Attached files

| file | filename |

|---|---|

| 8-K - 8-K - VANTAGESOUTH BANCSHARES, INC. | form8-k012714.htm |

| EX-99.1 - EXHIBIT - VANTAGESOUTH BANCSHARES, INC. | exhibit991-012417.htm |

NYSE: VSB NASDAQ: YDKN Creating North Carolina’s Largest Community Bank Through a Transformational Merger-of-Equals January 27, 2014

Cautionary statement regarding forward-looking statements 2 This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by words such as “may,” “hope,” “will,” “should,” “expect,” “plan,” “anticipate,” “intend,” “believe,” “estimate,” “predict,” “potential,” “continue,” “could,” “future” or the negative of those terms or other words of similar meaning. You should read statements that contain these words carefully because they discuss our future expectations or state other “forward-looking” information. These forward-looking statements involve a number of risks and uncertainties. VantageSouth Bancshares, Inc. (“Vantage”) and Yadkin Financial Corporation (“Yadkin”) caution readers that any forward-looking statement is not a guarantee of future performance and that actual results could differ materially from those contained in the forward-looking statement. Such forward-looking statements include, but are not limited to, statements about the benefits of the proposed merger involving Vantage and Yadkin, Vantage’s and Yadkin’s plans, objectives, expectations and intentions, the expected timing of completion of the transaction and other statements that are not historical facts. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements are set forth in Vantage’s and Yadkin’s filings with the SEC. These include risks and uncertainties relating to: the ability to obtain the requisite shareholder approvals; the risk that Vantage and Yadkin may be unable to obtain governmental and regulatory approvals required for the merger, or required governmental and regulatory approvals may delay the merger; the risk that a condition to closing of the merger may not be satisfied; the risk that a condition to the closing of Vantage’s private placement may not be satisfied; the timing to consummate the proposed merger; the risk that the business will not be integrated successfully; the risk that the cost savings and any other synergies from the transaction may not be fully realized or may take longer than expected; disruption from the transaction making it more difficult to maintain relationships with customers and employees; the diversion of management time on merger-related issues; general worldwide economic conditions and related uncertainties; the effect of changes in governmental regulations; and other factors discussed or referred to in the “Risk Factors” section of each of Vantage’s and Yadkin’s most recent Annual Report on Form 10-K filed with the SEC and their respective quarterly reports filed on Form 10-Qs and current reports on Form 8-K. Each forward-looking statement speaks only as of the date of the particular statement and except as may be required by law, neither Vantage nor Yadkin undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

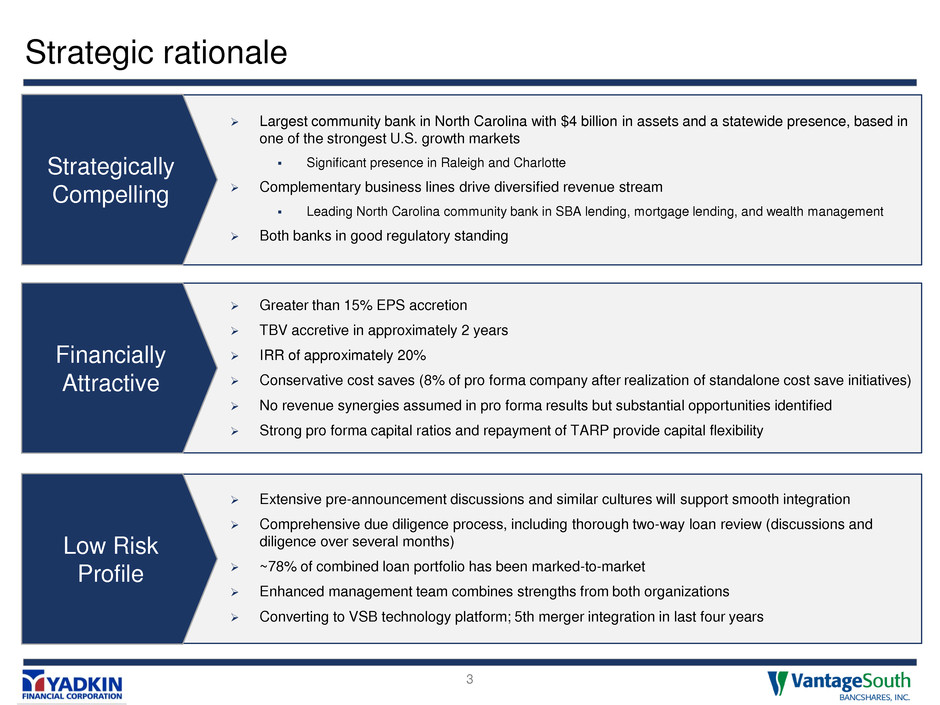

Strategic rationale 3 Largest community bank in North Carolina with $4 billion in assets and a statewide presence, based in one of the strongest U.S. growth markets Significant presence in Raleigh and Charlotte Complementary business lines drive diversified revenue stream Leading North Carolina community bank in SBA lending, mortgage lending, and wealth management Both banks in good regulatory standing Greater than 15% EPS accretion TBV accretive in approximately 2 years IRR of approximately 20% Conservative cost saves (8% of pro forma company after realization of standalone cost save initiatives) No revenue synergies assumed in pro forma results but substantial opportunities identified Strong pro forma capital ratios and repayment of TARP provide capital flexibility Extensive pre-announcement discussions and similar cultures will support smooth integration Comprehensive due diligence process, including thorough two-way loan review (discussions and diligence over several months) ~78% of combined loan portfolio has been marked-to-market Enhanced management team combines strengths from both organizations Converting to VSB technology platform; 5th merger integration in last four years Strategically Compelling Financially Attractive Low Risk Profile

