Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PUBLIC SERVICE ELECTRIC & GAS CO | d691072d8k.htm |

Forward-Looking Statement

2

Certain of the matters discussed in this communication about our and our

subsidiaries’ future performance, including, without limitation,

future revenues, earnings, strategies, prospects, consequences and all

other statements that are not purely historical constitute

“forward-looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Such forward-looking statements are subject

to risks and uncertainties, which could cause actual results to differ

materially from those anticipated. Such statements are based on

management's beliefs as well as assumptions made by and information

currently available to management. When used herein, the words

“anticipate,” “intend,” “estimate,” “believe,” “expect,” “plan,”

“should,” “hypothetical,” “potential,”

“forecast,” “project,” variations of such words and

similar expressions are intended to identify forward-looking statements.

Factors that may cause actual results to differ are often presented with

the forward-looking statements themselves. Other factors that could

cause actual results to differ materially from those contemplated in any

forward looking statements made by us herein are discussed in filings we

make with the United States Securities and Exchange Commission (SEC),

including our Annual Report on Form 10-K and subsequent reports

on Form 10-Q and Form 8-K and available on our website: http://www.pseg.com. These factors include,

but are not limited to: •

any deterioration in our credit quality or the credit quality of our

counterparties, including in our leveraged leases,

•

availability of capital and credit at commercially reasonable terms and

conditions and our ability to meet cash needs,

•

changes in the cost of, or interruption in the supply of, fuel and other

commodities necessary to the operation of our generating units,

•

delays in receipt of necessary permits and approvals for our construction and

development activities,

•

delays or unforeseen cost escalations in our construction and development

activities,

•

any inability to achieve, or continue to sustain, our expected levels of

operating performance,

•

any equipment failures, accidents, severe weather events or other

incidents that impact our ability to provide safe and reliable

service to our customers, and any inability to obtain sufficient

coverage or recover proceeds of insurance with respect to such events,

•

cybersecurity attacks or intrusions that could adversely impact our

businesses, •

increases in competition in energy supply markets as well as competition from

certain transmission projects,

•

any inability to realize anticipated tax benefits or retain tax credits,

•

challenges associated with recruitment and/or retention of a qualified

workforce, •

adverse performance of our decommissioning and defined benefit plan trust fund

investments and changes in funding requirements, and

•

changes in technology, such as distributed generation and micro grids, and

greater reliance on these technologies and changes in customer

behaviors, including energy efficiency, net metering and demand

response. All of the forward-looking statements made in this report

are qualified by these cautionary statements and we cannot assure you

that the results or developments anticipated by management will be

realized or even if realized, will have the expected consequences to,

or effects on, us or our business prospects, financial condition or

results of operations. Readers are cautioned not to place undue reliance on

these forward-looking statements in making any investment decision.

