Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Colfax CORP | cfx8-kxq42013earnings.htm |

| EX-99.1 - EXHIBIT - Colfax CORP | q42013earningspressrelease.htm |

FOURTH QUARTER 2013 | EARNINGS CONFERENCE CALL

2 FORWARD-LOOKING STATEMENTS The following information contains forward-looking statements, including forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements include, but are not limited to, statements concerning Colfax's plans, objectives, expectations and intentions and other statements that are not historical or current facts. Forward- looking statements are based on Colfax's current expectations and involve risks and uncertainties that could cause actual results to differ materially from those expressed or implied in such forward-looking statements. Factors that could cause Colfax's results to differ materially from current expectations include, but are not limited to, factors detailed in Colfax's reports filed with the U.S. Securities and Exchange Commission including its 2012 Annual Report on Form 10-K under the caption “Risk Factors”. In addition, these statements are based on a number of assumptions that are subject to change. This presentation speaks only as of this date. Colfax disclaims any duty to update the information herein.

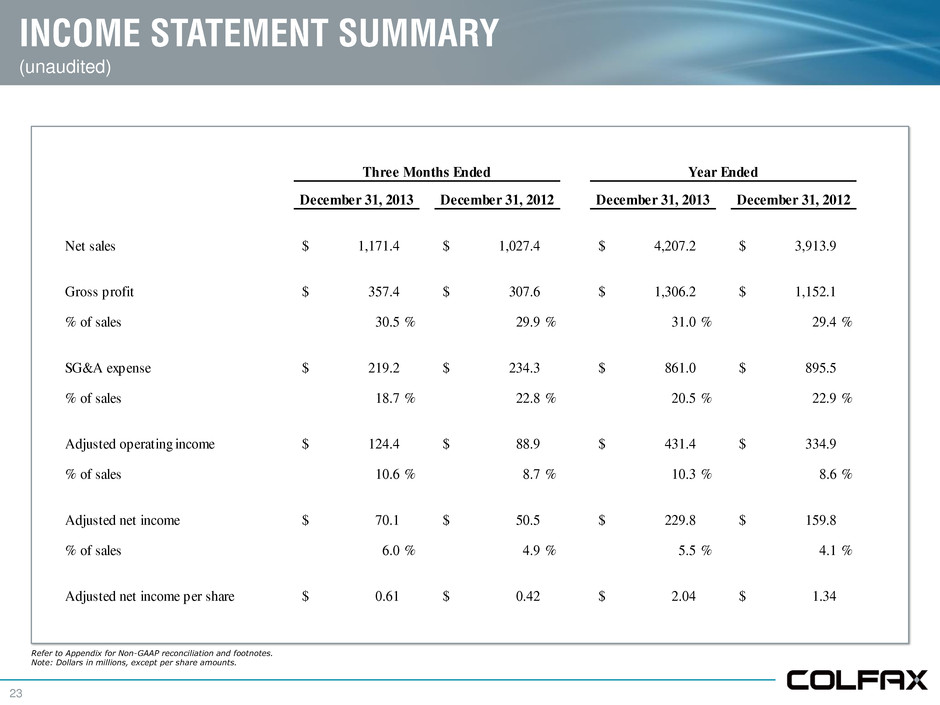

Q4 2013 RESULTS

4 Q4 2013 HIGHLIGHTS • Adjusted net income of $70.1 million ($0.61 per share) compared to $50.5 million ($0.42 per share) in Q4 2012 • Net sales of $1.17 billion, an increase of 14% from Q4 2012 net sales of $1.03 billion (an organic increase of 10.2%) • Adjusted operating income of $124.4 million compared to $88.9 million in Q4 2012 • Fourth quarter gas- and fluid-handling orders of $547.8 million compared to orders of $520.3 million in Q4 2012, an increase of 5.3% • Gas- and fluid-handling backlog of $1.58 billion at period end

5 FULL YEAR 2013 HIGHLIGHTS • Adjusted net income of $229.8 million ($2.04 per share) compared to $159.8 million ($1.34 per share) • Net sales of $4.21 billion, an increase of 7.5% from full year 2012 net sales of $3.91 billion (an organic increase of 2.7%) • Adjusted operating income of $431.4 million compared to $334.9 million in 2012 • Gas- and fluid-handling orders of $2.06 billion compared to orders of $2.0 billion in 2012, an increase of 3.3%

GAS AND FLUID HANDLING

7 GAS AND FLUID HANDLING Q4 2013 HIGHLIGHTS • Net sales of $650.8 million compared to net sales of $514.4 million in Q4 2012, an increase of 26.5% (an organic increase of 17.9%) • Adjusted segment operating income of $78.1 million and adjusted segment operating income margin of 12.0% – Margins flat as compared to Q4 2012 – 2013 acquisitions diluted margins by approximately 90 bps • Fourth quarter orders $547.8 million compared to orders of $520.3 million in Q4 2012, an increase of 5.3% • Backlog of $1.58 billion at period end

