Attached files

| file | filename |

|---|---|

| 8-K - 8-K - BLACKSTONE MORTGAGE TRUST, INC. | d663243d8k.htm |

January 2014

Exhibit 99.1 |

This

presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, which reflect the current views of

Blackstone Mortgage Trust, Inc. (“BXMT”) with respect to, among other things,

its operations and financial performance. You can identify these forward-looking statements by the use of words such as

“outlook,”

“believes,”

“expects,”

“potential,”

“continues,”

“may,”

“will,”

“should,”

“seeks,”

“approximately,”

“predicts,”

“intends,”

“plans,”

“estimates,”

“anticipates”

or the negative version of these words or other comparable words. Such forward-looking

statements are subject to various risks and uncertainties. Accordingly, there are or

will be important factors that could cause actual outcomes or results to differ

materially from those indicated in these statements. BXMT believes these factors

include, but are not limited, to those described under the section entitled

“Risk Factors”

in its Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and

subsequent quarterly reports on Form 10- Q as

such factors may be updated from time to time in its periodic filings with the Securities and

Exchange Commission, which are accessible on the SEC’s website at www.sec.gov.

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary

statements that are included in this presentation and in the filings. BXMT undertakes no

obligation to publicly update or review any forward- looking statement or other

information in this presentation, whether as a result of new information, future developments or otherwise.

We refer to “core earnings”, which is a non-GAAP financial measure, in this

presentation. A reconciliation of core earnings to net income, the most directly

comparable GAAP measure, is included in this presentation and our most recent Quarterly Report on Form 10-Q, and is available on our

website

at

www.bxmt.com.

Slide 11 of this presentation includes a reference to imputed core return on

equity (“Imputed Core ROE”) and other economic terms relating to a sample

BXMT loan transaction that are presented solely for purposes of illustrating the impact of using floating-rate financing to finance the

origination of a floating-rate loan and should not be viewed as indicative of the results

that will be achieved for any particular loan in BXMT’s portfolio or of

BXMT’s results as a whole. The loan economics presented are hypothetical and based upon a number of assumptions, including no

defaults on the loan, and are subject to various risks and uncertainties. Accordingly,

there are or will be important factors, including those referred to above that could

cause the actual economics that are achieved on this or any other loan in BXMT’s

loan portfolio to differ materially from those indicated in this illustration.

In particular, it should be noted that as a result of such factors the net spread between

whole loan yields and the cost of related leverage, the leverage multiple applicable to

any particular loan and allocable overhead may vary materially from period to period and

across BXMT’s loan portfolio. Imputed Core ROE also excludes potential incentive

management fees and is presented before any tax effects. Forward-Looking Statements

and Other Matters 1 |

Blackstone

Mortgage Trust, Inc. (NYSE: BXMT) is a real estate investment trust that primarily

originates

and

purchases

senior

mortgage

loans

collateralized

by

properties

in

the

U.S.

and

Europe

We are managed by Blackstone (“BX”), a world leader in real estate investing with

nearly $70 billion AUM and over $120 billion of owned real estate

•

BX’s equity investment platform, Blackstone Real Estate Partners, has nearly $60 billion

AUM •

BX’s CRE lending platform, Blackstone Real Estate Debt Strategies, has over $10 billion

AUM •

Significant

alignment

of

interest:

$96

million

BX

investment

(1)

Reluctance among traditional CRE lenders coupled with increased transaction volume creates a

compelling lending environment in the U.S. and Europe

BXMT

has

a

demonstrated

ability

to

originate

target

assets,

with

over

$2.2

billion

of

gross

originations

since

May

2013

equity

recapitalization

(2)

•

Our

diversified

portfolio

of

loans

has

a

weighted

average

loan

to

value

of

65%

(2)

Our focused senior lending strategy is designed both to provide attractive current income and

protect investors’

capital

•

Commercial mortgages, prudently levered, offer excellent risk adjusted returns

•

Simple business model translates net interest margin to bottom line

•

With a LIBOR-based lending and funding model, our returns increase with rising

short-term interest rates Blackstone Mortgage Trust Overview

2

(1)

Based upon closing price on the NYSE on January 23, 2014. Includes BX employees

and associates. (2)

As of October 30, 2013, includes loans closed and loans in closing; excludes CT Legacy

portfolio. |

Superior Real Estate Platform

3

(1)

As of September 30, 2013.

