Attached files

| file | filename |

|---|---|

| 8-K - 8-K - TEXAS CAPITAL BANCSHARES INC/TX | d659976d8k.htm |

| EX-99.1 - EX-99.1 - TEXAS CAPITAL BANCSHARES INC/TX | d659976dex991.htm |

| EX-99.3 - EX-99.3 - TEXAS CAPITAL BANCSHARES INC/TX | d659976dex993.htm |

| EX-99.4 - EX-99.4 - TEXAS CAPITAL BANCSHARES INC/TX | d659976dex994.htm |

January 22, 2014

TCBI Q4 2013

Earnings

Exhibit 99.2 |

Certain

matters

discussed

on

this

call

may

contain

forward-looking

statements,

which

are

subject

to

risks

and

uncertainties

and

are

based

on

Texas

Capital’s

current

estimates

or

expectations

of

future

events

or

future

results.

Texas

Capital

is

under

no

obligation,

and

expressly

disclaims

such

obligation,

to

update,

alter

or

revise

its

forward-looking

statements,

whether

as

a

result

of

new

information,

future

events

or

otherwise.

A

number

of

factors,

many

of

which

are

beyond

Texas

Capital’s

control,

could

cause

actual

results

to

differ

materially

from

future

results

expressed

or

implied

by

such

forward-looking

statements.

These

risks

and

uncertainties

include

the

risk

of

adverse

impacts

from

general

economic

conditions,

competition,

interest

rate

sensitivity

and

exposure

to

regulatory

and

legislative

changes.

These

and

other

factors

that

could

cause

results

to

differ

materially

from

those

described

in

the

forward-looking

statements

can

be

found

in

the

prospectus

supplements,

the

Annual

Report

on

Form

10-K

and

other

filings

made

by

Texas

Capital

with

the

Securities

and

Exchange

Commission

(SEC).

2 |

Opening Remarks

•

Exceptional growth in loans and deposits for 2013

•

Capital raising consistent with market opportunity for growth

•

Continued improvement in NPAs with low level of charge-offs for the

year •

2013 non-interest expense includes hiring foundation of market

leading talent supporting 2014 growth and beyond

•

Mortgage Finance levels up, with 2013 average slightly up as compared

to 2012 average, and continued to outperform the industry

3 |

Financial Review

Net Income

–

Decrease in net income of 9% compared to Q3-2013; full year net

income consistent with 2012 –

Profitability –

ROA and ROE remained strong, despite decrease in net income

–

Net Revenue

•

3% increase from Q3-2013

•

8% growth from Q4-2012

–

Exceptional growth in LHI average balances (excluding mortgage

finance) and Total Loans •

Growth of 5% from Q3-2013 and 22% from Q4-2012

•

Clear increase in market share for Mortgage Finance with growth of 2%

from 2012 and modest decrease from Q3-2013

–

Margin remained consistent with Q3-2013 at 4.21%

•

Strong LHI levels, improved composition with reduced proportion of MF

Loan balances and yields •

Improved funding profile from continued growth in DDA and total

deposits –

Correction of error

for

accounting

of

Mortgage

Finance

–

formerly

LHS

•

Previously classified as Held for Sale; will now be consistent with

regulatory accounting and treated as Held for Investment

•

No

change

in

business

direction

–

anticipate

continued

improvement

in

market

position

•

No

change

in

character

of

the

assets

–

quality,

liquidity

and

duration

unaffected

•

No

change

in

any

aspect

of

the

business

–

still

producing

excellent

returns

with

highly

liquid ownership

interests in individual mortgage loans of superior quality

4

Operating Leverage, Core Earnings Power & NIM

LHI/LHS Accounting |

Financial Review

Loan Growth

–

Broad-based growth in traditional LHI (excluding Mortgage

Finance) •

Growth of $435.1 million from Q3-2013 and $1.7 billion from

Q4-2012 •

Period end balance $343.7 million over average balance for the

quarter •

Averages increased 5% from Q3-2013 and 22% from Q4-2012

–

Average MF balances consistent with objectives

•

Results well above industry trends demonstrate increase in market

position and management’s focus on providing ongoing

income •

Growth of 2% from 2012 and only modest decrease from Q3-2013

–

Q4-2013 expenses were largest factor in linked quarter earnings

change, including those associated with exceptional performance

and growth •

Cost of long-term incentives increased $3.6 million ($0.06 per

share) resulting from unprecedented increase in stock price

from Q3-2013 •

Incentive true-up of $1.6 million (almost $0.03 per share) for

lines of business producing average of 20% increase in earnings

contribution from 2012 •

Build-out

expense

of

$0.02

per

share

related

to

exceptional

recruiting

in

Q3,

expansion

of

business

lines

and impact of lag in growth of support and infrastructure costs

associated with growth •

For all of 2013, the “unusual”