8 GAS AND FLUID HANDLING FULL YEAR 2013 HIGHLIGHTS • Net sales of $2.104 billion compared to net sales of $1.901 billion in 2012, an increase of 10.7% (an organic increase of 7.3%) • Adjusted segment operating income of $260.3 million and adjusted segment operating income margin of 12.4% • Orders of $2.06 billion compared to orders of $2.0 billion in 2012, an increase of 3.3%

9 ORDERS AND BACKLOG $520.3 $547.8 $1,996.0 $2,061.4 $0.0 $250.0 $500.0 $750.0 $1,000.0 $1,250.0 $1,500.0 $1,750.0 $2,000.0 $2,250.0 Q4 2012 Q4 2013 YTD 2012 YTD 2013 - 200.0 400.0 600.0 800.0 1,000.0 1,200.0 1,400.0 1,600.0 1,800.0 ORDERS BACKLOG(1) (1) Backlog data for the periods prior to Q1 2012 are presented on a proforma basis. Note: Dollars in millions (unaudited). $1.45B QTD YTD Existing Businesses (2.5)% (0.8)% Acquisitions 9.6% 4.8% FX Translation (1.8)% (0.7)% Total Growth 5.3% 3.3% $1.58B $1.43B

10 GEOGRAPHIC EXPOSURE YTD 2013 REVENUE $514.4 $650.8 $1,901.1 $2,104.0 $0.0 $250.0 $500.0 $750.0 $1,000.0 $1,250.0 $1,500.0 $1,750.0 $2,000.0 $2,250.0 Q4 2012 Q4 2013 YTD 2012 YTD 2013 67% 33% Foremarket Aftermarket REVENUE AFTERMARKET REVENUE YTD 2013 53% 47% Developed Economies Emerging Markets Note: Dollars in millions (unaudited). QTD YTD Existing Businesses 17.9% 7.3% Acquisitions 11.2% 4.4% FX Translation (2.6)% (1.0)% Total Growth 26.5% 10.7%

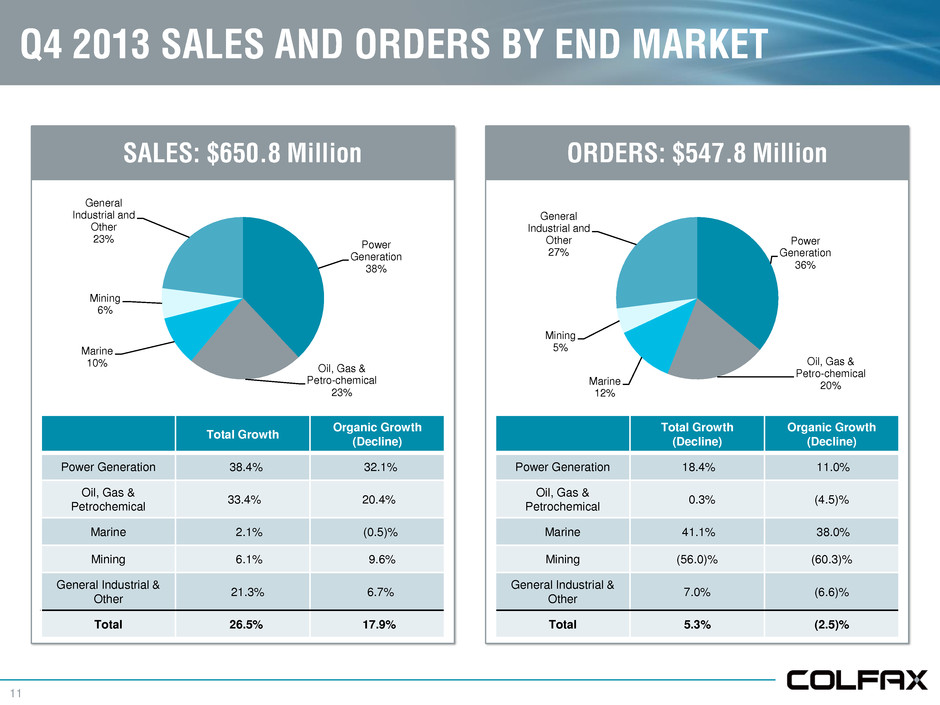

11 Q4 2013 SALES AND ORDERS BY END MARKET Power Generation 38% Oil, Gas & Petro-chemical 23% Marine 10% Mining 6% General Industrial and Other 23% SALES: $650.8 Million Total Growth Organic Growth (Decline) Power Generation 38.4% 32.1% Oil, Gas & Petrochemical 33.4% 20.4% Marine 2.1% (0.5)% Mining 6.1% 9.6% General Industrial & Other 21.3% 6.7% Total 26.5% 17.9% Power Generation 36% Oil, Gas & Petro-chemical 20% Marine 12% Mining 5% General Industrial and Other 27% ORDERS: $547.8 Million Total Growth (Decline) Organic Growth (Decline) Power Generation 18.4% 11.0% Oil, Gas & Petrochemical 0.3% (4.5)% Marine 41.1% 38.0% Mining (56.0)% (60.3)% General Industrial & Other 7.0% (6.6)% Total 5.3% (2.5)%