Forward-looking statements made in this report apply only as of the

date of this report. While we may elect to update forward-looking

statements from time to time, we specifically disclaim any obligation

to do so, even if internal estimates change, unless otherwise required

by applicable securities laws. The forward-looking statements contained in

this report are intended to qualify for the safe harbor provisions of

Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended. •

adverse changes in the demand for or the price of the capacity and energy that

we sell into wholesale electricity markets,

•

adverse changes in energy industry law, policies and regulation, including

market structures and a potential shift away from competitive markets

toward subsidized market mechanisms, transmission planning and cost

allocation rules, including rules regarding how transmission is

planned and who is permitted to build transmission in the future, and

reliability standards, •

any inability of our transmission and distribution businesses to obtain

adequate and timely rate relief and regulatory approvals from federal

and state regulators, •

changes in federal and state environmental regulations that could increase our

costs or limit our operations,

•

changes in nuclear regulation and/or general developments in the nuclear power

industry, including various impacts from any accidents or incidents

experienced at our facilities or by others in the industry, that could

limit operations of our nuclear generating units,

•

actions or activities at one of our nuclear units located on a multi-unit

site that might adversely affect our ability to continue to

operate that unit or other units located at the same site,

•

any inability to balance our energy obligations, available supply and risks,

EXHIBIT 99 |

GAAP Disclaimer

PSEG presents Operating Earnings in addition to its Income from Continuing

Operations/Net Income reported in accordance with accounting principles

generally accepted in the United States (GAAP). Operating Earnings is a

non- GAAP financial measure that differs from Income from Continuing

Operations/Net Income because it excludes gains or losses associated

with Nuclear Decommissioning Trust (NDT), Mark-to-Market (MTM)

accounting, and other material one-time items. PSEG presents

Operating Earnings because management believes that it is appropriate

for investors to consider results excluding these items in addition to

the results reported in accordance with GAAP. PSEG believes that the

non-GAAP financial measure of Operating Earnings provides a

consistent and comparable measure of performance of its businesses to

help shareholders understand performance trends. This information is

not intended to be viewed as an alternative to GAAP information.

Slide

A

at

the

end

of

this

presentation

includes

a

list

of

items

excluded

from

Income from Continuing Operations/Net Income to reconcile to Operating

Earnings, with a reference to that slide included on each of the

slides where the

non-GAAP information appears.

3 |

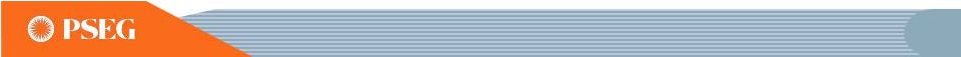

Operating Earnings Guidance

Building on the successful implementation of our strategy

S E E S L I D E A F O R I T E

M S E X C L U D E D F R O M I N C O M E F R O M C O N T I N U I N G

O

P

E

R

A

T

I

O

N

S

/

N

E

T

I

N

C

O

M

E

T

O

R

E

C

O

N

C

I

L

E

T

O

O

P

E

R

A

T

I

N

G

E

A

R

N

I

N

G

S

.

E

=

E

S

T

I

M

A

T

E

.