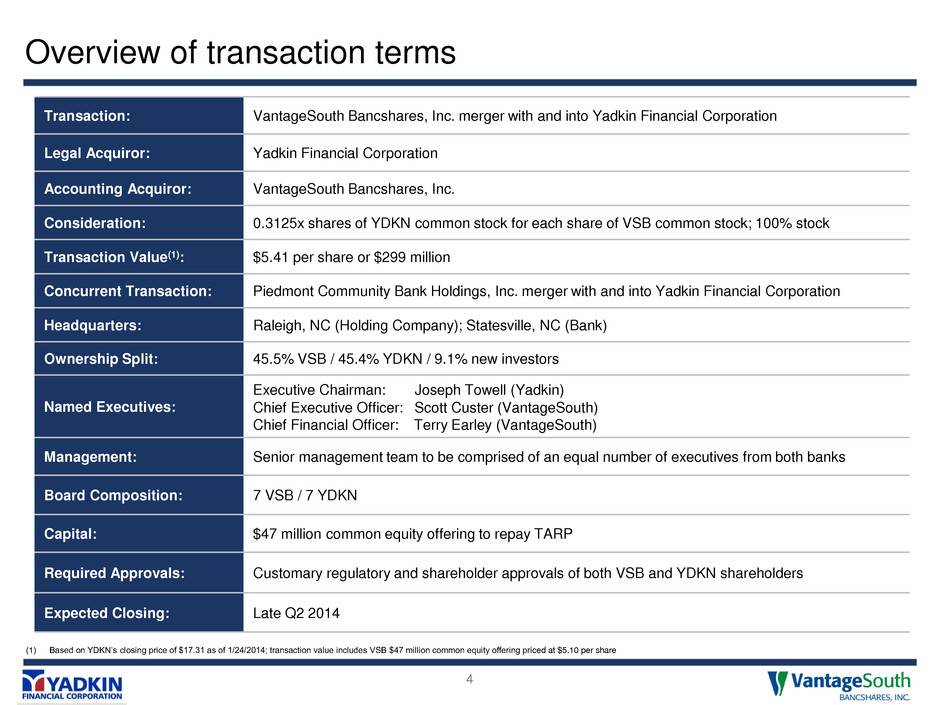

Overview of transaction terms 4 Transaction: VantageSouth Bancshares, Inc. merger with and into Yadkin Financial Corporation Legal Acquiror: Yadkin Financial Corporation Accounting Acquiror: VantageSouth Bancshares, Inc. Consideration: 0.3125x shares of YDKN common stock for each share of VSB common stock; 100% stock Transaction Value(1): $5.41 per share or $299 million Concurrent Transaction: Piedmont Community Bank Holdings, Inc. merger with and into Yadkin Financial Corporation Headquarters: Raleigh, NC (Holding Company); Statesville, NC (Bank) Ownership Split: 45.5% VSB / 45.4% YDKN / 9.1% new investors Named Executives: Executive Chairman: Joseph Towell (Yadkin) Chief Executive Officer: Scott Custer (VantageSouth) Chief Financial Officer: Terry Earley (VantageSouth) Management: Senior management team to be comprised of an equal number of executives from both banks Board Composition: 7 VSB / 7 YDKN Capital: $47 million common equity offering to repay TARP Required Approvals: Customary regulatory and shareholder approvals of both VSB and YDKN shareholders Expected Closing: Late Q2 2014 (1) Based on YDKN’s closing price of $17.31 as of 1/24/2014; transaction value includes VSB $47 million common equity offering priced at $5.10 per share

