Attached files

| file | filename |

|---|---|

| 8-K - 8-K - PARKER HANNIFIN CORP | form8-k2qfy14.htm |

| EX-99.1 - 8-K - PARKER HANNIFIN CORP | exhibit9912qfy14.htm |

2nd Quarter Fiscal Year 2014 Earnings Release Parker Hannifin Corporation January 22, 2014 Exhibit 99.2

Forward-Looking Statements Forward-looking statements contained in this and other written and oral reports are made based on known events and circumstances at the time of release, and as such, are subject in the future to unforeseen uncertainties and risks. All statements regarding future performance, earnings projections, events or developments are forward-looking statements. It is possible that the future performance and earnings projections of the company, including its individual segments, may differ materially from current expectations, depending on economic conditions within its mobile, industrial and aerospace markets, and the company's ability to maintain and achieve anticipated benefits associated with announced realignment activities, strategic initiatives to improve operating margins, actions taken to combat the effects of the current economic environment, and growth, innovation and global diversification initiatives. A change in the economic conditions in individual markets may have a particularly volatile effect on segment performance. Among other factors which may affect future performance are: changes in business relationships with and purchases by or from major customers, suppliers or distributors, including delays or cancellations in shipments, disputes regarding contract terms or significant changes in financial condition, changes in contract cost and revenue estimates for new development programs and changes in product mix; ability to identify acceptable strategic acquisition targets; uncertainties surrounding timing, successful completion or integration of acquisitions and similar transactions; ability to successfully divest businesses planned for divestiture and realize the anticipated benefits of such divestitures; the determination to undertake business realignment activities and the expected costs thereof and, if undertaken, the ability to complete such activities and realize the anticipated cost savings from such activities; the ability to realize anticipated benefits of the consolidation of the Climate and Industrial Controls Group; threats associated with and efforts to combat terrorism; uncertainties surrounding the ultimate resolution of outstanding legal proceedings, including the outcome of any appeals; competitive market conditions and resulting effects on sales and pricing; increases in raw material costs that cannot be recovered in product pricing; the company's ability to manage costs related to insurance and employee retirement and health care benefits; and global economic factors, including manufacturing activity, air travel trends, currency exchange rates, difficulties entering new markets and general economic conditions such as inflation, deflation, interest rates and credit availability. The company makes these statements as of the date of this disclosure, and undertakes no obligation to update them unless otherwise required by law. 2

Non-GAAP Financial Measures This presentation reconciles (a) sales amounts reported in accordance with U.S. GAAP to sales amounts adjusted to remove the effects of acquisitions & deconsolidation of subsidiaries (Joint Venture with JV Aviation) made within the prior four quarters and the effects of currency exchange rates, (b) cash flow from operating activities and cash flow from operating activities as a percent of sales in accordance with U.S. GAAP to cash flow and cash flow from operating activities as a percent of sales without the effect of a discretionary pension plan contribution, and (c) earnings per diluted share reported in accordance with U.S. GAAP to earnings per diluted share without the effect of restructuring expenses, impact of the Joint Venture with GE Aviation and asset write downs. The effects of acquisitions, divestitures, currency exchange rates, the discretionary pension plan contributions, restructuring expenses, impact of the Joint Venture with GE Aviation, and impact of the asset write downs are removed to allow investors and the company to meaningfully evaluate changes in sales, and cash flow from operating activities as a percent of sales, net income and earnings per diluted share on a comparable basis from period to period. 3

Agenda 4 • CEO 2nd Quarter Highlights • Key Performance Measures & Outlook • CEO Closing Comments • Questions and Answers