items represented almost $20 million

5

Expense Management |

Financial Review

Funding

–

Funding profile optimal with exceptional DDA and total deposit

growth •

Average DDA increased 5% from Q3-2013 and 40% from

Q4-2012 •

Total average deposits increased 5% from Q3-2013 and 31% from

Q4-2012 –

Total deposit cost stable at 17 bps

Credit Costs

–

Total credit costs of $5.4 million for Q4-2013

•

Provision of $5.0 million consistent with Q3-2013

•

OREO valuation cost of $466,000 in Q4-2013 associated with 60%

reduction in total ORE balances •

NCOs of 6 bps in Q4-2013 and 7 bps for all of 2013

•

Favorable trend in NPA ratio with $11.1 million (23%) decrease from

Q3-2013 6 |

Income Statement -

Quarterly

7

Q4-13

Q3-13

Q2-13

Q1-13

Q4-12

Net interest income

$ 111,475

$ 108,776

$ 101,220

$ 98,042

$ 101,155

Non-interest income

11,184

10,431

11,128

11,281

12,836

Net revenue

122,659

119,207

112,348

109,323

113,991

Provision for credit losses

5,000

5,000

7,000

2,000

4,500

OREO valuation and write-down expense

466

-

382

71

955

Total provision and OREO valuation

5,466

5,000

7,382

2,071

5,455

Non-interest expense

69,825

62,009

68,352

55,629

59,119

Income before income taxes

47,368

52,198

36,614

51,623

49,417

Income tax expense

17,012

18,724

12,542

18,479

17,982

Net income

30,356

33,474

24,072

33,144

31,435

Preferred stock dividends

2,438

2,437

2,438

81

–

Net income available to common shareholders

$ 27,918

$ 31,037

$ 21,634

$ 33,063

$ 31,435

Diluted EPS

$ .67

$ .74

$ .52

$ .80

$ .76

Net interest margin

4.21%

4.21%

4.19%

4.27%

4.27%

ROA

1.10%

1.25%

0.95%

1.38%

1.27%

ROE

11.94%

13.74%

9.94%

15.82%

15.35%

Efficiency

(1)

56.9%

52.0%

60.8%

50.9%

51.9%

(1) Excludes OREO valuation charge

|

Income Statement -

Annual

8

2013

2012

2011

2010

2009

Net interest income

$ 419,513

$ 376,879

$ 302,937

$ 241,674

$ 196,691

Non-interest income

44,024

43,040

32,232

32,263

29,260

Net revenue

463,537

419,919

335,169

273,937

225,951

Provision for credit losses

19,000

11,500

28,500

53,500

43,500

OREO valuation and write-down expense

920

6,883

6,798

8,504

7,809

Total provision and OREO valuation

19,920

18,383

35,298

62,004

51,309

Non-interest expense

255,814

212,961

181,403

154,984

137,733

Income before income taxes

187,803

188,575

118,468

56,949

36,909

Income tax expense

66,757

67,866

42,366

19,626

12,522

Net income

121,046

120,709

76,102

37,323

24,387

Preferred stock dividends

7,394

–

–

–

–

Net income available to common shareholders

$ 113,652

$ 120,709

$ 76,102

$ 37,323

$ 24,387

Diluted EPS

$ 2.72

$ 3.01

$ 1.99

$ 1.00

$ .56

Net interest margin

4.22%

4.41%

4.68%

4.28%

3.89%

ROA

1.17%

1.35%

1.12%

.63%

.46%

ROE

12.82%

16.93%

13.39%

7.23%

5.15%

Efficiency

(1)

55.2%

49.8%

54.1%

56.6%

61.0%

(1) Excludes OREO valuation charge

|

QTD Average Balances, Yields and Rates

9

(in thousands)

Q4 2013

Q3 2013

Q4 2012

Avg. Bal.

Yield Rate

Avg. Bal.

