Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - VALLEY NATIONAL BANCORP | d670208d8k.htm |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Investor Presentation

Exhibit 99.1 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. 2

The

foregoing

contains

forward-looking

statements

within

the

meaning

of

the

Private

Securities

Litigation

Reform

Act

of

1995.

Such

statements

are

not

historical

facts

and

include

expressions

about

management’s

confidence

and

strategies

and

management’s

expectations

about

new

and

existing

programs

and

products,

acquisitions,

relationships,

opportunities,

taxation,

technology,

market

conditions

and

economic

expectations.

These

statements

may

be

identified

by

such

forward-looking

terminology

as

“should,”

“expect,”

“believe,”

“view,”

“opportunity,”

“allow,”

“continues,”

“reflects,”

“typically,”

“usually,”

“anticipate,”

or

similar

statements

or

variations

of

such

terms.

Such

forward-looking

statements

involve

certain

risks

and

uncertainties.

Actual

results

may

differ

materially

from

such

forward-looking

statements.

Factors

that

may

cause

actual

results

to

differ

materially

from

those

contemplated

by

such

forward-looking

statements

include,

but

are

not

limited

to:

a

severe

decline

in

the

general

economic

conditions

of

New

Jersey

and

the

New

York

Metropolitan

area;

larger

than

expected

reductions

in

our

loans

originated

for

sale

or

a

slowdown

in

new

and

refinanced

residential

mortgage

loan

activity;

unexpected

changes

in

market

interest

rates

for

interest

earning

assets

and/or

interest

bearing

liabilities;

government

intervention

in

the

U.S.

financial

system

and

the

effects

of

and

changes

in

trade

and

monetary

and

fiscal

policies

and

laws,

including

the

interest

rate

policies

of

the

Federal

Reserve;

claims

and

litigation

pertaining

to

fiduciary

responsibility,

contractual

issues,

environmental

laws

and

other

matters;

our

inability

to

pay

dividends

at

current

levels,

or

at

all,

because

of

inadequate

future

earnings,

regulatory

restrictions

or

limitations,

and

changes

in

the

composition

of

qualifying

regulatory

capital

and

minimum

capital

requirements

(including

those

resulting

from

the

U.S.

implementation

of

Basel

III

requirements);

higher

than

expected

increases

in

our

allowance

for

loan

losses;

declines

in

value

in

our

investment

portfolio,

including

additional

other-than-temporary

impairment

charges

on

our

investment

securities;

unexpected

significant

declines

in

the

loan

portfolio

due

to

the

lack

of

economic

expansion,

increased

competition,

large

prepayments

or

other

factors;

unanticipated

credit

deterioration

in

our

loan

portfolio;

unanticipated

loan

delinquencies,

loss

of

collateral,

decreased

service

revenues,

and

other

potential

negative

effects

on

our

business

caused

by

severe

weather

or

other

external

events;

higher

than

expected

tax

rates,

including

increases

resulting

from

changes

in

tax

laws,

regulations

and

case

law;

an

unexpected

decline

in

real

estate

values

within

our

market

areas;

higher

than

expected

FDIC

insurance

assessments;

the

failure

of

other

financial

institutions

with

whom

we

have

trading,

clearing,

counterparty

and

other

financial

relationships;

lack

of

liquidity

to

fund

our

various

cash

obligations;

unanticipated

reduction

in

our

deposit

base;

potential

acquisitions

that

may

disrupt

our

business;

legislative

and

regulatory

actions

(including

the

impact

of

the

Dodd-

Frank

Wall

Street

Reform

and

Consumer

Protection

Act

and

related

regulations)

subject

us

to

additional

regulatory

oversight

which

may

result

in

higher

compliance

costs

and/or

require

us

to

change

our

business

model;

changes

in

accounting

policies

or

accounting

standards;

our

inability

to

promptly

adapt

to

technological

changes;

our

internal

controls

and

procedures

may

not

be

adequate

to

prevent

losses;

the

inability

to

realize

expected

revenue

synergies

from

recent

acquisitions

in

the

amounts

or

in

the

timeframe

anticipated;

inability

to

retain

customers

and

employees;

lower

than

expected

cash

flows

from

purchased

credit-impaired

loans;

cyber

attacks,

computer

viruses

or

other

malware

that

may

breach

the

security

of

our

websites

or

other

systems

to

obtain

unauthorized

access

to

confidential

information,

destroy

data,

disable

or

degrade

service,

or

sabotage

our

systems;

and

other

unexpected

material

adverse

changes

in

our

operations

or

earnings.