Blackstone Real Estate

Blackstone Real Estate

Debt Strategies (“BREDS”)

Blackstone Real Estate

Partners (“BREP”)

Nearly $60 billion AUM

210 professionals

(1)

Over $10 billion AUM

59 professionals

(1)

200 separate loans

(1)

Actively managed CMBS hedge

funds ($891 million

(1)

)

Rated/Approved Special Servicer

BX investment committee process and investment philosophy

Superior sourcing capabilities through long-standing industry relationships

Underwriting process includes proprietary data from extensive investment holdings

BREDS

BREDS

Blackstone

Drawdown Funds

Hedge Funds

Mortgage Trust |

Seasoned and Fully Integrated Platform

4

Origination

Europe –

United States

23 Professionals

Asset

Management

6 Professionals

Legal /

Compliance

3 Professionals

Michael Nash

Executive Chairman

CIO of BREDS

Jonathan Gray

Global Head of Real Estate

Member of Blackstone Board of Directors

Member of BXMT Investment Committee

John Schreiber

Co-Founder of Blackstone Real Estate Advisors

Member of BXMT Board of Directors

Chair of BXMT Investment Committee

Stephen Plavin

CEO & President

SMD of BREDS

Douglas

Armer

Anthony

Marone

Weston

Tucker

Robert

Harper

Thomas

Ruffing

Randall

Rothschild

Peter

Sotoloff

Capital Markets / Investor Relations /Finance

11 Professionals

Paul

Quinlan

Tim

Johnson |

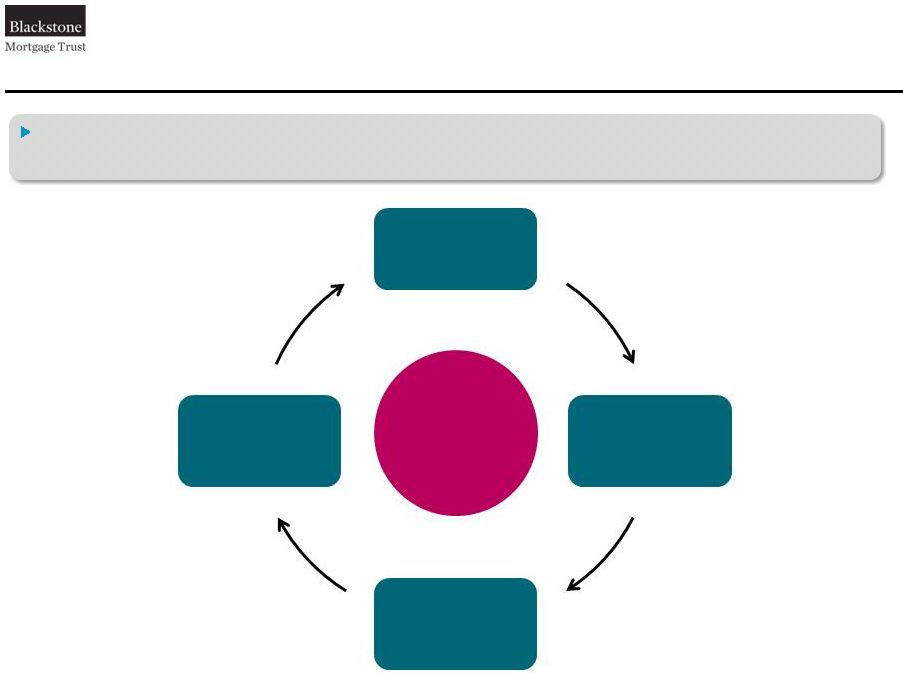

Real

Estate Market Overview 5

Positive

Feedback

Loop

Market conditions are sustaining a favorable commercial real estate environment

•

Liquidity and fundamentals in the commercial real estate market are generally in balance

Economy

Recovering

Technicals

Improving

Confidence

Growing

Capital

Returning |

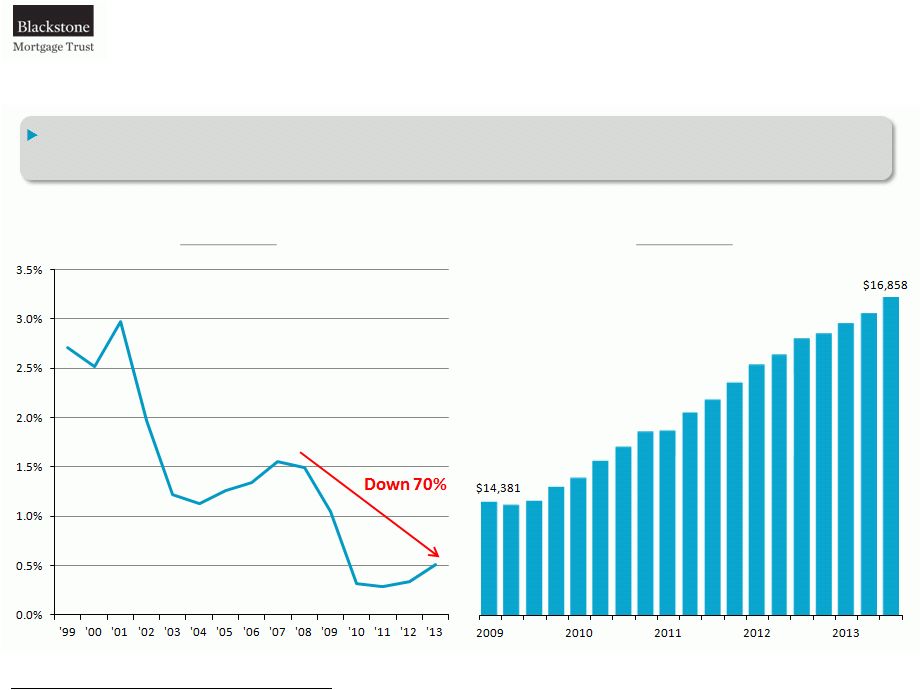

Real

Estate Market Overview 6

Limited new supply coupled with modest growth is a favorable investment environment for

senior commercial real estate debt

U.S. Aggregate Construction Completions

U.S. GDP ($ in billions)

