Attached files

| file | filename |

|---|---|

| 8-K - NOVAGOLD RESOURCES INC. 8-K - NOVAGOLD RESOURCES INC | novagold8k.htm |

Exhibit 99.1

NOVAGOLD’s 2013 Drill Results at Galore Creek

Identify Extensions to Mineralization at Legacy Zone

|

u

|

11,600-meter drill program confirmed significant mineralization in areas within and adjacent to the Legacy zone

|

|

u

|

Results should provide sufficient basis to arrive at an initial resource of the Legacy zone

|

|

u

|

The program planned for 2014 is focused on studies that could add further value to Galore Creek

|

January 23, 2014 — Vancouver, British Columbia — NOVAGOLD RESOURCES INC. (TSX, NYSE-MKT: NG) announces the results of the 2013 in-fill and exploration drilling program at its 50%-owned Galore Creek property, located in the Territory of the Tahltan Nation in northwestern British Columbia, Canada. Galore Creek is a large copper-gold-silver project held by a partnership in which NOVAGOLD and Teck Resources Inc. (“Teck”) each own a 50% interest. The 2013 program was completed ahead of schedule and below budget and confirmed significant mineralization at the recently discovered Legacy zone. The program also identified areas for potential resource growth.

The 2013 drill program focused on assessing the extent of the Legacy mineralization and evaluating its impact on future mine and project design. The objectives of the program were to:

|

u

|

Increase the density of drilling in the Legacy zone to the level required for the establishment of Inferred resources;

|

|

u

|

Provide new drill data to increase resource model confidence; and

|

|

u

|

Explore possible extension of known mineralized zones: Bountiful to the north, Legacy to the South, and potential connection of these two zones.

|

Program Highlights

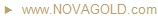

The most significant intersections from in-fill and exploration drilling in the Legacy zone were as follows:

|

u

|

GC13-0889 intersected 129 meters grading 0.72% copper, 0.17 g/t gold and 7.2 g/t silver

|

|

u

|

GC13-0890 intersected 117 meters grading 0.63% copper, 0.16 g/t gold and 8.3 g/t silver

|

|

u

|

GC13-0895 intersected 135 meters grading 1.50% copper, 0.34 g/t gold and 13.2 g/t silver, and a further 84 meters grading 0.78% copper, 0.10 g/t gold and 8.8 g/t silver

|

|

u

|

GC13-0901 intersected 58 meters grading 0.87% copper, 0.20 g/t gold and 12.6 g/t silver

|

“The 2013 drill program at Galore Creek produced excellent results which exceeded our stated objectives,” said Greg Lang, NOVAGOLD’s President and Chief Executive Officer. “With more than 11,600-meters drilled, the in-fill and exploration drilling confirmed significant mineralization in areas within and adjacent to the Legacy zone. The work was completed ahead of schedule and under budget. I would like to congratulate all members of the team on their hard work, enhanced safety practices and, most importantly, zero lost-time injuries.”

Mr. Lang further added: “If developed as envisioned in the pre-feasibility study (PFS), Galore Creek is expected to become the largest and lowest-cost copper mine in Canada, one of the most mining friendly jurisdictions in the world. In 2014, along with Teck, NOVAGOLD plans to carry out additional technical studies to further enhance the value of this significant project. NOVAGOLD continues to explore opportunities to monetize the value of its share of Galore Creek and redeploy the proceeds towards advancement of its flagship Donlin Gold project in Alaska. We believe that the results of the 2013 drill campaign and the work we plan for 2014 should facilitate this process both from the standpoint of marketability as well as value of Galore Creek.”

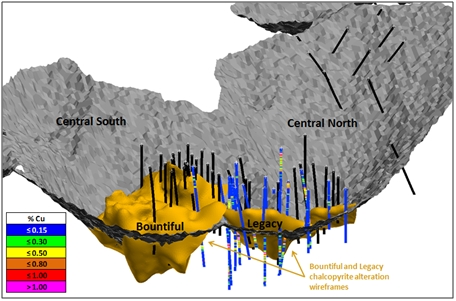

In 2013, Galore Creek completed 22 in-fill and exploration drill holes totaling 11,649-meters, 9,157-meters of which targeted the Legacy Zone. An additional 2,492 meters of exploration drilling was conducted to better understand geological features that could influence the mineralization in Legacy, identify mineralization trends, and explore possible extensions of known mineralized zones adjacent to Legacy. All assay results from the program have been received. From the 22 drill holes, 11 encountered 21 significant mineralized intercepts, as shown and defined in Table 1. The 2013 program increased the drill density to a level required to support an Inferred resource classification of the Legacy zone. As illustrated in Figure 1 below, the 2013 results also demonstrated that the copper mineralization may be extending beyond the initial Legacy discovery in the direction of the Bountiful mineralization. The mineralization remains open to the south, west, and at depth.

Page | 1

Figure 1: Model looking west at the Bountiful and Legacy zones showing copper mineralization wireframes and drill holes from 2012 (shown in black) and 2013 (shown in blue) drilling.