$2.44

$2.58

$2.55

-

$2.75E

2012

2013

2014 Guidance

8 |

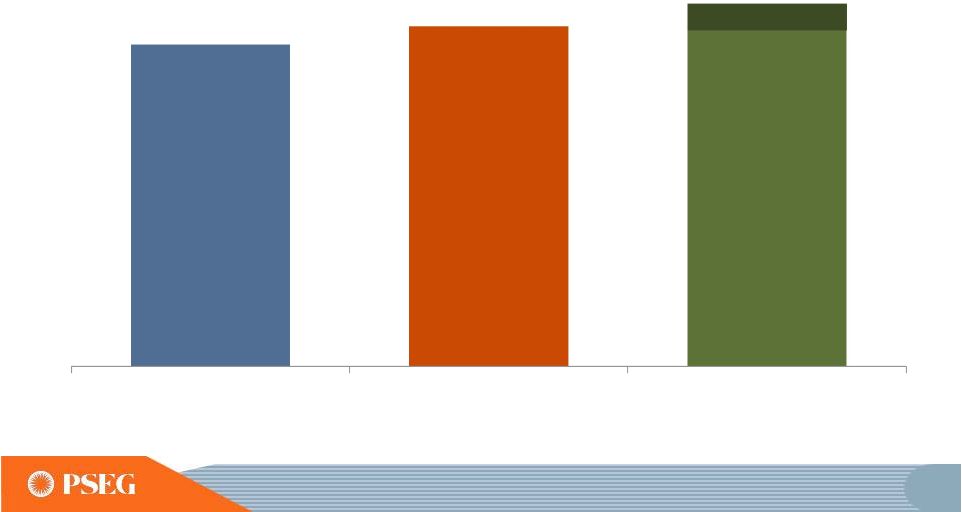

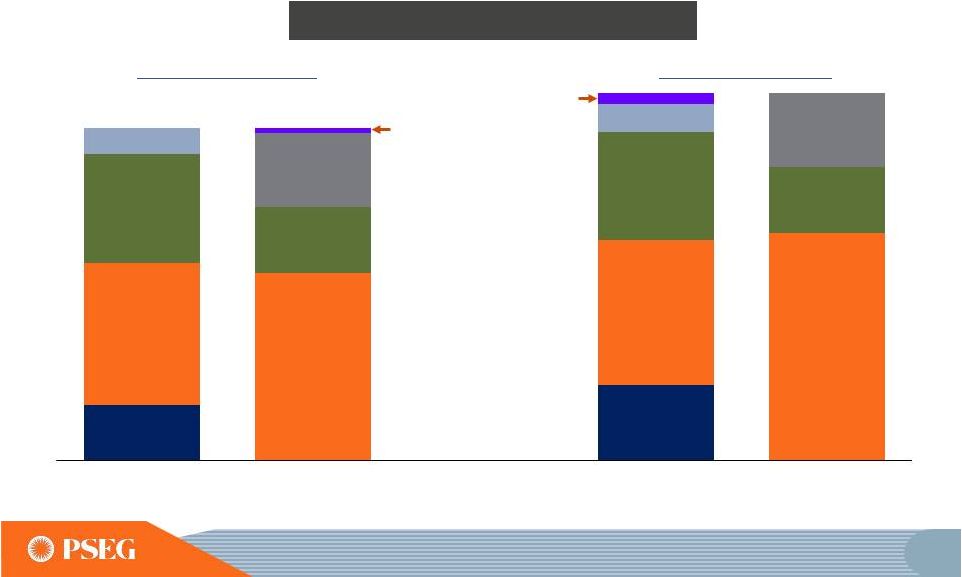

Operating Earnings Mix

Long term investment program has driven increased earnings

contribution from stable, regulated business

* S E E S L I D E A

F O R I T E M S E X C L U D E D F R O M I N C O M E F R O M C O N T I N U I N G O P E R A T I O N S /

N E T I N C O M E T O R E C O N C I L

E T O O P E R A T I N G E A R N I N G S ; D I S C O N T I N U E D O P E R A T I O N S R E F L E C T

T

E

X

A

S

.

E

=

E

S

T

I

M

A

T

E

*

*

2

0

1

4

P

E

R

C

E

N

T

S

U

S

E

M

I

D

P

O

I

N

T

O

F

E

A

R

N

I

N

G

S

G

U

I

D

A

N

C

E

.

Power’s

diverse

fuel

mix

and dispatch flexibility

continues to generate

earnings and free cash flow

PSE&G’s

investment in

transmission has

diversified its asset base

and, coupled with other

investments

and cost controls,

supported compound

annual earnings growth of

~18% over 2009 –

2013

Operating Earnings* Contribution by Subsidiary (%)

PSE&G

Power

Other

$2.44

$2.58

$2.55 -

$2.75E

$3.12

$2.74

$3.09

20%

27%

38%

43%

47%

54%

76%

69%

62%

54%

54%

43%

2009

2010

2011

2012

2013

2014E**

9 |

Where we’re going …

actions taken to focus on

more predictable growth

S E E S L I D E A F O R I T E M S E X C L U D E D F R O M I N C O M E F R O M C O N T I N U I N G O P E R A T I O N S /

N E T I N C O M E T O R E C O N C I L

E T O O P E R A T I N G E A R N I N G S . E = E S T I M A T E

.

