Attached files

| file | filename |

|---|---|

| EX-2.1 - EX-2.1 - UIL HOLDINGS CORP | d687617dex21.htm |

| EX-99.1 - EX-99.1 - UIL HOLDINGS CORP | d687617dex991.htm |

| 8-K - 8-K - UIL HOLDINGS CORP | d687617d8k.htm |

Acquisition of Philadelphia Gas

Works Operations

Investor Presentation

March 3, 2014

Exhibit 99.2 |

Note To Investors

2

Visit our website at www.UIL.com

James Torgerson

President and Chief Executive Officer

Richard Nicholas

Executive Vice President and Chief Financial Officer

Certain statements contained herein, regarding matters that are not

historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include

statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking

statements are based on UIL Holdings’ expectations and involve risks

and uncertainties; consequently, actual results may differ materially from

those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic

conditions, conditions in the debt and equity markets (particularly as

they affect the terms on which UIL Holdings and its subsidiaries can issue

equity securities and incur borrowings in connection with the

acquisition of the PGW Operations), legislative and regulatory changes, changes in demand for electricity, gas and other products

and services, unanticipated weather conditions, changes in accounting

principles, policies or guidelines, and other economic,

competitive, governmental, and technological factors affecting the

operations, markets, products and services of UIL Holdings’

subsidiaries, The United Illuminating Company, The Southern Connecticut

Gas Company, Connecticut Natural Gas Corporation and The Berkshire

Gas Company as well as the PGW Operations (including UIL Holdings’ ability to complete the announced

acquisition of those operations and achieve related financial, operational

and other benefits). The foregoing and other factors are discussed

and should be reviewed in our most recent Annual Report on Form 10-K and other subsequent filings with the Securities

and Exchange Commission. Forward-looking statements included herein

speak only as of the date hereof and we undertake no obligation to

revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of

unanticipated events or circumstances. |

Transaction Details

3

Description

Acquisition of assets and certain liabilities of Philadelphia Gas Works

(“PGW Operations”)

Purchase

Price

Financing

Plan

Selected

Approvals &

Timing

Philadelphia City Council (Late Spring / Summer 2014)

Pennsylvania Public Utility Commission (Q1 2015)

No shareowner vote required

Expected closing by Q1 2015

Total

consideration

of

$1.86

billion;

PGW

Operations

acquired

on

a

cash-free

and debt-free basis

UIL intends to issue long-term debt and equity in amounts consistent

with maintaining investment grade credit ratings to permanently

fund the transaction at close

UIL has secured a $1.90 billion fully committed facility to support the

transaction |

Compelling Opportunity

Builds on core strategy of owning regulated businesses with opportunity

to invest in growth

»

UIL has proven experience integrating, operating, and managing regulated

distribution systems with similar demographics

»

Opportunities for infrastructure investment

»

Provides regulatory diversification

Immediate cash flow accretion; initially earnings neutral, long-term

earnings accretion Significantly increases exposure to natural

gas »

More than doubles UIL’s gas customer base

»

Proximity to abundant regional supply (Marcellus & Utica)

Ability to unlock full potential of PGW Operations under traditional

utility model »

Opportunity to accelerate needed infrastructure investments

»

Potential growth opportunities related to LNG operations

Increased scale strengthens business profile and improved

profitability »

Leverage business expertise, processes and IT infrastructure

»

Increased financial flexibility and access to capital markets

»