Highlights 2nd Quarter FY2014 Sales & Orders • Sales of $3.1B, growth of 3% adjusted for Joint Venture with GE Aviation • Global economy gaining momentum • Orders rates continue to be positive, +5% Earnings & Margins • Segment Operating Margins of 12.2% vs 12.0% prior year • Adjusted Net Income & Earning Per Share • $190m or $1.24 vs prior of $181m or $1.19 • Excluding Restructuring & Non-Recurring items • Adjusted EPS of $1.31 vs. $1.21 prior year Non-Recurring Items • Joint Venture with GE Aviation gain of $256m after tax, increased EPS by $1.68 • Asset Write Downs of $192m after tax, reduced EPS by $1.26 5

Diluted Earnings Per Share 2nd Quarter FY2014 6 $1.66 $1.19 FY14 Q2 FY13 Q2 As Reported EPS $1.24 $1.19 FY14 Q2* FY13 Q2 Adjusted EPS* *Adjusted for Joint Venture with GE Aviation and Asset Write Downs

Influences on Earnings 2nd Quarter FY2014 vs. 2nd Quarter FY2013 7

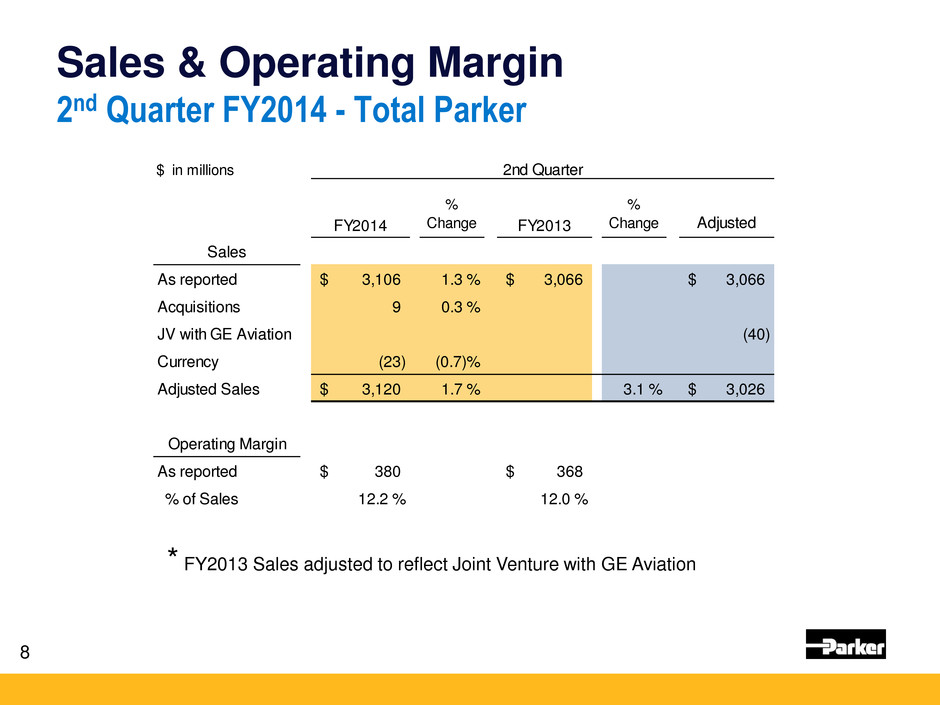

Sales & Operating Margin 2nd Quarter FY2014 - Total Parker 8 $ in millions 2nd Quarter FY2014 % Change FY2013 % Change Adjusted Sales As reported 3,106$ 1.3 % 3,066$ 3,066$ Acquisitions 9 0.3 % JV with GE Aviation (40) Currency (23) (0.7)% Adjusted Sales 3,120$ 1.7 % 3.1 % 3,026$ Operating Margin As reported 380$ 368$ % of Sales 12.2 % 12.0 % * FY2013 Sales adjusted to reflect Joint Venture with GE Aviation

Sales & Operating Margin 2nd Quarter FY2014 – Diversified Industrial North America 9 $ in millions 2nd Quarter FY2014 % Change FY2013 Sales As reported 1,325$ 0.6 % 1,317$ Acquisitions 8 0.6 % Currency (6) (0.4)% Adjusted Sales 1,323$ 0.4 % Operating Margin As reported 201$ 190$ % of Sales 15.1 % 14.5 %