Sources: REIS & Federal Reserve Economic Data as of Q3 2013.

|

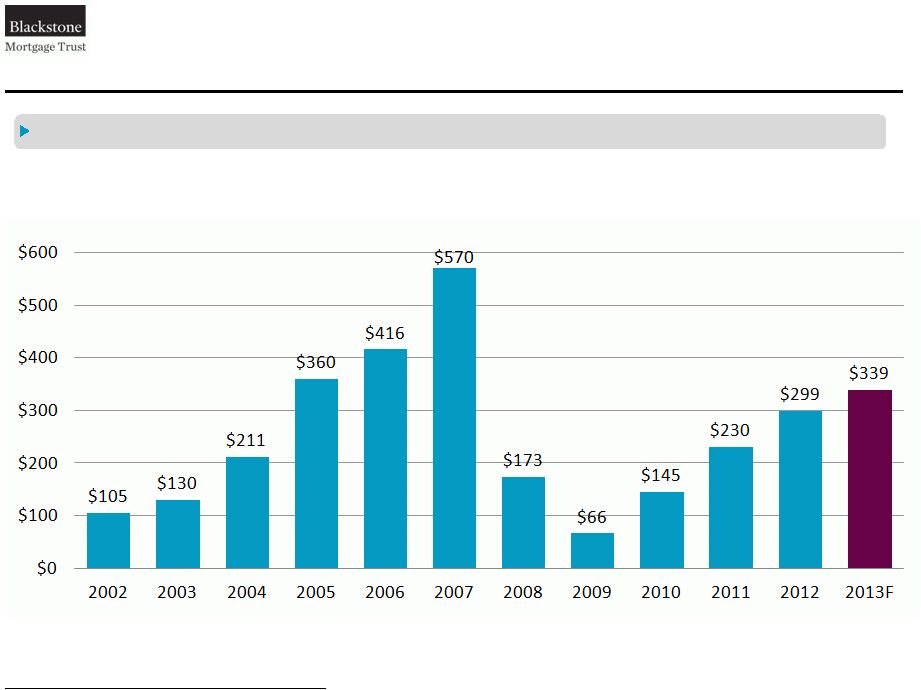

Real

Estate Market Overview 7

Source: Real Capital Analytics as of Q3 2013.

U.S. Aggregate Property Sale Volume

($ in billions)

Improving fundamentals and increased demand are driving volume |

Real

Estate Market Overview 8

Positive

Feedback

Loop

Real

Estate

Deleveraging

(2)

Overleveraged

Banks

(1)

European banks have over 2x the leverage of U.S. banks…

…

and have only shed 25% of expected RE dispositions

€450B to come

European banks remain overleveraged with enormous real estate exposure

U.S.

U.K.

France

Germany

12x

21x

23x

33x

Deleveraged to Date

Total Amount

Announced

€150B

€600B

(1)

SNL, ECB, April 2013; The ratio of tangible assets to tangible common equity for all

banks. (2) Morgan Stanley “Banks Deleveraging and Real Estate”