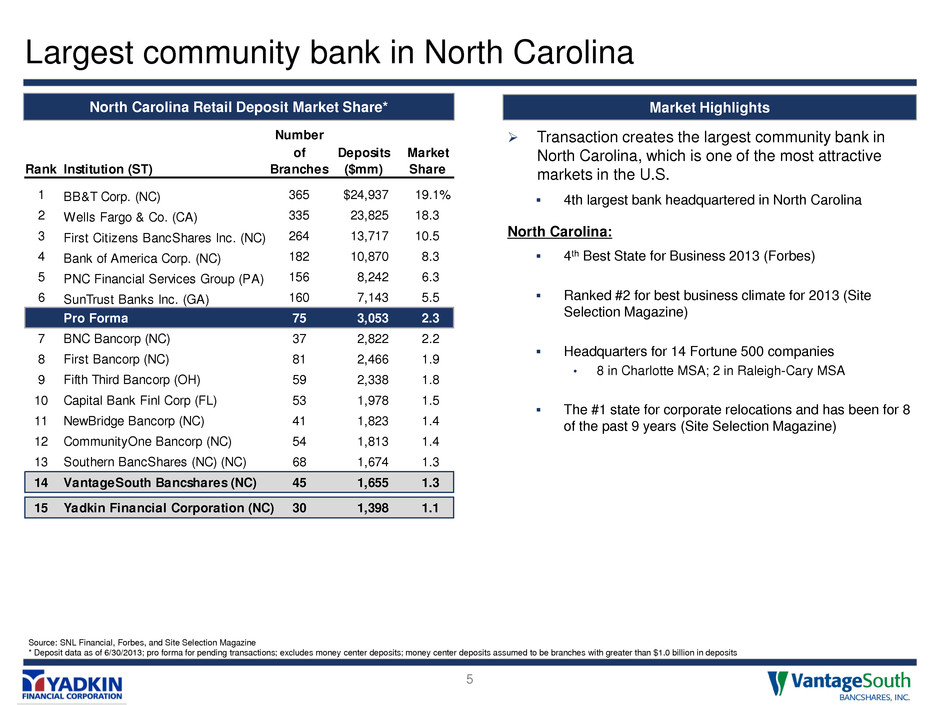

Largest community bank in North Carolina 5 Source: SNL Financial, Forbes, and Site Selection Magazine * Deposit data as of 6/30/2013; pro forma for pending transactions; excludes money center deposits; money center deposits assumed to be branches with greater than $1.0 billion in deposits Transaction creates the largest community bank in North Carolina, which is one of the most attractive markets in the U.S. 4th largest bank headquartered in North Carolina North Carolina: 4th Best State for Business 2013 (Forbes) Ranked #2 for best business climate for 2013 (Site Selection Magazine) Headquarters for 14 Fortune 500 companies • 8 in Charlotte MSA; 2 in Raleigh-Cary MSA The #1 state for corporate relocations and has been for 8 of the past 9 years (Site Selection Magazine) Market Highlights North Carolina Retail Deposit Market Share* Number of Deposits Market Rank Institution (ST) Branches ($mm) Share 1 BB&T Corp. (NC) 365 $24,937 19.1% 2 Wells Fargo & Co. (CA) 335 23,825 18.3 3 First Citizens BancShares Inc. (NC) 264 13,717 10.5 4 Bank of America Corp. (NC) 182 10,870 8.3 5 PNC Financial Services Group (PA) 156 8,242 6.3 6 SunTrust Banks Inc. (GA) 160 7,143 5.5 Pro Forma 75 3,053 2.3 7 BNC Bancorp (NC) 37 2,822 2.2 8 First Bancorp (NC) 81 2,466 1.9 9 Fifth Third Bancorp (OH) 59 2,338 1.8 10 Capital Bank Finl Corp (FL) 53 1,978 1.5 11 NewBridge Bancorp (NC) 41 1,823 1.4 12 CommunityOne Bancorp (NC) 54 1,813 1.4 13 Southern BancShares (NC) (NC) 68 1,674 1.3 14 VantageSou h Bancshares (NC) 45 1,655 1.3 15 Yadkin Financial Corporation (NC) 30 1,398 1.1

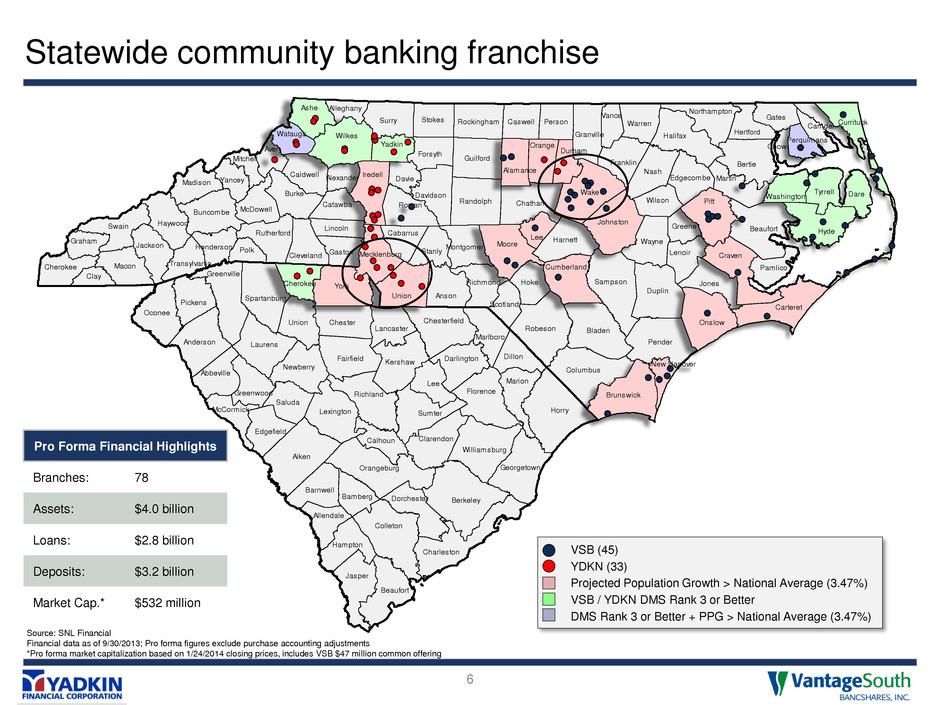

Stanly Cabarrus Vance Richmond Anson Florence Marion Darlington Marlboro Barnwell Greenwood Dillon Chesterfield Lancaster Columbus Lenoir Wayne Cleveland Rutherford Sampson Richland Greenville Halifax Alleghany Mitchell Avery McDowell McCormick Transylvania Martin Jackson Cherokee Graham Swain Haywood Hertford Northampton DorchesterBamberg Jasper Charleston Colleton Allendale Beaufort Alexander Beaufort Bertie Bladen Buncombe Burke Caldwell Camden Caswell Catawba Chatham Chowan Clay Davidson Davie Duplin Edgecombe Forsyth Franklin Gaston Gates Granville Greene Guilford Harnett Henderson Hoke Jones Lincoln Macon Madison Montgomery Nash Pamlico Pender Person Polk Randolph Robeson Rockingham Rowan Scotland StokesSurry Warren Wilson Yancey Abbeville Aiken Anderson Berkeley Calhoun Chester Clarendon Edgefield Fairfield Georgetown Hampton Horry Kershaw Laurens Lee Lexington Newberry Oconee Orangeburg Pickens Saluda Spartanburg Sumter Union Williamsburg Mecklenburg Union Brunswick Cumberland New Hanover Moore Lee Alamance Durham Orange Iredell Wake Pitt Carteret Onslow Craven Watauga Perquimans Ashe Wilkes Yadkin Washington Currituck Hyde Johnston York DareTyrrell Cherokee Statewide community banking franchise 6 Source: SNL Financial Financial data as of 9/30/2013; Pro forma figures exclude purchase accounting adjustments *Pro forma market capitalization based on 1/24/2014 closing prices, includes VSB $47 million common offering Pro Forma Financial Highlights Branches: 78 Assets: $4.0 billion Loans: $2.8 billion Deposits: $3.2 billion Market Cap.* $532 million • VSB (45) • YDKN (33) • Projected Population Growth > National Average (3.47%) • VSB / YDKN DMS Rank 3 or Better • DMS Rank 3 or Better + PPG > National Average (3.47%)

