Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SAFEWAY INC | d689318d8k.htm |

| EX-99.3 - EX-99.3 - SAFEWAY INC | d689318dex993.htm |

| EX-99.1 - EX-99.1 - SAFEWAY INC | d689318dex991.htm |

Exhibit 99.2

Announces Definitive Merger Agreement with Albertsons

Safeway Provides Estimated $40 Per Share in Total Value to Safeway Shareholders

March 6, 2014

Safe Harbor Language

This presentation contains certain forward-looking statements about the future performance of Safeway, including about the combined Safeway/Albertsons business (the “Combined Entity”). These statements are based on management’s assumptions and beliefs in light of the information currently available to it. These statements are indicated by words such as “expects,” “will,” “plans,” “intends,” “committed to,” “estimates” and “is.” No assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur. Accordingly, actual results may differ materially and adversely from those expressed in any forward-looking statements. Neither Safeway nor any other person can assume responsibility for the accuracy and completeness of forward-looking statements. There are various important factors that could cause actual results to differ materially from those in any such forward-looking statements, many of which are beyond Safeway’s control. These factors include: failure to obtain shareholder approval of the proposed merger; failure to obtain, delays in obtaining or adverse conditions contained in any required regulatory or other approvals; failure to consummate or delay in consummating the transaction for other reasons; changes in laws or regulations; and changes in general economic conditions. Among other things, the Combined Entity’s ability to achieve estimated price reductions from the transaction, as well as the timing of such reductions, will depend on the Combined Entity’s ability to integrate its businesses in a timely fashion, including realizing synergies anticipated by reduction of duplicative systems and processes. There is no assurance that any payments will be made with respect to the sales of PDC and/or Casa Ley, including with respect to the CVRs after the closing of the Acquisition. The right to receive any future payments with respect to the sales of PDC and/or Casa Ley, including with respect to the CVRs after the Closing of the Acquisition, will be contingent on a number of factors, including Safeway’s ability to sell all or a portion of PDC and/or Casa Ley, and the amount of after-tax net proceeds realized. If Safeway is unable to sell PDC prior to the second anniversary of the closing of the Acquisition, no payment will be made to Safeway shareholders with respect to PDC and the CVRs will expire valueless. If Safeway is unable to sell Casa Ley prior to the fourth anniversary of the Acquisition, Safeway shareholders will be entitled to receive the fair market value of Safeway’s interest in Casa Ley at that time. There can be no assurance as to the value of PDC and/or Casa Ley or that Safeway shareholders will receive the amount of after-tax net proceeds estimated in this press release, or any amount. Safeway undertakes no obligation (and expressly disclaims any such obligation) to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. For additional information please refer to Safeway’s most recent Form 10-K, 10-Q and 8-K reports filed with the SEC.

2

Agenda

Overview of Merger

Estimated $40 Per Share Provides Significant Premium to SWY Shareholders:

Value from Sales of PDC and Casa Ley

Value from Distribution of Blackhawk Shares

Rationale for Merger

Closing Conditions

Summary

3

Today’s Merger Announcement

Safeway and Albertsons will combine via acquisition of Safeway shares (NYSE:SWY) by AB Acquisition LLC

AB Acquisition owns Albertsons, and also operates other banners such as ACME, Jewel-Osco, Shaw’s and Star Market

Cerberus-led investor group owns AB Acquisition

Current Albertsons’ CEO Bob Miller to become

Executive Chairman of combined company

Current Safeway President and CEO Robert Edwards to become President and CEO of combined company

