Attached files

| file | filename |

|---|---|

| EX-31.3 - EX-31.3 - PANTRY INC | d664269dex313.htm |

| EX-31.4 - EX-31.4 - PANTRY INC | d664269dex314.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended September 26, 2013

Commission file number: 000-25813

THE PANTRY, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 56-1574463 | |

| (State or Other Jurisdiction of Incorporation or Organization) |

(IRS Employer Identification No.) |

P.O. Box 8019

305 Gregson Drive

Cary, North Carolina

27511

(Address of principal executive offices and zip code)

Registrant’s telephone number, including area code: (919) 774-6700

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

Name of Each Exchange on Which Registered | |

| Common Stock, $.01 par value | The NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of March 28, 2013 was $282,128,438.

As of January 16, 2014, there were issued and outstanding 23,468,045 shares of the registrant’s common stock.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Table of Contents

TABLE OF CONTENTS

| Page | ||||||

| EXPLANATORY NOTE | ||||||

| PART III | ||||||

| Item 10. | 1 | |||||

| Item 11. | 6 | |||||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

32 | ||||

| Item 13. | Certain Relationships and Related Transactions, and Director Independence |

34 | ||||

| Item 14. | 35 | |||||

| PART IV | ||||||

| Item 15. | 36 | |||||

| 43 | ||||||

Table of Contents

This Amendment No. 1 to Form 10-K (this “Amendment”) amends the Annual Report on Form 10-K for the year ended September 26, 2013 originally filed on December 10, 2013 (the “Form 10-K”) by The Pantry, Inc. (“The Pantry,” “we,” “us,” “our” and “our company”). We are filing this Amendment to present the information required by Part III of the Form 10-K as we will not file a definitive proxy statement within 120 days of the end of our fiscal year ended September 26, 2013.

Also included in this Amendment are (i) the signature page, (ii) certifications required of the principal executive officer and principal financial officer under Section 302 of the Sarbanes-Oxley Act of 2002 and (iii) Part IV of the Form 10-K, which has been included solely to allow for filing of the additional certifications. Because no financial statements are contained within this Amendment, we are not including certifications pursuant to Section 906 of the Sarbanes-Oxley Act of 2002.

Except as described above, no other changes have been made to the Form 10-K. Other than the information specifically amended and restated herein, this Amendment does not reflect events occurring after December 10, 2013, the date the Form 10-K was filed, or modify or update those disclosures that may have been affected by subsequent events.

Item 10. Directors, Executive Officers and Corporate Governance.

Directors

The following table and accompanying biographies provide information on our directors:

| Name |

Age | Year First Elected Director |

Position | |||

| Edwin J. Holman |

67 | 2005 | Chairman of the Board | |||

| Robert F. Bernstock |

63 | 2005 | Director | |||

| Paul L. Brunswick |

74 | 2003 | Director | |||

| Wilfred A. Finnegan |

55 | 2006 | Director | |||

| Kathleen Guion |

62 | 2013 | Director | |||

| Dennis G. Hatchell |

64 | 2012 | Director | |||

| Terry L. McElroy |

65 | 2006 | Director | |||

| Mark D. Miles |

60 | 2006 | Director | |||

| Bryan E. Monkhouse |

69 | 2004 | Director | |||

| Thomas M. Murnane |

66 | 2002 | Director |

Edwin J. Holman was named Chairman of our Board on September 17, 2009 and served as Interim Chief Executive Officer from October 5, 2011 through March 5, 2012. He has served on our Board since October 2005 and currently serves as a member of our Compensation and Organization Committee (the “CO Committee”) and our Audit and Finance Committee (the “Audit Committee”). Previously, he had served as Chairman of our CO Committee and as a member of our Executive Committee, the duties and responsibilities of which are now encompassed by our Audit Committee. Mr. Holman is a 2011 National Association of Corporate Directors (NACD) Governance Fellow and has been named as a Director honoree. He has demonstrated his commitment to boardroom excellence by completing NACD’s comprehensive program of study for corporate directors. He supplements his skill sets through ongoing engagement with the director community and access to leading practices. We believe Mr. Holman is especially qualified for our Board, and particularly as its Chair, because of his extensive executive experience in the retail industry. From March 2010 to the present, Mr. Holman also has served as the non-executive Chairman of RGIS International, which provides retail inventory solutions. Previously, Mr. Holman served as Chairman and CEO (2004-August 31, 2009) of Macy’s Central, a division of Macy’s Inc. that operates 217 department stores in the Midwest and Southern United States. He also served as President and CEO of Galyan’s Trading Company, a public company (2003-2004). Previously, Mr. Holman was the President and COO of Bloomingdale’s (2000-2003), a division of Federated Department Stores Inc.; President and COO of Rich’s/Lazarus/Goldsmiths divisions, a division of Federated Department Stores, Inc. (1999-2000); Chairman and CEO of Petrie Retail, Inc. (1996-1999); President and COO of Woodward & Lothrop (1994-1996); Vice Chairman and COO of The Carter Hawley Hale Stores; and a senior operating executive of The Neiman Marcus Group. Mr. Holman is well-versed in the various aspects of retail operations, and he also has high-level experience with a wide range of diverse companies, which we believe gives him very relevant skills in working with boards, overseeing management, assessing risk, and exercising diligence.

1

Table of Contents

Additionally, Mr. Holman’s substantive experience gives him a solid foundation from which to advise our company with respect to its numerous and diverse retail vendors, and his experience overseeing multiple retail stores under the same brand meshes with our business model organizational structure, vendor relations, and multiple retail store operations, making him an excellent fit for our Board and a prime choice as its Chair. Further, his diverse executive experience has prepared him to respond to complex financial and operational challenges, which we believe adds significant value to the critical skill sets needed by our Board, to help our company succeed in such a highly competitive marketplace. Finally, in addition to serving in several principal roles as employee, Mr. Holman has also served as an independent director on the boards of Office Max (2003) and Circle International (1994-2000), both public companies. During his tenure as director at Circle International, he served as Chairman of the Audit Committee for three years and also as Chairman of the Compensation Committee for two years. As of January 18, 2010, Mr. Holman also began serving on the Board of Directors of La-Z-Boy, a public company. We believe Mr. Holman’s commitment to boardroom excellence and his substantial retail, executive, and operational experience, particularly at large, multi-store companies, and his prior board experience make him valuable as Chairman of our Board.

Robert F. Bernstock has served on our Board since October 2005, and is currently a member of our Audit Committee and is Chairman of our CO Committee. Mr. Bernstock is currently self-employed as an independent consultant. Mr. Bernstock was president of the U.S. Postal Service Mailing and Shipping Services division from June 2008 until June 2010, which has produced in excess of $70 billion in annual revenues. As president, he was responsible for product management, development, and retail and commercial sales and services, which required his participation in pricing, operational support, service enhancements, partnerships, and investment activities. Mr. Bernstock’s other high level executive and director experience includes positions at SecureSheet Technologies (Chairman and CEO, 2006-2008); Scotts Miracle-Gro Company (COO and President of North America, 2003-2006); The Dial Corporation (Senior Vice President and General Manager); Campbell Soup Company (President of the U.S. Division, President of the International Division, and Executive Vice President); Vlasic Foods International (President, CEO, and Director, 1998-2001); Atlas Commerce, Inc. (President, CEO, and Director); and NutriSystem, Inc. (Director). We believe this broad executive experience not only equips Mr. Bernstock well to advise our Board generally, but it also provides him (and our company) with particular advantages. Specifically, the diversity of his corporate experience—from Scotts Miracle-Gro to Campbell Soup Company and Atlas Commerce—give him extensive experience working with diverse boards of directors and overseeing management. This background also provides him with a collection of best practices and strategies to help inform our Board’s general corporate decision-making, our CO Committee’s specific analyses regarding executive pay and benefits, and our Audit Committee’s oversight and review of our company’s financial plans and policies and our acquisition and divestiture strategies. We believe Mr. Bernstock’s significant experience as a director of Vlasic Foods, Atlas Commerce, Inc., and NutriSystem, Inc, as well as his high-level executive experience, qualifies him for service as a member of our Board of Directors, Chairman of our CO Committee, and member of our Audit Committee.

