Attached files

| file | filename |

|---|---|

| EX-23.1 - EX-23.1 - Continental Building Products, Inc. | d621418dex231.htm |

| EX-99.1 - EX-99.1 - Continental Building Products, Inc. | d621418dex991.htm |

| EX-99.2 - EX-99.2 - Continental Building Products, Inc. | d621418dex992.htm |

| EX-99.3 - EX-99.3 - Continental Building Products, Inc. | d621418dex993.htm |

| EX-99.6 - EX-99.6 - Continental Building Products, Inc. | d621418dex996.htm |

| EX-99.7 - EX-99.7 - Continental Building Products, Inc. | d621418dex997.htm |

| EX-99.8 - EX-99.8 - Continental Building Products, Inc. | d621418dex998.htm |

| EX-99.5 - EX-99.5 - Continental Building Products, Inc. | d621418dex995.htm |

| EX-99.4 - EX-99.4 - Continental Building Products, Inc. | d621418dex994.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 23, 2014

Registration No. 333-193078

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Amendment No. 2 to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Continental Building Products, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 3270 | 61-7178923 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

12018 Sunrise Valley Drive, Suite 600

Reston, VA 20191

(703) 480-3800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Isaac Preston

Chief Executive Officer

Continental Building Products, Inc.

12018 Sunrise Valley Drive, Suite 600

Reston, VA 20191

(703) 480-3800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Jeffrey A. Chapman Peter W. Wardle Gibson, Dunn & Crutcher LLP 2100 McKinney Ave., Suite 1100 Dallas, TX 75201 tel: (214) 698-3100 fax: (214) 571-2900 |

Douglass M. Rayburn Samantha H. Crispin Baker Botts L.L.P. 2001 Ross Avenue, Suite 600 Dallas, TX 75201 tel: (214) 953-6500 fax: (214) 953-6503 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||||||

| Title of Each Class of Securities to be Registered |

Amount to |

Proposed Maximum Per Unit(2) |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||||

| Common Stock, $0.001 par value per share |

15,221,400 | $18.00 | $273,985,200 | $35,290(3) | ||||

|

| ||||||||

|

| ||||||||

| (1) | Includes 1,985,400 shares that the underwriters have the option to purchase. See “Underwriting.” |

| (2) | Estimated solely for the purpose of calculating the registration fee under Rule 457(a) of the Securities Act of 1933, as amended. |

| (3) | $25,760 previously paid. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We and the selling stockholder may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 23, 2014

13,236,000 Shares

Continental Building Products, Inc.

Common Stock

$ per share

This is the initial public offering of our common stock. We are offering 11,765,000 shares of our common stock and the selling stockholder identified in this prospectus is offering 1,471,000 shares of our common stock. We will not receive any proceeds from the sale of shares by the selling stockholder. We currently expect the initial public offering price to be between $16.00 and $18.00 per share of common stock.

The selling stockholder has granted to the underwriters an option to purchase up to 1,985,400 additional shares of common stock.

We have applied to list our common stock on the New York Stock Exchange under the symbol “CBPX.”

We are an “emerging growth company” as the term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 18 to read about factors you should consider before buying shares of our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount(1) |

$ | $ | ||||||

| Proceeds to Continental Building Products, Inc. (before expenses) |

$ | $ | ||||||

| Proceeds to selling stockholder (before expenses) |

$ | $ | ||||||

| (1) | Please read “Underwriting (Conflicts of Interest)” for a description of all underwriting compensation payable in connection with this offering. |

The underwriters expect to deliver the shares to purchasers on or about , 2014 through the book-entry facilities of The Depository Trust Company.

| Citigroup | Credit Suisse |

| Barclays | Deutsche Bank Securities | RBC Capital Markets |

| Zelman Partners LLC | SunTrust Robinson Humphrey | |

| Stephens Inc. | BB&T Capital Markets | |

, 2014

Table of Contents

Table of Contents

| Page | ||||

| 1 | ||||

| 12 | ||||

| SUMMARY HISTORICAL AND UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION |

14 | |||

| 18 | ||||

| 35 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 43 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

53 | |||

| 71 | ||||

| 87 | ||||

| 94 | ||||

| 105 | ||||

| 107 | ||||

| 109 | ||||

| 114 | ||||

| 117 | ||||

| 122 | ||||

| 128 | ||||

| 128 | ||||

| 128 | ||||

| F-1 | ||||

We are responsible for the information contained in this prospectus and in any free-writing prospectus we prepare or authorize. We have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these shares in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than its date.

i

Table of Contents

INDUSTRY AND MARKET DATA

We use market data and industry forecasts throughout this prospectus and, in particular, in the sections entitled “Prospectus Summary” and “Business.” Unless otherwise indicated, statements in this prospectus concerning our industry and the markets in which we operate, including our general expectations, competitive position, business opportunity and market size, growth and share, are based on information obtained from periodic industry publications, government surveys, including from the U.S. Census Bureau, and other third-party sources such as reports published by the Gypsum Association.

Management estimates are derived from the information and data referred to above, as well as our internal research, calculations and assumptions made by us based on our analysis of such information and data and our knowledge of our industry and markets, which we believe to be reasonable, although they have not been independently verified. While we believe that the market position information included in this prospectus is generally reliable, such information is inherently imprecise. Assumptions, expectations and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and “Forward-Looking Statements.” These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

ii

Table of Contents

The following is a summary of material information discussed in this prospectus. The summary is not complete and does not contain all of the information that you should consider before investing in our common stock. You should read this entire prospectus carefully, including the risks discussed under the section entitled “Risk Factors” and our financial statements and the related notes included elsewhere in this prospectus, before making an investment decision to purchase shares of our common stock. Some of the statements in this summary constitute forward-looking statements. See “Forward-Looking Statements.”

On August 30, 2013, substantially all of the assets and liabilities related to our business were acquired from Lafarge North America Inc., or Lafarge. Prior to such acquisition, we operated as the gypsum division of Lafarge. See “Business—The Acquisition.” Unless otherwise specified, references in this prospectus to “our,” “we,” “us,” the “Company” and “our business” (i) for periods prior to the completion of the Acquisition, refer to the gypsum division of Lafarge, (ii) for periods after completion of the Acquisition but prior to the conversion refer to LSF8 Gypsum Holdings Company, LLC (the entity formed to complete the Acquisition that was converted into Continental Building Building Products, Inc.) and (iii) for the periods after the conversion, refer to Continental Building Products, Inc., in each case together with its consolidated subsidiaries. We are a holding company controlled by Lone Star Fund VIII (U.S.), L.P. and have a relatively short operating history as a stand-alone company.

All amounts in this prospectus are expressed in U.S. dollars and the financial statements have been prepared in accordance with generally accepted accounting principles in the United States, or GAAP.

Our Company

We are a leading, high margin manufacturer of gypsum wallboard and complementary finishing products. Our manufacturing facilities and sales efforts are concentrated in the eastern United States and eastern Canada. Gypsum wallboard, which is also known as drywall, is a primary building material used in new residential and commercial construction and in repair and remodel, or R&R. We estimate that in 2012 our market share in the United States east of the Mississippi River, a market which accounted for more than 55% of total U.S. wallboard demand, was approximately 17%, and our share is significantly higher in many of the major metropolitan areas within a shipping radius of 300 miles of our facilities, which include New York, Miami, Tampa, Orlando, Cincinnati, Cleveland, Columbus, Indianapolis, Nashville, Jacksonville and Hartford. For the fiscal year ended December 31, 2012, we had net sales of $311.4 million, net loss of $12.8 million and Adjusted EBITDA of $41.0 million. For the nine months ended September 30, 2013, we had net sales of $287.9 million, net loss of $2.8 million and Adjusted EBITDA of $72.7 million, which represented an increase of 175% in Adjusted EBITDA compared to the nine months ended September 30, 2012, each on a pro forma basis. See “Summary Historical and Unaudited Pro Forma Combined Financial Information” for how we define and calculate Adjusted EBITDA as a non-GAAP measure, a reconciliation thereof to net income and a description of why we believe this measure is important.