4

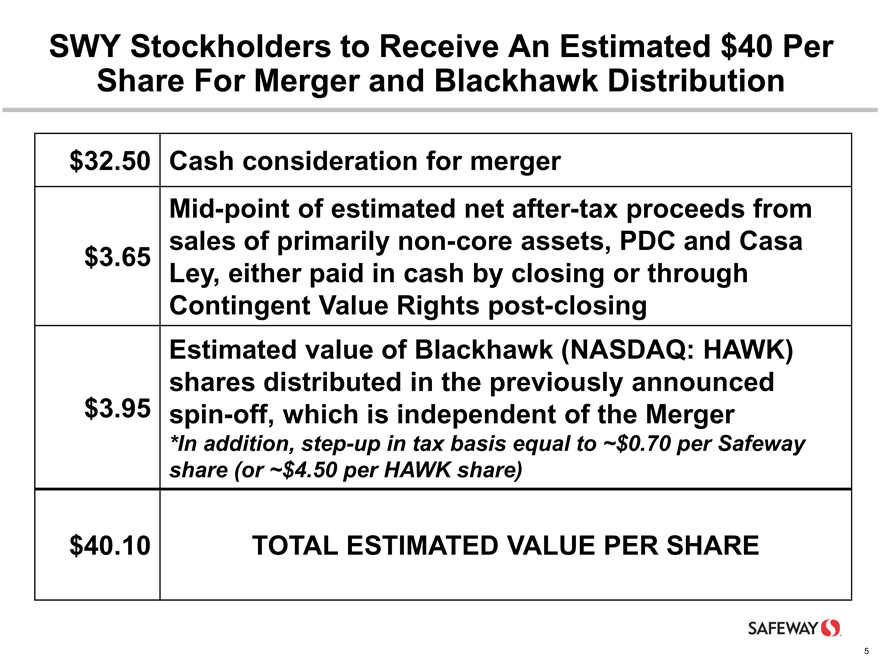

SWY Stockholders to Receive An Estimated $40 Per Share For Merger and Blackhawk Distribution

$32.50 Cash consideration for merger

Mid-point of estimated net after-tax proceeds from

sales of primarily non-core assets, PDC and Casa

$3.65 Ley, either paid in cash by closing or through

Contingent Value Rights post-closing

Estimated value of Blackhawk (NASDAQ: HAWK)

shares distributed in the previously announced

$3.95 spin-off, which is independent of the Merger

*In addition, step-up in tax basis equal to ~$0.70 per Safeway

share (or ~$4.50 per HAWK share)

$40.10 TOTAL ESTIMATED VALUE PER SHARE

5

Premium Paid to SWY Shareholders

Estimated total value of $40 per share for the combined transactions

Significant premium over SWY’s closing share prices:

+17% over $34.10 on February 18, 2014, the day prior to announcement of sale discussions

