Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LAYNE CHRISTENSEN CO | d674599d8k.htm |

February 2014

LAYNE CHRISTENSEN

Investor Presentation

Exhibit 99.1 |

SAFE HARBOR

2

This

presentation

may

contain

forward-looking

statements

within

the

meaning

of

Section

27A

of

the

Securities

Act

of

1933

and

Section

21E

of

the

Exchange

Act

of

1934.

Such

statements

may

include,

but

are

not

limited

to,

statements

of

plans

and

objectives,

statements

of

future

economic

performance

and

statements

of

assumptions

underlying

such

statements,

and

statements

of

management’s

intentions,

hopes,

beliefs,

expectations

or

predictions

of

the

future.

Forward-looking

statements

can

often

be

identified

by

the

use

of

forward-looking

terminology,

such

as

“should,”

“intend,”

“continue,”

“believe,”

“may,”

“hope,”

“anticipate,”

“goal,”

“forecast,”

“plan,”

“estimate”

and

similar

words

or

phrases.

Such

statements

are

based

on

current

expectations

and

are

subject

to

certain

risks,

uncertainties

and

assumptions,

including

but

not

limited

to:

the

outcome

of

the

ongoing

internal

investigation

into,

among

other

things,

the

legality,

under

the

FCPA

and

local

laws,

of

certain

payments

to

agents

and

other

third

parties

interacting

with

government

officials

in

certain

countries

in

Africa

relating

to

the

payment

of

taxes

and

the

importing

of

equipment

(including

any

government

enforcement

action

which

could

arise

out

of

the

matters

under

review

or

that

the

matters

under

review

may

have

resulted

in

a

higher

dollar

amount

of

payments

or

may

have

a

greater

financial

or

business

impact

than

management

currently

anticipates);

prevailing

prices

for

various

commodities;

unanticipated

slowdowns

in

the

Company’s

major

markets;

the

availability

of

credit;

the

risks

and

uncertainties

normally

incident

to

the

construction

industry;

the

impact

of

competition;

the

effectiveness

of

operational

changes

expected

to

increase

efficiency

and

productivity;

worldwide

economic

and

political

conditions;

and

foreign

currency

fluctuations

that

may

affect

worldwide

results

of operations. Should one or more of these risks or uncertainties materialize, or should

underlying assumptions prove

incorrect,

actual

results

may

vary

materially

and

adversely

from

those

anticipated,

estimated

or

projected.

These

forward-looking

statements

are

made

as

of

the

date

of

this

presentation

and

the

Company

assumes

no

obligation

to

update

such

forward-looking

statements

or

to

update

the

reasons

why

actual

results

could

differ

materially from those anticipated in such forward-looking statements.

