Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - BTCS Inc. | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - BTCS Inc. | f10k2011a1ex31i_touchit.htm |

| EX-32.1 - CERTIFICATION - BTCS Inc. | f10k2011a1ex32i_touchit.htm |

| EX-31.2 - CERTIFICATION - BTCS Inc. | f10k2011a1ex31ii_touchit.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1 TO

FORM 10-K

(Mark One)

|

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2011

|

OR

|

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

Commission file number: 333-151252

TouchIT Technologies, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Nevada

|

26-2477977

|

|

|

(State of Incorporation)

|

(I.R.S. Employer Identification Number)

|

|

100 West Big Beaver Road, Suite 200, Troy, MI 48084

|

|

(Address of Principal Executive Offices, Including Zip Code)

|

Registrant’s telephone number: +44 207 858 1045/+1 248 680 6700

Securities registered pursuant to Section 12(b) of the Act:

|

None

|

Not Applicable

|

|

|

(Title of each class)

|

(Name of each exchange on which registered)

|

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer o

|

Accelerated Filer o

|

Non-accelerated Filer o

(Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the voting common equity held by non-affiliates as of September 30, 2011, the last business day of the registrant’s most recently completed third fiscal quarter, was approximately $708 582.25

The number of shares outstanding of common stock as of December 31, 2011 was 55,839,419.

DOCUMENTS INCORPORATED BY REFERENCE

N/A.

|

TABLE OF CONTENTS

|

||

|

Part I

|

||

|

Item 1.

|

1

|

|

|

Item 1A.

|

5

|

|

|

Item 2.

|

9

|

|

|

Item 3.

|

9

|

|

|

Item 4.

|

9 | |

|

Part II

|

||

|

Item 5.

|

9

|

|

|

Item 6.

|

11

|

|

|

Item 7.

|

11

|

|

|

Item 7A.

|

17

|

|

|

Item 8.

|

17

|

|

|

Item 9.

|

18

|

|

|

Item 9A.

|

18

|

|

|

Item 9B.

|

19

|

|

|

|

||

|

Part III

|

||

|

Item 10.

|

19

|

|

|

Item 11.

|

20

|

|

|

Item 12.

|

22

|

|

|

Item 13.

|

23

|

|

|

Item 14.

|

23

|

|

|

Part IV

|

||

|

Item 15.

|

23

|

|

|

24

|

||

PART I

This amendment no. 1 to Annual Report on Form 10-K for fiscal year ended December 31, 2011 is pursuant to that certain Current Report on Form 8-K Item 4.02 filed with the Securities and Exchange Commission on January __, 2014 pertaining to non-reliance on previously issued financial statements. On approximately January 18, 2014, the Board of Directors was advised by the Company's independent public accountant, Edward Richardson Jr. CPA that its financial statements reviewed and/or audited by Richard for the quarters referenced below as filed (collectively, the Financial Statements") with the Securities and Exchange Commission could not be relied upon based upon the inadvertent non-disclosure of two 8% convertible notes due May 17, 2015 in the principal amounts of $400,000 and $100,000, respectively, on the balance sheets as of the dates indicated (collectively, the "Convertible Notes"), and accrued interest payable under the Convertible Notes.

The Convertible Notes were previously issued in connection with certain subscription agreements entered into by the Company and the related share exchange agreement dated May 7, 2010 among the Company, TouchIt Technologies Koll Sti ("TouchIt Tech KS), the stock holders of TouchIt Tech KS, TouchIt Education Koll Sti ("TouchIt Ed"), and the stockholders of TouchIt Ed (the "Share Exchange Agreement"), pursuant to which the Company entered into various agreements with purchasers of the Convertible Notes.

|

Period Ended

|

Form

|

Date Filed with SEC

|

|

September 30, 2011

|

10-Q

|

November 14, 2011

|

|

December 31, 2011

|

10-K

|

April 5, 2012

|

|

March 31, 2012

|

10-Q

|

May 10, 2012

|

|

June 30, 2012

|

10-Q

|

August 2, 2012

|

|

September 30, 2012

|

10-Q

|

November 9, 2012

|

|

December 31, 2012

|

10-K

|

March 28, 2013

|

|

March 31, 2013

|

10-Q

|

May 15, 2013

|

|

June 30, 2013

|

10-Q

|

August 14, 2013

|

|

September 30, 2013

|

10-K

|

November 14, 2013

|

See "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operation. "

|

Item 1.

|

Business

|

Business Development

TouchIT Technologies, Inc. was incorporated in the State of Nevada as “Hotel Management Systems, Inc.” (“HMSI”) in 2008. After HMSI's fiscal year end of April 30, 2010, we entered into a Share Exchange Agreement, dated May 7, 2010 (“Share Exchange”) with TouchIT Technologies Koll Sti (“TouchIT Tech KS”), the stockholders of TouchIT Tech KS, TouchIT Education Koll Sti (“TouchIT Ed”), and the stockholders of TouchIT Ed whereby HMSI effectively ceased doing business as HMSI. Both TouchIT Tech KS and TouchIT Ed are corporations formed under the laws of Turkey and are based in Istanbul, Turkey. The closing of the transaction (the “Closing”) took place on May 7, 2010 (the “Closing Date”).

In connection with the closing of the Share Exchange Agreement, on May 7, 2010, we entered into various subscription agreements (each “Subscription Agreement,” and collectively the “Subscription Agreements”) with certain investors for the sale of up to $1,500,000 of principal amount convertible promissory notes issued by our Company (“Note” or “Notes”) and share purchase warrants (the “Warrants”) to each subscriber to purchase shares of our Common Stock.

In connection with a breach of two promissory notes associated with the Share Exchange, we cancelled the Warrants related to those promissory notes.

In connection with the Share Exchange, we changed our fiscal year end from April 30 to December 31 and amended our Articles of Incorporation to change our name to TouchIT Technologies, Inc. This report shall cover the period of January 1 to December 31, 2010 and the description of the business and financial information provided herein will be the business and financials of TouchIT Technologies, Inc. and not HMSI, as the business was prior to the Share Exchange.

Unless the context indicates otherwise, as used herein the terms, the “Company”, “Registrant”, “we”, “our” and “us” refer to TouchIT Technologies, Inc.

Overview

We design, produce and market touch-based visual communication products. Our mission – the design and manufacture of high quality technology products under the TouchIT Technologies™ brand name. We manufacture a large range of touch screen and touch board products to suit all types of application from small liquid crystal display (“LCD”) touch-screens to large interactive whiteboard displays and audience response systems. To date, our revenues have come primarily from the sale of our Interactive Whiteboard products which we began shipping in 2009 to the worldwide market place. Most of our sales have been of the 78" TouchIT Board and original equipment manufacturer (“OEM”) equivalents that are suitable for use with almost any computer and data projector.

We plan to capitalize on the corporate vertical for boardroom and meeting room applications and also in the education market as there are an estimation of over a billion classrooms in the world that may develop a need for our products. In response to increased demand for interactive LCD displays, we have invested resources to expand our product line to include touch-based LCDs in 42", 55” and 65". We have also invested in the development of TouchIT Transcribe, our corporate annotation software. We undertake OEM and original design manufacturer (“ODM”) work for partners all over the world with 3rd party contract manufacturing facilities in Taiwan & China.