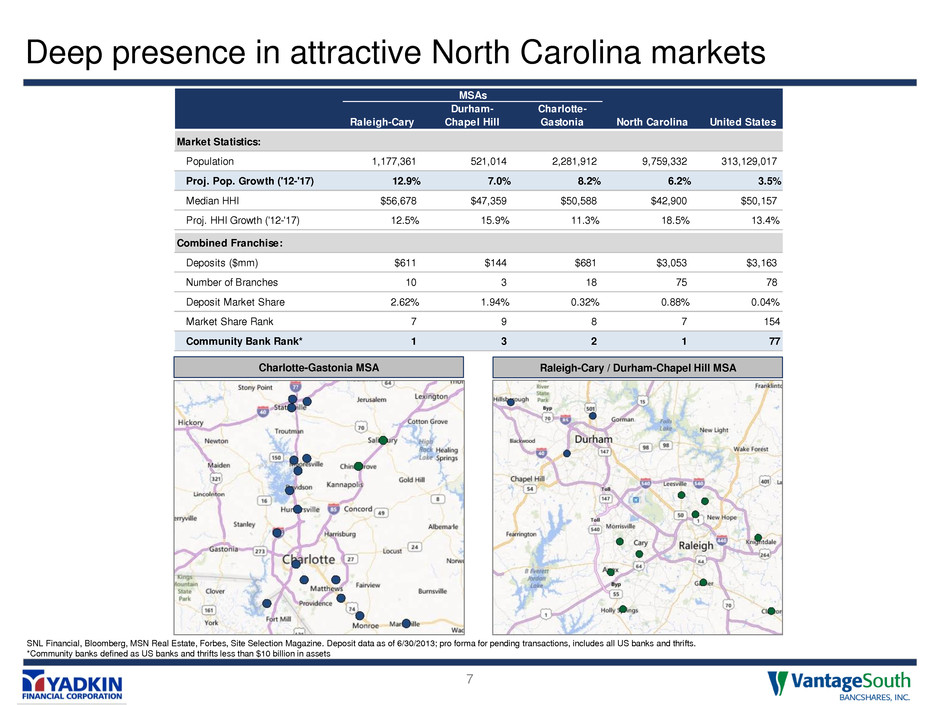

Deep presence in attractive North Carolina markets 7 SNL Financial, Bloomberg, MSN Real Estate, Forbes, Site Selection Magazine. Deposit data as of 6/30/2013; pro forma for pending transactions, includes all US banks and thrifts. *Community banks defined as US banks and thrifts less than $10 billion in assets Charlotte-Gastonia MSA Raleigh-Cary / Durham-Chapel Hill MSA MSAs Raleigh-Cary Durham- Chapel Hill Charlotte- Gastonia North Carolina United States Market Statistics: Population 1,177,361 521,014 2,281,912 9,759,332 313,129,017 Proj. Pop. Growth ('12-'17) 12.9% 7.0% 8.2% 6.2% 3.5% Median HHI $56,678 $47,359 $50,588 $42,900 $50,157 Proj. HHI Growth ('12-'17) 12.5% 15.9% 11.3% 18.5% 13.4% Combined Franchise: Deposits ($mm) $611 $144 $681 $3,053 $3,163 Number of Branches 10 3 18 75 78 Deposit Market Share 2.62% 1.94% 0.32% 0.88% 0.04% Market Share Rank 7 9 8 7 154 Community Bank Rank* 1 3 2 1 77

