Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Federal Home Loan Bank of New York | d674414d8k.htm |

| EX-99.1 - EX-99.1 - Federal Home Loan Bank of New York | d674414dex991.htm |

FHLBNY: Strong Performance for

Customers and Shareholders

February 11, 2014

©

2014

FEDERAL

HOME

LOAN

BANK

OF

NEW

YORK

•

101

PARK

AVENUE

•

NEW

YORK,

NY

10178

•

WWW.FHLBNY.COM

Exhibit 99.2 |

Key

Messages FEDERAL HOME LOAN BANK OF NEW YORK

1

»

“Advances Bank”

strategy

»

Strong performance record for customers and shareholders

»

Conservatively positioned balance sheet

»

HLBank System’s financial results have improved since the

financial crisis |

FEDERAL HOME LOAN BANK OF NEW YORK

HLBNY is the Largest Bank in the Home Loan Bank System

as Measured by Advances Balances and Total Assets

Total Advances

Change in Advances: 2Q07 vs 3Q13

Note: As of September 30, 2013

SEA

CHI

DAL

IND

TOP

BOS

PIT

SFR

DSM

CIN

ATL

NYK

$0

$20

$40

$60

$80

$100

102%

39%

46%

-100%

-50%

0%

50%

100%

150%

SEA

CHI

DAL

IND

TOP

BOS

PIT

SFR

DSM

CIN

ATL

NYK

25%

-

-74%

-29%

-42%

-34%

-14%

-54%

-38%

-62%

2

($ Billions) |

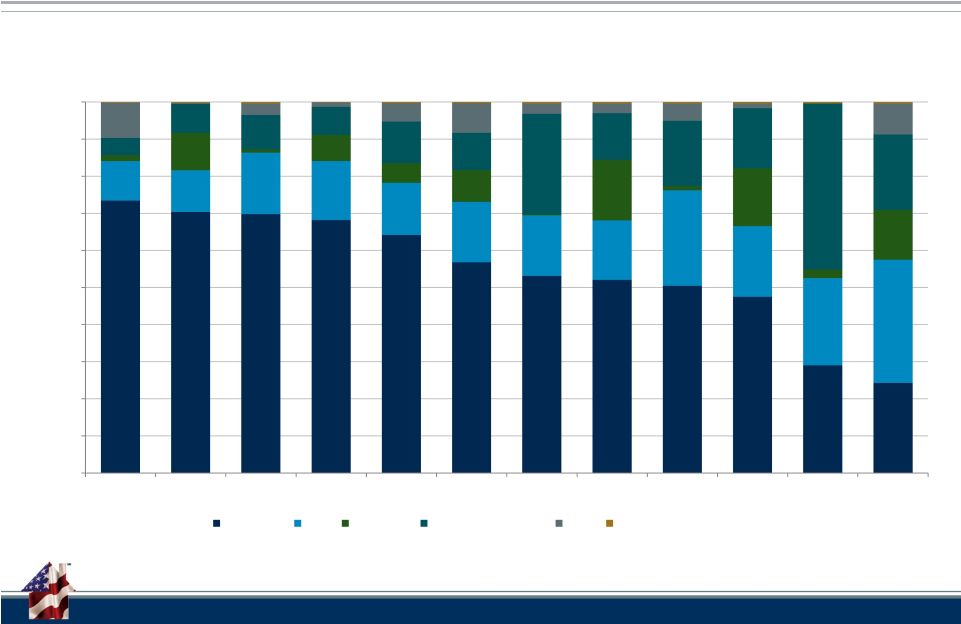

HLBNY

Has Consistently Maintained a High Percentage of Advances Relative to

Assets Balance Sheet by Type of Assets

3

Note: As of September 30, 2013

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

NYK

DSM

ATL

CIN

PIT

BOS

DAL

TOP

SFR

IND

SEA

CHI

Advances

MBS

MPF/MPP

Other Investments

Cash

Other

FEDERAL HOME LOAN BANK OF NEW YORK

3 |

FHLBNY’s Borrower Base is Diverse

Note: Par value of advances.

Top 5 Borrowers

December 31, 2013

Top 5 Borrowers

($ billions)

Citibank, N.A.

