Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Post Holdings, Inc. | form8k_31014a.htm |

| EX-99.1 - PRESS RELEASE - Post Holdings, Inc. | ex99-1prguidancemarch2014.htm |

Post Holdings, Inc. Guidance Update March 10, 2014

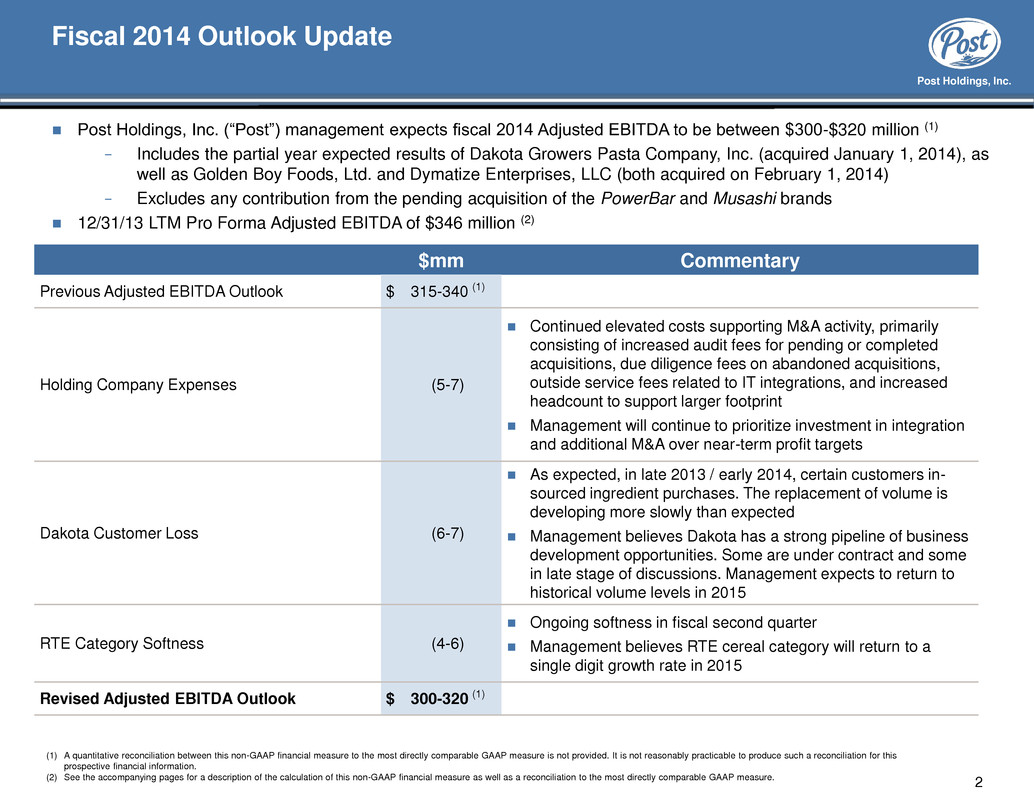

Post Holdings, Inc. 2 Post Holdings, Inc. (“Post”) management expects fiscal 2014 Adjusted EBITDA to be between $300-$320 million (1) − Includes the partial year expected results of Dakota Growers Pasta Company, Inc. (acquired January 1, 2014), as well as Golden Boy Foods, Ltd. and Dymatize Enterprises, LLC (both acquired on February 1, 2014) − Excludes any contribution from the pending acquisition of the PowerBar and Musashi brands 12/31/13 LTM Pro Forma Adjusted EBITDA of $346 million (2) Fiscal 2014 Outlook Update $mm Commentary Previous Adjusted EBITDA Outlook $ 315-340 (1) Holding Company Expenses (5-7) Continued elevated costs supporting M&A activity, primarily consisting of increased audit fees for pending or completed acquisitions, due diligence fees on abandoned acquisitions, outside service fees related to IT integrations, and increased headcount to support larger footprint Management will continue to prioritize investment in integration and additional M&A over near-term profit targets Dakota Customer Loss (6-7) As expected, in late 2013 / early 2014, certain customers in- sourced ingredient purchases. The replacement of volume is developing more slowly than expected Management believes Dakota has a strong pipeline of business development opportunities. Some are under contract and some in late stage of discussions. Management expects to return to historical volume levels in 2015 RTE Category Softness (4-6) Ongoing softness in fiscal second quarter Management believes RTE cereal category will return to a single digit growth rate in 2015 Revised Adjusted EBITDA Outlook $ 300-320 (1) (1) A quantitative reconciliation between this non-GAAP financial measure to the most directly comparable GAAP measure is not provided. It is not reasonably practicable to produce such a reconciliation for this prospective financial information. (2) See the accompanying pages for a description of the calculation of this non-GAAP financial measure as well as a reconciliation to the most directly comparable GAAP measure.

