Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - RCS Capital Corp | v365646_8k.htm |

| EX-2.2 - EXHIBIT 2.2 - RCS Capital Corp | v365646_ex2-2.htm |

| EX-99.2 - EXHIBIT 99.2 - RCS Capital Corp | v365646_ex99-2.htm |

Exhibit 99.1

1 January 17, 2014 RCS Capital to acquire J.P. Turner & Company L.L.C. and J.P. Turner & Company Capital Management, LLC

2 Cautionary Note Regarding Forward - Looking Statements • Information set forth herein contains “forward - looking statements” (as defined in Section 21E of the Exchange Act), which reflect RCS Capital Corporation’s (“RCAP”) expectations regarding future events. The forward - looking statements involve a number of risks, uncertainties and other factors that could cause actual results to differ materially from those contained in the forward - looking statements. Such forward - looking statements include, but are not limited to, whether and when the transactions contemplated by the purchase of J.P. Turner & Company, LLC and J.P. Turner & Company Capital Management, LLC (collectively, “JP Turner”) will be consummated, plans for the operations of RCAP and JP Turner post - closing, market and other expectations, objectives, intentions, as well as any expectations or projections with respect to RCAP and JP Turner post - closing, including regarding future dividends and market valuations, and other statements that are not historical facts. • The following additional factors, among others, could cause actual results to differ from those set forth in the forward - looking statements: the ability to obtain requisite approvals for the purchase of JP Turner, including, among other things, regulatory approval of certain changes in control of JP Turner’s FINRA - regulated broker - dealer businesses; market volatility; unexpected costs or unexpected liabilities that may arise from the purchase of JP Turner, whether or not consummated; the inability to retain key personnel; the deterioration of market conditions; and future regulatory or legislative actions that could adversely affect the parties to the purchase agreement relating to the purchase of JP Turner. Additional factors that may affect future results are contained in RCAP’s filings with the Securities and Exchange Commission (“SEC”), which are available at the SEC’s website at www.sec.gov. RCAP disclaims any obligation to update and revise statements contained in these materials based on new information or otherwise.

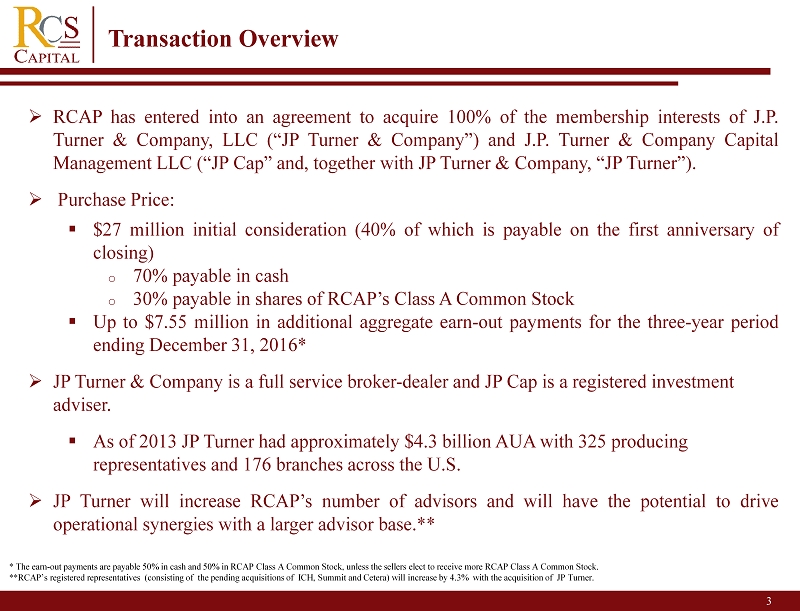

American Realty Capital 3 » RCAP has entered into an agreement to acquire 100 % of the membership interests of J . P . Turner & Company, LLC (“JP Turner & Company”) and J . P . Turner & Company Capital Management LLC (“JP Cap” and, together with JP Turner & Company, “JP Turner”) . » Purchase Price : ▪ $ 27 million i nitial consideration ( 40 % of which is payable on the first anniversary of closing) o 70 % payable in cash o 30 % payable in shares of RCAP’s Class A Common Stock ▪ Up to $ 7 . 55 million in additional aggregate earn - out payments for the three - year period ending December 31 , 2016 * » JP Turner & Company is a full service broker - dealer and JP Cap is a registered investment adviser. ▪ As of 2013 JP Turner had approximately $4.3 billion AUA with 325 producing representatives and 176 branches across the U.S. » JP Turner will increase RCAP’s number of advisors and will have the potential to drive operational synergies with a larger advisor base . ** Transaction Overview * The earn - out payments are payable 50% in cash and 50% in RCAP Class A Common Stock, unless the sellers elect to receive more RCA P Class A Common Stock. **RCAP’s registered representatives (consisting of the pending acquisitions of ICH, Summit and Cetera) will increase by 4.3% with the acquisition of JP Turne r.