We operate highly efficient and automated manufacturing facilities in Silver Grove (Kentucky), Palatka (Florida) and Buchanan (New York) that produce a full range of gypsum wallboard products for our diversified customer base. We are committed to operational excellence and have invested heavily in our facilities, which we believe are among the newest, largest and most efficient wallboard plants in North America. Our facilities have significant available capacity that will allow us to scale production in a cost-effective manner as wallboard demand increases. We use only synthetic gypsum in our products, which we believe enhances our manufacturing quality and consistency, reduces production costs and provides important environmental benefits relative to natural gypsum. We are the only producer of gypsum wallboard in the United States to use 100% synthetic gypsum. Our strategically positioned plants provide us with two key benefits: cost-effective access to our supplies of synthetic gypsum, which reduces our inbound transportation costs, and close proximity to many major metropolitan areas, which decreases our product delivery costs.

1

Table of Contents

We offer our customers a full range of gypsum wallboard products, including LiftLite®, our lightweight product designed to be easier to lift and install, our Mold Defense® line of products designed for enhanced protection against mold and mildew, and our Weather Defense® line of moisture and mold-resistant exterior sheathing. To complement our wallboard business and to better serve our customers, we also operate a finishing products business that manufactures a comprehensive line of joint compounds at our plant in Silver Grove (Kentucky) and our joint compound plant in Chambly (Quebec). We provide superior customer service by developing new products based on customer needs, consistently delivering high quality finished product and providing orders accurately with fast delivery times.

Our Industry

The North American gypsum wallboard industry is the largest in the world, with the world’s highest per capita consumption rate. Gypsum wallboard is a low cost, widely used building product for interior and exterior walls and ceilings in residential and commercial structures. It is highly regarded for its ease and speed of application and its superior performance in providing comfort, fire resistance and thermal and sound insulation. The primary raw material, gypsum, can be either natural or synthetic. Natural gypsum is a mineral mined in select areas throughout North America. Synthetic gypsum is sourced primarily via flue gas desulfurization within coal-fired power plants. According to the Gypsum Association, use of synthetic gypsum has increased from approximately 5% of total wallboard production in 1995 to approximately 45% in 2010. We currently use exclusively synthetic gypsum in our manufacturing process.

There are currently seven gypsum wallboard manufacturers in the United States, including us, of which we believe only six compete in the eastern United States. Gypsum wallboard has a high weight-to-value ratio, so it is advantageous to both source raw materials and produce gypsum wallboard in close proximity to where it is used. If manufacturing facilities are not located in close proximity to end markets, transportation costs can render the cost of finished goods uncompetitive compared to locally manufactured wallboard. Accordingly, competition in the industry occurs principally on a regional basis, and we believe that national scale has limited benefits. Each competitive geographic region has a different group of manufacturers and customers and, as a result, a different competitive landscape.

Although gypsum wallboard remains a regional industry, consolidation in the industry has resulted in increased market share for certain industry participants, including us. In 1997 there were thirteen gypsum wallboard producers, compared to seven in 2013. This consolidation has occurred almost entirely amongst the smaller producers. Since 1997, our national market share has grown from 3% to 10%.

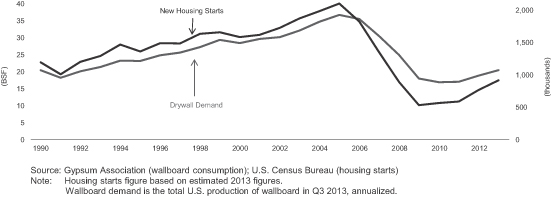

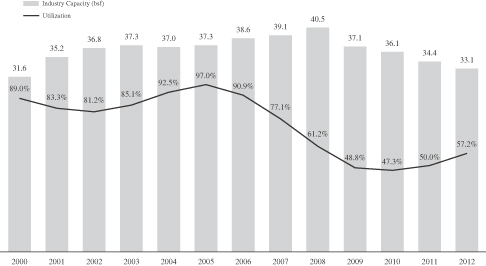

New housing starts have been the most significant driver of North American wallboard demand. Starting in 2007, the North American wallboard industry suffered a dramatic decrease in demand, driven primarily by the significant downturn of the North American housing market and the associated credit crisis and global recession. U.S. housing starts fell from a cyclical peak of 2.1 million in 2005 to a 50-year low of 554,000 in 2009. Correspondingly, U.S. wallboard consumption declined by more than 50% from 36.2 billion square feet, or bsf, in 2005 to a low of 17.1 bsf in 2010. Pricing across the industry suffered over this period due to the decline in demand.

2

Table of Contents

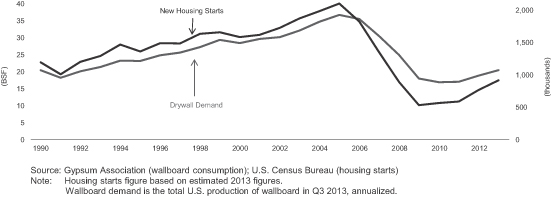

The following chart shows historical U.S. wallboard consumption and U.S. housing starts:

We believe that the U.S. housing market is in the early stages of a recovery. U.S. housing starts reached 0.78 million in 2012, driving U.S. wallboard consumption to 18.9 bsf. In 2013, the positive trend in housing starts has continued, with housing starts up 18% year-over-year to an estimated 923,000, according to the U.S. Census Bureau.

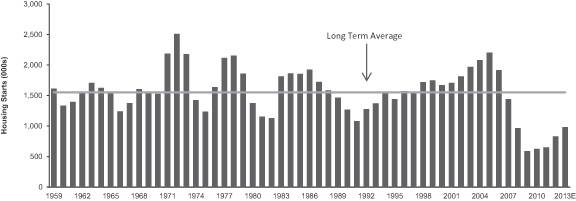

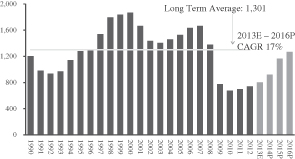

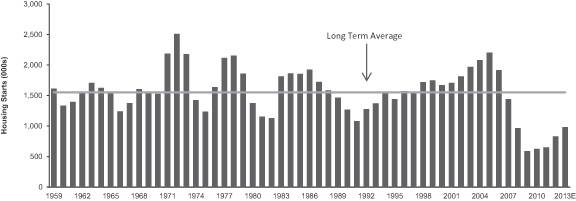

The graph below shows long-term annual U.S. housing starts:

| Housing Starts |

Units (000) |

Estimated 2013 |

Unit Difference |

Percentage Difference |

||||||||||||

|

Peak(1) |

2,357 | 923 | 1,434 | 155 | % | |||||||||||

| Long-Term Average(2) |

1,458 | 923 | 535 | 58 | % | |||||||||||

| Average Cyclical Low(3) |

1,131 | 923 | 208 | 22 | % | |||||||||||

Source: U.S. Census Bureau.

| (1) | Peak occurred in 1972. |

| (2) | Average housing starts from 1959 through estimated 2013. |

| (3) | Taken as the average of the 1960, 1966, 1975, 1982 and 1991 housing starts. |

3

Table of Contents

We believe that there is substantial room for continued improvement in housing starts. Housing starts have averaged 1.5 million over the past 50 years, which is approximately 58% greater than 2013 estimated starts of 923,000. Wallboard consumption has historically correlated closely with increased construction activity, typically trailing housing starts by approximately six to nine months. As housing starts return to normal levels, we expect a corresponding increase in wallboard demand.