PSEG Focus

Opportunity for

consistent,

sustainable growth

Operating Earnings Per Share

•

O&M Growth per year

•

PSE&G Rate Base

•

Transmission

•

E&G Distribution

•

EE and Solar

•

Nuclear Generation

•

CC Equivalent Availability

•

PSEG LI Earnings

•(0.5%) (forecast³) •$13,700

•$6,500

•$6,600

4

•$600

4

•31.4TWh

•91%

•$0.07

5

2016E

($ Millions except as noted)

•

1.5% (actual²) •

$10,400

•

$3,800

•

$6,000

•

$600

•

29.5TWh

•

89%

•

$0

2013

•

2.4% (planned¹) •

$6,800

•

$866

•

$5,900

•

$0

•

29.3TWh

•

90%

•

$0

2008

$1.29

$1.44

Common Dividend Per Share

$70

$38

$38

6

PJM West RTC ($/MWh)

$2.58

$2.91

(

1

)

P

l

a

n

n

e

d

c

o

m

p

o

u

n

d

a

n

n

u

a

l

g

r

o

w

t

h

r

a

t

e

2

0

0

8

–

2

0

1

3

.

(

2

)

A

c

t

u

a

l

c

o

m

p

o

u

n

d

a

n

n

u

a

l

g

r

o

w

t

h

r

a

t

e

2

0

0

8

–

2

0

1

3

.

(

3

)

P

l

a

n

n

e

d

c

o

m

p

o

u

n

d

a

n

n

u

a

l

g

r

o

w

t

h

r

a

t

e

2

0

1

3

–

2

0

1

6

.

( 4 ) I n c l u d e s a p p r o v e d s o l a

r p r o g r a m s . (

5

)

I

n

c

l

u

d

e

s

m

a

n

a

g

e

m

e

n

t

f

e

e

f

o

r

T

&

D

o

p

e

r

a

t

I

o

n

s

u

n

d

e

r

e

x

p

a

n

d

e

d

O

S

A

a

n

d

f u e l

a n d e n e r g y p r o c u r e m e n t c o n t r a c t

. ( 6 ) F o r w a r d m a r k e t a s o

f 2 / 2 6 / 2 0 1 4 . 16

|

PSE&G’s 2014 operating earnings

to benefit from increased investment in transmission and

on-going cost control

E=ESTIMATE

45

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING

OPERATIONS/NET INCOME TO RECONCILE TO

OPERATING EARNINGS. |

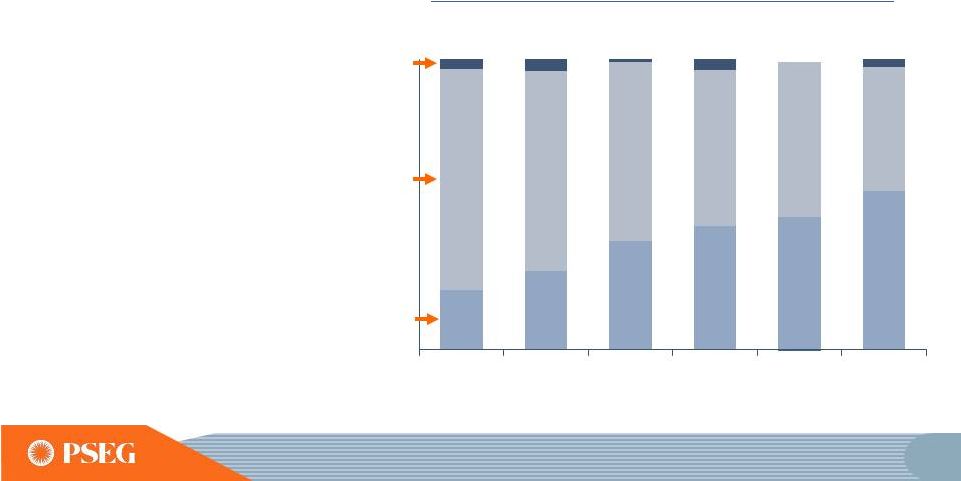

PSEG Power’s capital expenditures for

environmental requirements are essentially complete*

COMPLETION OF

CONEMAUGH SCR/FGD

MODS IN 2015

66

$0

$100

$200

$300

$400

$500

$600

$700

2009

2010

2011

2012

2013

2014E

2015E

2016E

Growth

Environmental / Regulatory

Maintenance

*BASED ON CURRENTLY KNOWN AND QUANTIFIABLE ENVIRONMENTAL REQUIREMENTS.