Maintains UIL investment-grade rating

4 |

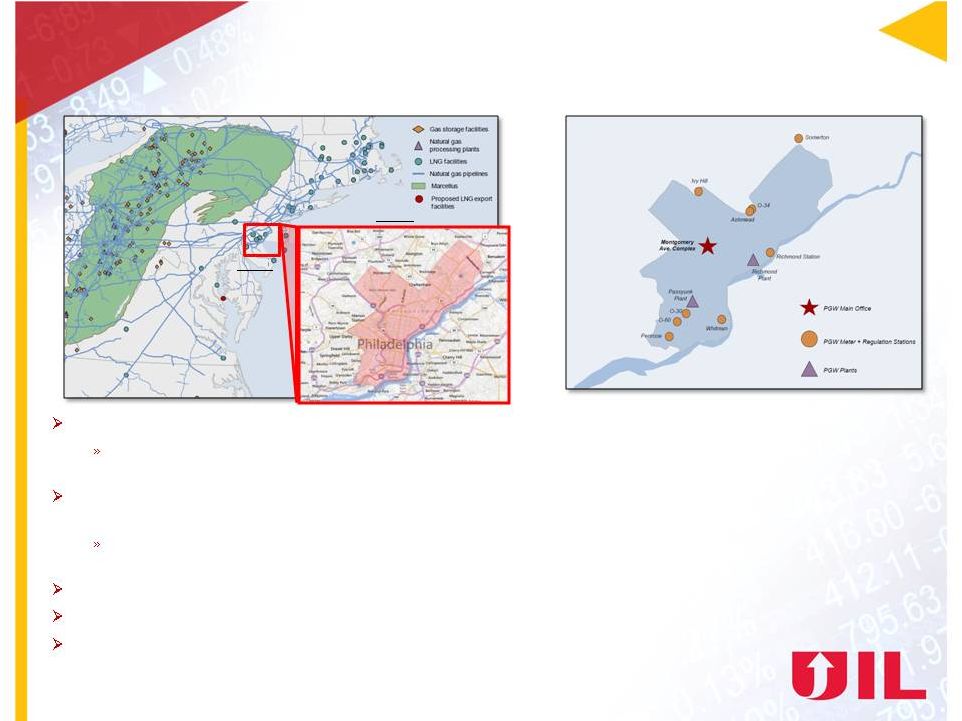

Philadelphia Gas Works Overview

Founded in February 1836, came under City ownership in 1841

Since December 1972, has been operated and managed by the Philadelphia

Facilities Management Corporation, a City-created and

controlled not-for-profit corporation Nation’s largest

municipally-owned gas utility; manages a distribution system of approximately 6,000 miles of gas

mains and service pipes

Serves the entire 129 square mile area contained within the boundaries of

Philadelphia and is the distributor and principal supplier of

natural gas in the City Approximately 500,000 customers

Rates and charges are regulated by the Public Utility Commission

of the Commonwealth of Pennsylvania

Owns two LNG facilities, one at the Richmond Plant and one at the Passyunk

Plant 5

PWG Positioning & Service Area

PGW Operations Service Area Detail & Infrastructure

See Insert

City Detail |

Committed to Building Stronger PGW

Operations

UIL brings a proven operating track record to Philadelphia

»

Well known for investing in its local distribution companies to enhance

system reliability »

Leverages best practices across its utilities to deliver superior

customer service »

Committed to energy efficiency programs, environmental stewardship and

safety »

Edison

Electric

Institute

award

winner:

Emergency

Response

Award

for

restoration

(2011

&

2012)

and Emergency Response Award for assistance (2012)

Dedicated

to

serving

PGW

Operations’

customers

»

Natural gas base rate freeze through 2017

»

PGW

Operations’

headquarters

will

remain

in

Philadelphia

»

UIL dual corporate headquarters (New Haven and Philadelphia)

»

No planned changes to six Customer Service Centers locations in

Philadelphia »

Potential to accelerate ongoing gas main replacement project

A strong, local employer

»

Honoring existing PGW Operations collective bargaining agreement

»

Offering employment to all existing PGW employees

A valued corporate partner

»

Increase

PGW

Operations’

level

of

community

support

»

Preserve local assistance programs available to customers requiring

additional support 6 |

Combined Business Overview

7

CT

MA

NY

RI

NJ

PA

NH

Pro Forma Service Territory

(1)

Pro Forma Statistics

Customers

Net PP&E

(1)

UIL Holdings Corporation subsidiary-level net PP&E as of

9/30/2013 and PGW Operations net PP&E as of 8/31/2013.