Paul L. Brunswick has been a director since July 2003, and is currently a member of our Audit Committee. He previously served on our Corporate Governance and Nominating Committee. Mr. Brunswick is currently on the Board of Directors of VTFLEX, Inc. and has served on the Board of Directors of Beroe, Inc. since 2005. Mr. Brunswick was on the board of The WakeMed Foundation from 2005 through 2011 and as a director of Lonesource, Inc. from 2003 until March 2010. Service on those boards has provided him with the background and experience of board processes, function, exercise of diligence and oversight of management. Since 1999, Mr. Brunswick has provided financial and business consulting services through his own company, General Management Advisory, and brings that expertise to our Board as well. Further, we find Mr. Brunswick’s financial background to provide additional value to our Board and our Audit Committee. From 1992 to 1999, Mr. Brunswick was Vice President and Chief Financial Officer of Good Mark Foods, Inc., a publicly-held meat snack manufacturer and marketer whose primary retail channel of distribution was via convenience stores, and in that role dealt with that company’s public accountants, regulatory agencies and the Audit Committee of its Board of Directors. Prior to 1992, he served as Chief Financial Officer of Compuchem Corporation and Photographic Sciences Corporation, and as Corporate Controller of Voplex Corporation, all publicly-held companies. In addition, he served as director, Chair of the Audit Committee, and Chair of the Compensation Committee of Waste Industries, another public company, from 1999 to 2005. Mr. Brunswick brings to us previous experience as Corporate Controller, Chief Financial Officer, and Audit Committee Chair, uniquely qualifying him to serve as a member of our Audit Committee.

Wilfred A. Finnegan was elected to our Board in July 2006, and currently serves as a member of our Corporate Governance and Nominating Committee and Chairman of our Audit Committee. We believe Mr. Finnegan’s experience in the financial sector and his demonstrated past board performance make him a good fit for our Board and, in particular, our Audit Committee. Mr. Finnegan co-founded the high yield securities business at JPMorgan Chase (then Chemical Bank, and later Chase Manhattan) in 1993 and subsequently was promoted to the head of Global Leveraged Finance, where he accumulated substantial leadership and financial experience. His later positions as Senior Advisor to The Carlyle Group, a global private equity firm (2003-2005), more

2

Table of Contents

recently as Managing Director (2007-2008) of GoldenTree Asset Management, LP, and as an independent consultant since 2003 further enhance his executive experience and fiscal know-how. His committee experience at JPMorgan – as a member of the Management, Global Markets, and Market Risk committees there – provides additional experience in analyzing risk and performing financial strategic planning that we believe adds value to his participation on our Audit Committee. Finally, Mr. Finnegan attained a B.A. and M.B.A. from Dartmouth College, one of the nation’s top undergraduate and business institutions. We believe Mr. Finnegan’s significant executive, financial, and educational background qualifies him for service as a member of our Board, Chairman of our Audit Committee, and member of our Corporate Governance and Nominating Committee, and also makes him a valuable addition to our team.

Kathleen Guion was elected to our Board in May 2013, and currently serves as a member of our Corporate Governance and Nominating and CO Committees. Ms. Guion most recently served as Division President of Store Operation and Development from 2005 until her retirement in 2012 from Dollar General Corporation. She led the retail field organization of store operations and store development with a team of 90,000 store employees, 100 directors and 14 Vice Presidents. Ms. Guion played a leading role in the company’s sales growth from $6.8 billion in 2003 to over $14 billion in 2011. At the same time she increased the number of stores from 6,500 to over 9,900. She has overseen brand enhancement and successfully championed supply chain overhauls by implementing new store technologies and corporate-wide merchandising strategies. Those efforts led to double-digit comp store sales during the 2007-09 recession, more than $160 million in shrink savings, and a 40 percent reduction in staff turnover. In 1979, Ms. Guion began her career with 7-Eleven Corporation (formerly known as Southland prior to 1999). Her most recent position was Vice President and General Manager from 1987 to 1997. She was a Senior Operating Manager with full profit and loss responsibility for the company’s largest and most profitable division of company-owned stores. After her time at 7-Eleven, Ms. Guion was President and Chief Operating Officer of E-Z Serve Corporation. She was recruited to plan and direct the turnaround and return to profitability of this seven-state southeastern convenience store chain with revenues of $745 million. During her tenure, the company was repositioned for successful acquisition by EBC Investment Group, and was sold at a multiple of 11 times EBITDA; the highest multiple paid for a publicly traded convenience store chain in the past 20 years. Ms. Guion was an Operating Partner with Devon Partners from 1999 to 2000. As an Operating Partner she identified acquisition targets and developed detailed operational improvement plans that would provide returns to investors in excess of 40 percent. More recently, she was appointed to the Board of True Value Company in July, 2012. True Value Company is one of the world’s largest retailer-owned hardware cooperatives serving 54 countries with more than 5,000 stores. Ms. Guion is a 2013 National Association of Corporate Directors (NACD) Governance Fellow. We believe Ms. Guion’s significant convenience store and operational experience, as well as her high-level executive experience, qualifies her for service as a member of our Board and the Corporate Governance and Nominating Committee and the CO Committee.

Dennis G. Hatchell joined as our President and Chief Executive Officer on March 5, 2012, and as a Director on March 27, 2012. Prior to joining us, he was with Alex Lee, Inc., (“Alex Lee”), where he served as Vice Chairman since April 2011. Prior to becoming Vice Chairman, Mr. Hatchell served as President and Chief Operating Officer of Alex Lee from December 1995 to April 2011, where he was responsible for developing and implementing the company’s strategic business plan and operating budgets and overseeing its three operating companies as well as carrying out the succession plan, supervision and training of senior leadership. Mr. Hatchell has also served as President of Lowes Food Stores, Inc., a division of Alex Lee, from 1989 to 1995 and Group Vice President of Merchandising and Store Operations from 1986 to 1989 for H. E. Butt Grocery Company in San Antonio, Texas. Prior to that, Mr. Hatchell served as President of Merchant Distributors, Inc., a division of Alex Lee from 1980 to 1986. He also served in several positions rising to Vice President, General Manager of Western Grocers (Super Valu) in Denver, Colorado from 1972 to 1980. Mr. Hatchell received a Bachelor degree from University of Colorado in 1971.

Terry L. McElroy was named director in March 2006 and currently serves on both the CO Committee and the Corporate Governance and Nominating Committee of our Board. He has also served on our Executive Committee, the duties and responsibilities of which are now encompassed by our Audit Committee. Since his 2006 retirement, Mr. McElroy has been self-employed as an independent consultant. Before his 2006 retirement, Mr. McElroy spent more than twenty-five years in multiple executive roles with McLane Company, Inc., a $34 billion supply chain services company that provides grocery and food service supply chain solutions for thousands of convenience stores, including for our company. For the last five years of his executive experience at McLane, he was President of McLane Grocery Distribution, which has provided him the background and experience of working with a board of directors and overseeing management in addition to his substantively valuable experience in a closely-related industry. We believe Mr. McElroy is well qualified to serve on the CO Committee and the Corporate Governance and Nominating Committee. As a former President and Vice President of Distribution at McLane, Mr. McElroy was responsible for developing and implementing corporate strategy, including how it related to compensation and benefits. Specifically, he served on the committee that developed the first formalized position description and salary framework for the company as a whole, and he later helped develop a formal succession planning process for senior positions that contributed to successful internal promotions for almost all open positions. During his tenure at McLane, Mr. McElroy also served on the

3

Table of Contents

committee that formalized the company’s beliefs and values and developed its first long-term strategic plan, and as President, he was responsible for developing and updating the strategic plan for that unit. We believe that Mr. McElroy’s broad executive experience, particularly as President and Vice President of a food service supply chain servicing convenience stores, qualifies him well to serve on our Board and the CO Committee and the Corporate Governance and Nominating Committee.

