Attached files

| file | filename |

|---|---|

| EX-23.01 - EX-23.01 - KUBOTA PHARMACEUTICAL HOLDINGS CO LTD | d538257dex2301.htm |

| EX-5.01 - EX-5.01 - KUBOTA PHARMACEUTICAL HOLDINGS CO LTD | d538257dex501.htm |

| EX-4.03 - EX-4.03 - KUBOTA PHARMACEUTICAL HOLDINGS CO LTD | d538257dex403.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 30, 2014

Registration No. 333-192900

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

to

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

ACUCELA INC.

(Exact name of registrant as specified in its charter)

| Washington | 2834 | 02-0592619 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

1301 Second Avenue, Suite 1900

Seattle, WA 98101

(206) 805-8300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Ryo Kubota, M.D., Ph.D.

Chairman, President & CEO

Acucela Inc.

1301 Second Avenue, Suite 1900

Seattle, WA 98101

(206) 805-8300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Stephen M. Graham, Esq. William L. Hughes, Esq. Fenwick & West LLP 1191 Second Avenue, 10th Floor Seattle, WA 98101 (206) 389-4510 |

Alan G. Cannon, Esq. Simpson Thacher & Bartlett LLP Ark Hills Sengokuyama Mori Tower - 41st Floor 9-10, Roppongi 1-Chome Minato-Ku, Tokyo 106-0032, Japan 011-81-3-5562-6200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement, although, at the time of filing of this Registration Statement, shares will have been offered for sale to the public in Japan pursuant to Japanese law.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||||

| Non-accelerated filer | x | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | ||||

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to be Registered(1) |

Proposed Maximum Aggregate Offering Price Per Share |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee(3) | ||||

| Common Stock, no par value per share |

10,580,000 | $18.00 | $190,440,000 | $24,528.68 | ||||

|

| ||||||||

|

| ||||||||

| (1) | Estimated pursuant to Rule 457(a) under the Securities Act of 1933, as amended. Includes the aggregate offering price of shares that the underwriters have the option to purchase from the selling shareholder. Includes an additional 1,380,000 shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Estimated solely for the purpose of calculating the registration fee. |

| (3) | The registrant previously paid $16,100 in connection with the initial public offering of this registration statement on December 17, 2013 and $8,428.68 in connection with the filing of Amendment No. 2 to this registration statement on January 24, 2014. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. Neither we nor the selling shareholder may sell these securities in the United States until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we and the selling shareholder are not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion, dated January 30, 2014

Preliminary prospectus

9,200,000 Shares

Acucela Inc.

Common Stock

We are selling 9,200,000 shares of our common stock. This is our initial public offering and no public market currently exists for our shares of common stock. It is currently estimated that the initial public offering price will be between $15.00 and $18.00 per share. These shares will be offered in Japan and to investors located in jurisdictions other than the United States.

We have applied for the listing of our common stock on the Mothers market of the Tokyo Stock Exchange under the symbol “M—

.”

.”

We are an “emerging growth company” as defined under U.S. federal securities laws and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus.

| Per share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to Acucela, before expenses |

$ | $ | ||||||

| (1) | Upon completion of this offering, we expect to have paid additional fees in the amount not exceeding $185,000 for certain financial consulting services to a consultant that is not part of the underwriting syndicate. We are also obligated to reimburse the underwriters for certain fees and expenses related to this offering. See “Underwriting.” |

Our founder and chief executive officer, Dr. Ryo Kubota, has granted the underwriters an option for a period of 30 days from the date of this prospectus to purchase up to 1,380,000 additional shares of our common stock to cover over-allotments, if any. We will not receive any proceeds from the sale of shares of our common stock by the selling shareholder. The underwriters have entered into a borrowing arrangement with the selling shareholder to facilitate the underwriters’ over-allotment option in accordance with Japanese laws.

Delivery of the shares of our common stock will be made on or about , 2014.

Neither the Securities and Exchange Commission, the Tokyo Stock Exchange, the Financial Services Agency, nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

Mitsubishi UFJ Morgan Stanley Securities Co., Ltd.

, 2014

Table of Contents

| Page | ||||

| 1 | ||||

| 11 | ||||

| 28 | ||||

| 29 | ||||

| 30 | ||||

| 31 | ||||

| 32 | ||||

| 34 | ||||

| 36 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

38 | |||

| 57 | ||||

| 86 | ||||

| 92 | ||||

| Transactions With Related Parties, Founders and Control Persons |

100 | |||

| 103 | ||||

| 105 | ||||

| 108 | ||||

| 111 | ||||

| 113 | ||||

| 119 | ||||

| 121 | ||||

| 121 | ||||

| 121 | ||||

| F-1 | ||||

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by or on behalf of us and delivered or made available to you. Neither we nor the selling shareholder have authorized anyone to provide you with information different from that contained in this prospectus. We and the selling shareholder are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since that date.

We have applied for the listing of our common stock for quotation on the Mothers market of the Tokyo Stock Exchange. No additional action is being taken in any jurisdiction outside the United States to permit a public offering of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States and Japan are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

Until , 2014 (the 90th day after the date of this prospectus), all dealers that buy, sell or trade in our common stock in the United States, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

Table of Contents

This summary does not contain all of the information you should consider before buying shares of our common stock. You should read the entire prospectus carefully, especially the “Risk Factors” section and our financial statements and the related notes appearing at the end of this prospectus, before deciding to invest in shares of our common stock. Unless otherwise indicated, the terms “Acucela,” “we,” “us” and “our” refer to Acucela Inc., a Washington corporation.

Acucela Inc.