Post Holdings, Inc. 3 The 2014 Adjusted EBITDA and specific dollar amounts and other plans, expectations, estimates and similar statements set forth on the previous slide captioned “Fiscal 2014 Outlook Update” are qualified by, and subject to, the assumptions and the other information set forth below under “Forward-Looking Statements.” The estimated 2014 Adjusted EBITDA is not prepared with a view toward compliance with published guidelines of the American Institute of Certified Public Accountants, and neither our independent registered public accounting firms nor any other independent expert or outside party compiles or examines the these estimates and, accordingly, no such person expresses any opinion or any other form of assurance with respect thereto. The estimated 2014 Adjusted EBITDA is based upon a number of assumptions and estimates that, while presented with numerical specificity, is inherently subject to business, economic and competitive uncertainties and contingencies, many of which are beyond our control and are based upon specific assumptions with respect to future business decisions, some of which will change. The estimated 2014 Adjusted EBITDA is stated as a high and low range which is intended to provide a sensitivity analysis as variables are changed but it is not intended to represent that actual results could not fall outside of the estimated ranges. The estimated 2014 Adjusted EBITDA and the dollar amounts and other plans, expectations, estimates and similar statements set forth on the slide captioned “Fiscal 2014 Outlook Update” are necessarily speculative in nature, and it can be expected that some or all of the assumptions of the estimates furnished by us will not materialize or will vary significantly from actual results. Accordingly, the information set forth herein is only an estimate of what management believes is realizable as of the date hereof. Actual results will vary from the estimates set forth herein. Investors should also recognize that the reliability of any forecasted financial data diminishes the farther in the future that the data is forecast. In light of the foregoing, investors are urged to put the estimated 2014 Adjusted EBITDA in context and not to place undue reliance on it. Any failure to successfully implement our operating strategy or the occurrence of any of the events or circumstances set forth below under “Forward-Looking Statements” could result in the actual operating results being different than the estimates set forth herein, and such differences may be adverse and material. Prospective Financial Information

Post Holdings, Inc. 4 The statements made by Post on the slide captioned “Fiscal 2014 Outlook Update” regarding estimated 2014 Adjusted EBITDA and specific dollar amounts and other plans, expectations, estimates and similar statements constitute forward-looking statements. The results of operations and financial condition of Post and the businesses Post has acquired may differ materially from those in the forward- looking statements. Such statements are based on management’s current views and assumptions, and involve risks and uncertainties that could affect expected results, including but not limited to the following: (i) as discussed under “Prospective Financial Information”, the forward-looking statements made herein are inherently speculative, and based upon assumptions that, although in some cases presented with numerical specificity, are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond Post’s control or relate to future business decisions, some of or all which may change or will vary significantly from actual results; (ii) our high leverage and substantial debt, including covenants that restrict the operation of our business; (iii) our ability to service our outstanding debt or obtain additional financing; (iv) our ability to continue to compete in our product markets and our ability to retain our market position; (v) our ability to identify and complete acquisitions, manage our growth and integrate acquisitions; (vi) changes in our cost structure, management, financing and business operations; (vii) significant increases in the costs of certain commodities, packaging or energy used to manufacture our products; (viii) our ability to recognize the expected benefits of the closing of our Modesto, California manufacturing facility; (ix) our ability to maintain competitive pricing, successfully introduce new products or successfully manage our costs; (x) our ability to successfully implement business strategies to reduce costs; (xi) impairment in the carrying value of goodwill or other intangibles; (xii) the loss or bankruptcy of a significant customer; (xiii) allegations that our products cause injury or illness, product recalls and product liability claims and other litigation; (xiv) our ability to anticipate changes in consumer preferences and trends; (xv) changes in economic conditions and consumer demand for our products; (xvi) disruptions in the U.S. and global capital and credit markets; (xvii) labor strikes or work stoppages by our employees; (xviii) legal and regulatory factors, including changes in food safety, advertising and labeling laws and regulations; (xix) our ability to comply with increased regulatory scrutiny related to certain of our products and/or international sales; (xx) disruptions or inefficiencies in supply chain; (xxi) our reliance on third party manufacturers for certain of our products; (xxii) fluctuations in foreign currency exchange rates; (xxiii) consolidations among the retail grocery and foodservice industries; (xxiv) change in estimates in critical accounting judgments and changes to or new laws and regulations affecting our business; (xxv) losses or increased funding and expenses related to our qualified pension plans; (xxvi) loss of key employees; (xxvii) our ability to protect our intellectual property; (xxviii) changes in weather conditions, natural disasters and other events beyond our control; (xxix) our ability to successfully operate our international operations in compliance with applicable regulations; (xxx) our ability to operate effectively as a standalone, publicly traded company; (xxxi) our ability to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, including with respect to acquired companies; (xxxii) business disruptions caused by information technology failures; and (xxxiii) other risks and uncertainties included under “Risk Factors” in our second 8-K filed with the Securities and Exchange Commission on March 10, 2014. Forward-Looking Statements