Mark D. Miles first joined our Board in January 2006 and currently serves on our CO Committee and our Corporate Governance and Nominating Committee. Mr. Miles’ wide array of experience, both in terms of industry and position, give him a valuable perspective from which to contribute to our Board as it oversees our company’s dealings with multiple-industry vendors and the public. Mr. Miles has been a member of the Hulman & Company (“Hulman”) Board of Directors since March 2012. Hulman is a private, family-owned company founded in 1850 by Francis Hulman as a wholesale grocery, tobacco and liquor store in Terre Haute, Indiana. Throughout the early half of the 20th century, Hulman became nationally known for its Clabber Girl baking powder, which it began producing in 1899. In 1945, Hulman purchased the Indianapolis Motor Speedway©. Hulman also owns a television production company, Wabash Valley Broadcasting, which does business as IMS Productions doing in-house work for their Indy Racing League, LLC. Since January 2006, Mr. Miles has been the President and Chief Executive Officer of Central Indiana Corporate Partnership, Inc., a not-for-profit organization of central Indiana CEOs and university presidents that seeks to foster growth and opportunity throughout the region. Additionally, Mr. Miles is currently a director for City Financial Corporation, a holding company for City Securities, in Indianapolis, Indiana and serves on its Compensation and Audit Committees. City Securities Corporation is Indiana’s oldest and largest, independent, full service investment firm active in investment services, money management, insurance, public finance, corporate finance, taxable fixed income, institutional sales and syndication of tax credits. Also, Mr. Miles recently served as the Chairman of the Board of “Our 2012 Super Bowl,” the host committee of Super Bowl 2012 in Indianapolis, Indiana. He has held numerous other executive positions in the sports industry, including fifteen years as CEO of the ATP, the official international circuit of men’s professional tennis tournaments (1990 to 2005); President of the Organizing Committee of the 1987 Pan American Games in Indianapolis; and President of the RCA Championships (formerly Indianapolis ATP tournament). We find that this exposure to major event planning has prepared Mr. Miles to offer substantive advice in the areas of marketing and negotiating with vendors, and it also provides experience in strategically responding to complex operational and financial challenges and overseeing an array of personnel, both of which are important Board and Committee functions. Mr. Miles was also Executive Director of Corporate Relations for Eli Lilly & Co., an international agricultural, medical instrument, and pharmaceutical company. Mr. Miles’ responsibilities at Eli Lilly included oversight of the company’s Washington, D.C. office and all of its federal and state governmental affairs, including all lobbying activities. Additionally, Mr. Miles has had experience managing political campaigns, including a mayoral campaign for the city of Indianapolis and several congressional candidate campaigns for both the Indiana and U.S. legislatures. Not only do these positions further underscore Mr. Miles’ diversity of experience in high level executive positions, but we believe that they, and particularly the not-for-profit position, highlight his experience helping businesses plan and strive for growth and show him to be well-situated to strengthen and expand his (and therefore our) business network. We believe Mr. Miles’ diverse and long-ranging executive and operational experience well prepares and qualifies him to serve on our Board and the CO Committee and the Corporate Governance and Nominating Committee.

Bryan E. Monkhouse has served on our Board since December 2004 and is currently a member of our Corporate Governance and Nominating Committee and our Audit Committee. Since 2003, Mr. Monkhouse has served as chairman of Blue Water Safaris, Ltd. and as managing director of Liamuiga Marine Limited, both privately-held companies offering tourism services in the Caribbean. Additionally, since his retirement from Irving Oil Limited in 2003, Mr. Monkhouse has been self-employed as a consultant and has provided consulting services to Irving Oil in 2004 and 2008. Mr. Monkhouse has broad high level executive experience in both the oil and convenience store industries, which we believe makes him an ideal fit for our Board. Early in Mr. Monkhouse’s career, he held senior positions in supply, corporate development, logistics, and marketing with Suncor, Inc., an integrated Calgary oil company. As VP of Marketing at Suncor, he was responsible for the operation of the company’s convenience store chain. He then moved to Irving Oil Limited, a petroleum refiner and marketer serving New England and eastern Canada, where he was responsible for approximately 800 convenience stores in Canada and the United States as Vice President of Marketing. Mr. Monkhouse was named COO of the four-billion dollar enterprise in 2001, and he was then charged with overseeing its operations, interacting with inside and outside public accountants and auditors and exercising diligence, all of which are relevant and valuable to our Board and particularly our Audit Committee. Further, at both oil companies, Mr. Monkhouse served as a supply executive, which we believe gives him unique and valuable insight into the goals and constraints of oil companies in their dealings with companies like ours. We believe that Mr. Monkhouse’s work in oil and convenience operations, his continuing executive experience, and his proven financial acumen make him a very valuable member of our Board and the Audit Committee and Corporate Governance and Nominating Committee.

Thomas M. Murnane has been a member of our Board since October 2002 and currently chairs our Corporate Governance and Nominating Committee and serves as a member of our Audit Committee. Since 2005, Mr. Murnane has been a Principal and co-owner

4

Table of Contents

of ARC Business Advisors, a boutique consultancy that provides strategic and operational advice to retailers and their suppliers, as well as mergers and acquisitions due diligence support to both strategic and financial investors on transactions in the retail sector. In light of our company’s history and strategy of growth through acquisitions, Mr. Murnane’s experience is relevant and useful to our company on a substantive level. In addition, advising on significant transactions also highlights Mr. Murnane’s skills in assessing risk and exercising diligence, which are functions relevant to his Committee positions. Mr. Murnane also has extensive experience in the financial sector and its retail applications, an attribute that adds value to his posts on our Board generally and on our Audit Committee in particular. Until his retirement in 2002, Mr. Murnane was a partner at PricewaterhouseCoopers, LLP. He began his career at PwC in 1980, and during his tenure there, he directed first the firm’s Retail Strategy Consulting Practice, later its Overall Strategy Consulting Practice for the East Region of the United States, and most recently served as Global Director of Marketing and Brand Management for PwC Consulting. From 2003-2008, Mr. Murnane also served on the board of Captaris, Inc., a company that developed software to automate paper and other document-centric processes. He chaired the Governance, Nominating, and Strategy Committee, and for various periods served on both the Audit and Compensation Committees there. Captaris was sold to Open Text, a Canadian Company, in 2008. From 2003 to the present, Mr. Murnane has served on the board of Pacific Sunwear of California, Inc., a national chain of specialty stores that retail apparel, accessories, and footwear to teenage consumers. He serves on the Audit Committee at Pacific Sunwear. Mr. Murnane also serves on the Board of Directors of Blain Supply, Inc., a privately held company located in Janesville, Wisconsin, and Goodwill Southern California, a non-profit organization. He was recently appointed to the Alumni Advisory Council of Ohio State University and serves on the Dean’s Alumni Advisory Committee for College of Arts and Sciences at that University. Mr. Murnane has demonstrated his commitment to boardroom excellence by serving on NACD’s Advisory Council on Risk Oversight and its Corporate Governance Chair Advisory Council. We believe Mr. Murnane’s diverse executive and board experience provides him key skills in working with directors, understanding board processes and functions, responding to complex financial and operational challenges, and overseeing management. Further, we believe that Mr. Murnane’s demonstrated commitment to boardroom excellence, his experience at a national accounting/consulting firm, his demonstrated understanding of business combinations, his retail prowess, and his prior and current experience on a variety of boards of directors make him a valuable addition to our Board and our Audit Committee and the Corporate Governance and Nominating Committee.