Drilling and Project Development to Date

NOVAGOLD published the Galore Creek PFS (as defined below) on July 27, 2011. The study confirmed the technical and economic viability of the project and identified opportunities to increase mineral resources and extend the project’s life. Throughout 2011 and 2012, resource and geotechnical drilling were carried out to upgrade the classification of Inferred mineral resources and obtain data to support further mine planning and engineering. An extensive 27,900-meter drilling campaign was completed in 2012. It confirmed previously reported drill results and demonstrated the potential for substantial extension of the mineralized area beyond the limits of the current PFS pit. Notably, it led to the discovery of the 700-meter long mineralized zone located northeast of Bountiful and adjacent to the eastern extents of the Central Pit called the Legacy zone. Approximately 1,212 core holes and 311,181 meters have been drilled in the project area since discovery.

The Galore Creek PFS outlined a large-scale open-pit mine with a conventional 95,000-tonne-per-day milling and concentrating facility. The PFS was based on Proven and Probable mineral reserves totaling 528 million tonnes grading 0.59% copper, 0.32 grams per tonne gold and 6.02 grams per tonne silver. Measured and Indicated mineral resources, exclusive of reserves totaled 287 million tonnes grading 0.33% copper, 0.27 grams per tonnes gold and 3.64 grams per tonne silver and Inferred mineral resources totaled 347 million tonnes grading 0.42% copper, 0.24 grams per tonne gold and 4.28 grams per tonne silver. Mineral resources that are not mineral reserves do not have demonstrated economic viability. The Galore Creek PFS, evaluated on a 100% basis, yielded a Net Present Value (“NPV7%”) of C$837 million and C$137 million on pre-tax and post-tax bases, respectively, using the base case metal price assumptions of US$2.65/lb copper, US$1,100/oz gold and US$18.50/oz silver and exchange rates of US$0.91 = Cdn$1.00.

Page | 2

Partnerships

NOVAGOLD hires locally whenever possible, collaborating with communities to create training, employment and business opportunities in the area. During the 2013 field program, ten local Tahltan businesses provided a significant portion of the on-site contract services.

2014 Outlook

NOVAGOLD and Teck have agreed to incorporate the 2012 and 2013 results into a capital efficient work plan that will advance the Galore Creek project toward a new resource and reserve estimate for next-level mine planning and design. As such, the 2014 work plan includes technical studies in the areas of environmental and water management, as well as site layout. Although the Legacy zone is still open, no drill program is planned for 2014. Further guidance on the 2014 budget will be provided in the fourth quarter results. In the meantime, the Company will continue to evaluate opportunities to monetize the value of the asset.

Table 1: Galore Creek Significant Drill Intervals

Footnotes to Drill Interval Table:

|

1.

|

AI = Continuous Assayed Interval (meters)

|

|

2.

|

Results are core intervals and not true thickness.

|

|

3.

|

Significant interval defined as a minimum 20.0 meter Cu interval with average grade ≥ 0.35% Cu.

|

|

4.

|

Mineralized cutoff grade of 0.20% Cu.

|

|

5.

|

Internal dilution up to eight continuous meters of <0.20% Cu allowed.

|

|

6.

|

Intervals of <20m and/or weight average grade <0.35% Cu, not reported.

|

|

7.

|

Some rounding errors may occur.

|

Quality Control

The drill program and sampling protocol were managed by qualified persons employed by Galore Creek Mining Company. The diamond drill holes were typically collared using HQ diameter drill core and reduced to NQ diameter during the drilling process. Samples were collected using a 0.5-meter minimum length and three-meter maximum length with 2.5-meters being the average sample length. Drill core recovery averaged 97%. Three quality control samples (one blank, one standard and one duplicate) were inserted into each batch of 20 samples. The drill core was sawn, with half sent to ALS Minerals in Terrace for sample preparation and the sample pulps forwarded to ALS Minerals’ North Vancouver facility for analysis. ALS Minerals is certified as ISO 9001:2008 and accredited to ISO / IEC 17025:2005 from the Standards Council of Canada.

Page | 3

Qualified Person

Heather White, P. Eng., President at White Mining Consulting Inc., and a consultant to NOVAGOLD, is a Qualified Person as defined by National Instrument 43-101. Ms. White has reviewed the results of the drill program and confirmed that all procedures, protocols and methodologies used in the drill program conform to industry standards and approves the disclosure contained herein.

About NOVAGOLD

NOVAGOLD is a well-financed precious metals company engaged in the exploration and development of mineral properties in North America. Its flagship asset is the 50%-owned Donlin Gold project in Alaska, one of the safest jurisdictions in the world. With approximately 39,000,000 ounces of gold in the Measured and Indicated resourcees categories (541 million tonnes at an average grade of approximately 2.2 grams per tonne), Donlin Gold is regarded to be one of the largest, highest quality, and most prospective known gold deposits in the world. According to the updated feasibility study (as defined below), once in production, Donlin Gold should average approximately 1,500,000 ounces of gold per year for the first five full years, followed by decades of more than one million ounces of gold per year on a 100% basis. The Donlin Gold project has substantial exploration potential beyond the designed footprint which currently covers only three kilometers of an approximately eight-kilometer long gold bearing trend. Current activities at Donlin Gold are focused on permitting, community outreach and workforce development in preparation for the construction and operation of this top tier asset. The Donlin Gold project commenced permitting in 2012, a clearly defined process expected to take approximately 4 years. NOVAGOLD also owns 50% of the Galore Creek copper-gold-silver project located in northern British Columbia. According to the 2011 PFS, once in production, Galore Creek is expected to be the largest copper mine in Canada, a tier-one jurisdiction. NOVAGOLD is currently evaluating opportunities to sell all or a portion of its interest in Galore Creek and would apply the proceeds toward the development of Donlin Gold. NOVAGOLD is well positioned to stay the course and take Donlin Gold through permitting and up to a construction decision.