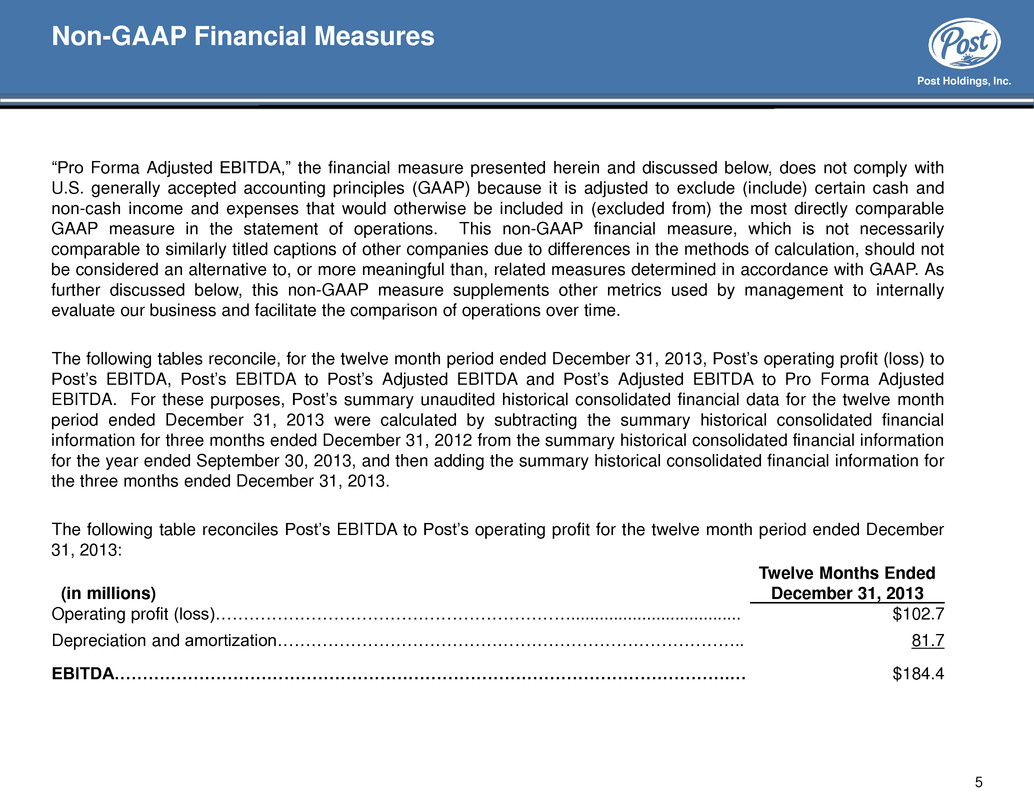

Post Holdings, Inc. 5 “Pro Forma Adjusted EBITDA,” the financial measure presented herein and discussed below, does not comply with U.S. generally accepted accounting principles (GAAP) because it is adjusted to exclude (include) certain cash and non-cash income and expenses that would otherwise be included in (excluded from) the most directly comparable GAAP measure in the statement of operations. This non-GAAP financial measure, which is not necessarily comparable to similarly titled captions of other companies due to differences in the methods of calculation, should not be considered an alternative to, or more meaningful than, related measures determined in accordance with GAAP. As further discussed below, this non-GAAP measure supplements other metrics used by management to internally evaluate our business and facilitate the comparison of operations over time. The following tables reconcile, for the twelve month period ended December 31, 2013, Post’s operating profit (loss) to Post’s EBITDA, Post’s EBITDA to Post’s Adjusted EBITDA and Post’s Adjusted EBITDA to Pro Forma Adjusted EBITDA. For these purposes, Post’s summary unaudited historical consolidated financial data for the twelve month period ended December 31, 2013 were calculated by subtracting the summary historical consolidated financial information for three months ended December 31, 2012 from the summary historical consolidated financial information for the year ended September 30, 2013, and then adding the summary historical consolidated financial information for the three months ended December 31, 2013. The following table reconciles Post’s EBITDA to Post’s operating profit for the twelve month period ended December 31, 2013: Non-GAAP Financial Measures (in millions) Twelve Months Ended December 31, 2013 Operating profit (loss)……………………………………………………….................................... $102.7 Depreciation and amortization……………………………………………………………………….. 81.7 EBITDA……………………………………………………………………………………………….… $184.4