Executive Officers

Information concerning our executive officers is included in the section entitled “Executive Officers of the Registrant” in Part I of this Annual Report on Form 10-K. Such information is incorporated herein by reference.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and 10% beneficial owners to file reports of ownership and changes in ownership with the SEC. Based solely on a review of the report forms that were filed and written representations from our executive officers and directors, we believe that during fiscal 2013 our officers, directors and 10% beneficial owners complied with all filing requirements applicable to them.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors. Our Code of Business Conduct and Ethics, which is available on our website at www.thepantry.com, is available free of charge upon written request to the attention of our Secretary, by mail addressed to The Pantry, Inc., 305 Gregson Drive, Cary, North Carolina 27511, or by telephone at (919) 774-6700. Consistent with Item 5.05 of Form 8-K, if we amend or grant any waiver from a provision of our Code of Business Conduct and Ethics that applies to our principal executives, financial or accounting officers or our Controller, we will publicly disclose such amendment or waiver, including by posting such amendment or waiver on our website at www.thepantry.com or by filing a Current Report on Form 8-K.

Director Nomination Process

There have been no material changes to the procedures by which security holders may recommend nominees to our board of directors since the date of our proxy statement for the Annual Meeting of Stockholders held March 14, 2013.

Audit Committee

We have a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The current members of the Audit Committee are Wilfred A. Finnegan (Chairperson), Robert F. Bernstock, Paul L. Brunswick, Edwin J. Holman, Bryan E. Monkhouse and Thomas M. Murnane. Mr. Bernstock and Mr. Holman joined the

5

Table of Contents

Committee, and Mr. Finnegan assumed the position of Chairperson, in January 2014. Terry L. McElroy served on the Committee until June of 2013. Our Board, in its business judgment, has made an affirmative determination that each member of the Audit Committee is an “independent director” as that term is defined by applicable NASDAQ Listing Rules, including the special independence requirements applicable to Audit Committee members. Our Board has also determined that Mr. Brunswick and Mr. Finnegan are “Audit Committee financial experts” as defined in the Exchange Act.

Item 11. Executive Compensation.

Compensation Discussion and Analysis

This Compensation Discussion and Analysis describes the philosophy and objectives of our executive compensation program, explains the compensation decision-making process and details the individual components of total compensation for our named executive officers. On February 7, 2013, B. Clyde Preslar was hired as Senior Vice President, Chief Financial Officer. In the absence of a Chief Financial Officer, Berry L. Epley served in the interim role as Principal Financial Officer for a portion of fiscal 2012 and 2013. Our named executive officers (the “NEOs”) for fiscal 2013 were:

| Name |

Position | |

| Dennis G. Hatchell | President, Chief Executive Officer and Director | |

| B. Clyde Preslar | Senior Vice President, Chief Financial Officer | |

| Berry L. Epley | Vice President, Assistant Corporate Secretary and Controller (former Principal Financial Officer) | |

| Keith S. Bell | Senior Vice President, Fuels | |

| Keith A. Oreson | Senior Vice President, Human Resources | |

| P. Joseph Venezia | Senior Vice President, Operations |

Executive Summary

2013 Company Performance

| • | Comparable store merchandise revenue increased 0.9% and increased 3.0% excluding cigarettes. |

| • | Merchandise gross margin increased to 34.0% compared to 33.7% a year ago. |

| • | Fuel gross profit was $199.3 million, compared to $210.3 million a year ago. Retail fuel margin per gallon was flat at $0.115 compared to the prior year as comparable store fuel gallons sold decreased 4.8%. |

| • | Store operating and general and administrative expenses were $609.0 million compared to $610.0 million a year ago. |

| • | Adjusted EBITDA was $202.4 million, down from $210.1 million a year ago. |

| • | While our financial results did not meet our expectations, we continued to make investments to support our future growth. We remodeled 72 stores to provide new product offerings and a better shopping experience. We rebuilt 3 stores and opened 4 new stores. We continued to expand our quick service restaurant business with 15 store openings. While it is still early, overall we are pleased with the results of these investments. |

| • | We have strengthened our leadership talent with the addition of Mr. Preslar as Chief Financial Officer, Mr. Venezia as Senior Vice President of Operations, and Boris Zelmanovich as Chief Merchandising Officer. |

6

Table of Contents

Summary of the Elements of Compensation

The following key components and objectives made up the fiscal 2013 executive compensation program for our executive officers, including our NEOs.

| Element |

Objectives |

Key Features | ||

| Base Salary | Attract and retain executives by providing a competitive and appropriate level of fixed cash compensation that reflects the executive’s primary duties and responsibilities, individual performance and the position’s relative value in the marketplace. | Fixed compensation element with merit increase component that considers the economic environment as well as intent to appropriately reward annual performance contributions. | ||

| Annual Incentive Awards |

Focus executives on achieving pre-determined, annual corporate objectives established by the CO Committee that support our business strategy and drive overall performance. | Variable cash compensation component with performance targets set annually that are determined by considering a number of internal and external environmental factors; payouts against these targets are intended to reward individuals based on achievement of corporate goals. These targets align with the Company’s fiscal financial plan. Actual annual incentives earned may be 0%, if threshold performance objectives are not achieved, or may range from 50% to 200% of the target annual incentive opportunity, depending on our actual performance compared to the performance targets. | ||

| Long-Term Incentive Awards |

Align an executive’s interests with the stockholders’ interests, reward executives for achieving our long-term business objectives and creating and improving stockholder value, and promote long-term retention of our executives. | Variable equity-based compensation component with awards that are a blend of 15% stock options, 30% time-based restricted stock and 55% performance-based restricted stock. Actual performance-based restricted stock earned may be 0%, if threshold performance objectives are not achieved, or may range from 50% to 150% of the target incentive opportunity, depending on our actual performance compared to the performance targets. | ||

| Health & Welfare Plans | Help protect executives and their families from the possibility of economic hardships caused by illness, disability or loss of life. | Indirect compensation component which mirrors the health and welfare benefits offered to employees in general. | ||

| Retirement Plan | To provide a tax-efficient retirement savings vehicle. | Indirect compensation component offered to all eligible employees to participate and receive Company contributions to our 401(k) plan. | ||

| Perquisites | Encourage the health of our executives and provide a similar level of benefits provided to other members of management. | Indirect compensation component includes an executive physical program and car allowance. | ||

Changes to Our Compensation Program - Fiscal 2013

The CO Committee made the following changes to the Annual Incentive Plan (“AIP”) for fiscal 2013 to strengthen our pay for performance focus: 1) increasing weight on inside comparable store sales; 2) providing a simpler measure to replace the merchandise gross profit ratio; 3) reducing the impact of fuel volatility on bonus payouts; and 4) preventing disproportionately high payouts because of the overachievement on some measures if other measures are underachieved. Specifically, the following changes were made:

| • | Inside comparable store sales metric weighting was changed from 35% to 40%; |

| • | Inside net profit contribution (merchandise gross margin dollars minus store operating and general and administrative expenses) replaced the merchandise gross profit ratio; |

7

Table of Contents

| • | Fuel gross margin metric weighting was changed from 30% to 25% due to its inherent volatility and to put more weighting on our year over year sales growth, which we believe is a critical driver of our future growth; |

| • | Inside net profit contribution and fuel gross margin qualifiers were added. Threshold performance on both metrics must be met to allow a bonus payout for any individual measure to exceed 100%; and |

| • | Retained a metric for achieving a threshold of Adjusted EBITDA to qualify for any bonus payout irrespective of the achievement of any other metric. |

The CO Committee also made a change to the performance-based restricted stock performance measurement in the Long-Term Incentive Program (“LTIP”) to address the unpredictability of fuel market conditions. This change addresses the difficulty of setting three-year Adjusted EBITDA performance targets given that fuel gross margins are volatile. For performance-based restricted stock awarded in 2013, the performance measurement period is based on the first year’s Adjusted EBITDA results. To keep the focus on driving long-term stockholder value, any shares earned vest over three years in three annual installments commencing on the first anniversary of the grant date.