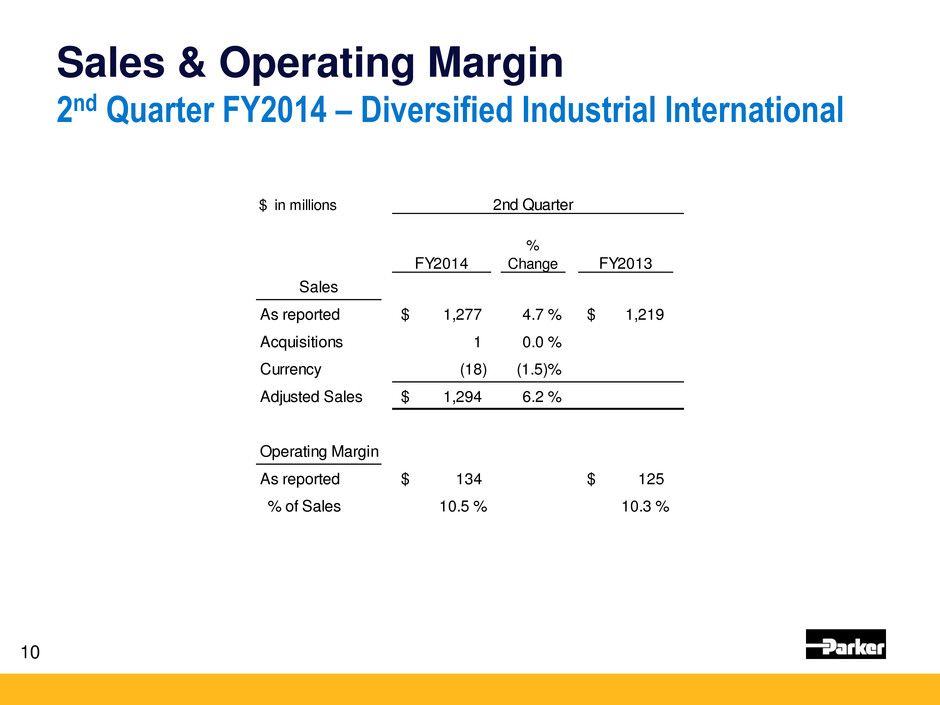

Sales & Operating Margin 2nd Quarter FY2014 – Diversified Industrial International 10 $ in millions 2nd Quarter FY2014 % Change FY2013 Sales As reported 1,277$ 4.7 % 1,219$ Acquisitions 1 0.0 % Currency (18) (1.5)% Adjusted Sales 1,294$ 6.2 % Operating Margin As reported 134$ 125$ % of Sales 10.5 % 10.3 %

Sales & Operating Margin 2nd Quarter FY2014 – Aerospace Systems 11 $ in millions 2nd Quarter FY2014 % Change FY2013 % Change Adjusted Sales As reported 504$ (4.7)% 529$ 529$ Acquisitions - - % JV with GE Aviation (40) Currency 1 0.2 % Adjusted Sales 503$ (4.9)% 2.9 % 489$ Operating Margin As reported 45$ 52$ % of Sales 8.9 % 9.9 % * FY2013 Sales adjusted to reflect Joint Venture with GE Aviation

