Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Jazz Pharmaceuticals plc | d658291d8k.htm |

Exhibit 99.1

Relevant portion of the slides presented by Jazz Pharmaceuticals plc at the J.P. Morgan Healthcare Conference in San Francisco, California on January 13, 2014:

Exhibit 99.1

Relevant portion of the slides presented by Jazz Pharmaceuticals plc at the J.P. Morgan Healthcare Conference in San Francisco, California on January 13, 2014:

Jazz Pharmaceuticals

32nd Annual JP Morgan Healthcare Conference

Bruce Cozadd, Chairman and CEO

January 13, 2014

Forward-Looking Statements

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995

This presentation contains forward-looking statements, including, but not limited to, statements related to Jazz Pharmaceuticals’ estimated financial results

and future growth potential, including expectations and estimates regarding 2013 sales of Xyrem® (sodium oxybate) oral solution and Erwinaze® (asparaginase Erwinia chrysanthemi), other financial and operating results and financial guidance,

the company’s growth and acquisition strategy and its 2014 goals (financial and otherwise), the therapeutic and commercial potential of the company’s product candidates, potential future clinical trials and other development of the

company’s product candidates and the indications the company plans to pursue, potential approval and commercialization of the company’s product candidates, expected patent protection for ADX-N05 and the potential extension of that patent

protection, the anticipated consummation of the tender offer for Gentium S.p.A. ordinary shares and American Depositary Shares and the timing and benefits thereof, the plan to launch DefitelioTM (defibrotide) and the timing thereof, future

commercial opportunities and potential expansion of European commercial operations after the expected completion of the Gentium acquisition, the potential to develop Defitelio for approval in other conditions, anticipated pipeline opportunities,

future clinical development andregulatory matters, the expected launch of VersaclozTM (clozapine, USP) oral suspension and other statements that are not historical facts. These forward-looking statements are based on Jazz Pharmaceuticals’

current expectations and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties,

which include, without limitation, risks and uncertainties associated with maintaining and increasing sales of and revenue from Xyrem, such as the potential introduction of generic competition and changed or increased regulatory restrictions on or

requirements with respect to Xyrem, as well as similar risks related to effectively commercializing the company’s other marketed products, including Erwinaze and Prialt® (ziconotide) intrathecal infusion; protecting and expanding the

company’s intellectual property rights; obtaining appropriate pricing and reimbursement for the company’s products in an increasingly challenging environment; ongoing regulation and oversight by U.S. and non-U.S. regulatory agencies;

dependence on key customers and sole source suppliers; the difficulty and

uncertainty of pharmaceutical product development, including the timing thereof, the uncertainty of clinical success,

such as the risk that results from early clinical trials may not be predictive of results obtained in later and larger clinical

trials planned or anticipated to be conducted for the company’s product candidates, and the uncertainty of regulatory

approval; the company’s ability to successfully manage the risks associated with integrating ADX-N05 and other acquired products or product

candidates into the company’s product portfolio, including the availability

of funding to complete the development of, obtain regulatory approval for and commercialize acquired product

candidates; the satisfaction of closing conditions and the availability and terms of the financing for the proposed

Gentium acquisition; risks associated with business combination or product acquisition transactions, such as the risk

that the acquired business or the products or product candidates acquired will not be integrated successfully or that such integration

may be more difficult, time-consuming or costly than expected; risks related to future opportunities and plans for the combined company following

the proposed Gentium acquisition, including uncertainty of the expected financial performance and results of the combined company following

completion of the proposed acquisition; disruption from the proposed Gentium acquisition, making it more difficult to

conduct business as usual or maintain relationships with customers,

employees or suppliers; the possibility that if Jazz Pharmaceuticals does not achieve the perceived or anticipated benefits

of the proposed acquisition of Gentium or

its acquisition of ADX-N05 as rapidly or to the extent anticipated by financial analysts or investors, the market price of Jazz

Pharmaceuticals’ ordinary shares could

decline; the company’s ability to identify and acquire, in-license or develop additional products or product candidates to grow its business;

and possible restrictions on the

company’s ability and flexibility to pursue certain future opportunities as a result of its substantial outstanding debt

obligations; as well as risks related to future opportunities and plans, including the uncertainty of expected future

financial performance and results, and those other risks detailed from time-to-time under the caption “Risk Factors” and elsewhere in Jazz

Pharmaceuticals plc’s Securities and Exchange

Commission filings and reports (Commission File No. 001-33500), including in the Quarterly Report on Form

10-Q for the quarter ended September 30, 2013 and future filings and reports by the company.

Jazz Pharmaceuticals

undertakes no duty or obligation to update any forward-looking statements contained in this presentation as a result of new information, future

events or changes in its expectations.