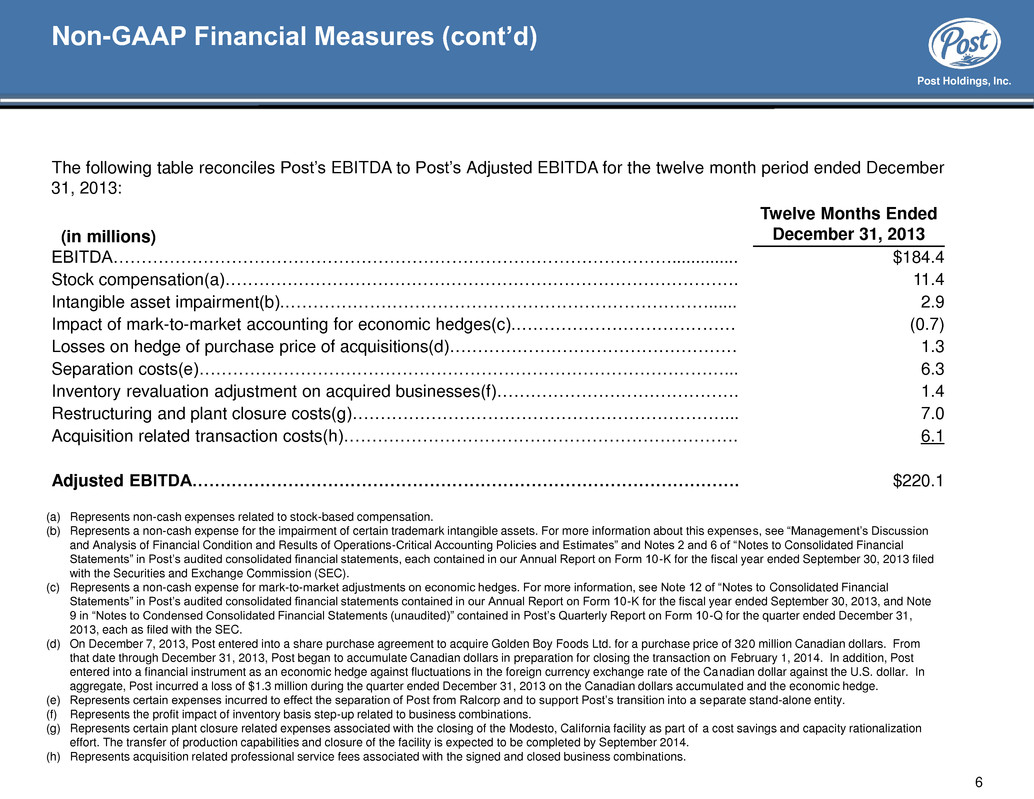

Post Holdings, Inc. 6 The following table reconciles Post’s EBITDA to Post’s Adjusted EBITDA for the twelve month period ended December 31, 2013: Non-GAAP Financial Measures (cont’d) (a) Represents non-cash expenses related to stock-based compensation. (b) Represents a non-cash expense for the impairment of certain trademark intangible assets. For more information about this expenses, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Critical Accounting Policies and Estimates” and Notes 2 and 6 of “Notes to Consolidated Financial Statements” in Post’s audited consolidated financial statements, each contained in our Annual Report on Form 10-K for the fiscal year ended September 30, 2013 filed with the Securities and Exchange Commission (SEC). (c) Represents a non-cash expense for mark-to-market adjustments on economic hedges. For more information, see Note 12 of “Notes to Consolidated Financial Statements” in Post’s audited consolidated financial statements contained in our Annual Report on Form 10-K for the fiscal year ended September 30, 2013, and Note 9 in “Notes to Condensed Consolidated Financial Statements (unaudited)” contained in Post’s Quarterly Report on Form 10-Q for the quarter ended December 31, 2013, each as filed with the SEC. (d) On December 7, 2013, Post entered into a share purchase agreement to acquire Golden Boy Foods Ltd. for a purchase price of 320 million Canadian dollars. From that date through December 31, 2013, Post began to accumulate Canadian dollars in preparation for closing the transaction on February 1, 2014. In addition, Post entered into a financial instrument as an economic hedge against fluctuations in the foreign currency exchange rate of the Canadian dollar against the U.S. dollar. In aggregate, Post incurred a loss of $1.3 million during the quarter ended December 31, 2013 on the Canadian dollars accumulated and the economic hedge. (e) Represents certain expenses incurred to effect the separation of Post from Ralcorp and to support Post’s transition into a separate stand-alone entity. (f) Represents the profit impact of inventory basis step-up related to business combinations. (g) Represents certain plant closure related expenses associated with the closing of the Modesto, California facility as part of a cost savings and capacity rationalization effort. The transfer of production capabilities and closure of the facility is expected to be completed by September 2014. (h) Represents acquisition related professional service fees associated with the signed and closed business combinations. (in millions) Twelve Months Ended December 31, 2013 EBITDA……………………………………………………………………………………….............. $184.4 Stock compensation(a)………………………………………………………………………………. 11.4 Intangible asset impairment(b).…………………………………………………………………...... 2.9 Impact of mark-to-market accounting for economic hedges(c).………………………………… (0.7) Losses on hedge of purchase price of acquisitions(d)…………………………………………… 1.3 Separation costs(e)…………………………………………………………………………………... 6.3 Inventory revaluation adjustment on acquired businesses(f)……………………………………. 1.4 Restructuring and plant closure costs(g)…………………………………………………………... 7.0 Acquisition related transaction costs(h)……………………………………………………………. 6.1 Adjusted EBITDA……………………………………………………………………………………. $220.1

