Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d658569d8k.htm |

Market Outlook

Picking Up the Knife

(and starting a fight?)

Mosaic AgCollege

Orlando, FL

January 14, 2014

Michael R. Rahm

Vice President

Market and Strategic Analysis

Andy Jung

Director

Market and Strategic Analysis

Exhibit 99.1 |

Safe

Harbor Statement 2

This presentation contains forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. Such statements include, but are not limited to,

statements about the proposed acquisition of the Florida phosphate assets and certain related liabilities of CF

Industries, Inc. (“CF”) and the ammonia supply agreements with CF; the benefits of the

transactions with CF; future strategic plans and other statements about future financial and

operating results. Such statements are based upon the current beliefs and expectations of The Mosaic

Company's management and are subject to significant risks and uncertainties. These risks and

uncertainties include but are not limited to risks and uncertainties arising from the

possibility that the closing of the proposed phosphate asset acquisition may be delayed or may not occur, including

delays arising from any inability to obtain governmental approvals of the transaction on the proposed

terms and schedule and the ability to satisfy other closing conditions; difficulties with

realization of the benefits of the transactions with CF, including the risks that the acquired assets may not

be integrated successfully or that the cost or capital savings from the transactions may not be fully

realized or may take longer to realize than expected, regulatory agencies might not take, or

might delay, actions with respect to permitting or regulatory enforcement matters that are

necessary for Mosaic to fully realize the benefits of the transactions including replacement of

CF’s escrowed financial assurance funds, or the price of natural gas or ammonia changes to

a level at which the natural gas based pricing under one of the long term ammonia supply agreements with

CF becomes disadvantageous to Mosaic; customer defaults; the effects of our decisions to exit business

operations or locations; the predictability and volatility of, and customer expectations about,

agriculture, fertilizer, raw material, energy and transportation markets that are subject to

competitive and other pressures and economic and credit market conditions; the level of inventories in

the distribution channels for crop nutrients; changes in foreign currency and exchange rates;

international trade risks; changes in government policy; changes in environmental and other

governmental regulation, including greenhouse gas regulation, implementation of numeric water quality

standards for the discharge of nutrients into Florida waterways or possible efforts to reduce

the flow of excess nutrients into the Mississippi River basin or the Gulf of Mexico; further

developments in judicial or administrative proceedings, or complaints that Mosaic's operations are

adversely impacting nearby farms, business operations or properties; difficulties or delays in

receiving, increased costs of or challenges to necessary governmental permits or approvals or

increased financial assurance requirements; resolution of global tax audit activity; the effectiveness

of the Company's processes for managing its strategic priorities; the ability of the Northern

Promise joint venture among Mosaic, Ma'aden and SABIC to obtain project financing in acceptable

amounts and upon acceptable terms, the future success of current plans for the joint venture and any

future changes in those plans; adverse weather conditions affecting operations in Central

Florida or the Mississippi River basin or the Gulf Coast of the United States, and including

potential hurricanes, excess rainfall or drought; actual costs of various items differing from

management's current estimates, including, among others, asset retirement, environmental

remediation, reclamation or other environmental regulation, Canadian resources taxes and royalties, or the

liabilities Mosaic is assuming in the proposed phosphate assets acquisition; brine inflows at Mosaic's

Esterhazy, Saskatchewan, potash mine or other potash shaft mines; other accidents and

disruptions involving Mosaic's operations, including potential mine fires, floods, explosions, seismic

events or releases of hazardous or volatile chemicals, as well as other risks and uncertainties

reported from time to time in The Mosaic Company's reports filed with the Securities and

Exchange Commission. Actual results may differ from those set forth in the forward-looking statements.

|

Welcome to AgCollege

We value our “relationship”

(a short story)

