Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - HEARTLAND EXPRESS INC | a2013acquisitionofgordontr.htm |

| EX-99.4 - INTERIM FINANCIAL STATEMENTS - HEARTLAND EXPRESS INC | interimfinancialstatements.htm |

| EX-99.5 - PRO FORMA FINANCIAL STATEMENTS - HEARTLAND EXPRESS INC | proformafinancialstatements.htm |

| EX-23.1 - CONSENT OF INDEPENDENT AUDITOR - HEARTLAND EXPRESS INC | consentofindependentauditor.htm |

Gordon Trucking, Inc. Consolidated Financial Report December 31, 2012

Gordon Trucking Inc. Consolidated Financial Report December 31 2012

Contents Independent Auditor’s Report ............................................................................................ 1 Consolidated Financial Statements Consolidated Balance Sheets ............................................................................................. 2-3 Consolidated Statements of Income ...................................................................................... 4 Consolidated Statements of Stockholders’ Equity ................................................................. 5 Consolidated Statements of Cash Flows ............................................................................ 6-7 Notes to Consolidated Financial Statements .................................................................... 8-16

McGladrey LLP Member of RSM International network, a network of independent accounting, tax and consulting firms. Independent Auditor’s Report To the Stockholders Gordon Trucking, Inc. Pacific, Washington Report on the Consolidated Financial Statements We have audited the accompanying consolidated financial statements of Gordon Trucking, Inc. as of December 31, 2012, 2011 and 2010, and the related consolidated statements of income, stockholders’ equity and cash flows for the years then ended, and the related notes to the consolidated financial statements. Management’s Responsibility for the Consolidated Financial Statements Management is responsible for the preparation and fair presentation of these consolidated financial statements in accordance with accounting principles generally accepted in the United States of America; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of the consolidated financial statements that are free from material misstatement, whether due to fraud or error. Auditor’s Responsibility Our responsibility is to express an opinion on these consolidated financial statements based on our audits. We conducted our audits in accordance with auditing standards generally accepted in the United States of America. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. In making those risk assessments, the auditor considers internal control relevant to the entity’s preparation and fair presentation of the consolidated financial statements in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements. We believe the audit evidence we have obtained is sufficient and appropriate to provide a reasonable basis for our audit opinion. Opinion In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Gordon Trucking, Inc. as of December 31, 2012, 2011 and 2010, and the results of its operations and its cash flows for the years then ended, in accordance with accounting principles generally accepted in the United States of America. Tacoma, Washington February 20, 2013, except for Notes 6 and 7 as to which the date is January 8, 2014

Consolidated Financial Statements

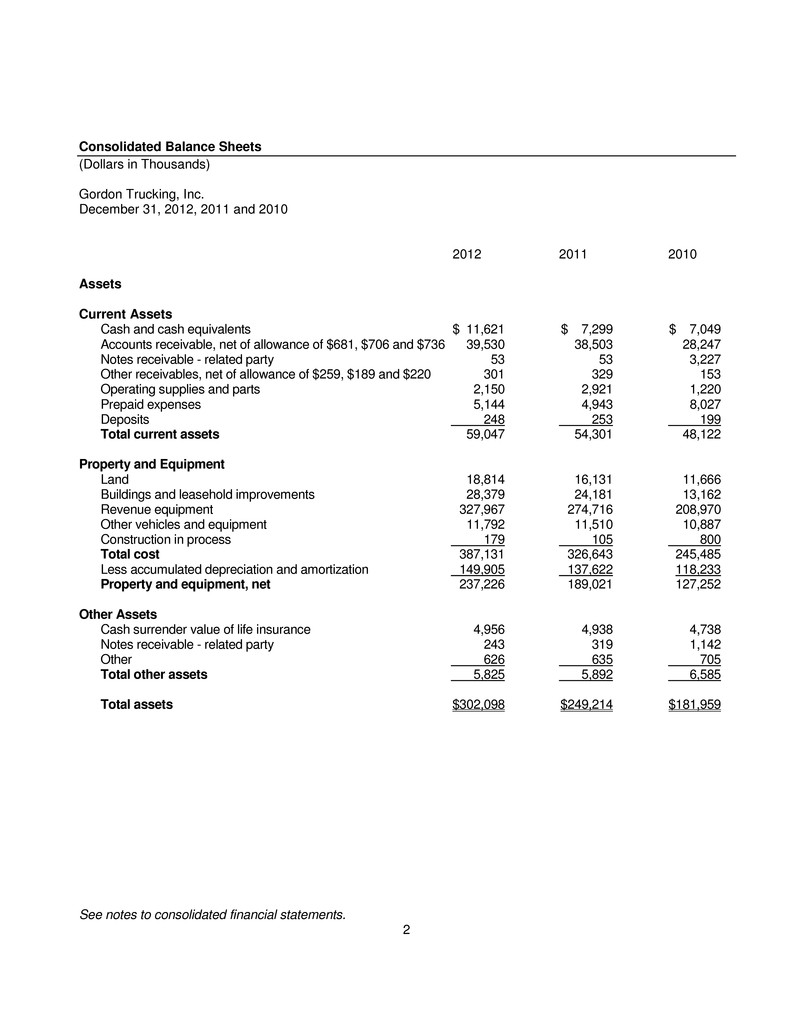

Consolidated Balance Sheets (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 2012 2011 2010 Assets Current Assets Cash and cash equivalents $ 11,621 $ 7,299 $ 7,049 Accounts receivable, net of allowance of $681, $706 and $736 39,530 38,503 28,247 Notes receivable - related party 53 53 3,227 Other receivables, net of allowance of $259, $189 and $220 301 329 153 Operating supplies and parts 2,150 2,921 1,220 Prepaid expenses 5,144 4,943 8,027 Deposits 248 253 199 Total current assets 59,047 54,301 48,122 Property and Equipment Land 18,814 16,131 11,666 Buildings and leasehold improvements 28,379 24,181 13,162 Revenue equipment 327,967 274,716 208,970 Other vehicles and equipment 11,792 11,510 10,887 Construction in process 179 105 800 Total cost 387,131 326,643 245,485 Less accumulated depreciation and amortization 149,905 137,622 118,233 Property and equipment, net 237,226 189,021 127,252 Other Assets Cash surrender value of life insurance 4,956 4,938 4,738 Notes receivable - related party 243 319 1,142 Other 626 635 705 Total other assets 5,825 5,892 6,585 Total assets $302,098 $249,214 $181,959 See notes to consolidated financial statements. 2

