Attached files

| file | filename |

|---|---|

| 8-K - 8-K - HOOPER HOLMES INC | form8-kfiling01242014.htm |

1 Hooper Holmes, Inc. January 24, 2014 2014 Cannell Alternative Asset Summit Speaker: Henry Dubois, Chief Executive Officer

2 Safe Harbor Statement 2 The presentation contains forward-looking statements concerning plans, objectives, goals, strategies, future events or performances, which are not statements of historical fact. The forward-looking statements contained in this release reflect our current beliefs and expectations. Actual results or performance may differ materially from what is expressed in the forward-looking statements. You are referred to the documents filed by us with the SEC, specifically reports on Form 10-K and Form 10-Q including risk factors that could cause actual results to differ from forward- looking statements. These reports are available at www.sec.gov. This presentation contains information from third-party sources, including data from studies conducted by others and market data and industry forecasts obtained from industry publication. Although Hooper Holmes Inc. believes that such information is reliable, Hooper Holmes Inc. has not independently verified any of this information and Hooper Holmes Inc. does not guarantee the accuracy or completeness of this information.

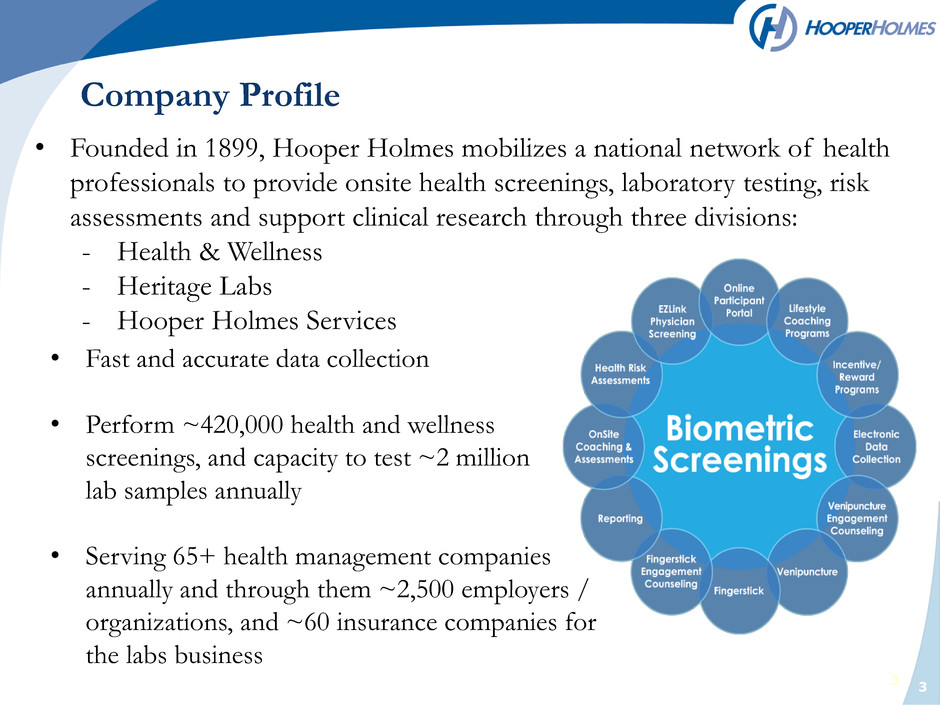

3 Company Profile • Founded in 1899, Hooper Holmes mobilizes a national network of health professionals to provide onsite health screenings, laboratory testing, risk assessments and support clinical research through three divisions: - Health & Wellness - Heritage Labs - Hooper Holmes Services • Fast and accurate data collection • Perform ~420,000 health and wellness screenings, and capacity to test ~2 million lab samples annually • Serving 65+ health management companies annually and through them ~2,500 employers / organizations, and ~60 insurance companies for the labs business 3