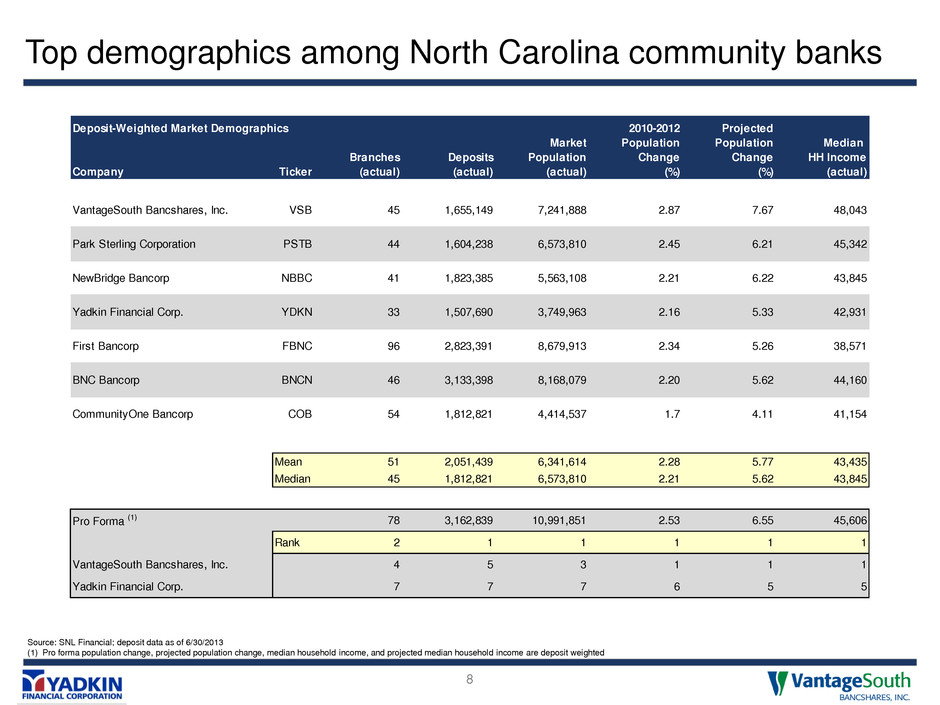

Top demographics among North Carolina community banks 8 Source: SNL Financial; deposit data as of 6/30/2013 (1) Pro forma population change, projected population change, median household income, and projected median household income are deposit weighted Deposit-Weighted Market Demographics 2010-2012 Projected Market Population Population Median Branches Deposits Population Change Change HH Income Company Ticker (actual) (actual) (actual) (%) (%) (actual) VantageSouth Bancshares, Inc. VSB 45 1,655,149 7,241,888 2.87 7.67 48,043 Park Sterling Corporation PSTB 44 1,604,238 6,573,810 2.45 6.21 45,342 NewBridge Bancorp NBBC 41 1,823,385 5,563,108 2.21 6.22 43,845 Yadkin Financial Corp. YDKN 33 1,507,690 3,749,963 2.16 5.33 42,931 First Bancorp FBNC 96 2,823,391 8,679,913 2.34 5.26 38,571 BNC Bancorp BNCN 46 3,133,398 8,168,079 2.20 5.62 44,160 CommunityOne Bancorp COB 54 1,812,821 4,414,537 1.7 4.11 41,154 Mean 51 2,051,439 6,341,614 2.28 5.77 43,435 Median 45 1,812,821 6,573,810 2.21 5.62 43,845 Pro Forma (1) 78 3,162,839 10,991,851 2.53 6.55 45,606 Rank 2 1 1 1 1 1 VantageSouth Bancshares, Inc. 4 5 3 1 1 1 Yadkin Financial Corp. 7 7 7 6 5 5

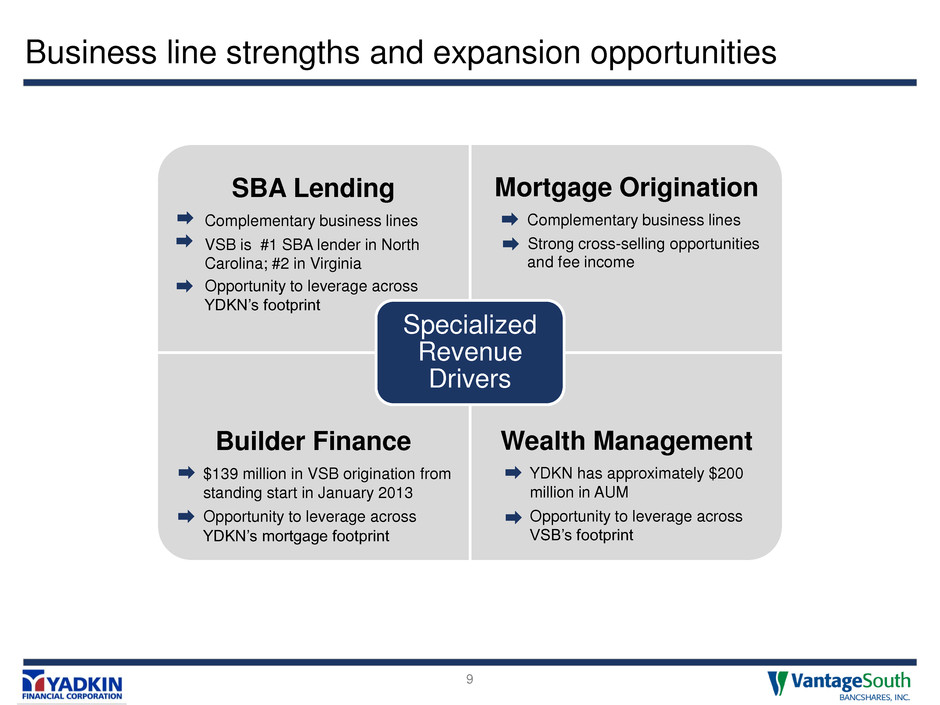

Business line strengths and expansion opportunities 9 SBA Lending Complementary business lines VSB is #1 SBA lender in North Carolina; #2 in Virginia Opportunity to leverage across YDKN’s footprint Mortgage Origination Complementary business lines Strong cross-selling opportunities and fee income Builder Finance $139 million in VSB origination from standing start in January 2013 Opportunity to leverage across YDKN’s mortgage footprint Wealth Management YDKN has approximately $200 million in AUM Opportunity to leverage across VSB’s footprint Specialized Revenue Drivers