How We Generate Revenue

We generate revenue from the sales of goods under the TouchIT Technologies brand name manufactured through 3rd party OEM contract manufacturers in China and Taiwan.

1

We also generate revenue from OEM manufacture facilities. This is where we take our existing products and rebrand them for a third party with differing degrees of customization.

Lastly, we generate revenue by charging for product design work where our team designs a new product for a customer that incorporates our technology. There is then repeat sales from this model as the customer engages the company to build its products.

Products or Services and their Markets

We offer a range of products that are designed for the education and the corporate government vertical markets. In addition, we offer our own proprietary annotation software designed for the corporate market.

TouchIT Interactive Whiteboard

TouchIT Board™ works in conjunction with a data projector and a computer to create a touch-based interactive whiteboard where the user obtains full control of a computer from the board. The TouchIT Board™ functions similar to a mouse allowing both left and right click functionality at the board. The TouchIT Board is supplied with Wizteach annotation software. The Wizteach annotation software is a 3rd party software that we purchase from Quizdom Uk Ltd based in Northern Ireland.

TouchIT LCD

The TouchIT LCD™ combines a HD display with IR touch technology to create an integrated, large format touch screen finished with a 4mm tempered glass for screen protection. The TouchIT LCD has a very small parallax enabling a much improved user experience when compared to traditional overlay products.

TouchIT Vote

TouchIT Vote™ is an radio Frequency (RF) audience response system that allows the user to obtain feedback or interaction from a class or audience to a series of questions posed with either Microsoft PowerPoint or the proprietary editor supplied. These responses can then be formulated into a series of reports where the data can be further analyzed.

TouchIT Tablet

TouchIT Tablet™ is a Radio Frequency (RF) wireless tablet that enables the user to control his/her computer from a distance with the tablet acting like a mouse.

TouchIT Transcribe Software

TouchIT Transcribe™ is the proprietary corporate annotation software supplied by us at no charge to users of the TouchIT Board™ and TouchIT LCD™. TouchIT Transcribe™ is unique in that currently on the market, there are very few pieces of software that cater directly for the corporate market.

Distribution Methods of the Products or Services

We currently maintain various distribution channels for our products in countries throughout the world. We would normally select a master distributor for a particular country where its specialty would be either the Information Technology (“IT”) Education or Audio Visual (“AV”) verticals. These master distributors usually sell on a trade-only basis to reselling companies that, in turn, supply the end user.

Status of New Product or Service

We are currently evaluating new touch technologies such as charge-couple device (“CCD”) image sensors that could be a more cost effective alternative in the future to IR. Our business strategy is to grow all three main areas of the business in tandem with the overall pursuit and development of new touch-based interactive products.

2

First, we hope to increase the growth of sales of our Company’s branded products through distribution partners on a worldwide basis. This involves the recruitment, training and support of the distribution partner and its resellers.

Second, we aim to grow the OEM side of the business. This involves the recruitment, product customization and rebranding, technical support and training of new OEM partners on a worldwide basis.

Third, we aim to work with a wider selection of ODM partners that recruit our services for the design and manufacture of new products under the client’s own brand name.

Business Organization

We manage our business on a central basis with all customers being supplied through either directly from the third part manufacturing facilities in China and Taiwan, or from our warehouse located in Troy, MI USA.

Markets & Trends In Our Business

Global Interactive Display sales in Q4 2011 increased by 14% Year-on-Year according to the new Interactive Displays Quarterly Insight report from Futuresource Consulting. Last year, the global market ended far in excess of 850,000 units shipped, - the year had a 1% volume reduction compared with 2010. Considering the economic pressures, this is a resilient result and there have been a number of strong regional success stories.

In the USA there have been challenges to budgets and reductions in funding, resulting in a 19% YoY Q4 sales unit decrease. The US market is forecast to steadily decline, but it will continue to remain the world’s largest interactive displays market.

Almost 4.5 million Interactive Displays have now been installed globally, with the technology taking a secure hold within the education sector, there is still a huge opportunity to be exploited, though companies operating within this marketplace must work cleverer to understand the opportunities and react ahead of the curve.

On February 16, 2011, our Company borrowed USD 250,000 from TCA Global Credit Master Fund pursuant to a revolving credit facility evidenced by a credit agreement with an effective date as of November 30, 2010. The Credit Agreement evidences a revolving credit facility in the maximum principal amount of USD 250,000, which subject to Lender approval, may be increased up to USD 1,000,000. The outstanding principal amount is due on February 16, 2012.

Competition

We echo the sentiments of Futuresource and feel that our competitors, the Chinese brands that are selling outside of China and India, are a reducing threat in the developed EMEA and U.S. markets. They are making little headway because while their products are on the low-cost end of the spectrum, they are not engaged in important deals and transactions, and are only getting peripheral businesses in the industry. Furthermore, the Chinese brands are also pushing their way into developing markets such as South America and Africa; however, these developing markets offer very little opportunities for the visual communication companies.

While the examples provided above do not appear to place our Company in a competitive business situation, there are also exceptions to the Chinese brands. For instance, Julong Educational Technology Co., Ltd, which is an OEM, has a large U.S. operation and has successfully worked its way into the U.S. market.

Our greatest competitor is probably Interactive Projectors. We are aware that they have already obtained some contracts in preference to IWBs (Finland, Estonia, Russia). In some countries, Interactive Flat panels are also emerging.

Despite the competition we face, our Company is in a strong position to capitalize on emergence of Interactive Flat Panels with the new LCD range.

3

Supply of Components

Although most components essential to our Company’s business are generally available from multiple sources, certain key components including but not limited to aluminum, plastics, LCDs, certain optical infrared technology (“IR”), and integrated circuits (“ICs”) are currently obtained by our Company from single or limited sources, which subjects us to significant supply and pricing risks.

Many of these and other key components that are available from multiple sources are subject at times to industry-wide shortages and significant commodity pricing fluctuations. In addition, we have entered into certain agreements for the supply of key components, including, but not limited to aluminum, plastics, LCDs, certain optical IR technology, and ICs at favorable pricing. However, there is no guarantee that we will be able to extend or renew these agreements on similar favorable terms, or at all, upon expiration or otherwise obtain favorable pricing in the future. Therefore, we remain subject to significant risks of supply shortages and/or price increases that can materially adversely affect its financial condition and operating results.

The TouchIT Tablet and TouchIT Vote plus printed circuit boards (“PCBs”) are assembled or are manufactured by outsourcing partners, primarily in various parts of Asia. The loss of supply from any of these suppliers or vendors, whether temporary or permanent, could materially adversely affect our business and financial condition.

Dependence on one or a few major customers

We recognize that we have a reliance on a few major customers. Most notably, Sahara Presentation Products PLC in the UK. We do however, expect to increase our customer base in line with our sales plan, strategy and forecast.

Patents and Trademark Licenses

We allow the use of the TouchIT Technologies brand name for trading purposes in Ireland and the UK. In Ireland, Mr. John Hughes operates TouchIT Technologies Ireland Limited. Our Company has no financial interest in this company. In the UK, Dynascreens UK Limited trades as TouchIT Technologies UK. We also have no financial interest in this company. Both the aforementioned companies use the TouchIT Technologies brand name and act as a master distributor in their respective countries.