August 2013. |

Target Investments

$50 million to $500 million

Loan Size

First mortgages on stabilized or transitional assets

Collateral

All commercial property types

Property Type

North America and Europe

Geographies

Last dollar 60-80%

Loan to Value

LIBOR + 3.75% and higher, scaled to risk

Rate

3 to 5 years

Term

Typically interest only

Amortization

Typically 1.0% origination fee and 0.25% to 0.50% extension fees

Fees

12 to 24 months of spread maintenance

Prepayment

9 |

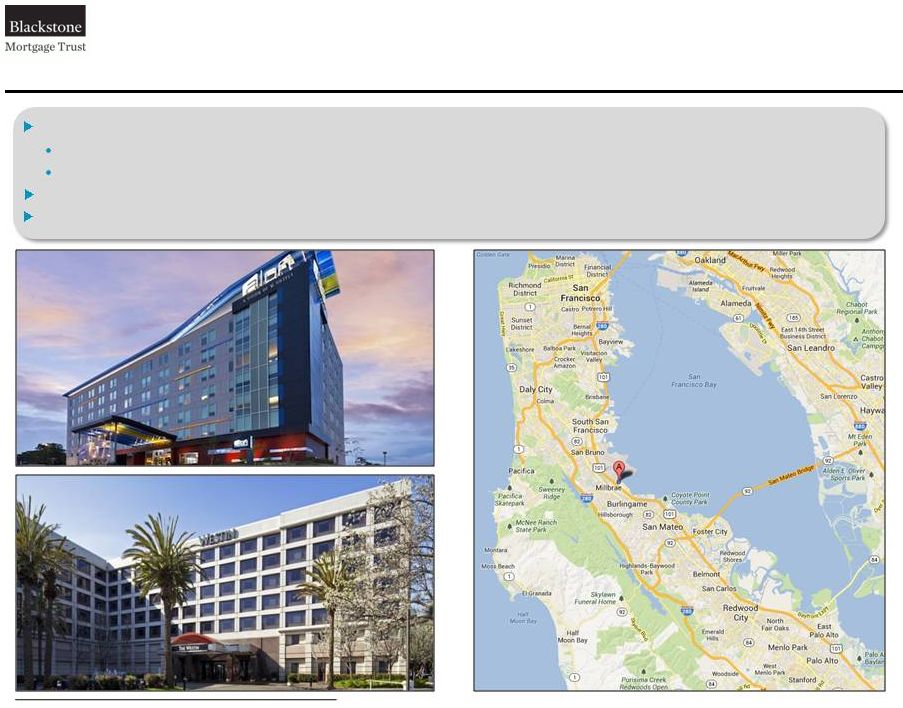

BXMT Sample Transaction: SFO Airport Hotels

$89.8

million

floating

rate,

first

mortgage

loan

secured

by

the

Westin

and

aLoft

San

Francisco

Airport

hotels

(1)

70.7% LTV; $138,290 per key

Diverse demand drivers including airport traffic and SF/Silicon Valley business overflow

Transaction sourced through existing Blackstone relationship with high quality sponsor

BX office holdings in northern CA and hospitality investments globally enabled definitive,

efficient execution 10

(1)

Loan closed during 4Q 2013. |

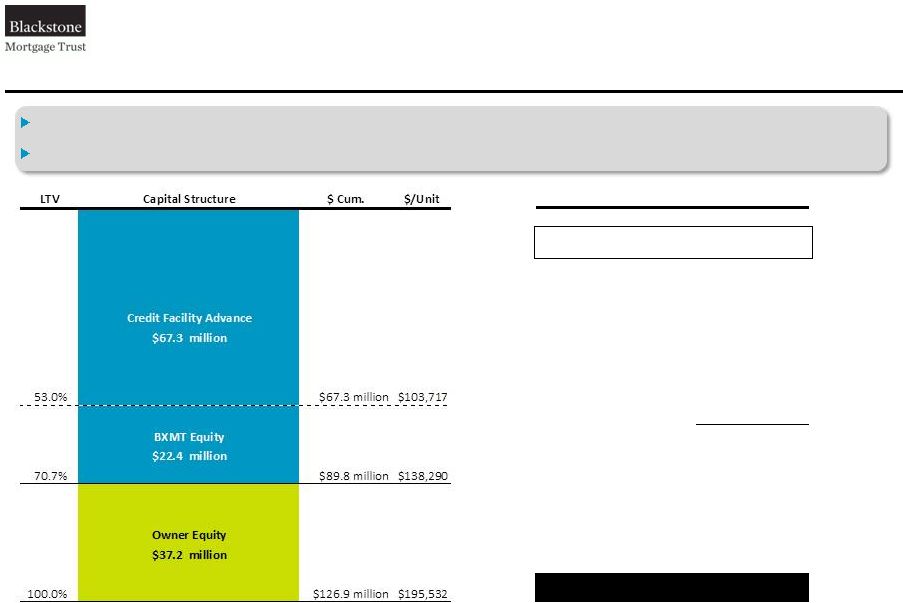

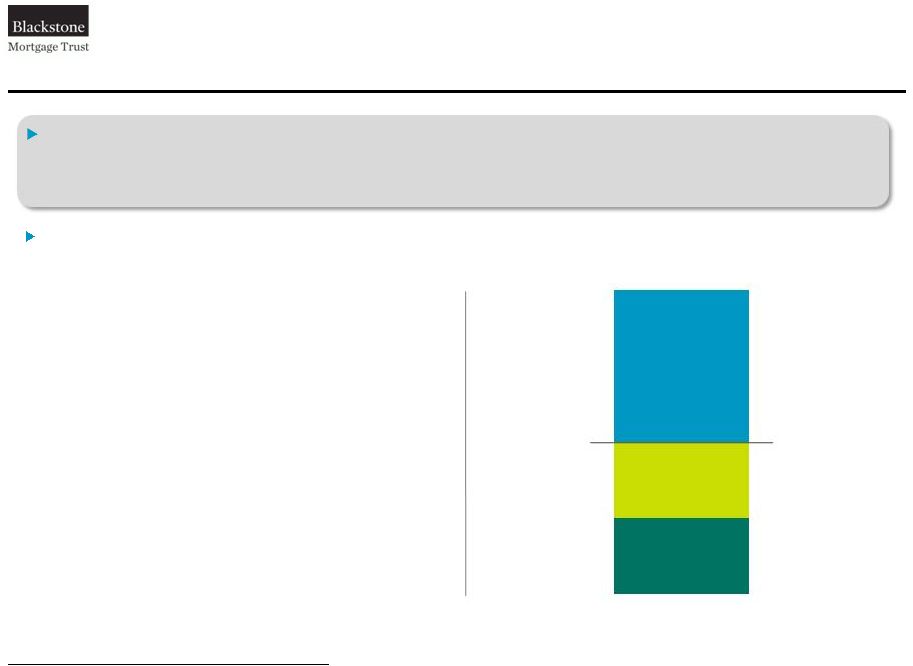

BXMT Sample Transaction: SFO Airport Hotels

BXMT’s floating rate senior mortgage loans are supported by significant owner’s

equity Prudent use of balance sheet leverage drives strong risk adjusted returns for