Pay Mix at Target

The table below illustrates how the primary components of target executive compensation (base salary, annual cash incentive opportunity and long-term equity incentive opportunity) are allocated. For our NEOs in fiscal 2013, the target allocation was as follows:

| 2013 Fiscal Year Compensation Mix (1)(3) |

||||||||||||

| Name |

Base Salary | Annual Incentive Plan |

Long-term Equity Incentive |

|||||||||

| Dennis G. Hatchell |

27 | % | 27 | % | 47 | % | ||||||

| B. Clyde Preslar |

36 | % | 22 | % | 42 | % | ||||||

| Berry L. Epley (2) |

53 | % | 21 | % | 26 | % | ||||||

| Keith S. Bell |

36 | % | 22 | % | 42 | % | ||||||

| Keith A. Oreson |

36 | % | 22 | % | 42 | % | ||||||

| P. Joseph Venezia |

36 | % | 22 | % | 42 | % | ||||||

| (1) | Total compensation for purposes of this table is the total of base salary, annual cash incentive opportunity at target level and long term incentive opportunities with performance-based incentive at target level. The amounts associated with these target percentages will differ from the actual amounts reflected in the Summary Compensation Table due to certain guarantees in employment agreements. The sum of the percentages in each row may not equal 100% due to rounding. |

| (2) | This pay mix of Mr. Epley, a Vice President of the Company, is different than that of Senior Vice Presidents. |

| (3) | The CO Committee believes that this compensation mix aligns with our compensation philosophy of pay-for-performance because a significant percentage of each NEO’s compensation is variable and/or equity-based compensation. The emphasis on performance serves to tie executive compensation to our annual and long-term success. |

Fiscal 2013 Compensation Results for the CEO and Other NEOs

Comparable same store sales and fuel gross margin dollars fell short of our expectations. While we are pleased with the improvements we made in our inside gross margin percent and expenses, these were not sufficient to offset sales and fuel margin misses. As a result, our Adjusted EBITDA declined year over year. With the implementation of stronger pay for performance programs, the CO Committee feels that the actual pay received by our NEOs is appropriately linked to the results that were achieved. As a significant amount of pay is at risk for our NEOs, the financial results and share price significantly affected the actual pay realized in fiscal 2013. NEOs who were employed for the full fiscal year realized an average of 50% of their total target compensation. The following summarizes the impact of 2013 results on pay:

| • | Salary: The CO Committee authorized a 3% base salary increase to Mr. Hatchell, Mr. Bell, and Mr. Oreson for fiscal 2013. Mr. Preslar was hired on February 7, 2013 and Mr. Venezia was hired on September 9, 2012 and did not receive salary increases in fiscal 2013. Mr. Epley received a salary increase at the end of fiscal 2012 and did not receive a salary increase in fiscal 2013. Additional details regarding this program can be found in the Elements of our Executive Compensation Program section. |

8

Table of Contents

| • | Non-Equity Annual Incentive: For the NEOs who were employed for the full fiscal year, payments under the AIP were 29.6% of target, reflecting the miss in Inside Comparable Store Sales and Fuel Gross Margin targets. |

| • | Bonus: Pursuant to their offer letters, Mr. Preslar and Mr. Venezia were guaranteed certain minimum levels of bonuses for fiscal 2013 in order to attract them to the Company. Mr. Preslar was guaranteed a bonus of $80,000, which equates to his threshold bonus payout level of 30% of salary, pro-rated for the number of days employed during the fiscal year. Mr. Venezia was guaranteed a bonus of $100,500, which equates to his threshold bonus payout level of 30% of salary. |

| • | Equity Incentive Awards: Performance-based restricted stock awarded for fiscal years 2013, 2012 and 2011 that had a measurement period in fiscal 2013 did not vest as a result of the Company missing the 2013 Adjusted EBITDA performance goals. Stock options granted in fiscal 2013 and 2012 were only slightly “in-the-money” at fiscal year-end, while all other outstanding options are underwater. Portions of each executive’s time-based restricted stock vested, which delivered some value to executives. |

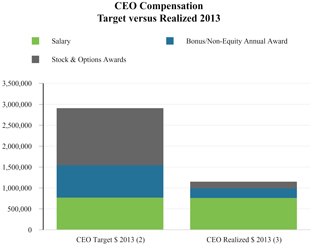

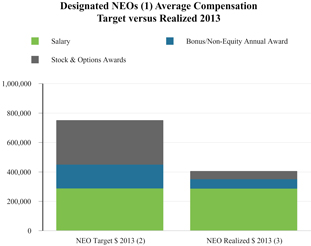

The CO Committee considers realized pay in assessing the relationship between pay and performance of the Company. The charts below are designed to show the average target compensation (salary, non-equity incentive and stock and option awards) set by the CO Committee for fiscal 2013 (labeled as “Target $”) and the amount actually earned (labeled as “Realized $”) during the fiscal year. Data is shown for the CEO and average of the other NEOs. These charts demonstrate how the CO Committee’s decisions on pay link to the Company’s financial performance and share price.

|

|

| (1) | The designated NEOs for purposes of this table are the NEOs, other than the CEO, who were employed by the Company at the end of fiscal 2013: Mr. Preslar, Mr. Epley, Mr. Bell, Mr. Oreson, and Mr. Venezia. Note that Mr. Preslar was not employed for the full fiscal year. He entered into his employment agreement with the Company effective February 7, 2013. |

| (2) | Every fiscal year the CO Committee determines an annualized salary, a target non-equity incentive as a percent of base salary, and a target stock and option award as a percent of salary for the CEO and each NEO. Both the target and realized amounts reflected in this table differ from those shown in the Executive Compensation-Summary Compensation Table for a variety of reasons, including the following: (i) the target equity amounts are based upon target values considered by the CO Committee in making the awards rather than accounting values reflected in the Summary Compensation Table; and (ii) realized amounts disregard the value of the unvested portions of the equity awards granted. The impact of the timing of any salary increase and the number of weeks in the fiscal year affect the actual salary earned in any one fiscal year. In order to neutralize the timing issues the salary in the “Target $” amount is the same as the salary amount in the “Realized $” amount. |

| (3) | Realized compensation is the actual salary earned in the fiscal year and the actual non-equity incentive earned in the fiscal year as reported in the Summary Compensation Table. The realized stock and option awards reflect the value of any stock that vested and the value of any options that vested in the fiscal year (regardless of when granted), with the value reflecting the difference between the strike price at issuance and the stock price at fiscal year closing. The realized stock and option award amount excludes any potential value that may be realized from future vesting or an increase in the Company’s stock price or any future value of stock options that have a strike price higher than the fiscal year closing price. |

9

Table of Contents

The following table reflects the specific realized compensation for each designated NEO for fiscal 2013.

