Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANK OF THE OZARKS INC | d665956d8k.htm |

| EX-99.1 - EX-99.1 - BANK OF THE OZARKS INC | d665956dex991.htm |

| EX-2.1 - EX-2.1 - BANK OF THE OZARKS INC | d665956dex21.htm |

| EX-2.2 - EX-2.2 - BANK OF THE OZARKS INC | d665956dex22.htm |

| EX-99.3 - EX-99.3 - BANK OF THE OZARKS INC | d665956dex993.htm |

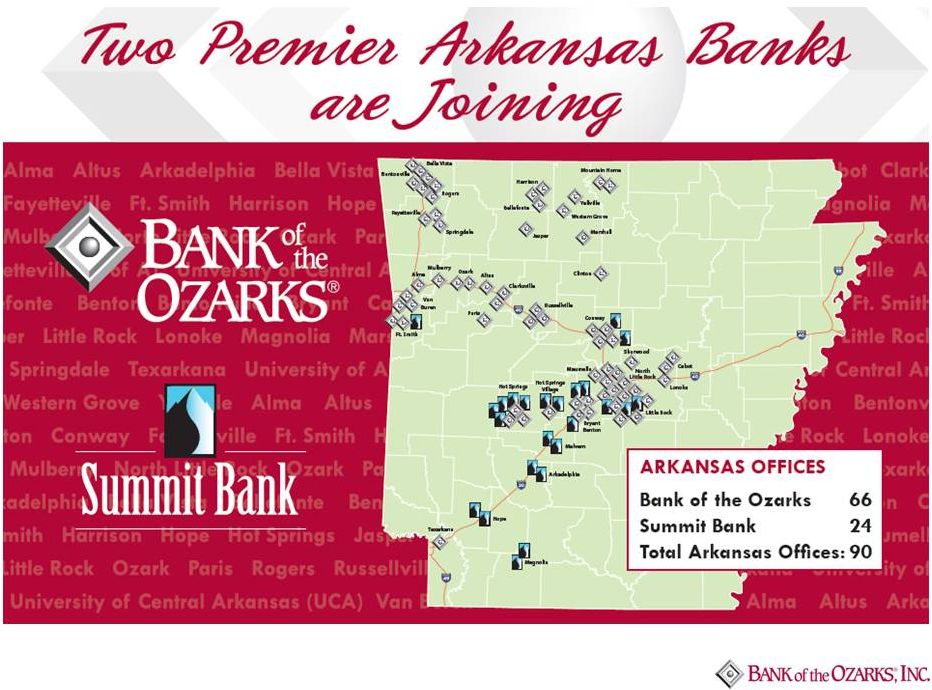

Acquisition of Summit Bancorp, Inc.

January 30, 2014

Exhibit 99.2 |

Forward Looking Information

This press release contains certain forward-looking information about the Company that is

intended to be covered by the safe harbor for “forward-looking statements”

provided by the Private Securities Litigation Reform Act of 1995. All statements other than

statements of historical fact are forward-looking statements. In some cases, you

can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,”

“estimate,” “predict,” “potential,” “continue,”

“could,” “future” or the negative of those terms or other words of similar meaning. These forward-looking statements include, without limitation,

statements relating to the terms and closing of the proposed transaction with Summit, the

proposed impact of the merger on the Company’s financial results, including any

expected increase in the Company’s book value and tangible book value per share and any expected increase in diluted earnings per common share, acceptance by

Summit’s customers of the Company’s products and services, the opportunities to

enhance market share in certain markets, market acceptance of the Company generally in

new markets, expected cost savings and merger related costs, and the integration of Summit’s operations. You should carefully read forward-looking statements,

including statements that contain these words, because they discuss the future expectations or

state other “forward-looking” information about the Company. Such

statements involve inherent risks and uncertainties, many of which are difficult to

predict and are generally beyond the control of the Company. Forward-looking

statements speak only as of the date they are made and the Company assumes no duty to update

such statements. In addition to factors previously disclosed in reports filed by the

Company with the SEC, additional risks and uncertainties may include, but are not limited to: the possibility that any of the anticipated benefits of the

proposed merger will not be realized or will not be realized within the expected time period;

the risk that integration of Summit’s operations with those of the Company will be

materially delayed or will be more costly or difficult than expected; the inability to complete the merger due to the failure of Summit’s shareholders to adopt the

merger agreement; the failure to satisfy other conditions to completion of the merger,

including receipt of required regulatory and other approvals; the failure of the

proposed merger to close for any other reason; the effect of the announcement of the merger on

customer relationships and operating results; dilution caused by the Company’s

issuance of additional shares of its common stock in connection with the merger; the possibility that the merger may be more expensive to complete than

anticipated, including as a result of unexpected factors or events; and general competitive,

economic, political and market conditions and fluctuations.