We greatly appreciate your business and want

to see us both succeed by delivering

innovative solutions & value to our customers

Introducing Andy Jung

An explanation of the title of our presentation

Preliminaries |

An explanation of the

title of our presentation 4

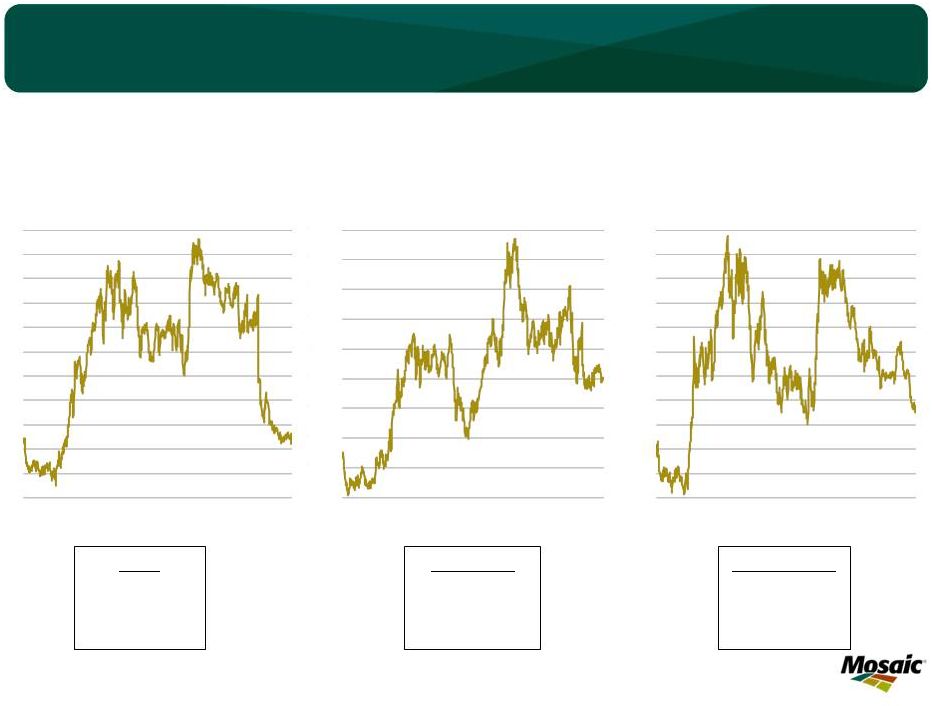

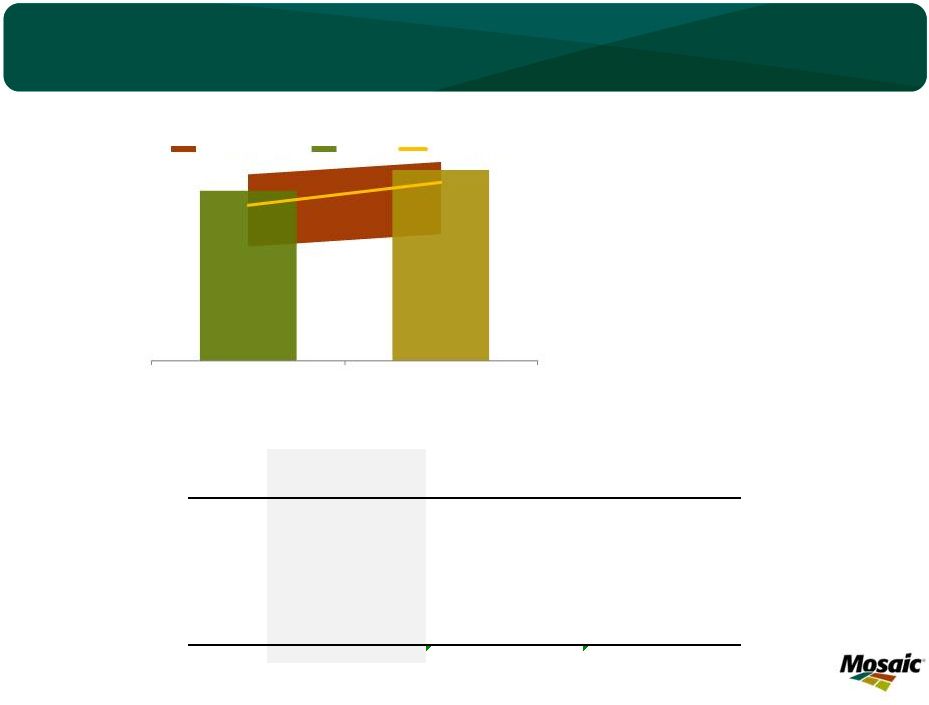

MOP

2011 Peak: $560

2013 Trough: $310

Change: -45%

Current: $320

Change: +3%

Urea

2012 Peak: $740

2013 Trough: $280

Change: -62%

Current: $390

Change: +39%

DAP

2011 Peak: $660

2013 Trough: $340

Change: -48%

Current: $439

Change: +29%

Let it hit the floor and pick it up

100

200

300

400

500

600

700

05

06

07

08

09

10

11

12

13

14

$ Ton/ne

Plant Nutrient Prices

Urea -

fob NOLA

DAP -

fob Tampa

MOP -

c&f Brazil

Source: Fertecon, CRU, FMB and ICIS |

Agricultural Situation and Outlook

Phosphate Situation and Outlook

Potash Situation and Outlook

Factors to Watch and Handicap

Q&A

Agenda

Mike

Andy

Mike

Andy |

Agricultural Situation and Outlook |

Key

Features and Take Aways Record-smashing global harvest and large stock

build in 2013/14 –

Record harvested area and yield

–

Significant pent-up demand

–

How low will prices have to fall in order to clear markets?

•

Need to reach the trigger point that unleashes pent-up demand and dulls supply

growth •

More downside but no collapse in agricultural commodity prices

All eyes on the corn market

–

Great news from the January 10 USDA reports, but . . .

–

Large stock build this year and the potential for another significant build in

2014/15 –

Changes

in

U.S.

2014

blending

mandate

–

impact

more

psychological

than

fundamental

for

now

–

Chinese imports a bigger concern

–

Fewer corn acres needed in 2014, but what will farmers plant

A wide range of potential outcomes in 2014/15

Food story still intact in the long run

Less robust but still constructive plant nutrient demand drivers

–

Decent plant nutrient affordability

–

Lower but continued profitable farm economics

–

Elevated farm income and strong balance sheets

7 |

The view from 60,000

feet (dumping all crops in the same basket) 8

The world harvested a monster crop in 2013/14 due to record

harvested area and yield.

Last year’s smaller than expected crop (but still the second

largest!) resulted in record prices for several commodities.

Record prices destroyed demand and allocated smaller supplies

to their highest valued uses. Global use increased just 0.4%

compared to a CAGR of 2.4% during the previous five years. Use

is projected to increase 4.3% in 2013/14 due to pent-up demand.

This year’s record crop is big enough to meet the rebound in

demand (two year’s worth) and rebuild the all of the inventory

drawn-downs during the last three years.

