Attached files

| file | filename |

|---|---|

| EX-21.1 - EX-21.1 - Prestige Cruises International, Inc. | d619102dex211.htm |

| EX-23.1 - EX-23.1 - Prestige Cruises International, Inc. | d619102dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on January 22, 2014

Registration Statement No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Prestige Cruises International, Inc.

(Exact name of registrant as specified in its charter)

| Republic of Panama | 4400 | 98-0622952 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

8300 NW 33rd Street, Suite 100

Miami, Florida 33122

(305) 514-2300

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jill Guidicy

General Counsel

Prestige Cruises International, Inc.

8300 NW 33rd Street, Suite 100 Miami, Florida 33122

Phone: (305) 514-2300

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

David S. Huntington, Esq.

Tracey A. Zaccone, Esq.

Paul, Weiss, Rifkind, Wharton & Garrison LLP

1285 Avenue of the Americas

New York, New York 10019-6064

(212) 373-3000

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to be Registered |

Proposed Offering Price (1)(2) |

Amount of Registration Fee | ||

| Ordinary shares, par value $.01 per share |

$250,000,000 | $32,200 | ||

|

| ||||

|

| ||||

| (1) | Includes shares that the underwriters have the option to purchase to cover over-allotments, if any. |

| (2) | Estimated solely for the purposes of computing the registration fee in accordance with Rule 457 under the Securities Act of 1933, as amended. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated January 22, 2014

Prestige Cruises International, Inc.

Ordinary Shares

This is the initial public offering of ordinary shares, par value $0.01 per share, of Prestige Cruises International, Inc. We are offering ordinary shares.

Prior to this offering, there has been no public market for our ordinary shares. We expect the initial public offering price will be between $ and $ per share. We expect to apply for listing of our ordinary shares on the under the symbol “ .”

We have granted the underwriters an option for a period of 30 days to purchase from us an aggregate of up to additional ordinary shares to cover over-allotments, if any.

Investing in our ordinary shares involves a high degree of risk. See “Risk Factors” beginning on page 19 to read about certain factors you should consider before buying our ordinary shares.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds to us before expenses |

$ | $ | ||||||

The underwriters expect to deliver the shares on or about , 2014.

Prospectus dated , 2014.

Table of Contents

| Page | ||||

| 1 | ||||

| 19 | ||||

| 35 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 40 | ||||

| 42 | ||||

| Management’s Discussion and Analysis of Financial Condition and Results of Operations |

46 | |||

| 65 | ||||

| 86 | ||||

| 91 | ||||

| 108 | ||||

| 110 | ||||

| 112 | ||||

| 114 | ||||

| 120 | ||||

| 125 | ||||

| 126 | ||||

| 129 | ||||

| 130 | ||||

| 135 | ||||

| 135 | ||||

| 135 | ||||

| F-1 | ||||

Neither we nor the underwriters have authorized anyone to provide you with different or additional information other than that contained in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. Neither we nor the underwriters take any responsibility for, nor can provide any assurance as to the reliability of, any information other than the information in this prospectus, any amendment or supplement to this prospectus or any free writing prospectus prepared by us or on our behalf. We and the underwriters are offering to sell, and seeking offers to buy, our ordinary shares only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus or such other date stated in this prospectus, regardless of the time of delivery of this prospectus or any sale of our ordinary shares, and our business, financial condition, results of operations and/or prospects may have changed since those dates.

Until , 2014 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligations to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

i

Table of Contents

TERMS USED IN THIS PROSPECTUS

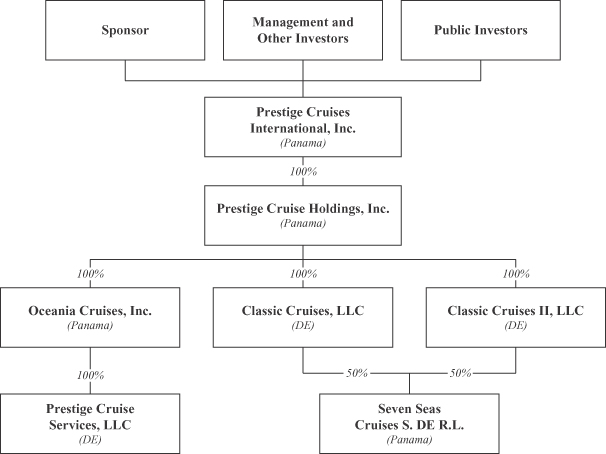

Unless otherwise indicated by the context, references in this prospectus to (i) the “Company,” “we,” “our,” “us,” “PCI” and “Prestige” refer to Prestige Cruises International, Inc., a Panamanian corporation, together with its consolidated subsidiaries. Prestige Cruises International, Inc. is the parent of Prestige Cruise Holdings, Inc. (“PCH”), which in turn is the parent of Oceania Cruises, Inc. (“Oceania”) and the parent of Seven Seas Cruises S. DE R.L. (“Regent”).

Unless otherwise indicated, the following terms have the meanings set forth below:

| • | Adjusted EBITDA refers to EBITDA as adjusted and described in footnote 10 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | Adjusted EBITDA Margin refers to Adjusted EBITDA as a percentage of total revenue; |

| • | APCD or Available Passenger Cruise Days refers to a measurement of capacity and represents double occupancy per cabin multiplied by the number of cruise days for the period. See footnote 9 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | Apollo or our sponsor refers collectively to Apollo Global Management, LLC and its affiliates and/or affiliated funds; |

| • | Berths refers to double occupancy capacity per suite, in accordance with cruise industry practice, even though many suites can accommodate three or more passengers; |

| • | CAGR refers to compound annual growth rate; |

| • | Charter refers to the hire of a ship for a specified period of time; |

| • | CLIA refers to Cruise Lines International Association, Inc. a marketing and training organization formed in 1975 to promote cruising. CLIA North America is composed of 26 cruise lines. CLIA’s website can be found at www.cruising.org; |

| • | Drydock refers to a dock that can be kept dry for use during the inspection or repairing of ships, and also refers to the scheduled or unscheduled removal of a vessel from regular service for maintenance or inspection in a drydock; |

| • | EBITDA refers to net income (loss) excluding depreciation and amortization, net interest expense and income tax benefit (expense). See footnote 10 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | EPS refers to earnings (loss) per share; |

| • | GAAP refers to generally accepted accounting principles in the United States of America set forth in the opinions and pronouncements of the Accounting Principles Board of the Public Company Accounting Oversight Board and statements and pronouncements of the Financial Accounting Standards Board or in such other statements by such other entities as have been approved by a significant segment of the accounting profession; |

| • | Gross Cruise Cost refers to the sum of cruise operating expenses and selling and administrative expenses; |

| • | Gross Tons refers to a unit of enclosed passenger space on a cruise ship, such that one gross ton equals 100 cubic feet or 2.831 cubic meters; |

ii

Table of Contents

| • | Gross Yield refers to total revenues, excluding charter per APCD. See footnote 9 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | IMO refers to the International Maritime Organization, a United Nations agency that sets international standards for shipping; |

| • | MARPOL refers to the International Convention for the Prevention of Pollution from Ships, an international environmental regulation; |

| • | Major North American Cruise Brands refers to Carnival Cruise Lines, Celebrity Cruises, Holland America, Norwegian Cruise Line, Oceania Cruises, Princess Cruises, Regent Seven Seas and Royal Caribbean International; |

| • | Net Cruise Cost refers to Gross Cruise Cost excluding commissions, transportation and other expenses and onboard and other expenses. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | Net Debt refers to our outstanding senior secured indebtedness less cash and cash equivalents; |