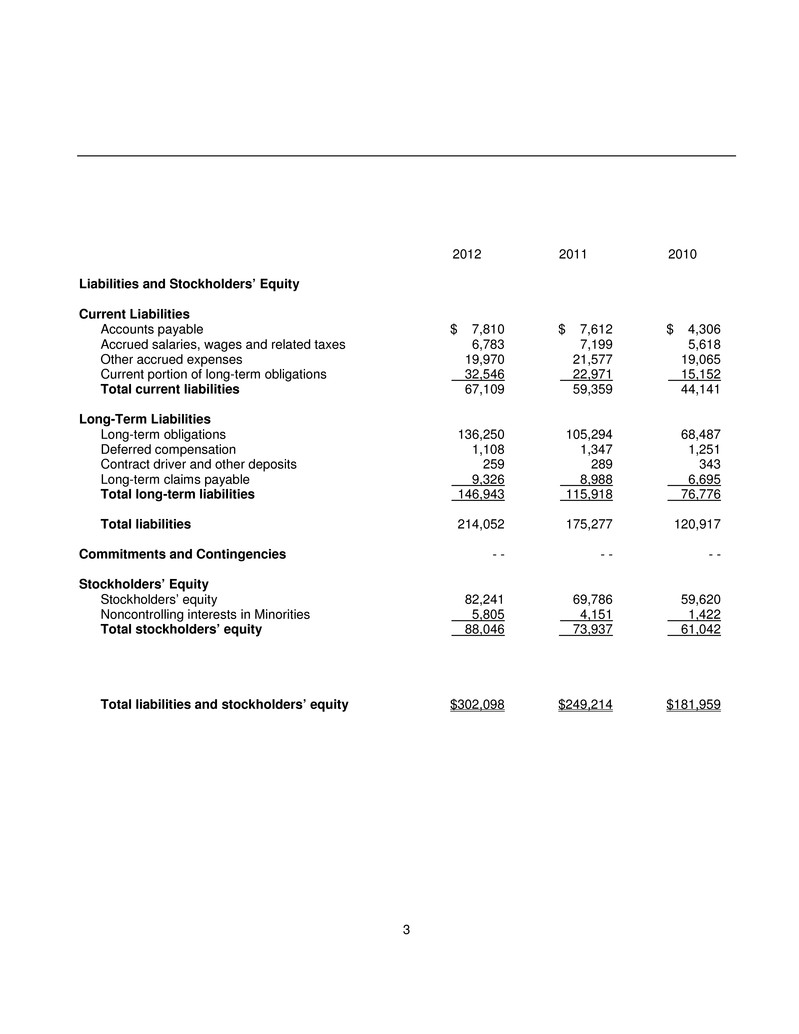

2012 2011 2010 Liabilities and Stockholders’ Equity Current Liabilities Accounts payable $ 7,810 $ 7,612 $ 4,306 Accrued salaries, wages and related taxes 6,783 7,199 5,618 Other accrued expenses 19,970 21,577 19,065 Current portion of long-term obligations 32,546 22,971 15,152 Total current liabilities 67,109 59,359 44,141 Long-Term Liabilities Long-term obligations 136,250 105,294 68,487 Deferred compensation 1,108 1,347 1,251 Contract driver and other deposits 259 289 343 Long-term claims payable 9,326 8,988 6,695 Total long-term liabilities 146,943 115,918 76,776 Total liabilities 214,052 175,277 120,917 Commitments and Contingencies - - - - - - Stockholders’ Equity Stockholders’ equity 82,241 69,786 59,620 Noncontrolling interests in Minorities 5,805 4,151 1,422 Total stockholders’ equity 88,046 73,937 61,042 Total liabilities and stockholders’ equity $302,098 $249,214 $181,959 3

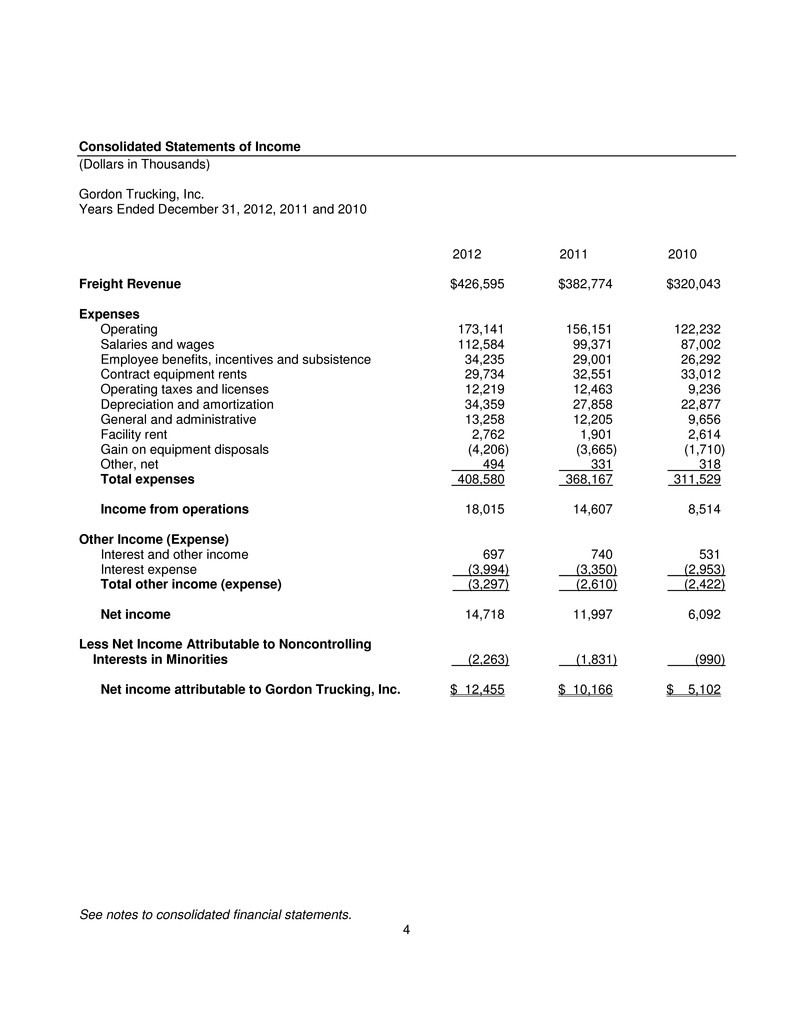

Consolidated Statements of Income (Dollars in Thousands) Gordon Trucking, Inc. Years Ended December 31, 2012, 2011 and 2010 2012 2011 2010 Freight Revenue $426,595 $382,774 $320,043 Expenses Operating 173,141 156,151 122,232 Salaries and wages 112,584 99,371 87,002 Employee benefits, incentives and subsistence 34,235 29,001 26,292 Contract equipment rents 29,734 32,551 33,012 Operating taxes and licenses 12,219 12,463 9,236 Depreciation and amortization 34,359 27,858 22,877 General and administrative 13,258 12,205 9,656 Facility rent 2,762 1,901 2,614 Gain on equipment disposals (4,206) (3,665) (1,710) Other, net 494 331 318 Total expenses 408,580 368,167 311,529 Income from operations 18,015 14,607 8,514 Other Income (Expense) Interest and other income 697 740 531 Interest expense (3,994) (3,350) (2,953) Total other income (expense) (3,297) (2,610) (2,422) Net income 14,718 11,997 6,092 Less Net Income Attributable to Noncontrolling Interests in Minorities (2,263) (1,831) (990) Net income attributable to Gordon Trucking, Inc. $ 12,455 $ 10,166 $ 5,102 See notes to consolidated financial statements. 4

