Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - PLEDGE PETROLEUM CORP | v366951_8k.htm |

February 2014

Some statements contained in this presentation are “ forward looking statements ” . All statements other than statements of historical facts included in this report, including without limitation, statements regarding planned capital expenditures, the availability of capital resources to fund capital expenditures, estimates of proved reserves, our financial position, business strategy and other plans and objectives for future operations, are forward looking statements . You can identify the use of forward looking statements by the use of forward looking terminology like “ may, ” “ will, ” “ expect, ” “ intend, ” “ forecast, ” “ anticipate, ” “ estimate, ” “ continue, ” “ present value, ” “ future, ” or “ reserves, ” or other variations of comparable terminology . We believe the assumptions and expectations reflected in these forward looking statements are reasonable . However, we can ’ t give any assurance that our expectations will prove to be correct or that we will be able to take any actions that are presently planned . All of these statements involve assumptions of future events and risks and uncertainties . Risks and uncertainties associated with forward looking statements include, but are not limited to : fluctuations in prices of oil and gas ; future capital requirements and availability of financing ; risks associated with the drilling or treating of wells ; competition ; general economic conditions ; governmental regulation ; potential defaults in the payment of amounts owed to us by purchasers of our treatment and initial treatment results may not be indicative of future results . For these and other reasons, actual results may differ materially form those projected or implied . We caution you against undue reliance on forward looking statements or projecting any future results based on such statements . FORWARD LOOKING STATEMENTS

Propell Technologies Group Inc. Listed on the OTC Markets - Symbol : PROP Novas Energy USA A wholly owned subsidiary of Propell. Exclusive Licensee of the Plasma Pulse Technology for the U.S. Novas Energy Invented the Plasma Pulse Technology in 2002 with further financial grant from the Skolkovo Foundation -- allied with Microsoft, General Electric, Intel, Nokia, Bessemer Trust Company & Siemens. ORGANIZATION CHART

CORPORATE INFORMATION □ Propell Technologies Group Inc . , fully reporting Delaware Corporation □ Auditor/Accountant – Liggett, Vogt & Webb P . A . , New York □ Legal Counsel – Gracin & Marlow LLP, New York □ Transfer Agent – Nevada Agency and Transfer Company – Reno, NV □ 1200 + shareholders

MANAGEMENT JOHN W. HUEMOELLER II: CEO • 30 years experience in investment banking, finance, sales and marketing. Worked for Smith Barney, Prudential, Drexel Burnham and Paine Webber - experience in stocks, bonds, commodities, mergers and acquisitions, leveraged buyouts and private placements. • CEO Joshua Tree Capital a Consultant to Small Cap Energy Companies. • Served as Chairman and CEO of HumWare Media Corp, a public software technology company. Co - author of U.S. Patent #5,855,005. JOHN ZOTOS: SECRETARY AND DIRECTOR • 27 years of business experience in Commercial and Residential Real Estate developmental and management in the Houston area including Construction and Finance • Initial education as a Geologist at SMU • Worked in the Yates Field for Rotary Lab of Midland Texas collecting Core Samples and worked as a roughneck for C & J Drilling Company in Sterling County Texas DAVID SHROFF: ENGINEERING CONSULTANT • Oil fluids engineer , 6 patents and 8 patents pending related to produced water treatment • 40 years experience running his own exploration and production company Excalibur • Founder of Universal Environmental Technologies, Inc., successfully remediated soils at the Miami Airport, Naval Air Base, and UST facilities in TX, FL, LA, OK, Neb., & Kansas • President & Chairman of Penn Pacific , Tulsa, Oklahoma, a Public E & P Company ALEX ADELMAN CONSULTANT • 20+ Years of Successful Executive Management and Business Development Experience • Weatherford International, Strategic Business Development Manager, AAT Global Business Unit Played an integral part in technology enhancement efforts & new product development. • President Russlink Energy Corp • Superior Oil Company (acquired by Exxon - Mobil) – Exploration Geophysicist

DISTINGUISHED BOARD OF DIRECTORS JIM FULLER: INDEPENDENT DIRECTOR • 3 decades of financial services experience serving, in key roles in major financial, educational and regulatory organizations, • In 1981, he was named by President Ronald Reagan to serve on the Board of Directors of the Securities Investor Protection Corporation (SIPC) until 1987 • Senior Vice President New York Stock Exchange (NYSE) from 1976 to 1981, responsible for corporate development, marketing, listing regulation oversight, research and public affairs. DAN STEFFENS: INDEPENDENT DIRECTOR • 30 years in the oil and gas industry and Founder of the Energy Prospectus Group, the publisher of a monthly newsletter the tracks 80 public oil and gas companies • Controller at Hess Oil (NYSE; HES) E & P Division in Houston • CFO of Oklahoma Petroleum Management in Tulsa, OK, Inc. • Graduate of Tulsa University, degree in Accounting, Masters in Taxation and a Licensed CPA MARK KALOW: INDEPEN DENT DIRECTOR • Managing Director at Soquel Group, a consulting firm specializing in Intellectual Property and Business Development • Serves on the Board of Directors of LSF Network, Reischling Press, Inc., and Pure Depth, Inc. • Served as a Managing Director for the Venture Capital Division of Trans Cosmos USA • Bachelor of Science degree in Management from the Massachusetts Institute of Technology and a Masters in Business Administration with a concentration in financial management from the University of Chicago. Attended Director's College at Stanford Law School.