$ 22.2

Metropolitan Life Insurance

Company

$ 12.8

New York Community Bank

$ 10.1

Hudson City Savings Bank, FSB

$ 6.0

First Niagara Bank, National

Association

$ 4.3

All Other

Borrowers

$21.1

Next 5

Borrowers

$12.2

Top 5

Borrowers

$55.4

4

FEDERAL HOME LOAN BANK OF NEW YORK |

The

Bank’s Financial Performance Has Been Strong FHLBNY -

Financial Results Highlights

Notes: All $ millions. *95% of the bank’s MBS investments are GSE

securities. 2013

2012

2011

Year End Balances

Advances

$90,765

$75,888

$70,864

MBS Investments*

12,954

12,620

12,477

Total Assets

128,333

102,989

97,662

Consolidated Obligations

119,146

94,564

89,564

Retained Earnings

999

894

746

Capital Stock

6,489

5,492

5,046

Annual Results

Net Interest Income

$421

$467

$509

Operating Expenses

83

83

109

Net Income

305

361

244

FEDERAL HOME LOAN BANK OF NEW YORK

5 |

FHLBNY Dividends Have Been Reliable and Exceeded

Market Reference Rates

6

FHLBNY Dividend

1 Month Libor

3 Month Libor

Fed Funds (Effective Rate)

4.0

5.0

6.0

7.0

8.0

9.0

0.0

1.0

2.0

3.0

FEDERAL HOME LOAN BANK OF NEW YORK |

FHLBNY Has Been Profitable With a Conservative Approach

Return on Equity

FEDERAL HOME LOAN BANK OF NEW YORK

7

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

14.00%

CHI

SFR

IND

NYK

TOP

CIN

BOS

SEA

DAL

ATL

DSM

PIT

Q3 2013

2012 |

HLBank Balance Sheets Are Scalable to Meet Member

Liquidity Needs

0

200,000

400,000

600,000

800,000

1,000,000

1,200,000

FHLB System Advances

($ Millions)