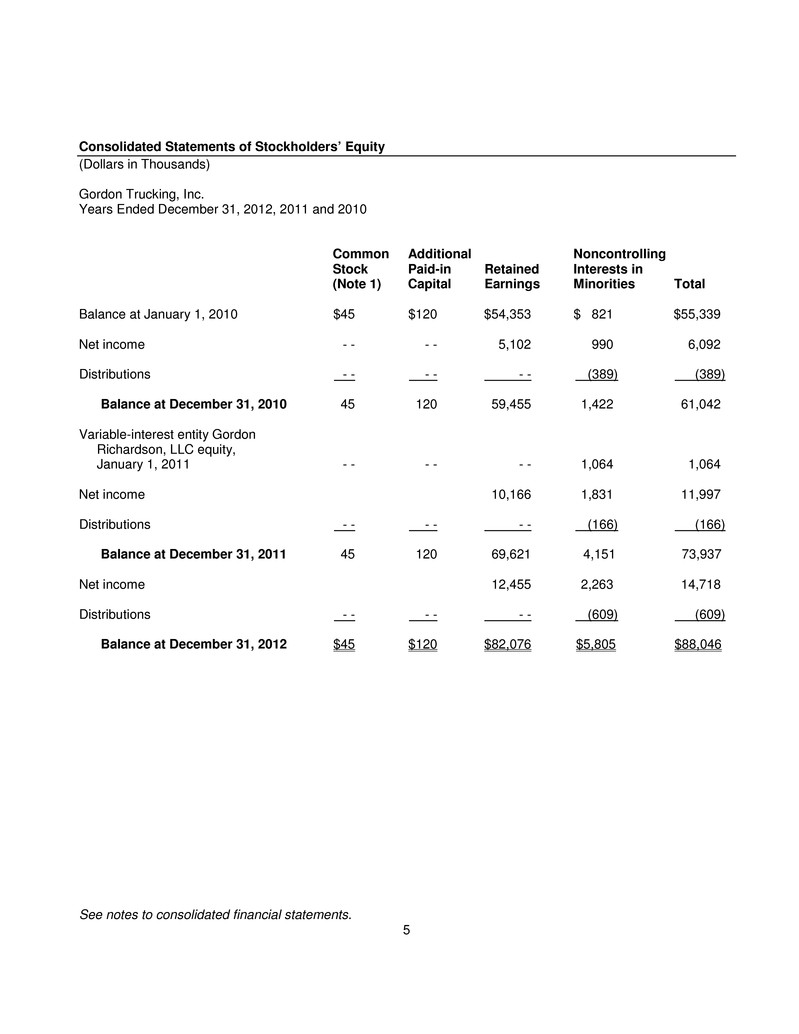

Consolidated Statements of Stockholders’ Equity (Dollars in Thousands) Gordon Trucking, Inc. Years Ended December 31, 2012, 2011 and 2010 Common Additional Noncontrolling Stock Paid-in Retained Interests in (Note 1) Capital Earnings Minorities Total Balance at January 1, 2010 $45 $120 $54,353 $ 821 $55,339 Net income - - - - 5,102 990 6,092 Distributions - - - - - - (389) (389) Balance at December 31, 2010 45 120 59,455 1,422 61,042 Variable-interest entity Gordon Richardson, LLC equity, January 1, 2011 - - - - - - 1,064 1,064 Net income 10,166 1,831 11,997 Distributions - - - - - - (166) (166) Balance at December 31, 2011 45 120 69,621 4,151 73,937 Net income 12,455 2,263 14,718 Distributions - - - - - - (609) (609) Balance at December 31, 2012 $45 $120 $82,076 $5,805 $88,046 See notes to consolidated financial statements. 5

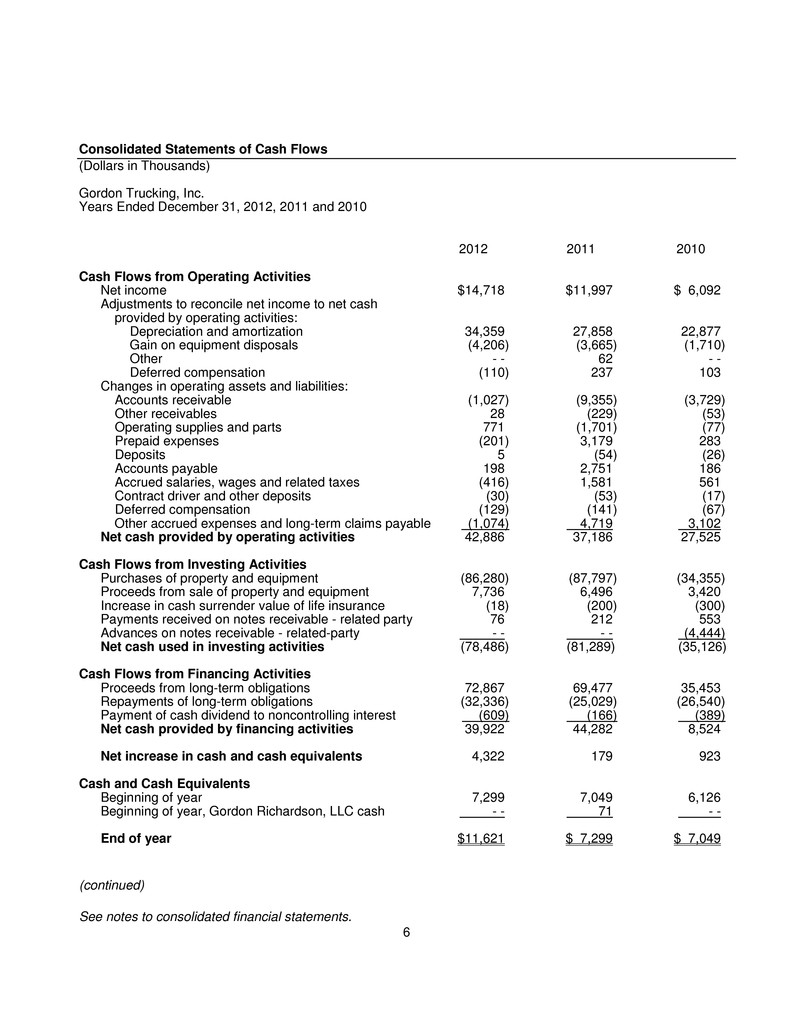

Consolidated Statements of Cash Flows (Dollars in Thousands) Gordon Trucking, Inc. Years Ended December 31, 2012, 2011 and 2010 2012 2011 2010 Cash Flows from Operating Activities Net income $14,718 $11,997 $ 6,092 Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization 34,359 27,858 22,877 Gain on equipment disposals (4,206) (3,665) (1,710) Other - - 62 - - Deferred compensation (110) 237 103 Changes in operating assets and liabilities: Accounts receivable (1,027) (9,355) (3,729) Other receivables 28 (229) (53) Operating supplies and parts 771 (1,701) (77) Prepaid expenses (201) 3,179 283 Deposits 5 (54) (26) Accounts payable 198 2,751 186 Accrued salaries, wages and related taxes (416) 1,581 561 Contract driver and other deposits (30) (53) (17) Deferred compensation (129) (141) (67) Other accrued expenses and long-term claims payable (1,074) 4,719 3,102 Net cash provided by operating activities 42,886 37,186 27,525 Cash Flows from Investing Activities Purchases of property and equipment (86,280) (87,797) (34,355) Proceeds from sale of property and equipment 7,736 6,496 3,420 Increase in cash surrender value of life insurance (18) (200) (300) Payments received on notes receivable - related party 76 212 553 Advances on notes receivable - related-party - - - - (4,444) Net cash used in investing activities (78,486) (81,289) (35,126) Cash Flows from Financing Activities Proceeds from long-term obligations 72,867 69,477 35,453 Repayments of long-term obligations (32,336) (25,029) (26,540) Payment of cash dividend to noncontrolling interest (609) (166) (389) Net cash provided by financing activities 39,922 44,282 8,524 Net increase in cash and cash equivalents 4,322 179 923 Cash and Cash Equivalents Beginning of year 7,299 7,049 6,126 Beginning of year, Gordon Richardson, LLC cash - - 71 - - End of year $11,621 $ 7,299 $ 7,049 (continued) See notes to consolidated financial statements. 6