Scientific and Technical Information

Certain scientific and technical information contained herein with respect to Galore Creek is derived from the technical report entitled “Galore Creek Project British Columbia NI 43-101 Technical Report on Pre-Feasibility Study” dated effective July 27, 2011. The Qualified Persons responsible for the preparation of the independent technical report are Robert Gill, P.Eng., Principal Consultant and Study Manager (AMEC Americas Limited), Greg Kulla, P. Geo., Principal Geologist (AMEC Americas Limited), Gregory Wortman, P. Eng., Technical Director Process (AMEC Americas Limited), Jay Melnyk, P. Eng. (AMEC Americas Limited), and Dana Rogers, P.E., Principal Tunnelling Engineer (Lemley International), each of whom are independent “qualified persons” as defined by NI 43-101.

Scientific and technical information contained herein with respect to Donlin Gold is derived from the “Donlin Creek Gold Project Alaska, USA NI 43-101 Technical Report on Second Updated Feasibility Study” compiled by AMEC. Kirk Hanson, P.E., Technical Director, Open Pit Mining, North America, (AMEC, Reno), Gordon Seibel, R.M. SME, Principal Geologist, (AMEC, Reno), Tony Lipiec, P.Eng. Manager Process Engineering (AMEC, Vancouver) are the Qualified Persons responsible for the preparation of the independent technical report, each of whom are independent “qualified persons” as defined by NI 43-101.

Page | 4

NOVAGOLD Contact:

Mélanie Hennessey

Vice President, Corporate Communications

Erin O’Toole

Analyst, Investor Relations

604-669-6227 or 1-866-669-6227

Cautionary Note Regarding Forward-Looking Statements

This press release includes certain “forward-looking information” and “forward-looking statements” (collectively “forward-looking statements”) within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the timing of permitting and potential development of the Project, statements relating to NOVAGOLD’s future operating and financial performance, outlook, and the potential sale of all or part of NOVAGOLD’s interest in Galore Creek are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible”, and similar expressions, or statements that events, conditions, or results “will”, “may”, “could”, or “should” occur or be achieved. These forward-looking statements may include statements regarding perceived merit of properties; exploration results and budgets; mineral reserves and resource estimates; work programs; capital expenditures; timelines; strategic plans; completion of transactions; market prices for precious and base metals; intended use of proceeds; or other statements that are not statements of fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from NOVAGOLD’s expectations include the uncertainties involving the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; the need for continued cooperation with Barrick Gold Corporation and Teck Resources Limited for the continued exploration and development of the Donlin Gold and Galore Creek properties; the need for cooperation of government agencies and native groups in the development and operation of properties; the need to obtain permits and governmental approvals; risks of construction and mining projects such as accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements, unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases, which could include significant increases in estimated capital and operating costs; fluctuations in metal prices and currency exchange rates; and other risk and uncertainties disclosed in NOVAGOLD’s Annual Information Form for the year-ended November 30, 2011, filed with the Canadian securities regulatory authorities, and NOVAGOLD’s annual report on Form 40-F filed with the United States Securities and Exchange Commission and in other NOVAGOLD reports and documents filed with applicable securities regulatory authorities from time to time. NOVAGOLD’s forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made. NOVAGOLD assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

Cautionary Note to United States Investors

This press release has been prepared in accordance with the requirements of the securities laws in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all resource and reserve estimates included in this press release have been prepared in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects ("NI 43-101”) and the Canadian Institute of Mining, Metallurgy, and Petroleum Definition Standards on Mineral Resources and Mineral Reserves. NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission ("SEC”), and resource and reserve information contained herein may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term "resource” does not equate to the term "reserves”. Under U.S. standards, mineralization may not be classified as a "reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves. The SEC's disclosure standards normally do not permit the inclusion of information concerning "measured mineral resources”, "indicated mineral resources” or "inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute "reserves” by U.S. standards in documents filed with the SEC. Investors are cautioned not to assume that any part or all of mineral deposits in these categories will ever be converted into reserves. U.S. investors should also understand that "inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an "inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated "inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an "inferred mineral resource” exists or is economically or legally mineable. Disclosure of "contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute "reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of "reserves” are also not the same as those of the SEC, and reserves reported by NOVAGOLD in compliance with NI 43-101 may not qualify as "reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable with information made public by companies that report in accordance with U.S. standards.

Page | 5