Opportunity □ Our down - hole tool and treatment has shown to increase oil production in over 200 wells throughout Russia and in the U.S. □ U.S. market is the World ’ s largest opportunity Objective □ Build reoccurring revenue with strong positive cash flow □ Position the Company as an acquisition candidate OPPORTUNITY & OBJECTIVE

HISTORY Novas – Russia □ 9 Patents issued in Russia □ $7 million invested developing technology □ Proven in over 150 wells in Russia , China, Eastern Europe □ Clients include Conoco Phillips, Lukoil, Rosneft □ Data supplied by Novas Russia Novas Energy USA □ Exclusive U.S. licensee – February 2013 □ Patent pending in U.S. □ Completed 27 treatments in Kansas, Louisiana, Oklahoma, Texas & Wyoming □ Re - engineering the tool for manufacturing in the U.S.

PLASMA PULSE TECHNOLOGY □ Plasma is the 4 th State of Matter □ Solid, Liquid, Gas & Plasma □ 18 various types of Plasma (Hot Plasma, Cold Plasma) □ Sun, Lightning, Neon lights

- 9 feet - 200 pounds - Connection to wire line Surface Controller Plasma Pulse Streamer discharges plasma at the perforation zone Energy Produced = 1.5 KJ Voltage - 220 V / 50 Hz Input Power = 500 watts TECHNOLOGY OVERVIEW Tool is lowered to the well’s perforation zone using a wire - line truck

TECHNOLOGY OVERVIEW A “Controlled” Plasma Arc creates a tremendous amount of heat for a fraction of a second and the subsequent pressure wave removes any clogged sedimentation from the perforation zone The series of waves or vibrations created penetrate deep into the reservoir causing the resonance frequency it oscillate with greater amplitude The expected end result is an increase in permeability, lowering of viscosity and increased production which can last for as long as a year

Density redistribution water oil gas cap • Changes in structure of porosity • Oil - water replacement Productive oil deposits are non - liner, non - equilibrium systems • Elasticity • Layers frequency • Porosity, permeability • Gas - oil - water liquid • Gravitation and push liquid flowing forces • All kinds of natural oscillatory processes 1 - drop of oil ; 2 - gravitation forces; 3 - bubbles of gas. Cavitations and flotation PARAMETRICAL RESONANCE

Perforated channels are closed by sedimentation TECHNOLOGY OVERVIEW Oil viscosity variation (laboratory research) 19 Rotary viscosity machine Rheotest RN 4.1 (Messgerate medingen GmbH) Rheology research of the oil of top carbon deposit of Republic of Tatarstan (dynamic viscosity in the formation > 40 mPa*s) before PP after PP shear velocity, 1/s E f f e c t i v e v i s c o s i t y , m P a * s □ Proven to Lower Viscosity □ Lowering Viscosity Allows the Oil to Flow Easier

Perforated channels are closed by sedimentation Formation of plasma accompanied by a compression wave Wave penetrates the drainage area and deep into the reservoir Sedimentation gone, pressure forces oil to flow again Before After NUMERAL MODULATION OF ELASTIC WAVE )( )( RL FPVI m K V V (FPVI) - flowing pressure velocity index k - permeability m - porosity μ - viscosity β L - liquid compressibility index β R - rocks compressibility index Treatment is repeated numerous times every 12 - 18 ” in the perforation zone of the well depending upon the geophysical characteristics including:

U.S. FIELD PICTURES

Plasma Emission Omni - Directional

TECHNOLOGY OVERVIEW Each well receives a unique treatment plan based on historical data including :

Candidate Well Requirements • No behind - the - casing flow • Well bore inclination (zenith angle) does not exceed 50 ° • Reservoir temperature is less than 204 ° F • Porosity is no more than 30% • Permeability is at least 2 – 4 mD • Reservoir pressure is below 500 atm • Presence of a drilling sump • The number of perforation holes is ≥ 10 per yard • The reservoir pressure is greater than the saturation pressure. Candidate Well Characteristics That Affect Treatment Efficiency Characteristics Key Performance Indicator Wellwork performed Reservoir hydraulic fracturing was carried out within the last 5 years Well performance history • Production declined by ≥ 30% following hydraulic fracturing • Water cut is ≤ 9 5 % Well log interpretation results Well log data collection (influx profile and intake capacity) Partial map of field development with both accumulated and current production Production and injection ratio TECHNOLOGY OVERVIEW