12 FULL YEAR 2013 SALES AND ORDERS BY END MARKET Power Generation 38% Oil, Gas & Petro-chemical 23% Marine 11% Mining 5% General Industrial and Other 23% SALES: $2.104 Billion Total Growth (Decline) Organic Growth (Decline) Power Generation 31.8 % 30.5 % Oil, Gas & Petrochemical 1.9 % (2.2)% Marine 7.0 % 3.9 % Mining (36.1)% (34.1)% General Industrial & Other 10.3 % 2.7 % Total 10.7 % 7.3 % Power Generation 38% Oil, Gas & Petro-chemical 22% Marine 12% Mining 5% General Industrial and Other 23% ORDERS: $2.061 Billion Total Growth (Decline) Organic Growth (Decline) Power Generation 17.5 % 13.4 % Oil, Gas & Petrochemical (2.6)% (5.3)% Marine 11.2 % 8.4 % Mining (39.6)% (37.1)% General Industrial & Other 2.8 % (5.8)% Total 3.3 % (0.8)%

13 POWER GENERATION MARKET PERSPECTIVE SALES & ORDERS GROWTH 38% • Served by both Howden and Colfax Fluid Handling • Driven by fundamental global undersupply of electricity • Growth driven by environmental upgrades in China and the U.S., strong pump sales to natural gas combined cycle power stations, as well as strength in maintenance work in South Africa 2013 SALES SPLIT 2013 ORDERS SPLIT 38% HIGHLIGHTS Q4 2013 vs. Q4 2012 YTD 2013 vs. YTD 2012 Total Organic Total Organic Sales 38.4 % 32.1 % 31.8 % 30.5 % Orders 18.4 % 11.0 % 17.5 % 13.4 %

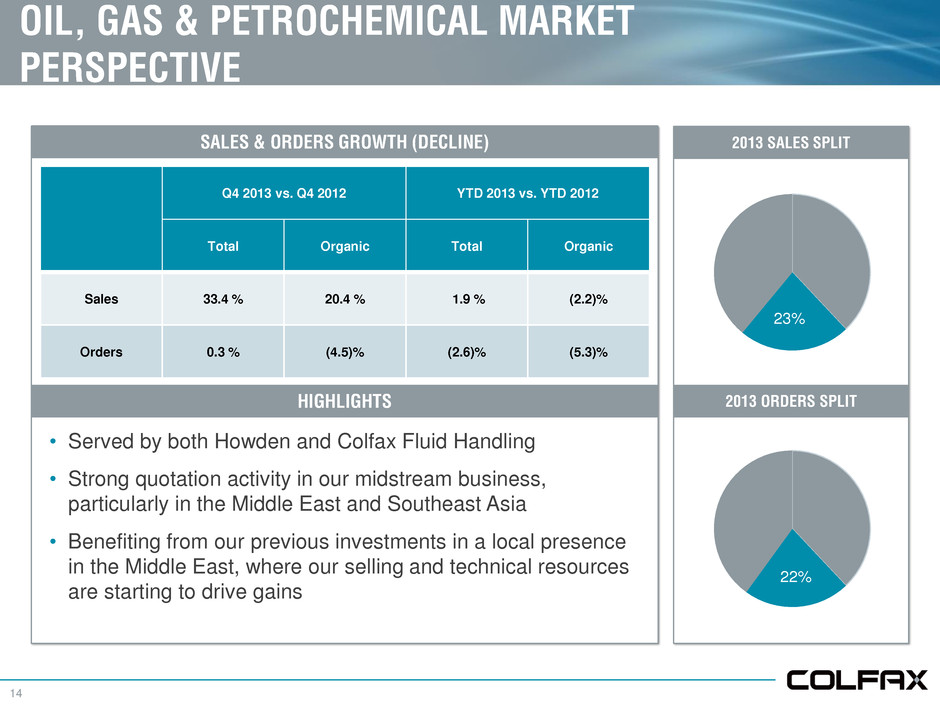

14 OIL, GAS & PETROCHEMICAL MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 22% • Served by both Howden and Colfax Fluid Handling • Strong quotation activity in our midstream business, particularly in the Middle East and Southeast Asia • Benefiting from our previous investments in a local presence in the Middle East, where our selling and technical resources are starting to drive gains 2013 SALES SPLIT 2013 ORDERS SPLIT 23% HIGHLIGHTS Q4 2013 vs. Q4 2012 YTD 2013 vs. YTD 2012 Total Organic Total Organic Sales 33.4 % 20.4 % 1.9 % (2.2)% Orders 0.3 % (4.5)% (2.6)% (5.3)%