2.40

2.50

2.60

2.70

2.80

2.90

3.00

3.10

3.20

800

820

840

860

880

900

920

940

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

MT Ha

Mil Ha

World Grain and Oilseed Area and Yields

Harvested Area

Yield

Trend

Source: USDA

2.0

2.1

2.2

2.3

2.4

2.5

2.6

2.7

2.8

2.9

3.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

Bil Tonnes

World Grain and Oilseed Production

Production

Use

Source: USDA

607

580

494

407

470

463

427

439

515

571

550

535

515

570

15.0%

17.5%

20.0%

22.5%

25.0%

27.5%

30.0%

350

400

450

500

550

600

650

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

Percent

Mil Tonnes

World Grain & Oilseed Stocks

Stocks

Percent of Use

Source: USDA |

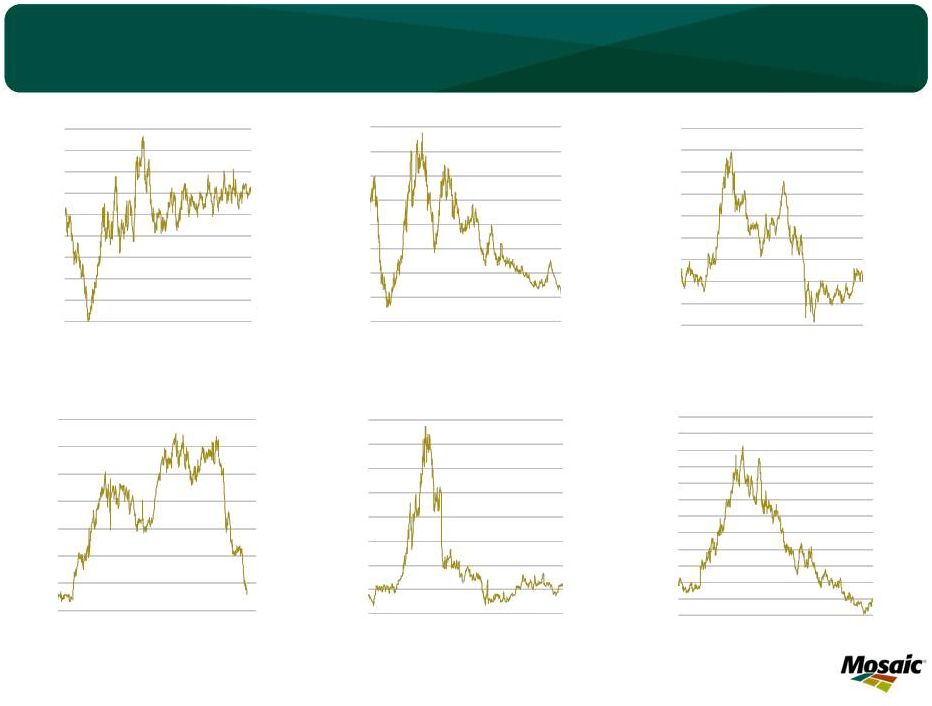

A different question

this year 9

2012/13: How high to allocate the short crop to its highest valued uses?

2013/14: How low to unleash pent-up demand and dull supply growth?

HRW Wheat

2012/13: $8.20

Current: $6.26

2013/14: ????

Corn

2012/13: $6.79

Current: $4.33

2013/14: ????

Soybeans

2012/13: $14.74

Current: $13.04

2013/14: ????

3.0

3.5

4.0

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

8.5

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

$ BU

Corn

Daily Close of Nearby Futures Contract

Source: CBOT

9.0

10.0

11.0

12.0

13.0

14.0

15.0

16.0

17.0

18.0

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

$ BU

Soybean Price

Daily Close of Nearby Futures Contract

Source: CBOT

4.5

5.0

5.5

6.0

6.5

7.0

7.5

8.0

8.5

9.0

9.5

10.0

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

$ BU

HRW Wheat Price

Daily Close of Nearby Futures Contract

Source: KCBOT |

Other agricultural

commodity prices also are lower 10

9.5

10.5

11.5

12.5

13.5

14.5

15.5

16.5

17.5

18.5

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

CTS/LB

Rice (#2) Price

Daily Close of Nearby Futures Contract

Source: CME

12

15

18

21

24

27

30

33

36

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

CTS/LB

Sugar (#11) Price

Daily Close of Nearby Futures Contract

Source: ICE

2000

2250

2500

2750

3000

3250

3500

3750

4000

4250

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

RM/

Tonne

Palm Oil Price

Daily Close of Nearby Futures Contract

Source: Kuala Lumpur Exchange

60

80

100

120

140

160

180

200

220

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

CTS/LB

Cotton Price

Daily Close of Nearby Futures Contract

Source: ICE

100

120

140

160

180

200

220

240

260

280

300

320

340

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

CTS/LB

Coffee Price

Daily Close of Nearby Futures Contract

Source: ICE

350

400

450

500

550

600

650

700

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

C$/MT

Canola

Daily Close Cash Price

Source: WCE |

Markets sending weaker

signals this year 11

3.50

4.00

4.50

5.00

5.50

6.00

6.50

7.00

7.50

8.00

J

A

S

O

N

D

J

F

M

A

M

J

US$ BU

New Crop Corn Prices

Daily Close of the New Crop Option Jul 1 to Jun 30

2008

2012

2013

2014

Source: CME

8.0

9.0

10.0

11.0

12.0

13.0

14.0

15.0

16.0

17.0

J

A

S

O

N

D

J

F

M

A

M

J

US$ BU

New Crop Soybean Prices

Daily Close of the New Crop Option Jul 1 to Jun 30

2008

2012

2013

2014

Source: CME

1.9

2.0

2.1

2.2

2.3

2.4

2.5

2.6

2.7

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

Jan-14

Close of New Crop Futures Soybean:Corn Ratio

2013

2014

Source: CME

4.00

5.00

6.00

7.00

8.00

9.00

10.00

11.00

12.00

13.00

J

A

S

O

N

D

J

F

M

A

M

J

US$ BU

New Crop Hard Red Winter Wheat Prices

Daily Close of the New Crop Option Jul 1 to Jun 30

2008

2012

2013

2014

Source: CME |

All eyes on the corn

market 12

The USDA’s January 10 reports delivered good news for

the crop input supply industry. Lower projected U.S.

production and inventories as well as a bump in use

caused a sharp rally in corn prices and eased fears that

corn could drop to less than $4 bu heading into the

spring planting season.

However, world and U.S. corn inventories still are

projected to increase sharply due to the bumper U.S.

crop as well as record crops in other parts of the world

such as Brazil. Market is expected to closely watch

South American crop progress, U.S. Prospective

Plantings survey results and Chinese imports for future

direction.

0

7

14

21

28

35

42

49

56

63

70

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Percent

Bil Bu

U.S. Corn Stocks

Stocks

Percent of Use

Source: USDA

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

0

25

50

75

100

125

150

175

200

225

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Percent

Mil Tonnes

World Corn Stocks

Stocks

Percent of Use

Source: USDA

0

2

4

6

8

10

12

14

70

74

78

82

86

90

94

98

02

06

10

Bil Bu

U.S. Corn Use

Exports

Feed and Residual

Food & Industrial

Source: USDA |

Impact of a lower

ethanol RFS is more psychological than economic at this point

13

The ethanol blending mandate was

scheduled to increase to 14.4

billion gallons in 2014, but the EPA

has proposed to lower the RFS to

13.01 billion gallons in order to

align it more closely with the E10

blend wall (current U.S. gasoline

demand is about 133 billion

gallons).

The 1.3 billion gallon decline is

equal to about 465 million bushels

of corn or almost 3 million

harvested acres. However,

ethanol production never would

have increased by this amount due

to the E10 blend wall. The change

likely will have a much greater

psychological impact than

fundamental impact on the corn

market.