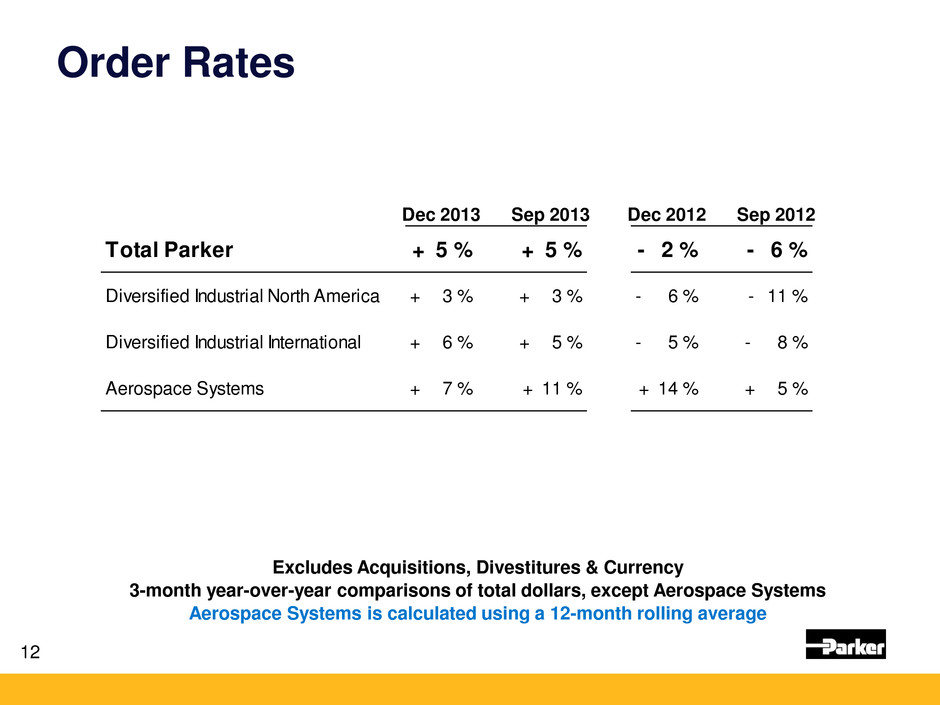

Dec 2013 Sep 2013 Dec 2012 Sep 2012 Total Parker 5 %+ 5 %+ 2 %- 6 %- Diversified Industrial North America 3 %+ 3 %+ 6 %- 11 %- Diversified Industrial International 6 %+ 5 %+ 5 %- 8 %- Aerospace Systems 7 %+ 11 %+ 14 %+ 5 %+ Order Rates 12 Excludes Acquisitions, Divestitures & Currency 3-month year-over-year comparisons of total dollars, except Aerospace Systems Aerospace Systems is calculated using a 12-month rolling average

Balance Sheet Summary • Cash • Working capital • Accounts receivable • Inventory • Accounts payable 13

$615 $573 FY14 YTD FY13 YTD Cash Flow from Operating Activities 2nd Quarter YTD FY2014 14 Cash Flow From Operating Activities YTD FY2014 FY2013 As Reported 540$ 347$ As Reported % Sales 8.5% 5.5% Discretionary Pension Plan Contribution 75$ 226$ Adjusted Cash From Operating Activities 615$ 573$ Adjusted % Sales 9.7% 9.1%