15 MARINE MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 12% • Primarily served by Colfax Fluid Handling • Sales increase driven largely by continued strength in vessels serving the offshore oil & gas industry • $4 million of CM-1000 orders in Q4 2013 SALES SPLIT 2013 ORDERS SPLIT 11% HIGHLIGHTS Note: Marine market comprised of commercial marine and government, or defense, customers Q4 2013 vs. Q4 2012 YTD 2013 vs. YTD 2012 Total Organic Total Organic Sales 2.1 % (0.5) % 7.0 % 3.9 % Orders 41.1% 38.0% 11.2 % 8.4 %

16 MINING MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 5% • Primarily served by Howden • Driven by demand of mined resources, including: coal, iron ore, copper, gold, nickel and potash • Significant decline in orders driven by decreased industry capital expenditures 2013 SALES SPLIT 2013 ORDERS SPLIT 5% HIGHLIGHTS Q4 2013 vs. Q4 2012 YTD 2013 vs. YTD 2012 Total Organic Total Organic Sales 6.1 % 9.6 % (36.1)% (34.1)% Orders (56.0)% (60.3)% (39.6)% (37.1)%

17 GENERAL INDUSTRIAL & OTHER MARKET PERSPECTIVE SALES & ORDERS GROWTH (DECLINE) 23% • Includes both Howden and Colfax Fluid Handling • Quarterly comparisons can be quite volatile due to the lumpiness of large orders • Environmental upgrades, particularly in China, offering significant opportunity 2013 SALES SPLIT 2013 ORDERS SPLIT 23% HIGHLIGHTS Q4 2013 vs. Q4 2012 YTD 2013 vs. YTD 2012 Total Organic Total Organic Sales 21.3 % 6.7 % 10.3 % 2.7 % Orders 7.0 % (6.6)% 2.8 % (5.8)%

FABRICATION TECHNOLOGY

19 FABRICATION TECHNOLOGY Q4 2013 HIGHLIGHTS • Net sales of $520.6 million compared to net sales of $513.0 million in Q4 2012, an increase of 1.5% (an organic increase of 2.5%) • Adjusted segment operating income of $58.2 million and adjusted segment operating income margin of 11.2%

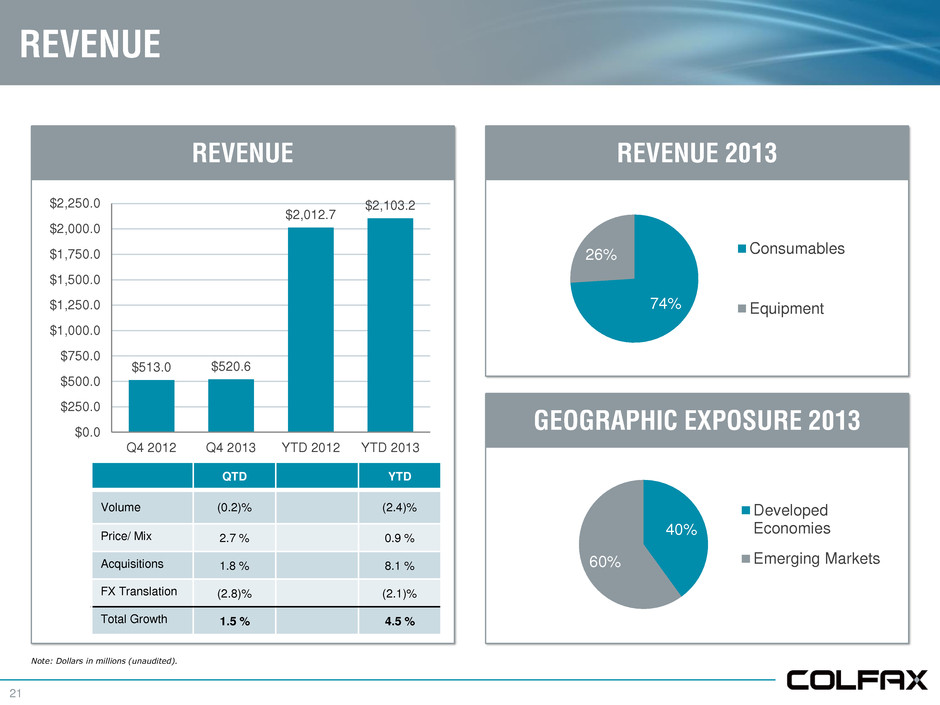

20 FABRICATION TECHNOLOGY FULL YEAR 2013 HIGHLIGHTS • Net sales of $2.1 billion compared to net sales of $2.0 billion in 2012, an increase of 4.5% (an organic decline of 1.5%) • Adjusted segment operating income of $219.6 million and adjusted segment operating income margin of 10.4% – Improvement of 260 basis points over 2012