4 2013 Accomplishments • Built a new management team - New CEO, CFO and a new board member - Streamlined organization • Turned the focus of the company from stabilizing a declining revenue business to growing our health and wellness business: - Sold our Portamedic business line to generate cash, jettisoning a business that we were losing money in, and would have taken capital to repair and about 18 months to achieve profitability - Added operational capabilities in our health & wellness business - Focused our H&W sales efforts and overcame a decline in volume from our 2012 largest customer due to a change in the business systems they used to interact with their customers – they are expected to rebound in 2014 4

5 2013 Accomplishments, Cont’d.. • Implemented our transition plan to a more lean corporate structure, which involves a move of the company HQ from Basking Ridge, NJ, to Olathe, KS - Consolidates our operations - Allows us to market our NJ property (currently listed for $ 4.1 million) - In conjunction with our overall restructuring, the run rate SG&A enables a reduction of SG&A expenses by more than 50% compared to 2012 • Began to change the culture to continuously review and improve our business 5

6 Our Competitive Advantage 6 COVERAGE CONSISTENCY COMPLIANCE • Hooper Health & Wellness provides the finest end-to-end biometric screening solutions in the industry • Our process ensures the highest possible participant satisfaction and results that fuel successful wellness programs

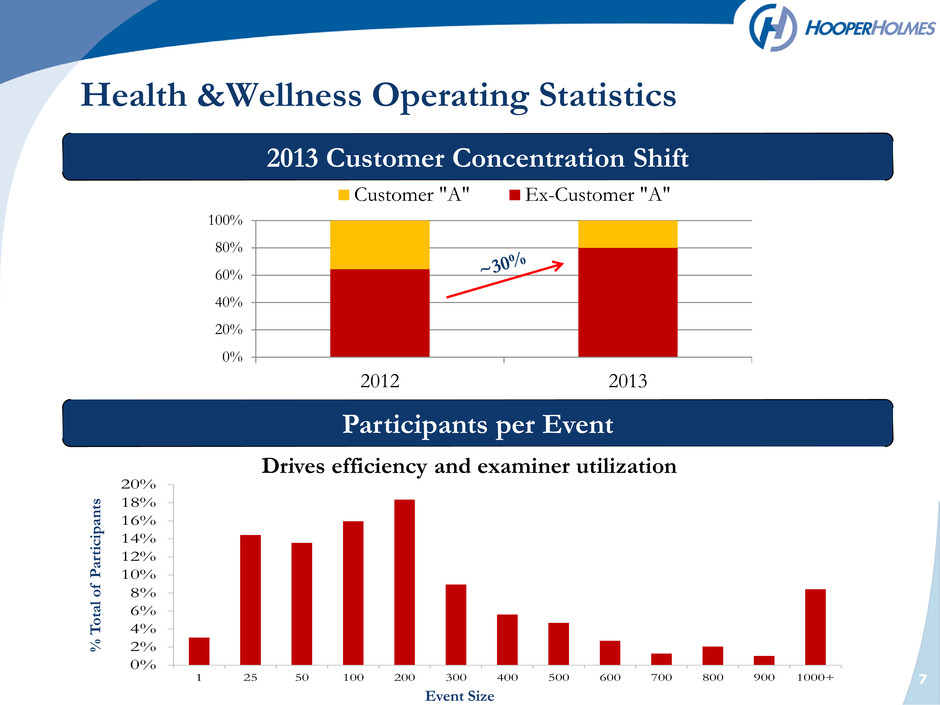

7 Health &Wellness Operating Statistics 7 2013 Customer Concentration Shift Participants per Event 0% 20% 40% 60% 80% 100% 2012 2013 Customer "A" Ex-Customer "A" Drives efficiency and examiner utilization Event Size 0% 2% 4% 6% 8% 1 % 12% 14% 16% 18% 20% 1 25 50 100 200 300 400 500 600 700 800 900 1000+ % T o tal o f P a rt icipa n ts