Environmental Laws

As a third party manufacturer of visual communication products, we have not incurred or have been subject to environmental laws and expenses.

Employees

During the year, we had up to 19 employees but the average was 6 over the 12 month period.

Available Information

The Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”), are filed with the U.S. Securities and Exchange Commission (the “SEC”). Such reports and other information filed by the Company with the SEC are available free of charge on the Company’s website at www.touchittechnologies.com/investor when such reports are available on the SEC website.

The public may read and copy any materials filed by the Company with the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Room 1580, Washington, DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at www.sec.gov. The contents of these websites are not incorporated into this filing. Further, the Company’s references to the URLs for these websites are intended to be inactive textual references only.

4

|

Item 1A.

|

Risk Factors.

|

Risks Relating to Our Business

WE HAVE A LIMITED OPERATING HISTORY THAT YOU CAN USE TO EVALUATE US, AND THE LIKELIHOOD OF OUR SUCCESS MUST BE CONSIDERED IN LIGHT OF THE PROBLEMS, EXPENSES, DIFFICULTIES, COMPLICATIONS AND DELAYS FREQUENTLY ENCOUNTERED BY A SMALL DEVELOPING COMPANY.

We were incorporated in Nevada in April 2008, under HMSI. Following the transactions described herein, we are now a manufacturer of touch based communication products for the education and corporate marketplaces. As such, we have a limited operating history, and historical operating results may not provide a meaningful basis for evaluating the business, financial performance and prospects. We have limited assets or financial resources and/or limited operating history. Therefore, the likelihood of our success must be considered in light of the problems, expenses, difficulties, complications and delays frequently encountered by a small developing company starting a new business enterprise and the highly competitive environment in which we will operate.

WE NEED TO MANAGE GROWTH IN OPERATIONS TO MAXIMIZE OUR POTENTIAL GROWTH AND ACHIEVE OUR EXPECTED REVENUES AND OUR FAILURE TO MANAGE GROWTH WILL CAUSE A DISRUPTION OF OUR OPERATIONS RESULTING IN THE FAILURE TO GENERATE REVENUE.

In order to maximize potential growth in our current and potential markets, we believe that we must expand our marketing operations. This expansion will place a significant strain on our management and our operational, accounting, and information systems. We expect that we will need to continue to improve our financial controls, operating procedures, and management information systems. We will also need to effectively train, motivate, and manage our employees. Our failure to manage our growth will disrupt our operations and ultimately prevent us from generating the revenues we expect.

In order to achieve the above mentioned targets, our general strategy is to maintain and search for hard-working employees who have innovative initiatives; on the other hand, we will also keep a close eye on expanding opportunities.

IF WE NEED ADDITIONAL CAPITAL TO FUND OUR GROWING OPERATIONS, WE MAY NOT BE ABLE TO OBTAIN SUFFICIENT CAPITAL AND MAY BE FORCED TO LIMIT THE SCOPE OF OUR OPERATIONS.

If adequate additional financing is not available on favorable terms or we are unable to secure additional financing, we may not be able to undertake expansion, continue our marketing efforts and we would have to modify our business plans accordingly. There is no assurance that additional financing will be available to us or financing on favorable terms.

In connection with our growth strategies, we may experience increased capital needs and accordingly, we may not have sufficient capital to fund our future operations without additional capital investments. Our capital needs will depend on numerous factors, including (i) our profitability; (ii) the release of competitive products by our competition; (iii) the level of our investment in research and development; and (iv) the amount of our capital expenditures, including acquisitions. We cannot assure you that we will be able to obtain capital in the future to meet our needs.

Even if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any additional financing will be available to us, or if available, will be on terms favorable to us.

5

NEED FOR ADDITIONAL EMPLOYEES.

The Company’s future success also depends upon its continuing ability to attract and retain highly qualified personnel. Expansion of our business and the management and operation of the Company will require additional managers and employees with industry experience, and the success of our Company will be highly dependent on our ability to attract and retain skilled management personnel and other employees. Competition for such personnel is intense. There can be no assurance that we will be able to attract or retain highly qualified personnel.

Competition for skilled personnel in our industry is significant. This competition may make it more difficult and expensive to attract, hire and retain qualified managers and employees. Our inability to attract skilled management personnel and other employees as needed could have a material adverse effect on our business, operating results and financial condition. Our arrangement with our current employees is at will, meaning its employees may voluntarily terminate their employment at any time. We anticipate that the use of stock options, restricted stock grants, stock appreciation rights, and phantom stock awards will be valuable in attracting and retaining qualified personnel. However, the effects of such plan cannot be certain.

OUR FUTURE SUCCESS IS DEPENDENT, IN PART, ON THE PERFORMANCE AND CONTINUED SERVICE OF OUR MANAGEMENT TEAM.

We are presently dependent to a great extent upon the experience, abilities and continued services of Andrew Brabin and Ronald Murphy, our management team. The loss of services of Mr. Brabin or Mr. Murphy, could have a material adverse effect on our business, financial condition or results of operation.

WE ARE IN AN INTENSELY COMPETITIVE INDUSTRY AND THERE CAN BE NO ASSURANCE THAT WE WILL BE ABLE TO COMPETE WITH OUR COMPETITORS WHO MAY HAVE GREATER RESOURCES.

We could face strong competition from our competitors in the touch technology industry who could duplicate our model. These competitors may have substantially greater financial resources and marketing, development and other capabilities than we have. In addition, there are very few barriers to enter into the market for our products. There can be no assurance; therefore, that any of our competitors, many of whom have far greater resources will not independently develop products that are substantially equivalent or superior to our products. Therefore, an investment in our Company is very risky and speculative due to the competitive environment in which we intend to operate.

OUR ABILITY TO CONTINUE TO DEVELOP AND EXPAND OUR PRODUCT OFFERINGS TO ADDRESS EMERGING CONSUMER DEMANDS AND TECHNOLOGICAL TRENDS WILL IMPACT OUR FUTURE GROWTH. IF WE ARE NOT SUCCESSFUL IN MEETING THESE BUSINESS CHALLENGES, OUR RESULTS OF OPERATIONS AND CASH FLOWS WILL BE MATERIALLY AND ADVERSELY AFFECTED.

Our ability to implement solutions for our customers incorporating new developments and improvements in technology which translate into productivity improvements for our customers and to develop product offerings that meet the current and prospective customers’ needs are critical to our success. The markets we serve are highly competitive. Our competitors may develop solutions or products which make our offerings obsolete. Our ability to develop and implement up to date solutions utilizing new technologies which meet evolving customer needs in touch technology solutions will impact our future revenue growth and earnings.

OUR FUTURE SUCCESS IS DEPENDENT UPON OUR ABILITY TO PROTECT OUR INTELLECTUAL PROPERTY.

We may not be able to protect unauthorized use of our intellectual property and take appropriate steps to enforce our rights. Although management does not believe that our products infringe on the intellectual rights of others, there is no assurance that we may not be the target of infringement or other claims. Such claims even if not true, could result in significant legal and other costs associated and may be a distraction to management. We plan to rely on a combination of copyright, trade secret, trademark laws and non-disclosure and other contractual provisions to protect our proprietary rights. We use and intend to use the trademark “TouchIT Technologies” name and logo. We intend to file federal trademark applications for “TouchIT Technologies” and to secure the Internet trade domain “Touchittechnologies.com” and related logo. There can be no assurance that the registrations applied for will be accepted. Because the policing of intellectual and intangible rights may be difficult and the ideas and other aspects underlying our business model may not in all cases be protectable under intellectual property laws, there can be assurance that we can prevent competitors from marketing the same or similar products and services.