21 GEOGRAPHIC EXPOSURE 2013 REVENUE $513.0 $520.6 $2,012.7 $2,103.2 $0.0 $250.0 $500.0 $750.0 $1,000.0 $1,250.0 $1,500.0 $1,750.0 $2,000.0 $2,250.0 Q4 2012 Q4 2013 YTD 2012 YTD 2013 74% 26% Consumables Equipment REVENUE REVENUE 2013 40% 60% Developed Economies Emerging Markets Note: Dollars in millions (unaudited). QTD YTD Volume (0.2)% (2.4)% Price/ Mix 2.7 % 0.9 % Acquisitions 1.8 % 8.1 % FX Translation (2.8)% (2.1)% Total Growth 1.5 % 4.5 %

RESULTS OF OPERATIONS

23 INCOME STATEMENT SUMMARY (unaudited) Refer to Appendix for Non-GAAP reconciliation and footnotes. Note: Dollars in millions, except per share amounts. December 31, 2013 December 31, 2012 December 31, 2013 December 31, 2012 Net sales 1,171.4$ 1,027.4$ 4,207.2$ 3,913.9$ Gross profit 357.4$ 307.6$ 1,306.2$ 1,152.1$ % of sales 30.5 % 29.9 % 31.0 % 29.4 % SG&A expense 219.2$ 234.3$ 861.0$ 895.5$ % of sales 18.7 % 22.8 % 20.5 % 22.9 % Adjusted operating income 124.4$ 88.9$ 431.4$ 334.9$ % of sales 10.6 % 8.7 % 10.3 % 8.6 % Adjusted net income 70.1$ 50.5$ 229.8$ 159.8$ % of sales 6.0 % 4.9 % 5.5 % 4.1 % Adjusted net income per share 0.61$ 0.42$ 2.04$ 1.34$ Three Months Ended Year Ended

APPENDIX

25 DISCLAIMER Colfax has provided financial information that has not been prepared in accordance with GAAP. These non-GAAP financial measures are adjusted net income, adjusted net income per share, projected adjusted net income per share, adjusted operating income, organic sales growth (decline) and organic order growth (decline). Adjusted net income, adjusted net income per share, projected adjusted net income per share and adjusted operating income exclude asbestos coverage litigation expense, expenses related to major restructuring programs and expenses, significant year-one fair value adjustment amortization expense related to the Charter acquisition, write-off of certain deferred financing fees and original issue discount associated with the refinancing of Colfax’s credit agreement and gain recorded on acquisition of remaining ownership interest of Sicelub, a less than wholly owned subsidiary, in which Colfax did not hold a controlling interest, to the extent they impact the periods presented. The effective tax rates used to calculate adjusted net income and adjusted net income per share are 27.6% and 26.6% for the fourth quarter and full year ended December 31, 2013, respectively, and 15% and 25% for fourth quarter and full year ended December 31, 2012. Organic sales growth (decline) and organic order growth (decline) exclude the impact of acquisitions and foreign exchange rate fluctuations. These non-GAAP financial measures assist Colfax in comparing its operating performance on a consistent basis because, among other things, they remove the impact of asbestos insurance coverage issues and expenses, expenses and year-one fair value adjustment amortization expense related to the Charter acquisition and major restructuring programs. Sales and order information by end market are estimates. We periodically update our customer groupings order to refine these estimates.