|

3

Integrated Technologies

Strong End Market Exposure

Clear

Growth

Initiatives

Blue Chip Client Relationships

New Management with Clear Vision

Diverse Revenue Base & Backlog

Soil

Stabilization

Water

Treatment

Exploration

Drilling

Sewer

Rehabilitation

Environmental

Drilling

Wastewater Plant

Construction

Pipeline Construction

Energy Services

OVERVIEW |

4

A leading global water management, construction and drilling company

–

Integrated solutions address the world’s toughest water, mineral and energy

challenges –

Over 130 years of experience, with more than 50,000 wells installed

–

80 facilities across 5 continents

Water

–

Market leading positions in water well drilling, sewer repair, construction and

rehabilitation –

Specialize in the design and delivery of tailored, end-to-end solutions

for complex projects Mineral Services

–

Leading global provider of drilling services for mining companies in North

America, South

America, Africa, and Australia Energy Services

–

Addressing the unique and substantial water requirements of the oil & gas

industry New management team focused on improving operations and strategic

growth ONE Layne operating paradigm has produced $1.1 billion of

multi-divisional project opportunities, up from $300 million last

year. Strengthened financial condition

INVESTMENT CONSIDERATIONS |

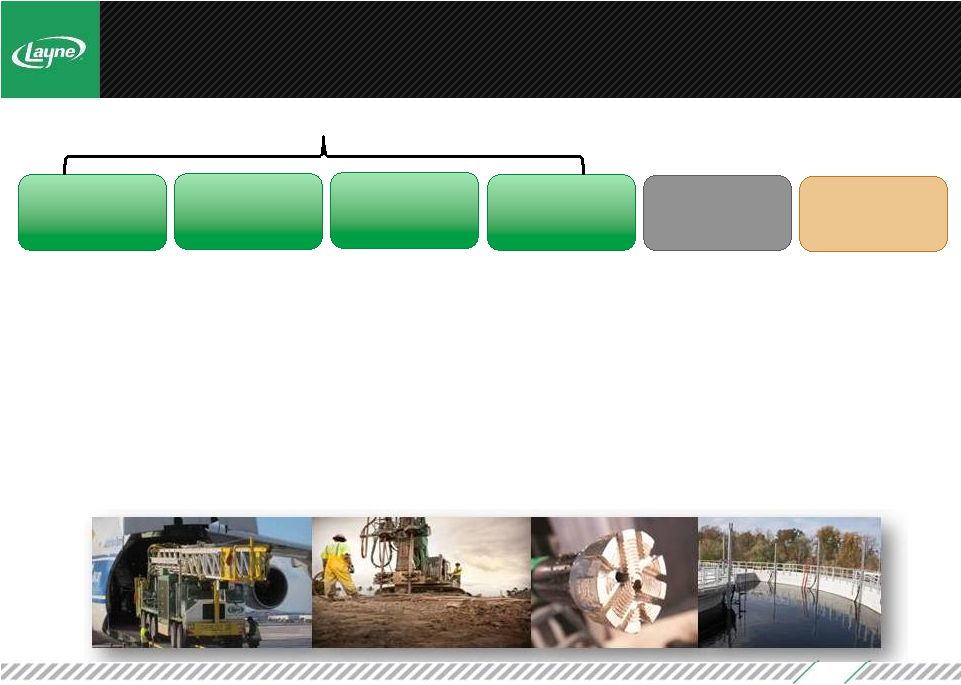

5

Geo-

construction

Energy

Services

Water

Resources

Heavy Civil

Inliner

Mineral

Services

LTM 10/31/13

Sales:

$92.0 Million

Dams, levees, tunnels,

subways, highways, and

marine facilities

LTM 10/31/13

Sales: $185.3 Million

#1: U.S.

water well drilling

LTM 10/31/13

Sales: $271.8 Million

Top 5 in U.S. sewer

repair and construction

LTM 10/31/13

Sales: $143.5 Million

#2: U.S. trenchless

pipeline rehab

LTM 10/31/13

Sales:

$202.5 Million

#3 in Mineral

Exploration

LTM 10/31/13

Sales: $6.7 Million

Focus on frac

market segment

Water

A MARKET LEADER IN THE U.S AND AROUND THE WORLD

Water supply, system

development,

sourcing, drilling,

repair and

installation of pumps

Water and wastewater

treatment, pipeline

installation, wells,

and biogas facilities

Proprietary CIPP

(Cured In Place Pipe)