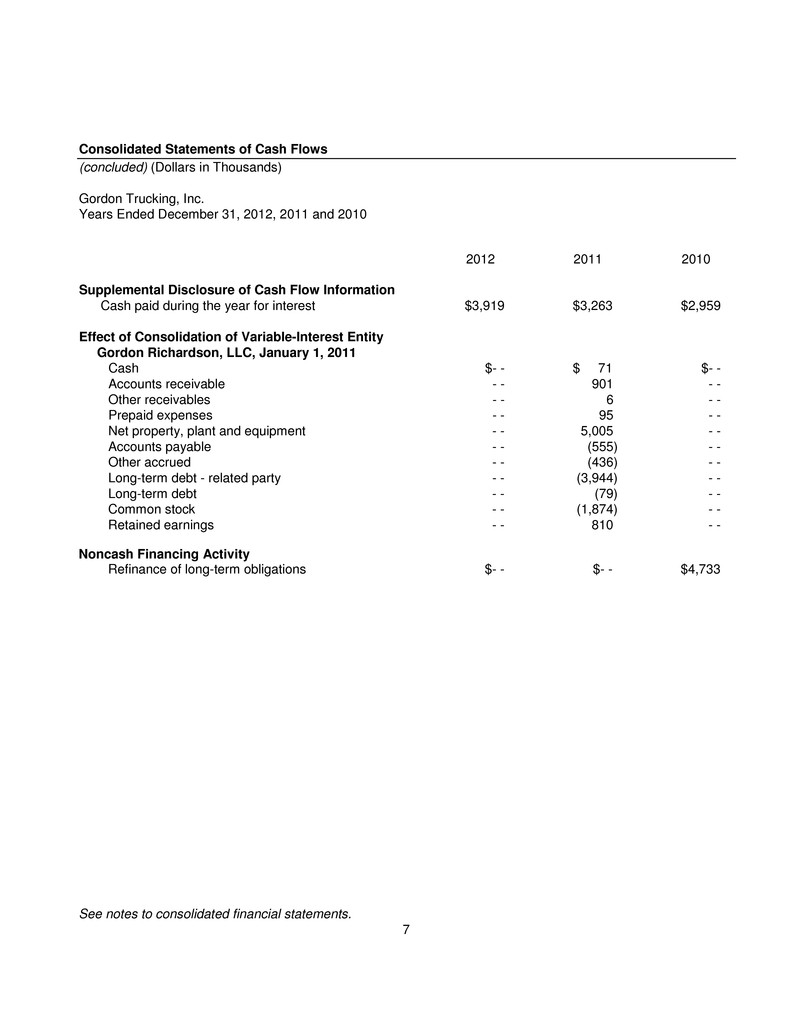

Consolidated Statements of Cash Flows (concluded) (Dollars in Thousands) Gordon Trucking, Inc. Years Ended December 31, 2012, 2011 and 2010 2012 2011 2010 Supplemental Disclosure of Cash Flow Information Cash paid during the year for interest $3,919 $3,263 $2,959 Effect of Consolidation of Variable-Interest Entity Gordon Richardson, LLC, January 1, 2011 Cash $- - $ 71 $- - Accounts receivable - - 901 - - Other receivables - - 6 - - Prepaid expenses - - 95 - - Net property, plant and equipment - - 5,005 - - Accounts payable - - (555) - - Other accrued - - (436) - - Long-term debt - related party - - (3,944) - - Long-term debt - - (79) - - Common stock - - (1,874) - - Retained earnings - - 810 - - Noncash Financing Activity Refinance of long-term obligations $- - $- - $4,733 See notes to consolidated financial statements. 7

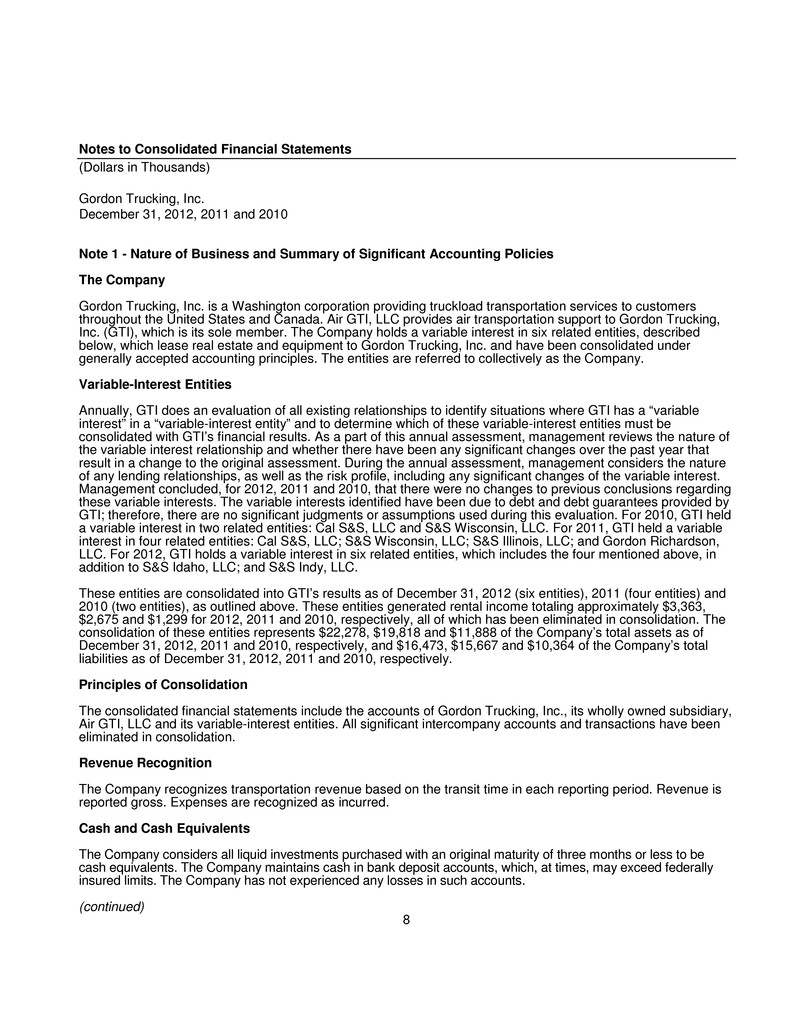

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 1 - Nature of Business and Summary of Significant Accounting Policies The Company Gordon Trucking, Inc. is a Washington corporation providing truckload transportation services to customers throughout the United States and Canada. Air GTI, LLC provides air transportation support to Gordon Trucking, Inc. (GTI), which is its sole member. The Company holds a variable interest in six related entities, described below, which lease real estate and equipment to Gordon Trucking, Inc. and have been consolidated under generally accepted accounting principles. The entities are referred to collectively as the Company. Variable-Interest Entities Annually, GTI does an evaluation of all existing relationships to identify situations where GTI has a “variable interest” in a “variable-interest entity” and to determine which of these variable-interest entities must be consolidated with GTI’s financial results. As a part of this annual assessment, management reviews the nature of the variable interest relationship and whether there have been any significant changes over the past year that result in a change to the original assessment. During the annual assessment, management considers the nature of any lending relationships, as well as the risk profile, including any significant changes of the variable interest. Management concluded, for 2012, 2011 and 2010, that there were no changes to previous conclusions regarding these variable interests. The variable interests identified have been due to debt and debt guarantees provided by GTI; therefore, there are no significant judgments or assumptions used during this evaluation. For 2010, GTI held a variable interest in two related entities: Cal S&S, LLC and S&S Wisconsin, LLC. For 2011, GTI held a variable interest in four related entities: Cal S&S, LLC; S&S Wisconsin, LLC; S&S Illinois, LLC; and Gordon Richardson, LLC. For 2012, GTI holds a variable interest in six related entities, which includes the four mentioned above, in addition to S&S Idaho, LLC; and S&S Indy, LLC. These entities are consolidated into GTI’s results as of December 31, 2012 (six entities), 2011 (four entities) and 2010 (two entities), as outlined above. These entities generated rental income totaling approximately $3,363, $2,675 and $1,299 for 2012, 2011 and 2010, respectively, all of which has been eliminated in consolidation. The consolidation of these entities represents $22,278, $19,818 and $11,888 of the Company’s total assets as of December 31, 2012, 2011 and 2010, respectively, and $16,473, $15,667 and $10,364 of the Company’s total liabilities as of December 31, 2012, 2011 and 2010, respectively. Principles of Consolidation The consolidated financial statements include the accounts of Gordon Trucking, Inc., its wholly owned subsidiary, Air GTI, LLC and its variable-interest entities. All significant intercompany accounts and transactions have been eliminated in consolidation. Revenue Recognition The Company recognizes transportation revenue based on the transit time in each reporting period. Revenue is reported gross. Expenses are recognized as incurred. Cash and Cash Equivalents The Company considers all liquid investments purchased with an original maturity of three months or less to be cash equivalents. The Company maintains cash in bank deposit accounts, which, at times, may exceed federally insured limits. The Company has not experienced any losses in such accounts. (continued) 8