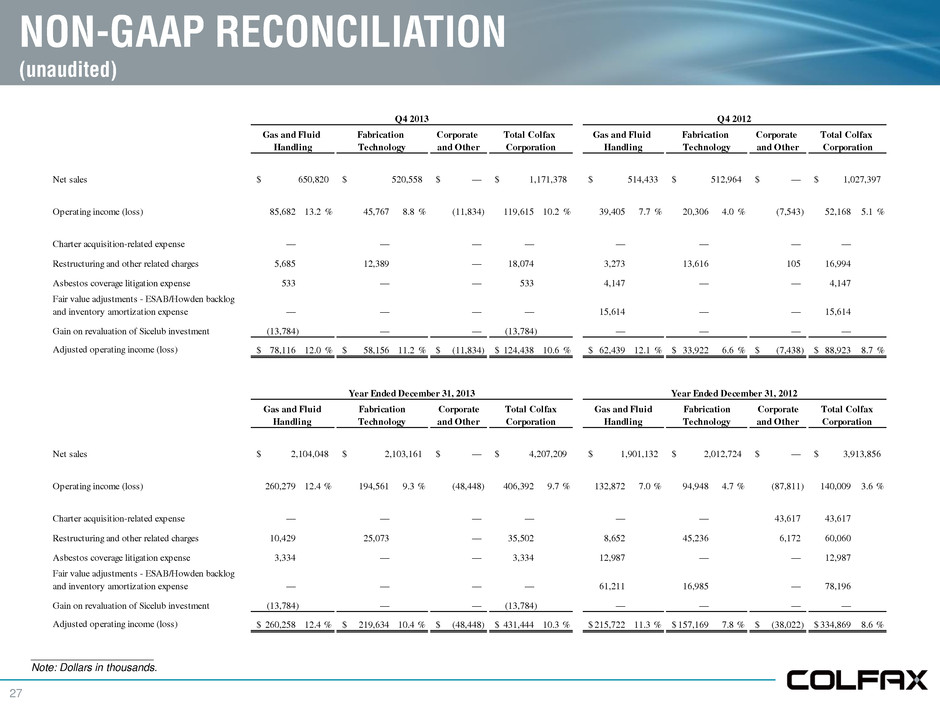

26 NON-GAAP RECONCILIATION (unaudited) (1) The effective tax rates used to calculate adjusted net income and adjusted net income per share are 27.6% and 26.6% for the fourth quarter and full year ended December 31, 2013, respectively, and 15.0% and 25.0% for the fourth quarter and full year ended December 31, 2012. (2) Adjusted net income per share for periods prior to April 23, 2013 were calculated consistently with the two-class method in accordance with GAAP as the Series A preferred stock were considered participating securities. Subsequent to April 23, 2013, adjusted net income per share was calculated consistently with the if- converted method in accordance with GAAP as the Series A preferred stock were no longer participating securities. Adjusted net income per share for the full year ended December 31, 2013 excludes the impact of 12,173,291 common stock equivalent shares as their inclusion would be anti-dilutive. _____________________ Note: Dollars in thousands, except per share amounts. December 31, 2013 December 31, 2012 December 31, 2013 December 31, 2012 Adjusted Net Income and Adjusted Net Income Per Share Net income (loss) attributable to Colfax Corporation 37,126 19,736$ 178,628$ (64,402)$ Restructuring and other related charges 18,074 16,994 35,502 60,060 Charter acquisition-related expense — — — 43,617 Fair value adjustments - ESAB/Howden backlog and inventory amortization expense — 15,614 — 78,196 Asbestos coverage litigation expense 533 4,147 3,334 12,987 Gain on revaluation of Sicelub investment (13,784) — (13,784) — Debt extinguishment charges- Refinancing of credit agreement 26,860 — 26,860 — Tax adjustment(1) 1,309 (6,022) (759) 29,297 Adjusted net income 70,118 50,469 229,781 159,755 Adjusted net income margin 6.0 % 4.9 % 5.5 % 4.1 % Dividends on preferred stock 5,142 5,072 20,396 18,951 Adjusted net income available to Colfax Corporation common shareholders 64,976 45,397 209,385 140,804 Less: adjusted net income attributable to participating securities (2) — 5,831 4,571 18,087 64,976$ 39,566$ 204,814$ 122,717$ Weighted-average shares outstanding - diluted 115,634,088 94,978,755 100,366,455 91,918,513 Adjusted net income per share 0.61$ 0.42$ 2.04$ 1.34$ Net income (loss) per share— diluted (in accordance with GAAP) 0.31$ 0.13$ 1.54$ (0.92)$ Three Months Ended Year Ended

