Attached files

| file | filename |

|---|---|

| EX-10.10 - EX-10.10 - ARATANA THERAPEUTICS, INC. | d599715dex1010.htm |

| EX-10.8(A) - EX-10.8(A) - ARATANA THERAPEUTICS, INC. | d599715dex108a.htm |

| EX-1.1 - EX-1.1 - ARATANA THERAPEUTICS, INC. | d599715dex11.htm |

| EX-23.2 - EX-23.2 - ARATANA THERAPEUTICS, INC. | d599715dex232.htm |

| EX-23.3 - EX-23.3 - ARATANA THERAPEUTICS, INC. | d599715dex233.htm |

| EX-5.1 - EX-5.1 - ARATANA THERAPEUTICS, INC. | d599715dex51.htm |

| EX-5.2 - EX-5.2 - ARATANA THERAPEUTICS, INC. | d599715dex52.htm |

| EX-23.1 - EX-23.1 - ARATANA THERAPEUTICS, INC. | d599715dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 28, 2014

Registration No. 333-193324

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ARATANA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 38-3826477 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

1901 Olathe Boulevard

Kansas City, KS 66103

(913) 951-2132

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Steven St. Peter, M.D.

President and Chief Executive Officer

Aratana Therapeutics, Inc.

1901 Olathe Boulevard

Kansas City, KS 66103

(913) 951-2132

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Peter N. Handrinos, Esq. B. Shayne Kennedy, Esq. Latham & Watkins LLP John Hancock Tower, 20th Floor 200 Clarendon Street Boston, MA 02116 (617) 948-6060 |

Donald J. Murray, Esq. Eric W. Blanchard, Esq. Covington & Burling LLP The New York Times Building 620 Eighth Avenue New York, NY 10018 (212) 841-1000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement is declared effective.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We and the selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED JANUARY 28, 2014

PRELIMINARY PROSPECTUS

5,500,000 Shares

Common Stock

We are offering 4,500,000 shares of our common stock and certain selling stockholders are offering 1,000,000 shares of our common stock. We will not receive any proceeds from the sale of shares of our common stock by any selling stockholders. Our common stock is listed on The NASDAQ Global Market under the symbol “PETX.” On January 21, 2014, the last reported sale price of our common stock was $18.96 per share.

We are an “emerging growth company” as defined by the Jumpstart Our Business Startups Act of 2012 and, as such, we have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 13 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| PER SHARE | TOTAL | |||||||

| Public Offering Price |

$ | $ | ||||||

| Underwriting Discounts and Commissions(1) |

||||||||

| Proceeds to Aratana Therapeutics, Inc. before expenses |

||||||||

| Proceeds to selling stockholders |

||||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

Delivery of the shares of common stock is expected to be made on or about , 2014. A selling stockholder has granted the underwriters an option for a period of 30 days to purchase an additional 825,000 shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholder if the underwriters exercise this option.

Joint Book-Running Managers

| Jefferies | Barclays | William Blair | ||||||||

Co-Managers

| JMP Securities | Craig-Hallum Capital Group |

Prospectus dated , 2014.

Table of Contents

Table of Contents

| PAGE | ||||

| 1 | ||||

| 13 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 44 | ||||

| 46 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

64 | |||

| 82 | ||||

| 86 | ||||

| 115 | ||||

| 122 | ||||

| 136 | ||||

| 139 | ||||

| 141 | ||||

| 144 | ||||

| Material U.S. Federal Income Tax Consequences to Non-U.S. Holders of Our Common Stock |

146 | |||

| 150 | ||||

| 155 | ||||

| 158 | ||||

| 158 | ||||

| 158 | ||||

| F-1 | ||||

Neither we, nor any of the selling stockholders nor any of the underwriters have authorized anyone to provide information different from that contained in this prospectus. When you make a decision about whether to invest in our common stock, you should not rely upon any information other than the information in this prospectus. Neither the delivery of this prospectus nor the sale of our common stock means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or solicitation of an offer to buy these shares of common stock in any circumstances under which the offer or solicitation is unlawful.

Unless otherwise indicated, information contained in this prospectus concerning our industry and the markets in which we operate, including our general expectations and market position, market opportunity and market share, is based on information from our own management estimates and research, as well as from industry and general publications and research, surveys and studies conducted by third parties. Management estimates are derived from publicly available information, our knowledge of our industry and assumptions based on such information and knowledge, which we believe to be reasonable. In addition, assumptions and estimates of our and our industry’s future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors.” These and other factors could cause our future performance to differ materially from our assumptions and estimates. See “Special Note Regarding Forward-Looking Statements.”

Table of Contents

ARATANA THERAPEUTICS and our logo are two of our trademarks that are used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, trademarks and tradenames referred to in this prospectus appear without the ® and ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights or that the applicable owner will not assert its rights, to these trademarks and tradenames.

Table of Contents

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our common stock. You should read this entire prospectus carefully, especially the section in this prospectus entitled “Risk Factors” beginning on page 13 and our financial statements and the related notes thereto appearing at the end of this prospectus, before making an investment decision. As used in this prospectus, unless the context otherwise requires, references to “we,” “us,” “our,” “our company” and “Aratana” refer to Aratana Therapeutics, Inc. and its subsidiaries.

Overview

Our Company

We are a pet therapeutics company focused on the licensing or acquisition, development and commercialization of innovative biopharmaceutical products for cats, dogs and other companion animals. We operate at the intersection of the more than $50 billion annual U.S. pet market and the more than $20 billion annual worldwide animal health market. Our current product portfolio includes over 15 product candidates consisting of small molecule pharmaceuticals and large molecule biologics that target large opportunities in serious medical conditions in pets. Our most advanced products, AT-004 and AT-005, are monoclonal antibodies for treating lymphoma in dogs. AT-004, which treats B-cell lymphoma, received a conditional license from the U.S. Department of Agriculture, or USDA, and is currently marketed by Novartis Animal Health Inc., or Novartis Animal Health. AT-005, which treats T-cell lymphoma, received a conditional license from the USDA in January 2014 and we expect to commence marketing the product later this year. Our other lead products include small molecules directed at treating osteoarthritis pain and inflammation, loss of appetite and post-operative pain in dogs and cats. Our product candidates are designed to enable veterinarians and pet owners to manage pets’ medical needs safely and effectively, potentially resulting in longer and improved quality of life for pets.

Since our initial public offering in June 2013, we have focused on executing our clinical development plan and continuing to expand our product pipeline and further augment our development capabilities. Recently, we acquired Vet Therapeutics, Inc., which provided us with a proprietary antibody-based biologics platform focused on the treatment of lymphoma, and Okapi Sciences N.V., which provided us with a pipeline of antiviral drugs, including product candidates focused on the treatment of herpes and immunodeficiency in cats. As part of these acquisitions, we also obtained two facilities that we are using to develop additional species-specific monoclonal antibodies, antivirals and other small molecules for use as pet therapeutics. In addition, we now have a commercial product and an additional product candidate that we expect to commercialize in 2014, we have more than doubled the size of our product pipeline since June 2013, and we have significantly increased our technology and development infrastructure. We are focused on advancing our product candidates to regulatory approval and believe that we have significantly accelerated our pathway toward becoming a commercial stage company.

