Attached files

| file | filename |

|---|---|

| 8-K - 8-K - LRI HOLDINGS, INC. | lgns8-k01x24x14.htm |

EXECUTION VERSION 24047478v03 AMENDMENT NO. 3, dated as of January 24, 2014 (this “Amendment”), among LOGAN’S ROADHOUSE, INC., a Tennessee corporation (the “Borrower”), LRI HOLDINGS, INC., a Delaware corporation (“Holdings”), JPMORGAN CHASE BANK, N.A., as Administra- tive Agent, and the Required Lenders listed on the signature pages hereto, to the CREDIT AGREEMENT, dated as of October 4, 2010, as amended, supplemented, amended and restated or otherwise modified from time to time (the “Credit Agreement”) among the Borrower, Hold- ings, each lender from time to time party thereto (collectively, the “Lenders” and, individually, a “Lender”), JPMORGAN CHASE BANK, N.A., as Administrative Agent, and the other financial institutions party thereto. Capitalized terms used and not otherwise defined herein shall have the meanings assigned to them in the Credit Agreement. WHEREAS, Section 10.1 of the Credit Agreement permits the Credit Agreement to be amended from time to time with the written consent of the Required Lenders, the Adminis- trative Agent and each Loan Party party thereto; NOW, THEREFORE, in consideration of the premises and covenants contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows: Section 1. Amendments. As of the Amendment No. 3 Effective Date (as defined below), the Credit Agreement shall be amended as follows: (a) Section 1.1 of the Credit Agreement is hereby amended by adding the following definitions: “Consolidated First Lien Leverage Ratio”: as at the last day of any period, the ratio of (a) Consolidated Total First Lien Debt on such day to (b) Consolidated EBITDA for such period. “Consolidated Total First Lien Debt”: at any date (a) an amount equal to Consolidated Total Debt as of such date that is secured by Liens on the Collateral (other than (i) Liens securing the Senior Secured Notes, (ii) Liens that are junior or subordinated to the Liens on the Collateral securing the Obligations to the ex- tent the parties secured by such junior or subordinated Liens (or their representa- tive) have entered into an intercreditor agreement in form and substance reasona- bly satisfactory to the Administrative Agent providing that such Liens are junior or subordinated to the Liens on the Collateral securing the Obligations and (iii) Liens on Collateral consisting of property or assets held in defeasance or deposit- ed in trust for redemption, repayment, retirement, satisfaction, discharge or defea- sance or similar arrangement for the benefit of the indebtedness secured thereby in connection with a redemption, repayment, retirement, satisfaction, discharge or defeasance or similar arrangement permitted by this Agreement).