Industry trends within our regions are particularly favorable. For the eleven-month period ended November 30, 2013, building permits within our key markets grew 38.5% over the equivalent period in 2012, versus 16.4% growth in the rest of the U.S., according to the U.S. Census Bureau.

The table below shows year-to-date building permits by metropolitan statistical area, or MSA, in some of the key markets in which we operate, which key markets accounted for approximately one-third of our total U.S. revenues for the nine months ended September 30, 2013:

| Building Permits | Growth | |||||||||||

| Continental BP Key MSA’s (all data in thousands) |

YTD 2012 | YTD 2013 | YoY | |||||||||

| Atlanta |

12.9 | 22.4 | 74.6 | % | ||||||||

| Chicago |

8.9 | 11.0 | 24.8 | |||||||||

| Cincinnati |

3.2 | 4.1 | 30.5 | |||||||||

| Columbus |

6.2 | 7.8 | 25.6 | |||||||||

| Fort Myers |

1.9 | 2.8 | 46.8 | |||||||||

| Indianapolis |

4.7 | 7.0 | 50.1 | |||||||||

| Jacksonville |

6.8 | 6.7 | (1.0 | ) | ||||||||

| Louisville |

3.5 | 3.7 | 5.1 | |||||||||

| Miami |

11.5 | 19.0 | 65.6 | |||||||||

| Nashville |

7.4 | 9.9 | 34.1 | |||||||||

| NYC / No. NJ / Long Island |

24.3 | 35.4 | 45.2 | |||||||||

| Orlando |

10.6 | 14.1 | 32.6 | |||||||||

| Philadelphia |

8.2 | 10.3 | 26.9 | |||||||||

| Southern Michigan(1) |

5.9 | 8.1 | 38.5 | |||||||||

| Tampa |

9.8 | 11.5 | 17.9 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total for all Continental BP regions |

125.6 | 174.0 | 38.5 | % | ||||||||

| Total for United States |

749.1 | 899.8 | 20.1 | |||||||||

| Total for United States ex Continental BP Regions |

623.5 | 725.9 | 16.4 | |||||||||

| Source: | U.S. Census Bureau |

| Note: | Year-to-date data is through November. |

| (1) | Southern Michigan includes Detroit, Grand Rapids, and Lansing MSA’s. |

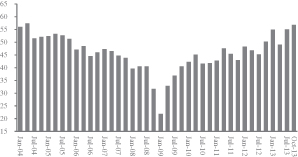

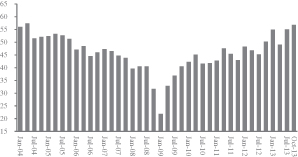

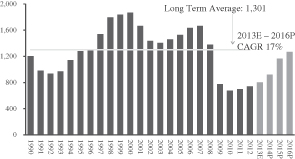

We also expect continued recovery in the repair and remodel market and improvement in the commercial construction market. The Remodeling Market Index from the National Association of Home Builders, or RMI, is based on a quarterly survey of about 2,000 residential remodelers nationwide and measures current market demand for remodeling as compared to three months prior as well as projected future market demand for remodeling, based on calls for bids, committed work for the next three months, backlog of remodeling projects and other factors. Results are seasonally adjusted. An increase in the RMI indicates that residential remodelers view remodeling conditions as more positive than in the previous quarter. The RMI has increased 160% from the trough in the fourth quarter in 2008 to October 2013. Additionally, according to data from McGraw Hill Construction, commercial construction square footage levels for 2012 are still near trough levels and 43% lower than the average of 1.3 billion square feet since 1990. The data from McGraw Hill Construction also indicates commercial construction square footage is expected to grow at a compounded annual growth rate of 17% from 2013 to 2016.

4

Table of Contents

| Quarterly Residential Remodeling Index (RMI Index Scale) |

Yearly Commercial Construction Square Footage (millions of Square Feet) | |

|

| |

| Source: National Association of Homebuilders. |

Source: McGraw Hill Construction. | |

Our Strengths

Leadership Positions in Attractive Geographic Markets

We estimate that in 2012 our market share in the eastern United States, a market which accounted for more than 55% of total U.S. wallboard demand, was approximately 17%. Importantly, our share is significantly higher in many of our primary metropolitan markets, including markets located in Florida, Georgia, the New York tri-state area, Michigan and Kentucky.

Our market leadership positions will enable us to take advantage of increased demand for gypsum wallboard associated with a recovery in the U.S. residential housing market, which we believe is already underway. Annual housing starts were 0.78 million for 2012 and estimated to be 0.92 million in 2013, an 18% increase on a year-over-year basis. Furthermore, the markets in which we operate have recovered particularly favorably versus the rest of the U.S. For the eleven-month period ended November 30, 2013, building permits within our key markets grew 38.5% compared to the same period in 2012, while the growth rate over that period in the rest of the U.S. was 16.4%, according to the U.S. Census Bureau. Notwithstanding this growth, we believe gypsum wallboard demand will continue to grow significantly in the coming years, as the U.S. housing market is still at relatively low levels compared to most recent historical housing cycles, and estimated starts in 2013 would need to grow by approximately 58% to achieve the 50-year average of 1.5 million.

Strong Margin Profile and Cash Flow Generation

We believe our strong margins and cash flow generation are attributable to our highly efficient, low cost manufacturing plants, attractive location of those plants relative to our customers and our sources of raw materials and management’s continuous focus on maximizing operating efficiencies. Our net sales have grown from $223.4 million for the nine months ended September 30, 2012 to $287.9 million for the nine months ended September 30, 2013, each on a pro forma basis. For the same periods, our Adjusted EBITDA grew from $26.5 million to $72.7 million, and our net loss improved from a loss of $57.3 million to a loss of $2.8 million, each on a pro forma basis. See “Summary Historical and Unaudited Pro Forma Combined Financial Information” for how we define and calculate Adjusted EBITDA as a non-GAAP measure, a reconciliation thereof to net income and a description of why we believe this measure is important.

For the nine months ended September 30, 2013, we generated an Adjusted EBITDA margin of 25.2%, representing an increase of 13.4 percentage points compared to the nine months ended September 30, 2012, each on a pro forma basis. Our operational excellence and rigorous focus on cost reduction between 2007 and 2012 has resulted in a fundamentally improved cost structure, which we believe has led to our Adjusted EBITDA

5

Table of Contents

margins being among the highest margins in the building products industry as a whole. Management uses Adjusted EBITDA for purposes of evaluating the Company’s performance. We have a lower cost structure today because we rationalized older, higher cost facilities and reduced our selling, general and administrative expense by reducing headcount. Further, our current facilities are new and modern and have lower costs due to greater fuel efficiency and faster lines speeds. We believe that our Adjusted EBITDA margins will continue to improve as the demand for gypsum wallboard grows and we capitalize on our significant operating leverage. We have announced a 20% price increase to our customers beginning in January 2014, and most wallboard manufacturers in the United States have also announced price increases for 2014. We believe these factors, along with capital expenditures that were less than 1% of net sales for the nine months ended September 30, 2013, will allow us to generate significant cash flow going forward.

Scalable Low-Cost Production

We have made over $550 million in capital investments to build our Silver Grove and Palatka plants, rebuild our Buchanan plant and make ongoing operational improvements at each of these plants. We believe that our wallboard facilities are among the largest and most modern in North America, resulting in productivity levels among the highest in the industry. Our plant utilization rate was approximately 58% in 2012, and increased to approximately 64% in the nine months ended September 30, 2013. Due to these recent investments and our cost efficient capacity, we expect to scale production to meet increasing demand with only a modest level of incremental capital expenditures.