• Fast – treatment usually done in a matter of hours – Well goes back into production immediately • Safe - in treating over 200 Wells across three Continents there has never been damage to a well or a field incident • May increase surrounding field production up to 1 mile in distance compared to the well being treated • Can Increase Recoverable Reserves CHARACTERISTICS OF TREATMENT

ENVIRONMENTALLY FRIENDLY Plasma - Pulse Treatment Applied to Wells Via Down - hole Equipment Operations Conducted by Digital Controller on Surface Environmentally “Clean Using No Chemicals and No Waste Uses Moderate Power Source Uses Densities and Velocities That Will Not Damage the Well

□ Since 1950, 2.6 million wells have been drilled in the U.S. □ There are approximately 1,000,000 producing oil and gas wells in the United States □ 45,000+ new wells expected to be drilled in the U.S. in each of the next 5 years □ 70% oil wells □ Data Source World Oil 2013 Oil & Gas Forecast U.S. MARKET OPPORTUNITY

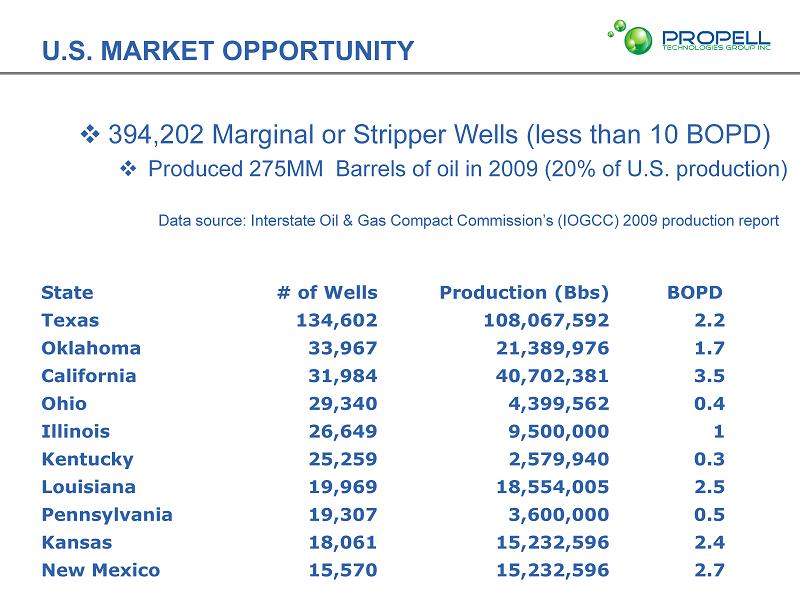

□ 394,202 Marginal or Stripper Wells (less than 10 BOPD) □ Produced 275MM Barrels of oil in 2009 (20% of U.S. production) Data source: Interstate Oil & Gas Compact Commission ’ s (IOGCC) 2009 production report State # of Wells Production (Bbs) BOPD Texas 134,602 108,067,592 2.2 Oklahoma 33,967 21,389,976 1.7 California 31,984 40,702,381 3.5 Ohio 29,340 4,399,562 0.4 Illinois 26,649 9,500,000 1 Kentucky 25,259 2,579,940 0.3 Louisiana 19,969 18,554,005 2.5 Pennsylvania 19,307 3,600,000 0.5 Kansas 18,061 15,232,596 2.4 New Mexico 15,570 15,232,596 2.7 U.S. MARKET OPPORTUNITY

U.S. INITIAL WELL RESULTS Average from 27 oil wells shows a 295 % increase in iniitial production after treatment . Before After Initial Increase % & Notes Oil Well BOPD BOPD Shreveport, LA - Limestone 1 2 100% - production held for 5 - 6 months Shreveport, LA - Limestone ½ 1 100% - production held for 5 - 6 months Kay, CO OK, Sandstone ¼ ½ 100% - production held for 3 months well problems Kay Co, OK, Limestone 5 - 6 12.75 155% - increased to 18 for few months now 10 - 12 Creek, CO, OK, Sandstone* 1 ½ 5.5 266% - production has held steady for 10 months Creek, CO, OK, Sandstone* 1 ½ 5.5 266% - production has held steady for 10 months Creek, CO, OK, Sandstone* 1 ½ 3.5 133% - held for 3 months – pump problem – well off Haysville, KS, Limestone 2.43 4.8 100% - production held for 6 months Haysville, KS, Limestone ¾ 1.7 107% - production held for 6 months Kay CO, OK, Limestone 19 19 0% - only 1 perforation every 2 feet *In addition to increasing production on treated wells we have increased production on nearby wells as far away as 1 mile