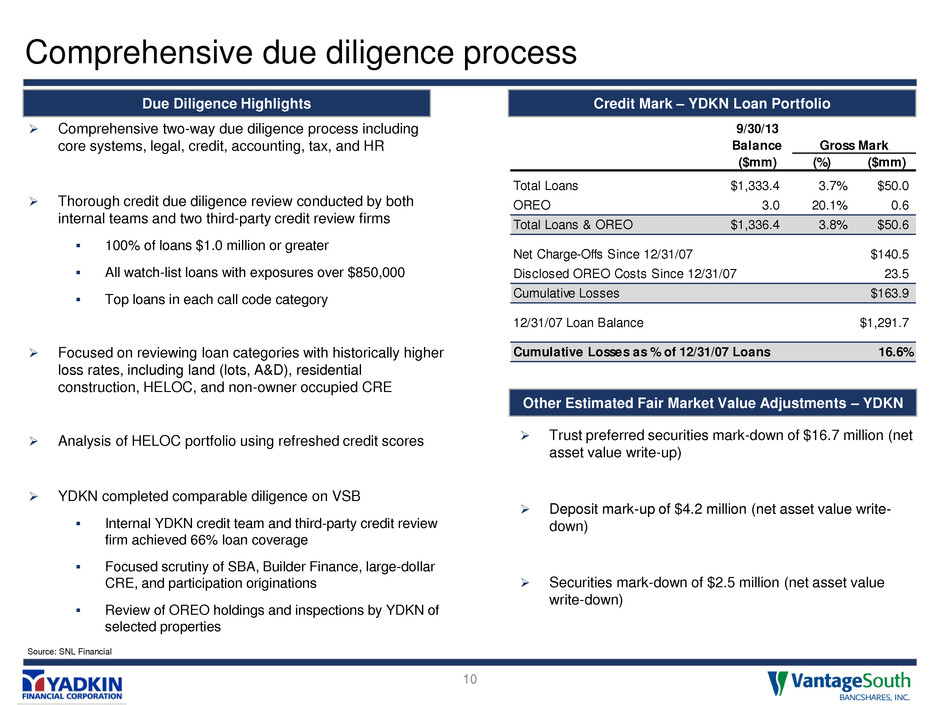

Comprehensive due diligence process 10 Source: SNL Financial Due Diligence Highlights Credit Mark – YDKN Loan Portfolio 9/30/13 Balance Gross Mark ($mm) (%) ($mm) Total Loans $1,333.4 3.7% $50.0 OREO 3.0 20.1% 0.6 Total Loans & OREO $1,336.4 3.8% $50.6 Net Charge-Offs Since 12/31/07 $140.5 Disclosed OREO Costs Since 12/31/07 23.5 Cumulative Losses $163.9 12/31/07 Loan Balance $1,291.7 Cumulative Losses as % of 12/31/07 Loans 16.6% Other Estimated Fair Market Value Adjustments – YDKN Trust preferred securities mark-down of $16.7 million (net asset value write-up) Deposit mark-up of $4.2 million (net asset value write- down) Securities mark-down of $2.5 million (net asset value write-down) Comprehensive two-way due diligence process including core systems, legal, credit, accounting, tax, and HR Thorough credit due diligence review conducted by both internal teams and two third-party credit review firms 100% of loans $1.0 million or greater All watch-list loans with exposures over $850,000 Top loans in each call code category Focused on reviewing loan categories with historically higher loss rates, including land (lots, A&D), residential construction, HELOC, and non-owner occupied CRE Analysis of HELOC portfolio using refreshed credit scores YDKN completed comparable diligence on VSB Internal YDKN credit team and third-party credit review firm achieved 66% loan coverage Focused scrutiny of SBA, Builder Finance, large-dollar CRE, and participation originations Review of OREO holdings and inspections by YDKN of selected properties

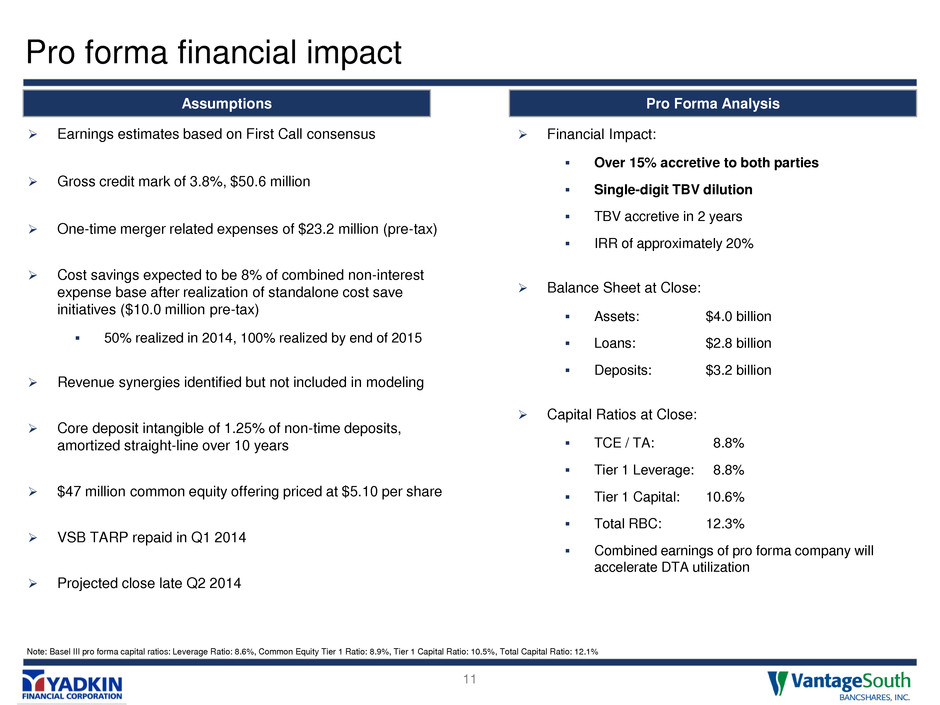

Pro forma financial impact 11 Assumptions Earnings estimates based on First Call consensus Gross credit mark of 3.8%, $50.6 million One-time merger related expenses of $23.2 million (pre-tax) Cost savings expected to be 8% of combined non-interest expense base after realization of standalone cost save initiatives ($10.0 million pre-tax) 50% realized in 2014, 100% realized by end of 2015 Revenue synergies identified but not included in modeling Core deposit intangible of 1.25% of non-time deposits, amortized straight-line over 10 years $47 million common equity offering priced at $5.10 per share VSB TARP repaid in Q1 2014 Projected close late Q2 2014 Pro Forma Analysis Financial Impact: Over 15% accretive to both parties Single-digit TBV dilution TBV accretive in 2 years IRR of approximately 20% Balance Sheet at Close: Assets: $4.0 billion Loans: $2.8 billion Deposits: $3.2 billion Capital Ratios at Close: TCE / TA: 8.8% Tier 1 Leverage: 8.8% Tier 1 Capital: 10.6% Total RBC: 12.3% Combined earnings of pro forma company will accelerate DTA utilization Note: Basel III pro forma capital ratios: Leverage Ratio: 8.6%, Common Equity Tier 1 Ratio: 8.9%, Tier 1 Capital Ratio: 10.5%, Total Capital Ratio: 12.1%