Our wallboard plants use only synthetic gypsum produced by power plants located near our facilities, which provides cost-effective access to one of our key raw materials. We believe our sources of synthetic gypsum provide us with a competitive advantage over plants using natural gypsum or other sources of lower quality synthetic gypsum. In comparison to natural gypsum, synthetic gypsum generally reduces production costs, provides environmental benefits and enhances manufacturing quality and consistency due to its higher purity, better binding properties and fewer required additives needed to improve overall quality of wallboard. We are the only producer of gypsum wallboard in the United States to use exclusively synthetic gypsum. We have entered into long-term agreements to purchase synthetic gypsum from a number of power plants located near our facilities, which lowers our costs because of reduced shipping distances. These synthetic gypsum suppliers provide us with amounts in excess of our current requirements, which allows for significant scalability in our wallboard production.

Strategically Situated Plants Near Both Our Primary Markets and Raw Materials

Our wallboard facilities are located in close proximity to major metropolitan areas in the eastern United States and eastern Canada, lowering both our inbound and outbound transportation costs and facilitating timely delivery to our customers. Each of our facilities allows us to offer same-day delivery service to many of our key metropolitan markets, including our Buchanan plant, which provides same day delivery service to customers in the New York City tri-state area, which management believes provides us with a competitive advantage.

Our plants use exclusively synthetic gypsum produced by power plants located near our facilities, which provides cost-effective access to one of our key raw materials. We believe that this provides us with a competitive advantage over plants using natural gypsum. Because natural gypsum is typically not mined near population centers, plants using natural gypsum generally incur higher transportation costs to obtain their natural gypsum supplies or have higher product delivery costs because they are located farther from end markets.

Full Range of High-Quality Wallboard Products

We offer a full range of gypsum wallboard products, which are available with a variety of value-added enhancements for specific applications, such as moisture and mold resistance. We believe that our broad product

6

Table of Contents

range makes us an attractive supplier to our customers. Certain customers and markets have also favored the use of synthetic gypsum products, which we manufacture, versus natural gypsum products for the additional benefit of receiving Leadership in Energy and Environmental Design, or LEED, ratings to support environmentally responsible initiatives.

We believe our industry experience, manufacturing expertise and flexible production facilities enable us to quickly develop and implement new products in response to market needs or competitor product introductions, as evidenced by the fact that 54% of our net sales in 2012 came from products developed in the last five years. For example, in 2011 we introduced LiftLite®, a lightweight wallboard for use on interior walls and ceilings. It is formulated to be up to approximately 20% lighter than standard 1/2” wallboard, making it easier to lift, carry and install. We designed LiftLite® in a relatively short period of time with only a limited investment, and it has replaced most of our standard 1/2” wallboard.

Track Record of High-Quality Customer Service to Our Diverse Customer Base

We regularly achieve high rankings in customer service surveys and have received numerous “supplier of the year” awards from major customers. We consistently provide a high level of service to our customers through a combination of product availability and quality, on-time delivery, and timely and accurate invoicing. We sell our products through several different channels and to a broad group of customers, including gypsum wallboard distributors, buying groups, wholesalers and mass merchants. Our largest customer represented 15% and 12% of our net sales in 2012 and 2011, respectively, and no other customer represented more than 10% of sales.

Our Strategy

Capitalize on Growth Opportunities Related to the Construction Recovery

We believe that we hold leading market positions in many of the major metropolitan areas near our facilities. We are well positioned to capitalize on the recovery in the U.S. housing market, which we believe is already underway. New housing starts have traditionally been the most significant driver of wallboard demand and we expect a strong increase in wallboard demand as housing starts return to more normalized levels. We intend to take advantage of our market leadership and our scalable low-cost production capacity to increase sales and expand margins as market conditions continue to improve.

We also expect that we will benefit from continued growth in R&R, from which we are already seeing significant increased demand, and the expected recovery in new commercial construction. We believe there is momentum in R&R as the Remodeling Market Index has increased 160% in the past five years, according to the National Association of Home Builders. Moreover, commercial construction starts are expected to grow 17% compounded annually from 2013 to 2016, according to data from McGraw Hill Construction.

Utilize Our Significant Operating Leverage to Deliver Strong Cash Flows

One of our primary objectives is maximizing growth in cash flows. As a result of more than $550 million of investments we have made in our facilities and our ongoing rigorous cost management, we expect to experience limited incremental fixed costs as our production increases. We currently have significant additional capacity at our plants, which were operating at a 58% utilization rate in 2012 and a 64% utilization rate in the nine months ended September 30, 2013. As the residential and commercial construction markets improve, we intend to capitalize on our operating leverage to expand our margins and cash flows. Our past investments enable us to maintain a high level of operating productivity with only a modest level of capital expenditures, which represented only one percent of sales during the nine months ended September 30, 2013, a level we believe to be indicative of our capital needs over the medium-term.

7

Table of Contents

Maintain Strong Commitment to Operational Excellence

Our management is committed to operational excellence throughout our operations, both on the manufacturing side and in customer-facing functions. Over the last decade we have transformed our asset base and built three highly automated, high capacity wallboard facilities that we believe are among the most modern and efficient in North America. As a result, we have one of the lowest cost bases in the industry and significant available capacity. Our management is constantly measuring our performance to improve our operational excellence based on various metrics throughout the organization, including on-time customer delivery, sales force productivity, product quality and back office reliability targets.

We are similarly focused on superior customer service. We seek to offer our customers a broad range of high-quality gypsum wallboard products. Our industry experience, manufacturing expertise and flexible production facilities enable us to quickly develop and implement new products in response to market needs or product introductions by our competitors. We are focused on building and maintaining strong customer relationships based on product quality and availability, value, just-in-time delivery and prompt and accurate order processing and billing.

Evaluate Strategic Opportunities

Despite the challenging market conditions associated with the housing downturn, we have increased our commitment to the industry and made major investments in our facilities, which has contributed to our enhanced competitive position and market share. Since the mid-1990s, the building materials industry has undergone consolidation as manufacturers have sought to achieve greater cost savings and distribution efficiencies. We believe our market leadership, scale, operating efficiency, and strong cash generation position us well to participate in acquisitions and pursue other strategic opportunities both in the gypsum wallboard market and in adjacent markets within the building materials industry.

Recent Developments

Our net sales for the three months ended December 31, 2013 are estimated to be between $110.0 million and $114.0 million, representing an increase of between $22.0 million and $26.0 million, or 25.0% and 29.5%, from our predecessor’s net sales of $88.0 million for the three months ended December 31, 2012. The increase in net sales was primarily due to higher wallboard sales volumes and pricing. Our operating income for the three months ended December 31, 2013 is estimated to be between $13.0 million and $16.0 million, representing an increase of between $10.2 million and $13.2 million, or 360.7% and 467.0%, from our predecessor’s operating income of $2.8 million for the three months ended December 31, 2012. The increase in operating income was primarily due to higher wallboard sales volumes and pricing, partially offset by higher depreciation and amortization. Our wallboard sales volume for the three months ended December 31, 2013 is estimated to be between 620 million square feet and 630 million square feet, representing an increase of between 83 million square feet and 93 million square feet, or 15.5% and 17.3%, from our predecessor’s wallboard sales volume of 537 million square feet for the three months ended December 31, 2012. This increase in wallboard sales volume was primarily due to higher levels of construction for new housing and strength in repair and remodel work. Our mill net sales price for the three months ended December 31, 2013 is estimated to be between $142/msf and $143/msf, representing an increase of between $16/msf and $17/msf, or 12.7% and 13.5%, from our predecessor’s mill net sales price of $126/msf for the three months ended December 31, 2012. Mill net sales price represents average selling price per thousand square feet net of freight and delivery costs. This increase in mill net sales price was primarily due to our successful price increase in early 2013.