Yield Rate

Avg. Bal.

Yield Rate

Assets

Securities

$ 65,067

4.25%

$ 71,717

4.25%

$103,483

4.55%

Fed funds sold & liquidity investments

158,594

.21%

167,613

.19%

91,503

.27%

Loans held for investment, mortgage finance

2,238,730

3.59%

2,362,118

3.79%

2,658,092

3.96%

Loans held for investment

8,142,569

4.73%

7,731,901

4.72%

6,662,817

4.79%

Total loans, net of reserve

10,297,290

4.52%

10,014,468

4.53%

9,246,997

4.59%

Total earning assets

10,520,951

4.45%

10,253,798

4.46%

9,441,983

4.55%

Total assets

$10,899,266

$10,637,766

$9,869,282

Liabilities and Stockholders’

Equity

Total interest bearing deposits

$ 5,887,252

.26%

$ 5,612,874

.26%

$4,662,116

.28%

Other borrowings

314,018

.20%

539,767

.20%

1,725,129

.19%

Subordinated notes

111,000

6.58%

111,000

6.54%

12,065

6.56%

Long-term debt

113,406

2.21%

113,406

2.23%

113,406

2.33%

Total interest bearing liabilities

6,425,676

.40%

6,377,047

.40%

6,611,651

.40%

Demand deposits

3,289,307

3,124,602

2,356,758

Stockholders’

equity

1,077,822

1,046,477

814,565

Total liabilities and stockholders’

equity

$10,899,266

.24%

$10,637,766

.24%

$9,869,282

.27%

Net interest margin

4.21%

4.21%

4.27% |

10

YTD Average Balances, Yields and Rates

10

(in thousands)

2013

2012

Avg. Bal.

Yield Rate

Avg. Bal.

Yield Rate

Assets

Securities

$ 77,178

4.39%

$117,375

4.46%

Fed funds sold & liquidity investments

144,050

.21%

72,689

.30%

Loans held for investment, mortgage finance

2,342,149

3.75%

2,298,651

4.06%

Loans held for investment

7,471,676

4.73%

6,148,860

4.88%

Total loans, net of reserve

9,735,543

4.53%

8,375,424

4.70%

Total earning assets

9,956,771

4.47%

8,565,488

4.66%

Total assets

$10,348,404

$8,965,960

Liabilities and Stockholders’

Equity

Total interest bearing deposits

$ 5,407,810

.26%

$4,459,836

.31%

Other borrowings

653,318

.19%

1,585,723

.20%

Subordinated notes

111,000

6.60%

30,934

6.58%

Long-term debt

113,406

2.24%

113,406

2.43%

Total interest bearing liabilities

6,285,534

.40%

6,189,899

.35%

Demand deposits

2,967,063

1,984,171

Stockholders’

equity

1,001,215

713,190

Total liabilities and stockholders’

equity

$10,348,404

.24%

$8,965,960

.24%

Net interest margin

4.22%

4.41% |

Financial Summary

11

(in thousands)

QTD Averages

Q4 2013

Q3 2013

Q4 2012

Q4/Q3 %

Change

YOY %

Change

Total assets

$10,899,266

$10,637,766

$9,869,282

2%

10%

Loans held for investment

8,142,569

7,731,901

6,662,817

5%

22%

Loans held for investment, mortgage finance

2,238,730

2,362,118

2,658,092

(5)%

(16)%

Total loans

10,381,299

10,094,019

9,320,909

3%

11%

Securities

65,067

71,717

103,483

(9)%

(37)%

Demand deposits

3,289,307

3,124,602

2,356,758

5%

40%

Total deposits

9,176,559

8,737,476

7,018,874

5%

31%

Stockholders’

equity

1,077,822

1,046,477

814,565

3%

32% |

12

Financial Summary

12

(in thousands)

YTD Averages

2013

2012

YOY % Change

Total assets

$10,348,404

$8,965,961

15%

Loans held for investment

7,471,676

6,148,860

22%

Loans held for investment, mortgage finance

2,342,149

2,298,651

2%

Total loans

9,813,825

8,447,511

16%

Securities

77,178

117,375

(34)%

Demand deposits

2,967,063

1,984,171

50%

Total deposits

8,374,873

6,444,007

30%

Stockholders’

equity

1,001,215

713,190

40% |

Financial Summary

13

(in thousands)