+56% over $25.62 six months ago, on September 6, 2013

+72% over $23.27 one year ago, on March 6, 2013

6

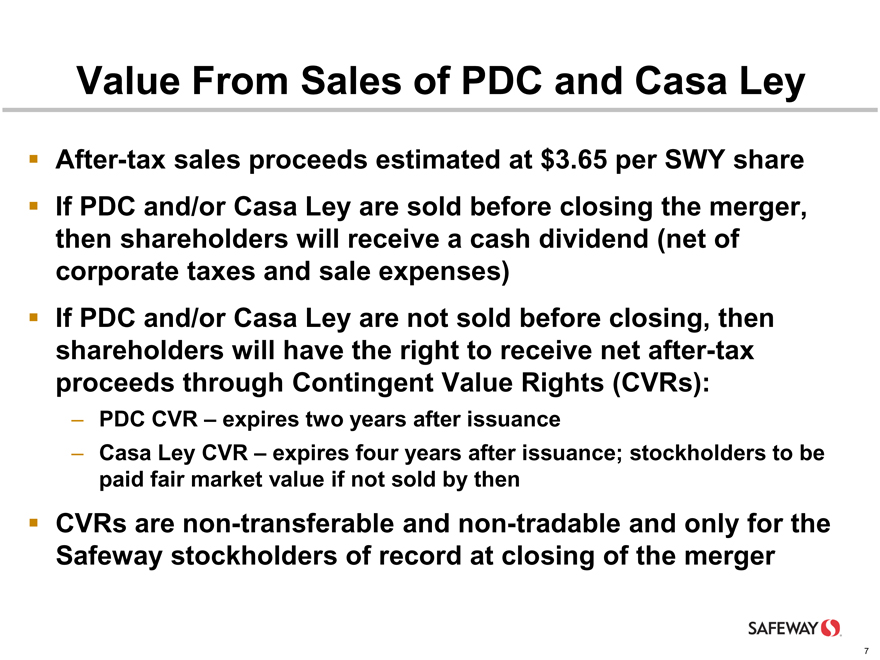

Value From Sales of PDC and Casa Ley

After-tax sales proceeds estimated at $3.65 per SWY share

If PDC and/or Casa Ley are sold before closing the merger, then shareholders will receive a cash dividend (net of corporate taxes and sale expenses)

If PDC and/or Casa Ley are not sold before closing, then shareholders will have the right to receive net after-tax proceeds through Contingent Value Rights (CVRs):

PDC CVR – expires two years after issuance

Casa Ley CVR – expires four years after issuance; stockholders to be paid fair market value if not sold by then

CVRs are non-transferable and non-tradable and only for the Safeway stockholders of record at closing of the merger

7

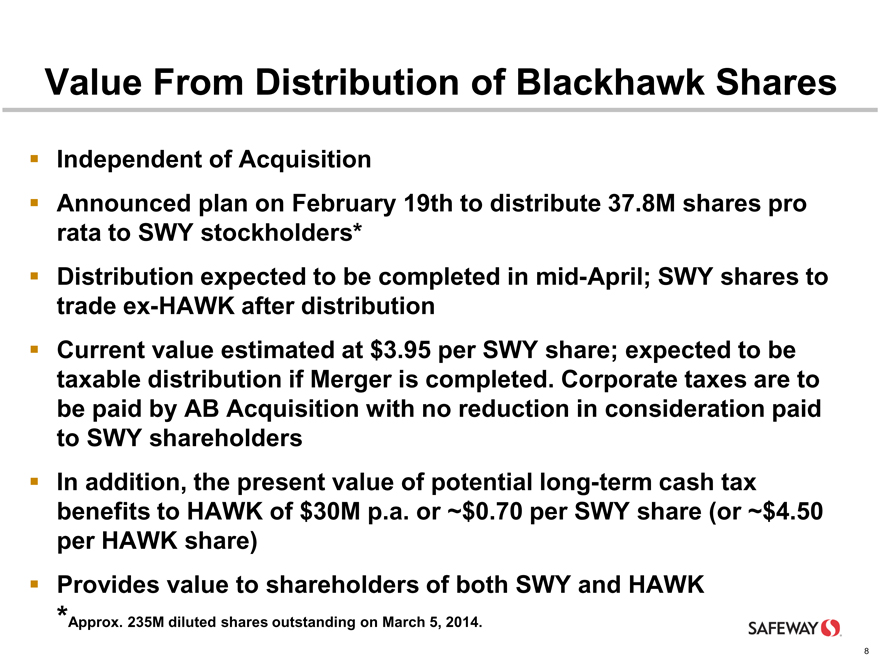

Value From Distribution of Blackhawk Shares

Independent of Acquisition

Announced plan on February 19th to distribute 37.8M shares pro rata to SWY stockholders*

Distribution expected to be completed in mid-April; SWY shares to trade ex-HAWK after distribution

Current value estimated at $3.95 per SWY share; expected to be taxable distribution if Merger is completed. Corporate taxes are to be paid by AB Acquisition with no reduction in consideration paid to SWY shareholders

In addition, the present value of potential long-term cash tax benefits to HAWK of $30M p.a. or ~$0.70 per SWY share (or ~$4.50 per HAWK share)

Provides value to shareholders of both SWY and HAWK

*Approx. 235M diluted shares outstanding on March 5, 2014.