Overview

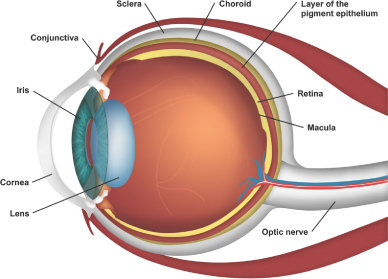

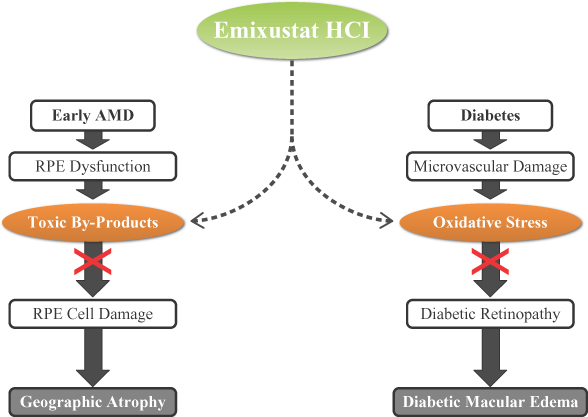

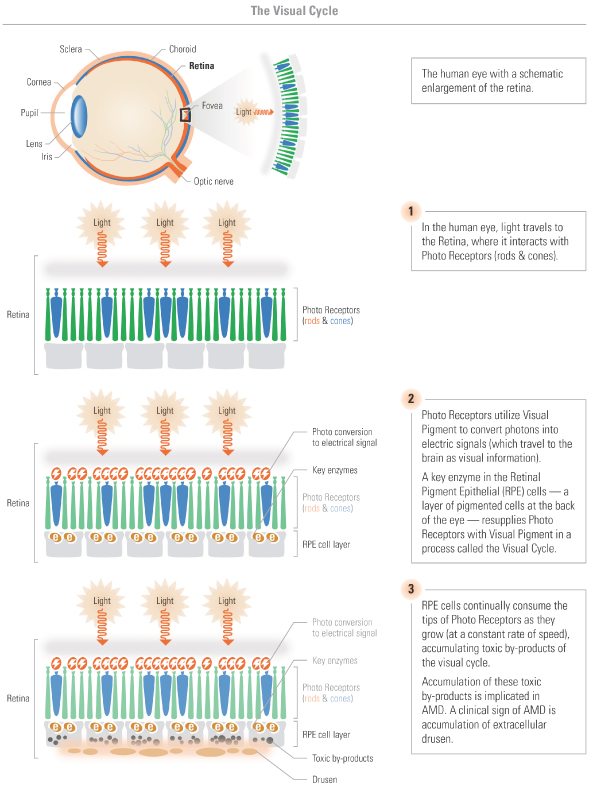

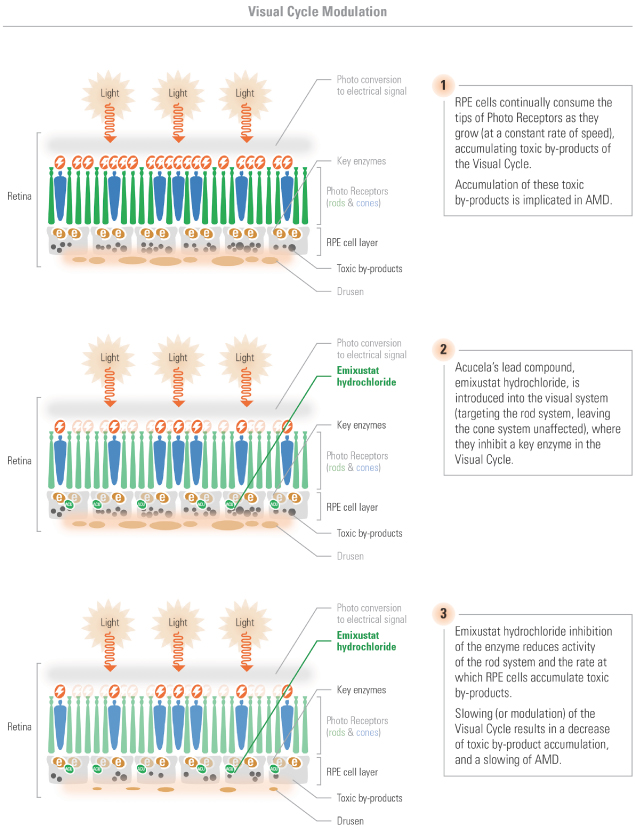

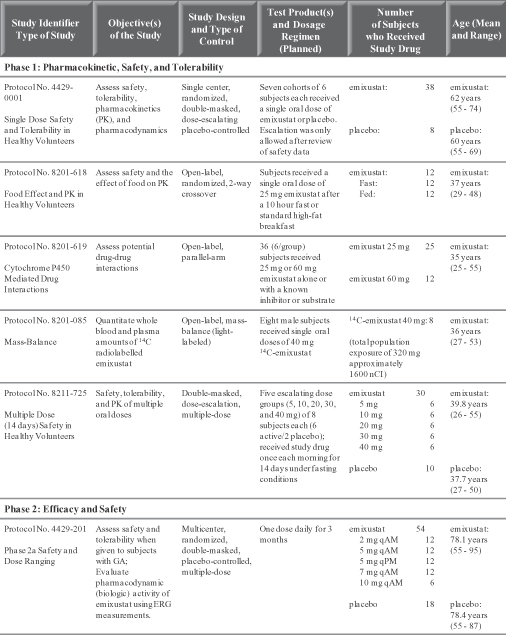

We are a clinical-stage biotechnology company that specializes in discovering and developing novel therapeutics to treat and slow the progression of sight-threatening ophthalmic diseases impacting millions of individuals worldwide. We focus on developing oral products based on our proprietary visual cycle modulation, or VCM, compounds to address a variety of retinal diseases, primarily age-related macular degeneration, or AMD, diabetic retinopathy, or DR, and diabetic macular edema, or DME, and potentially Stargardt disease, retinitis pigmentosa and retinopathy of prematurity. Our product candidates are designed to address the root cause of these diseases by reducing toxic by-products and oxidative damage as well as protecting the retina from light damage. The visual cycle is the biological conversion of a photon into an electrical signal in the retina. Our approach to treating and slowing the progression of ophthalmic diseases utilizes proprietary compounds that reduce the speed of, or modulate, the visual cycle. We believe that our insight into modulating the visual cycle combined with our deep expertise in ophthalmic research and development enables us to develop product candidates that, if approved, should preserve vision and provide relief to patients worldwide suffering from the debilitating effects of multiple eye diseases.

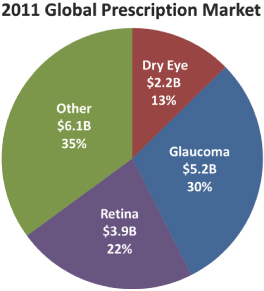

While we are primarily focused on developing product candidates based on our proprietary VCM compounds, we are in the early stages of developing a therapy for the treatment of glaucoma. We believe significant market opportunities exist for our lead product candidates based on a large and growing worldwide ophthalmic pharmaceutical market and our belief that currently available therapies are inadequate. According to visiongain, an independent research firm, the worldwide ophthalmic pharmaceutical market was $17.5 billion in 2011 and is expected to grow to $34.7 billion by 2023, representing a 5.9% compounded annual growth rate. Our two lead product candidates target segments of this market that collectively represented a majority of its value in 2011.

Since 2008, we have been closely and actively engaged with Otsuka Pharmaceutical Co., Ltd., or Otsuka, to jointly pursue development and commercialization efforts to deliver innovative ophthalmic drugs to patients with debilitating ophthalmic diseases. In September 2008, we entered into an agreement with Otsuka to co-develop and commercialize emixustat hydrochloride, or emixustat, our lead VCM-based product candidate, and its backup compounds for the dry form of age-related macular degeneration, or dry AMD, and other ophthalmic indications. Additionally, in September 2010, we further broadened our portfolio of potential ophthalmic treatments by entering into an agreement with Otsuka to co-develop and co-promote OPA-6566, an adenosine A2a receptor agonist discovered by Otsuka, for the treatment of glaucoma. From 2008 to 2013 we also provided development services to Otsuka under a recently-terminated agreement to co-develop rebamipide ophthalmic suspension, or rebamipide, Otsuka’s proprietary compound, for the treatment of dry eye syndrome in the United States.

Currently, we have two product candidates under clinical development in the United States:

| • | emixustat hydrochloride for AMD, which is currently in Phase 2b/3 as an oral therapy; and |

| • | OPA-6566 for glaucoma, which is currently in Phase 1/2. |

1

Table of Contents

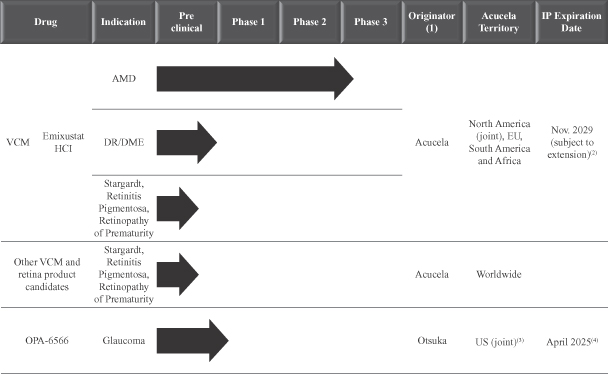

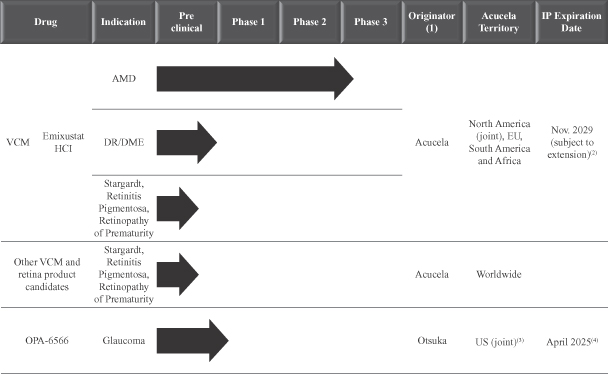

The following table presents our product candidates and their respective indications, stages of clinical development, relevant patent expiration dates, and geographic rights related to these product candidates.