FEDERAL HOME LOAN BANK OF NEW YORK

8 |

HLBNY Has Retained More of Our Advances From the Crisis

Than the HLBank System

0

20

40

60

80

100

120

140

160

180

200

System and HLBNY Advances: Indexed

1Q2006 = 100

HLBNY

FEDERAL HOME LOAN BANK OF NEW YORK

9

System |

System Advances Have Grown in Recent Quarters

System Quarterly Change in Advances

-8.21%

-11.98%

-9.62%

-8.25%

-6.89%

-9.37%

-5.55%

-7.53%

-4.21%

-7.00%

-3.74%

-3.05%

0.67%

-5.79%

6.20%

-1.46%

3.27%

-1.75%

9.60%

1.45%

-

15%

-

10%

-

5%

0%

5%

10%

15%

Q408

Q109

Q209

Q309

Q409

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Q312

Q412

Q113

Q213

Q313

FEDERAL HOME LOAN BANK OF NEW YORK

10 |

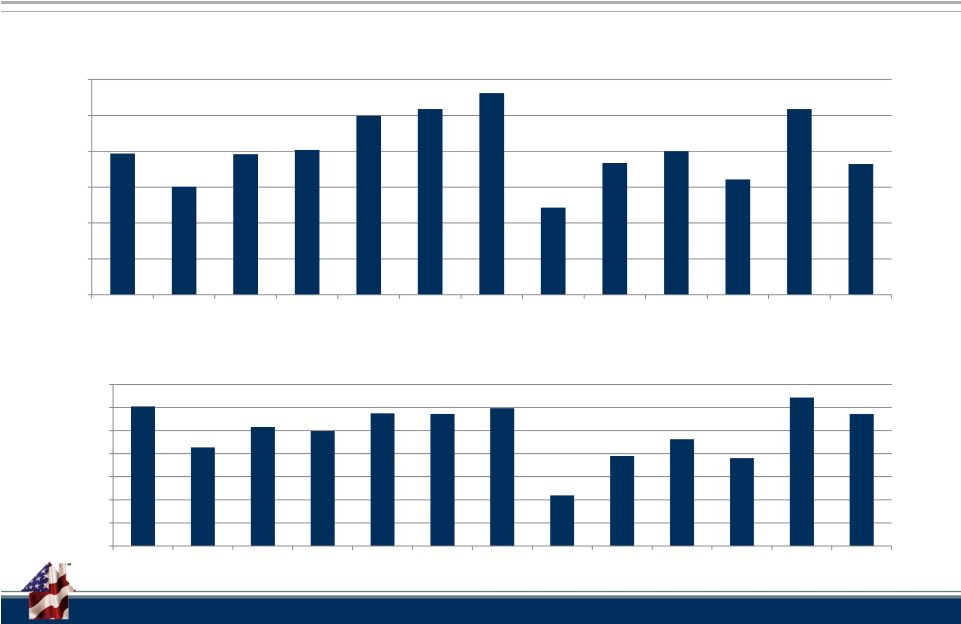

System Financial Performance Has Improved Considerably

Since the Financial Crisis

11

HLBank System Net Income: 2001-3Q2013

HLBank System ROE: 2001-3Q2013

-

500

1,000

1,500

2,000

2,500

3,000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

YTD Q3

2013

0.00%

1.00%

2.00%

3.00%

4.00%

5.00%

6.00%

7.00%

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

YTD Q3

2013

FEDERAL HOME LOAN BANK OF NEW YORK

11

($Millions) |

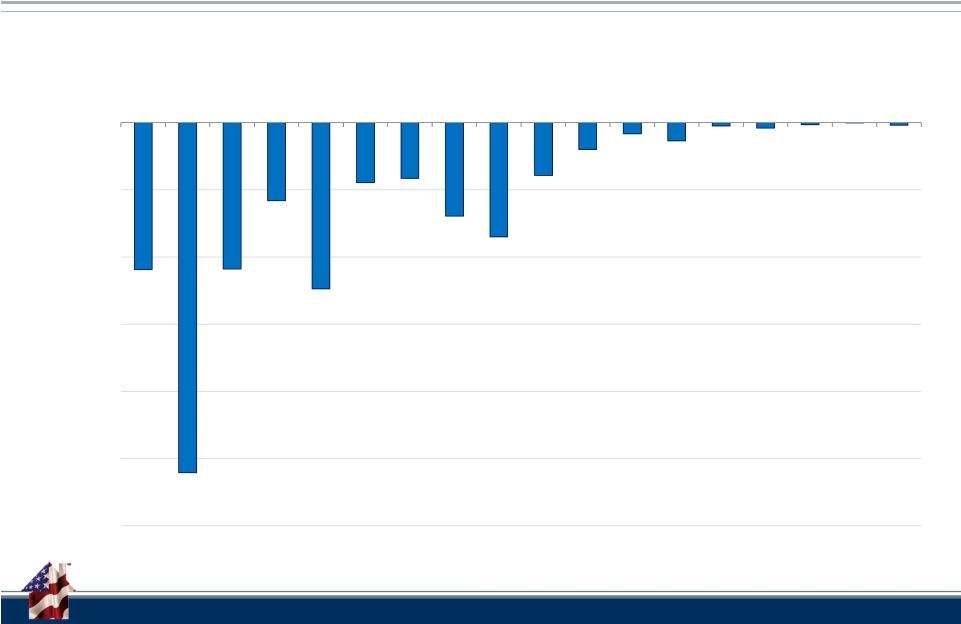

System OTTI Credit Losses Have Fallen Dramatically in

Recent Years

12

($1,200.0)

($1,000.0)

($800.0)

($600.0)

($400.0)

($200.0)

$0.0

Q209

Q309

Q409

Q110

Q210

Q310

Q410

Q111

Q211

Q311

Q411

Q112

Q212

Q312

Q412

Q113

Q213

Q313

System Credit OTTI by Quarter

($ Millions)

FEDERAL HOME LOAN BANK OF NEW YORK

12 |

Restricted Retained Earnings Balances

The HLBanks Continue to Build Restricted Retained

Earnings to Protect Debt Investors and Members’

Investment

13

= actual $ amount of RRE on balance sheet (LHS)

= RRE as % of CO’s outstanding (RHS)

Note: As of September 30, 2013

$90

$140

$51

$119

$98

$69

$167

$43

$36

$44

$174

$48

0.00%

0.20%

0.40%

0.60%

0.80%

1.00%

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

$200

FEDERAL HOME LOAN BANK OF NEW YORK

13 |

All

FHLBanks Exceed Minimum Regulatory Capital Requirements

Capital-to-Assets Ratio

14

Note: As of September 30, 2013

0.00%

2.00%

4.00%

6.00%

8.00%

10.00%

12.00%

BOS

SFR

SEA

IND

CHI

DAL

CIN

NYK

ATL

DSM

PIT

TOP

GAAP

Regulatory

FEDERAL HOME LOAN BANK OF NEW YORK

14 |

Questions?

101

PARK

AVENUE

•

NEW

YORK,

NY

10178

•

WWW.FHLBNY.COM

Advancing Housing and Community Growth

The information provided by the Federal Home Loan Bank of New York (HLB) in this

communications is set forth for informational purposes only. The information

should not be construed as an opinion, recommendation or solicitation regarding the use of any financial strategy and/or the purchase or sale of

any financial instrument. All customers are advised to conduct their own

independent due diligence before making any financial decisions. Please note that the

past performance of any HLB service or product should not be viewed as a guarantee

of future results. Also, the information presented here and/or the services

or products provided by the HLB may change at any time without notice. |