Map Legend

Current Customers

Net

PP&E

(1)

317,000

$1,744 MM

188,000

$521 MM

169,000

$451 MM

39,000

$126 MM

500,000

$1,155 MM

Total:

1,213,000

$3,997 MM |

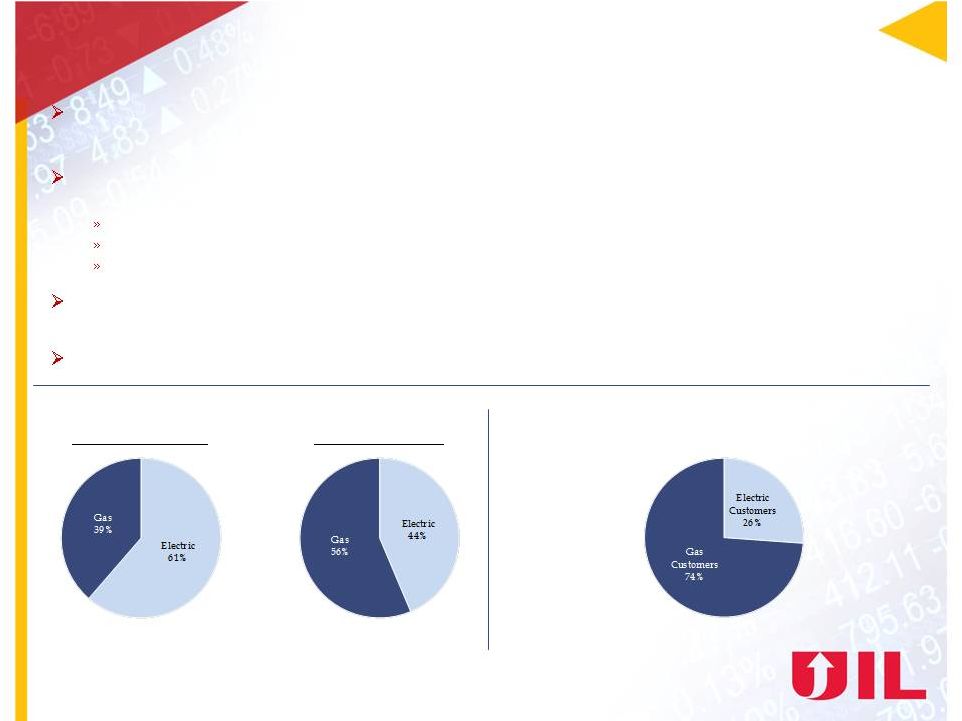

Experienced LDC Operator

UIL

has

experience

operating

and

managing

regulated

distribution

systems

with

similar

demographics

Pennsylvania currently the nation’s third largest natural gas

producer, behind Texas and Louisiana Supports favorable supply

dynamics for natural gas distributors and lower cost base LNG

emerging

as

an

alternative

to

fuel

oil/diesel

for

oil

&

gas,

marine,

mining

and

rail

industries

~1.2 million customers

8

(1)

“Asset Base”

defined as net PP&E.

Pro Forma Customer Mix

Pro Forma Asset Base: Gas vs. Electric

(1)

Status Quo Asset Base

Pro Forma Asset Base

Development of the Marcellus and Utica shales has fueled rapid growth in

Pennsylvania gas production

PGW Operations expected to increase UIL pro forma consolidated gas LDC

asset base to approximately 56%, vs. 39% currently

UIL has demonstrated success in integrating gas LDC operations

|

Financial Considerations

Immediate operating and free cash flow accretion

Long-term EPS accretion

Initially earnings neutral and long-term earnings accretive to

UIL Target efficiencies from combining existing systems, improved

capital allocation, scale benefits related to fuel costs and/or

other products and services UIL Holdings currently has an undrawn

$400 MM committed, credit agreement that extends to November 30,

2016 Expect to replace existing credit agreement with new, larger

5-year facility upon transaction close Ability to meet the

existing liquidity needs of the Company as well as incremental liquidity

requirements of the PGW Operations

Moody's recently upgraded UIL Holdings and subsidiaries by one notch;

outlooks are stable UIL to Baa2 from Baa3

UI to Baa1 from Baa2

CNG to A3 from Baa1

SCG to Baa1 from Baa2

BGC to Baa1 from Baa2

9 |

Substantial Transaction Benefits

Growth

Opportunities

Opportunities under UIL platform to drive long-term growth through

infrastructure investments

Diversification

Increased operational diversification improves business profile and

profitability

LDC Platform

Leverage business expertise, processes and IT / back-office

infrastructure Regulatory

Improves regulatory diversification

Attractive

Financial Profile

Increases financial flexibility and scale while maintaining an

investment- grade credit rating

10 |

Questions |