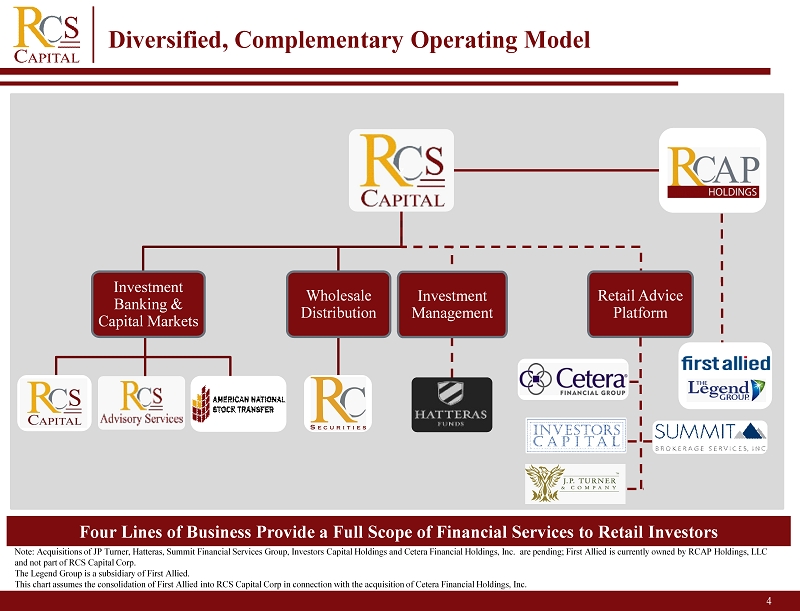

American Realty Capital 4 Diversified, Complementary Operating Model Wholesale Distribution Investment Management Investment Banking & Capital Markets Retail Advice Platform z Four Lines of Business Provide a Full Scope of Financial Services to Retail Investors Note: Acquisitions of JP Turner, Hatteras, Summit Financial Services Group, Investors Capital Holdings and Cetera Financial Holdings, Inc. are pending; First Allied is currently owned by RCAP H old ings, LLC and not part of RCS Capital Corp. The Legend Group is a subsidiary of First Allied. This chart assumes the consolidation of First Allied into RCS Capital Corp in connection with the acquisition of Cetera Financial Holdings, Inc.

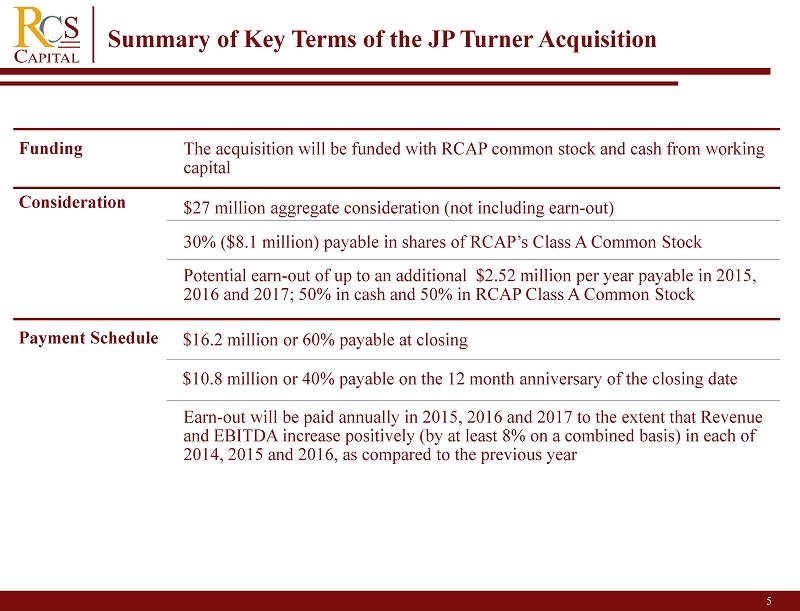

American Realty Capital 5 Funding The acquisition will be funded with RCAP common stock and cash from working capital Consideration $27 million aggregate consideration (not including earn - out) 30% ($8.1 million) payable in shares of RCAP’s Class A Common Stock Potential earn - out of up to an additional $2.52 million per year payable in 2015, 2016 and 2017; 50% in cash and 50% in RCAP Class A Common Stock Payment Schedule $16.2 million or 60% payable at closing $10.8 million or 40% payable on the 12 month anniversary of the closing date Earn - out will be paid annually in 2015, 2016 and 2017 to the extent that Revenue and EBITDA increase positively (by at least 8% on a combined basis) in each of 2014, 2015 and 2016, as compared to the previous year Summary of Key Terms of the JP Turner Acquisition