E=ESTIMATE |

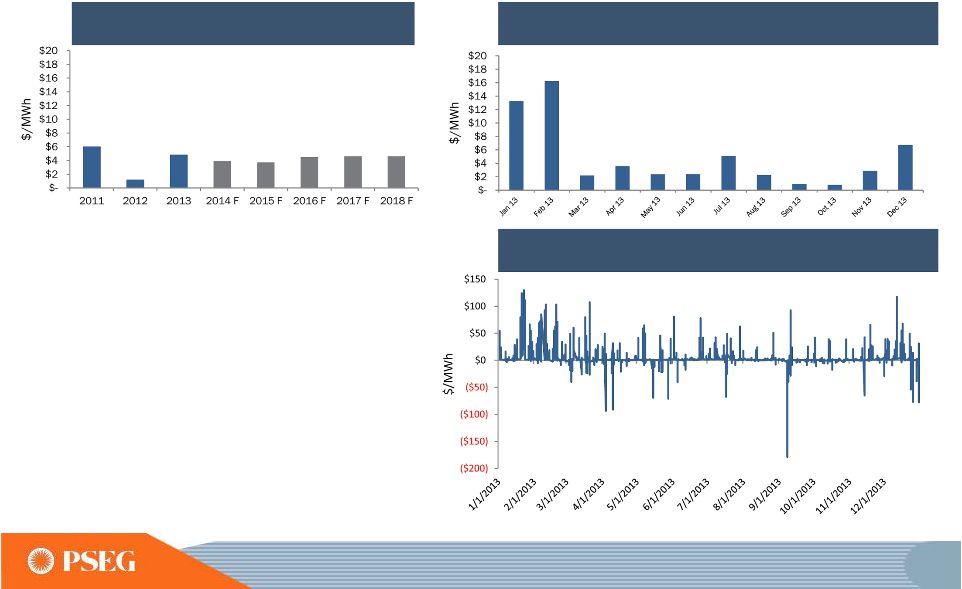

Competitive Advantage:

Locational advantage

from short term basis volatility

$45

-

$47

$56

-

$58

ANNUAL FORWARD BASIS TO PJM-WEST AS OF 12/31/2013.