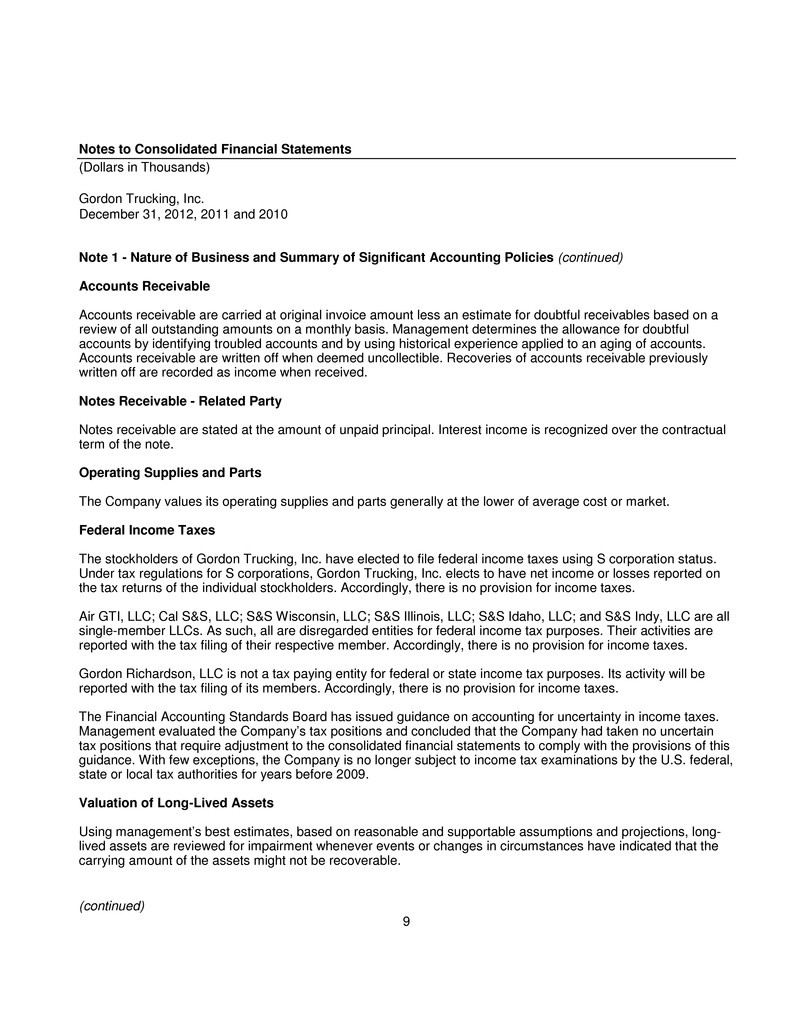

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 1 - Nature of Business and Summary of Significant Accounting Policies (continued) Accounts Receivable Accounts receivable are carried at original invoice amount less an estimate for doubtful receivables based on a review of all outstanding amounts on a monthly basis. Management determines the allowance for doubtful accounts by identifying troubled accounts and by using historical experience applied to an aging of accounts. Accounts receivable are written off when deemed uncollectible. Recoveries of accounts receivable previously written off are recorded as income when received. Notes Receivable - Related Party Notes receivable are stated at the amount of unpaid principal. Interest income is recognized over the contractual term of the note. Operating Supplies and Parts The Company values its operating supplies and parts generally at the lower of average cost or market. Federal Income Taxes The stockholders of Gordon Trucking, Inc. have elected to file federal income taxes using S corporation status. Under tax regulations for S corporations, Gordon Trucking, Inc. elects to have net income or losses reported on the tax returns of the individual stockholders. Accordingly, there is no provision for income taxes. Air GTI, LLC; Cal S&S, LLC; S&S Wisconsin, LLC; S&S Illinois, LLC; S&S Idaho, LLC; and S&S Indy, LLC are all single-member LLCs. As such, all are disregarded entities for federal income tax purposes. Their activities are reported with the tax filing of their respective member. Accordingly, there is no provision for income taxes. Gordon Richardson, LLC is not a tax paying entity for federal or state income tax purposes. Its activity will be reported with the tax filing of its members. Accordingly, there is no provision for income taxes. The Financial Accounting Standards Board has issued guidance on accounting for uncertainty in income taxes. Management evaluated the Company’s tax positions and concluded that the Company had taken no uncertain tax positions that require adjustment to the consolidated financial statements to comply with the provisions of this guidance. With few exceptions, the Company is no longer subject to income tax examinations by the U.S. federal, state or local tax authorities for years before 2009. Valuation of Long-Lived Assets Using management’s best estimates, based on reasonable and supportable assumptions and projections, long- lived assets are reviewed for impairment whenever events or changes in circumstances have indicated that the carrying amount of the assets might not be recoverable. (continued) 9