| • | Net Per Diem refers to Net Revenue divided by Passenger Days Sold. We utilize Net Per Diems to manage our business on a day-to-day basis. We believe that it is the most relevant measure of our performance as it reflects the revenues earned by us, net of our most significant variable costs. See footnote 9 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | Net Revenue refers to total revenues, less charter revenue less commissions, transportation and other expenses and onboard and other expenses; |

| • | Net Revenue Adjusted EBITDA Margin refers to Adjusted EBITDA divided by net revenue; |

| • | Net Yield refers to Net Revenue divided by APCD. See footnote 9 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | Occupancy Percentage refers to the ratio of Passenger Days Sold to APCD; |

| • | Oceania, Oceania Cruises or OCI refers to Oceania Cruises, Inc., a Panamanian corporation and a subsidiary of Prestige Cruise Holdings, Inc.; |

| • | PCH refers to Prestige Cruise Holdings, Inc., a Panamanian corporation and a subsidiary of Prestige Cruises International, Inc.; |

| • | PCI, Prestige, the Company, we, our or us refers to Prestige Cruises International, Inc., together with its consolidated subsidiaries; |

| • | PCS refers to Prestige Cruise Services, LLC, a subsidiary of Oceania Cruises, Inc.; |

| • | PDS or Passenger Days Sold refers to the number of revenue passengers carried for the period multiplied by the number of days within the period in their respective cruises. See footnote 9 in “Prospectus Summary—Summary Consolidated Financial Information” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Operational and Financial Metrics, including Non-GAAP Measures;” |

| • | Public Cruise Companies refers to Carnival Corp., Norwegian Cruise Line Holdings Ltd. and Royal Caribbean Cruises Ltd.; |

| • | Regent, Regent Seven Seas or SSC refers to Seven Seas Cruises S. DE R.L. and its subsidiaries; |

iii

Table of Contents

| • | Regent Seven Seas Transaction refers to the transaction that closed on January 31, 2008, pursuant to which Seven Seas Cruises S. DE R.L. purchased substantially all of the assets of Regent Seven Seas Cruises, Inc. and the equity of certain of its affiliated companies and joint ventures from Carlson Cruises Worldwide, Inc. and Vlasov Shipping Corporation; |

| • | SOLAS refers to the International Convention for the Safety of Life at Sea, a body of international regulations dealing with ship and operational safety standards; and |

| • | STCW refers to the Standard of Training Certification and Watchkeeping for mariners. |

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of the U.S. federal securities laws. Forward-looking statements include statements other than those that directly or exclusively relate to historical facts, including, without limitation, those regarding our business strategy, financial position, results of operations, plans, prospects and objectives of management for future operations (including development plans and objectives relating to our activities). Many, but not all, of these statements can be found by looking for terms like “expect,” “anticipate,” “goal,” “project,” “plan,” “believe,” “seek,” “could,” “will,” “may,” “might,” “forecast,” “estimate,” “intend,” and “future” and for similar words. Forward-looking statements reflect management’s current expectations and do not guarantee future performance and may involve risks, uncertainties and other factors that are difficult to predict and many of which are beyond our control. These factors could cause our actual results, performance, or achievements to differ materially from the future results, performance, or achievements expressed or implied in those forward-looking statements. Examples of these risks, uncertainties and other factors include, but are not limited to:

| • | adverse economic conditions that may affect consumer demand for cruises, such as declines in the securities and real estate markets, declines in disposable income and consumer confidence; |

| • | changes in cruise capacity, as well as capacity changes in the overall vacation industry; |

| • | intense competition from other cruise companies, as well as non-cruise vacation alternatives, which may affect our ability to compete effectively; |

| • | the delivery schedules and estimated costs of newbuilds, in particular the Seven Seas Explorer, on terms that are favorable or consistent with our expectations; |

| • | our substantial leverage, our potential inability to generate the necessary amount of cash to service our existing debt and the potential incurrence of substantial indebtedness in the future; |

| • | continued borrowing availability under our Secured Credit Facilities (as defined herein) and compliance with our covenants; |

| • | changes in interest rates, foreign currency rates, fuel costs or other cruise operating costs; |

| • | the risks associated with operating internationally; |

| • | changes in general economic, business and geopolitical conditions; |

| • | the impact of changes in the global credit markets on our ability to borrow and our counterparty credit risks, including with respect to our Secured Credit Facilities, derivative instruments, contingent obligations and insurance contracts; |

| • | the impact of problems encountered at shipyards, as well as any potential claim, impairment, loss, cancellation or breach of contract in connection with any contracts we have with shipyards; |

| • | the impact of any future changes relating to how travel agents sell and market our cruises; |

| • | the impact of any future increases in the price of, or major changes or reduction in, commercial airline services; |

| • | the impact of seasonal variations in passenger fare rates and occupancy levels at different times of the year; |

iv

Table of Contents

| • | adverse events impacting the security of travel that may affect consumer demand for cruises, such as terrorist acts, acts of piracy, armed conflict and other international events, including political hostilities or war; |

| • | the impact of the spread of contagious diseases; |

| • | the impact of mechanical failures or accidents involving our ships and the impact of delays, costs and other factors resulting from emergency ship repairs, as well as scheduled maintenance, repairs and refurbishment of our ships; |

| • | accidents, criminal behavior and other incidents affecting the health, safety, security and vacation satisfaction of passengers and causing damage to ships, which could, in each case, cause reputation harm, the modification of itineraries or cancellation of a cruise or series of cruises; |

| • | the continued availability of attractive port destinations; |

| • | our ability to attract and retain qualified shipboard crew members and key personnel; and |

| • | changes involving the corporate, tax, environmental, health, safety and other regulatory regimes in which we operate. |

The above examples are not exhaustive and speak only as of the date of this prospectus. These and other factors are more fully discussed in the “Risk Factors” section and elsewhere in this prospectus. These risks could cause actual results to differ materially from those implied by forward-looking statements in this prospectus.

From time to time, new risks emerge and existing risks increase in relative importance to our operations. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statement contained herein to reflect any change in our expectations with regard thereto or any change of events, conditions or circumstances on which any such statement was based. Such forward-looking statements are based on our current beliefs, assumptions, expectations, estimates and projections regarding our present and future business strategies and the environment in which we will operate in the future. All subsequent written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section and in this prospectus, particularly in “Risk Factors.”

MARKET AND INDUSTRY DATA AND FORECASTS

This prospectus includes market share and industry data and forecasts that we obtained from industry publications, third-party surveys and internal company surveys. Industry publications, including those from the Cruise Lines International Association, Inc. (“CLIA”) and surveys and forecasts generally state that the information contained therein has been obtained from sources believed to be reliable. All CLIA information, obtained from the CLIA website “www.cruising.org,” relates to CLIA member lines, which currently include 26 of the major North American cruise lines, including both Regent and Oceania. CLIA member lines cumulatively represented 97% of the North American cruise capacity as of September 30, 2013. All other references to third-party information are to information that is publicly available at nominal or no cost. We use the most currently available industry and market data to support statements as to our market position.

Although we believe that the industry publications and third-party sources are reliable, we have not independently verified any of the data from industry publications or third-party sources. Similarly, while we believe our internal estimates with respect to our industry are reliable, our estimates have not been verified by any independent sources. While we are not aware of any misstatements regarding any industry data presented herein, our estimates, in particular as they relate to market share and our general expectations, involve risks and uncertainties and are subject to change based on various factors, including those discussed under “Risk Factors,” “Cautionary Statement Concerning Forward-Looking Statements” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this prospectus.

v

Table of Contents

This summary highlights information about us and the offering contained elsewhere in this prospectus. It is not complete and may not contain all the information that may be important to you. You should read this entire prospectus carefully before making an investment decision, including the sections entitled “Risk Factors” and “Cautionary Statement Concerning Forward-Looking Statements” and our consolidated financial statements and related notes included elsewhere in this prospectus.