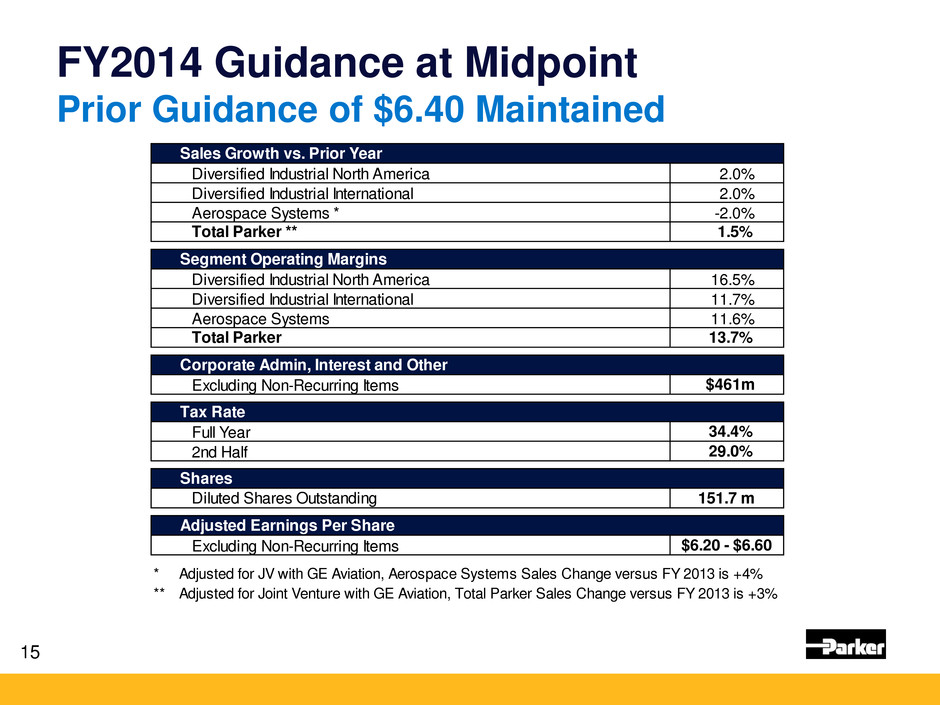

FY2014 Guidance at Midpoint Prior Guidance of $6.40 Maintained 15 Sales Growth vs. Prior Year Diversified Industrial North America 2.0% Diversified Industrial International 2.0% Aerospace Systems * -2.0% Total Parker ** 1.5% Segment Operating Margins Diversified Industrial North America 16.5% Diversified Industrial International 11.7% Aerospace Systems 11.6% Total Parker 13.7% Corporate Admin, Interest and Other Excluding Non-Recurring Items $461m Tax Rate Full Year 34.4% 2nd Half 29.0% Shares Diluted Shares Outstanding 151.7 m Adjusted Earnings Per Share Excluding Non-Recurring Items $6.20 - $6.60 * Adjusted for JV with GE Aviation, Aerospace Systems Sales Change versus FY 2013 is +4% ** Adjusted for Joint Venture with GE Aviation, Total Parker Sales Change versus FY 2013 is +3%

16

Appendix • Consolidated Statement of Income • Business Segment Information By Industry • Net Income & EPS Reconciliation • Consolidated Balance Sheet • Consolidated Statement of Cash Flows • Supplemental Sales Information – Global Technology Platforms