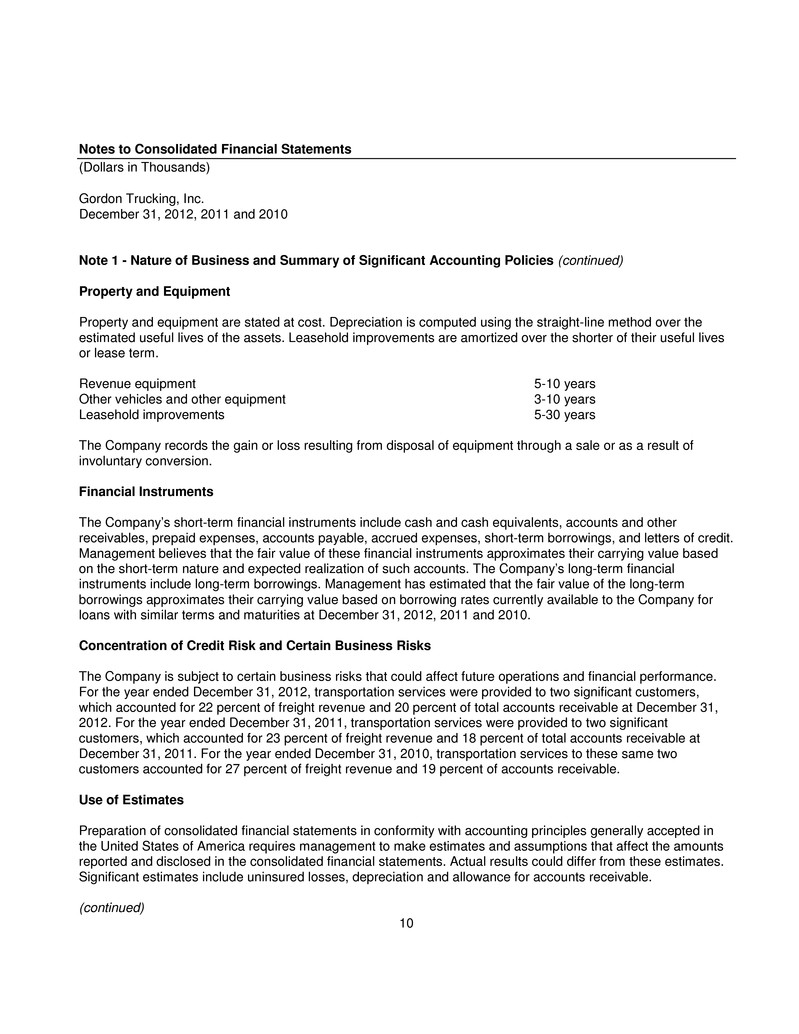

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 1 - Nature of Business and Summary of Significant Accounting Policies (continued) Property and Equipment Property and equipment are stated at cost. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Leasehold improvements are amortized over the shorter of their useful lives or lease term. Revenue equipment 5-10 years Other vehicles and other equipment 3-10 years Leasehold improvements 5-30 years The Company records the gain or loss resulting from disposal of equipment through a sale or as a result of involuntary conversion. Financial Instruments The Company’s short-term financial instruments include cash and cash equivalents, accounts and other receivables, prepaid expenses, accounts payable, accrued expenses, short-term borrowings, and letters of credit. Management believes that the fair value of these financial instruments approximates their carrying value based on the short-term nature and expected realization of such accounts. The Company’s long-term financial instruments include long-term borrowings. Management has estimated that the fair value of the long-term borrowings approximates their carrying value based on borrowing rates currently available to the Company for loans with similar terms and maturities at December 31, 2012, 2011 and 2010. Concentration of Credit Risk and Certain Business Risks The Company is subject to certain business risks that could affect future operations and financial performance. For the year ended December 31, 2012, transportation services were provided to two significant customers, which accounted for 22 percent of freight revenue and 20 percent of total accounts receivable at December 31, 2012. For the year ended December 31, 2011, transportation services were provided to two significant customers, which accounted for 23 percent of freight revenue and 18 percent of total accounts receivable at December 31, 2011. For the year ended December 31, 2010, transportation services to these same two customers accounted for 27 percent of freight revenue and 19 percent of accounts receivable. Use of Estimates Preparation of consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the amounts reported and disclosed in the consolidated financial statements. Actual results could differ from these estimates. Significant estimates include uninsured losses, depreciation and allowance for accounts receivable. (continued) 10

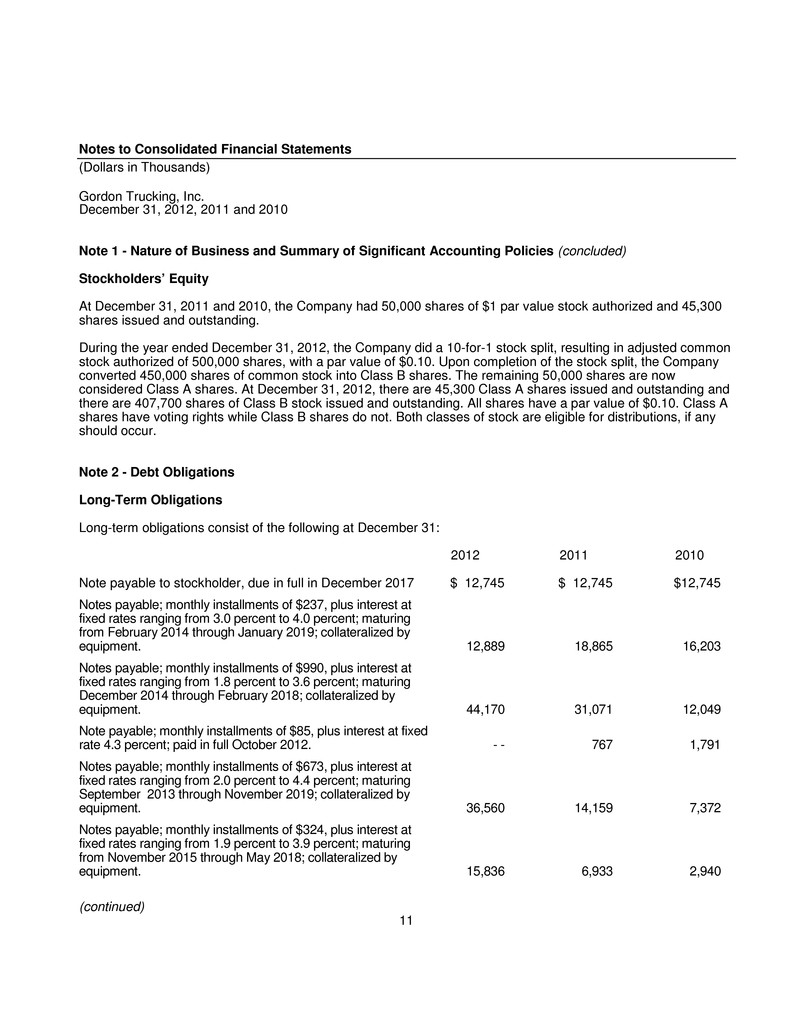

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 1 - Nature of Business and Summary of Significant Accounting Policies (concluded) Stockholders’ Equity At December 31, 2011 and 2010, the Company had 50,000 shares of $1 par value stock authorized and 45,300 shares issued and outstanding. During the year ended December 31, 2012, the Company did a 10-for-1 stock split, resulting in adjusted common stock authorized of 500,000 shares, with a par value of $0.10. Upon completion of the stock split, the Company converted 450,000 shares of common stock into Class B shares. The remaining 50,000 shares are now considered Class A shares. At December 31, 2012, there are 45,300 Class A shares issued and outstanding and there are 407,700 shares of Class B stock issued and outstanding. All shares have a par value of $0.10. Class A shares have voting rights while Class B shares do not. Both classes of stock are eligible for distributions, if any should occur. Note 2 - Debt Obligations Long-Term Obligations Long-term obligations consist of the following at December 31: 2012 2011 2010 Note payable to stockholder, due in full in December 2017 $ 12,745 $ 12,745 $12,745 Notes payable; monthly installments of $237, plus interest at fixed rates ranging from 3.0 percent to 4.0 percent; maturing from February 2014 through January 2019; collateralized by equipment. 12,889 18,865 16,203 Notes payable; monthly installments of $990, plus interest at fixed rates ranging from 1.8 percent to 3.6 percent; maturing December 2014 through February 2018; collateralized by equipment. 44,170 31,071 12,049 Note payable; monthly installments of $85, plus interest at fixed rate 4.3 percent; paid in full October 2012. - - 767 1,791 Notes payable; monthly installments of $673, plus interest at fixed rates ranging from 2.0 percent to 4.4 percent; maturing September 2013 through November 2019; collateralized by equipment. 36,560 14,159 7,372 Notes payable; monthly installments of $324, plus interest at fixed rates ranging from 1.9 percent to 3.9 percent; maturing from November 2015 through May 2018; collateralized by equipment. 15,836 6,933 2,940 (continued) 11