Period End

Q4 2013

Q3 2013

Q4 2012

Q4/Q3 %

Change

YOY %

Change

Total assets

$11,714,397

$10,797,448

$10,540,542

8%

11%

Loans held for investment

8,486,309

8,051,328

6,785,535

5%

25%

Loans held for investment, mortgage finance

2,784,265

2,262,085

3,175,272

23%

(12)%

Total loans

11,270,574

10,313,413

9,960,807

9%

13%

Securities

63,214

67,815

100,195

(7)%

(37)%

Demand deposits

3,347,567

3,242,060

2,535,375

3%

32%

Total deposits

9,257,379

8,957,081

7,440,804

3%

24%

Stockholders’

equity

1,096,350

1,066,629

836,242

3%

31% |

14

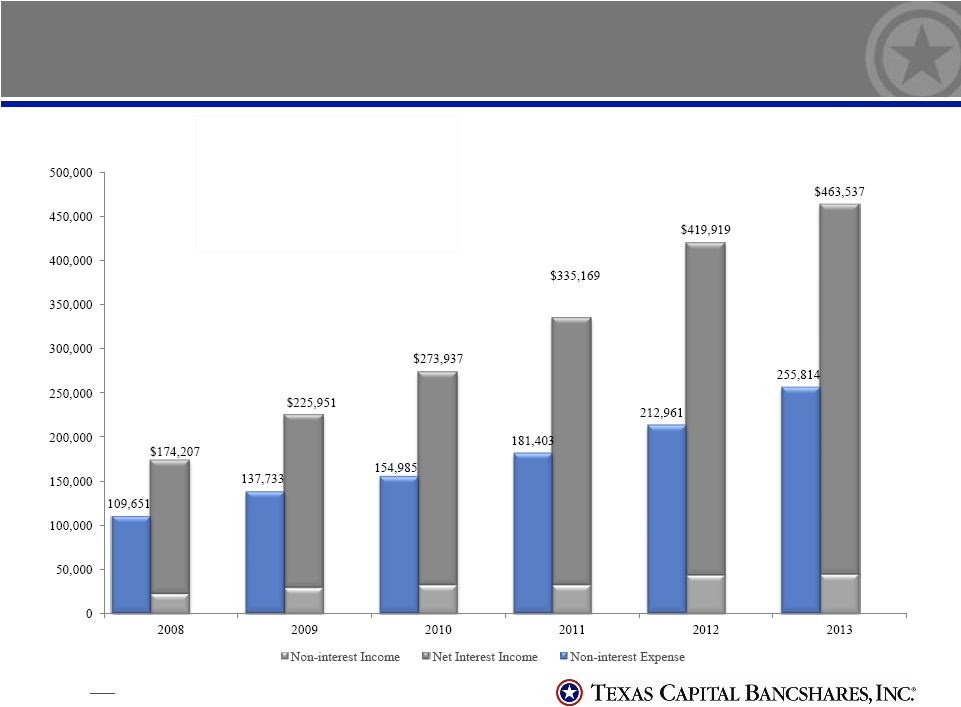

Revenue and Income Growth

Operating Revenue CAGR: 22%

Net Interest

Income CAGR:

23%

Non-interest Income CAGR: 14%

Non-interest Expense CAGR: 18%

Net Income CAGR: 37%

($ in thousands)

Note:

Excludes OREO valuation charge for YTD 2013, 2012, 2011 and

2010. |

15

EPS Growth

5 Year EPS CAGR: 27%

^Excludes $.15 effect of preferred TARP dividend during 2009. Reported

EPS was $0.56. |

16

Demand Deposit CAGR: 42%

Total Deposit CAGR: 23%

Loans Held for Investment* CAGR: 16%

Deposit and Loan Growth

($ in millions)

