Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NewPage Holdings Inc. | d659471d8k.htm |

January

15

th

,

2014

Lenders

Presentation

–

Public

$350,000,000 Senior Secured Asset-Based Loan Revolving Credit Facility

$750,000,000 Senior Secured First Lien Term Loan Facility

Exhibit 99.1 |

Forward-Looking Statements

Certain statements contained in this communication may constitute

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements include, but are

not limited to, statements regarding the expected timing of the completion of the

merger, the benefits of the merger, including future financial and operating

results, the combined company’s plans, objectives, expectations and

other statements that are not historical facts. Such statements are based on

the views and assumptions of the management of Verso and NewPage and are

subject to significant risks and uncertainties. Actual future events or results may differ

materially from these statements. Such differences may result from the following

factors: the ability to close the transaction on the proposed terms and

within the anticipated time period, or at all, which is dependent on the

parties’ ability to satisfy certain closing conditions, including the

receipt of governmental approvals; the risk that the benefits of

the transaction, including cost

savings and other synergies, may not be fully realized or may take longer to

realize than expected; the impact of the transaction on third-party

relationships; the outcome of government investigations

and

third-party

litigation

involving

both

Verso

and

NewPage;

actions

taken

by

either

of the companies; changes in regulatory, social and political conditions; and

general economic conditions. Additional risks and factors that may affect

results are set forth in Verso’s and

NewPage’s respective filings with the Securities and Exchange Commission,

including Verso’s annual report on Form 10-K for the year ending

December 31, 2012, and NewPage’s registration statement on Form 10. The

forward-looking statements speak only as of the date of this

communication. Neither Verso nor NewPage undertakes any obligation to update these

statements.

1 |

Participants

2

George F. Martin, Chief Executive Officer

Jay A. Epstein, Chief Financial Officer

David J. Paterson, Chief Executive Officer

Robert P. Mundy, Chief Financial Officer

Malcolm K. Price, Managing Director

Carly A. Baxter, Managing Director |

3

Table of Contents

1

Executive Summary

2

Pro Forma Combination Rationale

4

NewPage Overview

3

Industry Update

5

Financial Information

6

Syndication Overview |

4

1.

Executive Summary |

Executive Summary

On

January

6,

2013,

NewPage

Holdings

Inc.

(“NewPage”

or

the

“Company”)

announced

a

definitive

agreement

to

be

acquired by Verso Paper Holdings LLC (“Verso”) in a transaction valued at

approximately $1.4 billion (the “Transaction”) –

The

Transaction

represents

a

5.2x

enterprise

purchase

multiple

of

NewPage’s

2013E

Adj.

EBITDA

(1)

of

$270m

(or

6.2x

adjusting

for

NewPage’s

current

pension

&

OPEB

liability

)

–

NewPage operating company survives the Merger as a non-guarantor restricted

subsidiary of Verso (with a standalone capital structure)

–

The combination is expected to generate $175m in synergies for Verso and NewPage

(the "Combined Company") –

The Merger is subject to successful completion of the Verso exchange offer,

regulatory approvals and other customary closing conditions

In

connection

with

the

Merger,

NewPage

is

seeking

to

raise

a

new

$750m

First

Lien

Term

Loan

(the

“Term

Loan”)

and

a

$350m ABL Revolver (the “Revolver”) that will be portable and close

before Merger consummation –

Proceeds

will

be

used

to

repay

the

existing

$495m

Term

Loan,

and

fund

a

special

cash

payment

of

$250m

to

NewPage’s existing equityholders in satisfaction of the merger

agreement requirements for the transaction

–

Pro forma for the proposed financing, NewPage will have net leverage of 2.7x 2013E

Adj. EBITDA –

NewPage Moody’s corporate rating is B1, and S&P corporate rating is

expected to be B+ NewPage is the largest coated paper manufacturer in North

America based on production capacity, operating 8 mills in the

U.S.

The

combination

with

Verso

will

make

it

the

4

th

largest

coated

paper

producer

globally

–

NewPage expects 2013E revenue of $3,071m and Adj. EBITDA of $270m (margin:

8.8%) –

For

LTM

9/30/2013,

the

pro

forma

Combined

Company

had

revenue

of

$4.5bn

and

Adj.

EBITDA

of

$583m

(3)

(margin: 13.1%)

5

(2)

(1)

Adj. EBITDA refers to “Consolidated Adjusted EBITDA” as defined by the Credit

Agreement. (2)

Includes ~$271m in 2013E Pension & OPEB liability.

(3)

For LTM 9/30/2013, Verso and NewPage had revenues of $1,401m and $3,065m, respectively, and Adj. EBITDA of $155m and $253m, respectively; the combined company Adj. EBITDA includes

100% of synergies. Verso Adj. EBITDA is pro forma for the effects of cost savings

program. |

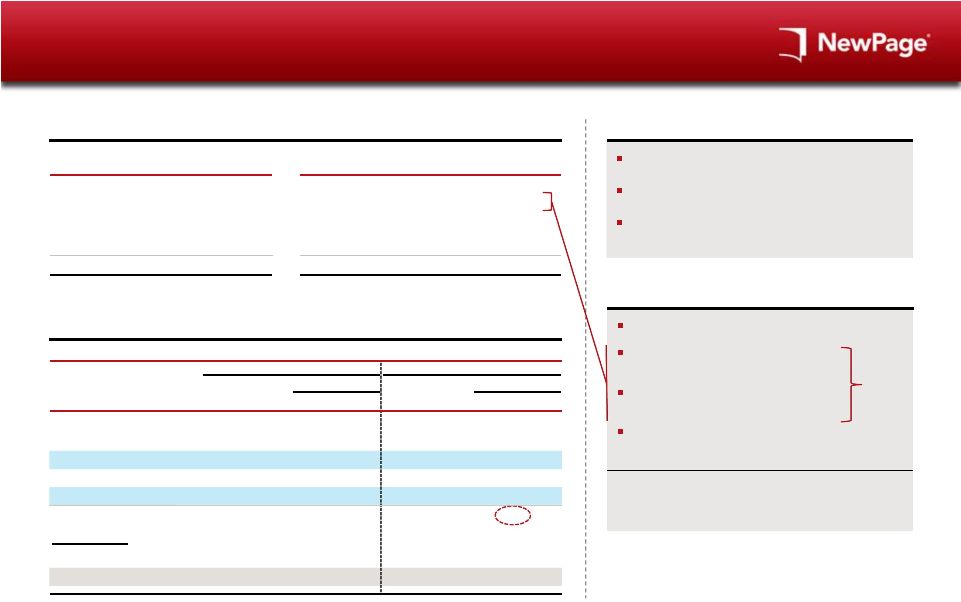

Transaction Overview

6

New $750m NewPage First Lien Term Loan (the

proposed “Term Loan”)

New $350m NewPage ABL Revolver (the proposed

“Revolver”)

Portable financing that will be in place prior to

regulatory approval and Merger close

NewPage Sources & Uses

$495m existing NewPage Term Loan refinancing

~$250m special cash payment to

NWP Equityholders

$650m of new Verso 1L Sr. Sec. “Seller”

Notes issued to NWP Equityholders

Shares of Verso common stock to NWP

Equityholders

(4)

Total

Enterprise

Value

of

~$1.4bn

/

~$1.7bn

(5)

EV

/

2013E

Adj.

EBITDA

of

5.2x

/

6.2x

(5,6)

NewPage

Financing

(3)

$900m

Equity

Purchase

Price

($ in millions)

Sources

Uses

New NWP $350m ABL

–

Refi Existing NWP 1L Term Loan

$495

New NWP 1L Term Loan

750

Equity Purchase Price

900

New VRS Seller Notes

650

Term Loan Prepayment Penalty

10

Cash from NWP Balance Sheet

70

Illustrative Fees & Expenses

(1)

65

Total Sources

$1,470

Total Uses

$1,470

Enterprise Purchase Consideration for NWP

(1)

Includes financing and M&A fees; subject to change.

(2)

Assumes $350m ABL less NewPage’s current LOCs of $33m.

(3)

As a condition to the Merger, Verso has agreed to retire a portion of existing Verso

Junior Notes through an Exchange Offer. (4)

Shares represent 20% (subject to potential adjustment up to 25% under certain

circumstances) of the outstanding shares immediately prior to closing.

(5)

Includes ~$271m in 2013E Pension & OPEB liability.

(6)

Multiples do not include expected cost synergies.

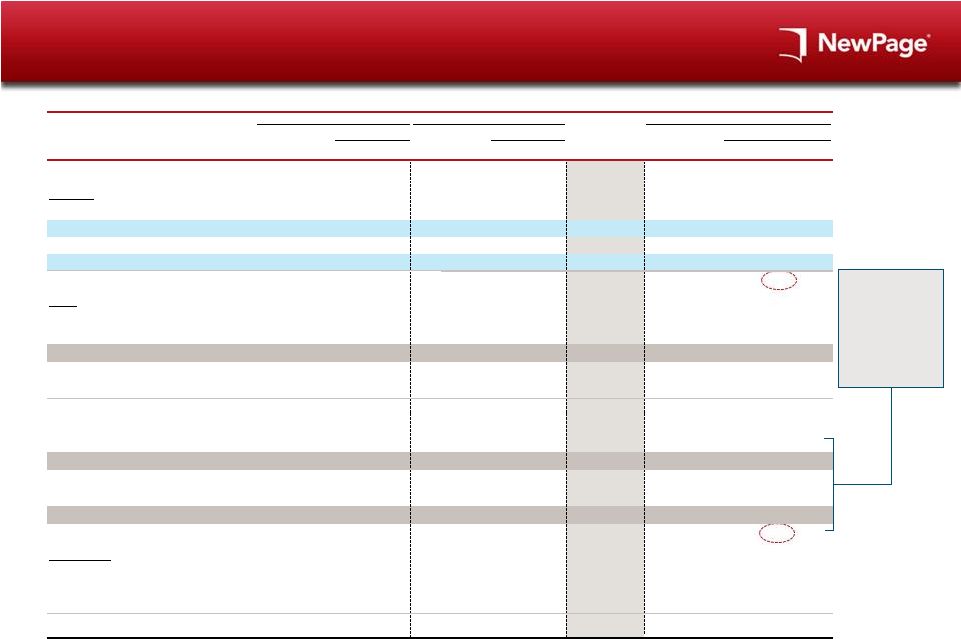

NewPage Pro Forma Capitalization

(2)

($ in millions)

Current

Pro forma

Net cum. mult.

Pro forma

Net cum. mult.