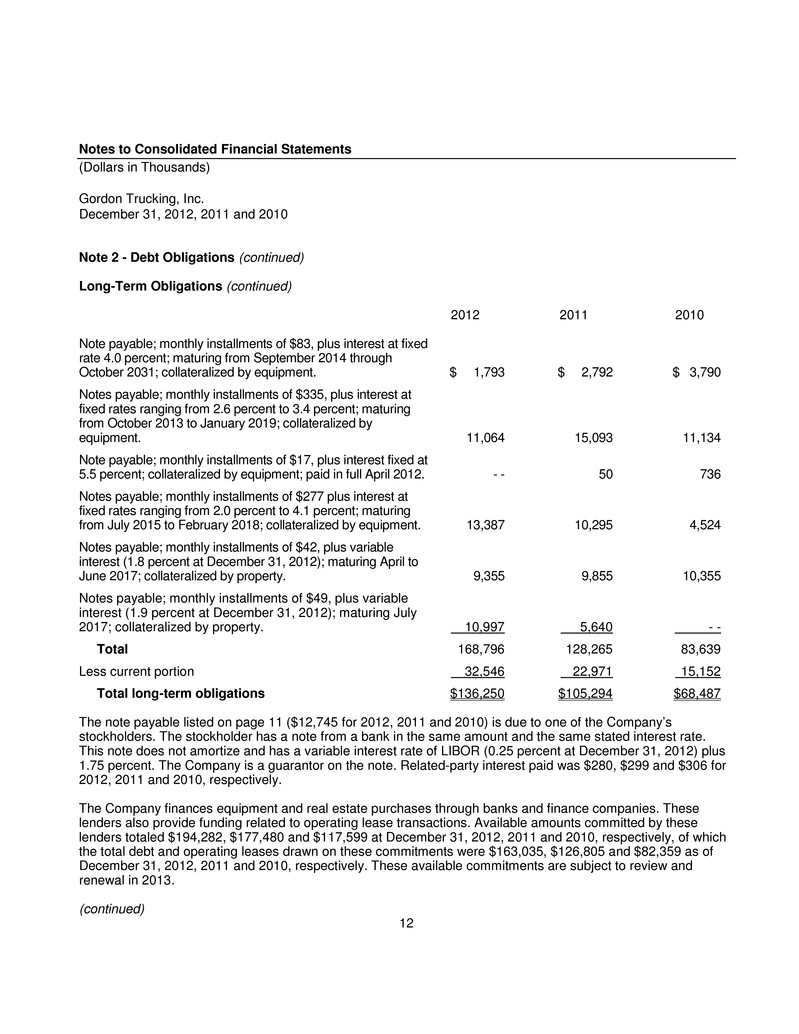

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 2 - Debt Obligations (continued) Long-Term Obligations (continued) 2012 2011 2010 Note payable; monthly installments of $83, plus interest at fixed rate 4.0 percent; maturing from September 2014 through October 2031; collateralized by equipment. $ 1,793 $ 2,792 $ 3,790 Notes payable; monthly installments of $335, plus interest at fixed rates ranging from 2.6 percent to 3.4 percent; maturing from October 2013 to January 2019; collateralized by equipment. 11,064 15,093 11,134 Note payable; monthly installments of $17, plus interest fixed at 5.5 percent; collateralized by equipment; paid in full April 2012. - - 50 736 Notes payable; monthly installments of $277 plus interest at fixed rates ranging from 2.0 percent to 4.1 percent; maturing from July 2015 to February 2018; collateralized by equipment. 13,387 10,295 4,524 Notes payable; monthly installments of $42, plus variable interest (1.8 percent at December 31, 2012); maturing April to June 2017; collateralized by property. 9,355 9,855 10,355 Notes payable; monthly installments of $49, plus variable interest (1.9 percent at December 31, 2012); maturing July 2017; collateralized by property. 10,997 5,640 - - Total 168,796 128,265 83,639 Less current portion 32,546 22,971 15,152 Total long-term obligations $136,250 $105,294 $68,487 The note payable listed on page 11 ($12,745 for 2012, 2011 and 2010) is due to one of the Company’s stockholders. The stockholder has a note from a bank in the same amount and the same stated interest rate. This note does not amortize and has a variable interest rate of LIBOR (0.25 percent at December 31, 2012) plus 1.75 percent. The Company is a guarantor on the note. Related-party interest paid was $280, $299 and $306 for 2012, 2011 and 2010, respectively. The Company finances equipment and real estate purchases through banks and finance companies. These lenders also provide funding related to operating lease transactions. Available amounts committed by these lenders totaled $194,282, $177,480 and $117,599 at December 31, 2012, 2011 and 2010, respectively, of which the total debt and operating leases drawn on these commitments were $163,035, $126,805 and $82,359 as of December 31, 2012, 2011 and 2010, respectively. These available commitments are subject to review and renewal in 2013. (continued) 12

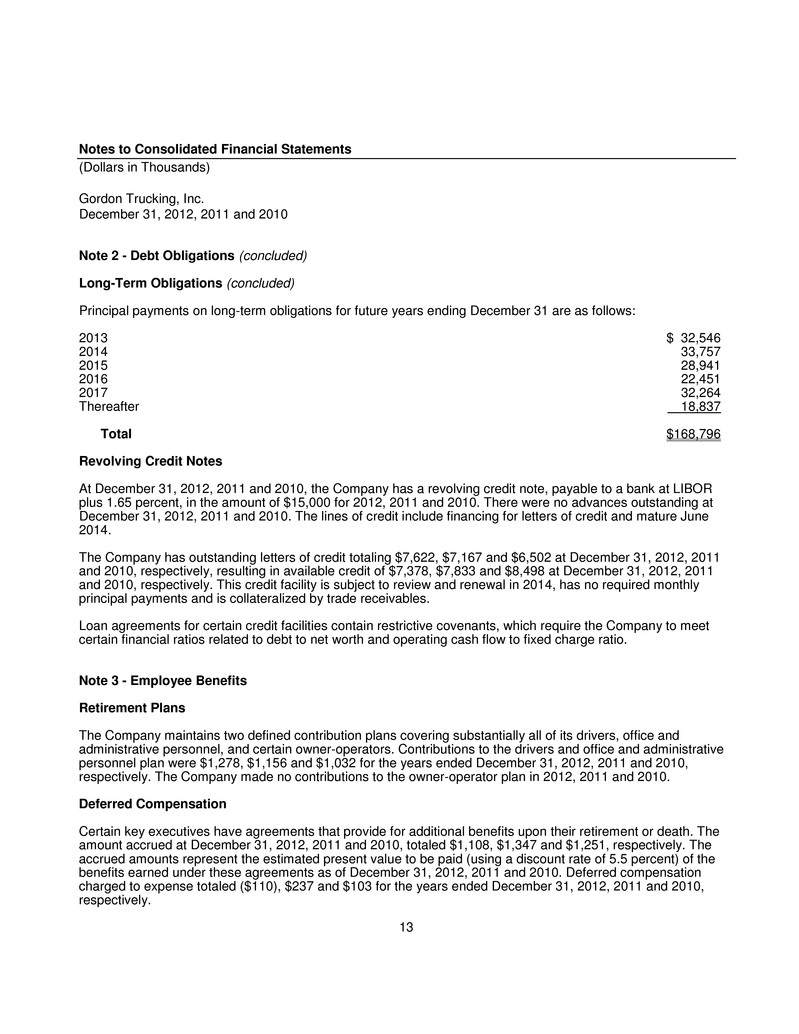

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 2 - Debt Obligations (concluded) Long-Term Obligations (concluded) Principal payments on long-term obligations for future years ending December 31 are as follows: 2013 $ 32,546 2014 33,757 2015 28,941 2016 22,451 2017 32,264 Thereafter 18,837 Total $168,796 Revolving Credit Notes At December 31, 2012, 2011 and 2010, the Company has a revolving credit note, payable to a bank at LIBOR plus 1.65 percent, in the amount of $15,000 for 2012, 2011 and 2010. There were no advances outstanding at December 31, 2012, 2011 and 2010. The lines of credit include financing for letters of credit and mature June 2014. The Company has outstanding letters of credit totaling $7,622, $7,167 and $6,502 at December 31, 2012, 2011 and 2010, respectively, resulting in available credit of $7,378, $7,833 and $8,498 at December 31, 2012, 2011 and 2010, respectively. This credit facility is subject to review and renewal in 2014, has no required monthly principal payments and is collateralized by trade receivables. Loan agreements for certain credit facilities contain restrictive covenants, which require the Company to meet certain financial ratios related to debt to net worth and operating cash flow to fixed charge ratio. Note 3 - Employee Benefits Retirement Plans The Company maintains two defined contribution plans covering substantially all of its drivers, office and administrative personnel, and certain owner-operators. Contributions to the drivers and office and administrative personnel plan were $1,278, $1,156 and $1,032 for the years ended December 31, 2012, 2011 and 2010, respectively. The Company made no contributions to the owner-operator plan in 2012, 2011 and 2010. Deferred Compensation Certain key executives have agreements that provide for additional benefits upon their retirement or death. The amount accrued at December 31, 2012, 2011 and 2010, totaled $1,108, $1,347 and $1,251, respectively. The accrued amounts represent the estimated present value to be paid (using a discount rate of 5.5 percent) of the benefits earned under these agreements as of December 31, 2012, 2011 and 2010. Deferred compensation charged to expense totaled ($110), $237 and $103 for the years ended December 31, 2012, 2011 and 2010, respectively. 13