BXMT shareholders 11

Illustrative Loan Economics

(1)

Whole Loan Yield

(2)

L + 4.50%

Leverage:

Advance Rate

75.0%

All-in Cost

(2)

L + 2.25%

Net Spread

2.55%

Leverage Multiple

3.0 X

Levered Spread

6.75%

Base Return

L + 4.50%

Gross ROI

L + 11.25%

Less Overhead Allocations

(3)

:

Management Fee

1.50%

General & Administrative

0.50%

Working Capital/

Equity Deployment

1.50% -

0.75%

Imputed Core ROE

(4)

L

+ 7.75% -

8.50%

(2) Whole loan yield and all-in cost of leverage include amortization of fees and expenses

pursuant to GAAP in addition to current pay rates assuming no defaults. (3) Overhead

allocations are illustrative, actual allocations vary materially and depend on expenses incurred, working capital needs and defensive liquidity needs, overall capital deployment and performance among other factors.

(4)

Imputed

Core

ROE

for

this

illustrative

loan

excludes

potential

incentive

fees

and

is

a

hypothetical

illustrative

measure

and

does

not

represent

BXMT

Core

Earnings.

(1)

This illustration is presented solely for purposes our floating-rate business model and

should not be viewed as indicative of the results that will be achieved for any particular loan in BXMT’s portfolio or of BXMT’s results as a

whole. The loan economics presented are hypothetical and are subject to various risks and

uncertainties. See “Forward-Looking Statements and Other Matters” for further discussion of such risks and uncertainties.

|

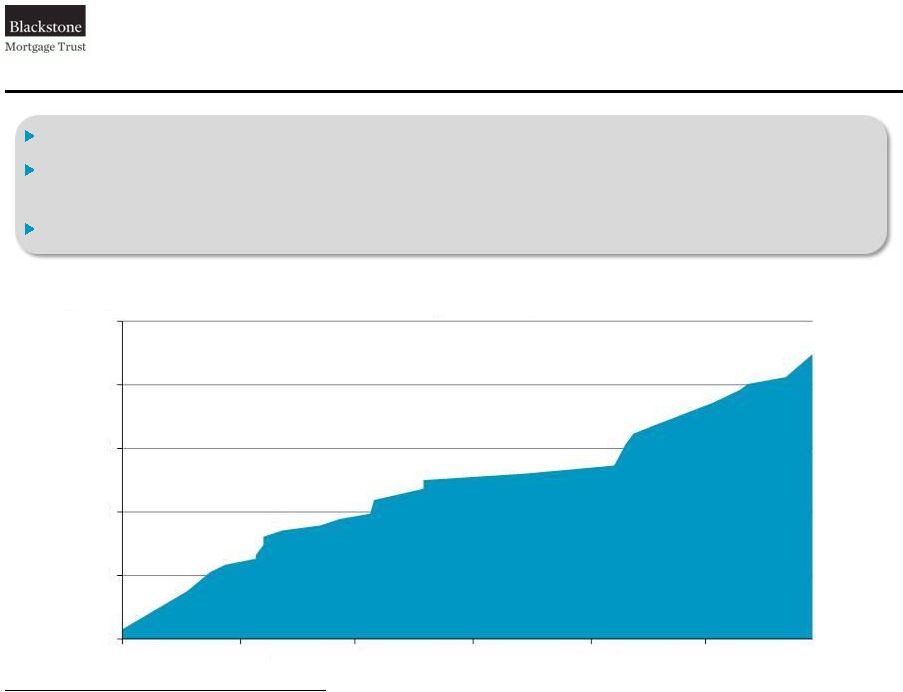

Capital Deployment

(1)

12

(1)

As of October 30, 2013.