Product Pipeline

| (1) | Refers to the party who identified the product candidate. |

| (2) | Excludes the potential for additional years of patent protection due to the Hatch-Waxman Act and additional use patents. |

| (3) | Following completion of the Phase 2 and Phase 3 clinical trials, subject to our election to co-develop and co-promote OPA-6566. |

| (4) | Otsuka, as the originator, may have the ability to apply for an extension of up to five years to increase the patent life for OPA-6566. |

| • | Emixustat hydrochloride is our lead VCM-based product candidate currently in development for the treatment of AMD. AMD is a retinal disease that causes patients to experience reduced central vision and leads to significant and irreversible loss of central vision in severe cases. There is currently no therapy approved by the Food and Drug Administration, or FDA, for the treatment of dry AMD, and we believe emixustat has the potential to be the first commercially available treatment for dry AMD. |

| • | OPA-6566 is a product candidate being developed by us under license from and in collaboration with Otsuka to treat ocular hypertension and glaucoma as a topical ophthalmic solution, or eye drop. Ocular hypertension is increased intraocular pressure and a major risk factor leading to glaucoma. Glaucoma is a progressive chronic disease and, if not adequately treated, may lead to diminished visual function and blindness. Although several treatment options are available, few, if any, are without ocular or systemic side effects, such as conjunctival hyperemia, or eye redness, and cardiac arrhythmia, or irregular heartbeat. We, in collaboration with Otsuka, conducted a Phase 1/2 clinical trial for OPA-6566 in the United States in patients with open-angle glaucoma, or ocular hypertension. Further pre-clinical evaluations to support the next phase of clinical trials are in progress, and we will determine the future development plans for OPA-6566 based on the results of such evaluations. |

2

Table of Contents

In addition to these product candidates, we plan to leverage our intellectual property relating to VCM to develop emixustat and potentially additional product candidates to treat and slow the progression of rare retinal diseases such as Stargardt disease, retinitis pigmentosa and retinopathy of prematurity.

Market Overview

We participate in the ophthalmic pharmaceuticals market, a large and growing segment within the ophthalmology market. According to visiongain, an independent research firm, the global ophthalmic pharmaceutical market is expected to increase from $17.5 billion in 2011 to $34.7 billion in 2023, representing a compounded annual growth rate of 5.9% during this period. The United States ophthalmic pharmaceutical market is the largest in the world and is expected to experience similar growth, from $6.7 billion, or 38.4%, of global sales in 2011 to $12.7 billion by 2023, representing a compounded annual growth rate of 5.5%. The drivers of this growth include the increasing number of elderly people and the consequent escalating occurrence of ophthalmic diseases, which is expected to stimulate demand for new ophthalmic product introductions to the market. Of the world’s leading causes of vision impairment and blindness, we believe AMD, DR/DME and glaucoma are the primary targets for pharmacological treatments based on their prevalence and an unmet need for non-invasive or more effective therapies.

Strategy

Our objective is to identify, develop or acquire, and commercialize novel therapeutics to treat sight-threatening ophthalmic diseases. The key elements of our strategy are to:

| • | collaborate with Otsuka to successfully develop our product candidates; |

| • | educate the marketplace on the benefits of VCM; |

| • | continue to expand our ophthalmic product pipeline through internal research and additional partnering opportunities; |

| • | drive the development and commercialization of our product candidates; and |

| • | continue to expand our infrastructure. |

Visual Cycle Modulation

We have established and maintain a leadership position in the area of visual cycle modulation as a result of our founder’s pioneering efforts to create and develop this technology, as well as the results of our clinical trials, and the patent portfolio we have assembled. The visual cycle is the biological conversion of a photon into an electrical signal in the retina. During exposure to bright light, the visual cycle is extremely active and can produce toxic by-products which cannot be eliminated. Over time, accumulation of these toxic by-products can compromise function of the visual cycle and damage the retina. VCM is designed to reduce the effects of toxic by-products and oxidative damage as well as protect the retina from light damage.

We believe that our VCM-based product candidates can be applied to treat a variety of retinal diseases at an early stage. These therapies are designed to specifically target cells within the retina to treat and slow the progression of certain retinal diseases. Our VCM-based product candidates have demonstrated modulation of the visual cycle and, as further addressed below, a favorable systemic safety profile in early clinical trials and, we believe, have the potential for broad application based on the ease of use and convenience of oral administration. There are currently no orally delivered FDA-approved drugs available to treat retinal diseases and few are in development due to the difficulty in delivering drugs to the back of the eye in sufficient concentrations. We have established an extensive portfolio of patents and patent applications surrounding emixustat and our other VCM-based product candidates and intend to aggressively pursue and defend our intellectual property.

3

Table of Contents

Competitive Strengths of Visual Cycle Modulation

We believe that VCM-based therapies have significant advantages over other therapies, including:

| • | the ability to address the root cause of multiple retinal diseases; |

| • | early intervention; |

| • | broad application; |

| • | oral tablet delivery; and |

| • | favorable safety profile. |

While clinical data available to date for emixustat demonstrate a favorable safety profile without clinically relevant systemic adverse effects, certain ocular adverse effects have been observed. Substantially all of these adverse events have been slight or moderate in severity and are predictable, monitorable, and reversible. The most commonly seen adverse effects are changes in color tint, blurred vision, visual impairment, and a delay in adapting from bright to dark light.

Risks

Our business and the success of our strategy are subject to numerous risks, which are highlighted in the section entitled “Risk Factors” immediately following this prospectus summary, including the following:

| • | We do not have any products that are approved for commercial sale and, therefore, do not expect to generate any revenues from product sales in the foreseeable future. |

| • | VCM is an emerging technology and its long-term effect is unknown, and thus, there can be no assurance that our product candidates will achieve regulatory approval. |

| • | Revenues from research and development activities on behalf of Otsuka and Otsuka’s funding of our portion of development costs under the collaboration agreement relating to emixustat represented all of our revenues during the two years ended December 31, 2012 and the nine months ended September 30, 2013, and the loss of these revenues would adversely affect our business. |

| • | The commercial success of our lead product candidates, if approved, will depend heavily on our collaboration with Otsuka, which will involve a complex sharing of control over decisions, responsibilities, and costs and benefits, and we cannot be certain that our product candidates will achieve success in clinical trials, that they will receive regulatory approval or be successfully commercialized. |

| • | The ophthalmic pharmaceutical market is intensely competitive and, even if we are successful in obtaining approval of any of our product candidates, we may be unable to compete effectively with existing drugs, new treatment methods and new technologies. |

| • | If we are unable to retain Ryo Kubota, M.D., Ph.D., our founder and chief executive officer, and retain and motivate other key management and scientific staff, our drug development programs may be delayed or terminated and we may be unable to successfully develop or commercialize our product candidates. |

Recent Events

Strategic Restructuring

In October 2013, we announced a plan to reduce expenses, including a workforce reduction, as a result of the termination of our agreement with Otsuka to co-develop rebamipide. The plan will result in a reduction in force of approximately 35% of our total workforce, or approximately 30 employees.

4

Table of Contents

As a result of this workforce reduction, we anticipate recording a charge of $1.0 million related to severance, other termination benefits, and outplacement services, in the three months ending December 31, 2013.

Preliminary Fourth Quarter and Full-Year Results

Our financial statements for the three months and year ended December 31, 2013 are not yet available. The following expectations regarding our results for these periods are solely management estimates based on currently available information. Our independent registered public accounting firm has not audited, reviewed or performed any procedures with respect to these preliminary financial data and, accordingly, does not express an opinion or any other form of assurance with respect to these data.