Annualized, pro forma, projected and estimated numbers are used for illustrative purposes only,

are not forecasts and may not reflect actual results.

ADDITIONAL INFORMATION

The Company intends to file a registration statement on Form S-4 with the Securities and

Exchange Commission (“SEC”) to register the Company’s shares that will be

issued to Summit’s shareholders in connection with the transaction. The

registration statement will include a joint proxy statement/prospectus and other relevant

materials in connection with the proposed merger transaction involving the Company and

Summit. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION

STATEMENT, JOINT PROXY/PROSPECTUS WHEN IT BECOMES AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE

TRANSACTION OR INCORPORATED BY REFERENCE INTO THE JOINT PROXY/PROSPECTUS) BECAUSE SUCH

DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION REGARDING THE PROPOSED MERGER

TRANSACTION. Investors and security holders may obtain free copies of these documents and other documents filed with the SEC

This communication does not constitute an offer to sell or the solicitation of an offer to buy

any securities or a solicitation of any vote or approval, nor shall there be any sale

of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such

jurisdiction.

Company’s

website

at

http://www.bankozarks.com, Investor

Relations,

or

by

contacting

Susan

Blair

at

(501)

978-2217.

on

the

SEC’s

website

at

http://www.sec.gov.

Investors

and

security

holders

may

also

obtain

free

copies

of

the

documents

filed

with

the

SEC

by

the

Company

at

the |

Transaction Overview

1

The price may be adjusted downward to the extent, among other things, Summit’s

consolidated net book value at closing (as adjusted) falls below $135,000,000. Exchange

ratio will be based on OZRK’s ten-day average closing price as of the fifth business day prior to closing

ranging between a ceiling of $72.63 and a floor of $43.58.

2

Based on Summit’s unaudited consolidated financial information as of December 31,

2013. Transaction

Purchase Price

Valuation Multiples

Required Approvals

Timing

Bank of the Ozarks, Inc. (“OZRK”) entered into a definitive

agreement and plan of merger with Summit Bancorp, Inc.

(“Summit”) headquartered in Arkadelphia, Arkansas

Summit shareholder approval

Customary regulatory approvals

Expected closing in late second quarter of 2014

Approximately 1.6x book value and tangible book value²

Approximately 15.8x 2013 net income²

$216,000,000 with a minimum of 80% stock consideration

and the balance in cash

1 |

Strategic Acquisition

Financially

Attractive

Strategic

Expansion

Low Risk

Tangible

Book

Value

by

approximately

$0.50

to

$0.60

per

share

Book

Value

by

approximately

$3.00

to

$3.25

per

share

EPS

by

approximately

$0.25

to

$0.30

during

the

first

12

months

Expected

to

be

accretive

to:

Total assets of $1.2 billion

Total loans of $778 million

, total deposits of $994 million

2

24 offices in nine Arkansas counties

Comprehensive due diligence process

In-market transaction with a familiar customer base

High-performing; minimal historical credit losses

2

2

1

1

1

1

Assumes OZRK’s ten-day average closing stock price of $58.10 (closing price as of

January 29, 2014) and election of 80% stock consideration by Summit shareholders.