EISA 2007 RFS2 & Proposed Adjustments

EPAct

Total

Advanced Biofuel

Conventional

2005

Renewable

Total

or Total Less

Year

RFS1

Fuel

Advanced

Cellulosic

Advanced

2006

4.00

na

na

na

na

na

2007

4.70

na

na

na

na

na

2008

5.40

9.00

na

na

na

9.00

2009

6.10

11.10

0.60

na

0.33

10.50

2010

6.80

12.95

0.95

0.01

0.82

12.00

2011

7.40

13.95

1.35

0.01

0.80

12.60

2012

7.50

15.20

2.00

0.09

1.00

13.20

2013

tbd

16.55

2.75

0.14

1.28

13.80

2014F

tbd

15.21

2.20

0.17

1.28

13.01

2015F

tbd

20.50

5.50

3.00

tbd

15.00

2016F

tbd

22.25

7.25

4.25

tbd

15.00

2017F

tbd

24.00

9.00

5.50

tbd

15.00

2018F

tbd

26.00

11.00

7.00

tbd

15.00

2019F

tbd

28.00

13.00

8.50

tbd

15.00

2020F

tbd

30.00

15.00

10.50

tbd

15.00

2021F

tbd

33.00

18.00

13.50

tbd

15.00

2022F

tbd

36.00

21.00

16.00

tbd

15.00

Source: Energy Policy Act of 2005 (EPACT 2005) and Energy Independence and Security Act of 2007

(EISA 2007), EPA-420-F-10-007, and Mosaic estimate.

Biomass-

Based Diesel |

Fewer U.S. corn acres

are needed in 2014/15 -- if

yield equals trend and demand remains at high levels

14

14/15 Scenarios

(mil bu)

05/06

06/07

07/08

08/09

09/10

10/11

11/12

12/13

13/14F

#1

#2

#3

Acreage and Yield

Planted (mil acres)

81.8

78.3

93.5

86.0

86.4

88.2

91.9

97.2

95.4

95.0

91.0

87.6

Harvested (mil acres)

75.1

70.6

86.5

78.6

79.5

81.4

84.0

87.4

87.7

86.9

83.3

80.2

Yield (bu/acre)

147.9

149.1

150.7

153.9

164.7

152.8

147.2

123.4

158.8

165.7

165.7

165.7

Harvested Ratio (%)

91.9%

90.2%

92.5%

91.4%

92.0%

92.4%

91.4%

89.9%

91.9%

91.5%

91.5%

91.5%

Supply

Beginning Stocks

2,114

1,967

1,304

1,624

1,673

1,708

1,128

989

821

1,631

1,631

1,631

Production

11,112

10,531

13,038

12,092

13,092

12,447

12,360

10,780

13,925

14,403

13,797

13,285

Imports

9

12

20

14

8

28

29

162

35

15

15

15

Total

13,235

12,510

14,361

13,729

14,773

14,182

13,517

11,932

14,781

16,050

15,443

14,931

Use

Feed & Residual

6,115

5,540

5,858

5,182

5,126

4,799

4,557

4,335

5,300

5,300

5,300

5,300

FIS

3,019

3,541

4,442

5,025

5,961

6,425

6,428

6,044

6,400

6,300

6,300

6,300

Ethanol for Fuel

1,603

2,119

3,049

3,709

4,591

5,019

5,011

4,650

4,900

4,800

4,800

4,800

Exports

2,134

2,125

2,437

1,849

1,979

1,830

1,543

731

1,450

1,700

1,700

1,700

Total

11,268

11,207

12,737

12,056

13,066

13,055

12,528

11,110

13,150

13,300

13,300

13,300

Ending Stocks

1,967

1,304

1,624

1,673

1,708

1,128

989

821

1,631

2,750

2,143

1,631

Stocks as % of Use

17.5%

11.6%

12.8%

13.9%

13.1%

8.6%

7.9%

7.4%

12.4%

20.7%

16.1%

12.3%

USDA |

A large rebound in

global soybean stocks largely due to record South American production

15

0%

5%

10%

15%

20%

25%

30%

35%

0

10

20

30

40

50

60

70

80

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Percent

Mil Tonnes

World Soybean Stocks

Source: USDA

0

5

10

15

20

25

30

0

100

200

300

400

500

600

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Percent

Mil Bu

U.S. Soybean Stocks

Source: USDA

0

20

40

60

80

100

120

140

160

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Mil Tonnes

South American Soybean Production

Brazil

Argentina

Paraguay

Source: USDA

Stocks

Percent of Use

Mil Bu

Percent of Use |

Oh Canada! What

a wheat (and canola) crop 16

12%

15%

18%

21%

24%

27%

30%

33%

36%

39%

0

25

50

75

100

125

150

175

200

225

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Percent

Mil Tonnes

World Wheat Stocks

Stocks

Percent of Use

Source: USDA

0

10

20

30

40

50

60

70

80

90

100

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Percent

Bil Bu

U.S. Wheat Stocks

Bil Bu

Percent of Use

Source: USDA

0

5

10

15

20

25

30

35

40

70

73

76

79

82

85

88

91

94

97

00

03

06

09

12

Mil Tonnes

Canada Wheat Production

Source: USDA

0

2

4

6

8

10

12

14

16

18

20

70

73

76

79

82

85

88

91

94

97

00

03

Mil Tonnes

Canada Rapeseed Production

Source: USDA

06

09

12 |

A wide range of

potential outcomes in 2014/15, but likely case illustrates the challenge of the food story