8

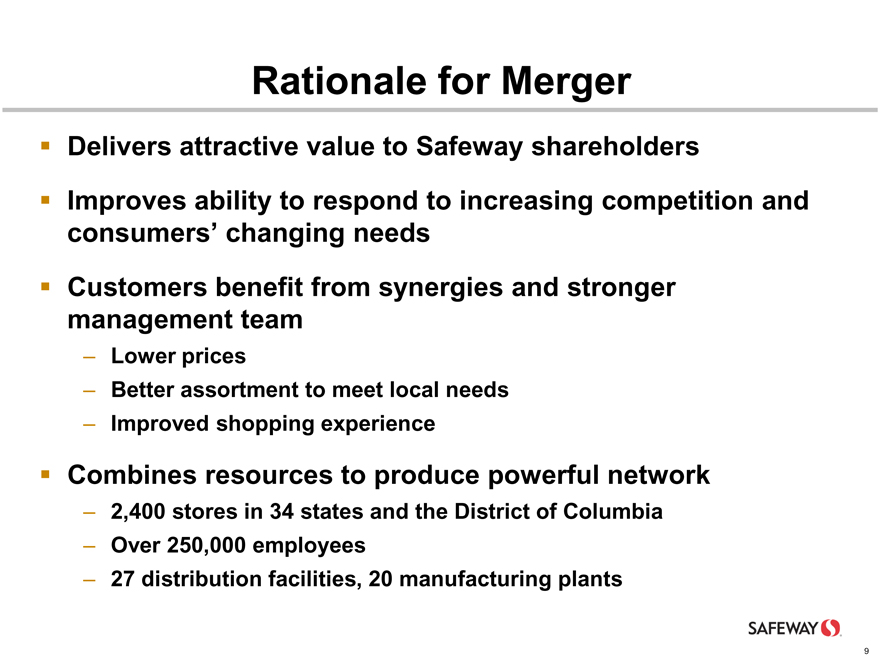

Rationale for Merger

Delivers attractive value to Safeway shareholders

Improves ability to respond to increasing competition and consumers’ changing needs

Customers benefit from synergies and stronger management team

Lower prices

Better assortment to meet local needs

Improved shopping experience

Combines resources to produce powerful network

2,400 stores in 34 states and the District of Columbia

Over 250,000 employees

27 distribution facilities, 20 manufacturing plants

9

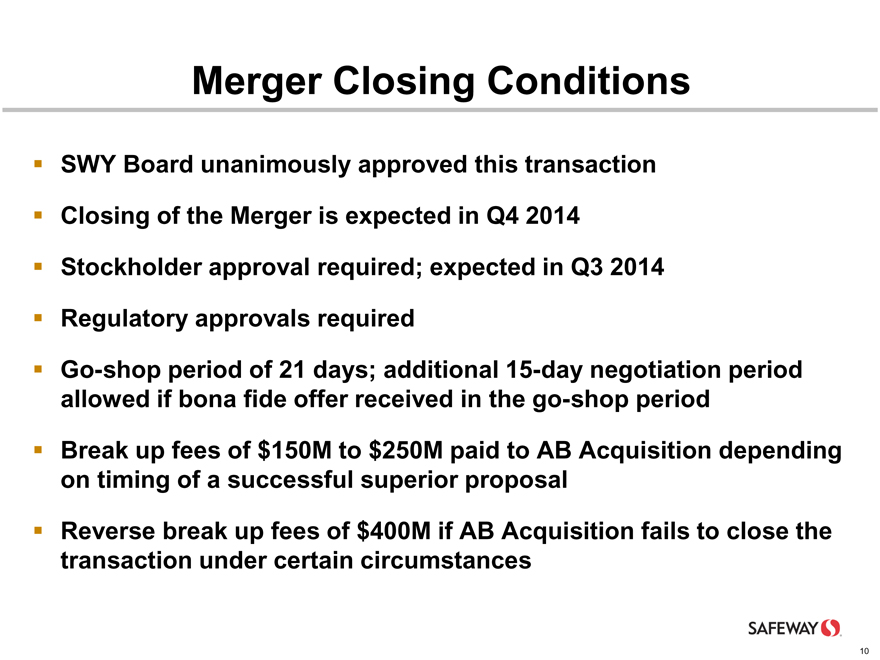

Merger Closing Conditions

SWY Board unanimously approved this transaction

Closing of the Merger is expected in Q4 2014

Stockholder approval required; expected in Q3 2014

Regulatory approvals required

Go-shop period of 21 days; additional 15-day negotiation period allowed if bona fide offer received in the go-shop period