NON RELIANCE ON PREVIOUSLY ISSUED FINANCIAL STATEMENTS OR A RELATED AUDIT REPORT OR COMPLETED INTERIM REVIEW.

On approximately January 18, 2014, our Board of Directors was advised by our independent public accountant, Edward Richardson Jr. CPA , that our financial statements reviewed and/or audited by Richardson for the certain quarters referenced herein as filed (collectively, the Financial Statements") with the Securities and Exchange Commission could not be relied upon based upon the inadvertent non-disclosure of two 8% convertible notes due May 17, 2015 in the principal amounts of $400,000 and $100,000, respectively, on the balance sheets as of the dates indicated (collectively, the "Convertible Notes"), and accrued interest payable under the Convertible Notes. The errors were corrected by us on our Financial Statements, including this Annual Report for fiscal year ended December 31, 2011 at the advice of our independent public accountant.

The errors on the financial statement for fiscal year ended December 31, 2011 related to the non-disclosure of the Convertible Notes. As a result, our Board of Directors concluded on January 18, 2014 that our previously issued financial statements for fiscal year ended December 31, 2011 should no longer be relied upon.

We have filed amendments to all financial statements and reports for those certain quarters.

6

Risks Associated with Our Shares of Common Stock

BROAD DISCRETION OF MANAGEMENT TO USE OF PROCEEDS FROM FINANCING.

Our management will have broad discretion with respect to the expenditure of the net proceeds from the financing that closed in connection with the Share Exchange Agreement. Accordingly, Subscribers will be entrusting their funds to our management, upon whose judgment they must depend, with limited information concerning the specific working capital requirements and general corporate purposes to which the funds will be ultimately applied

THE SECURITIES BEING ISSUED IN CONNECTION WITH AND FOLLOWING THE SHARE EXCHANGE AGREEMENT ARE RESTRICTED SECURITIES AND MAY NOT BE TRANSFERRED IN THE ABSENCE OF REGISTRATION OR THE AVAILABILITY OF A RESALE EXEMPTION.

The shares of Common Stock, Notes and Warrants being issued in connection with the Share Exchange Agreement and financing described herein are being issued in reliance on an exemption from the registration requirements of the Securities Act under Section 4(2) of the Securities Act and Regulation D promulgated under the Securities Act. Consequently, these securities will be subject to restrictions on transfer under the Securities Act and may not be transferred in the absence of registration or the availability of a resale exemption. In particular, in the absence of registration, such securities cannot be resold to the public until certain requirements under Rule 144 promulgated under the Securities Act have been satisfied, including certain holding period requirements. Furthermore, we are under no obligation to file a resale registration statement with respect to those securities except in connection with an unrelated secondary offering. As a result, a purchaser who receives any such securities issued in connection with the Share Exchange Agreement or the financing may be unable to sell such securities at the time, or at the price or upon such other terms and conditions, as the purchaser desires, and the terms of such sale may be less favorable to the purchaser than might be obtainable in the absence of such limitations and restrictions.

RESTRICTED SECURITIES; LIMITED TRANSFERABILITY.

Purchase of the Securities should be considered a long-term, illiquid investment. The Securities have not been registered under the Act, are being offered by reason of a specific exemption from registration and are “restricted securities” under Rule 144 promulgated under the Act, and cannot be sold without registration under the Act or any exemption from registration. In addition, the Securities will not be registered under any state securities laws that would permit their transfer. Because of these restrictions and the absence of a trading market for the Securities, a Subscriber will likely be unable to liquidate an investment even though other personal financial circumstances would dictate such liquidation.

OUR COMMON STOCK IS QUOTED ON THE OTC BULLETIN BOARD WHICH MAY HAVE AN UNFAVORABLE IMPACT ON OUR STOCK PRICE AND LIQUIDITY.

Our common stock is quoted on the OTC Bulletin Board (the “OTCBB”). The OTC Bulletin Board is a significantly more limited market than the New York Stock Exchange or Nasdaq system. The quotation of our shares on the OTC Bulletin Board may result in a less liquid market available for existing and potential stockholders to trade shares of our common stock, could depress the trading price of our common stock and could have a long-term adverse impact on our ability to raise capital in the future.

7

IF WE FAIL TO ESTABLISH AND MAINTAIN AN EFFECTIVE SYSTEM OF INTERNAL CONTROL, WE MAY NOT BE ABLE TO REPORT OUR FINANCIAL RESULTS ACCURATELY OR TO PREVENT FRAUD. ANY INABILITY TO REPORT AND FILE OUR FINANCIAL RESULTS ACCURATELY AND TIMELY COULD HARM OUR REPUTATION AND ADVERSELY IMPACT THE TRADING PRICE OF OUR COMMON STOCK.

Effective internal control over financial reporting is necessary for us to provide reliable financial reports and prevent fraud. If we cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would if an effective control environment existed, and our business and reputation with investors may be harmed. As a result, our small size and any current internal control deficiencies may adversely affect our financial condition, results of operation and access to capital. We have not performed an in-depth analysis to determine if in the past un-discovered failures of internal controls exist, and may in the future discover areas of our internal control that need improvement.

OUR SHARES OF COMMON STOCK ARE VERY THINLY TRADED, AND THE PRICE MAY NOT REFLECT OUR VALUE AND THERE CAN BE NO ASSURANCE THAT THERE WILL BE AN ACTIVE MARKET FOR OUR SHARES OF COMMON STOCK EITHER NOW OR IN THE FUTURE.

Our shares of common stock are very thinly traded, and the price if traded may not reflect our value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business and any steps that our management might take to bring us to the awareness of investors. There can be no assurance given that there will be any awareness generated. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business. If a more active market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms may not be willing to effect transactions in the securities. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of such shares of common stock as collateral for any loans.

THERE IS CURRENTLY NO LIQUID TRADING MARKET FOR OUR COMMON STOCK AND WE CANNOT ENSURE THAT ONE WILL EVER DEVELOP OR BE SUSTAINED.

To date there has been no liquid trading market for our common stock. We cannot predict how liquid the market for our common stock might become. We anticipate having our common stock continue to be quoted for trading on the OTC Bulletin Board, however, we cannot be sure that such quotations will continue. We currently do not satisfy the initial listing standards, and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted for listing on any such exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our common stock is otherwise rejected for listing and remain listed on the OTC Bulletin Board or suspended from the OTC Bulletin Board, the trading price of our common stock could suffer and the trading market for our common stock may be less liquid and our common stock price may be subject to increased volatility.

Furthermore, for companies whose securities are traded in the OTC Bulletin Board, it is more difficult (1) to obtain accurate quotations, (2) to obtain coverage for significant news events because major wire services generally do not publish press releases about such companies, and (3) to obtain needed capital.

In addition, the price at which our common stock may be sold is very unpredictable because there are very few trades in our common stock. Because our common stock is so thinly traded, a large block of shares traded can lead to a dramatic fluctuation in the share price.