•

Annual basis benefits baseload

units

•

Intermediate units flexible to

seasonal opportunities

•

Combined Cycle and Peaking

units positioned to optimize daily

and hourly volatility

PS Zone Annual Basis to PJM-W

PS Zone Day Ahead On Peak Monthly Basis to PJM-W

PS Zone Real Time On Peak Hourly Basis to PJM-W

81 |

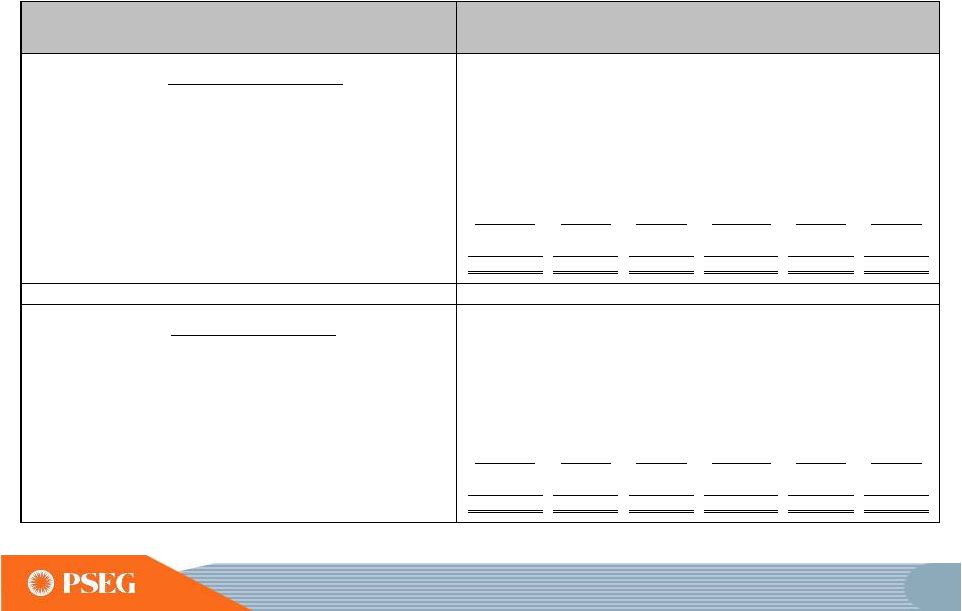

PSE&G’s Cash from Operations and Power’s Free Cash Flow support

growth investments without the need for new equity 2014 –

2016E

PSE&G

Cash from Ops

(1)

PSE&G

Capital

Investment

PSE&G

Net Debt

2014 –

2016E

PSEG Sources and Uses

(1)

PSE&G CASH FROM OPERATIONS ADJUSTS FOR SECURITIZATION PRINCIPAL REPAYMENTS

OF ~$500M FROM 2014-2016 (2)

OTHER CASH FLOW INCLUDES PSEG LI, HOLDINGS NET CASH FLOW, CASH, AND SHORT TERM

DEBT E = ESTIMATE

PSE&G

Cash from Ops

(1)

PSE&G

Capital

Investment

PSE&G

Net Debt

Approved Programs

With Energy Strong

Shareholder

Dividend

Power

Cash from Ops

Other

Cash Flow

(2)

Shareholder

Dividend

Power

Cash from Ops

Power Net

Debt

Power

Capital

Investment

Power

Capital

Investment

Other

Cash Flow

(2)