Our Company

We are the market leader in the Upscale segment, which is comprised of the Upper Premium and Luxury segments, of the $29 billion cruise industry, and we are focused on providing our guests with extraordinary experiences. These experiences are characterized by gourmet cuisine, high quality service, luxurious accommodations and distinctive itineraries to “must see” destinations worldwide. Our cruise vacations are tailored to the preferences of affluent individuals globally, who are generally 55 years of age and older. This target market, referred to as the baby-boomers in the United States, is both the largest and fastest growing U.S. demographic. Our focus on this demographic allows us to deliver a vacation lifestyle that our guests can expect, enjoy and are willing to pay a premium price to experience. Our cruise vacations are exclusive and upscale and are designed to encourage our guests to form an emotional attachment to our ships and staff, creating a long-lasting affinity for our brands.

Our brands, Oceania and Regent, are comprised of eight cruise ships, with a ninth under construction for Regent. Oceania operates in the Upper Premium segment and Regent operates in the Luxury segment. We believe we have successfully positioned our two brands as the cruise lines of choice with the fast growing baby-boomer demographic. Our brands occupy a leading position in the Upscale segment, representing approximately 46% of the combined berth capacity of the Upscale segment as of September 30, 2013. We believe our two-brand strategy is key to maintaining our market leading position, as it allows us to offer products in the Upscale segment with distinct brand promises to a growing global demographic.

We focus on providing destination-oriented vacations combined with distinctive onboard experiences, such as gourmet cuisine, spacious and comfortable public areas, high levels of service and luxurious in-suite amenities. Our ships have limited guest capacity per ship, ranging from 490 to 1,250 guests, and are significantly smaller than the typical 2,000 to 5,000 passenger ships operated by the Contemporary and Premium segment brands. Our stateroom accommodations are large and luxurious, consistent with an upscale and exclusive cruise experience, with over 87% of the suites and staterooms on our ships featuring private balconies. Our onboard dining is a central highlight of our cruise experience and features multiple open seating gourmet dining venues where guests may dine when, where and with whom they wish. Our ships are staffed with a crew-to-guest ratio of approximately 1 to 1.7, further promoting a high level of service. This luxury-focused product offering drives our industry leading Net Yields.

We focus on deploying our ships to high demand and in-season locations worldwide. Our smaller ship size allows us to travel to more remote ports around the world, thereby meeting our guests’ demand for experiencing the most sought after destinations. The duration of our cruises varies from seven to 180 days, featuring worldwide itineraries that visit approximately 350 ports each year, including destinations such as Scandinavia, Russia, the Mediterranean, the Greek Isles, Alaska, Canada and New England, Asia, Tahiti and the South Pacific, Australia and New Zealand, Africa, India, South America, the Panama Canal and the Caribbean. We also have the only cruise line (Oceania) to offer a port-intensive 180 day “Around the World” cruise that circumnavigates the globe. Our ships are designed to be classic and refined, providing a comfortable cruise experience featuring the gourmet cuisine, highly attentive service and elegant surroundings that our target market is seeking, rather than the extravagant and flashy onboard features found on many larger ships catering to the mass market. We

1

Table of Contents

believe this key advantage will allow us to continue to grow our Net Yields across our entire fleet, and not just from new ship introductions, and to experience a more consistent and predictable return on invested capital over the useful life of our ships.

Our affluent and mostly retired or semi-retired guests plan their cruise vacations well ahead of sail date, which gives us high visibility into our future revenues. On average, our guests book seven to nine months in advance of sail date, which provides us ample lead time to effectively plan our sales and marketing initiatives and optimize our industry leading Net Yields. Because of the more all-inclusive nature of our product offerings, we generate a larger share of our overall revenue at time of booking compared to the rest of the industry, which provides us with even greater visibility into our total revenues. Another key differentiating factor is our disciplined and transparent go-to-market strategy. Unlike most cruise lines that discount inventory regularly to fill capacity (“price to fill”), our strategy to maximize revenue is to increase marketing efforts (“market to fill”) as the cruise date approaches. In order to accelerate sales, we clearly articulate to customers and travel agents that our prices are subject to increase as the cruise date approaches, as well as the specific dates on which those increases may occur. This strategy allows us to maintain and improve our high price point, which is fundamental in the Upscale segment.

Our senior management team has delivered consistent revenue, EBITDA and net income growth, producing measurable improvements in all three growth phases of the cruise industry. Frank J. Del Rio launched a new brand with the introduction of Oceania in 2003 and leads the company as our Chairman and CEO. We acquired Regent in 2008 and improved our results following the acquisition, including generating $18.0 million in cost synergies and increasing occupancy and yields. We also completed a newbuild program with the successful launch of Oceania’s Marina in January 2011 and Oceania’s Riviera in April 2012. We are committed to maintaining a disciplined growth strategy to maximize shareholder value by profitably growing our business while continuing to reduce our debt and increase our return on invested capital.

Our operating structure is integrated, with both of our brands sharing a single headquarter location and back office functions. This approach creates a culture of institutionalizing best practices, driving efficiencies and taking advantage of scale. Our brands maintain separate sales and marketing teams as well as dedicated reservation centers, which allows each brand to maintain and effectively communicate its unique identity and brand promise. This balanced approach leverages best-in-class operations to deliver consistently outstanding experiences to our guests while keeping our overhead expenditures low and our competitive position strong. This strategy also allows us to leverage our scale in order to develop international source markets effectively and permits other efficiencies such as implementing a common reservation system, shared data center and a common pool of well trained and experienced onboard crew and officers.

For the twelve months ended September 30, 2013, we generated total revenue of $1.2 billion, Net Revenue of $787.2 million, Adjusted EBITDA of $253.4 million and Adjusted EBITDA Margin of 21.6%. In comparing our Adjusted EBITDA Margin to other cruise lines, it is important to note that our more inclusive product offering results in higher Commissions, transportation and other expense. Accordingly, we believe a more appropriate margin analysis is Net Revenue Adjusted EBITDA Margin, which is Adjusted EBITDA divided by Net Revenue, which was 32.2% for the twelve months ended September 30, 2013. See “Prospectus Summary—Summary Consolidated Financial Information” for a reconciliation of Adjusted EBITDA to net income.

Our Brands

Oceania

Oceania was formed in 2003 by Frank J. Del Rio, now Chairman and CEO of our company, to focus on the under-penetrated midsize ship cruise market. Oceania specializes in offering destination-oriented cruise vacations,

2

Table of Contents

gourmet culinary experiences, elegant accommodations and personalized service at a compelling value. Oceania owns and operates a five ship fleet, comprised of three 684 guest R-Class ships: Regatta, Insignia and Nautica, and two new 1,250 guest O-Class ships: Marina and Riviera, which joined the fleet in 2011 and 2012, respectively.

Oceania provides an Upper Premium midsize ship cruise experience designed primarily for affluent baby-boomers. The line positions itself as the affordable cruising alternative between the Luxury ($500 plus per person per diems) and Premium ($150 to $250 per person per diems) segments of the cruise industry. Affluent guests, who historically have been loyal cruise customers on small and midsize ships, have seen the number of these type of ships diminish in recent years as the major cruise operators have focused on building ever larger ships (2500+ passengers) in the Premium cruise category.

In 2011 and 2012, Oceania took delivery of the first two O-Class vessels, Marina and Riviera, with a capacity of 1,250 guests each. We believe the O-Class ships are the world’s finest vessels designed and purpose-built for the Upper Premium market, expanding upon the popular elements featured on Oceania’s original fleet of vessels, with an emphasis on large suites and staterooms and an exceptional epicurean experience. The overall mix of suite and balcony stateroom accommodations on the O-Class ships of 95% positions these vessels to generate higher Net Yields than the R-Class ships, with 68% balcony staterooms.