BXMT has executed on its first mortgage direct origination strategy with rapid success

Since May, BXMT has closed $2.0 billion of loans; and another $282 million of loans are

currently in closing

22 loans closed; 3 in closing; median loan size is $68 million

$

$500

$1,000

$1,500

$2,000

$2,500

21-May-13

21-Jun-13

21-Jul-13

21-Aug-13

21-Sep-13

21-Oct-13

Cumulative BXMT Loan Originations

($ in millions) |

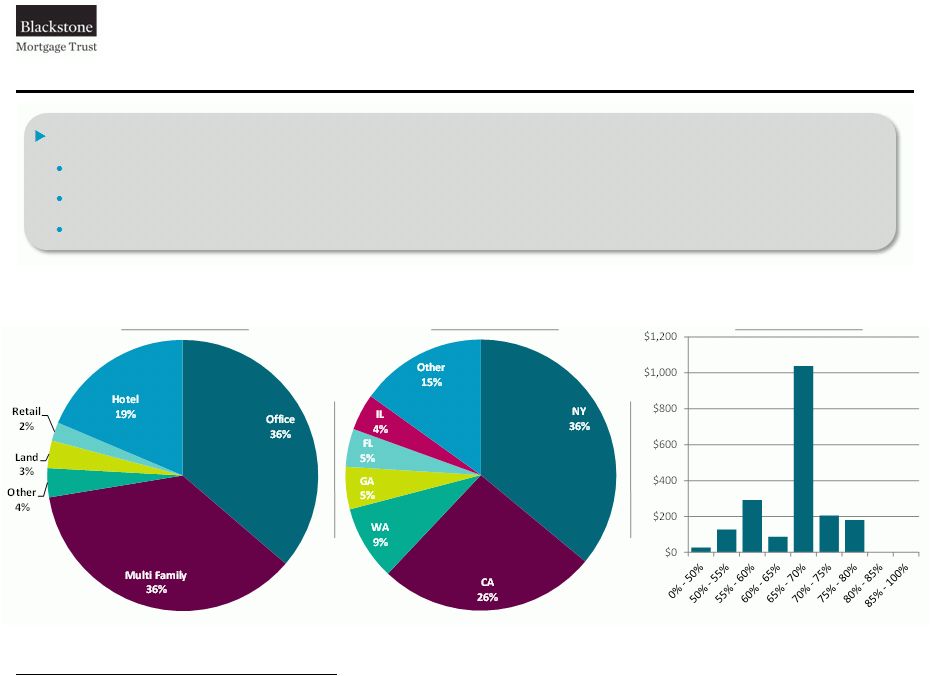

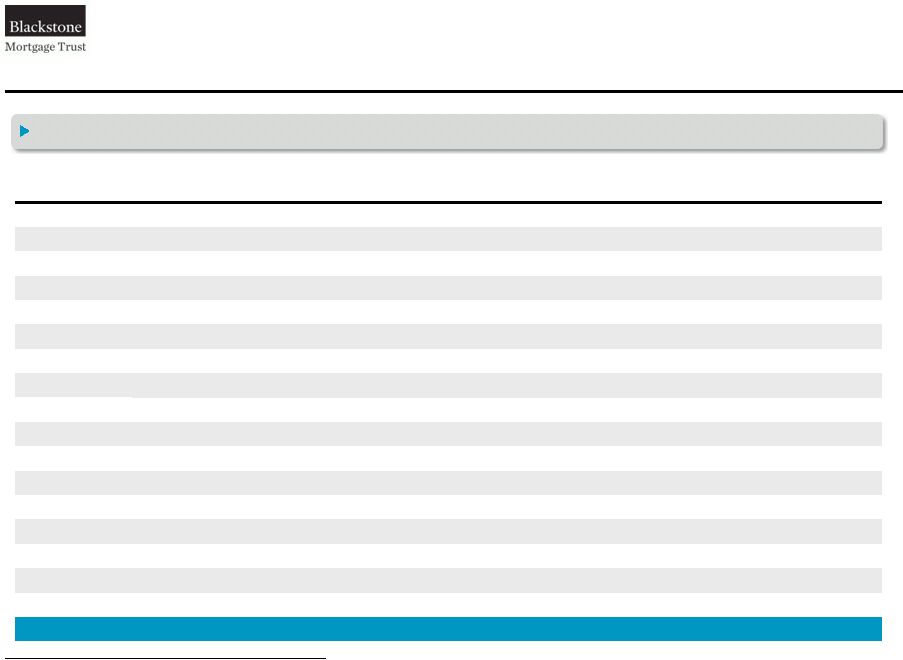

Portfolio Snapshot

13

The BXMT loan portfolio is comprised of a diversified portfolio of senior loans

100% of BXMT’s new loans are floating rate

High quality owners and sponsors

The

$2.2

billion

portfolio

has

a

weighted

average

LTV

of

65%

and

all-in

yield

of

L

+

4.88%

Property Type

Geography

Loan to Value

($ in millions)

Note: Portfolio data as of October 30, 2013; includes loans closed and in closing, except for

the all in yield, which includes only loans closed as of September 30, 2013; excludes

CT Legacy portfolio. |

Debt

Facilities ($1.8 billion in total) •

Revolving

debt

facilities

totaling

$1.5

billion

(1)

from

three

lenders

•

Non-Recourse Asset Specific Financings totaling $335 million

Other Potential Funding Sources

•

A-Note sale

•

CLO issuance

•

Corporate finance options

Financing

14

(1)

Availability of borrowings of up to $1.5 billion depending on amount of collateral pledged,

includes £153 million GBP denominated facility in USD terms. (2)