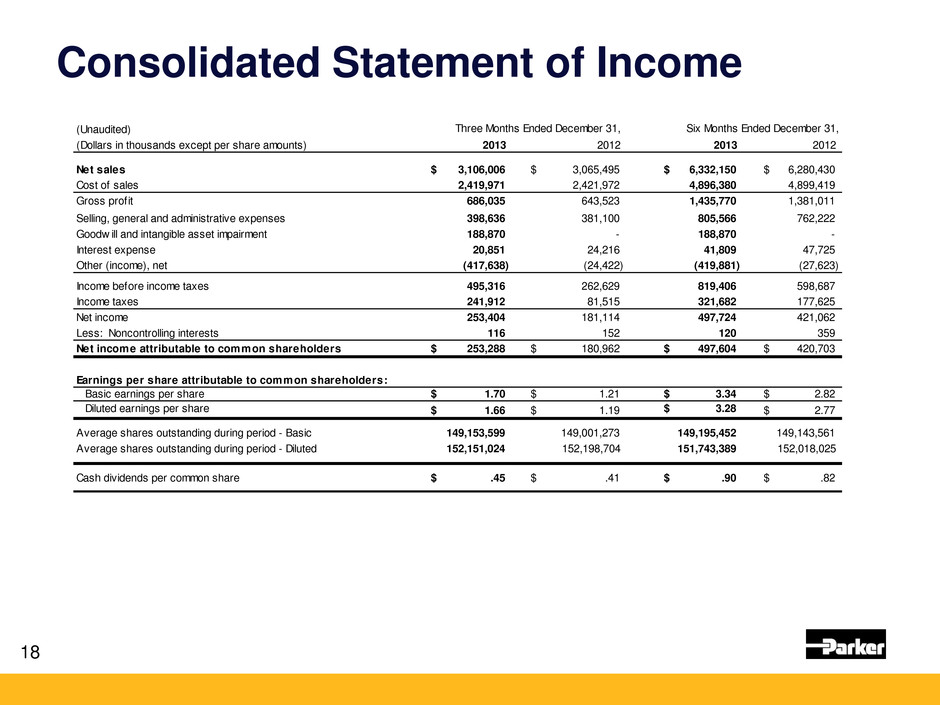

Consolidated Statement of Income 18 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands except per share amounts) 2013 2012 2013 2012 Net sales 3,106,006$ 3,065,495$ 6,332,150$ 6,280,430$ Cost of sales 2,419,971 2,421,972 4,896,380 4,899,419 Gross profit 686,035 643,523 1,435,770 1,381,011 Selling, general and administrative expenses 398,636 381,100 805,566 762,222 Goodw ill and intangible asset impairment 188,870 - 188,870 - Interest expense 20,851 24,216 41,809 47,725 Other (income), net (417,638) (24,422) (419,881) (27,623) Income before income taxes 495,316 262,629 819,406 598,687 Income taxes 241,912 81,515 321,682 177,625 Net income 253,404 181,114 497,724 421,062 Less: Noncontrolling interests 116 152 120 359 Net income attributable to common shareholders 253,288$ 180,962$ 497,604$ 420,703$ Earnings per share attributable to common shareholders: Basic earnings per share 1.70$ 1.21$ 3.34$ 2.82$ Diluted earnings per share 1.66$ 1.19$ 3.28$ 2.77$ Average shares outstanding during period - Basic 149,153,599 149,001,273 149,195,452 149,143,561 Average shares outstanding during period - Diluted 152,151,024 152,198,704 151,743,389 152,018,025 Cash dividends per common share .45$ .41$ .90$ .82$

Net Income & EPS Reconciliation 19 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands except per share amounts) 2013 2012 2013 2012 Net income 253,404$ 181,114$ 497,724$ 421,062$ Adjustments: Asset w ritedow ns 192,188 - 192,188 - Gain related to joint venture agreement (255,652) - (255,652) - Adjusted net income 189,940$ 181,114$ 434,260$ 421,062$ Earnings per diluted share 1.66$ 1.19$ 3.28$ 2.77$ Adjustments: Asset w ritedow ns 1.26 - 1.26 - Gain related to joint venture agreement (1.68) - (1.68) - Adjusted earnings per diluted share 1.24$ 1.19$ 2.86$ 2.77$

Business Segment Information By Industry 20 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands) 2013 2012 2013 2012 Net sales Diversif ied Industrial: North America 1,325,402$ 1,317,380$ 2,713,277$ 2,742,659$ International 1,276,851 1,219,459 2,547,646 2,468,032 Aerospace Systems 503,753 528,656 1,071,227 1,069,739 Total 3,106,006$ 3,065,495$ 6,332,150$ 6,280,430$ Segment operating income Diversif ied Industrial: North America 200,628$ 190,431$ 434,826$ 434,506$ International 134,198 125,047 307,608 281,645 Aerospace Systems 45,034 52,172 102,332 114,070 Total segment operating income 379,860 367,650 844,766 830,221 Corporate general and administrative expenses 46,819 45,401 94,029 85,168 Income before interest and other 333,041 322,249 750,737 745,053 Interest expense 20,851 24,216 41,809 47,725 Other (income) expense (183,126) 35,404 (110,478) 98,641 Income before income taxes 495,316$ 262,629$ 819,406$ 598,687$