Power Net

Debt

Sources

Uses

Sources

Uses

97 |

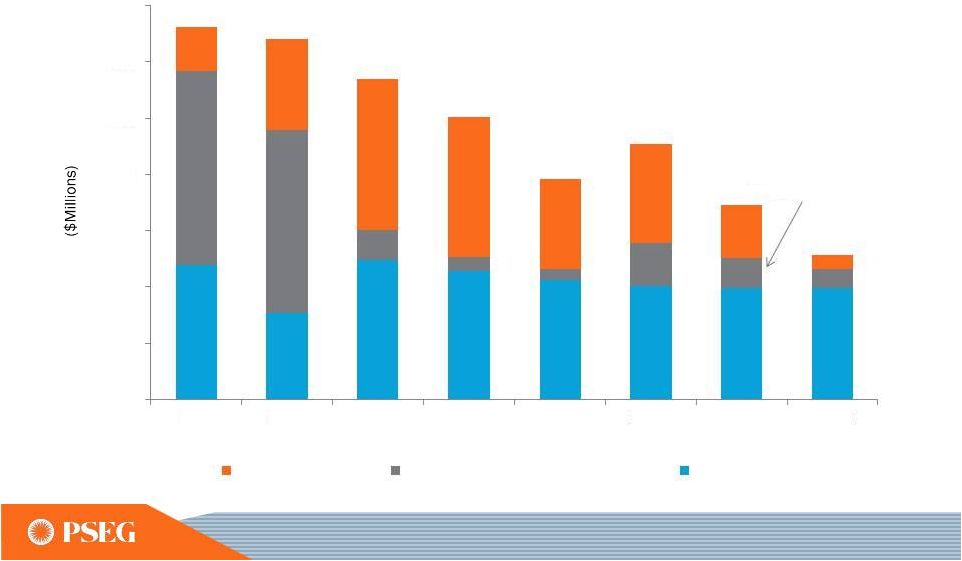

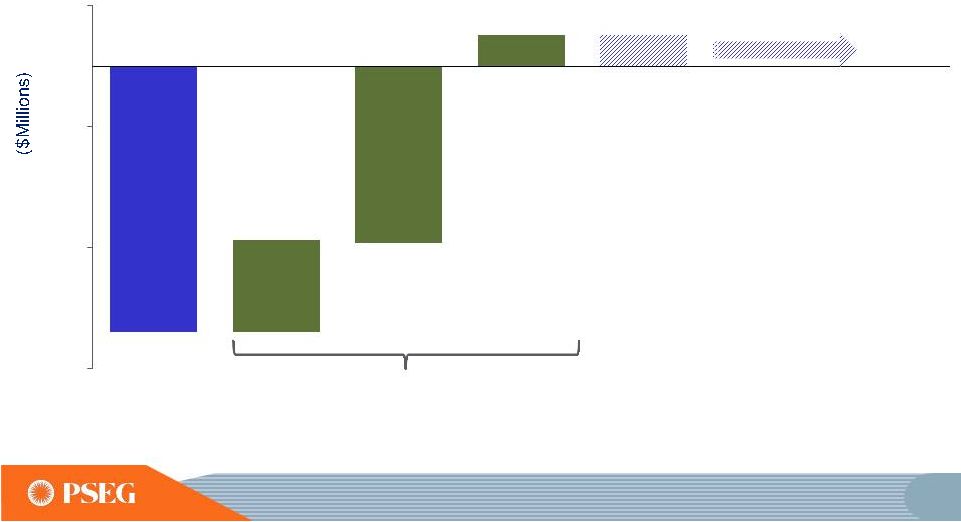

Our Pension Management

is expected to

result in pension income in 2014 and over the planning horizon

Pension (Expense)/Income

2013 to 2014 Drivers

2013

2014

2015E

2016E

Expense

($110) M

Discount

Rate

~$40M

Investment

Return

~$70M

Other

(1)

~$15M

($125)

($75)

($25)

$25

Income ~$15M per annum

100

(1) OTHER REFLECTS UPDATES TO THE POPULATION OF OUR EMPLOYEES AND

RETIREES E=ESTIMATE |

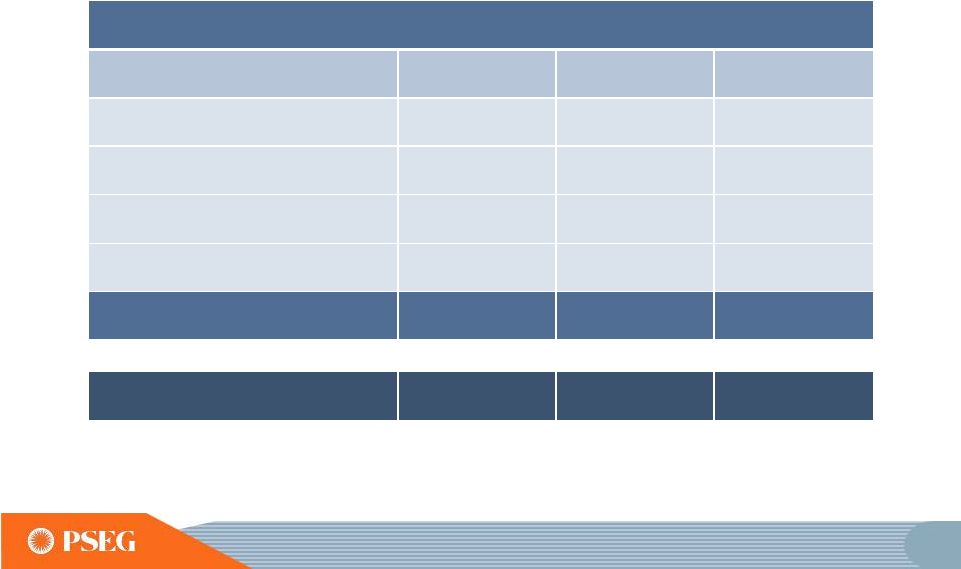

Improving Operating Earnings

and increased contribution from PSE&G

PSEG Operating Earnings

$ Millions (except EPS)