Oceania is ranked as one of the world’s best cruise lines by Condé Nast Traveler, Travel + Leisure, Departures, Travel Age West and Cruise Critic. Oceania ships received Best Dining, Best Public Rooms and Best Cabins from Cruise Critic Cruisers’ Choice Awards in 2013. Oceania also is the only cruise line to have had one of its ships receive a perfect “100” score for “Dining” in the Condé Nast Traveler Reader’s Choice Awards.

Regent

Regent is recognized as one of the world’s top luxury lines, featuring six-star service, oversized balcony suite staterooms and the cruise industry’s most inclusive product offering. Regent is a leading luxury cruise company and traces its origins to 1992, when Seven Seas Cruise Line merged with Diamond Cruise to become Radisson Seven Seas Cruises. In 2006, the cruise line was re-branded by its then-owner Carlson Company as Regent Seven Seas Cruises. Regent currently operates three award-winning, all-suite ships, comprised of Seven Seas Navigator, the all-balcony Seven Seas Mariner and the all-balcony Seven Seas Voyager, totaling 1,890 aggregate berths. Regent offers the industry’s most all-inclusive cruise vacation experience, including free air transportation, a pre-cruise hotel night stay, premium wines and top shelf liquors, gratuities, internet access and unlimited shore excursions.

Regent is currently building a 750 passenger ship, Seven Seas Explorer, for delivery in the summer of 2016, which we believe will further elevate the position of the Regent brand. The all-suite, all-balcony ship will feature sophisticated designer suites ranging from 300 to 3,500 square feet with an industry leading space ratio of 89.3 and a crew-to-guest ratio of 1 to 1.4. The ship will include six open-seating gourmet restaurants, Regent’s signature nine-deck open atrium, a two-story theater, three boutiques and an expansive Canyon Ranch SpaClub®. Operationally, the vessel will be a green ship, employing the most advanced environmental systems and state-of-the-art technology.

Regent focuses on providing guests with a high level of personal service, imaginative world-wide itineraries, unique shore excursions and land tours, world-class accommodations and top-rated cuisine. Regent is consistently ranked among the top luxury cruise lines by various travel publications. In 2011, 2012 and 2013, Regent was named the Best Luxury Cruise Line by Virtuoso, one of America’s largest travel agency networks, which caters to the highly affluent traveler. In 2012, Condé Nast Traveler awarded the brand “Best Cabins” and it received the “Best for Luxury” award from the Cruise Critic Editor’s Pick Awards. Regent also was honored with “World’s Best Service” from Travel + Leisure’s World’s Best Awards in 2013.

3

Table of Contents

Our Industry

We believe that the cruise industry demonstrates the following positive fundamentals:

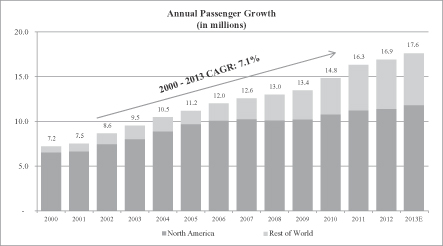

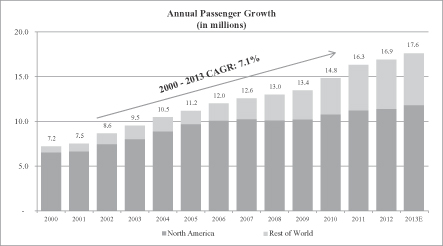

Strong Growth with Low Penetration and Significant Upside

Cruising represents a small but fast growing sector of the overall global vacation market. Cruising is a vacation alternative with broad appeal, as it offers a wide range of products, destinations and experiences from offerings in the Contemporary (large ships / low ticket prices) to Luxury (small ships / high ticket prices) segments to suit the various preferences of vacationing consumers of all ages, wealth levels and nationalities. According to CLIA, only 24% of the U.S. population has taken a cruise. However, CLIA estimates that during 2012, approximately 17 million global passengers went on a cruise, an increase of 5.4% over the preceding year. According to CLIA, the number of cruise passengers originating from North America has increased each year since 1995 as cruising has evolved from a niche vacation experience to a leisure holiday with broad appeal across all demographic and psychographic groups. Despite this consistent growth, the cruise industry still has low penetration levels compared to similar land-based vacations. Based on industry research, in 2012, 57.2 million people visited Orlando, Florida and 39.7 million people visited Las Vegas, Nevada. We believe this data highlights the continued growth potential for ocean going cruising. The future growth of the Contemporary and Premium segments, along with the normal aspirational life cycle of consumer preferences, is especially important for our company, because the vast majority of our first time guests are not first time cruisers. Accordingly, increases in the number of guests in the Contemporary and Premium segments will increase the pool of potential first time guests for our two brands.

Attractive Demographics of Target Market

Long-term demographics are favorable for the cruise industry, in particular for the Upscale segment. Historically, people 55 years of age and older have had the highest disposable income levels and the most leisure time, making them prime candidates for Upscale cruising given the longer itineraries and higher per diems of cruises in that category. According to U.S. Census Bureau data, in 2010, the 55 years and older age group was comprised of 77 million individuals, representing approximately 25% of the U.S. population. This group is expected to increase to 87 million by 2015 and 106 million by 2025. These individuals control $12.7 trillion of wealth and represent approximately 31% of the global high net worth individual population. The demographics in Europe are expected to follow a similar growth trend.

4

Table of Contents

International Growth in Emerging Markets

Significant growth opportunities exist for sourcing guests from Europe and other international markets, as the percentage of guests from outside North America who have taken cruises is far lower than the percentage of North Americans. Emerging markets in Asia and the Pacific Rim also hold strong potential for us to source future cruise passengers. As recently as seven years ago, no international cruise lines serviced these regions. However, a number of cruise lines in the Contemporary and Premium segments, which typically includes cruises of seven days or less, have a more casual ambiance, and offer the lowest prices, have recently deployed ships in Asia for seasonal or year-round operations. The increase in personal wealth in these and other emerging markets is particularly beneficial to the cruise industry, as historically, when the living standards improve in a country, the population first focuses on buying physical assets (e.g., houses, cars, etc.) and then focuses on buying aspirational experiences, such as travel. Overall, the growth in cruising outside of North America has been increasing at a considerably faster pace than within North America.

Multiple Segments

The cruise industry’s brands have been historically segmented into the Contemporary, Premium, Upper Premium and Luxury categories. Collectively, we refer to the Upper Premium and Luxury categories as the Upscale segment. The Premium segment typically includes cruises that range from seven to fourteen days. Premium cruises emphasize higher quality offerings, more personal comfort and greater worldwide itineraries, with higher average pricing than the Contemporary cruises. Upper Premium is a niche market segment created by Oceania in 2003 and defined by an experience that straddles the Premium and Luxury segments but with smaller ships than those operated by the Premium lines, higher space and higher crew-to-guest ratios, more refined culinary programs, higher service standards and a greater destination-oriented focus than the Premium segment. The Luxury segment is characterized by the smallest vessel size, unique itineraries, the largest stateroom accommodations, gourmet culinary programs, highly personalized service and a more inclusive offering. These exclusive attributes, combined with limited supply growth and a growing worldwide target population, provide Upscale operators with significant pricing leverage as compared to the other segments of the cruise industry.