We expect that, for the three months and year ended December 31, 2013, our selected results of operations will range as follows (in millions, except per share amounts):

| Three Months Ended December 31, 2013 |

Year Ended December 31, 2013 |

|||||||||||||||

| Low | High | Low | High | |||||||||||||

| Revenues from collaborations with related party |

$ | 10.3 | $ | 11.4 | $ | 52.0 | $ | 53.1 | ||||||||

| Income (loss) from operations |

$ | (1.5 | ) | $ | (1.0 | ) | $ | 6.3 | $ | 6.8 | ||||||

| Income (loss) before income tax |

$ | (1.5 | ) | $ | (1.0 | ) | $ | 6.3 | $ | 6.8 | ||||||

| Net income (loss) |

$ | (1.1 | ) | $ | (0.7 | ) | $ | 4.0 | $ | 4.4 | ||||||

| Net income (loss) attributable to participating securities |

$ | (0.8 | ) | $ | (0.5 | ) | $ | 2.9 | $ | 3.2 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) attributable to common shareholders |

$ | (0.3 | ) | $ | (0.2 | ) | $ | 1.1 | $ | 1.2 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) per share attributable to common shareholders |

||||||||||||||||

| Basic |

$ | (0.03 | ) | $ | (0.02 | ) | $ | 0.09 | $ | 0.10 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Diluted |

$ | (0.02 | ) | $ | (0.02 | ) | $ | 0.09 | $ | 0.10 | ||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares used to compute net income (loss) per share attributable to common shareholders: |

||||||||||||||||

| Basic |

11,972 | 11,972 | 11,964 | 11,964 | ||||||||||||

| Diluted |

12,385 | 12,385 | 12,355 | 12,355 | ||||||||||||

Our actual results may differ from these expectations.

We expect our revenues from collaborations with related party for the three months ended December 31, 2013 will be between $10.3 million and $11.4 million, a decrease of 9% to an increase of 1% from revenues from collaborations with related party of $11.3 million for the three months ended December 31, 2012. The expected changes are due to an approximate decrease of $1.8 million in revenue under our OPA-6566 collaboration agreement due to a completion of the Phase 1/2 clinical trial and an approximate decrease of $3.3 million to $3.5 million in revenue under our recently-terminated rebamipide collaboration agreement due to completion of the Phase 3 clinical trial. These reductions were offset in part by an approximate increase of $4.4 million to $5.2 million in revenue from development services under our emixustat collaboration agreement related to increased activity in the Phase 2b/3 clinical trial. We expect our revenues from collaborations with related party for the year ended December 31, 2013 will be between $52.0 million and $53.1 million, an increase of 12% to 14% from revenues from collaborations with related party of $46.4 million for the year ended December 31, 2012. The expected changes are due to an approximate decrease of $6.6 million in revenue under our OPA-6566 collaboration agreement due to a completion of the Phase 1/2 clinical trial and due to an approximate decrease of $6.4 million to $6.6 million in revenue under our recently-terminated rebamipide collaboration agreement due to completion of the Phase 3 clinical trial and a $3.0 million decrease in milestone revenue both of which are in

5

Table of Contents

part offset by an approximate increase of $19.0 million to $20.0 million in revenue from development services under our emixustat collaboration agreement due to increased activity in the Phase 2b/3 clinical trial.

We expect our results from operations for the three months ended December 31, 2013 will be an approximate loss of $1.5 to $1.0 million, a 375% to 283% decline from income from operations of $0.5 million for the three months ended December 31, 2012. In addition, we expect our income from operations for the year ended December 31, 2013 will be approximately $6.3 to $6.8 million, a 11% to 4% decline from income from operations of $7.0 million for the year ended December 31, 2012. This expected fourth quarter loss is due to our implementation during the three months ended December 31, 2013 of a plan to reduce expenses, including a workforce reduction following the termination of our rebamipide collaboration agreement, which we expect will result in a $1.0 million charge related to severance, other termination benefits, and outplacement services.

We expect our results before income tax for the three months ended December 31, 2013 will be an approximate loss of $1.5 million and $1.0 million, a 446% to 331% decline from income before income taxes of $0.4 million for the three months ended December 31, 2012. We expect our net income before taxes for the year ended December 31, 2013 will be between $6.3 million and $6.8 million, a 7% to 0% decline from income before taxes of $6.8 million for the year ended December 31, 2012.

We expect our results for the three months ended December 31, 2013 will be an approximate loss of between $1.1 to $0.7 million, a 1,722% to 1,114% decline from net income of $0.1 million for the three months ended December 31, 2012. We expect our net income for the year ended December 31, 2013 will be approximately $4.0 to $4.4 million, a 4% decline to 6% increase from net income of $4.2 million for the year ended December 31, 2012.

Corporate Information

We were incorporated in Washington in 2002. Our corporate headquarters are located at 1301 Second Avenue, Suite 1900, Seattle, Washington 98101-3805 and our telephone number is (206) 805-8300. Our website address is www.acucela.com. The information contained in, or that can be accessed through, our web site is not part of this prospectus and should not be considered part of this prospectus.

Acucela and the Acucela logo are our registered trademarks in the United States and Japan. Other trademarks appearing in this prospectus are the property of their respective holders.

We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of this offering, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means the market value of our common stock that is held by non-affiliates exceeds $700.0 million as of the prior June 30th, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We refer to the Jumpstart Our Business Startups Act of 2012 herein as the “JOBS Act,” and references herein to “emerging growth company” shall have the meaning associated with it in the JOBS Act.

6

Table of Contents

The Offering

| Common stock offered by us |

9,200,000 shares |

| Over-allotment option |

The selling shareholder has granted the underwriters a 30-day option to purchase up to 1,380,000 shares of our common stock. |

| Common stock to be outstanding after this offering |

35,621,959 shares |

| Use of proceeds |

We estimate that we will receive net proceeds from the sale of the 9,200,000 shares of our common stock offered by us in this offering of approximately $132.9 million, based on an assumed initial public offering price of $16.50 per share, the midpoint of the price range on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds of this offering for working capital and other general corporate purposes, which may include the acquisition of, or investment in, product candidates, new products, or intellectual property rights to products or companies that complement our business. We will not receive any proceeds from the sale of shares by the selling shareholder in the event the underwriters exercise their over-allotment option. See “Use of Proceeds.” |

| Dividends |

We have not declared or paid a cash dividend on our capital stock and do not intend to pay cash dividends on our capital stock for the foreseeable future. |

| Proposed Tokyo Stock Exchange Mothers market symbol |

“M—

”

” |

| Japanese offering |

We are filing a securities registration statement to permit a public offering of our shares in Japan and intend to offer the shares through Japanese underwriters. The shares will be offered in Japan and to investors located in jurisdictions other than the United States. No offering is planned in the United States. |

The number of shares of our common stock to be outstanding after this offering represents the shares outstanding as of September 30, 2013, after giving effect to the conversion of our outstanding preferred stock and contingently convertible debt into 14,450,231 shares of common stock (interest accrued under this debt does not convert into shares of our common stock), and excludes:

| • | 724,531 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2013 with a weighted average exercise price of $7.25 per share; and |

| • | 1,536,670 shares of our common stock reserved for issuance under our 2014 Equity Incentive Plan (which includes 1,236,670 shares of common stock reserved, as of September 30, 2013, for future issuance under our 2012 Equity Incentive Plan, which shares will be added to the shares reserved under our 2014 Equity Incentive Plan upon the effectiveness of the 2014 Equity Incentive Plan if those shares are not issued or subject to outstanding grants under the 2012 Stock Incentive Plan at that time), which will become effective in connection with this offering and contains provisions that will automatically increase its share reserve each year, as more fully described in “Executive Compensation—Employee Benefit Plans.” |

7

Table of Contents

Except as otherwise indicated, all information in this prospectus assumes:

| • | the automatic conversion of all outstanding shares of our preferred stock into 10,813,867 shares of our common stock upon the closing of this offering; |

| • | the automatic conversion of all outstanding contingently convertible debt into 3,636,364 shares of our common stock effective upon the closing of this offering; |

| • | the filing of our amended and restated articles of incorporation and the effectiveness of our amended and restated bylaws upon the closing of this offering; and |

| • | no exercise by the underwriters of their option to purchase up to an additional 1,380,000 shares of our common stock from the selling shareholder in this offering. |

8

Table of Contents

Summary Financial Data

The following tables present summary historical financial data for our business. You should read this information together with “Selected Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and related notes, each included elsewhere in this prospectus.