27 NON-GAAP RECONCILIATION (unaudited) _____________________ Note: Dollars in thousands. Corporate and Other Corporate and Other Net sales —$ —$ Operating income (loss) 85,682 13.2 % 45,767 8.8 % (11,834) 119,615 10.2 % 39,405 7.7 % 20,306 4.0 % (7,543) 52,168 5.1 % Charter acquisition-related expense — — — — — — — — Restructuring and other related charges 5,685 12,389 — 18,074 3,273 13,616 105 16,994 Asbestos coverage litigation expense 533 — — 533 4,147 — — 4,147 Fair value adjustments - ESAB/Howden backlog and inventory amortization expense — — — — 15,614 — — 15,614 Gain on revaluation of Sicelub investment (13,784) — — (13,784) — — — — Adjusted operating income (loss) 78,116$ 12.0 % 58,156$ 11.2 % (11,834)$ 124,438$ 10.6 % 62,439$ 12.1 % 33,922$ 6.6 % (7,438)$ 88,923$ 8.7 % Gas and Fluid Handling Fabrication Technology Total Colfax Corporation 650,820$ 520,558$ 1,171,378$ 514,433$ 512,964$ 1,027,397$ Q4 2013 Q4 2012 Gas and Fluid Handling Fabrication Technology Total Colfax Corporation Corporate and Other Corporate and Other Net sales $ $ Opera ing income ( oss) 260,279 12.4 % 194,561 9.3 % (48,448) 406,392 9.7 % 132,872 7.0 % 94,948 4.7 % (87,811) 140,009 3.6 % Charter acquisition-related expense — 43,617 43,617 Restructuring and other related charges 10,429 25,073 35,502 8,652 45,236 6,172 60,060 Asbestos coverage litigation expense 3,334 — — 3,334 12,987 — — 12,987 Fair value adjustments - ESAB/Howden backlog and inventory amortization expense — — — — 61,211 16,985 — 78,196 Gain on revaluation of Sicelub investment (13,784) — — (13,784) — — — — Adjusted operating income (loss) 260,258$ 12.4 % 219,634$ 10.4 % (48,448)$ 431,444$ 10.3 % 215,722$ 11.3 % 157,169$ 7.8 % (38,022)$ 334,869$ 8.6 % 2,103,161$ 4,207,209$ 1,901,132$ 2,012,724$ 3,913,856$ Year Ended December 31, 2013 Year Ended December 31, 2012 Gas and Fluid Handling Fabrication Technology Total Colfax Corporation Gas and Fluid Handling Fabrication Technology Total Colfax Corporation 2,104,048$

28 SALES & ORDERS GROWTH (unaudited) _____________________ Note: Dollars in millions. (1) Represents the incremental sales and orders as a result of our acquisitions of Charter, Soldex, Co-Vent, Clarus, CKD Kompressory, Flakt Woods, TLT-Babcock, Alphair, and Sicelub. The full year impact related to the Charter Acquisition represents 12 days of activity for ESAB and Howden as the acquisition closed on January 13, 2012. Represents the incremental order backlog as a result of our acquisitions of Clarus, CKD Kompressory, Flakt Woods, TLT-Babcock, Alphair, and Sicelub. $ % $ % For the three months ended December 31, 2012 1,027.4$ 520.3$ Components of Change: Existing Businesses 105.1 10.2 % (12.8) (2.5)% Acquisitions (1) 66.7 6.5 % 50.2 9.6 % Foreign Currency Translation (27.8) (2.7)% (9.9) (1.8)% Total 144.0 14.0 % 27.5 5.3 % For the three months ended December 31, 2013 1,171.4$ 547.8$ $ % $ % $ % As of and for the year ended December 31, 2012 3,913.9$ 1,996.0$ 1,431.5$ Components of Change: Existing Businesses 107.5 2.7 % (15.3) (0.8)% (58.6) (4.1)% Acquisitions (1) 246.9 6.3 % 96.4 4.8 % 231.2 16.2 % Foreign Currency Translation (61.1) (1.5)% (15.7) (0.7)% (26.7) (1.9)% Total 293.3 7.5 % 65.4 3.3 % 145.9 10.2 % As of and for the year ended December 31, 2013 4,207.2$ 2,061.4$ 1,577.4$ Backlog at Period End Net Sales Orders Net Sales Orders

