer preference for lighter weight and impact-resistant products and the development of new consumer electronics, increases in LED lighting applications and continuing growth in medical device applications. Additionally, we believe growth is bolstered by sustainability trends, such as the substitution of lighter-weight plastics for metal in automobiles, as well as more energy efficient, glazing solutions.

17

Table of Contents

In 2013, approximately 50% of our Engineered Polymer segment’s net sales were generated in Europe, approximately 20% were generated in the United States and approximately 15% were generated in Asia, with the remainder in other geographic regions, including Latin America and Canada.

Products and End Uses

Our Engineered Polymers segment consists of PC, compounds and blends and some specialized ABS grades. PC has high levels of clarity, impact resistance and temperature resistance. PC can be used in its neat form (prior to any compounding or blending) for markets such as construction sheet, optical media and LED lighting. Additionally, PC can be compounded or blended with other polymers, such as ABS, which imparts specific performance attributes tailored to the product’s end-use. Our compounds and blends business has a significant position in the PC/ABS blends, which combine the heat resistance and impact strength of PC with the easy to process qualities and resilience of ABS. In addition, we produce ignition resistant polystyrene for consumer electronics applications such as flat screen televisions. We believe our ability to offer technologically differentiated products to meet customer needs sets us apart from our competitors, and with our history as a leading innovator in PC and compounds and blends, we have established ourselves as a leading supplier of PC-based products.

Our products for glazing and construction sheets are marketed under the CALIBRE™ brand name and offer customers a combination of clarity, heat resistance and impact performance. Glazing and construction sheet represents our largest PC application, and is a key growth focus for us. Key end-markets include the construction industry, with additional opportunities for growth with compounded products in the medical device space, consumer electronics and other applications such as smart meter casings that require plastics with enhanced weatherability, ignition resistance and impact performance.

For the automotive industry, we manufacture PC blends under the PULSE™ brand, and we innovate collaboratively with our customers to develop performance solutions to meet the industry’s needs, such as removing weight from vehicles. As a result, we are a key supplier of these products to leading automotive companies in North America and Europe, who tend to specify these products on a per car program platform basis, making it difficult to be displaced as a supplier once selected and providing us with relatively stable and predictable cash flows for several years during the production lifecycle. We are also accelerating our development of similar supply capabilities in rapidly-growing areas such as China.

For the consumer electronics, electrical and lighting and medical device industries, we manufacture our products under the EMERGE™ brand, among others, and we believe that we have substantial growth opportunities in tablets, notebooks, smart phones and other handheld devices, as well as flat screen television sets, and electrical and lighting and medical device components. In serving these markets, we leverage our polymer and compound technologies to meet increasingly stringent performance requirements along with the aesthetic and color-matching requirements which are crucial characteristics for the products involved. The result is that we are a leading and long-standing supplier to many well known brands.

Technology licensing. From time to time, we may seek to opportunistically license our technology to third parties pursuant to licensing arrangements that may be exclusive to a particular geography or product.

Customers

We have a history of innovation in PC and compounds and blends in our Engineered Polymers segment, and we believe that our focus on differentiated products enhances our growth prospects in this segment. We develop tailored polymer, compound and process solutions for our customers and for end-markets such as consumer electronics, we believe that our ability to work with our customers to quickly and effectively develop product solutions is a key to our success. Our innovation has contributed to long-standing relationships with customers

18

Table of Contents

who are recognized leaders in their respective end-markets. We also believe our global facilities are a competitive advantage that allows us to provide customers with consistent grades and position us to strategically serve emerging markets.

Competition

Our principal competitors in our Engineered Polymers segment are Bayer MaterialScience AG, LG Chem Ltd., Mitsubishi Chemical Corporation, Saudi Basic Industries Corporation, Teijin Limited, Borealis AG, Celanese Corporation and LyondellBasell Industries. In our Engineered Polymers segment, we compete primarily based on our ability to offer differentiated products, the reliability of our products, the quality of our customer service and the length and depth of our relationships.

Industry Outlook

We believe we are a leading global producer of PC and PC blends. Smaller competitors tend to operate on a regional basis. We have developed a global, multi-tiered marketing approach targeting the tiered suppliers, as well as final product producers, which we believe most effectively addresses our customers’ needs.