A

detailed

discussion

of

factors

that

could

affect

our

results

is

included

in

our

SEC

filings,

including

the

“Risk

Factors”

section

of

our

Annual

Report

on

Form

10-K

for

the

year

ended

December

31,

2012.

We

undertake

no

duty

to

update

any

forward-looking

statement

to

conform

the

statement

to

actual

results

or

changes

in

our

expectations.

Although

we

believe

that

the

expectations

reflected

in

the

forward-looking

statements

are

reasonable,

we

cannot

guarantee

future

results,

levels

of

activity,

performance

or

achievements.

Forward Looking Statements |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Valley National Bancorp

•

Focus on credit quality

•

Conservative growth strategies

•

Never had a losing quarter

•

Affluent and heavily populated

footprint

•

Strong customer service

•

Experienced senior and executive

management

•

Large percentage of retail

ownership

–

Long-term investment approach

–

Focus on cash and stock

dividends

•

Large insider ownership, family

members, retired employees and

retired directors

•

Approximately 298 institutional

holders or 47% of all shares held*

Our Approach

3

*Source: Bloomberg as of 2/3/2014 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Valley National Bancorp

•

Traded on the NYSE (VLY)

•

Regional Bank Holding Company

•

Headquartered in Wayne, NJ

•

204 Branches

Corporate Profile

–

Northern NJ

–

Central NJ

–

Manhattan

–

Brooklyn

–

Queens

–

Long Island

As of 12/31/2013

Total Assets

$16.2 billion

Total Net Loans

$11.5 billion

Total Deposits

$11.3 billion

Market Cap

$1.9 billion*

*Source: Bloomberg as of 2/3/2014

As of 12/31/2013

4 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Valley’s 4Q 2013 Highlights

4Q Highlights

•

4Q 2013 net income of $39.6 million or $0.20 per

diluted common share as compared with 4Q 2012

net income of $36.8 million or $0.19 per diluted

common share

•

Tangible Book Value linked quarter increase of

$0.11 to $5.39

•

Total non-covered loans increased $195.8 million

or 7.0% on an annualized basis

•

4Q NIM linked quarter increased of 7 bps to 3.27%

•

Terminated a branch operating lease related to a

building sale-leaseback transaction resulting in a

$11.3 million realized pre-tax gain ($0.03 per share)

•

Non-performing assets decreased by 36% to $124.9

million

–

$21.0 million decrease in non-accrual loans

–

$48.6 million decrease due to the sale of non-accrual

debt securities

Non-Performing Assets**

Dashboard

**Excludes Covered Loans

As of 12/31/2013

5

Linked Quarter Loan Growth*

*Non-Covered Loans, annualized |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Asset & Loan

Composition

Total Assets

$16.2 Billion

Non-Covered Loans (Gross)

$11.5 Billion

<1> Other Assets includes bank owned branch locations carried at

a

cost estimated by management to be significantly less than the

current market value.