Year-end

2013E

EBITDA

2013E

EBITDA

Cash & Cash Equivalents

Existing $350m ABL

New $350m ABL

Existing 1L Term Loan

New 1L Term Loan

Total 1L Debt

LTM 12/31/13E

NewPage Adj. EBITDA

Liquidity

$83

–

–

495

–

$495

1.5x

$270

$13

–

–

–

750

$750

2.7x

$270

$330 |

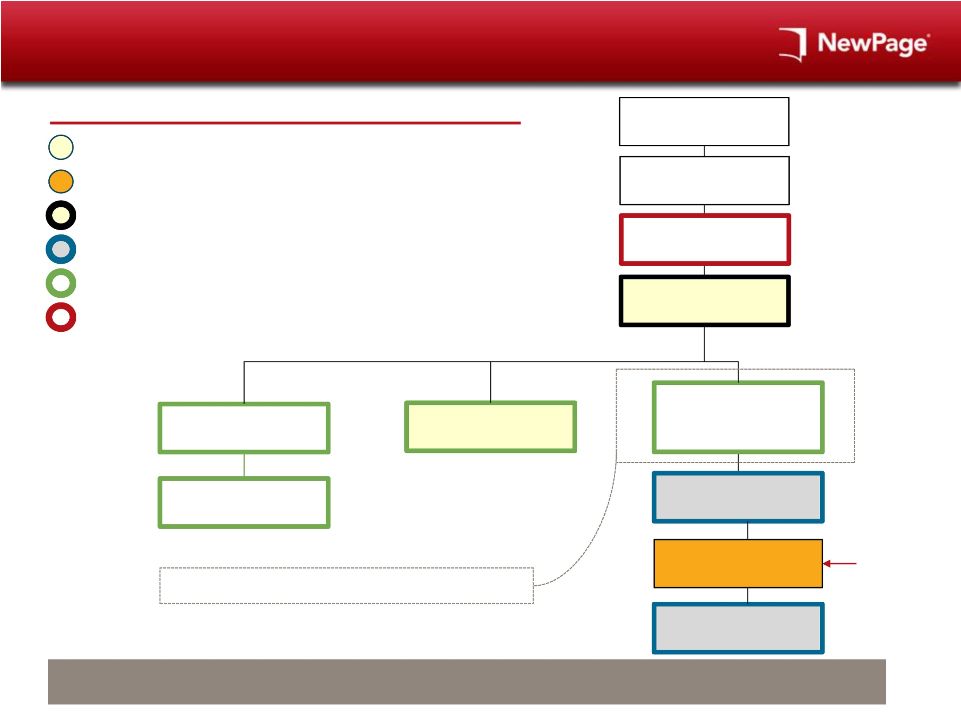

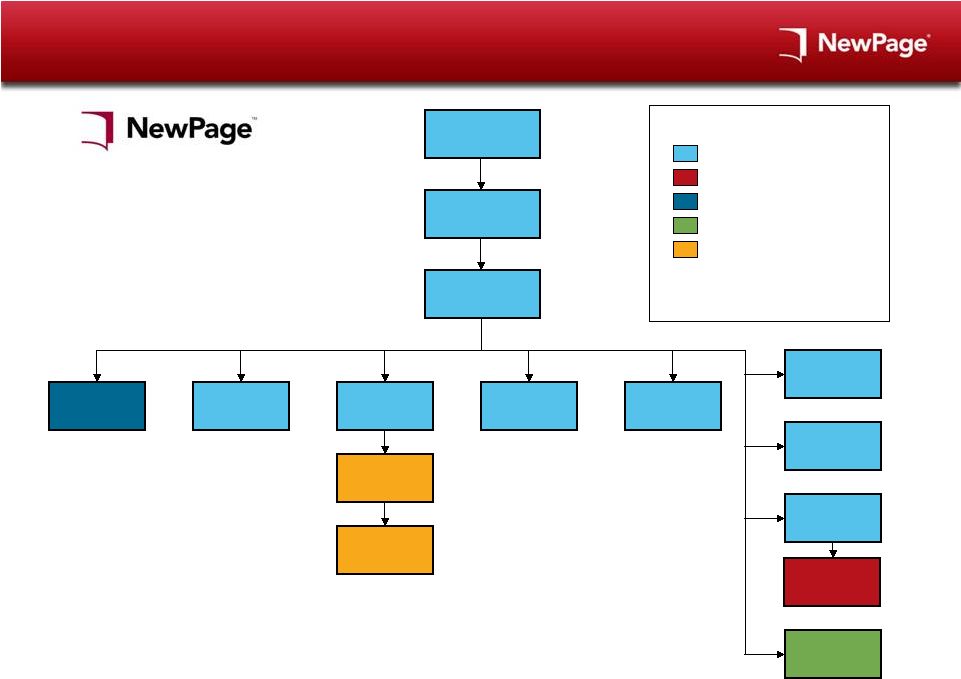

Post-Merger Pro Forma Combined Structure

7

Co-issuer of existing First Lien Notes, 1.5 Lien Notes, non-consenting

Second Lien Notes, non-consenting

Senior

Subordinated

Notes,

new

First

Lien

“Seller”

Notes,

new

Second

Lien

Notes and new Senior Subordinated Notes

NewPage ABL and Term Loan borrower

Verso ABL and Cash Flow borrower

Guarantor of NewPage ABL and Term Loan

Guarantor/co-issuer of Verso ABL and Cash Flow facilities, Verso First Lien

Notes, 1.5 Lien Notes, First Lien “Seller notes”, Second Lien

Notes, Senior Subordinated Notes, other than as noted below

Guarantor of Verso ABL and Cash Flow facilities

Note:

NewPage standalone organizational chart in the Appendix.

Legend

Verso Paper Corp.

Verso Paper Finance

Holdings One LLC

Verso Paper Finance

Holdings LLC

Verso Paper Holdings,

LLC

NewPage Holdings, Inc.

(Survivor of Merger with

Verso Paper Merger

Subsidiary)

NewPage Investment

Company LLC

NewPage Corporation

NewPage Subsidiaries

Verso Paper Inc.

Verso Paper LLC

Verso Subsidiaries

Guarantees all Verso debt except for Non-consenting Second Lien Notes

Or Non-consenting Senior Subordinated Notes

The NewPage Operating Company Will Be a Non-Guarantor Restricted Subsidiary for

Verso’s Notes with a Standalone Capital Structure

Borrower of

facilities

offered hereby |

8

2.

Pro Forma Combination Rationale |

9

9

Creates a Combined Company with the Scale Necessary to Reduce Operating Costs,

Generate Greater Economies of Scale and Provide a Higher Level of Customer

Service The Combined Entity Will Be a Strong,

Stable Coated Paper Producer

Will

be

the

largest

coated

paper

producer

in

North

America,

and

become

4

th

largest

globally

–

Pro

forma

combined

LTM

9/30/2013

revenue

and

Adj.

EBITDA

of

$4.5bn

and

$583m

(1)

,

respectively

(margin: 13.1%)

Combined company generates strong free cash flow for debt repayment

Leverages Verso’s operating expertise (R-Gap program) across a larger

company Anticipated annual cost synergies conservatively estimated at

$175m –

Production cost savings and efficiencies due to improved utilization, longer runs

and less grade changing –

Purchasing synergies

–

Reduction of redundant product and supply inventory

–

Reduction of overhead and administrative cost

(1)

For LTM 9/30/2013, Verso and NewPage had revenues of $1,401m and $3,065m, respectively, and Adj. EBITDA

of $155m and $253m, respectively; the combined company Adj. EBITDA

includes 100% of synergies. Verso Adj. EBITDA is pro forma for the effects of cost savings program. |

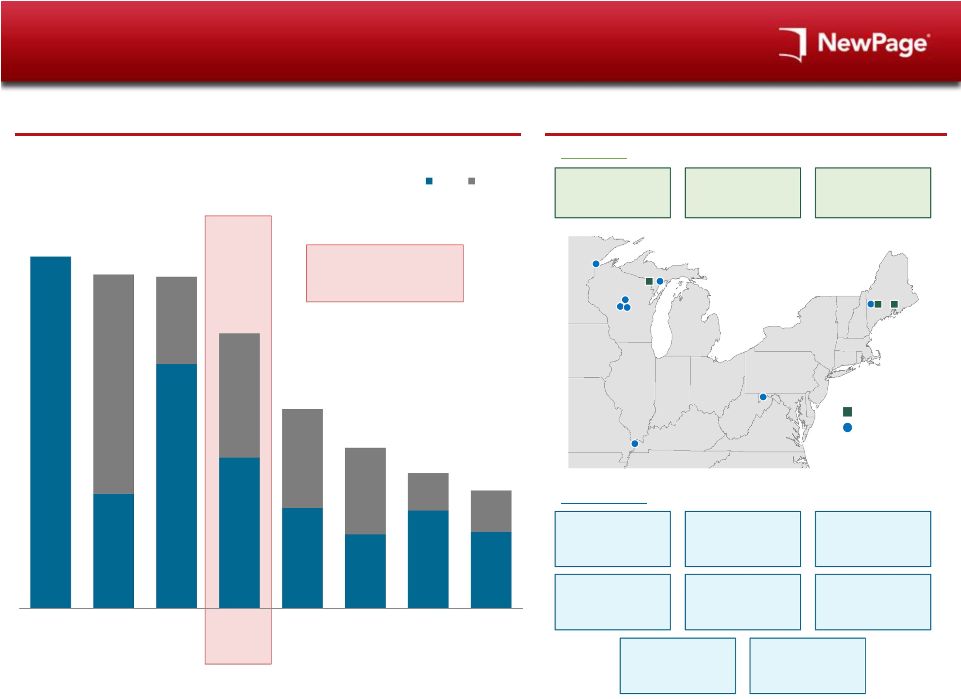

A Combination Will

Result in the Largest Coated Paper Producer in N. America & #4 Globally

10

(Tons in millions)

Global Coated Paper Capacity

Well-Located Mills

Verso Mills:

Androscoggin, ME

Capacity: 635k tons

Products: CGW, CFS

Quinnesec, MI

Capacity: 425k tons

Products: CFS

Bucksport, ME

Capacity: 405k tons

Products: LW CGW

NewPage

Verso

Duluth

Wisconsin Rapids

Biron

Stevens Point

Escanaba

Quinnesec

Adroscoggin

Luke

Bucksport

Wickliffe

Rumford

Biron, WI

Capacity: 370k tons

Products: LW CGW

Duluth, MN

Capacity: 270k tons

Products: SC

Escanaba, MI

Capacity: 785k tons

Products: CFS, CGW,

specialty, uncoated

Luke, MD

Capacity: 480k tons

Products: CFS,

specialty

Wickliffe, KY

Capacity: 285k tons

Products: CFS, UFS,

specialty

Rumford, ME

Capacity: 565k tons

Products: CFS, CGW,

specialty

Stevens Point, WI

Capacity: 185k tons

Products: specialty

Wisconsin

Rapids,

WI

Capacity: 560k tons

Products: CFS,

specialty

NewPage Mills:

#4 Coated Paper

Producer Globally

5.4

5.1

5.0

4.2

3.0

2.4

2.1

1.8

Asia Pulp

& Paper

UPM

Sappi

Verso /

NewPage

Stora

Burgo

Oji Paper

Nippon

CFS

CGW

Source:

NewPage

and

Verso

Annual

Reports,

NewPage

and

Verso

websites

and

RISI.