We believe that the role of pets in the family has significantly evolved over the last two decades. Many pet owners consider pets important members of their families, and they have been increasingly willing to spend money to maintain the health of their pets. Consequently, pets are living longer and, as they do, are exhibiting many of the same signs and symptoms of disease as humans, such as arthritis, cancer, obesity, diabetes and heart disease. Today veterinarians have comparatively few drugs at their disposal that have been specifically approved for use in pets. As a result, veterinarians often must resort to using products approved for use in humans, but not approved, or even formally studied, in pets, relying on key opinion leaders and literature, rather than regulatory review and approval.

We believe that pets deserve therapeutics that have been specifically studied and approved by regulatory authorities for each species, and that veterinarians and pet owners will increasingly demand that therapeutics are demonstrated to be safe and effective in pets before using them. We also believe there is an opportunity to leverage the investment in the human biopharmaceutical industry to bring therapeutics to pets in a capital and

1

Table of Contents

time efficient manner. For example, advances in human medicines have created new therapeutics for managing chronic diseases associated with aging, such as cancer, osteoarthritis, diabetes and cardiovascular diseases. However, these advances have not yet been translated into innovative therapies for pets, notwithstanding the fact that pets are living longer and manifesting many of these same diseases of aging. Moreover, while developing and commercializing therapeutics for humans and pets share a number of characteristics, there are also significant differences that we believe facilitate the development of pet therapeutics and make the market attractive. These differences include the role and economics of veterinary practices and the private pay nature of the veterinary market. Additionally, because the development of pet therapeutics requires fewer clinical studies, involves fewer subjects and trials are conducted directly in the target species, the development of drugs for pets is generally faster, less expensive and more predictable than for human therapeutics.

Our Products and Product Candidates

We have assembled a portfolio of more than 15 product candidates that are in various stages of development in either cats or dogs, and frequently in both. Our AT-004 monoclonal antibody product for B-cell lymphoma in dogs has received a conditional license from the USDA, the regulatory agency that oversees biologics in animals, and this product is currently being commercialized in the United States and Canada by Novartis Animal Health. Our AT-005 monoclonal antibody product for T-cell lymphoma in dogs has received a conditional license from the USDA and we expect to begin marketing the product later this year. The following table identifies the primary molecules in our current product portfolio:

| COMPOUND |

SPECIES |

INDICATION |

DEVELOPMENT STATUS |

EXPECTED NEXT STEP | ||||

| AT-001 |

Dog | Pain and inflammation associated with osteoarthritis | Dose selected |

n Initiate pivotal field effectiveness study in first quarter of 2014 n Expect U.S. marketing approval in 2016 | ||||

| Cat |

Pain and inflammation associated with osteoarthritis | Pilot studies | n Dose confirmation study | |||||

| AT-002 |

Dog | Stimulation of appetite | Pivotal field effectiveness study |

n Submission for approval n Expect U.S. marketing approval in 2016 | ||||

| Cat |

Stimulation of appetite | Pilot studies | n Dose confirmation study | |||||

| AT-003 |

Dog | Post-operative pain management | Proof of concept study |

n Dose confirmation study n Initiate pivotal field effectiveness study in second quarter 2014 n Expect U.S. marketing approval in 2016 | ||||

| Cat |

Post-operative pain management | Proof of concept study | n Dose confirmation study | |||||

| AT-004 |

Dog | B-cell lymphoma | Submitted pivotal field effectiveness study |

n Currently sold by Novartis Animal Health n Full license expected in 2015 | ||||

| AT-005 |

Dog | T-cell lymphoma | Completing pivotal field effectiveness study |

n Conditional license received in 2014 n Full license expected in 2015 | ||||

| AT-006 |

Cat | Ocular herpes infection | Pivotal field study in Europe |

n File for EU review in 2014 n Expect U.S. marketing approval in 2017 or 2018 | ||||

2

Table of Contents

| COMPOUND |

SPECIES |

INDICATION |

DEVELOPMENT STATUS |

EXPECTED NEXT STEP | ||||

| AT-007 |

Cat | Feline immunodeficiency virus infection | Pilot study in Europe |

n Initiate field effectiveness study in 2015 n Expect U.S. marketing approval in 2017 or 2018 | ||||

| AT-008 |

Dog | Lymphoma | Pivotal field effectiveness study | n Pivotal field effectiveness in the EU in 2014 | ||||

| AT-009 |

Dog | Mast cell tumor | Lead selection | n Pilot studies | ||||

| AT-010 |

Dog | Atopic dermatitis | Lead selection | n Pilot studies | ||||

| AT-011 |

Dog |

Parvovirus infections | Lead selection | n Proof of concept study | ||||

| AT-012 |

Cat | Calicivirus infections | Lead selection | n Proof of concept study | ||||

In addition to the above-listed product candidates, we are evaluating additional molecules for applications in other diseases including lymphoma in cats, seizures in dogs, atopic dermatitis in dogs and other cancers in cats and dogs, and we are researching new product concepts internally with our recently acquired antibody and antiviral research expertise. Furthermore, we have options with two parties for two additional molecules that we are considering licensing for further development. We aim to submit drug applications for U.S. approval for the majority of our existing product candidates and to make similar regulatory filings for European approval. Furthermore, where appropriate, we attempt to develop and submit regulatory filings for therapeutic indications in both cats and dogs, which will be separate products and require separate approval.

Our Development Strategy

Our strategy is to in-license proprietary compounds from human biopharmaceutical companies and academia or leverage existing insights in human biology applicable in pets and to develop therapeutics specifically for use in pets. We seek to identify human therapeutics that have demonstrated safety and effectiveness in at least two species and are in, or have completed, Phase I or Phase II clinical trials in humans, with well-developed active pharmaceutical ingredient, or API, process chemistry and a well-defined manufacturing process. We also seek to identify products already in development for pets and to license or acquire these products. To date, we have in-licensed and are further developing pharmaceutical compounds from Pacira Pharmaceuticals, Inc., RaQualia Pharma, Inc. and others, and we have acquired Vet Therapeutics and Okapi.

In order to successfully execute our plan, we have assembled an experienced management team consisting of veterinarians, physicians, scientists and other professionals that apply the core principles of drug development to the medical needs of pets. The members of our senior management team combined have over 100 years of experience in the animal health and human biopharmaceutical industries, as well as a strong track record of successfully developing and commercializing therapeutics for pets. Our Chief Scientific Officer and our Head of Drug Evaluation and Development have each been actively involved in the development and approval of over 20 animal health products. Our Chief Commercial Officer has been responsible for guiding the launch of 22 animal health products, including three of the most significant brands in companion animal health.