We derived the statement of income data for the years ended December 31, 2011 and 2012 from our audited financial statements included elsewhere in this prospectus. We derived the statement of income data for the nine months ended September 30, 2012 and 2013 and the balance sheet data as of September 30, 2013 from our unaudited financial statements included elsewhere in this prospectus, which have been prepared on a consistent basis with our audited financial statements. In the opinion of our management, our unaudited financial data reflect all adjustments, consisting of normal and recurring adjustments, necessary for a fair statement of our results for those periods. Our historical results are not necessarily indicative of our results to be expected in any future period.

The pro forma per share data give effect to the automatic conversion of all currently outstanding shares of our convertible preferred stock and contingently convertible debt into shares of our common stock effective upon the closing of this offering, as though the conversion had occurred at the beginning of the indicated fiscal period. For information concerning the calculation of diluted and pro forma per share information, please refer to note 2 to our financial statements.

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||

| Statements of Income Data: | 2011 | 2012 | 2012 | 2013 | ||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Revenues from collaborations with related party |

$ | 34,226 | $ | 46,424 | $ | 35,141 | $ | 41,695 | ||||||||

| Expenses: |

||||||||||||||||

| Research and development |

24,183 | 31,604 | 22,695 | 26,221 | ||||||||||||

| General and administrative |

6,174 | 7,787 | 5,593 | 7,724 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total expenses |

30,357 | 39,391 | 28,648 | 33,945 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income from operations |

3,869 | 7,033 | 6,493 | 7,750 | ||||||||||||

| Other income (expense), net: |

||||||||||||||||

| Interest income |

21 | 27 | 24 | 101 | ||||||||||||

| Interest expense |

(143 | ) | (138 | ) | (104 | ) | (88 | ) | ||||||||

| Other income (expense), net |

39 | (97 | ) | (21 | ) | 71 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income before income tax |

3,786 | 6,825 | 6,392 | 7,834 | ||||||||||||

| Income tax benefit (expense) |

2,480 | (2,647 | ) | (2,283 | ) | 2,723 | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income |

$ | 6,266 | $ | 4,178 | $ | 4,109 | $ | 5,111 | ||||||||

| Net income attributable to participating securities |

4,584 | 3,056 | 3,006 | 3,735 | ||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income attributable to common shareholders |

$ | 1,682 | $ | 1,122 | $ | 1,103 | $ | 1,376 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income per share attributable to common shareholders, basic |

$ | 0.14 | $ | 0.09 | $ | 0.09 | $ | 0.12 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Weighted average shares used to compute net income per share attributable to common shareholders, basic |

11,897 | 11,901 | 11,900 | 11,961 | ||||||||||||

| Net income attributable to common shareholders per share, diluted |

$ | 0.14 | $ | 0.09 | $ | 0.09 | $ | 0.11 | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||

9

Table of Contents

| Year Ended December 31, | Nine Months Ended September 30, |

|||||||||||||||

| Statements of Income Data: | 2011 | 2012 | 2012 | 2013 | ||||||||||||

| (in thousands, except per share data) | ||||||||||||||||

| Weighted average shares used to compute net income per share attributable to common shareholders, diluted |

12,045 | 12,158 | 12,147 | 12,346 | ||||||||||||

| Pro forma net income attributable to common shareholders per share, basic |

$ | 0.16 | $ | 0.20 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average shares used to compute pro forma net income attributable to common shareholders per share, basic |

26,351 | 26,411 | ||||||||||||||

| Pro forma net income attributable to common shareholders per share, diluted |

$ | 0.16 | $ | 0.19 | ||||||||||||

|

|

|

|

|

|||||||||||||

| Weighted average shares used to compute pro forma net income attributable to common shareholders per share, diluted |

26,608 | 26,796 | ||||||||||||||

| As of September 30, 2013 | ||||||||||||

| Balance Sheet Data: | Actual | Pro Forma(1) | Pro Forma as Adjusted(2)(3) |

|||||||||

| (in thousands) |

||||||||||||

| Cash, cash equivalents and investments |

$ | 21,719 | $ | 21,719 | $ | 158,738 | ||||||

| Working capital |

21,636 | 33,636 | 170,655 | |||||||||

| Total assets |

52,483 | 52,483 | 185,380 | |||||||||

| Contingently convertible debt, related party (including current portion) |

12,000 | — | — | |||||||||

| Convertible preferred stock |

28,209 | — | — | |||||||||

| Accumulated deficit |

(2,648 | ) | (2,648 | ) | (2,648 | ) | ||||||

| Total shareholders’ equity |

31,840 | 43,840 | 176,737 | |||||||||

| (1) | The pro forma column gives effect to (i) the automatic conversion of all outstanding shares of our convertible preferred stock into an aggregate of 10,813,867 shares of our common stock effective upon the closing of this offering, (ii) the automatic conversion of all outstanding contingently convertible debt into an aggregate of 3,636,364 shares of our common stock effective upon the closing of this offering, and (iii) the amendment and restatement of our articles of incorporation immediately following the closing of this offering. |

| (2) | The pro forma as adjusted column reflects the pro forma adjustments and gives effect to the issuance and sale by us of 9,200,000 shares of common stock in this offering and the receipt of the net proceeds from our sale of these shares at an assumed initial public offering price of $16.50 per share (the midpoint of the range on the cover page of this prospectus), after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | Each $1.00 increase or decrease in the assumed initial public offering price of $16.50 per share would increase or decrease, as applicable, our cash, cash equivalents and short-term investments, working capital, total assets and total shareholder’s equity by approximately $8.4 million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions payable by us. |

10

Table of Contents

Risks Related to Our Business and Industry

We do not have any products that are approved for commercial sale.

To date, we have not generated any product revenue and have funded our operations through private sales of our equity and debt securities and from our various collaboration agreements with Otsuka, primarily the co-development and collaboration agreement relating to the development and commercialization of emixustat which we refer to as the Emixustat Agreement. We will not receive revenues from sales of our product candidates unless we succeed, either independently or with third parties, in developing and obtaining regulatory approval and marketing drugs with commercial potential. We may never succeed in these activities, and may not generate sufficient revenues to continue our business operations.

Revenues from research and development activities in collaboration with Otsuka and Otsuka’s funding of our portion of development costs under the Emixustat Agreement represented all of our revenues during the two years ended December 31, 2012 and the nine months ended September 30, 2013, and the loss of these revenues would adversely affect our business.