Post Holdings, Inc. 7 We prepare Pro Forma Adjusted EBITDA by further adjusting Adjusted EBITDA to give effect to recent acquisitions as if those acquisitions had occurred on January 1, 2013 by adding, (i) with respect to Dakota Growers Pasta Company, Inc. (the “Dakota Growers Business”), which was acquired effective January 1, 2014, the Adjusted EBITDA for the Dakota Growers Business based upon the audited financial statements for the fiscal year ended October 31, 2013 of Agricore United Holdings Inc., the sole shareholder of Dakota Growers and (ii) with respect to the other recently acquired businesses, management’s estimate of the Adjusted EBITDA for each such business (based on the financial statements that were prepared by their respective prior management), as follows: Our acquisition of the branded and private label cereal, granola and snacks business of Hearthside Food Solutions, LLC (the “Hearthside Business”) was completed on May 28, 2013. Our financial results for the 12 month period ended December 31, 2013 includes seven months of financial results related to this acquisition. The adjustments to Pro Forma Adjusted EBITDA for the 12 month period ended December 31, 2013 include management’s estimate of the pre-acquisition Adjusted EBITDA of the Hearthside Business for January 1, 2013 through May 27, 2013. Because the financial statements for the assets that comprised the Hearthside Business did not include an allocation of taxes or interest expense, Adjusted EBITDA for the Hearthside Business was calculated as net income plus depreciation and amortization, without further adjustment. Our acquisition of the branded food and beverage business, including high protein bars and shakes and nutritional supplements, of Premier Nutrition Corporation and its subsidiary Premier Protein, Inc. (the “Premier Business”) was completed on September 1, 2013. Our financial results for the 12 month period ended December 31, 2013 includes four months of financial results related to this acquisition. The adjustments to Pro Forma Adjusted EBITDA for the 12 month period ended December 31, 2013 include management’s estimate of the pre-acquisition Adjusted EBITDA of the Premier Business for January 1, 2013 through August 31, 2013 and include adjustments to remove certain non-recurring compensation and transaction related costs. Non-GAAP Financial Measures (cont’d)

Post Holdings, Inc. 8 Our acquisition of the premium protein powders, bars and nutritional supplements business of Dymatize Enterprises, LLC (the “Dymatize Business”) was completed effective February 1, 2014.The adjustments to Pro Forma Adjusted EBITDA for the 12 month period ended December 31, 2013 include management’s estimate of the pre-acquisition Adjusted EBITDA of the Dymatize Business for January 1, 2013 through December 31, 2013 and also include adjustments to remove non-recurring transaction and legal expenses and costs incurred by the Dymatize Business as a stand-alone company for its board of directors. Our acquisition of Golden Boy Foods Ltd., a manufacturer of private label peanut and other nut butters, as well as dried fruits and snacking nuts (the “Golden Boy Business”), was completed effective February 1, 2014. The adjustments to Pro Forma Adjusted EBITDA for the 12 month period ended December 31, 2013 include management’s estimate of the pre-acquisition Adjusted EBITDA of the Golden Boy Business for January 1, 2013 through December 31, 2013 and also include adjustments to add back estimated lost profits from business interruption, remove non-recurring plant start-up costs and remove transaction costs. The Adjusted EBITDA presented below for the Hearthside, Premier, Dakota Growers, Dymatize and Golden Boy businesses are based on the financial statements for those businesses that were prepared by their respective prior management and do not include any contributions from synergies or cost savings management expects to achieve in the future. Except for Dakota Growers, these financial statements have not been audited or reviewed by independent auditors or any other accounting firm. Investors should be aware that Adjusted EBITDA for these acquired entities may not be entirely comparable to our measure of EBITDA or Adjusted EBITDA. Pro Forma Adjusted EBITDA has not been prepared in accordance with the requirements of Regulation S-X or any other securities laws relating to the presentation of pro forma financial information. Pro Forma Adjusted EBITDA is presented for information purposes only and does not purport to represent what our actual financial position or results or operations would have been if the acquisitions had been completed as of an earlier date or that may be achieved in the future. Pro Forma Adjusted EBITDA does not include any contribution from, or otherwise adjust for, our pending acquisition of the PowerBar and Musashi branded premium bars, powders and gel products business of Nestlé S.A. Non-GAAP Financial Measures (cont’d)