17

607

580

494

407

470

463

427

439

515

571

550

535

515

570

350

400

450

500

550

600

650

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

Mil Tonnes

World Grain & Oilseed Stocks

Historical

2014/15 Range

2014/15 Medium Scenario

Source: USDA and Mosaic

2014/15 Grain and Oilseed Scenario Assumptions

Low

Medium

High

Harvested Area Change

-0.50%

0.00%

0.50%

Yield Deviation from Trend *

Largest Negative

0.00

Largest Positive

Demand Growth

2.0%

2.5%

3.0%

* Trend yield for 2000/01 to 2012/13 crop years. |

Food story still

intact in the long run 18

1,000

1,500

2,000

2,500

3,000

3,500

80

85

90

95

00

05

10

20F

30F

Mil Tonnes

Source: USDA and Mosaic

World Grain and Oilseed Use

Actual for Biofuels

Actual

Forecast for Biofuels

Forecast

1.75

2.00

2.25

2.50

2.75

3.00

3.25

3.50

3.75

775

800

825

850

875

900

925

950

975

80

85

90

95

00

05

10

20F

30F

MT Ha

Mil Ha

World Harvested Area and Average Yield

Actual Area

Forecast Area

Actual Yield

Required Yield

1980-10 Yield Trend |

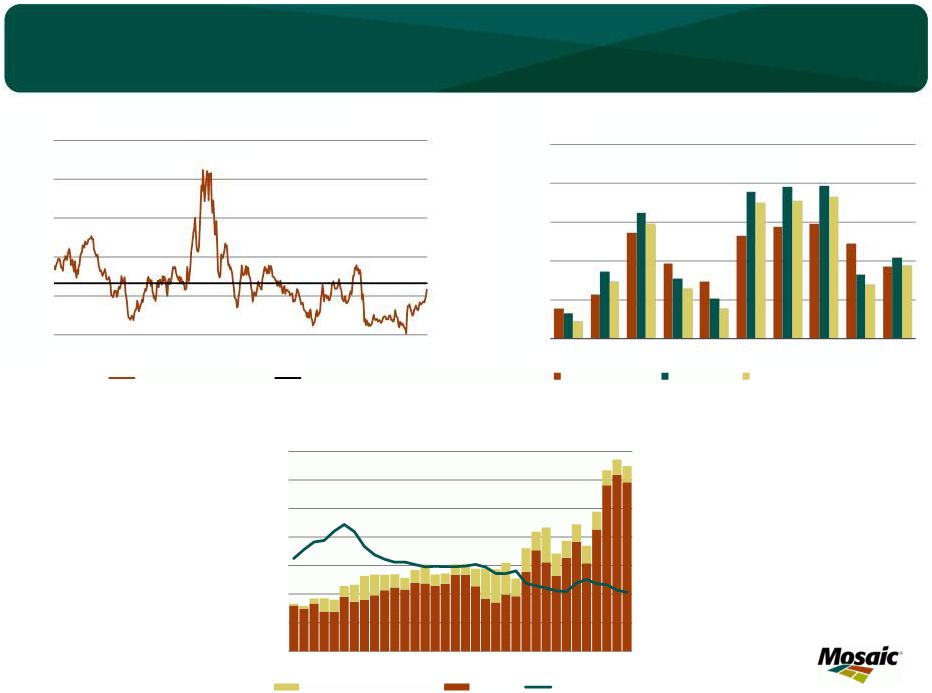

Less robust but still

constructive demand drivers 19

0.50

0.75

1.00

1.25

1.50

1.75

05

06

07

08

09

10

11

12

13

14

Plant Nutrient Affordability

Plant Nutrient Price Index / Crop Price Index

Affordability Metric

Average

Source: Weekly Price Publications, CME,

USDA, AAPFCO, Mosaic

0%

5%

10%

15%

20%

25%

30%

35%

0

20

40

60

80

100

120

140

80

83

86

89

92

95

98

01

04

07

10

13F

Debt:Asset

Ratio

Bil $

U.S. Net Cash Farm Income

Government Payments

Debt: Asset Ratio

Source: USDA

$0

$200

$400

$600

$800

$1,000

05/06

06/07

07/08

08/09

09/10

10/11

11/12

12/13

13/14F

14/15F

$ Acre

Source: Iowa State University, USDA and Mosaic

Estimated Return After Variable Cost

for a U.S. Midwest High Yield Farm Operation

Soybeans

Corn

Corn Following Corn

Market |

Phosphate Situation and Outlook |

Key

Features and Take Aways Prices have rallied ~$75-$100 tonne since the end

of November Positive demand prospects

–

Less robust but still constructive demand drivers

–

Record global shipments and a rebound in trade in 2014

Lean channel inventories worldwide (China the notable

exception) –

Limited livin’

off the pipeline this year

–

The knife has hit the floor and buyers are picking it up (i.e.

positioning product for the upcoming season) –

India case study: a rebound in shipments and imports are expected beginning

in Q2 China export policies/economics likely will set a price ceiling

Still several uncertainties and caution flags

–

The direction of agricultural commodity prices

–

Indian 2014/15 phosphate subsidy

–

New supplies

•

Continued ramp-up of Ma’aden production and additional finished product

and possibly acid capacity in Morocco •

Indian JV acid plants in Tunisia (Tifert) and Jordan (Jifco)

–

Raw materials costs (sulphur has roared higher over the past couple of

months) –

Macroeconomic backdrop and impact on exchange rates (especially the

Indian rupee) Bottom line: Tight near term with China economics

likely setting the ceiling later in 2014

21 |

Prices have rallied

~$70-$100 since the end of November

22

100

200

300

400

500

600

05

06

07

08

09

10

11

12

13

14

$ ST

Weekly DAP Prices

Central Florida Rail

Source: Green Markets

100

200

300

400

500

600

05

06

07

08

09

10

11

12

13

14

$ ST

Weekly DAP Prices

NOLA Barge

Source: Green Markets

200

300

400

500

600

700

05

06

07

08

09

10

11

12

13

14

$ MT

Weekly DAP Prices

fob Tampa

Source: Fertecon |

23

0

5,000

10,000

15,000

20,000

25,000

30,000

2008

2009

2010

2011

2012

2013

India Retail Plant Nutrient Prices

Urea

MOP

DAP

INR / MT

Source: FAI, Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14

YTD

Mil Tonnes

India DAP Imports

Actual

Forecast

Source: FAI, Mosaic

Fertilizer Year Ending March 31

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14

YTD

Mil Tonnes

India Urea Imports

Actual

Forecast

Source: FAI, Mosaic

Fertilizer Year Ending March 31

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14

YTD

Mil Tonnes

India MOP Imports

Actual

Forecast

Source: FAI, Mosaic

Fertilizer Year Ending March 31

What drove the decline in global DAP pricing?