| Incumbent |

Annualized Salary |

Realized Salary (Fiscal) |

Target Bonus |

Realized Bonus |

Target LTI(1) | Realized LTI(1) |

Total Target | Total Realized |

||||||||||||||||||||||||

| Dennis G. Hatchell |

$ | 772,500 | $ | 762,981 | $ | 772,500 | $ | 228,661 | $ | 1,351,875 | $ | 149,788 | $ | 2,896,876 | $ | 1,141,430 | ||||||||||||||||

| B. Clyde Preslar (2) |

$ | 246,154 | $ | 246,154 | $ | 147,692 | $ | 80,000 | $ | 283,077 | $ | — | $ | 676,923 | $ | 326,154 | ||||||||||||||||

| Berry L. Epley |

$ | 237,000 | $ | 237,000 | $ | 94,800 | $ | 28,061 | $ | 118,500 | $ | 11,688 | $ | 450,300 | $ | 276,749 | ||||||||||||||||

| Keith S. Bell |

$ | 319,000 | $ | 316,577 | $ | 191,400 | $ | 56,655 | $ | 366,850 | $ | 85,620 | $ | 877,250 | $ | 458,852 | ||||||||||||||||

| Keith A. Oreson |

$ | 299,000 | $ | 296,577 | $ | 179,400 | $ | 53,103 | $ | 343,850 | $ | 74,141 | $ | 822,250 | $ | 423,821 | ||||||||||||||||

| P. Joseph Venezia |

$ | 335,000 | $ | 335,000 | $ | 201,000 | $ | 100,500 | $ | 385,250 | $ | — | $ | 921,250 | $ | 435,500 | ||||||||||||||||

| Average |

$ | 368,109 | $ | 365,715 | $ | 264,465 | $ | 91,163 | $ | 474,900 | $ | 53,540 | $ | 1,107,475 | $ | 510,418 | ||||||||||||||||

| (1) | Long-Term Incentive Award (“LTI”). |

| (2) | Mr. Preslar was hired on February 7, 2013, therefore the salary, bonus, and LTI reflect a partial year. |

Policies and Practices Supporting Strong Compensation Governance

Annual Compensation Risk Assessment: In January 2011, the CO Committee implemented a formal annual review process of potential risks arising from our compensation programs and practices. Based on its most recent annual review, the CO Committee concluded that the risks were within our ability to effectively monitor and manage and were not reasonably likely to have a material adverse effect on the Company.

Stock Ownership and Retention Guidelines: Our executives are required to achieve ownership of a number of shares of our common stock to further align their interests and actions with the interests of our stockholders. The CEO’s ownership requirement is six times base salary, and the ownership requirement for SVPs is one time base salary. Until the ownership level is achieved executives must retain 75% of net after-tax shares from option exercises and stock vesting.

Clawback Policy: In fiscal 2011, the Company implemented a clawback policy that allows for the recovery of “excess” incentive-based compensation from all executive officers if financials are restated due to material non-compliance with reporting requirements. In addition to a stand-alone policy, the provisions of this clawback policy have been built into the AIP, long-term award agreements and individual employment agreements.

Annual Say-on-Pay Advisory Vote: In the March 2011 proxy statement, our Board recommended an annual advisory (nonbinding) vote on Executive Compensation that received the affirmative vote of 91% of the votes cast at the annual meeting, and therefore determined to hold advisory (nonbinding) votes on Executive Compensation annually. For fiscal 2012, the Advisory vote to ratify NEO compensation received 99% support.

Anti-Hedging Policy: Our employees, officers and directors may not engage in short-term speculative transactions involving trading of the Company’s securities.

Anti-Pledging Policy: In fiscal 2013, the Company implemented an anti-pledging policy. Our employees, officers and directors may not engage in transactions in which Company securities are used as collateral for any loan, including, but not limited to, “margin loans” in a brokerage account.

Gross up: The Company does not gross up excise taxes upon change in control, perquisites or benefits, except for selected relocation expenses.

Limited Perquisites: The CO Committee believes that benefits to executives should generally be aligned with those provided for other employees. The CO Committee views our limited executive perquisites as reasonable and competitive. Additional details regarding these programs can be found in the Benefits & Perquisites section.

Pay for Performance: The CO Committee feels that the actual pay received by our NEOs is appropriately linked to the results that were achieved, as a significant amount of pay is at risk for our NEOs through utilization of our AIP and LTIP design.

Our Executive Compensation Program Governance Practices

Compensation Program Objectives

The primary objectives of our executive compensation program are to fulfill our business and operating needs, comport with our general human resource strategies and enhance stockholder value. We believe the best way to attract, motivate and retain the executive talent essential to the achievement of our short-term and long-term business objectives is to provide a compensation package that:

| • | Provides for base compensation that attracts and retains executives by providing a competitive and appropriate level of fixed cash compensation; |

| • | Rewards executives for the accomplishment of pre-defined business goals and objectives (“pay for performance”); and |

| • | Aligns the interests of management with those of stockholders so that executives will receive financial rewards when performance is at a level that is expected to increase stockholder value. |

10

Table of Contents

The Compensation Process

The CO Committee is responsible for establishing and administering our policies, programs and procedures for annual and long-term executive and director compensation; reviewing and approving any additions or changes to employee benefit programs impacting executive and director compensation; and assessing our organizational structure and the development of our executives. Additional details about the CO Committee’s duties and responsibilities are outlined in its Charter, which can be found on our website at www.thepantry.com.

For the NEOs, the CO Committee reviews and approves all compensation decisions. In making its compensation decisions regarding our CEO, the CO Committee takes into consideration the Board of Directors’ annual performance evaluation of our CEO and competitive market analyses for other CEOs in our peer group based on publicly available information provided by our independent compensation consultant. As part of the review process for NEOs other than our CEO, the CO Committee takes into consideration recommendations from our CEO, competitive market analyses and other quantitative and qualitative factors such as overall Company performance, individual performance, internal pay alignment and retention concerns.

The CO Committee uses an annual calendar that provides a framework in which it works to accomplish each action required of it. Decisions on pay program changes for the fiscal year, including salary increases, bonus plan design and targets, and equity plan design and targets, are typically made in the first quarter of that fiscal year.

Role of Executive Officers

Our CEO and other NEOs have no role in recommending or setting their own compensation. Our CEO makes recommendations to the CO Committee regarding compensation matters related to his direct reports and provides input regarding executive compensation programs and policies.

Role of Compensation Consultant

In June 2011, after completing an extensive review of the incumbent consultant and six other firms, the Committee selected Frederic W. Cook & Co., Inc. (“Cook & Co.”) to be the consultant for the Committee on a go-forward basis. Cook & Co.’s role is to provide the CO Committee with expert analyses, advice and information with respect to executive and non-employee director compensation. A representative of Cook & Co. attends CO Committee meetings, as requested, and communicates with the Chair of the CO Committee between meetings. However, the CO Committee makes all decisions regarding the compensation of executive officers.

During fiscal 2013, Cook & Co. consulted with the CO Committee and management, as directed by the Committee, regarding the following:

| • | Peer group used for comparative pay and performance analyses; |

| • | Market analysis on executive pay for NEO new hires; |

| • | AIP design; |

| • | LTIP design, including grant-type alternatives and performance measures and weightings; |

| • | Target total direct compensation opportunities for our senior executives and aggregate long-term incentive practices versus peers; |

| • | Compensation issues associated with hiring new executives, including executive employment agreement terms and conditions; |

11

Table of Contents

| • | Non-employee director compensation levels and program structure; |

| • | Stock ownership guidelines for executives and non-employee directors; |

| • | Governance issues regarding existing and new regulations related to compensation; and |

| • | Review of sections of the annual proxy statement related to executive and non-employee director compensation. |

Cook & Co. reports directly to the CO Committee and all work conducted by Cook & Co. for the Company is on behalf of the CO Committee. Cook & Co. provides no services to the Company other than executive and non-employee director compensation consulting services and has no other direct or indirect business relationships with the Company or any of its affiliates. All executive compensation services provided by Cook & Co. are conducted under the direction and authority of the CO Committee. In addition, in its consulting agreement with the CO Committee, Cook & Co. agrees to advise the Chair of the CO Committee if any potential conflicts of interest arise that could cause Cook & Co.’s independence to be questioned, and to undertake no projects for management except at the request of the CO Committee Chair and as an agent for the CO Committee. In fiscal 2013, the CO Committee reviewed and confirmed Cook & Co.’s independence.

Role of Benchmarking

When making compensation decisions, the CO Committee compares the compensation of our NEOs against compensation paid to similarly-situated executives at companies in a peer group approved by the CO Committee. The CO Committee also utilizes national retail survey data from the Hay Group, in its review.