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 4 - Related-Party Transactions Terminal Leases The Company leases its terminal facilities under operating leases from certain limited liability companies, whose members include owners of the Company and a commercial tractor dealership owned by L.J. Gordon. The leases expire from 2035 through 2041 and contain options to renew. The Company guarantees debt of nonconsolidated related-party entities totaling approximately $5,102, $5,562 and $6,021 at December 31, 2012, 2011 and 2010, respectively, for these facilities. The Company is responsible for all taxes, insurance and utilities related to the terminal leases. Rent expense paid to related parties was $4,033, $3,472 and $3,058, of which $2,274, $1,713 and $998 was eliminated upon consolidation for the years ended December 31, 2012, 2011 and 2010, respectively. At December 31, 2012, future minimum payments to unconsolidated related parties under noncancellable leases total $1,759 annually for 2013 through 2017, with payments totaling $36,907 for the 23 years thereafter. Purchases and Sales Transactions The Company purchases tractors from and sells tractors and trailers to the commercial tractor dealership, related by common ownership. Purchases totaled $48,619, $38,355 and $20,689, while sales totaled $7,138, $4,456 and $2,571, in 2012, 2011 and 2010, respectively. The Company purchases parts and services from the same commercial tractor dealership. Parts and services purchases totaled $8,722, $8,109 and $7,150 in 2012, 2011 and 2010, respectively. At December 31, 2012, 2011 and 2010, the Company owed to the dealership $760, $894 and $426, respectively, which are included in accounts payable in the accompanying consolidated financial statements. The Company provides administrative services to the commercial tractor dealership discussed above. The Company received $720 for each of the years ended December 31, 2012, 2011 and 2010. This reimbursement was recorded as a reduction in salaries and wages in the accompanying consolidated financial statements. Notes Receivable At December 31, 2012, 2011 and 2010, the Company has notes receivable totaling $296, $372 and $4,369 due from entities related by common ownership. The receivables mature through December 2020 and bear a fixed interest rate of 5 percent. Interest income of $17, $20 and $41 was recognized during 2012, 2011 and 2010, respectively, on these notes. 14

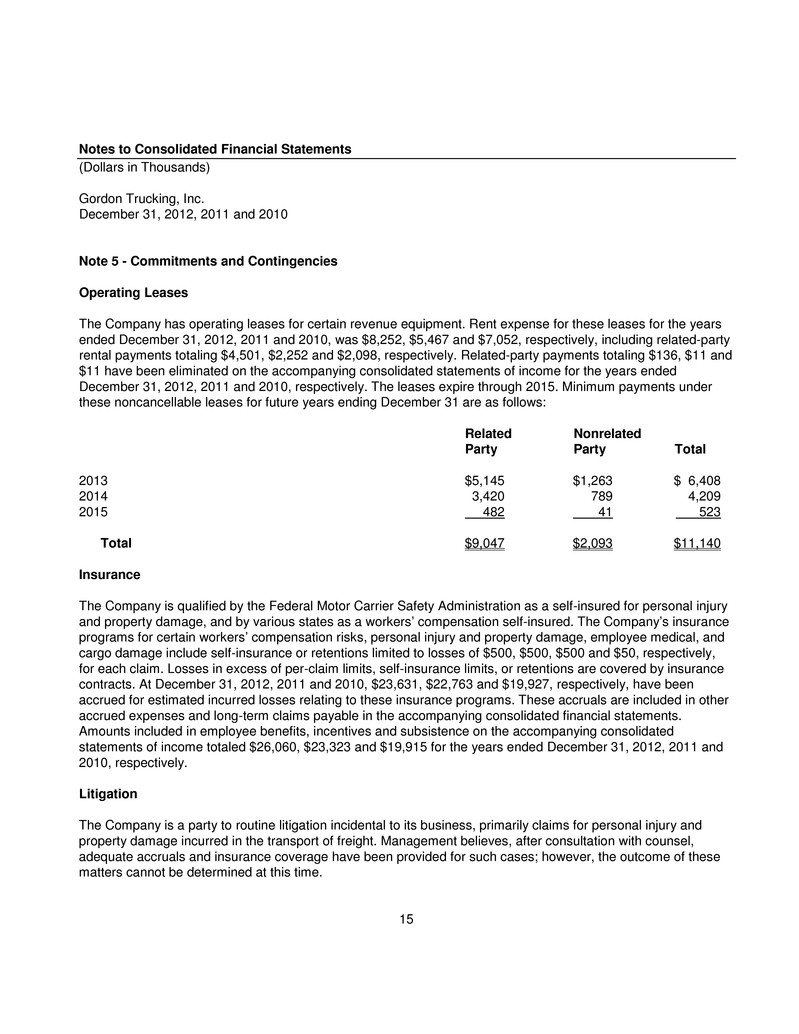

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 5 - Commitments and Contingencies Operating Leases The Company has operating leases for certain revenue equipment. Rent expense for these leases for the years ended December 31, 2012, 2011 and 2010, was $8,252, $5,467 and $7,052, respectively, including related-party rental payments totaling $4,501, $2,252 and $2,098, respectively. Related-party payments totaling $136, $11 and $11 have been eliminated on the accompanying consolidated statements of income for the years ended December 31, 2012, 2011 and 2010, respectively. The leases expire through 2015. Minimum payments under these noncancellable leases for future years ending December 31 are as follows: Related Nonrelated Party Party Total 2013 $5,145 $1,263 $ 6,408 2014 3,420 789 4,209 2015 482 41 523 Total $9,047 $2,093 $11,140 Insurance The Company is qualified by the Federal Motor Carrier Safety Administration as a self-insured for personal injury and property damage, and by various states as a workers’ compensation self-insured. The Company’s insurance programs for certain workers’ compensation risks, personal injury and property damage, employee medical, and cargo damage include self-insurance or retentions limited to losses of $500, $500, $500 and $50, respectively, for each claim. Losses in excess of per-claim limits, self-insurance limits, or retentions are covered by insurance contracts. At December 31, 2012, 2011 and 2010, $23,631, $22,763 and $19,927, respectively, have been accrued for estimated incurred losses relating to these insurance programs. These accruals are included in other accrued expenses and long-term claims payable in the accompanying consolidated financial statements. Amounts included in employee benefits, incentives and subsistence on the accompanying consolidated statements of income totaled $26,060, $23,323 and $19,915 for the years ended December 31, 2012, 2011 and 2010, respectively. Litigation The Company is a party to routine litigation incidental to its business, primarily claims for personal injury and property damage incurred in the transport of freight. Management believes, after consultation with counsel, adequate accruals and insurance coverage have been provided for such cases; however, the outcome of these matters cannot be determined at this time. 15

Notes to Consolidated Financial Statements (Dollars in Thousands) Gordon Trucking, Inc. December 31, 2012, 2011 and 2010 Note 6 - Subsequent Events In preparing the consolidated financial statements, management has evaluated subsequent events and transactions through January 8, 2014, the date of issuance. Effective November 11, 2013, Gordon Trucking, Inc. was sold to Heartland Express, Inc. of Iowa, a wholly owned subsidiary of Heartland Express, Inc. Note 7 - Reclassification Certain revenues and expenses have been reclassified in the 2012, 2011 and 2010 statements to conform to the classifications in the 2013 statements. 16