Revenues from research and development activities under our collaboration agreements with Otsuka have been our only source of revenues in 2011, 2012, and the nine months ended September 30, 2013, and we expect they will continue to have a significant impact on our results of operations in future years. As explained further below, Otsuka recently terminated a co-development agreement with us under which we derived significant revenues from in-licensed clinical programs in 2011, 2012 and the nine months ended September 30, 2013. It would be difficult to replace Otsuka as a collaboration partner, and the revenues derived from research and development activities on behalf of Otsuka and Otsuka’s funding of our portion of development costs under the Emixustat Agreement. Accordingly, the loss of Otsuka as a collaboration partner or revenues from other programs would have a material adverse effect on our business. In addition, any publicity associated with the loss of Otsuka as a collaboration partner could harm our reputation. This, as well as our obligation to repay development expenses funded by Otsuka if we succeed in commercializing emixustat independently of Otsuka, may make it more difficult to attract and retain other collaboration partners, and could lessen our negotiating power with prospective collaboration partners. Otsuka can terminate its collaboration agreements with us on relatively short notice in various circumstances, such as our material breach or insolvency, Dr. Kubota no longer serving as our chief executive officer, changes in control of us or, in the case of the Emixustat Agreement, a decision by Otsuka to discontinue funding development costs after considering the results of a Phase 2 or Phase 3 clinical trial, and also for any reason upon six months’ prior notice. For more information regarding the termination rights under each of our collaboration agreements with Otsuka, see “Business—Collaborations with Otsuka.”

In addition, Otsuka’s interests may differ from ours in relation to development of our product candidates due to changes in management, priorities or its strategic focus. For example, in September 2013, Otsuka terminated its agreement with us to co-develop rebamipide for the treatment of dry eye syndrome in the United States due to the fact that the primary endpoints were not met in the Phase 3 clinical trial in the United States. As a result, the associated clinical trials were suspended and our development activities halted. Losing the support and focus of Otsuka would adversely affect the development and commercialization of our product candidates. Our revenues and operating results would suffer and we may need to curtail or cease operations if, among other things, Otsuka terminates its other collaboration agreements with us or otherwise fails to fund development costs or continue to develop our other product candidates.

Our long-term prospects are dependent on our product candidates and we cannot be certain that they will achieve success in clinical trials, regulatory approval or be successfully commercialized.

We have two primary product candidates in development for ophthalmic indications and have invested a significant portion of our time and financial resources in the development of emixustat, the lead product candidate emerging from our internally-developed VCM compounds. VCM is an emerging technology and its

11

Table of Contents

long-term effect is unknown, and thus, there can be no assurance that our product candidates will achieve regulatory approval. Clinical development is a long, expensive and uncertain process and subject to delays. We may also encounter delays or rejections based on our inability to enroll enough patients to complete our clinical trials in a timely manner. It may take several years and require the expenditure of substantial resources to complete the testing of a product candidate, and failure can occur at any stage of testing. For example:

| • | interim results of clinical or non-clinical studies may not necessarily predict their final results, and acceptable results in early studies might not be seen in later studies, in large part because earlier phases of studies are often conducted in smaller groups of patients than later studies, and without the same trial design features, such as randomized controls and long-term patient follow-up and analysis; |

| • | product candidates that appear promising at early stages of development may ultimately fail for a number of reasons, including the possibility that the product candidates may be ineffective, less effective than products or product candidates of our competitors or cause harmful side effects; |

| • | any clinical or non-clinical test may fail to produce results satisfactory to the FDA or foreign regulatory authorities; |

| • | clinical and non-clinical data can be interpreted in different ways, which could delay, limit or prevent regulatory approval; |

| • | negative or inconclusive results from a non-clinical study or clinical trial or adverse medical events during a clinical trial could cause a non-clinical study or clinical trial to be repeated or a program to be terminated, even if other studies or trials relating to the program are successful; |

| • | the FDA can place a clinical hold on a trial if, among other reasons, it finds that patients enrolled in the trial are or would be exposed to an unreasonable and significant risk of illness or injury; |

| • | we may encounter delays or rejections based on changes in regulatory agency policies during the period in which we develop a drug or the period required for review of any application for regulatory agency approval; and |

| • | our clinical trials may not demonstrate the safety and efficacy of any product candidates or result in marketable products. |

Even if clinical trials and testing are successful in the future, we believe the process of completing clinical trials and submitting NDAs to the FDA for approval will take several years and require the expenditure of substantial resources. If we are required to conduct additional clinical trials or other studies of our product candidates beyond those that we currently contemplate, if we are unable to successfully complete our clinical trials or other studies or if the results of these trials or studies are not positive or are only modestly positive, we may be delayed or unsuccessful in obtaining marketing approval for our product candidates. Additionally, we may not be able to obtain marketing approval or we may obtain approval for indications that are not as broad as intended. Our product development costs will also increase if we experience delays in testing or approvals. Significant clinical trial delays could allow our competitors to bring products to market before we do and impair our ability to commercialize products.

Even if clinical trials are successful in the future, our growth prospects could be adversely affected and we may need to curtail or cease operations if we do not pursue the optimal commercialization strategy for us under our collaboration agreements.

As a part of our collaboration strategy, we seek to retain an option to choose either to obtain commercialization rights once our product candidates reach a later stage of development or to receive royalties from future product sales. Under our collaboration agreements with Otsuka, we have exclusive co-promotion rights. If we choose to not exercise these rights, we would be entitled to receive royalties on net sales of emixustat and we would not be entitled to any royalties or other payments based on the commercialization of OPA-6566. In general, we must make the decision to exercise these rights before the completion of clinical trials, based on our

12

Table of Contents

prediction of future sales and costs and other information. It is possible that the commercialization strategy we choose to pursue will ultimately be less beneficial to us than the other commercialization strategies available to us, which could harm our prospects for growth and could cause us to curtail or cease operations. We may choose a commercialization strategy that results in a less optimal outcome for a variety of reasons, including our failure to accurately predict future sales and costs or our inability to pay the exercise fees and milestone payments.

Our decision to license emixustat to Otsuka means that we no longer have complete control over how emixustat is developed and commercialized and how it may be perceived in the marketplace, and we may lose an even greater degree of control over how it is commercialized if we fail to make our co-promotion election under the terms of the Emixustat Agreement. In addition, unless and until we exercise co-promotion rights with respect to OPA-6566, we will have limited or no control over how the product candidate is developed and commercialized. Even if we exercise commercialization rights for these product candidates, we will depend, in part, on the efforts of Otsuka to commercialize our product candidates and will not have control over a number of key elements relating to the commercialization of these product candidates. Otsuka may fail to effectively commercialize our product candidates for a variety of reasons, including because it may not regard our programs as significant for its own businesses, because it does have sufficient resources or decides not to devote necessary resources.

The pharmaceutical market is intensely competitive. Even if we are successful in obtaining approval of any of our product candidates, we may be unable to compete effectively with existing drugs, new treatment methods and new technologies.

The pharmaceutical market is intensely competitive and rapidly changing. Many large pharmaceutical and biotechnology companies, academic institutions, governmental agencies and other public and private research organizations are pursuing the development of novel therapies for the same indications that we are targeting or expect to target.

If emixustat is approved for DR/DME, we anticipate that it would compete with Genentech’s Lucentis, which currently is the only FDA-approved treatment for DR/DME. Many drugs and other therapies have been approved for the treatment of glaucoma and would compete with OPA-6566 if it is approved. We are also aware of a number of new drugs and other therapies under development for the treatment of AMD (including dry AMD), DR/DME and glaucoma, including several for each of these disease categories by some of the largest pharmaceutical companies. For a listing of competing therapies or products and therapies under development, see “Business—Competition.”

Many of our competitors have:

| • | much greater financial, technical and human resources than we have at every stage of discovery, development, manufacture and commercialization of products; |

| • | more extensive experience in non-clinical testing, conducting clinical trials, obtaining regulatory approvals, manufacturing and marketing pharmaceutical products; |

| • | product candidates that are based on previously tested or accepted technologies; |

| • | products that have been approved or are in late stages of development; and |

| • | collaboration arrangements in our target markets with leading companies and research institutions. |

Our competitors may succeed in obtaining patent protection, receiving FDA approval or commercializing drugs for the same indications before we do. Any competing drugs may be more effective or marketed and sold more effectively than any products we develop. Moreover, physicians frequently prescribe therapies for uses that are not described in the product’s labeling and that differ from those tested in clinical studies and approved by the FDA or similar regulatory authorities in other countries. These unapproved, or “off-label,” uses are common

13

Table of Contents

across medical specialties and may represent a potential source of competition to our product candidates. Competitive therapies, including surgical procedures and medical devices, may make any drug products we develop obsolete or noncompetitive before we can recover the expenses of developing and commercializing them.