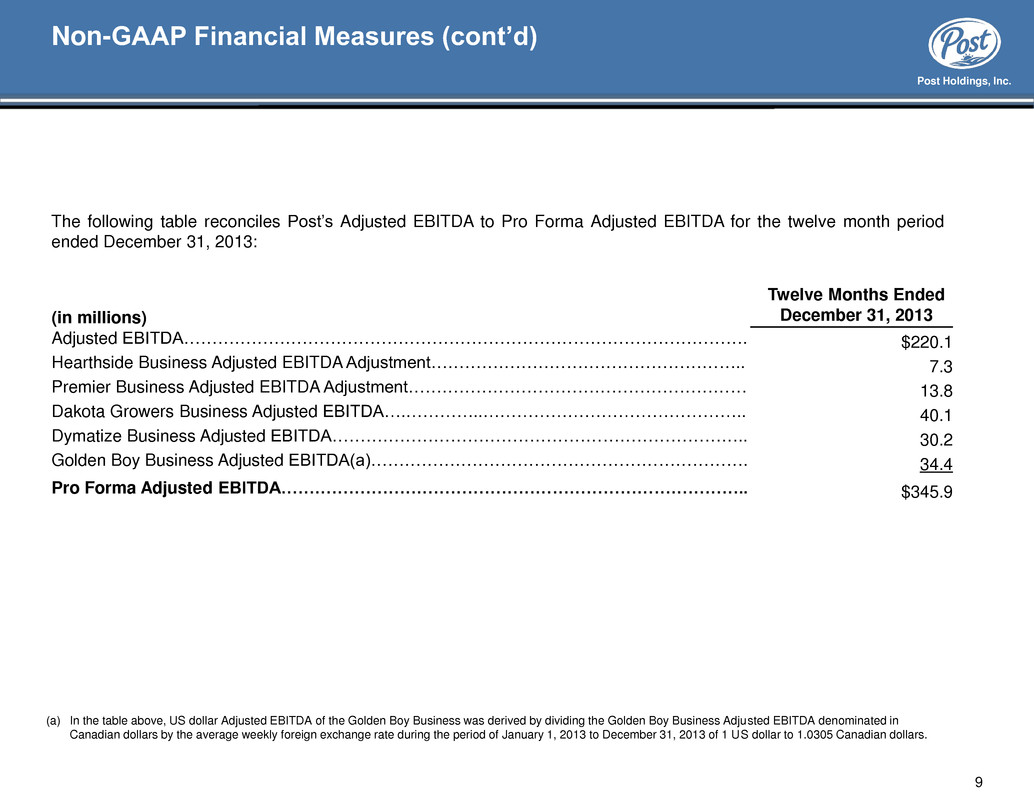

Post Holdings, Inc. 9 The following table reconciles Post’s Adjusted EBITDA to Pro Forma Adjusted EBITDA for the twelve month period ended December 31, 2013: Non-GAAP Financial Measures (cont’d) (a) In the table above, US dollar Adjusted EBITDA of the Golden Boy Business was derived by dividing the Golden Boy Business Adjusted EBITDA denominated in Canadian dollars by the average weekly foreign exchange rate during the period of January 1, 2013 to December 31, 2013 of 1 US dollar to 1.0305 Canadian dollars. (in millions) Twelve Months Ended December 31, 2013 Adjusted EBITDA………………………………………………………………………………………. $220.1 Hearthside Business Adjusted EBITDA Adjustment……………………………………………….. 7.3 Premier Business Adjusted EBITDA Adjustment…………………………………………………… 13.8 Dakota Growers Business Adjusted EBITDA….…………..……………………………………….. 40.1 Dymatize Business Adjusted EBITDA……………………………………………………………….. 30.2 Golden Boy Business Adjusted EBITDA(a)…………………………………………………………. 34.4 Pro Forma Adjusted EBITDA……………………………………………………………………….. $345.9