Proxy Peer Group

For fiscal 2013, the CO Committee directed Cook & Co. to recommend changes to the peer group and update the competitive compensation analysis for our executive officers. The fiscal 2013 analysis included compensation data from a peer group of companies viewed by the CO Committee as comparable in terms of size, industry, and business complexity. The peer group was selected by the CO Committee after reviewing all publicly-traded companies in the “retail” and “food and staples retail” categories per the Global Industry Classification System, and focusing on those that were “small-box,” food, automotive, fuel, and/or general merchandise retailers operating in multiple states, to reflect the CO Committee’s view of the retailers it considers as likely competitors for our executive talent. Compared to the 2012 peer group, the 2013 peer group excludes five companies and adds seven new companies to form a 14-company peer group. The table below shows the results of these changes:

| 2012 Peer Group (12) |

Deletions (5) |

Additions (7) |

2013 Peer Group (14) | |||

| Alimentation Couche-Tard | Dick’s Sporting Goods | Alon USA Energy | Alimentation Couche-Tard | |||

| Big Lots | Dollar General | Bob Evans | Alon USA Energy | |||

| Casey’s General Stores | O’Reilly Automotive | Cracker Barrel | Big Lots | |||

| Dick’s Sporting Goods | RadioShack | Fred’s | Bob Evans | |||

| Delek US Holdings | Tractor Supply | TravelCenters of America | Casey’s General Stores | |||

| Dollar General | Weis Markets | Cracker Barrel | ||||

| Harris Teeter Supermkts. | Wendy’s | Delek US Holdings | ||||

| O’Reilly Automotive | Fred’s | |||||

| Pep Boys | Harris Teeter Supermkts. * | |||||

| RadioShack | Pep Boys | |||||

| Susser Holdings | Susser Holdings | |||||

| Tractor Supply | TravelCenters of America | |||||

| Weis Markets | ||||||

| Wendy’s |

| * | Kroger to complete purchase of Harris Teeter Supermarkets by January 2014. |

Pay Comparative Methodology

Competitive data was collected from each peer company’s proxy statement, supplemented by more recent data if disclosed in Form 8-K filings. Proxy data was supplemented with survey data from the Hay Group 2012 Retail Executive & Management Total Remuneration Database for certain positions where there was not an exact position match in the proxy peer group. The

12

Table of Contents

companies in this database included the following: Ace Hardware, Advance Auto Parts, Alex Lee, Big Lots, Cabela’s, CBRL Group, Crate and Barrel, Dick’s Sporting Goods, Foot Locker, GNC, Harris Teeter, hhgregg, Michaels Stores, OfficeMax, PETCO, PetSmart, Pier 1 Imports, Rent-A-Center, Shopko Stores, Sports Authority, Tractor Supply, Ulta Salon, Cosmetics & Fragrance, United Natural Foods, Wawa, Wegmans Food Markets and William-Sonoma.

Role of Individual and Company Performance

Although the CO Committee compares our compensation levels to levels for similar positions at peer group companies and examines data from a broader retail sample, it does not rely solely on benchmarking in making its compensation decisions. While a competitive base salary is required to attract and retain executives, the CO Committee believes that a significant portion of the compensation earned by our NEOs should vary with the achievement of the Company’s short-term and long-term business goals. As previously identified, a significant portion of our executives’ total direct compensation is at risk through utilization of our AIP and LTIP design.

To measure individual performance, each NEO has annual objectives that include specific goals related to improving financial and operational results. An executive officer’s individual objectives and measurement of success vary with the individual executive’s area of responsibility. These measurements determine whether an individual is performing his or her job in a satisfactory manner and whether that individual may be eligible for an increase in salary. For each NEO other than the CEO, the CEO makes salary recommendations based on the individual performance of such NEO largely based on their review of achievement related to those objectives. Similarly, the CO Committee takes into consideration the individual performance of the CEO, largely based on its, and the Board’s, review of the achievement related to those goals and objectives established at the beginning of the fiscal year, as well as the demonstration of various competencies including leadership, strategic planning, communications, external relations, talent acquisition and development, board relations and customer focus. The CO Committee considers individual performance and achievement of objectives primarily when setting and adjusting base salary.

The CO Committee develops, measures and sets Company financial targets that apply equally to all NEOs. Due to the pay for performance structure of the AIP and LTIP, the performance of the Company against these key financial measures and the price of the stock determine, to a great extent, the overall realized pay of the NEOs.

Role of Tally Sheets

During fiscal 2013, the CO Committee reviewed tally sheets prepared for each NEO. The tally sheets describe the total dollar value of each NEO’s annual compensation for the past three fiscal years. The total dollar value includes salary, short-term and long-term incentive compensation and the costs incurred by us to provide various health and insurance benefits and perquisites to our NEOs. The tally sheets also describe the mix of compensation, the stock awards and their accumulated realized and unrealized stock gains and the amounts the NEOs will receive if they leave the Company under various circumstances (such as retirement, disability or termination in connection with a change in control).

The tally sheets provide a means of ensuring that the CO Committee is able to make informed decisions regarding the impact on executive officer compensation of changes it considers. These sheets provide insight into the compensation opportunities available to our executive officers (by component and in total), the motivational and retention aspects of outstanding equity plan awards and the potential obligations that could become payable under a variety of possible employment termination scenarios.

Elements of our Executive Compensation Program

The following key components made up the fiscal 2013 executive compensation program for our executive officers including our NEOs.

Base Salary

We consider the following factors in setting base salary levels for our executive officers (without applying a specific weighting to any factor):

| • | The executive’s achievement of his individual goals and objectives as well as the overall manner in which the duties of his assigned role have been carried out; |

| • | The relationship between current salary and appropriate internal and external salary comparisons; |

| • | The range of salary increases being granted by competitors; and |

| • | Whether the responsibilities of the position have changed during the preceding year. |

13

Table of Contents

Each of our NEOs, other than Mr. Epley, entered into an employment agreement with us which establishes the salary for such NEO, subject to increases at the discretion of the CO Committee and/or Board. Base salaries are reviewed annually and may be adjusted, as discussed above, with approval by the CO Committee. Base salaries are set to be competitive with market practices and sufficient to attract and retain executives whose skills are viewed as critical to our ability to achieve our business objectives. Current base salaries for our NEOs are generally between the 25th to 50th percentiles of our comparative benchmarks, depending on the executive’s experience and performance.

The CO Committee made the following decisions related to the fiscal 2013 base salaries for their achievements in fiscal 2012. These increases were effective December 2012:

| • | Mr. Hatchell received a 3% increase to recognize his strong start as CEO, including increasing inside comparable store sales, growing inside gross margin dollars, controlling expenses, his focus on upgrading the management team, and his rapid grasp of key business issues. |

| • | Mr. Bell received a 3% increase reflecting his successful negotiation of the Valero fuel contract, lowering fuel supply chain costs, and the implementation of fuel price optimization. |

| • | Mr. Oreson received a 3% increase to recognize his role in upgrading talent, the improvement in company training, and his leadership in the redesign of the Company’s compensation and benefits programs. |

Mr. Preslar was hired on February 7, 2013 and Mr. Venezia was hired on September 9, 2012 and therefore, they did not receive salary increases in fiscal 2013. Mr. Epley received a salary increase at the end of fiscal 2012 and did not receive a salary increase in fiscal 2013.

Annual Incentive Award

Our AIP is designed to reward the achievement of annual performance goals. It is one of our key management incentive plans covering 294 employees, including all of our NEOs. The AIP targets are competitively positioned with our comparative benchmarks generally at the 50th percentile. All participants, including our NEOs, are assigned target incentive opportunities expressed as a percent of fiscal base salary in fiscal 2013 as shown in the table called Grants of Plan-Based Awards. Actual payouts that can be earned by any of our NEOs can vary from 50% of target awards for achieving threshold performance goals to 200% of target awards for achieving or exceeding maximum performance targets.