Note: Figures represent capacity as of December

31, 2012. |

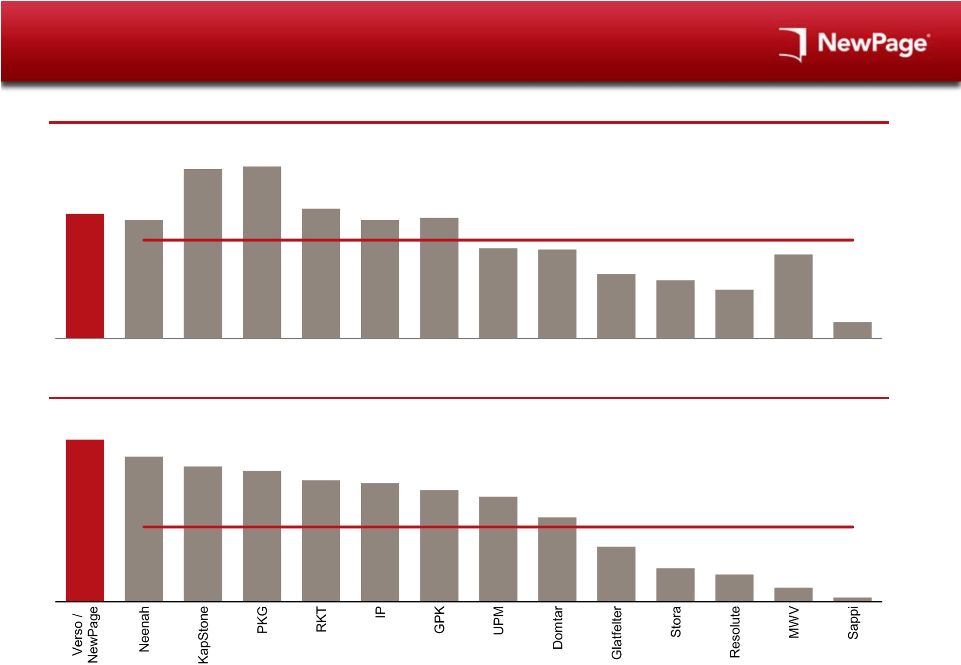

The

Combined Company Would Have Consistent Top Quartile FCF Metrics

11

Source:

FactSet, IBES consensus estimates and Wall Street Research.

Note:

FCF defined as EBITDA, less capex; FCF conversion defined as EBITDA, less capex as a

percent of EBITDA. Verso / NewPage represents LTM 9/30/13 financials, and

includes 100% of synergies. Comparable companies shown on a CY2013E basis

using IBES research estimates. Avg: 58%

Avg: 8%

14%

FCF Conversion

FCF as a % of Sales

10%

10%

14%

14%

11%

10%

10%

7%

7%

5%

5%

4%

7%

1%

79%

75%

72%

71%

69%

68%

67%

65%

60%

53%

48%

46%

43% |

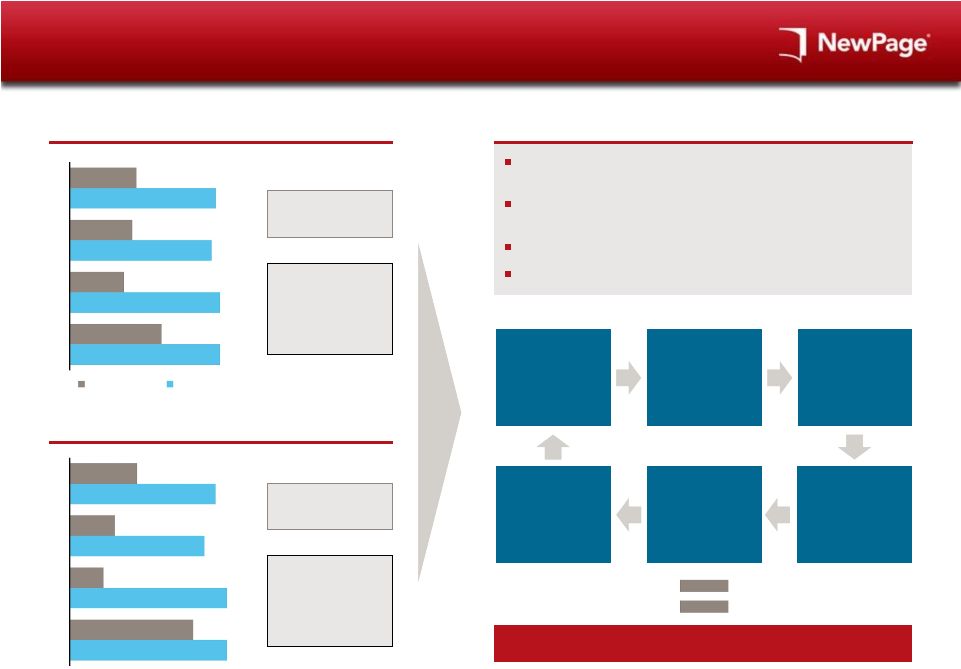

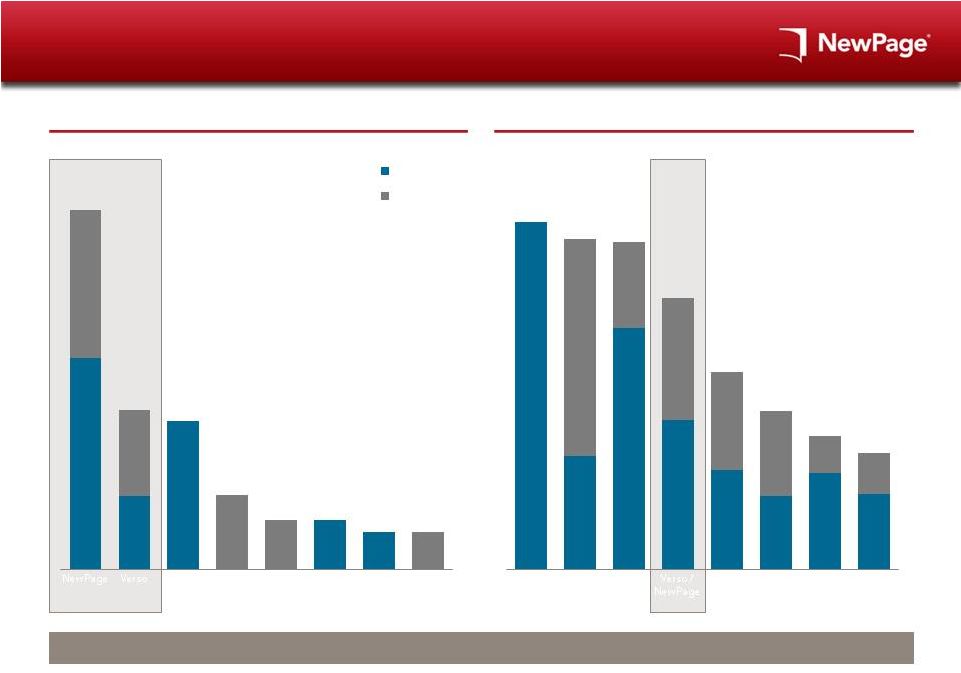

Significant Opportunity

to Leverage Verso’s Operating Expertise

12

NewPage Avg: 7.7%

Verso Avg: 9.5%

VRS adv: 180bps

Systematic

Review of

Each Process

& Component

Apparent Gap

Adjustment

Realizable Gap

Opportunity

Implement and

Track

Manage

Facility Plan

Improvement

Tactics

R-GAP is Verso’s highly successful continuous cost

improvement program

The program compares existing manufacturing processes to

the theoretical “best-in-class”

benchmarks

Hundreds of efficiency projects on-going at any given time

Requires minimal capex

NewPage Avg: $71

Verso Avg: $78

VRS adv: +11%

EBITDA Benefit From

Closing Gap: $55m

=

PF 2013E EBITDA:

$325m vs $270m

EBITDA Benefit From

Closing Gap: $25m

=

PF 2013E EBITDA:

$295m vs $270m

(1)

(1)

(1)

(1)

Source:

Company Filings and Management.

(1)

Illustrative calculation because Verso and NewPage differ with regards to product mix and