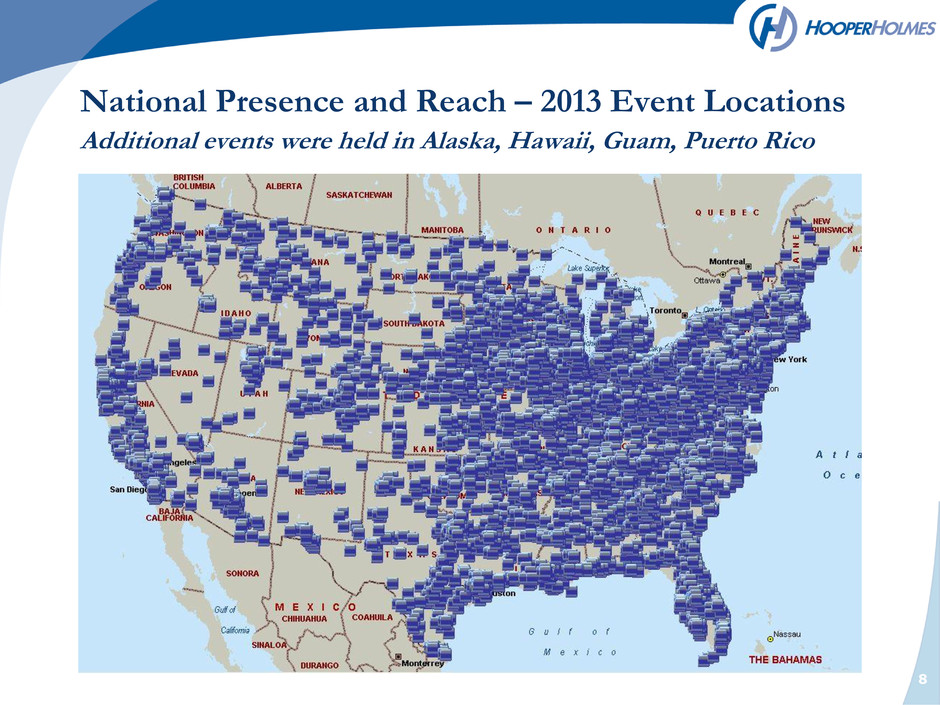

8 National Presence and Reach – 2013 Event Locations Additional events were held in Alaska, Hawaii, Guam, Puerto Rico 8

9 Industry Overview and Market Trends The New Hooper

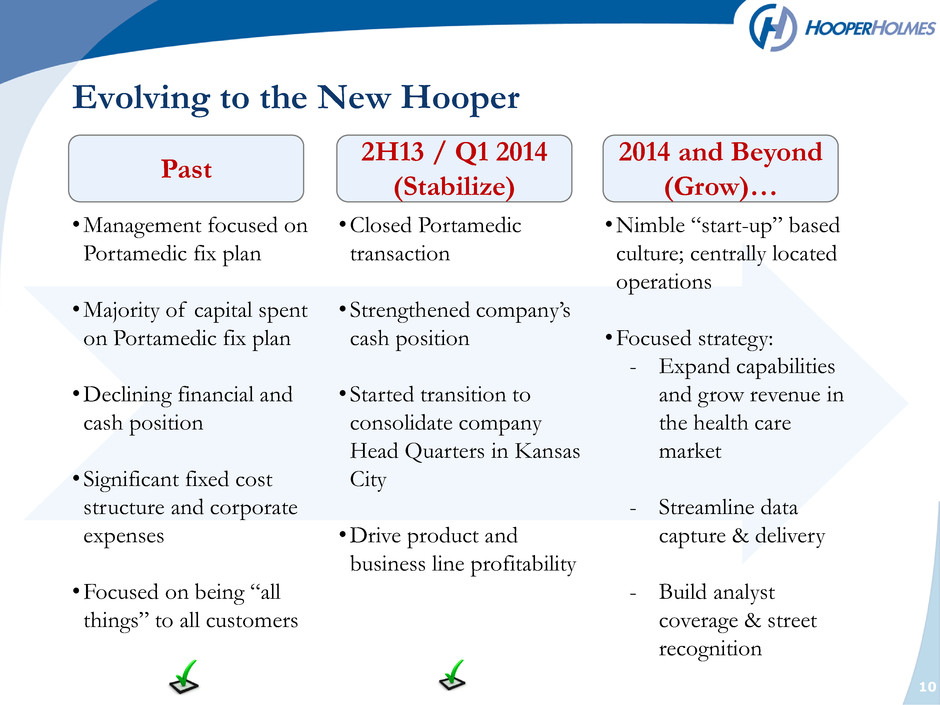

10 Evolving to the New Hooper •Management focused on Portamedic fix plan • Majority of capital spent on Portamedic fix plan •Declining financial and cash position • Significant fixed cost structure and corporate expenses •Focused on being “all things” to all customers •Closed Portamedic transaction • Strengthened company’s cash position • Started transition to consolidate company Head Quarters in Kansas City •Drive product and business line profitability •Nimble “start-up” based culture; centrally located operations •Focused strategy: - Expand capabilities and grow revenue in the health care market - Streamline data capture & delivery - Build analyst coverage & street recognition Past 2H13 / Q1 2014 (Stabilize) 2014 and Beyond (Grow)…

11 Looking Ahead.. While our longer term strategy is being finalized, we know we will be focusing on … We believe we can build a profitable $100 million annual revenue business over the next 4 to 6 years – growth will come from our H&W business, organically and potentially through acquisitions QUALITY: Leverage our capability: highest customer marks, some cases better than 20% NEW MARKETS: With our partners, attract new employers for services DIVERSIFY: With our partners, continually refine offerings to broaden our revenue base GROWTH: Drive growth through market penetration (e.g. higher participation rate with current clients) and new market entrance