for pipeline and

structure

rehabilitation

Soil stabilization and

subterranean

structural support

Determine minable

mineral deposit,

and economic

feasibility of

mining & mapping

Water sourcing,

surface water transfer

and treatment |

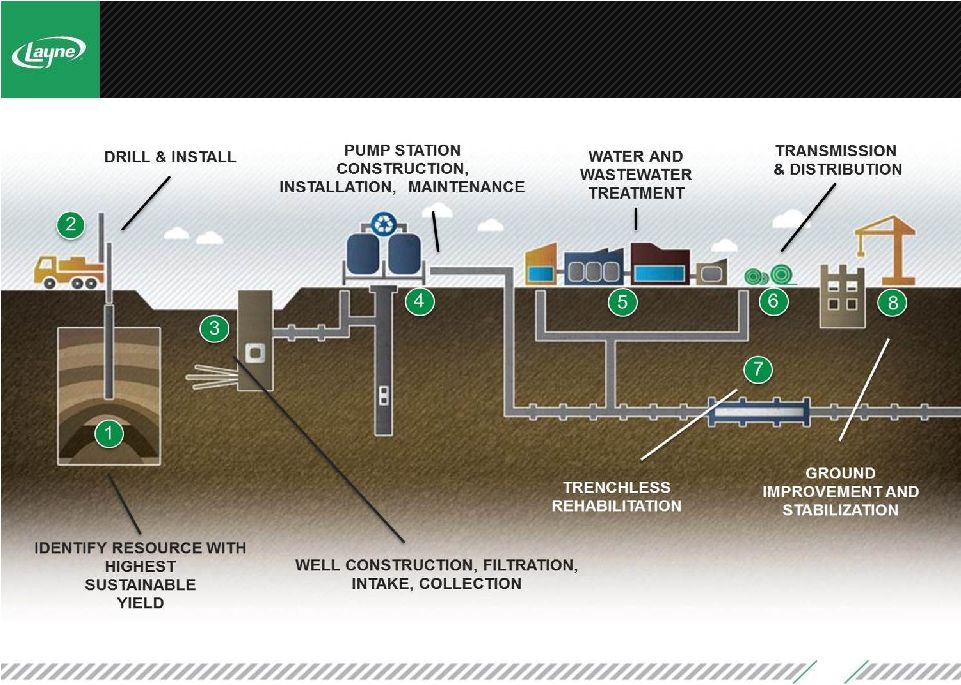

6

LAYNE SOLUTIONS LIFECYCLE |

7

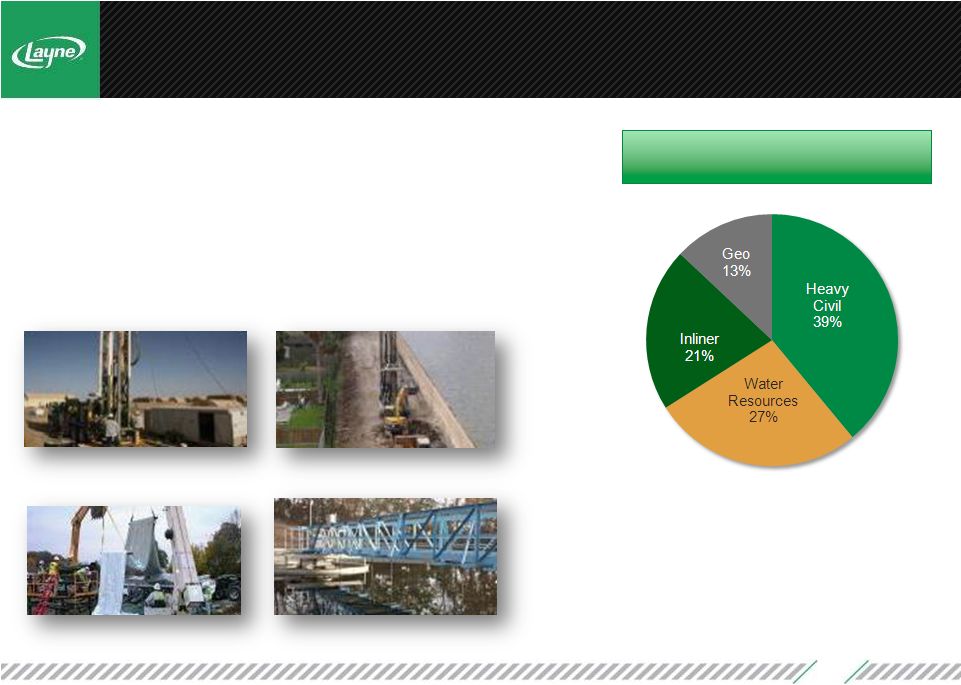

WATER

Managing Every Phase of the Water Cycle

LTM 10/31/13 Revenue Percentage

by Segment

Increasing demand driven by:

•

Population growth in water-challenged regions

•

Aging U.S. wastewater infrastructure

•

Targeted shift to private sector, away from hard-bid municipal contracts

•

Increased regulation

•

Growth in mining and energy services

•

Significant improvement in Heavy Civil; rapidly growing GEO backlog

Total Sales: $692.7 million

Supplying Water to U.S.

Troops in Afghanistan

Indiana Department of

Transportation Contract

Kentucky Water

Treatment Plant

Hurricane Katrina Flood

Wall Remediation |

8

MINERAL SERVICES

Full Spectrum Services for Global Mining Companies

Targeted Growth Strategies:

•

Provide differentiated water management, soil stabilization and

exploration services in greenfield and brownfield locations

•

Right-sized business in response to soft market conditions

and low global demand

•

Reduced operating expenses

•

Target high growth countries with rapid industrialization / urbanization

•

Shifting assets to Mexico and Brazil

•

Increase rig utilization

LTM 10/31/13 Revenue Profile

Total Sales: $271.8 million

Selected Clients

•

Longer-term mining industry fundamentals remain positive

•

Well-

positioned for next up-cycle in global commodities

|

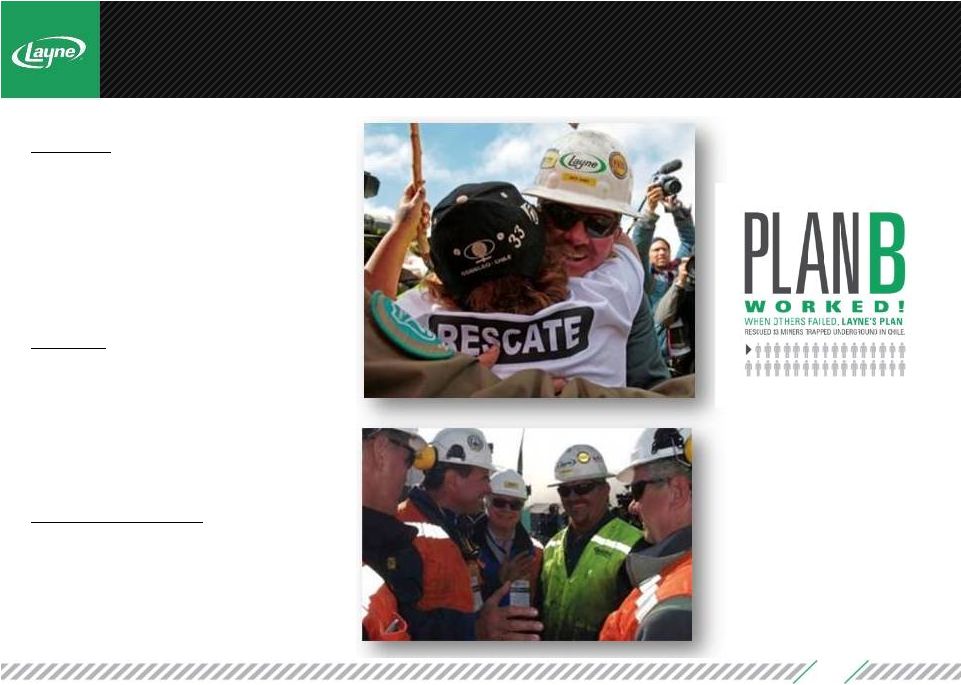

9

CHILEAN MINERS RESCUE

Situation

33 miners trapped 2,300 feet below

ground on August 5, 2010

700 tons of rock shifted in

the

San Jose Mine

Solution

Original estimate to reach miners was

4 months

The team worked around the clock to

bring all 33 miners to surface in 33 days

Services Employed

Directional Drilling

Large Diameter Drilling |

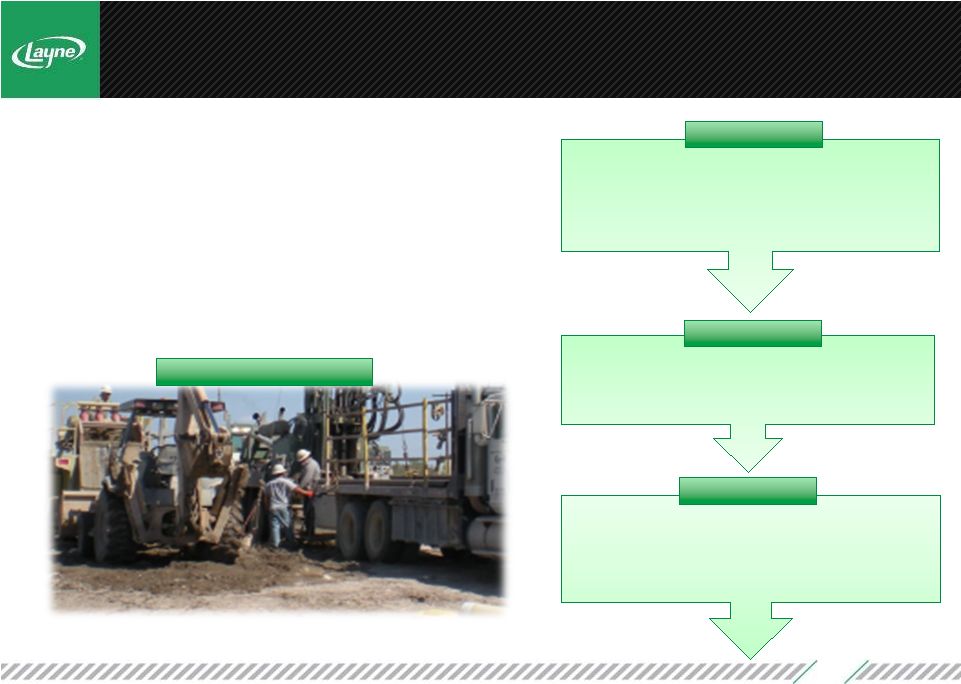

ENERGY SERVICES

10

Emerging Initiative: Fluid Sourcing & Treatment Solutions for the

E&P Industry •

Leveraging 130-year history of protecting municipal water supplies

to provide responsible, safe, and sustainable water management

solutions for the energy (E&P) industry

•

Developed cradle-to-cradle capabilities almost entirely in-house

•

Identify, evaluate, treat and develop optimal water sources

•

Superior water treatment technology

•

Low incremental capital investment required

•

Highly-synergistic with existing Layne businesses

Identified, drilled, and completed water

supply wells in the Santa Rosa Aquifer

•

Launched water sourcing businesses

•

Developed water transfer & treatment technologies

•

Significant capital investment

•

Exited upstream business with sale of E&P assets

•

Commercial validation

•

Launched water treatment business in

January 2014

•

Expect meaningful revenue generation in FY 2015

•

Substantial growth opportunity

•

Long-term target of 25% EBIT margins

Permian Water Sourcing

FY 2013

FY 2014

FY 2015-

2018 |

11

Geoconstruction

Backlog building quickly

Rapidly impoving bidding environment

Focus on competitive pricing and margin preservation

Heavy

Civil

Benefitting from higher margin new business, completion

of lower margin legacy projects, and asset sales

Leadership structure change to functional vs. regional

Significantly reduced employee base since early 2012

More ONE Layne opportunities than any other division

Energy

Services

Complete water recycling capability now in place

Negotiating MSAs with large E&P companies

Water

Resources

Focus on higher-margin, private sector customers and

negotiated project work

Pursuing

$125

million

“ONE

Layne”-

generated

bidding opportunities

Inliner

Expect 8

consecutive year of record profits

Fiberglass wet-out facility in Indiana

completed

this summer

Mineral

Services

Stabilizing gold and copper prices offset by weak demand

Shifting assets to promising geographies and services

Significantly reduced costs in Australia and most of Africa, with

targeted expansion in Ethiopia

Developing water management and soil stabilization business

The

statements

on

this

slide

that

are

not

statements

about

historical

facts

are

forward-looking

statements

and

represent

our

current

expectations

of

future

business

operations

and

opportunities.

Actual

results

may

vary

materially

and

adversely

from

these

forward-looking

statements,

including

for

reasons

that

are

beyond

our

control.

Accordingly,

you

should

not

unduly

rely

on

these

statements.

BUSINESS UPDATE

th |

12

Featured

Projects

Completed

Konnoco

Mineral Services

Gold Slickline

Directional Drilling

Louisville Water

Water Transmission

Main

Sahuarita Water

LayneRT

Arsenic Removal

UWNY

Deaeration Systems

City of Hutchinson, KS

6 MGD RO System

(1)

These

projects

are

still

in

development,

and

we

may

not

complete

these

projects

within

our

currently

planned

timelines

or

receive

the

indicated

contract

prices.