High Barriers to Entry

The cruise industry is characterized by high barriers to entry, including the existence of well-known and established consumer brands, the cost, time and personal relationships required to develop strong travel agent network partnerships necessary for success, the large capital expenditures required to build new and sophisticated ships, the limited number of ship builders with experience in constructing passenger ships and the long lead time necessary to construct new ships. Based on recently announced newbuilds and depending on the intended industry segment, the cost to build a new cruise ship can range from $340 million to $1.3 billion, or $195,000 to $741,000 per berth. The ultimate cost depends on the ship’s size and product offering, with the Upper Premium and Luxury segments having the highest cost per berth in the industry, ranging from $443,000 to $741,000 per berth. The Luxury segment in particular has demonstrated high barriers to entry with our competitors having participated in the market for an average of approximately 24 years. We believe that the newbuild pipeline in the Upscale segment is relatively favorable compared to the broader industry, with few deliveries scheduled through 2016 other than Regent’s newbuild.

Our Competitive Strengths

We believe that the following business model attributes enable us to successfully execute our strategy:

Lifestyle Brand

Prestige’s two brands, Regent and Oceania, both have long and venerable histories. We believe the two brands are well known within the affluent 55 and older age group in North America as offering a sophisticated

5

Table of Contents

experience. We partner with several fine luxury brands, including Lalique, Hermes, Bulgari, Canyon Ranch and Bon Appetit, to further add caché to the lifestyle experiences we deliver onboard our cruises. Consistent with our upscale image, we believe our two brands will continue to enjoy resiliency in economic downturns and achieve above-market Net Yields during normal economic conditions.

High Quality Fleet

Our two-brand fleet, which currently consists of eight ships, is designed to provide guests with the highest quality cruise experience. Our accommodations are large and luxurious with over 87% of our staterooms and suites featuring private balconies. Capacity per ship is limited and ranges from 490 to 1,250 guests, providing each guest a unique and highly personalized experience, with space ratios of 44.26 to 68.68, which are among the highest in the industry. Our cruises are staffed at a crew-to-guest ratio of approximately 1 to 1.7, further promoting a high level of personalized service. Seven Seas Mariner and Seven Seas Voyager feature all suite, all balcony accommodations, and Marina and Riviera, 95% of whose accommodations feature balconies, are the only ships at sea to feature suites designed and furnished by Ralph Lauren Home and noted interior designer Dakota Jackson. We expect delivery of our newbuild Seven Seas Explorer in the summer of 2016, which we believe will be the most luxurious ocean-going ship ever built.

Differentiated Product Offering

We believe that our destination-focused worldwide itineraries of varying lengths, augmented by exciting shore excursions and other land based programs and a diverse set of onboard enrichment programs, further differentiate our two brands from our competitors. We also focus on deploying our ships to high demand and in-season locations worldwide. We cruise to more remote ports around the world to meet passengers’ demands to experience new, exotic and out-of-the-way destinations. We feature itineraries that call on “must see” destinations, many of which include overnight stays in port, allowing guests to enjoy greater local immersion. A competitive advantage of our smaller ship size is that we can access smaller ports that are off-limits to larger ships. Our onboard dining is a central highlight of our cruise experience, with multiple open seating dining venues where guests may dine when, where and with whom they wish. We continue to receive awards for our onboard dining and, in 2013 received “Best Dining” from both Condé Nast Traveler Reader’s Choice Awards and Cruise Critic Cruisers Choice Awards. We also feature the only hands-on instructional culinary centers at sea onboard Oceania’s Marina and Riviera. Our state-of-the-art spa facilities on each vessel feature the highly renowned Canyon Ranch SpaClub®. We believe that these high quality product offerings positions us well compared to other cruise operators and provides us with the opportunity to continue growing our capacity and Net Yields.

Loyal and Repeat Customer Base

Our target customer is 55 years of age or older, has a net worth of over $1.0 million, is well educated and is a seasoned world traveler. This target audience has reached an age and wealth status where the convenience, comfort and luxury amenities of an upscale cruise product are extremely appealing.

Our award-winning service, innovative itineraries, gourmet cuisine and luxurious onboard amenities have resulted in nearly perfect passenger satisfaction ratings. In 2013, approximately 98% of guests that responded to our survey reported that their cruise experience met or exceeded their expectations, and that they will “definitely” or “probably” return. Furthermore, for the nine months ended September 30, 2013, repeat guests accounted for approximately 41% of total guests on a Passenger Days Sold basis. Our ability to consistently deliver a high quality, high value product, resulting in high guest satisfaction, continues to be a competitive advantage.

6

Table of Contents

Experienced Management Team and Shareholder

We are led by a management team with extensive cruise and leisure industry experience. The team includes Frank J. Del Rio as Chairman and CEO with 20 years of industry experience, Robert J. Binder as Vice Chairman and President with 23 years of industry experience, Kunal S. Kamlani as President of PCH, Regent and Oceania with 19 years of experience in the financial services and leisure industries, T. Robin Lindsay as Executive Vice President of Vessel Operations with 34 years of industry experience and Jason M. Montague as Executive Vice President and Chief Financial Officer with 13 years of industry experience.

Our principal shareholder and sponsor Apollo has experience investing in the cruise, leisure and travel related industries. Apollo is a leading global alternative asset manager. In addition to holding a controlling interest in us, Apollo is a significant shareholder and controls the board of Norwegian Cruise Line Holdings Ltd., one of the leading global cruise line operators. Apollo also has current investments in other travel and leisure companies, including Caesars Entertainment and Great Wolf Resorts, and has in the past invested in Vail Resorts, Wyndham International and other hotel properties.

Cash Flow Generation

Our business model allows us to generate a significant amount of free cash flow with high revenue visibility. We encourage our target customers to book their cruise vacations as early as possible in the sales cycle and to prepay for certain optional services. We begin to sell our inventory up to 20 months prior to sail date, with deposits generally due within seven days of booking and final payment collected 90 to 150 days before sailing. This payment model results in passenger deposits being a source of cash, provides strong visibility into our future revenues and corresponding cash flows and gives us ample time to adjust selling price and sales and marketing initiatives to minimize acquisition costs and maximize Net Yields. Moreover, we benefit from favorable U.S. tax status, as our income is primarily derived from the operation of cruise ships in international waters and is therefore generally exempt from U.S. federal income taxes. As a result of these factors, we generate significant free cash flow, a portion of which can be used for debt reduction and capacity expansion.

Superior Value Proposition

A substantial number of cruise customers purchase large balcony staterooms measuring over 200 square feet in size on cruise lines in the Contemporary and Premium segments. We believe that after factoring in additional onboard spending for items that would be included in our ticket price, these passengers are currently paying per diems similar to what we charge, but in our opinion, receive a lower quality product, with inferior cuisine, standard itinerary offerings, diminished personalized service due to significantly lower crew-to-guest ratios and markedly lower space ratios. According to our research, there are approximately 22,297 large balcony staterooms measuring over 200 square feet in the North American cruise industry. Our market share of this type of stateroom was only 10% in 2012. We believe our brands are well positioned for future capacity growth given each brand’s market positioning and strong value proposition.

Our Business Strategy

The following are the key components of our business strategy:

Disciplined Growth

Our goal is to grow with discipline, and we are constantly evaluating various strategies for further increasing our passenger capacity and, accordingly, our total revenues and net income with a specific focus on increasing our return on invested capital. These strategies include further penetration into emerging international markets and potential acquisitions of niche cruise operators, similar to the successful acquisition of Regent in 2008. Other possibilities include additional newbuild programs, similar to the additions of Marina and Riviera to

7

Table of Contents

the Oceania fleet in 2011 and 2012, respectively, as well as the scheduled delivery of the Seven Seas Explorer to the Regent fleet in the summer of 2016. Each ship that has joined our fleet has had a significant positive impact on our financial results with limited incremental overhead.