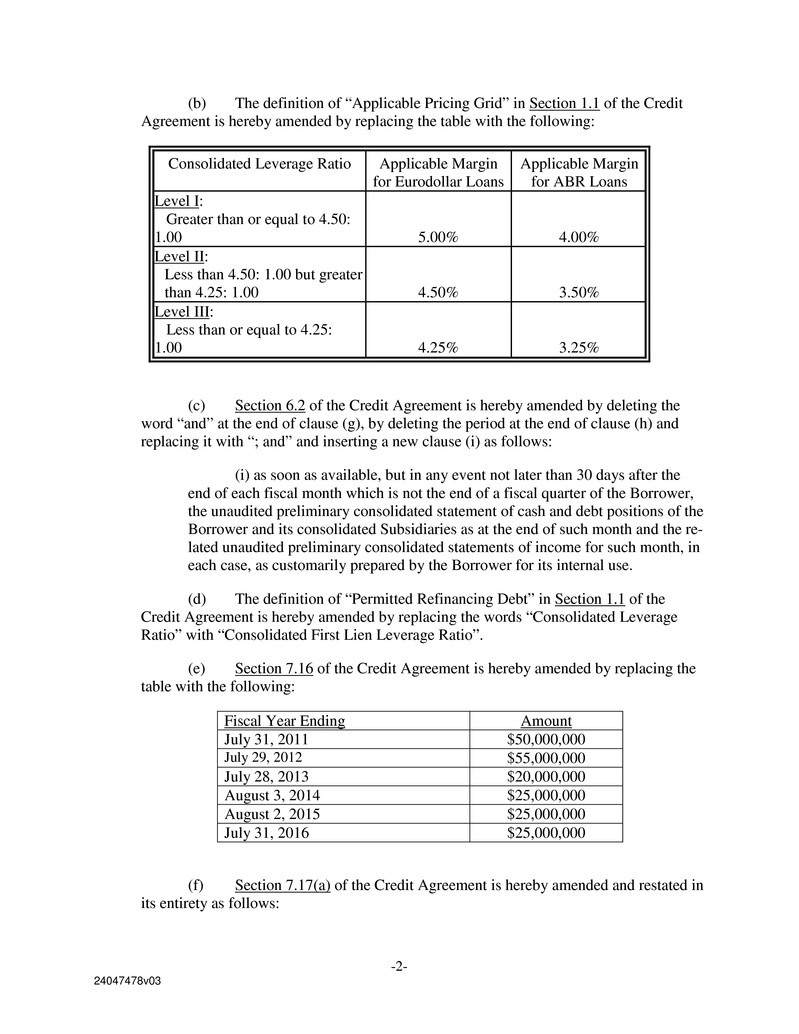

-2- 24047478v03 (b) The definition of “Applicable Pricing Grid” in Section 1.1 of the Credit Agreement is hereby amended by replacing the table with the following: Consolidated Leverage Ratio Applicable Margin for Eurodollar Loans Applicable Margin for ABR Loans Level I: Greater than or equal to 4.50: 1.00 5.00% 4.00% Level II: Less than 4.50: 1.00 but greater than 4.25: 1.00 4.50% 3.50% Level III: Less than or equal to 4.25: 1.00 4.25% 3.25% (c) Section 6.2 of the Credit Agreement is hereby amended by deleting the word “and” at the end of clause (g), by deleting the period at the end of clause (h) and replacing it with “; and” and inserting a new clause (i) as follows: (i) as soon as available, but in any event not later than 30 days after the end of each fiscal month which is not the end of a fiscal quarter of the Borrower, the unaudited preliminary consolidated statement of cash and debt positions of the Borrower and its consolidated Subsidiaries as at the end of such month and the re- lated unaudited preliminary consolidated statements of income for such month, in each case, as customarily prepared by the Borrower for its internal use. (d) The definition of “Permitted Refinancing Debt” in Section 1.1 of the Credit Agreement is hereby amended by replacing the words “Consolidated Leverage Ratio” with “Consolidated First Lien Leverage Ratio”. (e) Section 7.16 of the Credit Agreement is hereby amended by replacing the table with the following: Fiscal Year Ending Amount July 31, 2011 $50,000,000 July 29, 2012 $55,000,000 July 28, 2013 $20,000,000 August 3, 2014 $25,000,000 August 2, 2015 $25,000,000 July 31, 2016 $25,000,000 (f) Section 7.17(a) of the Credit Agreement is hereby amended and restated in its entirety as follows:

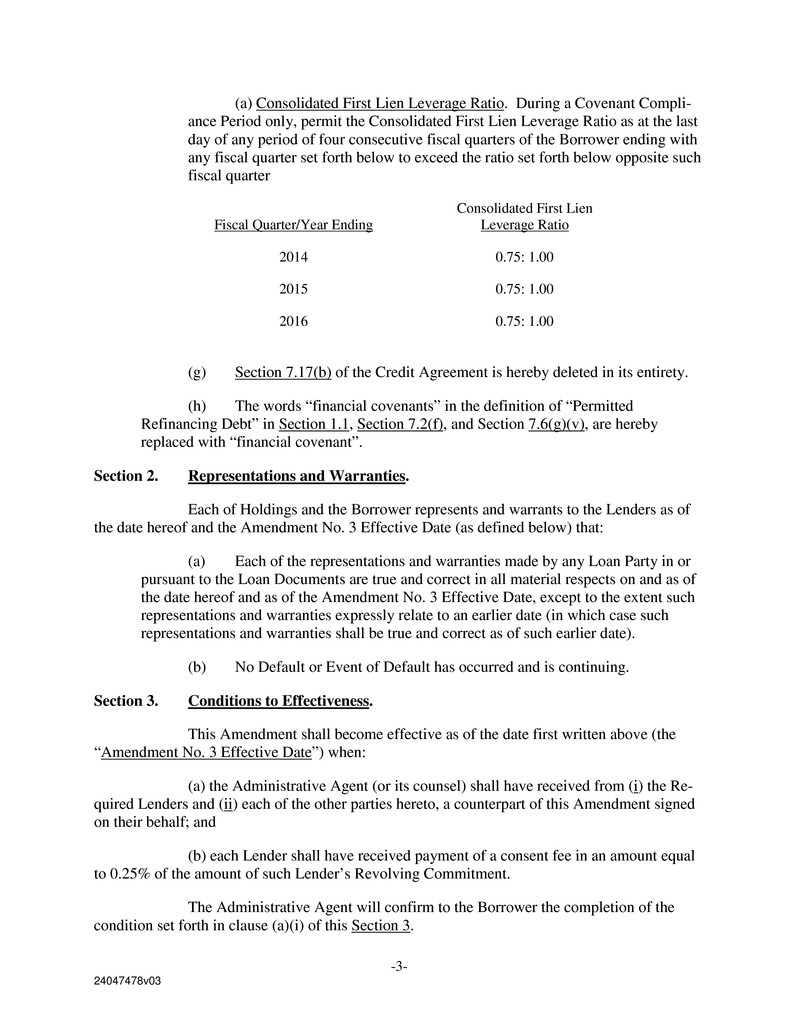

-3- 24047478v03 (a) Consolidated First Lien Leverage Ratio. During a Covenant Compli- ance Period only, permit the Consolidated First Lien Leverage Ratio as at the last day of any period of four consecutive fiscal quarters of the Borrower ending with any fiscal quarter set forth below to exceed the ratio set forth below opposite such fiscal quarter Fiscal Quarter/Year Ending Consolidated First Lien Leverage Ratio 2014 0.75: 1.00 2015 0.75: 1.00 2016 0.75: 1.00 (g) Section 7.17(b) of the Credit Agreement is hereby deleted in its entirety. (h) The words “financial covenants” in the definition of “Permitted Refinancing Debt” in Section 1.1, Section 7.2(f), and Section 7.6(g)(v), are hereby replaced with “financial covenant”. Section 2. Representations and Warranties. Each of Holdings and the Borrower represents and warrants to the Lenders as of the date hereof and the Amendment No. 3 Effective Date (as defined below) that: (a) Each of the representations and warranties made by any Loan Party in or pursuant to the Loan Documents are true and correct in all material respects on and as of the date hereof and as of the Amendment No. 3 Effective Date, except to the extent such representations and warranties expressly relate to an earlier date (in which case such representations and warranties shall be true and correct as of such earlier date). (b) No Default or Event of Default has occurred and is continuing. Section 3. Conditions to Effectiveness. This Amendment shall become effective as of the date first written above (the “Amendment No. 3 Effective Date”) when: (a) the Administrative Agent (or its counsel) shall have received from (i) the Re- quired Lenders and (ii) each of the other parties hereto, a counterpart of this Amendment signed on their behalf; and (b) each Lender shall have received payment of a consent fee in an amount equal to 0.25% of the amount of such Lender’s Revolving Commitment. The Administrative Agent will confirm to the Borrower the completion of the condition set forth in clause (a)(i) of this Section 3.

-4- 24047478v03 Section 4. Counterparts. This Amendment may be executed by one or more of the parties to this Amend- ment on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. Delivery of an executed signature page of this Amendment by email or facsimile transmission shall be effective as delivery of a manually executed counterpart hereof. A set of the copies of this Amendment signed by all the parties shall be lodged with the Borrower and the Administrative Agent. Section 5. Applicable Law. THIS AMENDMENT AND THE RIGHTS AND OBLIGATIONS OF THE PARTIES UNDER THIS AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED AND INTERPRETED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. Section 6. Effect of Amendment. Except as expressly set forth herein, this Amendment shall not by implication or otherwise limit, impair, constitute a waiver of or otherwise affect the rights and remedies of the Lenders or the Agents under the Credit Agreement or any other Loan Document, and shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Credit Agreement or any other provision of the Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall contin- ue in full force and effect. [Signature pages follow]