<2> Loans subject to loss sharing agreements with the FDIC

As of 12/31/2013

6 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. New Loan Originations

Trend

4 year average increase between 2010 –

2013

*Annualized

As of 12/31/2013, excludes purchased loans and line of credit originations

7 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

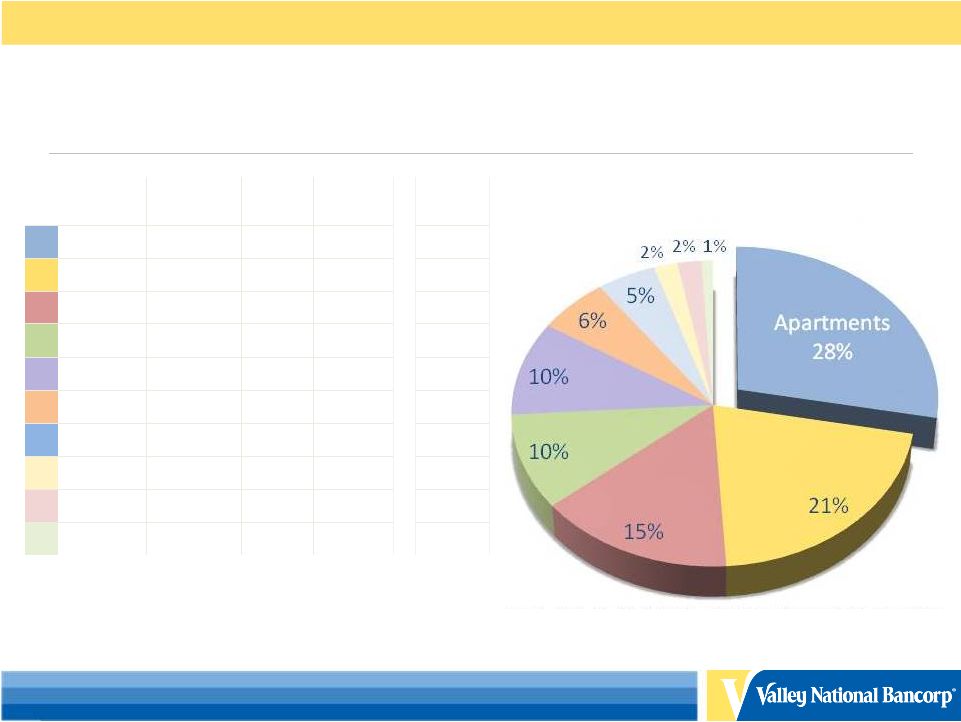

Reserved. Total Commercial Real Estate -

$5.0 Billion

(Includes both Covered and Non-Covered Loans)

Primary

Property Type

$ Amount

(Millions)

% of

Total

Avg

LTV

2009

Avg LTV

Apartments

1,369

28%

33%

49%

Retail

1,056

21%

51%

50%

Industrial

770

15%

53%

53%

Office

519

10%

48%

54%

Mixed Use

487

10%

46%

46%

Healthcare

289

6%

60%

61%

Specialty

254

5%

47%

49%

Land Loans

100

2%

62%

58%

Residential

89

2%

49%

52%

Other

47

1%

38%

46%

8

-Average LTV based on current balances and most recent appraised value.

-

LTV calculation excludes Covered Loans.

-The total CRE loan balance is based on Valley’s internal loan hierarchy

structure and does not reflect loan classifications reported in Valley’s SEC and bank regulatory reports.

-The chart above does not include $409 Million in Construction loans.

Commercial Real Estate

Diversified Portfolio

As of 12/31/2013 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Total Retail Property Types -

$1.1 Billion

(Non-Covered Loans)

Retail Property Type

% of

Total

Avg

LTV

2009

Avg LTV

Multi-Tenanted -

No

Anchor

23%

54%

56%

Multi-Tenanted -

Anchor

23%

54%

50%

Single Tenant

23%

53%

51%

Auto Dealership

9%

50%

50%

Private & Public Clubs

8%

35%

30%

Food Establishments

5%

56%

52%

Entertainment Facilities

4%

53%

43%

Private Education

Facilities

3%

43%

51%

Auto Servicing

2%

47%

53%

-Average LTV based on current balances and most recent appraised value

-The chart above excludes construction loans.

9

Retail Composition

Commercial Real Estate

As of 12/31/2013 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Primary Property

Type

$ Amount

(Millions)

% of Total

2009 % of

Total

Residential

129

32%

51%

Apartments

87

21%

2%

Retail

67

16%

8%

Land Loans

44

11%

13%

Mixed Use

30

7%

15%

Specialty

9

2%

1%

Healthcare

17

4%

2%

Other

26

7%

8%

10

Composition

Construction Loan

Total Construction Loans -

$409 Million

(Non-Covered Loans)

-Construction loan balance is based on Valley’s internal loan hierarchy

structure and does not reflect loan classifications reported in Valley’s SEC

and bank regulatory reports.