High Visibility and Differentiated Revenue Management Strategy

We have implemented a differentiated price enhancing revenue management strategy that encourages our target market to book early to obtain the most attractive value offering, with bookings made up to 20 months in advance of sail date. This timeline provides us with greater visibility into our future revenues and gives us ample time to adjust sales, marketing and pricing initiatives as necessary. Due to the more inclusive nature of our product offerings, a greater percentage of our Net Revenue is comprised of net ticket revenue as compared to Contemporary and Premium segment cruise lines, which must wait until the actual sailing to gain visibility into much of their revenues, as their onboard revenue represents a greater portion of their total revenue. On average, our guests book seven to nine months in advance of sail date. Based on our research, we believe the industry average booking curve is five months or less.

When we launch new itineraries, we clearly articulate to potential customers and travel agents that prices are subject to increase as the cruise date approaches, as well as the specific dates on which those price increases may occur. We believe the travel agent community favors our pricing strategy as it allows them to provide value to their customers in a completely transparent manner, resulting in early bookings. This early booking cycle allows us to make more informed decisions about pricing, inventory management and marketing efforts.

Focus on Occupancy and Maximize Net Yields

We concentrate on improving our early booking occupancy rates to drive higher Net Yields. We execute targeted and high frequency marketing campaigns that communicate a distinct message of our differentiated value-packed cruise offerings in both North American and select international markets. To increase the effectiveness of our targeted marketing programs, we recently transformed our Miami call center from an inbound-only reservation center to one that also makes outbound calls to high potential targeted customers. This dual prong strategy allows us to maximize the revenue potential from each customer contact (“leads”) generated by our various marketing campaigns. We expect that this strategic change and other initiatives in our sales organization and distribution channels will help drive sustainable growth in the number of guests carried and in Net Yields achieved.

Due to our brands’ clear positioning and our target market focus on an older and more affluent clientele, we do not carry many families with children or groups of individuals that travel three or four to a stateroom. Conversely, we have a small but increased number of elderly guests who prefer to travel as “singles,” or one to a stateroom. Because 100% occupancy is based on two persons in a stateroom, we tend to report occupancies that are somewhat lower than those of the Premium and Contemporary cruise lines, while still sailing close to full in terms of cabin occupancy.

Improve Operating Efficiency and Lower Costs

We focus on driving continued financial performance through a variety of business improvement initiatives. These initiatives focus on reducing costs while also improving the overall product quality we deliver to our customers. For example, when we acquired Regent in 2008, we were able to achieve $18 million in annual cost savings through rationalizing overhead and institutionalizing best practices across the two brands.

Our business improvement initiatives focus on various cost containment programs such as contract negotiations, global purchasing and logistics, fuel consumption efficiencies and optimal itinerary deployments. We hedge our fuel purchases in order to provide greater visibility and certainty of our fuel expenses. As of September 30, 2013, we had

8

Table of Contents

hedged approximately 75% of estimated fuel consumption for the remainder of 2013, and approximately 40% and 10% of our estimated fuel consumption for 2014 and 2015, respectively. In addition, we expect benefits derived from economies of scale from additional newbuilds will further drive operating efficiencies over the medium and long term.

Expand and Strengthen Our Product Distribution Channels

We have three primary sales channels that we constantly strive to optimize: “Retail/Travel Agent,” “International” and “Meetings, Incentives and Charters.” As part of this optimization, we continue to invest in our brands by enhancing our technology platforms across these channels, including through websites and other global distribution systems, as well as our inbound and outbound reservations department that travel agents and customers use to book cruise vacations. We strive to continually deliver efficient and timely marketing information across multiple technological and legacy type platforms.

| • | Retail/Travel Agent. We make substantial investments to facilitate our travel agent partners’ success with improvements in booking technologies, transparent pricing strategies, effective marketing tools, improved communication and cooperative marketing initiatives. We have also implemented automated communication, training and booking tools specifically designed to improve our efficiency with the travel agency community and our guests including aggressive call center quality monitoring. We have sales force teams dedicated to each of our two brands who work closely with our travel agency partners on maximizing their marketing and sales effectiveness through product training, education and the sharing of “best-practices.” |

| • | International. We have an international sales office in Southampton, United Kingdom that services Europe and various general sales agents covering Latin America, Australia and Asia. Since the expansion of our fleet in 2011, we have made a concerted effort to diversify the sourcing of our passengers worldwide. In 2010, 20.2% of our passengers were sourced from outside the United States. In 2012, we grew that amount to 25.3%. For the twelve months ended September 30, 2013, 26.6% of our passengers were sourced from outside the United States. We believe there remains significant opportunity to grow passenger sourcing in many major markets such as Europe and Australia as well as in emerging markets in the Asia Pacific region. |

| • | Meetings, Incentives and Charters. This channel focuses on full ship charters as well as partial ship groups for corporate meeting and incentive travel. These sales often have very long lead times and can fill a significant portion of a ship’s capacity, or even an entire sailing, in one transaction. In addition, full ship charters and/or large groups strengthens base-loading, which allows us to fill a particular sailing earlier than usual which in turn allows us to reduce sales and marketing spend on both the sailing with the large group as well as surrounding sailings. |

Our Fleet

Collectively, our two brands operate eight ships with 6,442 berths in aggregate. We also have one newbuild, Seven Seas Explorer, with 750 berths on order for delivery in the summer of 2016. Our current fleet has a maximum of 2,351,330 capacity days that will grow 11.6% to 2,625,080 after delivery of the Seven Seas Explorer in the summer of 2016.

Oceania operates five ships. The R-Class ships, Regatta, Insignia and Nautica are identical highly-rated 5-star ships featuring country club style accommodations and amenities. Capacity on each ship is limited to 684 guests and our cruises are staffed at a crew-to-guest ratio of approximately 1 to 1.7. These ships provide 68% of suites and staterooms with private balconies. Recently, Oceania successfully executed a fleet expansion program with the additions of two O-Class ships, Marina and Riviera, in 2011 and 2012, respectively. The O-Class vessels are staffed at a crew-to-guest ratio of approximately 1 to 1.6 and 95% of the staterooms are suites and have private balconies. Oceania’s fleet has grown 122% since 2010 to 4,552 berths in aggregate and operating a maximum annual capacity of 1,661,480 capacity days. Oceania is the world’s largest Upper Premium cruise line.

9

Table of Contents

Regent currently operates three six-star luxury cruise ships, Seven Seas Navigator, Seven Seas Mariner and Seven Seas Voyager, with 1,890 berths in aggregate, featuring world-class accommodations and amenities. Regent operates at a maximum capacity of 689,850 capacity days. Capacity on each ship is limited and ranges from 490 to 700 guests and cruises are staffed at a crew-to-guest ratio of approximately 1 to 1.6. All ships offer all-suite accommodations with 90-100% of the suites featuring private balconies. Delivery of the 750 guest newbuild, Seven Seas Explorer, is expected in the summer of 2016. The all-suite, all-balcony Seven Seas Explorer will feature sophisticated designer suites ranging from 300 square feet to 3,500 square feet with an industry leading space ratio of 89.3 gross tons per guest and a crew-to-guest ratio of 1 to 1.4. The ship will include six open-seating gourmet restaurants, Regent’s signature nine-deck open atrium, a two-story theater, three boutiques and an expansive Canyon Ranch SpaClub®. Operationally, it will be a green ship, employing the most advanced environmental systems and state-of-the-art technology. Upon delivery of the Seven Seas Explorer, Regent will be the world’s largest luxury cruise line.