San Francisco Subway

$57 Million

October 2013

Transbay Tower, San Francisco

$19 Million

October 2013

Cudjoe Wastewater

$80 Million

March 2013

Islamorada Wastewater

$91 Million

September 2012

LNG Terminal, Uruguay

$20.7 Million

January 2014

BUSINESS UPDATE

Complex Project Wins |

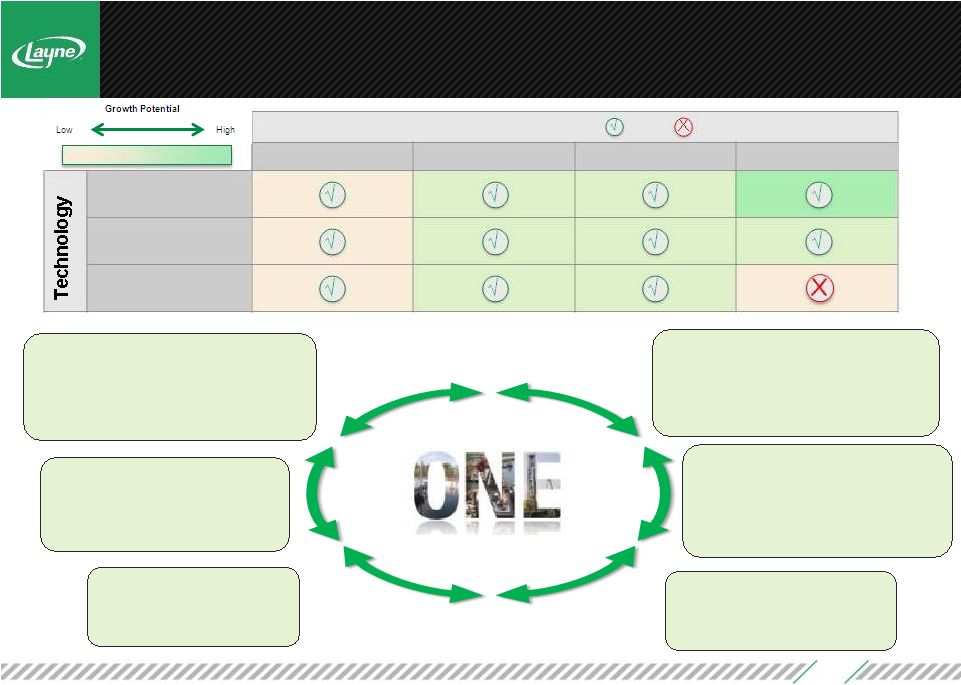

13

Water Resources

Integrated with Heavy Civil

Enhancing “presence”

with Mineral Services

clients and engaging Energy Services

projects

Energy Services

Engages with Water Resources and

Heavy Civil

Inliner

Cost sharing and cost controls

with Heavy Civil

Heavy Civil

Works closely with Water Resources

and Geo on water treatment and

transfer opportunities

Helping Energy Services division

Geoconstruction

Collaborates with Mineral

Services, Heavy Civil and

Water Resources

Water Management

Construction

Drilling

Water (Gov’t)

Water (Private)

Mining

Energy

Current Clients (Yes or

No ) Mineral Services

Collaborates with Geo, Water Resources and

Heavy Civil to improve project performance

Working with Water Resources’

mining clients

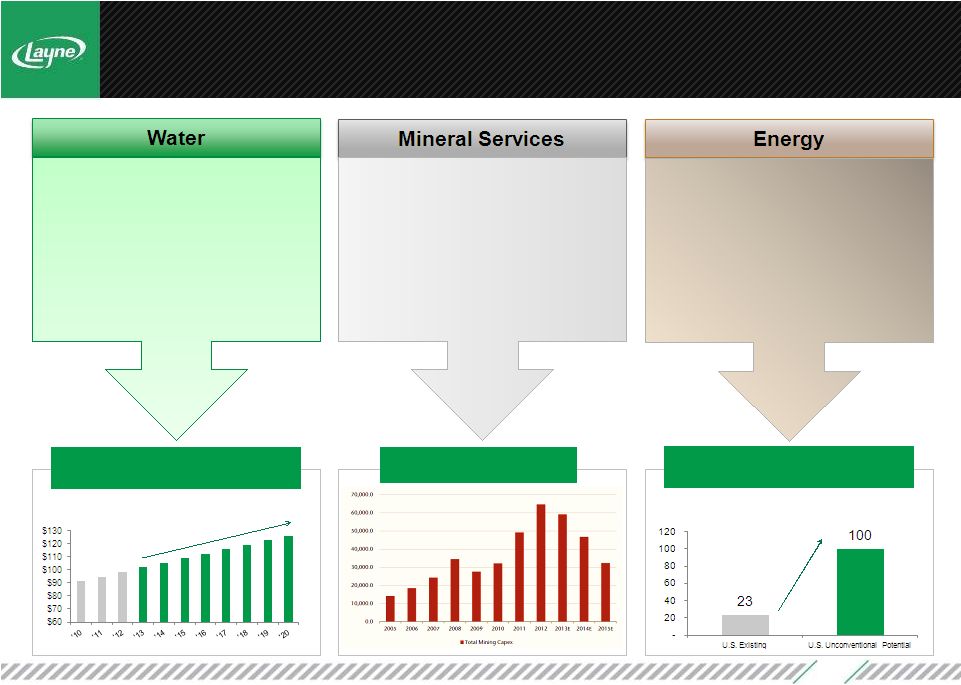

INTEGRATED SOLUTIONS, COLLABORATIVE MODEL |

(1)

Marketline

Outlook

June

2013.