12 Rapidly Growing Market • The Health and Wellness business is the cornerstone of our growth • U.S. healthcare market and costs are growing rapidly: - U.S. spends more on health care costs than any other country, more than $7,000 per capita and over 19% of GDP - More than 75% of the costs are due to chronic conditions, which hurts employee productivity and performance - Firms realize almost $2-3 in savings from every $1 spent on employee wellness - Affordable Care Act (ACA) has several provisions designed to expand health promotion and prevention - However, regardless of how the ACA is ultimately implemented, employers are focusing on how to get a better return on their medical benefit dollars Sources: Human Performance Institute White Pater: A Staircase of Individual and Organizational Health:Bringing the Biology of Business Performance to Life; National Institute for Health Care Reform: Reshaping Health Care, 18th Annual Towers Watson Report; RAND HEALTH: A Review of the U.S. Workplace Wellness Market.

13 Regulatory Dynamics Encourage H&W Programs “The Affordable Care Act creates new incentives and builds on existing wellness program policies to promote employer wellness programs and encourage opportunities to support healthier workplaces” – Department of Labor Website • Contains numerous provisions intended to contain health care cost growth and expand health promotion and prevention activities • $200 million has been dedicated to wellness program start-up grants for businesses with fewer than 100 employees • $1 billion for community-based initiatives, tobacco cessation activities, chronic disease reduction programs, and efforts to reduce healthcare-acquired infections • And more…