Management prepared this estimated financial information in good faith based upon our internal reporting for the three months ended December 31, 2013. These estimates are preliminary and represent the most current information available to management, and we have not identified any unusual or unique events or trends that

8

Table of Contents

occurred during the period which might materially affect these estimates. The preliminary estimates provided above have not been subject to the completion of our normal closing process for the three months ended December 31, 2013, and final adjustments and other developments may arise between now and the time the financial results for this period are finalized. As a result, our actual financial results for the three months ended December 31, 2013 may be different from such preliminary estimates and those differences could be material. Our financial statements for the fiscal year ended December 31, 2013 will not be filed with the SEC until after this offering is completed. Our independent registered public accounting firm has not audited or reviewed, and does not express an opinion with respect to, this estimated financial information.

Our Sponsor

In July 2013, Lone Star Fund VIII (U.S.), L.P., which we refer to in this prospectus, along with its affiliates and associates (excluding us and other companies that it owns as a result of its investment activity), as Lone Star, or our sponsor, formed the Company and its subsidiaries for the purpose of acquiring substantially all of the assets comprising Lafarge’s North American gypsum business, which we refer to as the Acquisition. Lone Star is part of a leading private equity firm that, since the establishment of its first fund in 1995, has organized 12 private equity funds with aggregate capital commitments totaling over $45 billion. The funds are structured as closed-end, private-equity limited partnerships, the limited partners of which include corporate and public pension funds, sovereign wealth funds, university endowments, foundations, funds of funds and high net worth individuals. Immediately prior to this offering, Lone Star owned all of our outstanding equity interests, and will own approximately 70.0% of our common stock immediately following consummation of this offering, assuming no exercise of the underwriters’ option to purchase additional shares of common stock. Therefore, we expect to be a “controlled company” under the NYSE corporate governance standards and to take advantage of the related corporate governance exceptions.

Risks Affecting Our Business

Our business is subject to numerous risks and uncertainties, including, but not limited to, those arising from:

| • | cyclicality in our markets, especially the new residential construction market; |

| • | the highly competitive nature of our industry and the substitutability of competitors’ products; |

| • | disruptions in our supply of synthetic gypsum due to regulatory changes or coal-fired power plants switching to natural gas or ceasing operations; |

| • | changes to environmental and safety laws and regulations requiring modifications to our manufacturing systems; |

| • | disruptions to our supply of paperboard liner, including termination of the Rock-Tenn contract; |

| • | potential losses of customers; |

| • | disruptions at our manufacturing facilities or at our suppliers’ facilities; |

| • | increases in energy and transportation costs; |

| • | our involvement in legal and regulatory proceedings; |

| • | our ability to attract and retain key management employees; |

| • | disruptions in our information technology systems; |

| • | labor disruptions; and |

| • | the seasonal nature of our business. |

9

Table of Contents

You should carefully consider all of the information set forth in this prospectus and, in particular, the information under the heading entitled “Risk Factors” beginning on page 18 of this prospectus prior to making an investment in our common stock. These risks, together with the other risks identified under “Risk Factors,” could prevent us from successfully executing our strategies and could result in a material adverse effect on our business, prospects, financial condition, cash flows and results of operations.

Implications of Being an Emerging Growth Company

We qualify as an “emerging growth company” under the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As a result, we are permitted to, and intend to, rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. Accordingly, we have included only two, rather than three, years of audited financial statements, have included detailed compensation information for only our three most highly compensated executive officers and have not included a compensation discussion and analysis of our executive compensation programs in this prospectus.

In addition, for so long as we are an emerging growth company, we will not be required to:

| • | have an auditor report on our internal controls over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act; |

| • | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (United States) regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis); |

| • | submit certain executive compensation matters to shareholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes” votes; and |

| • | disclose certain executive compensation-related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation. |

While we are an emerging growth company, the JOBS Act permits us to delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of this extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

We could be an emerging growth company for up to five full fiscal years after the date of our initial public offering, or until the earliest of (i) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (ii) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur at the end of the fiscal year during which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (iii) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three year period.

Principal Executive Offices

Our executive offices are located at 12018 Sunrise Valley Drive, Suite 600, Reston, VA 20191. Our principal mailing address is 12018 Sunrise Valley Drive, Suite 600, Reston, VA 20191, and our telephone number is (703) 480-3800. Our website address is www.continental-bp.com. Information contained on our

10

Table of Contents

website is not part of and is not incorporated by reference into this prospectus. LiftLite®, Mold Defense®, Weather Defense®, Firecheck®, Protecta®, and Rapid Coat® and other trademarks or service marks of ours appearing in this prospectus are our property. Other trademarks and service marks appearing in this prospectus are the property of their respective holders.

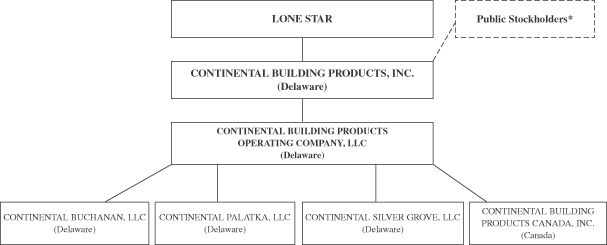

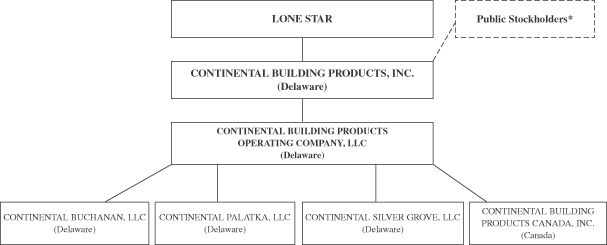

The following diagram summarizes our ownership and corporate structure as of January 23, 2014 and as expected to be in place following the offering:

| * | Post-offering only. |

11

Table of Contents

| Common stock offered by us |

11,765,000 shares |

| Common stock offered by the selling stockholder |

1,471,000 shares (or 3,456,400 shares if the underwriters exercise in full their option to purchase shares) |

| Common stock to be outstanding immediately after this offering |

44,069,000 shares |

| Use of proceeds |

We estimate our net proceeds from this offering will be approximately $183.8 million, based on the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. We intend to use the net proceeds from this offering as follows: |

| • | $2 million to make a one-time payment to Lone Star in consideration for the termination of our asset advisory agreement with affiliates of Lone Star upon consummation of this offering as described under “Certain Relationships and Related Party Transactions—Relationships with Lone Star and Affiliate—Asset Advisory Fees”; |

| • | to repay approximately $181.8 million of outstanding indebtedness, including amounts outstanding in respect of our First and Second Lien Credit Agreements; and |

| • | the remainder for working capital and other general corporate purposes. |

| We will not receive any of the proceeds from the sale of shares of common stock by the selling stockholder. See “Use of Proceeds,” “Principal and Selling Stockholders” and “Underwriting.” |

| Dividend policy |

We have no present intention to pay cash dividends on our common stock. Any determination to pay dividends to holders of our common stock will be at the discretion of our board of directors and will depend upon many factors, including our financial condition, results of operations, projections, liquidity, earnings, legal requirements, restrictions in our debt agreements and other factors that our board of directors deems relevant. See “Dividend Policy.” |

| Risk factors |

You should carefully read and consider the information set forth under the section entitled “Risk Factors” beginning on page 18, together with all of the other information set forth in this prospectus, before deciding to invest in our common stock. |

| Conflicts of Interest |

Credit Suisse Securities (USA) LLC and RBC Capital Markets, LLC, each of whom are underwriters in this offering, or their affiliates, will receive more than 5% of the net proceeds of this offering in |