2012

2013

2014E

PSE&G

$528

$612

$705 -

$745

PSEG Power

$663

$710

$550 -

$610

Other

$45

($13)

$35 -

$40

Operating Earnings*

$1,236

$1,309

$1,290 -

$1,395

Operating EPS*

$2.44

$2.58

$2.55 -

$2.75

Regulated % of Earnings

43%

47%

53% -

55%

*SEE SLIDE A FOR ITEMS EXCLUDED FROM INCOME FROM CONTINUING

OPERATIONS/NET INCOME TO RECONCILE TO OPERATING EARNINGS.

NOTE: 2012 OPERATING EARNINGS RE-STATED FOR TRANSFER OF ASSETS FROM PSEG

HOLDINGS TO PSEG POWER. E=ESTIMATE.

102 |

A

Items Excluded from Income from Continuing

Operations/Net Income to Reconcile to Operating Earnings

PLEASE SEE PAGE 3 FOR AN EXPLANATION OF PSEG’S USE OF OPERATING EARNINGS

AS A NON-GAAP FINANCIAL MEASURE AND HOW IT DIFFERS FROM NET

INCOME. (a)

Includes the financial impact from positions with forward delivery

months. 2013

2012

2011

2010

2009

2008

Operating Earnings

1,309

$

1,236

$

1,389

$

1,584

$

1,567

$

1,478

$

Gain (Loss) on Nuclear Decommissioning Trust (NDT)

Fund Related Activity (PSEG Power)

40

52

50

46

9

(71)

Gain (Loss) on Mark-to-Market (MTM)

(a)

(PSEG Power)

(74)

(10)

107

(1)

(11)

14

Lease Transaction Activity (Energy Holdings)

-

36

(173)

-

29

(490)

Storm O&M (PSEG Power)

(32)

(39)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

-

(72)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

-

34

-

-

(13)

Income from Continuing Operations

1,243

$

1,275

$

1,407

$

1,557

$

1,594

$

918

$

Discontinued Operations

-

-

96

7

(2)

270

Net Income

1,243

$

1,275

$

1,503

$

1,564

$

1,592

$

1,188

$

Fully Diluted Average Shares Outstanding (in Millions)

508

507

507

507

507

508

Operating Earnings

2.58

$

2.44

$

2.74

$

3.12

$

3.09

$

2.91

$

Gain (Loss) on NDT Fund Related Activity (PSEG Power)

0.08

0.10

0.10

0.09

0.02

(0.14)

Gain (Loss) on MTM

(a)

(PSEG Power)

(0.14)

(0.02)

0.21

-

(0.02)

0.03

Lease Transaction Activity (Energy Holdings)

-

0.07

(0.34)

-

0.05

(0.96)

Storm O&M (PSEG Power)

(0.07)

(0.08)

-

-

-

-

Market Transition Charge Refund (PSE&G)

-

-

-

(0.14)

-

-

Gain (Loss) on Asset Sales and Impairments (Energy Holdings)

-

-

0.06

-

-

(0.03)

Income from Continuing Operations

2.45

$

2.51

$

2.77

$

3.07

$

3.14

$

1.81

$

Discontinued Operations

-

-

0.19

0.01

-

0.53

Net Income

2.45

$

2.51

$

2.96

$

3.08

$

3.14

$

2.34

$

For the Year Ended

December 31,

(Unaudited)

Reconciling Items, net of tax

Earnings

Impact

($

Millions)

Per

Share

Impact

(Diluted)

PUBLIC SERVICE ENTERPRISE GROUP INCORPORATED |