end-markets. Adj. LTM EBITDA Margin –

Last 4 Quarters

Adj. LTM EBITDA per Ton –

Last 4 Quarters

Verso’s R-GAP Program will complement NewPage’s

Lean Six Sigma (LSS) Cost Saving Initiatives

9.6%

9.6%

9.4%

9.5%

8.2%

7.3%

7.5%

7.6%

3Q13

2Q13

1Q13

4Q12

NewPage

Verso

$79

$79

$77

$78

$76

$68

$69

$71

3Q13

2Q13

1Q13

4Q12

Verso’s Average Annual Savings >$45 Million Last 4 Years |

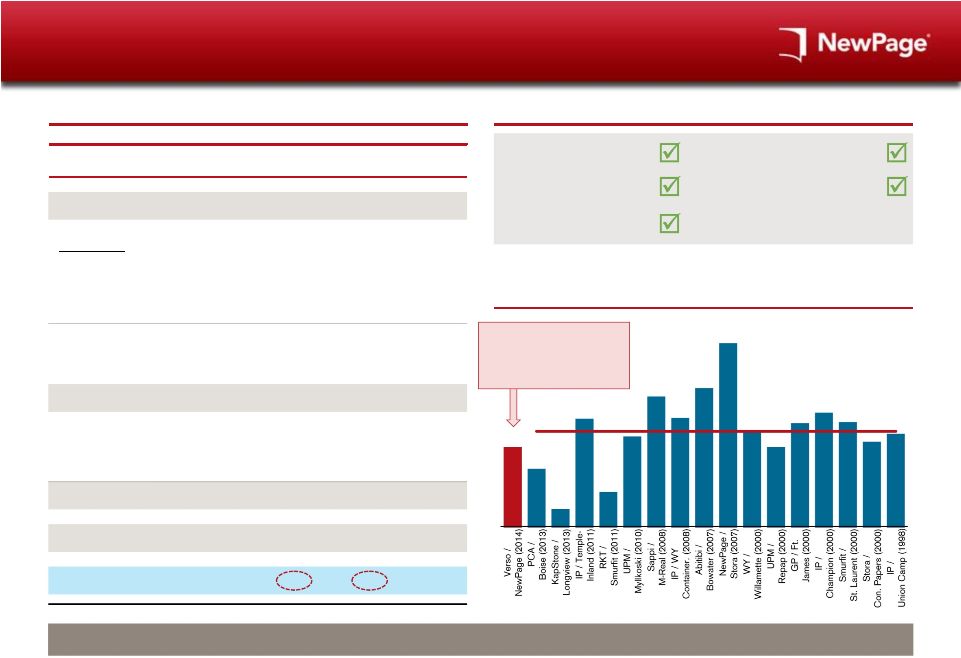

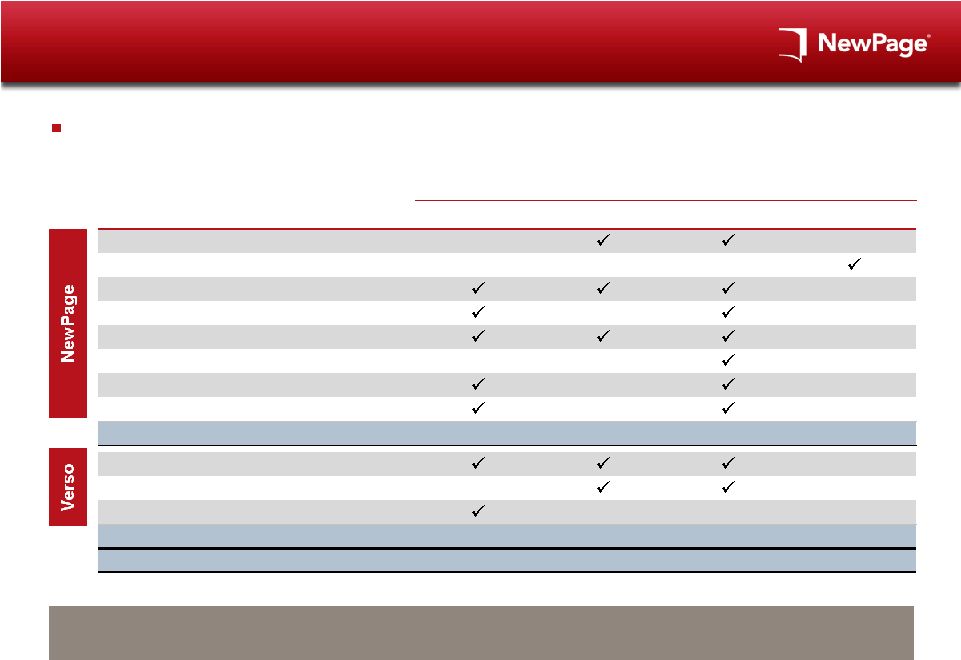

Cost

Synergies are Conservative and Achievable Source:

Verso Management, Company Annual Reports, Company websites, CapIQ, and Wall Street

Research. Restructuring costs related to implementation of synergies is

estimated by Verso Management to cost $80m. (1)

Net of expected cost savings already reflected in 2014E NewPage Adj. EBITDA from

NewPage’s optimization program, Lean Six Sigma (LSS). (2)

Transactions listed using the following format: Acquirer / Target (date of

transaction). Estimated

Synergies

are

Conservative

and

in

line

Compared

to

Precedent

Paper

Transactions

13

Good Strategic Fit

Improves Core Business

Significant Synergies

Low Integration Risk

Quality Assets

($ in millions)

% of

$ per

Amount

NWP Sales

Ton

Distribution Expense

$9

0.3%

$2

Direct Costs

Fiber

$19

0.6%

$4

Purchased pulp

5

0.1%

1

Energy

3

0.1%

1

Raw materials

42

1.3%

8

Total Direct Costs

$68

2.2%

$13

Indirect Costs

$5

0.2%

$1

Direct / Indirect Cost Synergies

$73

2.3%

$14

Corporate Overhead Costs

$57

1.8%

$11

IT Expenses

$6

0.2%

$1

Total SG&A Synergies

$63

2.0%

$12

Net First Year RGAP Savings

(1)

$30

1.0%

$6

Synergies Achieved in 18 Months

$175

5.6%

$34

Cost Synergy Summary

Synergy Assessment

Synergies as % of Sales in Precedent Transactions

(2)

5.6%

4.0%

1.2%

2.4%

7.6%

6.4%

9.2%

7.7%

10%

13.1%

6.8%

5.6%

7.3%

8.1%

7.4%

6.0%

6.6%

Avg: 6.8%

Verso / NewPage synergy

estimate below average

synergy estimates for

similar paper transactions |

14

3.

Industry Update |

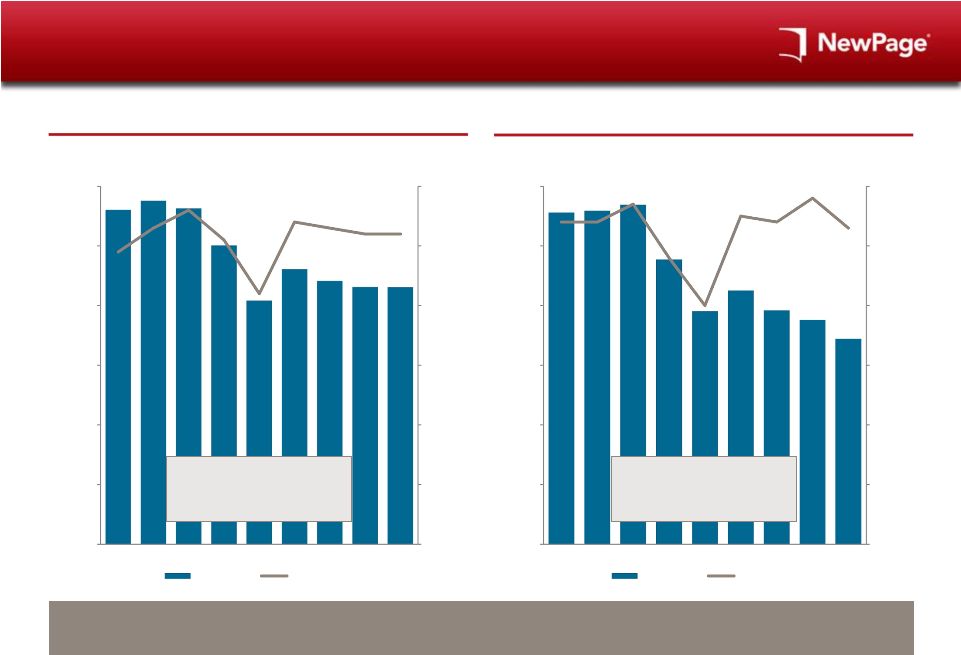

Industry Maintains Substantial Utilization Rates

15

Tons in '000s

% Utilization

Tons in '000s

% Utilization

North American Coated Paper has Witnessed a Decrease in Demand; However, Substantial

Utilization Rates have Remained

Source:

RISI historical for actuals, November 2013 RISI for forecast.

CGW Shipments: 2005A-2013F

Decline of ($2,117k) Tons,

(6%) Decline P.A.

CFS Shipments: 2005A-2013F

Decline of ($1,298k) Tons,

(3%) Decline P.A.

Relatively

Flat

Coated Freesheet –

Shipments and Utilization

Coated Groundwood –

Shipments and Utilization

6,000

5,000

4,000

3,000

2,000

1,000

–

6,000

5,000

4,000

3,000

2,000

1,000

–

2005A

2006A

2007A

2008A

2009A

2010A

2011A

2012A

2013F

2005A

2006A

2007A

2008A

2009A

2010A

2011A

2012A

2013F

Shipments

Utilization

Shipments

Utilization

5,606

5,756

5,628

5,008

4,084

4,609

4,413

4,312

4,308

94%

93%

92%

92%

5,560

5,590

5,689

4,774

3,907

4,253

89%

93%

96%

91%

82%

3,920

3,763

3,443

100%

90%

80%

70%

60%

50%

40%

100%

90%

80%

70%

60%

50%

40%

95%

94%

98%

93%

94%

94%

97%

88%

80% |

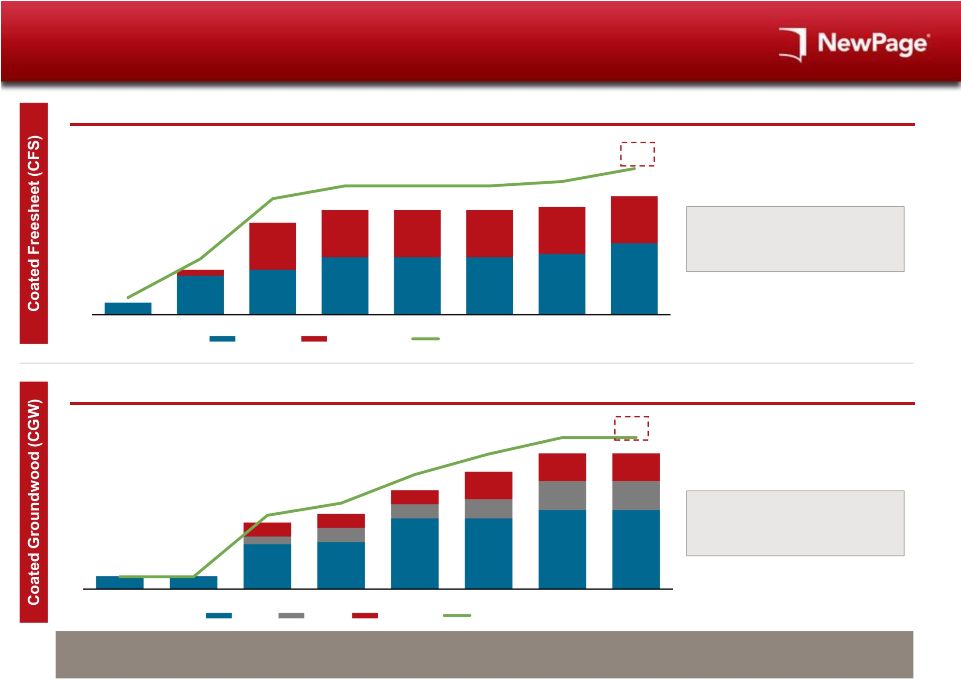

Competitive Forces Have Resulted in the Closure of High-

Cost Mills Over the Last Several Years as Demand Declined

16

Source:

RISI historical for actuals.

(1)

Beginning capacity based on 2005.