We expect to build a commercial organization to market our products in the United States and to leverage distributors in other important geographies. We anticipate building a small sales force targeting pet oncology centers to market AT-005. In addition, we expect to use the time preceding the full commercialization of our product candidates to build veterinarian and pet owner awareness of our company and our products. We believe that our product candidates, if approved, will enable veterinarians to deliver a higher level of medical care to pets while providing an important revenue stream to veterinarians’ practices.

3

Table of Contents

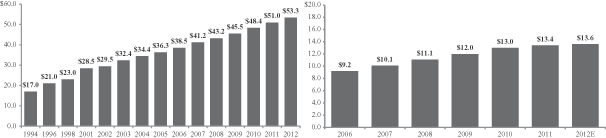

Pet Therapeutics Industry

According to the American Pet Products Association, or APPA, U.S. consumers spent an estimated $56 billion on their pets in 2013, up approximately 44% over 2006, representing a compound annual growth rate, or CAGR, of approximately 5.4% over that period. Cats and dogs are the most popular pet species in the United States and Europe: there are approximately 96 million cats and 83 million dogs in the United States and 90 million cats and 75 million dogs in Europe. An estimated 68% of U.S. households have at least one pet. The U.S. pet market has grown by rates far exceeding inflation, driven by increases in average spending per pet each year since 2006. The U.S. veterinary care segment has been among the fastest growing segments of the overall U.S. pet market, increasing from $9.2 billion in 2006 to $13.6 billion in 2012, representing a CAGR of 6.7%. We estimate that of this $13.6 billion, approximately $6.3 billion was related to consumer spending in pet medicines, which included approximately $4.7 billion for parasiticides and vaccines with approximately $1.6 billion for pet therapeutics. This $1.6 billion estimate excludes amounts spent on human drugs to treat pets. We derived these estimates using data from Vetnosis Limited, a research and consulting firm specializing in animal health and veterinary medicine, for sales of pet therapeutics directly to veterinarians and then adjusted the number to reflect a typical industry mark-up charged to the pet owners by the veterinarian. The $1.6 billion U.S. pet therapeutics market represents less than $10 per year per pet.

We believe that the pet market, driven in part by expansion of the veterinary care segment, will continue to grow and that the introduction of novel pet therapeutics offering significant safety and efficacy benefits over existing products will result in pet therapeutics garnering a larger share of total consumer spending on pets.

Differences Between Human and Pet Therapeutics

While the business of developing and commercializing therapeutics for pets shares a number of characteristics with the business of developing and commercializing therapeutics for humans, there are also significant differences between the pet therapeutics and human therapeutics businesses that we believe make the pet therapeutics market attractive, including:

Faster, less expensive and more predictable development

Development of pet therapeutics is generally faster and less expensive than for human therapeutics because it requires fewer clinical studies, involves fewer subjects and is conducted directly in the target species. Because there is no need to bridge from pre-clinical investigations in one species to the final target species, decisions on the potential efficacy and safety of products often can be made more quickly, and the likelihood of success often can be established earlier. This contributes to the enhanced process and greater capital efficiency of pet versus human drug development.

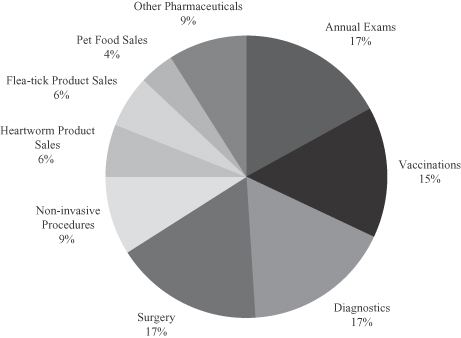

Role and economics of veterinary practices

In addition to the primary goal of improving the health of pets, veterinary practices can generate additional value and revenue growth by prescribing pet therapeutics. Unlike in the human pharmaceutical market, veterinarians often serve the dual roles of doctor and pharmacist as pet owners typically purchase medicines directly from veterinarians. As a result, the sale of pet therapeutics directly to pet owners is a meaningful contributor to veterinary practice economics. According to industry sources, approximately one-third of companion animal practice revenue comes from prescription drug sales, parasiticides, vaccinations and non-prescription medicines. We believe that this revenue stream could be increased significantly with the introduction of novel therapeutics that have been specifically developed for pets.

Partnership relationships with, and better access to, veterinarian decision-makers

The pet therapeutics industry typically uses a combination of sales representatives to inform veterinarians about the attributes of products, and technical and veterinary operations specialists to provide advice regarding local, regional and global trends. In many cases, a pet therapeutics sales representative is viewed by the veterinarian as both an educator and a business partner. These direct relationships allow pet therapeutics sales representatives to understand the needs of the veterinarians and ultimately pet owners and to develop products to better meet those needs.

4

Table of Contents

Primarily private-pay nature of veterinary market

Pet owners generally pay for pet healthcare, including pet therapeutics, out-of-pocket. Third-party insurance covers less than 5% of U.S. pet owners. Pet owners make decisions primarily on the advice of their veterinarian, without the influence of insurance companies or government payors that are often involved in product and pricing decisions in human healthcare. We believe the lack of pricing intervention of third-party payors in veterinary medicine results in less pricing pressure than in human health. Furthermore, this enables pet therapeutics companies to directly market to pet owners to encourage them to consult with their veterinarians.

Our Strategy

Our goal is to become a leading provider of therapeutics developed and approved specifically for the treatment of unmet medical needs in pets. We are a pet-focused company and we intend to help shape and define the pet therapeutics market. We plan to accomplish this by:

| n | Advancing our existing compounds to regulatory approval; |

| n | Leveraging our management team’s established experience in the human biopharmaceutical and animal health industries; |

| n | Using a direct sales organization and distributors to commercialize our products in the United States and Europe; |

| n | Engaging active partners to build a commercial presence; and |

| n | Continuing to expand our product pipeline by in-licensing additional compounds. |

Recent Developments

Conditional License for AT-005

Effective as of January 22, 2014, we received a conditional license from the USDA for AT-005 as an aid for the treatment of T-cell lymphoma in dogs. We expect to commence marketing the product later this year and expect to receive full licensure in 2015.

Acquisition of Okapi Sciences N.V.

On January 6, 2014, we acquired Okapi Sciences N.V., a Belgium-based company with a proprietary pet therapeutics antiviral platform and five clinical/development stage product candidates designed to treat important viral diseases. We plan to continue to advance the current Okapi pipeline of high value antiviral drugs, including its feline herpes and feline immunodeficiency virus products, which currently comprise our AT-006 and AT-007 product candidates, respectively. We are developing AT-006 as a treatment for ocular herpes in cats. If approved, AT-006 could become the first antiviral small molecule therapeutic developed specifically for veterinary use. AT-006, if approved, will be commercialized by Novartis Animal Health pursuant to an existing development and commercialization agreement. The Okapi product pipeline also includes additional antiviral and oncology products for both cats and dogs.

