Attached files

| file | filename |

|---|---|

| 10-K - 10-K - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_10k.htm |

| EX-31.1 - EXHIBIT 31.1 - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_ex31-2.htm |

| EX-10.5 - ADMINISTRATION AGREEMENT - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_ex10-5.htm |

| EX-32.1 - EXHIBIT 32.1 - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_ex32-1.htm |

| EX-4.1 - FORM OF SUBSCRIPTION AGREEMENT - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_ex4-1.htm |

| EX-32.2 - EXHIBIT 32.2 - VII Peaks Co-Optivist Income BDC II, Inc. | v368115_ex32-2.htm |

SUBSCRIPTION ADD ON Shares Of Common Stock Of VII Peaks Co]Op..vistTM Income BDC II, Inc. The undersigned hereby tenders this subscrip..on and applies for the purchase of the dollar amount of common shares of beneficial interest (the gSharesh) of VII Peaks Co]Op..vistTM Income BDC II, Inc. (some..mes referred to herein as the gCompanyh), set forth below. Addi..onal Investment ($500 minimum) NAV or Net of commission Investment Subscrip..on Amount $ 1. INVESTMENT Owner or authorized person: Print Name Signature Date Owner or authorized person: Print Name Signature Date Signature of Custodian (if applicable) Date I(We) am(are) an existing shareholder(s) in the Company, and desire to purchase additional shares in the Company in the amount specified above. I(We) hereby reaffirm as of the date hereof all of the representations, warranties and acknowledgements previously made in the most recent Subscription Agreement under which I(We) purchased shares in the Company. I(We) confirm that I(We) have received the Companyfs final prospectus (as amended or supplemented as of the date hereof) at least five business days prior to the signing of this Subscription Add On Form. I(We) confirm that my(our) prior election to participate or not participate in the Companyfs DRIP (Distribution Reinvestment Plan) shall apply to the shares purchased pursuant to this Subscription Add On Form. 4. REPRESENTATIONS, WARRANTIES AND COVENANTS OF INVESTOR A. Individual/Beneficial Owners (Trust/Corpora..on/Partnership) Social Security Number B. Joint Investor/Minor First Name (MI) Name of inves..ng en..ty First Name (MI) 3. INVESTOR INFORMATION Social Security Number Last Name Date of Birth (MM,DD,YYYY) Individual Joint Tenants with Right of Survivorship Pension Plan Trust (Complete Appendix A on page A]5) Non]Profit Organiza..on Corpora..on or Partnership (Complete Append ix B on page A]6) UGMA: State of _______ UTMA: State of _______ Other (Specify and include ..tle pages) ____________________________________________ Custodial Account: IRA SEP/IRA ROTH/IRA OTHER Qualified Acct: ________________________________________________________ Custodian Name: ___________ ____________ _____________ ____________________________________ Account #: _____________________________ Custodian Mailing Address: _______________________________________________________________________________________________________ 2. O WNERSHIP (Select only one) Last Name Date of Birth (MM

