Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - XCel Brands, Inc. | v371094_8k.htm |

| EX-99.2 - EXHIBIT 99.2 - XCel Brands, Inc. | v371094_ex99-2.htm |

March 10, 2014 Investor Update Roth Capital Conference

2 (3/10/14) Safe Harbor

3 (3/10/14) To Design and Produce the Best Products For Our Followers and Partners Differentiate by Design Our Mission :

4 (3/10/14) Our Business Model is Built for Today’s New Social Era We Are A Total OmniChannel Company

5 (3/10/14) Our Brands

6 (3/10/14) 59 Licenses 150 Product Categories 1000 Better Department Store Doors USA, Mexico, Canada, Middle East, Philippines x x x x

7 (3/10/14) x x x x 1 DTR 30 Product Categories 1 Direct Response TV Network USA, U.K. 2 DTR’s 30 Product Categories 2 Direct Response TV Networks USA, Canada, U.K. x x x x

8 (3/10/14) Modern Traditional B e t t e r R e t a i l e r s B r i d g e R e t a i l e r s MICHAEL Michael Kors Lauren by Ralph Lauren Tommy Hilfiger Elie Tahari Vince Tory Burch DVF Marc by Marc Jacobs Lilly Pulitzer Rachel Zoe Kate Spade Vineyard Vines J.Crew Juicy Couture BCBGMAXAZRIA Eileen Fisher Anne Klein Nicole Miller T Tahari Lucky Brand Jeans Jessica Simpson Ivanka Trump FCUK Ralph Lauren Blue Burberry Lafayette 148 Theory DKNY Joie Jones New York CK Jeans DKNY Jeans Lauren Denim Co. Vince Camuto Calvin Klein Our Better Retail Brand Positioning Calvin Klein

9 (3/10/14) Traditional Every Day Designer Our Interactive TV Brand Positioning Contemporary Luxe Rachel Zoe Bob Mackie Susan Graver Joan Rivers George Simonton Women in Control Quacker Factory Denim & Co. Attitudes by Rene Logo by Lori Goldstein K - Dash by Kardashian Dennis Basso American Glamour Badgley Mischka DKNY Jeans IMAN Jeffrey Banks Jessica Simpson DKNYC Betsey Johnson Judith Ripka Dooney & Bourke Nicole Richie Heidi Klum

10 (3/10/14) Our Growth Opportunities

11 (3/10/14) Continue to Increase S ales in our Interactive TV Business : Continue to Increase Productivity New Categories Geographies On - Air H ours, and Online S ales Continue to Launch New Categories : Wholesale Better Retail Business Other B ricks & Mortar Distribution Increase Door C ounts Continue to Grow International Business Increase O perating Margins as Revenues G row Increase Brand Awareness Continue to open new stores x x x x x x x x x x x x x x . Grow Existing Business

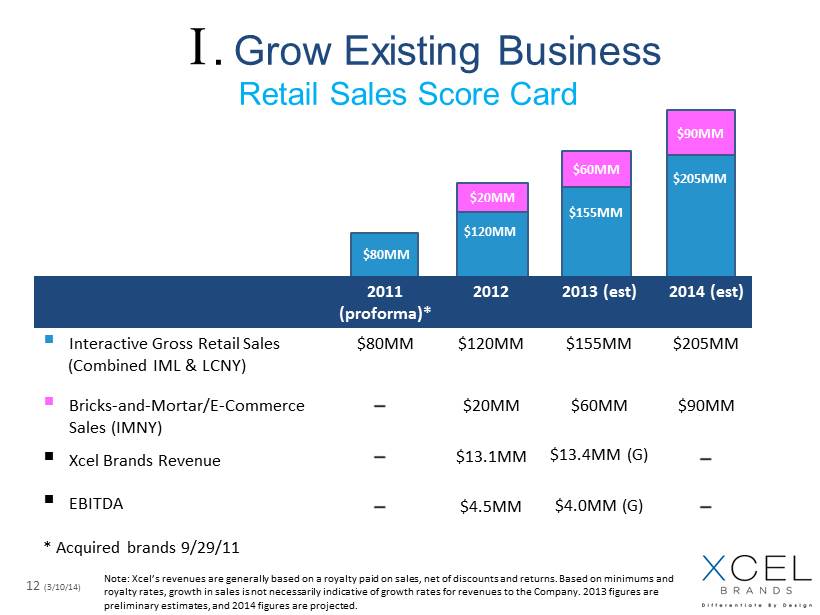

12 (3/10/14) Retail Sales Score Card . Grow Existing Business $80MM $20MM $60MM $90MM $155MM $120MM $205MM 2011 ( proforma )* 2012 2013 ( est ) 2014 ( est ) ▪ Interactive Gross Retail Sales (Combined IML & LCNY) $80MM $120MM $155MM $205MM ▪ Bricks - and - Mortar/E - Commerce Sales (IMNY) ▪ Xcel Brands Revenue ▪ EBITDA * Acquired brands 9/29/11 $20MM $13.1MM $4.5MM $60MM $13.4MM (G) $4.0MM (G) $90MM Note: Xcel’s revenues are generally based on a royalty paid on sales, net of discounts and returns. Based on minimums and royalty rates, growth in sales is not necessarily indicative of growth rates for revenues to the Company. 2013 figures are preliminary estimates, and 2014 figures are projected.