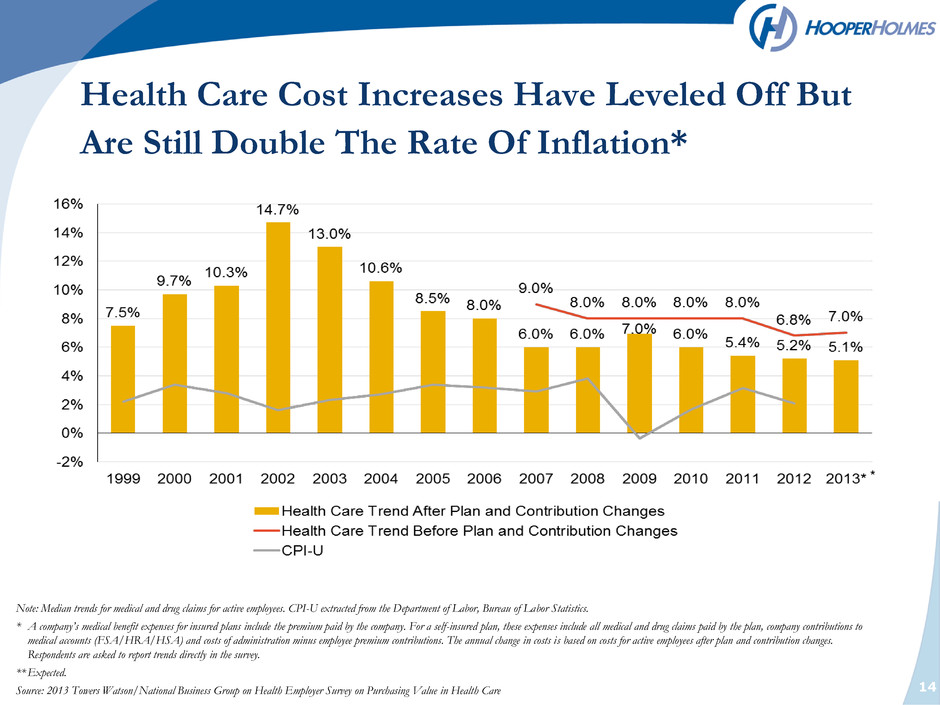

14 Health Care Cost Increases Have Leveled Off But Are Still Double The Rate Of Inflation* Note: Median trends for medical and drug claims for active employees. CPI-U extracted from the Department of Labor, Bureau of Labor Statistics. * A company’s medical benefit expenses for insured plans include the premium paid by the company. For a self-insured plan, these expenses include all medical and drug claims paid by the plan, company contributions to medical accounts (FSA/HRA/HSA) and costs of administration minus employee premium contributions. The annual change in costs is based on costs for active employees after plan and contribution changes. Respondents are asked to report trends directly in the survey. ** Expected. Source: 2013 Towers Watson/National Business Group on Health Employer Survey on Purchasing Value in Health Care *

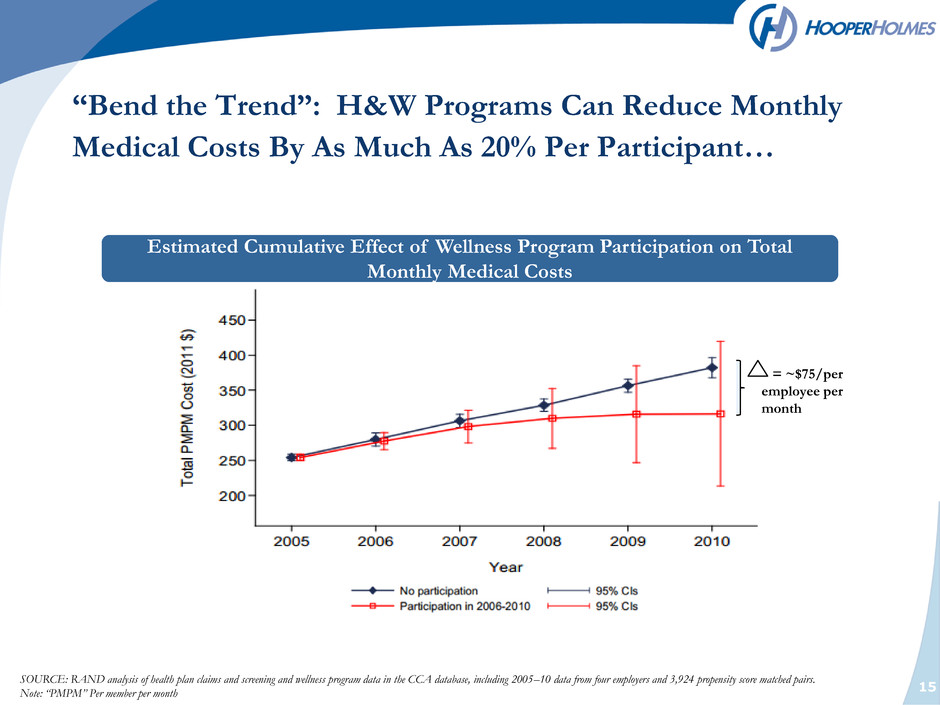

15 “Bend the Trend”: H&W Programs Can Reduce Monthly Medical Costs By As Much As 20% Per Participant… SOURCE: RAND analysis of health plan claims and screening and wellness program data in the CCA database, including 2005–10 data from four employers and 3,924 propensity score matched pairs. Note: “PMPM” Per member per month Estimated Cumulative Effect of Wellness Program Participation on Total Monthly Medical Costs = ~$75/per employee per month