The following table describes the features of our ships:

| Marina, |

Regatta, |

Seven Seas |

Seven Seas |

Seven Seas |

Seven Seas | |||||||

| Berths |

1,250 | 684 | 750 | 700 | 700 | 490 | ||||||

| Balconies |

95% | 68% | 100% | 100% | 100% | 90% | ||||||

| Gross tonnage |

66,084 |

30,277 |

67,000 | 42,363 | 48,075 | 28,803 | ||||||

| Space ratio (1) |

52.86 | 44.26 | 89.33 |

60.52 | 68.68 | 58.78 | ||||||

| Accommodations (sq ft) |

174-2,000 | 160-982 | 300-3,500 | 350-1,403 | 301-2,002 | 301-1,173 | ||||||

| Crew-to-guest ratio |

1:1.6 | 1:1.7 | 1:1.4 | 1:1.6 | 1:1.6 | 1:1.4 | ||||||

| Country of registry |

Marshall Islands | Marshall Islands | Marshall Islands | Bahamas | Bahamas | Bahamas | ||||||

| Restaurants |

6 | 4 | 6 | 4 | 4 | 3 | ||||||

| Year built |

2011, 2012 | 1998, 1998, 2000 | (2) | 2003 | 2001 | 1999 |

| (1) | Space ratio refers to a unit of enclosed space per passenger on the ship measured in cubic feet, and represents gross tonnage divided by the number of double occupancy berths. |

| (2) | The Seven Seas Explorer is currently under construction, with delivery expected in the summer of 2016. |

10

Table of Contents

Our Corporate Structure

The following chart shows our corporate structure immediately following the consummation of this offering:

11

Table of Contents

Our Sponsor

Our principal shareholder and sponsor, Apollo Global Management, LLC, is a leading global alternative asset manager with offices in New York, Los Angeles, London, Frankfurt, Luxembourg, Singapore, Hong Kong and Mumbai. As of September 30, 2013, Apollo had assets under management of $113.0 billion invested in its private equity, credit markets and real estate businesses. In addition to holding a controlling interest in us, Apollo is a significant shareholder and controls the board of Norwegian Cruise Line Holdings Ltd., one of the leading global cruise line operators. Apollo also has current investments in other travel and leisure companies, including Caesars Entertainment and Great Wolf Resorts, and has in the past invested in Vail Resorts, Wyndham International and other hotel properties.

Additional Information

Prestige is a company incorporated under the laws of Panama. Our registered offices are located at Plaza 2000 Building, 16th Floor, 50th Street, Panama, Republic of Panama. Our principal executive offices are located at 8300 NW 33rd Street, Suite 100, Miami, FL 33122. Our telephone number is (305) 514-2300. Our websites are www.rssc.com and www.oceaniacruises.com. The information that appears on our website is not part of, and is not incorporated by reference into, this prospectus.

12

Table of Contents

THE OFFERING

| Issuer |

Prestige Cruises International, Inc. |

| Ordinary shares offered by us |

shares, or shares if the underwriters exercise in full their option to purchase additional shares. |

| Ordinary shares to be outstanding after this offering |

shares, or shares if the underwriters exercise in full their option to purchase additional shares. |

| Over-allotment option |

We have granted the underwriters an option for a period of 30 days to purchase from us of up to additional ordinary shares to cover any over-allotments. |

| Use of proceeds |

We estimate that we will receive net proceeds from the sale of our ordinary shares in this offering of approximately $ million, after deducting the underwriting discount and estimated offering expenses, assuming the ordinary shares are offered at $ per share, which is the midpoint of the estimated offering price range set forth on the cover page of this prospectus, and assuming that the underwriters do not exercise their option to purchase additional shares. We intend to use the net proceeds that we receive (i) to redeem $ million of Regent’s outstanding Senior Secured Notes, (ii) to repay $ million of the Oceania Term Loan and $ million of the Regent Term Loan, and (iii) for future capital expenditures and general corporate purposes. See “Use of Proceeds.” |

| Listing |

We have applied to list the common shares on under the symbol “ .” |

| Dividend policy |

We currently do not intend to pay dividends following this offering. The agreements governing our debt instruments limit our ability to pay cash dividends to our shareholders above specified levels. In addition, any determination to pay dividends in the future will be at the discretion of our Board of Directors and will depend upon our results of operations, financial condition, contractual restrictions, restrictions imposed by applicable law and other factors that our Board of Directors deems relevant. See “Dividend Policy.” |

| Risk factors |

You should carefully read and consider the information set forth under “Risk Factors” beginning on page 19 of this prospectus and all other information set forth in this prospectus before investing in our ordinary shares. |

The number of ordinary shares to be outstanding after this offering is based on ordinary shares outstanding as of the date of this prospectus and the ordinary shares we are offering. This number of shares excludes ordinary shares issuable upon the exercise of outstanding options at a weighted-average exercise price of $ per share as of the date of this prospectus, of which were exercisable, and up to ordinary shares reserved for future issuance under our equity incentive plans following this

13

Table of Contents

offering. The number of ordinary shares reserved for future issuance will be reduced by options to purchase ordinary shares that we granted effective immediately following the pricing of this offering with an exercise price equal to the initial public offering price. Of these grants, our directors and named executive officers received options to purchase ordinary shares.

Except as otherwise indicated herein, all information in this prospectus, including the number of ordinary shares that will be outstanding after this offering, reflects or assumes:

| • | an initial public offering price of $ per ordinary share; |

| • | the underwriters do not exercise their option to purchase up to additional ordinary shares from us; |

| • | the stock split that we intend to effectuate prior to this offering, whereby each issued and outstanding ordinary share will be converted into shares; and |

| • | no exercise of the outstanding options described above. |

14

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL INFORMATION

In the tables below, the summary consolidated financial information as of December 31, 2012 and 2011 and for each of the three years ended December 31, 2012, 2011 and 2010 have been derived from our audited consolidated financial statements included elsewhere in this prospectus. The summary consolidated financial information as of December 31, 2010 has been derived from our audited consolidated financial statements not included in this prospectus. The summary consolidated financial information as of September 30, 2013 and for the nine months ended September 30, 2013 and 2012 has been derived from our unaudited consolidated financial statements included elsewhere in this prospectus. The summary consolidated balance sheet data as of September 30, 2012 has been derived from our unaudited consolidated financial statements not included in this prospectus. We have prepared our unaudited consolidated financial statements on the same basis as our audited consolidated financial statements and, in our opinion, have included all adjustments, which include only normal recurring adjustments, necessary to present fairly in all material respects our financial position and results of operations. The results for any interim period are not necessarily indicative of the results that may be expected for the full year.

Solely for the convenience of the reader, the tables below also provide certain of our financial data for the twelve months ended September 30, 2013, which have been calculated by adding the results for the year ended December 31, 2012 and the nine months ended September 30, 2013, and subtracting the results for the nine months ended September 30, 2012.

We utilize a variety of operational and financial metrics, which are defined below, to evaluate our performance and financial condition. We use certain non-GAAP financial measures, such as EBITDA, Adjusted EBITDA, Net Per Diems and Net Yields, to enable us to analyze our performance and financial condition. We utilize these financial measures to manage our business on a day-to-day basis and believe that they are the most relevant measures of our performance. Some of these measures are commonly used in the cruise industry to measure performance. We believe these non-GAAP measures provide expanded insight to measure revenue and cost performance, in addition to the standard GAAP-based financial measures. There are no specific rules or regulations for determining non-GAAP measures, and as such, they may not be comparable to measures used by other companies within our industry. The presentation of non-GAAP financial information should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP.

The historical results set forth below do not necessarily indicate results expected for any future period, and should be read in conjunction with “Risk Factors,” “Selected Consolidated Financial Information,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Description of Certain Indebtedness” and our consolidated financial statements and related notes thereto included elsewhere in this prospectus.