(2)

Jefferies,

January

27,

2014.

(3)

Interstate

Natural

Gas

Association

of

America

(INGAA).

U.S. Oil /

Liquids Reserves

(3)

Projected U.S. Water Infrastructure

Needs

(1)

14

State

of

U.S.

Water

Infrastructure

Rated

“D”

by

ASCE

25%+

of

U.S.

water

pipes

classified

as

“poor”

or

“very

poor”

by

EPA

~25%

of

U.S.

dams

and

levees

in

need

of

repair

Clean

Water

State

Revolving

Fund

Reduced segment operating costs to

align with global market conditions

Future demand for metals and raw

materials expected to rise as cities

and populations grow

Complexity of discovering and

accessing new reserves will benefit

Layne during next cyclical upturn

Total Mining Capex

(2)

North American frac forecast to

increase from 420 billion cubic

meters in 2010 to 760 by 2035

Hydraulic oil & gas fracking requires

25,000 -

140,000 bbl of water / well

E&P extraction requires massive fluid

infrastructure investment

INDUSTRY AND END MARKET TRENDS

($ in billions)

(billion barrels)

430% Increase in

potential domestic

reserves |

15

Energy Services

Water

Mineral Services

Water Resources

-

Increase international business

-

Focus on growth markets

Inliner

-

New territory expansion -

westward

toward Rocky Mountains and beyond

-

Expanded installation / curing

methods

Heavy Civil

-

Rebounding infrastructure market

-

Greater discipline in project choice

and bidding

Geoconstruction

-

Rapidly increasing U.S backlog

Expertise in water management forms

an outstanding foundation to serve the

hydraulic frac drilling market

Shale production of oil & gas support

continued growth in the sector

expected through 2020

Relocation to Houston better positions

Layne to develop E&P relationships

Develop services across various

geographies

Shifting assets to high potential

markets, such as Mexico and Brazil

Strong relationships with premier

mineral services clients:

-

Vale

-

BHP Billiton

-

First Quantum

-

Freeport-McMoRan Copper & Gold

GROWTH INITIATIVES |

16

Rene Robichaud –

President and CEO

CEO since February 2012

President since September 2011

Director since January 2009

Former President and CEO of NS Group

Mark Accetturo

President, Heavy

Civil

Mauro Chinchelli

President,

Geoconstruction

Kevin Maher

President, Mineral

Services

Larry Purlee

President, Inliner

Kent Wartick

President, Energy

Services

James R. Easter –

SVP & CFO

SVP & CFO since May 2013

Co-founder & Former CFO of SEH Offshore Ventures,

LLC

Former CEO and CFO at Seahawk Drilling where he

successfully managed the sale of the company

Gernot Penzhorn –

SVP, International

Operations

SVP since January 2013

Former President of Mineral Services Division

Former Int. Operations Director for Boart Longyear

David Singleton –

SVP, US Operations

SVP since January 2013

Former President of the Water Resources Division

Over 30 years of experience in various areas of the

Company’s operations

Ron Thalacker

President, Water

Resources

President since

February 2010

Over 42 years of

experience in water

and wastewater

industry

President since

August 2013

Over 40 years of

experience in

geoconstruction

President since

January 2013

Over 25 years of

experience in the

drilling industry

President since

February 2010

Over 42 years of

experience in

pipeline renewal

President since

January 2013

Over 27 years of

experience in drilling

and water supply

projects

President since

February 2013

Over 28 years of

experience in energy

engineering

NEW MANAGEMENT TEAM WITH CLEAR VISION |

17

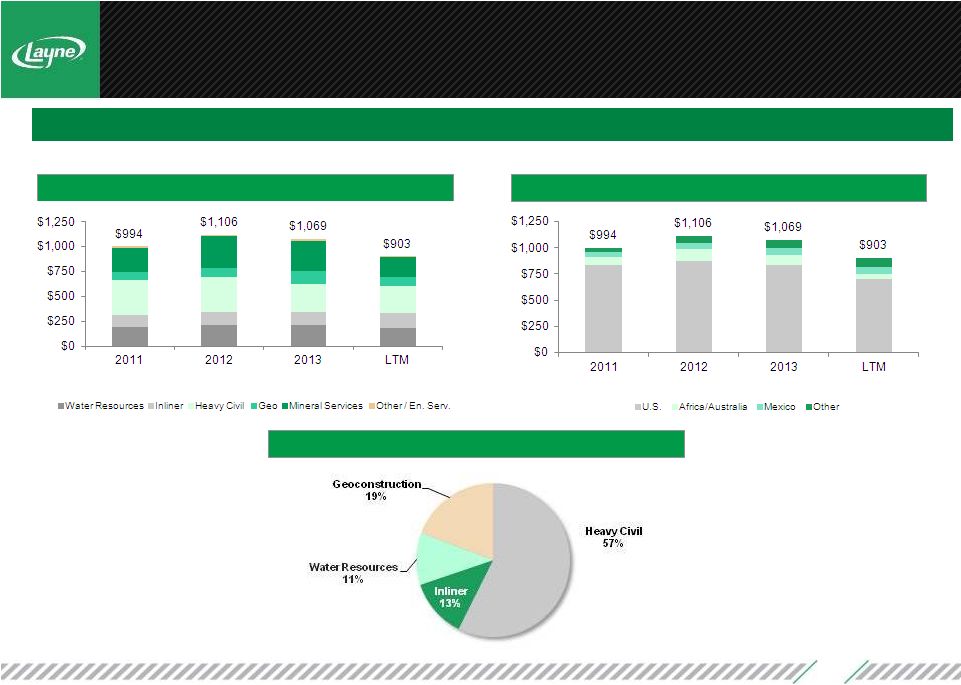

Revenue by Division

(1)

Revenue by Geography

(1)

Diverse and stable revenue base across 6 divisions + expanding international

presence 10/31/13

10/31/13

($ in millions)

($ in millions)

(1) Totals are net of intersegment eliminations.

DIVERSIFIED BACKLOG & REVENUE BASE

10/31/13 -

Backlog by Division ($551 million) |

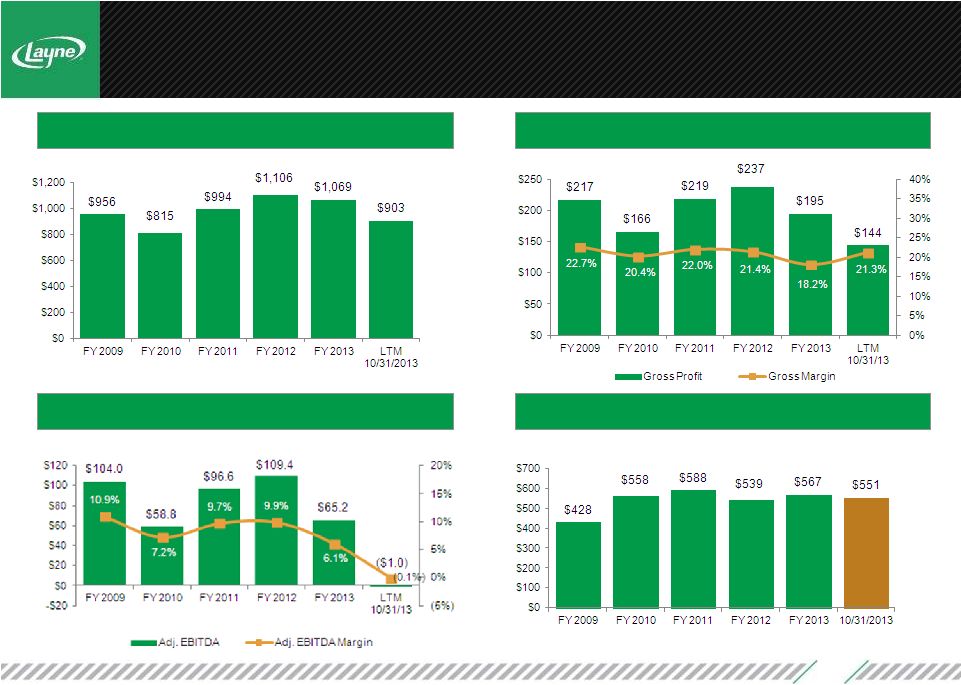

18

Total Revenues

(1)

Gross Profit & Margins

Total Backlog

Adjusted EBITDA & Margins

($ in millions)

($ in millions)

($ in millions)

($ in millions)

Layne uses certain “Non-GAAP”

financial measures as defined by the Securities and Exchange Commission. These are

measures of performance and not defined by accounting principles generally accepted in the United

States,

and

should

be

considered

in

addition

to,

not

in

lieu

of,

GAAP

reported

measures.

EBITDA

defined

as

earnings

before

interest,

income

taxes,

noncontrolling

interests,

depreciation

and

amortization,

non-cash

stock-based

compensation and certain one-time items.

(1) Totals are net of intersegment eliminations.