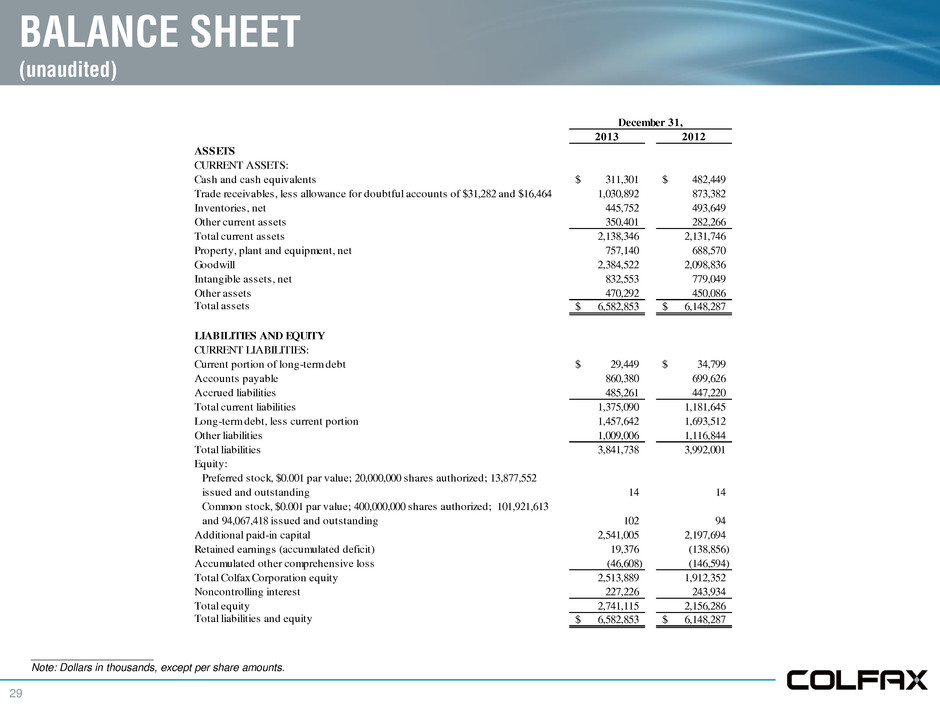

29 BALANCE SHEET (unaudited) _____________________ Note: Dollars in thousands, except per share amounts. 2013 2012 ASSETS CURRENT ASSETS: Cash and cash equivalents 311,301$ 482,449$ Trade receivables, less allowance for doubtful accounts of $31,282 and $16,464 1,030,892 873,382 Inventories, net 445,752 493,649 Other current assets 350,401 282,266 Total current assets 2,138,346 2,131,746 Property, plant and equipment, net 757,140 688,570 Goodwill 2,384,522 2,098,836 Intangible assets, net 832,553 779,049 Other assets 470,292 450,086 Total assets 6,582,853$ 6,148,287$ LIABILITIES AND EQUITY CURRENT LIABILITIES: Current portion of long-term debt 29,449$ 34,799$ Accounts payable 860,380 699,626 Accrued liabilities 485,261 447,220 Total current liabilities 1,375,090 1,181,645 Long-term debt, less current portion 1,457,642 1,693,512 Other liabilities 1,009,006 1,116,844 Total liabilities 3,841,738 3,992,001 Equity: Preferred stock, $0.001 par value; 20,000,000 shares authorized; 13,877,552 issued and outstanding 14 14 Common stock, $0.001 par value; 400,000,000 shares authorized; 101,921,613 and 94,067,418 issued and outstanding 102 94 Additional paid-in capital 2,541,005 2,197,694 Retained earnings (accumulated deficit) 19,376 (138,856) Accumulated other comprehensive loss (46,608) (146,594) Total Colfax Corporation equity 2,513,889 1,912,352 Noncontrolling interest 227,226 243,934 Total equity 2,741,115 2,156,286 Total liabilities and equity 6,582,853$ 6,148,287$ December 31,

30 STATEMENT OF CASH FLOWS (unaudited) _____________________ Note: Dollars in thousands. 2013 2012 2011 Cash flows from operating activities: Net income (loss) 209,143$ (42,264)$ 4,555$ Adjustments to reconcile net income (loss) to net cash provided by operating activities: Depreciation, amortization and fixed asset impairment charges 119,258 183,403 22,598 Stock-based compensation expense 13,334 9,373 4,908 Non-cash interest expense 44,377 16,997 735 Gain on revaluation of Sicelub investment (13,784) — — Unrealized loss on acquisition-related foreign currency derivative — — 21,146 Deferred income tax provision (benefit) 9,946 7,222 (1,722) Changes in operating assets and liabilities, net of acquisitions: Trade receivables, net (98,912) (37,338) (5,972) Inventories, net 79,987 26,694 10,844 Accounts payable 128,889 88,927 (7,298) Changes in other operating assets and liabilities (130,069) (78,994) 7,359 Net cash provided by operating activities 362,169 174,020 57,153 Cash flows from investing activities: Purchases of fixed assets, net (71,482) (83,187) (13,624) Acquisitions, net of cash received (372,476) (1,859,645) (56,346) Loans to non-trade creditors (31,012) — — Other, net — 1,857 — Net cash used in investing activities (474,970) (1,940,975) (69,970) Cash flows from financing activities: Borrowings under term credit facility 50,861 1,731,523 — Payments under term credit facility (679,755) (531,415) (10,000) Proceeds from borrowings on revolving credit facilities 648,000 13,149 141,203 Repayments of borrowings on revolving credit facilities (328,133) (53,414) (102,180) Proceeds from issuance of common stock, net 324,153 756,762 3,719 Proceeds from issuance of preferred stock, net — 332,969 — Acquisition of shares held by noncontrolling interest (14,913) (29,292) — Payments of dividend on preferred stock (20,396) (17,446) — Other (24,870) (19,608) — Net cash (used in) provided by financing activities (45,053) 2,183,228 32,742 Effect of foreign exchange rates on Cash and cash equivalents (13,294) (8,932) (5,359) (Decrease) increase in Cash and cash equivalents (171,148) 407,341 14,566 Cash and cash equivalents, beginning of period 482,449 75,108 60,542 Cash and cash equivalents, end of period 311,301$ 482,449$ 75,108$ Supplemental Disclosure of Cash Flow Information: Interest payments 58,970 79,857 5,209 Income tax payments, net 93,856 70,677 16,731 Year Ended December 31,