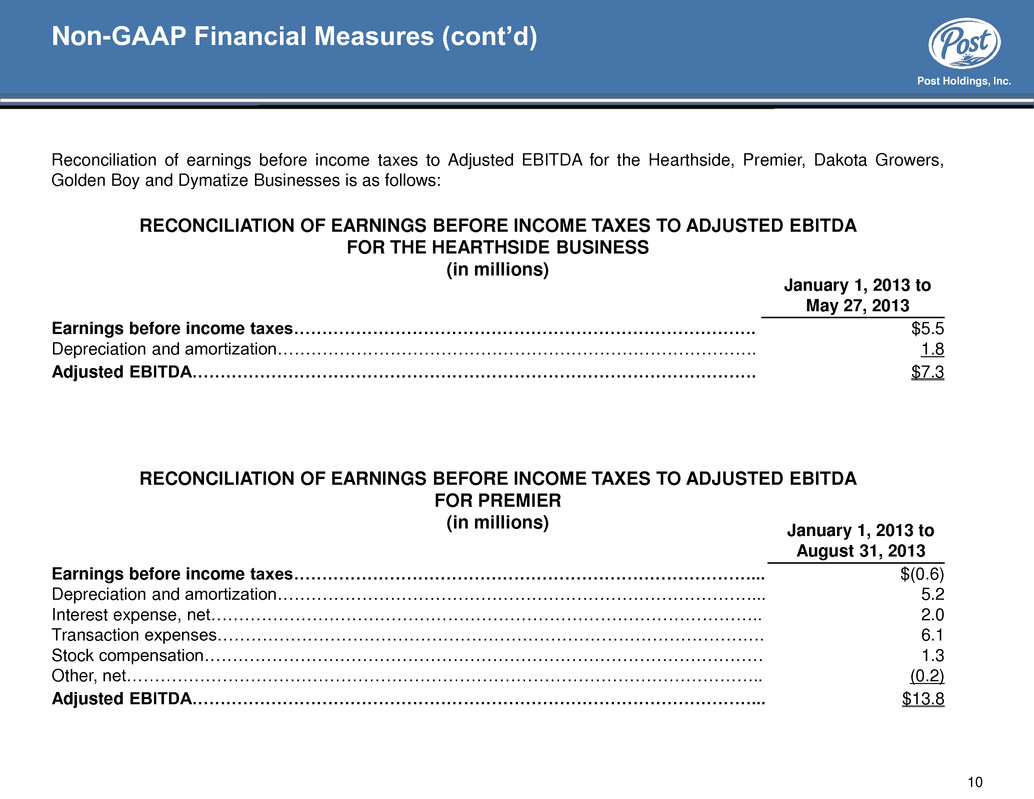

Post Holdings, Inc. 10 Reconciliation of earnings before income taxes to Adjusted EBITDA for the Hearthside, Premier, Dakota Growers, Golden Boy and Dymatize Businesses is as follows: RECONCILIATION OF EARNINGS BEFORE INCOME TAXES TO ADJUSTED EBITDA FOR THE HEARTHSIDE BUSINESS (in millions) Non-GAAP Financial Measures (cont’d) January 1, 2013 to May 27, 2013 Earnings before income taxes………………………………………………………………………. $5.5 Depreciation and amortization…………………………………………………………………………. 1.8 Adjusted EBITDA………………………………………………………………………………………. $7.3 RECONCILIATION OF EARNINGS BEFORE INCOME TAXES TO ADJUSTED EBITDA FOR PREMIER (in millions) January 1, 2013 to August 31, 2013 Earnings before income taxes………………………………………………………………………... $(0.6) Depreciation and amortization…………………………………………………………………………... 5.2 Interest expense, net…………………………………………………………………………………….. 2.0 Transaction expenses……………………………………………………………………………………. 6.1 Stock compensation……………………………………………………………………………………… 1.3 Other, net………………………………………………………………………………………………….. (0.2) Adjusted EBITDA………………………………………………………………………………………... $13.8