12

Table of Contents

| connection with the prepayment of a portion of our first and second lien credit facilities. See “Use of Proceeds.” Accordingly, this offering is being made in compliance with the requirements of Financial Industry Regulatory Authority, or FINRA, Rule 5121, which requires a “qualified independent underwriter,” as defined by the FINRA rules, participate in the preparation of the registration statement and the prospectus and exercise the usual standards of due diligence in respect thereto, and Citigroup Global Markets Inc. has served in that capacity and will not receive any additional fees for serving as qualified independent underwriter in connection with this offering. We have agreed to indemnify Citigroup Global Markets Inc. against liabilities incurred in connection with acting as a qualified independent underwriter, including liabilities under the Securities Act. To comply with FINRA Rule 5121, Credit Suisse Securities (USA) LLC and RBC Capital Markets, LLC will not confirm sales to any account over which it exercises discretionary authority without the specific written approval of the transaction of the accountholder. See “Underwriting—Conflicts of Interest.” |

| NYSE symbol |

“CBPX” |

The number of shares of our common stock to be outstanding immediately after this offering as set forth above is based on the number of shares outstanding as of January 23, 2014 and excludes 1,615,200 shares reserved for issuance under our equity incentive plan (under which no equity awards had been granted as of such date). We intend to grant an aggregate of approximately 142,000 stock options with an exercise price equal to the initial public offering price and approximately 75,000 shares of restricted stock to our executive officers and certain director nominees under our equity incentive plan at the time of the pricing of this offering.

Unless otherwise indicated, this prospectus:

| • | gives effect to a 32,304 for one stock split, which will occur shortly before the consummation of this offering; |

| • | assumes an initial public offering price of $17.00 per share, the midpoint of the estimated initial public offering price range set forth on the cover page of this prospectus; and |

| • | assumes no exercise of the underwriters’ option to purchase up to an additional 1,985,400 shares of our common stock. |

13

Table of Contents

SUMMARY HISTORICAL AND UNAUDITED PRO FORMA COMBINED FINANCIAL INFORMATION

The following financial data should be read in conjunction with the audited and unaudited financial statements and the related notes, and the unaudited pro forma combined financial information and the related notes, included elsewhere in this prospectus.

The financial statements included in this prospectus may not necessarily reflect our financial position, results of operations and cash flows as if we had operated as a stand-alone public company during all periods presented. Accordingly, the historical results should not be relied upon as an indicator of our future performance.

As discussed in more detail under “Business—The Acquisition,” the Company, formerly the gypsum division of Lafarge North America Inc., was acquired by Lone Star on August 30, 2013. The accompanying financial statements are presented for the “Predecessor,” which are the combined financial statements of the Lafarge gypsum division for the period preceding the Acquisition, and the “Successor,” which are the consolidated financial statements of the Company and subsidiaries for the period following the Acquisition. We were formed on July 26, 2013 and had no results of operations prior to the Acquisition on August 30, 2013. As such, our consolidated results of operations reflect activity of the acquired business for the month of September 2013. The Predecessor’s combined statements of operations data for the years ended December 31, 2011 and 2012 and the Predecessor’s combined balance sheet data as of December 31, 2011 and 2012 have been derived from the audited combined financial statements of the Lafarge gypsum division, which are included elsewhere in this prospectus. The Predecessor’s combined statements of operations data for the nine months ended September 30, 2012 and the period from January 1, 2013 through August 30, 2013 are derived from the unaudited combined financial statements of the Lafarge gypsum division, which are included elsewhere in this prospectus. Our balance sheet data as of September 30, 2013 and consolidated statements of operations for the period July 26, 2013 to September 30, 2013 are derived from the Successor unaudited consolidated financial statements, which are included elsewhere in this prospectus. The Predecessor’s financial statements may not necessarily be indicative of the cost structure or results of operations that would have existed if the gypsum division of Lafarge operated as a stand-alone, independent business. The Acquisition was accounted for as a business combination, which resulted in a new basis of accounting. The Predecessor’s and the Successor’s financial statements are not comparable as a result of applying a new basis of accounting. See the Notes to the unaudited consolidated financial statements for additional information regarding the accounting treatment of the Acquisition.

Our unaudited pro forma combined financial information has been prepared to reflect adjustments to our historical financial information that are (1) directly attributable to the transactions described below, (2) factually supportable, and (3) with respect to the unaudited pro forma combined statements of operations data, expected to have a continuing impact on our results. The unaudited pro forma combined financial information does not include non-recurring items, including, but not limited to, offering-related legal and advisory fees. The unaudited pro forma combined financial information reflects the impact of:

| • | the Acquisition; |

| • | the additional borrowings under our First and Second Lien Credit Agreements and the distribution of such borrowings to our sponsor, Lone Star; |

| • | the completion of this offering; |

| • | use of the net proceeds of this offering to repay debt; and |

| • | other adjustments described in the notes to the unaudited pro forma combined financial information. |

Collectively, the transactions underlying these adjustments are referred to as the “Pro Forma Transactions.”

14

Table of Contents

The unaudited pro forma combined statements of operations give effect to the Pro Forma Transactions as though the Pro Forma Transactions had occurred as of January 1, 2012. The unaudited pro forma combined balance sheet gives effect to the Pro Forma Transactions as though the Pro Forma Transactions had occurred as of September 30, 2013.

The information presented below should be read in conjunction with “Capitalization,” “Selected Historical Financial and Operating Data,” “Unaudited Pro Forma Combined Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Certain Relationships and Related Party Transactions” and our audited and unaudited combined financial statements and related notes, which are included elsewhere in this prospectus.

| Historical |

|

|||||||||||||||||||||||||||||||||

| Predecessor | Successor | Pro forma(1) | ||||||||||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||||||||||||||||

| Year ended December 31, |

Year ended December 31, |

Nine Months Ended September 30, |

January 1 to August 30, |

(Unaudited) July 26, to September 30, |

Year ended December 31, |

Nine months ended September 30, |

||||||||||||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | 2013 | 2012 | 2012 | 2013 | |||||||||||||||||||||||||||

| (in thousands, except per share and sales volume data) | ||||||||||||||||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||||||||||||||||

| Net sales |

$ | 252,111 | $ | 311,410 | $ | 223,449 | $ | 252,248 | $ | 35,630 | $ | 311,410 | $ | 223,449 | $ | 287,878 | ||||||||||||||||||

| Costs, expenses and other income: |

||||||||||||||||||||||||||||||||||

| Cost of goods sold |

279,638 | 289,936 | 213,474 | 195,338 | 31,537 | 322,068 | 237,948 | 242,975 | ||||||||||||||||||||||||||

| Selling and administrative: |

||||||||||||||||||||||||||||||||||

| Direct |

23,844 | 27,194 | 20,077 | 19,338 | 6,200 | 27,819 | 20,546 | 26,007 | ||||||||||||||||||||||||||

| Allocated from Lafarge |

9,745 | 7,037 | 5,477 | 4,945 | — | 7,037 | 5,477 | 4,945 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Total costs and operating expenses |

313,227 | 324,167 | 239,028 | 219,621 | 37,737 | 356,924 | 263,971 | 273,927 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Operating income (loss) |

(61,116 | ) | (12,757 | ) | (15,579 | ) | 32,627 | (2,107 | ) | (45,514 | ) | (40,522 | ) | 13,951 | ||||||||||||||||||||

| Other income and (expenses): |

||||||||||||||||||||||||||||||||||

| Other (expense) income, net |

303 | (87 | ) | (15 | ) | (191 | ) | 85 | (448 | ) | (376 | ) | (106 | ) | ||||||||||||||||||||

| Interest expense, net |

(273 | ) | (212 | ) | (150 | ) | (91 | ) | (2,364 | ) | (21,919 | ) | (16,461 | ) | (16,306 | ) | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income (Loss) before (losses) earnings from equity method investment and income taxes |