To acquire Okapi, we paid its equity holders approximately €10.3 million (equivalent to $13.9 million) in cash and issued a promissory note for €11.0 million ($14.9 million). The promissory note bears interest at 7% per annum payable quarterly in arrears and matures on December 31, 2014, subject to mandatory prepayment in the event of an equity financing, which would include this offering. We also agreed to pay up to an additional $16.3 million in cash or shares of common stock calculated in the manner specified in the purchase agreement within 90 days of the closing, subject to mandatory prepayment in cash in the event of an equity financing, which also includes this offering. We believe the strategic acquisition of Okapi further enhances our leadership position in pet therapeutics by providing us with a European base of operations that we believe enables better coordination of clinical and regulatory activities, enhances our business development and in-licensing capabilities and provides flexibility with respect to European commercialization. The acquisition also provides us with the technology for de novo product generation, diversifies our product pipeline and demonstrates our continued focus on innovation.

5

Table of Contents

Acquisition of Vet Therapeutics, Inc.

On October 15, 2013, we acquired Vet Therapeutics, Inc., a Del Mar, California-based company with a proprietary antibody-based biologics platform. We plan to continue to advance this pipeline of biologic drugs, including the lymphoma franchise, which currently comprises our AT-004, AT-005, AT-009 and AT-010 products. Beyond these products, the Vet Therapeutics’ pipeline includes biologics for the treatment of other cancers, atopic dermatitis and other immune conditions. We acquired Vet Therapeutics for a combination of $30.0 million in cash, 625,000 shares of our common stock, and a $3.0 million promissory note maturing on December 31, 2014 at an interest rate of 7% per year. The promissory note is subject to repayment in the event of specified equity financings, which include this offering. We also agreed to pay up to $5.0 million in contingent cash consideration in connection with the achievement of certain regulatory and manufacturing milestones for our AT-004. We believe this acquisition may significantly accelerate our pathway toward becoming a commercial-stage pet therapeutics company.

October 2013 Private Placement

On October 13, 2013, we entered into a stock purchase agreement with various accredited investors, pursuant to which we sold an aggregate of 1,234,375 shares of our common stock for an aggregate purchase price of approximately $19.8 million or $16.00 per share.

Risks Related to Our Business

Our ability to implement our business strategy is subject to numerous risks, as more fully described in the section entitled “Risk Factors” immediately following this prospectus summary. These risks include, among others:

| n | We have a limited operating history and have incurred significant losses since our inception. |

| n | Although we have two conditionally approved products, we are substantially dependent on the success of our current product candidates. |

| n | If we are not successful in identifying, licensing, developing and commercializing additional product candidates, our ability to expand our business and achieve our strategic objectives would be impaired. |

| n | We may not realize all of the anticipated benefits of our acquisitions of Vet Therapeutics and Okapi or those benefits may take longer to realize than expected. |

| n | We may not be able to obtain regulatory approval for our existing or future product candidates under applicable regulatory requirements. |

| n | Even if our current or future product candidates obtain regulatory approval, they may never achieve market acceptance or commercial success. |

| n | Development of pet therapeutics involves an expensive and lengthy process with uncertain outcome, and results of earlier studies may not be predictive of future study results. |

| n | We rely completely on third-party manufacturers to manufacture the supplies for the development of our small molecule product candidates and we intend to rely on third-party manufacturers to produce commercial quantities of any approved drug candidates. |

| n | We currently own two issued patents and license patents covering our biologics, small molecule and antiviral product candidates, and have limited rights to prosecute and enforce those licensed patents. |

| n | If we fail to comply with our obligations under our intellectual property licenses with third parties, we could lose license rights that are essential to our business. |

| n | The regulatory approval process is uncertain, requires us to utilize significant resources, and may prevent us or our collaboration partners from obtaining approvals for the commercialization of some or all of our product candidates. |

Corporate Information

Our principal executive offices are located at 1901 Olathe Boulevard, Kansas City, Kansas 66103, and our telephone number is (913) 951-2132. We also maintain business locations in Boston, Massachusetts, Del Mar, California, and Leuven, Belgium. Our website address is www.aratana.com. The information contained in, or accessible through, our website should not be considered a part of this prospectus.

6

Table of Contents

Implications of Being an Emerging Growth Company

As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act, or JOBS Act, enacted in April 2012. An “emerging growth company” may take advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not limited to:

| n | being permitted to present only two years of audited financial statements and only two years of related Management’s Discussion & Analysis of Financial Condition and Results of Operations in this prospectus; |

| n | not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act; |

| n | reduced disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| n | exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. |

We may take advantage of these provisions until December 31, 2018. However, if certain events occur prior to December 31, 2018, including if we become a “large accelerated filer,” our annual gross revenues exceed $1.0 billion or we issue more than $1.0 billion of non-convertible debt in any three-year period, we will cease to be an emerging growth company prior to December 31, 2018.

We have elected to take advantage of certain of the reduced disclosure obligations regarding executive compensation in this registration statement and may elect to take advantage of other reduced reporting requirements in future filings. As a result, the information that we provide to our stockholders may be different than the information you might receive from other public reporting companies in which you hold equity interests.

7

Table of Contents

THE OFFERING

| Common stock offered by us |

4,500,000 shares |

| Common stock offered by the selling stockholders |

1,000,000 shares (or 1,825,000 shares if the underwriters exercise their option to purchase additional shares from a selling stockholder in full) |

| Common stock to be outstanding after this offering |

28,597,738 shares |

| Use of proceeds |

We intend to use the net proceeds of this offering to satisfy our remaining purchase price obligation to the former stockholders of Okapi; to repay the outstanding principal amounts under our promissory notes held by the former stockholders of Okapi and the former stockholders of Vet Therapeutics; and the balance for the further development of our product candidates, expansion of our commercial infrastructure in anticipation of future product launches and for other general corporate and working capital purposes. We may also use a portion of our net proceeds to in-license or acquire additional product candidates, technologies or businesses; however, other than our existing option agreements for licenses, we currently have no agreements or commitments to complete any such transaction. See “Use of Proceeds.” |

| Risk factors |

See “Risk Factors” beginning on page 13 and other information included in this prospectus for a discussion of factors that you should consider carefully before deciding to invest in our common stock. |

| NASDAQ Global Market Symbol |

“PETX” |

The number of shares of our common stock to be outstanding after this offering is based on 24,097,738 shares of our common stock outstanding as of December 31, 2013 (including 670,374 shares of restricted common stock that are subject to vesting restrictions as of December 31, 2013 and are not considered outstanding for accounting purposes) and excludes:

| n | 949,401 shares of common stock issuable upon exercise of stock options outstanding as of December 31, 2013, at a weighted average exercise price of $11.41 per share; and |

| n | 206,217 shares of common stock reserved for issuance under our 2013 incentive award plan as of December 31, 2013 as well as shares that become available pursuant to provisions in our 2013 incentive award plan that automatically increase the share reserve under the plan on January 1 of each calendar year as more fully described in “Executive and Director Compensation—2013 Incentive Award Plan.” |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| n | no exercise of the outstanding options described above; and |

| n | no exercise by the underwriters of their option to purchase additional shares of our common stock. |