15

Table of Contents

| (in thousands, except per share data) | Twelve Months Ended September 30, 2013 |

Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||||

| 2013 | 2012 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Statement of operations data: |

||||||||||||||||||||||||

| Revenues: |

||||||||||||||||||||||||

| Passenger ticket |

$ | 994,751 | $ | 779,309 | $ | 731,629 | $ | 947,071 | $ | 834,868 | $ | 642,068 | ||||||||||||

| Onboard and other |

161,197 | 124,007 | 114,023 | 151,213 | 134,270 | 107,025 | ||||||||||||||||||

| Charter |

18,779 | 14,046 | 9,004 | 13,737 | — | — | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue |

1,174,727 | 917,362 | 854,656 | 1,112,021 | 969,138 | 749,093 | ||||||||||||||||||

| Cruise operating expenses: |

||||||||||||||||||||||||

| Commissions, transportation and other |

325,701 | 247,248 | 252,801 | 331,254 | 271,527 | 192,285 | ||||||||||||||||||

| Onboard and other |

43,065 | 33,732 | 31,085 | 40,418 | 36,854 | 28,981 | ||||||||||||||||||

| Payroll, related and food |

177,819 | 133,918 | 124,693 | 168,594 | 153,754 | 122,801 | ||||||||||||||||||

| Fuel |

104,391 | 77,978 | 75,272 | 101,685 | 92,921 | 57,913 | ||||||||||||||||||

| Other ship operating |

99,964 | 74,694 | 70,538 | 95,808 | 86,022 | 68,517 | ||||||||||||||||||

| Other |

14,026 | 8,368 | 16,310 | 21,968 | 26,305 | 16,085 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total cruise operating expenses |

764,966 | 575,938 | 570,699 | 759,727 | 667,383 | 486,582 | ||||||||||||||||||

| Selling and administrative |

170,633 | 131,871 | 114,985 | 153,747 | 145,802 | 134,676 | ||||||||||||||||||

| Depreciation and amortization |

87,731 | 62,683 | 67,955 | 93,003 | 79,269 | 56,606 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total operating expenses |

1,023,330 | 770,492 | 753,639 | 1,006,477 | 892,454 | 677,864 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Operating income |

151,397 | 146,870 | 101,017 | 105,544 | 76,684 | 71,229 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Non-operating income (expense): |

||||||||||||||||||||||||

| Interest expense, net of capitalized interest |

(142,774 | ) | (106,470 | ) | (95,347 | ) | (131,651 | ) | (101,560 | ) | (91,325 | ) | ||||||||||||

| Interest income |

552 | 367 | 567 | 752 | 670 | 513 | ||||||||||||||||||

| Other income (expense) (1) |

9,333 | 6,651 | 20,274 | 22,956 | (45,901 | ) | (42,179 | ) | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total non-operating expense |

(132,889 | ) | (99,452 | ) | (74,506 | ) | (107,943 | ) | (146,791 | ) | (132,991 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Income (loss) before income taxes |

18,508 | 47,418 | 26,511 | (2,399 | ) | (70,107 | ) | (61,762 | ) | |||||||||||||||

| Income tax benefit (expense) |

181 | 183 | (211 | ) | (213 | ) | 335 | (358 | ) | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income (loss) |

$ | 18,689 | $ | 47,601 | $ | 26,300 | $ | (2,612 | ) | $ | (69,772 | ) | $ | (62,120 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Earnings (loss) per share: |

||||||||||||||||||||||||

| Basic |

$ | 3.51 | $ | 1.94 | $ | (0.19 | ) | $ | (5.14 | ) | $ | (4.60 | ) | |||||||||||

| Diluted |

$ | 2.45 | $ | 1.94 | $ | (0.19 | ) | $ | (5.14 | ) | $ | (4.60 | ) | |||||||||||

| Balance sheet data (at end of period): |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 263,781 | $ | 253,303 | $ | 139,556 | $ | 147,212 | $ | 117,635 | ||||||||||||||

| Total restricted cash (2) |

51,693 | 65,588 | 63,692 | 58,168 | 40,768 | |||||||||||||||||||

| Property and equipment, net |

2,016,783 | 2,050,064 | 2,035,449 | 1,644,971 | 1,181,262 | |||||||||||||||||||

| Total assets |

2,983,085 | 3,013,632 | 2,872,110 | 2,479,581 | 1,939,146 | |||||||||||||||||||

| Total passenger deposits (2) |

428,265 | 364,347 | 365,296 | 336,203 | 291,977 | |||||||||||||||||||

| Long-term debt (3) |

1,618,585 | 1,717,712 | 1,695,656 | 1,328,518 | 830,724 | |||||||||||||||||||

| Total debt (3) |

1,685,940 | 1,839,884 | 1,713,216 | 1,350,840 | 855,724 | |||||||||||||||||||

| Related party notes payable |

698,985 | 649,714 | 661,304 | 615,143 | 572,736 | |||||||||||||||||||

| Total liabilities |

2,946,508 | 2,999,041 | 2,885,453 | 2,489,409 | 1,916,804 | |||||||||||||||||||

| Total stockholders’ equity (deficit) |

36,577 | 14,593 | (13,343 | ) | (9,828 | ) | 22,342 | |||||||||||||||||

16

Table of Contents

| (in thousands, except operating data) | Twelve Months Ended September 30, 2013 |

Nine Months Ended September 30, |

Year Ended December 31, | |||||||||||||||||||||

| 2013 | 2012 | 2012 | 2011 | 2010 | ||||||||||||||||||||

| Cash flow data: |

||||||||||||||||||||||||

| Net cash provided by operating activities |

$ | 200,309 | $ | 167,192 | $ | 188,068 | $ | 186,317 | $ | 89,766 | ||||||||||||||

| Net cash provided by (used in) investing activities |

(26,734 | ) | (549,116 | ) | (539,501 | ) | (603,733 | ) | (179,173 | ) | ||||||||||||||

| Net cash (used in) provided by financing activities |

(49,381 | ) | 487,920 | 343,621 | 447,193 | 57,743 | ||||||||||||||||||

| Operating data: |

||||||||||||||||||||||||

| Passenger Days Sold (4) |

1,966,601 | 1,488,703 | 1,395,793 | 1,873,691 | 1,688,958 | 1,305,578 | ||||||||||||||||||

| Available Passenger Cruise Days (5) |

2,092,920 | 1,571,934 | 1,464,536 | 1,985,522 | 1,836,722 | 1,406,298 | ||||||||||||||||||

| Occupancy (6) |

94.0 | % | 94.7 | % | 95.3 | % | 94.4 | % | 92.0 | % | 92.8 | % | ||||||||||||

| Net Per Diem (7) |

$ | 400.28 | $ | 418.04 | $ | 402.47 | $ | 387.80 | $ | 391.22 | $ | 404.29 | ||||||||||||

| Gross Yield (8) |

552.31 | 574.65 | 577.42 | 553.15 | 527.65 | 532.67 | ||||||||||||||||||

| Net Yield (9) |

376.12 | 395.90 | 383.58 | 365.96 | 359.75 | 375.33 | ||||||||||||||||||

| Adjusted EBITDA (10) |

253,370 | 216,171 | 190,138 | 227,337 | 182,196 | 152,246 | ||||||||||||||||||

| Capital Expenditures |

47,145 | 38,814 | 471,436 | 478,962 | 535,531 | 158,836 | ||||||||||||||||||

| (1) | Other income (expense) consists of a variety of non-operating items including but not limited to foreign transaction gains and losses, gain (loss) on early extinguishment of debt and realized and unrealized gain (loss) on derivative instruments. |