* Excludes MF loans. |

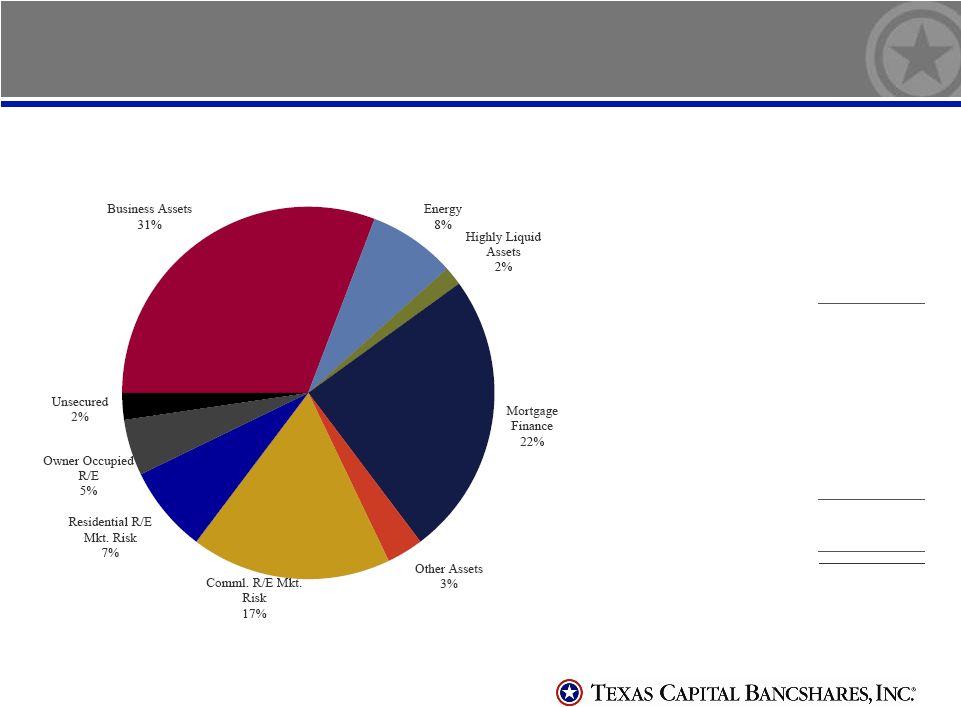

Loan Portfolio Statistics

17

Non-accrual loans

Commercial

$ 12,896

Construction

705

Real estate

18,670

Consumer

54

Equipment leases

50

Total non-accrual loans

32,375

Non-accrual loans as % of

loans excluding MF

.38%

Non-accrual loans as % of

total loans

.29%

OREO

5,110

Total Non-accruals +

OREO

37,485

Non-accrual loans + OREO

as % of loans excluding MF

+ OREO

.44%

Total Loans $11,270,574

All numbers in thousands.

Loan Collateral by Type 12/31/13 |

Credit Quality

Improved Credit Trends

–

Total credit cost of $5.4 million for Q4-2013, compared to $ 5.0

million in Q3-2013 and $5.5 million in Q4-2012

•

Provision of $5.0 million for Q4-2013 compared to $5.0 million for

Q3-2013 and $4.5 million in Q4-2012

•

NCOs $1.3 million (6 bps) in Q4-2013 compared to 0 bps in

Q3-2013 and 21 bps in Q4- 2012; NCO ratio of 7 bps for

YTD •

OREO valuation charge of $466,000 in Q4-2013 compared to none in

Q3-2013 and $955,000 in Q4-2012

–

NPA ratio continues to decline

•

Reduction of $11.1 million (23%) from Q3-2013 and $34.4 million

(48%) from Q4-2012 •

NPA ratio of .44% compared to .60% in Q3-2013 and 1.06% in

Q4-2012 •

NPLs at $32.4 million, down $3.4 million from Q3-2013 and down

$23.5 million from Q4-2012

•

NPL ratio at .29% of total loans and .38% of LHI excluding MF

loans •

OREO reduction of $7.7 (60%) from Q3-2013 and $10.9 million (68%)

from Q4-2012 18 |

19

Credit Quality

Net Charge-offs / Average Loans*

* Excludes MF loans.

Combined reserve /

Loans

*

1.09%

1.15%

1.31%

1.56%

1.59%

Non-accrual loans +

OREO to loans

*

+

OREO

.44%

1.06%

1.58%

3.25%

2.74%

Combined reserve to

non-accruals

2.7x

1.3x

1.3x

.6x

.7x |

Closing Comments

•

Strong core

earnings

power,

profitability

and

growth

to

continue

in

2014

•

Credit continues positive trend

•

Strong LHI pipeline and new commitments present opportunity for growth

potential

•

Producers in place for 2014 growth

•

Building more liquidity in 2014 which will impact NIM

•

Mortgage finance average balances to be down in 2014 but outperform

the industry

•

Improving capital position with capital raise to support growth

20 |

Q&A

21 |