We believe our base PC business will benefit from continued growth in demand of approximately 5% per year as well as capacity absorption following the large capacity additions in 2011 and 2012 by SABIC and other producers. In addition, we believe that capacity expansions in China by some of our competitors are being postponed by several years. Furthermore, some Asian producers, such as Teijin, have announced plans to reduce capacity. As a result of this dynamic, global PC utilization rates are expected to increase by approximately 6% over the next five years.

We also believe that automotive manufacturers will continue the practice of lightweighting vehicles in order to meet increasing fuel efficiency standards, which should increase demand for our compounds and blends products. We believe these same trends towards lighter weights and higher performance materials will also impact other key end-markets such as medical devices, lighting and consumer electronics, and will continue to be a source of growth for our differentiated products.

Our Relationship with Dow

In conjunction with the Acquisition, we entered into certain agreements with Dow, including the Second Amended and Restated Master Outsourcing Services Agreement, which was modified on June 1, 2013 (“SAR MOSA”), the Amended and Restated MOD5 Computerized Process Control Software, Licenses and Services Agreement, with Rofan Services, Inc. which was modified June 1, 2013 (“AR MOD5 Agreement”), site and operating services agreements, and supply agreements.

The SAR MOSA provides for ongoing worldwide services from Dow, in areas such as information technology, enterprise resource planning, finance, environmental health and safety, training, customer service, marketing and sales support, supply chain and purchasing. The term of this agreement runs through December 2020, which automatically renews for two year periods unless either party provides six months’ notice of non-renewal to the other party. The services provided pursuant to the SAR MOSA generally are priced per function, and we have the ability to terminate the services or any portion thereof, for convenience any time after June 1, 2015, subject to payment of termination charges. Services which are “highly integrated” follow a different process for evaluation and termination. In addition, either party may terminate for cause, which includes a bankruptcy, liquidation or similar proceeding by the other party, for material breach which is not cured, or by Dow in the event of our failure to pay for the services thereunder. In the event of a change of control as defined in the agreement, Dow has the right to terminate the SAR MOSA.

Under the AR MOD5 Agreement, Dow provides worldwide process control technology, including hardware, software licenses and support services, and related enterprise resource planning services. The AR

19

Table of Contents

MOD5 Agreement, with a term through December 2020, may be terminated by either party for cause, which includes a bankruptcy, liquidation or similar proceeding by the other party, for material breach which is not cured by us if we no longer wishes to receive maintenance and support for any licensed software; or by Dow if we use the licensed software for any purposes other than Company business. Dow may terminate the maintenance and support terms at any time if we fail to make payments when due and the default is not corrected within 30 days from notice, or upon two years written notice us, if Dow has made the decision not to support the software systems, provided that Dow will use commercially reasonable efforts to assist us in locating and transitioning to an alternate service provider.

In addition, we entered into various site services agreements with Dow, which were modified as of June 1, 2013, where at Dow owned sites, Dow provides site services to Company. Conversely, we entered into similar agreements with Dow in June 2010, where at Company owned sites, we provide such services to Dow. These agreements cover general services that are provided at specific facilities co-located with Dow, rather than organization-wide services, and include utilities, site administration, environmental health and safety, site maintenance and supply chain. In certain circumstances, the parties may adjust certain prices and volumes. These agreements generally have 25-year terms from the date of the Acquisition, with options to renew. These agreements may be terminated at any time by agreement of the parties, or, by either party, for cause, including a bankruptcy, liquidation or similar proceeding by the other party, or for a material breach which is not cured. In addition, we may terminate for convenience any services that Dow has agreed to provide to us that are identified in any site services agreement as “terminable” with 12 months prior notice to Dow, dependent upon whether the service is highly integrated into Dow operations. With respect to “nonterminable” services that Dow has agreed to provide to us, such as electricity and steam, we generally cannot terminate such agreements prior to the termination date unless we experience a production unit shut down for which we provide Dow with 15-months prior notice, or upon payment of a shutdown fee. Upon expiration or termination, we would be obligated to pay a monthly fee to Dow, which obligation extends for a period of 45 to 60 months following the termination or expiration of each site services agreement. The agreements under which Dow receives services from us may be terminated under the same circumstances and conditions.