As of 12/31/2013 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

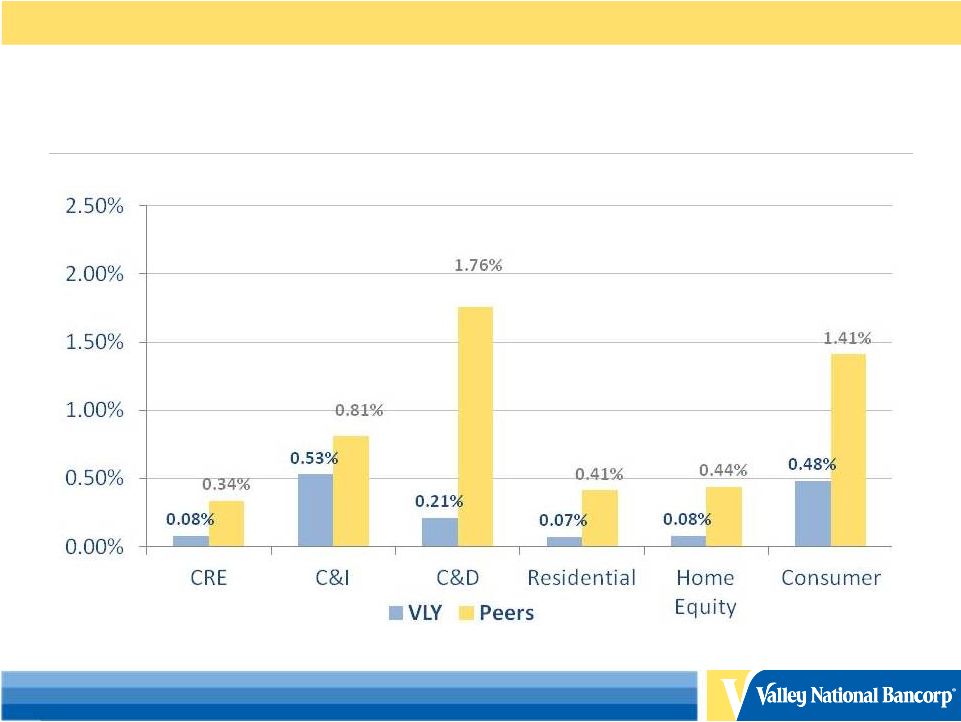

Reserved. Asset Quality

2003 –

2013 Average Net Charge-offs

Source: SNL Financial data as of 2/3/2014

Peer group includes banks between $3 billion and $50 billion in assets

As of 12/31/2013

11 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Investment Portfolio

By Investment Grade

Key Comments

Key Highlights & Composition

•

Net gains on securities transactions were

$10.7 million ($6.2 million after taxes, or

$0.03 per common share) for the fourth

quarter of 2013 as compared to immaterial

net gains for both the third quarter of 2013

and fourth quarter of 2012.

•

No OTTI on securities during all of 2013

Investment Grade

2013

AAA

70%

AA

11%

A

3%

BBB

5%

Non Investment Grade

3%

Not Rated

8%

Investment Type

2013

GSE MBS (GNMA)

29%

GSE MBS (FNMA/FHLMC)