8

Table of Contents

SUMMARY HISTORICAL FINANCIAL DATA

The following tables set forth a summary of our historical financial data as of, and for the period ended on, the dates indicated. We have derived the statement of operations data for the years ended December 31, 2011 and 2012 from our audited financial statements included elsewhere in this prospectus. The statement of operations data for the nine months ended September 30, 2012 and 2013 and for the period from our inception (December 1, 2010) to September 30, 2013 and the balance sheet data as of September 30, 2013 have been derived from our unaudited financial statements appearing elsewhere in this prospectus. This unaudited interim financial information has been prepared on the same basis as our audited financial statements and, in our opinion, reflects all adjustments, consisting only of normal and recurring adjustments, that we consider necessary for a fair presentation of our financial position as of September 30, 2013 and operating results for the nine months ended September 30, 2012 and 2013. You should read this data together with our financial statements and related notes appearing elsewhere in this prospectus and the sections in this prospectus entitled “Selected Historical Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” The historical results are not necessarily indicative of the results to be expected for any future periods and the results for the nine months ended September 30, 2013 should not be considered indicative of results expected for the fiscal year 2013.

| YEAR ENDED DECEMBER 31, |

NINE MONTHS ENDED SEPTEMBER 30, |

CUMULATIVE PERIOD FROM INCEPTION (DECEMBER 1, 2010) TO SEPTEMBER 30, 2013 |

||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | |||||||||||||||||

| (unaudited) | (unaudited) | (unaudited) | ||||||||||||||||||

| (in thousands, except share and per share data) | ||||||||||||||||||||

| Statement of Operations Data: |

||||||||||||||||||||

| Revenue |

$ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Operating expenses: |

||||||||||||||||||||

| Research and development |

2,196 | 7,291 | 5,338 | 7,817 | 17,304 | |||||||||||||||

| General and administrative |

1,274 | 2,987 | 2,186 | 3,911 | 8,481 | |||||||||||||||

| In-process research and development |

— | 1,500 | — | — | 8,025 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

3,470 | 11,778 | 7,524 | 11,728 | 33,810 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Loss from operations |

(3,470 | ) | (11,778 | ) | (7,524 | ) | (11,728 | ) | (33,810 | ) | ||||||||||

| Other income (expense): |

||||||||||||||||||||

| Interest income |

6 | 21 | 12 | 51 | 78 | |||||||||||||||

| Interest expense |

— | — | — | (182 | ) | (182 | ) | |||||||||||||

| Other income |

— | 121 | 81 | 455 | 576 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total other income (expense) |

6 | 142 | 93 | 324 | 472 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net loss |

(3,464 | ) | (11,636 | ) | (7,431 | ) | (11,404 | ) | $ | (33,338 | ) | |||||||||

|

|

|

|||||||||||||||||||

| Modification of Series A convertible preferred stock |

(276 | ) | — | — | — | |||||||||||||||

| Unaccreted dividends on convertible preferred stock |

(902 | ) | (2,035 | ) | (1,493 | ) | — | |||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss attributable to common stockholders |

$ | (4,642 | ) | $ | (13,671 | ) | $ | (8,924 | ) | $ | (11,404 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net loss per share attributable to common stockholders, basic and diluted(1) |

$ | (15.43 | ) | $ | (34.53 | ) | $ | (28.79 | ) | $ | (1.50 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

| Weighted average shares outstanding, basic and diluted(1) |

300,841 | 395,918 | 309,994 | 7,601,388 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

9

Table of Contents

| (1) | See Note 16 to our annual financial statements and Note 11 to our interim financial statements included elsewhere in this prospectus for further details on the calculation of basic and diluted net loss per share attributable to common stockholders. |

| AS OF SEPTEMBER 30, 2013 | ||||||||||||

| ACTUAL | PRO FORMA(1) | PRO FORMA AS ADJUSTED(2)(3) |

||||||||||

| (in thousands) | ||||||||||||

| Balance Sheet Data: |

||||||||||||

| Cash, cash equivalents and short-term investments |

$ | 52,306 | $ | 41,030 | $ | 87,089 | ||||||

| Working capital(4) |

47,557 | 16,770 | 77,995 | |||||||||

| Total assets |

52,668 | 155,613 | 201,672 | |||||||||

| Contingent consideration payable |

— | 18,976 | 3,810 | |||||||||

| Total long-term debt, net of discount |

4,941 | 32,817 | 14,928 | |||||||||

| Total stockholders’ equity |

43,836 | 86,731 | 165,845 | |||||||||

| (1) | Pro forma balance sheet data give effect to our October 2013 private placement and the acquisitions of Vet Therapeutics and Okapi, as described in the section of this prospectus entitled “Unaudited Pro Forma Consolidated Financial Information,” prior to giving effect to the pro forma adjustments for this offering. |

| (2) | Pro forma as adjusted balance sheet data give further effect to (i) the issuance and sale by us of 4,500,000 shares of common stock in this offering at an assumed public offering price of $18.96 per share, the last reported sale price on January 21, 2014, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us, and (ii) the application of net proceeds received by us in this offering as described in the section of this prospectus entitled “Use of Proceeds.” |

| (3) | A $1.00 increase (decrease) in the assumed public offering price of $18.96 per share, the last reported sale price on January 21, 2014, would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and short-term investments, working capital, total assets and total stockholders’ equity by approximately $4.2 million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, an increase (decrease) of 1.0 million in the number of shares offered by us at the assumed public offering price would increase (decrease) the pro forma as adjusted amount of each of cash, cash equivalents and short-term investments, working capital, total assets and total stockholders’ equity by approximately $17.9 million. The pro forma information discussed above is illustrative only and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

| (4) | We define working capital as current assets less current liabilities. |

10

Table of Contents

SUMMARY UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL INFORMATION

The following summary unaudited pro forma consolidated financial information has been prepared to give effect to our completed acquisitions of Vet Therapeutics and Okapi and the shares issued and net proceeds received by us in this offering, which will be used to pay purchase consideration and repay debt issued in connection with the acquisitions, as required upon the completion of this offering by the terms of the acquisition agreements and as described in the section of this prospectus entitled “Use of Proceeds.” The summary unaudited pro forma consolidated balance sheet data as of September 30, 2013 gives effect to the acquisitions of Vet Therapeutics and Okapi, the issuance and sale by us of shares in this offering, and the required purchase consideration payments and debt repayments as if each occurred on September 30, 2013. The summary unaudited pro forma consolidated statement of operations data for the year ended December 31, 2012 and nine months ended September 30, 2013 give effect to the acquisitions of Vet Therapeutics and Okapi, the issuance and sale by us of shares in this offering, and the required purchase consideration payments and debt repayments as if each occurred on January 1, 2012.

The summary unaudited pro forma consolidated financial information is derived from our, Vet Therapeutics’ and Okapi’s audited historical financial statements as of and for the year ended December 31, 2012, from Vet Therapeutics’ audited historical financial statements of as of and for the nine months ended September 30, 2013, and from our and Okapi’s unaudited historical financial statements of as of and for the nine months ended September 30, 2013.