2

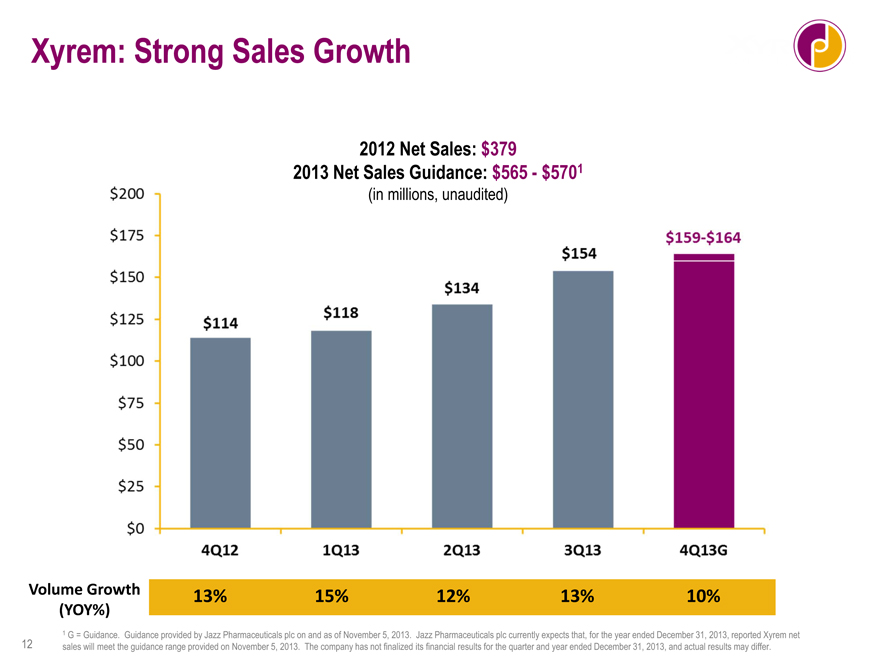

Xyrem: Strong Sales Growth

2012 Net Sales: $379

2013 Net Sales Guidance: $565—$5701

(in millions, unaudited)

$200 $175 $150 $125 $100 $75 $50 $25 $0

$114 $118 $134 $154 $159-$164

4Q12 1Q13 2Q13 3Q13 4Q13G

Volume Growth 13% 15% 12% 13% 10%

(YOY%)

1 G = Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 5, 2013. Jazz Pharmaceuticals plc currently expects that, for the year ended

December 31, 2013, reported Xyrem net sales will meet the guidance range provided on November 5, 2013. The company has not finalized its financial results for the quarter and year ended December 31, 2013, and actual results may

differ.

12

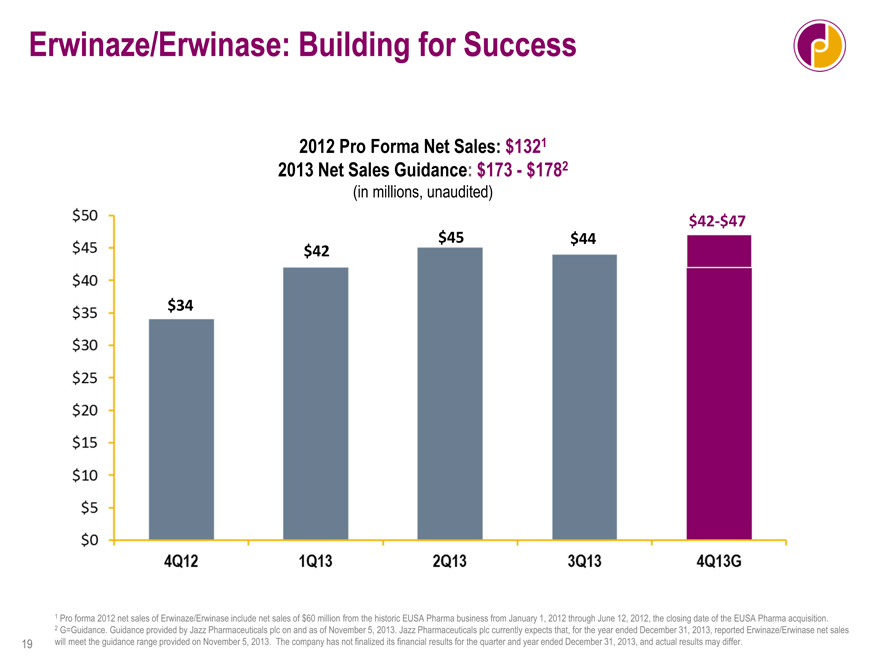

Erwinaze/Erwinase: Building for Success

2012 Pro Forma Net Sales: $1321 2013 Net Sales Guidance: $173—$1782

(in millions, unaudited)

$50 $45 $40 $35 $30 $25 $20 $15 $10 $5 $0

4Q12 1Q13 2Q13 3Q13 4Q13G

$42-$47

$45 $44 $42

$34

1 Pro forma 2012 net sales of Erwinaze/Erwinase include net sales of $60 million from the historic EUSA Pharma business from January 1, 2012 through June 12, 2012, the closing date of the EUSA Pharma acquisition.

2 G=Guidance. Guidance provided by Jazz Pharmaceuticals plc on and as of November 5, 2013. Jazz Pharmaceuticals plc currently expects that, for the year ended December 31, 2013, reported Erwinaze/Erwinase net sales will meet the guidance range provided on November 5, 2013. The company has not finalized its financial results for the quarter and year ended December 31, 2013, and actual results may differ.

19

Relevant portion of the transcript of the oral presentation by Jazz Pharmaceuticals plc at the J.P. Morgan Healthcare Conference in San Francisco, California on January 13, 2014:

Bruce C. Cozadd, Chairman & CEO, Jazz Pharmaceuticals plc

. . .

During my presentation today, I will make forward-looking statements. Actual results and timing may differ due to risks and uncertainties described here but also in our SEC filings.

. . .

Xyrem sales growth remains strong with annualized revenues north of $600 million. I can tell you today that we do expect to meet our Xyrem top-line guidance for 2013, which would represent growth of 50 percent over 2012. And volume growth remained strong. We saw 10 percent volume growth in the fourth quarter. This continues a string of double digit year-over-year volume growth for this product and gives us 12 percent volume growth for the year. We think that growth will continue. We are seeing growth in prescriptions by our lower and mid decile physicians, and we've recently expanded our sales force by 25 percent, to allow us to make more calls on a broader physician universe.

. . .

And, again, today, we can confirm that we will meet prior guidance, giving us sales for the year of $173 to $178 million, up 30 to 35 percent from pro forma 2012 sales. I can also tell you that, based on this, we expect that we will trigger the $50 million milestone payment to the EUSA shareholders.

. . .