Industry Has Reduced Capacity in the Face of Demand Declines which has Resulted in

the Removal of High Cost Capacity

(1)

(1)

Other

NewPage

Other

Verso

NewPage

Cumulative Capacity Reduction (‘000s Tons)

Cumulative Capacity Reduction (‘000s Tons)

CGW Shipments: 2005A-2013F

Demand Decline of ($2,117k) Tons,

(6%) Decline Per Annum

CFS Shipments: 2005A-2013F

Demand Decline of ($1,298k) Tons,

(3%) Decline Per Annum

4%

13%

27%

30%

30%

30%

31%

34%

210

776

1,591

1,812

1,812

1,812

1,867

2,052

210

100

676

776

815

815

997

815

997

815

997

815

1,052

815

1,237

2006

2007

2008

2009

2010

2011

2012

2013

2006

2007

2008

2009

2010

2011

2012

2013

234

234

1,208

1,365

1,796

2,133

2,463

2,463

234

234

254

140

814

853

258

254

1,284

258

254

1,284

348

501

1,434

528

501

1,434

528

501

3%

3%

18%

21%

28%

33%

37%

37%

% of Beginning Capacity

% of Beginning Capacity |

17

4.

NewPage Overview |

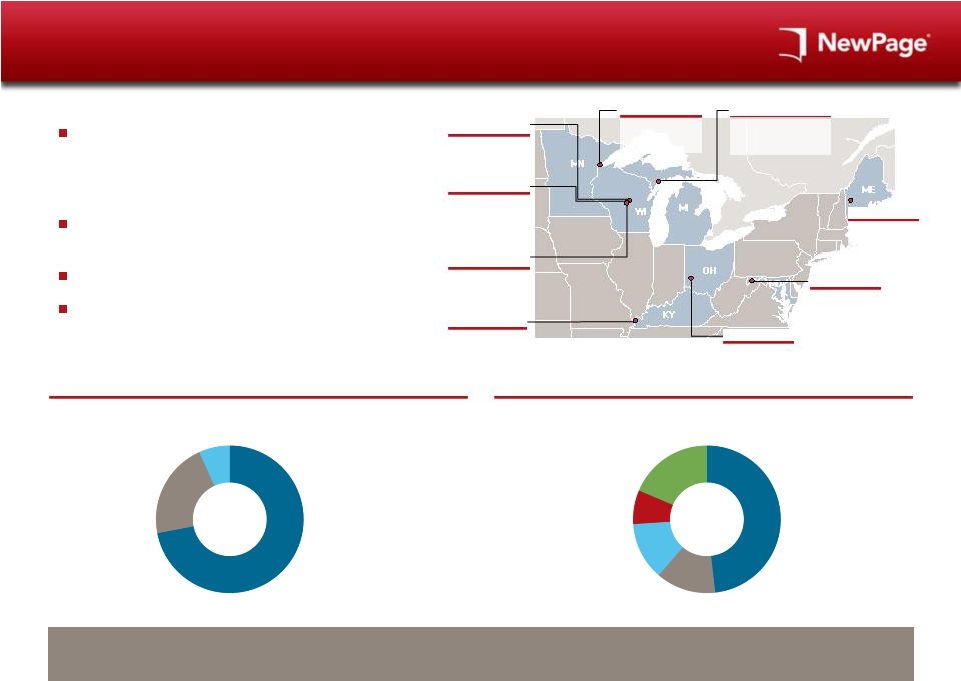

18

NewPage has Well-Located Mills Supplying

Diversified End-Markets

3.5 million tons of capacity across 8 mills

–

2.9 million tons of coated paper

–

400,000 tons of uncoated paper

–

200,000 tons of specialty paper

The Company has 2 major distribution facilities

in addition to its 8 paper mills

Headquartered in Miamisburg, Ohio

Approximately 5,600 employees

2012 NewPage Revenue by Product

2012 NewPage Revenue by End-Market

Source:

Company data.

Combination with Verso will Maintain Focus on Coated Paper Products, and Diversify

the Combined Company’s End-Markets

Rumford, Maine

Escanaba, Michigan

Biron, Wisconsin

Wisconsin Rapids,

Wisconsin

Wickliffe, Kentucky

Duluth, Minnesota

Luke, Maryland

Headquarters

Coated

72%

Other

21%

Supercalendered

7%

Commercial Print

48%

Catalog

13%

Magazine

13%

Coupons and

Inserts

7%

Other

19%

Stevens Point,

Wisconsin

Specialty paper

Coated and

specialty

paper

Coated and

specialty

paper

Coated, specialty and

uncoated paper

Supercalendered

paper

Coated, specialty

and uncoated paper

Coated and

specialty

paper

Coated and

specialty

paper

Miamisburg, Ohio |

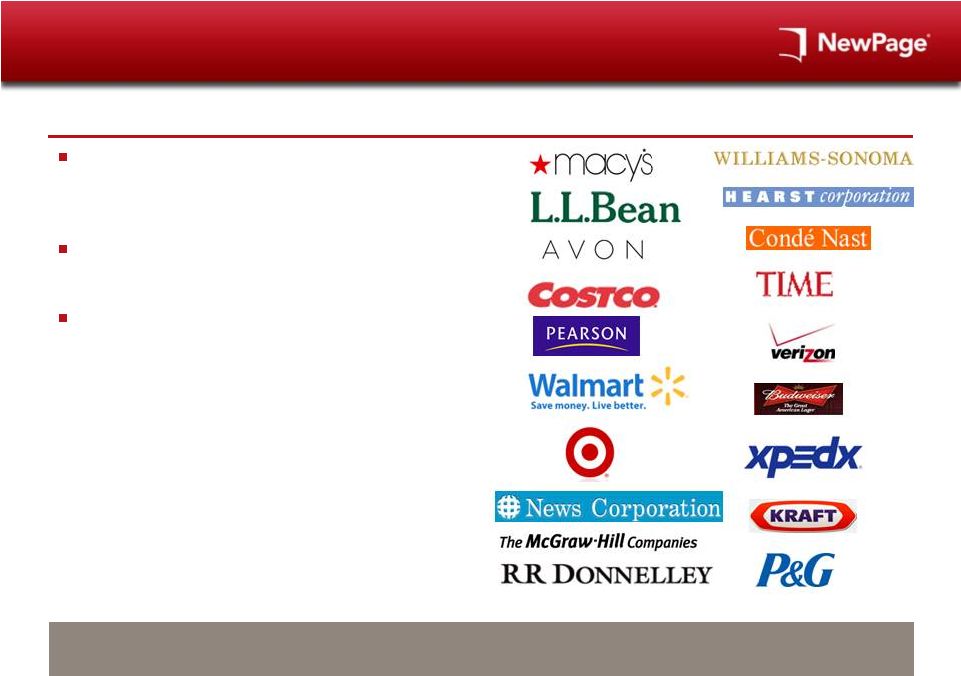

19

NewPage Enjoys Long Standing Relationships

with a Diverse Group of Customers

Source:

Company data.

Combination with Verso will Bolster NewPage’s Ability to Service the Needs of

its Customers Due to an Even More Flexible Operating Platform

NewPage Customers

NewPage has long-standing relationships

with

many leading publishers, commercial printers,

specialty retail merchandisers and paper merchants

Diversified sales channels

–

direct sales, merchant

and broker sales, and specialty sales

Efficient and integrated supply chain

–

NewPage has two major distribution facilities in

addition to its eight paper mills

–

The Company’s mills, along with the various

distribution systems, are strategically located

throughout North America

–

NewPage partners with paper merchants to

provide warehousing and distribution systems to

service both national and local markets |

20

Coated Paper Capacity Globally and in

North America

Source:

RISI Capacity reports.

(1)

IP's announced closure of Courtland, AL mill will reduce coated freesheet capacity

by ~185k tons. (Tons in millions)

(Tons in millions)

2.9

1.3

1.2

0.6

0.4

0.4

0.3

0.3

NewPage

Verso

Sappi

Resolute

UPM

IP

Sequana

Kruger

CFS

CGW

5.4

5.1

5.0

4.2

3.0

2.4

2.1

1.8

Asia Pulp

& Paper

UPM

Sappi

Verso /

NewPage

Stora

Burgo

Oji Paper

Nippon

A Combination will Result in the Largest Coated Paper Producer in North America &

#4 Globally (1)

North American Coated Paper Capacity

Global Coated Paper Capacity |

21

NewPage’s Efficient Mill System has Significant

Operating Flexibility

Source:

Management.

Note:

CFS = Coated Freesheet; CGW = Coated Groundwood; SC = Supercalendered.

(1)

On Nov 19th, NewPage announced its intention to idle No. 12 paper machine at

Rumford, which has estimated annual capacity of ~115K tons, beginning mid February 2014.

Capacity

Mill / Machine

(000 tons)

CFS

CGW

Specialty

SC

Biron

370

Duluth

270

Escanaba

785

Luke

480

Rumford

565

Stevens Point

185

Wickliffe

285

Wisconsin Rapids

560

Total NewPage

3,500

Androscoggin

635

Bucksport

405

Quinnesec

425

Total Verso

1,465

Pro Forma Total

4,965

Combination Presents Potential Cost Savings Upside in Rescheduling Production to

Lengthen Production Runs, Optimize Utilization, and Minimize Delivery

Costs (1)

The Combined Company will have improved operating flexibility in allocating production among

its facilities |

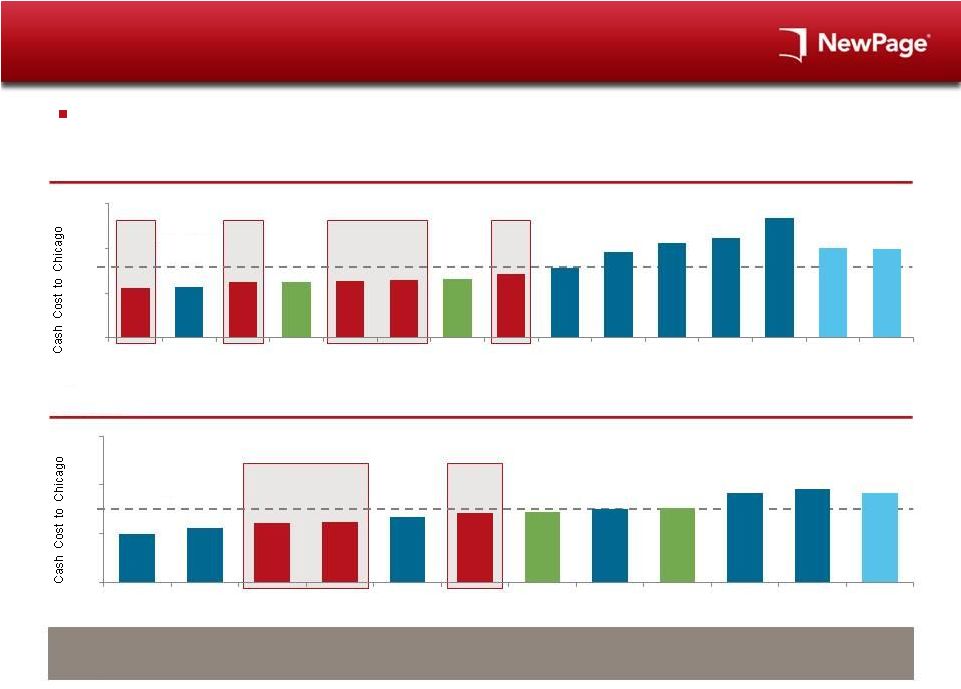

22

NewPage Operates Many of the Lowest Cost

Coated Paper Mills in the Industry

NewPage and Verso Mills have Lower Cash Costs Relative to Competitors, Driven by

their Pulp- Integration and Structural Characteristics

Average:

$705

Source:

RISI Cornerstone (As of Q3-2013).