(61,086 | ) | (13,056 | ) | (15,744 | ) | 32,345 | (4,386 | ) | (67,881 | ) | (57,359 | ) | (2,461 | ) | |||||||||||||||||||

| (Losses) earnings on equity method investment |

228 | (138 | ) | (156 | ) | (30 | ) | — | — | — | — | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Income (loss) before income |

(60,858 | ) | (13,194 | ) | (15,900 | ) | 32,315 | (4,386 | ) | (67,881 | ) | (57,359 | ) | (2,461 | ) | |||||||||||||||||||

| Income tax (expense) benefit |

316 | 352 | 65 | (130 | ) | (254 | ) | 352 | 65 | (384 | ) | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income (loss) |

$ | (60,542 | ) | $ | (12,842 | ) | $ | (15,835 | ) | $ | 32,185 | $ | (4,640 | ) | (67,529 | ) | (57,294 | ) | (2,845 | ) | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Foreign currency translation adjustments |

1,144 | (1,197 | ) | (1,923 | ) | 2,707 | 266 | (1,197 | ) | (1,923 | ) | 2,973 | ||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Comprehensive income (loss) |

$ | (59,398 | ) | $ | (14,039 | ) | $ | (17,758 | ) | $ | 34,892 | $ | (4,374 | ) | (68,726 | ) | (59,217 | ) | 128 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Net income per share, basic and diluted: |

||||||||||||||||||||||||||||||||||

| Basic |

$ | (1.53 | ) | $ | (1.30 | ) | $ | 0.06 | ||||||||||||||||||||||||||

| Diluted |

$ | (1.53 | ) | $ | (1.30 | ) | $ | 0.06 | ||||||||||||||||||||||||||

| Weighted average shares outstanding: |

||||||||||||||||||||||||||||||||||

| Basic |

44,069 | 44,069 | 44,069 | |||||||||||||||||||||||||||||||

| Diluted |

44,069 | 44,069 | 44,069 | |||||||||||||||||||||||||||||||

15

Table of Contents

| Historical |

|

|||||||||||||||||||||||||||||||||

| Predecessor | Successor | Pro forma(1) | ||||||||||||||||||||||||||||||||

| (Unaudited) | (Unaudited) | |||||||||||||||||||||||||||||||||

| Year ended December 31, |

Year ended December 31, |

Nine Months Ended September 30, |

January 1 to August 30, |

(Unaudited) July 26, to September 30, |

Year ended December 31, |

Nine months ended September 30, |

||||||||||||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | 2013 | 2012 | 2012 | 2013 | |||||||||||||||||||||||||||

| (in thousands, except per share and sales volume data) | ||||||||||||||||||||||||||||||||||

| Other financial data: |

||||||||||||||||||||||||||||||||||

| EBITDA(3) |

$ | (32,531 | ) | $ | 23,349 | $ | 14,179 | $ | 49,292 | $ | 2,572 | $ | 21,001 | $ | 12,005 | $ | 52,925 | |||||||||||||||||

| Adjusted EBITDA(3) |

(18,821 | ) | 40,985 | 26,768 | 63,683 | 9,443 | 40,498 | 26,455 | 72,687 | |||||||||||||||||||||||||

| Adjusted EBITDA margin(3) |

N/A | 13.2 | % | 12.0 | % | 25.2 | % | 26.5 | % | 13.0 | % | 11.8 | % | 25.2 | % | |||||||||||||||||||

| Capital expenditures |

$ | 5,863 | $ | 5,205 | $ | 2,144 | $ | 2,506 | $ | 43 | $ | 5,205 | $ | 2,144 | $ | 2,549 | ||||||||||||||||||

| Selected operating data: |

||||||||||||||||||||||||||||||||||

| Wallboard sales volume (million square feet) |

1,814 | 1,903 | 1,366 | 1,334 | 195 | 1,903 | |

1,366 |

|

1,528 | ||||||||||||||||||||||||

| Mill net sales price(2) |

$ | 98 | $ | 124 | $ | 123 | $ | 148 | $ | 144 | $ | 124 | $ | 123 | $ | 147 | ||||||||||||||||||

| Balance sheet data (at period end): |

||||||||||||||||||||||||||||||||||

| Cash |

$ | — | $ | — | $ | N/A | $ | N/A | $ | 16,760 | $ | N/A | $ | N/A | $ | 11,528 | ||||||||||||||||||

| Property, plant and equipment, net |

415,902 | 386,270 | N/A | N/A | 390,818 | N/A | N/A | 390,818 | ||||||||||||||||||||||||||

| Total assets |

576,044 | 556,746 | N/A | N/A | 757,960 | N/A | N/A | 749,858 | ||||||||||||||||||||||||||

| Total liabilities |

41,119 | 46,513 | N/A | N/A | 497,334 | N/A | N/A | 448,699 | ||||||||||||||||||||||||||

| Total equity |

534,925 | 510,233 | N/A | N/A | 260,626 | N/A | N/A | 301,159 | ||||||||||||||||||||||||||

| (1) | See “Unaudited Pro Forma Combined Financial Information” and the related notes and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included elsewhere in this prospectus. |

| (2) | Mill net sales price represents average selling price per thousand square feet net of freight and delivery costs. |

| (3) | EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP measures. EBITDA represents net income before interest, taxes, depreciation and amortization. Adjusted EBITDA excludes (i) expenses related to net pension and post-retiree benefit costs that were retained by Lafarge, (ii) fees paid under the master brand agreements with Lafarge, which were discontinued after the Acquisition, (iii) the payment of certain retention bonuses by Lafarge, (iv) spare parts write-off related to the closing of our Newark, New Jersey gypsum wallboard plant, (v) the payment of a lease termination fee for the Newark, New Jersey plant, (vi) the payment of a lease termination fee to discontinue the use of our co-generation power plant, (vii) payment of transaction costs associated with the Acquisition, and (viii) one month impact on cost of sales for the step-up of inventory to fair value due to the Acquisition. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of net sales. Management uses Adjusted EBITDA for purposes of evaluating the Company’s performance. We believe that Adjusted EBITDA is useful for investors because it allows them to view the Company’s business through the eyes of management and the Board of Directors, facilitating comparison of results across historical periods and providing a focus on the underlying ongoing operating performance of the business. |

16

Table of Contents

The following table reconciles net income to EBITDA and Adjusted EBITDA:

| Historical | Pro forma(1) | |||||||||||||||||||||||||||||||||

| Predecessor | Successor | |||||||||||||||||||||||||||||||||

| Year ended December 31, |

Nine months ended September 30, |

January 1 to August 30, |

July 26 to September 30, |

Year ended December 31 |

Nine months ended September 30, |

Nine months ended September 30, |

||||||||||||||||||||||||||||

| 2011 | 2012 | 2012 | 2013 | 2013 | 2012 | 2012 | 2013 | |||||||||||||||||||||||||||

| (in thousands) | ||||||||||||||||||||||||||||||||||

| Net income (loss) |

$ | (60,542 | ) | $ | (12,842 | ) | $ | (15,835 | ) | $ | 32,185 | $ | (4,640 | ) | (67,529 | ) | (57,294 | ) | (2,845 | ) | ||||||||||||||

| Income tax (benefit) expense |

(316 | ) | (352 | ) | (65 | ) | 130 | 254 | (352 | ) | (65 | ) | 384 | |||||||||||||||||||||

| Interest expense |

273 | 212 | 150 | 91 | 2,364 | 21,919 | 16,461 | 16,306 | ||||||||||||||||||||||||||

| Depreciation and amortization |

28,054 | 36,331 | 29,929 | 16,886 | 4,594 | $ | 66,963 | $ | 52,903 | $ | 39,080 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| EBITDA |