Break up fees of $150M to $250M paid to AB Acquisition depending on timing of a successful superior proposal

Reverse break up fees of $400M if AB Acquisition fails to close the transaction under certain circumstances

10

Summary

Merger provides attractive value for Safeway shareholders

Combined transactions deliver a significant premium to Safeway shareholders

Merger allows us to compete more effectively and efficiently in dynamic food retail environment

Merger benefits customers through synergies and a stronger management team

11

Appendix

12

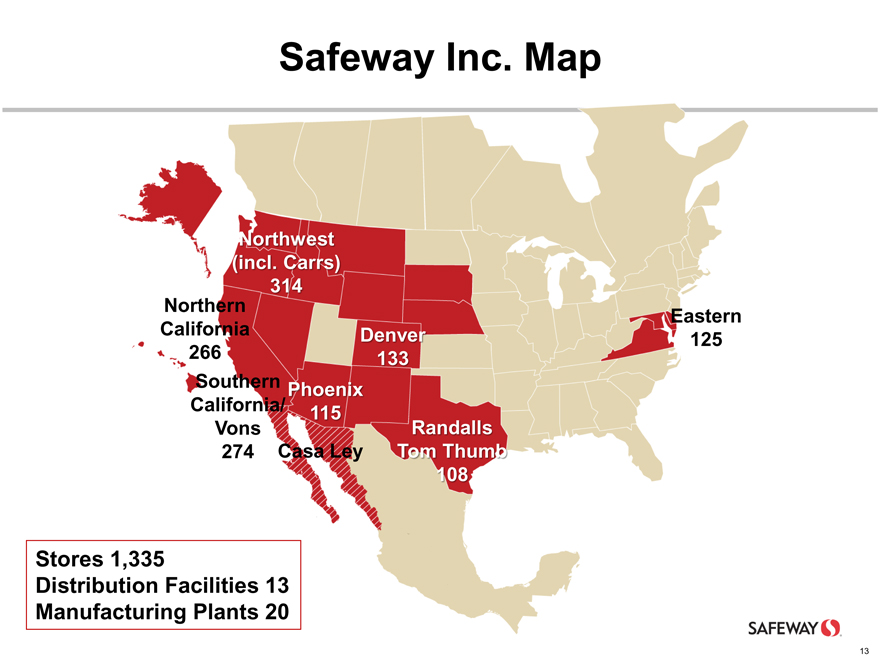

Safeway Inc. Map

Northwest

(incl. Carrs)