Average:

$682

NewPage and Verso have well invested mills, with cumulative capex spend since 2000

of approximately $1.7bn and $950m, respectively (total: ~$2.7bn)

CFS Mills

CGW Mills

400

600

800

$1,000

NWP -

Wisc Rapids

A

NWP -

Escanaba

VRS -

Quinnesec

NWP -

Luke

NWP -

Rumford

VRS -

Androscoggin

NWP -

Wickliffe

B

C

D

E

F

Europe

Asia

600

800

$1,000

NWP -

Escanaba

NWP -

C

NWP -

VRS -

Androscoggin

D

VRS -

Bucksport

E

F

Europe

400

A

B

Rumford

Biron |

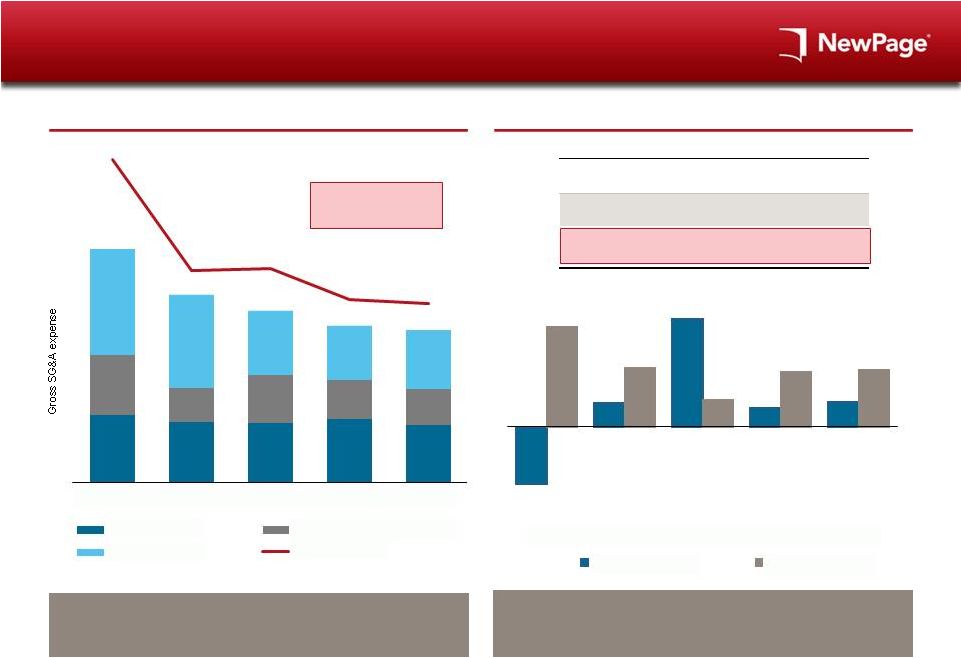

23

Cost Reduction Opportunities Will Be

Enhanced by Potential Combination

NewPage SG&A

NewPage Mill Productivity and Inflation

Decline in SG&A Expense on the Back of Reduction in

Headcount from 635 in 2009 to 503 in 2013F

Over $270 million in Cumulative Savings Have Been

Achieved at NewPage, Net of Inflation. Verso R-Gap Will

Provide Additional Upside

Source:

Company data.

(1)

Excludes

assessments,

pension/OPEB,

incentive,

equity

award,

and

depreciation.

Potential synergy upside of

$63 million for Combined

Company

(1)

($ in millions)

$249

$201

$184

$168

$163

$83

$55

$55

$47

$46

($ in millions)

$72

$65

$64

$68

$62

$64

$36

$51

$42

$38

$113

$100

$69

$58

$63

Employee Costs

Overhead Costs in COGS

All Other Costs

SG&A / Ton

2009A

2010A

2011A

2012A

2013F

($88)

$36

$164

$28

$38

$152

$90

$40

$83

$86

2009A

2010A

2011A

2012A

2013F

Inflation (deflation)

Mill productivity

Cumulative 2009A – 2013F

Mill Productivity

$451

Inflation / (Deflation)

178

Cumulative Net Mill Productivity

$273

Annual Mill Productivity Approximately $60m

Verso R-Gap Initiatives should yield an Incremental $30m in

Savings per Annum for the Combined Company |

24

Experienced Management Team

Years in

Industry

Relevant Experience

David J. Paterson

President and CEO

36

President and Chief Executive Officer and a director of Verso since May 2012

Served as President and Chief Executive Officer of AbitibiBowater Inc. from 2007 to 2011

Served as Chairman, President and Chief Executive Officer of Bowater Incorporated

during

2007

and

President

and

Chief

Executive

Officer

of

Bowater

Incorporated

from

2006

to 2007

Robert P. Mundy

Senior Vice President

and CFO

30

Senior Vice President and Chief Financial Officer since August 2006

Previously worked at International Paper Company from 1983 to 2006, where he was

Director of Finance of the Coated and Supercalendered Papers Division from 2002 to

2006,

Director

of

Finance

Projects

from

2001

to

2002,

Controller

of

Masonite

Corporation

from 1999 to 2001, and Controller of the Petroleum and Minerals business from 1996 to

1999

George F. Martin

President and CEO

30

President and Chief Executive Officer since August 2010

Held senior leadership positions with NewPage, MeadWestvaco Papers Group and

Westvaco

Jay A. Epstein

Senior Vice President

and CFO

15

Senior Vice President and Chief Financial Officer since July 2011

Served as Vice President finance, treasurer and secretary of Brant Industries and SP

Newsprint Company and was Chief Financial Officer for SP Recycling Company

Served as Vice President finance of White Birch Paper Company |

25

Key Credit Highlights

Scale will improve cost-savings and provide customer service advantages

Strong relationships with existing customer base will be reinforced through the

combination The Combined Company Would Become the Cost Leader in the North

American Coated Paper Industry Despite an already low cost structure

relative to peers, the Combined Company will improve its cost position

through synergy realization

Operates many of the lowest cost mills in both CFS and CGW

Modest

capital

requirements

and

favorable

tax

position

provide

Combined

Company

with

consistent

cash

flow

The Merger will reduce the cost structure and generate consistent top quartile FCF

metrics Experienced Management Team

Strong management team with extensive paper industry experience across its top

managers #1 Coated Paper Manufacturer in North America and #4 Globally after Combination with

Verso The Combined Company Generates Strong Free Cash Flow

for Debt Repayment |

26

5.

Financial Information |

Shared Services Agreement Summary

Synergy sharing overview

27

As a result of the more favorable cash flow profile at NewPage, a shared services

agreement has been put in place that allocates the synergies to the Verso

parent The

intent

is

that

as

a

result

of

the

shared

services

agreement,

NewPage

financials

will

remain

un-changed

from

what they would be at NewPage standalone

Verso will receive 100% of realized synergies and related cost savings (estimated

at $175m) Verso will bear 1/3 of the restructuring costs and NewPage will

bear 2/3 Verso will invoice NewPage for the synergy savings monthly, and

receive payment quarterly; amount of invoice will be expensed in NewPage

P&L, as it would be had it actually incurred the associated expense

Steering committee has at least one executive officer from each Company. Each party

to be represented equally Verso will provide corporate and

other shared services to

NewPage with any associated

cost savings accruing to Verso

NewPage will continue to pay

the "Standalone Cost" of shared

services as though it were a

standalone entity

The parties can agree to modify

terms and conditions upon good

faith negotiation

Shared Services

Purchasing

Any purchasing savings

resulting from bulk buying by the

Combined Company will accrue

to Verso

NewPage will be billed as if

purchasing for standalone

NewPage, and not a combined

entity

Capacity Protections

NewPage is protected against

diminutions in the value of

NewPage assets and the

negative operating impacts

resulting therefrom

As a Result of this Agreement, NewPage Does Not Get the Benefit of Synergies

|

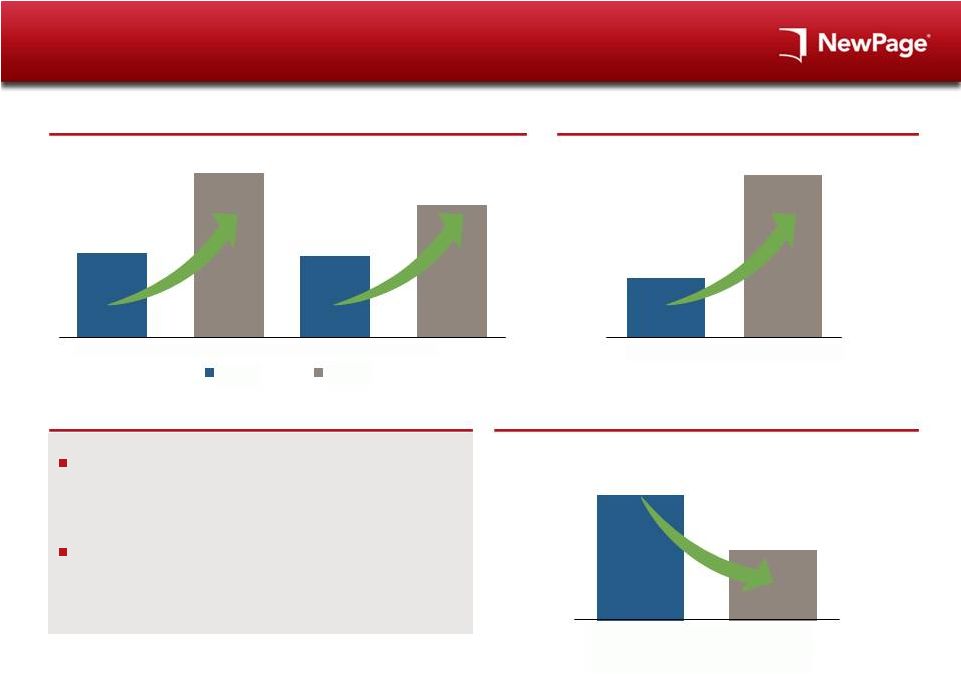

NewPage Earnings Momentum and Deleveraging

Despite Challenging Industry Dynamics

28

2013 Y-o-Y Quarterly Adj. EBITDA Performance

2013 Y-o-Y Annual Adj. EBITDA Performance

Commentary

Improved Leverage Since 2012 Bankruptcy Refinancing

NewPage cost saving initiatives have positioned the

Company for earnings growth with the evidence

proving out in 2013

In 2013, NewPage improved annual Adj. EBITDA by

13% and decreased leverage by .4x in a challenging

market backdrop

($ in millions)

($ in millions)

+47%

+30%

+13%

(.4x)

$58

$57

$85

$74

Q3

Q4E

2012

2013

$238

$270

2012

2013E

1.9x

1.5x

Post Bankruptcy

Emergence

(2012)

2013E |

29

NewPage Historical Financial Performance

($ in millions)

(1)

Pro-forma revenues of $3,169m equals Form 10 reported revenues of $3,502m but

adjusted for the elimination of $304m for Port Hawkesbury and $28m for Whiting.