Market acceptance of emixustat and other products we develop in the future may be limited.

The commercial success of the products for which we may obtain marketing approval from the FDA or other regulatory authorities will depend upon the acceptance of these products by the medical community and third-party payors as clinically useful, cost-effective and safe. Even if a potential product displays a favorable efficacy and safety profile in clinical trials, market acceptance of the product will not be known until after it is commercially launched. We expect that many of the products we develop will be based upon mechanisms new to the market. For example, emixustat is a small-molecule compound within the phenylalkylamine chemical family. To date, no such small-molecule compound has been approved as a pharmaceutical by the FDA. As a result, it may be more difficult for us to achieve market acceptance of our products, particularly the first products that we introduce to the market. Our efforts to educate the medical community about these potentially novel approaches may require greater resources than would be typically required for products based on previously tested or accepted technologies.

Our planned investment in building a sales and marketing capability will require significant resources and may not generate the return we anticipate.

In order to exploit our commercialization opportunities under our agreements with Otsuka and as part of our long-term strategy, we intend to hire sales and marketing personnel to establish our own specialized sales and marketing infrastructure for the commercialization of our product candidates. We would rely on this direct sales force to, among other things, provide access to, or persuade, adequate numbers of ophthalmic specialists to prescribe our products. If we are unsuccessful in hiring and retaining sales and marketing personnel with appropriate technical and sales expertise or in developing an adequate distribution capability to support them, our ability to generate product revenues will be adversely affected. Unforeseen costs and expenses associated with creating independent sales, marketing and distribution capabilities could adversely impact the marketing and commercialization of our product candidates, which would adversely affect our business, operating results and financial condition. There can be no assurance that we will establish our sales, marketing and distribution capabilities in a cost-effective manner or realize a positive return on this investment, or that establishing these capabilities independently would be better than utilizing third-party providers. To the extent we cannot or choose not to use internal resources for the marketing, sales or distribution of any product candidates in the United States or elsewhere, we intend to rely on collaboration partners, such as Otsuka, or licensees. We may not be able to establish or maintain such relationships. To the extent that we depend on collaboration partners or other third parties for marketing, sales and distribution, any revenues we receive will depend upon their efforts. Such efforts may not be successful, and we will not be able to control the amount and timing of resources that our licensees or collaborators or other third parties devote to our products.

In addition, to the extent we utilize such relationships for marketing, sales or distribution of any approved products outside of the United States, we will be subject to additional risks related to entering into international business relationships, such as reduced protection for intellectual property rights; unexpected changes in tariffs, trade barriers and regulatory requirements; economic weakness, including inflation, or political instability in particular foreign economies and markets; foreign taxes, including withholding of payroll taxes; and foreign currency fluctuations, which could result in increased operating expenses and reduced revenues, and other obligations incident to doing business in another country.

We may not be successful in our efforts to expand our portfolio of product candidates.

We are seeking to expand our portfolio of product candidates through internal development and by partnering with other pharmaceutical or biotechnology companies.

14

Table of Contents

A significant portion of our internal research program involves unproven technologies. Research programs to identify new disease targets and product candidates require substantial technical, financial and human resources whether or not we ultimately identify any candidates. Our research programs may initially show promise in identifying potential product candidates, yet fail to yield product candidates for clinical development for a number of reasons, including without limitation:

| • | the research methodology used may not be successful in identifying potential product candidates; |

| • | potential product candidates may, on further study, be shown to have harmful side effects or other characteristics that indicate they are unlikely to be effective drugs; or |

| • | we may fail to obtain intellectual property protection for our product candidates and technologies. |

We may attempt to license or acquire product candidates and be unable to do so for a number of reasons. In particular, the licensing and acquisition of pharmaceutical products is a competitive area. A number of more established companies are also pursuing strategies to license or acquire products in the ophthalmic field. These established companies may have a competitive advantage over us due to their size, cash resources and greater clinical development and commercialization capabilities. Other factors that may prevent us from licensing or otherwise acquiring suitable product candidates include the following:

| • | we may be unable to license or acquire the relevant intellectual property rights on terms that would allow us to make an appropriate return from the product; |

| • | companies that perceive us to be their competitors may be unwilling to assign or license their product rights to us; or |

| • | we may be unable to identify suitable products or product candidates within our areas of expertise. |

Relying on third-party manufacturers may result in delays in our clinical trials and product introductions.

We have limited experience in, and we do not own facilities for, manufacturing any product candidates, and we do not intend to develop facilities for the manufacture of product candidates for clinical trials or commercial purposes in the foreseeable future. We will depend on Otsuka for the manufacture and supply of product candidates subject to our collaboration agreements. Otsuka is contracting with third-party manufacturers to produce, in collaboration with Otsuka and us, our product candidates for clinical trials. While there are likely competitive sources available to manufacture our product candidates, entering into new arrangements may cause delays and additional expenditures, which we cannot estimate with certainty.

There are risks inherent in pharmaceutical manufacturing that could affect the ability of our third-party manufacturers to meet our requirements, which could result in unusable products and cause delays in our development process and our clinical trials. We need to contract with manufacturers who can comply with FDA-mandated current good manufacturing practices, or cGMPs, and comparable requirements of foreign regulatory bodies on an on-going basis. If we receive necessary regulatory approval for any product candidate, we also expect to rely on third parties, including our collaboration partners, to produce materials required for commercial production. Should we experience difficulties in obtaining and maintaining adequate manufacturing capacity, our ability to successfully develop and commercialize our products could be adversely impacted.

A failure of any of our third-party manufacturers to perform their obligations in a timely manner or establish and follow cGMPs with proper documentation may result in significant delays in clinical trials or in obtaining regulatory approval of product candidates or the ultimate launch of our products into the market. These failures could cause delays and other problems resulting in a material adverse effect on our business, financial condition and results of operations. If we are required to change manufacturers for any reason, we may incur significant costs and be required to devote significant time to verify that the new manufacturer maintains facilities and procedures that comply with quality standards and with all applicable regulations and guidelines.

15

Table of Contents

We are dependent on our management team, particularly Ryo Kubota, M.D., Ph.D., our founder and chief executive officer, and if we are unable to retain and motivate our key management and scientific staff, our drug development programs may be delayed and we may be unable to successfully develop or commercialize our product candidates.

We are dependent upon the continued services of our executive officers and other key personnel, particularly Ryo Kubota, M.D., Ph.D., our founder and chief executive officer, who is critical to our ability to continue collaborating with Otsuka and secure financing from Japanese institutions. The relationships that our collaboration team members have cultivated with Otsuka make us particularly dependent upon a significant number of them, including Dr. Kubota and many of our collaboration team leaders, remaining employed by us. In addition, our collaboration agreements with Otsuka can be terminated by Otsuka if Dr. Kubota ceases serving as our chief executive officer or, among other things, fails to be actively involved in our collaborations with Otsuka.

As we acquire or obtain rights to develop and commercialize new product candidates, our success will depend on our ability to attract, retain and motivate highly qualified management and scientific personnel to manage the development of these new product candidates. We face competition for experienced scientists and other technical and professional personnel from numerous companies and academic and other research institutions. Competition for qualified personnel is particularly intense in the Seattle, Washington area, where very few people possess the skills and expertise we need to develop and commercialize our product candidates. Our operating history and the uncertainties attendant to being a clinical-stage biotechnology company with limited capital resources could limit our ability to attract and retain personnel.