23%

State, County, Municipals

18%

US Treasury

9%

Other

7%

Trust Preferred

7%

Corporate Bonds

6%

Private Label MBS

1%

By Investment Type

As of 12/31/2013

12 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

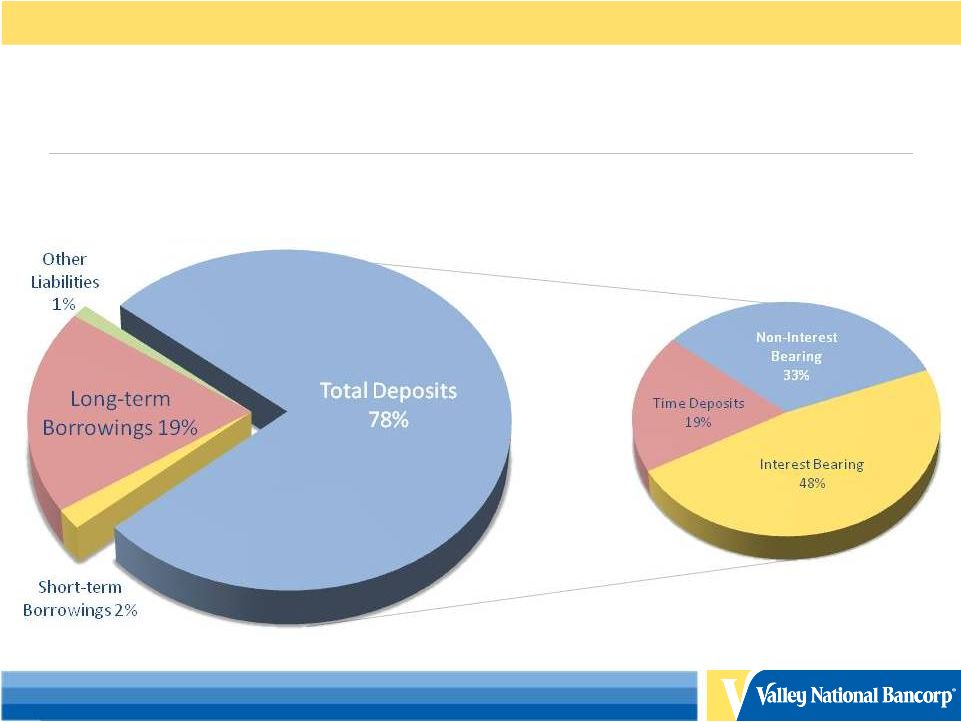

Reserved. Liability & Deposit

Composition

Total Liabilities

$14.6 Billion

Total Deposits

$11.3 Billion

As of 12/31/2013

13 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Deposits & Borrowings

Funding Base –

Scheduled Maturities

(thousands)

2015

2016

2017

Certificate of Deposits

$261,909

$134,555

$243,511

Borrowings

400,000

326,979

805,000

Derivatives*

100,000

200,000

100,000

Total

$761,909

$661,534

$1,148,511

Balance Sheet Average

Cost of Funds**

3.86%

4.40%

3.63%

Key Highlights and Comments

*Includes interest rate swaps and caps used to hedge deposit products

**Includes derivative premium amortization and current cash flows

14 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Significant estimated unrealized gains on the fair value of facilities,

referenced in slide 6, are not reflected in capital ratios above.

Capital Ratios

As of

12/31/13

“Well

Capitalized”

Tangible Common Equity

/ Tangible Assets

6.86%

N/A

Tangible Common Equity

/ Risk-Weighted Assets

9.10%

N/A

Tier I Common Ratio

9.28%

N/A

Tier I

9.65%

6.00%

Tier II

11.87%

10.00%

Leverage

7.27%

5.00%

Book Value

$7.72

N/A

Tangible Book Value

$5.39

N/A

Regulatory Capital

Composition & Ratios

As of 12/31/2013

Non-GAAP reconciliations shown on slides 18 and 19

15 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Shareholder Returns

16

Historical Financial Data (1)

(Dollars in millions, except for share data)