Assuming

five year senior mortgage transactions; includes applicable origination and extension

fees. Prudent use of leverage to enhance returns and diversification with an emphasis on

stability of the right hand side of the balance sheet

L + 2.00% -

L + 2.50%

All-in Pricing

(2)

75% -

80%

Advance Rate

Term matched to expected life of collateral loans

Term

No

capital

market

marks;

Underlying

RE

performance

mark-to-market

only

Mark-to-Market

Index matched

Index |

Superior

Sponsorship •

Affiliation

with

BX

Real

Estate,

the

largest

private

equity

real

estate

business

in

the

world

•

Significant

alignment

of

interest:

$96

million

BX

investment

(1)

•

BREDS has approximately $10 billion AUM

Strong Origination Platform

•

$2.2

billion

of

loans

have

closed

or

are

in-closing

(2)

•

Robust pipeline generated from BX network

Attractive Market Opportunity

•

Dislocation amongst CRE lenders coupled with increased transaction volume

Focused Strategy

•

Senior lending strategy provides attractive current income and protects capital

Floating-Rate Business Model

•

Returns increase with rising short-term interest rates, and therefore our asset and equity

values are insulated from such increases

BXMT Investment Highlights

15

(1)

Based upon closing price on the NYSE on January 23, 2014. Includes BX employees and

associates. (2)

As of October 30, 2013. |

Appendix |

Third Quarter 2013 Balance Sheet, Results and Core Earnings

17

Core Earnings

($ in thousands)

$0.28

Core Earnings per Share

Balance Sheet and 3Q Results

($ in millions)

$0.27

Dividends per Share

Net income

$8,320

-

CT Legacy net income

(437)

+ Non-cash compensation

94

Core earnings

$7,977

Loan portfolio

Repurchase

facilities

CT Legacy

portfolio, net

Equity and

other

(1)

Other expenses

($3.4)

Net

income

$8.3

Interest income

$15.1

Interest expense

($3.8)

CT Legacy, net

$0.4

$64

$1,286

$643

$707

(1)

Includes stockholders’ equity of $713.3 million, and the net of (i) cash and cash

equivalents of $10.3 million, (ii) accrued interest receivable, prepaid expenses, and other assets

of $8.7 million, and (iii) accounts payable, accrued expenses, and other liabilities of $12.8

million. |

Floating-Rate Business Model

18

As of September 30, 2013:

•

$1.3 billion of floating-rate loans, indexed to

one-month LIBOR

•

$643 million of floating-rate liabilities, also

indexed to one-month LIBOR

•

Return on $649 million of equity capital is

highly correlated to LIBOR

–

All else equal, as of September 30, 2013, a

100bp increase in LIBOR would have

increased

our

net

income

by

$6.5

million

(2)

per annum

Equity Capital

Due to our LIBOR-based lending and funding business model, our returns increase with

rising short-term interest rates and therefore our asset and equity values are

insulated from such increases

Loan Capitalization

(1)

($ in millions)

Floating-rate

loans

Floating-rate

borrowings

$1,292

$643

$649

(1)

Includes only our Loan Origination portfolio with an aggregate principal balance of $1.3

billion, capitalized with $643.0 million of debt and $649.0 million of equity as of

September 30, 2013. Excludes the assets, liabilities, and equity of the CT Legacy Portfolio.

(2)

Excludes the impact of LIBOR floors on certain of our loans receivable investments. |

Loan Origination Portfolio Details

19

(1)

Includes only loans in our Loan Origination portfolio. For information on loans in the CT

Legacy Portfolio, refer to our Form 10-Q, filed on October 29, 2013. (2)

All loans are floating-rate loans indexed to LIBOR as of September 30, 2013. LIBOR was

0.18% as of September 30, 2013. (3)

Maximum maturity date assumes all extension options are exercised.

The

following

table

provides

details

of

our

loan

portfolio

(1)

as

of

September

30,

2013:

($ in millions)

Loan Type

Principal

Balance

Book

Value

Cash

Coupon

(2)

All-In

Yield

(2)

Maximum

Maturity

(3)