OUR STOCK PRICE MAY BE VOLATILE.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

|

-

|

limited “public float” following the Share Exchange, in the hands of a small number of persons whose sales or lack of sales could result in positive or negative pricing pressure on the market price for our common stock;

|

|

-

|

sales of our common stock; and

|

|

-

|

our ability to execute our business plan.

|

8

Our shares of common stock are very thinly traded, and the price may not reflect our value and there can be no assurance that there will be an active market for our shares of common stock either now or in the future. Our shares of common stock are very thinly traded, only a small percentage of our common stock is available to be traded and is held by a small number of holders and the price, if traded, may not reflect our actual or perceived value. There can be no assurance that there will be an active market for our shares of common stock either now or in the future. The market liquidity will be dependent on the perception of our operating business, among other things. We will take certain steps including utilizing investor awareness campaigns, press releases, road shows and conferences to increase awareness of our business and any steps that we might take to bring us to the awareness of investors may require we compensate consultants with cash and/or stock. There can be no assurance that there will be any awareness generated or the results of any efforts will result in any impact on our trading volume. Consequently, investors may not be able to liquidate their investment or liquidate it at a price that reflects the value of the business and trading may be at an inflated price relative to the performance of our company due to, among other things, availability of sellers of our shares. If a market should develop, the price may be highly volatile. Because there may be a low price for our shares of common stock, many brokerage firms or clearing firms may not be willing to effect transactions in the securities or accept our shares for deposit in an account. Even if an investor finds a broker willing to effect a transaction in the shares of our common stock, the combination of brokerage commissions, transfer fees, taxes, if any, and any other selling costs may exceed the selling price. Further, many lending institutions will not permit the use of low priced shares of common stock as collateral for any loans.

WE CURRENTLY HAVE A LIMITED PUBLIC FLOAT HELD BY A LIMITED NUMBER OF PERSONS.

Of our 55,839,419 issued and outstanding shares of common stock, only 23 619 419 shares are presently eligible for resale without further registration by the holders thereof or pursuant to an exemption from registration. In addition, these 23 619 419 shares are presently held by a limited number of shareholders. As a result of the relatively small size of our public float and its initial concentration in the hands of only a few people, the liquidity of the market for our common stock may be both severely limited and subject to high levels of volatility.

|

Item 1B.

|

Unresolved Staff Comments.

|

Not Applicable.

|

Item 2.

|

Property.

|

We do not own any real property. We rent approximately 50 square meters (m2) of office space in suite 200 of the Liberty Center at 100 West Big Beaver Road, Troy, MI.

|

Item 3.

|

Legal Proceedings.

|

From time to time, we may become involved in various lawsuits and legal proceedings which arise in the ordinary course of business. Litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business. We are currently not aware of any such legal proceedings or claims that will have, individually or in the aggregate, a material adverse effect on our business, financial condition, or operating results.

|

Item 4.

|

(Removed and Reserved).

|

PART II

|

Item 5.

|

Market for Registrant’s Common Equity, and Related Stockholder Matters and Issuer Purchases of Equity Securities.

|

Market Information

Our common stock is currently quoted on the OTC Bulletin Board (“OTCBB”), which is sponsored by FINRA. Our shares are quoted on the OTCBB under the symbol “TUCN.” The following table sets forth the calendar quarter indicated, the quarterly range of high and low bid quotations for our common stock for each of the periods indicated as reported by the OTCBB. Trading in our common stock in the over-the-counter market has become limited and sporadic and the quotations set forth below are not necessarily indicative of actual conditions. Further, the quotations mainly reflect the prices at which transactions were proposed, and do not necessarily represent actual transactions.

|

Fiscal Year Ending December 31, 2011

|

||||

|

Quarter Ended

|

High $

|

Low $

|

||

|

March 31, 2011

|

$0.118

|

$0.06

|

||

|

June 30, 2011

|

$0.085

|

$0.043

|

||

|

September 30, 2011

|

$0.040

|

$0.010

|

||

|

December 31, 2011

|

$0.030

|

$0.005

|

9

Penny Stock

The SEC has adopted rules that regulate broker-dealer practices in connection with transactions in penny stocks. Penny stocks are generally equity securities with a market price of less than $5.00, other than securities registered on certain national securities exchanges or quoted on the NASDAQ system, provided that current price and volume information with respect to transactions in such securities is provided by the exchange or system. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock, to deliver a standardized risk disclosure document prepared by the SEC, that: (a) contains a description of the nature and level of risk in the market for penny stocks in both public offerings and secondary trading; (b) contains a description of the broker's or dealer's duties to the customer and of the rights and remedies available to the customer with respect to a violation of such duties or other requirements of the securities laws; (c) contains a brief, clear, narrative description of a dealer market, including bid and ask prices for penny stocks and the significance of the spread between the bid and ask price; (d) contains a toll-free telephone number for inquiries on disciplinary actions; (e) defines significant terms in the disclosure document or in the conduct of trading in penny stocks; and (f) contains such other information and is in such form, including language, type size and format, as the SEC shall require by rule or regulation.

The broker-dealer also must provide, prior to effecting any transaction in a penny stock, the customer with (a) bid and offer quotations for the penny stock; (b) the compensation of the broker-dealer and its salesperson in the transaction; (c) the number of shares to which such bid and ask prices apply, or other comparable information relating to the depth and liquidity of the market for such stock; and (d) a monthly account statement showing the market value of each penny stock held in the customer's account.

In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written acknowledgment of the receipt of a risk disclosure statement, a written agreement as to transactions involving penny stocks, and a signed and dated copy of a written suitability statement.

These disclosure requirements may have the effect of reducing the trading activity for our common stock. Therefore, stockholders may have difficulty selling our securities.

Record Holders of Our Common Stock

As of December 30, 2011, there were over 500 stockholders of record of our common stock.

10

Dividends

There are no restrictions in our Articles of Incorporation or Bylaws that prevent us from declaring dividends. The Nevada Revised Statutes, however, do prohibit us from declaring dividends where after giving effect to the distribution of the dividend:

1. We would not be able to pay our debts as they become due in the usual course of business, or;

2. Our total assets would be less than the sum of our total liabilities plus the amount that would be needed to satisfy the rights of shareholders who have preferential rights superior to those receiving the distribution.

We have not declared any dividends and we do not plan to declare any dividends in the foreseeable future.

|

Item 6.

|

Selected Financial Data.

|

We are a “smaller reporting company” (as defined by Rule 12b-2 of the Exchange Act) and are not required to provide the information required under this item.

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations.

|

Forward-Looking Statements

Certain statements, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives, and expected operating results, and the assumptions upon which those statements are based, are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements generally are identified by the words “believes,” “project,” “expects,” “anticipates,” “estimates,” “intends,” “strategy,” “plan,” “may,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. We intend such forward-looking statements to be covered by the safe-harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, and are including this statement for purposes of complying with those safe-harbor provisions. Forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties which may cause actual results to differ materially from the forward-looking statements. Our ability to predict results or the actual effect of future plans or strategies is inherently uncertain. Factors which could have a material adverse affect on our operations and future prospects on a consolidated basis include, but are not limited to: changes in economic conditions, legislative/regulatory changes, availability of capital, interest rates, competition, and generally accepted accounting principles. These risks and uncertainties should also be considered in evaluating forward-looking statements and undue reliance should not be placed on such statements. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Further information concerning our business, including additional factors that could materially affect our financial results, is included herein and in our other filings with the SEC.