314

Northern Eastern

California Denver 125

266 133

Southern Phoenix

California/ 115

Vons Randalls

274 Casa Ley Tom Thumb

108

Stores 1,335

Distribution Facilities 13

Manufacturing Plants 20

13

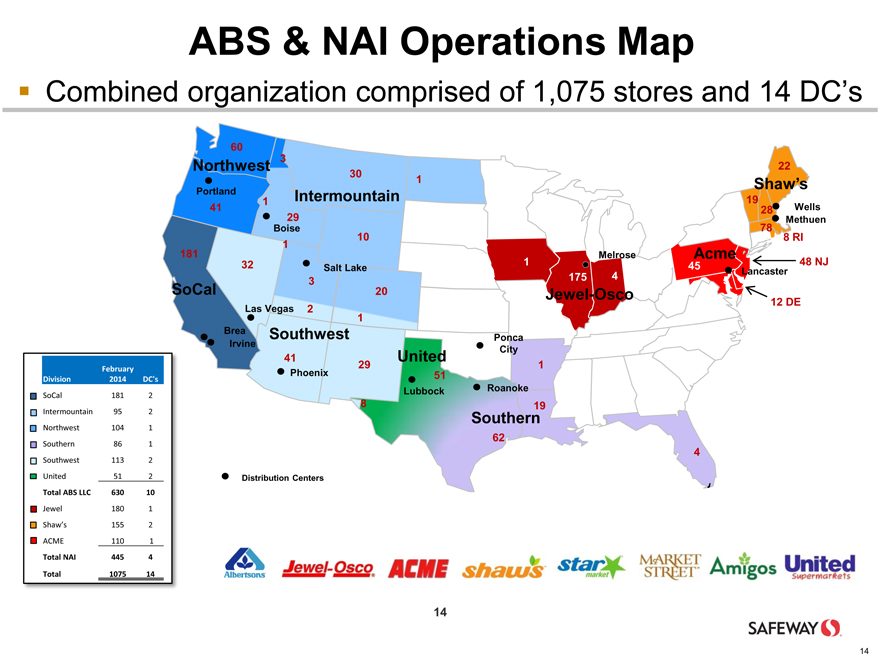

ABS & NAI Operations Map

Combined organization comprised of 1,075 stores and 14 DC’s

60

Northwest 3 22

30 1 Shaw’s

Portland 1 Intermountain 19

41 28 Wells

29 Methuen

Boise 78

1 10 8 RI

181 Melrose Acme

32 Salt Lake 1 45 48 NJ

175 4 Lancaster

3

SoCal 20 Jewel-Osco

Las Vegas 2 12 DE

1

Brea Southwest Ponca

Irvine

41 United City

29 1

Division February 2014 DC’s Phoenix 51

Lubbock Roanoke

SoCal 181 2

8 19

Intermountain 95 2 Southern

Northwest 104 1

62

Southern 86 1

4

Southwest 113 2

United 51 2 Distribution Centers

Total ABS LLC 630 10

Jewel 180 1

Shaw’s 155 2

ACME 110 1

Total NAI 445 4

Total 1075 14

14

14

Property Development Centers (PDC)

Focused on developing retail shopping centers with Safeway as the anchor store

Investments are concentrated in Safeway’s core urban/suburban markets

Proven track record with strong competitive advantages; 25 current properties

Provided pre-tax income of $44M and sale proceeds of $163M in 2013

15

Casa Ley

200 food and general merchandise stores in western Mexico

Private; family-owned and operated

Safeway’s 49% minority investment made in 1981

Portion of earnings in Other Income; $17.6M in 2013 and $63M over last four years

Dividends paid periodically; $4M for 2013 and $16M over last four years

16

Important Notice

Additional Information About the Merger and Where to Find it

This communication does not constitute a solicitation of materials of any vote or approval in respect of the proposed merger transaction involving Safeway or otherwise. In connection with the proposed merger, a special stockholder meeting will be announced soon to obtain stockholder approval. In connection with the merger, Safeway intends to file relevant materials, including a proxy statement, with the Securities and Exchange Commission. Investors and security holders of Safeway are urged to read the definitive proxy statement and other relevant materials when they become available because they will contain important information about Safeway, Albertsons and the proposed transaction. The proxy statement and other relevant materials (when they become available), and any other documents filed by Safeway with the Securities and Exchange Commission, may be obtained free of charge at the SEC’s website at www.sec.gov, at Safeway’s website at www.Safeway.com or by sending a written request to Safeway at 5918 Stoneridge Mall Road, Pleasanton, California 94588, Attention: Investor Relations.

Participants in the Solicitation

Safeway and its directors, executive officers and certain other members of management and employees may be deemed to be participants in soliciting proxies from the stockholders of Safeway in favor of the proposed merger. Information regarding the persons who may, under the rules of the SEC, be considered to be participants in the solicitation of Safeway’s stockholders in connection with the proposed transaction and their ownership of Safeway’s common stock will be set forth in Safeway’s proxy statement for its special meeting. Investors can find more information about Safeway’s executive officers and directors in its Annual Report on Form 10-K for the fiscal year ended December 28, 2013 and in its definitive proxy statement filed with the SEC on Schedule 14A on April 1, 2013.

17

SAFEWAY