The summary unaudited pro forma consolidated financial information is based on assumptions and preliminary information available and management’s preliminary valuation of the fair value of tangible and intangible assets acquired and liabilities assumed as described in the section of this prospectus entitled “Unaudited Pro Forma Consolidated Financial Information.” The summary unaudited pro forma consolidated financial information was prepared in accordance with the rules and regulations of the Securities and Exchange Commission, or SEC, and should not be considered indicative of the consolidated financial position or results of operations that would have occurred if the transactions described above had occurred on the dates indicated, nor are they indicative of the future consolidated financial position or results of operations of Aratana, Vet Therapeutics and Okapi following completion of the transactions described above. You should read this unaudited pro forma consolidated financial information together with our, Vet Therapeutics’ and Okapi’s financial statements and related notes appearing elsewhere in this prospectus.

For additional information regarding our summary unaudited pro forma consolidated financial information, see the section of the prospectus entitled “Unaudited Pro Forma Consolidated Financial Information.”

11

Table of Contents

| YEAR ENDED DECEMBER 31, 2012 |

NINE MONTHS ENDED SEPTEMBER 30, 2013 |

|||||||

| (in thousands, except share and per share data) | ||||||||

| Unaudited Pro Forma Consolidated Statement of Operations Data: |

||||||||

| Revenues: |

||||||||

| Licensing revenue |

$ | 173 | $ | 1,440 | ||||

| Product sales |

— | 157 | ||||||

|

|

|

|

|

|||||

| Total revenues |

173 | 1,597 | ||||||

|

|

|

|

|

|||||

| Costs and expenses: |

||||||||

| Cost of product sales |

10 | 137 | ||||||

| Royalty expense |

— | 70 | ||||||

| Research and development |

10,728 | 10,421 | ||||||

| General and administrative |

3,841 | 4,656 | ||||||

| In-process research and development |

1,500 | — | ||||||

| Amortization of acquired intangible assets |

1,822 | 1,367 | ||||||

|

|

|

|

|

|||||

| Total operating expenses |

17,901 | 16,651 | ||||||

|

|

|

|

|

|||||

| Loss from operations |

(17,728 | ) | (15,054 | ) | ||||

| Other income (expense): |

||||||||

| Interest income |

32 | 56 | ||||||

| Interest expense |

(550 | ) | (594 | ) | ||||

| Other income |

167 | 472 | ||||||

| Other expenses |

(8 | ) | (7 | ) | ||||

|

|

|

|

|

|||||

| Total other income (expense) |

(359 | ) | (73 | ) | ||||

|

|

|

|

|

|||||

| Loss before income taxes |

(18,087 | ) | (15,127 | ) | ||||

| Income tax benefit |

6,750 | 5,671 | ||||||

|

|

|

|

|

|||||

| Net loss |

(11,337 | ) | (9,456 | ) | ||||

| Unaccreted dividends on convertible preferred stock |

(2,035 | ) | — | |||||

|

|

|

|

|

|||||

| Net loss attributable to common stockholders |

$ | (13,372 | ) | $ | (9,456 | ) | ||

|

|

|

|

|

|||||

| Net loss per share attributable to common stockholders, basic and diluted |

$ | (3.23 | ) | $ | (0.83 | ) | ||

|

|

|

|

|

|||||

| Weighted average shares outstanding, basic and diluted |

4,135,555 | 11,341,025 | ||||||

|

|

|

|

|

|||||

| AS OF SEPTEMBER 30, 2013 | ||||

| (in thousands) | ||||

| Unaudited Pro Forma Consolidated Balance Sheet Data(1): |

||||

| Cash, cash equivalents and short-term investments |

$ | 87,089 | ||

| Working capital(2) |

77,995 | |||

| Total assets |

201,672 | |||

| Contingent consideration payable |

3,810 | |||

| Total long-term debt, net of discount |

14,928 | |||

| Total stockholders’ equity |

165,845 | |||

| (1) | The unaudited pro forma consolidated balance sheet data gives effect to this offering as described in Note 7 to the Unaudited Pro Forma Consolidated Financial Information. |

| (2) | We define working capital as current assets less current liabilities. |

12

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information in this prospectus, including our financial statements and the related notes and “Management’s Discussion and Analysis of Results of Operations and Financial Condition,” before deciding whether to invest in our common stock. The occurrence of any of the events or developments described below could harm our business, financial condition, results of operations and growth prospects. In such an event, the market price of our common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations.

Risks Related to Our Business

We have a limited operating history and have incurred significant losses since our inception and we anticipate that we will continue to incur losses for the foreseeable future, and our limited operating history makes it difficult to assess our future viability.

We are a development-stage biopharmaceutical company in the pet therapeutics industry with a limited operating history. Biopharmaceutical product development in the pet therapeutics industry is a highly speculative undertaking and involves a substantial degree of risk. We currently have a product pipeline with over 15 products under development including one biologic, AT-004, that is currently marketed by Novartis Animal Health, Inc., or Novartis Animal Health, and another biologic, AT-005 that we expect to begin marketing later this year, each under a conditional license. We are not profitable and have incurred losses in each year since our inception in December 2010. We have a limited operating history upon which you can evaluate our business and prospects. In addition, as an early stage company, we have limited experience and have not yet demonstrated an ability to successfully overcome many of the risks and uncertainties frequently encountered by companies in new and rapidly evolving fields, particularly in the biopharmaceutical industry. We have not generated any revenue from product sales to date, other than a small amount of royalties from the sales generated by Novartis Animal Health. We continue to incur significant research and development and other expenses related to our ongoing operations. Our net loss for the nine months ended September 30, 2013 was $11.4 million and for the year ended December 31, 2012 was $11.6 million. As of September 30, 2013, we had a deficit accumulated during development stage of $33.6 million and we had $52.3 million in cash, cash equivalents and short-term investments. Taking into account our October 2013 private placement and our recent acquisitions of Vet Therapeutics and Okapi, our pro forma net loss for the nine months ended September 30, 2013 was $9.9 million and for the year ended December 31, 2012 was $12.1 million, and as of September 30, 2013, we had a pro forma deficit accumulated during development stage of $25.2 million and we had pro forma cash, cash equivalents and short-term investments of $41.0 million. We expect to continue to incur losses for the foreseeable future, and we expect these losses to increase as we continue our development of, and seek regulatory approvals for, our product candidates and begin to commercialize them if they are approved by the U.S. Food and Drug Administration’s Center for Veterinary Medicine, or CVM, or for our biologic products, the U.S. Department of Agriculture, or the USDA. Even if we achieve profitability in the future, we may not be able to sustain profitability in subsequent periods. Our prior losses, combined with expected future losses, have had and will continue to have an adverse effect on our stockholders’ equity and working capital.

We may require substantial additional financing to achieve our goals, and a failure to obtain this necessary capital when needed on acceptable terms, or at all, could force us to delay, limit, reduce or terminate our product portfolio expansion, product development, other operations or commercialization efforts.