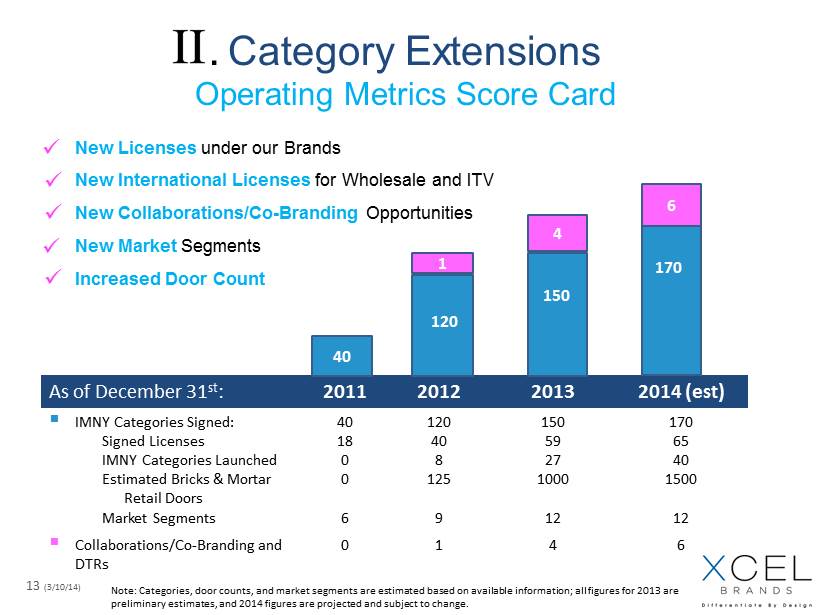

13 (3/10/14) New Licenses under our B rands New International Licenses for Wholesale and ITV New Collaborations/Co - Branding Opportunities New Market Segments Increased Door Count As of December 31 st : 2011 2012 2013 2014 ( est ) ▪ IMNY Categories Signed: Signed Licenses IMNY Categories Launched Estimated Bricks & Mortar Retail Doors Market Segments 40 18 0 0 6 120 40 8 125 9 150 59 27 1000 12 170 65 40 1500 12 ▪ Collaborations/Co - Branding and DTRs 0 1 4 6 . Category Extensions Operating Metrics Score Card 40 1 150 4 120 x x x x x 170 150 6 Note: Categories, door counts, and market segments are estimated based on available information; all figures for 2013 are preliminary estimates, and 2014 figures are projected and subject to change.

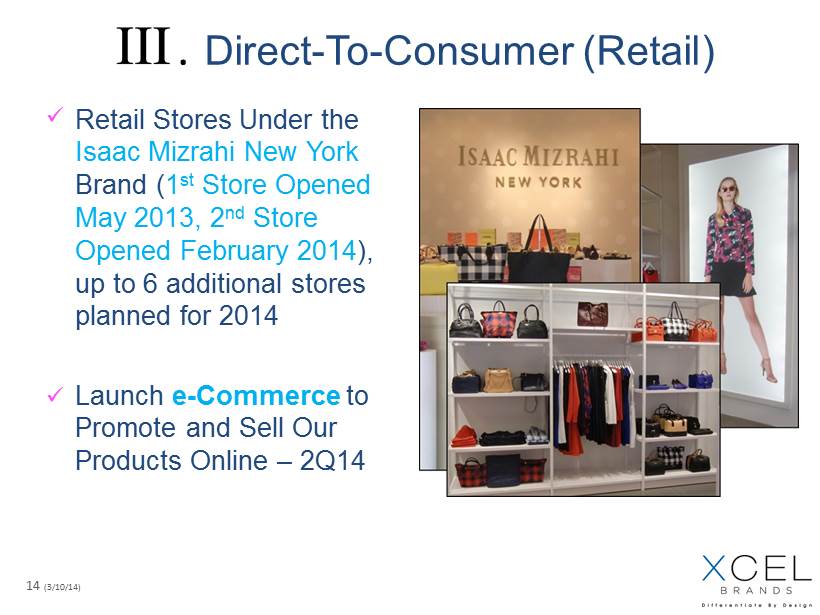

14 (3/10/14) Retail S tores U nder the Isaac Mizrahi New York Brand ( 1 st Store Opened May 2013, 2 nd Store Opened February 2014 ), u p to 6 additional stores planned for 2014 Launch e - Commerce to Promote and Sell O ur Products Online – 2Q14 . Direct - To - Consumer (Retail) x x

15 (3/10/14) . Acquisitions - Gates Strategic Synergistic Accretive x x x

16 (3/10/14) Positioned For The Future We Believe: The Way People Shop will continue to Change The Acceleration of Change will continue to increase The Way We Need to Reach our Customers will continue to Change Our Focus On Design and OmniChannel Distribution in this New Social Era positions us well to benefit from the Changes that Are Coming We Know: One Thing Remains Constant – Sales and customer satisfaction are achieved through great products!