American Realty Capital 6 » Founded in 1997. Based in Atlanta, GA » Led by Tim McAfee and Bill Mello » Aside from the broker - dealer and RIA platforms, JP Turner offers a variety of other investment services, including: ▪ Investment Banking ▪ Real Estate Practice Area ▪ Energy Practice Area ▪ Managed Products Department ▪ Bond Department ▪ Dedicated Trading Desk ▪ Insurance and Annuities » J.P. Turner has been voted… ▪ Top 50 Independent Broker - Dealers (based on number of reps, number of reps producing over $100,000 and revenue) by Investment News ▪ Top 50 Independent Broker - Dealers by Financial Advisor Magazine ▪ Top 10 Brokerage Firms in Atlanta by Atlanta Business Chronicle ▪ Best Places to Work in Georgia by Georgia Trend Magazine JP Turner Key Facts

7 » Increase shareholder value » Expand and complement existing distribution channels » Increase quality of value - added services to help advisors grow and ultimately monetize their practices » Expand management team expertise » Additional potential growth from back office, compliance and distribution synergies JP Turner will expand the RCAP retail brokerage business by adding 325 financial advisors and 176 branches to the platform. Transaction Benefits - Synergies

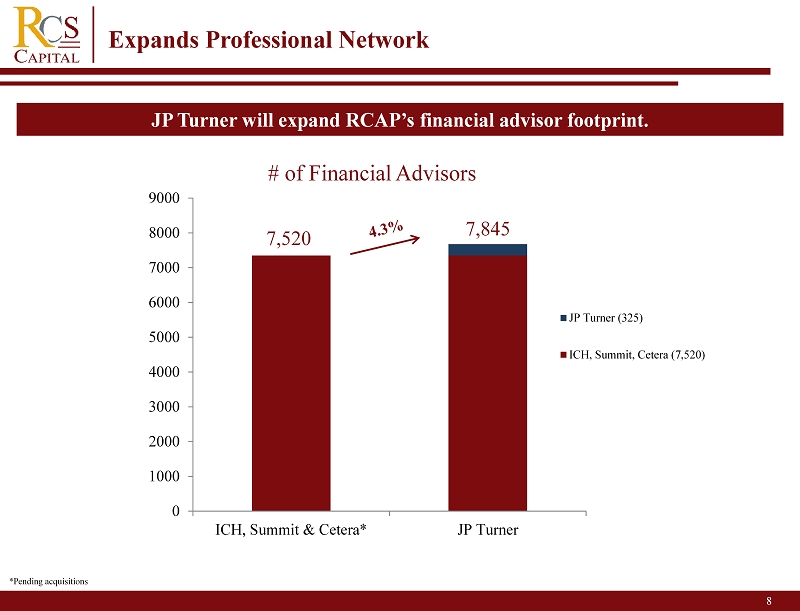

American Realty Capital 0 1000 2000 3000 4000 5000 6000 7000 8000 9000 ICH, Summit & Cetera* JP Turner JP Turner (325) ICH, Summit, Cetera (7,520) 8 # of Financial Advisors JP Turner will expand RCAP’s financial advisor footprint. 7,520 7,845 Expands Professional Network *Pending acquisitions

9 2 Bill Mello – Founding Partner » After serving a four - year enlistment in the United States Marine Corps, Bill Mello joined a subsidiary of Leucadia National Corp. in 1972. He rose quickly through the organization and served in a variety of management positions. In 1986, Mello changed careers and entered the securities industry, where he met Tim McAfee. They joined forces in 1993, opening an independent offi ce of J.W. Charles Securities. In 1997, Mello and McAfee opened J.P. Turner & Company. Mello has served on the board of directors of Sales Lead Management, LLC, and the National Investment Banking Association (NIBA). Dean Vernoia – Chief Operating Officer » Dean has over 25 years diversified experience in the i ndustry . Dean first joined the company at its inception in 1997 as vice president of business development and was promoted to chief operating officer in 2003. Prior to J.P. Turner, Vernoia owned, managed and operated an independent office of Raymond James Financial Services. Registered since 1987, he has also served as a financial consultant and recruiter for Robert Thomas Securities, where his operation ranked second in productivity out of s ome 300 locations for three years running. Most of his career has been focused on successfully growing firms and branch offices. He holds a bachelor's in business management from the New York Institute of Technology. Tim McAfee – Founding Partner » Tim McAfee's career in the financial services industry began in 1984, when he became a registered securities representative. Within his first five years in the industry, McAfee moved through the ranks as a producing broker, manager, area vice preside nt over South Carolina and North Carolina, and regional vice president over South Carolina, North Carolina and Georgia. During h is tenure as regional vice president, McAfee moved to Atlanta, where, in addition to overseeing the offices in his region, he bu ilt his base office and managed its growth to over 70 registered reps within the first year. Leadership Team Biographies