Plan of Operation – Executive Overview

We manufacture touch-based visual communication products for the education and corporate worldwide marketplaces specializing in Interactive Whiteboards and Interactive LCDs. Our products stand out from the competition in terms of their design, functionality and price offering. Our customers seek our products as they provide them a different point of entry to the market in terms of price, quality of design and margin. Currently, demand for our products is exceeding our ability to supply.

From market data, we understand that the market for our products will continue to grow for the next five years and possibly beyond.

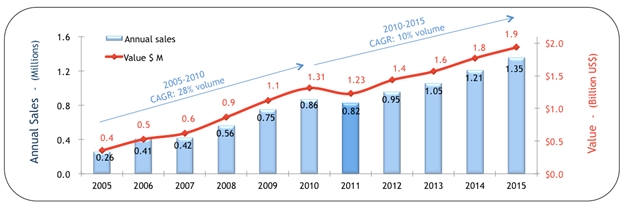

Interactive Whiteboard World Wide Market Overview

Data compiled by Futuresource Consulting UK Ltd, Q3 2011 Report, author - Colin Messenger

11

Critical Accounting Policies and Estimates

The accompanying financial statements include the financial statements of TouchIT Tech KS and TouchIT Ed. Although not significant, it should be noted that inter-company transactions and balances do exist and have not been consolidated. TouchIT Tech KS and TouchIT Ed together are referred to as the Company.

This management's discussion and analysis of our financial condition and results of operations are based on the financial statements of both TouchIT Tech and TouchIT Ed, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements as well as the reported net sales and expenses during the reporting periods. On an ongoing basis, we will evaluate these estimates and assumptions. We base our estimates on historical experience and on various other factors that we believe are reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. Actual results may differ from these estimates under different assumptions or conditions.

We believe that the following accounting policies are the most critical to aid you in fully understanding and evaluating this management discussion and analysis:

Basis of presentation financial statements:

We maintain our books of account and prepare its statutory financial statements in accordance with accounting principles in the United Stats of America. The accompanying financial statements are based on the statutory records, with adjustments and reclassifications, for the purpose of fair presentation in accordance with United States generally accepted accounting principles (“US GAAP”).

There are inter-company transactions that have not been consolidated on these financial statements.

Revenue recognition:

Revenue is measured at the fair value of the consideration received or receivable. Revenue is reduced for customer returns, rebates, and other similar allowances.

Inventories:

Inventories are stated at the lower of cost or net realizable value. Costs, including an appropriate portion of fixed and variable overhead expenses, are assigned to inventories held by the method most appropriate to the particular class of inventory being valued on the weighted average basis. Net realizable value represents the estimated selling price less all estimated costs of completion and costs necessary to deliver service.

12

Property, plant and equipment:

Property, plant and equipment are carried at cost less accumulated depreciation and any accumulated impairment losses, if any. Depreciation is charged so as to write off the cost of assets, other than land and construction in progress, over their estimated useful lives, using straight-line method. The estimated useful lives, residual values and depreciation method are reviewed at each year-end, with the effect of any changes in estimate accounted for on a prospective basis.

Assets held under finance leases are depreciated over their expected useful lives on the same basis as owned assets or, where shorter, the term of the relevant lease. The gain or loss arising on the disposal or retirement of an item of property, plant and equipment is determined as the difference between the sales proceeds and the carrying amount of the asset and is recognized in profit or loss.

The ranges of estimated useful lives are as follows:

|

-

|

Machinery and equipment 2-6 years

|

|

-

|

Motor vehicles 4 years

|

|

-

|

Furniture, fixtures and office equipment 4-5 years

|

Shipping and handling:

Shipping and handling costs related to costs of the raw material purchased is included in cost of revenues.

Research and development costs:

Research and development costs are expensed as incurred. The costs of material and equipment that are acquired or constructed for research and development activities, and have alternative future uses, either in research and development, marketing, or sales, are classified as property and equipment or depreciated over their estimated useful lives.

Company reporting year-end:

Our company uses a calendar year as its fiscal year ending December 31.

Results of Operations for the years ended December 31, 2011 and December 31 2010.

|

31/12/2011

|

31/12/2010

|

|||||||

|

NET SALES

|

1,595,943 | 3,577,881 | ||||||

|

COST OF SALES

|

1,341,374 | (2,502,037 | ) | |||||

|

Gross profit

|

254,569 | 1,075,844 | ||||||

|

MARKETING AND SELLING EXPENSE

|

(578,887 | ) | (504,329 | ) | ||||

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

(356,528 | ) | (479,064 | ) | ||||

|

Profit from operations

|

(680,847 | ) | 92,451 | |||||

|

OTHER INCOME AND EXPENSES, net

|

294,154 | 24,094 | ||||||

|

FINANCIAL INCOME AND EXPENSES, net

|

-- | (8,294 | ) | |||||

|

Profit Loss before taxation and currency translation gain/(loss)

|

(386,692 | ) | 60,063 | |||||

|

TAXATION CHARGE

|

-- | |||||||

|

Taxation current

|

-- | |||||||

|

Deferred

|

-- | |||||||

|

CURRENCY TRANSLATION GAIN/(LOSS)

|

-- | 60,063 | ||||||

|

Net income/(loss) for the year

|

(386,692 | ) | 105,115 | |||||

|

OTHER COMPREHENSIVE INCOME

|

-- | |||||||

|

Total comprehensive income

|

(386,692 | ) | 165,178 | |||||

13

Net Sales

Net sales for the fiscal year ended December 31, 2011 were $1,595,943, a decrease of approximately $1.98 million compared to the net sales for the year ended December 31, 2010. The decrease in our revenues from 2010 to 2011 was due primarily to a market slow down in the first half of the year, coupled with the transition period where the Company moved its manufacturing facilities from Istanbul, Turkey to Taiwan. There was a down time of approximately 10 weeks where no production was able to be undertaken. This had a knock-on effect for reoccurring sales.

Cost of Sales

The cost of sales for the fiscal year ended December 31, 2011 was $1,341,374 compared to a cost of $2,502,037, for the cost of sales for the fiscal year ended December 31, 2010. The decrease in the cost of sales from 2010 to 2011 was due to the decrease in revenue and subsequent production in the same period. The percentage of Cost of sales against NET sales has increased by 14%. This is due to the continued cost of monthly overhead coupled with the drop in sales revenue.

|

31/12/2011

|

31/12/2010

|

|||||||

|

NET SALES

|

1,595,943

|

3,577,881

|

||||||

|

COST OF SALES

|

(1,341,374

|

)

|

(2,502,037

|

)

|

||||

|

As a percentage of sales

|

84

|

%

|

70

|

%

|

||||

Marketing and Selling Expenses

Marketing and selling expenses for the fiscal year ended December 31, 2011 were a cost of $578,887 compared to a cost of $504,329 for the fiscal year ended December 31 2010. Marketing and selling expenses were up 15% from 2010 to 2011, which was primarily due to an increased customer base demanding MDF (market development funds) and also the “pay to play” culture in the USA. This is where a distributor or a reseller will charge the vendor a setup fee to get the products onto their system or charge for a internal training day for staff. These trends are currently becoming more common.