U.S. INITIAL WELL RESULTS Before After Initial Increase % & Notes Oil Well BOPD BOPD Creek, CO, OK, Sandstone 0 57 5700% - dropped to 15 in a month - plugged up Kay CO, OK - Sandstone 3/4 1.6 122% - production held for 3 - 4 months Casper, WY, Sandstone 5 22 340% - production fell 2 days later – paraffin clog Casper, WY, Sandstone 1 8 700% - production fell - well problems - on & off – Creek, CO, OK, Sandstone 0 44 4400% - dropped to 10 in a month - plugged up Safford, CO, KS - Limestone 2 40 1900% - dropped to 12 in month – needs bigger pump Kay CO, OK - Sandstone 3/4 3/4 0% - could not finish well full of sand - garbage Haysville, KS, Limestone ¾ 1.7 107% - only treated 1 foot - dropped to .78 next day

U.S. INITIAL WELL RESULTS Before After Initial Increase % & Notes Oil Well BOPD BOPD Creek, CO, OK, Sandstone 1 20 1900% - production sporadic – took month to put on Shackelford, TX, Sandstone 1.5 1.5 0% - weather problems – looked good initially Shackelford, TX, Sandstone 1.5 1.5 0% - weather problems – looked good initially Scurry, CO, TX, Sandstone 1.5 1.5 0% - no bottom hole pressure Scurry, CO, TX, Sandstone 1 ½ 1.5 0% - no bottom hole pressure Scurry, CO, TX, Sandstone 1 ½ 1.5 0% - no bottom hole pressure Scurry, CO, TX, Sandstone 1 ½ 1.5 0% - no bottom hole pressure Scurry, CO, TX, Sandstone Injector Increased amount of fluid Taylor CO, TX limestone 12 12 New well test with frack, no improvement Kay CO, OK, Limestone 5 5 New well test without frack – no improvement Average from 27 wells shows a 88 % increase in production after 60 days .

□ Over 144,000 injection wells in the U.S. □ Enhanced recovery wells (water floods) account for 80% □ Texas □ 52,016 Injector Wells □ Oklahoma □ 10,629 Injector Wells □ Kansas □ 16,658 Injector Wells Data Source: EPA U.S. INJECTION WELL MARKET

INJECTOR WELL RESULTS (RUSSIA) The table below sets forth the ownership of the issued and outstanding Common Stock and Fully Diluted Shares of Propel Technology Group Inc as of February 1 , 2013 . Propel has 250 million Shares of Common Stock authorized, and 50 million Shares of Preferred Stock . Average from 36 injector wells that we have data on shows a 545 % increase in the amount of fluid that was injected after treatment . Oil Field Bbls/Day Before Bbls/Day After Increase % Increase Lomovoe 119 728 609 511 Poludennoe 314 942 628 200 Sutorminskoe 157 1080 923 588 Sutorminskoe 63 345 282 450 Tajlakovskoe 31 376 345 1100 Arlanskoe 31 138 107 340 Turchaninovskoe 125 546 421 335 Muravlenkovskoe 1727 4396 2669 155 □ Treatment knocks sedimentation away from the wellbore perforation zone, opens the reservoir so that more fluid can be injected which results in increased oil production

□ Joint Venture with Well Owners & Operators □ We pay for the service □ $10,000 (pulling rig, wire - line truck, etc.) □ In Exchange for 49% of the increase in production after royalties and operating expenses □ We may Acquire Oil Fields After We Have Proven Results □ We keep 100% of the increase in production after expenses □ We may License Service Companies □ Charge a fixed fee for use □ After we have mass manufacturing of the tool in U.S. REOCCURRING REVENUE BUSINESS MODELS

□ Positioning the Company as a potential future acquisition candidate, as both: □ A service technology company □ An oil production company □ Service Technology Acquisitions □ Halliburton acquired Gearhart Industries for $277 MM in 1988 (Wireline tool company - today would be $ billions) □ Devon Energy bought Mitchell Energy in 2002 for $3.5 billion (Pioneered horizontal drilling) □ Apax Partners acquired Paradigm $1 billion August 2012( geoscience software provider) □ Oil Production M & A activity has never been bigger than now □ $232 billion in E & P acquisitions in 2012 (Wood Mackenzie) ACQUISITION TARGET

□ Treatment shown to be effective to increase oil production □ Environmentally Friendly □ Enormous growing U.S. market □ Reoccurring Revenue Model Summary

John W. Huemoeller II Novas Energy USA Inc. 1701 Commerce Street Houston, TX Cell: (720) 933 - 5745 email: jh@novasenergyusa.com www.novasenergyusa.com www.propell.com CONTACT