(32,531 | ) | 23,349 | 14,179 | 49,292 | 2,572 | 21,001 | 12,005 | 52,925 | |||||||||||||||||||||||||

| Pension and post-retiree benefit costs retained by Lafarge(a) |

8,037 | 11,925 | 7,940 | 7,636 | — | 11,925 | 7,940 | 7,636 | ||||||||||||||||||||||||||

| Master Brand Agreement(b) |

5,273 | 3,602 | 2,540 | 3,004 | — | 3,602 | 2,540 | 3,004 | ||||||||||||||||||||||||||

| Special bonus(c) |

400 | 904 | 904 | — | — | 904 | 904 | — | ||||||||||||||||||||||||||

| Spare parts write-off due to plant closure(d) |

— | 1,205 | 1,205 | — | — | 1,205 | 1,205 | — | ||||||||||||||||||||||||||

| Newark lease termination |

— | — | — | 2,556 | — | — | — | 2,556 | ||||||||||||||||||||||||||

| Co-generation lease termination costs(f) |

— | — | — | 1,195 | 2,075 | — | — | 3,270 | ||||||||||||||||||||||||||

| Acquisition closing costs(g) |

— | — | — | — | 3,296 | — | — | 3,296 | ||||||||||||||||||||||||||

| Inventory step-up impacting margin(h) |

— | — | — | — | 1,500 | 1,500 | 1,500 | — | ||||||||||||||||||||||||||

| Debt modification expense(i) |

— | — | — | — | — | 361 | 361 | — | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| Adjusted EBITDA |

$ | (18,821 | ) | $ | 40,985 | $ | 26,768 | $ | 63,683 | $ | 9,443 | $ | 40,498 | $ | 26,455 | $ | 72,687 | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

| (a) | Lafarge retained the pension and post-retiree liabilities related to its gypsum division and no new plans have been established by the Company. The adjustment represents pension and post-retiree benefit costs allocated to the Predecessor. |

| (b) | Adjusts for the amounts paid to Lafarge under the master brand agreements by Lafarge that were discontinued after the Acquisition. |

| (c) | Adjusts for special payouts paid by Lafarge related to a retention program due to the process of disposing of its gypsum division. |

| (d) | Adjusts for the write-off of spare parts related to the closure of the Newark, New Jersey gypsum wallboard plant. |

| (e) | Adjusts for the payment of a lease termination fee to the Port of Newark related to the Newark, New Jersey gypsum wallboard plant that was closed. |

| (f) | Adjusts for the payment of a lease termination fee to discontinue the use of the co-generation power plant. |

| (g) | Adjusts for the transaction costs associated with the Acquisition. |

| (h) | Adjusts for step-up to fair value of inventory that increased cost of sales for one month after the Acquisition. |

| (i) | Adjusts for debt modification costs related to the First and Second Lien Credit Agreements. |

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin have been presented in this prospectus as supplemental measures of financial performance that are not required by, or presented in accordance with, GAAP. We have presented EBITDA as a supplemental performance measure because we believe that it facilitates a comparative assessment of our operating performance relative to our performance based on our results under GAAP while isolating the effects of some items that vary from period to period without any correlation to core operating performance. Additionally, EBITDA is frequently used by analysts, investors and other interested parties to evaluate companies in our industry. We prepared Adjusted EBITDA to eliminate certain charges that we believe do not reflect our operations and underlying operational performance. Management believes that Adjusted EBITDA is useful to investors because it presents a better reflection of our performance as an independent company following the offering. Adjusted EBITDA margin provides a measure of operating efficiency, without regard for certain charges that we do not believe reflect our operations and underlying performance. Management believes it is useful to investors as a measure of our operating efficiency as an independent company.

EBITDA, Adjusted EBITDA and Adjusted EBITDA margin may not be comparable to similarly titled measures of other companies because other companies may not calculate EBITDA, Adjusted EBITDA or Adjusted EBITDA margin in the same manner as we do. EBITDA, Adjusted EBITDA and Adjusted EBITDA margin are not measurements of our financial performance under GAAP and should not be considered in isolation or as an alternative to net income or net income as a percentage of net sales determined in accordance with GAAP or any other financial statement data presented as indicators of financial performance or liquidity, each as calculated and presented in accordance with GAAP.

17

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this prospectus, including the combined financial statements and the related notes appearing elsewhere in this prospectus, before making an investment decision. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects could be materially and adversely affected. The trading price of our common stock could decline due to any of these risks and, as a result, you may lose all or part of your investment in our common stock.

Risks Relating to Our Business and Industry

Demand for our products is closely related to construction activity, particularly new residential construction, which is cyclical.

Historically, demand for the products that we manufacture has been closely correlated with new residential construction in the United States and Canada and, to a lesser extent, commercial construction and R&R activity. Since 2008, new residential construction activities have remained at their lowest levels since 1946 and, correspondingly, demand for the products that we manufacture has been weak. U.S. wallboard consumption was 17.1 bsf in 2010 and 17.2 bsf in 2011, down from pre-recession highs of 36.2 bsf in 2005. Prices fell significantly across the industry as demand decreased. Our net sales declined from $502.9 million for the year ended December 31, 2006 to $244.0 million for the year ended December 31, 2010. There is significant uncertainty regarding the timing and extent of the current recovery in such construction activity and resulting product demand levels. Demand for new residential construction is influenced by mortgage availability and rates, employment levels, household formation rates, domestic population growth, immigration rates, residential vacancy and foreclosure rates, demand for second homes, existing home prices, rental prices, housing inventory levels, consumer confidence, seasonal weather factors and other general economic factors. Our growth prospects depend, to a significant extent, on the degree by which conditions in the residential construction market improve in the future. We cannot control the foregoing and, as a result, our profitability and cash flow may vary materially in response to market conditions and changes in the supply and demand balance for our primary products.

During cyclical downturns in the markets in which we operate, we may incur losses. For example, for the years ended December 31, 2011 and 2012, we incurred net losses of $60.5 million and $12.8 million, respectively, while the housing downturn continued. As a result of any possible future cyclical downturns, the price of our common stock may decline, and you may lose all or a portion of your investment.

If we cannot effectively compete in our markets, our business, financial condition and operating results may be materially and adversely affected.

Many of the wallboard products sold by our competitors are close substitutes for our products. Because of this substitutability, competition among manufacturers is based in large part on price, as well as service, quality and range of products. Actions of our competitors, many of which have significant excess capacity, or the entry of new competitors into our markets, could lead to lower pricing by us in an effort to maintain our customer base and could also lead to lower sales volumes. At times, the price for any one or more of the products that we produce may fall below our production costs, requiring us to either incur losses on product sales or cease production at one or more of our manufacturing facilities. Prices are often subject to material changes in response to relatively minor fluctuations in supply and demand, general economic conditions and other market conditions beyond our control. There can be no assurance that prices for products sold by us will not decline in the future or that such declines will not have a material adverse effect on our business, financial condition and results of operations.

18

Table of Contents

Some of our competitors are larger companies and, therefore, have access to greater financial and other resources than we do. These resources may afford those competitors greater purchasing power, increased financial flexibility and more capital resources for expansion and improvement, which may enable those competitors to compete more effectively than we can. If we fail to compete effectively, we could suffer a loss of sales.

If our coal-fired power plant synthetic gypsum suppliers switch to natural gas or cease operations, our supply of synthetic gypsum could be constrained and our operating results or cash flows may be materially and adversely affected.