SUMMARY OF FINANCIAL PERFORMANCE |

19

APPENDIX |

20

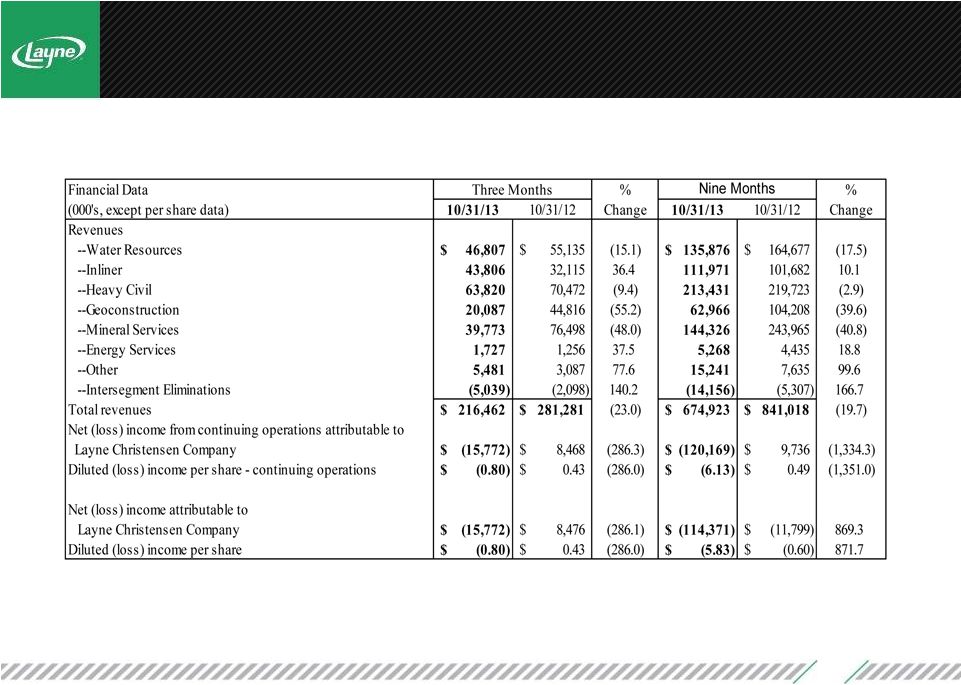

THREE AND NINE MONTHS FINANCIAL DATA |

21

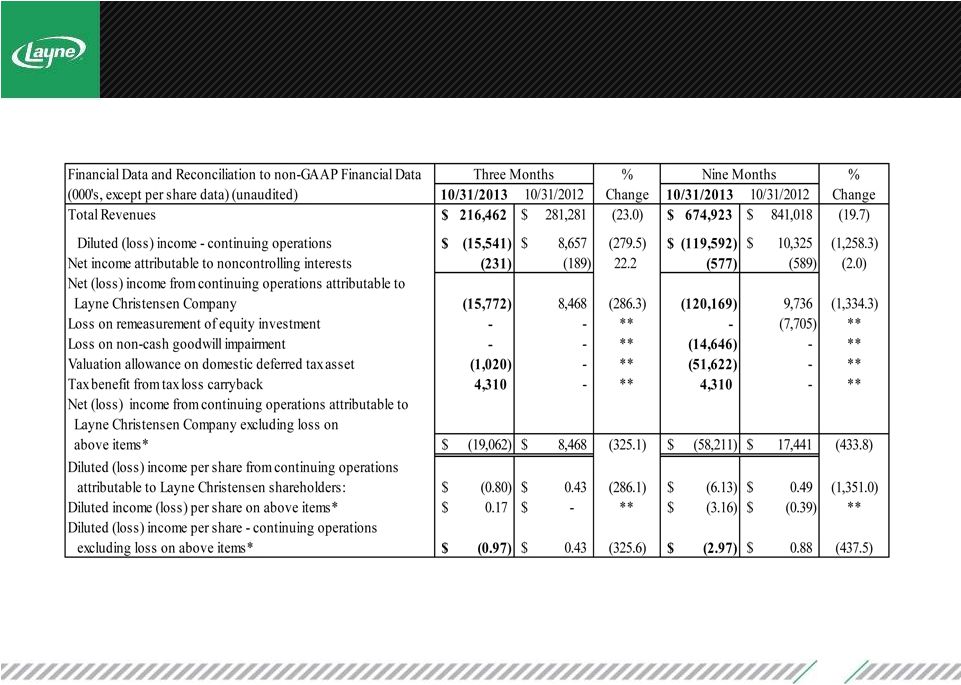

NON-GAAP RECONCILIATIONS: THREE AND NINE MONTHS |

22

Trailing twelve months

($ in millions)

Jan. 31, 2013

Apr. 30, 2013

Jul. 31, 2013

Oct. 31, 2013

Net income attributable to Layne

($24.9)

($23.8)

($74.8)

($15.8)

Loss from discontinued operations

2.2

(0.4)

($5.4)

-

Income tax benefit (expense)

14.7

(5.8)

(50.2)

3.9

Interest expense

1.3

1.3

1.6

2.0

Depreciation and amortization

15.8

15.3

15.2

15.2

Impairment Charges

8.4

-

14.6

-

Non-cash stock-based compensation

(0.2)

1.2

0.8

0.5

HQ Relocation Costs

2.7

3.7

3.2

1.9

Adjusted EBITDA

($9.4)

$3.0

$5.5

($0.1)

Layne uses certain “Non-GAAP”

financial measures as defined by the Securities and Exchange Commission. These are

measures of performance and not defined by accounting principles generally

accepted in the United States, and should be considered in addition to, not

in lieu of, GAAP reported measures. EBITDA defined as earnings before interest, income taxes, noncontrolling interests,

depreciation and amortization, non-cash stock-based compensation and

certain one-time items. NON-GAAP RECONCILIATIONS: TRAILING TWELVE

MONTHS |

23

Jim Easter, Chief Financial Officer

281.475.2694

jim.easter@layne.com

www.layne.com

Devin Sullivan, SVP

212.836.9608

dsullivan@equityny.com

www.theequitygroup.com

CONTACT |