Amounts also based on OZRK’s financial information as of December 31, 2013

disclosed in our press release dated January 16, 2014. 2

Obtained from Summit’s unaudited consolidated financial information as of

December 31, 2013. |

Key

Assumptions Cost Savings

Purchase Accounting

Assumptions

System Conversion

Merger Related

Costs

Fourteen offices located within two miles of an OZRK office, including

nine offices within one mile of an OZRK office

Expected loan mark of approximately 4% of total loans

Expected ORE mark of approximately 30%

Anticipated system conversion during the fourth quarter of 2014

Expected

non-interest

expense

savings

of

25%-30%

in

first

12

months

Expected

non-interest

expense

savings

in

the

mid-30%

range

thereafter

Expected

to

be

$4

million

on

a

pre-tax

basis |

|

California

Los

Angeles

Texas

Alabama

Georgia

South Carolina

North Carolina

Florida

New York

Little Rock

Austin

Dallas

Dawsonville

Cartersville

Atlanta

Dallas

Valdosta

Bainbridge

Brunswick

Savannah

Bluffton

Wilmington

Charlotte

Shelby

Mobile

Geneva

Bradenton

Palmetto

Ocala

San Antonio

Houston

Arkansas

Texarkana

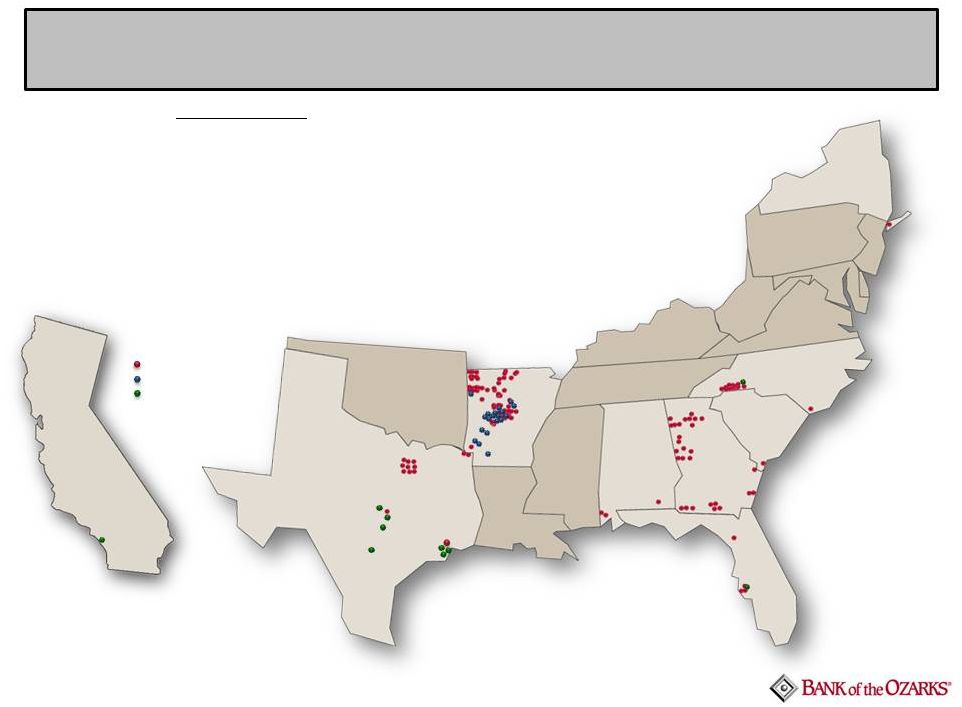

Offices By State:

Arkansas

90

Georgia

28

Texas

21

North Carolina

16

Florida

5

Alabama

3

South Carolina

1

New York

1

California

1

TOTAL

166

7

OZRK Offices

Summit Offices

OZRK Planned Offices

(including OmniBank)

New York

A Powerful Regional Franchise

with more offices on the way |

Highly Complimentary Franchises

Similar

culture

–

comfortable

transition

Addition of talented Summit team

Significant

presence

in

new

Arkansas

markets

–

Arkadelphia,

Malvern,

Magnolia and Hope

Combination

to

result

in

top

or

near-top

market

share

–

Saline

and

Garland

counties (Benton, Bryant, Hot Springs, Hot Springs Village)

Summit

Fort

Smith

loan

production

office

team

–

instantly

has

a

branch

network and strengthens OZRK Fort Smith team that is currently short-staffed

Summit

Conway

team

–

enhances

OZRK

Conway

team

that

is

currently

short-

staffed

Summit

Little

Rock

team

–

complements

OZRK

strong

position

in

Little

Rock

Summit consumer loan platform and processes may be a model for OZRK to

adopt

Trust and Mortgage operations should consolidate nicely providing valuable

scale to both teams |

Summary

Franchises are highly complimentary

Pro

forma

total

assets

of

$6.3

billion

Immediately accretive to tangible book

value and accretive to diluted earnings per

share in the first 12 months and thereafter

Eleventh acquisition announced by OZRK

since March 2010 and the largest in our

history

1

1

Includes total consolidated assets of OZRK as of December 31, 2013 disclosed in our press

release dated January 16, 2014, unaudited consolidated total assets of Summit as of

December 31, 2013 and unaudited total assets of OMNIBANK, N.A. as of December 31 2013,

which is expected to close in March of 2014. |