Geographic

Location

Property

Type

Origination

LTV

Loan 1

Sr. mortgage

291.5

$

290.1

$

L + 3.80%

L + 3.98%

6/15/18

West

Office

53%

Loan 2

Sr. mortgage

140.0

139.7

L + 3.70%

L + 3.83%

9/30/20

Northeast

Multifamily

67%

Loan 3

Sr. mortgage

109.8

109.7

L + 5.25%

L + 8.20%

7/9/14

Northeast

Multifamily

65%

Loan 4

Sr. mortgage

87.2

86.6

L + 4.25%

L + 4.52%

8/10/18

Diversified

Hotel/Office

61%

Loan 5

Sr. mortgage

81.0

80.6

L + 3.85%

L + 4.03%

7/9/18

Southeast

Multifamily

75%

Loan 6

Sr. mortgage

69.2

69.0

L + 3.95%

L + 4.05%

6/9/18

West

Office

72%

Loan 7

Sr. mortgage

68.0

67.7

L + 4.00%

L + 4.23%

6/10/16

Northeast

Office

68%

Loan 8

Sr. mortgage

64.0

64.3

L + 8.00%

L + 9.46%

2/9/15

Northeast

Land

69%

Loan 9

Sr. mortgage

57.1

56.5

L + 3.85%

L + 4.24%

10/10/18

Diversified

Multifamily

76%

Loan 10

Sr. mortgage

48.4

48.5

L + 5.00%

L + 5.68%

12/9/16

Midwest

Hotel

53%

Loan 11

Sr. mortgage

46.3

45.8

L + 4.25%

L + 4.64%

7/10/18

Southwest

Hotel

69%

Loan 12

Sr. mortgage

45.9

45.0

L + 5.00%

L + 6.07%

8/9/18

Southeast

Office

73%

Loan 13

Sr. mortgage

43.5

43.1

L + 4.50%

L + 5.11%

7/16/17

Northeast

Retail

69%

Loan 14

Sr. mortgage

42.6

42.1

L + 3.85%

L + 4.29%

9/10/18

Diversified

Multifamily

77%

Loan 15

Sr. mortgage

37.5

37.1

L + 3.85%

L + 4.04%

8/9/18

Midwest

Office

68%

Loan 16

Sr. mortgage

32.9

32.9

L + 3.95%

L + 4.20%

8/9/17

Southwest

Hotel

51%

Loan 17

Sr. mortgage

27.1

27.1

L + 3.87%

L + 3.87%

7/7/17

Northeast

Hotel

32%

Total/Wtd. Avg.

1,292.0

$

1,285.8

$

L + 4.31%

L + 4.88%

4.3 years

64% |

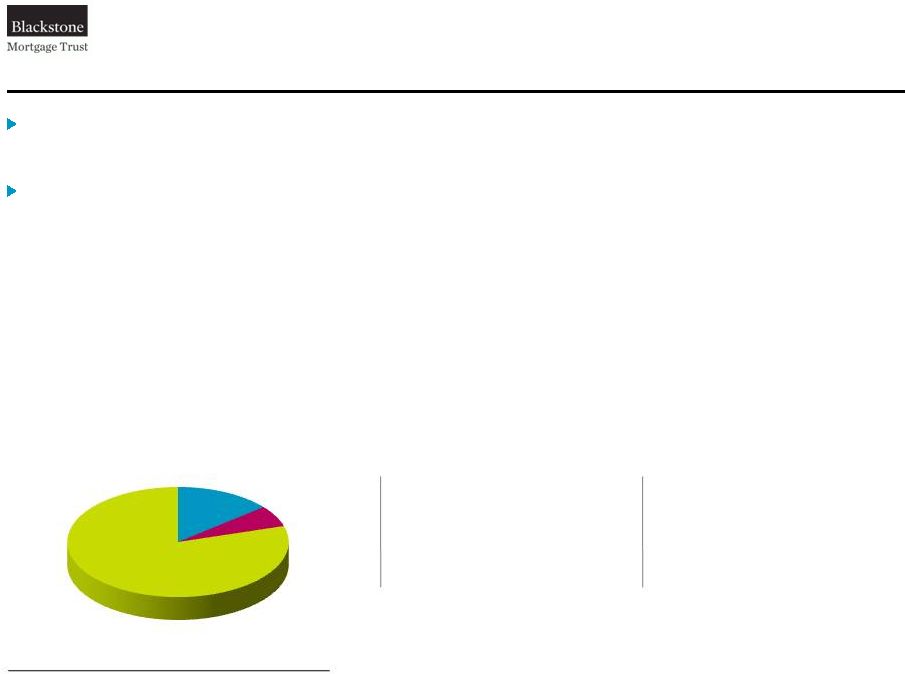

CT

Legacy

Portfolio

–

September

30,

2013

20

(1)

For calculation of segment Book Value and Equity per Share, refer to our Form 10-Q, filed

on October 29, 2013. The CT Legacy Portfolio consists of our investment in CT Legacy

Partners, our residual interests in CT

CDO

I,

and

our

carried

interest

in

CT

Opportunity

Partners

I,

LP

(“CTOPI”).

CT Legacy Portfolio book value was $64.3 million as of quarter-end, which represents

additional capital that, upon collection, will be available for investment in our Loan

Origination business. •

In

October,

we

received

a

net

$20.3

million

distribution

from

CT

Legacy

Partners,

representing

our

net

share

of

its first common equity distribution.

•

During

the

third

quarter,

CT

CDO

I

sold

its

one

loan

classified

as

held-for-sale

for

net

proceeds

of

$3.2

million.

•

Our share of the carried interest allocation from CTOPI, which is not reflected in our book

value, increased $1.4

million during the quarter to a net $13.5 million.

$2.22

CT Legacy Portfolio

Book Value per Share

(1)

$0.02

CT Legacy Portfolio

Earnings

per

Share

(2)

CT Legacy

Partners

CT CDO I

Other

Net Book Value

($ in millions)

$9

$4

$51 |

|