Since our inception, nearly all of our resources have been dedicated to the in-licensing, acquisition and research and development of our current product candidates. Completing the development and obtaining regulatory approval of our product candidates will require substantial funds. We also have an active in-licensing effort focused on identifying human therapeutics for development and commercialization as pet therapeutics. We believe that we will continue to expend substantial resources for the foreseeable future for the development of our current product candidates and any future product candidates we may choose to pursue. These expenditures will include costs associated with identifying potential product candidates, licensing or acquisition payments, conducting target animal studies, completing other research and development, obtaining regulatory approvals and manufacturing and supply, as well as marketing and selling any products approved for sale. In addition, other unanticipated costs may arise. Because the outcome of any target animal study is uncertain, we cannot reasonably estimate the actual amounts necessary to successfully complete the development and commercialization of any of our current or future product candidates.

13

Table of Contents

We believe that the net proceeds from this offering, together with our existing cash and cash equivalents and existing credit facility will allow us to fund our operations and our debt obligations through at least December 31, 2015. However, our operating plan may change as a result of many factors currently unknown to us, and we may need to seek additional funds sooner than planned through public or private equity or debt financings or other sources, such as strategic collaborations. Such financing may result in dilution to stockholders, imposition of debt covenants and repayment obligations, or other restrictions that may affect our business. In addition, we may seek additional capital due to favorable market conditions or strategic considerations even if we believe we have sufficient funds for our current or future operating plans.

Our future capital requirements depend on many factors, including, but not limited to:

| n | the results of our target animal studies for our current and future product candidates; |

| n | the amount and timing of any milestone payments or royalties we must pay pursuant to our current or future license agreements or collaboration agreements; |

| n | the timing of, and the costs involved in, obtaining regulatory approvals for any of our current or future product candidates; |

| n | the upfront and other payments, and associated costs, related to identifying, acquiring and in-licensing new product candidates; |

| n | the number and characteristics of the product candidates we pursue; |

| n | the scope, progress, results and costs of researching and developing any of our current or future product candidates and conducting target animal studies; |

| n | whether we acquire any other companies, assets, intellectual property or technologies in the future; |

| n | our ability to partner with companies with an established commercial presence in Europe to provide our products in that market; |

| n | the cost of commercialization activities, if any of our current or future product candidates are approved for sale, including marketing, sales and distribution costs; |

| n | the cost of manufacturing our current and future product candidates and any products we successfully commercialize; |

| n | our ability to establish and maintain strategic collaborations, licensing or other arrangements and the financial terms of such agreements; |

| n | whether we are required to repay amounts that we received from the Kansas Bioscience Authority, or the KBA, repurchase the shares of our capital stock owned by the KBA or repay Kansas income tax credits allocated to some of our investors (see “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Kansas Programs”); |

| n | the expenses needed to attract and retain skilled personnel; |

| n | the costs associated with being a public company; and |

| n | the costs involved in preparing, filing, prosecuting, maintaining, defending and enforcing patent claims, including litigation costs and the outcome of such litigation. |

Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available to us on a timely basis, we may be required to delay, limit, reduce or terminate:

| n | our target animal studies or other development activities for our current or future product candidates; |

| n | our establishment of sales and marketing capabilities or other activities that may be necessary to commercialize any of our current or future product candidates; or |

| n | our in-licensing and acquisition efforts and expansion of our product portfolio. |

14

Table of Contents

Although we have two conditionally approved products, we are substantially dependent on the success of our current product candidates.

We currently have no products approved for commercial distribution, except AT-004 and AT-005 which have received conditional licenses from the USDA. To date, we have invested nearly all of our efforts and financial resources in the in-licensing, research and development of AT-001, AT-002 and AT-003, which, prior to our acquisition of Vet Therapeutics and Okapi, were our only product candidates and are still in development.

Our near-term prospects, including our ability to finance our company and to enter into strategic collaborations and generate revenue, will depend heavily on the successful development and commercialization of our current product candidates. The development and commercial success of our current product candidates will depend on a number of factors, including the following:

| n | timely initiation and completion of our target animal studies for our current product candidates, which may be significantly slower than we currently anticipate and will depend substantially upon the satisfactory performance of third-party contractors; |

| n | our ability to demonstrate to the satisfaction of the CVM, the USDA and the European Medicines Agency, or EMA, or the applicable EU Member State national competent authorities, the safety and efficacy of our product candidates and to obtain regulatory approval in the United States and Europe; |

| n | our success in educating veterinarians and pet owners about the benefits, administration and use of our product candidates; |

| n | the prevalence and severity of adverse side effects, including a continued acceptable safety profile of the product following approval; |

| n | achieving and maintaining compliance with all regulatory requirements applicable to our product candidates; |

| n | the availability, perceived advantages, relative cost, relative safety and relative efficacy of alternative and competing treatments; |

| n | the effectiveness of our marketing, sales and distribution strategy and operations; |

| n | the ability of our third-party manufacturers to manufacture supplies of any of our current or future product candidates and to develop, validate and maintain commercially viable manufacturing processes that are compliant with current Good Manufacturing Practices, or cGMP; |

| n | our ability to successfully launch commercial sales of our current product candidates, assuming CVM, USDA or EMA approval is obtained, whether alone or in collaboration with others; |

| n | our ability to enforce our intellectual property rights in and to our product candidates and avoid third-party patent interference, third-party initiated and U.S. PTO-initiated administrative patent proceedings or patent infringement claims; and |

| n | acceptance of our product candidates as safe and effective by veterinarians, pet owners and the animal health community. |

Many of these factors are beyond our control. Accordingly, we cannot assure you that we will ever be able to generate revenue through the sale of our product candidates. If we are not successful in commercializing one or more of our product candidates, or are significantly delayed in doing so, our business will be materially harmed and the value of your investment could substantially decline.

The development of our biologic product candidates is dependent upon relatively novel technologies and uncertain regulatory pathways.

As a result of our acquisition of Vet Therapeutics, we are developing biologics, including animal antibodies, for pets. Identification, optimization and manufacturing of therapeutic animal biologics is a relatively new field in which unanticipated difficulties or challenges could arise. While many biologics have been approved for use in humans, very few have been approved for use in animals, except for vaccines. There are unique risks and uncertainties with biologics, the development, manufacturing and sale of which are subject to regulations that are often as complex and extensive as the regulations applicable to other small molecule products. We anticipate that our animal biologics may be regulated by the USDA, rather than CVM, and the regulatory standards that the USDA may require for novel biologics may be more difficult to satisfy than we anticipate.

15

Table of Contents

We may be unable to obtain regulatory approval for our existing or future product candidates under applicable regulatory requirements. The denial or delay of any such approval would delay commercialization efforts and adversely impact our potential to generate revenue, our business and our results of operations.

Our product candidates are in various stages of development, and our business currently depends entirely on their successful development, regulatory approval and commercialization. With the exception of AT-004 and AT-005, we currently have no products approved for sale, and we may never obtain regulatory approval to commercialize any of our other current or future product candidates. The research, testing, manufacturing, labeling, approval, sale, marketing and distribution of pet therapeutics products are subject to extensive regulation by the CVM, the USDA, the EMA and other regulatory authorities in the United States and other countries, whose regulations differ from country to country. We are not permitted to market our products in the United States until we receive approval of a New Animal Drug Application, or NADA, from the CVM or a full product license from the USDA with respect to our biologic products, or in Europe until we receive approval from the European Commission or applicable EU State national competent authorities.