The CO Committee reviewed the design of our AIP for fiscal 2013 and made several revisions intended to tie our rewards more closely to our strategic objectives while continuing to drive stockholder value:

| • | The CO Committee modified the financial performance metrics and weights for its fiscal 2013 program. The CO Committee increased the weighting for the Inside Comparable Store Sales growth metric from 35% to 40% weight, as sales growth is a key determinate of the health of the business. The Inside Net Profit Contribution (merchandise gross margin dollars minus store operating and general and administrative expenses) metric replaced the Merchandise Gross Profit Ratio metric and was weighted at 35%. The CO Committee changed the measure because the CO Committee believes the Inside Net Profit Contribution metric more accurately reflects the financial productivity of the sales inside our stores. The CO Committee decreased the weighting for the Fuel Gross Margin Dollars (gasoline sales minus the cost of gasoline sales) metric from 30% to 25%, to put more weighting to our year over year sales growth, which the CO Committee believes is a critical driver of our future growth. |

| • | Adjusted EBITDA (earnings before interest, taxes, depreciation and amortization adjusted for one-time accounting charges not forecasted but approved by CO Committee) continues to be an important aspect of the AIP in serving as a “qualifier” for the fiscal 2013 plan. We believe Adjusted EBITDA is a key measure our stockholders used to evaluate our performance. If a certain minimum level of Adjusted EBITDA is not achieved, no payments attributed to the other financial performance metrics (Inside Comparable Store Sales, Inside Net Profit Contribution and Fuel Gross Margin Dollars) will be earned under the plan. In addition, the CO Committee added Inside Net Profit Contribution and Fuel Gross Margin Dollars qualifiers. Threshold performance on both metrics must be met to allow a bonus payout for any individual measure to exceed 100%. |

| • | The chart below shows the measures and results for fiscal 2013. In accordance with the plan, when evaluating performance under the AIP, the Committee excluded extraordinary items associated with a strategic consulting project and a legal settlement. |

14

Table of Contents

| 2013 Annual Incentive Plan Performance Measures and Results |

||||||||||||||||||||||||||||

| Performance Measures |

Weighting | Threshold | Target | Maximum | 2013 Results |

Performance as a % of Target |

Payout as a % of Target |

|||||||||||||||||||||

| Comp Store Sales Growth |

40 | % | 3 | % | 5 | % | 7 | % | 0.9 | % | — | % | — | % | ||||||||||||||

| Inside Net Profit Contribution (1) |

35 | % | $ | (0.9 | ) | $ | 12.5 | $ | 25.9 | $ | 8.4 | 84.6 | % | 84.6 | % | |||||||||||||

| Fuel Gross Margin Dollars |

25 | % | $ | 210.3 | $ | 217.4 | $ | 235.3 | $ | 199.3 | — | % | — | % | ||||||||||||||

| Payout as % of Target Award (2) |

50 | % | 100 | % | 200 | % | 29.6 | % | 29.6 | % | ||||||||||||||||||

| (1) | Excludes extraordinary items associated with a strategic consulting project and a legal settlement. |

| (2) | Minimum Adjusted EBITDA of $198.9 million had to be achieved for any payment to be made. Actual Adjusted EBITDA achievement was $207.6 million excluding extraordinary items associated with a strategic consulting project and a legal settlement. |

Long-Term Incentive Awards

The CO Committee granted long-term incentive awards in fiscal 2013 pursuant to our Omnibus Plan. We provide long-term incentive awards to ensure that our overall compensation program is competitive and supports our goal of attracting and retaining talented executives. The LTI targets are competitively positioned with our comparative benchmarks generally at the 50th percentile. Long-term incentive awards are intended to align the interests of our NEOs and other key employees with those of our stockholders, especially when combined with our minimum stock ownership requirements (discussed below), to reward executives for achieving our long-term business objectives and for creating and improving stockholder value, and to promote long-term retention of our executives.

Fiscal 2013 Equity Grants - Type and Mix

In December 2012, the CO Committee granted long-term incentive awards to eligible NEOs with the following mix: 55% performance-based restricted stock, 30% time-based restricted stock and 15% stock options. We consider all equity-based compensation to be performance-based, in that the ultimate value is tied to our share price and total stockholder return performance. The CO Committee chose this mix to reflect market trends and to align our compensation program with our pay for performance philosophy by providing the majority of each executive’s long-term incentive earning opportunity in the form of performance-based restricted stock. The target award opportunity as a percentage of base salary (based on grant date fair value at target) was 175% for our CEO and 115% for eligible NEOs with the exception of Mr. Epley whose target award opportunity was 50%. Due to an inducement commitment for the grant of time-based restricted stock under Mr. Hatchell’s employment agreement, he was not expected to receive regular time-based restricted stock for the fiscal 2013 grant under our long-term incentive program, but did receive grants of performance-based restricted stock and stock options under the program. Our inducement commitment for time-based restricted stock pursuant to Mr. Hatchell’s employment agreement is described below under Executive Employment Agreements- CEO Employment Agreement - Inducement Equity Grants.

15

Table of Contents

| Award Type |

Grant Date Fair Value Mix |

Reason for Type of Award | ||

| Performance-Based Restricted Stock | 55% | The CO Committee emphasizes performance-based, at-risk equity awards. The shares of performance-based restricted stock vest only if certain performance goals are achieved and align the executive officers’ incentives with both our operational and stockholder return performance. | ||

| Time-Based Restricted Stock | 30% | The shares of time-based restricted stock are intended primarily as a long-term retention tool to encourage executive officers to continue to serve the Company. The CO Committee believes that time-based restricted stock will also align the interests of executives with stockholders by encouraging executives to focus on maximizing stockholder value as the economic value of these awards is tied to our stock price. | ||

| Stock Options | 15% | Stock options are also intended to align our executive officers’ interests with our stockholders’ interests and to reward share price appreciation, as stock options have value to executive officers only if our share price increases. | ||

For fiscal 2013, the CO Committee believes that the combination of these types and amounts of stock awards fell within the targeted range for competitiveness and gave executives considerable incentive to maximize long-term financial growth for our stockholders. Specific grants to our NEOs made in fiscal 2013 are disclosed in the Grants of Plan-Based Awards in Fiscal 2013 table below.

Performance-Based Restricted Stock

Fiscal 2013 Performance-Based Grants

For performance-based restricted stock granted in fiscal year 2013, the CO Committee kept the percent of performance-based restricted stock at 55% of total equity for eligible NEO’s but changed the performance measurement period to be based on the first year’s Adjusted EBITDA results. Any shares earned vest over three years in three annual installments commencing on the first anniversary of the grant date. Participants have the opportunity to earn up to 150% of the target number of shares. Based on fiscal 2013 performance, the CO Committee determined that fiscal 2013 Adjusted EBITDA did not meet the threshold level, resulting in no shares vesting.

Fiscal 2012 Performance-Based Grants

For performance-based restricted stock granted in fiscal year 2012, the CO Committee kept the percent of performance-based restricted stock at 55% of total equity for eligible NEOs and used the same design and structure as was used in the fiscal 2011 grant. That is, the grant included both one-year and three-year performance periods to focus executives on our growth strategy and achieving long-term results. Shares of the fiscal 2012 grant may vest in each of three performance periods beginning on December 16, 2012. The performance goals are based on year over year Adjusted EBITDA growth. Participants have the opportunity to earn up to 33.3% of the target number of shares granted for annual Adjusted EBITDA performance in each of fiscal years 2012 and 2013. At the end of fiscal 2014, participants may earn up to 150% (minus the shares earned in the first two years) of the full target number of shares based on cumulative Adjusted EBITDA performance over the three-year period. Based on fiscal 2013 performance, the CO Committee determined that fiscal 2013 Adjusted EBITDA did not meet the threshold level, resulting in no shares vesting in the second performance period of this grant.

Fiscal 2011 Performance-Based Grants