2013

16,157

$

132.0

$

$0.66

0.83

%

8.69

%

$0.60

N/A

N/A

2012

16,013

143.6

0.73

0.91

9.57

0.65

5/12 -

5%

Stock Dividend

2011

14,253

132.5

0.74

0.93

10.11

0.66

5/11 -

5%

Stock Dividend

2010

14,151

130.0

0.73

0.92

10.23

0.65

5/10 -

5%

Stock Dividend

2009

14,291

114.8

0.57

0.80

8.55

0.66

5/09 -

5%

Stock Dividend

2008

14,724

92.3

0.57

0.68

8.61

0.66

5/08 -

5%

Stock Dividend

2007

12,749

153.2

1.00

1.25

16.43

0.65

5/07 -

5%

Stock Dividend

2006

12,395

163.7

1.04

1.33

17.24

0.64

5/06 -

5%

Stock Dividend

2005

12,436

163.4

1.06

1.39

19.17

0.62

5/05 -

5%

Stock Dividend

2004

10,763

154.4

1.05

1.51

22.77

0.60

5/04 -

5%

Stock Dividend

2003

9,873

153.4

1.05

1.63

24.21

0.57

5/03 -

5%

Stock Dividend

2002

9,148

154.6

1.01

1.78

23.59

0.54

5/02 -

5:4

Stock Split

2001

8,590

135.2

0.85

1.68

19.70

0.51

5/01 -

5%

Stock Dividend

2000

6,426

106.8

0.82

1.72

20.28

0.48

5/00 -

5%

Stock Dividend

1999

6,360

106.3

0.77

1.75

18.35

0.45

5/99 -

5%

Stock Dividend

1998

5,541

97.3

0.74

1.82

18.47

0.41

5/98 -

5:4

Stock Split

1997

5,091

85.0

0.68

1.67

18.88

0.36

5/97 -

5%

Stock Dividend

Period Ended

(2)

Total Assets

Net Income

(3)

Common Stock Splits and Dividends

Diluted

Earnings Per

Common

Share

Return on

Average

Assets

Return on

Average

Equity

Cash Dividends

Declared Per

Common Share

(1)

All per share amounts have been adjusted retroactively for stock splits and stock

dividends during the periods presented. Data for the years prior to 2001 in the table above exclude certain prior year results for

merger transactions accounted for using the pooling-of-interests method.

(2)

Previously reported results for 2011, 2010, 2009 and 2008 have been revised to reflect an

increase in non-interest expense, which after taxes, reduced net income by $1.1 million, $1.2 million, $1.2 million and

$1.3 million, respectively, and reduced basic and diluted earnings per common share by $0.01

for each of these years. Total assets and the other statistical data presented in the table have been revised

accordingly.

(3)

Net income includes other-than-temporary impairment charges on investment securities,

net of tax benefit, totaling $3.0 million, $12.2 million, $2.9 million, $4.0 million, $49.9 million, $10.4 million, and $3.0

million for the years ended 2012, 2011, 2010, 2009, 2008, 2007, and 2006, respectively.

|

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. For More Information

Log onto our web site: www.valleynationalbank.com

E-mail requests to: tscortes@valleynationalbank.com

Call Shareholder Relations at: (973) 305-3380

Write to: Valley National Bank

1455 Valley Road

Wayne, New Jersey 07470

Attn: Tina Cortes, Shareholder Relations Specialist

Log onto our website above or www.sec.gov to obtain free copies of documents

filed by Valley with the SEC

17 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. Total Equity

$1,541,040

Total Assets

$16,156,541

Plus: Net unrealized losses on securities

available for sale, net of tax

21,661

Less: Goodwill & Other Intangible Assets

(464,364)

Plus: Accumulated net losses on cash

flow hedges, net of tax

6,271

Total Tangible Assets (TA)

$15,692,177

Plus: Defined benefit pension plan

net assets, net of tax

10,320

Total Equity

$1,541,040

Less: Goodwill, net of tax

(427,392)

Less: Goodwill & Other Intangible Assets

(464,364)

Less: Disallowed other intangible assets

(13,122)

Total Tangible Common Equity (TCE)

$1,076,676

Less: Disallowed deferred tax assets

(41,252)

Tier I Common Capital

$1,097,526

Ratios

Plus: Trust preferred securities

44,000

TCE / TA

6.86%

Total Tier I Capital

$1,141,526

TCE / RWA

9.10%

Plus: Qualifying allowance for credit losses

$117,310

Plus: Qualifying sub debt

145,000

Tier I (Total Tier I / RWA)

9.65%

Total Tier II Capital

$1,403,836

Tier II (Total Tier II / RWA)

11.87%

Risk Weighted Assets (RWA)

$11,830,604

Tier I Common Capital Ratio

(Tier 1 Common /RWA)

9.28%

12/31/2013

Non-GAAP Disclosure Reconciliations

($ in Thousands)

18 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. 12/31/2013

Non-GAAP Disclosure Reconciliations

($ in Thousands)

Common Shares Outstanding

199,593,109

Shareholders’ Equity

$1,541,040

Less: Goodwill and Other

Intangible Assets

(464,364)

Tangible Shareholders’ Equity

$1,076,676

Tangible Book Value

$5.39

19 |

©

2013 Valley National Bank. Member FDIC. Equal Opportunity Lender. All Rights

Reserved. |