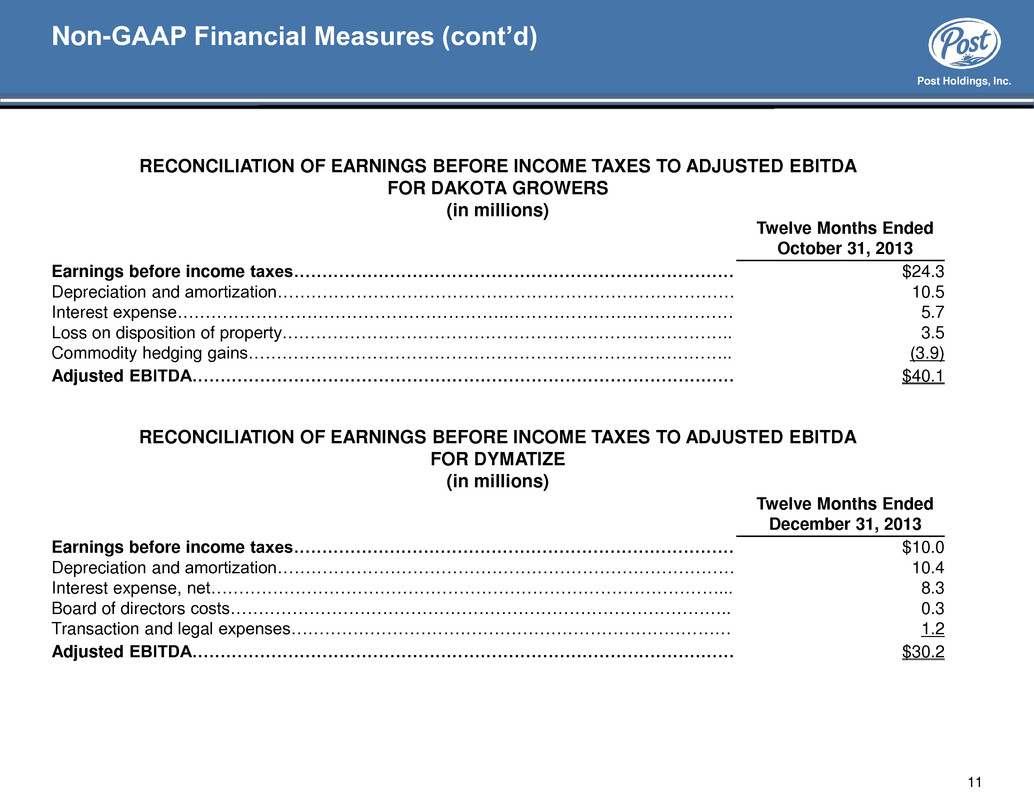

Post Holdings, Inc. 11 RECONCILIATION OF EARNINGS BEFORE INCOME TAXES TO ADJUSTED EBITDA FOR DAKOTA GROWERS (in millions) Non-GAAP Financial Measures (cont’d) Twelve Months Ended October 31, 2013 Earnings before income taxes…………………………………………………………………… $24.3 Depreciation and amortization……………………………………………………………………… 10.5 Interest expense…………………………………………………..………………….……………… 5.7 Loss on disposition of property…………………………………………………………………….. 3.5 Commodity hedging gains………………………………………………………………………….. (3.9) Adjusted EBITDA…………………………………………………………………………………… $40.1 RECONCILIATION OF EARNINGS BEFORE INCOME TAXES TO ADJUSTED EBITDA FOR DYMATIZE (in millions) Twelve Months Ended December 31, 2013 Earnings before income taxes…………………………………………………………………… $10.0 Depreciation and amortization……………………………………………………………………… 10.4 Interest expense, net………………………………………………………………………………... 8.3 Board of directors costs…………………………………………………………………………….. 0.3 Transaction and legal expenses…………………………………………………………………… 1.2 Adjusted EBITDA…………………………………………………………………………………… $30.2

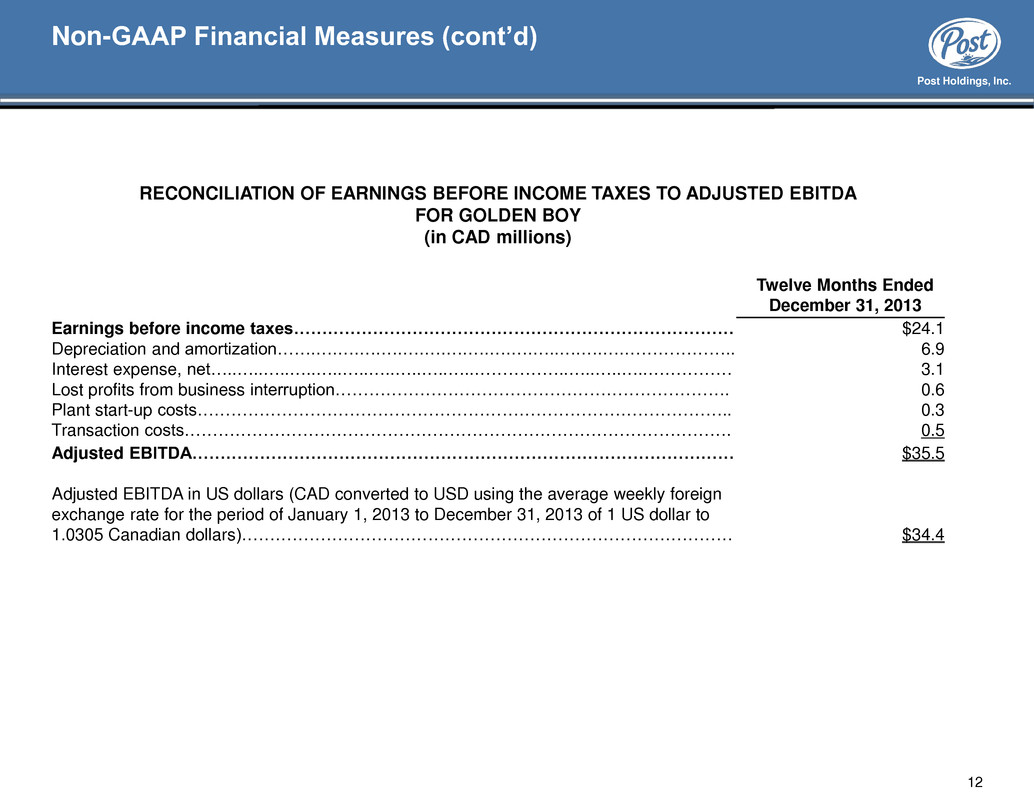

Post Holdings, Inc. 12 RECONCILIATION OF EARNINGS BEFORE INCOME TAXES TO ADJUSTED EBITDA FOR GOLDEN BOY (in CAD millions) Non-GAAP Financial Measures (cont’d) Twelve Months Ended December 31, 2013 Earnings before income taxes…………………………………………………………………… $24.1 Depreciation and amortization…….….….….….….….….….….….…..….….….……………….. 6.9 Interest expense, net…..…..…..…..…..…..…..…..…..…..……………..…..…..…..…………… 3.1 Lost profits from business interruption……………………………………………………………. 0.6 Plant start-up costs………………………………………………………………………………….. 0.3 Transaction costs……………………………………………………………………………………. 0.5 Adjusted EBITDA…………………………………………………………………………………… $35.5 Adjusted EBITDA in US dollars (CAD converted to USD using the average weekly foreign exchange rate for the period of January 1, 2013 to December 31, 2013 of 1 US dollar to 1.0305 Canadian dollars)…………………………………………………………………………… $34.4