Collapse of Indian Import Demand |

Livin’

off the Pipeline: India DAP Example

24

Million Tonnes DAP

2013/14E

2014/15

Producer/Importer Beginning Inventory

1.45

Production

3.67

Imports

3.90

Producer/Importer Sales to Retailer Dealers

7.82

Retail Dealer Sales to Farmers

9.82

Retail Inventory Change

-2.00

Producer/Importer Ending Inventory

1.20

Producer/Importer Inventory Change

-0.25

Total Pipeline Inventory Change

-2.25

Our Delhi team estimates that DAP demand by farmers remains strong due to an

outstanding monsoon and profitable farm economics. The government has

raised minimum support prices for major crops, retail urea prices remain

stable at the extremely low level of $80-$85 per tonne, and retail P&K prices, while up sharply from pre-

reform

levels,

have

declined

modestly

in

2013/14.

As

a

result,

retail

dealer

DAP

sales

to

farmers

are

projected

to

total 9.8 million tonnes this fertilizer year.

Producer and importer sales, however, are projected to drop to 7.8 million tonnes,

implying a retail inventory decline of 2.0 million tonnes. In

addition, producer/importer inventories also are projected to decline 250,000

tonnes in 2013/14. |

Which Led to a Tale of

Two Hemispheres 25

Americas –

Strong Demand in 2013

and Outstanding Prospects Remain

0.0

0.2

0.4

0.6

0.8

1.0

1.2

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Mil Tons

U.S. DAP and MAP/MES Shipments

MIN MAX Range (05/06-11/12)

2012/13

7-Yr Olympic Avg

Source: TFI and Mosaic

0.0

0.2

0.4

0.6

0.8

1.0

1.2

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Mil Tons

U.S. DAP and MAP/MES Shipments

MIN MAX Range (06/07-12/13)

2013/14

7-Yr Olympic Avg

Source: TFI and Mosaic

3.0

4.5

6.0

7.5

9.0

10.5

12.0

3.0

3.5

4.0

4.5

5.0

5.5

6.0

95

97

99

01

03

05

07

09

11

13

15F

Mil Tons

Product

Mil Tons

P

2

O

5

NA Phosphate Use and

DAP/MAP/MES/TSP Shipments

Phosphate Use

Phosphate Product Shipments

Source: AAPFCO, TFI, IFA and Mosaic

Fertilizer Year Ending June 30 |

Actual

Forecast

Shipments

13/14

Shipments

13/14

Shipments

13/14

Jun-May

% Chg

Jun-Nov

% Chg

Dec-May

% Chg.

2005/06

8,218

18%

3,726

22%

4,492

14%

2006/07

8,485

14%

3,600

27%

4,885

5%

2007/08

9,507

2%

4,639

-2%

4,868

5%

2008/09

6,415

51%

3,040

50%

3,375

51%

2009/10

8,078

20%

3,573

27%

4,505

13%

2010/11

9,673

0%

4,355

5%

5,317

-4%

2011/12

9,042

7%

4,556

0%

4,486

14%

2012/13

10,076

-4%

4,983

-9%

5,094

0%

2013/14F

9,668

n/a

4,555

n/a

5,113

n/a

7-yr Oly Avg

8,957

8%

4,145

10%

4,768

7%

1000 tons of DAP, MAP, TSP, MES

North American Domestic Phosphate Shipments

Which Led to a Tale of Two Hemispheres

26

Americas

–

Strong

Demand

in

2013

and Outstanding Prospects Remain

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Jun-Nov 2013

Dec-May 2014 F

Mil Tons

North American Phosphate Product Shipments

7-Yr Min-Max Range

2013/14

7-Yr Olympic Average |

Which Led to a Tale of

Two Hemispheres 27

Americas

–

Strong

Demand

in

2013

and Outstanding Prospects Remain

0

100

200

300

400

500

600

700

800

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

1000 Tonnes

Brazil DAP/MAP/TSP Imports

Min/Max Range (2008-2012)

2013 Fcst

7-Yr Olympic Average

Source: Brazil Mosaic

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

5.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13F

14F

MMT

Brazil DAP/MAP/TSP Imports

DAP

MAP/MES

TSP

Souce:

Fertecon, ANDA, Mosaic |

India DAP Pipeline Example: 2014/15

28

Million Tonnes DAP

2013/14E

2014/15F

Producer/Importer Beginning Inventory

1.45

1.20

Production

3.67

3.80

Imports

3.90

5.70

Producer/Importer Sales to Retailer Dealers

7.82

9.70

Retail Dealer Sales to Farmers

9.82

10.30

Retail Inventory Change

-2.00

-0.60

Producer/Importer Ending Inventory

1.20

1.00

Producer/Importer Inventory Change

-0.25

-0.20

Total Pipeline Inventory Change

-2.25

-0.85

India will have a limited ability to further draw down pipeline inventories to meet

farmer demand, and we expect marked improvement in imports even under the

assumption that they can flush the pipeline further (to the tune of nearly 1

million tonnes). |

Will Likely Remain a

Tale of Two Hemispheres, but the Beginning of a Recovery in India

29

The exchange rate remains a risk to the

forecast, as depreciation of the Rupee

was a primary driver of lower Indian

imports in 2013.

Changes to the subsidy regime could

also play a role, with election year

politics another wildcard.

1.2

1.8

1.3

3.3

3.6

5.5

3.8

4.2

2.6

3.4

1.2

1.0

1.5

3.0

2.2

2.1

3.4

1.5

1.2

2.3

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

06

07

08

09

10

11

12

13

14F

15F

Mil Tonnes

Fertilizer Year Ending March 31

India DAP Imports

Kariff (Apr 1-Sep 30)

Rabi (Oct 1-Mar 31)

Source: FAI

and Mosaic India

38

43

48

53

58

63

68

A-03

N-04

F-06

M-07

A-08

N-09

F-11

M-12

A-13

N-14

F-16

INR/US$

India Forex

November Fcst

December Fcst

Source: IHS Global

0

200

400

600

800

1,000

1,200

1,400

1,600

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

1000 Tonnes

India DAP Imports

Source: FAI |

No More Living off the

Pipeline, so: Record Shipments and a Rebound in Import Demand

30

51

47

53

59

62

63

63-64

64-66

30

35

40

45

50

55

60

65

70

00

01

02

03

04

05

06

07

08

09

10

11

12

13F

14F

Global Phosphate Shipments

Likely Scenario

MMT Product

DAP/MAP/MES/TSP

Source: Fertecon

& Mosaic

0

5

10

15

20

25

00

01

02

03

04

05

06

07

08

09

10

11

12

13F

14F

MMT

Source: CRU/FRC and Mosaic

Global Phosphate Import Demand

Likely Scenario excluding China

Asia and Oceania

Latin America

Europe

Mideast

Africa

North America

FSU |

2014 Wildcard:

China’s exports likely will cap the recent rally in DAP prices later in 2014

31

Chinese phosphates exports declined in 2013 due to a

combination of lower Indian imports and profitability issues

during a period of falling prices.