(2)

Does not include $54m for Paper Machine 35 at Steven's Point.

(2)

(2)

(1)

$3,724

$2,614

$3,062

$3,169

$3,131

$3,065

$3,071

2008

2009

2010

2011

2012

LTM

9/30/13

2013E

$148

$64

$53

$75

$103

$85

$77

2008

2009

2010

2011

9/30/13

2013E

$498

$151

$289

$324

$238

$253

$270

13.4%

5.8%

9.4%

10.2%

7.6%

8.2%

8.8%

2008

2009

2010

2011

2012

LTM

9/30/13

2013E

Adjusted EBITDA

Adjusted EBITDA margin

$350

$87

$236

$249

$135

$168

$193

2008

2009

2010

2011

2012

LTM

9/30/13

2013E

LTM

2012

Revenue

Adjusted EBITDA

Capex

Adjusted EBITDA –

Capex |

Significant NewPage Free Cash Flow Potential

Illustrative

30

2013E Current

Last "Peak" EBITDA

NewPage Adjusted EBITDA

$270

$324

2013E Capex

(77)

(77)

Pro Forma Cash Interest

(66)

(66)

Cash Taxes

–

–

Free Cash Flow

$127

$181

Pension Funding

(1)

($47)

($47)

FCF After Pension

$81

$135

FCF as a % of Net Debt

11%

18%

Excludes WC changes

(1)

Average for the next 5 years.

($ in millions)

NewPage Generates Significant Free Cash Flow After Capex, Interest, Taxes and

Pension EBITDA peak after the “Great

Recession”

of 2008/2009 |

NewPage Borrowing Estimated Borrowing Base

Availability Forecast

31

The following chart details the borrowing base availability as of November 30,

2013: Notes:

(1)

The

NewPage

borrowing

base

will

include

foreign

accounts

that

meet

an

eligibility

criteria

to

be

agreed

and

will

be

capped

at

an

amount

to

be

agreed.

The

pro-forma

November

30,

2013

borrowing

base

has

been

updated

to

reflect

an

estimated

$7

million

of

eligible

foreign

accounts.

(2)

The

definitive

documentation

will

include

eligible

stores

inventory

up

to

an

amount

to

be

agreed

and

will

also

allow

for

eligible

raw

materials

that

are

comprised

of

chemicals.

Both

of

the

aforementioned

inventory

types

are

considered

ineligible

in

the

existing

NewPage

ABL

and

there

will

be

no

availability

from

these

inventory

types

in

the

new

$350

million

NewPage

ABL

until

a

satisfactory

appraisal

and

field

exam

are

conducted.

(3)

Per

the

Hilco

inventory

appraisal

dated

as

of

November

22,

2013

The borrowing base is equal to

the sum of:

85% of the book value of

eligible accounts receivable,

plus

The lesser of (i) 80% of net

book value and (ii) 85% of the

net orderly liquidation value of

eligible inventory, minus

Customary reserves

Accounts Receivable

Total

Gross Accounts Receivable

$217.5

Less Ineligibles:

27.3

Accrued Rebates

17.8

Customer Adjustments

0.9

Past Due A/R (>60 DPD) or (>90 DOI)

1.5

Discounts

1.2

Contras

1.4

Disputed Balances or Customer Chargebacks

2.2

Credit Reclass

0.4

Affiliate / Officer / Director / Employee Receivables

0.1

Other

(1)

1.8

Total Ineligible

$27.3

Eligible Accounts Receivable

$190.2

Advance Rate

85.0%

Accounts Receivable Availability

$161.7

Inventory

Raw Materials

Semi-Finished

Goods

Finished

Goods

Total

Gross Inventory

$88.3

$55.7

$239.8

$383.8

Less Ineligibles

(2)

:

41.2

2.9

13.1

57.2

Eligible Inventory

$47.1

$52.8

$226.8

$326.6

NOLV

(3)

67.8%

57.9%

81.0%

75.4%

Advance Rate

85.0%

85.0%

85.0%

85.0%

$27.1

$26.0

$156.1

$209.2

80% of Cost

$37.7

$42.2

$181.4

$261.3

Lesser of (i) 80% of Cost or (ii) 85% of NOLV

$27.1

$26.0

$156.1

$209.2

Total Borrowing Base Availability

$370.9

Reserves (including rent reserves)

(1.6)

Total Net Borrowing Base Availability

$369.3

Suppressed Availability

$19.3

Lesser of Borrowing Base and Facility Size ($350 million)

$350.0

Loan Balance at Closing

0.0

Letters of Credit Outstanding at Closing

(33.1)

Excess Availability

$316.9

Inventory Availability |

32

NewPage Pension and OPEB

The pension and OPEB balance sheet liability calculation is prescribed by GAAP and

is calculated using a discount rate of 5.1% and 4.3%, respectively

2014E

2015E

2016E

2017E

2018E

Pension Beginning Balance

$210.9

$154.5

$97.2

$41.5

$4.4

Pension Expense/(Credit)

(1.7)

(9.5)

(7.7)

(6.2)

(5.0)

Pension Funding

(54.7)

(47.8)

(48.0)

(30.9)

(6.5)

Pension Closing Balance

$154.5

$97.2

$41.5

$4.4

($7.1)

OPEB Beginning Balance

$60.0

$50.5

$42.5

$35.2

$28.3

OPEB Expense/(Credit)

2.8

2.2

1.7

1.2

1.0

OPEB Funding

(12.3)

(10.2)

(9.0)

(8.1)

(6.5)

OPEB Closing Balance

$50.5

$42.5

$35.2

$28.3

$22.8

Total Cash Expense

($65.9)

($65.3)

($63.0)

($44.0)

($17.0)

Pension/OPEB Beginning Balance

$270.9

$205.0

$139.7

$76.7

$32.7

Pension/OPEB Expense/(Credit)

1.1

(7.3)

(6.0)

(5.0)

(4.0)

Pension/OPEB Funding

($67.0)

($58.0)

($57.0)

($39.0)

($13.0)

Pension/OPEB Closing Balance

$205.0

$139.7

$76.7

$32.7

$15.7

The

actual

required

amounts

and

timing

of

all

such

future

cash

contributions

will

be

highly

sensitive

to

changes

in

the

applicable

discount

rates

and

returns

on

pension

plan

assets,

and

could

also

be

impacted

by

future

changes

in

the

laws

and

regulations applicable to

pension plan funding

While not reflected in the current projections, there may be changes to funding

levels associated with the Pension Protection Act or “PPA”, which

represents the funding stabilization provisions under the Moving Ahead for Progress in the 21st Century Act signed into law by the

President on July 6, 2012

2014 beginning pension and OPEB balance updated for actuarial assessment of year

end 2013. 2014 through 2018 expense and funding projections estimated based

on plan status at Q3, 2013. ($ in millions) |

33

6.

Syndication Overview |

First

Lien Term Loan Indicative Terms 34

Borrower:

NewPage Corporation (the “Borrower”)

Joint Lead Arrangers, Joint

Bookrunners:

CS, Barclays, UBS, BMO

Admin Agent:

CS

Facilities Offered:

$750 million Senior Secured Term Loan Facility

Incremental:

Not to exceed the sum of $140 million and additional amounts subject to certain

leverage ratios; incremental facilities shall provide for 50 bps of MFN for

the first year post closing Initial LIBOR Margin:

L+750-775bps

LIBOR Floor:

1.25%

Issue Price:

99

Term Loan Amortization:

5% after 18 month holiday

Maturity:

7 years

Use of Proceeds:

Proceeds from the new NewPage financing will be used to repay the existing $495

million NewPage Term Loan, fund a special cash payment of approximately

$250 million to NewPage’s existing equityholders, pay fees and expenses in connection with the Facilities and apply to

corporate purposes

Guarantees:

Guaranteed by (i) NewPage Investment Company LLC and (ii) all wholly-owned

domestic subsidiaries of the Borrower (other than (a) domestic

subsidiaries

that

are

subsidiaries

of

foreign

subsidiaries,

(b)

Unrestricted

Subsidiaries

and

(c)

any

bankruptcy

remote

special

purpose receivables entities designated by the Borrower (collectively, the

“NewPage Subsidiary Guarantors”) Security:

Secured

by

first

priority

security

interest

in

substantially

all

of

the

assets

of

the Borrower and each Guarantor and a second priority security

interest in the ABL-Priority Collateral

Optional Prepayments:

Soft call 103 / 102 / 101 / par, also callable at par within 30 calendar days of

any termination of the Merger Agreement Mandatory Prepayments:

100% of cash proceeds from asset sales not reinvested within 12 months

50% ECF sweep (stepping down to 25% if Net First Lien Leverage Ratio less than or

equal to 2.25:1:00 and to 0% if 1.50:1.00) 100% of cash proceeds from debt

financings not otherwise permitted under the facility Affirmative

Covenants: Customary for facilities of this type

Negative Covenants:

Customary for facilities of this type, including limitations on indebtedness,

liens, sale and lease-back transactions, investments, loans and

advances, Mergers, consolidations, sales of assets and acquisitions, restricted

payments, etc.; RP capacity:

1)

Cash / Asset transfers to Verso: $50m per annum, and addtl. amounts subject to

2.50x Net First Lien Leverage; plus, 2)

General

RPs:

customary

“Cumulative

Credit”

amount

subject

to

1.50x

Net

First

Lien

Leverage

Financial Covenants:

Net total leverage ratio of 4.15:1.00 |

ABL

Revolver Indicative Terms 35

Borrower:

NewPage Corporation (the “Borrower”)

Joint Lead Arrangers, Joint

Bookrunners:

Barclays, CS, UBS, BMO

Admin Agent:

Barclays

Facilities Offered:

$350 million senior secured asset-based revolving credit facility ($200

million through letter of credit subfacility, $30 million swingline facility)

Incremental Facilities:

Up to the greater of (i) $200 million and (ii) the excess of the borrowing

base over the then effective commitments under the facility; incremental

facilities shall provide for 50 bps of MFN for the first year post closing

Borrowing Base:

(a) 85% Eligible Accounts, plus

(b) the lesser of (i) 80% of the net book value of Eligible Inventory and (ii) 85%

of the net orderly liquidation value of Eligible Inventory, minus (c)

reserves against the Borrowing Base as established by the Agent LIBOR

Margin: L + 200 bps for the first three full months post closing, thereafter

subject to an availability based grid ranging from L + 175-225 bps

Commitment Fees:

50 bps for the first three full months post closing, thereafter subject to a

utilization based grid ranging from 37.5-50 bps Maturity:

5 years

Security:

(i) First priority security interests in all accounts receivable, loans

receivable, other receivables, inventory, related books and records and

general intangibles, deposit accounts, cash and proceeds of the Borrower and

Guarantor (“ABL-Priority Collateral”) (ii) Second priority

secured interests in the Non-ABL Priority Collateral underlying the term loan

Financial Covenant:

Should excess availability fall below the greater of (a) 10% of the lesser of (i)

the total Facility Commitments and (ii) the Borrowing Base and (b) $20

million at any time (“Covenant triggering event”), FCCR of 1.0x tested on a trailing four-quarter basis

Field Exams and Appraisals:

One per annum springing to two per annum if Excess Availability falls below the

greater of (a) 12.5% of the lesser of (i) the total Facility

Commitments and (ii) the Borrowing Base and (b) $35 million for five consecutive

business days (an “Excess Availability Triggering Event’) and

more frequently during an event of default

Reporting:

Monthly borrowing base reporting springing to weekly during (i) an Excess

Availability Triggering Event or (ii) an event of default Cash Dominion:

Springing cash dominion during (i) an Excess Availability Triggering Event or (ii)

during an event of default Affirmative Covenants:

Customary for facilities of this type

Negative Covenants:

Customary for facilities of this type, including limitations on indebtedness,

liens, sale and lease-back transactions, investments, loans and

advances, Mergers, consolidations, sales of assets and acquisitions, restricted

payments, etc.; Restricted

Payments

to

Verso:

$40m

per

annum

plus

any

additional

amounts

subject

to

satisfaction

of

the

payment

conditions

Guarantees:

Guaranteed by (i) NewPage Investment Company LLC and (ii) all wholly-owned

domestic subsidiaries of the Borrower (other than (a) domestic subsidiaries

that are subsidiaries of foreign subsidiaries, (b) Unrestricted Subsidiaries and (c) any bankruptcy remote

special purpose receivables entities designated by the Borrower (collectively, the

“NewPage Subsidiary Guarantors”) |

Key

Financing Dates 36

January 2014

February 2014

Su

Mo

Tu

We

Th

Fr

Sa

Su

Mo

Tu

We

Th

Fr

Sa

1

2

3

4

1

5

6

7

8

9

10

11

2

3

4

5

6

7

8

12

13

14

15

16

17

18

9

10

11

12

13

14

15

19

20

21

22

23

24

25

16

17

18

19

20

21

22

26

27

28

29

30

31

23

24

25

26

27

28

Holiday

Key dates

Key Dates:

Event:

January

15

Bank Meeting in New York

January

29

Commitments due

Week

of

February

3

Close and Fund (will close and fund before Merger close)

2H 2014

Anticipated

Merger

close

(2H

of

2014

due

to

timing

of

regulatory

approval)

th

th

rd |

Public Q&A

37 |

38

Appendix |

Complete Merger Sources & Uses

Includes Proposed Verso Exchange Offer

39

($ in millions)

Sources

Uses

New NWP $350m ABL

–

Refi Existing NWP 1L Term Loan

$495

New NWP 1L Term Loan

750

Equity Purchase Price

900

New VRS Seller Notes

650

Term Loan Prepayment Penalty

10

Cash from NWP Balance Sheet

70

Illustrative Fees & Expenses

(1)

65

Total Cash Sources

$1,470

Total Cash Uses

$1,470

New VRS 2nd Pr. Exchange Notes

$186

Retire VRS 2nd Pr. Sr. Sec. Notes

$396

Discount on New VRS 2nd Pr. Notes

210

Retire VRS Sr. Sub. Notes

143

Total existing 2nd Priority Notes

$396

New VRS Sub. Exchange Notes

$81

Discount on New VRS Sub. Notes

61

Total existing Subordinated Notes

$143

Total Sources

$2,008

Total Uses

$2,008

(2)

(3)

The NewPage financing is “portable”

and will be in place prior to the close of the Merger

The VRS Seller Notes will be issued at Merger close, after the Merger Agreement

conditions, including the Verso Exchange

Offer,

regulatory

approvals

and

other

customary

closing

conditions

have

been

met

An important condition of the Merger consummation is the successful reduction of

VRS Junior Debt levels by an amount that has not yet been disclosed

Note:

Assumes 100% participation in Exchange Offers at the Exchange Prices by the Early

Tender Time. (1)

Includes financing and M&A fees; subject to change.

(2)

Based

on

exchange

ratio

of

$470

in

principal

amount

of

New

2

nd

Pr.

Exchange

Notes

for

$1,000

in

principal

amount

of

Existing

2

nd

Pr.

Notes.

(3)

Based on exchange ratio of $570 in principal amount of New Sub. Exchange Notes for

$1,000 in principal amount of Existing Sub. Notes. |

Pro

Forma Combined Capitalization 40

Note:

Assumes 100% participation in Exchange Offers at the Exchange Prices by the Early

Tender Time. (1)

Pro forma for the effects of cost savings program.

(2)

Assumes 100% participation by early tender date.

(3)

TTM ending 9/30/13.

Assuming 100%

participation at

indicative

exchange prices,

Verso

is

to

reduce

its Junior Debt

levels by ~$271

($ in millions)

Verso Standalone

NewPage Standalone

Pro Forma Combined

Net mult.

Net mult.

Pro forma

Net mult.

9/30/13

Adj. EBITDA

12/31/2013E

Adj. EBITDA

adj.

Pro forma

Adj. EBITDA 9/30/13

Cash & Cash Equivalents

$9

$83

($70)

$22

NewPage

Existing $350m ABL

–

–

–

–

New $350m ABL

–

–

–

–

Existing 1L Term Loan

–

495

(495)

–

New 1L Term Loan

–

–

750

750

Total NewPage debt

–

–

$495

1.6x

$255

$750

1.2x

Verso

$150m ABL

$23

–

–

$23

$50m CF Revolver

–

–

–

–

1L Senior Secured Notes

418

–

650

1,068

Total 1L debt

$440

2.8x

–

–

$905

$1,840

3.1x

1.5L Secured Notes

272

–

–

272

Total 1L, 1.5L debt

$712

4.5x

–

–

$905

$2,112

3.6x

2nd Priority Senior Secured Notes (floating)

13

–

–

13

2nd Priority Senior Secured Notes (fixed)

396

–

(396)

–

New VRS 2nd Pr. Exchange Notes

–

–

186

186

Total secured debt

$1,121

7.2x

–

–

$695

$2,311

3.9x

Senior Subordinated Notes

143

–

(143)

–

New VRS Sub. Exchange Notes

–

–

81

81

Total debt

$1,264

8.1x

–

–

$634

$2,393

4.1x

Verso Adj. EBITDA

(1)

$155

$155

NewPage Adj. EBITDA

(3)

$253

253

Synergies

175

Pro forma combined Adj. EBITDA

$583

(2)

LTM 9/30/13 |

41

NewPage

Net

Income

to

Adjusted

EBITDA

Walk

Q1 2012

Q2 2012

Q3 2012

Q4 2012

FY 2012

Q1 2013

Q2 2013

Q3 2013

LTM 9/30

Revenue

$760

$759

$803

$809

$3,131

$756

$720

$780

$3,065

Less: Cost of Sales

(723)

(728)

(778)

(786)

(3,015)

(715)

(686)

(715)

(2,902)

Gross Profit

$37

$31

$25

$23

$116

$41

$34

$65

$163

Less: SG&A

($33)

($37)

($35)

($34)

($139)

($41)

($34)

($34)

($143)

Less: Reorganization Items

(33)

(15)

(26)

1,362

1,288

--

--

--

1,362

Less: Other (Expense) / Income

--

--

--

--

--

--

--

1

1

Less: Interest

(112)

105

(10)

(9)

(26)

(11)

(13)

(11)

(44)

Less: Taxes

18

--

(1)

2

19

--

--

--

2

Net Income

($123)

$84

($47)

$1,344

$1,258

($11)

($13)

$21

$1,341

Plus: Interest

112

(105)

10

9

26

11

13

11

44

Plus: Taxes

(18)

--

1

(2)

(19)

--

--

--

(2)

Plus: Depreciation & Amortization

60

59

61

62

242

46

45

46

199

EBITDA

$31

$38

$25

$1,413

$1,507

$46

$45

$78

$1,582

Plus: Restructuring Items

33

15

26

(1,362)

(1,288)

--

--

--

(1,362)

Plus: Equity Award

--

--

--

1

1

4

4

4

13

Plus: Non-Cash Pension Expense

--

--

5

1

6

--

--

--

1

Plus: Gain/Loss

1

1

2

2

6

--

1

--

3

Plus: Other Addbacks

1

3

--

2

6

11

--

3

16

Adjusted EBITDA

$66

$57

$58

$57

$238

$61

$50

$85

$253

($ in millions)

Note:

Totals may not foot due to rounding. |

NewPage Standalone Structure Chart

42

As of October 31, 2013

NewPage

Corporation

Wickliffe Paper

Company LLC

NewPage

Investment

Company LLC

Rumford Paper

Company

Luke Paper

Company

Escanaba Paper

Company

Chillicothe

Paper Inc.

NewPage

Energy

Services LLC

Gulf Island Pond

Oxygenation

Project

Upland

Resources, Inc.

Entity Key

Delaware

Maine

Michigan

West Virginia

Note:

All entities are 100% owned

unless otherwise indicated

30.5%

Rumford Mill

Luke Mill

Escanaba Mill

NewPage

Consolidated

Papers Inc.

NewPage

Wisconsin

System Inc.

Consolidated

Water

Power Co.

Biron Mill

Duluth Mill

Stevens Point Mill

Wisconsin Rapids Mill

Wickliffe Mill

Wisconsin

Electric Utility

Rumford

GIPOP Inc.

NewPage

Holdings Inc. |

43 |