Even if we receive approval of an NADA, USDA product license or foreign regulatory filing for our product candidates, the CVM, the USDA or the applicable foreign regulatory body may approve our product candidates for a more limited indication than we originally requested, and the CVM or the USDA may not approve the labeling that we believe is necessary or desirable for the successful commercialization of our product candidates. Any delay in obtaining, or inability to obtain, applicable regulatory approval would delay or prevent commercialization of our product candidates and would materially adversely impact our business and prospects.

Even if our current or future product candidates obtain regulatory approval, they may never achieve market acceptance or commercial success.

Even if we obtain CVM, USDA, EMA or other regulatory approvals, our current or future product candidates may not achieve market acceptance among veterinarians and pet owners, and may not be commercially successful. Market acceptance of any of our current or future product candidates for which we receive approval depends on a number of factors, including:

| n | the safety of our products as demonstrated in our target animal studies; |

| n | the indications for which our products are approved; |

| n | the acceptance by veterinarians and pet owners of the product as a safe and effective treatment; |

| n | the proper training and administration of our products by veterinarians; |

| n | the potential and perceived advantages of our product candidates over alternative treatments, including generic medicines and products approved for use by humans that are used off label; |

| n | the cost of treatment in relation to alternative treatments and willingness to pay for our products, if approved, on the part of veterinarians and pet owners; |

| n | the willingness of pet owners to pay for our treatments, relative to other discretionary items, especially during economically challenging times; |

| n | the relative convenience and ease of administration; |

| n | the prevalence and severity of adverse side effects; and |

| n | the effectiveness of our sales and marketing efforts. |

Any failure by our product candidates that obtain regulatory approval to achieve market acceptance or commercial success would adversely affect our financial results.

We may not realize all of the anticipated benefits of our acquisitions of Vet Therapeutics or Okapi, or those benefits may take longer to realize than expected. We may also encounter significant unexpected difficulties in integrating three businesses.

Our ability to realize the anticipated benefits of our acquisitions of Vet Therapeutics and Okapi will depend in part on our ability to integrate their businesses with ours. The combination of three independent businesses is a complex, costly and time-consuming process. As a result, we will be required to devote significant management attention and resources to integrating the business practices and operations of Vet Therapeutics and Okapi. The integration process may disrupt the businesses and, if implemented ineffectively, would preclude realization of the full benefits

16

Table of Contents

expected by us. Our failure to meet the challenges involved in integrating the businesses to realize the anticipated benefits of the transaction could cause an interruption of, or a loss of momentum in, our activities and could adversely affect our results of operations.

In addition, the overall integration of the businesses may result in material unanticipated problems, expenses, liabilities, competitive responses, and diversion of management’s attention. The difficulties of combining the operations of the companies include, among others:

| n | the diversion of management’s attention to integration matters; |

| n | difficulties in achieving anticipated cost savings, synergies, business opportunities and growth prospects from combining the business of Vet Therapeutics and Okapi with our company; |

| n | difficulties in the integration of operations and systems; |

| n | difficulties in the assimilation of employees; |

| n | challenges in attracting and retaining key personnel; and |

| n | challenges in maintaining previously-established relationships with licensors and licensees. |

Many of these factors will be outside of our control and any one of them could result in increased costs and diversion of management’s time and energy, which could materially impact our business, financial condition and results of operations. In addition, even if the operations of the businesses are integrated successfully, we may not realize the full benefits of the transaction, including the synergies or growth opportunities that we expect. These benefits may not be achieved within the anticipated time frame, or at all.

Development of pet therapeutics involves an expensive and lengthy process with an uncertain outcome, and results of earlier studies may not be predictive of future study results.

Development of pet therapeutics is expensive and can take many years to complete, and its outcome is inherently uncertain. To gain approval to market a pet therapeutic for a particular species of pet, we must provide the CVM, the USDA or foreign regulatory authorities, as applicable, with data from animal safety and effectiveness studies that adequately demonstrate the safety and efficacy of that product in the target animal for the intended indication applied for in the NADA, product license or other regulatory filing. We rely on contract research organizations, or CROs, and other third parties to ensure the proper and timely conduct of our studies and development efforts and, while we have agreements governing their committed activities, we have limited influence over their actual performance. Failure can occur at any time during the development process. Success in prior target animal studies or in the treatment of human beings with a product candidate does not ensure that our target animal studies will be successful and the results of development efforts by other parties may not be indicative of the results of our target animal studies and other development efforts. Product candidates in our studies may fail to show the desired safety and efficacy despite showing such results in initial data or previous human or animal studies conducted by other parties. Even if our studies and other development efforts are completed, the results may not be sufficient to obtain regulatory approval for our product candidates.

Once our target animal studies commence, we may experience delays in such studies and other development efforts and we do not know whether planned studies will begin on time, need to be redesigned or be completed on schedule, if at all. Pet therapeutics studies can be delayed or discontinued for a variety of reasons, including delay or failure to:

| n | reach agreement on acceptable terms with prospective CROs and study sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| n | complete target animal studies due to deviations from study protocol; |

| n | address any safety concerns that arise during the course of testing; |

| n | address any conflicts with new or existing laws or regulations; |

| n | add new study sites; or |

| n | manufacture sufficient quantities of formulated drug for use in studies. |

If we experience delays in the completion or termination of any development efforts for our product candidates, the commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from

17

Table of Contents

any of these product candidates will be delayed. In addition, any delays in completing our development efforts will increase our costs, slow down our product candidate development and approval process and jeopardize our ability to commence product sales and generate revenues. Any of these occurrences may harm our business, financial condition and prospects significantly. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of our development efforts may also ultimately lead to the denial of regulatory approval of our product candidates.

Our product candidates, if approved, will face significant competition and our failure to effectively compete may prevent us from achieving significant market penetration.

The development and commercialization of pet therapeutics is highly competitive, and we expect considerable competition from major pharmaceutical, biotechnology and specialty animal health medicines companies. As a result, there are and will likely continue to be extensive research and substantial financial resources invested in the discovery and development of new pet therapeutics. Our potential competitors include large animal health companies, such as Zoetis, Inc.; Merck Animal Health, the animal health division of Merck & Co., Inc.; Merial, the animal health division of Sanofi S.A.; Elanco, the animal health division of Eli Lilly and Company; Bayer Animal Health, the animal health division of Bayer AG; Boehringer Ingelheim Animal Health, the animal health division of Boehringer Ingelheim GmbH; Novartis Animal Health, the animal health division of Novartis AG; Virbac Group; Ceva Animal Health; Vetoquinol and Dechra Pharmaceuticals PLC. We are also aware of several smaller early stage companies that are developing products for use in the pet therapeutics market.