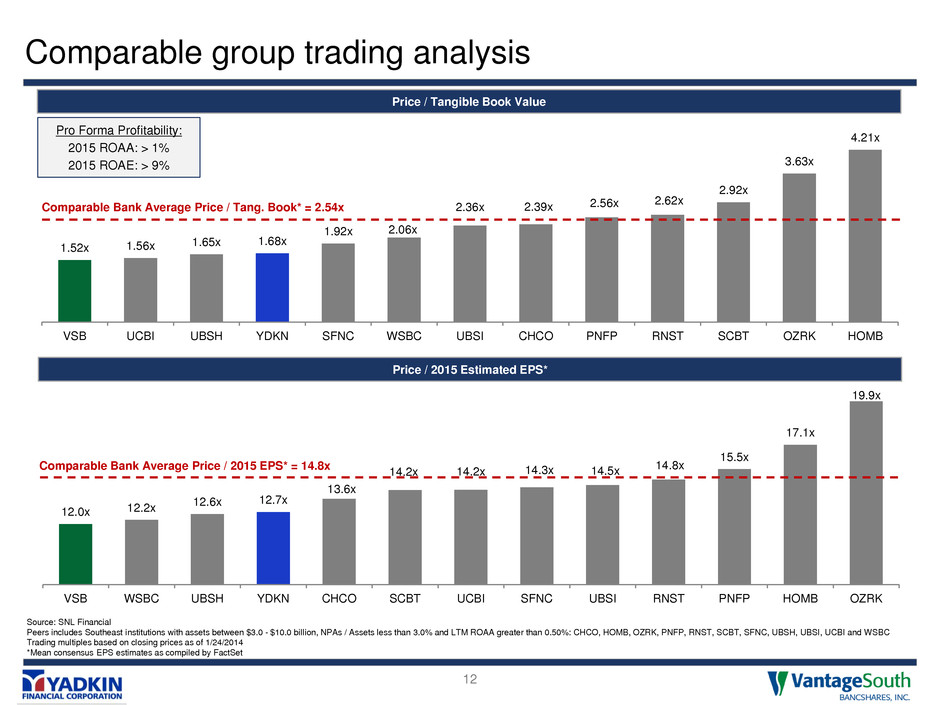

1.52x 1.56x 1.65x 1.68x 1.92x 2.06x 2.36x 2.39x 2.56x 2.62x 2.92x 3.63x 4.21x VSB UCBI UBSH YDKN SFNC WSBC UBSI CHCO PNFP RNST SCBT OZRK HOMB Comparable group trading analysis 12 12.0x 12.2x 12.6x 12.7x 13.6x 14.2x 14.2x 14.3x 14.5x 14.8x 15.5x 17.1x 19.9x VSB WSBC UBSH YDKN CHCO SCBT UCBI SFNC UBSI RNST PNFP HOMB OZRK Price / 2015 Estimated EPS* Comparable Bank Average Price / 2015 EPS* = 14.8x Price / Tangible Book Value Comparable Bank Average Price / Tang. Book* = 2.54x Pro Forma Profitability: 2015 ROAA: > 1% 2015 ROAE: > 9% Source: SNL Financial Peers includes Southeast institutions with assets between $3.0 - $10.0 billion, NPAs / Assets less than 3.0% and LTM ROAA greater than 0.50%: CHCO, HOMB, OZRK, PNFP, RNST, SCBT, SFNC, UBSH, UBSI, UCBI and WSBC Trading multiples based on closing prices as of 1/24/2014 *Mean consensus EPS estimates as compiled by FactSet