General and Administrative Expenses

General and administrative expenses for the fiscal year ended December 31, 2011 were a cost of $356,528 compared to a cost of $479,064 for the fiscal year ended December 31, 2010. General and administrative expenses decreased by 25% or $122,536 from 2010 to 2011. This decrease can be attributed to the closure of the Turkish facilities and the subsequent reduction in overhead costs after its closure in September 2011.

14

|

31/12/2011

|

31/12/2010

|

|||||||

|

MARKETING AND SELLING EXPENSE

|

(578,887

|

)

|

(504,329

|

)

|

||||

|

As a percentage of revenue

|

36

|

%

|

14

|

%

|

||||

|

GENERAL AND ADMINISTRATIVE EXPENSES

|

(356,528

|

)

|

(479,064

|

)

|

||||

|

As a percentage of revenue

|

22

|

%

|

13

|

%

|

||||

Operational Profit

The operational loss for the fiscal year ended December 31, 2011 was $680,847 compared to a profit of $92,451 for the fiscal year ended December 31, 2010. Operational profit has decreased by $588,396 from 2010 to 2011 and this can be attributed to a downturn in the markets that lead to a subsequent drop in sales revenue whilst the monthly overhead cost remained the same.

Other Income and Expenses, net

Other Income and Expenses, net have increased by $270,060 from $24,094 for the fiscal year ended December 31, 2010 to $294,154 for the fiscal year ended December 31, 2011. This increase can be attributed to the closure of the Turkish Subsidiaries and a subsequent equity gain through the cancellation of debt that the subsidiaries owed to suppliers and related parties.

Total Comprehensive Income

Our total comprehensive income has decreased by $221,514 from $165,178 profit in 2010 to a $386,692 loss in 2011. This decrease can be attributed to a downturn in the markets that lead to a subsequent drop in sales revenue.

|

CURRENT ASSETS

|

31/12/2011

|

31/12/2010

|

||||||

|

Cash and cash equivalents

|

70,289 | 50,556 | ||||||

|

Trade receivables, net

|

240,867 | 705,225 | ||||||

|

Due from related parties

|

- | 863,395 | ||||||

|

Due from Shareholders

|

- | 50,585 | ||||||

|

Inventories

|

55,689 | 365,643 | ||||||

|

Other current assets

|

1,106 | |||||||

|

Total current assets

|

366,845 | 2,036,510 | ||||||

|

NON CURRENT ASSETS

|

||||||||

|

Property, plant and equipment, net

|

1,027 | 64,495 | ||||||

|

Intangible assets, net

|

- | 25,145 | ||||||

|

Other non current assets

|

- | 3,555 | ||||||

|

Total non current assets

|

1,027 | 93,195 | ||||||

|

TOTAL ASSETS

|

367,872 | 2,129,705 | ||||||

|

CURRENT LIABILITIES

|

||||||||

|

Borrowings

|

- | 2,351 | ||||||

|

Trade payables

|

181,984 | 124,745 | ||||||

|

Due to shareholders

|

- | 47,257 | ||||||

|

Due to related parties

|

265,318 | 1,145,992 | ||||||

|

Other current liabilities

|

27,390 | 73,233 | ||||||

|

Total current liabilities

|

474,692 | 1,393,578 | ||||||

|

NON CURRENT LIABILITIES

|

||||||||

|

Borrowings

|

250,000 | - | ||||||

|

Employee termination benefits

|

- | - | ||||||

|

Reserve for retirement pay

|

- | 1,842 | ||||||

|

Convertible Notes

|

540,000 | 750,000 | ||||||

|

Total non current liabilities

|

790,000 | 751,842 | ||||||

|

COMMITMENTS AND CONTINGENCIES

|

||||||||

|

SHAREHOLDERS' EQUITY

|

||||||||

|

Share capital

|

127,570 | 127,570 | ||||||

|

Retained earnings

|

(637,698 | ) | -308,463 | |||||

|

Net income / (loss) for the period

|

(386,692 | ) | 173,899 | |||||

|

Total shareholders’ equity

|

(896,820 | ) | -7,004 | |||||

|

TOTAL LIABILITIES AND

|

||||||||

|

SHAREHOLDERS' EQUITY

|

367,872 | 3,138,416 | ||||||

Cash and Equivalents

Cash and equivalents have increased by $19,733 from $50,556 for the fiscal year ended December 31, 2010 compared to $70,289 for the fiscal year ended December 31, 2011. We believe a lack of working capital has hindered our growth this year and we are currently evaluating new finance facilities that should be in place in early 2012 to improve our cash situation.

15

Trade Receivables

Trade receivables for the fiscal year ended December 31, 2011 were $240,867, compared to $705,225 for the fiscal year ended December 31, 2010. Trade receivables have decreased by 464,358 from 2010 to 2011. This is the by-product of decreased revenues.

Related Party Transactions

Related party transactions NET for the fiscal year ended December 31, 2011 were $(265,318) compared to $282,597 for the fiscal year ended December 31, 2010. Related party transactions have decreased. This decreased is due to removal of inter-company transactions as both TouchIT Ed and TouchIT Tech KS have been dissolved. Furthermore, the Company no longer uses Emko Emaye as a supplier of raw materials.

|

31/12/2011

|

31/12/2010

|

|||||||

|

Due from related parties

|

0

|

863,395

|

||||||

|

Due to related parties

|

265,318

|

1,145,992

|

||||||

|

NET Amount

|

(265,318)

|

282,597

|

||||||

Inventories

Inventories for the fiscal year ended December 31, 2011 were $55,689, compared to $365,643 for fiscal year ended December 31, 2010. Inventories have decreased from 2010 to 2011 by $309,954 reflecting our move to third party manufacture in a just in time manor rather than holding large quantities of inventory.

|

31/12/2011

|

31/12/2010

|

|||||||

|

Total current assets

|

367,872

|

2,129,705

|

||||||

Trade Payables

Trade payables for the fiscal year ended December 31, 2011 were $181,984, compared to $124,745 for the fiscal year ended December 31, 2010. Trade Payables have increased by 45% or $57,239. This is due to the Company’s decision to move to third party manufacture and the extension of credit terms by the vendors.

Due to Related Parties

Due to related parties have decreased from 2010 to 2011 by $880,674 from $1,145,992 for the fiscal year ended December 31, 2010 to $265,318 for the fiscal year ended December 31, 2011. This was primarily due to the closure of the Turkish Subsidiaries and the subsequent cancellation of the debt that they owed to Recep Tanisman and Emko Emaye. Current related party transactions are with Kamron Inc which is Ronnie Murphy’s USA Tax entity and ASB Trading, which is Andrew Brabin’s UK Tax entity – both are used for payroll.

|

31/12/2011

|

31/12/2010

|

|||||||

|

Due from related parties

|

0

|

863,395

|

||||||

|

Due to related parties

|

265,318

|

1,145,992

|

||||||

|

NET Amount

|

(265,318)

|

282,597

|

||||||

Convertible Notes

Two 8% convertible notes due May 17, 2015 in the principal amounts of $400,000 and $100,000, respectively, on the balance sheets as of the dates indicated (collectively, the "Convertible Notes"), and accrued interest payable under the Convertible Notes. The Convertible Notes were issued in connection with certain subscription agreements entered into by the Company and the related share exchange agreement dated May 7, 2010 among the Company, TouchIt Tech KS, the stock holders of TouchIt Tech KS, TouchIt Ed, and the stockholders of TouchIt Ed (the "Share Exchange Agreement"), pursuant to which we entered into various agreements with purchasers of the Convertible Notes.