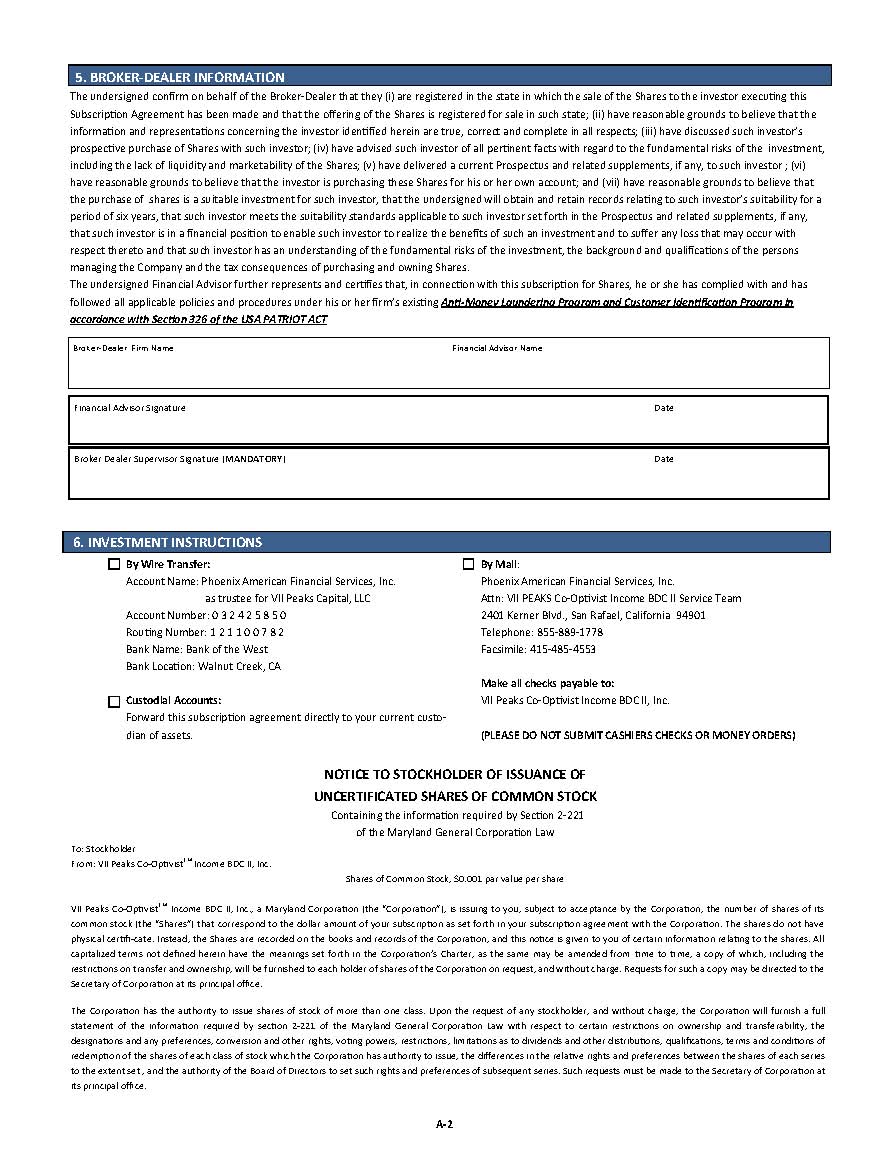

5. BROKER]DEALER INFORMATION The undersigned confirm on behalf of the Broker]Dealer that they (i) are registered in the state in which the sale of the Shares to the investor execu..ng this Subscrip..on Agreement has been made and that the offering of the Shares is registered for sale in such state; (ii) have reasonable grounds to believe that the informa..on and representa..ons concerning the investor iden..fied herein are true, correct and complete in all respects; (iii) have discussed such investorfs prospec..ve purchase of Shares with such investor; (iv) have advised such investor of all per..nent facts with regard to the fundamental risks of the investment, including the lack of liquidity and marketability of the Shares; (v) have delivered a current Prospectus and related supplements, if any, to such investor ; (vi) have reasonable grounds to believe that the investor is purchasing these Shares for his or her own account; and (vii) have reasonable grounds to believe that the purchase of shares is a suitable investment for such investor, that the undersigned will obtain and retain records rela..ng to such investorfs suitability for a period of six years, that such investor meets the suitability standards applicable to such investor set forth in the Prospectus and related supplements, if any, that such investor is in a financial posi..on to enable such investor to realize the benefits of such an investment and to suffer any loss that may occur with respect thereto and that such investor has an understanding of the fundamental risks of the investment, the background and qualifica..ons of the persons managing the Company and the tax consequences of purchasing and owning Shares. The undersigned Financial Advisor further represents and cer..fies that, in connec..on with this subscrip..on for Shares, he or she has complied with and has followed all applicable policies and procedures under his or her firmfs exis..ng An..]Money Laundering Program and Customer Iden..fica..on Program in accordance with Sec..on 326 of the USA PATRIOT ACT B roker]Dealer Firm Name Financial Advisor Name Financial Advisor Signature Date Broker Dealer Supervisor Signature (MANDATORY) Date 6. INVESTMENT INSTRUCTIONS By Wire Transfer: Account Name: Phoenix American Financial Services, Inc. as trustee for VII Peaks Capital, LLC Account Number: 0 3 2 4 2 5 8 5 0 Rou..ng Number: 1 2 1 1 0 0 7 8 2 Bank Name: Bank of the West Bank Loca..on: Walnut Creek, CA Custodial Accounts: Forward this subscrip..on agreement directly to your current custodian of assets. By Mail: Phoenix American Financial Services, Inc. A..n: VII PEAKS Co]Op..vist Income BDC II Service Team 2401 Kerner Blvd., San Rafael, California 94901 Telephone: 855]889]1778 Facsimile: 415]485]4553 Make all checks payable to: VII Peaks Co]Op..vist Income BDC II, Inc. (PLEASE DO NOT SUBMIT CASHIERS CHECKS OR MONEY ORDERS) NOTICE TO STOCKHOLDER OF ISSUANCE OF UNCERTIFICATED SHARES OF COMMON STOCK Containing the informa..on required by Sec..on 2]221 of the Maryland General Corpora..on Law To: Stockholder From: VII Peaks Co]Op..vistTM Income BDC II, Inc. Shares of Common Stock, $0.001 par value per share VII Peaks Co]Op..vistTM Income BDC II, Inc., a Maryland Corpora..on (the gCorpora..onh), is issuing to you, subject to acceptance by the Corpora..on, the number of shares of its common stock (the gSharesh) that correspond to the dollar amount of your subscrip..on as set forth in your subscrip..on agreement with the Corpora..on. The shares do not have physical cer..fi]cate. Instead, the Shares are recorded on the books and records of the Corpora..on, and this no..ce is given to you of certain informa..on rela..ng to the shares. All capitalized terms not defined herein have the meanings set forth in the Corpora..onfs Charter, as the same may be amended from ..me to ..me, a copy of which, including the restric..ons on transfer and ownership, will be furnished to each holder of shares of the Corpora..on on request, and without charge. Requests for such a copy may be directed to the Secretary of Corpora..on at its principal office. The Corpora..on has the authority to issue shares of stock of more than one class. Upon the request of any stockholder, and without charge, the Corpora..on will furnish a full statement of the informa..on required by sec..on 2]221 of the Maryland General Corpora..on Law with respect to certain restric..ons on ownership and transferability, the designa..ons and any preferences, conversion and other rights, vo..ng powers, restric..ons, limita..ons as to dividends and other distribu..ons, qualifica..ons, terms and condi..ons of redemp..on of the shares of each class of stock which the Corpora..on has authority to issue, the differences in the rela..ve rights and preferences between the shares of each series to the extent set , and the authority of the Board of Directors to set such rights and preferences of subsequent series. Such requests must be made to the Secretary of Corpora..on at its principal office.