Export tariffs have been set for 2014. While lower than last

year, the tariff appears to remain prohibitive during the

‘high tax’

season.

High-Tax

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

95

97

99

01

03

05

07

09

11

13

YTD

Mil Tonnes

China DAP/MAP/TSP Exports

Actual

Forecast

Source: Fertecon, China Customs, Mosaic

($160)

($140)

($120)

($100)

($80)

($60)

($40)

($20)

$0

$20

$40

$60

$300

$325

$350

$375

$400

$425

$450

$475

$500

$ Tonne

DAP CNF India

Chinese FOB Gross Export Margin to India

Integrated

Non-Integrated

Source: Mosaic

Product

Urea

DAP/MAP

TSP/SSP

MOP/SOP

NPKs

NPs

PKs

Amm Chloride

CNY 600/tonne

30%

CNY 50/tonne

15% + CNY 50/tonne

16 May-15 Oct

1 Jan-15 May / 16 Oct-31 Dec

5%

5%

16 May-15 Oct

1 Jan-15 May / 16 Oct-31 Dec

5%

CNY 50/tonne

15% + CNY 50/tonne

CNY 40/tonne

15% + CNY 40/tonne

Jul-Oct

Jan-Jun / Nov-Dec

Chinese Export Tariffs for 2014

Off Season

Peak Season |

Potash Situation and Outlook |

Key

Features and Take Aways Prices likely at or near a floor

Expected demand rebound in response to lower prices in 2014

–

Less robust but still constructive demand drivers

–

Rebound led by the “Big Six”

Large producer but lean channel inventories worldwide

Trigger event required to get product moving down the pipeline

–

2014 FH China contract settlement (following recently announced

North American fill prices) –

More clarity/certainty about agricultural commodity prices following the January 10

USDA reports –

BPC 2.0: potential significant impact on psychology/sentiment but not on

market fundamentals Still several uncertainties and caution flags

–

Agricultural commodity prices

•

Size of the Southern Hemisphere crop

•

2014 U.S. Prospective Plantings report (March 31)

•

China corn imports (resolution to the GMO issue)

•

Instincts of the speculative herd

–

Indian 2014/15 potash subsidy

–

Impact of two Canpotex proving runs

–

Macroeconomic backdrop (especially impact on exchange

rates) Bottom line: stable near term price outlook with modest upside

risk later in 2014 33 |

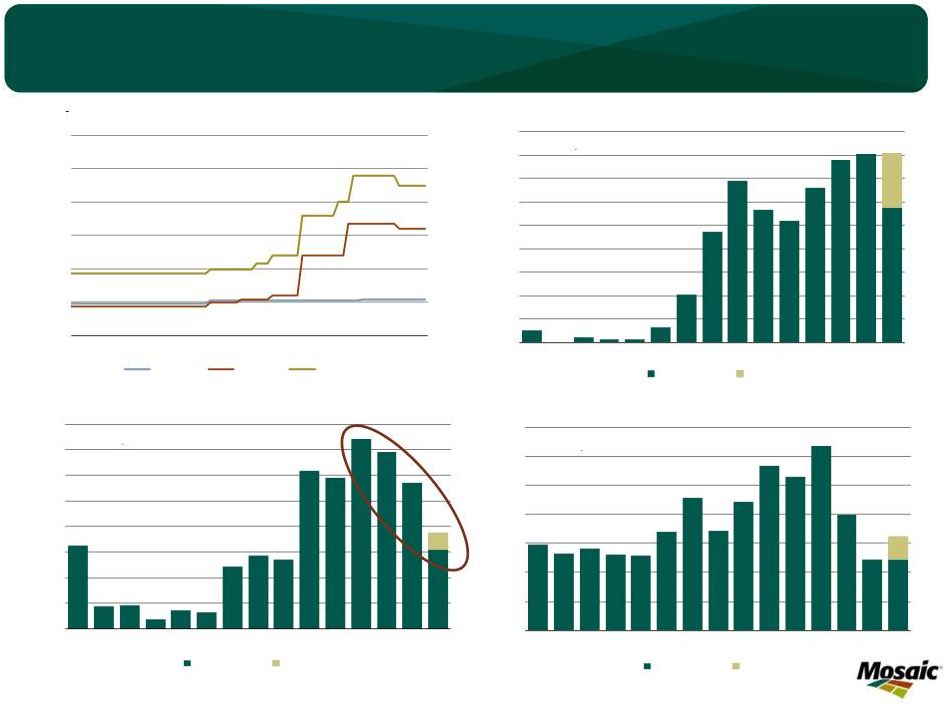

Prices likely at or near a bottom

34

100

200

300

400

500

600

700

100

200

300

400

500

600

700

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14

$ MT c&f

Brazil

$ ST fob

Midwest

Terminal

Blend Grade Muriate of Potash Prices

fob U.S. Midwest Warehouse

c&f Brazil

Source: Green Markets and ICIS |

Demand rebound in

response to lower prices in 2014 35

54

50

30

53

55

51

54-55

-59

25

30

35

40

45

50

55

60

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

Global Potash Shipments

Likely Scenario

MMT Product

KCl

Source: Fertecon

and Mosaic

57

0

5

10

15

20

25

30

35

40

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

MMT KCl

Global Potash Import Demand

Likely Scenario excluding Canada => U.S.

Asia/Oceania

Latin America

Europe/FSU

North America

Other

Source: Fertecon

and Mosaic |

36

Rebound led by the “Big Six”

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

MMT

Brazil MOP Import Demand

Source: Fertecon and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

9.0

10.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

MMT

China Net MOP Import Demand

Source: Fertecon and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

MMT

India MOP Import Demand

Source: Fertecon and Mosaic

0.0

1.0

2.0

3.0

4.0

5.0

6.0

00

01

02

03

04

05

06

07

08

09

10

11

12

13E

14F

MMT

Indonesia/Malaysia MOP Import Demand

Source: Fertecon and Mosaic |

Large expected rebound

in NA exports in response 37

North American MOP Exports

Mil Tons

KCl

Source: IPNI and Mosaic

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

MIN MAX Range (05/06-11/12)

2012/13

7-Yr Olympic Avg

0

2

4

6

8

10

12

14

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14F15F

Mil Tons

KCl

North American MOP Exports

U.S.