As of December 31, 2011, we owed approximately $500,000 in aggregate principal amount and $,40,000 in accrued interest.

Our NET Income has decreased by $511,870 from $165,178 profit in 2010 to a $386,692 loss in 2011. This decrease can be attributed to a downturn in the markets that lead to a subsequent drop in sales revenue.

|

31/12/2011

|

31/12/2010

|

|||||||

|

Net income / (loss) for the period

|

(346,692)

|

165,178

|

||||||

16

Liquidity and Capital Resources

|

31/12/2011

|

31/12/2010

|

||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES

|

|||||||||

|

Net income

|

(386,692 | ) | 165,178 | ||||||

|

Adjustments to reconcile net income to net cash provided PPA

|

(401,447,28 | ) | -- | ||||||

|

By operating activities:

|

-- | ||||||||

| Depreciation and amortisation | -- | 17,516 | |||||||

| Provision for employee benefit | -- | 801 | |||||||

|

Changes in operating assets and liabilities

|

|||||||||

|

Trade receivables, net

|

1,378,337 | (430,428 | ) | ||||||

|

Due from shareholders

|

-- | (773,544 | ) | ||||||

|

Due from related parties

|

-- | ||||||||

|

Inventories

|

309,953 | (17,620 | ) | ||||||

|

Other current assets

|

1,106 | 98,467 | |||||||

|

Other non current assets

|

-- | 331 | |||||||

|

Trade payables

|

322,557 | 54,126 | |||||||

|

Due to shareholders

|

-- | 54,413 | |||||||

|

Due to related parties

|

-- | 392,276 | |||||||

|

Other current liabilities

|

(1,241,442 | ) | (47,386 | ) | |||||

|

Convertible Notes

|

-- | 750,000 | |||||||

|

Net cash generated from (used for) operating activities

|

(17,628 | ) | 67,197 | ||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES

|

|||||||||

|

Increase/(decrease) in short-term borrowings

|

-- | (8,931 | ) | ||||||

|

Increase/(decrease) in long-term borrowings

|

(38,158 | ) | -- | ||||||

|

Dividends paid

|

-- | -- | |||||||

|

Net cash (used for) provided from financing activities

|

(38,158 | ) | (8,931 | ) | |||||

|

CASH FLOWS FROM INVESTING ACTIVITIES

|

|||||||||

|

Purchases of property, plant and equipment and intangible assets

|

(797 | ) | (62,304 | ) | |||||

|

Share capital increase

|

-- | -- | |||||||

|

Net cash used for investing activities

|

(797 | ) | (62,304 | ) | |||||

|

NET INCREASE / (DECREASE) IN CASH AND BANKS

|

19,733 | (4,289 | ) | ||||||

|

CASH AND BANKS AT BEGINNING OF THE YEAR

|

50,556 | 54,845 | |||||||

|

CASH AND BANKS AT END OF THE PERIOD

|

70,289 | 50,556 | |||||||

Net Income

For fiscal year ended December 31, 2011, when compared to the same period in 2010, NET income for the period our NET Income has decreased by $511,870 from $165,178 profit in 2010 to a $386,692 loss in 2011. This decrease can be attributed to a downturn in the markets that lead to a subsequent drop in sales revenue. The sales revenue continues to come predominately from TouchIT Interactive Whiteboards, or OEM models under a different name that are sold into distribution companies that in turn, supply to education.

Net Cash Generated from Operating Activities

For fiscal year ended December 31, 2011, when compared to the same period in 2010, NET cash used for operating activities was ($17,628) compared to $67,197 generated from operating activities for the same period in 2010. This is an increase of $363,237. This increase was due to the closure of the Turkish Subsidiaries and the subsequent cancellation of the debt that they owed to Recep Tanisman and Emko Emaye.

Cash Flow Used Investing Activities

For fiscal year ended December 31, 2011, when compared to the same period in 2010, there was a NET cash flow decrease of $61,507 from $(62,304) to ($797). This decrease was due to the equity gain following the closure of the Turkish Subsidiaries.

Cash Position

There was a net increase in cash and cash equivalents of $19 733 for the beginning and the end of the period from $50,556 at the beginning of the period, to $70,289 for fiscal year ended December 31, 2011.

Off Balance Sheet Arrangements

As of December 31, 2011, there were no off balance sheet arrangements.

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk.

|

A smaller reporting company is not required to provide the information required by this Item.

|

Item 8.

|

Financial Statements and Supplementary Data.

|

See the financial statements annexed to this annual report.

17

|

Item 9.

|

Changes In and Disagreements with Accountants on Accounting and Financial Disclosure.

|

No events occurred requiring disclosure under Item 304(b) of Regulation S-K during the fiscal year ending December 31, 2011.

|

Item 9A.

|

Controls and Procedures.

|

Management’s annual report on internal control over financial reporting.

Our Chief Executive Officer/Chief Financial Officer is responsible for establishing and maintaining adequate internal control over financial reporting. Internal control over financial reporting is defined in Rule 13a-15(f) and 15d-15(f) promulgated under the Securities Exchange Act of 1934 as a process designed by, or under the supervision of, our principal executive and principal financial officers and effected by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles and includes those policies and procedures that:

|

·

|

Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets;

|

|

·

|

Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorizations of management and our directors; and

|

|

·

|

Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of our assets that could have a material effect on the financial statements.

|

Because of its inherent limitations, our internal control over financial reporting may not prevent or detect misstatements. Therefore, even those systems determined to be effective can provide only reasonable assurance with respect to financial statement preparation and presentation. Projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our Chief Executive Officer/Chief Financial Officer assessed the effectiveness of our internal control over financial reporting as of December 31, 2011. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission (“COSO”) in Internal Control — Integrated Framework.

Based on our assessment, our Chief Executive Officer/Chief Financial Officer believe that, as of December 31, 2011, our internal control over financial reporting is not effective based on those criteria, due to the following:

|

·

|

Deficiencies in Segregation of Duties. Lack of proper segregation of functions, duties and responsibilities with respect to our cash and control over the disbursements related thereto due to our very limited staff, including our accounting personnel.

|

|

·

|

Deficiencies in the staffing of our financial accounting department. The number of qualified accounting personnel with experience in public company SEC reporting and GAAP is limited. This weakness does not enable us to maintain adequate controls over our financial accounting and reporting processes regarding the accounting for non-routine and non-systematic transactions. There is a risk that a material misstatement of the financial statements could be caused, or at least not be detected in a timely manner, by this shortage of qualified resources.

|

In light of this conclusion and as part of the preparation of this report, we have applied compensating procedures and processes as necessary to ensure the reliability of our financial reporting. Accordingly, management believes, based on its knowledge, that (1) this report does not contain any untrue statement of a material fact or omit to state a material face necessary to make the statements made not misleading with respect to the period covered by this report, and (2) the financial statements, and other financial information included in this report, fairly present in all material respects our financial condition, results of operations and cash flows for the years and periods then ended.