Dr. Kubota and each of our key management and scientific personnel may terminate his or her employment at any time. If we lose any of our key management personnel, we may not be able to find replacements suitable to us or Otsuka, and our business would be harmed as a result. In addition, if we cannot continue to attract and retain, on acceptable terms, the qualified personnel necessary for the continued development of our business, we may not be able to sustain our operations or grow.

Our future workforce reduction may impact the performance of our continuing personnel, and make it more difficult to retain the services of key personnel.

In October 2013, we elected to restructure our operations, resulting in a substantial workforce reduction beginning in December 2013. This reduction will have an impact on all functional areas of the business. This reduction in our workforce may create concerns about job security or lower productivity, which may, in turn, lead some of our remaining employees to seek new employment and require us to hire replacements. This workforce reduction may also make the management of our business more difficult and may make it harder for us to attract employees in the future.

If any products we develop become subject to third-party reimbursement practices, unfavorable pricing regulations or healthcare reform initiatives, our business could be harmed.

The availability and levels of reimbursement by governmental and other third-party payors of healthcare services affect the market for our potential products. These payors continually attempt to contain or reduce the costs of healthcare by challenging the prices charged for medical products and services. In the United States, we will need to obtain approvals for payment for our potential products from private insurers, including managed care organizations, and from the Medicare program. We cannot be sure that reimbursement will be available for any future product candidates and reimbursement amounts, if any, may reduce the demand for, or the price of, our future products.

Obtaining approvals from governmental and other third-party payors of healthcare services can be a time-consuming and expensive process. Because our product candidates are under development, we are unable at this time to determine the level or method of reimbursement. Our business would be materially adversely affected if we do not receive approval for reimbursement of our product candidates from Medicare or private insurers on a

16

Table of Contents

timely or satisfactory basis. The Medicare program can deny coverage of a particular drug on the basis of the drug not being “reasonable and necessary” for Medicare beneficiaries. Limitations on coverage could also be imposed at the local Medicare carrier level or by fiscal intermediaries. Our business could be materially adversely affected if the Medicare program, local Medicare carriers or fiscal intermediaries were to make such a determination and deny or limit the reimbursement of our potential products, including the procedures under which they are administered, if any. Our business could also be adversely affected if private insurers, including managed care organizations, the Medicare program or other reimbursing bodies or payors limit the indications for which our potential products will be reimbursed.

There have been, and likely will continue to be, legislative and regulatory proposals in the United States and in some foreign jurisdictions directed at broadening the availability of health care and containing or lowering the cost of health care. We cannot predict the initiatives that may be adopted in the future. These legislative and/or regulatory changes may negatively impact the reimbursement for drug products, following approval, and thus affect our ability to sell our products profitably. The continuing efforts of government and other third-party payors of healthcare services to contain or reduce costs of health care may adversely affect:

| • | the demand for any drug products for which we may obtain regulatory approval; |

| • | our ability to set a price or achieve a rate of reimbursement that we believe is fair for our product candidates; |

| • | our ability to generate revenue and achieve or maintain profitability; |

| • | the level of taxes that we are required to pay; and |

| • | our access to capital. |

In order to achieve our commercialization goals, we will need to grow the size of our organization, and we may experience difficulties in managing this growth.

As our commercialization plans and strategies develop, we will need to expand the size of our employee base for managerial, operational, sales, marketing, financial, human resources and other functional areas. Competition for these employees is intense and we may not be able to hire additional qualified personnel in a timely manner and on reasonable terms. Future growth would impose significant added responsibilities on members of management, including the need to recruit, hire, retain, motivate and integrate additional employees. Also, our management may have to divert a disproportionate amount of its attention away from our day-to-day activities and devote a substantial amount of time to managing these growth activities. Our future financial performance and our ability to commercialize our product candidates and compete effectively will depend, in part, on our ability to effectively manage any future growth.

We face the risk of product liability claims and may not be able to obtain insurance, and we may have exposure to significant contingent liabilities.

Our business exposes us to the risk of product liability claims that are inherent in the development, manufacturing, testing and marketing of drugs and related products. If the use of one or more of our products harms people, we may be subject to costly and damaging product liability claims. We have product liability insurance that covers our clinical trials up to a $10 million annual aggregate limit. We intend to expand our insurance coverage to include the sale of commercial products if we obtain marketing approval for any of the products that we may develop. Insurance coverage is increasingly expensive and may not be available on reasonable terms, if at all. We may not be able to obtain or maintain adequate protection against potential liabilities. If we are unable to obtain insurance at acceptable cost or otherwise protect against potential product liability claims, we will be exposed to significant liabilities, which may materially and adversely affect our business and financial position.

17

Table of Contents

Regulatory Risks

We may not be able to obtain regulatory approval for any of the products resulting from our development efforts, including emixustat and OPA-6566. Failure to obtain these approvals could materially harm our business.

All of the products we are developing or may develop in the future will require additional research or development. We have two product candidates that have advanced to the point that they are undergoing clinical trials. None of our product candidates have received regulatory approval for marketing in the United States and failure to receive such approvals on one or more of our product candidates could materially harm our business. We will be required to obtain an effective Investigational New Drug Application, or IND, prior to initiating new human clinical trials in the United States, and must submit a New Drug Application, or NDA, to obtain marketing approval prior to commercializing our products in the United States. This process is expensive, highly uncertain and lengthy, often taking a number of years until a product is approved for marketing in the United States, if at all. Approval policies or regulations may change and the FDA and other comparable foreign regulatory authorities have substantial discretion in the drug approval process, including the ability to delay, limit, or deny approval of a product candidate for many reasons, such as:

| • | such authorities may disagree with the design or implementation of our, Otsuka’s, or any of our future development partners’ clinical trials; |

| • | we, Otsuka, or any of our future development partners may be unable to demonstrate to the satisfaction of the FDA or other regulatory authorities that a product candidate is safe and effective for any indication or its clinical and other benefits outweigh any safety risk; |

| • | such authorities may not accept clinical data from trials which are conducted at clinical facilities or in countries where the standard of care is potentially different from the United States; |

| • | the results of clinical trials may not demonstrate the safety or efficacy required by such authorities for approval; |

| • | such authorities may disagree with our interpretation of data from pre-clinical studies or clinical trials or the use of results from antibody studies that served as precursors to our current drug candidates; |

| • | such authorities may find deficiencies in the manufacturing processes or facilities of third-party manufacturers with which we, Otsuka, or any of our future development partners contract for clinical and commercial supplies; and |

| • | the approval policies or regulations of such authorities may significantly change in a manner rendering our, Otsuka’s, or any of our future development partners’ clinical data insufficient for approval. |

With respect to foreign markets, approval procedures vary among countries and, in addition to the aforementioned risks, can involve additional product testing, administrative review periods and agreements with pricing authorities. In addition, events raising questions about the safety of certain marketed pharmaceuticals may result in increased cautiousness by the FDA and comparable foreign regulatory authorities in reviewing new drugs based on safety, efficacy or other regulatory considerations and may result in significant delays in obtaining regulatory approvals. Any delay in obtaining, or inability to obtain, applicable regulatory approvals would prevent us, Otsuka, or any of our future development partners from commercializing our product candidates.

We may need to successfully address a number of technological challenges in order to complete the development of our product candidates. Success in early clinical trials does not mean that later clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety or efficacy despite having progressed through initial clinical testing. Companies frequently suffer significant setbacks in advanced clinical trials, even after earlier clinical trials have shown promising results. In addition, our product candidates may not be effective, may be only moderately effective or may prove to have undesirable or unintended side effects, toxicities or other characteristics that may preclude our obtaining regulatory approval or prevent or limit commercial use, which could have a material adverse effect on our business. Accordingly, there can be no assurance that the FDA and other regulatory authorities will approve any product that we develop.

18

Table of Contents