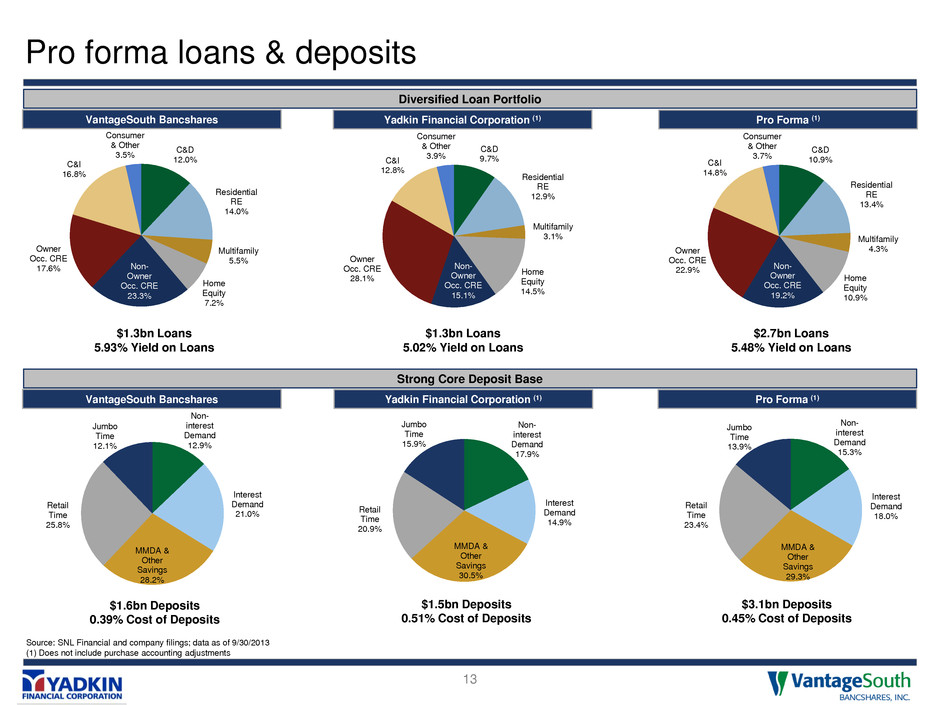

Pro forma loans & deposits 13 VantageSouth Bancshares Yadkin Financial Corporation (1) Pro Forma (1) Source: SNL Financial and company filings; data as of 9/30/2013 (1) Does not include purchase accounting adjustments C&D 9.7% Residential RE 12.9% Multifamily 3.1% Home Equity 14.5% Non- Owner Occ. CRE 15.1% Owner Occ. CRE 28.1% C&I 12.8% Consumer & Other 3.9% C&D 10.9% Residential RE 13.4% Multifamily 4.3% Home Equity 10.9% Non- Owner Occ. CRE 19.2% Owner Occ. CRE 22.9% C&I 14.8% Consumer & Other 3.7% C&D 12.0% Residential RE 14.0% Multifamily 5.5% Home Equity 7.2% Non- Owner Occ. CRE 23.3% Owner Occ. CRE 17.6% C&I 16.8% Consumer & Other 3.5% Strong Core Deposit Base Diversified Loan Portfolio Non- interest Demand 12.9% Interest Demand 21.0% MMDA & Other Savings 28.2% Retail Time 25.8% Jumbo Time 12.1% Non- interest Demand 17.9% Interest Demand 14.9% MMDA & Other Savings 30.5% Retail Time 20.9% Jumbo Time 15.9% Non- interest Demand 15.3% Interest Demand 18.0% MMDA & Other Savings 29.3% Retail Time 23.4% Jumbo Time 13.9% VantageSouth Bancshares Yadkin Financial Corporation (1) Pro Forma (1) $1.3bn Loans 5.93% Yield on Loans $1.3bn Loans 5.02% Yield on Loans $1.6bn Deposits 0.39% Cost of Deposits $1.5bn Deposits 0.51% Cost of Deposits $3.1bn Deposits 0.45% Cost of Deposits $2.7bn Loans 5.48% Yield on Loans

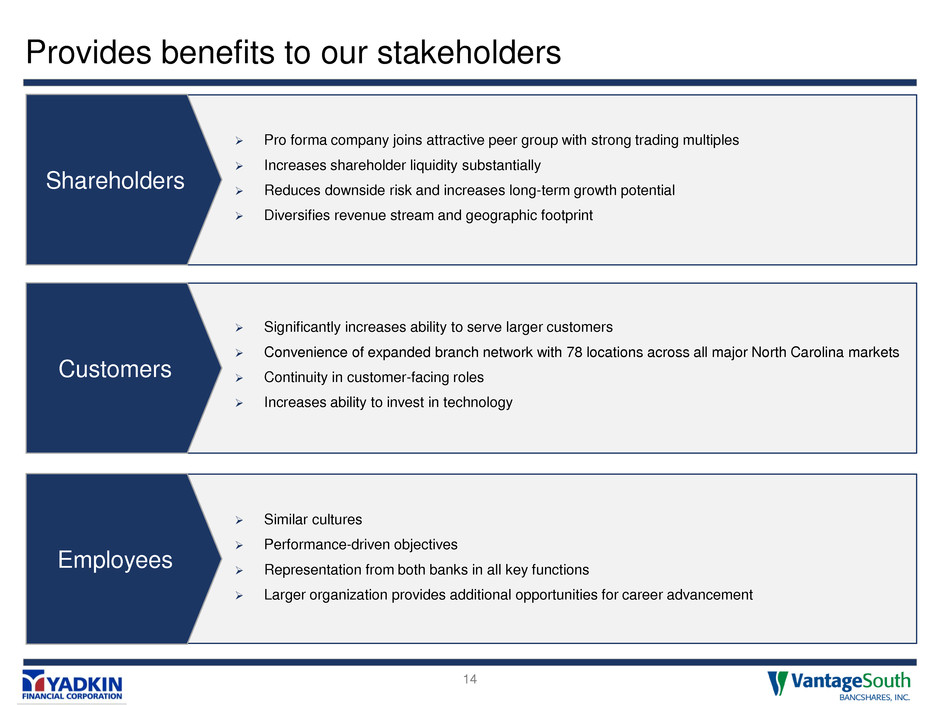

Provides benefits to our stakeholders 14 Pro forma company joins attractive peer group with strong trading multiples Increases shareholder liquidity substantially Reduces downside risk and increases long-term growth potential Diversifies revenue stream and geographic footprint Significantly increases ability to serve larger customers Convenience of expanded branch network with 78 locations across all major North Carolina markets Continuity in customer-facing roles Increases ability to invest in technology Similar cultures Performance-driven objectives Representation from both banks in all key functions Larger organization provides additional opportunities for career advancement Shareholders Customers Employees

Additional information about the merger and where to find it 15 In connection with the proposed merger, Yadkin Financial Corporation (“Yadkin”) will file with the Securities and Exchange Commission (“SEC”) a Registration Statement on Form S-4 that will include a joint proxy statement of Yadkin and VantageSouth Bancshares, Inc. (the “Company”) and a prospectus of Yadkin, as well as other relevant documents concerning the proposed transaction. Both the Company and Yadkin will mail the joint proxy statement/prospectus to their respective stockholders. SHAREHOLDERS OF YADKIN AND THE COMPANY ARE URGED TO READ THE REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE PROPOSED MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain a free copy of the proxy statement/prospectus (when available) and other filings containing information about Yadkin and the Company at the SEC’s website at www.sec.gov. The joint proxy statement/prospectus (when available) and the other filings may also be obtained free of charge at Yadkin’s website at www.Yadkinbank.com, or at the Company’s website at www.VSB.com. Yadkin and certain of their respective Directors and executive officers, under the SEC’s rules, may be deemed to be participants in the solicitation of proxies of Yadkin and the Company’s stockholders in connection with the proposed merger. Information about the Directors and executive officers of Yadkin and their ownership of Yadkin common stock is set forth in the proxy statement for Yadkin’s 2013 Annual Meeting of Shareholders, as filed with the SEC on Schedule 14A on April 4, 2013. Information about the Directors and executive officers of the Company and their ownership of the Company common stock is set forth in the proxy statement for the Company’s 2013 Annual Meeting of Stockholders, as filed with the SEC on a Schedule 14A on April 23, 2013. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the joint proxy statement/prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such jurisdiction.