Canada

Source: IPNI and Mosaic

Fertilizer Year Ending June 30

Mil Tons

KCl

North American MOP Exports

Source: IPNI and Mosaic

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

MIN MAX Range (06/07-12/13)

2013/14

7-Yr Olympic Avg

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

Jul

2008/09

Jan

Jul

2009/10

Jan

Jul

2010/11

Jan

Jul

2011/12

Jan

Jul

2012/13

Jan

Jul

2013/14

Jan

Mil Tonnes KCl

North America MOP Exports

Source: IPNI |

Actual

Forecast

Shipments

13/14

Shipments

13/14

Shipments

13/14

Jun-May

% Chg

Jun-Nov

% Chg

Dec-May

% Chg.

2005/06

9,050

10%

4,355

7%

4,695

13%

2006/07

11,205

-11%

4,376

6%

6,829

-22%

2007/08

10,653

-7%

4,698

-1%

5,955

-11%

2008/09

5,764

73%

3,953

17%

1,811

193%

2009/10

7,671

30%

2,112

120%

5,558

-5%

2010/11

10,681

-7%

4,701

-1%

5,980

-11%

2011/12

8,667

15%

4,577

1%

4,090

30%

2012/13

10,092

-1%

4,867

-5%

5,225

1%

2013/14F

9,945

n/a

4,645

n/a

5,300

n/a

7-yr Oly Avg

9,553

4%

4,461

4%

5,362

-1%

1000 tons of MOP

North American Domestic Muriate of Potash Shipments

Rebound led by the “Big

Six”

including

high and

steady NA shipments

38

5

6

7

8

9

10

11

12

13

0

1

2

3

4

5

6

7

8

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14F15F

Mil Tons

KCl

Mil Tons

K

2

O

North American Potash Use and MOP Shipments

Ag Use (L)

Total Shipments (R)

Source: IPNI and Mosaic

Fertilizer Year Ending June 30

0.0

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Jun-Nov 2013

Dec-May 2014 F

Mil Tons KCl

North American Potash Shipments

7-Yr Min-Max Range

2013/14

7-Yr Olympic Average |

U.S. offshore imports

expected to drop in 2013/14 and rebound to average levels in 2014/15

39

0

50

100

150

200

250

Jul

2008/09

Jan

Jul

2009/10

Jan

Jul

2010/11

Jan

Jul

2011/12

Jan

Jul

2012/13

Jan

Jul

2013/14

Jan

1,000 Tonnes

KCl

U.S. MOP Offshore Imports

Source: U.S. Department of Commerce

U.S. trade data one month delayed

0.0

0.1

0.1

0.2

0.2

0.3

0.3

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Mil Tons

KCl

North American MOP Imports

MIN MAX Range (06/07-12/13)

13/14 Fcst

7-Yr Oly Avg

Source: IPNI and Mosaic

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

96

97

98

99

00

01

02

03

04

05

06

07

08

09

10

11

12

13

14F15F

Mil Tons

KCl

North American MOP Imports

Source: IPNI, USDOC, and Mosaic

Fertilizer Year Ending June 30 |

Large producer

but

lean

channel

inventories

–

need

a

trigger to get the ‘K pig moving through the python’

40

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

Jul

2008/09

Jan

Jul

2009/10

Jan

Jul

2010/11

Jan

Jul

2011/12

Jan

Jul

2012/13

Jan

Jul

2013/14

Jan

Mil Tonnes KCl

North America MOP Producer Stocks

Source: IPNI

0.0

0.5

1.0

1.5

2.0

2.5

3.0

3.5

4.0

4.5

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Mil Tons

KCl

North American MOP Stocks

MIN MAX Range (06/07-12/13)

13/14

7-Yr Oly Avg

Source: IPNI and Mosaic |

Factors to Watch and Handicap |

Factors to Watch and Handicap

42

Agricultural Commodity Prices

–

South American crop progress

•

The market likely has baked in a record soybean crop but it could further weigh on

prices once it is in the bin (Feb/Mar) –

Energy, biofuels and livestock prices

•

But proposed changes to the U.S. RFS in 2014 likely will have only a limited impact

in the near term –

U.S. Prospective Plantings report on March 31

•

Less

corn

acreage

is

required

but

will

farmers

plant

too

much

if

2015

new

crop

is

$4.50+

and

it

is

an

early

spring?

–

China soybean (how large?) and corn (how low) imports

–

Macroeconomic developments and their impact on exchange rates

–

Instincts

of

the

large

speculative

herd

–

what

might

drive

them

in

or

spook

them

out? |

Factors to Watch and Handicap

43

Other P&K Fundamentals

–

Global pipeline and producer inventories

•

The

“P”

pig

is

moving

through

the

python

but

when

will

the

python

swallow

the

“K”

pig?

–

Developments in India

•

Plant nutrient subsidy rates (2014/15 budget tabled by February 28)

•

Settlement of P&K contracts

–

Developments in China

•

Settlement of K contract

•

Phosphate exports –

what volume at what price?

–

New P&K supplies in 2014

•

Continued ramp-up of Ma'aden production and commissioning of OCP granulation

and acid plants •

Indian JV plants in Tunisia (Tifert) and Jordan (Jifco)

•

Continued start-up of brownfield K projects and management of Canpotex proving

runs Triggers that could change sentiment

–

Settlement of large contracts in China and India

–

Agricultural commodity price breakout from current range

–

Unexpected supply disruption (e.g. mine/plant outage or transportation

glitch) –

Political or macroeconomic event |

Market Outlook

Picking Up the Knife (and starting a fight?)

Mosaic AgCollege

Orlando, FL

January 14, 2014

Michael R. Rahm

Vice President

Market and Strategic Analysis

Andy Jung

Director

Market and Strategic Analysis

Thank You for Your Business! |