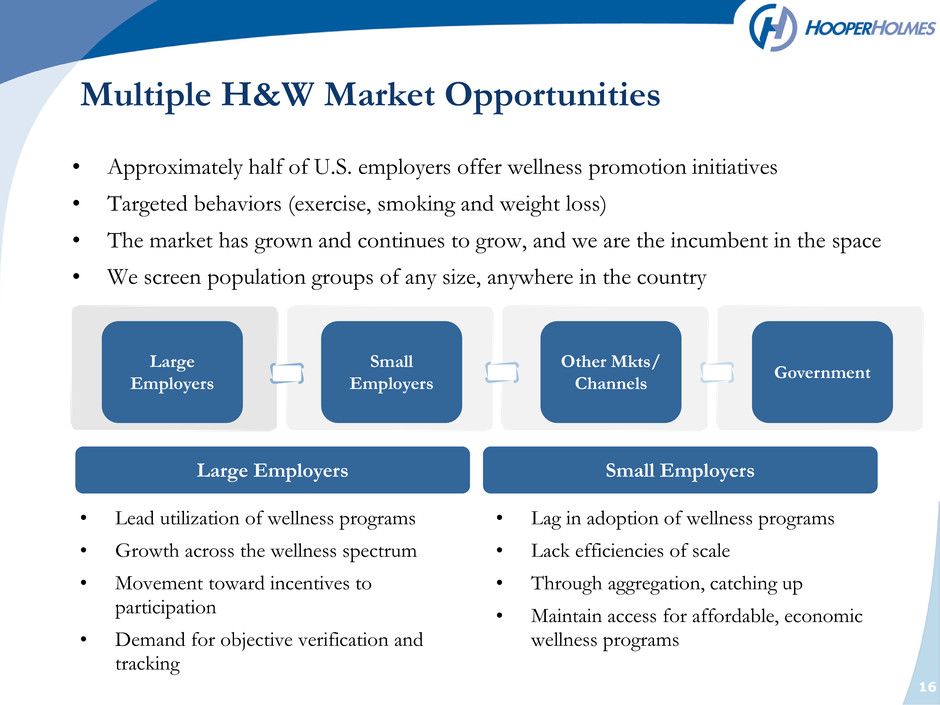

Multiple H&W Market Opportunities 16 Large Employers Small Employers Other Mkts/ Channels Government • Lead utilization of wellness programs • Growth across the wellness spectrum • Movement toward incentives to participation • Demand for objective verification and tracking • Lag in adoption of wellness programs • Lack efficiencies of scale • Through aggregation, catching up • Maintain access for affordable, economic wellness programs • Approximately half of U.S. employers offer wellness promotion initiatives • Targeted behaviors (exercise, smoking and weight loss) • The market has grown and continues to grow, and we are the incumbent in the space • We screen population groups of any size, anywhere in the country Large Employers Small Employers

17 Heritage Labs & Hooper Holmes Services 2014 Priorities • Leverage laboratory data to provide new knowledge and tools for evaluating risk • Focus on core HHS services to provide highly-automated, high- volume, value-add solutions • Support H&W through laboratory testing and materials management

18 2014 Key Objectives: Cash flow positive and H&W growth • Continue to focus our attention on our long-term strategy • Leverage existing assets to take advantage of our immediate opportunities while positioning the company for long-term growth – explore opportunities to accelerate growth through selective acquisitions • While we have done much in the last year, we still have more to do and we are confident that we are moving in the right direction

19 The New Hooper: Leveraging our capabilities in a Rapidly Growing Market Our Opportunity Our Existing Capabilities Market Dynamics & Growth Existing Customer Base Enhancements Underway