Consolidated Balance Sheet 21 (Unaudited) December 31, June 30, December 31, (Dollars in thousands) 2013 2013 2012 Assets Current assets: Cash and cash equivalents 2,139,522$ 1,781,412$ 497,635$ Accounts receivable, net 1,861,849 2,062,745 1,802,405 Inventories 1,448,628 1,377,405 1,515,325 Prepaid expenses 169,262 182,669 152,477 Deferred income taxes 125,612 126,955 127,905 Total current assets 5,744,873 5,531,186 4,095,747 Plant and equipment, net 1,820,312 1,808,240 1,844,643 Goodw ill 3,161,699 3,223,515 3,295,141 Intangible assets, net 1,220,547 1,290,499 1,367,978 Other assets 916,505 687,458 857,852 Total assets 12,863,936$ 12,540,898$ 11,461,361$ Liabilities and equity Current liabilities: Notes payable 1,217,292$ 1,333,826$ 510,006$ Accounts payable 1,074,512 1,156,002 1,073,233 Accrued liabilities 839,095 894,296 810,546 Accrued domestic and foreign taxes 172,204 136,079 94,475 Total current liabilities 3,303,103 3,520,203 2,488,260 Long-term debt 1,507,019 1,495,960 1,509,238 Pensions and other postretirement benefits 1,303,527 1,372,437 1,704,349 Deferred income taxes 112,561 102,920 128,892 Other liabilities 339,440 307,897 301,633 Shareholders' equity 6,295,226 5,738,426 5,325,717 Noncontrolling interests 3,060 3,055 3,272 Total liabilities and equity 12,863,936$ 12,540,898$ 11,461,361$

Consolidated Statement of Cash Flows 22 (Unaudited) Six Months Ended December 31, (Dollars in thousands) 2013 2012 Cash flows from operating activities: Net income 497,724$ 421,062$ Depreciation and amortization 170,090 163,827 Stock incentive plan compensation 75,370 46,527 Goodw ill and intangible asset impairment 188,870 - Gain on deconsolidation of subsidiary (412,612) - Gain on sale of businesses - (12,708) Net change in receivables, inventories, and trade payables 53,841 102,612 Net change in other assets and liabilities (80,362) (408,895) Other, net 47,188 34,913 Net cash provided by operating activities 540,109 347,338 Cash flows from investing activities: Acquisitions (net of cash of $33,160 in 2012) 728 (621,716) Capital expenditures (111,847) (140,221) Proceeds from sale of plant and equipment 8,790 14,173 Proceeds from sale of businesses - 68,569 Proceeds from deconsolidation of subsidiary 202,498 - Other, net (728) (7,765) Net cash provided by (used in) investing activities 99,441 (686,960) Cash flows from financing activities: Net payments for common stock activity (81,784) (101,160) Acquisition of noncontrolling interests - (1,072) Net (payments for) proceeds from debt (116,834) 168,712 Dividends (134,718) (123,328) Net cash (used in) financing activities (333,336) (56,848) Effect of exchange rate changes on cash 51,896 55,788 Net increase (decrease) in cash and cash equivalents 358,110 (340,682) Cash and cash equivalents at beginning of period 1,781,412 838,317 Cash and cash equivalents at end of period 2,139,522$ 497,635$

Supplemental Sales Information Global Technology Platforms 23 (Unaudited) Three Months Ended December 31, Six Months Ended December 31, (Dollars in thousands) 2013 2012 2013 2012 Net sales Diversif ied Industrial: Motion Systems 928,466$ 934,647$ 1,862,654$ 1,929,793$ Flow and Process Control 1,001,366 967,167 2,027,055 2,000,029 Filtration and Engineered Materials 672,421 635,025 1,371,214 1,280,869 Aerospace Systems * 503,753 528,656 1,071,227 1,069,739 Total 3,106,006$ 3,065,495$ 6,332,150$ 6,280,430$